Abstract

The Magallanes region, in southern Chile, is positioned as a strategic hub for the production of green hydrogen (GH2), green ammonia, and synthetic fuels, thanks to its exceptional wind potential and commitment to sustainability. This article analyzes the opportunities and challenges of these energy vectors in the context of global decarbonization, highlighting the key role of the Magallanes region in the energy transition. Green hydrogen production, through wind-powered electrolysis, takes advantage of the region’s constant, high-speed winds, enabling competitive, low-emission generation. In turn, green ammonia, derived from GH2, emerges as a sustainable alternative for the agricultural industry and maritime transport, while synthetic fuels (e-fuels) offer a solution for sectors that are difficult to electrify, such as aviation. The sustainability approach addresses not only emissions reduction but also the responsible use of water resources, the protection of biodiversity, and integration with local communities. The article presents the following structure: (i) introduction, (ii) wind resource potential, (iii) water resource potential, (iv) different forms of hydrogen and its derivatives production (green hydrogen, green ammonia, and synthetic fuels), (v) pilot-scale demonstration plant for Haru Oni GH2 production, (vi) future industrial-scale GH2 production projects, (vii) discussion, and (viii) conclusions. In addition, the article discusses public policies, economic incentives, and international collaborations that promote these projects, positioning Magallanes as a clean energy export hub. Finally, the article concludes that the region can lead the production of green fuels, contributing to global energy security and the fulfillment of the Sustainable Development Goals (SDGs). However, advances in infrastructure, regulation, and social acceptance are required to guarantee a balanced development between technological innovation and environmental conservation.

1. Introduction

1.1. Global Context of Production of Green Hydrogen

According to the Intergovernmental Panel on Climate Change (IPCC), the global average temperature of land and ocean surfaces increased by approximately 1.1 °C since the pre-industrial period (1850–1900) to the present. This increase in average temperatures coincides with the beginning of the Industrial Revolution, when an economy based on agriculture and artisanal production transformed into one dominated by technology and mechanical manufacturing, requiring the intensive use of fossil fuels [1,2].

This process, along with other human activities such as deforestation, land use, and climate change, etc., has led to a sustained accumulation of greenhouse gases (GHGs) in the atmosphere, triggering the phenomenon known as climate change. This is manifested not only in rising global temperatures but also in extreme weather patterns, loss of biodiversity, and alterations in the planet’s hydrological and chemical cycles [3]. Likewise, climate change puts the global economy and food security at risk by affecting agriculture through changes in precipitation patterns and increasing the frequency and severity of heat waves, droughts and floods, hurricanes, and fires. World Bank data estimate that climate-induced natural disasters “are equivalent to a loss of $520 billion in global consumption and push some 26 million people into poverty each year”. For this reason, climate change is one of our main global challenges, and action must be taken to reduce greenhouse gas emissions [4,5].

In this sense, hydrogen is emerging as a promising energy source to combat climate change, transition to cleaner and more sustainable energy sources, and decarbonize the global economy [6]. This is due to its multiple benefits, including its versatility and high energy content, which can be up to three times higher than that of commonly used liquid fuels, such as gasoline, diesel, or oil. Furthermore, it is emerging as a key energy vector to replace fossil fuels as the primary source of energy in sectors that are difficult to electrify, such as heavy transport, the chemical industry, and the steel industry. It is estimated that, in 2020, the chemical industry consumed around 46 million tons, and the steel industry consumed 5 million tons of hydrogen [7].

Hydrogen (H2) is the chemical element with the simplest structure on the periodic table and is the most abundant in the universe. On our planet, it is only found in combination with other elements, such as water (H2O) and methane (CH4). Hydrogen can be produced by a variety of methods, and depending on how it is produced, it can have different environmental impacts [8]. This type is classified as gray hydrogen, blue hydrogen, and green hydrogen. Gray hydrogen is produced from fossil fuels, primarily natural gas (methane) and coal. In 2020, 79% of global hydrogen demand (90 million tons) was met by fossil fuels. Of this, 60% was obtained through methane reforming, which splits natural gas into hydrogen and CO2. The remaining 19% was generated through coal gasification. Both processes generate GHG emissions that are not captured and released into the atmosphere. The latter is particularly carbon-intensive, emitting between 18 and 25 kg of CO2 per kg of H2, making it one of the most polluting methods for producing hydrogen, commonly called “brown hydrogen” [9].

Each year, approximately 6% of global natural gas and 2% of coal reserves are used for the production of gray hydrogen, a process that results in the emission of approximately 830 million metric tons of CO2, representing 2.5% of global emissions of this gas. In total, global hydrogen production generates approximately 900 million metric tons of CO2 annually. Despite its significant environmental impact, gray hydrogen is widely used due to its low production costs and large installed capacity [10].

Blue hydrogen is also produced from fossil fuels. Like gray hydrogen, the methane gas reforming production process is used, but it is combined with carbon capture and sequestration technologies to mitigate environmental impacts. The process begins when the methane is heated with water vapor at high temperatures ranging from 700 °C to 1000 °C. The chemical reaction between methane and steam generates hydrogen (H2) and carbon monoxide (CO), CO then reacts with more steam to produce H2 and carbon dioxide (CO2). This results in high yields of H2 [11]. After hydrogen production, the generated CO2 is captured, compressed, and permanently stored in geological formations or used in industrial processes. This significantly reduces GHG emissions, resulting in low-carbon hydrogen production. The carbon footprint of blue hydrogen production is estimated to range from 3.97 to 6.87 kg of CO2 per kg of H2 produced, depending on the efficiency of CO2 capture from the atmosphere. With capture rates close to 90%, the associated carbon footprint will be lower. While blue hydrogen represents an alternative solution on the path to decarbonization because it has lower emissions compared to gray hydrogen (12–13.5 kg of CO2 per kg of H2 produced with natural gas), its dependence on fossil fuels is problematic [12].

Green hydrogen is defined as that produced from the electrolysis of water, a process whereby the molecule is divided into H2 and oxygen. To achieve this, electricity from renewable sources (wave, tidal, hydroelectric, geothermal, biomass, solar, and wind) are used. Since it does not require fossil fuels, it does not generate direct CO2 emissions. This represents the main benefit of green hydrogen, as it does not rely on fossil fuels, nor does it exacerbate the problem of global warming through GHG emissions [13,14].

1.2. Production of Green Hydrogen with Wind Energy and Electrolysis

Green hydrogen is emerging as a crucial transition technology in the search for environmentally friendly alternatives to fossil fuels. Its production is based on the use of renewable energy sources, such as wind, solar, biomass, and hydroelectric power. Among these, wind energy has gained significant importance in recent years, becoming a primary source for electricity generation through wind turbines, which transform the kinetic energy of the wind [15].

In the field of wind generation, two main types of wind turbines are distinguished: vertical-axis wind turbines (VAWTs) and horizontal-axis wind turbines (HAWTs). Vertical wind turbines, whose blades rotate perpendicularly to the ground, typically have a lower energy generation capacity and are more compact, generating less noise. These characteristics make them ideal for domestic environments and urban areas with low-speed, turbulent winds. In contrast, horizontal wind turbines, with their blades parallel to the ground, are more efficient at capturing wind energy [16]. Available in both domestic (from 3 m) and industrial (up to 120 m) scales, these wind turbines are capable of generating larger amounts of energy [17].

Green hydrogen production is based on water electrolysis, a process that requires renewable, emission-free electrical energy supplied through an electrolyzer. During this process, water (H2O) decomposes into hydrogen (H2) and oxygen (O2) [18]. Some authors provide an overview of the various water electrolysis technologies for green hydrogen production. Among them, alkaline electrolysis (AEL), which operates at temperatures between 30 and 80 °C, uses an alkaline solution and nickel-coated stainless-steel electrodes (Ni), with asbestos and zirconium oxide (ZrO2) diaphragms [19]. This system design is considered favorable for large-scale applications. Another relevant technology is proton exchange membrane (PEM) electrolysis, developed by General Electric Company in 1996. PEM electrolysis stands out for its sustainability and favorable environmental impact in converting renewable energy into high-purity hydrogen. It uses high-activity noble metals, such as palladium and platinum, and operates at lower temperatures (20–80 °C). Finally, solid oxide electrolysis (SOE), introduced in the 1980s, has gained attention for its efficiency in converting electrical energy into chemical energy and producing ultrapure hydrogen [20]. SOE operates at high temperatures (500–850 °C) and pressure, using water in the form of steam and O2 conductors, primarily nickel- and yttrium-stabilized zirconium. The diversity of electrolysis technologies, including alkaline, PEM, and solid oxide, offers distinct advantages in terms of efficiency, hydrogen purity, and operating conditions, allowing production to be tailored to diverse needs and contexts. The continued development and optimization of these technologies is crucial to the consolidation of green hydrogen as a key energy source in the transition to a low-carbon economy [21].

1.3. Aim of the Article

This article presents the advances and future perspectives of the insertion of the green hydrogen production projects in the Magallanes region, considering efforts to mitigate climate change and the fulfil the Sustainable Development Goals (SDG) for 2030 of the United Nations (UN). The development of on-shore wind energy, desalination plants, and electrolyzers is described, considering the production projects of green hydrogen, green ammonia, and green e-fuels for the decarbonization of the planet by 2050. The article has the following structure: (i) introduction, (ii) potential of wind energy resources, (iii) potential of water resources, (iv) different manners of production of green hydrogen and derivatives, (v) demonstrative plant of production of green hydrogen in pilot scale Haru Oni, (vi) future projects of production of green hydrogen on an industrial scale, (vii) discussion, and (viii) conclusions. Finally, the article explores and discusses advances in green hydrogen production/storage, green policies, and sustainability challenges.

2. Potential of Wind Energy Resources in Magallanes Region

The Magallanes Region, located in the extreme south of Chile, is recognized for its exceptional wind potential, being one of the areas with the greatest wind energy resources in the world. This is primarily due to its unique geographic and climatic conditions, which favor the presence of intense and constant winds [22].

In the Magallanes Region, wind speeds are remarkably high, especially in coastal areas and in open areas of the Patagonian steppe. At an altitude of 100 m, the average wind speeds can exceed 9–12 m/s and even reach peaks of 15 m/s in certain areas. These speeds are significantly higher than those recorded in many other regions of the world, making the Magallanes Region an ideal location for wind energy generation [23].

The hourly wind variation in the Magallanes Region is influenced by local and global weather patterns. In general, winds tend to be strong during the afternoon and evening hours, while they may decrease slightly during the early morning hours. However, the hourly variation is not as pronounced as in other regions, as the winds in Magallanes are relatively constant throughout the day. This is due to the influence of the low-pressure systems that pass through the area and the absence of geographical obstacles that slow the flow of wind.

The main factors influencing wind potential are the following:

- Geography: Patagonia is exposed to westerly winds, which are accelerated by the funnel effect generated by the Andes Mountains. This creates intense and constant air currents.

- Climate: The region is dominated by a cold and windy climate, with low temperatures and high atmospheric pressure, which contributes to the generation of strong winds.

- Altitude: At higher altitudes, wind speeds increase due to less friction with the Earth’s surface. At 100 m above sea level, winds are stronger and more stable than at ground level.

The wind potential of the Magallanes Region has led to the development of wind energy projects in the area, such as the Cabo Negro Wind Farm and other projects in their planning phases. These projects take advantage of the high and consistent wind speeds to generate electricity efficiently and sustainably.

In short, the Magallanes Region has enormous wind potential due to its high wind speeds, exceeding 9–12 m/s at 100 m above sea level, and its relatively stable hourly variation [24]. These conditions make it one of the most promising regions in the world for wind energy generation.

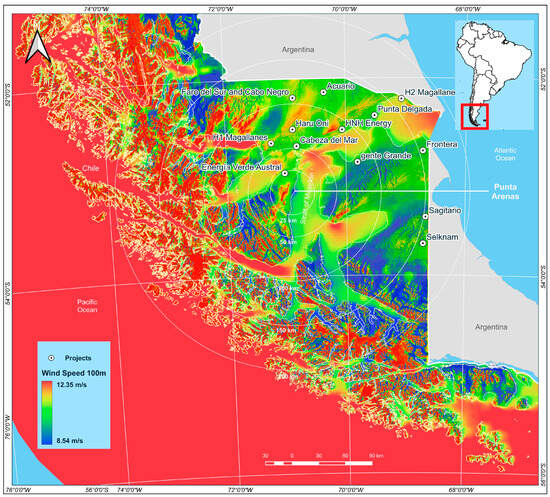

Figure 1 also shows the 13 largest GH2 production projects considered for the period 2025–2050 for the Magallanes region.

Figure 1.

Map of the wind potential at an average wind turbine height of 100 m and the location of the 13 largest wind farms related with GH2 production projects projected for Magallanes region in period 2025–2050.

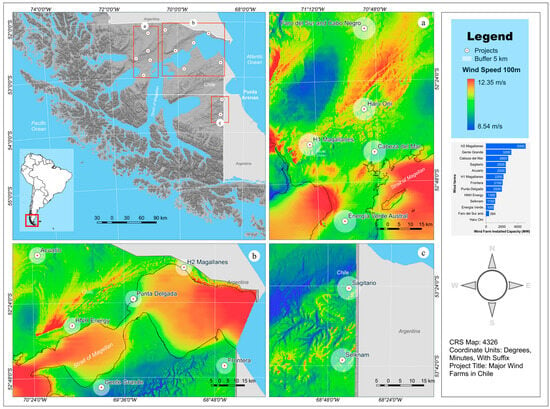

The spatialization of on-shore wind farms is quite localized. The north region from the Punta Arenas city will concentrate the largest number of wind farms as follows: (i) Energía Verde Austral, (ii) Haru Oni, (iii) Faro del Sur and Cabo Negro, (iv) H1 Magallanes, and (v) Cabeza del Mar. The northeast region from Punta Arenas city will concentrate several numbers of wind farms, as follows: (vi) Gente Grande, (vii) HNH Energy, (viii) Punta Delgada, (ix) H2 Magallanes, (x) Acuario, and (xi) Frontera. Finally, in the east region of Punta Arenas city, we have two wind farms as follows: (xii) Selknam and (xiii) Sagitario (Figure 2).

Figure 2.

Occupation of the 13 largest future wind farms related to GH2 production projects in the North, Northeast, and East of Punta Arenas City in the Magallanes region, (a) North zone, (b) Northeast zone, and (c) East zone.

The speeds recorded in the North, Northeast, and East regions from Punta Arenas City correspond to Classes I and II, for hub heights of 80 m and 100 m. These speeds are also referred to as IEC 61400-1 wind turbine generator systems. Another important characteristic of these regions is their high-capacity factors, ranging from 0.45 to 0.60 [22].

The Magallanes region, in the far south of Chile, stands out for its exceptional wind potential, thanks to its intense and constant winds, influenced by its proximity to the Pacific Ocean and the Drake Passage, one of the windiest areas on the planet. These geographic and climatic conditions allow wind farms in the region to achieve remarkably high plant factors, above global averages.

Some of the main characteristics of the wind conditions in the Magallanes region are the following:

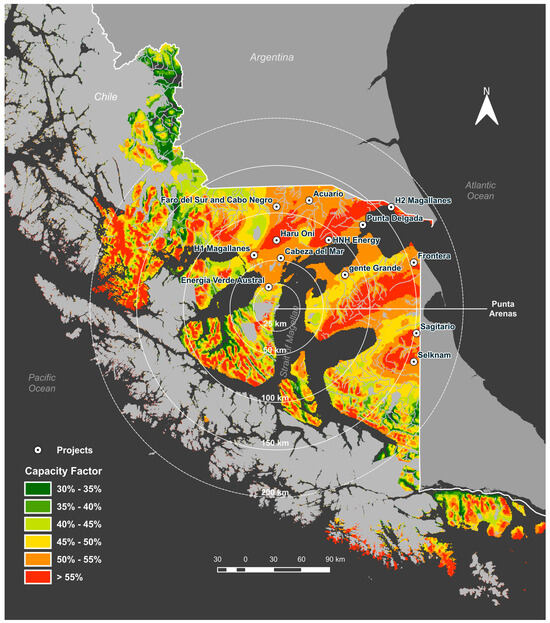

- High plant factor: In Magallanes, plant factors for wind projects typically range between 45% and 60%, figures much higher than the world average (30–35%) and even other regions of Chile. This is due to the high and persistent wind speed, with average annual speeds that can exceed 9–10 m/s in optimal areas (Figure 3).

Figure 3. Wind farm capacity factors in the Magallanes region.

Figure 3. Wind farm capacity factors in the Magallanes region. - Seasonality and consistency: Unlike other regions, winds in Magallanes are relatively constant throughout the year, although they intensify somewhat in the spring and summer. The absence of major geographical obstacles (such as high mountains) in certain areas favors laminar wind flow.

- Adaptive technology: Given the intensity of the winds, robust wind turbines are required, capable of operating efficiently in extreme conditions, with regulation systems for strong winds. Turbines typically have taller towers and longer blades to better capture low-altitude winds.

- Logistical challenges: Despite the excellent wind resource, the remoteness of consumption centers and limited infrastructure increase the development and transmission costs. Extreme weather conditions (cold, snow, and storms) require increased maintenance and equipment durability.

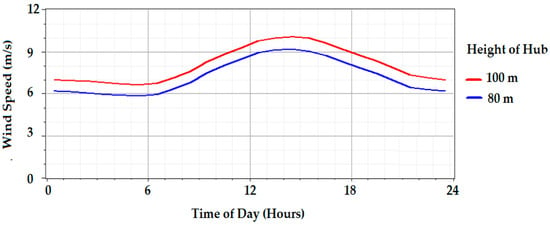

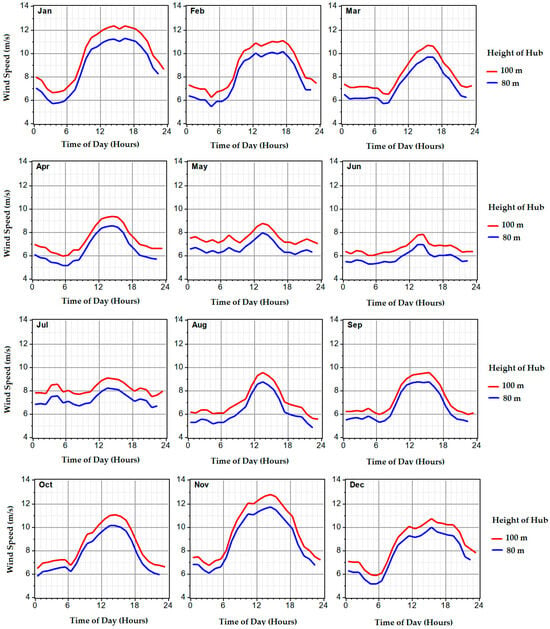

Wind speed has a spatial and temporal distribution. Its spatial distribution depends on the roughness of the terrain, for example, the presence of trees, buildings, hills, or mountains. Temporarily, wind speed can vary during the day or night, and even more so in the early morning, morning, midday, afternoon, or evening. Figure 4 shows the representative average hourly wind speed profile for the Northeast region of Magallanes, considering different wind turbine hub heights.

Figure 4.

Average hourly wind speed profile at different heights registered in the Northeast region of Magallanes.

Figure 4 shows the hourly variation in wind speed in the Northeast region of Magallanes, where the highest speeds, around 11 m/s, are recorded between 1:00 p.m. and 4:00 p.m. Wind speeds then decrease between 11:00 p.m. and 6:00 a.m., with minimum wind speeds around 6 m/s. Despite the decrease in wind speed during the afternoon, the recorded speeds are considered excellent for wind turbine performance. Furthermore, the temporal distribution of wind speeds varies seasonally throughout the year, with speeds varying from lower to higher depending on whether it is autumn, winter, spring, or summer. Figure 5 shows the seasonal variation in wind speeds in the northeastern region of Magallanes.

Figure 5.

Average monthly wind speed profile at different heights registered in the Northeast region of Magallanes.

Wind turbine performance is strongly influenced by interannual climate variability and extreme events (e.g., El Niño/La Niña phenomena: These affect wind patterns in Latin America and the Pacific, and Climate Change), which can affect both power generation and the structural integrity of wind turbines. The main impacts and associated resilience metrics are described below.

- Impacts of Extreme Weather on Wind Turbines

- (a)

- Extreme Winds (Storms, Hurricanes, Cyclones)

Effects:

- Mechanical damage to blades, towers, and yaw systems.

- Forced shutdowns due to exceeding the cut-in speed (≈25–30 m/s).

- Increased structural fatigue, reducing the equipment’s lifespan.

- (b)

- Severe Winter (Ice, Snow, Low Temperatures)

Effects:

- Ice buildup on blades, reducing aerodynamic efficiency (losses of 10–50%).

- Failure of anemometer sensors and control systems.

- Extended downtime due to unsafe conditions.

- (c)

- Heat Waves and Droughts

Effects:

- Reduction in air density (lower energy production).

- Overheating of electrical components (inverters, transformers).

- (d)

- Lightning and Thunderstorms

Effects:

- Damage to electronic systems and blade surfaces.

- Failure rate: ≈1–5% of affected turbines annually.

- 2.

- Resilience Metrics for Wind Turbines

To assess resilience to extreme events, metrics including the following were used:

- Average stop time: The average time the turbine is inactive due to weather events. Typical values are 2–10 days/year (depending on the region).

- Availability factor: Percentage of operating time of the annual total. Typical values are 95–98% (under normal conditions).

- Energy loss from extreme events: Percentage of generation lost due to storms/ice. Typical values are 5–20% in high-risk areas.

- Repair cost per event: Average cost of post-storm maintenance. Typical values are USD 10,000–500,000 (according to damage).

Finally, Figure 5 shows that wind speeds vary between 5 m/s and 13 m/s throughout the year, with minimum values recorded in June, while maximum values are observed in November. The curve shows an upward trend from November to January, with decreases from May to July.

Validation of wind energy projections is essential to ensure model reliability and efficiency in wind farm planning. Given the high variability and uncertainty associated with wind resources (wind speed, turbulence, geographic, and climatic factors), advanced statistical methods are used to quantify the risks and improve the accuracy of estimates. A detailed justification of the Monte Carlo methods used is presented below:

- Uncertainty in input parameters: Wind energy generation depends on random variables such as wind speed, air density, and turbine availability. Monte Carlo simulation allows these uncertainties to be modeled using probability distributions (Weibull, Rayleigh, Normal, etc.).

- Evaluation of the probabilistic scenarios: Through thousands of iterations, multiple possible scenarios are generated, allowing the estimation of an expected value and confidence intervals (e.g., P10, P50, P90) for energy production.

- Financial risk analysis: This method incorporates economic factors (investment costs, electricity rates) to help assess the risk that a project will not meet expected returns.

3. Potential of Water Resources in Magallanes Region

The Magallanes region and Chilean Antarctica, despite its relative abundance of water resources, faces important restrictions for the use of land water in the production of green hydrogen, derived from legal, environmental, climatic, and social factors. These limitations pose significant challenges for the development of great GH2 projects that exclusively depend on fresh water sources [23].

First, the Chilean legal framework establishes rigorous conditions for the appropriation of water resources. The current water code, although modified in 2022, maintains a system of use rights that, in Magallanes, is already partially assigned for other priority uses. Obtaining new water decrees for industrial green hydrogen projects can be complex, especially in areas close to populated centers such as Punta Arenas or Puerto Natales, where the resource is mainly intended for human consumption and traditional productive activities [22].

From the environmental point of view, water extraction for electrolysis faces important barriers. The region houses fragile ecosystems, such as Patagonia wetlands and ice fields, protected by various regulations. The Glacier Protection Law (Law 21.100) especially restricts any intervention in areas close to these natural freshwater reservoirs. In addition, environmental impact studies for large-scale projects usually face particularly rigorous scrutiny, considering the ecological and tourist value of many bodies of water in region [25].

The climatic characteristics of Magallanes add another layer of complexity. The marked seasonality in water availability, with maximum flows in summer for thaw and minimums in winter, would require expensive storage systems to guarantee a continuous supply. Additionally, low winter temperatures can freeze superficial water courses, limiting their accessibility during that part of the year. These variations would force specialized infrastructure to design and increase operating costs [26].

The competition for water resources with other economic sectors represents another important limitation. Tourism, a key activity in the region, directly depends on the conservation of the landscape and the bodies of water in places such as the Torres del Paine National Park. Simultaneously, sheep livestock, although less intensive in water use than other agricultural activities, remains an economic pillar that requires a supply of water. This multifunctionality of the water resource generates potential tensions that must be considered in any green hydrogen project [25].

Finally, from a logistics and economic perspective, the use of land water has comparative disadvantages against the desalination of seawater. The need to transport water from distant sources to optimal places for wind generation (frequently located in coastal areas) would significantly increase costs. In addition, the infrastructure required for sweet water treatment and distribution would have to adapt to the extreme climatic conditions of the region, increasing the necessary initial investment [26].

The Magallanes region is positioned as one of the largest potential territories to produce green hydrogen (GH2) globally, thanks to its exceptional windings and the strategic availability of seawater, which can be transformed in a key input through desalination processes against the use of fresh water (Table 1).

Table 1.

Comparative analysis between the use of desalinated seawater and fresh water.

Magallanes has an extensive coast bathed by the Pacific Ocean and the Magallanes Strait, which guarantees an unlimited supply of seawater for GH2 production [23]. Some of the key benefits of the use of desalinated water are the following:

- Abundant resources: unlike freshwater, seawater does not compete with agricultural, human, or tourist uses.

- Strategic location: Desalination plants can be installed near wind farms (such as those projected in Tierra del Fuego or San Gregorio), minimizing the logistics costs.

- Sustainability: If residual brine is properly managed, environmental impact can be controlled by dilution or re-utilization technologies.

To produce GH2, water must be ultrapure, which implies a desalination by reverse osmosis where 99% of salts are eliminated, with an energy consumption of 3–5 kWh/m³. In that sense, the Magallanes region can take advantage of its cheap wind energy (~20 USD/MWh) to make the process cheaper than in other regions. Desalinated water requires subsequent treatment (demineralization) to meet electrolyte standards (especially PEM technology) [19].

In terms of costs and energy viability, producing 1 kg of GH2 requires ~9 L of purified water. With desalination, total energy consumption increases by ~10–15% concerning the use of fresh water. However, the Magallanes wind surpluses (with capacity factors > 50%) compensate for this additional cost. Finally, considering the investment in infrastructure, modular desalination plants are required near the GH2 production centers [20].

However, in order to more objectively assess its viability as an energy vector in economic decarbonization processes, it is essential to incorporate life cycle analysis (LCA) criteria for its production among the variables.

The article by Goren et al. (2025) [27], conducts a comparative assessment of the environmental impact of three hydrogen production methods: gasification, electrolysis, and a hybrid process combining dark fermentation with microbial electrolysis. The results indicate that coal gasification presents the highest global warming potential, reaching a value of 21.75 kg CO2-eq/kg of H2 produced. In contrast, the electrolysis process showed the lowest atmospheric emissions and environmental impacts, with an estimated value of 6.94 kg CO2-eq/kg of H2. It is important to mention that this study adopts a comprehensive life cycle analysis approach, considering the entire production system and not just the isolated electrolysis process. Consequently, these include the emissions associated with the extraction of raw materials, the carbon intensity of the electricity used, the manufacture of electrolysis equipment, the auxiliary processes involving the use of carbon-based materials, and the storage and transportation of hydrogen.

On the other hand, the study conducted by Loiy Al-Ghussain et al. (2024) [28] compares, using a life cycle analysis (LCA), the environmental impacts associated with hydrogen production using photovoltaic (PV) systems versus wind systems. Overall, the results show that wind-based systems have a lower carbon intensity, with emissions ranging from 0.35 to 1.9 kg CO2-eq/kg H2, compared to photovoltaic systems, whose values range from 1.58 to 2.95 kg CO2-eq/kg H2.

From an economic perspective, similar trends are observed. The estimated cost of hydrogen production from wind energy ranges between 1.5 and 15 USD/kg of H2, while for photovoltaic systems, it ranges between USD 3.0 and USD 5.2/kg of H2. Despite these differences, both renewable systems have considerably lower emissions than conventional fossil fuel-based technologies, which generate between 3.8 and 12 kg CO2-eq/kg of H2 produced.

However, a strong advantage of fossil fuel technologies remains their economic competitiveness, with production costs ranging between USD 2.73 and USD 5.94/kg of H2, which remains a barrier to the widespread adoption of green hydrogen in highly price-sensitive markets.

However, there are other impacts associated with large-scale green hydrogen production, which are not necessarily related to the emissions category. As proposed by Weidner et al. (2023) [29], although green hydrogen reduced its impacts on global warming, hydrogen from solar photovoltaic systems is observed to impact biogeochemical fluxes. This collateral damage originates in the process of the “treatment of wastewater from photovoltaic cell production, through the “nitrates in water bodies” impact pathway”. Likewise, green hydrogen has greater impacts in the biosphere integrity category, due to the land use required for the installation of solar panels. The authors conclude that large-scale green hydrogen production is primarily associated with impacts in categories such as freshwater ecotoxicity and resource depletion, particularly metals. These impacts are primarily generated from metal waste during the mining extraction stage and the production of steel for the manufacture of the solar panel and wind turbine structures, as well as the photovoltaic cell itself.

4. Different Manners of Production of Green Hydrogen and Derivatives

4.1. Process of Production of Green Hydrogen

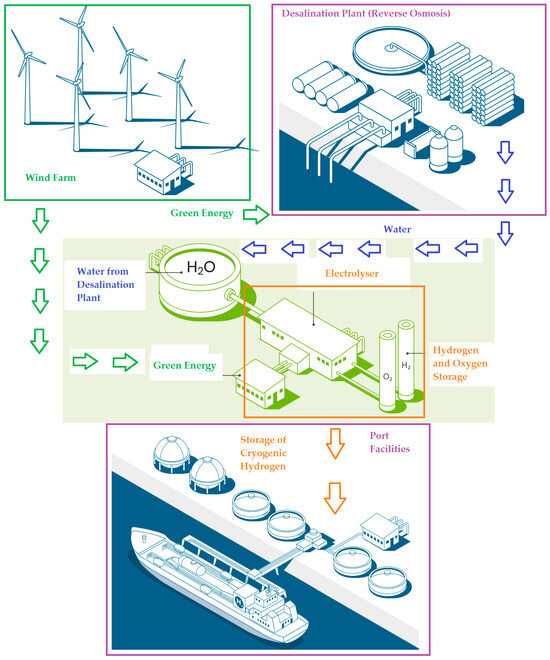

The Magallanes region, in the southern end of Chile, has positioned itself as a strategic place to produce green hydrogen, a clean fuel for the global energy transition. This process takes advantage of the abundant wind resources in the area and follows several stages [30,31,32,33,34,35] (Figure 6):

Figure 6.

Schematic process of GH2 production considered for the Magallanes region.

- Renewable wind energy generation: Magallanes has exceptionally strong and constant winds, ideal for wind farms. Large wind turbines transform this kinetic energy into renewable, emission-free energy.

- Water electrolysis: the electricity generated feeds electrolyte, equipment that decomposes water molecules (H2O), in hydrogen (H2) and oxygen (O2) by electrolysis. The water used can come from local sources, even desalinated if necessary.

- Storage and transport: The hydrogen produced is compressed or liquefied for storage. Given the remote location of Magallanes, certain options include the following: (i) conversion into ammonia (NH3), which is evaluated to facilitate maritime transport; and (ii) export via specialized ships to international markets.

- Uses and applications: Magellan green hydrogen could be (i) used as fuel for heavy industries (mining, maritime transport); (ii) used as raw material for green fertilizers and chemicals; and (iii) exported to Europe and Asia, where demand is growing.

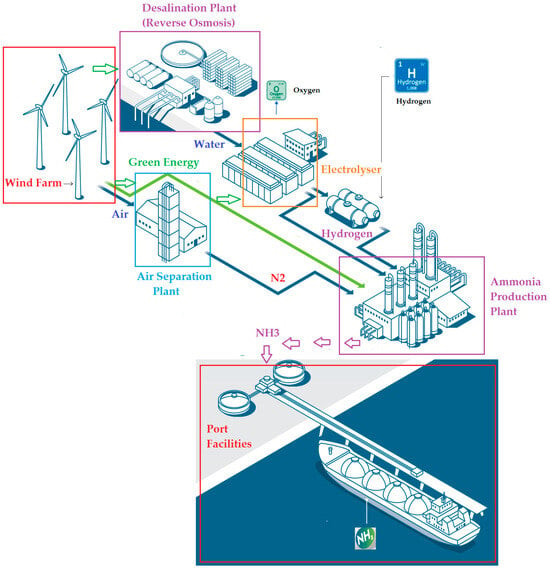

4.2. Process of Production of Green Ammonia

The Magallanes region, in southern Chile, has become a strategic pole for the production of green ammonia (NH3), an essential compound for fertilizers and clean fuels, manufactured without carbon emissions. The process integrates renewable energy and green hydrogen into several key stages [36,37,38,39,40,41] (Figure 7):

Figure 7.

Schematic process of green ammonia production considered for the Magallanes region.

- Wind energy generation: Magallanes has one of the most powerful wind resources in the world, with constant and high speed winds. The Great wind farms will generate 100% renewable electricity to feed the process.

- Green hydrogen production (H2): Wind energy drives electrolyzing water molecules (H2O) into hydrogen (H2) and oxygen (O2) by electrolysis. Water can come from the public network, wells, or desalination plants, ensuring a sustainable supply.

- Nitrogen (N2) extraction: The nitrogen needed to synthesize ammonia is extracted from the air using a process called cryogenic separation or adsorption (PSA), which filters and purifies atmospheric N2 (air contains 78% nitrogen).

- Green ammonia synthesis (modified Haber–Bosch): Green hydrogen and nitrogen are combined in a synthesis reactor under high pressures and temperatures (using iron catalysts), following the traditional Haber–Bosch process, but with two key differences: (i) The energy comes from renewable sources (wind power), and (ii) No CO2 is emitted, unlike conventional ammonia (which uses natural gas).

- Storage and export: Liquid ammonia (NH3) is stored in cryogenic tanks and transported by specialized vessels to international markets. Its application includes (i) green agricultural fertilizers (reducing the carbon footprint of the sector); (ii) decarbonized marine fuel (alternative to diesel in ships); and (iii) using it as an energy vector to transport green hydrogen (NH3 is easier to handle than pure H2).

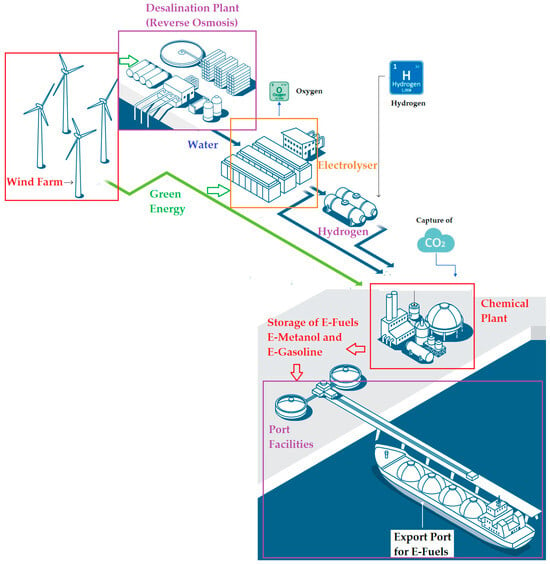

4.3. Process of Production of Green E-Fuels

The Magallanes region, thanks to its exceptional wind resources and commitment to decarbonization, has become a pioneering center for the production of green synthetic fuels, also known as e-fuels. These fuels, made from green hydrogen and captured CO2, allow emissions reductions in sectors that are difficult to electrify, such as aviation and maritime transport. The following stages are considered in the production process [42,43,44,45,46,47] (Figure 8):

Figure 8.

Schematic process of green e-fuels production considered for the Magallanes region.

- Renewable wind energy generation: The Magallanes region has intense, constant winds, ideal for large-scale wind farms. Projects like Haru Oni (HIF Global) use this clean energy to power the entire process without CO2 emissions.

- Green hydrogen (H2) production: Using wind-powered electrolyzers, desalinated seawater (H2O) is broken down into hydrogen (H2) and oxygen (O2). This green hydrogen is the basis for synthetic fuels.

- CO2 capture: The necessary carbon dioxide can be obtained in two ways: (i) directly from the atmosphere using direct air capture (DAC) technologies, and (ii) from industrial sources (such as biogas plants or nearby industrial processes).

- Fuel synthesis (power-to-liquid process): Green hydrogen and CO2 are combined in a synthesis reactor through two key processes: (i) Fischer–Tropsch process: Converts H2 and CO2 into liquid hydrocarbons (such as e-kerosene or e-diesel), and (ii) synthetic methanol; alternatively, e-methanol, a clean fuel for ships and aircraft, can be produced.

- Refining and distribution: Synthetic fuels are purified and adapted to international standards before being (i) transported by ship to global markets (Europe, Asia, USA) and (ii) used locally in heavy transport, mining or aviation.

Synthetic fuels (e-fuels) can be produced using various methods, including the Fischer–Tropsch (FT) process and methanol synthesis. Each method offers specific technical characteristics and advantages, particularly relevant in applications such as sustainable aviation fuels and integration with renewable energy sources.

The Fischer–Tropsch process converts syngas (a mixture of carbon monoxide and hydrogen, CO + H2) into liquid hydrocarbons such as diesel, kerosene, and gasoline. Its main advantages include high carbon conversion efficiency into liquid products, the ability to generate fuels with fossil-like properties, good regulatory and social acceptance, and compatibility with existing refinery infrastructure [48]. These characteristics make the FT method an attractive option for gradually replacing fossil fuels in sectors that are difficult to decarbonize.

On the other hand, methanol synthesis also starts with syngas but produces methanol as its main product. This can be used directly as fuel or as an input for the subsequent production of gasoline, aviation fuels, or high-value chemicals. This route is characterized by greater energy efficiency, greater flexibility for smaller-scale plant applications, and a better combined performance in terms of carbon efficiency and adaptation to existing infrastructure [49]. Its modularity makes it a viable solution for regions with distributed renewable resources and lower installed capacity.

While both routes present considerably higher production costs compared to conventional fossil fuels, their adoption represents substantial potential for reducing CO2 emissions, especially if integrated with carbon capture systems and renewable energy sources. The choice between one process or the other will depend on factors such as the scale of the project, the type of end application, available resources, and energy market conditions.

5. Demonstrative Plant of Production of Green Hydrogen in Pilot Scale Haru Oni

GH2 Projects—In Operation (2025)

The Haru Oni project represents one of the most innovative initiatives in the development of clean energy and the decarbonization of the economy in Latin America. Located in the state of Tehuel Aike, north of Punta Arenas, in the Magallanes region of Chilean Patagonia, this project consists of a pilot plant to produce synthetic fuels based on green hydrogen, which seeks to demonstrate the technical and economic viability of producing this type of fuel. In this sense, it has become the first integrated industrial e-fuels plant operational worldwide [22].

In 2021, the Chilean Ministry of Energy and Mining approved the environmental impact statement (EIS) for the Haru Oni project, after obtaining the support of the Magallanes Regional Environmental Commission through a favorable vote. Thus, construction of the plant began in July of that same year. It lasted approximately 11 months and included the installation of a 3.4 MW wind turbine supplied by Enel Green Power, a 13 kV backup transmission line, a 1.2 MW electrolyzer, a synthesizer to combine recycled CO2 with green hydrogen to create e-methanol, and a plant to convert e-methanol into e-gasoline and e-LG. This covers a 3.7-hectare area within the Tehuel Aike property in the municipality of Punta Arenas. The project is expected to expand to a total of 5.7 hectares during Phase II of construction, with a 325 MW on-shore wind farm, which would allow the production of up to 140,000 tons of synthetic methanol per year. The location of the green hydrogen plant is truly strategic, given the enormous potential of wind and water resources in the Magallanes region (Figure 9). These conditions improve the plant’s efficiency, reduce supply-related risks, and prevent potential negative impacts on the environment and society [22].

Figure 9.

Panoramic view of Haru Oni GH2 project located in the Magallanes region.

Haru Oni uses wind energy to produce green hydrogen through the electrolysis of water. The hydrogen obtained from the splitting of the water molecule is stored, while the oxygen is released into the atmosphere. This hydrogen is then combined with captured CO2 to produce methanol in a reactor, through a process called synthesis. The project’s methanol synthesis unit, developed by the German company MAN Energy Solutions, uses the English company Johnson Matthey’s CO2-to-methanol catalyst conversion technology [22].

The wind energy will also be used for a battery storage system (BESS), planned for implementation in 2024, to supply electricity to the turbine and facilities during periods when the turbine is not in operation.

The result is the production of synthetic methanol, which could be used as a final fuel to meet the demand of ships in maritime transport. Through further refining processes, it could be converted into synthetic gasoline or diesel for land transport, synthetic liquefied natural gas (e-LG), synthetic aviation fuel (e-SAF) for air transport, or even used in the production of plastics. Regarding CO2 supply, Haru Oni began operations using CO2 from biogenic sources, with the main supplier being the multinational chemical company Linde. However, the medium-term goal is to utilize the CO2 present in the atmosphere through direct air capture (DAC) technologies. During 2024, HIF, together with other project partners—Porsche & Volkswagen Group Innovation and Baker Hughes—began developing this technology at Haru Oni, and the “Mosaic” pilot unit was tested to accelerate this transition to commercial scale. By 2025, this unit is expected to be on a commercial scale and operating at full capacity, to extract and remove 600 metric tons of CO2 from the atmosphere annually.

Synthetic fuels have gained significant importance in recent years. This importance lies in the multiple benefits offered by their manufacture. First, they are considered carbon-neutral because their production and use comply with a closed carbon cycle, in which the carbon dioxide (CO2) released when burned is equivalent to that previously captured during their manufacture. In other words, the use of e-fuels emits an amount of CO2 equivalent to that previously captured during their production, allowing for the implementation of a balanced carbon recycling system [22].

Furthermore, synthetic fuels are chemically equivalent to conventional fossil fuels. This characteristic allows for their immediate use in internal combustion engines and existing infrastructure, without requiring technical modifications or additional adaptations to current transportation or distribution systems. Finally, Table 2 presents some key technical data about the Haru Oni Project.

Table 2.

Haru Oni GH2 plant main specifications.

According to Table 2, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 1560 m3/year. Also, the plant will have an electrolyzer with 1.2 MW of installed capacity. In this sense, the GH2 production plant will generate 138 tons/year of GH2, 131,000 L/year of e-fuel, and 323 tons/year of e-methanol. Finally, this facility will save 1380 tons/year of CO2 from being emitted into the atmosphere.

6. Future Projects of the Production of Green Hydrogen on an Industrial Scale

Below, information on the future GH2 production projects in the Magallanes region is presented in detail (2025–2050), considering (i) on-shore wind farm projects, (ii) desalination plants, (iii) electrolyzer facilities, and (iv) ancillary facilities (stage of technical studies and/or environmental impact assessment (EIA) studies).

6.1. GH2 Projects—Future Facilities (2025–2050)

Below are the 12 most significant GH2 investment projects for the future of the Magallanes territory.

6.1.1. Faro del Sur and Cabo Negro Project—Magallanes Region

The Faro del Sur on-shore wind farm is a facility that will be located in Tehuel Aike site, Cabo Negro, north of Punta Arenas, in the Magallanes region. It will have 64 wind turbines, the owner of which will be HIF. Furthermore, the height of the towers from the ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 384 MW, with an estimated capacity factor of 0.57. Figure 10 shows a panoramic image of the landscape of the project site, and Table 3 provides some key technical data for this GH2 production facility.

Figure 10.

Panoramic view of the landscape in Faro del Sur and Cabo Negro project.

Table 3.

Faro del Sur and Cabo Negro GH2 plant main specifications.

Considering Figure 10, it is evident that the Faro del Sur on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 3, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 314,600 m3/year. Also, the plant will have an electrolyzer with 242 MW of installed capacity. In this sense, the GH2 production plant will generate 27,830 tons/year of GH2, 26,418,333 L/year of e-fuels, and 175,000 tons/year of e-methanol. Finally, this facility will save 278,300 tons/year of CO2 from being emitted into the atmosphere.

6.1.2. Energia Verde Austral Project—Magallanes Region

The Energía Verde Austral on-shore wind farm is a facility that will be located in the north of Punta Arenas, Magallanes region. It will have 167 wind turbines, the owner of which will be EDF. Furthermore, the height of the towers from ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, considering all the wind turbines, and the wind farm will have a total installed capacity equivalent to 1000 MW, with an estimated capacity factor of 0.56. Figure 11 shows a panoramic image of the landscape of the project site and Table 4 provides some key technical data for this GH2 production facility.

Figure 11.

Panoramic view of the landscape in the Energía Verde Austral project.

Table 4.

Energía Verde Austral GH2 plant main specifications.

Considering Figure 11, it is evident that the Energía Verde Austral on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 4, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 1,020,500 m3/year. Also, the plant will have an electrolyzer with 785 MW of installed capacity. In this sense, the GH2 production plant will generate 90,275 tons/year of GH2, and 506,325 tons/year of NH3. Finally, this facility will save 902,750 tons/year of CO2 from being emitted into the atmosphere.

6.1.3. Selknam Project—Magallanes Region

The Selknam on-shore Wind Farm is a facility that will be located in the north of Punta Arenas, Magallanes region. It will have 192 wind turbines, the owner of which will be Albatros—Alfanar and ENAP. Furthermore, the height of the towers from ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 1150 MW, with an estimated capacity factor of 0.60. Figure 12 shows a panoramic image of the landscape of the project site, and Table 5 provides some key technical data for this GH2 production facility.

Figure 12.

Panoramic view of the landscape in the Selknam project.

Table 5.

Selknam GH2 plant main specifications.

Considering Figure 12, it is evident that the Selknam on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 5, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 1,121,250 m3/year. Also, the plant will have an electrolyzer with 863 MW of installed capacity. In this sense, the GH2 production plant will generate 99,188 tons/year of GH2, and 556,313 tons/year of NH3. Finally, this facility will save 991,875 tons/year of CO2 from being emitted into the atmosphere.

6.1.4. HNH Energy Project—Magallanes Region

The HNH Energy on-shore wind farm is a facility that will be located in the northeast of Punta Arenas in the Magallanes region. It will have 217 wind turbines, the owner of which will be HNH Energy. Furthermore, the height of the towers from ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 1300 MW, with an estimated capacity factor of 0.54. Figure 13 shows a panoramic image of the landscape of the project site, and Table 6 provides some key technical data for this GH2 production facility.

Figure 13.

Panoramic view of the landscape in the HNH energy project.

Table 6.

HNH Energy GH2 plant main specifications.

Considering Figure 13, it is evident that the HNH Energy on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 6, this GH2 production plant will use seawater from a desalina-tion plant, considering a water supply of 1,267,500 m3/year. Also, the plant will have an electrolyzer with 975 MW of installed capacity. In this sense, the GH2 production plant will generate 112,125 tons/year of GH2, and 628,875 tons/year of NH3. Finally, this facility will save 1,121,250 tons/year of CO2 from being emitted into the atmosphere.

6.1.5. Punta Delgada Project—Magallanes Region

The Punta Delgada on-shore wind farm is a facility that will be located in the northeast of Punta Arenas, Magallanes region. It will have 333 wind turbines, the owner of which will be EDF Renewables. Furthermore, the height of the towers from ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 2000 MW, with an estimated capacity factor of 0.57. Figure 14 shows a panoramic image of the landscape of the project site, and Table 7 provides some key technical data for this GH2 production facility.

Figure 14.

Panoramic view of the landscape in the Punta Delgada project.

Table 7.

Punta Delgada GH2 plant main specifications.

Considering Figure 14, it is evident that the Punta Delgada on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 7, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 1,950,000 m3/year. Also, the plant will have an electrolyzer with 1500 MW of installed capacity. In this sense, the GH2 production plant will generate 172,500 tons/year of GH2, and 967,500 tons/year of NH3. Finally, this facility will save 1,725,000 tons/year of CO2 from being emitted into the atmosphere.

6.1.6. Frontera Project—Magallanes Region

The Frontera on-shore wind farm is a facility that will be located in the northeast of Punta Arenas, Magallanes region. It will have 350 wind turbines, the owner of which will be Acciona and Nordex. Furthermore, the height of the towers from ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 2100 MW, with an estimated capacity factor of 0.54. Figure 15 shows a panoramic image of the landscape of the project site, and Table 8 provides some key technical data for this GH2 production facility.

Figure 15.

Panoramic view of the landscape in the Frontera project.

Table 8.

Frontera GH2 plant main specifications.

Considering Figure 15, it is evident that the Frontera on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 8, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 2,210,000 m3/year. Also, the plant will have an electrolyzer with 1700 MW of installed capacity. In this sense, the GH2 production plant will generate 195,500 tons/year of GH2, and 1,096,500 tons/year of NH3. Finally, this facility will save 1,955,000 tons/year of CO2 from being emitted into the atmosphere.

6.1.7. H1 Magallanes—Magallanes Region

The H1 Magallanes on-shore wind farm is a facility that will be located in the northeast of Punta Arenas, Magallanes region. It will have 367 wind turbines, the owner of which will be CWP Global. Furthermore, the height of the towers from the ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 2200 MW, with an estimated capacity factor of 0.57. Figure 16 shows a panoramic image of the landscape of the project site, and Table 9 provides some key technical data for this GH2 production facility.

Figure 16.

Panoramic view of the landscape in the H1 Magallanes project.

Table 9.

H1 Magallanes GH2 plant main specifications.

Considering Figure 16, it is evident that the H1 Magallanes on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 9, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 2,288,000 m3/year. Also, the plant will have an electrolyzer with 1760 MW of installed capacity. In this sense, the GH2 production plant will generate 202,400 tons/year of GH2, and 1,135,200 tons/year of NH3. Finally, this facility will save 2,024,000 tons/year of CO2 from being emitted into the atmosphere.

6.1.8. Sagitario Project—Magallanes Region

The Sagitario on-shore wind farm is a facility that will be located in the north of Punta Arenas, Magallanes region. It will have 417 wind turbines, the owner of which will be Consorcio Austral. Furthermore, the height of the towers from the ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 2500 MW, with an estimated capacity factor of 0.57. Figure 17 shows a panoramic image of the landscape of the project site, and Table 10 provides some key technical data for this GH2 production facility.

Figure 17.

Panoramic view of the landscape in the Sagitario project.

Table 10.

Sagitario GH2 plant main specifications.

Considering Figure 17, it is evident that the Sagitario on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 10, this GH2 production plant will use seawater from a desalination plant, providing a water supply of 2,437,500 m3/year. Also, the plant will have an electrolyzer with 1875 MW of installed capacity. In this sense, the GH2 production plant will generate 215,625 tons/year of GH2, and 1,209,375 tons/year of NH3. Finally, this facility will save 2,156,250 tons/year of CO2 from being emitted into the atmosphere.

6.1.9. Acuario Project—Magallanes Region

The Acuario on-shore wind farm is a facility that will be located in the north of Punta Arenas, Magallanes region. It will have 417 wind turbines, the owner of which will be Consorcio Austral. Furthermore, the height of the towers from ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 2500 MW, with an estimated capacity factor of 0.52. Figure 18 shows a panoramic image of the landscape of the project site, and Table 11 provides some key technical data for this GH2 production facility.

Figure 18.

Panoramic view of the landscape in the Acuario project.

Table 11.

Acuario GH2 plant main specifications.

Considering Figure 18, it is evident that the Acuario on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 11, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 2,437,500 m3/year. Also, the plant will have an electrolyzer with 1875 MW of installed capacity. In this sense, the GH2 production plant will generate 215,625 tons/year of GH2, and 1,209,375 tons/year of NH3. Finally, this facility will save 2,156,250 tons/year of CO2 from being emitted into the atmosphere.

6.1.10. Cabeza del Mar Project—Magallanes Region

The Cabeza del Mar on-shore wind farm is a facility that will be located in the north of Punta Arenas, in the Magallanes region. It will have 467 wind turbines, the owner of which will be Acciona and Nordex. Furthermore, the height of the towers from the ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 2800 MW, with an estimated capacity factor of 0.55. Figure 19 shows a panoramic image of the landscape of the project site, and Table 12 provides some key technical data for this GH2 production facility.

Figure 19.

Panoramic view of the landscape in the Cabeza de Mar project.

Table 12.

Cabeza de Mar GH2 plant main specifications.

Considering Figure 19, it is evident that the Cabeza del Mar on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 12, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 2,925,000 m3/year. Also, the plant will have an electrolyzer with 2250 MW of installed capacity. In this sense, the GH2 production plant will generate 258,750 tons/year of GH2, and 1,451,250 tons/year of NH3. Finally, this facility will save 2,587,500 tons/year of CO2 from being emitted into the atmosphere.

6.1.11. Gente Grande Project—Magallanes Region

The Gente Grande on-shore wind farm is a facility that will be located in the northeast of Punta Arenas, Magallanes region. It will have 533 wind turbines, the owner of which will be TEG Chile. Furthermore, the height of the towers from the ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 3200 MW, with an estimated capacity factor of 0.54. Figure 20 shows a panoramic image of the landscape of the project site, and Table 13 provides some key technical data for this GH2 production facility.

Figure 20.

Panoramic view of the landscape in the Gente Grande project.

Table 13.

Gente Grande GH2 plant main specifications.

Considering Figure 20, it is evident that the Gente Grande on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 13, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 3,120,000 m3/year. Also, the plant will have an electrolyzer with 2400 MW of installed capacity. In this sense, the GH2 production plant will generate 276,000 tons/year of GH2, and 1,548,000 tons/year of NH3. Finally, this facility will avoid 2,760,000 tons/year of CO2 from being emitted into the atmosphere.

6.1.12. H2 Magallanes Project—Magallanes Region

The H2 Magallanes on-shore wind farm is a facility that will be located in the northeast of Punta Arenas, in the Magallanes region. It will have 533 wind turbines, the owner of which will be Total Energies H2. Furthermore, the height of the towers from the ground level to the hub will be in the range of 110 m. Each wind turbine will have an installed capacity of 6.0 MW, and considering all the wind turbines, the wind farm will have a total installed capacity equivalent to 5000 MW, with an estimated capacity factor of 0.59. Figure 21 shows a panoramic image of the landscape of the project site, and Table 14 provides some key technical data for this GH2 production facility.

Figure 21.

Panoramic view of the landscape in the H2 Magallanes project.

Table 14.

H2 Magallanes GH2 plant main specifications.

Considering Figure 21, it is evident that the H2 Magallanes on-shore wind farm is situated near the desert part of Patagonia, where no contiguous human settlements are present.

According to Table 14, this GH2 production plant will use seawater from a desalination plant, considering a water supply of 4,550,000 m3/year. Also, the plant will have an electrolyzer with 3500 MW of installed capacity. In this sense, the GH2 production plant will generate 402,500 tons/year of GH2, and 2,257,500 tons/year of NH3. Finally, this facility will avoid 4,025,000 tons/year of CO2 from being emitted into the atmosphere.

6.1.13. Summary of Future GH2 Production Projects in Magallanes Region

Table 15 summarizes the main characteristics of the GH2 production projects planned in the Magallanes region, indicating their electrolyzer installed capacity and the total installed capacity for wind energy:

Table 15.

Summary of specifications of future GH2 production projects in Magallanes region.

Considering Table 15, it is possible to see that there will be a total of 12 large GH2 production projects considered during the period 2025–2050. It is observed that the wind farm with the lowest energy generation capacity is Faro del Sur—Cabo Negro with 384 MW, while the H2 Magallanes wind farm is the facility with the highest energy generation capacity with 5000 MW. Finally, the 12 large wind farms projected herein will have a total installed capacity equivalent to 26,134 MW.

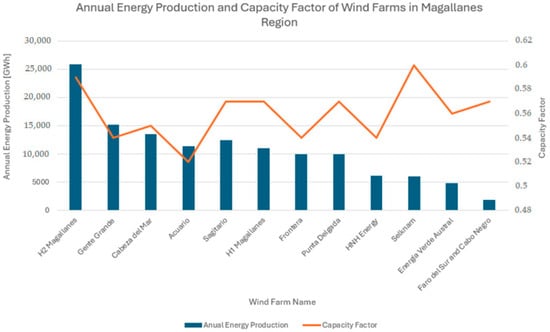

In Figure 22, it is possible to see a summary indicating the amount of annual energy generated in GWh and the capacity factor of each on-shore wind farm that is projected for the Magallanes region.

Figure 22.

Comparative graph for annual energy production and capacity factors for on-shore wind farms in Magallanes Region.

According to Figure 22, the wind farm that will generate the greatest amount of annual energy production is H2 Magallanes with approximately 25,000 GWh, while the Faro del Sur—Cabo Negro wind farm will generate the least annual energy production with 1200 GWh. On the other hand, the capacity factors oscillate in a range between 0.52 for the Acuario wind farm and 0.60 for the Selknam wind farm.

7. Discussion

7.1. Different Uses of Green Hydrogen in Society

The global demand for hydrogen reached approximately 90 Mt in 2020, representing a 50% increase since the beginning of the millennium [50]. This demand is primarily concentrated in the refining and industrial sectors. Given its nature as the lightest and most abundant element in the universe, hydrogen is distinguished by its high energy density per unit of weight, which is three times that of gasoline. Its versatility in storage, transportation, and use establishes it as a fundamental energy vector, adaptable to various physical states (gaseous, liquid, and solid) and susceptible to conversion into other substances. It facilitates energy utilization at times and locations far removed from its primary production [51].

While its current application focuses on the petrochemical industry, particularly in the synthesis of ammonia for fertilizers, refining processes, and the production of steel and iron (with China, the United States, and the Middle East as the main consumers in refining), the hydrogen value chain encompasses a wide range of energy-intensive sectors. These include the oil industry, the chemical industry (to produce synthetic fuels and other products), power generation, mobility (land, sea, and air), and heavy industry (cement, steel, etc.). These sectors were responsible for a significant carbon footprint, with approximately 11.2 Gt of CO2 emissions in 2017 derived from fossil fuels [52].

In this context, green hydrogen, produced from renewable sources, is emerging as a promising solution for the decarbonization of these various sectors. Some authors specifically explore its potential in agriculture, aquaculture, and livestock farming, where it could power agricultural machinery, HVAC systems, and the production of sustainable fertilizers. The combustion of green hydrogen generates only water, making it an attractive alternative for reducing the carbon footprint of these activities [53].

Globally, there is growing interest in and deployment of large-scale green hydrogen projects. In Latin America and the Caribbean, countries such as Chile, Colombia, Costa Rica, El Salvador, and Uruguay are developing national hydrogen roadmaps or strategies intending to use it in key sectors such as transportation (air and maritime), mining, fertilizer production, the chemical industry, and steel, seeking to achieve decarbonization goals by 2050.

Despite its potential, the economic viability of green hydrogen is a crucial factor. Its production cost varies considerably depending on the geographic location, electricity prices, and equipment costs. Estimates for 2020 place production from renewables between 4.0 and 7.0 USD/kgH2, with projections suggesting a reduction to a range of 1.5 to 3.0 USD/kgH2 by 2030 and beyond. In this regard, some authors emphasize the need for a thorough economic analysis to determine the large-scale viability of green hydrogen, considering production costs, infrastructure development, and demand in the various application sectors—elements that will define its competitiveness in the future energy market [54].

Financing mechanisms play a fundamental role in the viability and scalability of green hydrogen production, especially in regions such as Magallanes, Chile. The specialized literature underscores the importance of diversifying financing sources and implementing effective risk mitigation instruments to attract sustainable investments. Among the most relevant approaches are public–private partnerships (PPPs), which allow for risk sharing and the mobilization of both public and private capital in the development of green hydrogen projects [55].

Likewise, green bonds are positioned as a key financial tool. These instruments, commonly structured as bank loans, allow for channeling investments toward sustainable initiatives, attracting investors with environmental, social, and governance (ESG) criteria [56].

Another essential component is access to multilateral climate funds and international support, which can offer grants, concessional loans, and guarantees that lower the cost of capital, thereby improving the economic viability of projects [57].

Overall, a strategy combining PPPs, green bonds, and multilateral climate funds, supported by risk-reduction instruments and appropriate policy incentives, provides a solid foundation for financing the transition to green hydrogen. Source diversification and risk sharing are key to accelerating project development and ensuring their long-term sustainability.

Current literature reveals rapid progress and persistent challenges in the production of green hydrogen and synthetic fuels (e-fuels), positioning these fields as strategic pillars for global decarbonization. Innovation in both sectors is geared towards increasing efficiency, reducing costs, and effectively integrating with renewable energy sources.

However, significant challenges remain, including high production costs, infrastructure limitations, and the need for public policies and regulatory frameworks that incentivize its development.

Green hydrogen also plays an essential role in the production of synthetic fuels or e-fuels. When combined with captured carbon dioxide (CO2), it allows the synthesis of carbon-neutral liquid fuels through processes such as methanol synthesis, the Fischer-Tropsch process, and ammonia synthesis using the Haber–Bosch process [58]. These fuels are of particular interest for sectors that are difficult to electrify, such as aviation, maritime transport, and heavy industry. León et al. (2024) [58] also mentions that, although current production costs remain high compared to fossil fuels, technical and economic feasibility studies indicate that future cost reductions largely depend on the reduction in cost and scaling of green hydrogen. Consequently, technological innovation in synthesis, storage, transportation, and distribution processes is key to improving the competitiveness of e-fuels.

Overall, the scientific literature underscores the growing importance of green hydrogen and synthetic fuels as essential solutions for achieving deep decarbonization, especially in sectors where direct electrification is not viable. Ongoing research is driving new production, integration, and efficiency solutions, reinforcing their strategic role in current and future sustainable energy policies.

7.2. Limitations and Challenges in the Storage and Transport of Green Hydrogen

Hydrogen is emerging as a key solution for the decarbonization of energy-intensive sectors such as heavy industry, long-distance transportation, and seasonal storage. The International Renewable Energy Agency (IRENA) estimates that global hydrogen production will need to increase five-fold by 2050, reaching 12% of final energy demand and contributing 10% to CO2 emissions reductions by that same year. Green hydrogen, produced from renewable sources, is the main contributor to this growth [50].

However, green hydrogen production faces significant challenges. Reliance on renewable energy sources such as wind and photovoltaics, while sustainable, can be expensive and difficult to access for countries with limited geographical access to renewable resources. Additionally, the intermittent nature of these large-scale energy sources can lead to fluctuations and instability in the electricity supply, posing a challenge to the efficient operation and lifespan of electrolyzers, as well as to the purity of the hydrogen produced. The transportation of green hydrogen constitutes another crucial hurdle in its value chain. While some authors suggest leveraging existing pipelines for the transport of hydrogen and natural gas blends as an efficient and cost-effective strategy for long distances, hydrogen can also be transported in high-pressure gaseous form, low-temperature liquid form, or via liquid organic carriers [59]. However, the transportation of high-pressure gaseous and low-temperature liquid hydrogen is costly and inefficient for large-scale regional coverage. In this regard, some authors propose that the transportation of blended hydrogen through gas pipelines will become an inevitable trend, with the potential to significantly reduce infrastructure costs. Some authors [59], meanwhile, emphasize the importance of bulk maritime transport for establishing a global green hydrogen supply chain, although they note that the considerable investment required and limited experience in this type of transport may require long-term supply contracts to secure financing for these projects. From an economic perspective, some authors have analyzed the potential of green hydrogen for transportation, but identified challenges in its widespread development, primarily its current lack of competitiveness compared to fossil fuels and blue hydrogen due to its expensive infrastructure and long lead times for the acquisition of electrolyzers. The authors in [12] corroborate these findings, noting that the current efficiency and costs of green hydrogen production, transportation, storage, and re-electrification technologies still represent significant obstacles to its widespread implementation.

Finally, the safety of hydrogen transportation and handling is a key concern. Its potential to generate explosions in confined spaces due to leaks and ignition sources, coupled with its colorless and odorless nature, which makes it difficult to detect, and its ability to displace oxygen, represent significant risks. Despite the growing number of green hydrogen projects worldwide, knowledge about the behavior of hydrogen leaks and deflagrations in complex environments is still limited. Overcoming these technical, economic, and security challenges will be crucial to consolidating green hydrogen as a viable energy vehicle in the transition to a low-carbon economy.

7.3. Scale Economies and Production Costs of Green Hydrogen

The need for a transition to cleaner energy sources has driven interest in green hydrogen as a key energy vector in the decarbonization of various industrial sectors. However, its large-scale adoption depends largely on its economic viability. In this context, analyzing the economies of scale and costs associated with its production are essential to understand its competitiveness compared to other energy alternatives [60,61,62].

The first factor influencing green hydrogen production costs is the cost of electricity production. Depending on the type of renewable energy and the number of annual operating hours, between 60% and 70% of the total cost of green hydrogen is related to electricity consumption. Therefore, ensuring access to abundant, reliable, and affordable renewable energy is essential [63].

In regions with consistently strong winds, such as the Magallanes region, the southernmost point of Chile, this factor can be a significant benefit. Furthermore, according to data from the Global Wind Energy Council (GWEC), global installed wind power capacity has experienced sustained growth over the past decade, with an average annual growth rate exceeding 30% [17].

Another factor influencing the price structure of green hydrogen is the cost of electrolysis. The electrolyzer has a high initial investment cost, which includes auxiliary systems, compressors, converters, and cooling systems. Currently, large-scale electrolysis infrastructure is underdeveloped. However, according to the International Renewable Energy Agency (IRENA), it is estimated that the price of electrolyzers could decrease by up to 60% by 2030 with industrial scaling [53].

Third, the distribution of green hydrogen presents significant logistical challenges that exponentially increase its production costs. This is because hydrogen, due to its low energy density per unit volume, needs to be compressed at high pressures or converted to its liquid state at very low temperatures for transportation and storage [52].

Furthermore, the existing natural gas infrastructure is not easily compatible with hydrogen, which requires considerable investments in the construction of new gas pipelines or the adaptation of current networks. Added to this are the costs associated with the gradual dismantling of natural gas networks [59].

Moreover, unlike synthetic fuels, hydrogen does present technical risks as it requires modifications to the infrastructure or engines in which it will be used. Hydrogen-based fuel cells are very expensive, while hydrogen-powered engines are a more economical option but their use is very limited [64].

The cost competitiveness of hydrogen applications will improve over time as production scales increase. As the production capacity increases, unit costs decrease due to the distribution of fixed costs over a larger production volume and improved operational efficiency. Several recent studies indicate that scaling up production can result in a 60–70% reduction in unit costs. Furthermore, automating the manufacturing of gigawatt-scale electrolyzers could generate substantial cost reductions [20].

In other words, as utilization increases and economies of scale are achieved, green hydrogen costs are projected to decrease by up to 70% over the next decade, allowing it to be dispensed at a price of approximately USD 4.50–6 per kilogram [54].

The development of a large-scale hydrogen economy cannot be achieved solely through technological innovations or improvements in production efficiency. Here, regulation plays a crucial role. It is essential to establish solid and coherent regulatory frameworks that provide a stable regulatory environment and adequate incentives to attract private investment and encourage the development of critical infrastructure and the scaling of this technology.

Current GH2 production costs in some regions (notably South America) are reported at USD 1–1.5/kg, which is significantly lower than global benchmarks of USD 4–6/kg. This cost advantage positions these regions competitively for export markets, especially as the EU seeks cost-effective decarbonization pathways and large-scale investments in renewables to meet its greenhouse gas (GHG) reduction targets [65].

The comparative analysis of the economic viability of green hydrogen (and its synthetic derivatives) with fossil fuels is based on indicators such as the levelized cost of energy (LCOE) and the levelized cost of hydrogen (LCOH). Currently, renewable hydrogen production ranges from 4.45 to 10 USD/kg H2, which is approximately two to four times higher than that of gray hydrogen, which has production costs ranging from 1 to 2.25 USD/kg H2 through methane reforming or coal gasification processes. This highlights the challenges and opportunities for achieving cost parity.

What is even worse, however, is that the levelized cost of e-fuels produced with renewable sources far exceeds current fossil fuel prices. While the production price of methanol from natural gas and coal ranges from 100 to 250 USD/t, e-methanol is estimated to reach values between 800 and 1600 USD/t.