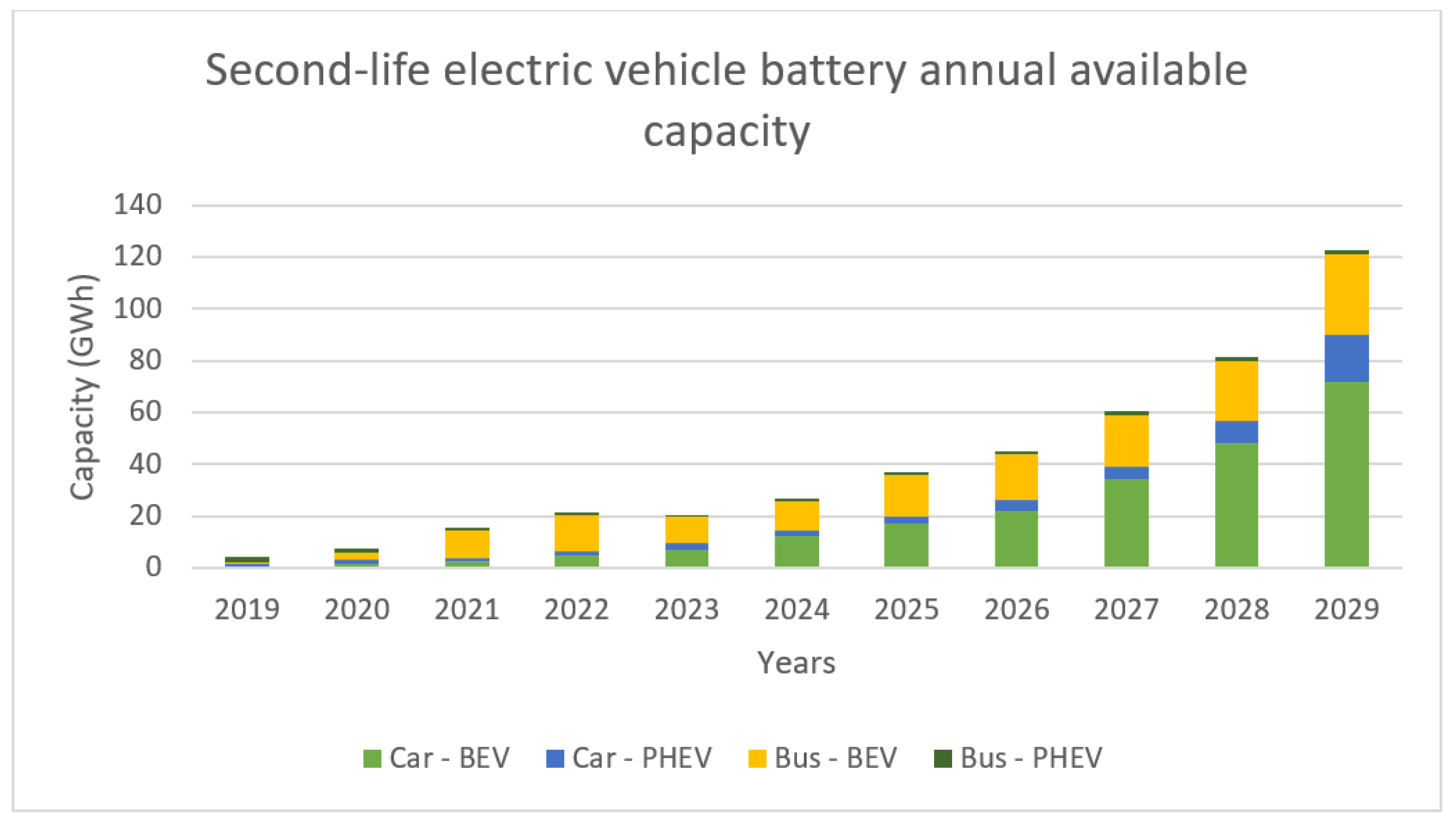

All car manufacturers operating on the European market are intensively involved in the development of new EVs because if the manufacturers do not meet the strict EU emission requirements, they will be forced to leave the European car market by financial restrictions. One of the options to economically help the expensive development of EVs today is the effective use of 2nd life batteries.

Automotive companies are analyzing various strategies for dealing with used batteries from EVs. According to law, they are obliged to ensure the take-back of all batteries, including those from EVs. The simplest option seems to be the take-back and subsequent sale (donation) to recycling centers. In this way, the car manufacturers will ensure a legal obligation, but it will lose potential in the field of power engineering. Almost all large companies are trying to diversify their business activities to increase profits and ensure economic stability. For this reason, car manufacturers are investing in projects that at first glance are not related to car production. For example, the subsidiary of the large Czech car manufacturer ŠKO ENERGO in Mladá Boleslav (Czech Republic), supplies heat to 12,000 households in Mladá Boleslav. However, the main reason for its existence is primarily to provide heat, water and, in part, electricity for the actual production of vehicles. A similar procedure could be used by automotive companies in the area of using 2nd life batteries. For example, they could build a large network of charging stations with solar panels and a sufficiently dimensioned accumulator composed of 2nd life batteries, which would primarily generate a profit from charging. In general, it is known about electromobility that a sufficient infrastructure of charging stations is very important for its massive development. If a sufficient network of chargers is built, the automotive companies will also ensure the sale of its EVs and thus ensure the economic stability of its entire company.

The economic analysis will focus on two possible strategies for using 2nd life batteries. Both will be primarily focused on the provision of regulatory energy in the form of ancillary services and regulatory energy in the balancing market. The first option will be more energetical, where the car manufacturer will build its battery storage on a green field for the needs of the energy network. The second option will be more interconnected with the automotive industry, mainly with the support of the charging station infrastructure. There will be several small battery compartments, which will have central remote control, and which will also include a fast-charging station.

3.1. Input Parameters for the Calculation and 2nd Life Battery Pricing

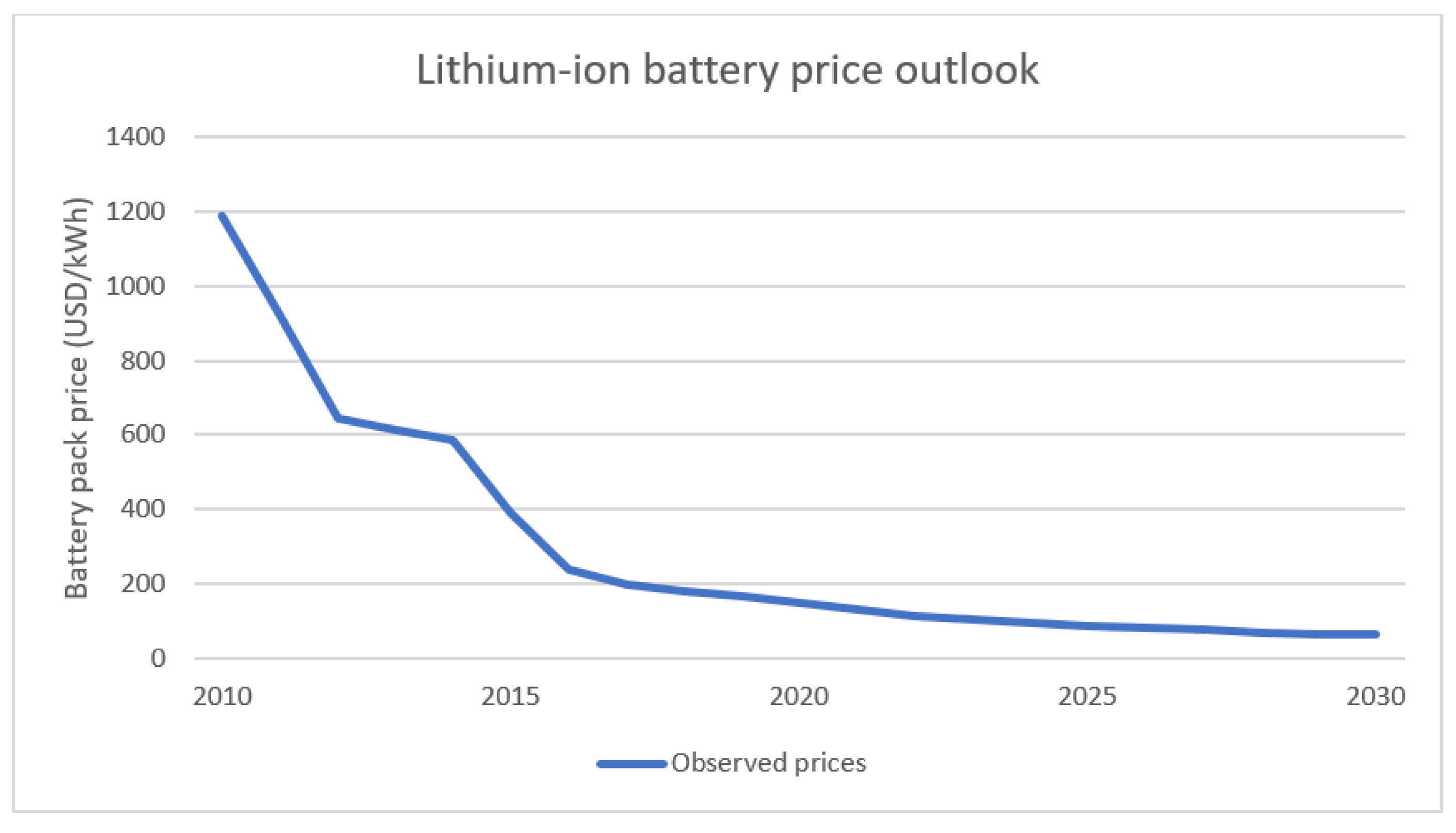

The unit price of the battery is a key expense for most buyers. Due to the technological progress, the production costs of new lithium batteries per 1 kWh have fallen by hundreds of euros in the last decade, but it is still a very expensive item. The development and projection of the unit price of a lithium battery in the future are described in the BloombergNEF chart. The key determinant of this forecast is the relationship between price and volume. From the observed historical values, a learning rate of about 18% was calculated. The learning speed is a hyperparameter that controls the extent to which the model needs to be changed in response to an estimated error each time the model weights are updated. This means that for each doubling of the cumulative volume, an 18% decrease in price was observed. Based on this observation and forecast of battery demand, the price of the average battery is therefore expected to be around 94 USD/kWh by 2024 and 62 USD/kWh by 2030 but this is only the expected average price (see

Figure 2). [

18]

Back in 2010, when the production of the first middle-class EVs (such as the Nissan Leaf), the unit price per 1 kWh was $1160. At that time, EVs were fitted with a battery with a capacity of 24 kWh, which means that the price of the battery itself reached values of 20 thousand euros. If the base selling price of the Nissan Leaf was $33,000 (€24,000), then the financial unprofitability of the vehicle is evident. Five years later, the price of batteries was already at 377 USD/kWh. The final price in 2030 is still set at 62 USD/kWh, but the final price in the distant future will be affected by the economic advantage of recycling lithium batteries.

The value of the theoretically delivered energy per year is calculated using the entered parameters, such as the DoD, the charging voltage, the capacity degradation of the new battery and the number of CCs. Regarding the dependence of the DoD and the charging voltage on the total number of cycles, a simple example is given lithium-ion batteries at an operating voltage of 3.6 V are usually charged to a voltage of 4.2 V to achieve a nominal value of the battery. Of course, it is also possible to charge higher or lower voltages. However, this change will have a major impact on both the total charge capacity of the battery and the total number of CCs. Reducing the charging voltage by 0.1 V doubles the possible number of cycles, but also reduces the usable battery capacity by approximately 15% [

19]. There is still not enough evidence today to accurately determine the dependence of battery degradation on mileage. Data on its batteries are given only by Tesla, which claims to have very low degradation. Other automotive companies do not publish data, so experimental measurements on a limited number of samples must be taken into account. According to publicly available materials, the degradation of the Tesla 100 kWh battery from the S and X models was chosen and also the 40 kWh battery from Nissan Leaf (see

Figure 3). Based on these two possibilities, the process of degradation was determined for a computational model with a 43 kWh battery.

The graph shows a significant difference between the batteries from manufacturers. Tesla, which often presents itself as an innovative company in the field of electromobility, has achieved respectable results, probably with a constantly updated control system for charging and discharging in cooperation with a large battery. On the contrary, in a competition that uses a much smaller battery, degradation is noticeable. Therefore, most automotive companies offer a battery replacement guarantee. For example, with a 40 kWh battery, the Nissan Leaf now offers a warranty of 8 years or approximately 160,000 km.

In case that the secondary use of batteries is applied and batteries from EV are used, the question arises: how to properly price these batteries. The calculated price will be paid to the owner of the EV (or dealer), who will reduce the cost of purchasing a new battery. This analysis will work with a slightly modified procedure from the team of authors from the source [

22], there is a basic formula for pricing the 2nd battery life:

where

is the price for 1 kWh of the battery from the EV (USD/kWh),

is the price for 1 kWh of a new battery (USD/kWh),

is the coefficient of the 2nd battery life status <0; 1> (-) and

is the demand coefficient of used batteries <0; 1> (-) [

22].

Coefficient

captures the current market demand for used batteries, which cannot be reliably calculated. Neubauer et al. (2012) set this coefficient at 0.75, which will be used in this analysis, and a sensitivity analysis will be performed at the end [

22]. The 2nd battery life factor can be calculated as follows:

where

is the present value of the theoretically possible supplied energy of the selected battery from the EV (kWh) and

is the current value of the theoretically possible supplied energy of a new battery (kWh) [

22].

The current values are calculated as follows:

where

is the life of the battery (year),

is a year,

is theoretically supplied energy per year (kWh),

is discount cash (%) and

is the annual increase in the price of electricity (%).

To determine the price of the 2nd life of the battery, it was necessary to enter the following technical and economic input parameters for the calculation model (see

Table 5).

According to Damodaran’s cash flow valuation, this cash discount (r) was chosen in energy production at 7.2% [

23]. The annual increase in the price of electricity (v) was set at 3.1% based on historical data. Next, it was necessary to enter the DoD and charging voltage, which the model used to calculate the total number of batteries CCs. The power dependence of the DoD and the charging voltage on the total number of batteries CCs is used. Due to the use of a lower charging voltage, the model corrected the available battery capacity. After dividing the total number of cycles by the number of days in the year, the battery life (n) was obtained. For direct calculation, the DoD was set at 40% and the charging voltage at 4.1 V to increase battery life. Other input parameters include mileage and average EV power consumption, which help determine the residual capacity and remaining CCs of the 2nd battery life. Due to the lack of data, it was not easy to determine the dependence of battery degradation on mileage. Therefore, the battery capacity in EV was fixed at 43 kWh, which corresponds to the weighted average of EV sold in the EU until mid-2019, and the dependence of degradation on mileage was also determined for this value. The battery in an EV is limited by its size and weight, so car companies set DoD to higher values at the expense of life. The computational model works with DoD in EV at 80%. Based on all these values, it was possible to calculate the total EV consumption and the number of CCs used. By back-calculation using the power dependence, the model calculated the remaining cycles of the 2nd battery life at a DoD of 40% and determined the amount of degradation of the capacity of the 2nd life battery. Due to these values, it is possible to determine the theoretically delivered energy per year (

) for the battery from EV. For a new battery,

is only calculated by multiplying the total battery capacity (43 kWh), DoD and correcting the capacity due to a change in charging voltage. The input values from the model are shown in the following

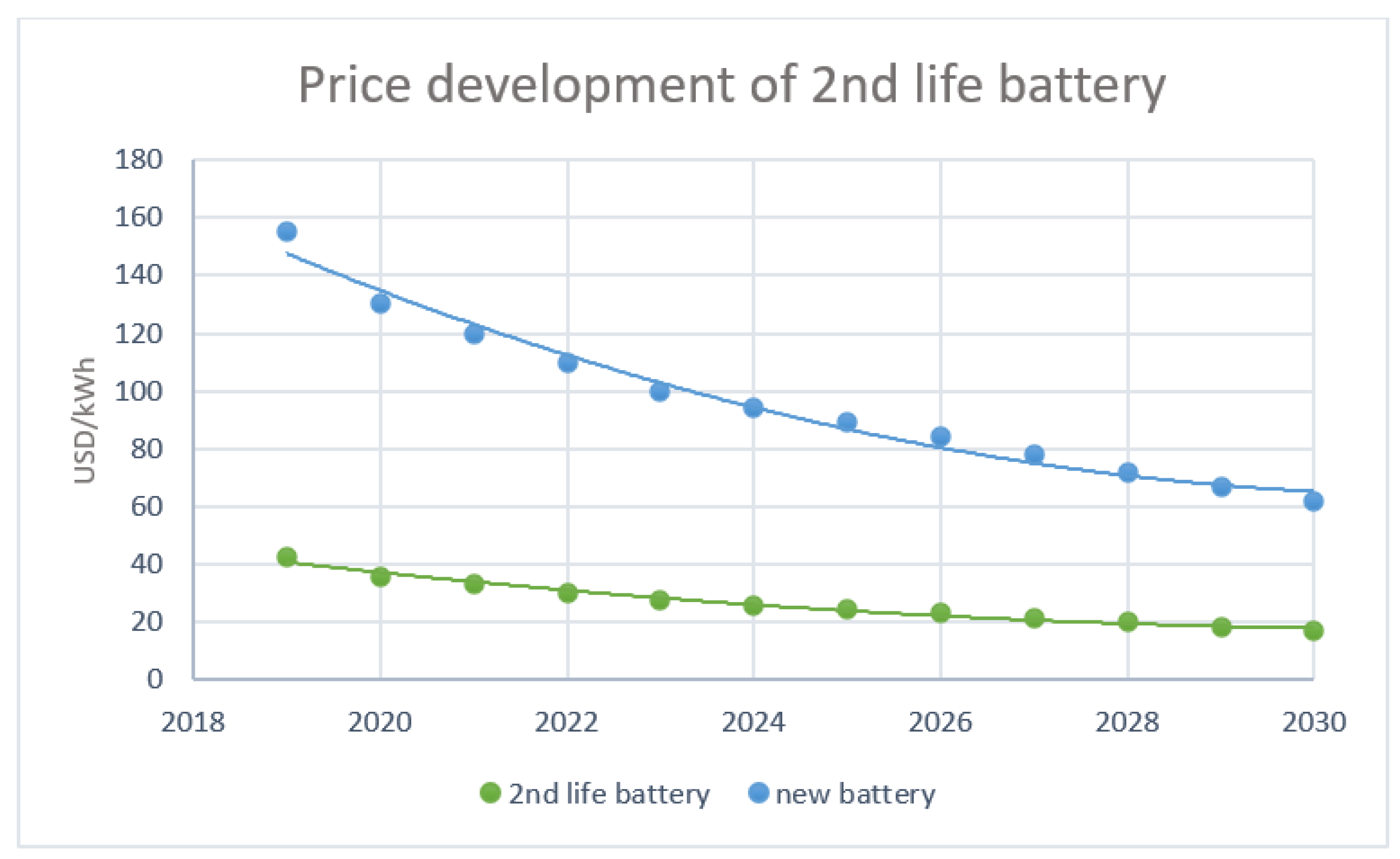

Table 6 and the approximate price development of 2nd life batteries can be seen in

Figure 4. Calculations of values cannot be documented in detail in this article, as the calculation was performed in MS Excel software and works with many values and functions. The main task on which the article focuses is to point out the possibility of secondary use of batteries from EVs and this computational model serves as a simulation of possible economic costs in the case of its application.

When using the above calculation to evaluate the 2nd life of the battery, the resulting price changes the most depending on the change in electricity consumption of the vehicle and the total mileage. If you increase consumption by, for example, 4 kWh/100 km and maintain a 100,000-km drive, the unit price of the battery will be reduced to USD 31. However, it should be noted that in this case, the number of remaining cycles for the secondary application of the battery also decreases at a lower cost. A lower number of 2nd life battery cycles can increase the overall cost of the investment, due to more frequent replacement of battery modules and expensive transportation of lithium batteries. The specific values are shown in

Table 7.

Other important results-sensitive parameters include the demand coefficient of the batteries used. This coefficient could be determined by a very costly market analysis through direct research. For this reason, it is more appropriate to use only sensitivity analysis (see

Figure 5).

Currently, the demand coefficient cannot be determined unambiguously. However, it can be expected to be higher due to the versatile use of lithium batteries. Demand for used lithium batteries in the future can easily reach up to 75%. With the condition 10% smaller (larger), the unit price of the 2nd life battery changed by 5.7 USD/kWh in 2019 and in 2029 it will change by 2.3 USD/kWh accordingly. On the contrary, the smallest dependence was found during the calculation on the selected DoD and charging voltage to evaluate the 2nd life battery. For example, when the DoD changed from 40% to 70%, the price of the battery decreased by approximately USD 1/kWh in 2019 and by less than half a dollar in 2029.

The above-calculated value of the 2nd life battery is the price only for the battery itself. For the calculation model, it is necessary to determine other expenses associated with the battery removed from the vehicle, testing, repair or transport. It will be assumed that most of these tasks can be done in an authorized service of the car company, where the hourly rate of the employee is €50–70 [

24]. The first service task corresponds to the actual removal of the battery from the vehicle. It takes approximately 3 h to completely replace the battery of a mid-size vehicle (Nissan Leaf) [

25]. From this, it can be deduced that the removal itself will take 90 min. Subsequently, it is necessary to connect the battery to the diagnostic devices and to replace the faulty battery cells. With freely available materials, it is not possible to determine how many cells will need to be replaced to ensure trouble-free reusability. Various analyses show a range from 0.001% to 10% [

26]. The 5% variant was chosen for this model. The price of one battery cell was set at EUR 72 per one piece using the portal ev-power.eu. Connection, disconnection and evaluation take 90 min [

27]. It takes approximately 18 h to disassemble and reassemble the entire battery [

26]. From this number, it can be estimated that it will take a minimum of 1 h and a maximum of 18 h to disassemble approximately 5% of the battery. The middle value that was chosen is 9 h. Packing and manipulation of the battery takes about 45 min for the worker [

26]. In total, it will be necessary to spend 12.75 h of work on one battery. Lithium batteries belong to the class of dangerous goods number 9—other dangerous substances and objects. This is mainly due to the possibility of the battery igniting spontaneously due to physical damage. For this reason, transporting these batteries is more expensive than with other components needed for battery storage. After a telephone consultation with Chemtrec, an approximate mileage rate for a 500-kg lithium battery was found. For this calculation, the value has been reduced to €1.25 per km, as a 43 kWh battery weighing approximately 250 kg is expected to be used. The road from Bratislava to Banska Bystrica with a length of 208 km was chosen as the average distance for battery transport in the Slovak Republic. Preparing for shipment takes about 0.75 h for the service worker [

26].

3.4. Important Investment Equipment

For the proper functioning of the battery storage, not only the batteries themselves are needed but also a substantial number of other devices. These are mainly DC/AC inverters, SCADA remote control system, transformers, storage containers and air conditioning. In the case of small repositories at dealers, it is necessary to include the fast charging station. For the batteries to be connected to the power system, their DC/AC inverters must first be used to change the nature of their energy from DC to AC. A modern three-phase inverter with an output of 50 kW from the manufacturer Kaco, whose supplies, including an integrated control system, was chosen for this calculation model. It can be connected to the superior system of the entire dispatching via USB or LAN port. The device is stored in a separate cabinet measuring 140 cm × 84 cm × 36 cm, which can be placed inside or outside the universal container. According to [

32] the market price was set at €3696. Universal storage containers were selected using the company Algeco s.r.o., which builds modular buildings in the Czech Republic with a variety of uses. Two options were considered for this model. The first larger container with dimensions 601 cm × 244 cm × 260 cm for the price of €2900. The basic electrical installation, including the switchboard, costs €192, air conditioning €958 and fire protection, including fire alarm, approximately €3300. Approximately 28 batteries can be accommodated in this container so that there are sufficient gaps between the batteries for airflow and space remains even for a small background for air conditioning, server and computer. The second smaller container with dimensions of 299 cm × 244 cm × 260 cm for the price of €1920. The price of electrical installation and air conditioning remains the same, only fire protection costs less—about €2000. Professional installation of batteries and the connection of other devices inside the battery storage was evaluated using the hourly rate of installation on electrical equipment for 13 EUR/hour [

33]. It will take approximately 1 h to install one battery and about 24 h to install the entire container, including inverters and support devices.

The small, decentralized battery storage will belong to the subcategory of production modules A2 (up to 100 kV) or the subcategory B1 (up to 1 MW). All manufacturers from category A2 are connected directly to low voltage. For B1, it depends on the local conditions of the distribution network, and this source can also be connected to low voltage. Due to this, it will not be necessary to install an expensive transformer at the expense of the car company. In the case of a large central repository, the installed capacity will certainly exceed 1 MW, due to which it will fall into the subcategory of production modules B2. This category is only connected to high voltage lines. For direct connection to the mains, it is necessary to change the low voltage inside the device (400 V) to a high voltage (22 kV). Transformers from RTS a.s. with an output of 1000 kVA costs €13,700, including installation. Regular annual inspection and maintenance cost €420, while as part of the simplification of the model, it is paid once during the procurement.

According to the Code, PSS certification is performed regularly at a time interval of 4 years. When determining the price of FCP certification as battery storage, it was found that there is no exact price list for any company yet. However, one of the interviewed experts set the price at €1950.

The fast-charging station was selected to have a communication interface for remote management and to be suitable for public use. The second condition would allow for the drawing of procurement subsidies from the European Union up to 55% of eligible costs. The EVlink Parking station charging station with an output of 2 × 22 kW was chosen for this model. This station is compatible with the Smart EV box, which will allow continuous management of the charging station with the possibility of optimizing the maximum power consumption. According to [

34,

35], the price including the Smart EV box was set at €4620. The photovoltaic power plant will not be included in the calculation model due to the small installation area on the universal container. It is not easy to determine the potential of this power plant without specifying a predetermined location and thus appropriately assess the price of its energy production.

To ensure trouble-free and reliable operation of the battery system, it is necessary to set up a continuous control dispatching center. The dispatcher will monitor and manage the capacity of the batteries and, in case there is a problem, immediately contact ČEPS. Besides, he will be in charge of shops with free battery capacity in the balancing market and will be involved in the creation of operational preparation. In order to ensure continuous operation and comfort of the operator, it is necessary to hire at least five dispatchers, who will alternate in a 12-h shift. The annual cost per dispatcher was set at €36,000. A simple SCADA system was chosen as the dispatching system, which will control the individual devices using an industrial computer located in the container. The SCADA program was very tentatively priced by the Control System company to €9500. The industrial PC was chosen from Advantech for €490. Although the control system can theoretically be controlled online from anywhere, permanent physical dispatching must also be considered. Therefore, the item office rental appears in the calculation, which was calculated using the unit rental price in Prague (€15 per square meter). The required area was set at 60 square meters to ensure the comfort of five workers. The model also works with a computer system cost of €770 per piece for each dispatcher.

3.5. Large Battery Storage Strategy from 2nd Life Batteries

Large battery storages are already being built both in the Czech Republic and in Slovakia. As a result, supplier companies offer components directly for this application and no costly technological development is required. This fact can be used by the automotive company, which takes over the technology from the suppliers and itself supplies the 2nd life battery. It is obvious from the above chapters that their batteries will significantly reduce the size of the total investment. On the contrary, more frequent battery replacement must be considered, which entails additional costs during operation. However, the cyclic change of batteries during the entire life of the device can also be used for the benefit of the car manufacturer. Depending on the energy market, it may regularly reduce or increase its storage capacity. The entered change in the number of batteries is always due to the default investment. On the contrary, the increase in connected power is based on the last known change. The input investments and parameters of the computational model are given in

Table 9 and

Table 10.

The main input parameter is the total number of 2nd life batteries used for this application. From this value, the investment costs for the batteries, the number of containers required to store the batteries and the total available commercial capacity of the device was calculated using the current price of the 2nd life battery. The device must have a sufficiently sized network connection to work properly. Therefore, as a second parameter, the user selects the connected power, which allows the two-way transfer of energy from the device to the power system. After that model calculates the investment costs for inverters and transformers. To increase the stability of the control power supply, the model of the transformer considers the required number of N + 1 transformers. During the regular replacement of the batteries, the number of batteries can be operatively increased or decreased, or the connected power can be increased. The last parameter chosen by the user is the discount, which is used to calculate the value of the financial indicator net present value (NPV).

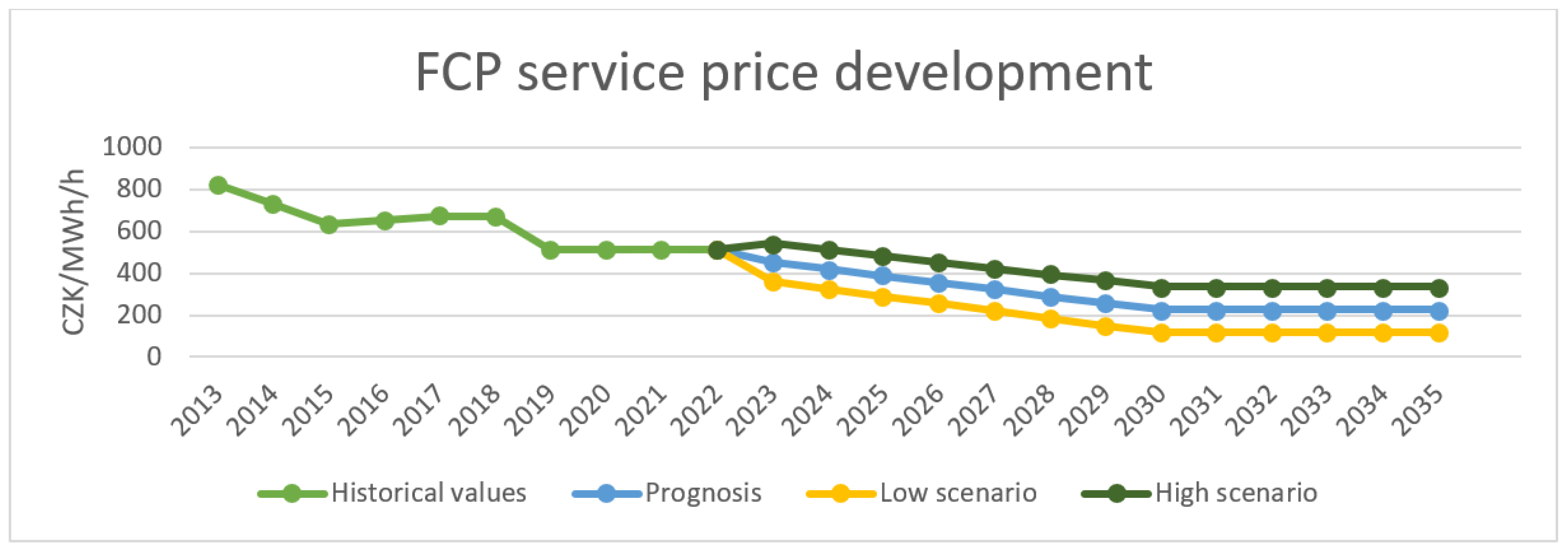

The computational model itself optimizes the amount of FCP service offered. It uses a series of conditions that work with connected power and trading capacity. It always strives to make the provision of PSS the primary source. This means that it will only transfer excess and unused capacity in the balancing market. From the series of conditions for offering FCP service, it is necessary to mention the interval of offering FCR from 3 to 5 MW, sufficiently dimensioned connected to power and sufficient commercial capacity to provide mutual FCP service. The balancing market will use the remaining trading capacity, only in case that several conditions are met. As an example, the condition of a minimum offered power may be 1 MW or a sufficiently dimensioned connected power. The model does not work with a direct dependence of revenues from the balancing market on free trading capacity but corrects the amount of traded energy based on the analysis of historical data of the balancing market. After generating financial flows from investing activities, the model calculates the amount of depreciation for determining the tax base. Depreciation is linear and the economic life was determined as follows: battery 5 years, inverter 15 years, universal container 15 years, transformer 15 years, dispatching 15 years and charging station 15 years. Operating cash flows other than electricity expenditures are not dependent on input parameters. These are personnel expenses and office rental. The electricity consumed was calculated using the number of positive energies sold on the balancing market and the air conditioning’s consumption. Due to the climate in the Czech Republic and Slovakia, the model assumed an annual use of air conditioning of 2232 h (6 months—12 h per day). Power consumption was set at 1500 W. As part of the refinement of the results, three scenarios of revenues from the provision of regulatory energy were worked on. For this reason, we also work with three scenarios of the tax base and subsequently with three scenarios of higher tax. Here, the model recognized whether the amount of depreciation is not higher than the tax base. After that, the model calculated the cash flows for each year and determined the NPV.

For this economic analysis, the entered parameters were calculated using the software Solver in MS Excel so that the resulting NPV was maximized. An evolutionary algorithm with several constraint conditions based on the above assumptions was used. Output investments and parameters can be seen in

Table 11 and

Table 12.

According to the calculation model, the NPV for this strategy came out in two positive values out of the three scenarios (see

Table 13). Based on the definition of a positive NPV, it can be concluded that this investment can be recommended and implemented.

Sensitivity Analysis of Large Battery Storage Strategy

The first sensitivity analysis shows the dependence of the best found NPV on the number of batteries installed in 2021 (see

Figure 7). This analysis assumed that there was no certain number of 2nd life batteries in 2021. For this reason, the automotive company should have an idea of how much it will pay to invest in storage. To find the best NPV value of all sensitivity analyzes, the Solver in MS Excel was used, limiting the time to find the best result up to 45 s.

In all three scenarios, the NPV reached a maximum of around 700 installed batteries in 2021. This is a relatively high number for which it is not clear whether the market will offer so many batteries. For possible decision-making, it was recommended to use a medium scenario, which reached a non-negative NPV of 370 installed batteries in 2021.

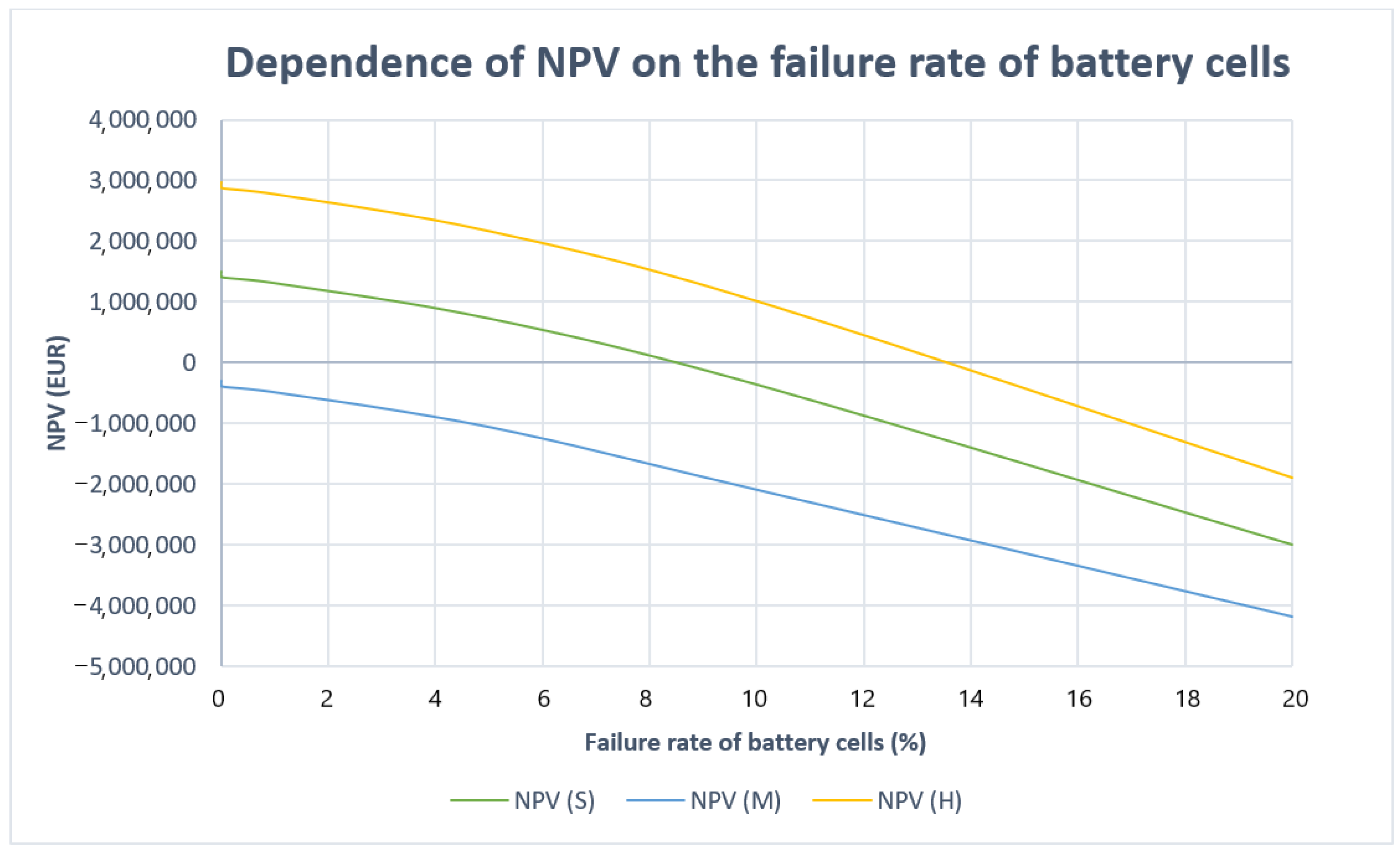

Another important analysis was the dependence of NPV on the failure rate of battery cells (see

Figure 8). Currently, it is known exactly how much service 2nd life batteries will need. However, today’s literature estimates that the failure rate of battery cells should be no more than tenths of a percent.

3.6. Small Battery Storage Strategy from 2nd Life Batteries

Every major automotive company has its network of authorized dealerships. There is no difference in the Czech Republic, where, for example, ŠKODA AUTO has approximately 190 branches. That is why a strategy of small battery storage, which places small storage in selected dealerships, were used. Of course, each dealer must first agree to the project because the repository will be installed on their land. In return, the car manufacturer will also build a fast-charging station as part of the project. It will serve not only the public but also the dealers themselves, who will always have one socket reserved for the needs of selling or servicing EVs. It can also be stated that in the case of the construction of a fast-charging station in the vicinity of the store, the demand for EVs will most likely increase.

The main input parameters of this strategy are the number of dealers and the number of 2nd life batteries in individual installations (see

Table 14). Input parameters are shown in

Table 15. By multiplying these two values, the total number of used batteries can be determined, and all investment costs associated with them. Furthermore, it is assumed that the 2nd life batteries will come from individual local dealerships, so the transport of 2nd life batteries to the storage location was not considered. The number of dealerships themselves was used to calculate the investment costs for universal containers, fast-charging stations, and inverters.

In this model, the power of the inverters was entered directly as an input parameter, mainly due to the possibility of connecting the storage to the low-voltage distribution network. The distribution system operator has different requirements for maximum power connectable to its networks, to which it is appropriate to adapt the model. As a result, in this strategy, it is not necessary to build transformers at the expense of the automotive company.

Another new input parameter is the central reservation. This value determines what percentage of the total usable capacity of individual devices will be used for centrally controlled dispatching for the provision of regulated energy. The remaining part of the capacity will be used for the needs of the fast-charging station, which should have sufficient capacity to charge at least one electric vehicle from batteries only.

The fast-charging station itself plays a significant economic role in this strategy. This is not the investment in the facility itself, but rather the costs and revenues from its operation. For this reason, it was decided to consider three possible scenarios again. In the first small scenario, it will be assumed that all operating costs will cover operating income (not the investment itself). The medium and high scenario is based on predictions of the low and medium scenario of the development of the number of EVs and charging stations from the source [

36]. Calculation of revenues and costs of the charging station and the introduction of some parameters was inspired based on [

37,

38]. Specifically, the following values were taken: the average annual mileage of the EV owner 13,000 km and the utilization coefficient of the public AC station 20%. Furthermore, to determine the yield, the number of charges at one public charging station per year was calculated concerning the total number of EVs and the total number of public charging stations. In the last phase of determining the yield, the time spent by one vehicle at the charging station (with an average battery capacity of 43 kWh) was calculated and multiplied by the selected charging price from the input parameters. The operating costs of the charging station and the revenues are based on the number of charges at one public charging station. However, this time a simplification has been introduced so that the costs will be the same for the medium and high scenarios. Using the number of charges per year and the average battery capacity, the amount of electricity consumed was determined. The distribution tariff for EV c27d on a 3 × 32 A circuit breaker from Czech energy plants (CEZ) was chosen. This tariff has an 8-h (night) low rate, which charges the battery in the storage, from which the next day will primarily draw energy to EVs. Other calculation procedures are like the previous strategy. The output parameters of this strategy can be seen in

Table 16 and

Table 17.

Additionally, in this strategy, in two out of three scenarios, NPV acquires positive values (see

Table 18).

Sensitivity Analysis of Small Battery Storage Strategy

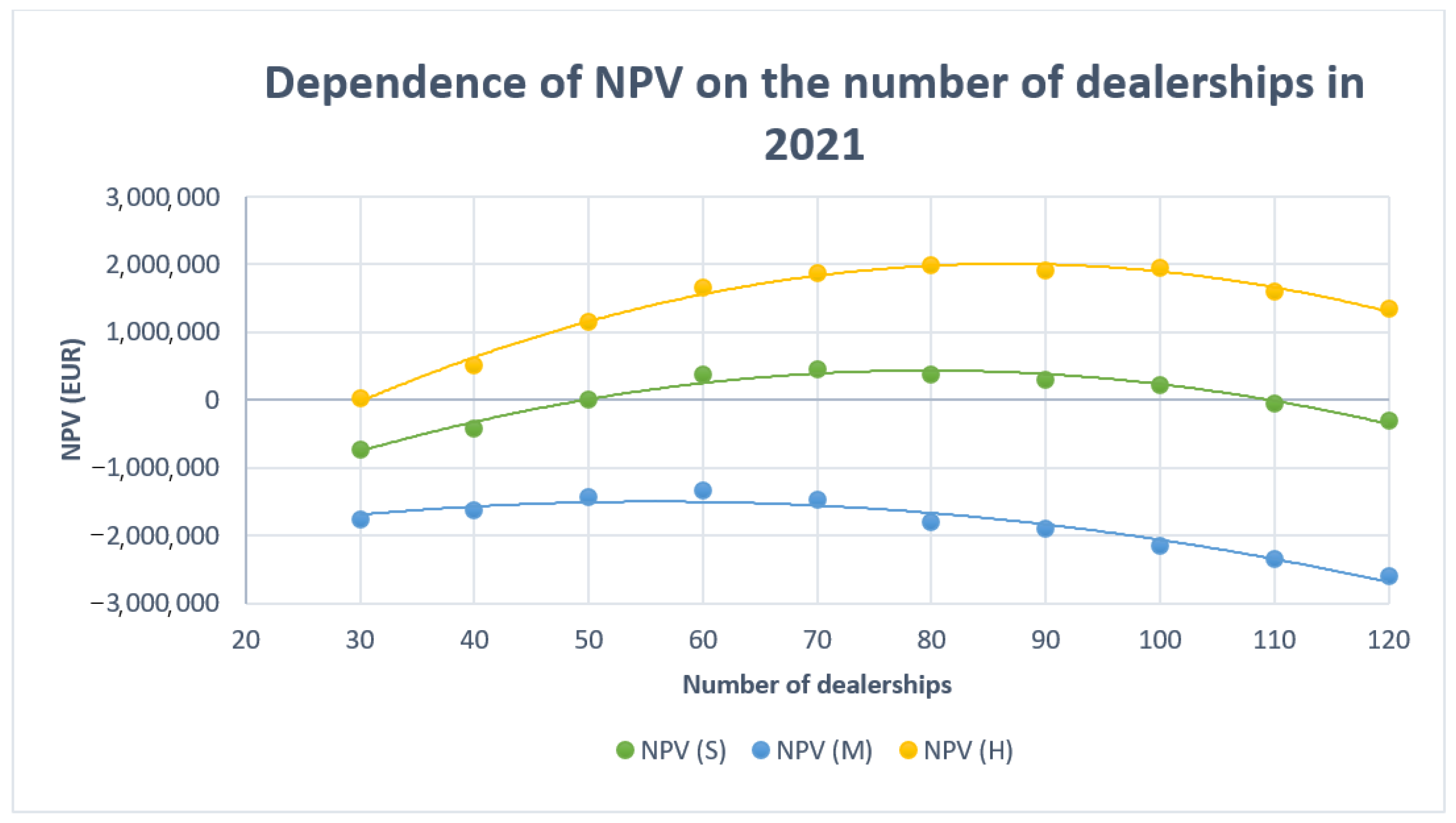

The dependence of the best-found value of NPV on the number of dealerships in 2021 was chosen as the first sensitivity analysis in this strategy. Most car companies have a great influence on what is happening in the dealership. However, they cannot order them to install a “foreign” facility on their land, from which they will not benefit financially. Therefore, for the right investment decision-making, it is necessary to examine the dependence of the initial number of dealerships in 2021 on the NPV.

From

Figure 9 it is clear that the right choice of the number of dealerships for this strategy will be crucial for the success of the project. In all three scenarios, the course has the shape of a concave function, which reaches a maximum in values from 60 to 90 dealerships. For the final decision, it is again appropriate to use the middle scenario, which in this case acquires positive values in the range from 50 to 110 dealerships in 2021.

The second sensitivity analysis shows the dependence of the best found NPV on the connected power, which may be limited by the distribution system operator due to the insufficiently dimensioned network (see

Figure 10). Therefore, it is appropriate to know the impact of the change in connected power on the NPV before implementation.

When choosing a medium scenario, the NPV strategy achieves positive values only when choosing a power of 100, 150, 200 or 250 kW. Furthermore, the values were negative, mainly due to the limited size of the container located at the dealer and the expensive 50 kW inverter.