Abstract

Construction projects in Saudi Arabia are frequently plagued by cost overruns and time delays, with change orders being a major contributing factor. These modifications, which can occur at various stages throughout the project lifecycle, tend to negatively impact costs and cash flows. This study developed a classification impact index model to assess the potential impact of change orders on contractors’ cash flow in building construction projects. This study identified the factors and subfactors affecting contractors’ cash flow, organizing them into a hierarchical structure of main and sub-main factors. The relative importance of these factors was then assessed using the Analytical Hierarchical Process (AHP). The findings showed that project financing schemes had the most substantial impact (44%), followed by contract type (30%) and characteristics of change orders (26%). Among the subfactors, cash availability under project financing had the highest influence at 56%, while the value of change orders was the most significant subfactor under change order characteristics, contributing 30%. The Multi-Attribute Utility Theory (MAUT) was subsequently used to evaluate the attributes of these factors, applying utility scores to provide a more comprehensive assessment. The resulting Change Order Impact Index integrates AHP and MAUT to quantify the impacts of change orders. This model categorizes the effects of change orders into four levels: minor, moderate, significant, and severe. The developed Change Order Impact Index provides a systematic approach for proactively managing financial risks, optimizing project financing decisions, and supporting contractors in mitigating the impacts of change orders to maintain financial stability and reduce negative impacts on their cash flow.

1. Introduction and Literature Review

Change orders are an inherent and often unavoidable component of construction projects, introduced to accommodate design modifications, unforeseen site conditions, or evolving project requirements. Their occurrence can lead to significant implications for contractors, particularly in terms of financial performance and cash flow management. As such, the financial impact of change orders has become a topic of growing importance within both academic research and industry practices. Given the significance of this topic a review of the relevant literature was conducted using academic databases including Scopus, Web of Science, and Google Scholar. Keywords such as “cash flow”, “change orders”, “construction finance”, “project disruptions”, and “contractor financial risk” were used to identify studies addressing the financial implications of change orders in construction. A wide range of peer-reviewed articles and technical reports were reviewed to provide both theoretical insights and practical context.

While change orders provide necessary flexibility, poor management can lead to significant disruptions, including cost overruns, schedule delays, and contractual disputes [1,2,3]. Various studies have identified change orders as a primary contributor to financial instability, often resulting in legal claims and project inefficiencies [4,5]. Given their impact on project performance, the proper management of change orders is essential to mitigating adverse financial and operational effects [6,7].

Research on change orders in construction has been extensive, yet much of it focuses on specific aspects such as cost implications, scheduling effects, or legal disputes, rather than providing a holistic assessment of their financial consequences. While some contractors perceive change orders as opportunities to increase revenue, ineffective management can severely impact financial stability and long-term business sustainability [8,9,10].

Beyond their direct effect on project budgets, numerous financial risks influence contractors’ cash flow. Several studies have examined these risks, highlighting their significance in determining contractors’ financial health. Chadee et al. [11] identified inconsistent payment cycles as a critical challenge, leading to liquidity shortages and unpredictable financial planning. Sahu et al. [12] emphasized procurement inefficiencies and inventory mismanagement as significant contributors to cash flow disruptions, while Kyrychenkoand Katsevych [13] explored how economic instability, inflation, and currency fluctuations complicate financial forecasting. These studies underscore the importance of managing financial risks to maintain contractors’ stability [14,15].

Many factors contribute to financial instability in construction projects. Martanti et al. [16] demonstrated that variation orders frequently result in unexpected cost escalations, complicating financial planning. Sanjaya and Isvara [17] found that procurement inefficiencies and delayed payments are major risks affecting contractor liquidity. Waty [18] investigated how supply chain disruptions and contract mismanagement lead to unpredictable expenses, while Muhammad et al. [19] identified economic instability, inflation, and contractual disputes as exacerbating cash flow inconsistencies. Buertey and Adjei-Kumi [20] categorized cash flow risks as endogenous (contractor-driven) and exogenous (client-driven), highlighting late payments and forecasting errors as major contributors to financial distress.

A structured literature review was conducted to identify key factors influencing project performance, contractors’ cash flow, and financial stability in construction. Various studies have examined the impact of macroeconomic conditions, financial policies, cash flow management strategies, investment decisions, and payment structures on project success. Kazar [21] analyzed public project cash flow in Turkey, finding that inflation, consumer price index fluctuations, and project duration significantly influence payments from public agencies to contractors. Delayed payments from government entities were identified as a leading cause of financial instability, contributing to project delays and disputes. Similarly, Firmansyah et al. [22] investigated investment decisions, free cash flow, and debt policies, concluding that poor investment planning and high debt dependency negatively impact long-term financial stability.

Further research by Maulanisa [23] examined engineering, procurement, and construction (EPC) projects, demonstrating that subcontractor payment delays and procurement inefficiencies contribute to cost overruns and weaken contractors’ financial resilience. Using system dynamics modeling, the study emphasized the importance of structured payment systems to maintain liquidity. Refs. [7,24,25,26,27] explored broader construction industry challenges, identifying risk mismanagement, cash flow forecasting errors, and contractual disputes as key factors contributing to financial losses. Similarly, F. Majaham et al. [28] reviewed internal factors affecting construction firm growth, noting that financial mismanagement, inadequate project oversight, and weak leadership contribute to cash flow volatility and project underperformance.

Additional studies reinforce these findings by linking cash shortages, inefficient payment cycles, and risk allocation to project failures. Voigt et al. [27] examined how delayed payments disrupt procurement schedules, extend project timelines, and reduce labor efficiency, often leading to disputes. Dorrah and McCabe [29] applied agent-based simulations and game theory to analyze cash flow and payment negotiations, illustrating how payment imbalances disproportionately affect small-scale contractors. Refs. [19,29] explored cash flow management in Nigerian construction projects, identifying material procurement inefficiencies, credit restrictions, and the absence of pre-bid cash flow assessments as major contributors to financial distress. Alshibhabi and Eazouni and others [21,30,31] further categorized cash flow risks, demonstrating that late payments and contract breaches are among the most significant external risks affecting contractor liquidity. Safitre et al. [32] investigated the role of payment variations, showing that structured down payments and progress payments significantly contribute to stabilizing contractors’ cash flow.

Several computational approaches have been developed to enhance cash flow forecasting in the early stages of construction projects. Jiang et al. [33] and Zayed and Liu [34] developed models based on machine learning and reinforcement learning to address planning-related financial risks. Söylen et al. [35] and Zheng and Tu [36] introduced time-series forecasting frameworks using wavelet transforms to improve prediction accuracy. Kim and Grobler [37] proposed a BIM-based approach for estimating cash flow by integrating scheduling and quantity take-off data. At the enterprise level, Zhu et al. [38] applied advanced neural network models to refine free cash flow predictions. Although these studies demonstrate significant progress in financial forecasting, they primarily focus on pre-construction planning and do not explicitly address the financial consequences of change orders during the execution phase.

Despite extensive research on change orders and their associated impacts, most studies have primarily addressed individual aspects such as cost overruns, schedule delays, and legal disputes. However, a comprehensive, quantitative evaluation model that systematically quantifies the financial risks and implications of change orders on contractor cash flow remains absent. While existing methodologies, such as fuzzy logic models and deep learning techniques, assess isolated effects, they do not provide an integrated approach for evaluating overall financial risks. This gap is particularly relevant in the Saudi Arabian construction industry, where rapid development under Vision 2030 has led to increased project modifications and financial uncertainties for contractors. Saudi contractors often face financial difficulties due to excessive change orders, the absence of reliable financial assessment tools, and insufficient risk mitigation strategies.

Therefore, the primary objective of this study is to develop a Change Order Impact Index (COII), a structured and quantitative model designed to enhance the understanding of change order impacts, particularly in the Saudi Arabian context. The COII integrates financial, contractual, and operational factors to provide a systematic framework for assessing cash flow disruptions and financial risks caused by change orders. By employing the Analytical Hierarchy Process (AHP) and Multi-Attribute Utility Theory (MAUT), the proposed model offers contractors a proactive tool to assess both short-term and long-term financial consequences of change orders, supporting improved financial risk management and project success.

2. Research Methodology Phases

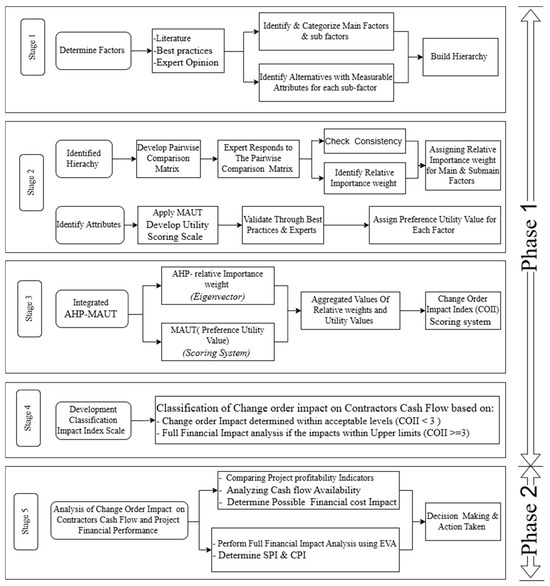

The research methodology, depicted in Figure 1, is divided into two phases. The first phase involves establishing a classification framework that categorizes change orders based on their financial implications, particularly their effects on contractors’ cash flow and cost stability. When significant deviations in cost or schedule occur, further analysis is conducted to examine broader impacts. This phase considers a wide array of factors that influence project financing and affect the financial performance of the project, in addition to contractors’ cash flow. These elements are then systematically organized into a hierarchy, categorizing them into main and sub-main factors. The AHP is then employed to evaluate the relative importance of these factors, followed by a verification of the consistency and reliability of the derived weights.

Figure 1.

Research stages.

The second phase focuses on developing an index to quantify the financial effects of change orders on contractors’ cash flow and cost performance. In cases requiring a deeper examination, advanced analytical methods are utilized to assess wider project implications. This process involves a comprehensive integration of the relative weights determined in the first phase with specifically assigned utility values. These elements are combined to produce a unified, singular quantifying index. This index is designed to facilitate a proactive and thorough evaluation of the potential impacts that change orders could have on the cash flow of a construction project, providing contractors with a valuable tool for advanced planning and effective financial management.

2.1. Stages of Phase One

Phase one of the research methodology is divided into four stages, as shown in Figure 1. These stages are designed to achieve the research objectives in a systematic manner.

2.1.1. First Stage: Identification and Categorization of Factors

The first stage focuses on identifying and categorizing the factors that influence how change orders impact contractors’ cash flow. These factors are systematically classified into main factors and subfactors, forming a hierarchical structure that clarifies their relationships with the overall objective. This structured classification enables a clear differentiation between criteria and sub-criteria, ensuring an organized framework for analysis. Each subfactor is further broken down into quantifiable attributes, which serve as measurable indicators of its impact. These attributes are assigned utility scores, allowing for a structured and objective assessment of the influence of change orders on contractors’ cash flow. By establishing a well-defined structure, this stage lays the foundation for subsequent evaluations, ensuring that all relevant factors are systematically incorporated into the analysis.

2.1.2. Second Stage: Determining Relative Importance Using AHP

The second stage employs the Analytic Hierarchy Process (AHP) to determine the relative weightings of the factors identified in the first stage. This process systematically prioritizes factors based on expert assessments, ensuring that decision-making is data-driven and reflective of industry insights.

The process begins with the structuring of the factors into a hierarchical model, after which they are evaluated using pairwise comparisons. Experts assign preference values on a scale from 1 to 9, where a score of 1 indicates equal importance between two factors and a score of 9 signifies that one factor is far more influential than the other. The pairwise comparison matrix enables the computation of eigenvectors, which determine the relative weightings of each factor in affecting contractors’ cash flow.

To ensure the consistency and reliability of expert judgments, a consistency ratio (CR) check is performed. The CR must remain below 10%, confirming that the comparisons are logically coherent. If the CR exceeds this threshold, expert assessments must be refined to improve consistency. This validation step enhances the reliability of the weighting system and strengthens the overall analysis.

Following the AHP weighting process, the Multi-Attribute Utility Theory (MAUT) is applied to further refine the evaluation. MAUT assigns a preference score ranging from 1 to 5 to each factor, reflecting its significance in financial risk assessments. This structured scoring system ensures a comprehensive evaluation of risk levels, incorporating both the relative importance of factors and their specific impact on contractors’ cash flow. The integration of AHP and MAUT provides a balanced decision-making framework, combining qualitative expert evaluations with quantitative impact measurements for a more robust financial risk assessment.

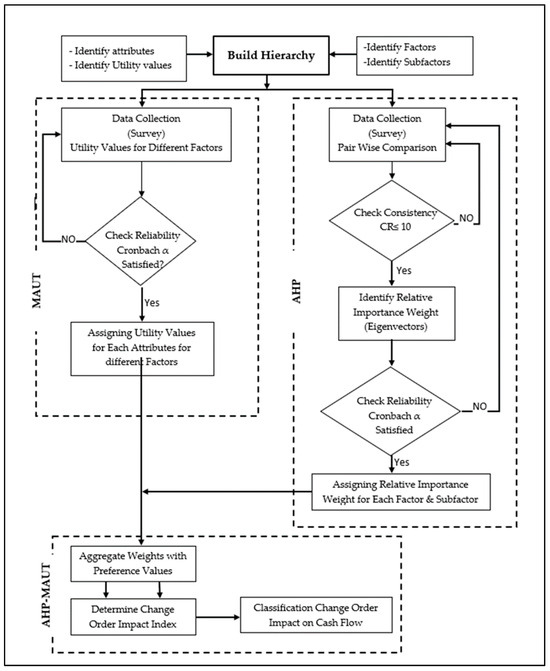

2.1.3. Third Stage: Integration of AHP and MAUT for COII Development

The third stage integrates the AHP and MAUT methodologies to develop the Change Order Impact Index (COII). This step focuses on establishing preference utility values for each attribute within the subfactors, utilizing MAUT to quantify their effects. By merging AHP-derived relative importance weights with MAUT-based severity scores, the methodology ensures a multi-dimensional evaluation of how change orders affect contractors’ cash flow. The integration of these two approaches enhances the precision and objectivity of the assessment, allowing for a detailed quantification of change order impacts.

2.1.4. Fourth Stage: Classification of the COII Scale

The final stage involves developing a classification scale for interpreting the COII values, providing a structured means of categorizing the potential financial impact of change orders on construction projects. This classification system allows decision-makers to systematically assess and compare the severity of financial disruptions, facilitating more informed risk management strategies. The COII serves as a comprehensive index that consolidates multiple factors into a single, interpretable score, ensuring practical applicability for industry professionals.

Upon completing these four stages, Phase One of the study is finalized, establishing a well-structured model for assessing the financial impact of change orders on contractors’ cash flow. The methodology for Phase One and its four stages is depicted in Figure 2, illustrating the step-by-step integration of AHP and MAUT into the assessment framework. This structured approach ensures that all relevant factors are systematically evaluated, providing a robust and data-driven decision-making tool for analyzing change order impacts in construction projects.

Figure 2.

Change Order Impact Index model development.

2.2. Stage Five of Phase Two

In the second phase, the change order impact on the project’s financial performance is evaluated based on the imposed change order. This phase is important if the COII value is relatively high and can jeopardize the financial performance of the construction project. After this phase, the contractor will not only have a clear understanding of the impact of the change order on their cash flow but also its impact on the overall financial performance of the project.

This phase will provide the contractors with different scenarios to predict and mitigate different impacts of the change order on the project’s financial and schedule performance and therefore provide the contractor with a powerful tool to communicate these impacts among stakeholders and provide clear justifications to negotiate or proactively litigate these impacts.

In this phase, the profitability indicators along with the Schedule Performance Index (SPI) and Cost Performance Index (CPI) are utilized to quantify these impacts. To evaluate and mitigate financial and schedule-related disruptions, advanced financial analysis and time-based performance assessment techniques are applied, ensuring a structured and data-driven approach to understanding the effects of change orders.

The analysis also considers factors such as cash liquidity availability and the financial impact of change order timing. A crucial component of this phase is timing analysis, which correlates with the project’s S-curves. These curves illustrate the relationship between time and project finances, capturing both inflows and outflows affected by the imposed change order. Further details are provided in the model analysis section.

3. Data Collection and Analysis

To construct the COII model, a substantial amount of data is required, focusing on various factors that affect the financial performance of a project and the cash flow of contractors. These factors should be organized into categories and then structured hierarchically. As detailed in the methodology section, it is essential to assign a relative weight to each factor to reflect its impact on the contractor’s cash flow. For each factor, a standardized utility scale and a corresponding utility score need to be established. These scores, combined with the factors’ relative weights, are aggregated to develop the COII. The section highlights the data collection processes used in the development of this model.

3.1. Factors Affecting Contractors’ Cash Flow and Project Financial Performance

An extensive literature review was conducted to identify key factors influencing contractors’ cash flow and financial performance in construction projects. Several studies have highlighted critical issues such as cost and time overruns, ineffective cash flow models, and fluctuations in client financial statuses [6]. Payment delays, cost escalations, scheduling inaccuracies, and the impact of change orders have been identified as significant factors [5,6,39]. Additionally, late payments, lengthy claim resolution processes, loan repayments, consultant directives, and interest rate changes have been identified as significant challenges impacting cash flow [6].

Broader economic conditions, project duration, accounts payable and receivable, construction costs, retention practices, loan repayments, and tax considerations have also been identified as major influences on financial performance [33]. Contractors’ performance has been linked to factors such as experience, resource management, financial stability, and client relationships [40]. A framework integrating financial and non-financial elements, such as project costs, adherence to schedules, contractual compliance, and risk management strategies, has been proposed to comprehensively assess financial performance [40].

The impacts of different contract types, such as lump-sum and unit price contracts, on cash flow have been explored [3]. The significant effects of change orders, particularly their timing, scope, and complexity, on financial outcomes have been analyzed [2]. Effective project management practices, such as monitoring schedules, resource allocation, and clear communication, have been found to be crucial for enhancing cash flow [7]. Financial risk management has also been highlighted as important for reducing financial uncertainties and stabilizing cash flow [9].

Further studies have identified factors causing delays in Saudi Arabian construction projects, such as ineffective project management, design changes, financial constraints, and labor shortages [15]. Factors influencing change orders in Saudi Arabia’s oil and gas sector, including design errors, scope modifications, client demands, and unforeseen site conditions, have been identified [4]. Contractor selection criteria, including technical competence, past performance, financial capacity, and project management skills, have been found to be critical to the success of public projects [41]. Key performance factors during the implementation phase of construction projects in Iraq, including project planning, risk management, resource availability, and stakeholder engagement, have been identified [42]. Causal relationships between various delay factors, such as poor planning, a lack of coordination, financial issues, and contractor inexperience, have been analyzed [24]. The positive impact of effective change order management on project success has been demonstrated [1]. The effects of change orders on timelines, costs, and project outcomes have been assessed using AHP [43].

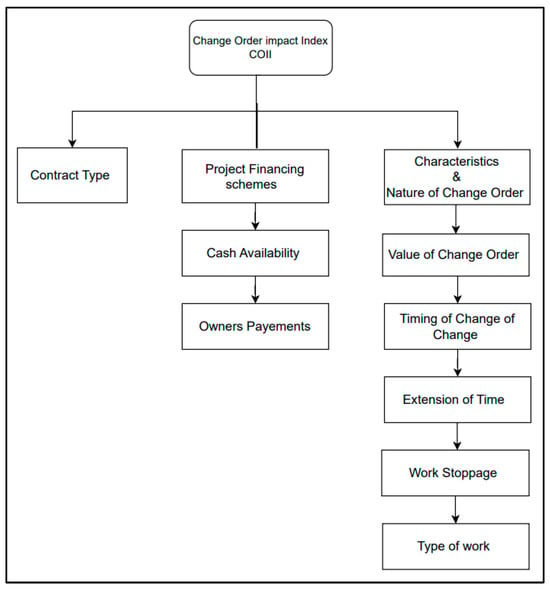

Based on the findings from these studies and extensive interviews and surveys with local experts, it has been determined that contract type, project financing schemes, and the characteristics and nature of change orders are the primary factors affecting contractors’ cash flow. The term “characteristics and nature of change orders” is used in this study to collectively describe key attributes of a change order that specifically influence financial outcomes, its value, timing, whether it results in an extension of time, involves a work stoppage, or requires a specific type of work. These are treated as subfactors under this category. Similarly, cash availability and owner payments are identified as subfactors under project financing schemes. The factors and subfactors considered in this study are organized into a hierarchical structure, as shown in Figure 3.

Figure 3.

Factors and subfactors for COII.

3.2. Factors Utility Values

For each selected factor, specific attributes that contribute to the overall financial performance and therefore affect the contractors’ cash flow will be measured to assess their impact. The attributes considered in this study for the factors and subfactors are shown in Table 1.

Table 1.

Utility attributes for different factors.

4. Data Analysis and Model Development

In this section, data collected from the questionnaire surveys are analyzed and interpreted. The findings are also discussed to give better reflections on the proposed study.

In order to develop the classification impact index model, necessary data regarding the relative weights of the main and subfactors were collected through a survey sent to contractors, consultants, and experienced construction practitioners in the industry via a questionnaire. The respondents of this survey are shown in Table 2. Utility values were obtained from best practices, standards, and previous studies.

Table 2.

Breakdown details of the research sample.

4.1. The Sample Characteristics

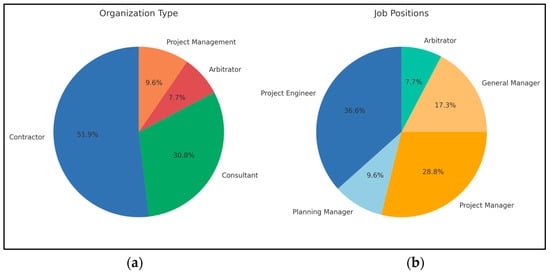

The first part of the survey form is designed to gather general information about the respondents, including the name of their organization, the type of organization, job/position, education level, years of experience, industry experience, and the most common types of contracts used in their projects. This section aims to provide an understanding of the background and experience of the respondents.

As shown in Figure 4a, the types of organizations that respondents work for include contracting companies (51.9%), consultant offices (30.8%), project management offices (9.6%), and arbitration offices (7.7%). Additionally, Figure 4b provides insights into respondents’ job positions within these organizations, with 36.5% working as project engineers, 28.8% as project managers, 17.3% as general managers, 9.6% as planning managers, and 7.7% as arbitrators.

Figure 4.

Respondent distribution: (a) Organization type; (b) Job position.

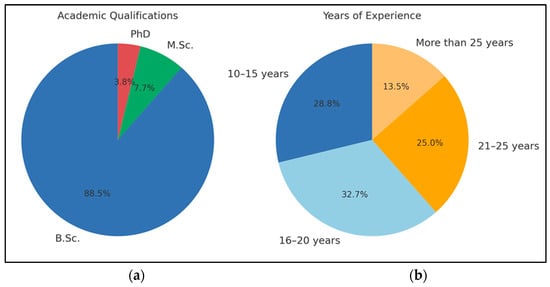

The academic qualifications of participants are shown on Figure 5a, where 88.5% of respondents hold a B.Sc. degree, 7.7% hold an M.Sc. degree, and 3.8% hold a PhD degree. Moreover, Figure 5b shows the experience level among the participants, where 28.8% have experiences between 10 and 15 years, 32.7% between 16 and 20 years, 25% between 21 and 25 years, and 13.5% with more than 25 years of experience.

Figure 5.

Respondent distribution: (a) Academic qualifications; (b) Years of experience.

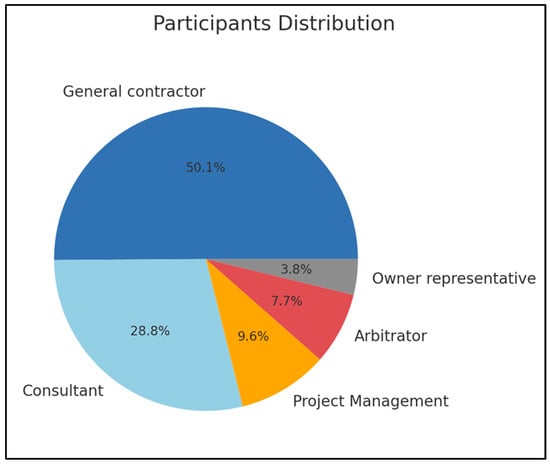

Figure 6, titled “Industry Previous Experience”, shows respondents’ prior experience in the construction industry, indicating that 50% have experience in contracting, 28.8% in consulting, 9.6% in project management, 7.7% in arbitration, and 3.8% as owner representatives.

Figure 6.

Respondents’ previous experience.

4.2. Determining Relative Weights

The relative importance weights for main and sub-main factors were calculated from data collected through pairwise comparison matrices from the distributed surveys. Out of 120 surveys sent, only 52 met the necessary criteria for inclusion in this study. This is mainly due the complex nature of the pairwise comparison matrix, leading to numerous surveys being either incomplete or not meeting consistency standards, with a consistency ratio exceeding 10% as stipulated by AHP guidelines. The relative weights for the main factors are referred to as Level 1 (W1), while the relative weights for subfactors are referred to as Level 2 (W2). Finally, the overall relative weight (W3) is the multiplication product of W1 × W2. These relative importance weights for factors and subfactors considered in this research are shown in Table 3.

Table 3.

Relative weights for factors and subfactors.

4.3. Data Reliability

Reliability refers to the consistency and stability in the results of a test or scale. The reliability of expert responses was verified using the Cronbach’s alpha approach, which is the most widely applied estimator of internal consistency. Cronbach’s alpha is a coefficient that measures the ratio of true variance to total variance and is based on the number of observations, variances, and covariances among the items. It is determined using Equation (1). In this study, the reliability analysis was conducted using Microsoft Excel spreadsheets.

where

n is the number of points;

vi is the variance of scores for each point;

V is the total variance of all data points.

Cronbach’s alpha coefficient of reliability is measured on a scale from 0 to 1. A higher value indicates greater reliability. A score of 0.70 or higher is generally considered acceptable. Table 4 provides typical Cronbach’s alpha values and their interpretations.

Table 4.

Cronbach’s alpha and its interpretation.

Main Factors Relative Weight Data Reliability

To verify a respondent’s reliability, each variance is measured against the overall variance using Cronbach’s alpha. The reliability of the main factors and subfactors are calculated and ranged from 0.75 to 0.91, showing high reliability for these weights. The reliability for main factors and subfactors are shown in Table 5 and Table 6, respectively.

Table 5.

Reliability of main factors.

Table 6.

Reliability of subfactors.

4.4. Determining Utility Values

The main factors influencing contractors’ cash flow due to change orders include project financing schemes, contract type, and change order characteristics. The upcoming sections provide a comprehensive analysis of these factors, detailing their utility scores and evaluating their financial impact. This section introduces the methodology used to develop utility values for each factor. By relying on industry best practices, expert assessments, and empirical data, the framework ensures a structured and reliable evaluation of financial aspects. A multi-criteria approach is applied to assess each factor, offering a precise representation of its effect on contractor liquidity and overall financial stability.

Within this section, the attributes associated with each subfactor are analyzed using the MAUT technique. Utility values are assigned to reflect their significance in determining the financial consequences of change orders on contractors’ cash flow. These values range from 1 to 5, where 1 signifies a minimal effect on cash flow, while 5 indicates a severe impact. Utility values for each subfactor are derived from established standards, industry benchmarks, and previous research. The following subsections describe the methodology used in assigning these utility values, ensuring a clear and systematic approach to financial evaluation.

4.4.1. Cash Availability

Cash availability plays a crucial role in determining how contractors manage financial disruptions caused by change orders. Several studies have highlighted the importance of effective cash flow management in mitigating financial risks and ensuring project success [6,9]. It has been researched that while advanced payments are beneficial for contractors, they do not necessarily guarantee positive project cash flow, but the success of any project depends on organizational management and project performance [44].

Payment delays, change orders, and project financing schemes are significant factors affecting cash flow [11,33,45,46]. Effective project management practices, such as schedule monitoring and resource allocation, are crucial for maintaining positive cash flow [7]. Additionally, the timely resolution of claims and the implementation of robust financial risk management strategies are vital for stabilizing cash flow [9,31]. In a study, it was concluded that contractors’ limited access to finance, particularly bank loans, poses a major barrier to project performance [47]. A study defined 19 key indicators, including 17 financial and 2 non-financial, to evaluate and model contractor liquidity based on multiple discriminate analyses [48]. Understanding the interplay of these factors and implementing appropriate strategies can significantly improve a contractor’s financial performance and overall project success.

To assess the impact of cash availability on contractors’ cash flow, a scoring system has been developed. This system assigns a score from 1 to 5, where 1 indicates a minimal impact and 5 signifies a severe impact. A score of one reflects a scenario of ample cash reserves, while a score of two suggests a moderately complex financial situation. A score of three indicates reliance on bank loans, which can have mixed effects on financial stability. A score of four represents a heightened financial risk, warranting further investigation. Finally, a score of five signifies reaching loan limits, which can have severe implications for the contractor’s financial health. This scoring system provides a comprehensive framework for evaluating the financial stability of construction projects. The utility values and their impact interpretations are shown in Table 7.

Table 7.

Utility score and interpretation for the cash availability subfactor.

4.4.2. Owners’ Payments

The status of owner’s payments affects how contractors handle financial risks associated with change orders. Timely payments from owners are essential for maintaining the financial health of construction projects. Delays in payments disrupt cash flow, leading to financial strain, project delays, and quality issues [11,45]. Effective cash flow management, including accurate forecasting and risk assessments, is critical for addressing these challenges.

Contractual provisions, such as those outlined in FIDIC contracts, play a pivotal role in managing payment terms and resolving disputes [49,50]. Adherence to these provisions helps ensure timely payments and reduces financial risks. Additionally, delayed payments can negatively impact worker productivity, which is vital for the overall success of projects [51].

To quantify the impact of payment delays, a scoring system is developed. This system assigns a score ranging from 1 to 5, where 1 represents timely payments and 5 indicates significant delays, as illustrated in Table 8. By using this scoring system, contractors can assess the severity of payment delays and implement proactive measures to mitigate their effects. The scoring system, aligned with FIDIC clauses, provides an effective framework for evaluating how payment timing influences the financial stability of construction projects. However, it is also essential to consider external economic factors and market conditions, as they can have a significant impact on cash flow dynamics.

Table 8.

Owners’ payment status and its impact utility value interpretations.

4.4.3. Contract Types

Different contract types influence the financial risks that change orders impose on contractors’ cash flow. The choice of contract type plays a key role in defining a contractor’s financial risk profile. Lump sum contracts, which provide cost certainty for the owner, can expose contractors to significant financial risks in unforeseen circumstances. Unit price contracts offer greater flexibility but require precise cost management and accurate measurements to avoid disputes. Cost-plus contracts transfer much of the risk to the owner but may lead to cost overruns if not properly controlled. Timely owner payments are critical to sustaining contractor cash flow and minimizing the negative effects of delays, as highlighted in [11,45]. Provisions in FIDIC contracts [49,50] play a crucial role in managing payment terms and resolving disputes. Furthermore, understanding the impact of delayed payments on workforce productivity is vital for project success [51]. Effective cash flow management, supported by accurate forecasting and risk assessments, is indispensable for reducing financial risks. The Cash Flow Risk Index (CFRI) was introduced to assess risks impacting cash flow, aiding informed decisions for improved outcomes and financial stability [9]. A scoring system was developed to assess these impacts on a scale from 1 to 5. This scoring framework, along with its interpretations, provides contractors with a comprehensive tool to manage cash flow and effectively navigate project risks based on the contract type. The scores and their corresponding interpretations are presented in Table 9.

Table 9.

Contract type utility scores and impact interpretation.

4.4.4. Change Order Values

The potential impact of change order values on contractor cash flow can be comprehensively understood by integrating a MAUT scoring system with relevant FIDIC clauses. This approach enables contractors to anticipate the financial implications of change orders based on their value and the associated contractual conditions. For instance, minor change orders might have a minimal impact, while significant changes can lead to substantial disruptions or severe financial challenges. By associating these scenarios with specific FIDIC clauses, contractors can gain insights into how contractual terms affect cash flow, enhancing their ability to manage risks and maintain financial stability amid project modifications. This scoring system, presented in Table 10, offers a structured approach to assessing the impact of change order values on cash flow, ranging from minimal to severely impactful scenarios within the context of FIDIC contractual terms. The framework is supported by insights from studies conducted in [8,50,52].

Table 10.

Change order values and score interpretations.

4.4.5. Timing of Change Orders

The timing of change orders has a significant impact on contractors’ cash flow and overall project financial performance, as shown in several studies [14,43]. The possible effects of change order timing on contractors’ cash flow are presented in Table 11.

Table 11.

Change order time impact on the contractor’s cash flow.

4.4.6. Time Extension

Time extensions related to change orders significantly impact contractors’ performance and cash flow, as evidenced by numerous studies [43,53,54,55]. These extensions often result in increased overhead and labor costs, payment delays, and disruptions to workflows, which collectively hinder project timelines and financial stability. Insights from Purnus and Bodea [8] further support these findings, emphasizing that effective financial planning and cash flow analysis are essential for mitigating the risks associated with change orders.

The financial impact of time extensions on contractors’ cash flow can be systematically evaluated using structured methodologies. For instance, tools like the MAUT framework, as discussed in prior research, provide a comprehensive method for assessing these impacts. Within this context, the time extension impact score and its interpretation are systematically represented in Table 12. This table offers a clear breakdown of the severity of time extensions on contractors’ cash flow and performance, serving as a practical guide for contractors to evaluate and mitigate risks.

Table 12.

Time extension impact score and its interpretation.

4.4.7. Addition, Omission, and Rework

Addition, omission, and rework significantly impact the performance of construction projects and the cash flow of contractors, creating complexities that demand precise evaluation and management. A structured scoring system, ranging from 1 (no impact) to 5 (critical impact), provides contractors with a practical tool to assess the financial implications of these changes. This methodology enables better risk management and financial planning, ensuring that contractors can effectively navigate the challenges posed by change orders. The significance of these impacts and the necessity for their quantification are emphasized by research conducted in numerous studies [6,14,54,56,57,58,59,60]. These studies collectively highlight the critical role of robust change management practices in mitigating the adverse effects of addition, omission, and rework on project performance and contractors’ cash flow. The interpretations of the impact of these actions on contractors’ cash flow are comprehensively detailed in Table 13.

Table 13.

Addition omission and rework impact interpretations.

4.4.8. Work Stoppage

Work stoppages in construction contracts are often governed by FIDIC clauses, which provide a structured framework for managing and mitigating their impact. These clauses are instrumental in determining the extent to which stoppages affect a project, particularly in terms of the contractor’s cash flow. The levels of work stoppages, associated scores, and their impact on the contractor’s cash flow are controlled by relevant FIDIC clauses. A score of one corresponds to no stoppage, as per FIDIC Clause 14.1, which ensures timely payments to maintain continuity. A score of two represents minor stoppages, aligning with Clause 20.1, which addresses claims and disputes that may cause brief interruptions. Moderate stoppages, scored as three, are linked to Clause 8.4, which provides time extensions for delays due to employer actions or unforeseen conditions. Significant stoppages, scored at four, are governed by Clause 19, which deals with force majeure events disrupting project progress. The most severe stoppages, assigned a score of five, relate to Clause 69, which addresses substantial non-performance or default, potentially leading to termination. These scores and their impact interpretations on the contractor’s cash flow are shown in Table 14. This structured approach helps contractors understand and quantify the impact of work stoppages on their cash flow and is guided by the FIDIC clauses.

Table 14.

Work stoppage impact interpretations on the contractor’s cash flow.

The impact of work stoppages on contractors’ performance and cash flow is supported by studies highlighting the importance of frameworks like FIDIC clauses. Some studies emphasize challenges from change orders affecting costs and schedules [61,62], while others press the need for structured approaches to mitigate delays and disruptions [53,55]. Additionally, the risk management’s role in addressing unforeseen conditions, reinforcing the relevance of FIDIC’s provisions for managing stoppages effectively, has also been highlighted [63]. These studies highlight the critical role of effective risk management and communication in mitigating the adverse effects of work stoppages caused by change orders.

4.5. Change Order Impact Index Calculation

The COII is determined by integrating the AHP and the MAUT techniques. In this approach, the relative importance weight for main factors (Wi) and the relative importance weight for subfactors (Vij) are calculated using AHP and then multiplied by the utility score (Pvij) for each factor, as determined by MAUT. The COII is mathematically computed by summing the products of the weights and utility values for all factors.

The relative importance weight represents the significance of the main factors, as illustrated in Figure 3, which displays the hierarchical model constructed for this study. These factors, namely contract type (0.44), project financing schemes (0.30), and characteristics and nature of change orders (0.26), were evaluated alongside their subfactors using AHP and MAUT. The utility scores, reflecting the current condition of each subfactor, are detailed in Table 7, Table 8, Table 9, Table 10, Table 11, Table 12, Table 13 and Table 14 and are used as input in the Change Order Impact Index (COII) formulation.

where

COII is the Change Order Impact Index;

Wi is the relative weight of main factor i;

Vij is the weight of subfactor j within the i factor;

PVij is the utility score for subfactor j within main factor i.

4.5.1. Change Order Impact Index Interpretation

The proposed classification COII scale is divided into four different categories as presented in Table 15, ranging numerically from 1 to 5, and linguistically from minor to severe. These values are determined based on their impact on the Change Order Impact Index.

Table 15.

Change Order Impact Index (COII) scale and interpretations.

4.5.2. Change Order Impact Index Analysis

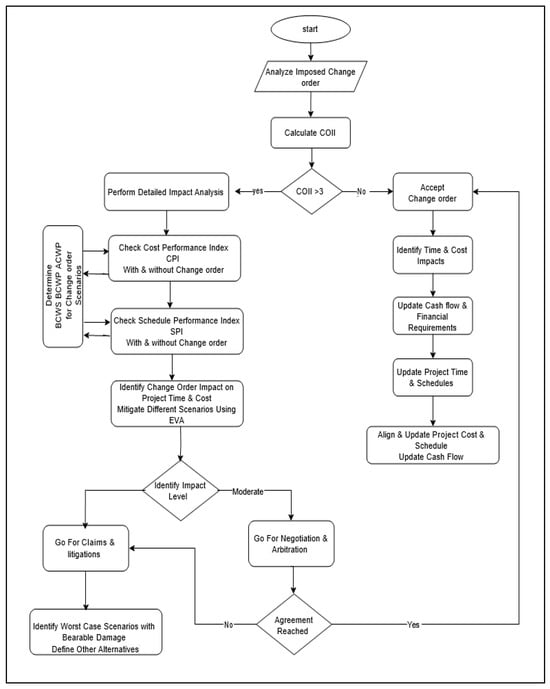

According to the developed Change Order Impact Index (COII) presented in Table 15, a COII value greater than three necessitates a detailed impact analysis to mitigate potential effects on the contractor’s cash flow. This is further illustrated in Phase Two of the methodology section. However, when the COII falls between 2 and 3, the need for further analysis depends on project-specific conditions. If cost overruns or schedule deviations exceed predefined project tolerance limits, additional investigation may be required to assess potential financial challenges. This approach ensures flexibility in applying the model while maintaining alignment with industry practices.

In this section, the COII analysis is thoroughly investigated, and analyses are conducted according to different profitability indicators, aiming to provide contractors with a proactive tool to mitigate such change orders with minimal impacts on their financial status and cash flow. In addition, the analysis provides a transparent tool for project stakeholders to communicate and proactively resolve predicted impacts. A detailed analysis of the project profitability indicators impacted by such change orders is shown in Figure 7.

Figure 7.

Change Order Impact Index Analysis.

The change order impact analysis begins with calculating the COII value. If this value exceeds three, as indicated in Table 3, further investigation and analysis must be conducted to determine the exact impacts on the contractor’s cash flow, as well as the time and cost variations affecting the overall performance of the project. At this stage, a detailed financial analysis is required, measured against the contractor’s financial status in relation to the project’s progress. This allows the contractor to accurately identify all potential impacts on cash flow, as well as the project’s schedule and budget.

In this phase, the contractor calculates the precise impact by using the Schedule Performance Index (SPI) to assess how the change order affects the project’s schedule. This assessment is then compared to the project’s S-curve, enabling adjustments to be made with minimal disruption and negative consequences. The contractor aims to avoid implementing change orders during financially challenging periods, particularly when cash flow is sustained through loans or overdraft conditions. These financial constraints can lead to higher interest charges and increased borrowing costs, creating additional risks. To manage these risks effectively, the contractor must carefully consider the timing of change orders in relation to project cash flow.

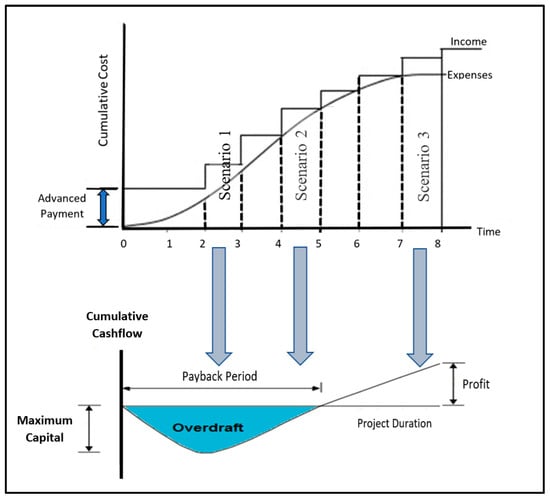

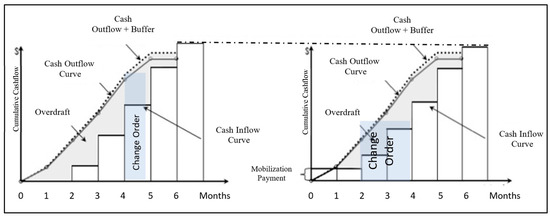

As depicted in Figure 8, the impact of a change order varies depending on the scenario in which it occurs. Scenario 1 (Early Project Phase—Negative Cash Flow) occurs when a change order is issued during a period of negative cash flow, where project expenses exceed income, and financing is often dependent on overdrafts or loans. During this phase, financial strain is at its peak, and additional costs from a change order further increase borrowing requirements and associated expenses, posing the greatest financial risk to the contractor. In contrast, Scenario 2 (Mid-Project Phase—Transitioning Cash Flow) takes place when a change order occurs as the project transitions from negative to positive cash flow. While financial risk remains, it may be partially mitigated depending on how well the contractor manages funds and financing strategies. The ability to navigate this phase effectively determines the extent to which a change order affects cash flow stability. Meanwhile, Scenario 3 (Late Project Phase—Positive Cash Flow) refers to a change order introduced after the contractor has achieved positive cash flow, where accumulated income exceeds expenses. At this stage, the financial risk associated with a change order is significantly lower, making it easier for the contractor to absorb additional costs without major disruptions. By understanding these scenarios, the contractor can strategically plan and negotiate with the project owner to minimize financial strain and optimize cash flow management, ensuring that change orders are handled with minimal adverse impact on the project’s financial health.

Figure 8.

Change order timing and value impact with overdraft.

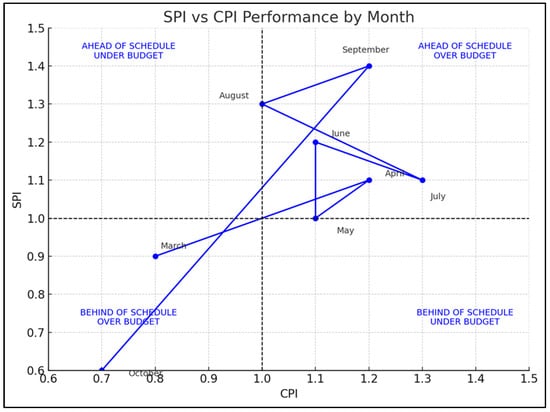

Moreover, the Cost Performance Index (CPI) will also be calculated to examine the impact on the project’s cost and evaluate different financing scenarios on how to accommodate the change order with minimal financial impacts, as illustrated in Figure 9. These scenarios are well defined, and their impacts do not severely affect the contractor’s performance related to financial and schedule obligations. Rather, they can be claimed and resolved through negotiations or arbitrations. These impacts and all possible scenarios will be reflected on the overall contractor’s performance and are quantified in terms of cost and time using the earned value (EV).

Figure 9.

Change order impact on project payments.

Earned value (EV) analysis is used to assess the impact of change orders, providing a clear representation of their effect on project timing through the Schedule Performance Index (SPI) and on project costs through the Cost Performance Index (CPI). As shown in Figure 10, the position of each point on the EV graph reflects the overall project performance, offering insights into how change orders influence cost efficiency and schedule adherence. The graph illustrates performance trends across four distinct quadrants: the first quadrant (SPI > 1, CPI > 1) indicates that the project is ahead of schedule and under budget, demonstrating optimal efficiency; the second quadrant (SPI > 1, CPI < 1) represents a scenario where the project progresses ahead of schedule but exceeds the allocated budget; the third quadrant (SPI < 1, CPI < 1) highlights the most critical situation, where both cost overruns and schedule delays occur simultaneously, posing significant financial and operational risks; and the fourth quadrant (SPI < 1, CPI > 1) depicts a case where the project is behind schedule but remains within budgetary limits.

Figure 10.

EV for different change order impacts for different scenarios.

SPI and CPI values are measured relative to a baseline of one, where values greater than one indicate favorable project performance, while those less than one reflect cost overruns or schedule delays. This evaluation enables contractors to analyze the impact of change orders, communicate potential consequences to stakeholders, and provide a basis for dispute resolution or arbitration when necessary. Depending on the severity and expected impact of a change order, the contractor can assess its feasibility and determine whether it should be accepted or contested, forming the foundation for contractual discussions and decision-making. This assessment provides a foundation for contractual discussions and decision-making and serves as a basis for dispute resolution or potential litigation if needed.

4.6. Model Validation

The developed methodology and classification model were explained to contractors and experienced construction practitioners in the industry. After presenting the models and explaining how they work and can be used to classify and predict the possible impact of change orders in contractor’s cash flow, the experts were asked to evaluate the applicability and validation of the developed model and methodology.

The evaluation was conducted using a set of questions answered by 20 experts, each with a minimum of 10 years of experience. Table 16 presents the scale used to classify the experts’ evaluation results, where responses are categorized as weak (<2.5), moderate (2.5–3.49), or high (3.5–5) based on the weighted average of their ratings.

Table 16.

Scale mean value classification.

As presented, experts were asked to indicate their level of agreement with the questions regarding the developed model and the impact analysis of change orders impact on contractor’s cash flow as per the following rating scale shown in Table 17.

Table 17.

Rating scale of the experts’ evaluation.

Table 18 shows the expert responses based on their level of agreement on the applicability and validation of the developed model and the impact analysis. The results demonstrated high support for the developed model and the impact analysis of change orders with a mean of (4.28). Experts were satisfied with the developed model and impact analysis. They also appreciate the fact that the developed model and impact analysis can be used to predict, evaluate, and analyze the impact of change orders on contractor’s cash flow in Saudi Arabian construction projects.

Table 18.

Frequencies of the experts’ responses, mean, percentage, and classification for the developed model and impact analysis.

5. Discussion and Conclusions

Change orders significantly affect the cash flow of contractors and subcontractors, primarily through unforeseen cost increases, delayed payments, and project schedule changes. While numerous studies have focused on predicting cash flow in construction projects, there is a notable gap in research specifically evaluating the impact of change orders on contractors’ cash flow. This distinction is critical, as change orders can lead to additional expenses beyond initial budgets, cause lengthy delays in payment processing and approval, and result in project timeline extensions that disrupt planned cash flow patterns. The need to understand and address these specific challenges highlights the importance of this research area.

Traditional cash flow models in construction, as discussed earlier in the literature, have predominantly concentrated on pre-construction financial planning, with the goal of improving cost forecasting accuracy and reducing financial uncertainty before project execution. Several previously mentioned studies have employed advanced computational techniques, such as machine learning, reinforcement learning, and neural networks, to support early-phase cash flow prediction. For instance, Zayed and Liu [34] developed a construction-specific model to manage financial risk, while Jiang et al. [33] applied deep reinforcement learning to enhance resource allocation and real-time forecasting. Similarly, Söylen [35] and Zheng and Tu [36] adopted wavelet transforms and multi-series frameworks to improve prediction accuracy in the planning stage.

Building information modeling (BIM) has also been utilized, as noted in earlier studies, to improve early-stage cash flow estimation. Kim and Grobler [37] proposed BIM-based models to extract parameters such as quantity take-offs and scheduling data for more accurate financial projections. Additionally, neural networks enhanced with genetic algorithms have been used by Zhu et al. to refine free cash flow estimates at the enterprise level [38]. Collectively, these models reflect a strong emphasis on financial risk mitigation during the pre-construction phase, with a focus on predictive methodologies that support upfront planning.

In contrast, the developed COII model in this research targets the direct financial consequences of change orders during the construction phase. Unlike traditional models that focus on early financial planning, COII delivers a dynamic, real-time evaluation of cash flow disruptions caused by change orders. It offers contractors a structured tool to assess financial risk as it emerges, facilitating immediate intervention strategies. By integrating financial data with live project information, the COII supports proactive cash flow management throughout execution.

The COII’s use of earned value (EV) analysis to combine the Schedule Performance Index (SPI) and Cost Performance Index (CPI) provides a powerful visual and analytical tool for contractors. This approach enables contractors to effectively communicate with project stakeholders about the real-time impacts of change orders on both project timing and profitability, an aspect that earlier cash flow prediction models did not explicitly address. Several researchers utilized techniques like fuzzy logic, Monte Carlo simulations, and linear programming to analyze cash flow trends, and they predominantly provided broad predictions [64,65,66,67]. These approaches lacked a detailed focus on how individual project changes affect financial health during the construction phase. The developed model in this study is more comprehensive, offering real-time insights into project performance and enabling contractors to proactively and reactively manage change orders, as well as effectively communicate the financial implications to stakeholders.

Additionally, the integration of AHP and MAUT enables the COII to account for both qualitative and quantitative factors, making it more adaptable to complex construction environments. This multidimensional capability distinguishes it from previous models that often relied on a single type of input or did not capture the interplay of factors introduced by change orders.

By categorizing change order impacts as minor, moderate, significant, or severe, the COII facilitates actionable scenario analysis. This supports contractors in identifying high-risk periods, such as phases prone to overdrafting and high interest payments, and in developing mitigation strategies. This targeted analytical approach extends beyond the scope of traditional cash flow models, which primarily focus on general financial planning.

The practical implications of this research are substantial for both contractors and project owners. The COII equips contractors with a structured framework for deciding whether to accept or reject change orders based on projected cash flow impacts. Beyond estimating immediate financial effects, it supports proactive financial planning and reduces the likelihood of disputes. Unlike earlier models focused on aggregate forecasts, the COII provides detailed, scenario-based assessments, enhancing financial clarity during execution.

In summary, while past models have centered on early-phase forecasting using advanced computational tools, this research fills a notable gap by concentrating on change orders during project execution. The COII serves as both an analytical and communication framework, enhancing transparency, supporting informed decision-making, and strengthening financial management practices in construction.

The study’s key findings highlight the COII’s capability to quantify the financial effects of change orders on contractors’ cash flow. Through AHP and MAUT, the model prioritizes and weights factors such as contract type, project financing, and change order characteristics. When combined with earned value analysis, the model provides real-time cost and schedule impact assessments. This positions the COII as a vital financial management tool, particularly for large-scale construction in Saudi Arabia, where frequent change orders disrupt cash flow. The model enables better risk management and more consistent financial outcomes.

Although the developed COII is intended for large-scale projects, it can also be used for small- to medium-sized projects. The COII model can be adapted by modifying the factors considered and simplifying the analysis to accommodate less complex project environments. While the comprehensive approach of COII is especially valuable for managing the complexities of larger projects, simpler and more direct tools might suffice for smaller projects. Nonetheless, the model remains flexible and can be scaled according to the specific requirements of different project types and sizes.

Additionally, the framework integrates both proactive assessments and real-time management capabilities to address the financial and scheduling impact of change orders. Before a change order occurs, it enables risk identification and mitigation planning by assessing potential financial implications based on project conditions and historical data. During the construction phase, it functions as a real-time evaluation tool, utilizing SPI and CPI indicators to analyze the immediate effects of change orders on project cash flow and performance. This dual approach ensures that stakeholders can make informed decisions both before and during the implementation of change orders, enhancing project financial stability and control.

The COII model was developed for the Saudi Arabian construction context, but it can be modified to accommodate other countries’ rules and regulations, as well as different industries. Adapting the model would require the consideration of variations in legal frameworks, contract types, and cultural factors. Regulatory differences can affect the financial impact of change orders, requiring adjustments to model parameters. Additionally, the prevalence of certain contract types, such as lump sum or cost-plus, may vary, influencing the weights and utility values used. Cultural differences in risk management and negotiation styles may also necessitate recalibrating utility scores. Addressing these factors would enhance the model’s adaptability and effectiveness in diverse contexts.

The developed COII model could be enhanced by incorporating more precise data and advanced artificial intelligence techniques if such data become available. The AHP-MAUT framework was selected for this study due to its flexibility in accommodating combined data sources, including expert-based inputs, making it well suited to the available information.

While the COII model presents a comprehensive and adaptable framework for assessing the financial impact of change orders, its application in real project settings would further demonstrate its effectiveness across different project types and regulatory contexts. The model is flexible enough to be adjusted for varying project scales and contractual environments and may be enhanced in future work by incorporating more detailed project data and advanced analysis methods. Its practical utility lies in supporting contractors, project owners, and consultants with proactive planning and real-time decision-making, ultimately contributing to more stable and informed project cash flow management.

Funding

This research received no external funding.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Naji, K.K.; Gunduz, M.; Naser, A.F. The Effect of Change-Order Management Factors on Construction Project Success: A Structural Equation Modeling Approach. J. Constr. Eng. Manag. 2022, 148, 04022085. [Google Scholar] [CrossRef]

- Demiss, B.A.; Elsaigh, W.A. Application of novel hybrid deep learning architectures combining Convolutional Neural Networks (CNN) and Recurrent Neural Networks (RNN): Construction duration estimates prediction considering preconstruction uncertainties. Eng. Res. Express 2024, 6, 032102. [Google Scholar] [CrossRef]

- Heravi, G.; Charkhakan, M.H. Predicting Change by Evaluating the Change Implementation Process in Construction Projects Using Event Tree Analysis. J. Manag. Eng. 2015, 31, 04014081. [Google Scholar] [CrossRef]

- Alkhalifah, S.J.; Tuffaha, F.M.; Al Hadidi, L.A.; Ghaithan, A. Factors influencing change orders in oil and gas construction projects in Saudi Arabia. Built Environ. Proj. Asset Manag. 2023, 13, 430–452. [Google Scholar] [CrossRef]

- Zangana, H.M.; Bazeed, S.M.S.; Ali, N.Y.; Abdullah, D.T. Navigating Project Change: A Comprehensive Review of Change Management Strategies and Practices. Indones. J. Educ. Soc. Sci. 2024, 3, 166–179. [Google Scholar] [CrossRef]

- Tarawneh, S.; Almahmoud, A.F.; Hajjeh, H. Impact of cash flow variation on project performance: Contractors’ perspective. Eng. Manag. Prod. Serv. 2023, 15, 73–85. [Google Scholar] [CrossRef]

- Koopman, K.; Cumberlege, R. Cash flow management by contractors. IOP Conf. Ser. Earth Environ. Sci. 2021, 654, 012028. [Google Scholar] [CrossRef]

- Purnus, A.; Bodea, C.-N. Financial Management of the Construction Projects: A Proposed Cash Flow Analysis Model at Project Portfolio Level. Organ. Technol. Manag. Constr. Int. J. 2015, 7, 1217–1227. [Google Scholar] [CrossRef]

- Mahmoud, H.; Ahmed, V.; Beheiry, S. Construction Cash Flow Risk Index. J. Risk Financ. Manag. 2021, 14, 269. [Google Scholar] [CrossRef]

- Alashwal, A.M.; Chew, M.Y. Simulation techniques for cost management and performance in construction projects in Malaysia. Built Environ. Proj. Asset Manag. 2017, 7, 534–545. [Google Scholar] [CrossRef]

- Chadee, A.; Ali, H.; Gallage, S.; Rathnayake, U. Modelling the Implications of Delayed Payments on Contractors’ Cashflows on Infrastructure Projects. Civ. Eng. J. 2023, 9, 52–71. [Google Scholar] [CrossRef]

- Sahu, P.; Bera, D.K.; Parhi, P.K. Analyzing the impact of construction delays on disputes in india: A statistical and machine learning approach. J. Mech. Contin. Math. Sci. 2024, 19, 24–34. [Google Scholar] [CrossRef]

- Kyrychenko, S.O.; Katsevych, M.M. Risk Management of Financial Activities in the Construction Industry. Bus. Inf. 2024, 10, 175–181. [Google Scholar] [CrossRef]

- Alzara, M. Exploring the Impacts of Change Orders on Performance of Construction Projects in Saudi Arabia. Adv. Civ. Eng. 2022, 2022, 5775926. [Google Scholar] [CrossRef]

- Alajmi, A.M.; Ahmed Memon, Z. A Review on Significant Factors Causing Delays in Saudi Arabia Construction Projects. Smart Cities 2022, 5, 1465–1487. [Google Scholar] [CrossRef]

- Martanti, A.Y.; Kasih, T.P.; Tanojo, F.H. Study of Work Order Variation and Its Influence On Project Performance in Terms of Cost and Implementation Time in the Tenjoresmi Area Arrangement Project. Asian J. Eng. Soc. Health 2024, 3, 362–373. [Google Scholar] [CrossRef]

- Sanjaya, A.; Isvara, W. Risk Factor Assessment Causing Contract Change Orders in the Double-Double Track Project. J. Res. Soc. Sci. Econ. Manag. 2024, 4, 485–496. [Google Scholar] [CrossRef]

- Waty, M. Road construction change order analysis (technical causes and initiators). Int. J. Appl. Sci. Technol. Eng. 2023, 1, 866–881. [Google Scholar] [CrossRef]

- Muhammad, Q.S.A.; Shuaibu, Q.K.U.; Hassan, I.A. Assessing the Factors Influencing Cashflow Management in Project Delivery in Kaduna Metropolis, Nigeria. Int. J. Sci. Adv. 2023, 4, 719–725. [Google Scholar] [CrossRef]

- Buertey, J.I.T.B.; Adjei-Kumi, T.A.K. Cashflow forecasting in the construction industry: The case of Ghana. Pentvars Bus. J. 2012, 6, 65–81. [Google Scholar] [CrossRef]

- Kazar, G. A data-driven approach for predicting cash flow performance of public owners in building projects: Insights from Turkish cases. Eng. Constr. Archit. Manag. 2024, 31, 2541–2564. [Google Scholar] [CrossRef]

- Firmansyah, A.A.; Sahab, M.T.Z.; Wisudanto, W. The influence of investment decisions, free cash flow, and debt policy on the financial performance of construction companies. J. Ilm. Manaj. Ekon. Akunt. (MEA) 2023, 7, 1719–1734. [Google Scholar] [CrossRef]

- Maulanisa, N.F.; Chumaidiyah, E.; Sriwana, I.K. A system dynamics modeling approach for improving engineering, procurement, and construction project performance: A case study. J. Infrastruct. Policy Dev. 2024, 8, 8730. [Google Scholar] [CrossRef]

- Jahangoshai Rezaee, M.; Yousefi, S.; Chakrabortty, R.K. Analysing causal relationships between delay factors in construction projects. Int. J. Manag. Proj. Bus. 2021, 14, 412–444. [Google Scholar] [CrossRef]

- Kotb, M.; Ibrahim, M.A.R.; Al-Olayan, Y.S. A Study of the Cash Flow Forecasting Impact on the Owners Financial Management of Construction Projects in the State of Kuwait. Asian Bus. Res. 2018, 3, 69. [Google Scholar] [CrossRef]

- Jagannathan, M.; Delhi, V.S.K. Decoding a construction organisation’s tendency to litigate: An understanding through financial statements. Built Environ. Proj. Asset Manag. 2023, 13, 453–470. [Google Scholar] [CrossRef]

- Voigt, A.; Khalaf, M.; Mattar, S.G. Impact of Cash Shortages on Project Performance. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2023, 15. [Google Scholar] [CrossRef]

- FMajaham, R.F.; Mustapa, M.; Darmansah, N.F. A Critical Review of Internal Factors Impacting the Growth of Construction Firms. Int. J. Res. Innov. Soc. Sci. 2025, VIII, 1501–1513. [Google Scholar] [CrossRef]

- Dorrah, D.H.; McCabe, B. Integrated Agent-Based Simulation and Game Theory Decision Support Framework for Cash Flow and Payment Management in Construction Projects. Sustainability 2023, 16, 244. [Google Scholar] [CrossRef]

- Al-Shihabi, S.; Elazouni, A. Modified Finance-Based Scheduling with Activity Splitting. Mathematics 2025, 13, 139. [Google Scholar] [CrossRef]

- Kim, Y.J.; Skibniewski, M.J. Cash and Claim: Data-Based Inverse Relationships between Liquidity and Claims in the Construction Industry. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2020, 12. [Google Scholar] [CrossRef]

- Safitri, A.A.; Wiryasuta, I.K.H.; Sandi, E.A. Variasi Sistem Pembayaran Terhadap Cash Flow (Studi Kasus: Pembangunan Laboratorium Terpadu AKN Blitar). J. Tek. Sipil Giratory UPGRIS 2024, 1, 10–19. [Google Scholar] [CrossRef]

- Jiang, C.; Li, X.; Lin, J.-R.; Liu, M.; Ma, Z. Adaptive control of resource flow to optimize construction work and cash flow via online deep reinforcement learning. Autom. Constr. 2023, 150, 104817. [Google Scholar] [CrossRef]

- Zayed, T.; Liu, Y. Cash flow modeling for Construction projects. Eng. Constr. Archit. Manag. 2014, 21, 170–189. [Google Scholar] [CrossRef]

- Söylen, Z.; Mammadova, F.; Fasounaki, M.; Özmen, A.İ.; İnce, G. Cash Flow Forecasting Based on Wavelet Transform and Neural Networks. In Proceedings of the 2023 8th International Conference on Computer Science and Engineering (UBMK), Burdur, Turkey, 13–15 September 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 306–311. [Google Scholar] [CrossRef]

- Zheng, Y.; Tu, K. A Robust Forecasting Framework for Multi-Series Cash Flow Prediction. In Proceedings of the 2023 6th International Conference on Information Communication and Signal Processing (ICICSP), Xi’an, China, 23–25 September 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 898–902. [Google Scholar] [CrossRef]

- Kim, H.; Grobler, F. Preparing a Construction Cash Flow Analysis Using Building Information Modeling (BIM) Technology. J. Constr. Eng. Proj. Manag. 2013, 3, 1–9. [Google Scholar] [CrossRef]

- Zhu, L.; Yan, M.; Bai, L. Prediction of Enterprise Free Cash Flow Based on a Backpropagation Neural Network Model of the Improved Genetic Algorithm. Information 2022, 13, 172. [Google Scholar] [CrossRef]

- Alkhattabi, L.; Alkhard, A.; Gouda, A. Effects of change orders on the budget of the public sector construction projects in the kingdom of Saudi Arabia. Results Eng. 2023, 20, 101628. [Google Scholar] [CrossRef]

- Xiao, H.; Proverbs, D. Factors influencing contractor performance: An international investigation. Eng. Constr. Archit. Manag. 2003, 10, 322–332. [Google Scholar] [CrossRef]

- Adejoh, A.A.; Asebiomo, M.M.; Ogunbode, E.B.; Oyewobi, L.O.; Sani, M.A.; Isa, R.B.; Jimoh, R.A. Influence of Contractor Selection Criteria on Critical Success Factors of Public Project Delivery in Abuja. Environ. Technol. Sci. J. 2023, 13, 86–98. [Google Scholar] [CrossRef]

- Zamim, S.K. Identification of crucial performance measurement factors affecting construction projects in Iraq during the implementation phase. Cogent Eng. 2021, 8, 1882098. [Google Scholar] [CrossRef]

- Gunduz, M.; Mohammad, K.O. Assessment of change order impact factors on construction project performance using Analytic Hierarchy Process (AHP). Technol. Econ. Dev. Econ. 2019, 26, 71–85. [Google Scholar] [CrossRef]

- Omopariola, E.D.; Windapo, A.O.; Edwards, D.J.; Aigbavboa, C.O.; Yakubu, S.U.-N.; Obari, O. Modelling the domino effect of advance payment system on project cash flow and organisational performance. Eng. Constr. Archit. Manag. 2023, 31, 59–78. [Google Scholar] [CrossRef]

- Bissoon, S.; Outridge, D. Delayed payments impacts on planned cash flow of small and medium contractors for a special purpose company. In Proceedings of the International Conference on Emerging Trends in Engineering & Technology (IConETech-2020), Vellore, India, 24–25 February 2020; pp. 313–324. [Google Scholar] [CrossRef]

- Cui, Q.; Hastak, M.; Halpin, D. Systems analysis of project cash flow management strategies. Constr. Manag. Econ. 2010, 28, 361–376. [Google Scholar] [CrossRef]

- Chiang, Y.; Cheng, E.W.L. Construction loans and industry development: The case of Hong Kong. Constr. Manag. Econ. 2010, 28, 959–969. [Google Scholar] [CrossRef]

- Lee, J.I.; Lee, H.-S.; Park, M. Contractor Liquidity Evaluation Model for Successful Public Housing Projects. J. Constr. Eng. Manag. 2018, 144, 04018109. [Google Scholar] [CrossRef]

- El-adaway, I.; Fawzy, S.; Burrell, H.; Akroush, N. Studying Payment Provisions under National and International Standard Forms of Contracts. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2017, 9, 04516011. [Google Scholar] [CrossRef]

- Hesham, H.K. Payment procedures under FIDIC construction contract. Proc. Int. Struct. Eng. Constr. 2022, 9(LDR-05-1–LDR-05-6). [Google Scholar] [CrossRef]

- Roja, Z.; Kalkis, H.; Roja, I.; Zalkalns, J.; Sloka, B. Work strain predictors in construction work. Agron. Res. 2017, 15, 2090–2099. [Google Scholar] [CrossRef]

- Marulanda, A.; Neuenschwander, M. Contractual time for completion adjustment in the FIDIC Emerald Book. In Tunnels and Underground Cities: Engineering and Innovation Meet Archaeology, Architecture and Art; CRC Press: Boca Raton, FL, USA, 2019; pp. 4494–4500. [Google Scholar] [CrossRef]

- Moselhi, O.; Assem, I.; El-Rayes, K. Change Orders Impact on Labor Productivity. J. Constr. Eng. Manag. 2005, 131, 354–359. [Google Scholar] [CrossRef]

- Choi, K.; Lee, H.W.; Bae, J.; Bilbo, D. Time-Cost Performance Effect of Change Orders from Accelerated Contract Provisions. J. Constr. Eng. Manag. 2016, 142, 04015085. [Google Scholar] [CrossRef]

- Khuder, S.S.; Ibrahim, A.; Eedan, O. Adopting a Method for Calculating the Impact of Change Orders on the Time it Takes to Complete Bridge Projects. Iraqi J. Civ. Eng. 2022, 15, 52–58. [Google Scholar] [CrossRef]

- Omopariola, E.D.; Windapo, A.O.; Edwards, D.J.; Chileshe, N. Attributes and impact of advance payment system on cash flow, project and organisational performance. J. Financ. Manag. Prop. Constr. 2022, 27, 306–322. [Google Scholar] [CrossRef]

- Dabirian, S.; Ahmadi, M.; Abbaspour, S. Analyzing the impact of financial policies on construction projects performance using system dynamics. Eng. Constr. Archit. Manag. 2023, 30, 1201–1221. [Google Scholar] [CrossRef]

- Liu, Y. Risk Analysis and Research for Construction Projects. Adv. Econ. Manag. Political Sci. 2023, 19, 181–187. [Google Scholar] [CrossRef]

- Ismaeil, E.M.H.; Sobaih, A.E.E. A Proposed Model for Variation Order Management in Construction Projects. Buildings 2024, 14, 726. [Google Scholar] [CrossRef]

- Mofleh Alshehhi, H.S. The impact of risk management on the performance of construction projects. In Proceedings of the MBP 2024 Tokyo International Conference on Management & Business Practices, 18–19 January Proceedings of Social Science and Humanities Research Association (SSHRA), Tokyo, Japan, 18–19 January 2024; pp. 114–115. [Google Scholar] [CrossRef]

- Oladapo, A.A. A quantitative assessment of the cost and time impact of variation orders on construction projects. J. Eng. Des. Technol. 2007, 5, 35–48. [Google Scholar] [CrossRef]

- Al Maamari, A.; Khan, F. Evaluating the Causes and Impact of Change Orders on Construction Projects Performance in Oman. Int. J. Res. Entrep. Bus. Stud. 2021, 2, 41–50. [Google Scholar] [CrossRef]

- Wang, J.; Yuan, H. Factors affecting contractors’ risk attitudes in construction projects: Case study from China. Int. J. Proj. Manag. 2011, 29, 209–219. [Google Scholar] [CrossRef]

- Taylan, O.; Bafail, A.O.; Abdulaal, R.M.S.; Kabli, M.R. Construction projects selection and risk assessment by fuzzy AHP and fuzzy TOPSIS methodologies. Appl. Soft Comput. 2014, 17, 105–116. [Google Scholar] [CrossRef]

- Cheng, M.-Y.; Hoang, N.-D.; Wu, Y.-W. Cash flow prediction for construction project using a novel adaptive time-dependent least squares support vector machine inference model. J. Civ. Eng. Manag. 2015, 21, 679–688. [Google Scholar] [CrossRef]

- Peleskeica, C.A.; Dorcav, V.; Munteanura, R.A.; Munteanur, R. Risk Consideration and Cost Estimation in Construction Projects Using Monte Carlo Simulation. Management 2015, 10, 18544223. [Google Scholar]

- Barbosa, P.S.F.; Pimentel, P.R. A linear programming model for cash flow management in the Brazilian construction industry. Constr. Manag. Econ. 2001, 19, 469–479. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).