Evolutionary Game Analysis of Credit Supervision for Practitioners in the Water Conservancy Construction Market from the Perspective of Indirect Supervision

Abstract

1. Introduction

2. Model Building

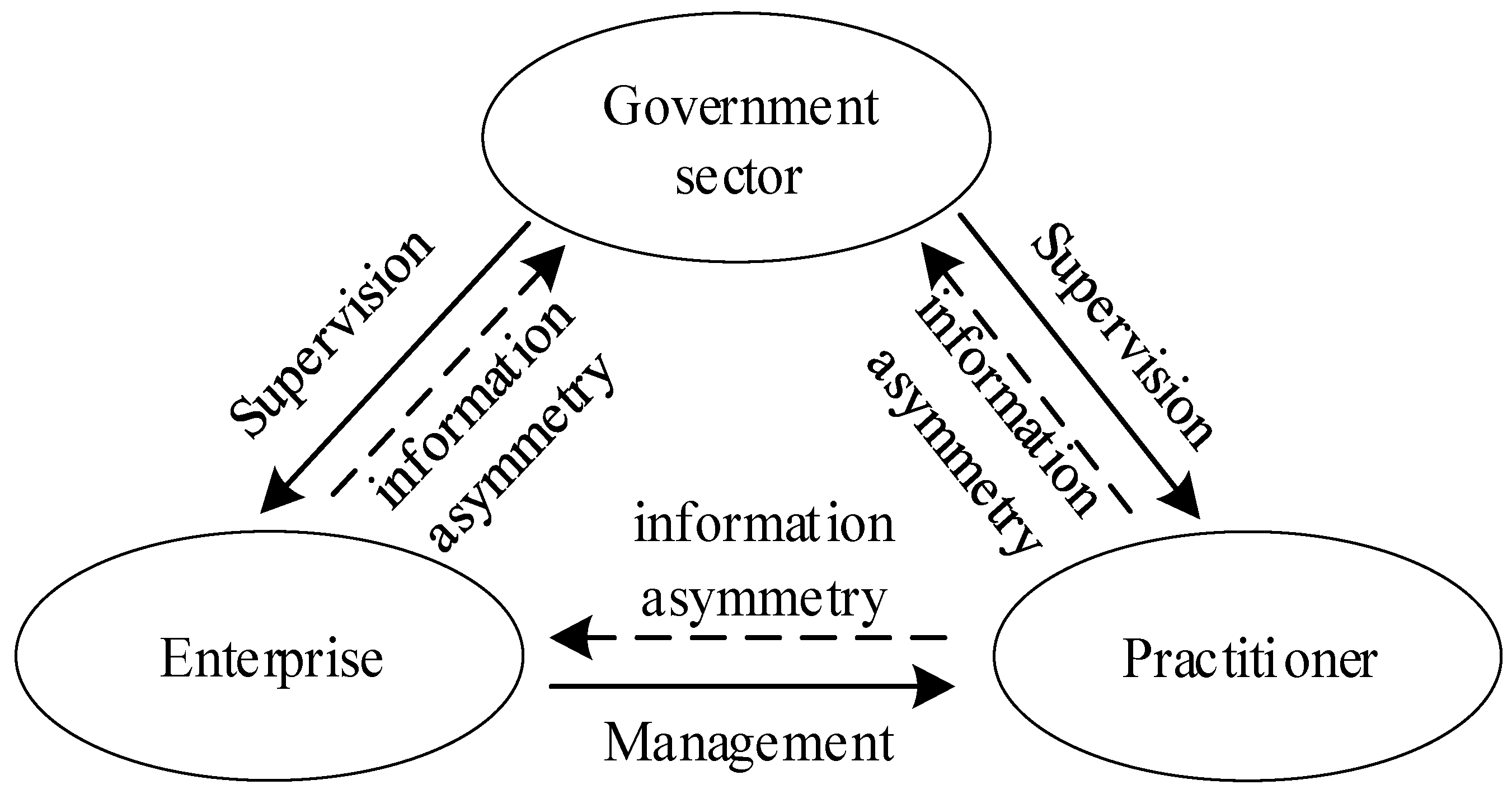

2.1. Problem Description and Model Construction

2.2. Model Solving and Analysis

2.2.1. Analysis of Regulatory Strategies of Government Departments

2.2.2. Analysis of Firms’ Expected Return Game Strategies

2.2.3. Analysis of Practitioners’ Expected Return Game Strategies

2.3. Evolutionary Stability Analysis

2.3.1. Evolutionary Game Analysis of Game Subjects

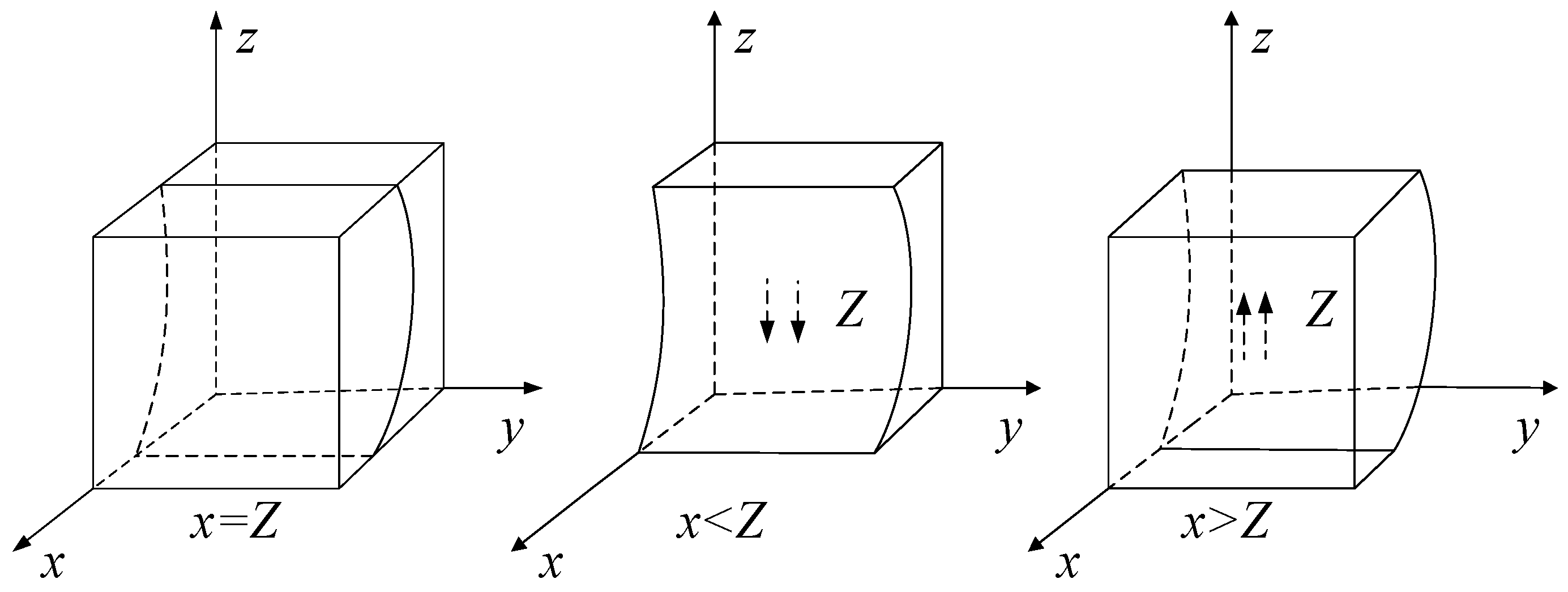

- (1)

- Evolutionary Equilibrium Analysis of Government Sectors

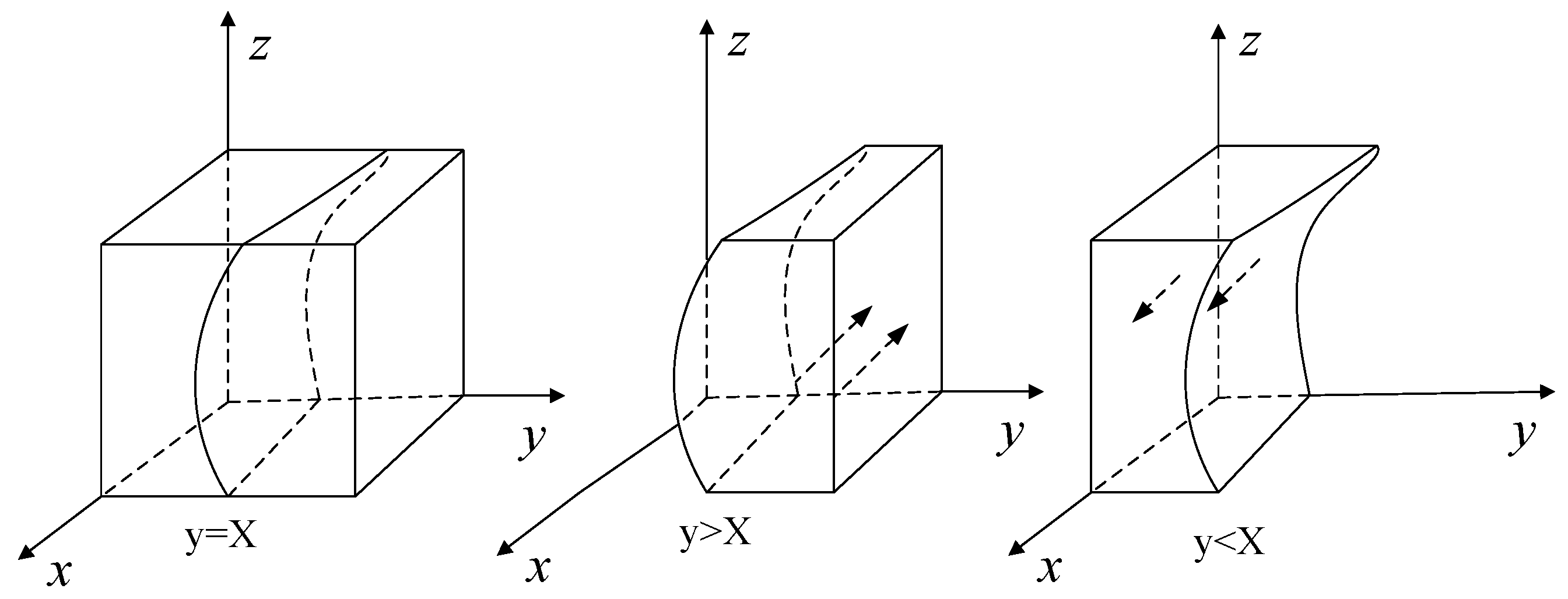

- (2)

- Evolutionary Equilibrium Analysis of Firms

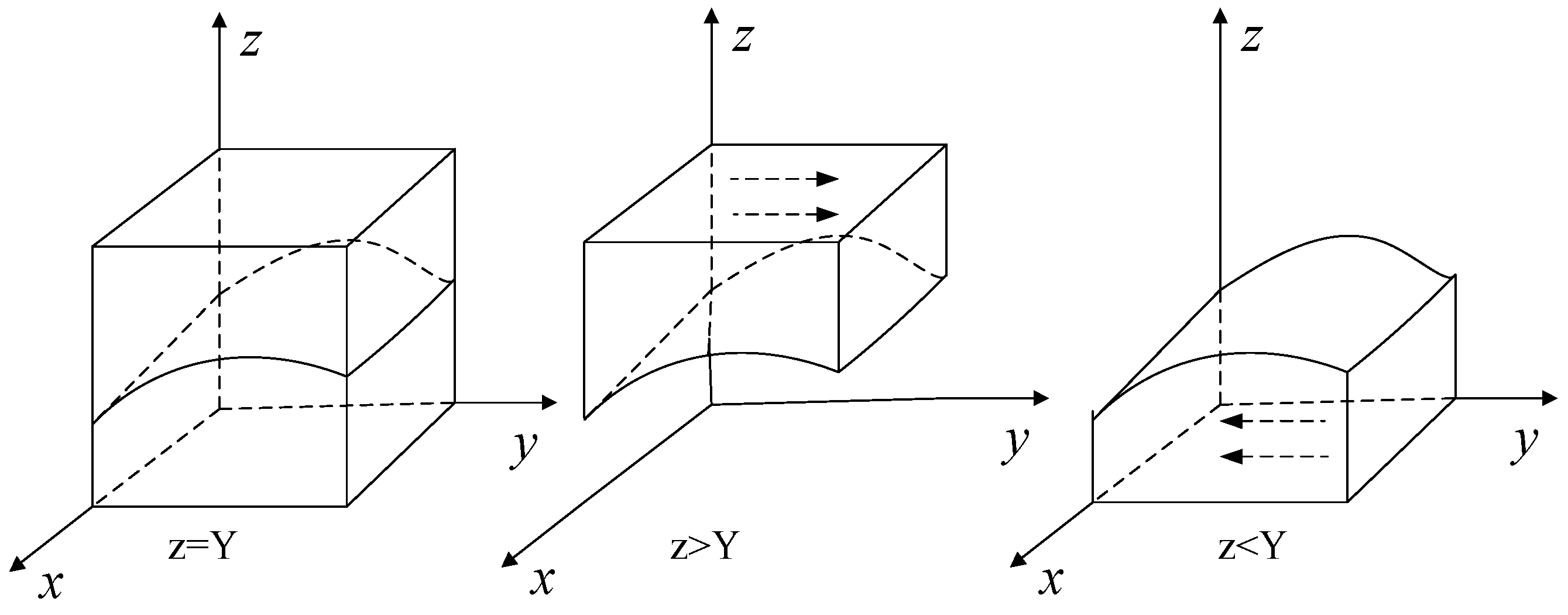

- (3)

- Evolutionary Equilibrium Analysis of Practitioners

2.3.2. Evolutionary Equilibrium Analysis of the Three-Way Game

- (1)

- Equilibrium Analysis

- (2)

- Analysis of Stability Conditions and Discussion of Results

3. Simulation Analysis of Evolutionary Game Models

3.1. Model Parameterization

3.2. Simulation Experiment Analysis

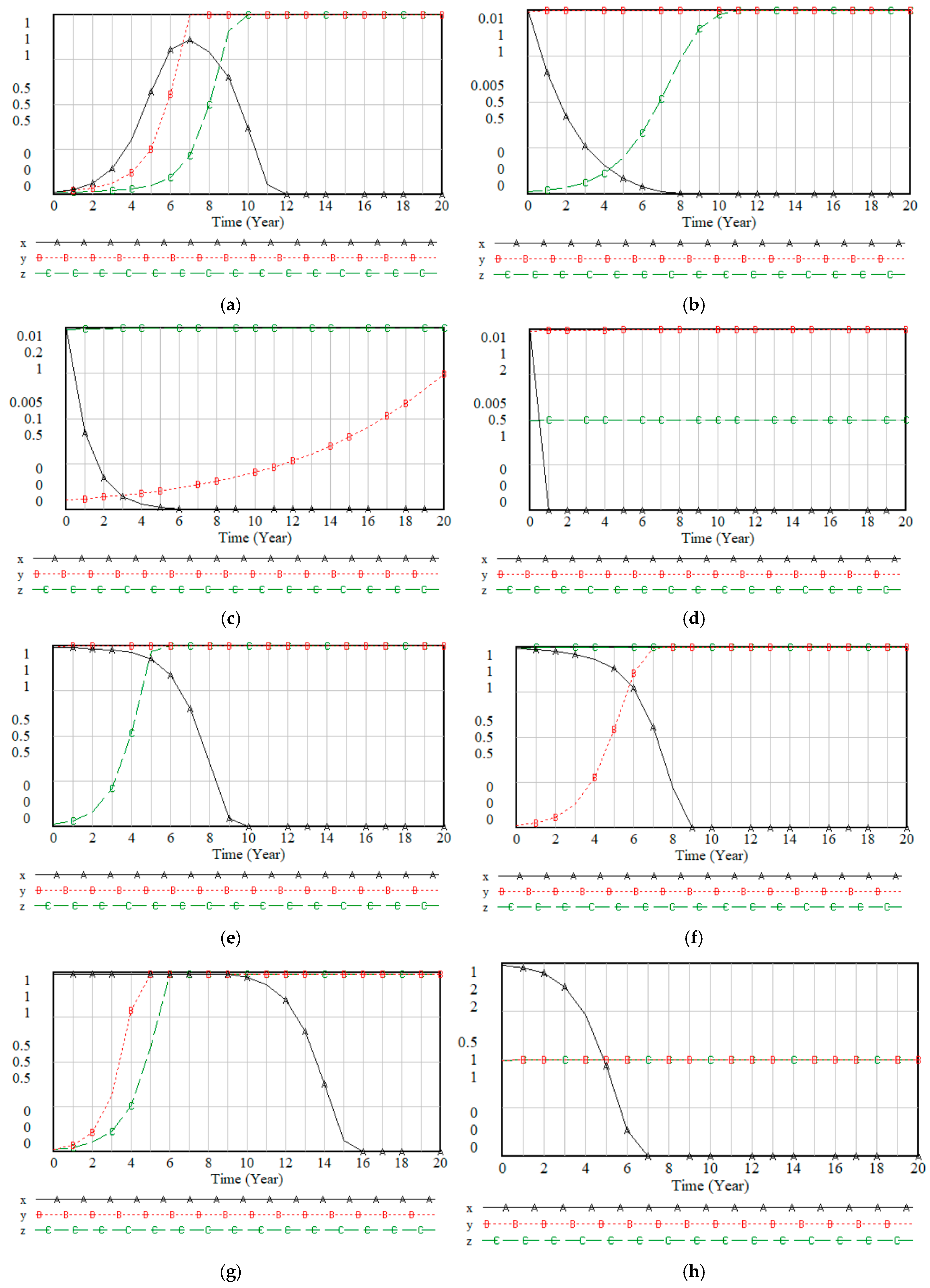

3.2.1. Analysis of Pure Simulation Strategies

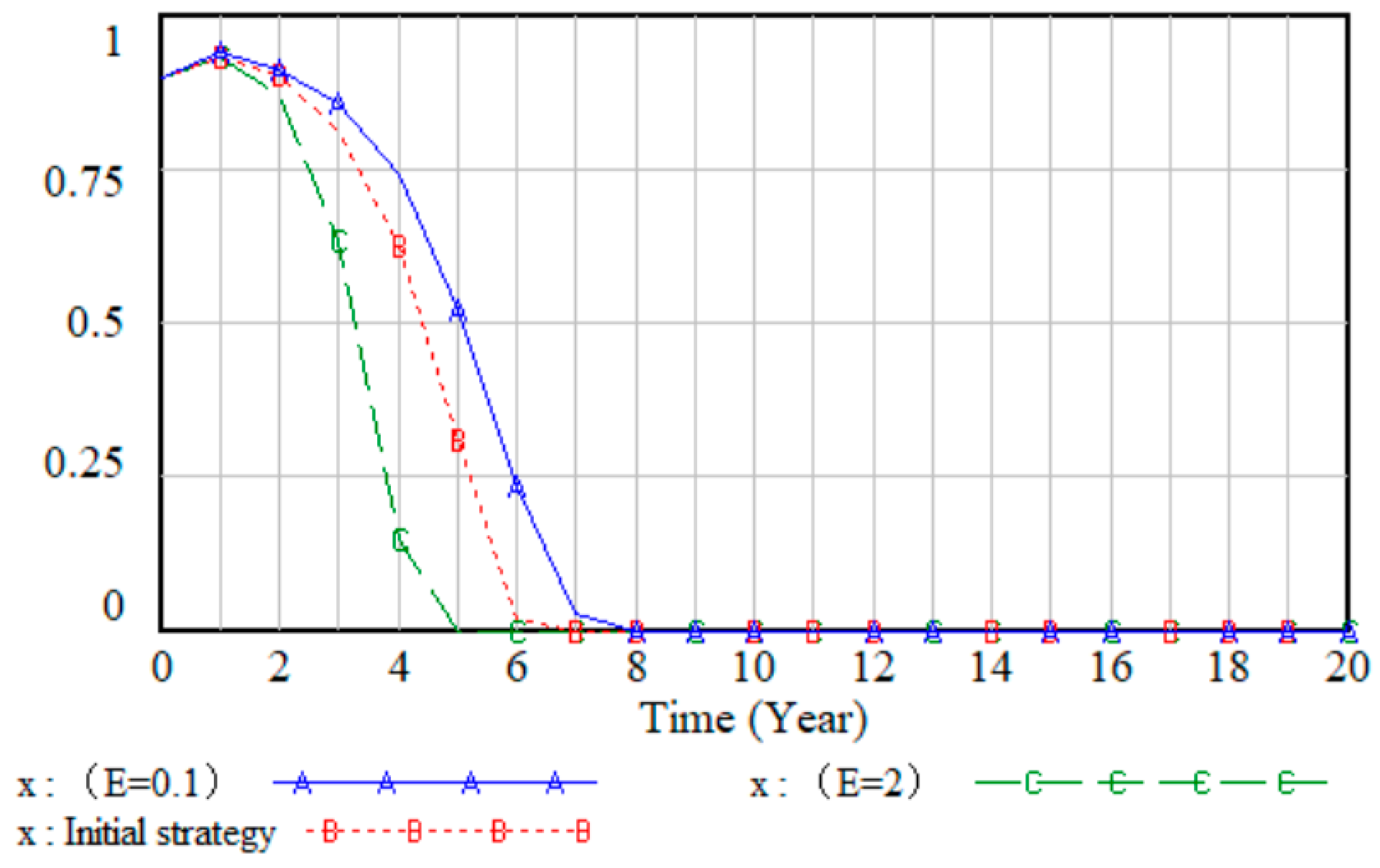

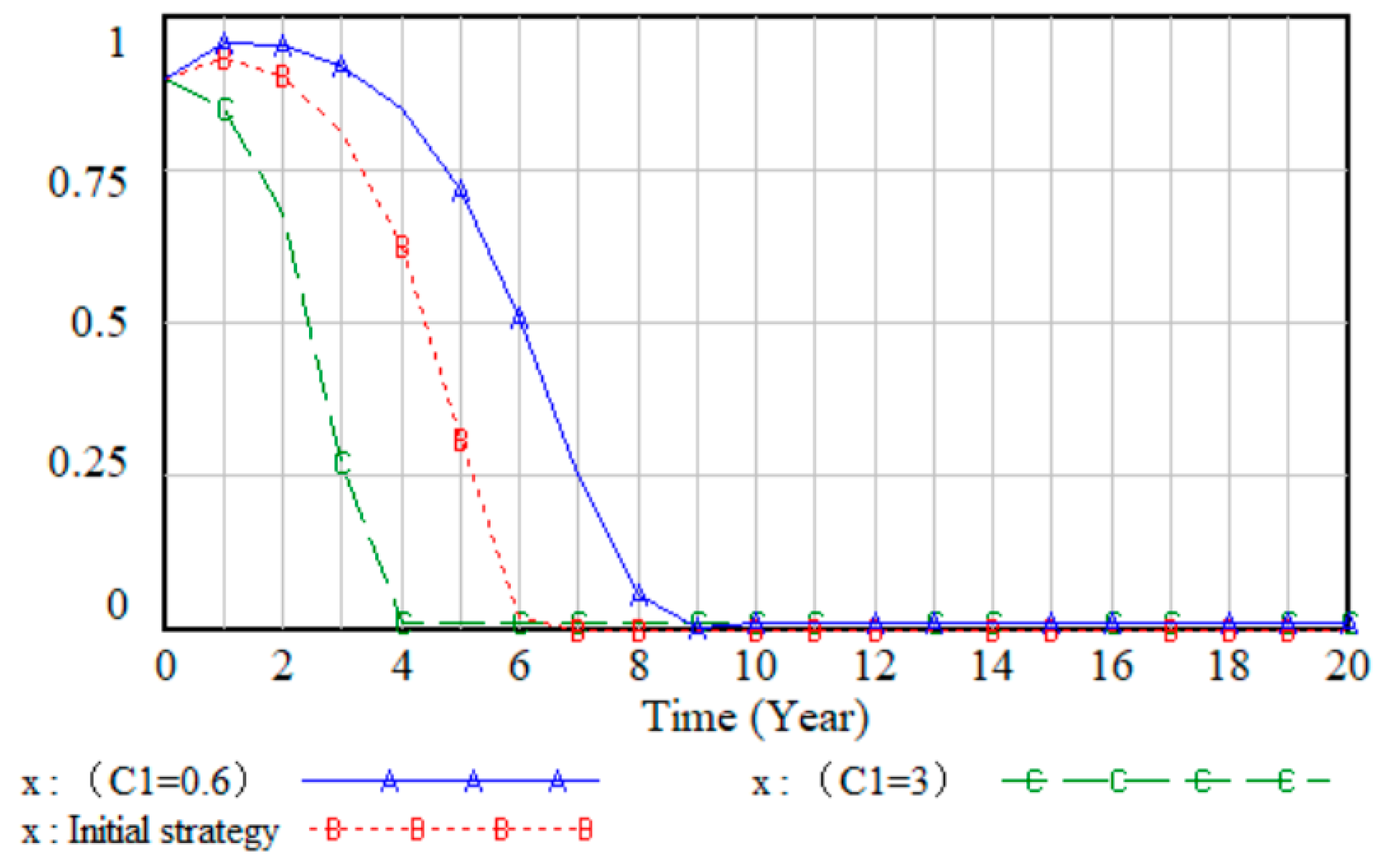

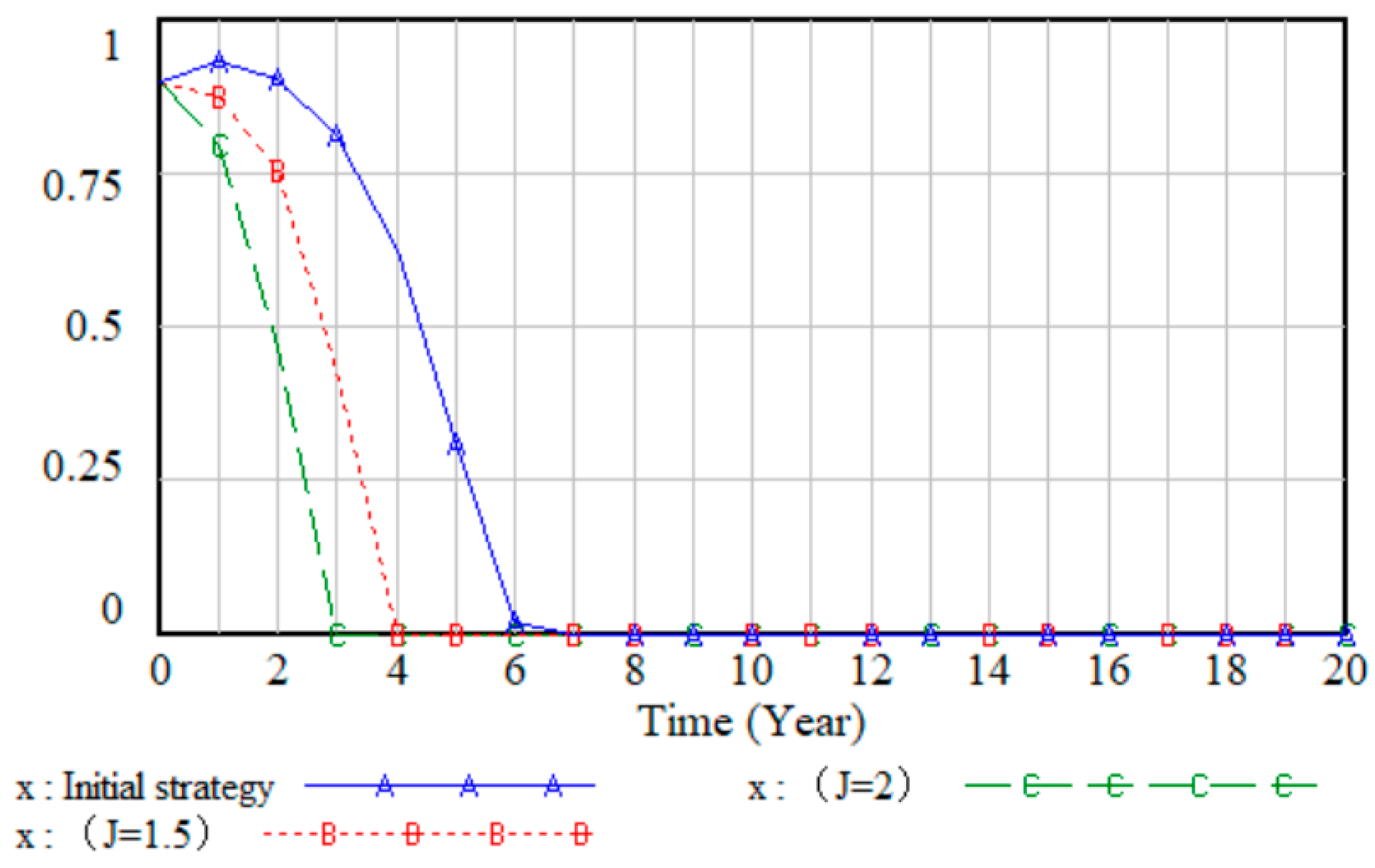

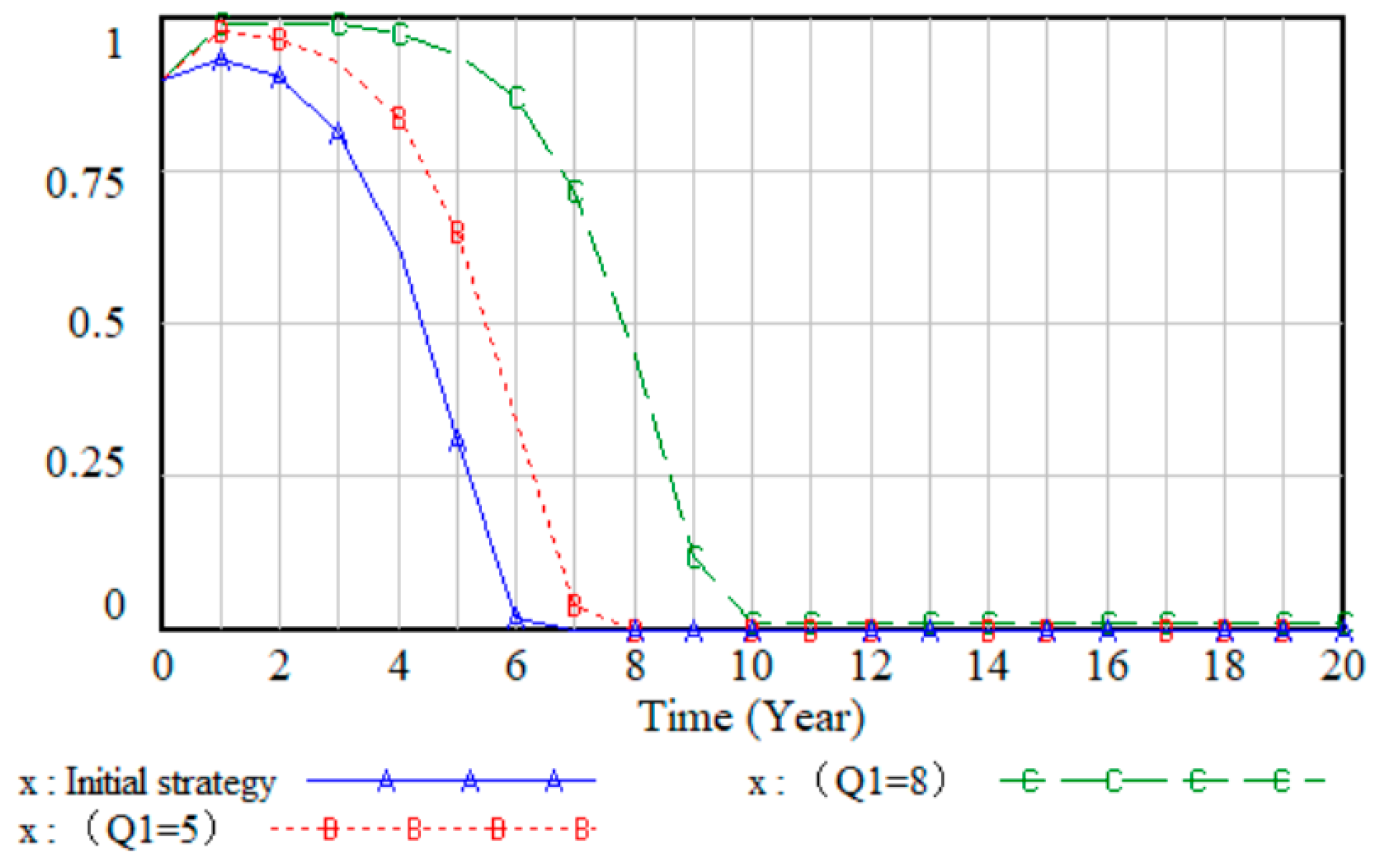

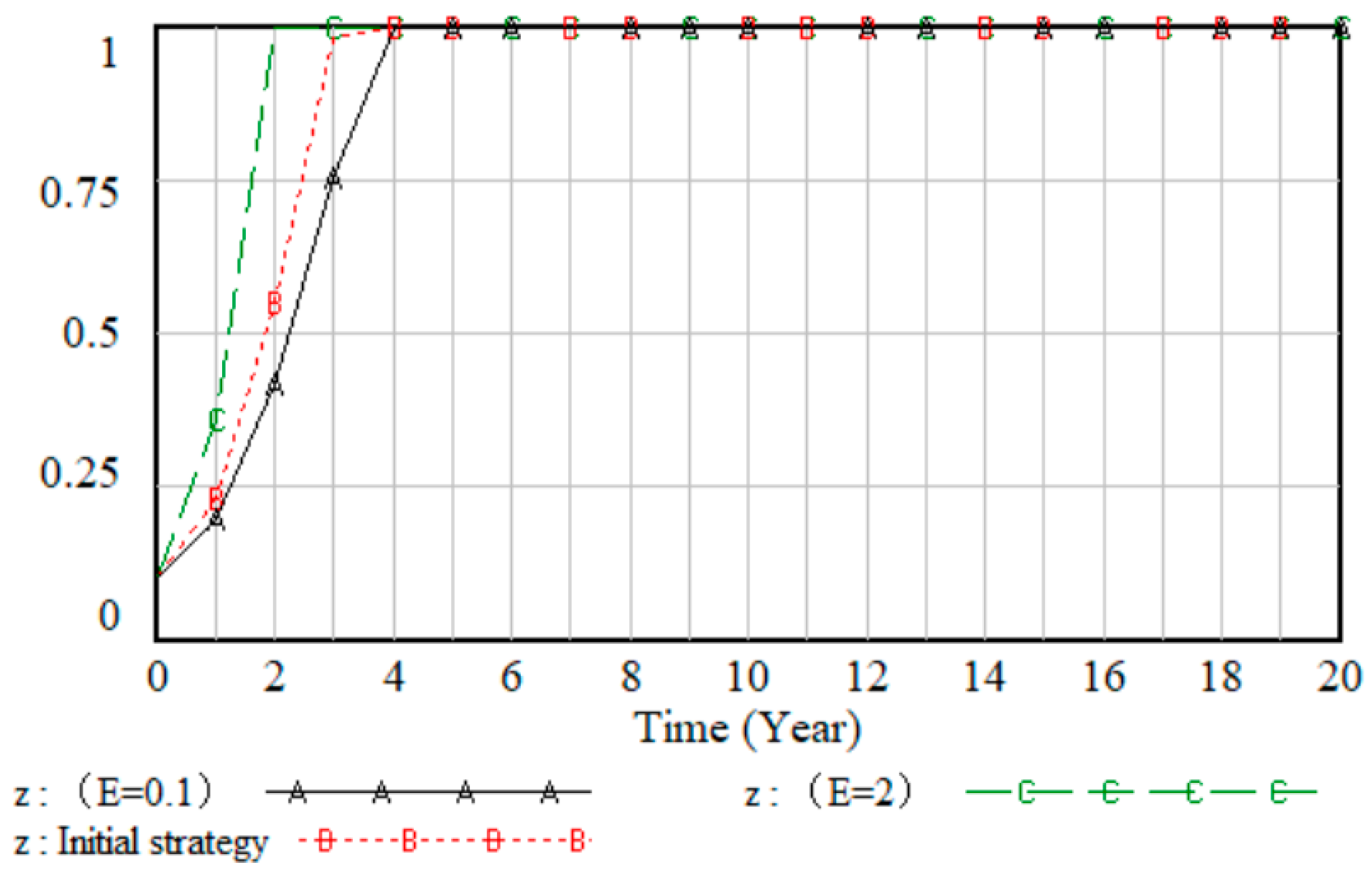

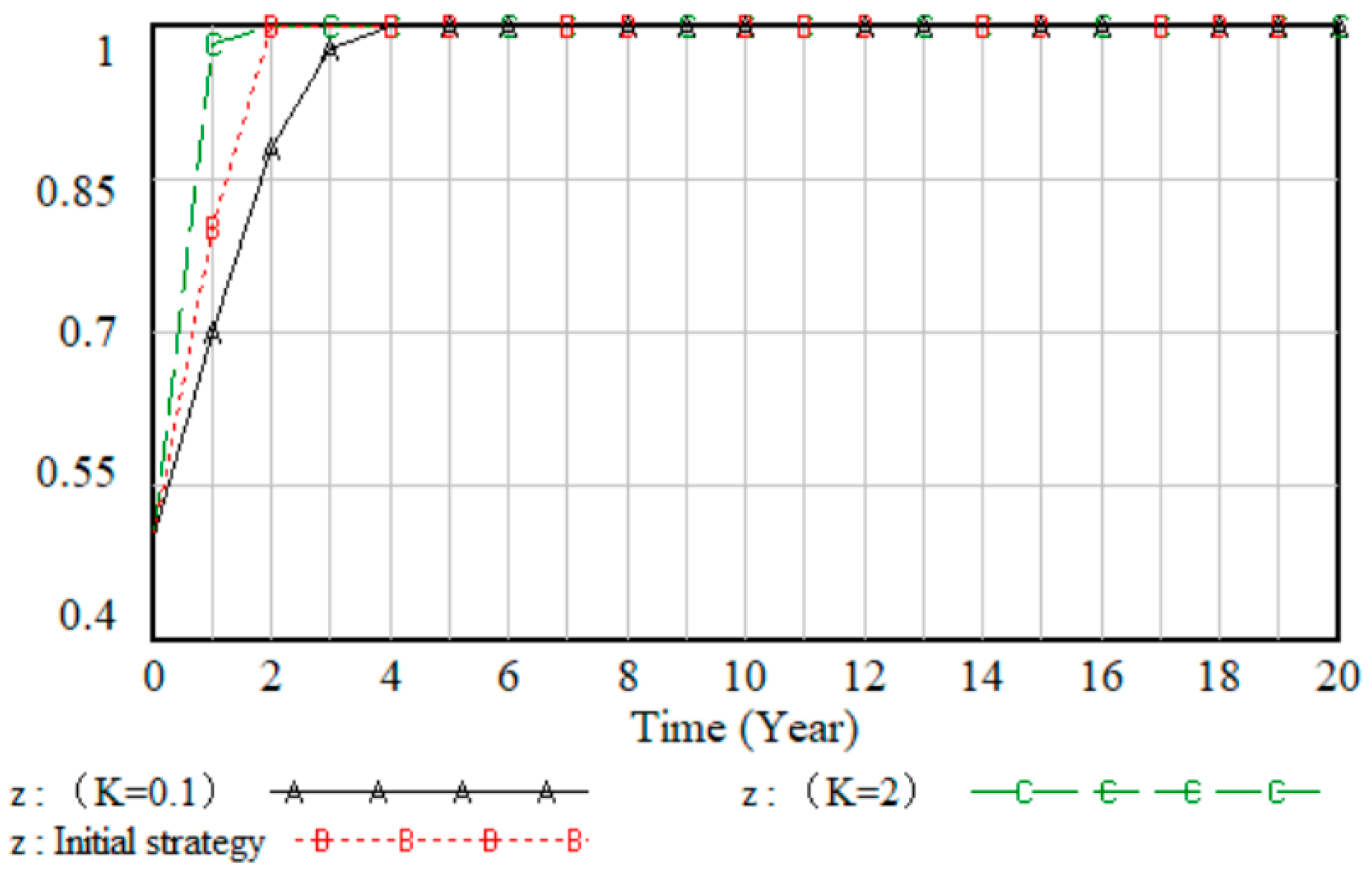

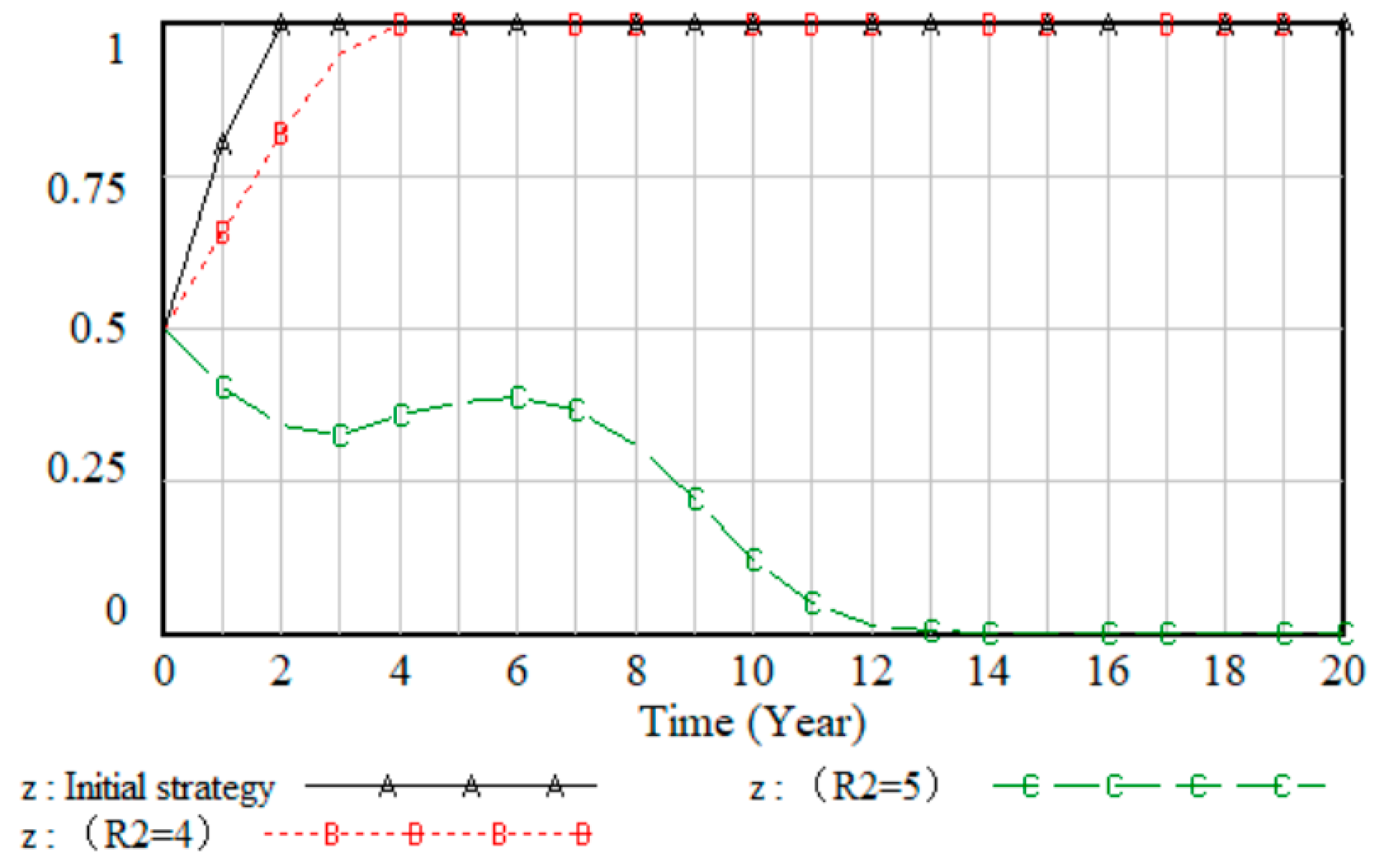

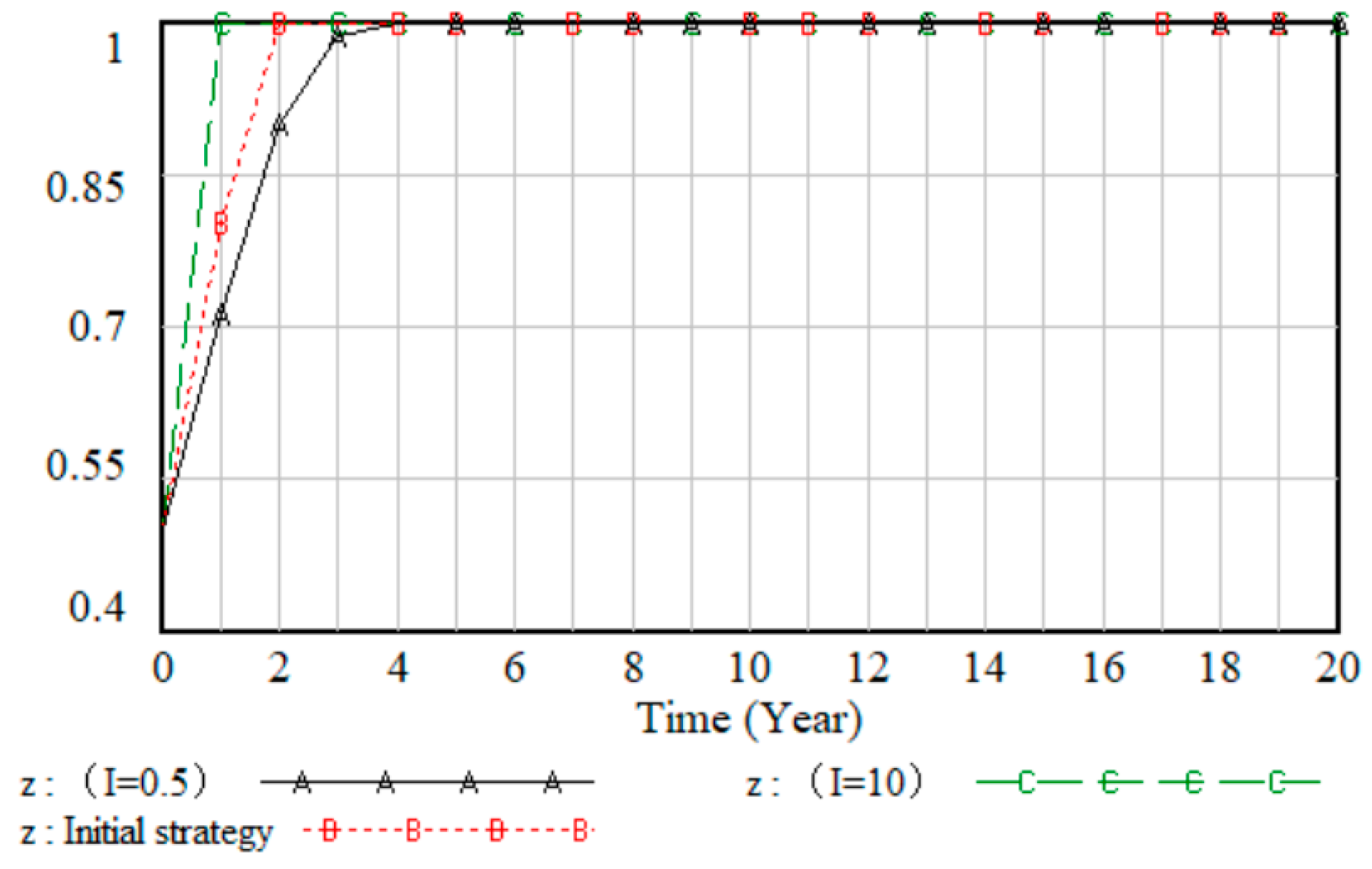

3.2.2. Sensitivity Analysis

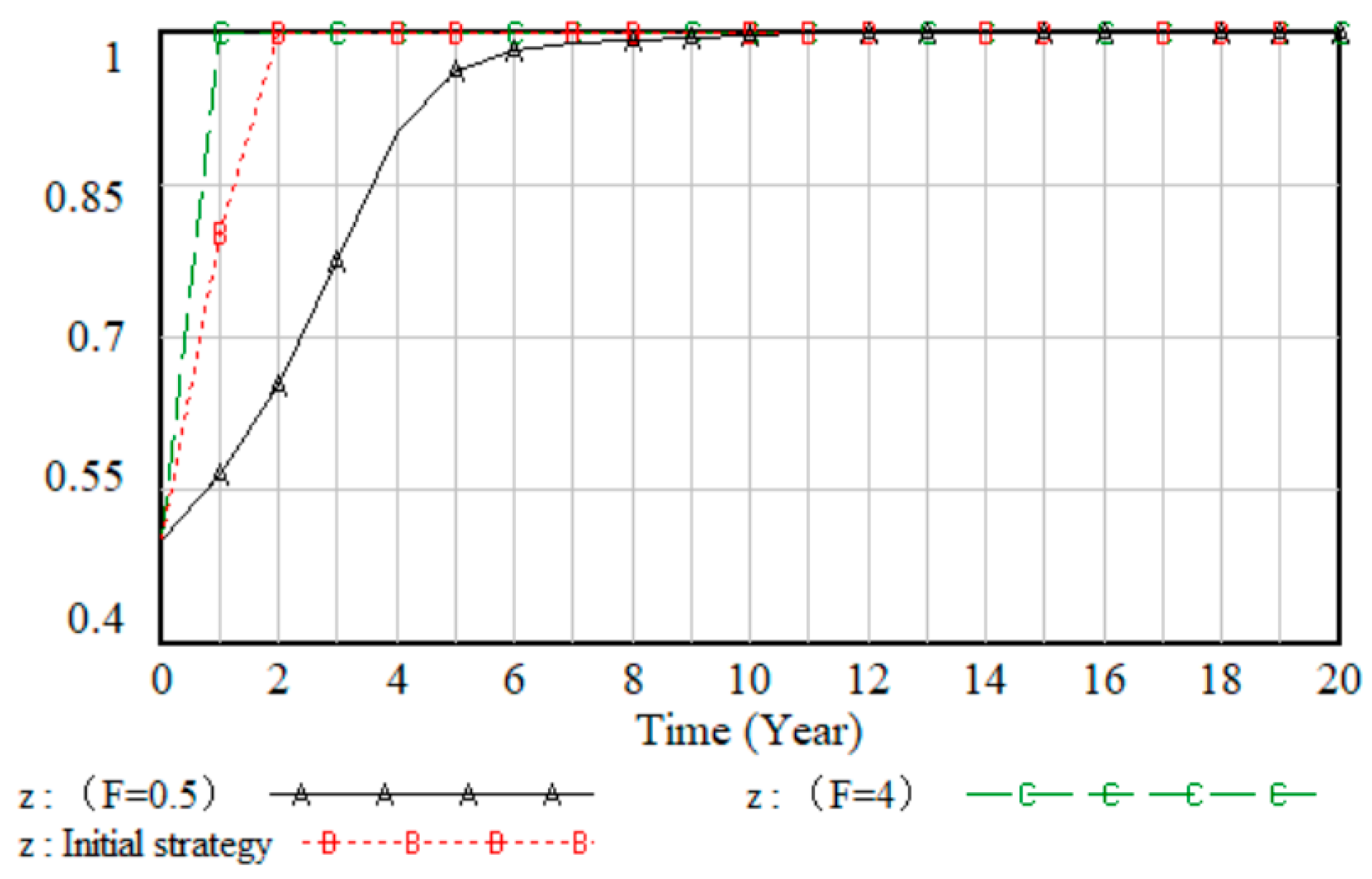

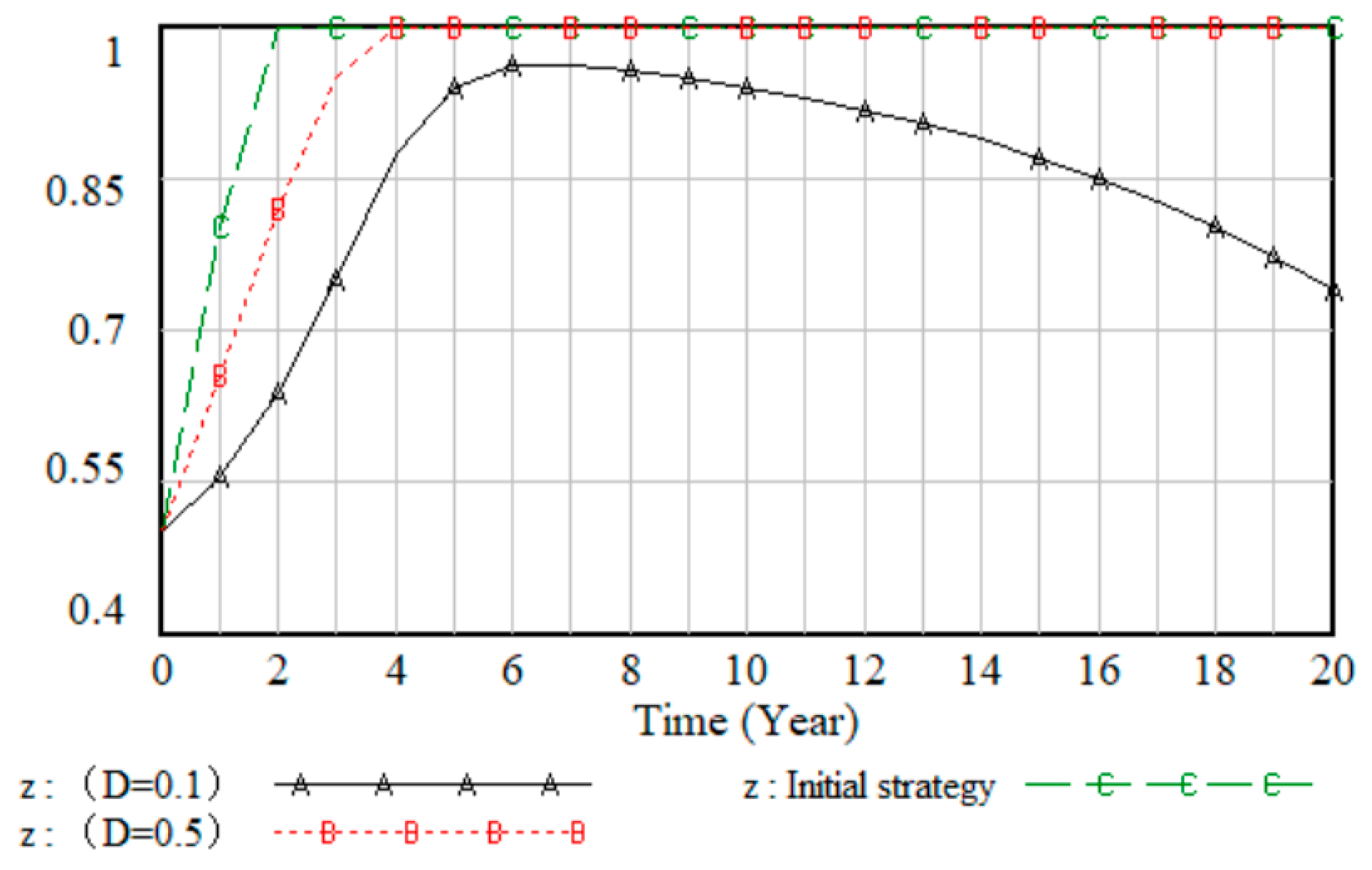

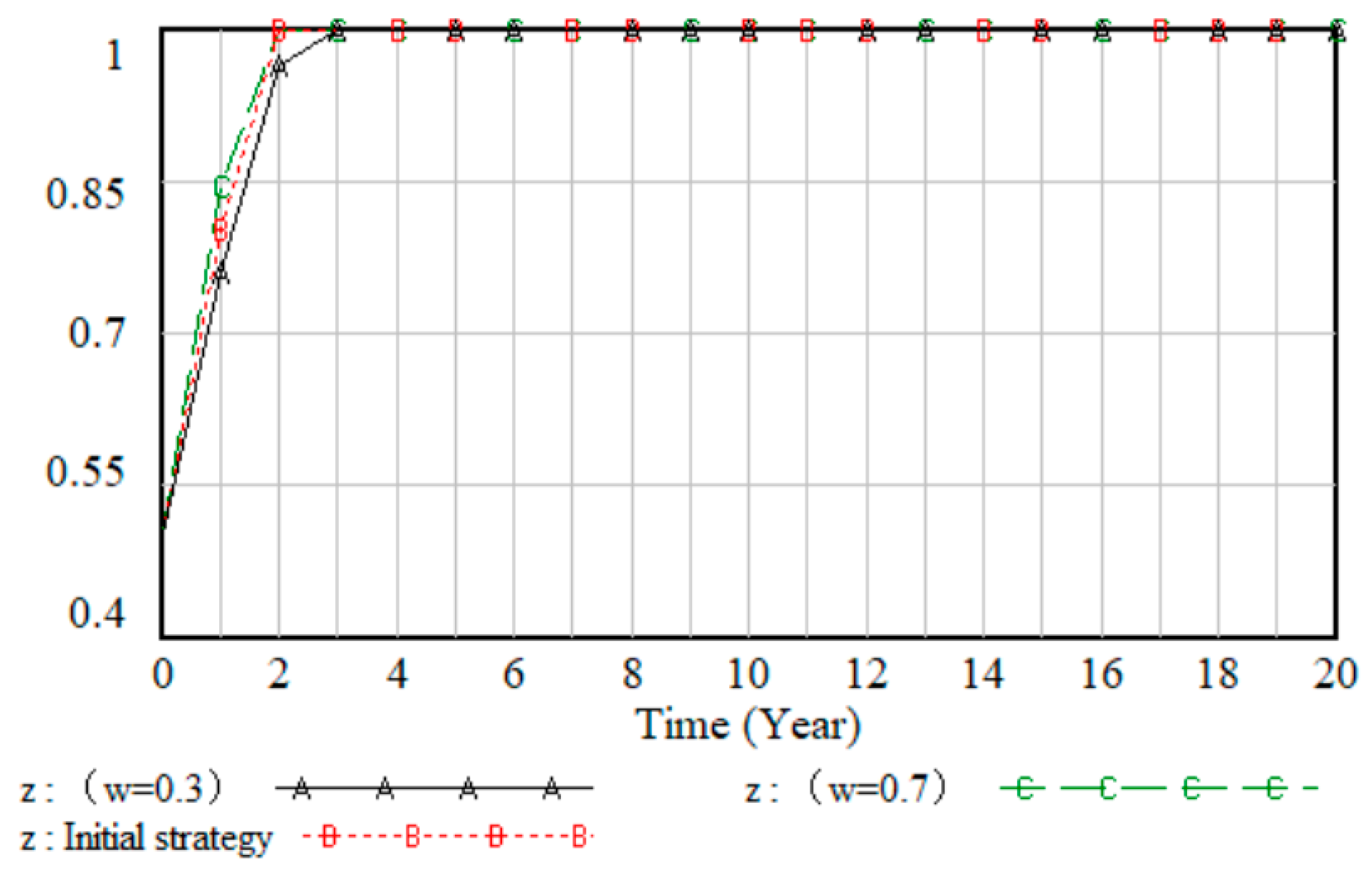

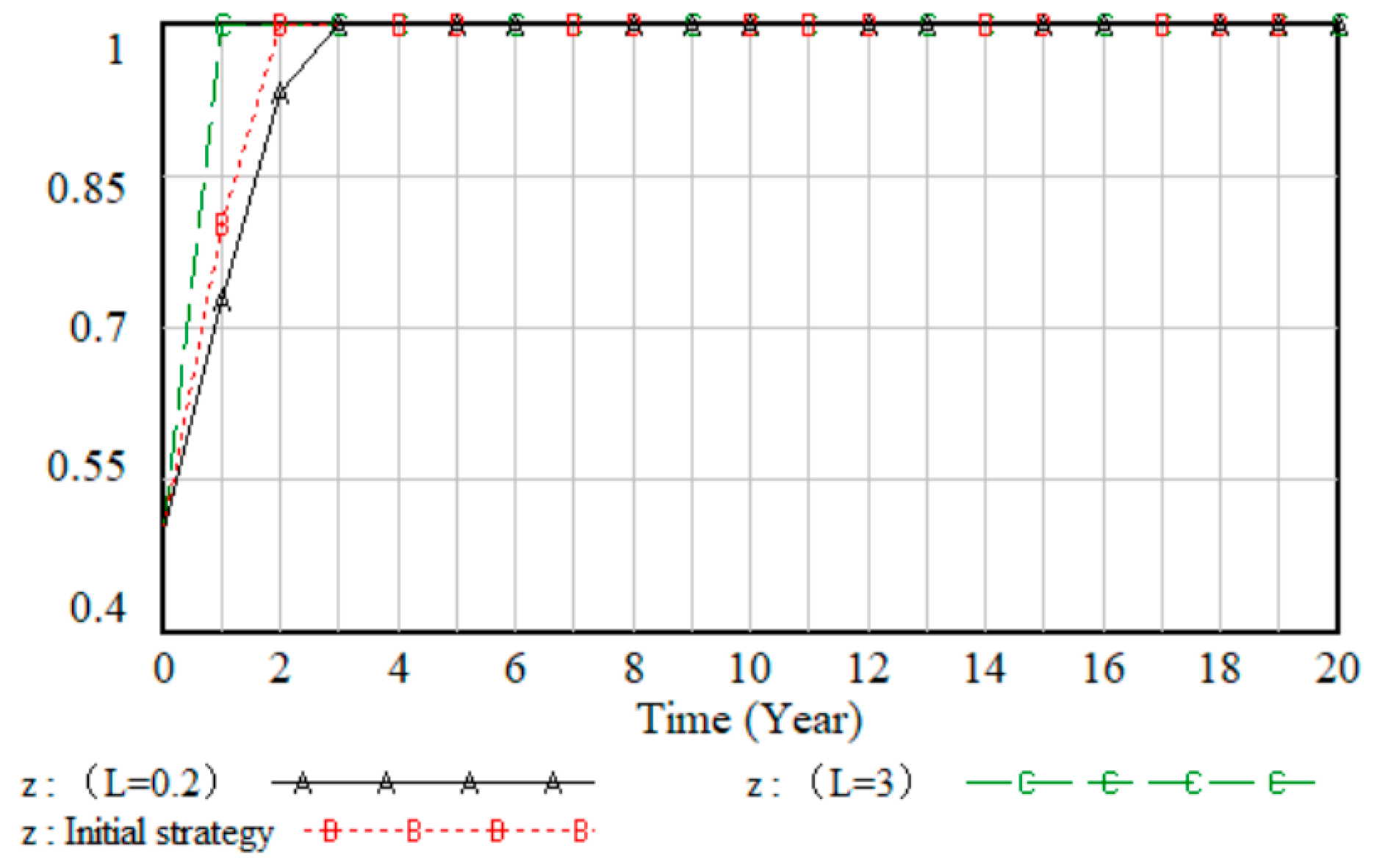

- (1)

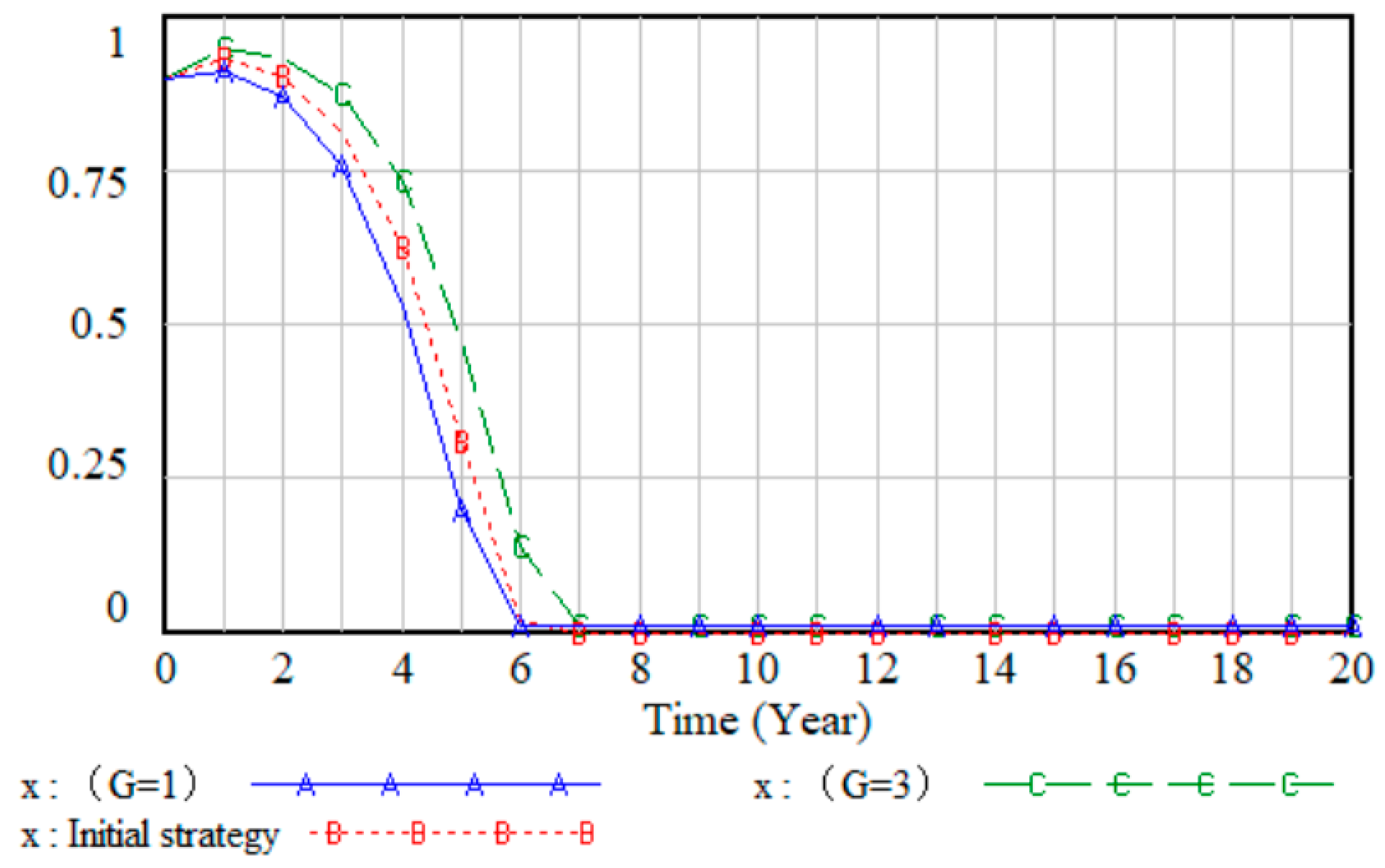

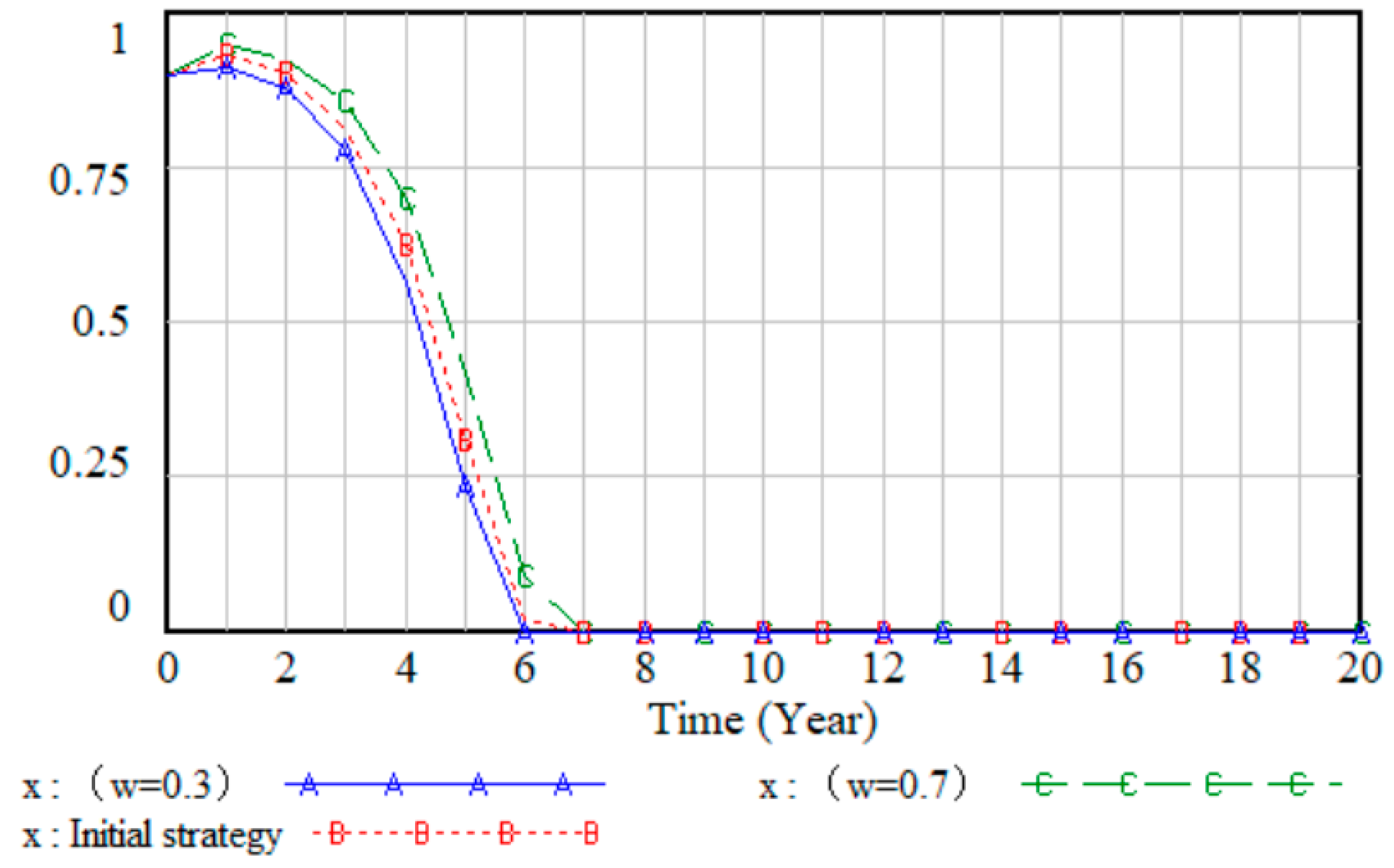

- Analysis of the Impact of Strategic Choices of Government Departments

- (2)

- Impact Analysis of Practitioner Strategy Selection

4. Policies and Recommendations

- (1)

- We recommend innovating the mode of government supervision and enhancing the effectiveness of supervision. Currently, there are problems such as high cost and low efficiency in single government supervision, and it is necessary to promote the transformation of the supervision mode to “multi-dimensional common governance.” On the one hand, based on the simulation results, it is evident that the involvement of non-governmental actors in supervision can enhance overall supervision effectiveness. However, delegating regulatory authority to non-governmental entities is a complex and high-stakes process that requires careful planning and execution. To achieve this, we should first conduct a comprehensive assessment of the capabilities and reliability of industry associations, enterprises, and the public in terms of regulatory functions. Then, we can gradually and selectively delegate appropriate regulatory tasks to them, starting with areas where they have demonstrated expertise and a high level of responsibility. At the same time, a well-defined and transparent regulatory framework should be established to clearly outline the roles, responsibilities, and rights of both the government and non-governmental actors in the supervision process. This framework should also include mechanisms for accountability and oversight to ensure that non-governmental actors perform their regulatory duties effectively and in compliance with the law. By doing so, we can gradually form a synergistic governance pattern of “government-led + industry self-regulation + social supervision,” which not only aims to improve supervision effectiveness but also helps to reduce the administrative burden on the government in a more secure and sustainable manner. On the other hand, the simulation shows that when the accuracy of credit information supervision increases by 30%, the probability of practitioners choosing integrity rises by about 10%. It is necessary to improve the construction of the credit information supervision platform, realize the dynamic sharing of national credit data, unify evaluation standards, and incorporate the function of public reporting to improve supervision accuracy. Concurrently, the division of powers and responsibilities within the government should be optimized, the regulatory responsibilities of each department should be clarified, the interface between the upper and lower levels should be strengthened, and the motivation of regulation should be enhanced through the mechanism of rewards and punishments so as to avoid the loss efficiency caused by the intersection of functions. Additionally, it is also imperative to strengthen supervision during and after the incident, formulate supporting regulations, and establish joint industry associations with the media, etc., to carry out dynamic sampling, to change the status quo of “heavy on approval but light on supervision,” and to ensure full coverage of whole-process supervision.

- (2)

- We recommend strengthening the primary responsibility of enterprises and building a joint credit constraint mechanism. The simulation shows that enterprises’ management enthusiasm and reward policies have a significant impact on practitioners’ integrity behavior. For this reason, the credit linkage mechanism of “enterprise–individual” should be established, and the credit of the practitioners should be incorporated into the credit rating system of the enterprise to encourage the enterprise to strengthen its internal management. At the same time, efforts should be dedicated to improving the reward and punishment policy. Capital subsidies, tax incentives, and other incentives should be provided to enterprises with good credit, while penalties for enterprises that tolerate or conceal dishonest behavior should be increased to raise the cost of their violations. Additionally, it is important to optimize the market access mechanism. This involves gradually reducing the rigid linkage between enterprise and practice qualifications, increasing the weight of credit evaluation in bidding and reducing “dependence” and other rent—seeking behaviors. Through policy guidance, enterprises will shift from passive compliance to active management, thereby forming a market self-regulatory mechanism.

- (3)

- We recommend the improvement of social supervision and the credit system to establish long-term constraints. The simulation results show that social public supervision and reporting intensity, reporting success benefits, and reputation loss due to being reported all have a promoting effect on practitioners’ integrity. Social supervision is an important supplement to government supervision, and public participation should be stimulated through system optimization. On the one hand, the reporting incentive mechanism should be improved, the bonus standard should be raised, the monitoring channels should be broadened, and publicity and guidance should be strengthened to enhance public awareness of monitoring. On the other hand, it is imperative to strengthen credit information disclosure and expose typical cases through credit platforms and the media to magnify the reputational loss of non-compliant behaviors and prompt practitioners to pay attention to long-term credibility. In addition, it is necessary to accelerate the construction of the credit system, establish a credit scoring system for practitioners, implement differentiated supervision, tilt policies towards those with high scores, and subject those with low scores to joint disciplinary measures. At the same time, market-based restraints such as professional liability insurance can be explored to make credit the core competitive metric of practitioners in the industry. This will ultimately form an all-round governance pattern featuring “government regulation+ enterprise self-discipline + social supervision + credit restraint.”

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Winch, G.M. Governing the Project Process: A Conceptual Framework. Constr. Manag. Econ. 2001, 19, 799–808. [Google Scholar] [CrossRef]

- Turner, J.R. Farsighted Project Contract Management: Incomplete in Its Entirety. Constr. Manag. Econ. 2004, 22, 75–83. [Google Scholar] [CrossRef]

- Seaden, G.; Manseau, A. Public Policy and Construction Innovation. Build. Res. Inf. 2001, 29, 182–196. [Google Scholar] [CrossRef]

- Park, H.; NamKyeongsook. A Study on the Improvement of Domestic Qualification System through the Comparison of Abroad Interior Architecture Qualification System. J. Korean Soc. Des. Cult. 2013, 19, 329–337. [Google Scholar]

- Drahos, P. (Ed.) Regulatory Theory: Foundations and Applications; ANU Press: Canberra, Australia, 2017. [Google Scholar]

- Loeb, M.; Magat, W.A. A Decentralized Method for Utility Regulation. J. Law Econ. 1979, 22, 399–404. [Google Scholar] [CrossRef]

- Peltzman, S. “The Theory of Economic Regulation” after 50 Years. Public Choice 2022, 193, 7–21. [Google Scholar] [CrossRef]

- Hancher, D.E.; Lambert, S.E.; Maloney, W.F. Quality Based Prequalification of Contractors; KTC-01-24/SPR-212-00-1F; University of Kentucky: Lexington, KY, USA, 2001. [Google Scholar]

- Essig, M.; Batran, A. Public–Private Partnership—Development of Long-Term Relationships in Public Procurement in Germany. J. Purch. Supply Manag. 2005, 11, 221–231. [Google Scholar] [CrossRef]

- Elliott, R.P. Quality Assurance: Top Management’s Tool for Construction Quality. Transp. Res. Rec. 1991, 17–19. [Google Scholar]

- Kaiser, M.G.; El Arbi, F.; Ahlemann, F. Successful Project Portfolio Management beyond Project Selection Techniques: Understanding the Role of Structural Alignment. Int. J. Proj. Manag. 2015, 33, 126–139. [Google Scholar] [CrossRef]

- Sun, Y.; Sun, H.; Sun, P.; Jin, X.; Yang, Y. Elevating the Corporate Social Responsibility Level: A Media Supervision Mechanism Based on the Stackelberg-Evolutionary Game Model. Omega 2025, 131, 103215. [Google Scholar] [CrossRef]

- Zhao, L.; Sun, M. How Can Credit Supervision Mechanism Improve Security Crowdsourcing Ecosystem Governance: An Evolutionary Game Theory Perspective. IEEE Access 2024, 12, 21647–21661. [Google Scholar] [CrossRef]

- Wu, Y.; Liu, Z.; Wang, X.; Zhang, S.; Feng, J. An Evolutionary Dynamical Analysis of Low-Carbon Technology Diffusion among Enterprises in the Complex Network. Technol. Forecast. Soc. Change 2024, 208, 123726. [Google Scholar] [CrossRef]

- Hu, W.; Ma, F.; Li, T. An Evolutionary Game and Simulation Study of Work Safety Governance and Its Impact on Long-Term Sustainability Under the Supervisory System. Sustainability 2025, 17, 566. [Google Scholar] [CrossRef]

- Chang, Y.-C. The Tripartite Evolutionary Game of Enterprises’ Green Production Strategy with Government Supervision and People Participation. J. Environ. Manag. 2024, 370, 122627. [Google Scholar] [CrossRef] [PubMed]

- Hegarty, W.H.; Sims, H.P. Some Determinants of Unethical Decision Behavior: An Experiment. J. Appl. Psychol. 1978, 63, 451–457. [Google Scholar] [CrossRef]

- May, D.R.; Gilson, R.L.; Harter, L.M. The Psychological Conditions of Meaningfulness, Safety and Availability and the Engagement of the Human Spirit at Work. J. Occup. Organ. Psychol. 2004, 77, 11–37. [Google Scholar] [CrossRef]

- Branzei, O.; Vertinsky, I.; Camp, R.D. Culture-Contingent Signs of Trust in Emergent Relationships. Organ. Behav. Hum. Decis. Process. 2007, 104, 61–82. [Google Scholar] [CrossRef]

- Sheldon, K.M. Integrating Behavioral-Motive and Experiential-Requirement Perspectives on Psychological Needs: A Two Process Model. Psychol. Rev. 2011, 118, 552–569. [Google Scholar] [CrossRef]

- Bowen, P.; Pearl, R.; Akintoye, A. Professional Ethics in the South African Construction Industry. Build. Res. Inf. 2007, 35, 189–205. [Google Scholar] [CrossRef]

- Kim, P.H.; Cooper, C.D.; Dirks, K.T.; Ferrin, D.L. Repairing Trust with Individuals vs. Groups. Organ. Behav. Hum. Decis. Process. 2013, 120, 1–14. [Google Scholar] [CrossRef]

- Abdul-Rahman, H.; Wang, C.; Saimon, M.A. Clients’ Perspectives of Professional Ethics for Civil Engineers. J. S. Afr. Inst. Civ. Eng. 2011, 53, 2–6. [Google Scholar]

- Abdul-Rahman, H.; Wang, C.; Yap, X.W. How Professional Ethics Impact Construction Quality: Perception and Evidence in a Fast Developing Economy. Sci. Res. Essays 2010, 5, 3742–3749. [Google Scholar] [CrossRef]

- Han, W.; Zhang, Z.; Zhu, Y.; Xia, C. Co-Evolutionary Dynamics in Optimal Multi-Agent Game with Environment Feedback. Neurocomputing 2024, 581, 127510. [Google Scholar] [CrossRef]

- Liu, X.; Yue, J.; Luo, L.; Liu, C.; Zhu, T. Evolutionary Analysis of Nuclear Wastewater Collaborative Governance Based on Prospect Theory. J. Clean. Prod. 2024, 465, 142856. [Google Scholar] [CrossRef]

- Li, S.; Chen, R.; Li, Z.; Chen, X. Can Blockchain Help Curb “Greenwashing” in Green Finance?—Based on Tripartite Evolutionary Game Theory. J. Clean. Prod. 2024, 435, 140447. [Google Scholar] [CrossRef]

- Qi, S.; Jia, M.; Zhou, X.; Zhang, T. Green Finance and “Greenization” of Enterprise’s Technology: Based on Evolutionary Game Theory and Empirical Test in China. Appl. Econ. 2025, 1–18. [Google Scholar] [CrossRef]

- Janan, M.; Taleizadeh, A.A.; Jolai, F. Electric Energy Supply Chain Finance and Pricing in an Energy Blockchain Environment: Sustainable Energy Bonds and Evolutionary Game Theory. Energy 2025, 320, 135186. [Google Scholar] [CrossRef]

- Peng, J.; Zhang, Q.; Feng, Y.; Liu, X. Optimization of Construction Safety Resource Allocation Based on Evolutionary Game and Genetic Algorithm. Sci. Rep. 2023, 13, 17097. [Google Scholar] [CrossRef]

- Guo, W.; Liang, Y.; Lei, M.; Cai, D.; Wu, X. A Stochastic Catastrophe Model of Construction Site Safety Hazards Supervision and Its Resilience. Energy 2024, 300, 131468. [Google Scholar] [CrossRef]

- Zhao, L.; Yang, W.; Wang, Z.; Liang, Y.; Zeng, Z. Long-Term Safety Evaluation of Soft Rock Tunnel Structure Based on Knowledge Decision-Making and Data-Driven Models. Comput. Geotech. 2024, 169, 106244. [Google Scholar] [CrossRef]

| Parameters | Meaning and Description |

|---|---|

| Costs of adopting strict regulation incurred by government departments | |

| Rewards from government departments when practitioners are honest | |

| Penalties for government departments when practitioners lack credibility | |

| Incentives from government departments when companies adopt proactive management strategies | |

| Penalties imposed by government departments when enterprises adopt negative management strategies | |

| Costs when firms adopt active management strategies | |

| Penalties for firms when a practitioner lacks credibility | |

| Rewards for businesses when practitioners are honest | |

| Normal earnings of practitioners on completion of projects | |

| Additional benefits for practitioners adopting bad faith strategies | |

| Benefits of successful rent-seeking by firms and practitioners | |

| Efforts of the public to monitor and report the behavior of practitioners | |

| Benefits of successful reporting by the public | |

| Loss of credibility of government departments in adopting less stringent regulatory strategies when the public report successfully | |

| Additional penalties imposed by government departments on enterprises for negative management in the event of a successful report by the public | |

| Loss of credibility of the practitioner in the event of successful public reporting | |

| Anticipated losses, including honor and finances, incurred by a practitioner who adopts a bad faith strategy | |

| Government Branch | Corporations | Practitioner | |

|---|---|---|---|

| Integrity () | Lack of Credibility () | ||

| Strict supervision () | Active management () | ||

| Negative management ) | |||

| Not strictly regulated ) | Active management () | ||

| Negative management ) | |||

| Balance Point | Eigenvalue 1 | Eigenvalue 2 | Eigenvalue 3 |

|---|---|---|---|

| (0, 0, 0) | |||

| (0, 1, 0) | |||

| (1, 1, 0) | |||

| (0, 1, 1) | |||

| (0, 0, 1) | |||

| (1, 0, 1) | |||

| (1, 0, 0) | |||

| (1, 1, 1) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, S.; Xue, S.; Qu, Q. Evolutionary Game Analysis of Credit Supervision for Practitioners in the Water Conservancy Construction Market from the Perspective of Indirect Supervision. Buildings 2025, 15, 2470. https://doi.org/10.3390/buildings15142470

Du S, Xue S, Qu Q. Evolutionary Game Analysis of Credit Supervision for Practitioners in the Water Conservancy Construction Market from the Perspective of Indirect Supervision. Buildings. 2025; 15(14):2470. https://doi.org/10.3390/buildings15142470

Chicago/Turabian StyleDu, Shijian, Song Xue, and Quanhua Qu. 2025. "Evolutionary Game Analysis of Credit Supervision for Practitioners in the Water Conservancy Construction Market from the Perspective of Indirect Supervision" Buildings 15, no. 14: 2470. https://doi.org/10.3390/buildings15142470

APA StyleDu, S., Xue, S., & Qu, Q. (2025). Evolutionary Game Analysis of Credit Supervision for Practitioners in the Water Conservancy Construction Market from the Perspective of Indirect Supervision. Buildings, 15(14), 2470. https://doi.org/10.3390/buildings15142470