A Modified Shapley Value Model for Equitable Benefit Distribution in Design-Led EPC Consortia

Abstract

1. Introduction

2. Literature Review

2.1. EPC Model

2.2. Benefit Distribution in Consortia

2.3. Benefit Distribution in EPC Project Consortia

3. Quantification of Net Benefits for Consortium Members

3.1. Cost Analysis of Consortium Members

3.2. Benefit Analysis of Consortium Members

- (1)

- Direct economic benefits refer to the immediate financial returns earned by consortium members through their own activities during the execution of the EPC project. These mainly include the following:

- Contractual Income: Payments received according to the contract terms upon the completion of project tasks;

- Cost-saving Benefits: Additional gains achieved through cost reduction measures such as design optimization, technical innovation, and improved communication;

- External Financial Rewards: Economic incentives or bonuses granted due to outstanding performance in project management during implementation.

- (2)

- Future benefits refer to the long-term strategic gains beyond the current EPC project, derived from value-adding activities carried out during project implementation. Based on enterprise needs, future benefits can be classified into three main pathways:

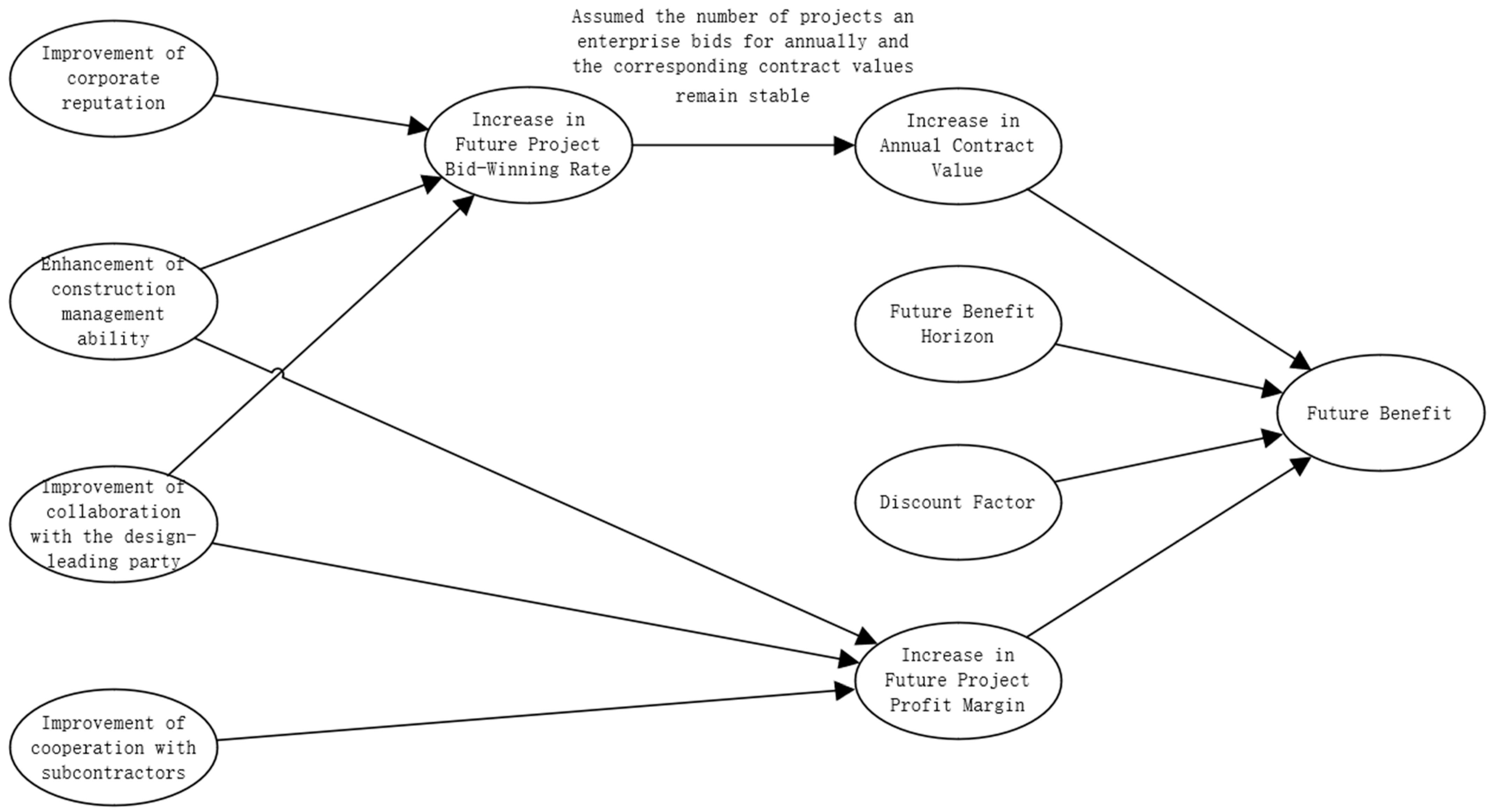

- Improved Corporate Reputation: Corporate reputation is a key indicator of a consortium member’s recognition within the industry, market, and client base. By delivering high-quality project services, consortium members can build a strong reputation, enhance client trust, and increase market credibility. An improved reputation not only attracts more potential partners, but also offers a competitive advantage in future EPC project bidding, thereby increasing the likelihood of contract awards;

- Enhanced Organizational Abilities: Through the practice and experience gained in managing EPC projects, consortium members can continuously refine and establish standardized project management systems, improve collaboration efficiency, and enhance resource integration abilities—thus reducing management costs in future projects. Meanwhile, the introduction of innovative technologies and methodologies not only increases the value of the current project, but also helps firms to develop efficient, cost-effective, and standardized procedures. This facilitates the undertaking of more complex and higher-level projects, while improving future cost control and profitability;

- Improved Cooperative Relationships: Maintaining collaborative relationships is a cornerstone of long-term development for consortium members. This includes sustained cooperation with owners, subcontractors, and suppliers. The performance of consortium members in EPC projects directly influences their future cooperation opportunities. During project execution, members can establish a stable strategic network through efficient information sharing, optimized collaboration processes, and strengthened mutual trust. This not only increases the likelihood of securing future projects, but also reduces transaction and procurement costs, enhances supply chain stability, and improves the overall effectiveness of future projects.

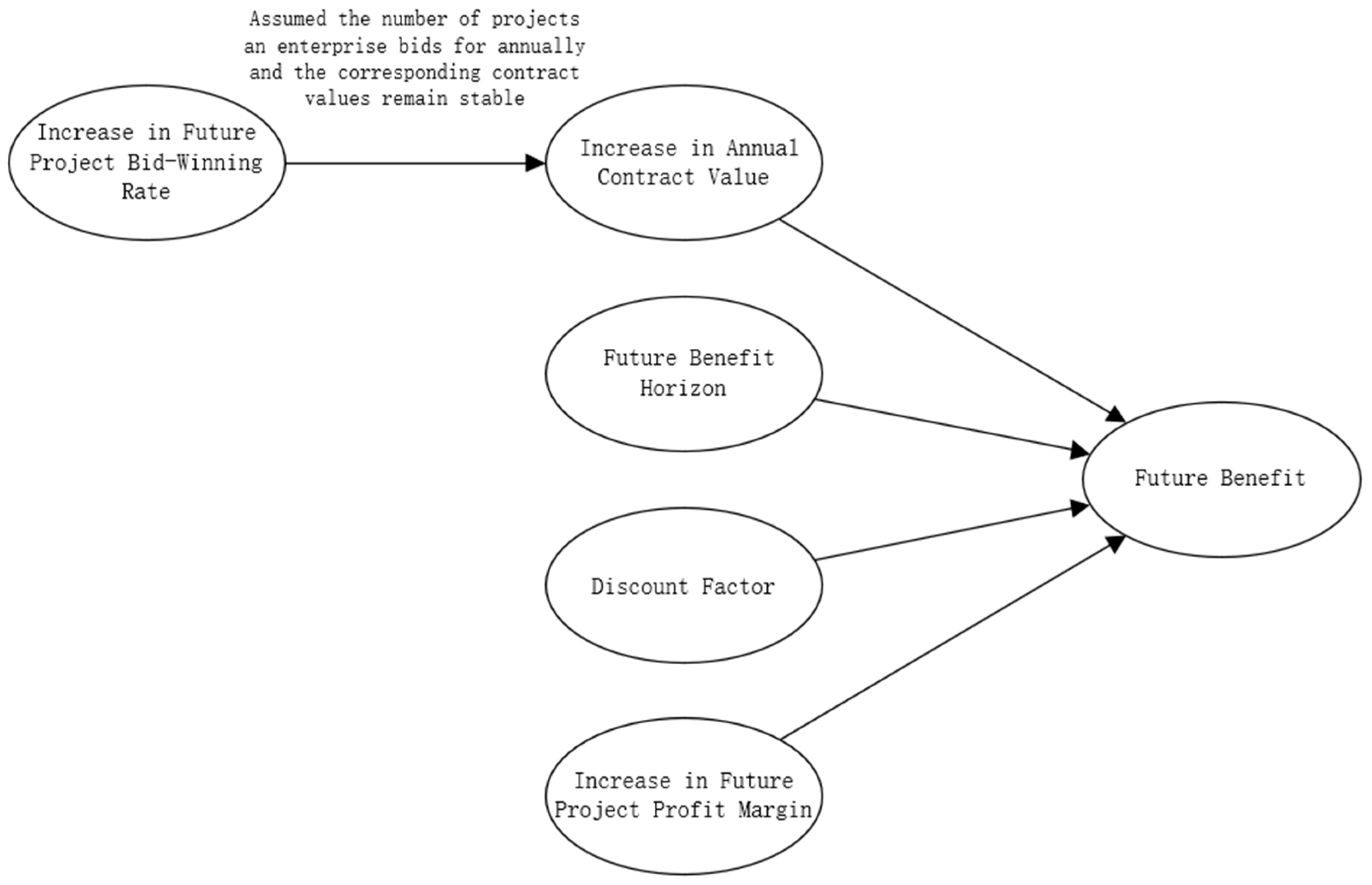

3.3. Quantification of Consortium Members’ Future Benefits

- (1)

- Quantification of the Design-leading Party’s Future Benefits

- (2)

- Quantification of the Contractor’ Future Benefits

4. Benefit Distribution of EPC Consortium Based on Modified Shapley Value

4.1. Basic Assumptions of Benefit Distribution

4.2. Determination of Classical Shapley Value for Consortium Members

- When the subset is an empty set, none of the enterprises participate in the implementation of the EPC project. In this case, the net benefit of the consortium is obviously zero, denoted as ;

- When the subset contains only one element, each of the three firms participates in the EPC project independently. The corresponding net benefits are denoted as , , and ;

- When , it indicates that Design Firm X and Construction Firm Y jointly participate in the EPC project. The net benefit of the consortium at this time is denoted as ;

- When , it indicates that Design Firm X and Construction Firm Z jointly participate in the EPC project. The net benefit of the consortium at this time is denoted as ;

- When , it indicates that Construction Firms Y and Z jointly participate in the EPC project. The net benefit of the consortium at this time is denoted as ;

- When , it indicates that Design Firm X, Construction Firm Y, and Construction Firm Z jointly participate in the EPC project. The net benefit of the consortium at this time is denoted as .

- denotes the number of members in coalition , reflecting its size;

- represents the total benefit generated by the full coalition ;

- is the total benefit of the same coalition without member ;

- The difference captures the marginal contribution of member —that is, the added value generated by its inclusion;

- The term indicates the probability of coalition forming in a random sequence.

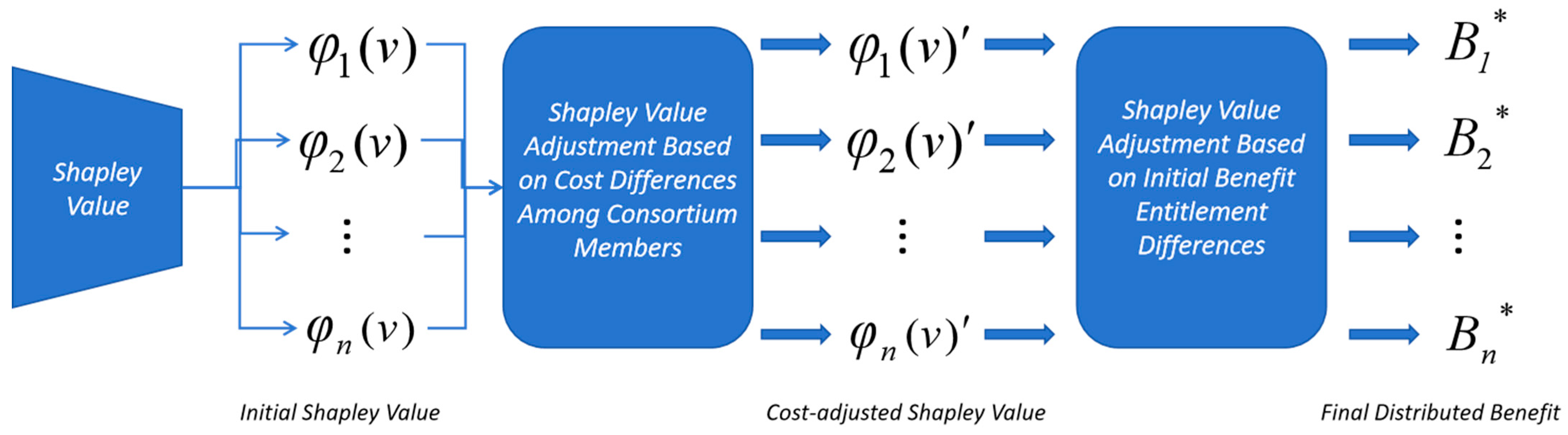

4.3. Construction of the Modified Shapley Value Model

- (1)

- Shapley Value Adjustment Based on Cost Differences Among Consortium Members

- (2)

- Shapley Value Adjustment Based on Initial Benefit Entitlement Differences

- Initial Benefit Proportion (): The proportion of initial net benefits controlled by member ;

- Willingness to Cooperate (): The degree to which other consortium members are willing to accept the dominant party’s proposed distribution;

- Bargaining Power (): Reflects the strategic or contractual authority a member holds in internal negotiations.

5. Case Study

5.1. Case Analysis

5.2. Quantification of Net Benefits in the Case Project

- (1)

- Estimating Future Benefits for Consortium Members

- (2)

- Estimating Net Benefits for Consortium Members

5.3. Analysis of Benefit Distribution in the Case Project

- (1)

- Construction of the Modified Shapley Value Model in the Case Project

- Historical data from similar EPC projects with comparable size, scope, and structure;

- Expert assessments from project managers involved in the case study;

- The actual cost–revenue structure and task allocation observed in the Hangzhou national highway reconstruction project.

- (2)

- Construction of the Modified Shapley Value Model in the Case Project

- Design Firm X: ≈ 0.24;

- Construction Firm Y: ≈ 0.41;

- Construction Firm Z: ≈ 0.35.

- Design Firm X: CNY 15.76 million;

- Construction Firm Y: CNY 21.55 million;

- Construction Firm Z: CNY 14.44 million.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire on Correction Coefficients for the Future Benefit of the Design-Leading Party

- Dear respondent,

- This questionnaire aims to investigate how various influencing factors affect the Future Benefit of the design-leading party in a design-led EPC model. Your participation is critical to the success of this study. Thank you for taking the time to contribute.

Appendix A.1

- If the corporate reputation of the design firm improves by 10%, how will its Future Project Bid-Winning Rate change?

- ○

- No significant change

- ○

- The Future Project Bid-Winning Rate increases by ( )%

- If the professional design ability of the design firm improves by 10%, how will its Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

- If the professional design ability of the design firm improves by 10%, how will its Future Project Bid-Winning Rate change?

- ○

- No significant change

- ○

- The Future Project Bid-Winning Rate increases by ( )%

- If the EPC Project Management Ability of the design firm improves by 10%, how will its Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

- If the EPC Project Management Ability of the design firm improves by 10%, how will its Future Project Bid-Winning Rate change?

- ○

- No significant change

- ○

- The Future Project Bid-Winning Rate increases by ( )%

- If the cooperation with the owner improves by 10%, how will the design firm’s Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

- If the cooperation with the owner improves by 10%, how will the design firm’s Future Project Bid-Winning Rate change?

- ○

- No significant change

- ○

- The Future Project Bid-Winning Rate increases by ( )%

- If the cooperation with the contractor improves by 10%, how will the design firm’s Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

- If the cooperation with suppliers improves by 10%, how will the design firm’s Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

Appendix A.2

- 10.

- After implementing “coordination and design optimization during the construction phase of the EPC project,” how will the design firm’s professional design ability change?

- ○

- No significant change

- ○

- The design firm’s professional design ability improves by ( )%

- 11.

- After implementing “coordination and design optimization during the construction phase of the EPC project,” how will the design firm’s EPC Project Management Ability change?

- ○

- No significant change

- ○

- The design firm’s EPC Project Management Ability improves by ( )%

- 12.

- After implementing “coordination and design optimization during the construction phase of the EPC project,” how will the cooperation with the contractor change?

- ○

- No significant change

- ○

- The cooperation with the contractor improves by ( )%

Appendix B. Questionnaire on Correction Coefficients for the Future Benefit of the Contractor

- Dear respondent,

- This questionnaire aims to investigate how various influencing factors affect the Future Benefit of the Contractor in a design-led EPC model. Your participation is critical to the success of this study. Thank you for taking the time to contribute.

Appendix B.1

- If the corporate reputation of the contractor improves by 10%, how will its Future Project Bid-Winning Rate change?

- ○

- No significant change

- ○

- The Future Project Bid-Winning Rate increases by ( )%

- If the construction management ability of the contractor improves by 10%, how will its Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

- If the construction management ability of the contractor improves by 10%, how will its Future Project Bid-Winning Rate change?

- ○

- No significant change

- ○

- The Future Project Bid-Winning Rate increases by ( )%

- If the cooperation with the design firm improves by 10%, how will the contractor’s Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

- If the cooperation with the design firm improves by 10%, how will the contractor’s Future Project Bid-Winning Rate change?

- ○

- No significant change

- ○

- The Future Project Bid-Winning Rate increases by ( )%

- If the cooperation with subcontractors improves by 10%, how will the contractor’s Future Project Profit Margin change?

- ○

- No significant change

- ○

- The Future Project Profit Margin increases by ( )%

Appendix B.2

- 7.

- After participating in “coordination and design optimization during the construction phase of the EPC project,” how will the contractor’s construction management ability change?

- ○

- No significant change

- ○

- The construction firm’s construction management ability improves by ( )%

- 8.

- After participating in “coordination and design optimization during the construction phase of the EPC project,” how will the cooperation with the design firm change?

- ○

- No significant change

- ○

- The cooperation with the design firm improves by ( )%

References

- Amoah, A.; Berbegal-Mirabent, J.; Marimon, F. Making the Management of a Project Successful: Case of Construction Projects in Developing Countries. J. Constr. Eng. Manag. 2021, 147, 4021166. [Google Scholar] [CrossRef]

- Toyin, J.O.; Sattineni, A.; Wetzel, E.M.; Fasoyinu, A.A.; Kim, J. Augmented reality in US Construction: Trends and future directions. Autom. Constr. 2025, 170, 105895. [Google Scholar] [CrossRef]

- Chen, Y.; Ren, Z.; Hu, B.; Zheng, H. Investigation of the Critical Factors Influencing Multi-Stakeholders’ Participation in Design Optimization of EPC Projects. Buildings 2023, 13, 1654. [Google Scholar] [CrossRef]

- Tang, L.; Shen, Q.; Cheng, E.W.L. A review of studies on Public–Private Partnership projects in the construction industry. Int. J. Proj. Manag. 2010, 28, 683–694. [Google Scholar] [CrossRef]

- Turner, R. Gower Handbook of Project Management; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Zhou, Z. Research on Procurement Management of EPC Project Led by Design Institute. Constr. Econ. 2024, 45, 43–47. (In Chinese) [Google Scholar]

- Tian, R. Research on Profit Distribution of EPC Project Consortium in Transportation Infrastructure Construction. Master’s Thesis, Changsha University of Science & Technology, Changsha, China, 2020. (In Chinese). [Google Scholar]

- Jiang, W.; Tang, S. The cooperation establishment mechanism of EPC project consortium in context of China: Form the perspective of trust. Sustainability 2023, 15, 1266. [Google Scholar] [CrossRef]

- Li, H.; Lv, L.; An, X.; Dong, G.; Ozmen, H.B. Profit Sharing Mechanism of Large EPC Project considering the Behavior of Fairness Concern. Adv. Civ. Eng. 2020, 2020, 3725254. [Google Scholar] [CrossRef]

- Kwak, Y.H.; Sadatsafavi, H.; Walewski, J.; Williams, N.L. Evolution of project based organization: A case study. Int. J. Proj. Manag. 2015, 33, 1652–1664. [Google Scholar] [CrossRef]

- Sun, C.; Wang, M.; Zhai, F. Research on the Collaborative Application of BIM in EPC Projects: The Perspective of Cooperation between Owners and General Contractors. Adv. Civ. Eng. 2021, 2021, 4720900. [Google Scholar] [CrossRef]

- Wagner, R.F. EPC 4.0: The quest for reducing CAPEX in EPC projects. Organ. Technol. Manag. Constr. Int. J. 2020, 12, 2245–2255. [Google Scholar] [CrossRef]

- Gao, L.; Deng, X.; Yang, W.; Chang, T.; Liu, X. Exploring Critical Factors Affecting Contractors’ Coopetition Relationship in International Construction Projects. Adv. Civ. Eng. 2021, 2021, 8897395. [Google Scholar] [CrossRef]

- Du, L.; Tang, W.; Liu, C.; Wang, S.; Wang, T.; Shen, W.; Huang, M.; Zhou, Y. Enhancing engineer–procure–construct project performance by partnering in international markets: Perspective from Chinese construction companies. Int. J. Proj. Manag. 2016, 34, 30–43. [Google Scholar] [CrossRef]

- Wang, T.; Tang, W.; Du, L.; Duffield, C.F.; Wei, Y. Relationships among Risk Management, Partnering, and Contractor Capability in International EPC Project Delivery. J. Manag. Eng. 2016, 32, 4016017. [Google Scholar] [CrossRef]

- Baghalzadeh Shishehgarkhaneh, M.; Keivani, A.; Moehler, R.C.; Jelodari, N.; Laleh, S.R. Internet of Things (IoT), Building Information Modeling (BIM), and Digital Twin (DT) in construction industry: A review, bibliometric, and network analysis. Buildings 2022, 12, 1503. [Google Scholar] [CrossRef]

- Kabirifar, K.; Mojtahedi, M. The impact of Engineering, Procurement and Construction (EPC) Phases on Project Performance: A Case of Large-scale Residential Construction Project. Buildings 2019, 9, 15. [Google Scholar] [CrossRef]

- Shen, W.; Tang, W.; Yu, W.; Duffield, C.F.; Hui, F.K.P.; Wei, Y.; Fang, J. Causes of contractors’ claims in international engineering-procurement-construction projects. J. Civ. Eng. Manag. 2017, 23, 727–739. [Google Scholar] [CrossRef]

- Aldhaheri, M.; Bakchan, A.; Sandhu, M.A. A structural equation model for enhancing effectiveness of engineering, procurement and construction (EPC) major projects. Eng. Constr. Archit. Manag. 2018, 25, 1226–1252. [Google Scholar] [CrossRef]

- Liu, J.; Wang, Z.; Skitmore, M.; Yan, L. How Contractor Behavior Affects Engineering Project Value-Added Performance. J. Manag. Eng. 2019, 35, 4019012. [Google Scholar] [CrossRef]

- Wang, T.; Tang, W.; Qi, D.; Shen, W.; Huang, M. Enhancing Design Management by Partnering in Delivery of International EPC Projects: Evidence from Chinese Construction Companies. J. Constr. Eng. Manag. 2016, 142, 4015099. [Google Scholar] [CrossRef]

- Lee, C.; Chong, H.; Li, Q.; Wang, X. Joint Contract–Function Effects on BIM-Enabled EPC Project Performance. J. Constr. Eng. Manag. 2020, 146, 4020008. [Google Scholar] [CrossRef]

- Fan, Z.; Liu, Y.; Li, Y. Research on Collaborative Mechanisms of Railway EPC Project Design and Construction from the Perspective of Social Network Analysis. Systems 2023, 11, 443. [Google Scholar] [CrossRef]

- Von Neumann, J.; Morgenstern, O. Theory of Games and Economic Behavior; Princeton University Press: Princeton, NJ, USA, 1944. [Google Scholar]

- Nash, J.F. The bargaining problem. Econometrica 1950, 18, 155–162. [Google Scholar] [CrossRef]

- Shapley, L.S. Contributions to the Theory of Games II; Princeton University Press: Princeton, NJ, USA, 1953. [Google Scholar]

- Gillies, D.B. Contributions to the Theory of Games IV; Princeton University Press: Princeton, NJ, USA, 1959. [Google Scholar]

- Schmeidler, D. The Nucleolus of a Characteristic Function Game. SIAM J. Appl. Math. 1969, 17, 1163–1170. [Google Scholar] [CrossRef]

- Gulati, R.; Wohlgezogen, F.; Zhelyazkov, P. The Two Facets of Collaboration: Cooperation and Coordination in Strategic Alliances. Acad. Manag. Ann. 2012, 6, 531–583. [Google Scholar] [CrossRef]

- Feng, X.; Moon, I.; Ryu, K. Revenue-sharing contracts in an N-stage supply chain with reliability considerations. Int. J. Prod. Econ. 2014, 147, 20–29. [Google Scholar] [CrossRef]

- Guo, S.; Wang, J.; Xiong, H. The influence of effort level on profit distribution strategies in IPD projects. Eng. Constr. Archit. Manag. 2022, 30, 4099–4119. [Google Scholar] [CrossRef]

- Liu, D.; Liu, L.; Tan, X. Risk sharing in quasi-public-welfare water conservancy (PPP) public-private participation projects: An integrated application of Shapley value and utility theory. Front. Earth Sci. 2023, 11, 1234319. [Google Scholar] [CrossRef]

- Shang, T.; Liu, P.; Guo, J. How to allocate energy-saving benefit for guaranteed savings EPC projects? A case of China. Energy 2020, 191, 116499. [Google Scholar] [CrossRef]

- Yu, H.; Liu, Z.; Liu, Y.; Chen, T.; Cong, M.; Weng, X.; Niyato, D.; Yang, Q. A Fairness-Aware Incentive Scheme for Federated Learning. In Proceedings of the AAAI/ACM Conference on AI, Ethics, and Society, New York City, NY, USA, 7–8 February 2020; pp. 393–399. [Google Scholar]

- Hosseinian, S.M.; Carmichael, D.G. Optimal outcome sharing with a consortium of contractors. J. Civ. Eng. Manag. 2016, 22, 655–665. [Google Scholar] [CrossRef]

- Ding, J.; Chen, C.; An, X.; Wang, N.; Zhai, W.; Jin, C. Study on Added-Value Sharing Ratio of Large EPC Hydropower Project Based on Target Cost Contract: A Perspective from China. Sustainability 2018, 10, 3362. [Google Scholar] [CrossRef]

- Yue, Y.; Wang, S.; Que, Z. Analysis of revenue distribution of assembly building under EPC model based on entropy weight-TOPSIS improved Shapley value. Bioresources 2025, 20, 322–330. [Google Scholar] [CrossRef]

- Liu, X.; Wang, X.; Guo, H.; An, X. Benefit Allocation in Shared Water-Saving Management Contract Projects Based on Modified Expected Shapley Value. Water Resour. Manag. 2021, 35, 39–62. [Google Scholar] [CrossRef]

- Kalai, E.; Smorodinsky, M. Other solutions to Nash’s bargaining problem. Econom. J. Econom. Soc. 1975, 43, 513–518. [Google Scholar] [CrossRef]

| Existing Methods | Limitations |

|---|---|

| Core | Computationally complex with limited practical applicability |

| Nucleolus | |

| Classical Shapley Value | Assumes equal distribution of all factors |

| Existing Modified Shapley Value | Fails to account for differences in initial benefit entitlements among consortium members |

| Impact Factors | Sub-Correction Coefficient of Future Project Profit Margin | Sub-Correction Coefficient of Future Project Bid-Winning Rate |

|---|---|---|

| Improvement in corporate reputation | / | 1.06 |

| Enhancement in professional design ability | 1.09 | 1.07 |

| Enhancement in EPC project management ability | 1.08 | 1.05 |

| Improvement in cooperation with the owner | 1.04 | 1.07 |

| Improvement in cooperation with the contractor | 1.06 | / |

| Improvement in cooperation with suppliers | 1.05 | / |

| Impact Factors | Sub-Correction Coefficient of Future Project Profit Margin | Sub-Correction Coefficient of Future Project Bid-Winning Rate |

|---|---|---|

| Improvement in corporate reputation | / | 1.07 |

| Enhancement in construction management ability | 1.07 | 1.05 |

| Improvement in collaboration with the design-leading party | 1.08 | 1.05 |

| Improvement in cooperation with subcontractors | 1.05 | / |

| 0 | ||||

| Consortium Member | Labor Cost (CNY Million) | Material Cost (CNY Million) | Capital Cost (CNY Million) |

|---|---|---|---|

| Design Firm X | 6.5 | 2.5 | 1 |

| Construction Firm Y | 7 | 6.5 | 3.3 |

| Construction Firm Z | 6 | 5.5 | 2.8 |

| Consortium Member | Design Firm X | Construction Firm Y | Construction Firm Z |

|---|---|---|---|

| Cost (CNY million) | 10.00 | 16.80 | 14.30 |

| Direct Economic Benefit (CNY million) | 12.00 | 31.00 | 27.00 |

| Future Benefit (CNY million) | 4.10 | 11.25 | 7.50 |

| Net Benefit (CNY million) | 6.10 | 25.45 | 20.20 |

| Non-Empty Subsets | |||||||

|---|---|---|---|---|---|---|---|

| Consortium Members | X | Y | Z | X, Y | X, Z | Y, Z | X, Y, Z |

| Characteristic Function | v(1) | v(2) | v(3) | v(1,2) | v(1,3) | v(2,3) | v(1,2,3) |

| Net Benefit (CNY million) | 3 | 7 | 5 | 29 | 23 | 13 | 51.75 |

| Consortium Member | Design Firm X | Construction Firm Y | Construction Firm Z |

|---|---|---|---|

| Equal Distribution (CNY million) | 17.25 | 17.25 | 17.25 |

| Classical Shapley (CNY million) | 20.59 | 17.58 | 13.58 |

| φi(v)′ (CNY million) | 15.76 | 21.55 | 14.44 |

| (CNY million) | 13.96 | 22.63 | 15.16 |

| Contract-Based Distribution (CNY million) | 14.22 | 22.52 | 15.01 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lao, J.; Qin, Z. A Modified Shapley Value Model for Equitable Benefit Distribution in Design-Led EPC Consortia. Buildings 2025, 15, 2024. https://doi.org/10.3390/buildings15122024

Lao J, Qin Z. A Modified Shapley Value Model for Equitable Benefit Distribution in Design-Led EPC Consortia. Buildings. 2025; 15(12):2024. https://doi.org/10.3390/buildings15122024

Chicago/Turabian StyleLao, Jiangtao, and Zhongfu Qin. 2025. "A Modified Shapley Value Model for Equitable Benefit Distribution in Design-Led EPC Consortia" Buildings 15, no. 12: 2024. https://doi.org/10.3390/buildings15122024

APA StyleLao, J., & Qin, Z. (2025). A Modified Shapley Value Model for Equitable Benefit Distribution in Design-Led EPC Consortia. Buildings, 15(12), 2024. https://doi.org/10.3390/buildings15122024