1. Introduction

The real estate industry plays a crucial role in boosting domestic development and the worldwide economy. In 2017, worldwide real estate transactions amounted to a value of

$873 billion, according to [

1]. Further, the global real estate market was valued at approximately

$379.7 trillion in 2022, as per [

2] in comparison to the global GDP, which stood at around

$100.6 trillion in the same year, based on data from the World Bank (2022). The fact that the valuation of the global real estate market is almost four times larger than the global GDP highlights the sheer size and economic significance of the real estate sector. Within this industry, property evaluation stands as a critical factor affecting the operations of the real estate market. It is crucial for valuers to accurately determine property prices, as imprecise valuations can have substantial effects on various stakeholders, including governments, policymakers, banks, investors, insurance companies, real estate developers, and the general public [

3,

4,

5]. The literature indicates that real estate property evaluation is a complex, multi-criteria process involving diverse factors that collectively influence the final valuation. Among these, location is relevant, as it directly influences demand and price; studies by [

6,

7] have demonstrated the significant impact of location and environmental quality on property values. Additionally, the physical characteristics of the property, including size, age, and architectural design, play crucial roles in determining its value [

8,

9,

10]. Market conditions, reflecting the current economic climate and real estate trends, also heavily influence valuations, a concept originally elaborated by [

11] and later studied further by the literature [

12,

13].

Within the frameworks for defining a property value, some authors have started mentioning facility management (FM) as a possible influencing factor, underlining the importance of maintaining and enhancing the functionality and sustainability of a property to ensure its appeal and longevity [

14,

15,

16]. FM can be broadly defined as the integrated management of an organization’s services and physical infrastructure to optimize the environment and support its primary operations and objectives [

17]. It encompasses a broad spectrum of services related to facilities, playing a crucial role in overseeing facility resources, auxiliary services, and the work environment to facilitate the primary operations of an organization over both the short and long-term. FM can be broadly classified into two main categories: ‘hard’ and ‘soft’ services. Hard services refer to the physical and non-removable aspects of a building, such as heating, fire safety, and elevators, while soft services enhance workplace comfort and security, including cleaning, catering, security, and landscaping [

18]. Effective facility management can lead to improved operational efficiency, reduced costs, and increased property desirability, likely positively impacting its valuation [

19]. Over the last decade, the extant literature has shown that the streamlining of facility management processes has been predominantly linked to innovations in IT, among which Building Information Modeling (BIM) stands out significantly [

19,

20].

Defined by [

21] as generating, storing, managing, exchanging, and sharing building information in an interoperable and reusable format, BIM represents a critical enabler for improving the efficiency and effectiveness of FM processes. By connecting BIM-based structural components with FM work details, the BIM model and FM database can be merged, facilitating easy access and use of information [

22]. Maintenance staff can access both FM data and the BIM geometric model, including equipment location, accessibility, and maintainability [

19]. Virtualization within the BIM framework can support on-site FM tasks and address the challenge of a skilled workforce shortage. In this study, BIM is considered the central digital infrastructure supporting facility management (FM), while Building Management Systems (BMSs) are treated as complementary technologies that, when integrated with BIM, enhance real-time data acquisition and operational responsiveness, contributing to the creation of a digital twin environment [

23].

Earlier studies have highlighted that adopting BIM offers improved collaboration, increased automation, enhanced analytics, and optimized information management [

23].

Further, the increasing relevance of BIM integration in FM is also reinforced by broader policy and market trends. In the European context, the Energy Performance of Buildings Directive (EPBD) and the Digital Decade initiative emphasize data-driven building performance and smart infrastructure as strategic priorities. In parallel, the rise of ESG reporting frameworks, including the EU Taxonomy and CSRD [

24], encourages real estate owners to demonstrate sustainability, operational transparency, and digital traceability. As a result, the adoption of BIM and BMS is no longer only a matter of efficiency but also a response to evolving compliance requirements and investor expectations in both public and private sectors. However, despite its potential benefits, there has been a noticeable lack of enthusiasm among property owners and facility managers to adopt BIM or to invest in creating interoperability between design, construction models, and maintenance software systems. A primary reason for this reluctance is the perception among these stakeholders that the advantages and return on investment from implementing BIM are not sufficiently compelling [

25]. The literature has shown that, despite stakeholder reluctance rooted in doubts about the return on investment, the benefits of implementing Building Information Modeling (BIM) in facility management (FM) are significant and well-documented, emerging through three main lines of inquiry. First, a range of (i) illustrative case studies highlight how BIM has enhanced FM and maintenance processes. For instance, [

26] reports that at the Fort Garry campus of the University of Manitoba, BIM enabled facility staff to swiftly respond to temperature-related complaints by providing access to real-time and historical environmental data, as well as detailed operational information about surrounding rooms. Similarly, [

26] demonstrates that BIM applications in tunnel FM significantly contribute to safer and more reliable infrastructure operation.

Second, researchers have explored BIM’s potential in FM through (ii) expert interviews to forecast future application areas and benefits. For example, refs. [

23,

27] identify key use cases such as identifying building components, accessing real-time data, supporting visualization and marketing, and assessing maintainability. Furthermore, refs. [

28,

29] report anticipated advantages such as improved system maintenance and using BIM as a data source for planning, monitoring, and optimizing maintenance activities. Third, scholars have focused on developing the conceptual models, data frameworks, and technologies necessary to integrate BIM with maintenance management systems. For instance, refs. [

30,

31] discuss approaches such as defining the critical information required for FM models, designing BIM servers, and creating dedicated repositories for FM-related objects. However, despite these promising developments, a notable gap persists in the existing body of research: few, if any, studies attempt to quantify the financial value generated by BIM implementation in FM. Despite growing interest in the application of BIM and BMS within facility management, the literature remains fragmented and predominantly focused on technical benefits [

31], with limited efforts to quantitatively assess their long-term financial impact, integrate expert-based scenario modeling in this evaluation, or explicitly link digital FM practices, intended as the digitally enabled management of facility services, to real estate asset valuation and investor decision-making frameworks.

While the economic benefits of BIM implementation during the construction phase have been well-documented—such as the 15% reduction in direct construction costs reported by [

22,

32]—there remains, to the best of the authors’ knowledge, a notable lack of studies assessing the financial value of BIM adoption across the entire building lifecycle. In particular, the facility management phase is critically underrepresented in the literature, despite its potential to yield substantial long-term economic returns. This value can be assessed by recognizing that adopting BIM within a company’s real estate portfolio can significantly reduce management costs [

27]. Our study aims to fill the gaps in literature by combining expert-based insights with probabilistic financial modeling to quantify the long-term economic impact of BIM/BMS implementation in facility management, linking digitalization not only to operational cost savings but also to real estate asset valuation.

Thus, in line with the proposed objective, we have structured our work around the following research questions:

RQ1: what factors, associated with implementing BIM, influence the costs of facility management activities, either by reducing or increasing them?

RQ 2: following the investment in BIM implementation, what is the estimated quantification of the impact of these factors on the cash flows of facility management activities?

RQ 3: under what conditions can cost reductions and practices specific to BIM-enabled facility management be linked to increased asset value?

We conducted thirteen semi-structured interviews with expert professionals from the Italian real estate sector to address these questions. These interviews provided both an assessment of which BIM-related benefits and implementation costs—previously identified in the literature—are most likely to materialize within their specific business context, as well as an estimation of the expected economic impact of BIM adoption on facility management cash flows. Through the quantification of the value of BIM’s impact on the cash flows of facility management, we were able to estimate a Net Present Value (NPV) that provides a comprehensive financial metric for assessing the viability and profitability of implementing BIM in real estate investments. This NPV calculation incorporates the initial investment costs, the ongoing operational savings, and the enhancements in efficiency brought about by BIM, offering a holistic view of the economic benefits over the facility management building’s lifecycle—an approach that aligns with the FM Value Map in highlighting value creation through operational support and with the Technology-Organization-Environment (TOE) framework in framing digital adoption within organizational and environmental contexts [

33,

34].

The paper is structured as follows:

Section 2 describes the research method, outlining the four-phase framework adopted for the study.

Section 3 presents the results, including the literature review on BIM and FM, the design and deployment of the assessment tool, and the findings from expert interviews and financial modeling.

Section 4 discusses the results in light of the research questions, highlighting key insights regarding cost impacts, economic implications, and asset valuation. Finally,

Section 5 provides the conclusions and outlines recommendations for future research.

2. Research Method

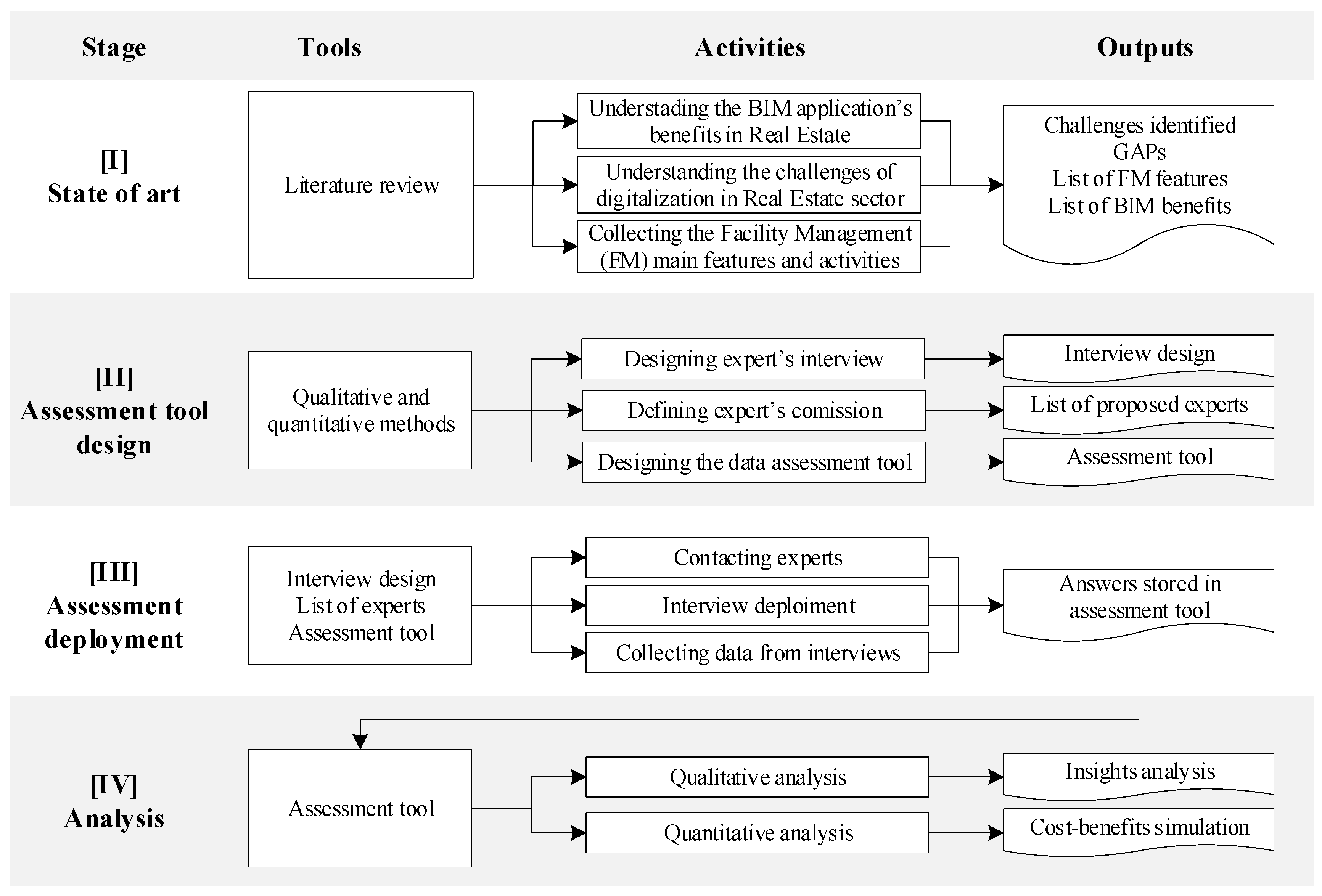

Figure 1 presents the research method followed in this research, which is based on four stages.

The diagram presents the methodological framework employed in this study, structured into four main stages. The first stage, State of the Art, involves conducting a literature review to explore the benefits of BIM applications in real estate, the challenges of digitalization in the sector, and the core features and activities associated with FM. This phase results in the identification of existing research gaps, as well as comprehensive lists of FM features and BIM-related benefits. The second stage, Assessment Tool Design, combines qualitative and quantitative methods to develop the instruments needed for data collection. This includes designing the expert interview protocol, defining the composition of the expert panel, and creating the assessment tool. In the third stage, Assessment Deployment, the research team engages with selected experts by conducting interviews and collecting data using the previously designed tools. The collected data is then stored in the assessment tool for subsequent analysis. Finally, in the Analysis stage, both qualitative and quantitative analyses are carried out to extract key insights and simulate the cost-benefit impact of BIM adoption in FM. This comprehensive approach allows for estimating the economic value generated by digital innovations in real estate management.

3. Results

This section presents the results obtained through the application of the Design Science Research Method (DSRM), a problem-solving framework used to develop and evaluate practical solutions [

35]. As shown in

Figure 1, the process is structured into four main phases: State of the Art, Assessment Tool Design, Assessment Deployment, and Analysis.

3.1. State of the Art

To support the development of our research, we conducted an extensive literature review using Scopus and Web of Science. The primary objective was to identify and extract the key benefits and challenges associated with the application of BIM in facility management (FM). These insights were then used to guide expert interviews, allowing participants to evaluate the potential impact of each benefit and challenge on specific FM activities. This approach enabled a quantitative assessment of both the positive value and the implementation costs of BIM, specifically in terms of their effects on the cash flows generated by FM operations.

3.1.1. BIM Benefits

The literature highlights a broad and transformative spectrum of benefits associated with implementing BIM, extending well beyond the construction phase into the entire lifecycle of a building. Literature shows that through the adoption of BIM, teams experience significant enhancements in efficiency—resulting in streamlined workflows, reduced schedules, and optimized decision-making processes—not only during project delivery but also throughout the entire building lifecycle, from design and construction to operation, maintenance, and eventual decommissioning [

36]. BIM’s diverse toolkit equips stakeholders with an array of tools and capabilities that empower them to work cohesively, thereby elevating project and facility management to a higher level of precision and effectiveness [

37]. Safety and energy efficiency stand out as key advantages of BIM implementation during a building lifecycle, enabling proactive hazard identification, improved emergency response planning, and adherence to stringent quality standards—contributing to a safer, more energy-efficient, and well-regulated built environment [

31]. The literature also highlights the importance of “Quality, Inspection, and Control Improvement”, emphasizing the critical role of BIM and digital twins in raising quality assurance standards. Their precision in modeling and information management enables more rigorous inspections and oversight, leading to enhanced project quality across all phases. This increased level of control benefits the construction process and has a lasting impact on facility management, ensuring that assets are delivered with higher standards of accuracy, reliability, and maintainability throughout their operational life [

38]. “Communication improvement” also emerges as a key benefit of BIM, highlighting its crucial role in enhancing information exchange among stakeholders. Beyond facilitating internal team collaboration, BIM enables communication with external factors such as suppliers, clients, and service providers. Ensuring consistent, transparent, and real-time information flow supports a more integrated and cooperative working environment throughout the building lifecycle [

29]. Coordination is also widely recognized as a key benefit of BIM, particularly in improving collaboration between contractors and suppliers during construction and facility management [

39,

40]. According to the extant literature, the integration between BIM and FM offers an end-to-end perspective that extends well into the building’s operational phase. BIM’s ability to bridge the gap between construction and facility management ensures that the value it brings persists well beyond project completion. This integration optimizes maintenance and operational processes, reinforcing BIM’s status as a holistic solution [

41].

Table 1 categorizes the benefits associated with the application of BIM across the entire building lifecycle, as identified in the literature. Each category is accompanied by a brief description and relevant references supporting it.

3.1.2. Challenges

In general, the literature places a strong emphasis on exploring the benefits associated with the implementation of BIM practices. Nonetheless, some studies also address the potential drawbacks, while others focus on the challenges posed by digitalization within the AEC (Architecture, Engineering, and Construction) sectors [

61]. Cultural resistance within organizations often impedes the adoption of BIM practices. Employees may resist change, especially if they are accustomed to traditional workflows. In such cases, companies must invest substantial effort and resources into training programs to familiarize their workforce with BIM tools and methodologies. Failure to address cultural resistance and adequately train employees can lead to inefficiencies, reduced productivity, and missed opportunities for improvement [

51]. On the technology side, the need for systems integration and interoperability is crucial in a BIM-driven environment. Many companies use diverse technological systems for various aspects of their operations. Failure to achieve this integration can result in data silos, increased manual data entry, and a lack of real-time collaboration, all of which undermine the potential benefits of BIM [

40]. In parallel, BIM relies heavily on data, and the sheer volume of information generated can be overwhelming. Companies may struggle to manage and maintain data integrity. Poor data quality can lead to inaccuracies in models and analyses, jeopardizing project outcomes. Inadequate data management techniques can result in costly errors, rework, and a failure to capitalize on the benefits of data-driven decision-making [

55]. Moreover, BIM thrives on real-time information updates. Outdated data can lead to misinformed decisions, errors in construction, and a lack of alignment between project phases. Companies that do not prioritize information updates risk compromising project quality and efficiency [

67]. Also, still in terms of processes and flows inside projects, effective collaboration is fundamental to BIM’s success. In an industry known for its competitiveness, fostering cooperation among stakeholders can be challenging [

68]. Imagining construction’s digital future [

55]. Finally, from a legal point of view, the absence of BIM standards poses significant challenges. This can result in contractual disputes, increased administrative burdens, and inefficiencies in project delivery [

69]. To mitigate these risks, companies must proactively tackle these challenges by fostering a culture of openness to change, investing in training and education, adopting interoperable technologies, promoting collaboration, implementing robust data management strategies, prioritizing timely updates, and advocating for the development and adoption of BIM standards [

61]. Similar to the previous categorization of benefits, the identified challenges have been organized into thematic groups based on their nature and characteristics. Specifically, four main categories have been defined as shown in

Table 2: people-related challenges, process-related challenges, technology-related challenges, and legal and regulatory challenges.

The final selection of articles for this review reveals a noticeable imbalance between the evaluation of benefits and challenges. As shown in the previous table, five benefit categories appear in approximately 50% of the reviewed documents, whereas challenge categories are represented in no more than 30%. Nevertheless, it is important to highlight that a significant number of articles report reductions in project effectiveness or efficiency due to BIM-related obstacles. For this reason, challenges were included in the framework to account for the increased costs associated with these issues.

Among the identified challenge categories, process-related challenges are the most frequently cited, appearing in 12 articles—accounting for 34% of the total difficulties reported. Technological and people-related challenges follow, each comprising roughly a quarter of the citations. Legal challenges, while the least frequently mentioned, should not be considered less significant. Their potential impact on real estate asset maintenance costs is explored further in this study.

Alongside the literature review, a structured research effort was undertaken to identify the key competencies within facility management, including associated activities, tasks, and roles. Particular attention was paid to ensuring that the identified activities align with digitalization processes and digital twin solutions found in the literature, particularly those classified as potential benefits [

72]. Depending on the building, the activities can vary significantly and may not apply to other real estate assets. For this reason, a selection process for activities was undertaken to include in the document only those that are generalizable to the vast majority of commercial or production buildings [

73]. This approach allows the analyses presented in the following chapters to be interpreted without the need for exceptions or special cases. Furthermore, given that this article focuses on the Italian market, we consulted public tender guidelines related to maintenance and, more broadly, facility management activities issued by Consip. Consip, a public company under the Italian Ministry of Economy and Finance, is responsible for managing high-value public procurement tenders, ensuring that processes maintain high quality while adhering to established norms, standards, and procedures. Notably, in tenders where BIM is mandatory for AEC projects exceeding one million euros, Consip provides clear guidelines on the classification and assignment of facility management activities and responsibilities. The output of this phase is a comprehensive table listing the activities and tasks relevant to the facility management domain. This list includes the most common and widely applicable responsibilities involved in the management of real estate assets (see

Table 3).

3.2. Assessment Tool Design

We adopted a robust methodological approach to estimate the financial impact of implementing BIM in FM: conducting interviews with industry experts. This method was strategically chosen for several reasons, exploiting its advantages in closing the identified gap. In this regard, on the one hand, the following reasons support the choice of the interview method:

Access to Expert Insights: interviews provided us with direct access to professionals and experts within the facility management and BIM domains. Industry experts possess a wealth of in-depth knowledge, cultivated over years of hands-on experience [

74]. Their careers span various roles in facility management, design, construction, and project management. These professionals bring a level of expertise that extends beyond what is typically found in academic research papers. In particular, under this perspective, the interviews enabled us to tap into the practical wisdom that experts have gained through projects and problem-solving experiences.

Real-World Data: by engaging with experts, we gained access to real-world scenarios showcasing the challenges and opportunities faced in actual facility management projects, making our research more grounded and applicable [

75]. Facility management practices can vary greatly depending on the type of facility and regional context. Interviews allowed us to gather context-specific insights that contributed to a more holistic understanding of BIM’s financial implications.

Tailored Information: the interview approach allowed us to tailor our inquiries to specific areas of interest, ensuring that we gathered pertinent data directly related to our research objectives. By tailoring our questions to their specific knowledge domains, interviewees felt more engaged and valued, leading to richer and more insightful responses. This depth of understanding was pivotal in uncovering information related to cost reductions, information assessments, and digital element value [

76].

Data were collected through a structured interview process with industry experts to gain a practical understanding of these challenges and their financial implications. Participants were asked to quantitatively assess the expected impacts—both benefits and costs—of BIM implementation within facility management. This approach allowed us to estimate the value that BIM can generate not only during the construction phase but also across the entire lifecycle of a building, including its operation, maintenance, and long-term asset management. By cross-referencing expert insights with existing literature, we harnessed a triangulation of data sources, bolstering the overall credibility of our study [

75,

77]. Interviews were conducted via online meeting platforms, and each session was recorded and transcribed to ensure the accuracy and traceability of the collected data.

Interview Structure

The interviews followed a semi-structured protocol organized around four practical objectives (see

Table 4), with questions designed to explore both perceived benefits and challenges of BIM/BMS implementation in FM. While not directly anchored to a single theoretical model, the structure was informed by existing literature on digital innovation, facility management, and BIM adoption. Responses were later coded thematically into benefit and challenge categories identified during the literature review, supporting analytical consistency. To validate the insights, a triangulation process was employed: interview data were cross-checked with published studies, sector guidelines, and expert-based quantitative assessments collected via a standardized Excel tool used during the final stage of each interview. This tool also acted as a feedback mechanism, allowing respondents to independently rank and quantify key drivers, reinforcing reliability and alignment across participants.

The first three objectives were pursued during the interview through a structured and exploratory set of questions designed to investigate the topics raised by the interviewees. The fourth objective was addressed separately using an Excel file, prepared in advance and kept identical for all participants.

Table 5 illustrates the structure of the interviews, highlighting their objectives and the corresponding questions.

To enhance transparency regarding the interview design and its role in shaping the cost impact model, it is important to clarify the logic connecting each interview phase with the study objectives. The semi-structured interviews were organized around four main goals, as outlined in

Table 4. First, participants were asked to validate the relevance of benefits and challenges identified through the literature review within the Italian real estate context. Then, they were requested to provide quantitative estimates of the expected financial impact of those benefits and challenges, expressed as percentages of FM-related costs. This was followed by open-ended questions aimed at understanding how professionals recognize value creation over time. Finally, participants selected and ranked the most significant items using a structured Excel form. This step enabled the mapping of benefits and challenges to specific FM activities. This workflow ensured that expert insights were not only qualitatively captured but also directly converted into modeling variables used in the simulation phase (see

Table 6 and

Table 7).

3.3. Assessment Tool Deployment

While the integration of BIM and BMS into FM operations and their associated cost impacts are primarily described through structured narrative and simulation outputs in this study, the underlying workflow follows a sequential logic: from data collection via expert interviews to the categorization of BIM-related benefits and challenges, probabilistic modeling, and scenario-based NPV estimation. This process is analytically represented in

Figure 2 and

Figure 3, which illustrate the range and uncertainty of modeled financial outcomes. A dedicated visualization of this workflow will be explored in follow-up research with a focus on implementation support tools.

3.3.1. Integration of Expert Knowledge with Financial Modeling

Interview candidates were carefully selected from key roles within the facility management field, divided into operational/logistical and financial/profitability-oriented categories. Additionally, professionals from global service providers, which often manage outsourced facility services, were considered due to their technical and operational expertise. The organizations targeted for interviews included three typologies: financial institutions managing real estate as capital goods, investment firms focused on acquiring and selling upgraded properties, and large enterprises where real estate assets play a central operational role, such as hospitals, hotels, and shopping centers. Correspondingly, the study also categorized real estate assets into three types: capital goods (core operational assets), hold-to-be-sold properties (primarily for future resale), and hold-to-be-rented properties (used to generate rental income). This classification allowed us to account for different FM needs and accounting treatments when assessing the impact of digitalization. Experts were identified through LinkedIn and company websites, and interviews were arranged between August and mid-October 2023. The selected professionals came from institutions such as Generali, AXA, Unicredit, Intesa San Paolo, and COIMA. Participants provided quantitative estimates on the cost impact of BIM and DT adoption. These estimates were modeled using @Risk in Excel, applying a PERT distribution for probabilistic simulation over a 30-year building lifecycle. A total of 13 semi-structured interviews were conducted, a sample size deemed appropriate based on thematic saturation—observed after approximately 10 interviews—and the intentional inclusion of diverse expert profiles spanning finance, operations, and academia to ensure broad representation across roles and asset types in the real estate sector. As the study involved non-sensitive interviews with professionals acting in their institutional capacity, no formal ethical approval was required. All participants were informed of the research objectives and data treatment procedures and gave their explicit verbal consent to participate.

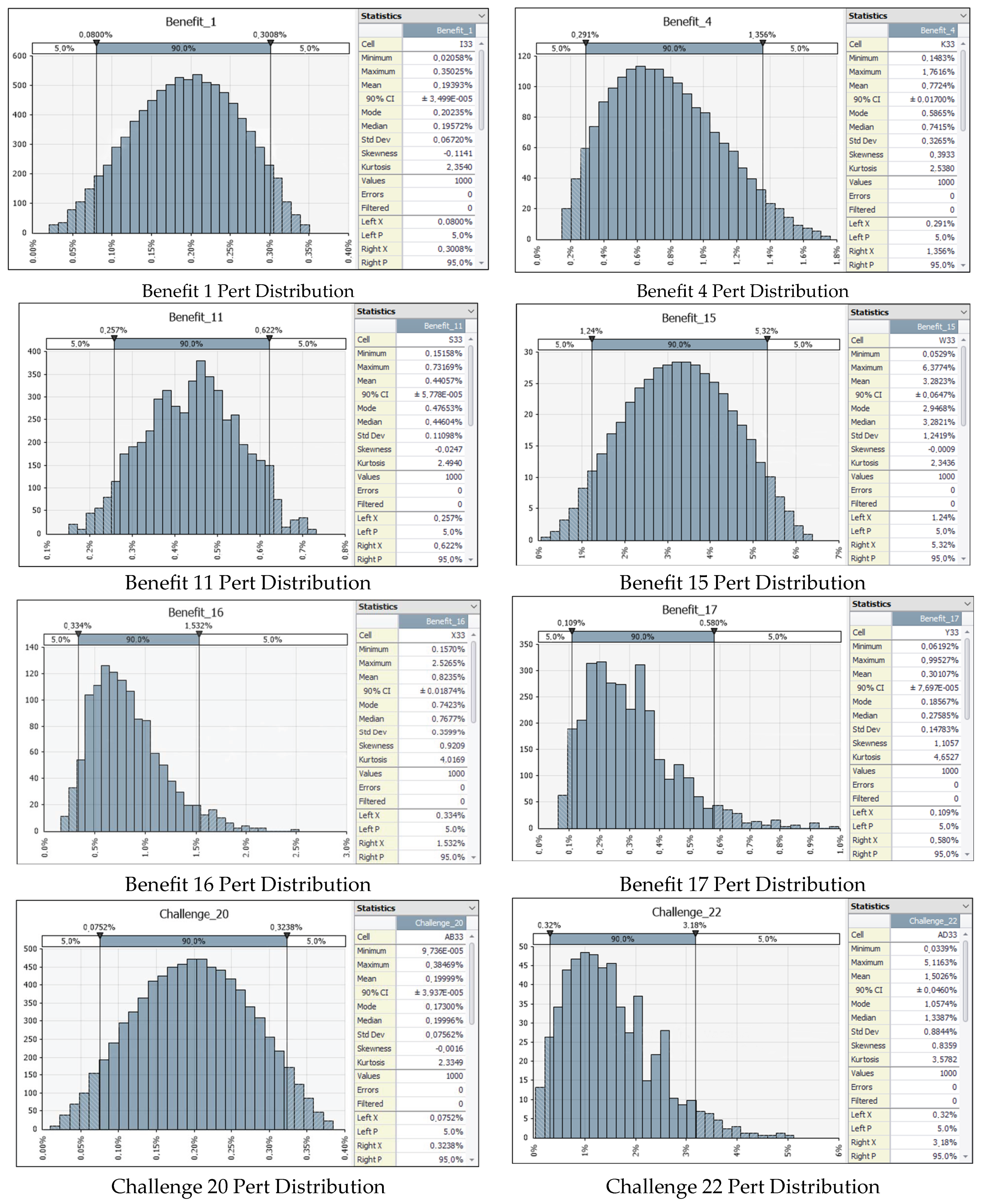

Four variables were considered: initial digital investment, cost savings, cost increases, and ongoing maintenance costs. Simulations explored pessimistic, neutral, and optimistic scenarios, incorporating inflation adjustments and real estate market variations. Results were expressed as percentages of real estate asset value to ensure comparability. Although no discount rate was applied, the model offers a static yet practical framework to assess BIM’s financial impact and can be replicated in future studies or different markets.

Table 6 provides an overview of the interviewee participants.

3.3.2. Financial Modeling Approach: From Expert Estimates to Cash Flow Simulation

The data modeling and simulation process began with collecting all relevant data and Excel files generated from the interviews. These files identified frequently mentioned benefits and challenges categories, which were converted into a monetary configuration. Experts were asked to estimate cost variations associated with the benefits, challenges, and specific FM activities. In some cases, interviewees provided company performance indicators that helped quantify differences between digitized and non-digitized buildings. To express these cost variations—particularly savings—the value of the company’s real estate portfolio was adopted as the baseline. This choice aligns with corporate objectives and avoids inconsistencies arising from comparing internal budgets, which vary widely across firms. Using asset value also enhances sector-wide benchmarking, allowing for meaningful comparisons among companies and improving stakeholder understanding of the impact of BIM. Additionally, expressing cost reductions to asset value facilitates more effective communication with investors and other external stakeholders. However, as real estate portfolio value is relatively static while BIM-related savings may fluctuate over time, periodic updates are recommended to track and reflect evolving benefits. Given the diverse backgrounds of the experts, the financial impacts of BIM-related benefits and challenges were modeled using probability distributions with @Risk, an Excel add-in for Monte Carlo simulations and scenario analysis. These distributions accounted for cost savings, additional expenditures from implementation challenges, and the costs associated with adopting BIM in facility management. All values were expressed as percentages of the asset value to ensure comparability. When sufficient data were available, @Risk was used to identify the most appropriate probability distributions. The PERT distribution was applied in cases of limited data, as it requires only three inputs: minimum, most likely, and maximum values [

78]. Unlike the triangular distribution, PERT emphasizes the most likely value, making it particularly suitable for subjective estimates based on expert judgment. Its smoother shape and more realistic representation of uncertainty offer a more accurate reflection of the expected outcomes associated with BIM implementation. Once these distributions were defined, values were summed to represent four key components of cash flows: (1) the initial investment in BIM (year zero), (2) cost savings from benefits, (3) cost increases from challenges, and (4) ongoing maintenance costs for digitalized assets. These elements are not considered constant because many external factors influence them over time. For example, greater market maturity may lead to lower implementation costs and enhanced benefits, while initial adoption hurdles in certain corporate cultures may lead to increased costs early in the digitalization journey. To simulate the long-term impact, a 30-year building lifecycle was used, with 30 iterations per year to reflect the variability of each cash flow component. The results formed the basis for three distinct scenarios—pessimistic, neutral, and optimistic—reflecting different assumptions about future adoption rates and efficiencies. Coefficients based on expert judgment and literature were applied to model how benefits and challenges might evolve. The simulation produced aggregated real cash flows for each scenario, providing a dynamic understanding of potential value creation over time. The analysis integrated two external variables to improve accuracy: inflation and commercial property price trends. Converting nominal cash flows into real terms eliminates the impact of inflation, which would otherwise distort comparisons over time. Real cash flows are preferred for long-term planning as they offer consistency, better risk assessment, and support more accurate investment decision-making. Similarly, incorporating real estate price trends helps reflect the changing denominator (asset value) in cost variation calculations. For example, if asset values decline, the same cost savings would represent a larger relative impact, which is relevant when interpreting results. Due to a lack of existing literature quantifying the temporal evolution of BIM-related cost benefits, the modeling provides only a static snapshot of the current state. The simulations do not predict how benefits and challenges will evolve naturally, as no established models link those changes to time-based variables. Therefore, while the results are useful for assessing the current financial potential of digitalization in FM, they should be interpreted as a preliminary approximation. To ensure neutrality and comparability, the analysis excludes the cost of capital and models facility management costs as fixed percentages of asset value, avoiding firm-specific financial assumptions and internal budgeting variations.

3.4. Analysis

Table 7 summarizes interviewees’ opinions on the financial impact of BIM and DT (digital twin) on facility management. Participants indicated whether they viewed the impact as positive (“YES” or “NO”) and whether BIM or DT solutions were currently implemented in their projects (shown in parentheses). Each row lists the respondent’s identification number and their professional role: “O” for operational and “F” for finance.

Overall, there was a stronger understanding and appreciation for digital twin solutions, which are widely adopted in the market—particularly in the context of energy systems. In contrast to BIM, all interviewees expressed a favorable opinion of digital twin technologies. BIM, on the other hand, received two negative responses, as two participants did not consider it essential or financially viable, especially for buildings managed primarily from a facility perspective. While the usefulness of BIM in facility management is acknowledged, its perceived value and applicability varied among respondents.

Table 8 and

Table A1 (available in

Appendix A) present participants’ rankings of BIM-related benefits and challenges. The top-rated benefits were facility management (FM), Decision Support (DS), and Cost Cognition (CC), aligning with the priorities of data-driven professionals. Safety and Sustainability (SS) and Tenant Wellbeing (TW) also scored well, though TW was less emphasized. Human Management (HM) ranked lowest among benefits. On the challenge side, process (PR) and people (PE) were seen as the most critical barriers, reflecting the need for organizational and cultural change. At the same time, technology (TE) was considered less problematic. The results support the view that BIM/DT can deliver financial and organizational value.

The final set of benefits and challenges, shown in

Table 8 along with their corresponding values for Criterion 2 and Criterion 3, was derived from the data processing phase. These items form the basis for analyzing cost variations associated with facility management activities.

Among the identified benefits and challenges, experts felt confident providing monetary estimates for only a subset of them, as reported in

Table 9, For these items, cash flows were calculated based on a set of defined assumptions. The Net Present Value (NPV) simulation was conducted over a 30-year time horizon, which aligns with the typical lifecycle of commercial real estate assets [

7]. To ensure comparability and generalizability across different organizational contexts, all cash flows were modeled in real terms and adjusted for inflation using data from ISTAT [

79]. An annual inflation rate (π) of 3.54% was applied, representing the average of the past five years in the Italian market. This relatively high value is attributed primarily to post-pandemic inflationary trends, with peaks reaching 7–8%, which raised the average but was nonetheless accepted to preserve the consistency and interpretability of the results. To isolate the financial effect of implementing BIM/BMS-enabled facility management practices, no explicit discount rate was applied. This approach avoids assumptions about the cost of capital or investor-specific hurdle rates, thereby allowing the analysis to focus on relative impacts. Consequently, the cost of capital (k) was set at 0%. Furthermore, the simulation included expert-based estimates related to initial digital investments, expected cost savings, additional implementation costs, and long-term maintenance. The analysis was carried out using @Risk 7.6 software, applying PERT distributions to account for uncertainty. Additional assumptions included a 0% taxation rate on real estate value (t), consistent with the absence of specific property taxes on transactions or revaluation gains in the Italian context, and a –2.2% annual change in commercial building prices (π_CB), reflecting recent market data from ISTAT.

Although @Risk was unable to fit standard probability distributions to the benefit-related data from the interviews—primarily due to the limited sample size and the qualitative nature of the expert input—the collected estimates still provide valuable insights. These quantifications help to define the boundaries, risks, and opportunities associated with digitalization, including BIM and digital twin solutions. As explained in the methodology section, PERT distributions offer a robust and flexible modeling approach when data availability is limited. In this context, the minimum and maximum values reported by experts were used as distribution limits, while the average of all responses was taken as the most likely value.

Figure 2 shows the @Risk output, clearly visualizing the modeled variables.

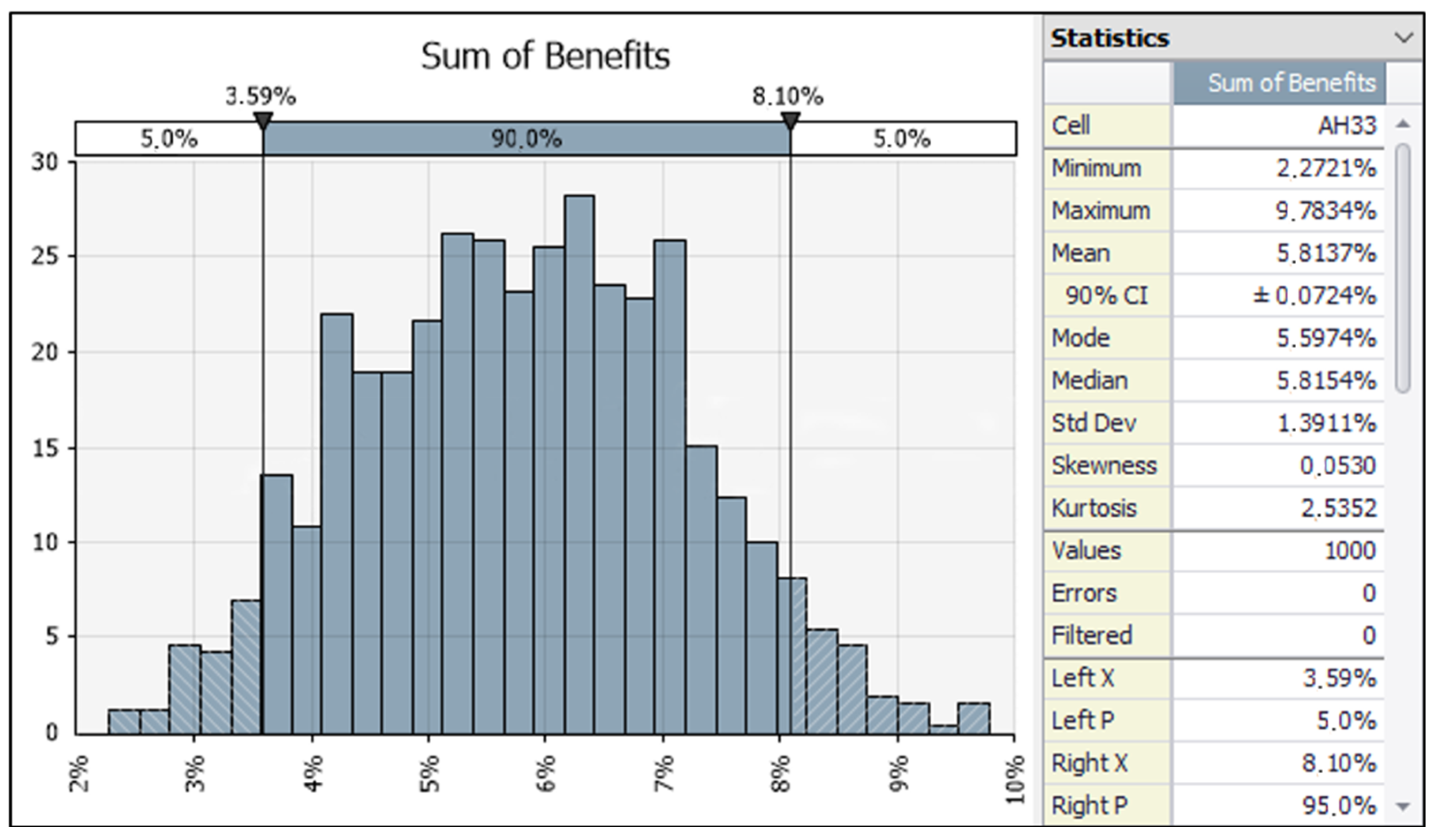

Benefits 1, 4, 11, 15, 16, and 17 generate the range of values in

Figure 3. The simulation suggests that BIM/BMS-enabled practices may lead to an average annual cost savings equivalent to approximately 5.81% of the asset’s value, with coordination improvements (Benefit 15) emerging as the most influential factor—potentially contributing up to 3.28% annually. These values should be interpreted as expert-informed projections rather than evidence of direct causal relationships.

4. Discussion

This discussion integrates and deepens the analysis developed in this study, aiming to answer the three research questions and to contextualize the results within the broader transformation of the real estate and facility management sectors. The qualitative evidence from expert interviews, the literature synthesis, and the probabilistic financial modeling allows us to critically interpret how the implementation of BIM and digital twin (DT) solutions impacts cost dynamics, decision-making processes, and the valuation of real estate assets.

RQ1: What factors, associated with implementing BIM, influence the costs of facility management activities, either by reducing or increasing them?

This study identifies a wide range of factors that influence facility management (FM) costs following the implementation of BIM. On the cost reduction side, key benefits include increased operational efficiency, enhanced coordination among stakeholders, real-time data access, and more structured maintenance planning. BIM enables the digital representation of building elements and their lifecycle behaviors, supporting preventive and predictive maintenance, energy optimization, and the reduction of communication inefficiencies. These advantages are further amplified when the BIM model is continuously updated and integrated with Building Management Systems (BMSs) and sensor networks—forming a comprehensive digital twin ecosystem.

However, the study also highlights several factors that may increase costs or delay returns. These include high upfront implementation expenses, the complexity of retrofitting legacy buildings and processes, and a lack of qualified personnel or organizational readiness. Some interviewees also raised concerns about the risk of underutilization, where digital tools are adopted but not effectively used due to fragmented governance or weak information management systems.

The maturity level of existing FM practices plays a crucial role. In organizations with advanced FM systems, BIM tends to generate incremental improvements, particularly in coordination and reporting. In contrast, in low-maturity environments, digitalization serves as a catalyst for broader process reengineering and governance transformation—offering greater potential benefits but also requiring more substantial organizational change.

RQ2: Following the investment in BIM implementation, what is the estimated quantification of the impact of these factors on the cash flows of facility management activities?

Using a probabilistic model based on three scenarios (optimistic, realistic, and pessimistic), this study estimates that BIM-enabled FM strategies can reduce total facility management expenditures by between 6.42% and 11.32% over a 30-year lifecycle. Considering that FM costs can amount to as much as 720% of an asset’s value over such a period, these savings are substantial. The financial simulation—grounded in expert assessments and scenario-based logic—translates qualitative insights into quantifiable economic impacts.

These savings are not merely theoretical. Interviewees reported that even partial implementations—particularly those involving BMS and structured data models—are already delivering reductions in energy and maintenance costs. Moreover, organizations that have adopted QR-code tracking, asset-specific data catalogs, and integrated monitoring systems have observed tangible improvements in process efficiency and reductions in contractor overhead.

However, the financial impact of BIM implementation varies depending on asset type and organizational model. Assets held for long-term use (instrumental assets) are more likely to justify investment in BIM, given their ongoing FM cost exposure. Conversely, investment properties leased to third parties offer weaker incentives unless BIM deliverables are contractually required or explicitly recognized in the market.

RQ3: Under what conditions can cost reductions and practices specific to BIM-enabled facility management be linked to increased asset value?

This question is central to the study’s value proposition: moving from cost savings to asset valorization. The findings driven from simulations suggest that when digital FM practices generate recurring, certifiable cost reductions, they become financially relevant in valuation models. Discounted cash flow logic implies that lower operational expenditures improve net operating income, thus supporting higher valuations under income-based methods.

In optimistic scenarios, the modeled annual savings of 2.7% can offset the average annual depreciation of 2.2% observed in the Italian commercial real estate market over the last decade. This aligns with the proposition that digitalization can act not only as a driver of operational excellence but also as a financial hedge against macroeconomic depreciation.

Nonetheless, for this value to be market-recognized, it must be formalized. Interviewees emphasized the need for certification mechanisms, similar to ESG frameworks, that quantify and validate FM performance improvements. Such certifications would help investors and buyers differentiate assets based on their digital maturity, fostering a virtuous investment cycle in high-performance buildings.

Importantly, the study notes that value creation does not occur uniformly. It is conditioned by asset governance models, the presence of dedicated FM teams, and the integration of digital tools into daily operations. For publicly owned assets or properties with outsourced FM, a gap remains between potential and realized value. Bridging this gap requires improved role clarity, contract design, and stronger performance monitoring systems.

Overall, this discussion positions digital FM as a technological upgrade and strategic asset management transformation. It reinforces the idea that BIM and DT tools create financial, operational, and market differentiation advantages when properly implemented and governed. The recognition of these advantages, however, remains contingent upon institutional innovations in certification, valuation, and stakeholder alignment. In fact, while the financial projections highlight significant potential for cost savings, it is equally important to acknowledge the risks and organizational barriers associated with digital adoption. These include high initial implementation costs, limited interoperability between BIM and BMS platforms, and internal resistance to process change, particularly in organizations with low digital maturity. Cultural inertia, insufficient training, and unclear ownership of digital processes can delay adoption or lead to suboptimal use of the technology, undermining expected benefits. Furthermore, without robust change management strategies, organizations may experience increased overhead or duplicated effort during the transition period. These risks highlight the need for phased implementation approaches, targeted training programs, and governance mechanisms to ensure alignment between technological capabilities and organizational readiness.

The findings offer practical value for FM professionals and real estate investors by providing a structured framework to quantify the financial impact of digital FM initiatives such as BIM/BMS integration. This framework can support investment appraisal, inform procurement and maintenance planning, and guide asset valuation by linking operational savings to net operating income, thus enabling more informed, data-driven decision-making. For example, a property manager overseeing a hospital or shopping center can use the model to estimate whether the upfront cost of BIM implementation is offset by long-term gains in maintenance efficiency and energy savings, helping justify the investment to internal stakeholders or external investors.

5. Limitations and Conclusions

This study aimed to evaluate whether digital innovation—particularly BIM and DT integration into facility management—can be monetized in the real estate sector, with a focus on the Italian market.

The evidence confirms that digitalization not only reduces operational costs but also enhances asset performance, providing a compelling case for its inclusion in real estate valuation frameworks. Three key conclusions emerge from the findings. First, BIM and DT can generate substantial cost savings over the asset lifecycle, ranging from 6.4% to 11.3% of asset value, depending on the adoption scenario. Second, despite this potential, current market conditions lack mechanisms to formally recognize and capitalize on these digital elements, thereby limiting their diffusion. Third, the misalignment of incentives across stakeholders continues to be a critical barrier, calling for new contractual models and governance structures that ensure shared investment and shared benefit.

From a methodological standpoint, this study makes an original contribution by combining expert-based qualitative research with probabilistic financial modeling to simulate digital value creation in facility management. It introduces a pragmatic framework for linking digital innovation to investment criteria such as Net Present Value (NPV), potentially transforming how digital components are incorporated into financial evaluations.

To address uncertainty in projections, we employed Monte Carlo simulation using PERT distributions, which allowed us to incorporate variability in expert-derived inputs and obtain 90% confidence intervals for key output metrics. This approach captures the combined effects of multiple sources of uncertainty and provides a more realistic estimate of potential outcomes compared to deterministic models.

Nonetheless, certain limitations remain. Future research could build upon this foundation by applying more granular sensitivity analyses, such as variance-based techniques, or by introducing time-dependent stochastic processes to reflect dynamic factors such as market maturity, regulatory changes, or technology adoption trends. Additionally, the relatively small sample size and reliance on expert judgment introduce a degree of subjectivity, and the static nature of the current model limits its ability to reflect temporal evolution in digitalization impacts.

While the study is grounded in the Italian real estate context, the methodological approach, combining expert elicitation, standardized FM activity mapping, and probabilistic financial modeling, is designed to be transferable and can be adapted to other geographic markets with similar asset management structures, regulatory frameworks, and levels of digital maturity. By adjusting context-specific variables such as labor costs, inflation rates, and real estate valuation practices, the simulation model can support cross-market comparisons and inform digital investment decisions in a variety of national settings, particularly within the EU and other OECD countries.

Future research should aim to expand the scope of the analysis to a more diverse set of assets and geographical contexts. Longitudinal studies tracking digital adoption and cost performance over time would be particularly valuable, as would investigations into the integration of digital maturity indicators into investment risk profiles. Additionally, more work is needed to understand how digitalization influences other real estate dimensions, including asset liquidity, user satisfaction, and regulatory compliance. Ultimately, recognizing and monetizing the digital dimension of real estate assets represents both a technical and strategic frontier—one with the potential to redefine value creation in the AEC industry.