Probabilistic Cash Flow Analysis Considering Risk Impacts by Integrating 5D-Building Information Modeling and Bayesian Belief Network

Abstract

1. Introduction

Research Significance and Identified Gaps

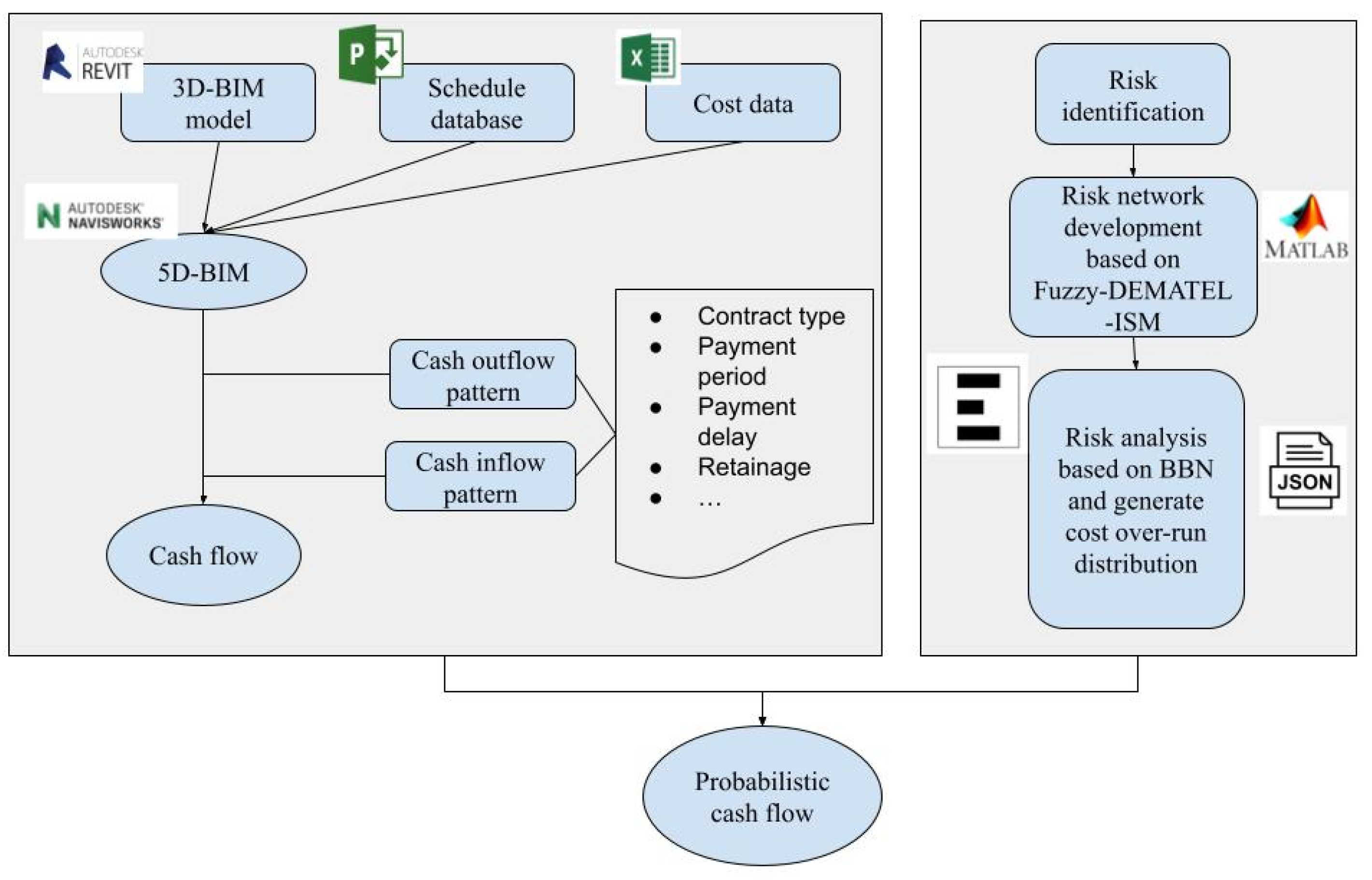

- Contribution 1: The study is the first to combine 5D-BIM with a BBN for cash flow prediction. This can provide an efficient approach that automates the cash flow calculations while considering the complex impact of inter-related risk factors.

- Contribution 2: The proposed approach will also address three significant challenges associated with traditional BBN methods, including the following:

- ○

- The inability to consider uncertainty and vagueness in experts’ opinions:One significant challenge in using BBNs is relying on professionals’ expertise and subjective judgment because of the scarcity of objective project-specific data for risk assessment during the project’s initial phase [36]. However, such judgment-based assessment is often biased, inconsistent, and imprecise [37]. To address the challenge, this research integrates fuzzy logic into the BBN to handle the vagueness or uncertainty in expert’s opinions when limited information is available. A hybrid approach combining fuzzy theory and a BBN has been widely employed in risk management research, yielding robust outcomes and gaining substantial attention from scholars [27,38,39].

- ○

- Failure to provide a suitable systematic method to determine the BBN structure:Another challenge in using a BBN is confirming the BBN structure with reality and project complexities [40]. To overcome this challenge, the Fuzzy DEMATEL-ISM method will be used to form the structure of the BBN.

- ○

- A lack of ability to reduce the elicitation workload to complete the parametric component of the BBN:

2. Materials and Methods

2.1. Cash Flow Analysis Using 5D-BIM

2.1.1. Preparation of 5D-BIM

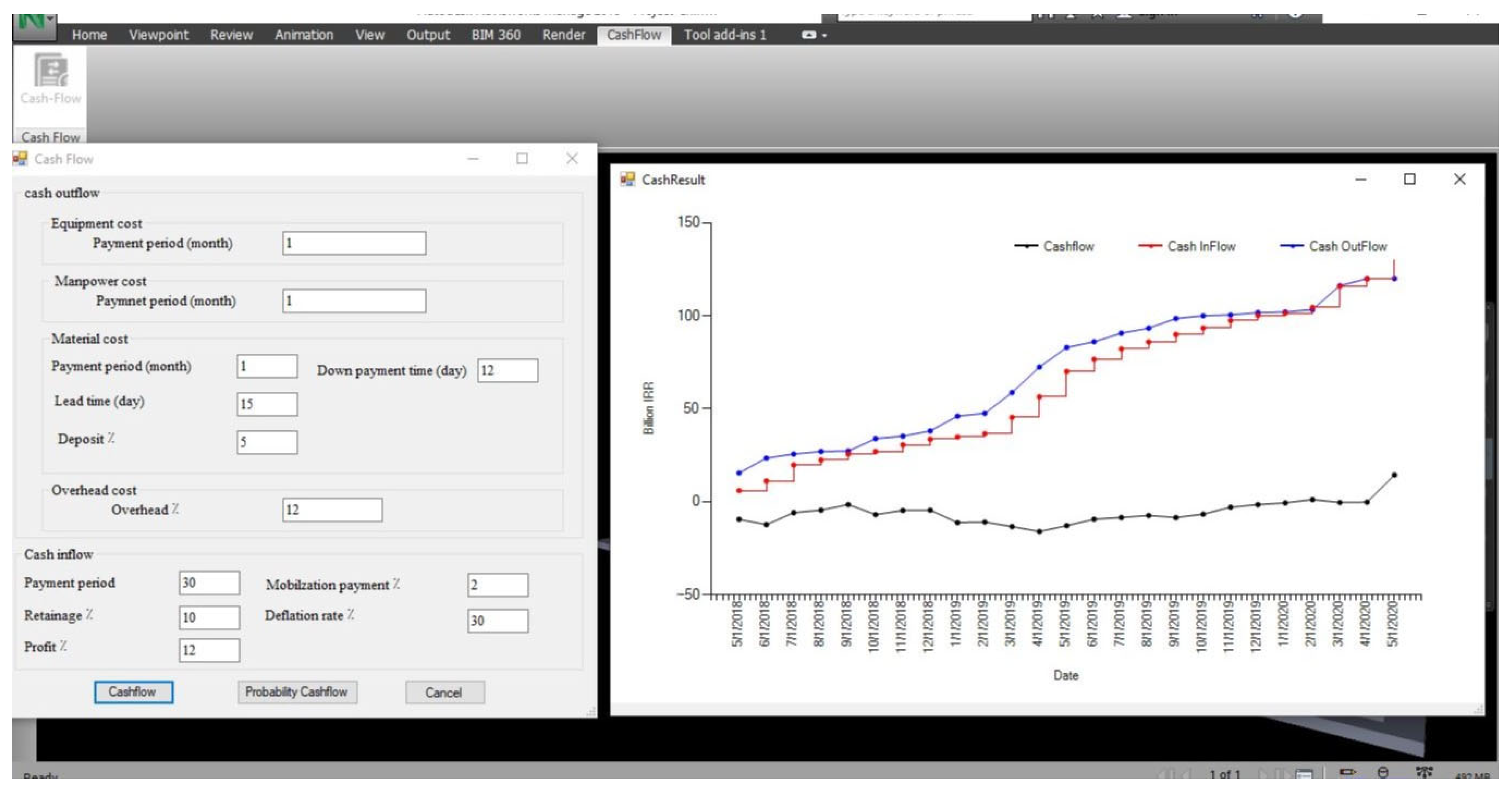

2.1.2. Cash Flow Analysis

2.2. Risk Assessment Using BBN

2.2.1. Risk Identification

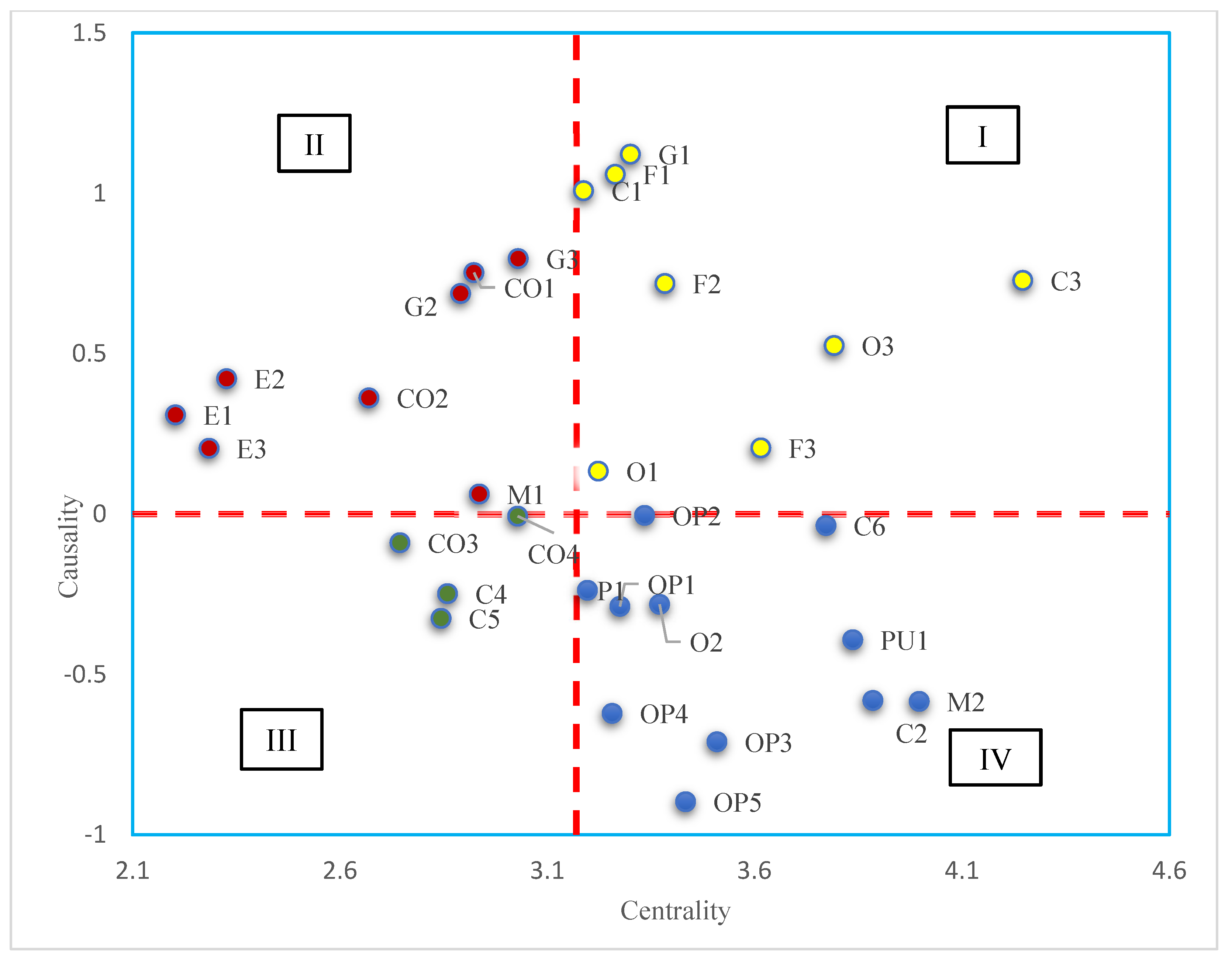

2.2.2. Risk Network Development

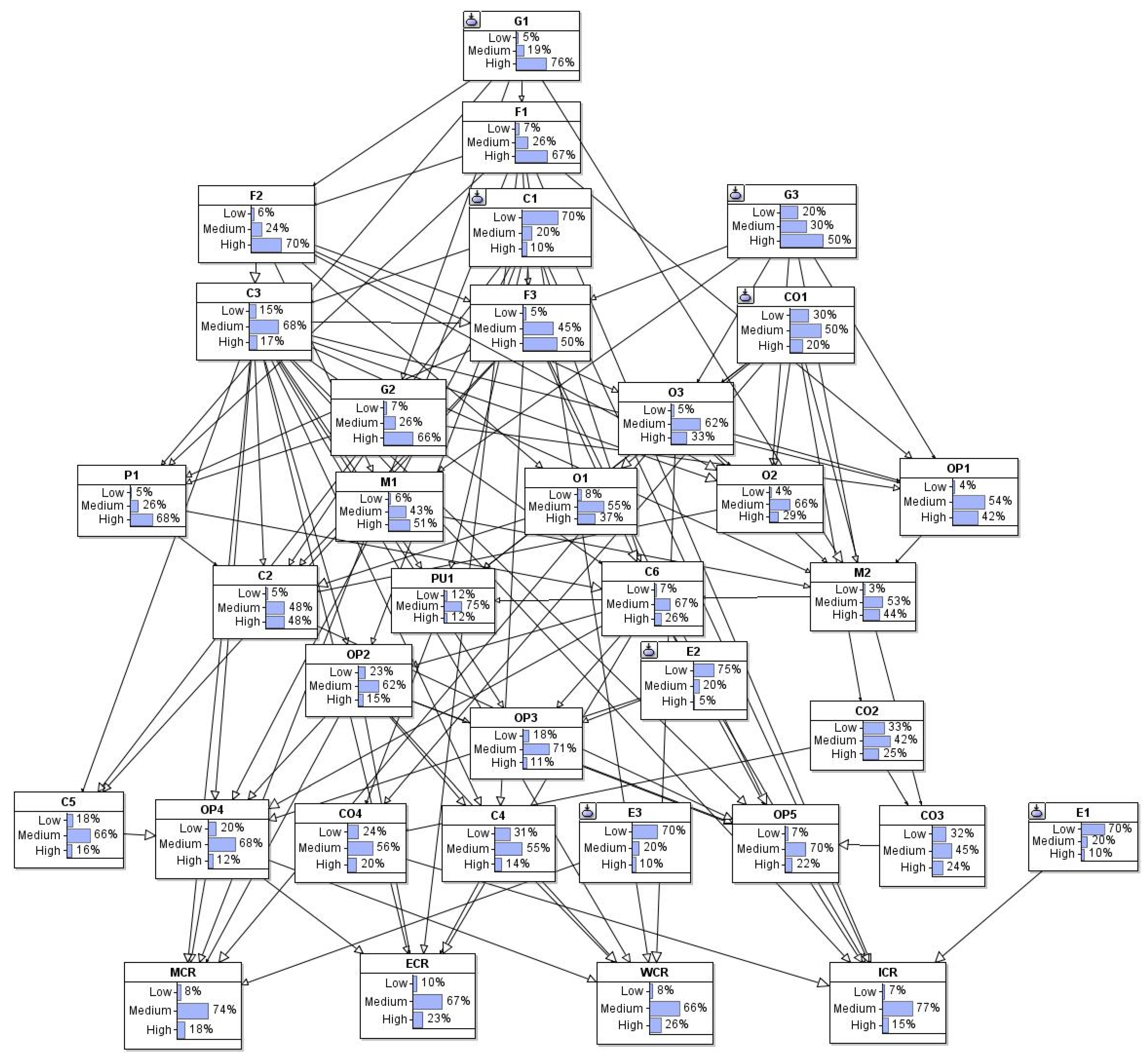

2.2.3. Risk Analysis Using BBN

2.3. Integrating 5D-BIM and BBN Models

2.4. Source of Expert and Information

3. Results

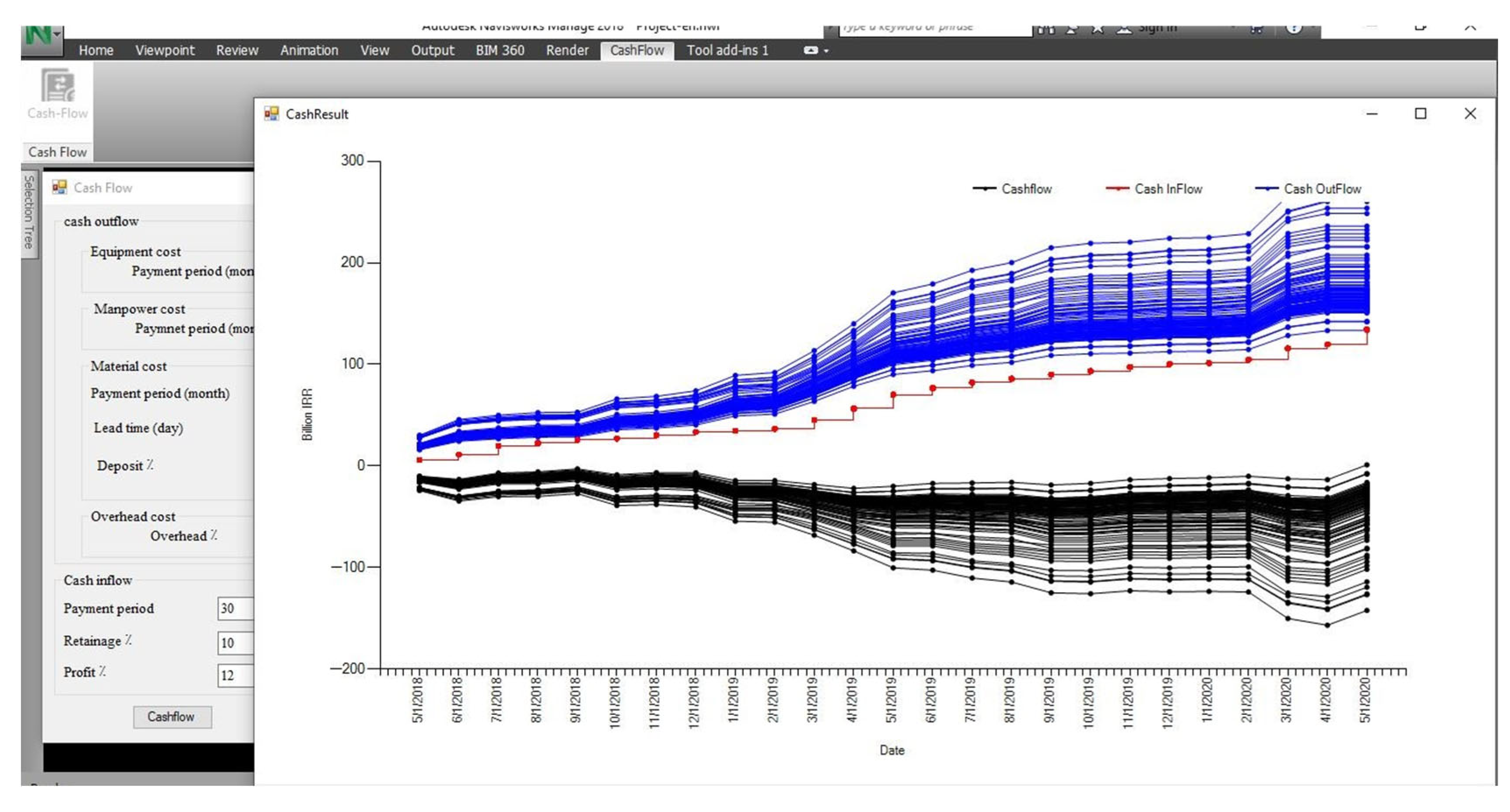

3.1. Cash Flow Analysis Using 5D-BIM for the Case Study Project

3.1.1. Preparation of 5D-BIM for the Mass Housing Project

3.1.2. Cash Flow Analysis for the Mass Housing Project

3.2. Risk Assessment Using a BBN for the Case Study Project

3.2.1. Risk Identification Results

3.2.2. Risk Network Development Result

3.2.3. Risk Analysis Results Using BBN

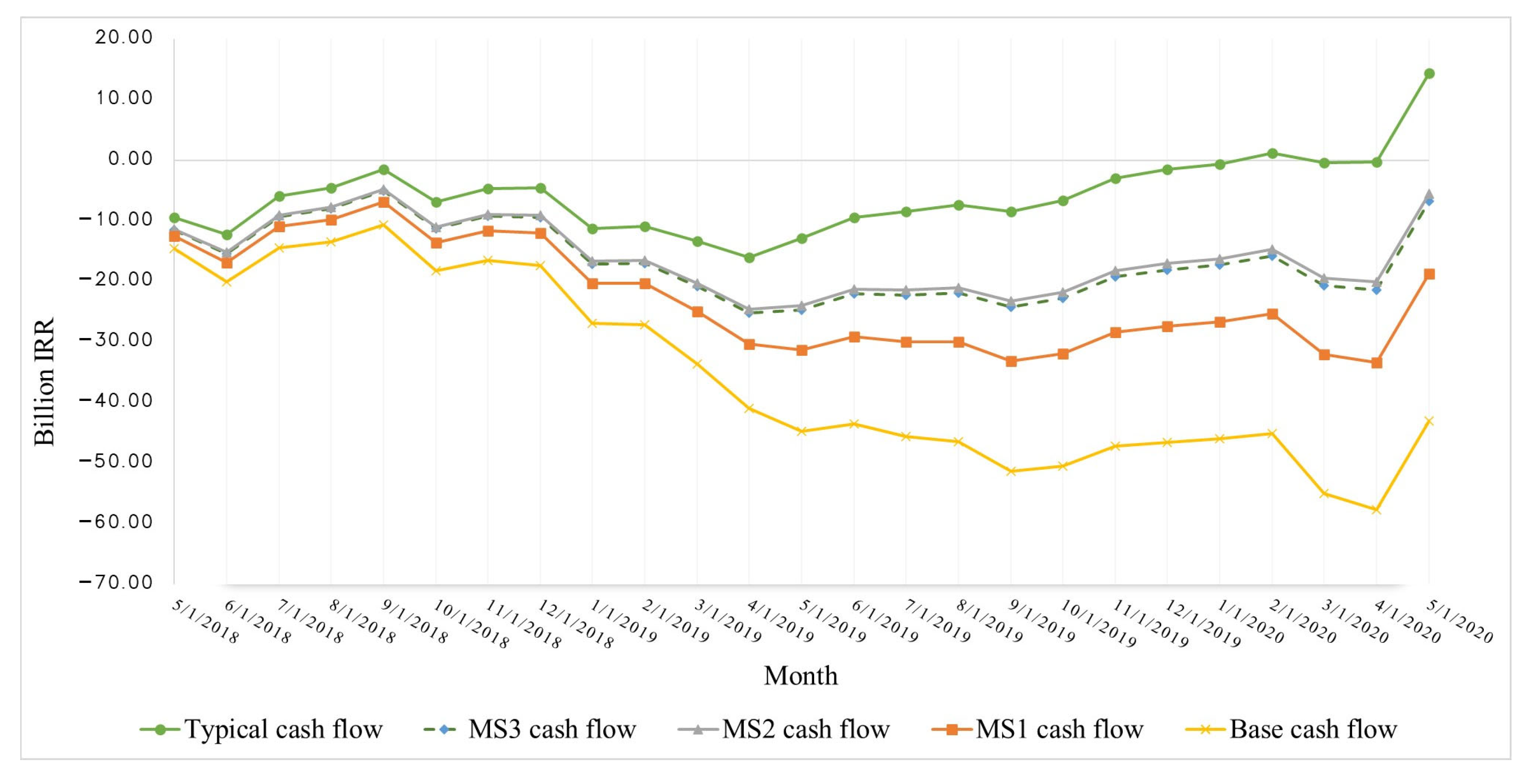

3.3. Result of Integrating 5D-BIM and BBN Models

Scenario Analysis

4. Discussion

5. Conclusions

- Presenting an integrated 5D-BIM and BBN approach for probabilistic cash flow forecasting;

- Improving reliability by using fuzzy logic to deal with expert opinion uncertainty;

- Overcoming the shortcomings of classical BBNs by introducing a hybrid fuzzy DEMATEL-ISM approach to systematically define the network structure and using the RNM method to reduce the parameter elicitation workload.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BIM | Building information modeling |

| BBN | Bayesian Belief Network |

| RNM | Ranked Node Method |

| DEMATEL | Decision-making trial and evaluation laboratory |

| ISM | Interpretive structural modeling |

References

- Lu, Q.; Won, J.; Cheng, J.C. financial decision making framework for construction projects based on 5D Building Information Modeling (BIM). JPMA 2016, 34, 3–21. [Google Scholar] [CrossRef]

- Zayed, T.; Liu, Y. Cash flow modeling for construction projects. Eng. Constr. Archit. Manag. 2014, 21, 170–189. [Google Scholar] [CrossRef]

- Govan, P.; Damnjanovic, I. Structural network measures for risk assessment of construction projects. ASCE-ASME J. Risk Uncertain. Eng. Syst. Part A Civ. Eng. 2020, 6, 4019024. [Google Scholar] [CrossRef]

- Banihashemi, S.; Khalili, S.; Sheikhkhoshkar, M.; Fazeli, A. Machine learning-integrated 5D BIM informatics: Building materials costs data classification and prototype development. Innov. Infrastruct. Solut. 2022, 7, 1–25. [Google Scholar] [CrossRef]

- Barbosa, P.S.F.; Pimentel, P.R. A linear programming model for cash flow management in the Brazilian construction industry. Constr. Manag. Econ. 2001, 19, 469–479. [Google Scholar] [CrossRef]

- Hegazy, T.; Ersahin, T. Simplified spreadsheet solutions. II: Overall schedule optimization. J. Constr. Eng. Manag. 2001, 127, 469–475. [Google Scholar] [CrossRef]

- Kim, H.; Grobler, F. Preparing a Construction Cash Flow Analysis Using Building Information Modeling (BIM) Technology. J. Constr. Eng. Proj. Manag. 2013, 3, 1–9. [Google Scholar] [CrossRef]

- Park, H.K.; Han, S.H.; Russell, J.S. Cash flow forecasting model for general contractors using moving weights of cost categories. J. Manag. Eng. 2005, 21, 164–172. [Google Scholar] [CrossRef]

- Al-Yami, A.; Sanni-Anibire, M.O. BIM in the Saudi Arabian construction industry: State of the art, benefit and barriers. Int. J. Build. Pathol. Adapt. 2021, 39, 33–47. [Google Scholar] [CrossRef]

- Ferdosi, H.; Abbasianjahromi, H.; Banihashemi, S.M. Ravanshadnia BIM applications in sustainable construction: Scientometric and state-of-the-art review. Int. J. Constr. Manag. 2023, 23, 1969–1981. [Google Scholar]

- Liu, X.; Li, Z.; Jiang, S. Ontology-based representation and reasoning in building construction cost estimation in China. Future Internet 2016, 8, 39. [Google Scholar] [CrossRef]

- Zhang, C.; Kumar, D.; Li, H.; Zhou, R.; Lv, L.; Tian, J. Development of a BIM-Enabled Automated Cost Segregation System. Buildings 2023, 13, 1805. [Google Scholar] [CrossRef]

- Yoon, J.H.; Pishdad-Bozorgi, P. Potentials of 5D BIM with Blockchain-enabled Smart Contracts for Expediting Cash Flow in Construction Projects. In Proceedings of the International Symposium on Automation and Robotics in Construction, ISARC, Bogota, Colombia, 12–15 July 2022; pp. 238–245. [Google Scholar]

- Stanley, R.; Thurnell, D. The benefits of, and barriers to, implementation of 5D BIM for quantity surveying in New Zealand. Australas. J. Constr. Econ. Build. 2014, 14, 105–117. [Google Scholar] [CrossRef]

- Abdel, M.; Khalaf, L. Parametric Construction Cash Flow Modeling Combined with Building Information Modeling and Simulation Cash Flow Generation and Alternatives Analysis Through Bim and Simulation View Project Parametric Construction Cash Flow Modeling Combined with Building. 2019. Available online: https://www.researchgate.net/publication/332951025 (accessed on 21 November 2019).

- Le, H.T.T.; Cong, T.D. Bim-Integrated System: A successful alternative for estimating cash flow in building projects. ASEAN Eng. J. 2023, 13, 103–112. [Google Scholar]

- Abma, V.; Farhana, A.; Rachmawati, S. Cash flow simulation planning based on building information modeling for construction projects. AIP Conf. Proc. 2024, 3114, 030010. [Google Scholar] [CrossRef]

- Mahboob, A.; Rathnasinghe, A.; Ekanayake, P.; Tennakoon, P. Evaluating BIM’s Role in Transforming Cash Flow Forecasting Among Construction SMEs: A Saudi Arabian Narrative. Sustainability 2024, 16, 10221. [Google Scholar] [CrossRef]

- El-Sayegh, S.M.; Mansour, M.H. Risk assessment and allocation in highway construction projects in the UAE. J. Manag. Eng. 2015, 31, 4015004. [Google Scholar] [CrossRef]

- Ranjbar, A.A.; Ansari, R.; Taherkhani, M.R. Hosseini Developing a novel cash flow risk analysis framework for construction projects based on 5D BIM. J. Build. Eng. 2021, 44, 103341. [Google Scholar] [CrossRef]

- Dada, J.O.; Jagboro, G.O. An evaluation of the impact of risk on project cost overrun in the Nigerian construction industry. J. Financ. Manag. Prop. Constr. 2007, 12, 37–44. [Google Scholar] [CrossRef]

- Lee, D.-E.; Lim, T.-K.; Arditi, D. Stochastic project financing analysis system for construction. J. Constr. Eng. Manag. 2012, 138, 376–389. [Google Scholar] [CrossRef]

- Hwee, N.G.; Tiong, R.L. Model on cash flow forecasting and risk analysis for contracting firms. Int. J. Proj. Manag. 2002, 20, 351–363. [Google Scholar] [CrossRef]

- Odeyinka, H.A.; Lowe, J.; Kaka, A. An evaluation of risk factors impacting construction cash flow forecast. J. Financ. Manag. Prop. Constr. 2008, 13, 5–17. [Google Scholar] [CrossRef]

- Kim, D.; Yoo, T.; Tran, S.V.-T.; Lee, D.; Park, C.; Lee, D. Automated Safety Risk Assessment Framework by Integrating Safety Regulation and 4D BIM-Based Rule Modeling. Buildings 2024, 14, 2529. [Google Scholar] [CrossRef]

- Ganbat, T.; Chong, H.-Y.; Liao, P.-C. Mapping BIM uses for risk mitigation in international construction projects. Adv. Civ. Eng. 2020, 2020, 5143879. [Google Scholar] [CrossRef]

- Afzal, F.; Yunfei, S.; Nazir, M.; Bhatti, S.M. A review of artificial intelligence based risk assessment methods for capturing complexity-risk interdependencies: Cost overrun in construction projects. Int. J. Manag. Proj. Bus. 2019, 14, 300–328. [Google Scholar] [CrossRef]

- Liu, J. Bayesian network inference on risks of construction schedule-cost. In Proceedings of the 2010 International Conference of Information Science and Management Engineering, Xi’an, China, 7–8 August 2010; Volume 2, pp. 15–18. [Google Scholar]

- Khanzadi, M.; Eshtehardian, E.; Mokhlespour, M. Esfahani Cash flow forecasting with risk consideration using Bayesian Belief Networks (BBNS). J. Civ. Eng. Manag. 2017, 23, 1045–1059. [Google Scholar] [CrossRef]

- Hon, C.K.H.; Sun, C.; Xia, B.; Jimmieson, N.L.; Way, K.A.; Wu, P.P.-Y. Applications of Bayesian approaches in construction management research: A systematic review. Eng. Constr. Archit. Manag. 2022, 29, 2153–2182. [Google Scholar] [CrossRef]

- Li, Z.; Zhu, X.; Liao, S.; Yin, J.; Gao, K.; Liu, X. Integrating Bayesian Network and Cloud Model to Probabilistic Risk Assessment of Maritime Collision Accidents in China’s Coastal Port Waters. J. Mar. Sci. Eng. 2024, 12, 2113. [Google Scholar] [CrossRef]

- Morgenstern, H.; Raupach, M. Predictive BIM with Integrated Bayesian Inference of Deterioration Models as a Four-Dimensional Decision Support Tool. CivilEng 2023, 4, 185–203. [Google Scholar] [CrossRef]

- Hosamo, H.H.; Nielsen, H.K.; Kraniotis, D.; Svennevig, P.R.; Svidt, K. Improving building occupant comfort through a digital twin approach: A Bayesian network model and predictive maintenance method. Energy Build. 2023, 288, 112992. [Google Scholar] [CrossRef]

- Fan, W.; Yan, B.; Bao, Q.; Zhao, Y.; Zhou, J. Green Evaluation for Building Interior Decoration Based on BIM-BN Technology. Buildings 2023, 13, 744. [Google Scholar] [CrossRef]

- Alavi, H.; Bortolini, R.; Forcada, N. BIM-based decision support for building condition assessment. Autom. Constr. 2021, 135, 104117. [Google Scholar] [CrossRef]

- Cárdenas, I.C.; Al-Jibouri, S.S.; Halman, J.I.; van Tol, F.A. Capturing and integrating knowledge for managing risks in tunnel works. Risk Anal. Int. J. 2013, 33, 92–108. [Google Scholar] [CrossRef]

- Guyonnet, D.; Bourgine, B.; Dubois, D.; Fargier, H.; Co, B.; Chilès, J.-P. Hybrid approach for addressing uncertainty in risk assessments. J. Environ. Eng. 2003, 129, 68–78. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, J.; Zhu, K.; Guo, P.; Shen, C.; Xiong, Z. The safety risk assessment of mine metro tunnel construction based on fuzzy Bayesian network. Buildings 2023, 13, 1605. [Google Scholar] [CrossRef]

- Cheng, M.; Liu, L.; Cheng, X.; Tao, L. Risk analysis of public-private partnership waste-to-energy incineration projects in China: A hybrid fuzzy DEMATEL-ISM approach. Eng. Constr. Archit. Manag. 2023; ahead-of-print. [Google Scholar] [CrossRef]

- Qin, M.; Wang, X.; Du, Y. Factors affecting marine ranching risk in China and their hierarchical relationships based on DEMATEL, ISM, and BN. Aquaculture 2021, 549, 2022. [Google Scholar] [CrossRef]

- Zhang, G.; Thai, V.V. Expert elicitation and Bayesian Network modeling for shipping accidents: A literature review. Saf. Sci. 2016, 87, 53–62. [Google Scholar] [CrossRef]

- Sacks, R.; Eastman, C.; Lee, G.; Teicholz, P. BIM Handbook: A Guide to Building Information Modeling for Owners, Designers, Engineers, Contractors, and Facility Managers; Wiley: Hoboken, NJ, USA, 2018. [Google Scholar]

- Elghaish, F.; Abrishami, S.; Samra, S.A.; Gaterell, M.; Hosseini, R.; Wise, R. Cash flow system development framework within integrated project delivery (IPD) using BIM tools. Int. J. Constr. Manag. 2019, 21, 1–16. [Google Scholar] [CrossRef]

- Li, F.; Wang, W.; Dubljevic, S.; Khan, F.; Xu, J.; Yi, J. Analysis on accident-causing factors of urban buried gas pipeline network by combining DEMATEL, ISM and BN methods. J. Loss Prev. Process Ind. 2019, 61, 49–57. [Google Scholar] [CrossRef]

- Madihi, M.H.; Javid, A.A.S.; Nasirzadeh, F. Enhancing risk assessment: An improved Bayesian network approach for analyzing interactions among risks. Eng. Constr. Archit. Manag. 2023, 32, 2022–2043. [Google Scholar] [CrossRef]

- Şeker, Ş.; Zavadskas, E. Application of fuzzy DEMATEL method for analyzing occupational risks on construction sites. Sustainability 2017, 9, 2083. [Google Scholar] [CrossRef]

- Fenton, N.E.; Neil, M.; Caballero, J.G. Using ranked nodes to model qualitative judgments in Bayesian networks. IEEE Trans. Knowl. Data Eng. 2007, 19, 1420–1432. [Google Scholar] [CrossRef]

- Laitila, P.; Virtanen, K. Improving Construction of Conditional Probability Tables for Ranked Nodes in Bayesian Networks. IEEE Trans. Knowl. Data Eng. 2016, 28, 1691–1705. [Google Scholar] [CrossRef]

- Xu, Y.; Yeh, C.-H.; Yang, S.; Gupta, B. Risk-based performance evaluation of improvement strategies for sustainable e-waste management. Resour. Conserv. Recycl. 2020, 155, 104664. [Google Scholar] [CrossRef]

- Zhou, Q.; Huang, W.; Zhang, Y. Identifying critical success factors in emergency management using a fuzzy DEMATEL method. Saf. Sci. 2011, 49, 243–252. [Google Scholar] [CrossRef]

| Experts | Age | Work Experience | Degree | Job Title |

|---|---|---|---|---|

| 01 | 73 | 42 years | M.S/Civil Engineering | Project manager |

| 02 | 63 | 30 years | B.S/Civil Engineering | Head of the technical office |

| 03 | 55 | 22 years | B.S/Civil Engineering | Site manager |

| 04 | 49 | 18 years | B.S/Civil Engineering | Deputy site manager |

| 05 | 53 | 21 years | B.S/Civil Engineering | Deputy site manager |

| Risk Classification | Risk Factors | Codes |

|---|---|---|

| Risks associated with owner | Specification variations during building | O1 |

| Delays in approvals | O2 | |

| Owner’s managerial deficiency | O3 | |

| Risks associated with contractor | Insufficient expertise and experience | C1 |

| Delay in procurement | C2 | |

| Contractor’s managerial deficiency | C3 | |

| Inadequate site safety management | C4 | |

| Poor workmanship | C5 | |

| Poor planning and scheduling | C6 | |

| Financial risks | Inflation | F1 |

| Client’s payment delay | F2 | |

| Financial insufficiency of the contractor | F3 | |

| Management risks | Inadequate communication of project stakeholders | M1 |

| Conflict among project stakeholders | M2 | |

| Procurement risks | Insufficient supplies of materials and equipment | P1 |

| Public conditions risks | Complexity of the project | PU1 |

| Risks associated with consultant | Insufficient expertise and experience, as well as managerial shortcomings | CO1 |

| Design mistakes | CO2 | |

| Delay in design delivery | CO3 | |

| Modifying the specs of materials and equipment throughout the building process | CO4 | |

| Country conditions risks | Economic volatility | G1 |

| Non-economic instabilities | G2 | |

| Legal systems’ immaturity and weak bureaucracy | G3 | |

| Environmental conditions risks | Bad weather condition | E1 |

| Force majeure | E2 | |

| Risks imposed by environmental regulations | E3 | |

| Operational risks | Corruption and fraud | OP1 |

| Defects in construction method | OP2 | |

| Damage incurred to the contractor’s equipment and tools | OP3 | |

| Rework | OP4 | |

| Not adhering to the job orders and delay in completing the predecessors | OP5 |

| Linguistic Terms | Triangular Fuzzy Numbers |

|---|---|

| Very high influence | (0.75, 1, 1) |

| High influence | (0.5, 0.75, 0.1) |

| Medium influence | (0.25, 0.5, 0.75) |

| Low influence | (0, 0.25, 0.5) |

| No influence | (0, 0, 0.25) |

| Level | 1st | 2nd | 3rd | 4th | 5th | 6th | 7th | 8th | 9th | 10th |

|---|---|---|---|---|---|---|---|---|---|---|

| Risk factors | G1 | F1 | C1; G3; F2 | F3; CO1; C3 | G2; O3 | P1; M1; O2; OP1; O1; | C2; C6; M2; PU1 | E2; OP2 | CO2; OP3 | C4; E3; C5; OP4 CO3; CO4; OP5; E1 |

| State | Cost Over-Run Magnitude (Percentage) |

|---|---|

| Low | 0–15% |

| Medium | 15–40% |

| High | 40–100% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Madihi, M.H.; Tafazzoli, M.; Shirzadi Javid, A.A.; Nasirzadeh, F. Probabilistic Cash Flow Analysis Considering Risk Impacts by Integrating 5D-Building Information Modeling and Bayesian Belief Network. Buildings 2025, 15, 1774. https://doi.org/10.3390/buildings15111774

Madihi MH, Tafazzoli M, Shirzadi Javid AA, Nasirzadeh F. Probabilistic Cash Flow Analysis Considering Risk Impacts by Integrating 5D-Building Information Modeling and Bayesian Belief Network. Buildings. 2025; 15(11):1774. https://doi.org/10.3390/buildings15111774

Chicago/Turabian StyleMadihi, Mohammad Hosein, Mohammadsoroush Tafazzoli, Ali Akbar Shirzadi Javid, and Farnad Nasirzadeh. 2025. "Probabilistic Cash Flow Analysis Considering Risk Impacts by Integrating 5D-Building Information Modeling and Bayesian Belief Network" Buildings 15, no. 11: 1774. https://doi.org/10.3390/buildings15111774

APA StyleMadihi, M. H., Tafazzoli, M., Shirzadi Javid, A. A., & Nasirzadeh, F. (2025). Probabilistic Cash Flow Analysis Considering Risk Impacts by Integrating 5D-Building Information Modeling and Bayesian Belief Network. Buildings, 15(11), 1774. https://doi.org/10.3390/buildings15111774