Methods of Construction to the Meet Housing Crisis in the UK Residential Sector: A Comparative Study between Timber Frame and Masonry Construction

Abstract

1. Introduction

2. Literature Review

2.1. UK Residential Sector: Deficits and Shortfalls

2.2. Timber Framed Construction: Overview and Usage

2.3. Timber Framed Construction: Value and Benefits

2.4. Timber Framed Construction: Issues and Complexities

2.5. Masonry Construction: Overview and Usage

2.6. Masonry Construction: Value and Benefits

2.7. Masonry Construction: Issues and Complexities

2.8. Timber Frame vs. Masonry: An Insight into Sustainability

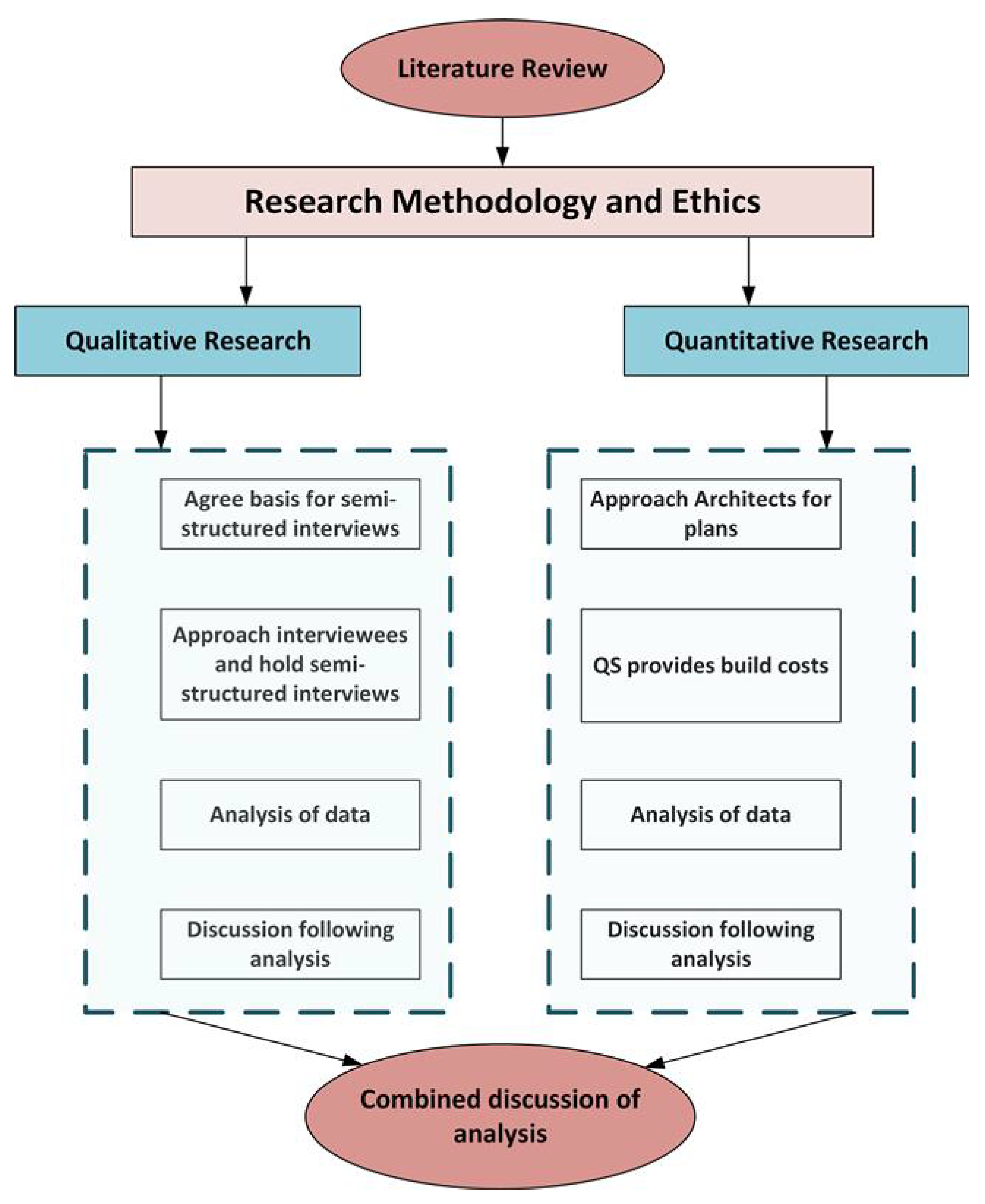

3. Research Methodology

- From your experience, what has been the dominant construction method adopted by your organisation within the residential scheme?

- Based on the projects executed, could you explain why masonry construction is the main construction method adopted in the residential sector?

- In your opinion, what role does longevity or consumer confidence play when selecting materials for residential projects?

- In your organisation, how are managing the integration of Net Zero standards, and achieving sustainability targets?

- Looking at the current situation within the housing market, what is your view in terms material selection process, say within the next 5 years?

4. Results and Analysis

4.1. Analysis of Build Cost (Quantitative Data)

4.2. Thematic Analysis (Qualitative Data)

4.2.1. Timber Frame vs. Masonry: Material Choice and Drivers

4.2.2. Timber Frame vs. Masonry: Longevity and Consumer Confidence

4.2.3. Timber Frame vs. Masonry: Insight into Sustainability

4.2.4. Timber Frame vs. Masonry: Five-Year View

4.2.5. Summary and Highlights

5. Discussion and Practical Implications

5.1. Timber Frame or Masonry: Can Decisions Be Backed Up?

5.2. UK Residential Sector: Decisions for the Future

6. Conclusions and Future Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- McMullan, L.; Osborne, H.; Blight, G.; Duncan, P. UK Housing Crisis: How Did Owning a Home Become Unaffordable? 2021. Available online: https://www.theguardian.com/business/ng-interactive/2021/mar/31/uk-housing-crisis-how-did-owning-a-home-become-unaffordable (accessed on 23 June 2022).

- Wilson, W. Stimulating Housing Supply—Government Initiatives (UK). 2020. Available online: www.parliament.uk/commons-library|intranet.parliament.uk/commons-library|papers@parliament.uk|@commonslibrary (accessed on 11 February 2021).

- Department for Communities and Local Government. Fixing Our Broken Housing Market; Department for Communities and Local Government: London, UK, 2017. Available online: www.gov.uk/government/publications (accessed on 23 June 2022).

- OSN. Housing in Construction Output Statistics, Great Britain 2010 to 2019. 2020. Available online: https://www.ons.gov.uk/businessindustryandtrade/constructionindustry/articles/housinginconstructionoutputstatisticsgreatbritain/2010to2019 (accessed on 23 June 2022).

- Savills. What Next for Housebuilding? Boosting Build-Out Rates Land Value Capture Housebuilding Forecasts. 2018. Available online: https://pdf.euro.savills.co.uk/uk/residential—other/spotlight-what-next-for-housebuilding.pdf (accessed on 23 June 2022).

- Švajlenka, J.; Kozlovská, M. Houses based on wood as an ecological and sustainable housing alternative—Case study. Sustainability 2018, 10, 1502. [Google Scholar] [CrossRef]

- Kubba, S. Handbook of Green Building Design and Construction: LEED, BREEAM, and Green Globes; Butterworth-Heinemann: Oxford, UK, 2017. [Google Scholar]

- Savills. Modern Methods of Construction UK Cross Sector-Spring 2020 What Can MMC Offer the Housebuilding Industry in the UK? 2020. Available online: https://www.savills.co.uk/research_articles/229130/301059-0 (accessed on 23 June 2022).

- RICS. Modern Methods of Construction a Forward-Thinking Solution to The Housing Crisis? 2018. Available online: www.rics.org (accessed on 1 September 2018).

- Böke, H.; Akkurt, S.; Ipekoǧlu, B.; Uǧurlu, E. Characteristics of brick used as aggregate in historic brick-lime mortars and plasters. Cem. Concr. Res. 2006, 36, 1115–1122. [Google Scholar] [CrossRef]

- ONS. House Building, UK: Permanent Dwellings Started and Completed. 2019. Available online: https://www.ons.gov.uk/peoplepopulationandcommunity/housing/datasets/ukhousebuildingpermanentdwellingsstartedandcompleted (accessed on 23 June 2022).

- Gompertz, S. Housing Shortage: Scale of UK’s Housing Gap Revealed. Personal Finance Correspondent, BBC News. 23 February 2020. Available online: https://www.bbc.co.uk/news/business-51605912.amp (accessed on 23 June 2022).

- STA. STA Annual Survey of UK Structural Timber Markets. 2016. Available online: https://www.structuraltimbermagazine.co.uk/news/sta-annual-survey-of-uk-structural-timber-markets/ (accessed on 23 June 2022).

- Brunskill, R.W. Timber Building in Britain; ORION: London, UK, 1999. [Google Scholar]

- Robinson, B. London’s Burning: The Great Fire. 2011. Available online: https://www.bbc.co.uk/history/british/civil_war_revolution/great_fire_01.shtml (accessed on 23 June 2022).

- UK Parliament. An Act for Rebuilding the City of London. 1667. Available online: https://www.parliament.uk/about/living-heritage/transformingsociety/towncountry/towns/collections/collections-great-fire-1666/1666-act-to-rebuild-the-city-of-london/ (accessed on 23 June 2022).

- Hearn, J. A Short History of Prefabs—Building the Post-War World; The Prefab Museum: London, UK, 2016. [Google Scholar]

- Marshall, D.; Worthing, D.; Heath, R.; Dann, N. The Construction of Houses; Estates Gazette: London, UK, 2013. [Google Scholar] [CrossRef]

- ASHGATE. Practical Building Conservation: Timber—English Heritage; Ashgate: Aldershot, UK, 2018. [Google Scholar]

- Mills, C.M. Dendrochronological evidence for Scotland’s native timber resources over the last 1000 years. Scott. For. 2012, 66, 18–33. [Google Scholar]

- Forest Research. Origin of Wood Imports. 2018. Available online: https://www.forestresearch.gov.uk/tools-and-resources/statistics/forestry-statistics/forestry-statistics-2018/trade-2/origin-of-wood-imports/ (accessed on 23 June 2022).

- Law, C. Where Does Your Timber Come from? Sustainable Construction Solutions Limited: Uxbridge, UK, 2016; Available online: http://www.susconsol.co.uk/blog/where-timber-comes-from/ (accessed on 23 June 2022).

- RLB. Timber & Masonry Construction Cost Comparison Report—Affordable Housing; Rider Levett Bucknall: London, UK, 2018. [Google Scholar]

- Emmitt, S. Barrys Introduction to Construction of Buildings; John Wiley & Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- Lowe, T. Labour Shortage Worries Gather Pace as Vacancies Jump More Than 50% Since April. The Building Boardroom. 21 May 2021. Available online: https://www.building.co.uk/news/labour-shortage-worries-gather-pace-as-vacancies-jump-more-than-50-since-april/5111931.article?utm_source=ground.news&utm_medium=referral (accessed on 23 June 2022).

- NHBC Standards. Substructure and Ground-Bearing Floors. 2020. Available online: https://www.nhbc.co.uk/builders/products-and-services/techzone/nhbc-standards (accessed on 23 June 2022).

- Marshall, D.; Worthing, D.; Heath, R.; Dann, N. Understanding Housing Defects, 4th ed.; Estates Gazette: London, UK, 2013. [Google Scholar]

- Haseltine, B. The evolution of the design and construction of masonry buildings in the UK. Gestão Tecnol. Proj. 2012, 7, 20–26. [Google Scholar] [CrossRef][Green Version]

- Taly, N. Design of Reinforced Masonry Structures; McGraw-Hill Education: Berkshire, UK, 1867. [Google Scholar]

- Jenkins, M. Building History: Bricks and Mortar; RICS: London, UK, 2019. [Google Scholar]

- Brunskill, R.W. Brick and Clay Building in Britain; Yale University Press: London, UK, 2009. [Google Scholar]

- Historic England. Practical Building Conservation: Earth, Brick and Terracotta; Historic England: London, UK, 2015. [Google Scholar]

- Lynch, G. Gauged Brickwork, 2nd ed.; Routledge: London, UK, 2006. [Google Scholar]

- McCaig, I.; Pender, R.; Pickles, D. Energy Efficiency and Historic Buildings: How to Improve Energy Efficiency; Historic England: London, UK, 2018. [Google Scholar]

- Kingspan. Cavity Walls: The Past; Kingspan Insulation UK: Leominster, UK, 2016. [Google Scholar]

- Modern Masonry. A Dream Home: An Exploration of Aspirations. 2021. Available online: www.thinktank.org.uk (accessed on 1 March 2021).

- Hayes, D. Masonry or Timber Frame? Build IT, 26 November 2012. [Google Scholar]

- Brick Development Association. Structural Giude. 2020. Available online: https://www.brick.org.uk/technical/structural-brickwork (accessed on 23 June 2022).

- Fyffe, M. Timber Frame Homes vs Brick Homes. CLPM. 14 June 2012. Available online: https://cl-pm.com/timber-frame-homes-vs-brick-homes/ (accessed on 23 June 2022).

- The Brick Industry Association. 6 TECHNICAL NOTES on Brick Construction Fire Resistance of Brick Masonry. 2008. Available online: www.gobrick.com (accessed on 1 March 2008).

- Financial Times. Where Have All the Bricklayers Gone? 2022. Available online: https://www.ft.com/content/5ec21cca-a967-11e5-9700-2b669a5aeb83 (accessed on 23 June 2022).

- Statista. Annual Rain Days in the United Kingdom (UK) from 1990 to 2021. 2022. Available online: https://www.statista.com/statistics/610677/annual-raindays-uk/ (accessed on 23 June 2022).

- The Ministry of Housing, Communities and Local Government. The Future Homes Standard. 2021. Available online: http://forms.communities.gov.uk/or (accessed on 27 January 2021).

- Khatib, J. Sustainability of Construction Materials, 2nd ed.; Woodhead Publishing: Cambridge, UK, 2016. [Google Scholar]

- Mundy, J. The Green Guide Explained; BRE Centre for Sustainable Products: Johannesburg, South Africa, 2015. [Google Scholar]

- Hammond, M.; Wellington, J. Research Methods: The Key Concepts, 2nd ed.; Routledge: London, UK, 2013. [Google Scholar] [CrossRef]

- Johnson, B.; Onwuegbuzie, A. Mixed Methods Research: A Research Paradigm Whose Time Has Come. Educ. Res. 2004, 33, 14–26. [Google Scholar] [CrossRef]

- Dawson, C. A Practical Guide to Research Methods: A User Friendly Manual for Mastering Research Techniques and Projects, 3rd ed.; How to Books Ltd.: Oxford, UK, 2007. [Google Scholar]

- Emmitt, S. Barry’s Advanced Construction of Buildings, 4th ed.; Wiley-Blackwell: Chichester, UK, 2018. [Google Scholar]

- Booth, R.; Siddique, H. Government’s Housebuilding U-Turn Makes It ‘Harder to Deliver 300,000 Homes. The Guardian Lab. 15 December 2020. Available online: https://www.theguardian.com/society/2020/dec/16/brownfield-sites-prioritised-in-plan-to-build-300000-homes-a-year-in-england (accessed on 24 June 2022).

- Forestry Commission. Timber Price Indices. 2019. Available online: https://cdn.forestresearch.gov.uk/2022/03/tpi092019.pdf (accessed on 24 June 2022).

- SKANSKA. Annual-and-Sustainability. 2021. Available online: https://group.skanska.com/49b28a/siteassets/investors/reports-publications/annual-reports/2021/annual-and-sustainability-report-2021.pdf (accessed on 24 June 2022).

- Morby, A. BoKlok to Build 1000 Housing Association Homes. TARMAC. 21 December 2020. Available online: https://www.constructionenquirer.com/2020/12/21/boklok-to-build-1000-housing-association-homes/ (accessed on 24 June 2022).

- Bennett, K.; Mayouf, M. Value management integration for whole life cycle: Post covid-19 strategy for the UK construction industry. Sustainability 2021, 13, 9274. [Google Scholar] [CrossRef]

| Building Type by the Material Specification | Labour Cost | Material Cost | Build Time | Total Build Cost |

|---|---|---|---|---|

| Timber Frame | £136,319.70 | £142,015.04 | 26 weeks | £278,334.74 |

| Masonry | £134,781.48 | £118,331.14 | 27 weeks | £253,334.74 |

| The difference in cost/time by percentage | +1.13% (Timber Frame) | +18.19% (Timber Frame) | +3.77% (Masonry) | +9.49% (Timber Frame) |

| Timber Frame Cost Summary | Price | Masonry Cost Summary | Price |

|---|---|---|---|

| Scaffolding | £6187.62 | Scaffolding | £6187.62 |

| Enabling works | £1253.60 | Enabling works | £1253.60 |

| Excavations and foundations | £4632.63 | Excavations and foundations | £4632.63 |

| Drainage | £9353.95 | ||

| Foundation Masonry | £2306.90 | ||

| Brickworks | £5798.50 | ||

| Timber Frame manufactured kit | £25,905.00 | ||

| Timber Frame Erecting | £425.00 | ||

| Roof Carpentry | £3347.46 | Roof Carpentry | £3347.46 |

| Roof Covering | £9448.28 | Roof Covering | £9448.28 |

| Total Cost | £68,658.94 | Total Cost | £48,703.00 |

| Interviewee # | Background | Position |

|---|---|---|

| 1 | A leading housing authority producing over 1000 new homes/year, while maintaining a portfolio of over 60,000 homes | Construction and Technical Director |

| 2 | A leading housing authority responsible for one of the largest new-build affordable home schemes in the UK, approaching 6000 new homes | Planning and Technical Director |

| 3 | A small development company producing up to 50 high-quality homes/year, for sale on the open market | Director, head of development |

| 4 | A nationwide housing developer, homes are predominately for sale on the open market along with limited affordable housing | Director |

| 5 | A small-scale family development firm producing between 5–10 homes/year, for sale on the open market | Director |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mayouf, M.; Jones, R.; Ashayeri, I.; Nikologianni, A. Methods of Construction to the Meet Housing Crisis in the UK Residential Sector: A Comparative Study between Timber Frame and Masonry Construction. Buildings 2022, 12, 1177. https://doi.org/10.3390/buildings12081177

Mayouf M, Jones R, Ashayeri I, Nikologianni A. Methods of Construction to the Meet Housing Crisis in the UK Residential Sector: A Comparative Study between Timber Frame and Masonry Construction. Buildings. 2022; 12(8):1177. https://doi.org/10.3390/buildings12081177

Chicago/Turabian StyleMayouf, Mohammad, Rory Jones, Ilnaz Ashayeri, and Anastasia Nikologianni. 2022. "Methods of Construction to the Meet Housing Crisis in the UK Residential Sector: A Comparative Study between Timber Frame and Masonry Construction" Buildings 12, no. 8: 1177. https://doi.org/10.3390/buildings12081177

APA StyleMayouf, M., Jones, R., Ashayeri, I., & Nikologianni, A. (2022). Methods of Construction to the Meet Housing Crisis in the UK Residential Sector: A Comparative Study between Timber Frame and Masonry Construction. Buildings, 12(8), 1177. https://doi.org/10.3390/buildings12081177