1. Introduction

Bankruptcy laws in the United States allow overburdened debtors to file for bankruptcy and to get a fresh financial start (Chapter 7) or reorganize debts (Chapter 13). If a debtor files for bankruptcy under Chapter 7, unsecured debts are wiped out in exchange for nonexempt assets and the debtor is allowed to keep future incomes. Chapter 13 petitioners retain all of the assets and should repay their debts over a 3–5 year period.

There is a plenty of economic literature on personal bankruptcy. Reference [

1] argued that the dramatic rise of personal bankruptcy in the U.S. was due to the changes in social norms, and [

2] attributed it to the expansion of credit card borrowing. How the bankruptcy protection affects on consumers was investigated by [

3] (bankruptcy protection increase earnings and employment) and [

4] (role of bankruptcy protection as implicit health insurance). Empirical studies [

5,

6,

7] revealed that filers have restrictions on access to credit markets.

On the other hand, personal bankruptcy decision problem, unlike retirement decision problem, receives little attention in mathematical finance literature. Optimal retirement problem attracts enormous interests in mathematical finance literature as well as in economics literature, for examples [

8,

9,

10,

11,

12,

13,

14] and others. Our personal bankruptcy decision problem, however, can also be cast into optimal stopping problems, which is the same as an agent’s voluntary retirement problem. The symmetry feature between personal bankruptcy and voluntary retirement can be found in manners that characterize the stopping times. The former characterizes it as the first hitting time the wealth level reaches a certain wealth threshold from above, the latter does it from below.

The first mathematical treatment of personal bankruptcy decision problem is provided in [

15], which uses dynamic programming method to solve the optimization problem of a debtor who is not a wage earner. Recently, [

16] considers the case where a Chapter 7 filer faces borrowing constraints against future labor income and solves utility maximization problem using martingale and duality method. In [

16], the debtor is a wage earner with a fixed labor income stream, i.e., the debtor’s labor supply (or leisure rate) is not a control variable.

This paper investigates the optimal consumption, leisure, portfolio, and bankruptcy, assuming that the debtor is eligible for Chapter 7 bankruptcy. Numerous empirical studies have investigated the personal bankruptcy and labor supply (see [

3,

17,

18,

19]). All of them discuss how the debt relief have impacts on the

post-bankruptcy consumer’s labor supply. However, to the best of our knowledge, there are little empirical studies for the effects of personal bankruptcy option on

pre-bankruptcy debtor’s consumption, portfolio, and labor supply. An intuition is that with an option to file for bankruptcy the debtor tends supply less labor than he/she does without such an option. The aim and contribution of this paper is to justify this intuition based on a quantitative method. Our numerical illustrations based on the explicit solution we derived reveal that a debtor with an option to file for bankruptcy tends to enjoy more consumption, supply less labor and reduce savings comparing to a debtor without such an option. Moreover, with an option to file for bankruptcy the debtor tends to invest more in the risky asset than he/she does without the option. Although we have little empirical results available for our analysis, we believe this study contributes to providing an implication for policy making.

The utility is derived from consumption and leisure and has a form of Cobb-Douglas function. The Cobb-Douglas function is well suited for considering utility from consumption/leisure and is popularly accepted by many researchers in this field (for example see [

11,

12]). In addition, the Cobb-Douglas utility function capture consumption jump at the optimal stopping times, such as retirement time or bankruptcy time. A dynamic programming method is applied to obtain value functions and explicit forms of the optimal strategies. Numerical illustrations with our solution show the effects of an option to file for bankruptcy on debtor’s consumption, portfolio, and leisure: with an option to file for bankruptcy, he/she enjoys more consumption, leisure and invests more in the risky asset than he/she does without such an option.

The paper proceeds as follows.

Section 2 introduces our markets and utility function.

Section 3 defines maximization problems and solves them.

Section 4 exhibits numerical results from our explicit solutions and derives the effects of an option to file for bankrputcy, and

Section 5 concludes.

3. The Optimization Problems and Solution

Under Chapter 7, unsecured debts are discharged but nonexempt assets should be relinquished to the bankruptcy trustee who will liquidate them to repay creditors. To reconcile this Chapter 7 bankruptcy rule with our model, we postulate that if the debtor files for bankruptcy, the debtor (hence becomes a filer) retains some proportion

of wealth less a fixed cost

. Let

be the wealth level and

be the time of filing for Chapter 7 bankruptcy. Then we have

After filing for Chapter 7 bankruptcy, the debtor is allowed to keep future incomes. We assume that the debtor and the filer have the same labor market parameters. Before filing for bankruptcy, the debtor repays a debt at a constant rate

p. Therefore, the wealth level process satisfies the following equation

Remark 1. We define and consider two roots and of the equationfor solutions to the optimization problems. 3.1. Filer’s Optimization Problem

Firstly, we will derive the filer’s value function

and optimal strategies. The filer’s wealth level process evolves according to the following equation

Definition 1. We call an admissible policy for a filer at x if

- (a)

c, , and satisfy Equation (1), - (b)

- (c)

Let

be the set of all admissible policies for a filer at

x. Then the value function

is defined as follows

Before we state the filer’s value function and optimal strategies, we define the following constants and functions

Theorem 1. The filer’s value function is given bywhere and are the inverse functions of and , respectively, and is given by Moreover, the filer’s optimal strategies are given as follows Proof. The Bellman equation for the value function

is given by

The maximizer

to Equation (

3) is given by

and there exists a wealth threshold

such that the first order conditions (FOCs) for Equation (

3) are given by

Firstly, we consider the case where

. Borrowing the idea from [

20], we write the maximizer

c to Equation (

3) be a function of

x such that

for a function

Denote by

the inverse function of

such that

. Then we have

Combining Equations (

4) and (

5) and plugging into Equation (

3) yields

If we differentiate Equation (

6) with respect to

c, we obtain the following ordinary differential equation

which has the general solution of the form

We choose

to discard a rapid growth term

of Equation (

7) as

. Substituting Equation (

7) into Equation (

6), we find

For the case where

, the maximizer

l to Equation (

3) is

L and we write the maximizer

c to (

3) as

for a function

and denote by

the inverse function of

such that

. Then we obtain

Similarly to the way we obtained Equation (

7), it is possible to find

We take

due to rapid growth of

in Equation (

8) when

. The value function for this case is given by

To find out

and

B, we apply

condition of

at

, so we have the followings:

which is equivalent to

Therefore, we have

and, consequently

Combining Equations (

9) and (

10) yields

The optimal strategies follow from the first order conditions (FOCs). □

With the filer’s value function in hand, we are ready to investigate the optimization of the debtor.

3.2. Debtor’s Optimization Problem

The debtor’s wealth level satisfies the following equation

Definition 2. We call an admissible policy for a debtor at x if

- (a)

c, , and satisfy Equation (1), - (b)

τ is an -stopping time,

- (c)

- (d)

Let

be the set of all admissible policies for the debtor at

x. Then the debtor’s optimization problem is to choose optimally consumption, portfolio, leisure processes and time for filing for bankruptcy, which is defined by

Similarly to the case of the filer, there exists a wealth threshold above which the debtor enjoys the maximum leisure L.

Assumption 2. The debtor does not file for bankruptcy while enjoying the maximum leisure L nor enjoys the maximum leisure L immediately after filing for bankruptcy.

Assumption 2 is reasonable since the personal bankruptcy is intended for debt relief for

overburdened debtors. The optimal time for filing for bankruptcy

is described as the first hitting time of the wealth level on a certain threshold, call the bankruptcy wealth level

such that

(See [

15]). Therefore, Assumption 2 implies

Before we state the debtor’s value function and optimal strategies, we define the following constants and functions

where

solves

Theorem 2. The debtor’s value function is given bywhere and are the inverse functions of and , respectively. and are given by Proof. The Bellman equation of

is given by

Due to the constraint

there exists a wealth threshold

with the corresponding optimal consumption

such that the first order conditions (FOCs) of Equation (

11) are given by

For the case where

(resp.

), write the maximizer

c to Equation (

11) be a function of

x such that

(resp.

) for a function

(resp.

). Denote by

(resp.

) the inverse function of

(resp.

). Similar lines to the proof of Theorem 1 leads us to obtain

where the rapid growth term

term of Equation (

12) is discarded.

Let us denote by

and

the optimal consumption rate such that

In addition, let

be the optimal consumption rate that corresponds

. To determine

and

we apply

condition of

at

and the smooth pasting condition of

and

at

. The condition

implies

and

imply

respectively. At

, we have the following smooth pasting condition

which yields

Combining Equations (

13) and (

14) with Equation (

17) we obtain

The value matching condition

gives

where Equation (

17) is used. Combining Equations (

15) and (

16) results in

and Equation (

18) implies

Plugging Equation (

20) into Equation (

19) we find

From Equation (

15), we obtain

□

Theorem 3. The debtor’s optimal strategies are given as follows Proof. The optimal strategies

follow from the first order conditions (FOCs), and the rest of the proof follows similar lines to the proof of Theorem 3.1 of [

15]. □

4. Numerical Illustrations

We provide some numerical results from our explicit expressions for the optimal strategies of a debtor with an option to file for bankruptcy.

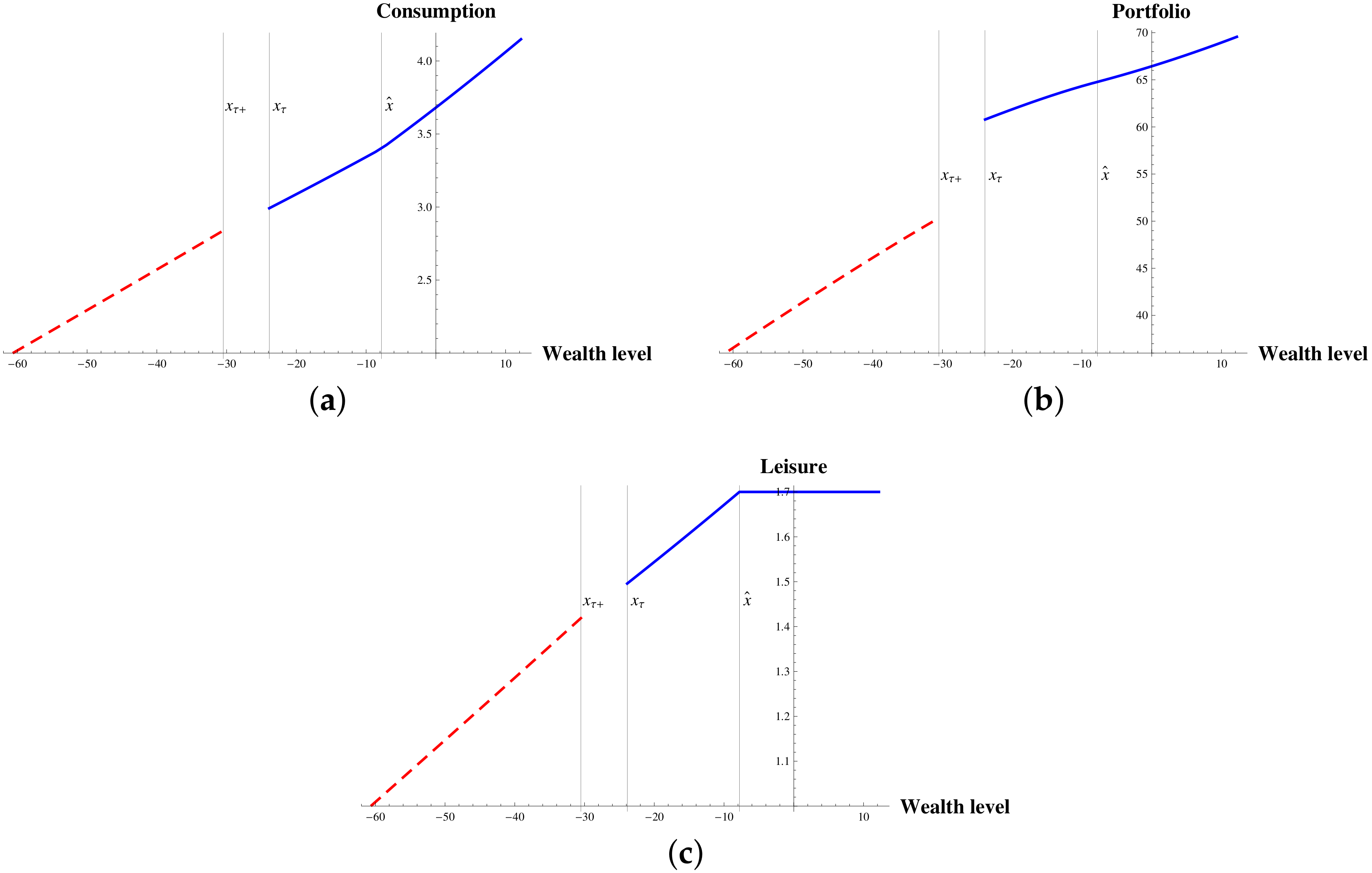

Figure 1 shows the optimal consumption, portfolio, and leisure for the debtor and filer. We see that consumption, portfolio, and leisure drop at bankruptcy. From Equation (

17), the consumption

drop at bankruptcy is given by

regardless of magnitude of the coefficient of relative risk aversion

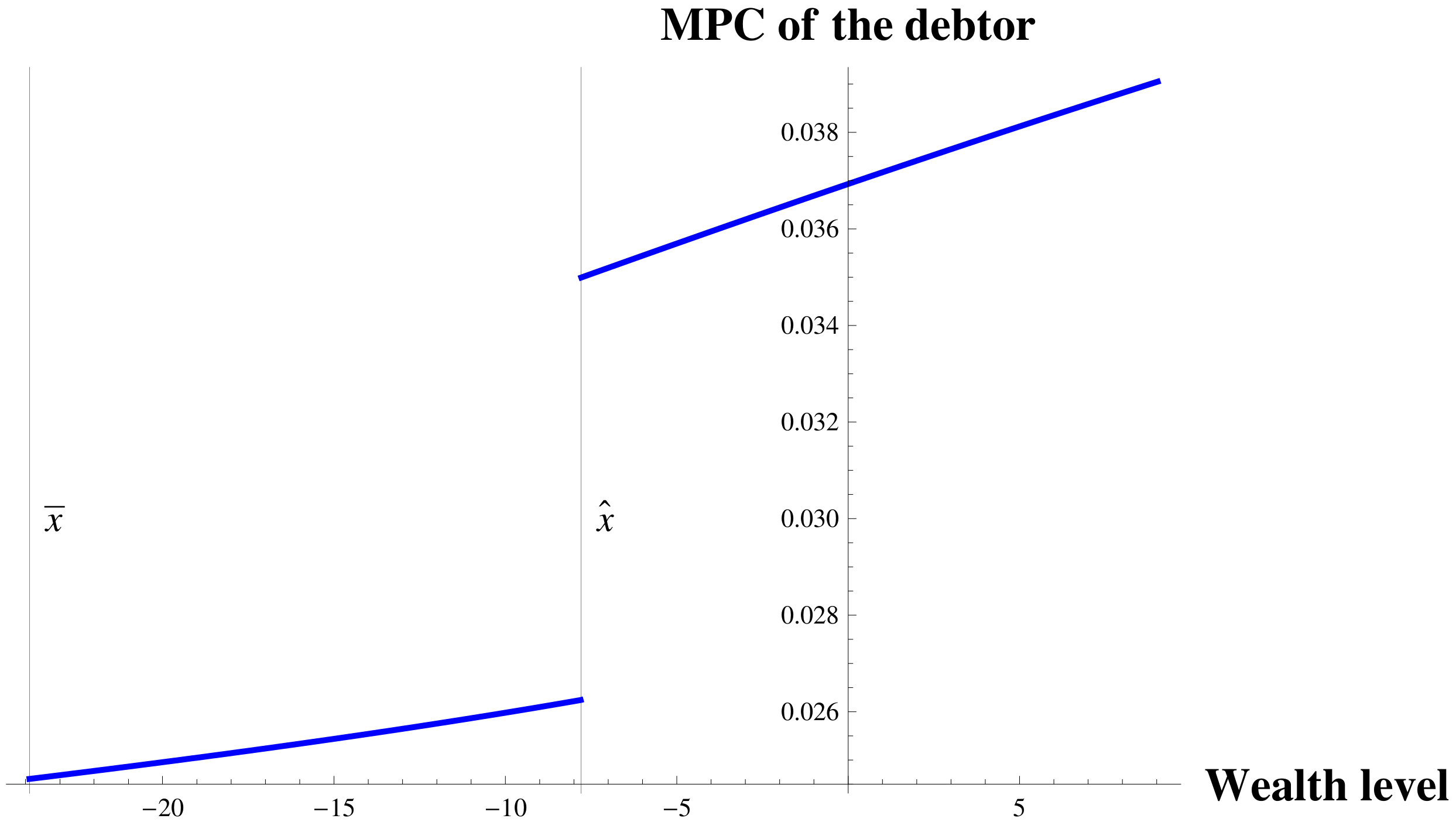

. To take a close look at the debtor’s consumption as the wealth level approaches the bankruptcy wealth level, we define the marginal propensity to consume (MPC) out of wealth as follows

From the inverse relation of

(resp.

) and

(resp.

), the MPC of the debtor is given by

The optimal bankruptcy decision problem in this paper is similar to the optimal retirement problem (for example, [

8,

9,

11]) in that both the optimal bankruptcy time and the retirement time are characterized as the first time the wealth level hit a certain threshold from above and below, respectively. From [

11], which employ a Cobb-Douglas utility function, consumption jumps (resp. drops) at retirement if the coefficient of relative risk aversion is larger (resp. smaller) than 1. In addition, we see from [

11] that the consumption is concave with wealth as the wealth level approaches to the retirement wealth level from below. On the other hand, we see from

Figure 2 that when the debtor has an option to file for bankruptcy, consumption is convex with wealth as the wealth level approaches to the retirement wealth level from above.

We compare the optimal strategies of a debtor who are given an opportunity to file for bankruptcy with those of a debtor without such an opportunity. Denote by

the triple of the optimal consumption, portfolio, and leisure policies of a debtor without an option to file for bankruptcy. It is easy to find the optimal strategies

which are given by

where

(resp.

) is the inverse function of

(resp.

).

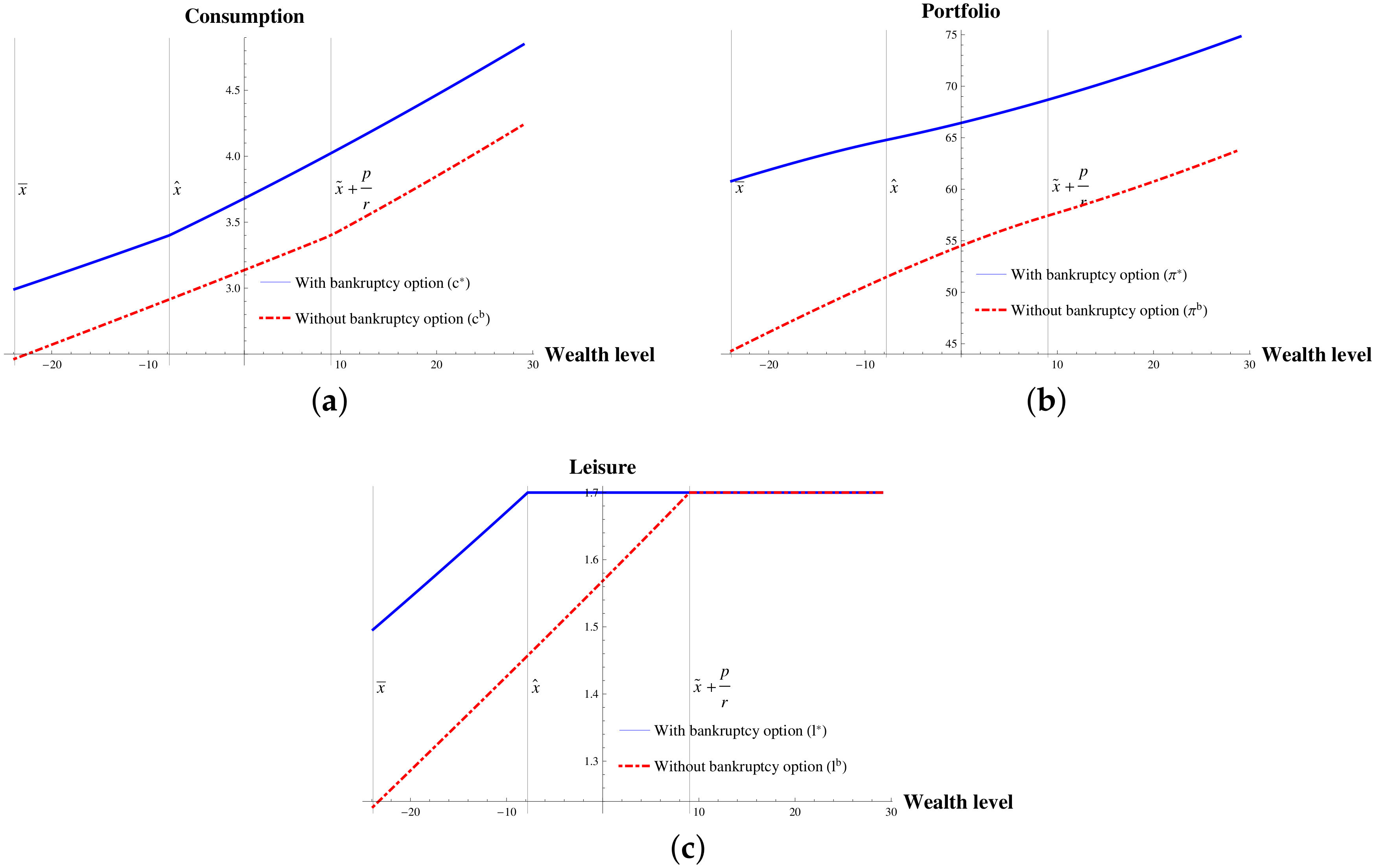

From

Figure 3, we see that an opportunity to file for bankruptcy leads a debtor to consume more and work less than he/she does without an option to file for bankruptcy. Due to the existence of a refuge from financial distress, a debtor with such an option can enjoy consumption and leisure more and reduces savings comparing to a debtor without and option to file for bankruptcy. Also, with an option to file for bankruptcy the debtor tends to invest more in the risky asset than he/she does without the option.

5. Conclusions

This paper investigates the optimal consumption, portfolio and leisure of a debtor who is eligible for Chapter 7 bankruptcy. Explicit expressions for the optimal strategies can be obtained with a Cobb-Douglas utility function. There exists consumption and leisure drops at bankruptcy regardless of magnitude of the coefficient of relative risk aversion. An option to file for bankruptcy enables the debtor to increase consumption, leisure and to invest more in the risky asset.

Unlike the debtor, we assume that the filer receives a fixed income stream and is not able to control labor supply. Due to the bankruptcy flag, the filer is likely to face restriction to borrow against future income, but we assume that the filer can borrow up the 100% of the present value of the future income stream. These are limitations to this study. Therefore, considering the liquidity constraint of the filer or providing labor supply flexibility to the filer, although methodologically challenging, can increase realism and are possible future research directions.