Theoretical Study and Numerical Experiment on the Influence of Trend Changes on Correlation Coefficient

Abstract

:1. Introduction

2. Materials and Methods

2.1. Trend Coefficient

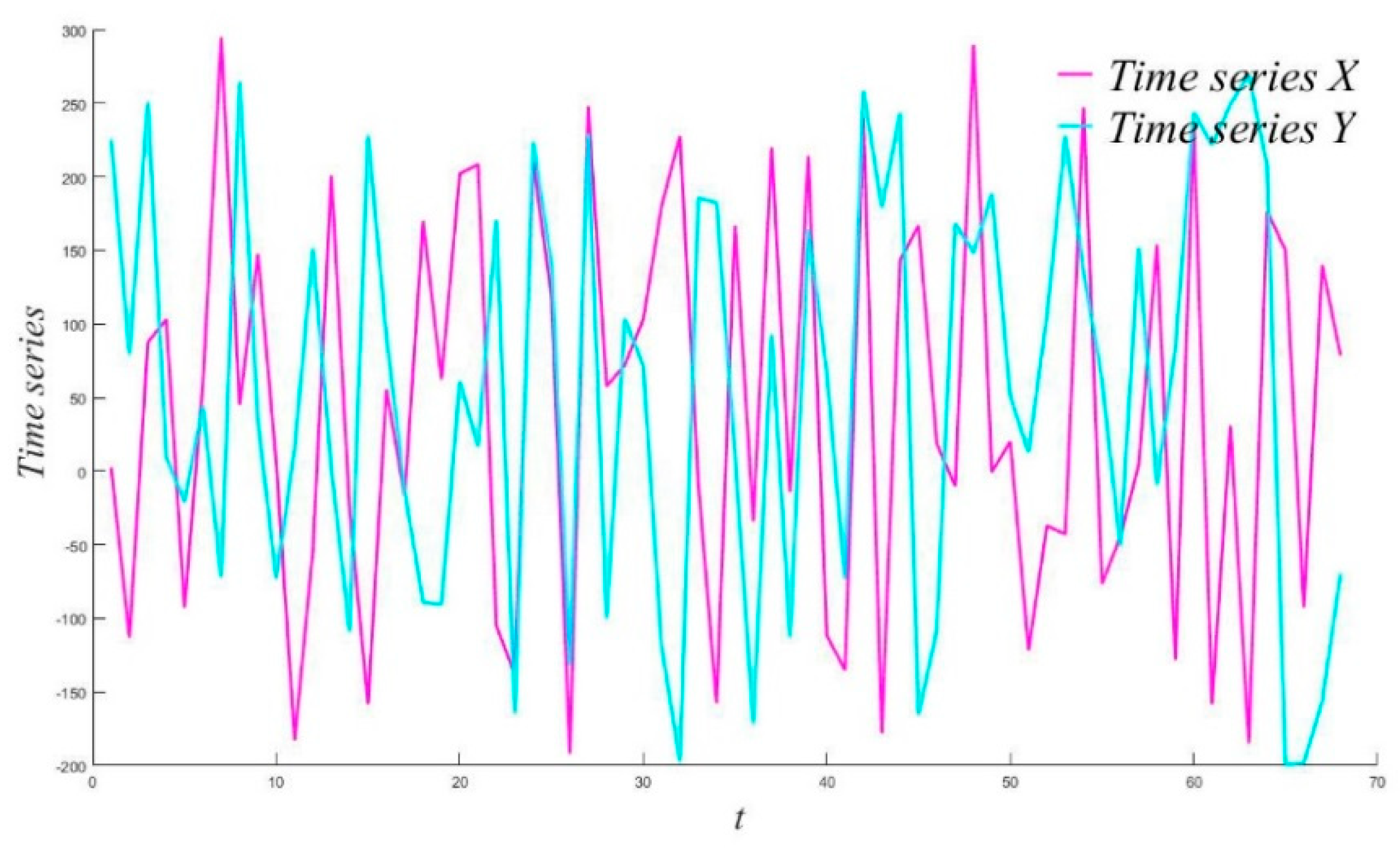

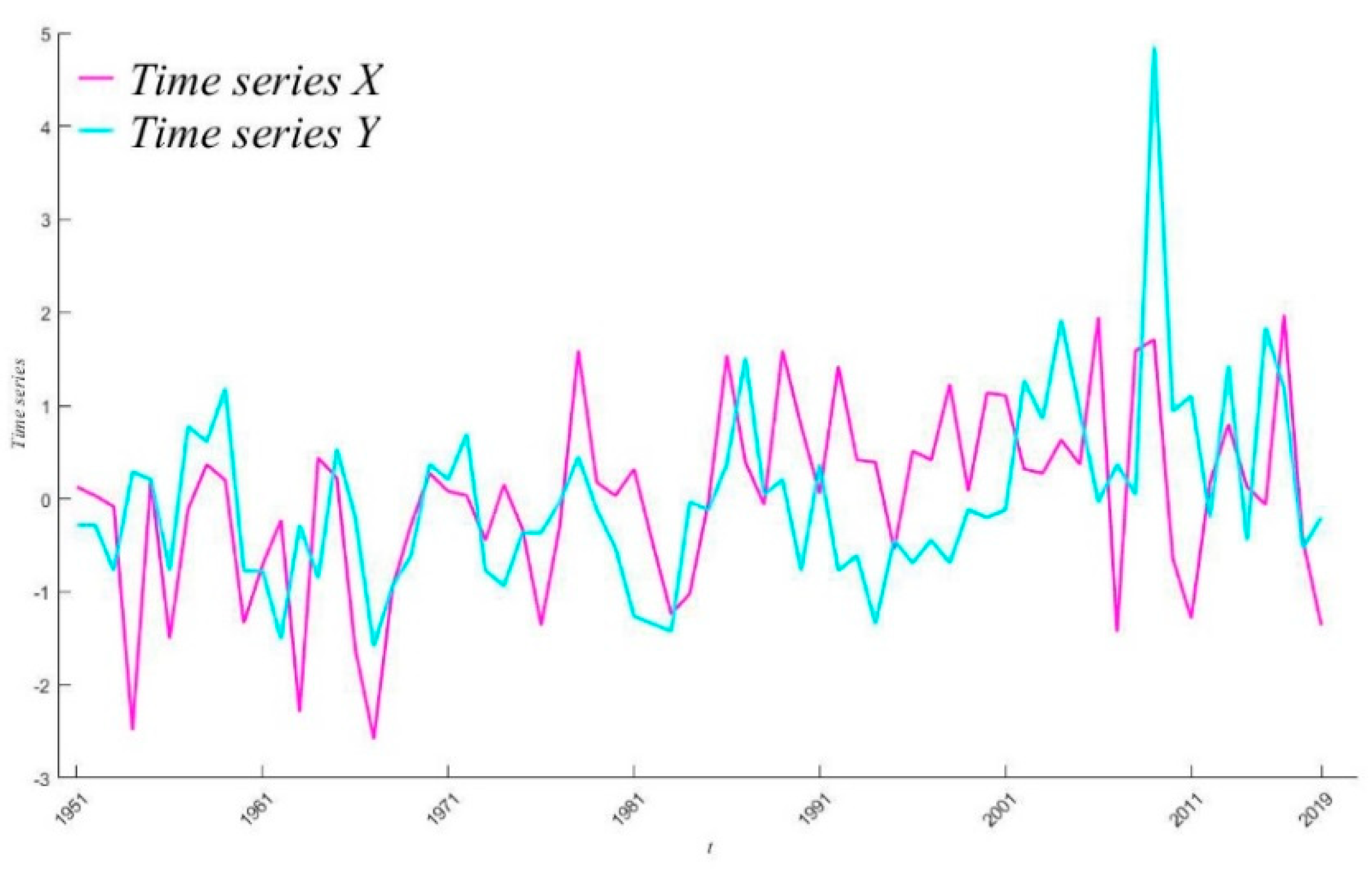

2.2. Time Series with Trend Changes

2.3. Correlation Coefficients

2.4. Special Cases

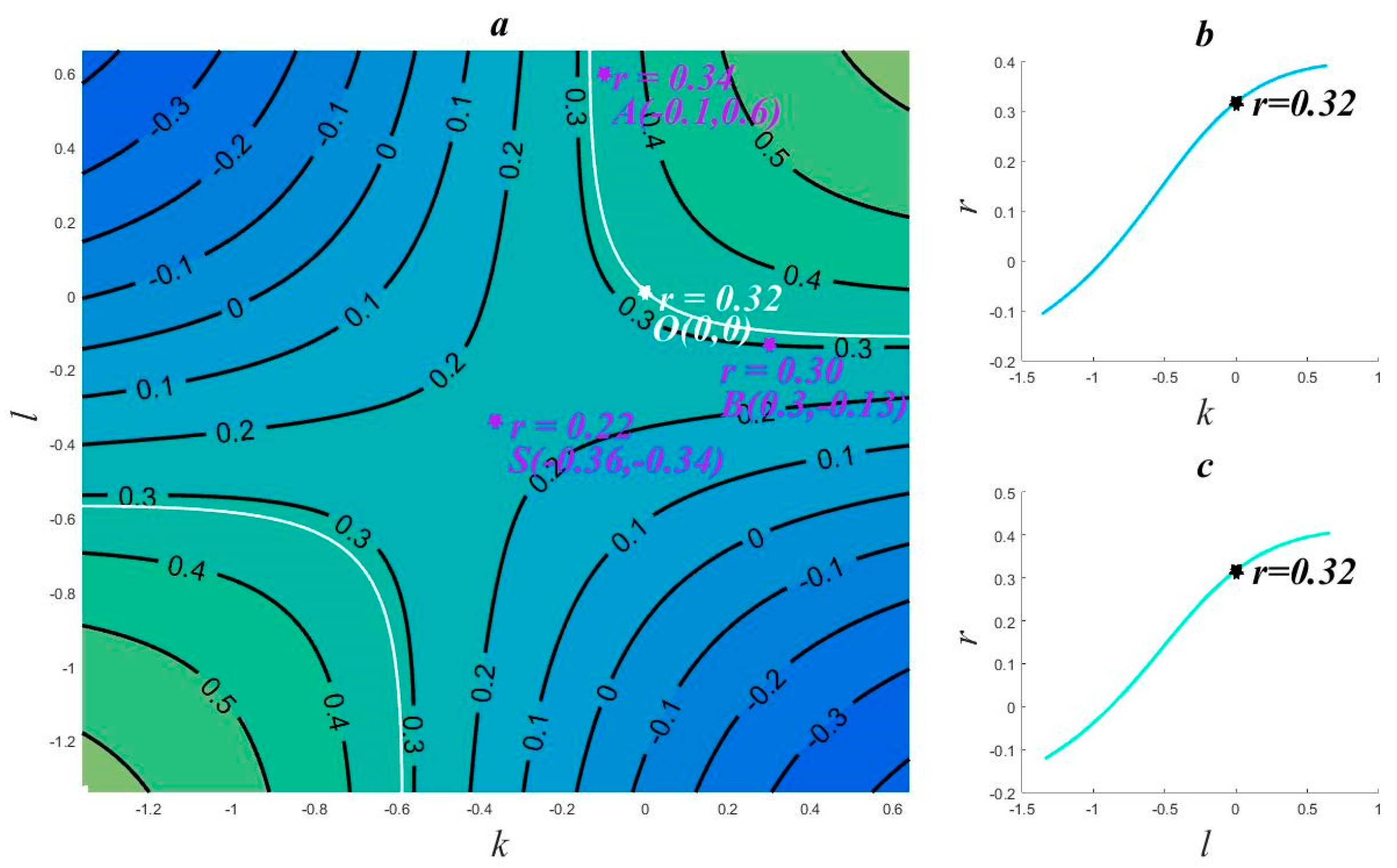

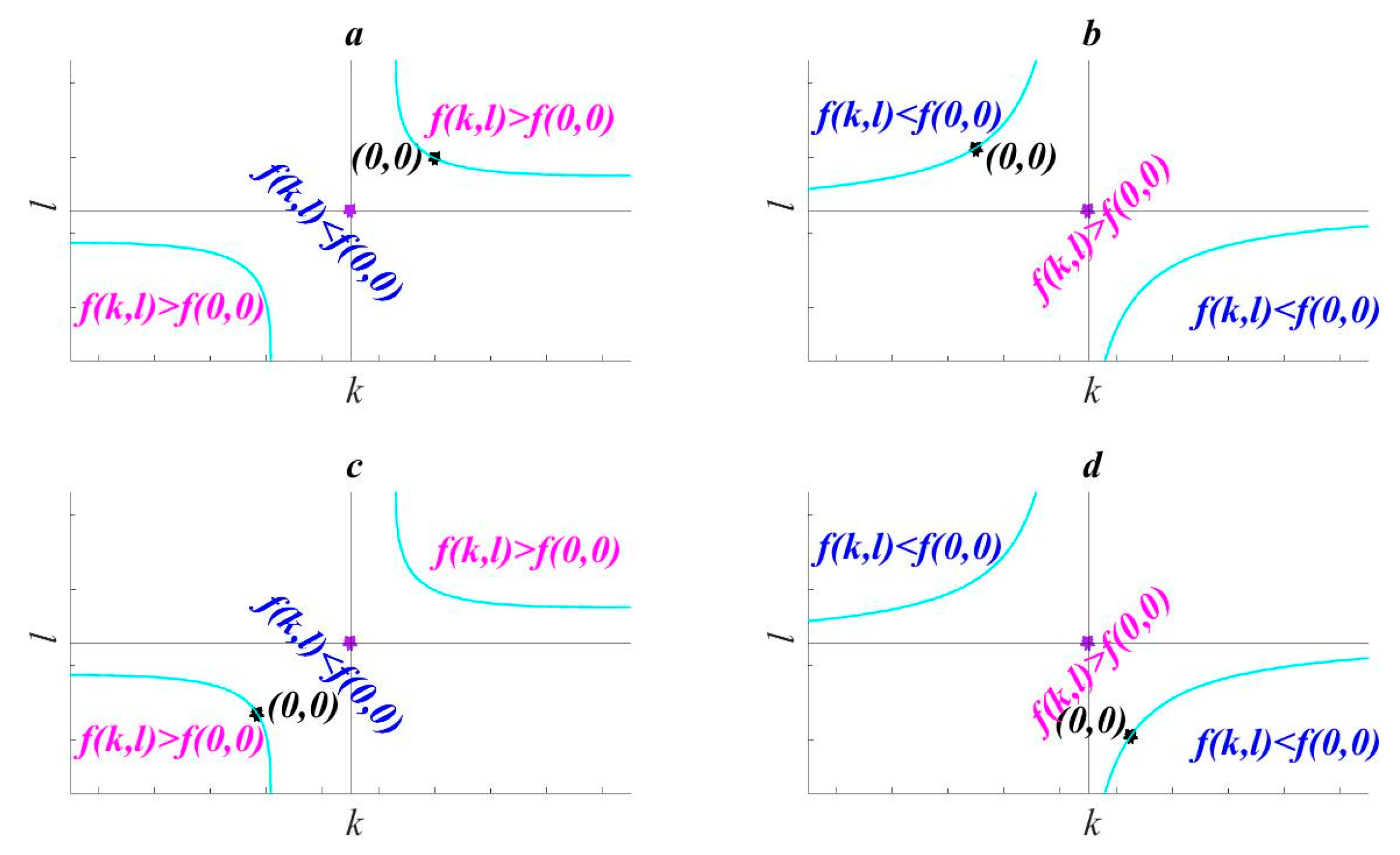

2.5. Function Properties and Graph

2.6. Operational Process

3. Two Examples

4. Spatial Distribution of Correlation Coefficient

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- IPCC. Climate Change 2013: The Physical Science Basis; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Kossin, J.P.; Emanuel, K.A.; Vecchi, G.A. The poleward migration of the location of tropical cyclone maximum intensity. Nature 2014, 509, 349–352. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Zhao, Z.; Luo, Y.; Wang, S.; Huang, J.B. Scientific problems in global warming. J. Meteorol. Environ. 2015, 31, 1–5. [Google Scholar]

- Jia, X.; Han, Q. Prediction and analysis of long-term trend of ground temperature by IAP AGCM model. Clim. Environ. Res. 2011, 16, 753–759. [Google Scholar]

- Wang, Y.; Shi, N.; Gu, J.; Feng, G.; Zhang, L. Climate change in rainy days in China. Atmos. Sci. 2006, 30, 162–170. [Google Scholar]

- Gocic, M.; Trajkovic, S. Analysis of changes in meteorological variables using Mann-Kendall and Sen’s slope estimator statistical tests in Serbia. Glob. Planet. Chang. 2013, 100, 172–182. [Google Scholar] [CrossRef]

- Espinosa, L.A.; Portela, M.M.; Rui, R. Rainfall trends over a north atlantic small island in the period 1937/1938–2016/2017 and an early climate teleconnection. Theor. Appl. Climatol. 2021, 144, 1–23. [Google Scholar] [CrossRef]

- Ayers, J.R.; Villarini, G.; Jones, C.; Schilling, K. Changes in monthly base flow across the U.S. Midwest. Hydrol. Processes 2019, 33, 748–758. [Google Scholar] [CrossRef]

- Li, K.; Wang, A.; Zhao, T. Time delay analysis of broadband chaotic light generated by optoelectronic oscillator. J. Phys. 2013, 62, 144207. [Google Scholar]

- Liang, S.X.; Qin, M.; Duan, J. Application of airborne cavity enhanced absorption spectroscopy system to the measurement of atmospheric No_2 with high spatial and temporal resolution. J. Phys. 2017, 66, 090704. [Google Scholar]

- Shi, N.; Chen, J.; Tu, Q. Characteristics of climate change in China in the past 100 years. J. Meteorol. 1995, 53, 431–439. [Google Scholar]

- Shi, N. Meteorological Statistical Forecast; Beijing Meteorological Press: Beijing, China, 2009. [Google Scholar]

- Huang, J.P.; Yi, Y.H.; Wang, S.W.; Chou, J. An analogue-dynamical long-range numerical weather prediction system incorporating historical evolution. Q. J. R. Meteorol. Soc. 1993, 119, 547–565. [Google Scholar]

- Huang, J. Significance test of meteorological element field. Meteorology 1989, 15, 3–7. [Google Scholar]

- Wei, F. Modern Climate Statistical Diagnosis and Prediction Technology, 2nd ed.; Meteorological Press: Beijing, China, 2007. [Google Scholar]

- He, G.; Su, Y.; Li, G.; Liu, B.H.; Meng, X.M. Correlation between in situ sound velocity and physical properties of marine sediments in the Central South Yellow Sea. J. Oceanogr. 2013, 35, 166–171. [Google Scholar]

- Yu, C. Method and Application of Mathematical Geology; Metallurgical Industry Press: Beijing, China, 1980. [Google Scholar]

- Li, T.; Ma, J. Application of correlation coefficient of earthquake fitting in earthquake prediction in Qinghai area. J. Earthq. Eng. 2008, 30, 184–188. [Google Scholar]

- Wang, J.; Zhu, B.; Zhu, S. Remote sensing image stitching detection algorithm based on correlation coefficient. Mapp. Spat. Geogr. Inf. 2011, 34, 162–164. [Google Scholar]

- Lu, D.; Zhao, W.Q.; Zeng, X.Y.; Wu, N.; Gao, G.T.; Zhang, Q.A.; Zhang, B.S.; Lei, Y.S. Relationship between stress relaxation characteristics and quality of kiwifruit ‘Hayward’. China Agric. Sci. 2019, 34, 201–206. [Google Scholar]

- Wang, C.R.; Su, W.W.; Jiang, G.; Li, H.W.; Liang, Z.Q.; Yang, X.; Yuan, X.P.; Li, H.; Liao, F.C.; Ge, H.Z.; et al. Yangtze finless porpoise in Dongting Lake and its correlation with fish resources. Chin. Environ. Sci. 2019, 39, 4424–4434. [Google Scholar]

- Fang, J. Statistical Methods of Biomedical Research; Higher Education Press: Beijing, China, 2007. [Google Scholar]

- Shi, N.; Yi, Y.-M.; Gu, J.-Q.; Xia, D. On the correlation of nonlinear variables containing secular trend variations: Numerical experiments. Chin. Phys. 2006, 15, 2180–2184. [Google Scholar]

- Kendall, M.A.; Stuart, A. The Advanced Theory of Statistics, 2nd ed.; Charles Griffin: Londres, UK, 1967. [Google Scholar]

- Chandler, R.E.; Scott, M.E. Statistical Methods for Trend Detection and Analysis in the Environmental Analysis, 1st ed.; John Wiley & Sons: Chichester, UK, 2011. [Google Scholar]

- Hamed, K.H. Exact distribution of the Mann–Kendall trend test statistic for persistent data. J. Hydrol. 2009, 365, 86–94. [Google Scholar] [CrossRef]

- Peng, C.K. Havlin, S.; Stanley, H.E.; Goldberger, A.L. Quantification of scaling exponents and crossover phenomena in nonstationary heartbeat time series. Chaos 1995, 5, 82–87. [Google Scholar] [CrossRef] [PubMed]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Da, C.; Hu, L.; Shen, B.; Yang, Y.; Wan, S.; Song, J. Theoretical Study and Numerical Experiment on the Influence of Trend Changes on Correlation Coefficient. Atmosphere 2022, 13, 66. https://doi.org/10.3390/atmos13010066

Da C, Hu L, Shen B, Yang Y, Wan S, Song J. Theoretical Study and Numerical Experiment on the Influence of Trend Changes on Correlation Coefficient. Atmosphere. 2022; 13(1):66. https://doi.org/10.3390/atmos13010066

Chicago/Turabian StyleDa, Chaojiu, Lei Hu, Binglu Shen, Yuyin Yang, Shiquan Wan, and Jian Song. 2022. "Theoretical Study and Numerical Experiment on the Influence of Trend Changes on Correlation Coefficient" Atmosphere 13, no. 1: 66. https://doi.org/10.3390/atmos13010066

APA StyleDa, C., Hu, L., Shen, B., Yang, Y., Wan, S., & Song, J. (2022). Theoretical Study and Numerical Experiment on the Influence of Trend Changes on Correlation Coefficient. Atmosphere, 13(1), 66. https://doi.org/10.3390/atmos13010066