The Effect of Technological Progress, Demand, and Energy Policy on Agricultural and Bioenergy Markets

Abstract

1. Introduction

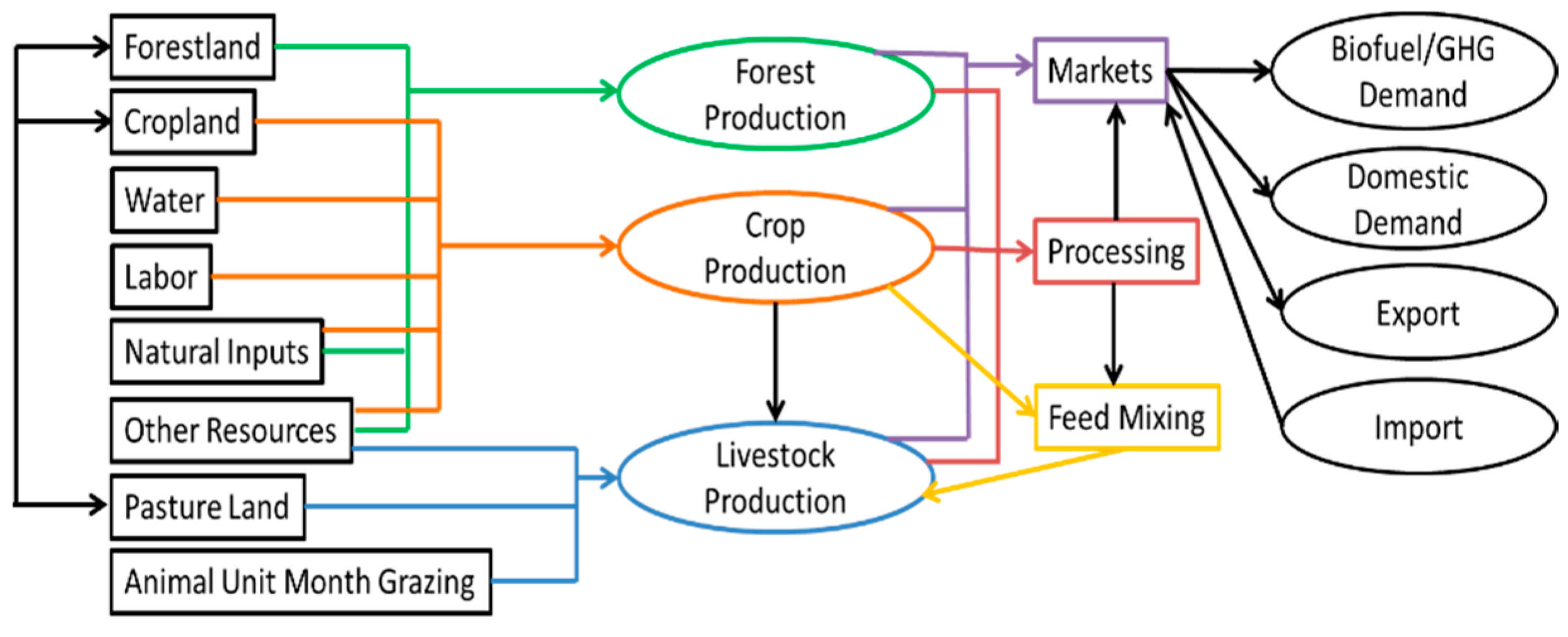

2. Methodology

2.1. Forming Future Scenarios

2.1.1. Technological Progress Scenarios

2.1.2. Demand Growth Scenarios

- Base Demand scenario uses the mean of the estimates of quantity demanded (),

- Fast Demand scenario uses the upper boundary of a 66.67 percent confidence interval estimate (),

- Slow Demand scenario uses the lower boundary of a 66.67 percent confidence interval estimate (),

2.1.3. Biofuel Policy Scenarios

2.1.4. Main Integrated Scenarios

2.2. Dynamic Simulation

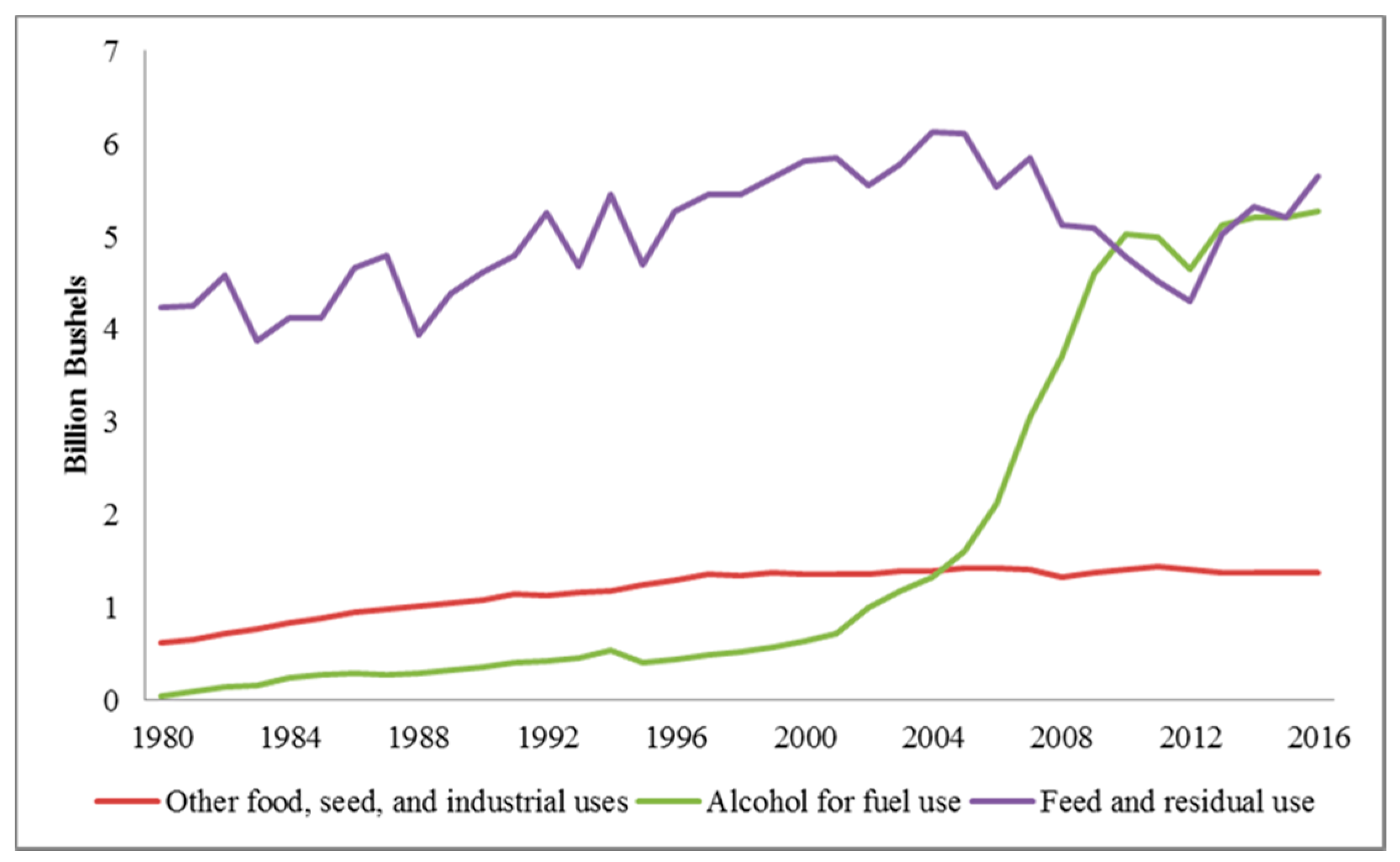

3. Data

4. Analysis and Results

4.1. Effect on the Mean

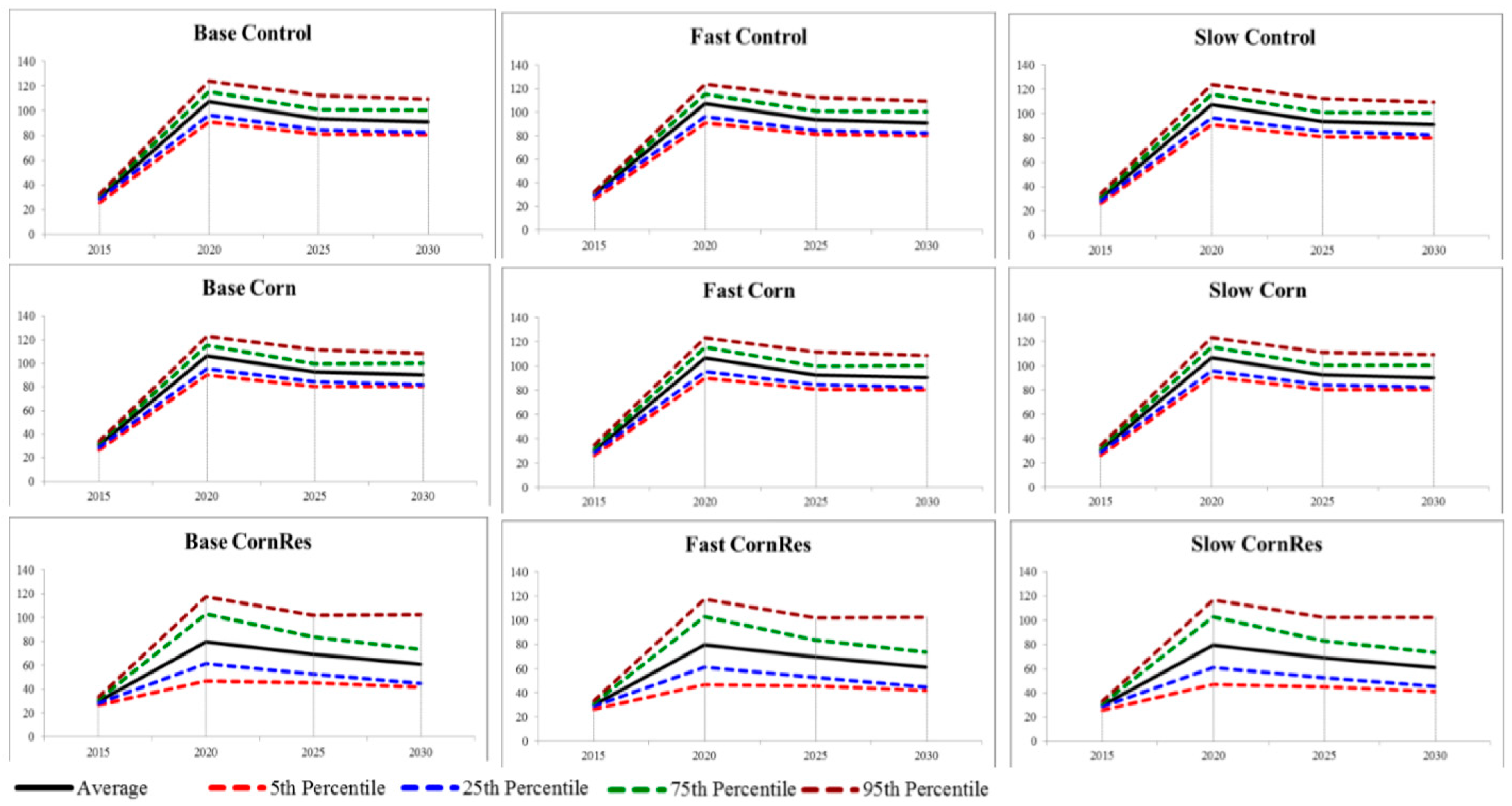

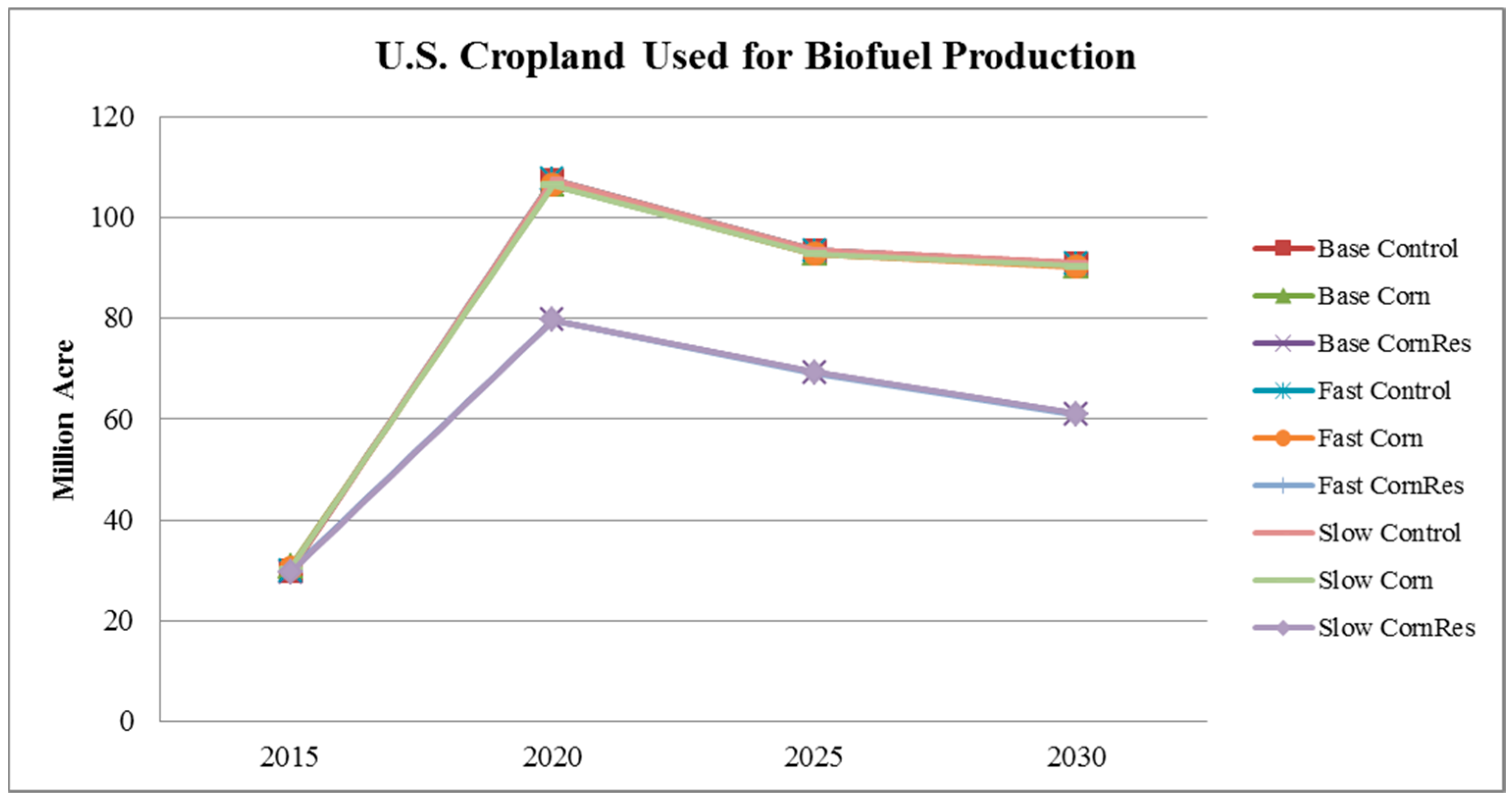

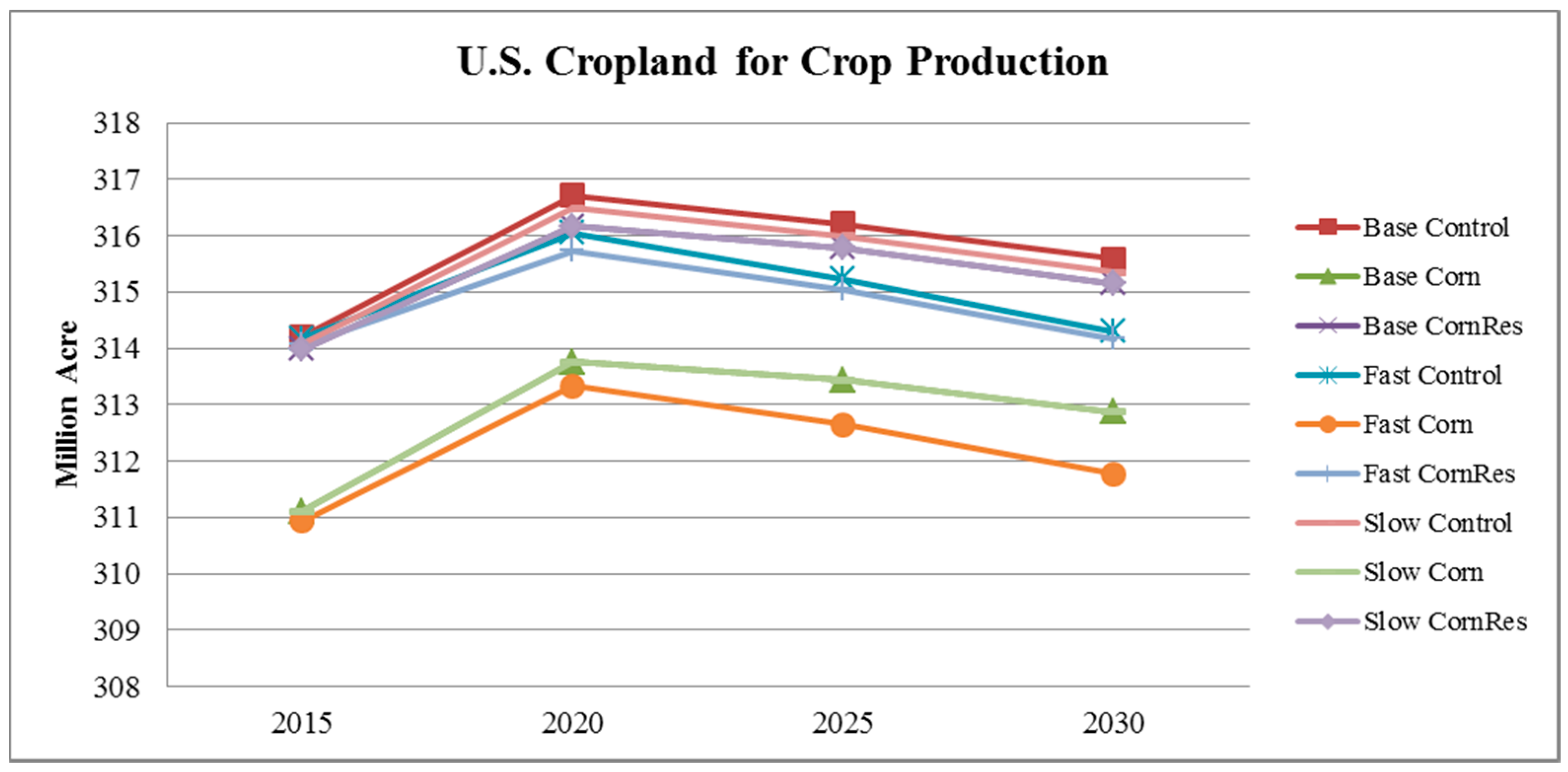

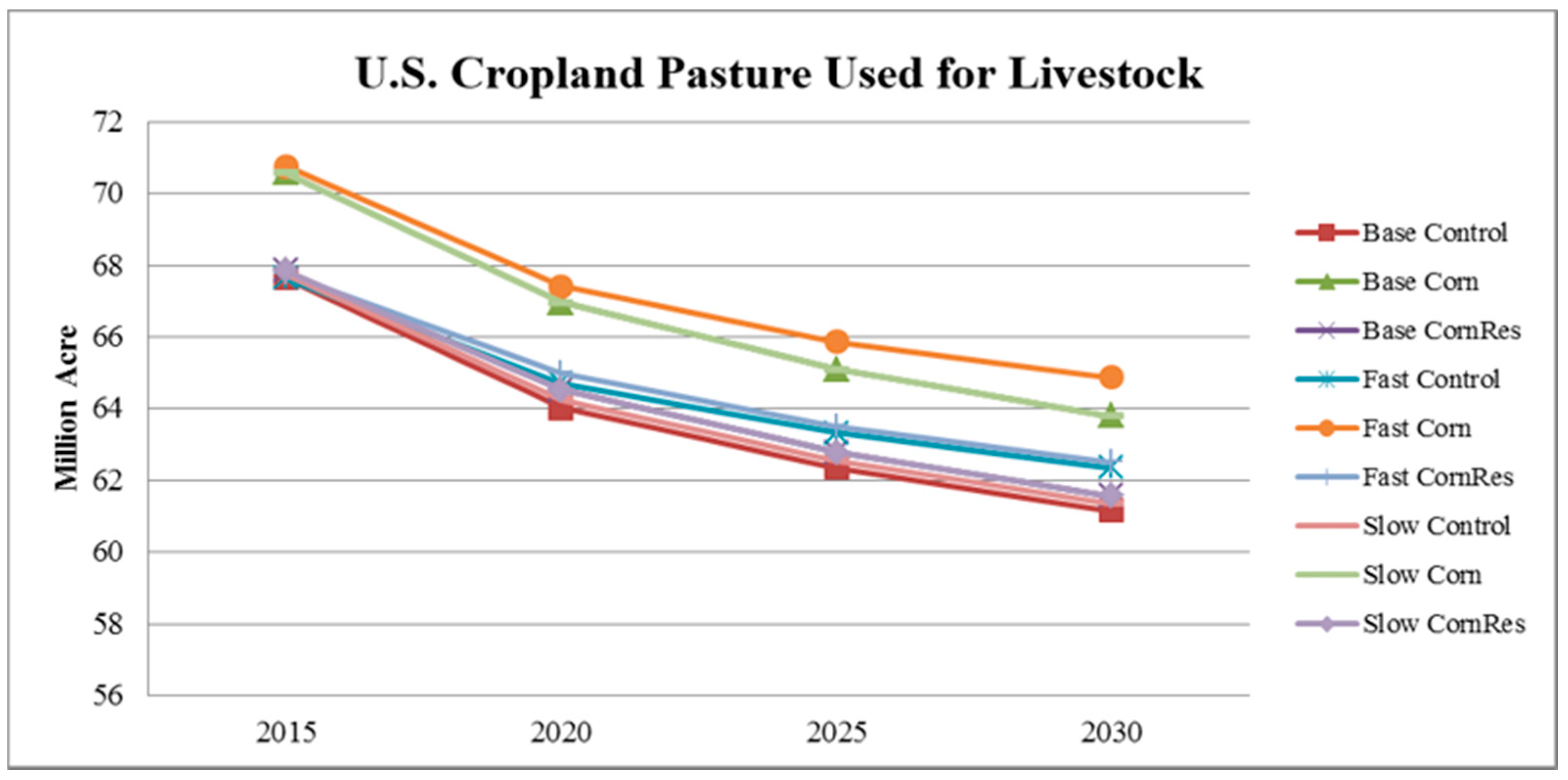

4.1.1. Cropland Mean Results

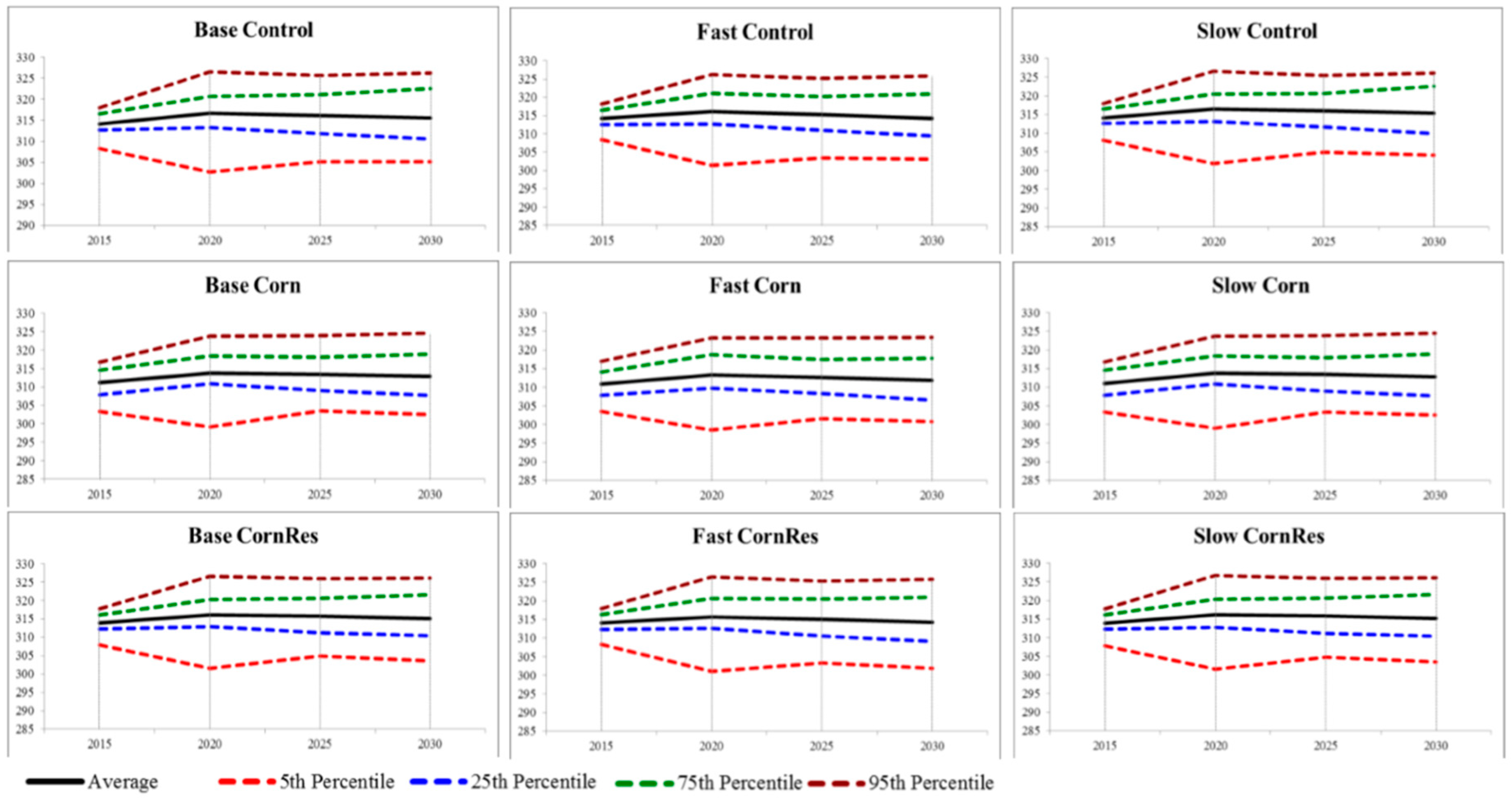

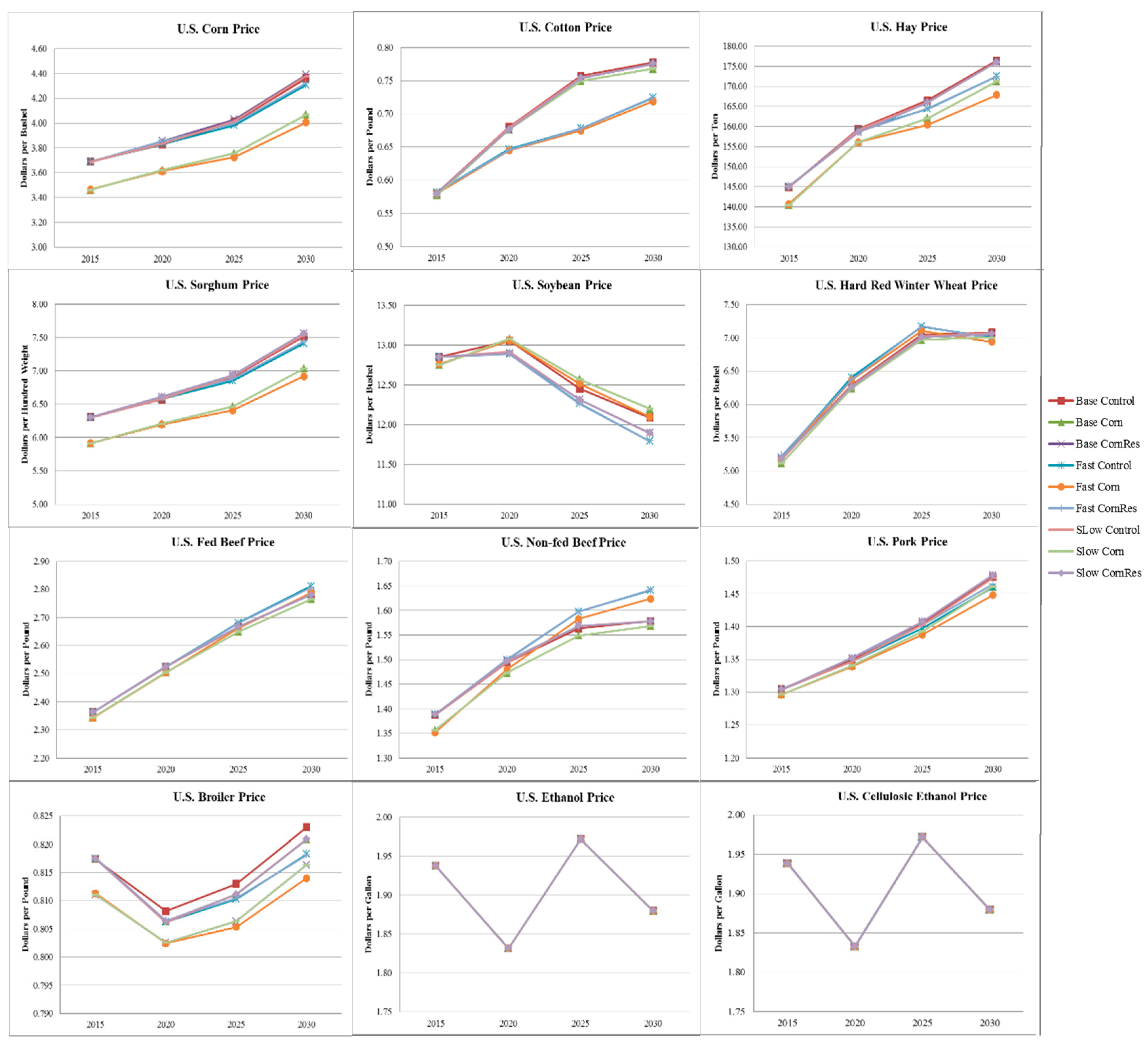

4.1.2. Price Mean Results

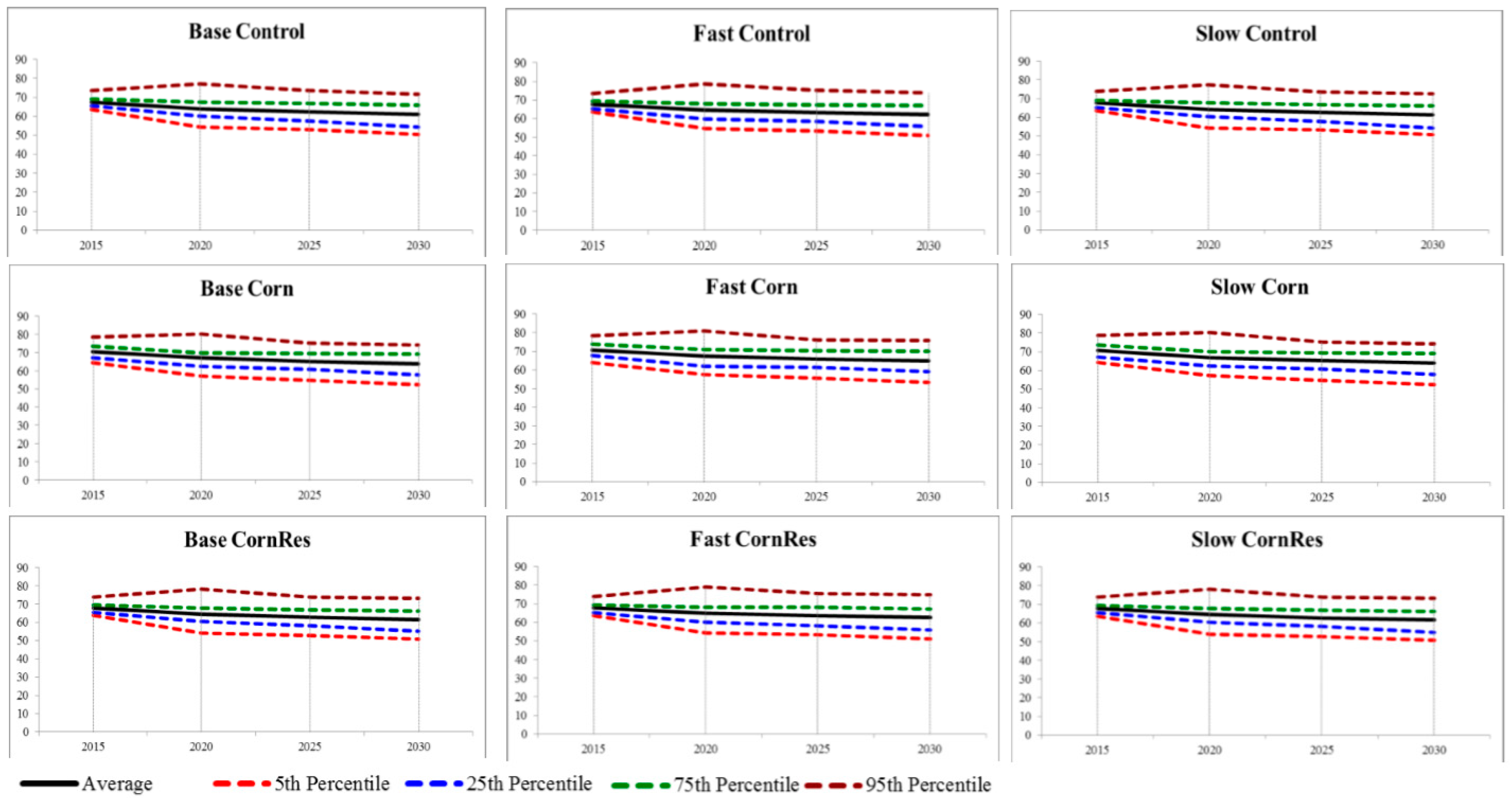

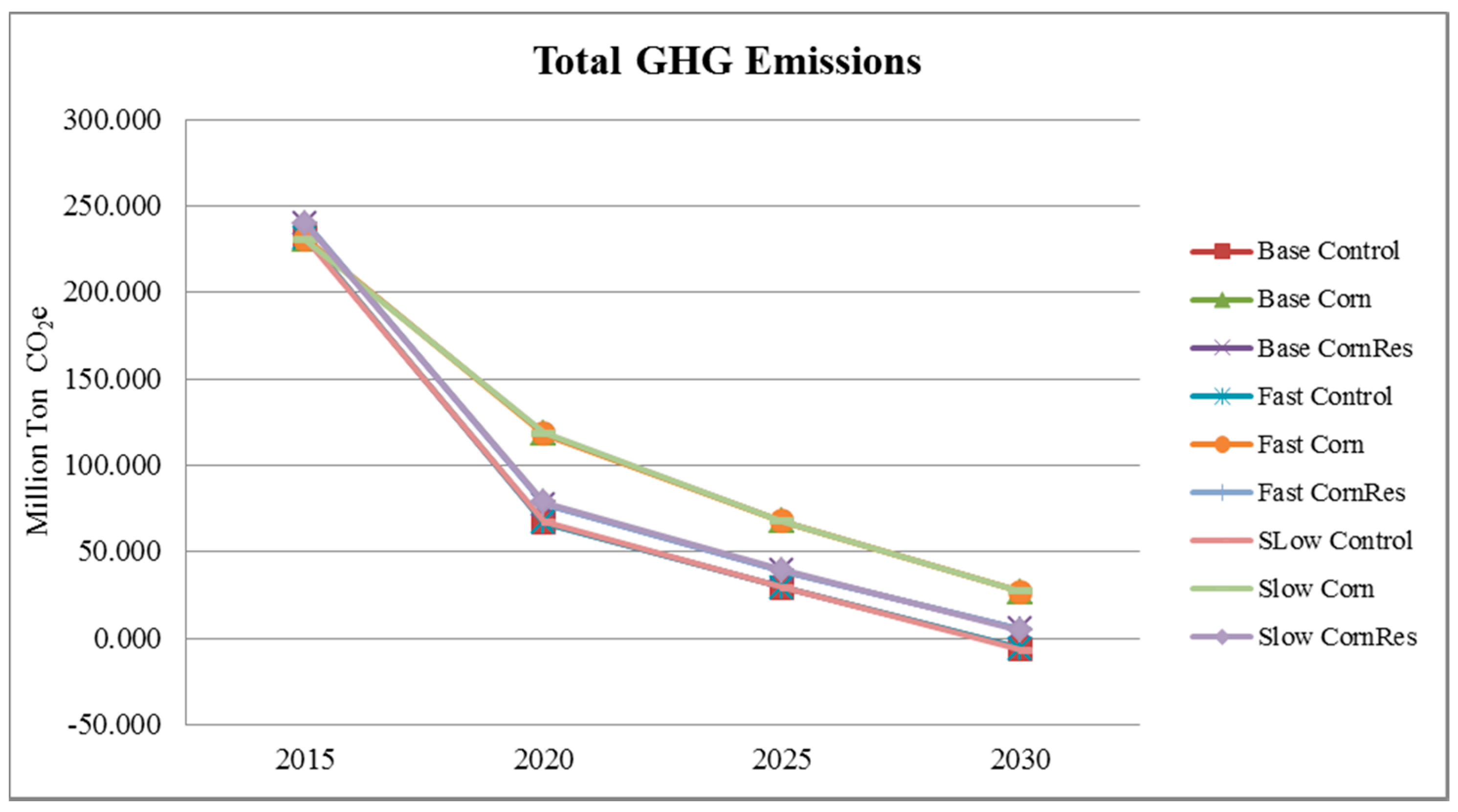

4.1.3. GHG Emissions Mean Results, Cropland Regression Results

4.2. Regression Analysis

4.2.1. Cropland Regression Results

4.2.2. GHG Emissions Regression Results

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2007: Mitigation of Climate Change. Contribution of Working Group III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2007. [Google Scholar]

- United States Department of Agriculture: Economic Research Service (ERS). Domestic Corn Use. Available online: https://www.ers.usda.gov/topics/crops/corn-and-other-feedgrains/feedgrains-sector-at-a-glance/ (accessed on 11 July 2016).

- Garibaldi, L.A.; Aizen, M.A.; Klein, A.M.; Cunningham, S.A.; Harder, L.D. Global Growth and Stability of Agricultural Yield Decrease with Pollinator Dependence. Proc. Natl. Acad. Sci. USA 2011, 108, 5909–5914. [Google Scholar] [CrossRef] [PubMed]

- United Nations, Department of Economic and Social Affairs (UN DESA). World Population Prospects: The 2012 Revision; United Nations Publication: New York, NY, USA, 2013. [Google Scholar]

- Food and Agriculture Organization of the United Nations (FAO). FAO Statistical Yearbook 2013: World Food and Agriculture; FAO: Rome, Italy, 2013. [Google Scholar]

- International Energy Agency (IEA). World Energy Outlook 2013; International Energy Agency: Paris, France, 2013. [Google Scholar]

- Gonzalez, A.O.; Karali, B.; Wetzstein, M.E. A Public Policy Aid for Bioenergy Investment: Case Study of Failed Plants. Energy Policy 2012, 51, 465–473. [Google Scholar] [CrossRef]

- Alexander, C.; Hurt, C. Bioenergy: Biofuels and Their Impact on Food Prices. Purdue Extension. 2007. Available online: https://www.extension.purdue.edu/extmedia/id/id-346-w.pdf (accessed on 2 June 2016).

- Mitchell, D.A. Note on Rising Food Prices; World Bank Policy Research Working Paper Series; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Ajanovic, A. Biofuels Versus Food Production: Does Biofuels Production Increase Food Prices? Energy 2011, 36, 2070–2076. [Google Scholar] [CrossRef]

- Olesen, J.; Bindi, M. Consequences of Climate Change for European Agricultural Productivity, Land Use, and Policy. Eur. J. Agron. 2002, 16, 239–262. [Google Scholar] [CrossRef]

- Chen, C.; McCarl, B.A.; Schimmelpfennig, D.E. Yield Variability as Influenced by Climate: A Statistical Investigation. Clim. Chang. 2004, 66, 239–261. [Google Scholar] [CrossRef]

- Torriani, D.S.; Calanca, P.; Schmid, S.; Beniston, M.; Fuhrer, J. Potential Effects of Changes in Mean Climate and Climate Variability on the Yield of Winter and Spring Crops in Switzerland. Clim. Res. 2007, 34, 59–69. [Google Scholar] [CrossRef]

- McCarl, B.A.; Villavicencio, X.; Wu, X. Climate Change and Future Analysis: Is Stationarity Dying? Am. J. Agric. Econ. 2008, 90, 1241–1247. [Google Scholar] [CrossRef]

- Xiong, W.; Conway, D.; Lin, E.; Holman, I. Potential Impacts of Climate Change and Climate Variability on China’s Rice Yield and Production. Clim. Res. 2009, 40, 23–35. [Google Scholar] [CrossRef]

- Wang, J.; Wang, E.; Liu, D.L. Modelling the Impacts of Climate Change on Wheat Yield and Field Water Balance over the Murray-Darling Basin in Australia. Theor. Appl. Climatol. 2011, 104, 285–300. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014. [Google Scholar]

- Feng, S. Three Essays on Agricultural and Forestry Offsets in Climate Change Mitigation. Ph.D. Thesis, Texas A&M University, College Station, TX, USA, 16 July 2012. [Google Scholar]

- Karp, A.; Richter, G.M. Meeting the Challenge of Food and Energy Security. J. Exp. Bot. 2011, 62, 3263–3271. [Google Scholar] [CrossRef] [PubMed]

- Tilman, D.; Socolow, R.; Foley, J.A.; Hill, J.; Larson, E.; Lynd, L.; Pacala, S.; Reilly, J.; Searchinger, T.; Somerville, C.; et al. Beneficial Biofuels—The Food, Energy, and Environment Trilemma. Science 2009, 325, 270–271. [Google Scholar] [CrossRef] [PubMed]

- Richardson, J.W. Simulation for Applied Risk Management; Department of Agricultural Economics, Agricultural and Food policy center, Texas A&M University: College Station, TX, USA, 2010. [Google Scholar]

- Beach, R.H.; Adams, D.; Alig, R.; Baker, J.; Latta, G.S.; McCarl, B.A.; Murray, B.C.; Rose, S.K.; White, E. Model Documentation for the Forest and Agricultural Sector Optimization Model with Greenhouse Gases (FASOMGHG); RTI International: Research Triangle Park, NC, USA. Available online: http://www.cof.orst.edu/cof/fr/research/tamm/FASOMGHG_Model_Documentation_Aug2010.pdf (accessed on 2 June 2016).

- Baker, J.S.; Murray, B.C.; McCarl, B.A.; Feng, S.; Johansson, R. Implications of Alternative Agricultural Productivity Growth Assumptions on Land Management, Greenhouse Gas Emissions, and Mitigation Potential. Am. J. Agric. Econ. 2013, 95, 435–441. [Google Scholar] [CrossRef]

- McCarl, B.A.; Sands, R.D. Competitiveness of Terrestrial Greenhouse Gas Offsets: Are They a Bridge to the Future? Clim. Chang. 2007, 80, 109–126. [Google Scholar] [CrossRef]

- National Agricultural Statistics Service (NASS) Database. USDA/NASS QuickStats Ad-hoc Query Tool. 2015. Available online: https://quickstats.nass.usda.gov/ (accessed on 1 February 2015).

- National Agricultural Statistics Service (NASS) Database. USDA/NASS QuickStats Ad-hoc Query Tool. 2016. Available online: https://quickstats.nass.usda.gov/ (accessed on 11 July 2016).

- United States Department of Agriculture (USDA). USDA Agricultural Projections to 2024; World Agricultural Outlook Board, U.S. Department of Agriculture: Washington, DC, USA, 2015. Available online: https://www.usda.gov/oce/commodity/projections/USDA_Agricultural_Projections_to_2024.pdf (accessed on 11 July 2016).

- United States Department of Agriculture: Economic Research Service (ERS) Database. USDA ERS-International Macroeconomic Data Set. Available online: http://www.ers.usda.gov/data-products/international-macroeconomic-data-set.aspx (accessed on 11 July 2016).

- Economic Research Division Federal Reserve Bank of St. Louis Database. Federal Reserve Economic Data—FRED—St. Louis Fed. Available online: https://research.stlouisfed.org/fred2 (accessed on 11 July 2016).

- McCarl, B.A. Bioenergy in a Greenhouse Gas Mitigating World. Choices 2008, 23, 31–33. [Google Scholar]

| Model Type and Functional Form | Model Specification | Model Number |

|---|---|---|

| 1. Main Demand | ||

| Linear | 1.1 | |

| Log-Lin | 1.2 | |

| Lin-Log | 1.3 | |

| Double-Log | 1.4 | |

| 2. Time Demand | ||

| Linear | 2.1 | |

| Log-Lin | 2.2 | |

| Lin-Log | 2.3 | |

| Double -Log | 2.4 | |

| 3. Lag Demand | ||

| Linear | 3.1 | |

| Log-Lin | 3.2 | |

| Lin-Log | 3.3 | |

| Double -Log | 3.4 | |

| 4. Time and Lag Demand | ||

| Linear | 4.1 | |

| Log-Lin | 4.2 | |

| Lin-Log | 4.3 | |

| Double -Log | 4.4 |

| Ethanol Produced from the Feedstock | Biofuel Policy Scenario | ||

|---|---|---|---|

| Control | Corn | CornRes | |

| Corn | 15.0 | 12.4 | 15.0 |

| Switchgrass | 8.8 | 8.8 | 8.8 |

| Corn Residue | 4.0 | 4.0 | 0 |

| Other Ethanol | 0.2 | 0.2 | 0.2 |

| Total | 28 | 25.4 | 24 |

| Main Integrated Scenario | Scenario | ||

|---|---|---|---|

| Technical Progress | Demand | Biofuel Policy | |

| 1. Base Control | All (50 scenarios) | Base | Control |

| 2. Base Corn | All (50 scenarios) | Base | Corn |

| 3. Base CornRes | All (50 scenarios) | Base | CornRes |

| 4. Fast Control | All (50 scenarios) | Fast | Control |

| 5. Fast Corn | All (50 scenarios) | Fast | Corn |

| 6. Fast CornRes | All (50 scenarios) | Fast | CornRes |

| 7. Slow Control | All (50 scenarios) | Slow | Control |

| 8. Slow Corn | All (50 scenarios) | Slow | Corn |

| 9. Slow CornRes | All (50 scenarios) | Slow | CornRes |

| Cropland Use (Million Acre) | Year | Base Demand | Fast Demand | Slow Demand | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Control | Corn | CornRes | Control | Corn | CornRes | Control | Corn | CornRes | ||

| Biofuel Production | 2015 | 29.80 | 30.71 | 29.65 | 30.00 | 30.37 | 29.72 | 30.08 | 30.28 | 29.51 |

| 2020 | 107.40 | 106.50 | 79.74 | 107.53 | 106.56 | 79.64 | 107.46 | 106.50 | 79.74 | |

| 2025 | 93.48 | 92.79 | 69.36 | 93.46 | 92.73 | 69.16 | 93.52 | 92.79 | 69.36 | |

| 2030 | 90.93 | 90.38 | 61.09 | 90.82 | 90.29 | 60.97 | 90.92 | 90.38 | 61.09 | |

| Crop Production | 2015 | 314.21 | 311.11 | 313.98 | 314.18 | 310.94 | 314.06 | 314.08 | 311.11 | 313.98 |

| 2020 | 316.71 | 313.75 | 316.17 | 316.06 | 313.33 | 315.73 | 316.49 | 313.75 | 316.17 | |

| 2025 | 316.21 | 313.44 | 315.78 | 315.23 | 312.64 | 315.04 | 315.99 | 313.44 | 315.78 | |

| 2030 | 315.58 | 312.87 | 315.15 | 314.31 | 311.77 | 314.17 | 315.35 | 312.87 | 315.15 | |

| Cropland pasture use for livestock | 2015 | 67.64 | 70.58 | 67.86 | 67.65 | 70.76 | 67.77 | 67.75 | 70.58 | 67.86 |

| 2020 | 64.03 | 66.96 | 64.53 | 64.71 | 67.41 | 65.00 | 64.25 | 66.97 | 64.53 | |

| 2025 | 62.35 | 65.11 | 62.79 | 63.32 | 65.86 | 63.52 | 62.57 | 65.11 | 62.79 | |

| 2030 | 61.15 | 63.81 | 61.58 | 62.35 | 64.89 | 62.52 | 61.37 | 63.81 | 61.58 | |

| Commodity Price | Year | Base Demand | Fast Demand | Slow Demand | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Control | Corn | CornRes | Control | Corn | CornRes | Control | Corn | CornRes | ||

| Corn (USD/bushel) | 2015 | 3.69 | 3.46 | 3.69 | 3.69 | 3.47 | 3.69 | 3.69 | 3.46 | 3.69 |

| 2020 | 3.83 | 3.62 | 3.85 | 3.83 | 3.61 | 3.85 | 3.84 | 3.62 | 3.85 | |

| 2025 | 4.01 | 3.76 | 4.03 | 3.98 | 3.73 | 4.00 | 4.02 | 3.76 | 4.03 | |

| 2030 | 4.36 | 4.07 | 4.39 | 4.31 | 4.01 | 4.32 | 4.38 | 4.07 | 4.39 | |

| Cotton (USD/pound) | 2015 | 0.58 | 0.58 | 0.58 | 0.58 | 0.58 | 0.58 | 0.58 | 0.58 | 0.58 |

| 2020 | 0.68 | 0.68 | 0.68 | 0.65 | 0.65 | 0.65 | 0.68 | 0.68 | 0.68 | |

| 2025 | 0.76 | 0.75 | 0.75 | 0.68 | 0.68 | 0.68 | 0.76 | 0.75 | 0.75 | |

| 2030 | 0.78 | 0.77 | 0.78 | 0.72 | 0.72 | 0.72 | 0.78 | 0.77 | 0.78 | |

| Hay (USD/ton) | 2015 | 144.86 | 140.36 | 145.00 | 144.91 | 140.66 | 145.18 | 144.77 | 140.36 | 145.00 |

| 2020 | 159.33 | 156.10 | 158.56 | 159.04 | 156.03 | 158.59 | 159.05 | 156.10 | 158.56 | |

| 2025 | 166.52 | 162.00 | 165.97 | 164.37 | 160.37 | 164.42 | 166.05 | 162.00 | 165.97 | |

| 2030 | 176.40 | 171.19 | 176.07 | 172.46 | 167.86 | 172.43 | 176.04 | 171.19 | 176.07 | |

| Sorghum (USD/hundred weight) | 2015 | 6.31 | 5.91 | 6.30 | 6.30 | 5.92 | 6.30 | 6.30 | 5.91 | 6.30 |

| 2020 | 6.57 | 6.20 | 6.61 | 6.57 | 6.20 | 6.61 | 6.58 | 6.20 | 6.61 | |

| 2025 | 6.91 | 6.46 | 6.93 | 6.85 | 6.41 | 6.88 | 6.92 | 6.46 | 6.93 | |

| 2030 | 7.51 | 7.03 | 7.56 | 7.41 | 6.92 | 7.43 | 7.54 | 7.03 | 7.56 | |

| Soybeans (USD/bushel) | 2015 | 12.85 | 12.75 | 12.85 | 12.85 | 12.76 | 12.85 | 12.85 | 12.75 | 12.85 |

| 2020 | 13.05 | 13.08 | 12.90 | 12.89 | 13.06 | 12.89 | 12.91 | 13.08 | 12.90 | |

| 2025 | 12.45 | 12.57 | 12.32 | 12.27 | 12.51 | 12.26 | 12.32 | 12.57 | 12.32 | |

| 2030 | 12.09 | 12.20 | 11.89 | 11.79 | 12.10 | 11.79 | 11.89 | 12.20 | 11.89 | |

| Hard red winter wheat. (USD/bushel) | 2015 | 5.18 | 5.12 | 5.19 | 5.20 | 5.17 | 5.23 | 5.17 | 5.12 | 5.19 |

| 2020 | 6.29 | 6.24 | 6.26 | 6.41 | 6.36 | 6.37 | 6.27 | 6.24 | 6.26 | |

| 2025 | 7.05 | 6.97 | 7.01 | 7.17 | 7.11 | 7.17 | 7.02 | 6.97 | 7.01 | |

| 2030 | 7.08 | 7.00 | 7.06 | 7.01 | 6.94 | 6.99 | 7.07 | 7.01 | 7.06 | |

| Fed beef (USD/pound) | 2015 | 2.36 | 2.34 | 2.36 | 2.36 | 2.34 | 2.36 | 2.36 | 2.34 | 2.36 |

| 2020 | 2.52 | 2.51 | 2.52 | 2.52 | 2.50 | 2.52 | 2.52 | 2.51 | 2.52 | |

| 2025 | 2.67 | 2.65 | 2.67 | 2.68 | 2.66 | 2.68 | 2.67 | 2.65 | 2.67 | |

| 2030 | 2.78 | 2.77 | 2.78 | 2.81 | 2.79 | 2.81 | 2.78 | 2.77 | 2.78 | |

| Non-fed beef (USD/pound) | 2015 | 1.39 | 1.36 | 1.39 | 1.39 | 1.35 | 1.39 | 1.39 | 1.36 | 1.39 |

| 2020 | 1.49 | 1.47 | 1.50 | 1.50 | 1.48 | 1.50 | 1.49 | 1.47 | 1.50 | |

| 2025 | 1.56 | 1.55 | 1.57 | 1.60 | 1.58 | 1.60 | 1.57 | 1.55 | 1.57 | |

| 2030 | 1.58 | 1.57 | 1.58 | 1.64 | 1.62 | 1.64 | 1.58 | 1.57 | 1.58 | |

| Pork (USD/pound) | 2015 | 2.36 | 2.34 | 2.36 | 2.36 | 2.34 | 2.36 | 2.36 | 2.34 | 2.36 |

| 2020 | 2.52 | 2.51 | 2.52 | 2.52 | 2.50 | 2.52 | 2.52 | 2.51 | 2.52 | |

| 2025 | 2.67 | 2.65 | 2.67 | 2.68 | 2.66 | 2.68 | 2.67 | 2.65 | 2.67 | |

| 2030 | 2.78 | 2.77 | 2.78 | 2.81 | 2.79 | 2.81 | 2.78 | 2.77 | 2.78 | |

| Broiler (USD/pound) | 2015 | 0.82 | 0.82 | 0.81 | 0.82 | 0.81 | 0.82 | 0.82 | 0.81 | 0.82 |

| 2020 | 0.81 | 0.81 | 0.80 | 0.81 | 0.80 | 0.81 | 0.81 | 0.80 | 0.81 | |

| 2025 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | 0.81 | |

| 2030 | 0.82 | 0.82 | 0.82 | 0.82 | 0.81 | 0.82 | 0.82 | 0.82 | 0.82 | |

| Ethanol (USD/gallon) | 2015 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 |

| 2020 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | |

| 2025 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | |

| 2030 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | |

| Cellulosic Ethanol (USD/gallon) | 2015 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 | 1.94 |

| 2020 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | 1.83 | |

| 2025 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | 1.97 | |

| 2030 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | |

| Year | Base Demand | Fast Demand | Slow Demand | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Control | Corn | CornRes | Control | Corn | CornRes | Control | Corn | CornRes | |

| 2015 | 231.89 | 230.66 | 240.15 | 231.80 | 230.66 | 240.15 | 231.26 | 230.24 | 239.54 |

| 2020 | 66.83 | 118.30 | 77.37 | 66.80 | 118.30 | 77.37 | 67.36 | 118.59 | 78.62 |

| 2025 | 29.17 | 67.75 | 39.19 | 29.17 | 67.75 | 39.19 | 29.38 | 67.75 | 39.46 |

| 2030 | −6.07 | 26.89 | 5.18 | −6.17 | 26.89 | 5.18 | −6.73 | 27.14 | 4.68 |

| Crop Tech/ Variable | Base Demand | Fast Demand | Slow Demand | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Control | Corn | CornRes | Control | Corn | CornRes | Control | Corn | CornRes | |

| Corn | −13.39 * | −13.55 * | −32.55 ** | −14.64 ** | −13.55 * | −32.67 ** | −13.46 * | −13.56 * | −32.55 ** |

| (7.076) | (6.905) | (13.01) | (7.055) | (6.881) | (13.00) | (7.074) | (6.905) | (13.01) | |

| Cotton | −32.46 *** | −29.38 ** | −62.81 *** | −32.96 *** | −30.42 *** | −62.91 *** | −32.54 *** | −29.37 ** | −62.81 *** |

| (11.55) | (11.27) | (21.23) | (11.51) | (11.23) | (21.22) | (11.54) | (11.27) | (21.23) | |

| Hay | 7.719 | 7.477 | 30.69 | 8.412 | 7.244 | 31.37 | 7.544 | 7.477 | 30.69 |

| (12.24) | (11.94) | (22.50) | (12.20) | (11.90) | (22.48) | (12.23) | (11.94) | (22.50) | |

| Sorghum | 5.749 | 5.660 | 11.06 | 5.743 | 5.251 | 10.79 | 5.748 | 5.659 | 11.06 |

| (5.241) | (5.114) | (9.636) | (5.226) | (5.097) | (9.630) | (5.240) | (5.115) | (9.636) | |

| Soybeans | −21.14 ** | −22.13 *** | −19.51 | −22.02 *** | −21.54 *** | −19.31 | −21.50 *** | −22.13 *** | −19.51 |

| (8.135) | (7.938) | (14.96) | (8.111) | (7.910) | (14.95) | (8.132) | (7.938) | (14.96) | |

| Winter Wheat | −19.85 ** | −19.76 ** | 8.039 | −18.41 ** | −19.74 ** | 8.747 | −19.84 ** | −19.76 ** | 8.041 |

| (9.267) | (9.042) | (17.04) | (9.239) | (9.011) | (17.03) | (9.264) | (9.043) | (17.04) | |

| Constant | 185.3 *** | 182.5 *** | 155.0 *** | 186.1 *** | 183.7 *** | 153.7 *** | 186.1 *** | 182.5 *** | 155.0 *** |

| (18.19) | (17.75) | (33.44) | (18.13) | (17.69) | (33.42) | (18.18) | (17.75) | (33.44) | |

| N | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 |

| R2 | 0.297 | 0.296 | 0.205 | 0.305 | 0.300 | 0.204 | 0.300 | 0.296 | 0.205 |

| Adjusted R2 | 0.268 | 0.267 | 0.171 | 0.276 | 0.271 | 0.171 | 0.270 | 0.267 | 0.171 |

| Root MSE | 10.96 | 10.96 | 10.96 | 10.96 | 10.96 | 20.14 | 10.96 | 10.70 | 20.15 |

| Crop Tech/ Variable | Base Demand | Fast Demand | Slow Demand | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Control | Corn | CornRes | Control | Corn | CornRes | Control | Corn | CornRes | |

| Corn | −10.87 ** | −10.34 ** | −11.34 ** | −11.55 ** | −10.99 ** | −11.74 ** | −10.99 ** | −10.34 ** | −11.34 ** |

| (4.897) | (4.904) | (5.023) | (5.107) | (5.009) | (5.161) | (4.955) | (4.904) | (5.023) | |

| Cotton | −29.03 *** | −29.18 *** | −30.05 *** | −30.96 *** | −29.15** | −31.16 *** | −29.98 *** | −29.17 *** | −30.05 *** |

| (10.99) | (11.00) | (11.27) | (11.46) | (11.24) | (11.58) | (11.12) | (11.00) | (11.27) | |

| Hay | 11.20 | 10.42 | 11.64 | 10.17 | 10.66 | 10.83 | 10.83 | 10.42 | 11.64 |

| (7.933) | (7.943) | (8.136) | (8.273) | (8.114) | (8.361) | (8.027) | (7.943) | (8.136) | |

| Sorghum | 2.731 | 3.132 | 2.837 | 3.149 | 3.163 | 3.132 | 2.808 | 3.132 | 2.837 |

| (3.366) | (3.370) | (3.452) | (3.510) | (3.443) | (3.547) | (3.405) | (3.370) | (3.452) | |

| Soybeans | −9.302 | −9.099 | −9.836 * | −9.721 | −10.38 * | −9.699 | −9.621 * | −9.097 | −9.837 * |

| (5.687) | (5.695) | (5.833) | (5.931) | (5.817) | (5.994) | (5.755) | (5.695) | (5.833) | |

| Winter Wheat | 1.360 | 3.740 | 1.692 | 1.642 | 3.144 | 1.643 | 1.541 | 3.740 | 1.691 |

| (6.119) | (6.127) | (6.276) | (6.381) | (6.258) | (6.449) | (6.191) | (6.127) | (6.276) | |

| Constant | 2.607 | 2.213 | 2.697 | 3.155 | 2.712 | 3.091 | 2.721 | 2.213 | 2.697 |

| (1.979) | (1.982) | (2.030) | (2.064) | (2.024) | (2.086) | (2.003) | (1.982) | (2.030) | |

| D25 | 6.276 * | 5.540 * | 6.530 * | 7.326 ** | 6.554 * | 7.282 ** | 6.512 * | 5.540 * | 6.530 * |

| (3.257) | (3.261) | (3.341) | (3.397) | (3.331) | (3.433) | (3.296) | (3.261) | (3.341) | |

| D30 | 102.4 *** | 102.5 *** | 104.2 *** | 106.7 *** | 105.4 *** | 106.7 *** | 104.2 *** | 102.5 *** | 104.2 *** |

| (18.13) | (18.16) | (18.60) | (18.91) | (18.55) | (19.11) | (18.35) | (18.16) | (18.60) | |

| N | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 |

| R2 | 0.111 | 0.117 | 0.114 | 0.105 | 0.107 | 0.106 | 0.113 | 0.117 | 0.114 |

| Adjusted R2 | 0.061 | 0.066 | 0.063 | 0.054 | 0.056 | 0.055 | 0.062 | 0.066 | 0.063 |

| Root MSE | 6.979 | 6.988 | 7.158 | 7.278 | 7.138 | 7.355 | 7.061 | 6.988 | 7.158 |

| Crop Tech/ Variable | Base Demand | Fast Demand | Slow Demand | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Control | Corn | CornRes | Control | Corn | CornRes | Control | Corn | CornRes | |

| Corn | 10.26 ** | 9.689 * | 10.85 ** | 10.81 ** | 10.32 ** | 11.16 ** | 10.36 ** | 9.689 * | 10.85 ** |

| (4.957) | (5.002) | (5.114) | (5.189) | (5.124) | (5.258) | (5.022) | (5.002) | (5.114) | |

| Cotton | 28.93 ** | 29.08 ** | 29.84 ** | 30.67 *** | 28.73 ** | 30.80 ** | 29.86 *** | 29.08 ** | 29.84 ** |

| (11.12) | (11.22) | (11.47) | (11.64) | (11.49) | (11.80) | (11.27) | (11.22) | (11.47) | |

| Hay | −11.26 | −10.26 | −11.65 | −9.910 | −10.41 | −10.68 | −10.82 | −10.26 | −11.65 |

| (8.030) | (8.102) | (8.284) | (8.406) | (8.300) | (8.517) | (8.135) | (8.102) | (8.284) | |

| Sorghum | −2.793 | −3.030 | −2.922 | −3.036 | −3.133 | −3.178 | −2.792 | −3.030 | −2.922 |

| (3.407) | (3.437) | (3.515) | (3.566) | (3.521) | (3.614) | (3.452) | (3.437) | (3.515) | |

| Soybeans | 9.483 | 9.427 | 10.09 * | 9.949 | 10.77 * | 9.971 | 9.814 * | 9.426 | 10.09 * |

| (5.757) | (5.809) | (5.939) | (6.027) | (5.951) | (6.107) | (5.833) | (5.809) | (5.939) | |

| Winter Wheat | −1.341 | −3.498 | −1.671 | −1.244 | −2.864 | −1.409 | −1.434 | −3.498 | −1.670 |

| (6.194) | (6.249) | (6.390) | (6.484) | (6.402) | (6.570) | (6.275) | (6.249) | (6.390) | |

| Constant | −4.754 ** | −4.372 ** | −4.794 ** | −5.334 ** | −4.915 ** | −5.225 ** | −4.863 ** | −4.371 ** | −4.794 ** |

| (2.004) | (2.021) | (2.067) | (2.097) | (2.071) | (2.125) | (2.030) | (2.021) | (2.067) | |

| D25 | −10.18 *** | −9.513 *** | −10.40 *** | −11.32 *** | −10.51 *** | −11.20 *** | −10.43 *** | −9.513 *** | −10.40 *** |

| (3.297) | (3.326) | (3.401) | (3.451) | (3.408) | (3.497) | (3.340) | (3.326) | (3.401) | |

| D30 | 279.1 *** | 278.2 *** | 277.1 *** | 274.2 *** | 275.6 *** | 274.4 *** | 277.0 *** | 278.2 *** | 277.1 *** |

| (18.36) | (18.52) | (18.94) | (19.21) | (18.97) | (19.47) | (18.60) | (18.52) | (18.94) | |

| N | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 |

| R2 | 0.086 | 0.084 | 0.087 | 0.092 | 0.088 | 0.090 | 0.088 | 0.084 | 0.087 |

| Adjusted R2 | 0.035 | 0.032 | 0.036 | 0.040 | 0.037 | 0.039 | 0.036 | 0.032 | 0.036 |

| Root MSE | 7.064 | 7.127 | 7.288 | 7.395 | 7.302 | 7.493 | 7.157 | 7.127 | 7.288 |

| Crop | Base Demand | Fast Demand | Slow Demand | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Control | Corn | CornRes | Control | Corn | CornRes | Control | Corn | CornRes | |

| Corn | −47.32 *** | −50.61 *** | −46.16 *** | −48.15 *** | −50.61 *** | −46.15 *** | −46.83 *** | −49.17 *** | −47.07 *** |

| (16.83) | (16.77) | (16.88) | (16.80) | (16.77) | (16.88) | (16.90) | (16.79) | (16.76) | |

| Cotton | −162.4 *** | −225.7 *** | −163.9 *** | −163.8 *** | −225.7 *** | −163.9 *** | −170.1 *** | −226.0 *** | −168.9 *** |

| (27.47) | (27.37) | (27.55) | (27.42) | (27.37) | (27.55) | (27.58) | (27.41) | (27.36) | |

| Hay | 91.54 *** | 84.09 *** | 98.01 *** | 91.06 *** | 84.09 *** | 98.01 *** | 88.16 *** | 81.04 *** | 100.6 *** |

| (29.11) | (29.00) | (29.20) | (29.06) | (29.00) | (29.20) | (29.23) | (29.04) | (28.99) | |

| Sorghum | −1.264 | 1.858 | 0.945 | −1.507 | 1.857 | 0.946 | −1.881 | 0.963 | 1.832 |

| (12.47) | (12.42) | (12.51) | (12.45) | (12.42) | (12.51) | (12.52) | (12.44) | (12.42) | |

| Soybeans | −66.98 *** | −80.26 *** | −63.58 *** | −64.38 *** | −80.26 *** | −63.59 *** | −65.15 *** | −82.03 *** | −66.37 *** |

| (19.35) | (19.28) | (19.41) | (19.32) | (19.28) | (19.41) | (19.43) | (19.31) | (19.27) | |

| Winter Wheat | −39.10 * | −44.83 ** | −33.82 | −38.33 * | −44.82 ** | −33.83 | −38.99 * | −44.32 ** | −33.77 |

| (22.04) | (21.96) | (22.11) | (22.01) | (21.96) | (22.11) | (22.14) | (21.99) | (21.95) | |

| Constant | 312.5 *** | 459.3 *** | 304.6 *** | 312.0 *** | 459.3 *** | 304.6 *** | 323.0 *** | 463.6 *** | 311.6 *** |

| (43.27) | (43.10) | (43.40) | (43.19) | (43.10) | (43.40) | (43.45) | (43.17) | (43.09) | |

| N | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 | 150 |

| R2 | 0.526 | 0.643 | 0.515 | 0.526 | 0.643 | 0.515 | 0.533 | 0.642 | 0.533 |

| Adjusted R2 | 0.506 | 0.628 | 0.495 | 0.506 | 0.628 | 0.495 | 0.513 | 0.627 | 0.513 |

| Root MSE | 26.07 | 25.98 | 26.15 | 26.03 | 25.98 | 26.15 | 26.19 | 26.02 | 25.97 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kapilakanchana, M.; McCarl, B.A. The Effect of Technological Progress, Demand, and Energy Policy on Agricultural and Bioenergy Markets. Atmosphere 2020, 11, 31. https://doi.org/10.3390/atmos11010031

Kapilakanchana M, McCarl BA. The Effect of Technological Progress, Demand, and Energy Policy on Agricultural and Bioenergy Markets. Atmosphere. 2020; 11(1):31. https://doi.org/10.3390/atmos11010031

Chicago/Turabian StyleKapilakanchana, Montalee, and Bruce A. McCarl. 2020. "The Effect of Technological Progress, Demand, and Energy Policy on Agricultural and Bioenergy Markets" Atmosphere 11, no. 1: 31. https://doi.org/10.3390/atmos11010031

APA StyleKapilakanchana, M., & McCarl, B. A. (2020). The Effect of Technological Progress, Demand, and Energy Policy on Agricultural and Bioenergy Markets. Atmosphere, 11(1), 31. https://doi.org/10.3390/atmos11010031