Government Subsidies and Sustainable Development in Manufacturing: Evidence from Product Quality and Production Efficiency

Abstract

1. Introduction

2. Literature Review

2.1. Review Methodology

2.2. Theoretical Foundations and International Empirical Evidence

2.3. Research Gaps and Study Contributions

3. Hypotheses

3.1. Direct Effects of Government Subsidies

3.2. Mediating Mechanisms: R&D Investment and Equipment Depreciation

3.3. Heterogeneity Effects: Moderation by Company and Market Characteristics

3.3.1. Moderation by Ownership Structure

3.3.2. Moderating Effect of Export Behavior

3.3.3. Differences in the Degree of Industry Competition

4. Study Design and Methodology

4.1. Average Treatment Effect of Government Subsidies

4.2. Effect of Government Subsidies at Different Quantiles

4.3. Dynamic Effect of Government Subsidies

4.4. Mechanism for the Role of Government Subsidies

4.5. Analytical Procedure

4.6. Addressing Potential Biases and Measurement Error

5. Data Presentation

5.1. Data Source and Data Processing

5.2. Outcome Variables

5.3. Proxy Variables and Mediator Variable

5.4. Policy Variable and Control Variables

6. Effects of Subsidies and Mechanisms

6.1. Average Treatment Effect

6.1.1. Benchmark Test Result

6.1.2. Robustness Test

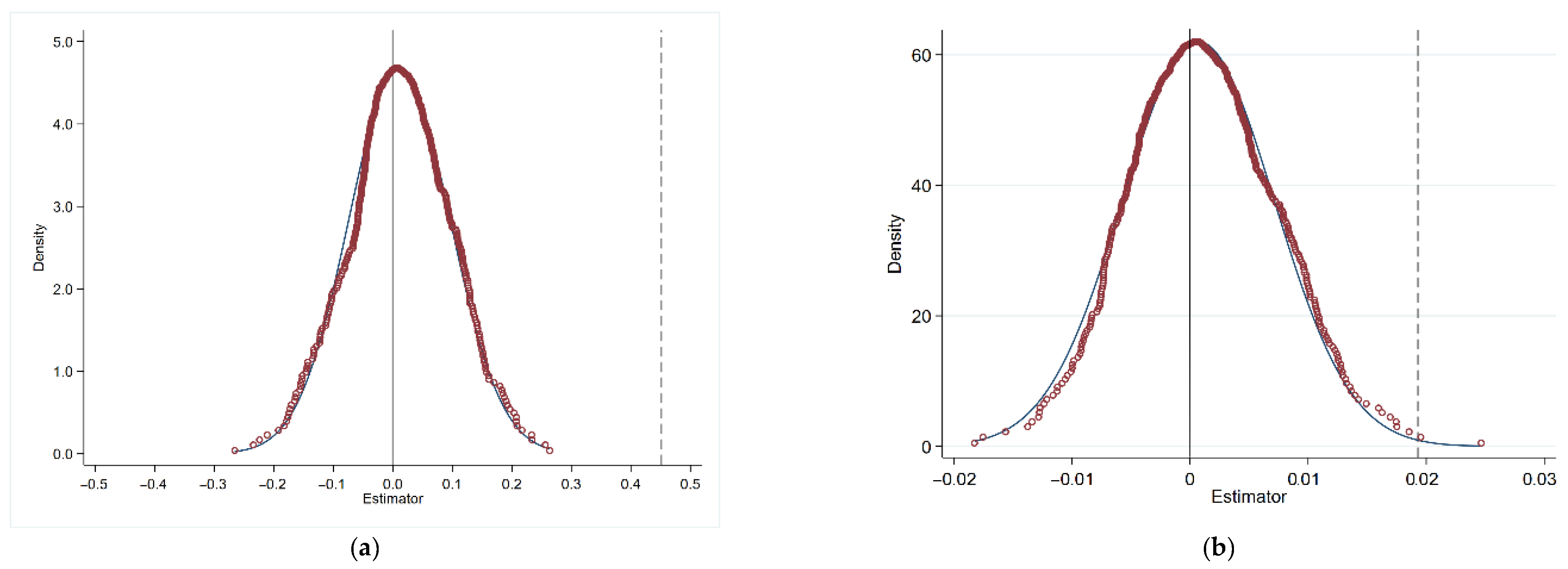

6.1.3. Placebo Test

6.1.4. Heteroskedasticity-Robust Standard Errors

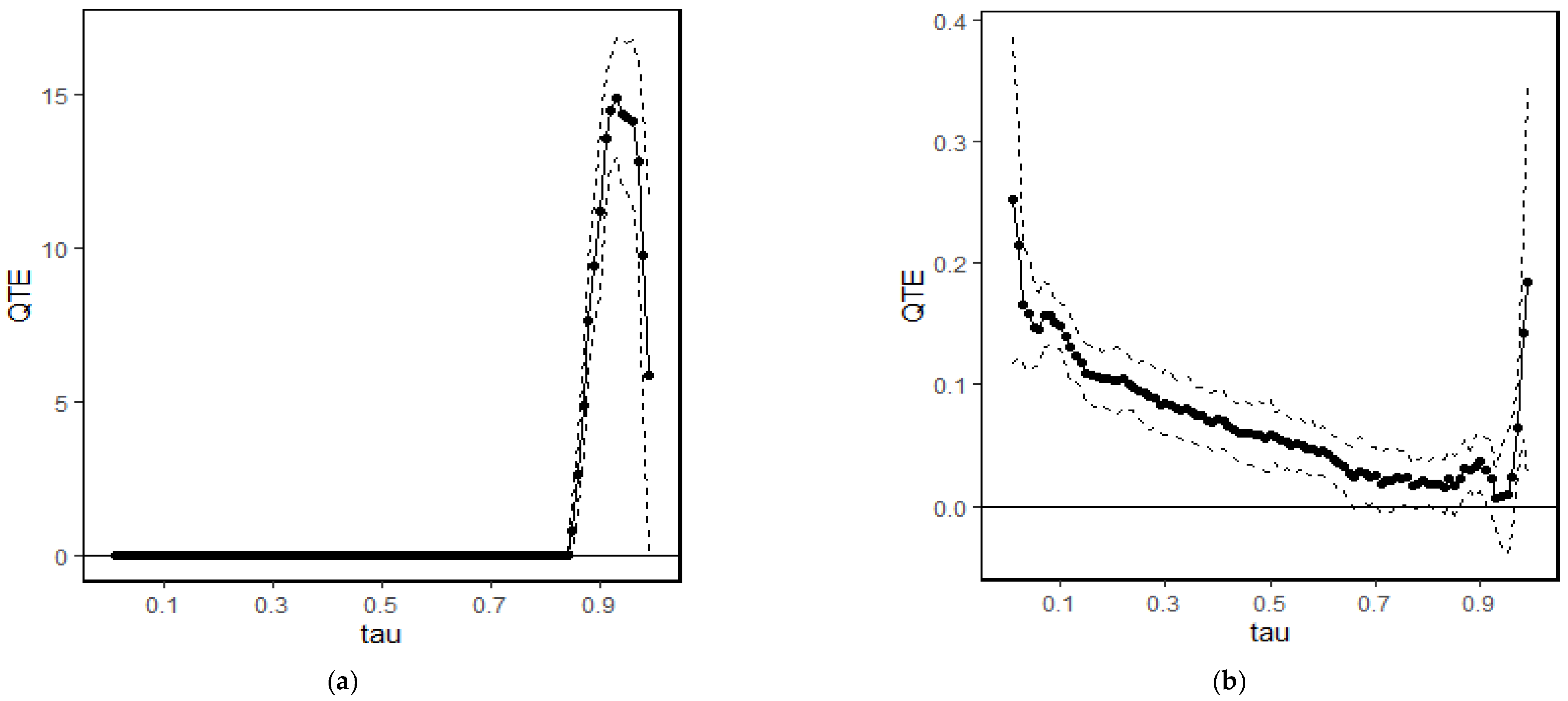

6.2. Regression Result at Different Quantiles

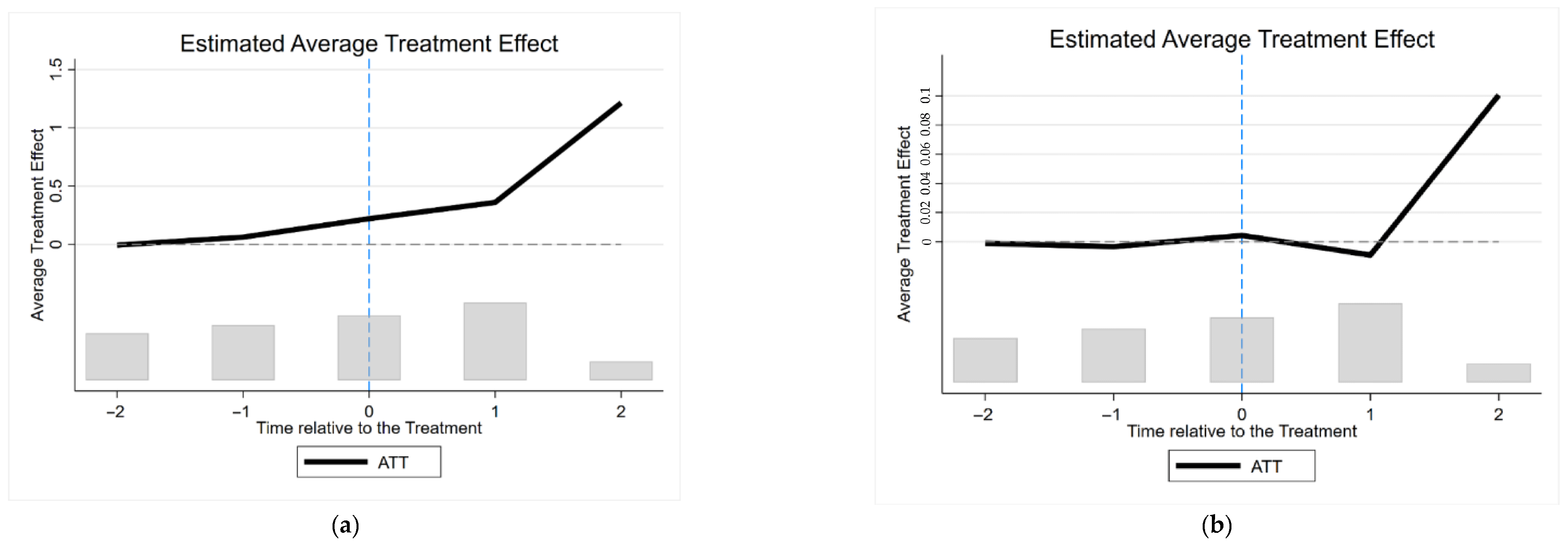

6.3. Dynamic Effect

6.4. Discussion on the Mechanism

7. Heterogeneity Study

7.1. Differences in Property Rights

7.2. Differences in Export Behavior

7.3. Differences in Industry Competition

8. Conclusions

8.1. Main Findings of the Study

8.2. Recommendations for Policymakers

8.3. Recommendations for Company Managers

8.4. Limitations of the Study and Directions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Falegnami, A.; Romano, E.; Tomassi, A. The emergence of the GreenSCENT competence framework: A constructivist approach: The GreenSCENT theory. In The European Green Deal in Education; Routledge: Oxfordshire, UK, 2024; pp. 204–216. [Google Scholar] [CrossRef]

- Wang, K.-L.; Sun, T.-T.; Xu, R.-Y. The Impact of Artificial Intelligence on Total Factor Productivity: Empirical Evidence from China’s Manufacturing Enterprises. Econ. Change Restruct. 2022, 56, 1113–1146. [Google Scholar] [CrossRef]

- Liu, H.; Fan, L.; Shao, Z. Threshold Effects of Energy Consumption, Technological Innovation, and Supply Chain Management on Enterprise Performance in China’s Manufacturing Industry. J. Environ. Manag. 2021, 300, 113687. [Google Scholar] [CrossRef]

- Lin, S.-H.; Weng, Y. Market Size, Productivity and Product Quality Regarding Firm Heterogeneity. Econ. Res.-Ekon. Istraž. 2019, 32, 2924–2940. [Google Scholar] [CrossRef]

- Cerqua, A.; Pellegrini, G. Do Subsidies to Private Capital Boost Companies’ Growth? A Multiple Regression Discontinuity Design Approach. J. Public Econ. 2014, 109, 114–126. [Google Scholar] [CrossRef]

- Yaghi, A.Z.A.; Tomaszewski, T. Measuring the Impact of R&D&I Subsidies on Innovative Inputs and Outputs in Polish Manufacturing Companies. J. Knowl. Econ. 2024, 15, 3792–3823. [Google Scholar] [CrossRef]

- Aghion, P.; Cai, J.; Dewatripont, M.; Du, L.; Harrison, A.; Legros, P. Industrial Policy and Competition. Am. Econ. J-Macroecon. 2015, 7, 1–32. [Google Scholar] [CrossRef]

- Hall, B.; Van Reenen, J. How Effective Are Fiscal Incentives for R&D? A New Review of the Evidence. National Bureau of Economic Research. 1999. Available online: https://www.nber.org/system/files/working_papers/w7098/w7098.pdf (accessed on 1 May 2025).

- Koniewski, M.; Krupnik, S.; Skórska, P. Beyond the Average Effect of the Innovation Subsidies: Using Case Selection via Matching to Break Impasse in Delivering Useful Advice to Policy Makers. Eval. Program Plan. 2024, 104, 102429. [Google Scholar] [CrossRef]

- Chen, L.; Yang, W. R&D Tax Credits and Firm Innovation: Evidence from China. Technol. Forecast. Soc. Change 2019, 146, 233–241. [Google Scholar] [CrossRef]

- Li, B.; Wang, S.; Dong, N.; Li, J.; Li, X.; Yu, H. Empirical Analysis of Subsidy Industrial Policy’s Effect on Export Innovation in the Chinese Manufacturing. Sage Open 2023, 13, 21582440231204187. [Google Scholar] [CrossRef]

- Zhao, X.; Zhao, L.; Sun, X.; Xing, Y. The Incentive Effect of Government Subsidies on the Digital Transformation of Manufacturing Enterprises. Int. J. Emerg. Mark. 2024, 19, 3892–3912. [Google Scholar] [CrossRef]

- Yue, W. Foreign Direct Investment and the Innovation Performance of Local Enterprises. Hum. Soc. Sci. Commun. 2022, 9, 252. [Google Scholar] [CrossRef]

- He, H.; Tang, H.; Guo, S. Technology Acquisition Strategy in the Context of the Internet of Things Using Game Theory. Technol. Anal. Strateg. Manag. 2022, 36, 1604–1620. [Google Scholar] [CrossRef]

- Zhu, S.; Tang, C. The Impact of Going Public on Quality Upgrading of Export Products–Evidence from China’s Manufacturing Companies. China Ind. Econ. 2020, 2, 117–135. [Google Scholar] [CrossRef]

- Li, C.; Wang, Y.; Zhou, Z.; Wang, Z.; Mardani, A. Digital Finance and Enterprise Financing Constraints: Structural Characteristics and Mechanism Identification. J. Bus. Res. 2023, 165, 114074. [Google Scholar] [CrossRef]

- Wang, J.; Lv, W.; Zhao, Y.; Xu, N. The Impact of Global Value Chain Embedding on Corporate Risk Taking of China’s A-Share Market-Listed Companies from 2000–2016. Sustainability 2022, 14, 12969. [Google Scholar] [CrossRef]

- Liu, Z.; Zhou, X. Can Direct Subsidies or Tax Incentives Improve the R&D Efficiency of the Manufacturing Industry in China? Processes 2023, 11, 181. [Google Scholar] [CrossRef]

- Sun, Q.; Liu, L. Impact of Government Subsides on Companies’ Technological Innovation Inputs and Outputs: Moderating Effect of Regional Innovation Capacity. Rom. J. Econ. Forecast. 2023, 26, 91–106. [Google Scholar]

- Dong, Z.; Dai, P. Dynamic Mechanism of Digital Transformation in Equipment Manufacturing Enterprises Based on Evolutionary Game Theory: Evidence from China. Systems 2023, 11, 493. [Google Scholar] [CrossRef]

- Li, G.; Reimann, M.; Zhang, W. When Remanufacturing Meets Product Quality Improvement: The Impact of Production Cost. Eur. J. Oper. Res. 2018, 271, 913–925. [Google Scholar] [CrossRef]

- Yue, W. Government Subsidy and Aggregate Production Efficiency Dynamics: Evidence from China. Pac. Econ. Rev. 2021, 26, 263–282. [Google Scholar] [CrossRef]

- Guo, D.; He, Y.; Wu, Y.; Xu, Q. Analysis of Supply Chain under Different Subsidy Policies of the Government. Sustainability 2016, 8, 1290. [Google Scholar] [CrossRef]

- Liu, Y.; Tang, T.; Li, H.; Luo, L. How Do Government Subsidies Affect OFDI of Private Enterprises? Evidence from China. Int. Rev. Econ. Financ. 2024, 90, 241–251. [Google Scholar] [CrossRef]

- McKitrick, R. Global Energy Subsidies: An Analytical Taxonomy. Energy Policy 2017, 101, 379–385. [Google Scholar] [CrossRef]

- Wu, Y.; Li, H.; Luo, R.; Yu, Y. How Digital Transformation Helps Enterprises Achieve High-Quality Development? Empirical Evidence from Chinese Listed Companies. Eur. J. Inno. Manag. 2023, 27, 2753–2779. [Google Scholar] [CrossRef]

- Xu, D.; Wang, F.; Zhuo, X.; Liu, Y. The Performance of Government Subsidy Schemes in a Competitive Vaccine Market Considering Consumers’ Free-Riding Behavior. Int. J. Prod. Econ. 2024, 268, 109122. [Google Scholar] [CrossRef]

- Yue, W.; Wang, J. Government Subsidies and Firm-Level Markups: Impact and Mechanism. Sustainability 2020, 12, 2726. [Google Scholar] [CrossRef]

- Wang, Y.; Fu, L. Analysis on the Evolution Mechanism of Open Environmental Protection Innovation among Equipment Manufacturing Oligopolistic Enterprises Based on Data Simulation. Math. Probl. Eng. 2022, 2022, 1–19. [Google Scholar] [CrossRef]

- Chen, X.; Cai, X.W.; Ding, X.; Song, L.; Chen, C. Intellectualization and Substitution Elasticity of Capital on the Labour Force in Logistics Enterprises: Evidence from China and the United States. Appl. Econ. Lett. 2024, 31, 395–400. [Google Scholar] [CrossRef]

- Dai, X.; Cheng, L. Public Selection and Research and Development Effort of Manufacturing Enterprises in China: State Owned Enterprises Versus Non-State-Owned Enterprises. Innovation 2015, 17, 182–195. [Google Scholar] [CrossRef]

- Liu, D.; Chen, T.; Liu, X.; Yu, Y. Do More Subsidies Promote Greater Innovation? Evidence from the Chinese Electronic Manufacturing Industry. Econ. Model 2019, 80, 441–452. [Google Scholar] [CrossRef]

- Su, Y.; Li, D. Interaction Effects of Government Subsidies, R&D Input and Innovation Performance of Chinese Energy Industry: A Panel Vector Autoregressive (PVAR) Analysis. Technol. Anal. Strateg. Manag. 2021, 35, 493–507. [Google Scholar] [CrossRef]

- She, M.; Hu, D.; Wang, Y.; Li, L. How Do Top Management Team Characteristics Affect Government R&D Subsidy Grants? Evidence from an Information Economics Perspective. Asian Bus. Manag. 2021, 22, 330–353. [Google Scholar] [CrossRef]

- Wei, J.; Zuo, Y. The Certification Effect of R&D Subsidies from the Central and Local Governments: Evidence from China. RD Manag. 2018, 48, 615–626. [Google Scholar] [CrossRef]

- Yan, Z.; Li, W.; Tang, X.; Wang, H. Overseas Corporate Social Responsibility Engagement and Competitive Neutrality of Government Subsidies: Evidence from Multinational Enterprises in Emerging Markets. J. Int. Financ. Mark. Inst. Money 2022, 80, 101625. [Google Scholar] [CrossRef]

- Yang, Y.; Qi, Y.; Yang, S. Can Government Funding Revive Zombie Enterprises? Evidence from Listed Chinese Manufacturing Enterprises. J. Bus. Econ. Manag. 2021, 22, 1633–1654. [Google Scholar] [CrossRef]

- Defever, F.; Riaño, A. Subsidies with Export Share Requirements in China. J. Dev. Econ. 2017, 126, 33–51. [Google Scholar] [CrossRef]

- Li, B.; Zhang, J. Subsidies in An Economy with Endogenous Cycles over Investment and Innovation Regimes. Macroecon. Dyn. 2013, 18, 1351–1382. [Google Scholar] [CrossRef]

- Song, F.; Xu, X. How Operation Scale Improve the Production Technical Efficiency of Grape Growers? An Empirical Evidence of Novel Panel Methods for China’s Survey Data. Sustainability 2023, 15, 3694. [Google Scholar] [CrossRef]

- Dosi, G.; Lamperti, F.; Mazzucato, M.; Napoletano, M.; Roventini, A. Mission-Oriented Policies and the “Entrepreneurial State” at Work: An Agent-Based Exploration. J. Econ. Dyn. Control. 2023, 151, 104650. [Google Scholar] [CrossRef]

- Guo, F.; Zou, B.; Zhang, X.; Bo, Q.; Li, K. Financial Slack and Firm Performance of SMMEs in China: Moderating Effects of Government Subsidies and Market-Supporting Institutions. Int. J. Prod. Econ. 2020, 223, 107530. [Google Scholar] [CrossRef]

- Takahashi, K.; Hashimoto, Y. Small Grant Subsidy Application Effects on Productivity Improvement: Evidence from Japanese SMEs. Small Bus. Econ. 2022, 60, 1631–1658. [Google Scholar] [CrossRef]

- Havnes, T.; Mogstad, M. Is Universal Child Care Leveling the Playing Field? J. Public Econ. 2015, 127, 100–114. [Google Scholar] [CrossRef]

- Hu, L.; Li, Z.L.; Zhang, Q. Research on the Effect of External Regulation on State-Owned Companies. Econ. Rev. 2020, 3, 118–130. [Google Scholar] [CrossRef]

- Christofzik, D.I.; Kessing, S.G. Does Fiscal Oversight Matter? J. Urban Econ. 2018, 105, 70–87. [Google Scholar] [CrossRef]

- Ma, S.; Fang, C. Cross-Border E-Commerce and New Export Growth in China: Based on the Dual Perspective of Information Costs and Economies of Scale. Econ. Res. J. 2021, 6, 159–176. [Google Scholar]

- Brandt, L.; Van Biesebroeck, J.; Zhang, Y. Creative Accounting or Creative Destruction? Firm-Level Productivity Growth in Chinese Manufacturing. J. Dev. Econ. 2012, 97, 339–351. [Google Scholar] [CrossRef]

- Le, D.; Ren, F.; Tang, Y.; Zhu, Y. The effect of environmental policy uncertainty on enterprises’ pollution emissions: Evidence from Chinese industrial enterprise. Int. J. Environ. Res. Public Health 2022, 19, 9849. [Google Scholar] [CrossRef] [PubMed]

- Scotchmer, S.; Green, J.; Wright, B. On the Division of Profit in Sequential Innovation. Rand J. Econ. 2017, 57, 102. [Google Scholar] [CrossRef]

- Xu, J.Y.; Mao, Q.L. Productive Subsidies and Firm Import Behavior: Evidence from Chinese Manufacturing Companies. World Econ. 2019, 42, 46–70. [Google Scholar] [CrossRef]

- Luo, L.; Yang, Y.; Luo, Y.; Liu, C. Export, Subsidy and Innovation: China’s State-Owned Enterprises versus Privately-Owned Enterprises. Econ. Polit. Stud. 2016, 4, 137–155. [Google Scholar] [CrossRef]

- Wu, A. The Signal Effect of Government R&D Subsidies in China: Does Ownership Matter? Technol. Forecast. Soc. Change 2017, 117, 339–345. [Google Scholar] [CrossRef]

- Yu, F.; Guo, Y.; Le-Nguyen, K.; Barnes, S.J.; Zhang, W. The Impact of Government Subsidies and Enterprises’ R&D Investment: A Panel Data Study from Renewable Energy in China. Energy Policy 2016, 89, 106–113. [Google Scholar] [CrossRef]

- Qu, J.; Cao, J.; Wang, X.; Tang, J.; Bukenya, J.O. Political Connections, Government Subsidies and Technical Innovation of Wind Energy Companies in China. Sustainability 2017, 9, 1812. [Google Scholar] [CrossRef]

- Zhang, H.; Li, L.; Zhou, D.; Zhou, P. Political Connections, Government Subsidies and Firm Financial Performance: Evidence from Renewable Energy Manufacturing in China. Renew. Energy 2014, 63, 330–336. [Google Scholar] [CrossRef]

- Jin, Z.; Shang, Y.; Xu, J. The Impact of Government Subsidies on Private R&D and Firm Performance: Does Ownership Matter in China’s Manufacturing Industry? Sustainability 2018, 10, 2205. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderator–Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Pers. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Sun, X.; Yu, R.; Wang, Y.; Colombage, S.R.N. Do Government Subsidies Stimulate Firms’ R&D Efforts? Empirical Evidence from China. Asian J. Technol. Inno. 2020, 28, 163–180. [Google Scholar] [CrossRef]

- Li, S.; Wu, Y. Government Subsidies, Ownership Structure and Operating Performance of State-Owned Enterprises: Evidence from China. Appl. Econ. 2022, 54, 6480–6496. [Google Scholar] [CrossRef]

- Ren, Y.; Zhao, W.; Zhang, L.; Hou, T. R&D Subsidy and Corporate Innovation: An Integrated View of Resource Allocation and Resource Utilisation. Ind. Inno. 2023, 31, 727–752. [Google Scholar] [CrossRef]

- Guan, Y. Research on the Relationship between Government Subsidies, R&D Investment and High-Quality Development of Manufacturing Industry. Appl. Math. Nonlinear Sci. 2022, 8, 2653–2666. [Google Scholar] [CrossRef]

- Wang, D.; Sun, Y. The Effect of Different Government Subsidies on Total-Factor Productivity: Evidence from Private Listed Manufacturing Enterprises in China. PLoS ONE 2022, 17, e0263018. [Google Scholar] [CrossRef] [PubMed]

- Qi, Z.-Y.; Yang, S.-Y. Can Government Subsidies Promote the TFP of Enterprises? The Mediating Effect of R&D Decisions. Sci. Technol. Soc. 2021, 26, 392–412. [Google Scholar] [CrossRef]

- Amiti, M.; Khandelwal, A.K. Import competition and quality upgrading. Rev. Econ. Stat. 2013, 95, 476–490. [Google Scholar] [CrossRef]

| Variable Type | Name | Symbol | Definition |

|---|---|---|---|

| Outcome Variables | product quality of companies | quality1 | Proportion of the output value of new products in the total output value of companies |

| production efficiency of companies | tfp1 | Total factor production efficiency calculated based on the OP | |

| Policy Variable | government subsidies | treati × timet | Interaction term between dummy variables for the treatment group and dummy variables for the treatment period |

| Mediator Variable | R&D investment | crdinv | R&D investment scale of companies (in thousands of RMB), then take the logarithm |

| equipment depreciation | cdep | The proportion of the company depreciation of the current year in the original price of fixed assets | |

| Control Variable | company ownership | soe | For state-owned companies, the value is 1, otherwise is 0 |

| company scale | size | Net fixed assets of companies (in thousands of RMB), then take the logarithm | |

| company age | age | The statistical year minus year of company establishment + 1, then take the logarithm | |

| company export | export | If companies have the export behavior, the value is 1, otherwise is 0. | |

| company leverage | fasset | Asset–liability ratio of companies | |

| degree of industry competition | hhi | Herfindahl index multiplied by 100 | |

| Proxy Variable (robustness test) | product quality of companies | quality2 | The number of patent applications of companies+1, then take the logarithm |

| production efficiency of the companies | tfp2 | Total factor production efficiency calculated based on the LP |

| Variable | Mean Value | Standard Deviation | Minimum Value | Maximum Value | the Number of Observations |

|---|---|---|---|---|---|

| quality1 | 3.925 | 13.943 | 0 | 88.752 | 188,683 |

| tfp1 | 1.488 | 1.084 | −8.358 | 7.779 | 210,535 |

| treati × timet | 0.191 | 0.393 | 0 | 1 | 215,812 |

| crdinv | 7.298 | 2.213 | −6.543 | 16.946 | 56,081 |

| cdep | 5.793 | 5.110 | 0 | 33.246 | 215,595 |

| soe | 0.215 | 0.411 | 0 | 1 | 215,812 |

| size | 9.371 | 1.655 | −0.120 | 16.957 | 215,812 |

| age | 2.421 | 0.995 | 0 | 7.602 | 215,812 |

| export | 0.128 | 0.283 | 0 | 1 | 215,812 |

| fasset | 0.661 | 0.293 | 0.025 | 1.577 | 215,812 |

| hhi | 3.114 | 3.517 | 0.140 | 38.382 | 215,812 |

| quality2 | 0.066 | 0.356 | 0 | 7.368 | 215,812 |

| tfp2 | 6.313 | 1.223 | −2.859 | 12.617 | 210,535 |

| (1) | (2) | |

|---|---|---|

| quality1 Product Quality | tfp1 Production Efficiency | |

| 0.4512 *** (0.1470) | 0.0193 * (0.0100) | |

| control variable | yes | yes |

| company fixed effect | yes | yes |

| year fixed effect | yes | yes |

| adjusted R-squared | 0.6152 | 0.6676 |

| sample size | 166,642 | 188,670 |

| 1. Replace the Explained Variables | 2. Sample Winsorization | 3. Add Control Variables | 4. Adjust the Estimation Method | |||||

|---|---|---|---|---|---|---|---|---|

| quality2 | tfp2 | quality1 | tfp1 | quality1 | tfp1 | quality1 | tfp1 | |

| 0.0073 * (0.0040) | 0.0402 *** (0.0104) | 0.3908 *** (0.0692) | 0.0137 *** (0.0050) | 0.4004 *** (0.0911) | 0.0179 *** (0.0058) | 0.4511 *** (0.0862) | 0.0193 *** (0.0055) | |

| control variable | yes | yes | yes | yes | yes | yes | yes | yes |

| company fixed effect | yes | yes | yes | yes | yes | yes | yes | yes |

| year fixed effect | yes | yes | yes | yes | yes | yes | yes | yes |

| adjusted R-squared | 0.4571 | 0.7420 | 0.6192 | 0.6679 | 0.6202 | 0.6667 | 0.6153 | 0.6676 |

| sample size | 193,931 | 188,670 | 164,754 | 184,519 | 149,821 | 171,503 | 166,640 | 188,668 |

| (1) | (2) | |

|---|---|---|

| quality1 Product Quality | tfp1 Production Efficiency | |

| 0.5885 *** [0.1128] | 0.0772 *** [0.0063] | |

| control variable | yes | yes |

| company fixed effect | yes | yes |

| year fixed effect | yes | yes |

| adjusted R-squared | 0.0234 | 0.1291 |

| sample size | 188,683 | 210,535 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| quality1 Product Quality | quality1 Product Quality | tfp1 Production Efficiency | tfp1 Production Efficiency | |

| 0.1586 *** (0.0274) | 0.2421 *** (0.0556) | 0.1034 *** (0.0229) | 0.0268 *** (0.0034) | |

| 0.0178 ** (0.0084) | 0.0130 ** (0.0065) | |||

| 0.0070 ** (0.0029) | 0.0017 *** (0.0005) | |||

| control variable | yes | yes | yes | yes |

| company fixed effect | yes | yes | yes | yes |

| year fixed effect | yes | yes | yes | yes |

| adjusted R-squared | 0.6912 | 0.7302 | 0.6382 | 0.6472 |

| sample size | 14,332 | 45,888 | 18,250 | 30,134 |

| State-Owned Companies | Non-State-Owned Companies | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| quality1 Product Quality | tfp1 Production Efficiency | quality1 Product Quality | tfp1 Production Efficiency | |

| 0.1945 (0.1769) | 0.0188 (0.0139) | 0.5108 *** (0.1018) | 0.0186 *** (0.0062) | |

| control variable | yes | yes | yes | yes |

| company fixed effect | yes | yes | yes | yes |

| year fixed effect | yes | yes | yes | yes |

| adjusted R-squared | 0.7034 | 0.6420 | 0.5943 | 0.6387 |

| sample size | 35,928 | 36,710 | 125,683 | 147,014 |

| Exporting Companies | Non-Exporting Companies | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| quality1 Product Quality | tfp1 Production Efficiency | quality1 Product Quality | tfp1 Production Efficiency | |

| 0.7061 *** (0.1823) | 0.0071 (0.0088) | 0.2422 *** (0.0940) | 0.0234 *** (0.0073) | |

| control variable | yes | yes | yes | yes |

| company fixed effect | yes | yes | yes | yes |

| year fixed effect | yes | yes | yes | yes |

| adjusted R-squared | 0.6737 | 0.6646 | 0.5747 | 0.6767 |

| sample size | 45,315 | 51,719 | 115,794 | 131,086 |

| Low-Competition Manufacturing Companies | Highly Competitive Manufacturing Companies | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| quality1 Product Quality | tfp1 Production Efficiency | quality1 Product Quality | tfp1 Production Efficiency | |

| 0.6710 *** (0.1440) | 0.0100 (0.0084) | 0.1598 (0.1048) | 0.0182 ** (0.0078) | |

| control variable | yes | yes | yes | yes |

| company fixed effect | yes | yes | yes | yes |

| year fixed effect | yes | yes | yes | yes |

| adjusted R-squared | 0.6469 | 0.6886 | 0.5895 | 0.6558 |

| sample size | 77,926 | 88,065 | 79,573 | 91,628 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Song, W.; Zhao, K. Government Subsidies and Sustainable Development in Manufacturing: Evidence from Product Quality and Production Efficiency. Sustainability 2025, 17, 10150. https://doi.org/10.3390/su172210150

Zhang Y, Song W, Zhao K. Government Subsidies and Sustainable Development in Manufacturing: Evidence from Product Quality and Production Efficiency. Sustainability. 2025; 17(22):10150. https://doi.org/10.3390/su172210150

Chicago/Turabian StyleZhang, Yuchen, Weilong Song, and Kai Zhao. 2025. "Government Subsidies and Sustainable Development in Manufacturing: Evidence from Product Quality and Production Efficiency" Sustainability 17, no. 22: 10150. https://doi.org/10.3390/su172210150

APA StyleZhang, Y., Song, W., & Zhao, K. (2025). Government Subsidies and Sustainable Development in Manufacturing: Evidence from Product Quality and Production Efficiency. Sustainability, 17(22), 10150. https://doi.org/10.3390/su172210150