Abstract

Climate risks are one of the major challenges facing sustainable development. This study examines how physical and transition climate risks influence the volatility and correlation of fossil energy futures and clean energy stock indices, using a mixed-frequency modeling framework. Taking the Paris Agreement as the starting point for the global energy transition, we aim to compare the impacts of climate risks on various fossil energy assets and clean energy assets and investigate how the dynamic linkages between clean energy and fossil energy assets have evolved under the influence of climate risks. The results show that climate risks have increased the volatility of fossil energy and clean energy assets to varying degrees. Correlation patterns vary by energy type: crude oil futures and clean energy indices exhibit a decoupling trend under climate risks, while natural gas futures show a more consistent, positive linkage. These findings not only provide useful guidance for investors in formulating more effective strategies under increasing climate risks but also offer policymakers valuable insights into designing optimal approaches to balance decarbonization objectives with energy security.

1. Introduction

In recent years, extreme natural disasters have occurred with alarming frequency across the globe. Characterized by unprecedented speed and severity, these events have posed significant challenges to sustainable development. Consequently, societies have increasingly acknowledged the critical importance of the global energy transition. The Paris Agreement, adopted in December 2015 at the 21st United Nations Climate Change Conference (COP21) and signed by 178 countries, aims to limit the rise in global average temperatures to within 2 °C above pre-industrial levels by the end of the century. As fossil fuel consumption is a primary driver of climate change, energy transition has become a global imperative.

According to REN21’s 2024 Global Status Report, renewable energy accounted for 12.7% of global energy use in 2023, marking the 22nd consecutive year of record growth. Similarly, the International Renewable Energy Agency (IRENA), in its Annual Review of Renewable Energy and Jobs, reported an 18% increase in renewable energy employment, reaching an all-time high in 2023. The International Energy Agency’s (IEA) World Energy Outlook 2024 highlighted that annual investments in clean energy projects approached $2 trillion, nearly double the spending on traditional energy sources. Additionally, the costs of clean energy technologies have continued to decline following a temporary rise during the COVID-19 pandemic. In 2023, the United Nations Climate Change Conference (COP28) made a landmark commitment to triple global renewable energy capacity and double energy efficiency by 2030.

Traditionally, scholars have focused on factors such as geopolitical risks and economic policy uncertainty in explaining fossil fuel price volatility [1,2]. However, with the intensification of global warming and the increasing frequency of natural disasters, climate risks have emerged as a crucial factor affecting energy prices, which means climate risks are not only the starting point of the energy transition but also a major driver of energy price volatility [3,4].

Under transition risks dominated by climate policies, energy development has exhibited certain imbalances. The excessive investment in clean energy has suppressed the growth of the fossil fuel industry. However, the expansion of clean energy markets has been accompanied by capital operations and speculative activities, giving rise to widespread “green bubbles” and “green washing” phenomena [5]. Amid increasingly energy security concerns, whether climate policies still support the stable development of clean energy and enhance the returns of clean energy assets, or whether some policy uncertainties trigger price fluctuations in clean energy assets, remains an important issue for investigation.

Physical climate risks have severely disrupted energy supply in numerous events. Hurricanes and floods have repeatedly damaged oil extraction, transportation, and natural gas infrastructure, triggering the volatility of fossil energy markets [6]. Furthermore, the supply of clean energy is not only sensitive to extreme climate events but also other environmental conditions including wind and solar availability. The 2021 European energy crisis stemmed from a rapid surge in energy demand during economic recovery. However, coupled with extremely low wind speeds constrained renewable energy output in winter, this surge ultimately caused a severe supply–demand imbalance in fossil fuel markets. The situation was further exacerbated by the Russia–Ukraine conflict in 2022, which severely disrupted fossil fuel supply chains and caused significant volatility in global energy markets [7]. Although continuous technological innovations have significantly improved the storage and dispatch capacity of renewable energies in recent years, climate events may still have long-lasting effects on clean energy production.

Given the remaining weaknesses in clean energy technologies, climate risks may strengthen the linkages between fossil energy and clean energy assets since a diversified energy supply offer greater stability. Notably, fossil fuels with lower carbon emissions are more likely to develop synergistic linkages with clean energy assets, also serving as energy sources in the decarbonization process. Addressing this question is not only essential for understanding the market volatility spillovers under climate risk shocks, but also contributes to better coping with the challenges inherent in the energy transition. Recent studies have increasingly examined the interplay between fossil fuels and clean energy assets [8,9], as well as the influence of climate transition policies on their correlation dynamics [10,11]. However, existing evidence on these issues remains limited and often yields mixed results.

Through a review of the literature, we identify several key gaps and the contributions are as follows. First, we examine how transition and physical climate risks have differentially affected the volatility of various fossil energy futures and clean energy asset prices in the post-Paris Agreement era. Given that many developing countries have embarked on the path of energy transition in recent years, our analysis focuses on a relatively short period, thereby filling an important gap since the existing literature often employed long study periods and empirical parameters are influenced by early data. Second, in order to appropriately measure influential physical climate risks, we construct a comprehensive global physical climate risk index (CRI), weighted by disaster-related casualties and economic losses across 211 countries. In addition, we incorporate it alongside the climate policy uncertainty index (CPU) into a unified analytical framework, thereby advancing the related literature. Third, we further introduce the European Climate Transition Concern (ECTC) index and Global Temperature Anomalies (GTA) as additional climate risk measures, in order to compare the impacts of different regional climate policies as well as acute and chronic physical climate risks on asset price volatility. Fourth, although clean energy stock indices have increasingly become the focus of attention, existing evidence regarding their volatility under different climate risks, as well as their evolving relationship with fossil energy markets, remains limited. By adopting a mixed-frequency modeling framework and plotting the dynamic evolution of correlations, we capture both the short-term fluctuations and long-term correlation shifts influenced by climate shocks.

Specifically, we conduct an empirical investigation using daily futures prices for crude oil, natural gas, and coal, alongside three major clean energy stock indices, covering the period from January 2016 to August 2024. All three critical fossil fuels are analyzed separately to capture heterogeneity in their market behavior. Our findings provide investors with a deeper understanding of how climate risks affect asset price dynamics across fossil and clean energy markets. This enables more informed investment strategies, including risk hedging and portfolio diversification. In parallel, the results offer practical insights for policymakers seeking to balance decarbonization goals with energy security concerns.

The remainder of this paper is structured as follows. Section 2 reviews the related literature and develops the research hypotheses. Section 3 describes the data. Section 4 outlines the methodology. Section 5 presents the empirical results. Section 6 provides extended empirical analyses. Section 7 concludes.

2. Literature Review and Hypothesis Development

2.1. Impacts of Climate Risks on Fossil and Clean Energy Markets

According to the definitions provided by the Task Force on Climate-related Financial Disclosures (TCFD) and the Basel Committee on Banking Supervision, climate risks are generally divided into two categories: physical risks and transition risks. Transition risks primarily refer to the economic losses resulting from climate-related policies, while physical risks arise from climate-induced natural disasters and extreme weather events.

In the measurement of transition risk, scholars have adopted both micro-level and macro-level approaches. At the micro level, transition pressure faced by firms is commonly evaluated using indicators such as carbon emissions, asset stranding, and environmental governance performance [12,13,14,15]. At the macro level, transition risk is often measured using word frequency-based textual analysis. A representative work in this field is Gavriilidis [16], who was the first to construct a Climate Policy Uncertainty (CPU) index using text mining methods based on climate-related terms from eight major U.S. newspapers. This index draws methodological inspiration from the widely used Economic Policy Uncertainty (EPU) index and has rapidly become a key empirical tool in climate risk research.

Some studies suggest a dynamic impact from climate transition policy on fossil energy markets. Regional policies, laws, and market demand changes directly affect companies that rely on fossil fuels or their derivatives as raw materials [17]. These companies face not only increasing carbon reduction costs and technological challenges but also significant risks of asset stranding, leading to a significant decline in corporate values [15]. Consequently, with the progressive implementation of climate policies, market acceptance, and reliance on fossil energy decline. Empirical studies have also shown that an increase in the CPU index is often associated with reduced returns on fossil fuel futures, while fossil fuel futures price volatility positively correlates with the CPU [3]. Cao et al. [18] highlight the heterogeneous impacts of climate transition risks across different fossil energy markets in China. Specifically, transition risks exert positive impacts on natural gas markets, reinforcing its role as a transitional energy source, while oil derivatives such as gasoline and diesel are subject to significant negative shocks.

Empirical evidence suggests that climate transition risks also affect clean energy stock indices. Bua et al. [19] utilize European financial market data and testified the green stock return increases alone with climate transition risk. Li et al. [20] demonstrate that renewable energy consumption is positively correlated with CPU during periods of active transition policies, thereby reinforcing the shift toward a low-carbon energy structure. Yi [21] validate that global climate transition concern exerts positive long-term effects on green technology, smart grids, and innovation-related indices. However, according to Ren et al. [5], while mainstream climate policies generally foster the growth of the clean energy sector, volatility in fossil fuel markets under energy security crises tends to increase policy uncertainty, making clean energy assets particularly vulnerable. Rong et al. [22] also find transition risk has an inverted U-shaped influence on the volatility of green energy stock market in China, and that transition risk can amplify crude oil price fluctuations triggered by physical risks. Furthermore, CPU index demonstrates predictive capability for the volatility of out-of-sample renewable energy stock indices [23].

Based on the existing research, we propose the first hypothesis.

Hypothesis (H1).

Climate transition risk significantly increases the volatility of both fossil energy markets and clean energy markets.

Whereas transition risks reflect policy-related pressures on traditional industries, physical climate risks are associated with weather variability and climate disasters. Physical climate risks can act as both catalysts and disruptors in the energy transition process [24]. Tumala et al. [25] use a global temperature index to assess physical risks and find that rising temperatures increase fossil fuel price volatility. Lin et al. [26] demonstrate that climate disasters can lead to geopolitical tensions, and that volatility spillovers from the U.S. Climate Disaster Risk Index positively affect the futures prices of crude oil, natural gas, and coal. Albanese et al. [27] suggest that, compared with the gradual effects of transition risks, the impacts of physical risks are more immediate and tend to increase market volatility. Gu et al. [28] combine eight natural disaster indices and use daily volatility data to confirm a positive association between climate disaster risk and volatility in the crude oil and natural gas markets.

Existing studies on the impact of physical climate risk on clean energy assets remain relatively scarce. Basher and Sadorsky [29] find that natural disasters exert minimal effects on the systemic risk network formed by clean energy, critical minerals, and electric vehicle stocks. Bouri et al. [30] empirically identify a negative correlation between physical climate risk and green bond volatility. Gong et al. [31] argue that natural disasters may pose serious challenges for emerging clean energy firms and lead to regulatory adjustments in technical standards that are difficult for clean energy companies to comply with. Iyke [32] suggests that disasters case short-term surges in energy prices, they do not necessarily indicate a reversal of the energy transition. He highlights the importance of post-disaster investment in clean energy in mitigating the threat climate change poses to energy security. In sum, physical climate risks tend to generate pronounced short-term fluctuations in fossil fuel prices, while their influence on clean energy assets has received relatively limited scholarly attention.

According to these findings, we propose the second hypothesis.

Hypothesis (H2).

Climate physical risk significantly increases the volatility of both fossil energy markets and clean energy markets.

2.2. Linkages Between Fossil Energy and Clean Energy Markets

The crude oil futures market remains the most active segment of the energy sector and has attracted extensive scholarly attention regarding its relationship with clean energy assets. Early studies generally adopted a skeptical view of their correlation. Ferrer et al. [33] argue that crude oil futures serve as crucial hedging instruments in financial markets and act as net receivers of financial shocks. They demonstrate that the development of the clean energy industry is largely independent of the crude oil futures market, and that fluctuations in crude oil prices have no significant short- or long-term impact on the stock performance of clean energy firms. Similarly, Kyritsis and Serletis [34] find no statistical evidence that the oil price uncertainty index influences the returns of clean energy and technology-related stocks.

With the rapid development of the clean energy sector in recent years, some studies have confirmed the correlation between crude oil and clean energy. Sahu et al. [9] suggest that a decline in crude oil prices temporarily reduces renewable energy consumption in the short run, although the effect diminishes over time. Xi et al. [35] demonstrate that the causal relationship between crude oil futures and clean energy stock indices is negligible under normal market conditions but becomes significant during periods of extreme market turbulence. However, some studies indicate the observed correlation between crude oil futures and clean energy assets may stem primarily from the financial attributes of the crude oil futures market rather than a substitutive relationship. Since crude oil futures are frequently used as risk-hedging instruments in financial markets, their sharp price fluctuations can weaken economic growth expectations and introduce volatility across other sectors of the economy [36]. Given that the clean energy sector still faces challenges in achieving cost efficiency, economic downturns resulting from fossil energy price volatility may hinder its development [20]. Tang et al. [37] also confirm that in the short term, green bonds and clean energy passively absorb risk shocks originating from WTI crude oil and heating oil, underscoring their vulnerability as emerging market segments to energy price fluctuations.

Some studies have examined the impact of climate risks on the volatility correlation between crude oil and clean energy markets. Ding et al. [38], employing a multidimensional network model, assess risk spillovers across the traditional energy, carbon, and clean energy stock markets. Their findings indicate that spillovers from the oil market to the clean energy stock market are limited, but heightened investor attention to climate change in recent years can strengthen the volatility transmission between the two sectors. However, Zhang et al. [10] use crude oil as a representative fossil energy source and find that CPU negatively affects the volatility correlation between crude oil prices and most categories of clean energy stock indices.

Accordingly, we propose the third hypothesis.

Hypothesis (H3).

Climate transition risk and physical climate risk weaken the correlation between the crude oil futures market and clean energy markets.

Coal and natural gas are critical components of the fossil energy supply chain. However, there is limited research on their correlation with clean energy markets. Natural gas, which consists primarily of methane, emits significantly less carbon dioxide and other pollutants than oil and coal when burned. Thus, the integration of natural gas with renewable energy systems has become a central strategy in meeting the carbon emission targets set by the Paris Agreement [39]. Umar et al. [40] construct a volatility spillover network and find that although the natural gas market is connected to other energy markets, spillovers between clean energy stocks and natural gas are minimal. In contrast, Kanamura et al. [41] argue that because natural gas and renewables are both key sources of low-emission power, the value of renewable energy companies is expected to rise alongside natural gas futures prices. Their empirical results support the hypothesis of a positive correlation between clean energy stock indices and natural gas futures.

Regarding coal, their relationship varies across countries depending on national energy structures. Coal-fired power generation results in substantial emissions of fine particulate matter and toxic pollutants, prompting many European Union member states to commit to phasing out coal. In contrast, many Asia-Pacific countries continue to rely heavily on coal due to its affordability and widespread availability [42]. One study has confirmed a significant bidirectional volatility spillover between thermal coal prices and clean energy stocks in China, which is the world’s largest coal-consuming nation [43].

Research about the impact of climate risks on the correlation between clean energy and other fossil energy market is even more limited. Hu & Borjigin [4] argue that physical climate risks, together with geopolitical risks and economic policy uncertainty, have deepened the linkages between fossil energy markets and global stock markets. Liu [11] demonstrate that dynamic risk spillovers exist between traditional energy and green financial markets, with CPU serving as a key driver that amplifies these spillovers. Hany [44] considers the Paris Agreement a turning point in the relationship between fossil fuels and clean energy. His study finds that climate policies and climate-related events following the Agreement have increasingly driven the decoupling of clean energy assets from fossil energy markets.

Given that natural gas’s lower emissions compared to oil and coal, we propose the fourth hypothesis.

Hypothesis (H4).

Climate transition and physical risks strengthen the correlation between natural gas futures and clean energy markets, while weakening the correlation between coal futures and clean energy markets.

2.3. Research Gaps and Motivation

The existing literature offers valuable insights into how both transition and physical climate risks influence fossil and clean energy markets. However, several important limitations persist. First, previous studies often used long study periods of fifteen to twenty years, which caused some empirical parameters to be heavily influenced by early data. For many developing countries, climate risk has only gained enough attention in recent years, and research based only on recent data is almost nonexistent. By taking the signing of the Paris Agreement as a turning point, we place greater emphasis on the differentiated impacts of climate risks on energy market volatility in the post-Agreement era.

Second, although both climate policy uncertainty and physical climate risks are important drivers of energy market fluctuations, studies incorporating both risks into a unified analytical framework remain limited. Meanwhile, although various approaches exist for measuring physical climate risks, selecting appropriate variables is challenging, since the empirical results on energy market volatility may vary substantially. We attempt to construct a global physical climate risk index covering disaster-related losses across 211 countries, and incorporates it into empirical analysis alongside the climate policy uncertainty index. Furthermore, we introduce the European climate policy index and temperature anomalies index to compare how regional climate policies and different types of physical climate risks (acute vs. chronic) affect asset price volatility.

Third, although clean energy stock indices have become an increasingly prominent subject of investigation, the evidence regarding their volatility under different climate risk conditions, as well as their evolving relationship with fossil energy markets under varying climate risk conditions remains fragmented and inconclusive. Furthermore, many empirical studies rely on low-frequency asset price data sources, such as monthly or quarterly observations, which may obscure short-term dynamics and fail to capture the volatility spillovers induced by climate shocks. To address this gap, this study adopts a mixed-frequency modeling framework that integrates daily market prices with monthly climate risk indicators, thereby providing a more comprehensive assessment of how climate risks affect energy markets.

3. Data

We utilize a dataset that includes daily frequency data on fossil energy futures prices and clean energy stock indices, alongside monthly frequency data for multiple climate risk indicators.

For clean energy stock indices, we incorporate the S&P Global Clean Energy Index (GCE), with daily data obtained from Investing.com (cn.investing.com). We also include two WilderHill indices with different regional coverage focus: the WilderHill New Energy Global Innovation Index (NEX), which tracks companies advancing green energy and efficiency outside the U.S., and the WilderHill Clean Energy Index (ECO), which primarily consists of the U.S.-listed firms. Daily data for both indices are retrieved from the official WilderShares website (wildershares.com).

With regard to fossil energy markets, we use daily prices for crude oil (WTI), natural gas (GAS), and coal futures (COAL). Specifically, West Texas Intermediate (WTI) crude oil futures are obtained from NYMEX, which closely track Brent crude oil futures on ICE and together represent the two primary global oil benchmarks. Given that the United States is the largest exporter of liquefied natural gas, Henry Hub natural gas futures are also sourced from the NYMEX. Coal futures data are obtained from ICE due to the absence of a widely traded coal futures contract on NYMEX. And, the trading activities of these coal futures cover a broad range of markets, including the U.S., the U.K., the EU, Canada, and Singapore.

Our sample period spans from 4 January 2016, to 31 August 2024. Given the differences in trading calendars across markets, we restrict the correlation analysis in 5.2 to overlapping trading days for each pair of variables. Concretely, for each pair (e.g., crude oil futures and the clean energy index), we take the intersection of their trading dates and exclude days when only one market is closed or data are missing. To ensure stationarity in daily financial time series, we compute returns as , where denotes the price at time t.

Since our study focuses on the U.S. and European regions, we collect two corresponding climate risk indices. The first is the Climate Policy Uncertainty (CPU) index, available from January 2016 to August 2024, which is constructed based on climate-related news coverage in eight major U.S. newspapers and obtained from the Policy Uncertainty website “www.policyuncertainty.com (accessed on 30 November 2024)”. The second is the Climate Physical Risk Index (CRI), which we construct using raw data from the International Disaster Database (EM-DAT). Following the approach of Gu et al. [28], we select four categories of natural disaster data (meteorological, climatological, hydrological, and geophysical), covering 211 countries with records dating back to 2012. For each country i and each month t, we calculate the CRI using a weighted ranking method based on the number of deaths, total damages, and number of people affected. The detailed construction formula is as follows:

where represents the number of countries affected by natural disasters at month t. If a specific country does not experience any natural disasters in a given month t, its physical climate risk index is assigned the minimum value of that month.

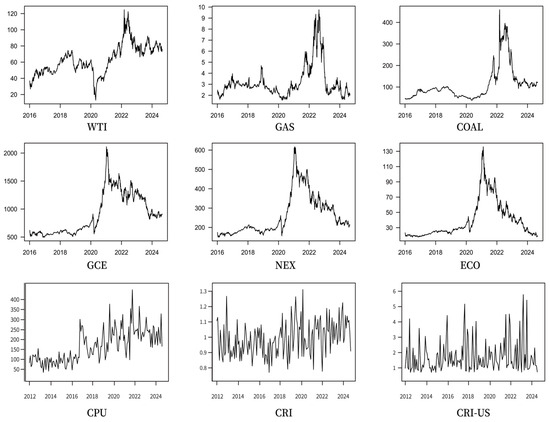

Unlike Gu et al. [28], who compute the global CRI using a subset of developed countries, we construct a monthly global CRI by averaging across all 211 countries. The variable definitions and measurement methods are provided in Table 1, and summary statistics are presented in Table 2. Figure 1 illustrates the time-series trends for selected variables.

Table 1.

Definitions and regarding measurement of the main variables.

Table 2.

Summary statistic.

Figure 1.

Time evolution of the selected variables.

During the sample period, both price and index series exhibit considerable fluctuations as shown in Figure 1. For price series, these are especially evident during major events such as the COVID-19 pandemic starting from December 2019, the OPEC oil production cuts in April 2020, and the Russia–Ukraine conflict starting from February 2022. By visually comparing the fluctuations, we observe a noticeable positive degree of correlation between fossil energy and clean energy markets.

Although our main research period begins in 2016 following the signing of the Paris Agreement, we extend the climate risk index data back to January 2012 to observe its dynamic evolution. In Figure 1, the CPU index remained relatively stable before 2016 but has shown a clear upward trend since the official signing of the Paris Agreement in New York on April 22, 2016. Regarding physical climate risks, since the CRI is constructed based on exogenous and unpredictable natural disasters, its series displays significant volatility. Nevertheless, its mean value has exhibited a visible upward trend in recent years. Since our empirical study incorporates a clean energy index that based on U.S.-listed companies, we also extracted the U.S. climate physical risk index (CRI-US). As shown in Figure 1, the losses caused by natural disasters in the U.S. exceed the global average and exhibit certain seasonal characteristics.

4. Methodology

4.1. Garch-Midas-X Model

To study the long-term impact of climate risk on the price volatility of fossil energy futures and clean energy stock indices, we first establish the GARCH-MIDAS model. This framework (MIDAS) allows us to combine high-frequency daily price data with low-frequency monthly climate risk indicators. Each daily observation within a given month is linked to the same monthly value of the climate risk index. Moreover, through a flexible lag-polynomial weighting scheme, the model also incorporates historical information, thereby capturing the persistent influence of past climate risks on the long-term volatility of asset prices.

where is the series of returns for fossil energy futures and clean energy stock indices of n days on month t, is the expected returns. The total conditional variance consists of the information of short-term component and long-term component . , where represent the historical information set before date i on month t.

We assume that short-term volatility follows the GARCH (1,1) model, with , and is specifically defined as follows.

is the indicator function, contains the information about asymmetry.

We employ two types of climate risks including climate transition risk (CPU) and physical climate risk (CRI), denoted as X, to model the long-term volatility . The estimated coefficients represent the impact of different climate risks on the long-term volatility of fossil energy futures and clean energy stock indices, as detailed below:

where K represents the lag periods of X and serves as the weighting function in the MIDAS model.

Drawing on the findings of Ghysels et al. [45], who demonstrated the effectiveness of the beta weighting scheme, we set and the weights decay over the lag periods. So, the parameter is estimated by the model. The specific weight structure (Beta polynomial structure) is as follows.

4.2. Dcc-Midas-X Model

Some studies integrate the DCC-MIDAS model with the GARCH-MIDAS model to identify dynamic correlations [46], which means they first pre-process the series through a GARCH-MIDAS model incorporating climate risk variables. However, we adopt a more streamlined approach by constructing the DCC-MIDAS model directly on the basis of the standard GARCH framework. This strategy minimizes preliminary data processing and allows for a more direct and effective identification of the influence of climate risks on the long-term dynamics of cross-market correlations.

The conditional correlation between fossil energy futures and clean assets returns is given as , and represents the short-term correlation matrix, with its elements on time t following:

where and respectively denote the standardized residuals of fossil energy futures and clean energy stock indices, obtained from GARCH (1,1) model. The correlation coefficient of the standardized residuals is calculated as follows.

The long-term correlation is defined by a Fisher-z transformation with parameter determined by climate risks, ensuring the values remain within the range of −1 to +1. The detailed function is as follows:

where measures the impact from two types of climate risks on the correlation between fossil energy markets and clean energy stock indices. K is the lag periods, and we adopt the same Beta polynomial structure as in the GARCH-MIDAS model.

5. Empirical Analysis

5.1. The Effect of Climate Risks on Fossil Energy Markets and Stock Prices of Clean Energy

We begin by analyzing the effects of climate transition risks and physical climate risks on fossil fuel futures and clean energy indices. Table 3 and Table 4 present the GARCH-MIDAS-X model results regarding the impact of these risks on the long-term volatility of fossil and clean energy markets.

Table 3.

GARCH-MIDAS-CPU estimation results.

Table 4.

GARCH-MIDAS-CRI estimation results.

In this model, a parameter α close to zero indicates that short-term shocks have minimal impact on the short-term volatility of fossil fuel futures and clean energy indices. A parameter β close to 1 indicates a strong persistence of past volatility in influencing current volatility. When the sum of α and β approaches 1, it suggests a high degree of volatility persistence and a good model fit. The parameter γ captures the asymmetric impact of short-term shocks on asset prices. The parameter γ of crude oil is significantly positive, indicating negative shocks exerting a stronger influence on crude oil futures prices. Similarly, the clean energy stock indices are more affected by negative shocks. Our main focus lies on the statistical significance of the parameters θ and w. The parameter θ quantifies the long-term volatility effects of climate risks on fossil fuel futures and clean energy indices, while w represents the lagged weighting of the climate risk impacts.

Table 3 reports the impact of climate transition risks (CPU) on long-term asset price volatility. The θ parameters for crude oil, natural gas, and coal futures are positive and statistically significant at the 1% level, indicating a notable increase in their long-term volatility as CPU rises. Similarly, Clean energy indices are also sensitive to shocks from climate transition risks. As CPU increases, the Global Clean Energy Index (GCE) and the Non-U.S. Clean Energy Index (NEX) show significantly higher volatility at 1% level. These findings provide empirical support for hypothesis 1.

Given the United States’ dominant role in global energy production, consumption, and financial markets, the CPU index exerts significant spillover effects on energy and financial markets as a globally recognized benchmark of transition risk. Rising CPU indicates the increased variance of future climate policy pathways, including carbon pricing/quotas, subsidy rules, tariffs, and localization requirements. First, such uncertainty substantially elevates the risk of asset stranding in the traditional energy sector, as existing projects and capital investments may rapidly lose value once stricter climate regulations or carbon pricing mechanisms are enforced. Second, policy implementation timelines may induce fluctuations in cash flows for both clean and traditional energy industries, thereby increasing refinancing pressure and create uncertainty for equity valuations. Third, the lagged transmission of policies further reinforces the persistence of volatility.

However, according to the empirical results in Table 3, the clean energy index composed of the U.S. domestic firms (ECO) exhibits limited responsiveness to climate transition risks. The limited responsiveness of U.S. clean energy firms to climate transition risks can be explained by several factors. First, this may be attributed to the federal governance structure in the United States, where climate policies often differ between state and federal levels. When national policies shift, state-level frameworks often remain stable, mitigating abrupt shocks to firms. Second, the U.S. climate policies have historically experienced high volatility and frequent reversals, reflecting deep partisan divisions over energy and climate agendas. Such situations diminish the influence of climate policies at the domestic level. Third, clean energy firms in the United States are highly market-oriented and internationally integrated. Their access to diversified sources of capital—ranging from financial markets and venture capital to non-governmental organizations—further reduces dependence on federal subsidies. Consequently, these firms exhibit only limited adjustments to shifting and uncertain policy signals, underscoring their relatively low sensitivity to federal climate policy incentives.

The work of Hu and Borjigin [4] regarding the impact of climate policy changes on crude oil market volatility is consistent with this paper. But, Li et al. [20] suggest that the clean energy stock indices experience a reduction in volatility as CPU rises, which contrasts with our findings. One possible reason for this difference is the time period considered. The earlier study covered a longer time frame when climate risk received relatively less attention, and the clean energy sector was characterized by high investment risk and volatility. Over time, the growing emphasis on climate-related policies supported the development of clean energy industries and strengthened investor confidence, which reduced overall volatility. Our study focuses on a later period, following the signing of the Paris Agreement, when global awareness of climate issues had already intensified. During the economic downturn caused by COVID-19, especially after December 2019, many countries experienced economic stagnation. In November 2022, OPEC announced oil production cuts, marking the economic recovery even harder. During this time, climate-related policies reflected not only the goal of promoting energy transition but also concerns about economic stability and energy security. Under such circumstances, clean energy indices exhibited increased volatility.

Next, according to , the long-term impact of low-frequency monthly climate transition risk index on asset price volatility can be effectively estimated as . Specifically, a one-unit increase in the monthly CPU index leads to a 0.13% rise in the long-term volatility of crude oil futures, a 0.20% rise in natural gas futures, and a 0.46% rise in coal futures. Similarly, the same change in the CPU index results in a 0.18% increase in the long-term volatility of the GCE index and a 0.22% increase for the NEX index. It is evident that fossil energy assets and clean energy assets are similarly affected by shocks from climate policy uncertainty.

Table 4 presents the results of GARCH-MIDAS-CRI model. The characteristics of both the parameters α and β align closely with those presented in Table 2. The significantly positive value of parameter γ for crude oil indicates that the negative shocks exerting a greater influence on crude oil futures. Similarly, the U.S. clean energy stock index is more affected by negative shocks, whereas non-U.S. clean energy stock index is more sensitive to positive shocks. The parameters θ and w serve as effective measures of the long-term impact of the physical climate risk (CRI) on the volatility of fossil energy futures and clean energy stock indices.

Although sudden natural disasters can trigger short-term fluctuations across all fossil energy futures markets, our results show that the CRI only increases the long-term volatility of crude oil futures significantly, as indicated by a significantly positive θ parameter. One possible explanation is that the production, storage, and management of crude oil are more complex and demanding than those of natural gas and coal. Additionally, crude oil is a globally indispensable resource, and most countries emphasize maintaining a certain level of strategic reserves. As a result, the effects of natural disasters on infrastructure and transportation are more prominently reflected in crude oil futures prices.

Regarding clean energy indices, the CRI is found to significantly increase the long-term volatility of clean energy stock indices. Specifically, the CRI significantly affects the Global Clean Energy Index (GCE) and the Non-U.S. Clean Energy Index (NEX). The θ parameters are significant and positive in these cases. Several mechanisms may account for these findings. On the one hand, natural disasters can heighten global environmental awareness. Media reports on climate-related damages may encourage investors to seek high-potential clean energy sectors. Physical risks may also catalyze public interest in dismantling outdated systems, thereby creating opportunities for niche transition experiments. These experiments are crucial for fostering innovation and promoting the development of the clean energy sector [24]. On the other hand, certain natural disasters may damage clean energy infrastructure, leading to financial losses for clean energy firms. For instance, droughts may disrupt key mineral supply chains critical for clean energy technologies, such as lithium, cobalt, and rare earth elements.

Based on the empirical results, hypothesis 2 (H2) is supported, indicating that climate physical risk significantly increases the volatility of both fossil energy markets and clean energy markets. Next, we quantify the influence of physical climate risks on long-term volatility using the θ and w parameters. Given that the maximum monthly values of CRI in this study do not exceed 2, we also examine the effects of a 0.01-unit increase in CRI on the long-term volatility of the selected indices. A 0.01 increase in the CRI leads to a 1.03% rise in the long-term volatility of crude oil futures. Simultaneously, the GCE index rises by 0.87%, and the NEX index increases by 1.01%. The findings suggest that physical climate risks exert a significant influence on the volatility of clean energy assets, while natural gas and coal assets exhibit no statistically significant response.

5.2. Dynamic Correlation Between Fossil Energy Futures and Clean Energy Stock Indices

Previous research has identified the positive correlation between crude oil futures and clean energy assets. During periods of high oil prices, clean energy becomes more attractive to consumers and investors, leading to rising prices of clean energy assets. Conversely, when oil prices decline, investors adopt a more cautious stance toward clean energy investments, resulting in falling prices of related assets [10].

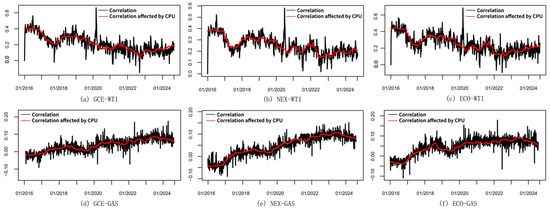

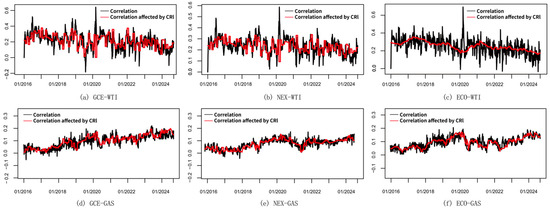

Table 5 and Table 6 report the results of the DCC-MIDAS-X models, which examine the effects of climate risks on the correlation between fossil fuel futures and clean energy indices. Figure 2 and Figure 3 illustrate the dynamic evolution of the short- and long-term correlations between fossil energy futures and clean energy indices, with the long-term correlations computed after incorporating adjustments for climate risks. In this model, a parameter b close to 1 indicates that long-term correlations are stable and persistent. As in previous sections, the key parameters of interest are θ and w. The θ parameter reflects the impact of climate risks on the correlation between fossil fuel markets and clean energy indices, while the w parameter captures the influence of lagged climate risk indices on the evolution of this correlation.

Table 5.

DCC-MIDAS-CPU estimation results.

Table 6.

DCC-MIDAS-CRI estimation results.

Figure 2.

Dynamic correlation between fossil resources and clean energy indexes influenced by CPU.

Figure 3.

Dynamic correlation between fossil resources and clean energy indexes influenced by CRI.

Table 6 examines how the transition risks (CPU) affect the correlation between fossil energy futures and clean energy stock indices. The parameters a are small but statistically significant, indicating that past short-term shocks have had a limited impact on the data. And the parameters b are greater than 0.8 and statistically significant, suggesting that the long-term correlations remain relatively stable. The θ parameters for the relationship between crude oil futures and clean energy indices are significantly negative, indicating that their correlation weakens as CPU increase. Specifically, the CPU significantly affects the correlation between crude oil futures and both the Global Clean Energy Index (GCE) and the Non-U.S. Clean Energy Index (NEX). This finding is consistent with Hany [44], who confirmed a decoupling between the crude oil and clean energy markets. The Paris Agreement led investors to anticipate an accelerated energy transition. Even though the economic growth declined following the COVID-19 shock, global efforts to promote energy transition have persisted.

In contrast, the θ parameters for natural gas futures and clean energy indices are significantly positive, suggesting that their correlation increases with higher values of the CPU. More specifically, the CPU significantly strengthen the correlation between natural gas futures and the GCE index and the NEX index. Compared with crude oil and coal, natural gas produces substantially lower emissions. Specifically, it emits approximately 45 percent less carbon than coal for the same amount of energy output. Given its critical role in ensuring energy security, natural gas has become an essential bridge in the evolving global energy system [47]. This explains the observed co-movement between natural gas and clean energy under increasing transition risks.

However, the θ parameters for coal futures are statistically insignificant, indicating that their correlation with clean energy indices is not affected by transition risks. Although transition risks significantly influence the long-term volatility of coal futures (as shown in Section 5.1), the share of coal in the energy mix of developed countries has been consistently decreasing. Consequently, the correlation between coal and clean energy indices that primarily consisting of companies from developed countries appears unstable. This is further supported by the low and insignificant values of the b parameter, indicating a lack of persistence. Moreover, subsequent analysis also shows that the correlations between coal futures and clean energy indices are not significantly affected by physical climate risks.

According to these results, hypothesis 3 (H3) and hypothesis 4 (H4) is partially confirmed: climate transition risk weakens the correlation between the crude oil futures market and clean energy markets, while it strengthens the correlation between natural gas futures and clean energy markets. The impact of CPU on the correlations operates through two main channels. First, the investor expectation effect alters capital allocation between the two asset classes. If investors anticipate stricter transition policies, clean energy assets benefit while fossil fuel industries face potential value impairment, thereby weakening or even reversing the correlation. Conversely, if the energy security concerns are prioritized, fossil fuel prices may rebound, and their correlation with clean energy assets hinges on investor expectations: perceived instability weakens the correlation, while strong confidence strengthen it through simultaneous inflows. Second, the heterogeneous roles of fossil fuels in the transition process also shape their correlation with clean energy assets. Our empirical evidence suggests that crude oil and clean energy assets exhibit a pronounced weakening in their correlation, while natural gas—given its relatively low-carbon profile—shows a co-movement with clean energy, jointly underpinning the development of a low-emission energy system.

As shown in Figure 2, the long-term correlations between crude oil futures and clean energy indices under the influence of CPU fluctuate considerably. During certain extreme events, the climate policies have, to some extent, amplified the changes in the correlation between fossil fuels and clean energy assets. After the outbreak of COVID-19 in late 2019, the crude oil market was severely hit due to the suspension of transportation and industrial consumption. In contrast, clean energy assets demonstrated relative resilience. They are still supported by policy incentives since the electricity demand fell moderately. This divergence contributed to the correlation decline. Around September 2021, the European energy crisis sharply increased fossil fuel demand. The Russia–Ukraine war in February 2022 further intensified fears of fossil fuel supply shortages. In response, policy priorities gradually shifted toward energy security, leading to higher climate policy uncertainty. Investors temporarily increased allocations to traditional energy, while clean energy companies were constrained by supply chain bottlenecks and tighter financial conditions. As a result, the downward fluctuation in correlations was amplified. Overall, throughout the study period, crude oil and clean energy markets exhibit a decoupling trend, with correlations stabilizing in recent years at a relatively low positive level.

In contrast, the long-term correlation between natural gas futures and clean energy indices is more stable over the entire period, displaying a steady upward trend: from virtually no correlation in early 2016 to a stable, low positive level. During periods of extreme events, climate policy uncertainty still exerts a positive influence on the correlation, which underscores the stabilizing role of natural gas in balancing energy security with cleaner production. Figure 2 also demonstrates that long-term volatility trends occasionally deviate from short-term correlations under the influence of the CPU index. This suggests that fluctuations in climate policy uncertainty have some predictive power over long-term correlation trends.

Table 6 examines how acute and chronic physical climate risks (CRI) affect the long-term correlation between fossil fuel futures and clean energy indices. Most of the parameters a and b are also statistically significant and similar to the results in Table 5, indicating that the long-term correlation of the data remains relatively stable with minimal short-term impact. The negative values of the θ parameter suggest that the correlation between crude oil futures and clean energy indices weakens as CRI increases, while significantly positive θ values imply that the correlation between natural gas futures and clean energy indices strengthens under the same conditions. The θ parameters for coal futures are statistically insignificant. More precisely, an increase in CRI reduces the correlation between crude oil futures and both the Global Clean Energy Index (GCE) and the Non-U.S. Clean Energy Index (NEX). At the same time, CRI enhances the correlation between natural gas futures and both the GCE and the U.S. Clean Energy Index (ECO). Additionally, the negative value of parameter θ indicates that the correlation between the U.S. clean energy stock index and crude oil/coal weakens as the domestic physical climate risk (CRI-US) increases. These findings suggest that hypothesis 3 (H3) and hypothesis 4 (H4) are partially confirmed: under climate physical risks, clean energy indices become more closely linked with natural gas markets, while their relationship with crude oil weakens.

Climate disasters exert multifaceted impacts on energy supply conditions, demand scale, and policy orientation. In the short run, if large-scale disasters disrupt multiple energy sources, they may trigger price co-movements and strengthen the positive correlation between fossil fuels and clean energy. Conversely, when disasters reinforce the demand for fossil fuels while limiting clean energy capacity, the correlation tend to decrease—for example, extreme cold spells boost demand for natural gas and coal-fired power generation, whereas the clean energy cannot fully substitute. In the long run, however, disasters often prompt governments to accelerate policy responses in environmental problems and reinforce market expectations of an accelerated transition. Our empirical results indicate that climate disasters have accelerated the decoupling of crude oil from clean energy, while natural gas, owing to its transitional and complementary role in energy security, shows increasing integration with clean energy markets.

Figure 3 provides a clearer depiction of how the CRI influences the long-term correlation between fossil energy futures and clean energy indices. As shown in the figure, the long-term correlations between fossil energy futures and clean energy indices show pronounced fluctuations, indicating that short-term volatility of the two series can exert a substantial effect on their long-term correlations. Compared with the CPU, the explanatory power of the CRI for long-term correlations is relatively weaker. Nevertheless, the trends shown in Figure 3 suggest the similar results as Figure 2 that, crude oil futures tend to decouple from clean energy indices under higher CRI conditions, whereas natural gas futures show a tendency toward co-movement, reflecting their relatively stronger integration with the clean energy sector.

6. Further Analysis

6.1. Substituting Climate Risk Indices

In the baseline analysis, climate transition risk is proxied by the U.S. Climate Policy Uncertainty (CPU) index. This index has been adopted in cross-country empirical research as a benchmark measure of transition risk, allowing for comparability across different studies and regions. However, regional heterogeneity in climate policies may generate different impacts on fossil and clean energy markets, largely due to variations in regional energy structures and dependence on specific energy sources. We further employ the European Climate Transition Concern (ECTC) index as an alternative proxy. The European Union has long been a global pioneer in the deployment of clean energy. The reformed EU Emissions Trading System (EU ETS) established a meaningful economy-wide carbon price and has continued to expand its coverage. The ECTC index is constructed from climate-related articles published by Reuters and is available through the European Central Bank Working Paper Series. Since the index is expressed as a ratio, we multiply it by 100 to convert it into percentage terms. The data are currently updated through June 2024. Therefore, our empirical tests using the ECTC index are constrained to this endpoint.

For physical climate risks, both acute and chronic dimensions have received considerable attention in the academic literature [27]. While our baseline model incorporates an acute risk measure based on climate-related disasters, we further introduce a chronic risk proxy to provide a complementary analysis. Specifically, we adopt the Northern Hemisphere Land and Ocean Average Temperature Anomalies (GTA) as an indicator of chronic physical risks, given that most major global economies are located in the Northern Hemisphere. The data are sourced from the National Centers for Environmental Information (NCEI).

In Table 7, the ECTC index has a positive effect on fossil energy market volatility, although its impact on crude oil futures is not statistically significant according to the θ parameter. This may be explained by Europe’s diversified crude oil supply sources, which include countries such as Russia, Norway, the United States, and various Middle Eastern nations. Such diversification reduces the influence of European climate transition policies on NYMEX crude oil futures, even though NYMEX remains the most actively traded oil futures platform worldwide. Europe’s energy structure differs across countries: in Germany and Poland, coal remains dominant, while in Italy and the Netherlands, natural gas plays a central role. Thus, the ECTC index exerts a significant impact on coal and natural gas futures. Regarding the clean energy market, the ECTC index exerts effects similar to those of the CPU index, significantly increasing the volatility of the Global Clean Energy Index (GCE) and the Non-U.S. Clean Energy Index (NEX), while showing no significant impact on the volatility of the U.S. domestic clean energy index (ECO). Given that the maximum monthly ECTC value observed in this study is 10, a small change in this index can influence the long-term volatility of the selected variables. Specifically, a 0.01 increase in the ECTC index raises long-term volatility by 0.15% for natural gas futures, 0.44% for coal futures, 0.07% for the GCE Index, and 0.08% for the NEX index.

Table 7.

GARCH-MIDAS-ECTC/GTA estimation results.

Table 8 reports the effects of the ECTC index on the long-term correlations between fossil energy markets and clean energy markets. Based on the significance of θ and w parameters, the ECTC index significantly weakens the long-term correlation between crude oil futures and the NEX index, while strengthening the long-term correlation between natural gas futures and the GCE index. Compared with the empirical results for the CPU index, the directions of influence are consistent; however, the scope of the ECTC index’s effects is relatively limited

Table 8.

DCC-MIDAS-ECTC/GTA estimation results.

For the GTA index, all θ parameters for fossil energy futures are statistically insignificant in Table 7, suggesting that GTA does not have a notable effect on the long-term volatility of fossil fuel futures. Theoretically, abnormal temperatures are expected to increase global electricity demand, leading to higher energy consumption and greater energy price volatility. However, two mitigating factors may explain this finding. First, human adaptability to temperature changes has improved over time. Second, technological advancements have enhanced energy efficiency, helping satisfy part of the additional electricity demand. These developments may help offset the pressure that temperature anomalies exert on fossil fuel markets. By contrast, the GTA indices are found to significantly increase the long-term volatility of all clean energy stock indices. Temperature anomalies not only affect clean energy infrastructure directly, but also cause droughts that may disrupt key mineral supply chains critical for clean energy technologies, such as lithium, cobalt, and rare earth elements. These disruptions may further increase volatility in clean energy equity indices. The empirical results show that the GTA index leads to a 0.84% rise in the volatility of GCE, a 0.58% rise in the ECO index and a 1.01% rise in the NEX index.

In Table 8, the results show that the GTA index only has a significant effect on the correlation between natural gas futures and clean energy indices. As the GTA increases, the correlation between natural gas futures and both the GCE and NEX indices strengthens. This may be because natural gas plays a vital role in electricity generation, making it more directly associated with clean energy companies in meeting rising electricity demand, particularly as extreme temperatures become more frequent. In contrast, most uses of crude oil and its refined products are concentrated in the transportation and industrial sectors, with only a small share linked to power generation. As a result, the correlation between crude oil futures and clean energy indices does not appear to be significantly influenced by chronic physical climate risks.

6.2. Interaction Effects of Climate Risks

We further explore the interaction effects of the two types of climate risks in the baseline analysis. The results in Table 9 show that under the influence of CPU*CRI, the θ parameters for both fossil energy and clean energy indices are positive and statistically significant at the 1% level, indicating a greater impact on long-term volatility than CRI alone, as shown in Table 4. One possible explanation is that energy firms already under policy pressure experience sharper valuation declines when an acute climate event occurs, including clean energy and fossil energy sectors. Additionally, such events often serve as catalysts for new or accelerated policy interventions, which increase market uncertainty and the potential for overreactions. As a result, CPU significantly amplifies the effect of acute physical risks on long-term asset volatility.

Table 9.

GARCH-MIDAS-CPU*CRI estimation results.

In comparison with the significant impact that the interaction indices exert on the long-term volatility of fossil energy futures and clean energy indices, as shown in Table 9, their influence on cross-market correlations appears to be relatively weak in Table 10. This asymmetry may arise from timing mismatches in how the interaction climate risks affect the two markets. In other words, the periods during which CPU*CRI generate substantial shocks in the fossil energy futures market may not coincide with the periods when they have notable effects on clean energy stock indices. As a result, the overall influence of these synergistic indices on long-term cross-market correlations is limited.

Table 10.

DCC-MIDAS-CPU*CRI estimation results.

7. Conclusions and Discussion

Against the backdrop of rising global energy demand, this study investigates how climate policy uncertainty and physical climate risks influence the volatility of three major fossil energy futures and three representative clean energy stock indices. It also explores how these risks affect the correlations between fossil energy markets and clean energy asset prices. Using the signing of the Paris Agreement as a benchmark for the onset of the global energy transition, we construct a mixed-frequency dataset that combines daily market data with monthly climate risk indicators.

The key findings are as follows. First, results from the GARCH-MIDAS models show that both transition and physical climate risks significantly affect the volatility of fossil energy and clean energy markets. Higher levels of CPU increase the volatility of crude oil, natural gas, and coal futures. The increasing CPU also raises the volatility of global and non-U.S. clean energy stock indices but has no significant effect on the U.S.-based indices. CRI, constructed from global natural disaster data, increases the volatility of crude oil futures and clean energy indices (both global and non-U.S.-based indices).

Second, DCC-MIDAS results reveal that long-term correlations between fossil energy and clean energy markets exhibit considerable heterogeneity. The CPU reduces the long-term correlation between crude oil and clean energy indices and increases the long-term correlation between natural gas and clean energy indices. Although the results for physical climate risk (CRI) are broadly consistent with those for the CPU, its explanatory power for long-term volatility is relatively weaker. Nevertheless, the analysis reveals that both the global CRI and the U.S. domestic CRI exert a negative impact on the correlation between the U.S. domestic clean energy index and crude oil futures, whereas the CPU does not significantly affect this correlation.

Finally, further analysis indicates that compared with the CPU, European climate policies exert a weaker influence on the long-term volatility and correlations of energy markets. The long-term volatility of the crude oil market is not significantly affected by the ECTC. Meanwhile, chronic physical climate risks do not significantly influence the long-term volatility of fossil energy markets but exert some impact on clean energy assets. Moreover, the results on the interaction effects of CPU and CRI suggest that combined climate risks have a stronger effect on long-term asset volatility, while their influence on inter-market correlations is not reinforced.

These findings carry several important implications. For investors, these results underscore that the climate risks have become a systemic risk factor, thereby elevating the Value-at-Risk (VaR) of related portfolios. Meanwhile, the instability of correlations caused by climate risks, on the one hand, increases the difficulty of risk management and challenges traditional diversification strategies and hedging tools; on the other hand, it also creates opportunities for asset reallocation.

Investors’ key concerns arising from climate risks vary due to differences in risk tolerance, investment objectives, and portfolio preferences. For institutional investors, who typically manage large-scale portfolios with long holding periods, the primary focus lies in systemic volatility and tail risks triggered by climate shocks. Therefore, greater attention should be paid to monitoring and assessing climate risk factors, and climate-related financial derivatives should be actively employed to achieve effective risk hedging. For retail investors, given their limited capital base and weaker risk-bearing capacity, they are more vulnerable to abrupt short-term market fluctuations. Since policy-driven tailwinds in the clean energy sector remain subject to considerable uncertainty, retail investors are advised to avoid excessive speculation and leverage in related assets. Regarding ESG funds, their investors are more concerned with the impact of climate risks on sustainability-aligned assets. Although clean energy assets exhibit heightened volatility under the influence of climate risks, their decoupling trend from crude oil futures also indicates growing industrial independence. Therefore, it is feasible to evaluate clean energy firms without taking into account the short-term fluctuations of the crude oil market driven by geopolitical factors frequently. Meanwhile, given the relatively clear prospects for the natural gas industry, ESG funds may increase natural gas exposure in certain products, such as those designed to support the transitional phase of the energy shift.

For policymakers, first, the rising volatility in clean energy assets in response to climate transition risks underscores the urgent need for stable and consistent climate policy frameworks. In light of increasing extreme weather events, it is essential to develop and actively support technologies that enhance the resilience of clean energy storage systems, while at the same time avoiding undue suppression of the traditional energy sector so as to maintain a stable energy supply. This implies that clean energy enterprises are going to face greater operational and technological pressures, while traditional energy sectors should focus on exploring viable development pathways instead of rushing into rapid transformation.

Second, the increasing correlation between natural gas and clean energy indices points to a potential pathway for balancing energy transition and energy security under climate risk: the coordinated integration of the two sectors. For example, policies could support the development of clean energy smart grids capable of integrating natural gas as a backup energy source. Investments should also be encouraged for firms operating across both natural gas and clean energy sectors since they can better withstand climate risks and help smooth the energy transition. In this process, these industries are likely to capture substantial growth opportunities, while traditional companies are encouraged to pursue diversification strategies to cope with the market pressures.

Third, while physical climate risks pose challenges to clean energy industries, it is critical to prevent setbacks in global energy transition efforts. In the post-COVID fiscal landscape, many countries have shifted their focus from energy transition to economic recovery. Although non-governmental organizations (NGOs) have continuously advocated for greater attention to energy transition, their efforts have had only a marginal impact. One viable approach to counter this trend is the implementation of Carbon Border Adjustment Mechanisms (CBAMs), which impose a carbon cost on imports based on their embedded emissions. In this process, international NGOs can play an important role in cross-border coordination and oversight. Such mechanisms not only incentivize cleaner production abroad, particularly in regions still reliant on coal and oil, but also help safeguard the progress of domestic energy transition.

Despite its contributions, this study has several limitations. First, it focuses on the dynamics of energy prices in developed regions, where mature markets and well-established indices offer reliable data. However, emerging economies such as China, India, or Brazil have distinct energy structures, along with different policy frameworks. As a result, our findings may not generalize to these regions. Future studies should therefore conduct region-specific analyses and examine the factors influencing the interaction between fossil energy futures and clean energy stock prices. Second, the CPU index used in this study does not distinguish between supportive and restrictive climate policies. Future work could refine this measure to better capture the direction and content of policy signals. Additionally, incorporating technological and regulatory differences across regions would help uncover deeper mechanisms behind the evolving relationship between fossil energy and clean energy markets.

Author Contributions

Conceptualization, L.Y.; methodology, Y.Z.; software, Y.Z.; validation, L.Y., W.L. and Y.Z.; formal analysis, Y.Z.; investigation, Y.Z.; resources, L.Y.; data curation, Y.Z.; writing—original draft preparation, Y.Z.; writing—review and editing, W.L. and L.Y.; visualization, Y.Z.; funding acquisition, L.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Foundation of Liaoning Province Education Administration, grant number LJKR0050.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study were derived from the following resources available in the public domain: Daily data for the fossil energy futures: https://www.wind.com.cn/, accessed on 30 August 2025. Daily data for S&P Global Clean Energy Index (GCE): http://cn.investing.com/, accessed on 30 August 2025. Daily data for New Energy Global Innovation Index (NEX): https://wildershares.com/stock.php/, accessed on 30 August 2025. Daily data for Clean Energy Index (ECO): https://wildershares.com/stock.php/, accessed on 30 August 2025. Construct Physical Climate Risk (CRI) Index: EM-DAT International Disaster Database, https://public.emdat.be/, accessed on 30 August 2025.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Liu, H.; Yang, P.; He, Y.; Oxley, L.; Guo, P. Exploring the influence of the geopolitical risks on the natural resource price volatility and correlation: Evidence from DCC-MIDAS-X model. Energy Econ. 2024, 129, 107204. [Google Scholar] [CrossRef]

- Yuan, D.; Li, S.; Li, R.; Zhang, F. Economic policy uncertainty, oil and stock markets in BRIC: Evidence from quantiles analysis. Energy Econ. 2022, 110, 105972. [Google Scholar] [CrossRef]

- Siddique, A.; Nobanee, H.; Hasan, B.; Uddin, G.S.; Hossain, N.; Park, D. How do energy markets react to climate policy uncertainty? Fossil vs. renewable and low-carbon energy assets. Energy Econ. 2023, 128, 107195. [Google Scholar] [CrossRef]

- Hu, Z.; Borjigin, S. The amplifying role of geopolitical Risks, economic policy Uncertainty, and climate risks on Energy-Stock market volatility spillover across economic cycles. N. Am. J. Econ. Financ. 2024, 71, 102114. [Google Scholar] [CrossRef]

- Ren, X.; Li, J.; He, F.; Lucey, B. Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renew. Sustain. Energy Rev. 2022, 173, 113058. [Google Scholar] [CrossRef]

- Xie, B.; Xie, B. Assessing the impact of climate policy on energy security in developed economies. Int. Rev. Econ. Financ. 2024, 90, 265–282. [Google Scholar] [CrossRef]

- Gong, X.; Xu, J. Geopolitical risk and dynamic connectedness between commodity markets. Energy Econ. 2022, 110, 106028. [Google Scholar] [CrossRef]

- Geng, J.-B.; Liu, C.; Ji, Q.; Zhang, D. Do oil price changes really matter for clean energy returns? Energy Rev. 2021, 150, 111429. [Google Scholar] [CrossRef]

- Xi, Y.; Zeng, Q.; Lu, X.; Huynh, T.L. Oil and renewable energy stock markets: Unique role of extreme shocks. Energy Econ. 2022, 109, 105995. [Google Scholar] [CrossRef]

- Zhang, H.; Hong, H.; Ding, S. The role of climate policy uncertainty on the long-term correlation between crude oil and clean energy. Energy 2023, 284, 128529. [Google Scholar] [CrossRef]

- Liu, J. Ripple Effects of Climate Policy Uncertainty: Risk Spillovers between Traditional Energy and Green Financial Markets. Sustainability 2025, 17, 5500. [Google Scholar] [CrossRef]

- Huang, B.; Punzi, M.T.; Wu, Y. Do banks price environmental transition risks? Evidence from a quasi-natural experiment in China. J. Corp. Financ. 2021, 69, 101983. [Google Scholar] [CrossRef]

- Dietz, S.; Stern, N. Endogenous Growth, Convexity of Damage and Climate Risk: How Nordhaus’ Framework Supports Deep Cuts in Carbon Emissions. Econ. J. 2015, 125, 574–620. [Google Scholar] [CrossRef]

- Li, S.; Pan, Z. Climate transition risk and bank performance: Evidence from China. J. Environ. Manag. 2022, 323, 116275. [Google Scholar] [CrossRef]

- Guo, L.; Kuang, H.; Ni, Z. A step towards green economic policy framework: Role of renewable energy and climate risk for green economic recovery. Econ. Chang. Restruct. 2023, 56, 3095–3115. [Google Scholar] [CrossRef]

- Gavriilidis, K. Measuring Climate Policy Uncertainty; SSRN Scholarly Paper 3847388; Social Science Research Network: Rochester, NY, USA, 2021. [Google Scholar] [CrossRef]

- Juhola, S.; Laurila, A.; Groundstroem, F.; Klein, J. Climate risks to the renewable energy sector: Assessment and adaptation within energy companies. Bus. Strat. Environ. 2024, 33, 1906–1919. [Google Scholar] [CrossRef]

- Cao, S. Risk Spillover Effects in Energy Markets Under Climate Change: Evidence from the Chinese Market. Sustainability 2025, 17, 2126. [Google Scholar] [CrossRef]

- Bua, G.; Kapp, D.; Ramella, F.; Rognone, L. Transition versus physical climate risk pricing in European financial markets: A text-based approach. Eur. J. Finance 2024, 30, 2076–2110. [Google Scholar] [CrossRef]

- Li, Z.Z.; Su, C.-W.; Moldovan, N.-C.; Umar, M. Energy consumption within policy uncertainty: Considering the climate and economic factors. Renew. Energy 2023, 208, 567–576. [Google Scholar] [CrossRef]

- Yi, D. Global Climate Risk Perception and Its Dynamic Impact on the Clean Energy Market: New Evidence from Contemporaneous and Lagged R2 Decomposition Connectivity Approaches. Sustainability 2025, 17, 3596. [Google Scholar] [CrossRef]

- Rong, X.; Chen, H.; Liu, S. Nonlinear impact of climate risks on renewable energy stocks in China: A moderating effects study. Int. Rev. Financ. Anal. 2024, 96, 103613. [Google Scholar] [CrossRef]

- Liang, C.; Umar, M.; Ma, F.; Huynh, T.L. Climate policy uncertainty and world renewable energy index volatility forecasting. Technol. Forecast. Soc. Chang. 2022, 182, 121810. [Google Scholar] [CrossRef]

- Brundiers, K.; Eakin, H.C. Leveraging Post-Disaster Windows of Opportunities for Change towards Sustainability: A Framework. Sustainability 2018, 10, 1390. [Google Scholar] [CrossRef]

- Tumala, M.M.; Salisu, A.; Nmadu, Y.B. Climate change and fossil fuel prices: A GARCH-MIDAS analysis. Energy Econ. 2023, 124, 106792. [Google Scholar] [CrossRef]

- Jin, Y.; Zhao, H.; Bu, L.; Zhang, D. Geopolitical risk, climate risk and energy markets: A dynamic spillover analysis. Int. Rev. Financ. Anal. 2023, 87, 102597. [Google Scholar] [CrossRef]

- Albanese, M.; Caporale, G.M.; Colella, I.; Spagnolo, N. The effects of physical and transition climate risk on stock markets: Some multi-Country evidence. Int. Econ. 2025, 181, 100571. [Google Scholar] [CrossRef]

- Gu, Q.; Li, S.; Tian, S.; Wang, Y. Climate, geopolitical, and energy market risk interconnectedness: Evidence from a new climate risk index. Finance Res. Lett. 2023, 58, 104392. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Do climate change risks affect the systemic risk between the stocks of clean energy, electric vehicles, and critical minerals? Analysis under changing market conditions. Energy Econ. 2024, 138, 107832. [Google Scholar] [CrossRef]

- Bouri, E.; Rognone, L.; Sokhanvar, A.; Wang, Z. From climate risk to the returns and volatility of energy assets and green bonds: A predictability analysis under various conditions. Technol. Forecast. Soc. Chang. 2023, 194, 122682. [Google Scholar] [CrossRef]

- Gong, X.; Lai, P.; He, M.; Wen, D. Climate risk and energy futures high frequency volatility prediction. Energy 2024, 307, 132466. [Google Scholar] [CrossRef]

- Iyke, B.N. Climate change, energy security risk, and clean energy investment. Energy Econ. 2024, 129, 107225. [Google Scholar] [CrossRef]

- Ferrer, R.; Shahzad, S.J.H.; López, R.; Jareño, F. Time and frequency dynamics of connectedness between renewable energy stocks and crude oil prices. Energy Econ. 2018, 76, 1–20. [Google Scholar] [CrossRef]

- Kyritsis, E.; Serletis, A. Oil Prices and the Renewable Energy Sector. Energy J. 2019, 40, 337–364. [Google Scholar] [CrossRef]

- Sahu, P.K.; Solarin, S.A.; Al-Mulali, U.; Ozturk, I. Investigating the asymmetry effects of crude oil price on renewable energy consumption in the United States. Environ. Sci. Pollut. Res. 2022, 29, 817–827. [Google Scholar] [CrossRef] [PubMed]

- Xiuzhen, X.; Zheng, W.; Umair, M. Testing the fluctuations of oil resource price volatility: A hurdle for economic recovery. Resour. Policy 2022, 79, 102982. [Google Scholar] [CrossRef]

- Tang, C.; Aruga, K.; Hu, Y. The Dynamic Correlation and Volatility Spillover among Green Bonds, Clean Energy Stock, and Fossil Fuel Market. Sustainability 2023, 15, 6586. [Google Scholar] [CrossRef]

- Ding, Q.; Huang, J.; Zhang, H. Time-frequency spillovers among carbon, fossil energy and clean energy markets: The effects of attention to climate change. Int. Rev. Financ. Anal. 2022, 83, 102222. [Google Scholar] [CrossRef]

- Mohammad, N.; Ishak, W.W.M.; Mustapa, S.I.; Ayodele, B.V. Natural Gas as a Key Alternative Energy Source in Sustainable Renewable Energy Transition: A Mini Review. Front. Energy Res. 2021, 9, 625023. [Google Scholar] [CrossRef]

- Umar, M.; Farid, S.; Naeem, M.A. Time-frequency connectedness among clean-energy stocks and fossil fuel markets: Comparison between financial, oil and pandemic crisis. Energy 2022, 240, 122702. [Google Scholar] [CrossRef]

- Kanamura, T. A model of price correlations between clean energy indices and energy commodities. J. Sustain. Financ. Investig. 2020, 12, 319–359. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Awosusi, A.A.; Bekun, F.V.; Altuntaş, M. Coal energy consumption beat renewable energy consumption in South Africa: Developing policy framework for sustainable development. Renew. Energy 2021, 175, 1012–1024. [Google Scholar] [CrossRef]