Differential Game Model of Fresh Supply Chain, Considering Preservation Efforts and Member Behavior Under Government Subsidies

Abstract

1. Introduction

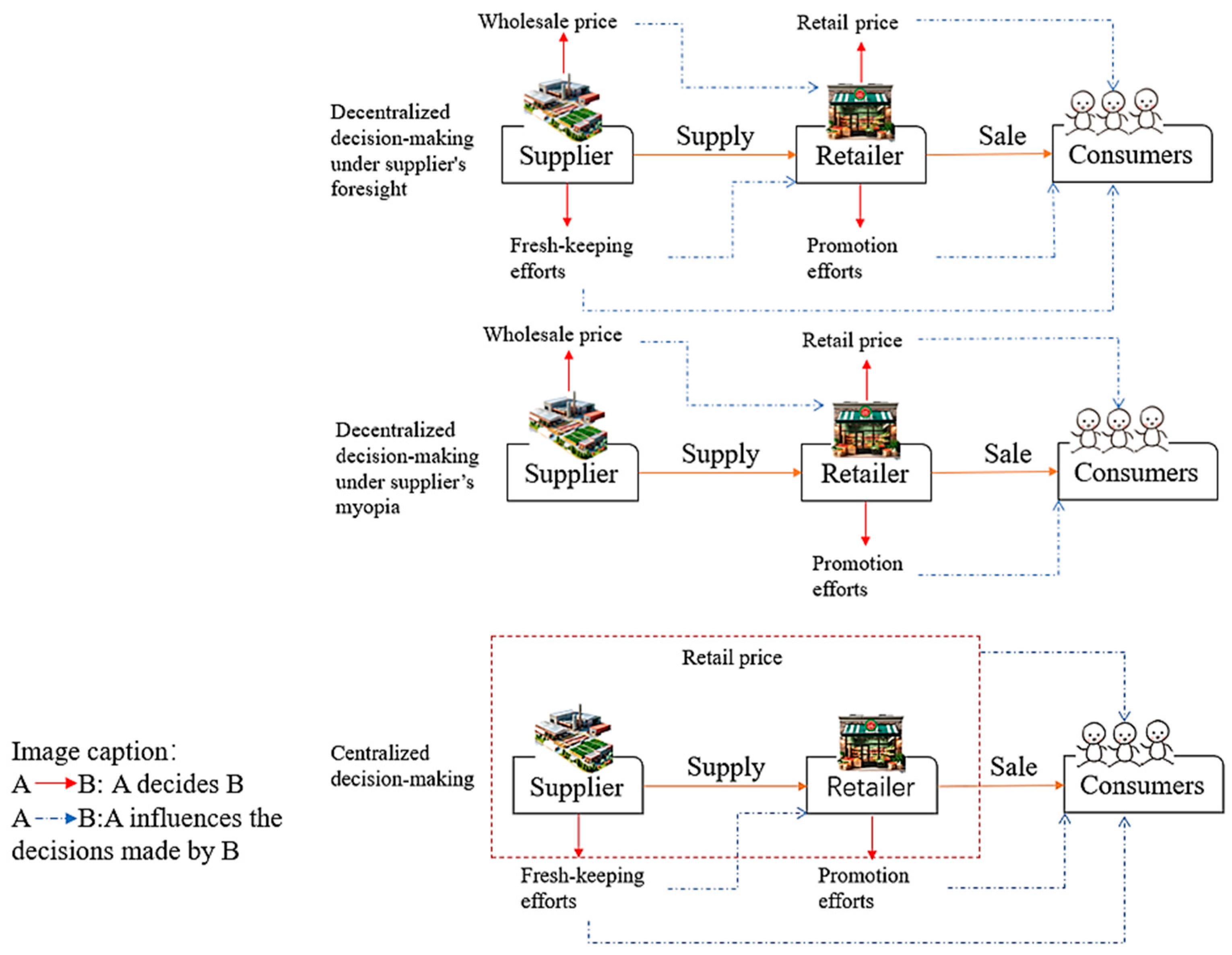

- This paper develops a two-echelon differential game model, encompassing the supplier and retailer, to analyze preservation efforts and participant conduct. Among them, the supplier can choose myopia or foresight behavior.

- This research analyzes how the supplier and retailer achieve optimal coordination through strategic decision-making in continuous-time systems, enabling rigorous analysis of time-dependent operational variables, and thus authentically replicating the inherent continuity and adaptive strategic interplay observed in actual market ecosystems.

- This paper models consumer preferences as state variables and analyzes their evolution in continuous time. This achieves dynamic consistency of the strategy, making it more realistic.

- Rather than simply considering preservation efforts, this paper will incorporate promotional efforts for research.

2. Literature Review

2.1. Research Status of Myopic and Foresighted Behavior

2.2. Key Determinants in the Fresh Supply Chain

2.2.1. Government Subsidies

2.2.2. Preservation Initiatives

2.2.3. Consumer Demand

2.3. Research Models of Fresh Supply Chains

3. Differential Game-Theoretic Model of Fresh Supply Chain

3.1. Problem Description

3.2. Model Assumptions

3.3. Analysis of Differential Game Models

3.3.1. Distributed Decision-Making Model Under Supplier’s Foresight

- (i)

- The optimal wholesale price for the supplier is as follows:

- (ii)

- The optimal retail price for the retailer is as follows:

- (iii)

- The supplier’s best preservation effort is as follows:

- (iv)

- The retailer’s best publicity effort is as follows:

- (v)

- The optimal consumer surplus is as follows:

- (vi)

- The optimal profits of the supplier and retailer at point are as follows:

- (vii)

- Under the equilibrium strategy, the state variables encompassing product freshness, consumer preferences, and brand equity are articulated as follows:

3.3.2. Decentralized Decision-Making in the Face of Supplier Myopia

- (i)

- The optimal wholesale price for the supplier is as follows:

- (ii)

- The optimal retail price for the retailer is as follows:

- (iii)

- The retailer’s best publicity effort is as follows:

- (iv)

- The optimal consumer surplus is as follows:

- (v)

- The optimal profits of the supplier and retailer at point are as follows:

- (vi)

- Under this strategy, the changes in product freshness, brand goodwill, and consumer preference are detailed below:

3.3.3. Centralized Decision-Making

- (i)

- The optimal retail price is as follows:

- (ii)

- The supplier’s best preservation effort is as follows:

- (iii)

- The retailer’s best publicity effort is as follows:

- (iv)

- The optimal consumer surplus is as follows:

- (v)

- The optimal profit of the supply at point is as follows:

- (vi)

- In the context of an equilibrium strategy, the state changes of product perishability, consumer preferences, and brand goodwill are as follows:

3.4. Comparison of the Results of Three Decision-Making Models

4. Numerical Simulation Analysis

4.1. Trajectory Analyses of Temporal Evolution

4.1.1. Analysis of Product Freshness Trajectory

4.1.2. Analysis of Consumer Preference Trajectory

4.1.3. Analysis of Goodwill Trajectory

4.1.4. Brief Summary

4.2. Examination of Determinants Influencing Member Strategies

4.2.1. The Impact of and on Preservation Efforts

4.2.2. Analysis of the Impact of Factors and on Retailers’ Promotional Efforts

4.2.3. Analysis of the Impact of Factors and on Supply Chain Profits

4.2.4. Analysis of the Impact of Factors and on Social Welfare

5. Conclusions

5.1. Main Conclusions

5.2. Research Shortcomings and Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

References

- Liu, J.; Chen, Z.P.; Consigli, G. Interval-based stochastic dominance: Theoretical framework and application to portfolio choices. Ann. Oper. Res. 2021, 307, 329–361. [Google Scholar] [CrossRef] [PubMed]

- Hyun, J.E.; Lee, S.Y. Blue light-emitting diodes as eco-friendly non-thermal technology in food preservation. Trends Food Sci. Technol. 2020, 105, 284–295. [Google Scholar] [CrossRef]

- Boxma, O.; Perry, D.; Stadje, W. Perishable inventories with random input: A unifying survey with extensions. Ann. Oper. Res. 2024, 332, 1069–1105. [Google Scholar] [CrossRef]

- Fang, X.; Yuan, F.J.; Cai, J.R. An optimized coordination model of freshness-keeping efforts and shelf service for fresh produce supply chain. Chin. J. Manag. Sci. 2023, 31, 142–152. [Google Scholar]

- Wu, Y.T.; Zhu, A.M. Research on the fresh-keeping cooperation strategy of fresh supply chain members under government subsidies. Syst. Eng. 2024, 1–12. [Google Scholar]

- Wu, S.; Li, B.; Li, Y.R. Advance selling decisions of retailer in dual channel of the fresh product supply chain. J. Syst. Eng. 2023, 38, 372–394. [Google Scholar]

- CCLC, National Agricultural Products Modern Logistics Engineering Technology Research Center. Wanwei Cold Chain; 2024 China Cold Chain Logistics Development Report; China Fortune Press: Beijing, China, 2024. [Google Scholar]

- Zhao, Z.; Cheng, Y. Coordination of fresh product supply chain with option contract considering freshness-keeping effort. Chin. J. Manag. Sci. 2024, 32, 258–269. [Google Scholar]

- Xiao, M.; Zhang, S.Y. Research on fresh supply chain preservation effort and advertising cost sharing considering risk attitude. J. Hefei Univ. Technol. 2023, 46, 1564–1572. [Google Scholar]

- Dan, B.; Lei, T.; Zhang, X.M.; Liu, M.L.; Ma, S.X. Modeling of the subsidy policy in fresh produce wholesale markets under yield uncertainty. Econ. Model. 2023, 126, 106413. [Google Scholar] [CrossRef]

- Zhu, J.H.; Zhang, X.M.; Dan, B. Combined policy of fiscal subsidies and tax reduction in fresh produce supply chain. Syst. Eng. Theory Pract. 2024, 44, 2557–2575. [Google Scholar]

- Benchekroun, H.; Martin-Herran, G.; Taboubi, S. Could myopic pricing be a strategic choice in marketing channels? A game theoretic analysis. J. Econ. Dyn. Control 2009, 33, 1682–1698. [Google Scholar] [CrossRef]

- Yu, M.Y.; Lu, K.F.; Ruan, Y.P. Supply chain network location and enterprise competitive position. Syst. Eng. Theory Pract. 2022, 42, 1796–1810. [Google Scholar]

- He, Y.; Hao, X.L. Empowerment or disempowerment: Supply chain digitization and corporate ESG performance. Resour. Ecol. Manag. 2025, 46, 96–118. [Google Scholar]

- Liu, Y.; Zhang, J.X.; Zhang, S.C.; Liu, G.W. Prisoner’s dilemma on behavioral choices in the presence of sticky prices: Farsightedness vs myopia. Int. J. Prod. Econ. 2017, 191, 128–142. [Google Scholar] [CrossRef]

- Huang, Z.; Bai, P. Dynamic cooperative promotion in the presence of private brand introduction and retailer myopic behavior. Dyn. Games Appl. 2024, 14, 1131–1159. [Google Scholar] [CrossRef]

- Wen, Y.; Yu, X.Y.; Hu, J.S. R&D innovation strategy and behavior choice of competition drug supply chain. J. Shandong Univ. 2023, 58, 18–31. [Google Scholar]

- Wu, S.C.; Wang, H.; Guo, Y.; Fan, Y.J. Supply chain concentration, financing constraints, and carbon performance. Sustainability 2024, 16, 1354. [Google Scholar] [CrossRef]

- Arash, A.; Imad Taher, L.; Bita, M. The impact of managerial psychological characteristics on the supply chain management efficiency. TQM J. 2025, 37, 150–170. [Google Scholar]

- He, Y.; Chen, L.D.; Xu, Q.Y. Optimal pricing decisions for a global fresh product supply chain in the blockchain technology era. Int. J. Logist. Res. Appl. 2021, 27, 649–666. [Google Scholar] [CrossRef]

- Di, W.; Tian, X.Y.; Guo, M.C. Pricing decision and channel selection of fresh agricultural products dual-channel supply chain based on blockchain. PLoS ONE 2024, 19, e0297484. [Google Scholar]

- Jiang, Y.C.; Cao, J.X.; Zhu, H.J. Research on inventory control and pricing decisions in the supply chain of fresh agricultural products under the advertisement delay effect. IEEE Access 2024, 12, 197468–197487. [Google Scholar]

- Guan, Z.M.; Mou, Y.X.; Sun, M.H. Hybrid robust and stochastic optimization for a capital-constrained fresh product supply chain integrating risk-aversion behavior and financial strategies. Comput. Ind. Eng. 2022, 169, 108224. [Google Scholar] [CrossRef]

- Lu, Z.G.; Yu, J.X. An OGSM-based multi-objective optimization model for partner selection in fresh produce supply chain considering carbon emissions. Comput. Ind. Eng. 2024, 194, 110402. [Google Scholar] [CrossRef]

- Zhang, D.F.; Shen, Z.F.; Li, Y.L. Requirement analysis and service optimization of multiple category fresh products in online retailing using importance-Kano analysis. J. Retail. Consum. Serv. 2023, 72, 103253. [Google Scholar] [CrossRef]

- Feng, Z.; Jin, P.; Li, G. Investment decision of blockchain technology in fresh food supply chains considering misreporting behavior. Sustainability 2023, 15, 7421. [Google Scholar] [CrossRef]

- Liu, Y.H.; Ma, D.Q.; Hu, J.S.; Zhang, Z.Y. Sales mode selection of fresh food supply chain based on blockchain technology under different channel competition. Comput. Ind. Eng. 2021, 162, 107730. [Google Scholar] [CrossRef]

- Yuan, H.P.; Zhang, L.; Cao, B.B.; Chen, W.W. Optimizing traceability scheme in a fresh product supply chain considering product competition in blockchain era. Expert Syst. Appl. 2024, 258, 125127. [Google Scholar] [CrossRef]

- Yan, B.; Liu, Y.P.; Fan, J. Two-echelon fresh product supply chain with different transportation modes. Ann. Oper. Res. 2022, 1–24. [Google Scholar] [CrossRef]

- Zeng, M.; Wu, Y.X.; Xing, X.L.; Tang, W.J.; Xu, H.Y. Coordinating principal-agent and incentive strategy of cold chain logistics service in fresh food supply chain. PLoS ONE 2024, 19, e0306976. [Google Scholar] [CrossRef]

- Siraj, Z.R. Optimizing supply chain management of fresh e-commerce agri-consumer products using energy-efficient vehicle routing. IEEE Trans. Consum. Electr. 2024, 70, 1685–1693. [Google Scholar]

- Wang, Y.Y.; Wu, Q.C.; Cheng, T.C.E.; Sun, Y.L. Supply chain modelling considering blockchain improvement and publicity with fairness concern. J. Intell. Manuf. 2025, 36, 681–702. [Google Scholar] [CrossRef]

- Wang, G.; Shen, J.F. Decision-making of fresh supply chain based on cost-sharing contract. J. Cent. China Norm. Univ. 2019, 53, 977–986. [Google Scholar]

- Wang, W.B.; Zhu, A.M.; Yu, L.J.; Wer, H.J. Research on cooperative advertising strategies for dual channel supply chain of fresh agricultural products considering carbon reduction efficiency under retailer leadership. PLoS ONE 2024, 19, e0303525. [Google Scholar]

- Guo, F.; Zhang, T.; Huang, X.; Zhong, Y. Government subsidy strategies considering greenness on agricultural product e-commerce supply chain. Mathematics 2023, 11, 1662. [Google Scholar] [CrossRef]

- Wu, Z.X.; Zhu, J.L. Optimal strategies for contract farming supply chain with government subsidies under e-commerce assistance to farmers. PLoS ONE 2024, 19, e0311490. [Google Scholar] [CrossRef]

- Xu, Y.; Tian, Y.; Pang, C.; Tang, H. Manufacturer vs. Retailer: A comparative analysis of different government subsidy strategies in a dual-channel supply chain considering green quality and channel preferences. Mathematics 2024, 12, 1433. [Google Scholar] [CrossRef]

- Shi, L.G.; Pang, T.; Peng, H.J.; Feng, X. Green technology outsourcing for agricultural supply chains with government subsidies. J. Clean. Prod. 2024, 436, 140674. [Google Scholar] [CrossRef]

- Guo, L.B.; Zhang, Q.Q.; Wu, J.; Gonzalez, E.D.R.S. An evolutionary game model of manufacturers and consumers’ behavior strategies for green technology and government subsidy in supply chain platform. Comput. Ind. Eng. 2024, 189, 109918. [Google Scholar] [CrossRef]

- Zhang, R.R.; Ma, W.M.; Liu, J.J. Impact of government subsidy on agricultural production and pollution: A game-theoretic approach. J. Clean. Prod. 2021, 285, 124806. [Google Scholar] [CrossRef]

- Song, H.X.; Li, Q.X. Decision-making in closed-loop supply chains: Effects of government subsidies and risk aversion. Int. Rev. Financ. Anal. 2024, 96, 103566. [Google Scholar] [CrossRef]

- Zhang, R.; Huang, Z.J.; Liu, B.; Wang, J.L. Freshness-keeping efforts and value-added service choice in fresh food supply chain. Comput. Ind. Eng. 2024, 190, 110063. [Google Scholar] [CrossRef]

- Liu, M.L.; Dan, B.; Zhang, S.G.; Ma, S.X. Information sharing in an E-tailing supply chain for fresh produce with freshness-keeping effort and value-added service. Eur. J. Oper. Res. 2021, 290, 572–584. [Google Scholar] [CrossRef]

- Feng, Y.G.; Hu, Y.; He, L. Research on coordination of fresh agricultural product supply chain considering fresh-keeping effort level under retailer risk avoidance. Discrete Dyn. Nat. Soc. 2021, 2021, 1–15. [Google Scholar] [CrossRef]

- Chen, X.; Li, J.; Wang, Z. Equilibrium decisions for fresh product supply chain considering consumers’ freshness preference. Netw. Spat. Econ. 2023, 23, 771–797. [Google Scholar] [CrossRef]

- Yang, Y.; Yao, G.X. Fresh-keeping decision and coordination of fresh agricultural product supply chain considering carbon cap-and-trade under different dominance. J. Syst. Sci. Syst. Eng. 2024, 33, 30–51. [Google Scholar] [CrossRef]

- Liao, Z.Z.Y.; Li, C.L.; Lu, L.; Luo, X.C. The improvement strategy of fresh produce supply chain resilience based on extenics. PLoS ONE 2024, 19, e0309008. [Google Scholar] [CrossRef]

- Yang, M.Y.; Qu, S.J.; Ji, Y.; Abdoulrahaman, D.B. Vulnerability of fresh agricultural products supply chain: Assessment, interrelationship analysis and control strategies. Socio-Econ. Plan. Sci. 2024, 94, 101928. [Google Scholar] [CrossRef]

- Zhang, H.; Yan, J.N.; Wang, L.L. Hybrid tabu-grey wolf optimizer algorithm for enhancing fresh cold-chain logistics distribution. PLoS ONE 2024, 19, e0306166. [Google Scholar] [CrossRef]

- Wang, Y.; Gao, B. Dual-channel supply chain of agricultural products under centralised and decentralised decision-making. Appl. Sci. 2024, 14, 8039. [Google Scholar] [CrossRef]

- Ran, W.; Chen, Y. Fresh produce supply chain coordination based on freshness preservation strategy. Sustainability 2023, 15, 8184. [Google Scholar] [CrossRef]

- Zhao, H.Y.; Yang, J. Evolutionary game analysis of stakeholders’ decision-making behavior in agricultural data supply chain. Front. Phys. 2024, 11, 1–17. [Google Scholar] [CrossRef]

- Cheng, Y.K.; Wang, X.X.; Tian, X.M.; Chen, J.M. Study of the Cooperation between E-commerce Platform and Merchants Based on Differential Game. Oper. Res. Manag. Sci. 2023, 32, 56–63. [Google Scholar]

- Isaacs, R. Differential Games; John Wiley Sons: New York, NY, USA, 1965. [Google Scholar]

- Mu, X.P.; Liu, J.J.; Pu, Y.T. Differential games in the supply chain of innovative products with consumer purchase regret induced returns. PLoS ONE 2024, 19, e0302154. [Google Scholar] [CrossRef]

- Shi, T.; Xiao, X.; Liu, G.F. Dynamic coordination strategy of fresh supply chain based on compound contract mechanism. J. Chongqing Univ. Technol. 2020, 34, 228–237. [Google Scholar]

- Zhang, K.J.; Ma, M.Q. Differential game model of a fresh dual-channel supply chain under different return modes. IEEE Access 2021, 9, 8888–8901. [Google Scholar] [CrossRef]

- Liu, Z.; Huang, Y.Q.; Shang, W.L.; Zhao, Y.J.; Yang, Z.L.; Zhao, Z. Precooling energy and carbon emission reduction technology investment model in a fresh food cold chain based on a differential game. Appl. Energy 2022, 326, 119945. [Google Scholar] [CrossRef]

- De Zeeuw, A. A crash course in differential games and applications. Environ. Resour. Econ. 2024, 87, 1521–1544. [Google Scholar] [CrossRef]

- Li, X.R.; Ou Yang, A.W. A study on pricing and coordination of online fresh produce supply chain considering time and temperature. Ind. Eng. Manag. 2024, 29, 32–39. [Google Scholar]

- Dong, Z.N.; Zhou, X.J.; Lin, Q. Coordination of fresh products supply chain with freshness-keeping effort. J. Syst. Eng. 2022, 37, 362–374. [Google Scholar]

- Wang, W.L.; He, Z.Y.; Zhang, S.X. Joint decision of freshness-keeping effort and promotion effort in a dual-channel fresh produce supply chain from a dynamic perspective. Chin. J. Manag. Sci. 2023, 1–16. [Google Scholar]

- Luo, M.; Zhou, G.H. Research on temperature control input of three-level supply chain of fresh agricultural products based on differential game. Oper. Res. Manag. Sci. 2024, 33, 64–68. [Google Scholar]

- Nerlove, M.; Arrow, K.J. Optimal advertising policy under dynamic conditions. Economica 1962, 114, 129–142. [Google Scholar] [CrossRef]

- Yao, F.J.; Xiao, H.; Gao, Y.; Gao, H.W. A Differential Game Study of Supply Chain Considering Consumers’ Green preference and Member’s Behavior under Cap-and-trade Policy. Chin. J. Manag. Sci. 2024, 32, 231–241. [Google Scholar]

- Su, B.W.; Zheng, Q. Supply Chain Coordination of Fresh Products with Government Subsidy in the Live-streaming E-commerce. Oper. Res. Manag. 2024, 33, 71–77. [Google Scholar]

- Panda, S.; Mohan Modak, N.; Cárdenas-Barrón, L.E. Coordinating a socially responsible closed-loop supply chain with product recycling. Int. J. Prod. Econ. 2017, 188, 11–21. [Google Scholar] [CrossRef]

- Guo, W.Q.; Liang, Y.Z.; Ming, L. Dynamic strategy for low-carbon supply chain considering retailers competition and technological innovation. Heliyon 2023, 10, e27474. [Google Scholar] [CrossRef]

- Li, Z.P.; Wang, J.J. High-Quality Service Capacity Reallocation Decision and Profit-Sharing Coordination Scheme Design in the Hierarchical Healthcare Systems. Chin. J. Manag. Sci. 2023, 31, 205–217. [Google Scholar]

- Huang, X.Q.; Ye, Q.L.; Fu, H.J. Identification and Measurement of Key Factors of Energy Security Based on Dual Perspectives; Central South University Press: Changsha, China, 2024; Volume 10, pp. 106–138. [Google Scholar]

- Wang, H.; Bai, C.G.; Zhang, C. The optimal inventory policy of perishable retailers considering regret behavior of strategic consumers. J. Ind. Eng. Eng. Manag. 2024, 38, 251–270. [Google Scholar]

| References | Focus | Dynamic Game | Decision-Maker Interaction | Promotion Efforts | Myopia and Foresighted Behavior | Efforts to Preserve Freshness |

|---|---|---|---|---|---|---|

| Zhang et al. [49] | Hybrid taboo gray wolf optimizer algorithm | No | No | No | No | Yes |

| Ran et al. [51] | Stackelberg | No | Yes | No | No | Yes |

| Zhao et al. [52] | Evolutionary game | No | Yes | No | No | No |

| Mu et al. [55] | Differential game | Yes | Yes | No | Yes | No |

| Shi et al. [56] | Differential game | Yes | Yes | Yes | No | Yes |

| Zhang et al. [57] | Differential game | Yes | Yes | No | No | Yes |

| Liu et al. [58] | Differential game | Yes | Yes | No | No | Yes |

| This paper | Differential game | Yes | Yes | Yes | Yes | Yes |

| Notations | Descriptions |

|---|---|

| Parameters | |

| Impact coefficient of promotional efforts on consumer preference | |

| Retailer’s efforts to promote their products | |

| Supplier’s level of preservation efforts | |

| Impact coefficient of preservation efforts on product freshness | |

| Freshness reduction rate | |

| Direct conversion coefficient between preservation efforts and costs | |

| Conversion coefficient between promotion and advertising costs | |

| Supplier unit production cost | |

| Variables | |

| Cost of supplier’s preservation efforts at point | |

| Retailer’s product demand at point | |

| Goodwill of product at point | |

| Freshness of product at point | |

| Promotional cost of retailer at point | |

| Consumer preference at point | |

| Retail price established at point | |

| Wholesale price established at point | |

| Decision variables | |

| Overall profit of fresh supply chain under centralized decision-making | |

| Profit of fresh food supplier (retailer) under decentralized decision-making | |

| Type | Symbols |

|---|---|

| Demand parameters | , , |

| Cost parameters | , |

| Parameters of goodwill dynamic equation | , , , |

| Dynamic equation parameters of product freshness | , |

| Parameters of dynamic equation of consumer preference | , , |

| Discount rate |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ren, H.; Xu, Y.; Han, L.; Huang, X. Differential Game Model of Fresh Supply Chain, Considering Preservation Efforts and Member Behavior Under Government Subsidies. Sustainability 2025, 17, 4820. https://doi.org/10.3390/su17114820

Ren H, Xu Y, Han L, Huang X. Differential Game Model of Fresh Supply Chain, Considering Preservation Efforts and Member Behavior Under Government Subsidies. Sustainability. 2025; 17(11):4820. https://doi.org/10.3390/su17114820

Chicago/Turabian StyleRen, Haiping, Yuanda Xu, Lian Han, and Xiaoqing Huang. 2025. "Differential Game Model of Fresh Supply Chain, Considering Preservation Efforts and Member Behavior Under Government Subsidies" Sustainability 17, no. 11: 4820. https://doi.org/10.3390/su17114820

APA StyleRen, H., Xu, Y., Han, L., & Huang, X. (2025). Differential Game Model of Fresh Supply Chain, Considering Preservation Efforts and Member Behavior Under Government Subsidies. Sustainability, 17(11), 4820. https://doi.org/10.3390/su17114820