Addressing Individual Perception: Extending the Technology Acceptance Model to the Interim Payment Method in Construction Projects

Abstract

1. Introduction

2. Literature Review

2.1. Causes and Countermeasures of Payments Problems

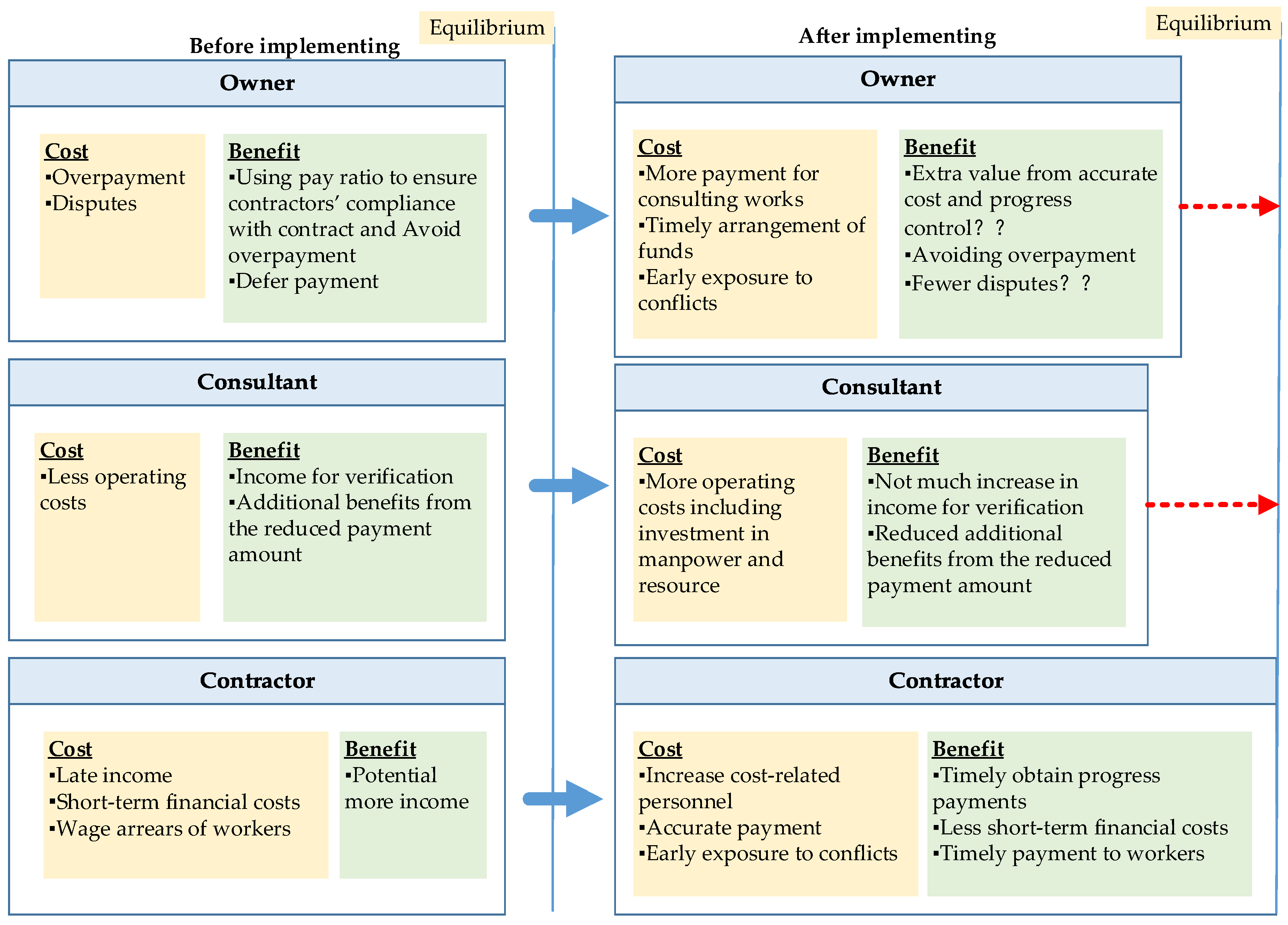

2.2. Increasing Complexity in the Interim Payment of Construction Projects

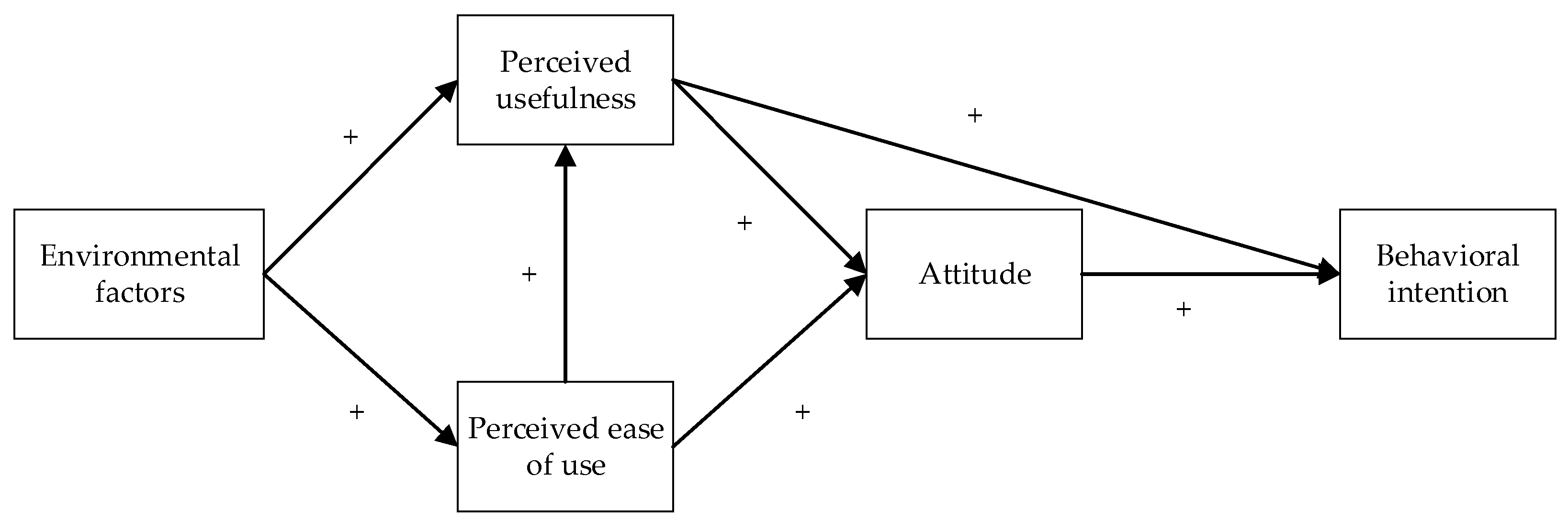

3. Conceptual Framework and Hypotheses Development

3.1. Critical Factors

3.1.1. Environmental Factors

3.1.2. Perceived Ease of Use

| Factor | Code | Measurement | Reference |

|---|---|---|---|

| Environmental factors (EF) | EF1 | Promotion policies of the government prompt me to use the interim payment method. | European Commission [8], Expert interview in 2021, Howard, et al. [21], Peters, et al. [4] |

| EF2 | The actual use or recommendations from peers prompt me to use the interim payment. | ||

| EF3 | The support from seniors or managers prompts me to use the interim payment. | ||

| EF4 | The client’s requirement forces me to use the interim payment. | ||

| Perceived ease of use (PEOU) | PEOU1 | The pricing method of the interim payment method is simpler than that of the as-built drawing-based method. | Im, et al. [38], Howard, et al. [21] |

| PEOU2 | The settlement process of the interim payment method is simpler than that of the as-built drawing-based method. | ||

| PEOU3 | The requirements for workability are lower in the interim payment method. | ||

| PEOU4 | With the increase in utilization rate, the interim payment method becomes easier to use. | Expert interview in 2021, Peters, et al. [4], Abdul-Rahman, et al. [9], Nayan, et al. [36], Wang, et al. [16] | |

| PEOU5 | The interim payment method can be easily learned. | ||

| PEOU6 | My company is able to prepare the project funds and make payments according to the interim payment amount (owner). | ||

| I am able to apply for progress payment using the interim payment method (contractor). | |||

| I am able to verify the progress payment made by the interim payment method and suggest the owner adopt the interim payment method (consulting enterprise). | |||

| My company or I have the ability to apply the interim payment method (other enterprises). | |||

| Perceived usefulness (PU) | PU1 | The interim payment method can bring the company extra value because it can accurately control the cost and match the cost with the progress and quality of the project (owner). | Nanayakkara, et al. [12], Kennedy [27] |

| The interim payment method can help us to timely obtain progress payments matching with project progress and cost expenditure (contractor). | Ansah [23], Odeyinka and Kaka [39], Euginie [40] | ||

| Undertaking projects with the interim payment method can improve the cost consulting capability and bring the company or me more business and profits (consulting enterprise). | Howard, et al. [21], Nayan, et al. [36] | ||

| Applying the interim payment method can improve the workability/work experience/cost control ability etc. (other enterprises). | Im, et al. [38] | ||

| PU2 | The interim payment method can improve the accuracy of settlement results. | Expert interview in 2021 | |

| PU3 | The interim payment method can reduce payment-related contradictions or disputes. | Euginie [40], Chan and Suen [26] | |

| PU4 | The interim payment method can reduce repetitive work and improve settlement efficiency. | Euginie [40], Expert interview in 2021 | |

| PU5 | The interim payment method can bring more profits. | Marchewka and Kostiwa [41] | |

| Attitude (AT) | AT1 | It is a good idea to use the interim payment method. | Howard, et al. [21], Expert interview in 2021 |

| AT2 | Using the interim payment method makes my work more fulfilling and meaningful. | ||

| AT3 | Using the interim payment method makes my work process more interesting. | ||

| AT4 | Using the interim payment method is necessary. | ||

| AT5 | Compared with other settlement methods, I prefer the interim payment method. | ||

| Behavioral intention (BI) | BI1 | I want to try the interim payment method in future projects in the next 36 months. | Howard, et al. [21] |

| BI2 | I expect that my future projects will adopt the interim payment method in the next 36 months. | ||

| BI3 | I plan to use the interim payment method in future projects in the next 36 months. |

3.1.3. Perceived Usefulness

3.1.4. Attitude

3.1.5. Behavioral Intention

3.2. Conceptual Framework and Hypotheses Development

4. Research Method and Data Presentation

4.1. Sampling and Measurements

4.2. Descriptive Results of Collected Data

5. Acceptance Analysis and Model Evaluation

5.1. Acceptance Rate Analysis

5.2. Measurement Model Evaluation

5.3. Structural Model Evaluation

6. Discussion

6.1. Impeding Effect of Difficulty in Use

6.2. Incentive Effect of Perceived Usefulness

6.3. Incentive Effect of Environmental Factors and Attitude

7. Conclusions and Recommendations

7.1. Conclusions

7.2. Theoretical and Practical Contribution

7.3. Limitations and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- PAYAPPS. Late Payments in Construction-the Supply Chain Domino Effect. Available online: https://uk.payapps.com/blog/late-payments-in-construction-the-supply-chain-domino-effect# (accessed on 4 October 2022).

- Horgan, R. UK Contractors Report Increase in Late Payments. Available online: https://www.constructionnews.co.uk/contractors/uk-contractors-report-increase-in-late-payments-21-03-2022/ (accessed on 4 October 2022).

- Zhang, Y.; Fang, C.; Sun, P. Analysis on the operation of eight construction central enterprises. Constr. Archit. 2020, 19, 26–30. (In Chinese) [Google Scholar]

- Peters, E.; Subar, K.; Martin, H. Late payment and nonpayment within the construction industry: Causes, effects, and solutions. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2019, 11, 04519013. [Google Scholar] [CrossRef]

- Ramachandra, T.; Rotimi, J.O.B. Mitigating payment problems in the construction industry through analysis of construction payment disputes. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2015, 7, A4514005. [Google Scholar] [CrossRef]

- Maritz, M.J. What are the legal remedies available to contractors and consultants to enforce payment? J. S. Afr. Inst. Civ. Eng. 2012, 54, 27–35. [Google Scholar]

- El-Adaway, I.; Fawzy, S.; Burrell, H.; Akroush, N. Studying payment provisions under national and international standard forms of contracts. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2017, 9, 04516011. [Google Scholar] [CrossRef]

- European Commission. European Construction Sector Observatory-Late Payment in the Construction Sector; European Commission: Brussels, Belgium, 2020; p. 64.

- Abdul-Rahman, H.; Kho, M.; Wang, C. Late payment and nonpayment encountered by contracting firms in a fast-developing economy. J. Prof. Issues Eng. Ed. Pract. 2014, 140, 04013013. [Google Scholar] [CrossRef]

- Ramachandra, T.; BamideleRotimi, J.O. Causes of payment problems in the New Zealand construction industry. Constr. Econ. Build. 2015, 15, 43–55. [Google Scholar] [CrossRef]

- Das, M.; Luo, H.; Cheng, J.C. Securing interim payments in construction projects through a blockchain-based framework. Autom. Constr. 2020, 118, 103284. [Google Scholar] [CrossRef]

- Nanayakkara, S.; Perera, S.; Senaratne, S.; Weerasuriya, G.T.; Bandara, H.M.N.D. Blockchain and smart contracts: A solution for payment issues in construction supply chains. Informatics 2021, 8, 36. [Google Scholar] [CrossRef]

- Wu, L.; Lu, W.; Xu, J. Blockchain-based smart contract for smart payment in construction: A focus on the payment freezing and disbursement cycle. Front. Eng. Manag. 2022, 9, 177–195. [Google Scholar] [CrossRef]

- Ramachandra, T.; Rotimi, J.O. The nature of payment problems in the New Zealand construction industry. Australas. J. Constr. Econ. Build. 2011, 11, 22–33. [Google Scholar] [CrossRef]

- Sambasivan, M.; Soon, Y.W. Causes and effects of delays in Malaysian construction industry. Int. J. Proj. Manag. 2007, 25, 517–526. [Google Scholar] [CrossRef]

- Wang, P.; Wang, K.; Huang, Y.; Zhu, J.; Fenn, P.; Zhang, Y. Payment Issues in China’s Construction Industry: Nature, Causes, and a Predictive Model. J. Constr. Eng. Manag. 2022, 149, 04022144. [Google Scholar] [CrossRef]

- Zhang, L.; Fenn, P.; Fu, Y. To insist or to concede? Contractors’ behavioural strategies when handling disputed claims. Eng. Constr. Archit. Manag. 2019, 26, 424–443. [Google Scholar] [CrossRef]

- Brown, S.A.; Massey, A.P.; Montoya-Weiss, M.M.; Burkman, J.R. Do I really have to? User acceptance of mandated technology. Eur. J. Inf. Syst. 2002, 11, 283–295. [Google Scholar] [CrossRef]

- Ministry of Housing and Urban-Rural Development of the People’s Republic of China. Notice of the General Office of the Ministry of Housing and Urban-Rural Development on Printing and Distributing the Work Plan for Project Cost Reform. Available online: https://www.mohurd.gov.cn/gongkai/fdzdgknr/tzgg/202007/20200729_246578.html (accessed on 2 April 2022). (In Chinese)

- Kamble, S.; Gunasekaran, A.; Arha, H. Understanding the Blockchain technology adoption in supply chains-Indian context. Int. J. Prod. Res. 2019, 57, 2009–2033. [Google Scholar] [CrossRef]

- Howard, R.; Restrepo, L.; Chang, C.-Y. Addressing individual perceptions: An application of the unified theory of acceptance and use of technology to building information modelling. Int. J. Proj. Manag. 2017, 35, 107–120. [Google Scholar] [CrossRef]

- Badroldin, M.K.A.M.; Hamid, A.R.A.; Raman, S.A.; Zakaria, R.; Mohandes, S.R. Late payment practices in the Malaysian construction industry. Malays. J. Civ. Eng. 2016, 28, 16005. [Google Scholar]

- Ansah, S.K. Causes and effects of delayed payments by clients on construction projects in Ghana. J. Constr. Proj. Manag. Innov. 2011, 1, 27–45. [Google Scholar]

- Azman, M.N.A.; Dzulkalnine, N.; Abd Hamid, Z.; Beng, K.W. Payment issue in Malaysian construction industry: Contractors’ perspective. J. Teknol. 2014, 70, 2804. [Google Scholar] [CrossRef]

- Chang, C.Y.; Ive, G. Reversal of bargaining power in construction projects: Meaning, existence and implications. Constr. Manag. Econ. 2007, 25, 845–855. [Google Scholar] [CrossRef]

- Chan, E.H.; Suen, H.C. Dispute resolution management for international construction projects in China. Manag. Decis. 2005, 43, 589–602. [Google Scholar] [CrossRef]

- Kennedy, P. Progress of statutory adjudication as a means of resolving disputes in construction in the United Kingdom. J. Prof. Issues Eng. Ed. Pract. 2006, 132, 236–247. [Google Scholar] [CrossRef]

- Li, J.; Greenwood, D.; Kassem, M. Blockchain in the built environment and construction industry: A systematic review, conceptual models and practical use cases. Autom. Constr. 2019, 102, 288–307. [Google Scholar] [CrossRef]

- Peterson, S.J.; University, W.S.; Dagostino, F.R. Estimating in Building Construction, 8th ed.; Pearson: London, UK, 2015. [Google Scholar]

- Finance Department of Ministry of Railways of the People’s Republic of China. Regulation for Settlement of Construction Project Price; Ministry of Finance of the People’s Republic of China: Beijing, China, 1989.

- Ministry of Finance of the People’s Republic of China. Notice on Printing and Distributing the Regulation for Settlement of Construction Project Price; Ministry of Finance of the People’s Republic of China: Beijing, China, 2004.

- Fang, D.; Li, M.; Fong, P.S.-W.; Shen, L. Risks in Chinese construction market-Contractors’ perspective. J. Constr. Eng. Manag. 2004, 130, 853–861. [Google Scholar] [CrossRef]

- The State Council of the People’s Republic of China. Decision of the State Council on the Reform of the Investment System. Available online: http://www.gov.cn/zhengce/content/2008-03/28/content_1387.htm (accessed on 4 November 2022).

- Ministry of Finance of the People’s Republic of China. Notice on the Measures for Improving the Settlement of Construction Project. Available online: http://www.gov.cn/zhengce/zhengceku/2022-06/30/content_5698595.htm (accessed on 8 October 2022). (In Chinese)

- Tran, H.; Carmichael, D.G. Contractor’s financial estimation based on owner payment histories. Organ. Technol. Manag. Constr. 2012, 4, 481–489. [Google Scholar] [CrossRef]

- Nayan, R.; Mustaffa, N.E.; Judi, S.S. Valuation of Interim Payment: Issues Encountered by the Parties Involved in relation to Interim Payment. Built Environ. Technol. Eng. 2017, 2, 133–141. [Google Scholar]

- Odeh, A.M.; Battaineh, H.T. Causes of construction delay: Traditional contracts. Int. J. Proj. Manag. 2002, 20, 67–73. [Google Scholar] [CrossRef]

- Im, I.; Hong, S.; Kang, M.S. An international comparison of technology adoption: Testing the UTAUT model. Inf. Manag. 2011, 48, 1–8. [Google Scholar] [CrossRef]

- Odeyinka, H.A.; Kaka, A. An evaluation of contractors’ satisfaction with payment terms influencing construction cash flow. J. Financ. Manag. Prop. Constr. 2005, 3, 171–180. [Google Scholar] [CrossRef]

- Euginie, L. Curing the ills of nonpayment in the construction industry—The Singapore experience. In Proceedings of the 8th Surveyors’ Congress, ISM, Kuala Lumpur, Malaysia, 14–15 June 2006. [Google Scholar]

- Marchewka, J.T.; Kostiwa, K. An application of the UTAUT model for understanding student perceptions using course management software. Commun. IIMA 2007, 7, 10. [Google Scholar] [CrossRef]

- Hwang, B.-G.; Zhu, L.; Wang, Y.; Cheong, X. Green building construction projects in Singapore: Cost premiums and cost performance. Proj. Manag. J. 2017, 48, 67–79. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An introduction to Theory and Research. Philosophy and Rhetoric; Addison-Wesley: Boston, MA, USA, 1977; p. 10. [Google Scholar]

- Davis, F.D. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results; Massachusetts Institute of Technology: Cambridge, MA, USA, 1985. [Google Scholar]

- Di Marco, L.; Venot, A.; Gillois, P. Does the acceptance of hybrid learning affect learning approaches in France? J. Educ. Eval. Health Prof. 2017, 14, 24. [Google Scholar] [CrossRef]

- Liu, Y.; Hong, Z.; Zhu, J.; Yan, J.; Qi, J.; Liu, P. Promoting green residential buildings: Residents’ environmental attitude, subjective knowledge, and social trust matter. Energy Policy 2018, 112, 152–161. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Davis, F.D.; Warshaw, P.R. Development and test of a theory of technological learning and usage. Hum. Relat. 1992, 45, 659–686. [Google Scholar] [CrossRef]

- Nadri, H.; Rahimi, B.; Afshar, H.L.; Samadbeik, M.; Garavand, A. Factors affecting acceptance of hospital information systems based on extended technology acceptance model: A case study in three paraclinical departments. Appl. Clin. Inform. 2018, 9, 238–247. [Google Scholar] [CrossRef] [PubMed]

- Jia, H.; Zhu, L.; Du, J. Fuzzy comprehensive evaluation model of the farmers’ sense of gain in the provision of rural infrastructures: The case of tourism-oriented rural areas of China. Sustainability 2022, 14, 5831. [Google Scholar] [CrossRef]

- Hwang, B.-G.; Zhu, L.; Tan, J.S.H. Green business park project management: Barriers and solutions for sustainable development. J. Clean. Prod. 2017, 153, 209–219. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; Sage: London, UK, 2009; Volume 5. [Google Scholar]

- Zhu, L.; Zhu, Q.; Zhao, X. Identifying determinants of student learning effects in intensive online environments: An empirical investigation in civil engineering education. Int. J. Constr. Manag. 2022, 1–10. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Banihashemi, S.; Hosseini, M.R.; Golizadeh, H.; Sankaran, S. Critical success factors (CSFs) for integration of sustainability into construction project management practices in developing countries. Int. J. Proj. Manag. 2017, 35, 1103–1119. [Google Scholar] [CrossRef]

- Hult, G.T.M.; Hair Jr, J.F.; Proksch, D.; Sarstedt, M.; Pinkwart, A.; Ringle, C.M. Addressing endogeneity in international marketing applications of partial least squares structural equation modeling. J. Int. Mark. 2018, 26, 1–21. [Google Scholar] [CrossRef]

- Jackson, D.L.; Gillaspy Jr, J.A.; Purc-Stephenson, R. Reporting practices in confirmatory factor analysis: An overview and some recommendations. Psychol. Methods 2009, 14, 6. [Google Scholar] [CrossRef] [PubMed]

- Hulland, J. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strateg. Manag. J. 1999, 20, 195–204. [Google Scholar] [CrossRef]

- Cronbach, L.J. Coefficient alpha and the internal structure of tests. Psychometrika 1951, 16, 297–334. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics; Sage Publications Sage CA: Los Angeles, CA, USA, 1981. [Google Scholar]

- Gefen, D.; Straub, D.; Boudreau, M.-C. Structural equation modeling and regression: Guidelines for research practice. Commun. Assoc. Inf. Syst. 2000, 4, 7. [Google Scholar] [CrossRef]

- Sheather, S. A Modern Approach to Regression with R; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Geisser, S. A predictive approach to the random effect model. Biometrika 1974, 61, 101–107. [Google Scholar] [CrossRef]

- Stone, M. Cross-validatory choice and assessment of statistical predictions. J. R. Stat. Soc. Ser. B (Methodol.) 1974, 36, 111–133. [Google Scholar] [CrossRef]

- Sigalov, K.; Ye, X.; König, M.; Hagedorn, P.; Blum, F.; Severin, B.; Hettmer, M.; Hückinghaus, P.; Wölkerling, J.; Groß, D. Automated payment and contract management in the construction industry by integrating building information modeling and blockchain-based smart contracts. Appl. Sci. 2021, 11, 7653. [Google Scholar] [CrossRef]

- Ministry of Housing and Urban-Rural Development of the People’s Republic of China. Letter of the Standards and Quota Department of the Ministry of Housing and Urban-Rural Development on Soliciting Opinions on “Code of Bills of Quantities and Valuation for Construction Works” (draft for comments). Available online: https://www.mohurd.gov.cn/gongkai/fdzdgknr/zqyj/202111/20211119_763065.html (accessed on 19 October 2022). (In Chinese)

- Project Management Institute. A Guide to the Project Management Body of Knowledge (PMBOK® Guide)-and The Standard for Project Management; Project Management Institute: Newtown Square, PA, USA, 2021. [Google Scholar]

- Ning, Y.; Kwak, Y.H. How Do Consulting Firms with Different Project Experience Configure Dynamic Capabilities? J. Manag. Eng. 2022, 38, 04022029. [Google Scholar] [CrossRef]

- Bajari, P.; McMillan, R.; Tadelis, S. Auctions versus negotiations in procurement: An empirical analysis. J. Law Econ. Organ. 2009, 25, 372–399. [Google Scholar] [CrossRef]

| Category | Classification | Frequency | Percentage |

|---|---|---|---|

| Gender | Male | 80 | 61.07 |

| Female | 51 | 38.93 | |

| Work experience (year) | 1–5 | 37 | 28.24 |

| 5–10 | 48 | 36.64 | |

| 10–15 | 27 | 20.61 | |

| 15–20 | 11 | 8.40 | |

| ≥20 | 8 | 6.11 | |

| Company type | Owner | 27 | 20.61 |

| Contractor | 26 | 19.85 | |

| Consultant | 65 | 49.62 | |

| Others | 13 | 9.92 | |

| Projects involved | 1–5 | 46 | 35.11 |

| 6–10 | 43 | 32.82 | |

| 11–15 | 10 | 7.63 | |

| 16–20 | 8 | 6.11 | |

| ≥20 | 24 | 18.32 | |

| Interim payment experience | Yes | 91 | 69.47 |

| No | 40 | 30.53 |

| Project Type | Proportion of Projects (%) | Adoption Rate (%) |

|---|---|---|

| Public project | 56.9 | 17.0 |

| Private project | 43.1 | 44.8 |

| Total | 100 | - |

| Factor | Code | Loading | T Statistic | Cronbach’s Alpha | AVE | CR | Mean |

|---|---|---|---|---|---|---|---|

| Environment factors (EF) | EF1 | 0.879 | 29.847 | 0.880 | 0.735 | 0.917 | 5.294 |

| EF2 | 0.828 | 15.860 | |||||

| EF3 | 0.875 | 28.119 | |||||

| EF4 | 0.847 | 30.968 | |||||

| Perceived ease of use (PEOU) | PEOU1 | 0.815 | 4.302 | 0.862 | 0.646 | 0.901 | 3.620 |

| PEOU2 | 0.915 | 5.159 | |||||

| PEOU3 | 0.705 | 3.010 | |||||

| PEOU4 | 0.795 | 3.600 | |||||

| PEOU6 | 0.774 | 3.419 | |||||

| Perceived usefulness (PU) | PU2 | 0.807 | 17.116 | 0.853 | 0.694 | 0.901 | 5.155 |

| PU3 | 0.822 | 22.062 | |||||

| PU4 | 0.869 | 34.602 | |||||

| PU5 | 0.833 | 26.201 | |||||

| Attitude (AT) | AT1 | 0.883 | 36.619 | 0.926 | 0.772 | 0.944 | 5.231 |

| AT2 | 0.863 | 32.712 | |||||

| AT3 | 0.849 | 23.700 | |||||

| AT4 | 0.884 | 37.118 | |||||

| AT5 | 0.914 | 41.775 | |||||

| Behavioral intention (BI) | BI1 | 0.929 | 57.071 | 0.935 | 0.885 | 0.959 | 5.208 |

| BI2 | 0.943 | 74.663 | |||||

| BI3 | 0.950 | 83.686 |

| Code | AT | BI | EF | PEOU | PU |

|---|---|---|---|---|---|

| AT | 0.879 | ||||

| BI | 0.811 | 0.941 | |||

| EF | 0.740 | 0.606 | 0.857 | ||

| PEOU | 0.066 | 0.026 | −0.026 | 0.804 | |

| PU | 0.790 | 0.578 | 0.661 | 0.120 | 0.833 |

| Code | EF | PEOU | PU | AT | BI |

|---|---|---|---|---|---|

| EF1 | 0.879 | −0.054 | 0.498 | 0.649 | 0.534 |

| EF2 | 0.828 | 0.011 | 0.578 | 0.673 | 0.531 |

| EF3 | 0.875 | 0.034 | 0.611 | 0.607 | 0.466 |

| EF4 | 0.847 | −0.089 | 0.565 | 0.609 | 0.552 |

| PEOU1 | −0.066 | 0.815 | 0.048 | 0.01 | −0.029 |

| PEOU2 | −0.022 | 0.915 | 0.128 | 0.071 | 0.014 |

| PEOU3 | −0.087 | 0.705 | 0.095 | 0.005 | −0.036 |

| PEOU4 | 0.064 | 0.795 | 0.082 | 0.082 | 0.031 |

| PEOU6 | −0.013 | 0.774 | 0.098 | 0.07 | 0.092 |

| PU2 | 0.547 | 0.149 | 0.807 | 0.634 | 0.448 |

| PU3 | 0.564 | 0.170 | 0.822 | 0.629 | 0.461 |

| PU4 | 0.560 | 0.089 | 0.869 | 0.702 | 0.536 |

| PU5 | 0.531 | −0.007 | 0.833 | 0.665 | 0.477 |

| AT1 | 0.738 | −0.048 | 0.747 | 0.883 | 0.683 |

| AT2 | 0.605 | 0.094 | 0.651 | 0.863 | 0.616 |

| AT3 | 0.581 | 0.123 | 0.674 | 0.849 | 0.682 |

| AT4 | 0.671 | 0.002 | 0.720 | 0.884 | 0.712 |

| AT5 | 0.651 | 0.124 | 0.678 | 0.914 | 0.850 |

| BI1 | 0.618 | −0.011 | 0.556 | 0.788 | 0.929 |

| BI2 | 0.547 | −0.001 | 0.515 | 0.722 | 0.943 |

| BI3 | 0.543 | 0.084 | 0.556 | 0.775 | 0.950 |

| Factor | R2 | Stone-Geisser’s Q2 |

|---|---|---|

| EF | / | / |

| PEOU | 0.001 | −0.000 |

| PU | 0.455 | 0.305 |

| AT | 0.625 | 0.475 |

| BI | 0.668 | 0.581 |

| Factor | Mean | t-Test Significance | ||||

|---|---|---|---|---|---|---|

| Owner (O) | Consulting (QS) | Contractor (C) | O-QS | O-C | QS-C | |

| PU1 | 5.96 | 5.06 | 5.46 | 0.040 | 0.100 | 0.689 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, L.; Xiong, H.; Ning, Y.; Lv, M. Addressing Individual Perception: Extending the Technology Acceptance Model to the Interim Payment Method in Construction Projects. Sustainability 2023, 15, 7120. https://doi.org/10.3390/su15097120

Zhu L, Xiong H, Ning Y, Lv M. Addressing Individual Perception: Extending the Technology Acceptance Model to the Interim Payment Method in Construction Projects. Sustainability. 2023; 15(9):7120. https://doi.org/10.3390/su15097120

Chicago/Turabian StyleZhu, Lei, Hui Xiong, Yan Ning, and Miaomiao Lv. 2023. "Addressing Individual Perception: Extending the Technology Acceptance Model to the Interim Payment Method in Construction Projects" Sustainability 15, no. 9: 7120. https://doi.org/10.3390/su15097120

APA StyleZhu, L., Xiong, H., Ning, Y., & Lv, M. (2023). Addressing Individual Perception: Extending the Technology Acceptance Model to the Interim Payment Method in Construction Projects. Sustainability, 15(9), 7120. https://doi.org/10.3390/su15097120