When making investment decisions for UUUT, government departments need to consider a wide range of indicators that influence the project. UUUTs are public infrastructure, and sustainability is key to investment decisions. Economic, social and environmental impacts are often considered to assess the sustainability of public infrastructure [

20]. The technical feasibility of construction and implementation should also be considered for an UUUT project [

21]. Therefore, the decision model includes economic, social, environmental and technical aspects to comprehensively examine the feasibility of UUUT.

MIVES was first used for the sustainability of industrial buildings [

31], and is a method that allows for the simultaneous analysis of multiple influences. MIVES combines, Multi-Criteria Decision Making (MCDM) and Multi-Attribute Utility Theory (MAUT) with Value Functions (VF) and Analytic Hierarchy Process (AHP), which has been widely used for sustainability evaluation and comparative evaluation of similar projects. In addition, traditional methods such as the NPV method are often used by government departments to analyze the economic viability of utility tunnel projects, which reveals the shortcomings of failing to fully consider project risks and the value of project management flexibility [

12]. The real option theory is a way to compensate for these shortcomings. Therefore, in this paper, the investment decision model for UUUT is established based on MIVES and real option theory.

4.1. Establishment Investment Decision-Making Index System of UUUT

Urban infrastructure projects need to consider their sustainability at the planning and design stage, which is generally assessed in terms of social, economic and environmental impacts [

20]. Based on a review of studies related to utility tunnel, the addition of technical feasibility indicators in conjunction with expert opinion, a total of 24 impact indicators were obtained. However, not all the influencing indicators should be included in the evaluation system, therefore, this paper uses the fuzzy Delphi method to screen the indicators, which is a method to integrate multiple expert opinions to reach a consensus [

28]. This research distributed a total of five questionnaires to experts with more than five year work experience, including three from personnel involved in the construction of urban utility tunnel, and two from university staff with professional expertise. All five questionnaires were retrieved, resulting in a 100% recovery rate. By distributing the first stage expert questionnaires and integrating expert opinions, the screening resulted in a total of 16 evaluation indicators is shown in

Table 1.

In this paper, the AHP method is used to determine the weights of each level of the UUUT decision index system, which adopts the nine-scale method to compare the importance of two indicators, construct a judgment matrix, and then calculate the weights of each level. In this paper, we calculate the weights of each level of the UUUT investment decision indicator system according to the general steps of the AHP. The calculation results are given in

Table 1.

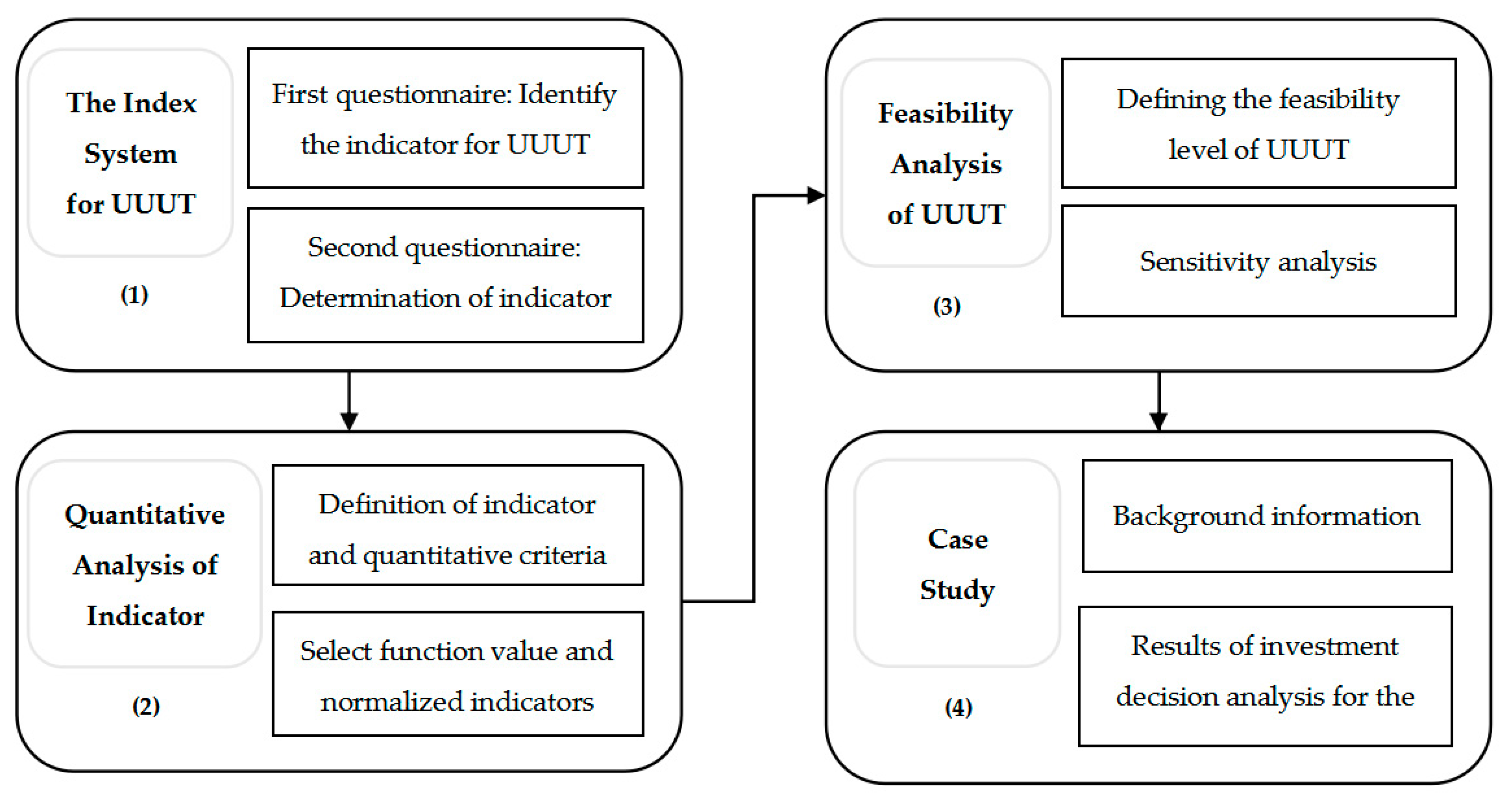

After the screening of indicators and the calculation of weights, we obtain the investment decision model of UUUT based on MIVES and real option theory, as shown in

Figure 2.

While, , represent the score value corresponding to each level, which is calculated according to the calculation rules corresponding to each index; , represent the weight of each index, which is determined by the AHP method, and PIUT (Prioritization Index for Utility Tunnel) represents the final feasibility result of the construction of the UUUT project.

4.2. Calculation Modalities for Determining the Indicators

From a sustainability point of view, investment decisions in UUUT are influenced by four aspects: economic, social, environmental and technological, and a method for quantifying each indicator needs to be defined [

29].

4.2.1. Economic Assessment of UUUT

Using the analytic hierarchy process (AHP), four indicators were selected as the most heavily weighted indicators to evaluate the economics of UUUT, which are Project Economic Benefit (PEB), Annual Unit Cost (AUC), Annual Maintenance Cost (AMC), and Possibility of Obtaining External Funding (POEF) [

21].

(1) Project Economic Benefit (PEB)-Based on Real Option Value

Project Economic Benefit (PEB) is mainly used to measure the future revenue of the project [

38]. As quasi-operational construction projects, UUUT have significant externalities and can generate cash income from utility tunnel entry fees, lease fees, maintenance fees and financial subsidies. In most cases, investors ignore the value of management flexibility and the uncertainty of the project when evaluating the economic benefits of a UUUT project. The real option approach is based on risk uncertainty and recalculates the return of an investment project by considering the possible beneficial value of the uncertainty risk. Therefore, it is more accurate and realistic to calculate the economic benefits of a UUUT project based on the real options theory.

Pricing in real options theory is derived from financial options theory. Dynamic planning, simulation and partial differential equation methods are usually used to calculate the option value [

39]. The partial differential equation method is a pricing method for continuous time, and the Black-Scholes (B-S) model proposed by Merton is the most basic pricing model [

5]. In this paper, we refer to the B-S model and the study by Antonio L to use partial differential equation for option value calculation. This paper determines the actual value of the project from the perspective of expansion options. The following calculations are based on the calculation of expansion options, but the calculation of deferred options is also applicable [

40].

Definition C is the value of the expansion option for the utility tunnel project, then

where:

where I is the discounted value of the project company’s construction period cost, and V is the net present value of the total revenue of the utility tunnel project in the operational phase, and r is the risk-free interest rate.

Using option theory, the calculation of the net present value of the original traditional investment decision is converted into the calculation of the current option value, which is more in line with the actual situation. Using ENPV to represent the extended net present value of the utility tunnel project, the formula is:

NPV is the net present value of the project, V is the net present value of the project’s operation period, and I is the net present value of the investment cost of the project.

PEB is divided into 5 levels based on percentage, See

Table 2 for details.

(2) Annual Unit Cost (AUC)

Annual Unit Cost (AUC) is defined as the ratio of the total project cost to the expected lifecycle, which is a key factor in the economic impact indicators [

41]. The main consideration is the cost of the project’s annual input. The AUC is divided into five tiers based on 1 million USD/year, 2 million USD/year, 3 million USD/year, and 4 million USD/year [

21].

Table 2 gives the score corresponding to the AUC for each tier.

(3) Annual Maintenance Cost (AMC)

Annual Maintenance Cost (AMC) is a qualitative indicator of the cost of annual maintenance work on a project [

42], quantified in five levels based on the difficulty of the annual maintenance work on the project, as shown in

Table 2.

(4) Possibility of Obtaining External Funding (POEF)

The Possibility of Obtaining External Funding (POEF) is the product of the proportion of external obtain to finance and the probability [

43], and is classified into five levels. See

Table 2 for details.

4.2.2. Social Assessment for UUUT

The influence of the social dimension on the investment decision of UUUT is reflected in the direct or indirect role of the direct users and maintainers. We measure this in terms of the six dimensions of Improved Service Quality (SQI), Improved Service Capacity(SCI), Employment Creation (EC), Social Acceptability (SA), Functional Urban Areas (FUAs) and Urban Population Density (UPD) resulting from investment projects [

21].

(1) Service Quality Improvement (SQI)

Investment projects are all aimed at improving service quality and enhancing service capacity. SQI is evaluated in terms of the project’s safety performance, project accessibility, cultural and educational access, public health and social security, and social cohesion. The project’s SQI score is determined by the cumulative value.

(2) Service Capacity Improvement (SCI)

The more residents a utility project can serve, the greater the social benefits it will provide, and the project’s Service Capacity Improvement score is based on the incremental user level.

User increment levels are divided into 5 levels according to 5 degrees of very high, high, medium, low, and very low, corresponding to 5 scores as shown in

Table 3.

(3) Employment Creation (EC)

Jobs are created at all stages of the project, but the stability of jobs created at different stages varies, with job stability at the construction stage being lower than at the operation stage. In addition, the number of jobs created directly by the UUUT is less than the number of jobs created indirectly, therefore, we calculate the project’s employment creation capacity according to a ratio of 1:1:3 (Employment Creation capacity at the project construction stage [

44]: Direct employment creation capacity at the utilization stage: Indirect employment creation capacity at the utilization stage), and the calculation metric is shown in (11), the values of CSE, UDE and UIE are shown in

Table 3.

(4) Social Acceptability (SA)

Public infrastructure projects cannot be considered ‘sustainable’ in the full sense if they are not acceptable to people as places to live, work and interact [

45]. Utility tunnel are public infrastructure projects whose ultimate beneficiaries and users are the public, therefore, SA is one of the indicators that influence decisions. We have classified the SA into 5 levels and the corresponding scores are shown in

Table 3.

(5) Functional Urban Areas (FUAs)

The city will continue to plan and build functional areas as the economy grows. The construction of UUUT must be in line with the city’s future development plan. The more important the city’s functional areas are, the higher the requirements for the city’s image, and the higher the buildability of the UUUT.

(6) Urban Population Density (UPD)

Utility tunnel ultimately serve the urban population, therefore, population density has an impact on the investment decision for UUUT. We use the urban population density indicator [

46] to measure the impact of population.

4.2.3. Environmental Assessment for UUUT

The environmental impact of public infrastructure projects needs to be evaluated. The environmental impact of UUUT is measured by the environmental contribution level index. The environmental contribution of a utility tunnel can improve the urban environment in many aspects, such as the appearance of the city, air quality and sound quality, which can be analyzed from seven aspects: (1) waste management, (2) energy efficiency, (3) water efficiency, (4) air quality, (5) sound quality, (6) biodiversity city, and (7) urban landscape [

21]. The indicators for each aspect are set on a scale of five very low to very high, corresponding to a score of 1 to 5, as shown in

Table 4, and the environmental contribution level score for utility tunnel is calculated by Equation (12).

4.2.4. Assessment of the Technical Feasibility for UUUT

(1) Availability of Underground Space (AoUS)

Not all UUS can be developed, it is influenced by geological conditions, topography, surface architecture and technology and economy [

3]. The lower the Availability of the Underground Space, the less suitable it is for the construction of UUUT. We classify the availability of underground space into 5 levels, and the higher the availability, the higher the score.

(2) Underground Traffic Complexity (UTC)

With the dramatic increase in urban population, the construction of subways and underground businesses has accelerated, and the underground transportation system has become increasingly complex. Therefore, we introduce the complexity of underground traffic to characterize the impact of underground traffic on the construction of UUUT, and classify the complexity into five levels.

(3) Pipeline Type Requirements (PTR)

A utility tunnel is a collection of multiple types of pipelines that can accommodate power cables, communication cables, gas lines, heating lines and water supply lines. In general, the more types of pipelines a utility tunnel can accommodate, the higher the need for construction, therefore, it is divided into five levels according to the number of types of pipelines to be accommodated.

(4) Pipeline Quantity Requirements (PQR)

Similarly, the number of pipeline accommodations is also one of the indicators influencing the construction of UUUT, therefore, the PQR is divided into five levels based on the number of proposed accommodations.

(5) Road Width (RW)

The construction of a utility tunnel can have an impact on road traffic. We have chosen the road width indicator to reflect this impact. The wider the road, the easier it is to construct a utility tunnel. Road widths are divided into 5 classes, with road widths of 1–9 m get 1 point, and greater than 36 m get 5 points (

Table 5).

4.2.5. Determination of the Value Function for Each Indicator

In the decision-making system established in this paper, there are both qualitative and quantitative indicators, using different units and ratios depending on their meaning. Therefore, a value function is needed to standardize the indicators and to be able to represent the satisfaction of the decision maker. The value function is a single mathematical function that converts the qualitative and quantitative variables of the indicator and their different units and scales into a single scale from 0 to 1. This study utilizes previous research [

47] as its value function and the value function is determined based on the decision maker satisfaction into Incremental functions (I) and Decreasing functions (D), and classified into Linear (LR), Concave (CE), Con-vex (CX), or S-shaped (S) according to the increasing or decreasing trend of satisfaction.

Table 6 gives the value function types for each indicator of the decision model developed in this paper [

5].

Then the indicator value can be calculated accordance with Equation (13).

where

is the value of the indicator being evaluated

is a factor that allows the function to remain within the range from 0 to 1. It is assumed that the highest level of satisfaction has a value of 1. This factor is determined by Equation (14).

is the point of minimum satisfaction, with a value of 0.

is the point of maximum satisfaction, with a value of 1.

X is the abscissa that generates a value equal to .

defines approximately the shape of the curve: concave, convex, linear or S-shaped. If < 1 the curve is concave; if > 1 the curve is convex or S-shaped; if = 1 it is linear.

is a parameter that approximately defines the x-value of the point of inflexion for curves with > 1.

is a parameter that approximately defines the

y-value at the point

.

4.3. PIUT (Prioritization Index for UUUT)

From a sustainability perspective, decisions on urban underground integrated tunnels are influenced by four aspects: social, economic, environmental and technical. Referred to F. Pardo-Bosch and A. Aguado [

48], this research defines the Priority Index for Utility Tunnel (PIUT) to characterize the feasibility and priority of the project, and the PIUT is calculated by multiplying the score of each layer by the weight of each layer, as shown in Equation (14).

The symbols in the formula are as follows:

indicates the constructability score of the utility tunnel;

represents the score of the value function of each indicator;

represents the weight of the indicator layer;

represents the weight of the criteria layer.

The value of PIUT is in the range of [0,100], and the lower the score, the lower the buildability it has. Based on the PIUT score, decision makers can analyze the buildability of the project or compare different construction options to determine the optimal solution. The buildability of UUUT is classified into five levels, characterizing the level of contribution to project sustainability, as shown in

Table 7. Level A indicates that the project is socially, economically, environmentally, and technically beneficial and can be carried out as soon as possible, while level E indicates that the project is poorly sustainable, unsuitable under current conditions, and recommended for rejection. According to Pardo-Bosch and Aguado [

49], investment projects may hardly score over 80 due to the highly demanding requirements of a multi-criteria analysis. At the same time, it is unlikely to get projects with an E level score, as those are directly rejected beforehand for its obvious lack of contribution to sustainability.

After considering the social, economic, environmental and technical benefits of a UUUT project, the calculated PIUT can be used to evaluate and make decisions on the sustainability of the proposed project, as well as to compare and select multiple options. In this sustainability perspective, the decision to consider the option benefits of the project is more objective and realistic, and can be used to guide the relevant government departments to make scientific decisions.