Photovoltaic Solar Energy in Forest Nurseries: A Strategic Decision Based on Real Options Analysis

Abstract

1. Introduction

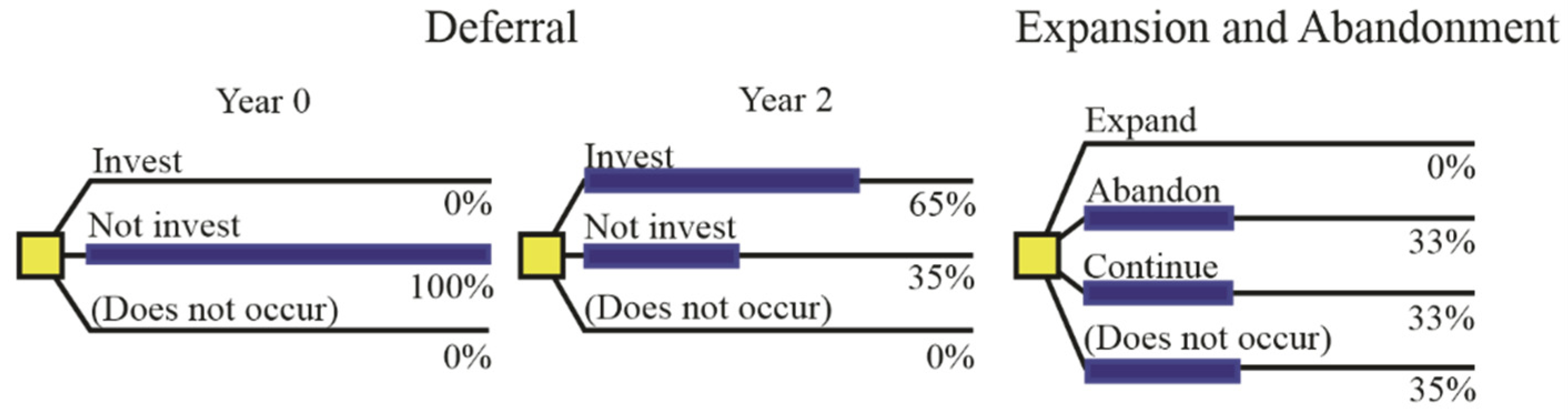

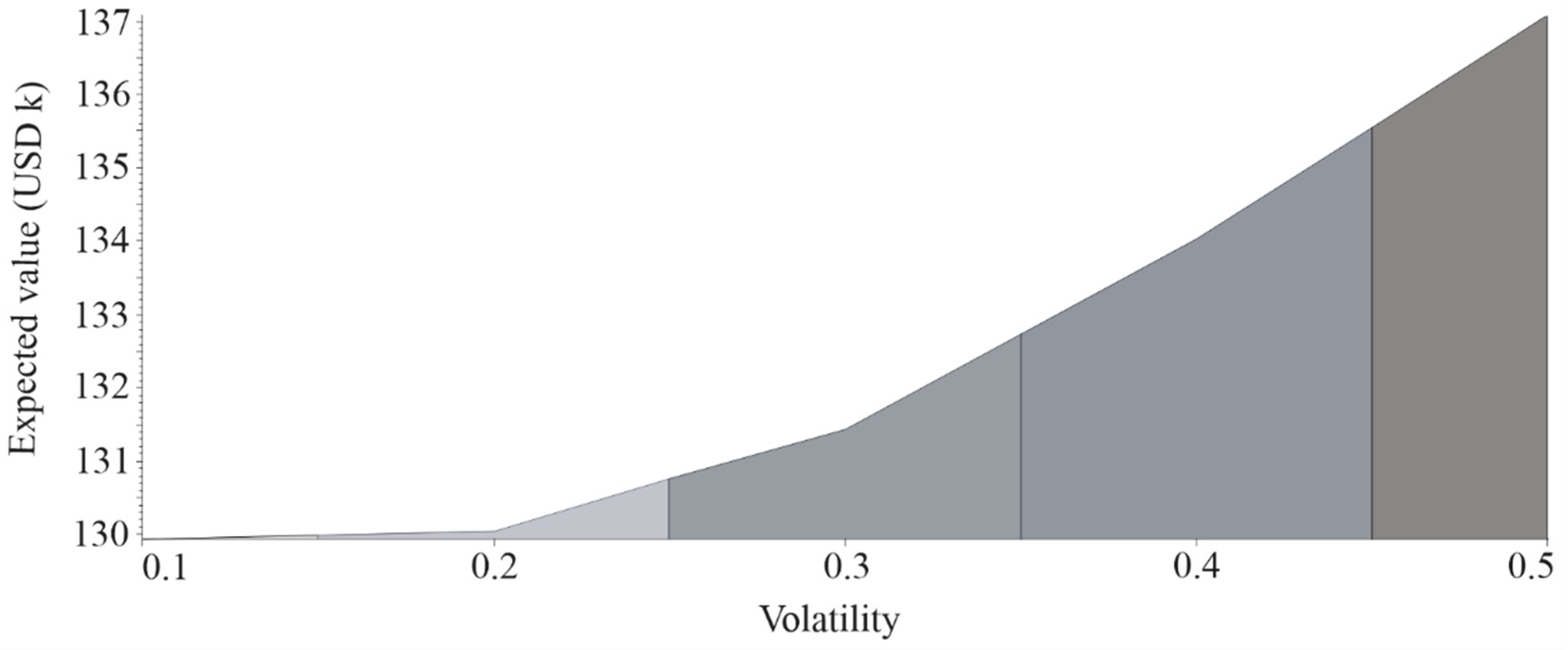

2. Materials and Methods

2.1. Electrical Capacity of the Forest Nursery

2.2. Deterministic Economic Analysis

2.3. Opportunity Cost Rate

2.4. Traditional Net Present Value

2.5. Dynamic Modeling

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- United Nations World Water Assessment Programme. The United Nations World Water Development Report 2017. In Wastewater: The Untapped Resource.; UNESCO: Paris, France, 2017; ISBN 9789231002014. [Google Scholar]

- Bandyopadhyay, S. Pinch Analysis for Economic Appraisal of Sustainable Projects. Process Integr. Optim. Sustain. 2020, 4, 171–182. [Google Scholar] [CrossRef]

- Gutiérrez, R.E.; Haro, P.; Gómez-Barea, A. Techno-economic and operational assessment of concentrated solar power plants with a dual supporting system. Appl. Energy 2021, 302, 117600. [Google Scholar] [CrossRef]

- Kapitonov, I.A.; Patapas, A. Principles regulation of electricity tariffs for the integrated generation of traditional and alternative energy sources. Renew. Sustain. Energy Rev. 2021, 146, 111183. [Google Scholar] [CrossRef]

- Sabyrzhan, A.; Balgimbekova, G.; Shestak, V. Economic and legal regulation of the use and development of renewable energy sources. Int. Environ. Agreements Polit. Law Econ. 2021, 21, 595–610. [Google Scholar] [CrossRef]

- Fuqiang, W.; Ziming, C.; Jianyu, T.; Yuan, Y.; Yong, S.; Linhua, L. Progress in concentrated solar power technology with parabolic trough collector system: A comprehensive review. Renew. Sustain. Energy Rev. 2017, 79, 1314–1328. [Google Scholar] [CrossRef]

- Modi, A.; Bühler, F.; Andreasen, J.G.; Haglind, F. A review of solar energy based heat and power generation systems. Renew. Sustain. Energy Rev. 2017, 67, 1047–1064. [Google Scholar] [CrossRef]

- Carvalho, D.B.; Guardia, E.C.; Marangon Lima, J.W. Technical-economic analysis of the insertion of PV power into a wind-solar hybrid system. Sol. Energy 2019, 191, 530–539. [Google Scholar] [CrossRef]

- Islam, M.T.; Huda, N.; Saidur, R. Current energy mix and techno-economic analysis of concentrating solar power (CSP) technologies in Malaysia. Renew. Energy 2019, 140, 789–806. [Google Scholar] [CrossRef]

- REN21 Renewables 2020 Global Status Report; Secretariat: Paris, France, 2020; ISBN 978-3-948393-00-7.

- Awan, A.B.; Zubair, M.; Memon, Z.A.; Ghalleb, N.; Tlili, I. Comparative analysis of dish Stirling engine and photovoltaic technologies: Energy and economic perspective. Sustain. Energy Technol. Assess. 2021, 44, 101028. [Google Scholar] [CrossRef]

- Gürtürk, M. Economic feasibility of solar power plants based on PV module with levelized cost analysis. Energy 2019, 171, 866–878. [Google Scholar] [CrossRef]

- Leite, G.d.N.P.; Weschenfelder, F.; Araújo, A.M.; Ochoa, Á.A.V.; Prestrelo Neto, N. da F.; Krajc, A. An economic analysis of the integration between air-conditioning and solar photovoltaic systems. Energy Convers. Manag. 2019, 185, 836–849. [Google Scholar] [CrossRef]

- De Doyle, G.N.D.; Rotella Junior, P.; Rocha, L.C.S.; Carneiro, P.F.G.; Peruchi, R.S.; Janda, K.; Aquila, G. Impact of regulatory changes on economic feasibility of distributed generation solar units in Brazil. Sustain. Energy Technol. Assess. 2021, 48, 101660. [Google Scholar] [CrossRef]

- Solarin, S.A.; Bello, M.O.; Bekun, F.V. Sustainable electricity generation: The possibility of substituting fossil fuels for hydropower and solar energy in Italy. Int. J. Sustain. Dev. World Ecol. 2021, 28, 429–439. [Google Scholar] [CrossRef]

- Loučanová, E.; Paluš, H.; Báliková, K.; Dzian, M.; Slašťanova, N.; Šálka, J. Stakeholder’s perceptions of the innovation trends in the Slovak forestry and forest based sectors. J. Bus. Econ. Manag. 2020, 21, 1610–1627. [Google Scholar] [CrossRef]

- Trigkas, M.; Anastopoulos, C.; Papadopoulos, I.; Lazaridou, D. Business model for developing strategies of forest cooperatives. Evidence from an emerging business environment in Greece. J. Sustain. For. 2020, 39, 259–282. [Google Scholar] [CrossRef]

- Guerrero, J.E.; Hansen, E. Cross-sector collaboration in Oregon’s forest sector: Insights from owners and CEOs. Int. Wood Prod. J. 2021, 12, 135–143. [Google Scholar] [CrossRef]

- Weiss, G.; Hansen, E.; Ludvig, A.; Nybakk, E.; Toppinen, A. Innovation governance in the forest sector: Reviewing concepts, trends and gaps. For. Policy Econ. 2021, 130, 102506. [Google Scholar] [CrossRef]

- Singh, V. Influence of Manually Adjustable Photovoltaic Array on the Performance of Water Pumping Systems. Glob. Chall. 2019, 3, 1900009. [Google Scholar] [CrossRef]

- Siraganyan, K.; Perera, A.T.D.; Scartezzini, J.-L.; Mauree, D. Eco-SiM: A parametric tool to evaluate the environmental and economic feasibility of decentralized energy systems. Energies 2019, 12, 776. [Google Scholar] [CrossRef]

- Magadley, E.; Teitel, M.; Kabha, R.; Dakka, M.; Friman Peretz, M.; Ozer, S.; Levi, A.; Yasuor, H.; Kacira, M.; Waller, R.; et al. Integrating organic photovoltaics (OPVs) into greenhouses: Electrical performance and lifetimes of OPVs. Int. J. Sustain. Energy 2022, 41, 1005–1020. [Google Scholar] [CrossRef]

- Mindú, A.J.; Capece, J.A.; Araújo, R.E.; Oliveira, A.C. Feasibility of utilizing photovoltaics for irrigation purposes in moamba, mozambique. Sustainability 2021, 13, 10998. [Google Scholar] [CrossRef]

- Rocha, L.C.S.; Aquila, G.; de Oliveira Pamplona, E.; de Paiva, A.P.; Chieregatti, B.G.; Lima, J.d.S.B. Photovoltaic electricity production in Brazil: A stochastic economic viability analysis for small systems in the face of net metering and tax incentives. J. Clean. Prod. 2017, 168, 1448–1462. [Google Scholar] [CrossRef]

- Liu, Z. What is the future of solar energy? Economic and policy barriers. Energy Sources, Part B Econ. Planning, Policy 2018, 13, 169–172. [Google Scholar] [CrossRef]

- Georgitsioti, T.; Pearsall, N.; Forbes, I.; Pillai, G. A combined model for PV system lifetime energy prediction and annual energy assessment. Sol. Energy 2019, 183, 738–744. [Google Scholar] [CrossRef]

- Li, H.; Zhao, J.; Li, M.; Zhong, S.; Wang, F.; He, F.; Zhu, J. Determining the economic design radiation for a solar heating system through uncertainty analysis. Sol. Energy 2020, 195, 54–63. [Google Scholar] [CrossRef]

- Tang, T.; Ding, H.; Nojavan, S.; Jermsittiparsert, K. Environmental and Economic Operation of Wind-PV-CCHP-Based Energy System Considering Risk Analysis Via Downside Risk Constraints Technique. IEEE Access 2020, 8, 124661–124674. [Google Scholar] [CrossRef]

- Vargas, C.; Chesney, M. End of life decommissioning and recycling of solar panels in the United States. A real options analysis. J. Sustain. Financ. Investig. 2020, 11, 82–102. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment Under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Chesney, M.; Gheyssens, J.; Troja, B. Market uncertainty and risk transfer in REDD projects. J. Sustain. For. 2017, 36, 535–553. [Google Scholar] [CrossRef]

- Glensk, B.; Madlener, R. Energiewende @ Risk: On the continuation of renewable power generation at the end of public policy support. Energies 2019, 12, 3616. [Google Scholar] [CrossRef]

- Pringles, R.; Olsina, F.; Penizzotto, F. Valuation of defer and relocation options in photovoltaic generation investments by a stochastic simulation-based method. Renew. Energy 2020, 151, 846–864. [Google Scholar] [CrossRef]

- Farzan, F.; Mahani, K.; Gharieh, K.; Jafari, M.A. Microgrid investment under uncertainty: A real option approach using closed form contingent analysis. Ann. Oper. Res. 2015, 235, 259–276. [Google Scholar] [CrossRef]

- Martín-Barrera, G.; Zamora-Ramírez, C.; González-González, J.M. Application of real options valuation for analysing the impact of public R&D financing on renewable energy projects: A company′s perspective. Renew. Sustain. Energy Rev. 2016, 63, 292–301. [Google Scholar] [CrossRef]

- Guo, K.; Zhang, L.; Wang, T. Optimal scheme in energy performance contracting under uncertainty: A real option perspective. J. Clean. Prod. 2019, 231, 240–253. [Google Scholar] [CrossRef]

- Penizzotto, F.; Pringles, R.; Olsina, F. Real options valuation of photovoltaic power investments in existing buildings. Renew. Sustain. Energy Rev. 2019, 114, 109308. [Google Scholar] [CrossRef]

- Simões, D.; Gil, J.F.S.; da Silva, R.B.G.; Munis, R.A.; da Silva, M.R. Stochastic economic analysis of investment projects in forest restoration involving containerized tree seedlings in brazil. Forests 2021, 12, 1381. [Google Scholar] [CrossRef]

- Trigeorgis, L. Real Options: A Primer BT—The New Investment Theory of Real Options and Its Implication for Telecommunications Economics; Alleman, J., Noam, E., Eds.; Springer: Boston, MA, USA, 1999; Volume 13, ISBN 0792377346. [Google Scholar]

- Odetayo, B.; MacCormack, J.; Rosehart, W.D.; Zareipour, H. A real option assessment of flexibilities in the integrated planning of natural gas distribution network and distributed natural gas-fired power generations. Energy 2018, 143, 257–272. [Google Scholar] [CrossRef]

- Nunes, L.E.; de Lima, M.V.A.; Davison, M.; Leite, A.L. da S. Switch and defer option in renewable energy projects: Evidences from Brazil. Energy 2021, 231, 120972. [Google Scholar] [CrossRef]

- Weibel, S.; Madlener, R. Cost-effective design of ringwall storage hybrid power plants: A real options analysis. Energy Convers. Manag. 2015, 103, 871–885. [Google Scholar] [CrossRef]

- Herder, P.M.; De Joode, J.; Ligtvoet, A.; Schenk, S.; Taneja, P. Buying real options—Valuing uncertainty in infrastructure planning. Futures 2011, 43, 961–969. [Google Scholar] [CrossRef]

- Inthavongsa, I.; Drebenstedt, C.; Bongaerts, J.; Sontamino, P. Real options decision framework: Strategic operating policies for open pit mine planning. Resour. Policy 2016, 47, 142–153. [Google Scholar] [CrossRef]

- Song, N.; Xie, Y.; Ching, W.K.; Siu, T.K. A real option approach for investment opportunity valuation. J. Ind. Manag. Optim. 2017, 13, 1213–1235. [Google Scholar] [CrossRef]

- Kim, B.; Kim, C.; Han, S.U.; Bae, J.H.; Jung, J. Is it a good time to develop commercial photovoltaic systems on farmland? An American-style option with crop price risk. Renew. Sustain. Energy Rev. 2020, 125, 109827. [Google Scholar] [CrossRef]

- Oliveira, A.; Couto, G.; Pimentel, P. Uncertainty and flexibility in infrastructure investments: Application of real options analysis to the Ponta Delgada airport expansion. Res. Transp. Econ. 2021, 90, 100845. [Google Scholar] [CrossRef]

- Yue, Y.; Ying, Y. Real option analysis for emission reduction investment under the sulfur emission control. Sustain. Energy Technol. Assess. 2021, 45, 101055. [Google Scholar] [CrossRef]

- Zhang, X.; Yin, J. Assessment of investment decisions in bulk shipping through fuzzy real options analysis. Marit. Econ. Logist. 2021, 23, 1–18. [Google Scholar] [CrossRef]

- Liu, B.Y.H.; Jordan, R.C. The long-term average performance of flat-plate solar-energy collectors. Sol. Energy 1963, 7, 53–74. [Google Scholar] [CrossRef]

- Klein, S.A. Calculation of Monthly Average Insolation on Tilted Surfaces. Sol. Energy 1977, 19, 325–329. [Google Scholar] [CrossRef]

- Borhanazad, H.; Mekhilef, S.; Saidur, R.; Boroumandjazi, G. Potential application of renewable energy for rural electrification in Malaysia. Renew. Energy 2013, 59, 210–219. [Google Scholar] [CrossRef]

- Alsharif, M.H.; Nordin, R.; Ismail, M. Energy optimisation of hybrid off-grid system for remote telecommunication base station deployment in Malaysia. Eurasip J. Wirel. Commun. Netw. 2015, 2015, 1–15. [Google Scholar] [CrossRef]

- Rosas-Flores, J.A.; Zenón-Olvera, E.; Gálvez, D.M. Potential energy saving in urban and rural households of Mexico with solar photovoltaic systems using geographical information system. Renew. Sustain. Energy Rev. 2019, 116, 109412. [Google Scholar] [CrossRef]

- Ekici, S.; Kopru, M.A. Investigation of PV system cable losses. Int. J. Renew. Energy Res. 2017, 7, 807–815. [Google Scholar] [CrossRef]

- Al-Badi, A.; Yousef, H.; Al Mahmoudi, T.; Al-Shammaki, M.; Al-Abri, A.; Al-Hinai, A. Sizing and modelling of photovoltaic water pumping system. Int. J. Sustain. Energy 2018, 37, 415–427. [Google Scholar] [CrossRef]

- Gitman, L.J.; Zutter, C.J. Principles of Managerial Finance, 14th ed.; Pearson: London, UK, 2019. [Google Scholar]

- Law No. 7,689, of December 15, 1988. Establishes Social Contribution on the Profit of Legal Entities and Makes Other Arrangements; Official Gazette of the Federative Republic of Brazil: Brasília, Brazil, 1988.

- Law No. 9,250, of December 26, 1995. Amends the Legislation of the Income Tax of Individuals and Other Measures; Official Gazette of the Federative Republic of Brazil: Brasília, Brazil, 1995.

- Complementary Law No. 87, of September 13, 1996. Provides for the Tax of the States and the Federal District on Operations Related to the Circulation of Goods and on the Provision of Interstate and Intercity and Communication Services, and Other Measures; Official Gazette of the Federative Republic of Brazil: Brasília, Brazil, 1996.

- Law No. 10,147, of December 21, 2000. Provides for the Incidence of the Contribution to the Social Integration and Training Programs of the Public Servant’s Heritage—PIS/PASEP, and the Contribution to the Financing of Social Security—COFINS, in the Sales Operations of the Products You Specify; Official Gazette of the Federative Republic of Brazil: Brasília, Brazil, 2000.

- Mariani, M.; Pizzutilo, F.; Caragnano, A.; Zito, M. Does it pay to be environmentally responsible? Investigating the effect on the weighted average cost of capital. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1854–1869. [Google Scholar] [CrossRef]

- Zaroni, H.; Maciel, L.B.; Carvalho, D.B.; de Oliveira Pamplona, E. Monte Carlo Simulation approach for economic risk analysis of an emergency energy generation system. Energy 2019, 172, 498–508. [Google Scholar] [CrossRef]

- Moody’s Spread. Available online: https://www.moodys.com (accessed on 26 August 2021).

- United States Department of the Treasury Daily Treasury Yield Curve Rates. Available online: https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield (accessed on 12 February 2022).

- Damodaran, A. Investment valuation: Tools and techniques for determining the value of any asset, 3rd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2012; ISBN 9781118011522. [Google Scholar]

- Alexandridis, A.K.; Hasan, M.S. Global financial crisis and multiscale systematic risk: Evidence from selected European stock markets. Int. J. Financ. Econ. 2019, 25, 518–546. [Google Scholar] [CrossRef]

- B3, S.A. BRASIL BOLSA Balcão Séries Históricas. Available online: http://www.b3.com.br/pt_br/market-data-e-indices/servicos-de-dados/market-data/historico/mercado-a-vista/series-historicas/ (accessed on 15 January 2021).

- S&P Global Timber & Forestry Index Overview. Available online: https://www.spglobal.com/spdji/en/indices/equity/sp-global-timber-and-forestry-index/#overview (accessed on 15 January 2021).

- Morgan, J.P. Emerging Markets Bond Index. Available online: https://www.jpmorgan.com/global (accessed on 26 January 2021).

- Ihm, S.H.; Seo, S.B.; Kim, Y.O. Valuation of Water Resources Infrastructure Planning from Climate Change Adaptation Perspective using Real Option Analysis. KSCE J. Civ. Eng. 2019, 23, 2794–2802. [Google Scholar] [CrossRef]

- Smit, H.T.J.; Trigeorgis, L. Strategic Investment Real Options and Games; Princeton University Press: Princeton, NJ, USA, 2004; ISBN 0691010390. [Google Scholar]

- Copeland, T.E.; Antikarov, V. Opções Reais: Um novo Paradigma para Reinventar a Avaliação de Investimentos, 1st ed.; Campus: Rio de Janeiro, Brazil, 2001. [Google Scholar]

- Zhang, W.; Dai, C.; Luo, X.; Ou, X. Policy incentives in carbon capture utilization and storage (CCUS) investment based on real options analysis. Clean Technol. Environ. Policy 2021, 23, 1311–1326. [Google Scholar] [CrossRef]

- Samuelson, P.A. Proof That Properly Anticipated Prices Fluctuate Randomly. Ind. Manag. Rev. 1965, 6, 41–49. [Google Scholar] [CrossRef]

- Palisade Corporation Software Risk Analysis and Risk Mod_eling, vers 7.6.0. Palisade Corporation. Available online: https://www.palisade-br.com/2021 (accessed on 26 January 2021).

- Ryu, Y.; Kim, Y.O.; Seo, S.B.; Seo, I.W. Application of real option analysis for planning under climate change uncertainty: A case study for evaluation of flood mitigation plans in Korea. Mitig. Adapt. Strateg. Glob. Chang. 2018, 23, 803–819. [Google Scholar] [CrossRef]

- Syncopation Software. DPL—Decision Programming Language. versão 9.02.00 Concord. 2021. Available online: https://www.syncopation.com/ (accessed on 26 January 2021).

- Miranda, R.; Fiorentin, L.; Péllico Netto, S.; Juvanhol, R.; Corte, A.D. Prediction system for diameter distribution and wood production of Eucalyptus. Floresta e Ambient. 2018, 25, 1–12. [Google Scholar] [CrossRef]

- Durica, M.; Guttenova, D.; Pinda, L.; Svabova, L. Sustainable value of investment in real estate: Real options approach. Sustainability 2018, 10, 4665. [Google Scholar] [CrossRef]

- McConnell, J.J.; Muscarella, C.J. Corporate capital expenditure decisions and the market value of the firm. J. financ. econ. 1985, 14, 399–422. [Google Scholar] [CrossRef]

- Baig, U.; Khalidi, M.A. A grounded theory exploration of appraisal Process of Capital Investment Decisions—Capex Appraisal Model (CAM). Indep. J. Manag. Prod. 2020, 11, 2778–2804. [Google Scholar] [CrossRef]

- Vartiainen, E.; Masson, G.; Breyer, C.; Moser, D.; Román Medina, E. Impact of weighted average cost of capital, capital expenditure, and other parameters on future utility-scale PV levelised cost of electricity. Prog. Photovoltaics Res. Appl. 2020, 28, 439–453. [Google Scholar] [CrossRef]

- Choi, G.; Heo, E.; Lee, C.Y. Dynamic economic analysis of subsidies for new and renewable energy in South Korea. Sustainability 2018, 10, 1832. [Google Scholar] [CrossRef]

- Sow, A.; Mehrtash, M.; Rousse, D.R.; Haillot, D. Economic analysis of residential solar photovoltaic electricity production in Canada. Sustain. Energy Technol. Assessments 2019, 33, 83–94. [Google Scholar] [CrossRef]

- Shimbar, A.; Ebrahimi, S.B. Political risk and valuation of renewable energy investments in developing countries. Renew. Energy 2020, 145, 1325–1333. [Google Scholar] [CrossRef]

- Gu, Y.; Zhang, X.; Myhren, J.A.; Han, M.; Chen, X.; Yuan, Y. Techno-economic analysis of a solar photovoltaic/thermal (PV/T) concentrator for building application in Sweden using Monte Carlo method. Energy Convers. Manag. 2018, 165, 8–24. [Google Scholar] [CrossRef]

- Li, Y.; Lou, Z.; Zhang, Q.; Zhang, M. Sequential Monte Carlo estimation for Present-Value model. Appl. Econ. Lett. 2021, 2021, 1–7. [Google Scholar] [CrossRef]

- Köse, E.; Sauer, A. Reduction of energy costs and grid instability with energy flexible furnaces. Procedia CIRP 2018, 72, 832–838. [Google Scholar] [CrossRef]

- Ríos-Ocampo, J.P.; Arango-Aramburo, S.; Larsen, E.R. Renewable energy penetration and energy security in electricity markets. Int. J. Energy Res. 2021, 45, 17767–17783. [Google Scholar] [CrossRef]

- Porcu, A.; Sollai, S.; Marotto, D.; Mureddu, M.; Ferrara, F.; Pettinau, A. Techno-economic analysis of a small-scale biomass-to-energy BFB gasification-based system. Energies 2019, 12, 494. [Google Scholar] [CrossRef]

- Bari, A. Di A real options approach to valuate solar energy investment with public authority incentives: The Italian case. Energies 2020, 13, 4181. [Google Scholar] [CrossRef]

- Abban, A.R.; Hasan, M.Z. Solar energy penetration and volatility transmission to electricity markets—An Australian perspective. Econ. Anal. Policy 2021, 69, 434–449. [Google Scholar] [CrossRef]

- Tiwana, A.; Jijie, W.; Keil, M.; Ahluwalia, P. The bounded rationality bias in managerial valuation of real options: Theory and evidence from IT projects. Decis. Sci. 2007, 38, 157–181. [Google Scholar] [CrossRef]

- Huang, C.Y.; Hsieh, H.L.; Chen, H. Evaluating the investment projects of spinal medical device firms using the real option and DANP-mV based MCDM methods. Int. J. Environ. Res. Public Health 2020, 17, 3335. [Google Scholar] [CrossRef]

- Benitez, G.B.; Lima, M.J. do R.F. The real options method applied to decision making—An investment analysis. Braz. J. Oper. Prod. Manag. 2019, 16, 562–571. [Google Scholar] [CrossRef]

- Shi, J.; Duan, K.; Wen, S.; Zhang, R. Investment valuation model of public rental housing PPP project for private sector: A real option perspective. Sustainability 2019, 11, 1857. [Google Scholar] [CrossRef]

- Balibrea-Iniesta, J. Economic analysis of renewable energy regulation in France: A case study for photovoltaic plants based on real options. Energies 2020, 13, 2760. [Google Scholar] [CrossRef]

- Fattahi, K.; Naeini, A.B.; Sadjadi, S.J. Technology valuation of NTBFs in the field of cleaner production with regard to the investors’ flexibilities and uncertainties in public policy. Sci. Iran. 2020, 27, 3322–3337. [Google Scholar] [CrossRef]

- Golub, A.A.; Lubowski, R.N.; Piris-Cabezas, P. Business responses to climate policy uncertainty: Theoretical analysis of a twin deferral strategy and the risk-adjusted price of carbon. Energy 2020, 205, 117996. [Google Scholar] [CrossRef]

- Myers, S.C.; Majd, S. Abandonment Value and Project Life. Adv. Futur. Options Res. 1990, 4, 1990. [Google Scholar]

- Berger, P.G.; Ofek, E.; Swary, I. Investor valuation of the abandonment option. J. financ. econ. 1996, 42, 259–287. [Google Scholar] [CrossRef]

- Savolainen, J. Real options in metal mining project valuation: Review of literature. Resour. Policy 2016, 50, 49–65. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rocha, Q.S.; Munis, R.A.; da Silva, R.B.G.; Aguilar, E.W.Z.; Simões, D. Photovoltaic Solar Energy in Forest Nurseries: A Strategic Decision Based on Real Options Analysis. Sustainability 2023, 15, 3960. https://doi.org/10.3390/su15053960

Rocha QS, Munis RA, da Silva RBG, Aguilar EWZ, Simões D. Photovoltaic Solar Energy in Forest Nurseries: A Strategic Decision Based on Real Options Analysis. Sustainability. 2023; 15(5):3960. https://doi.org/10.3390/su15053960

Chicago/Turabian StyleRocha, Qüinny Soares, Rafaele Almeida Munis, Richardson Barbosa Gomes da Silva, Elí Wilfredo Zavaleta Aguilar, and Danilo Simões. 2023. "Photovoltaic Solar Energy in Forest Nurseries: A Strategic Decision Based on Real Options Analysis" Sustainability 15, no. 5: 3960. https://doi.org/10.3390/su15053960

APA StyleRocha, Q. S., Munis, R. A., da Silva, R. B. G., Aguilar, E. W. Z., & Simões, D. (2023). Photovoltaic Solar Energy in Forest Nurseries: A Strategic Decision Based on Real Options Analysis. Sustainability, 15(5), 3960. https://doi.org/10.3390/su15053960