Procurement Strategies and Auction Mechanism for Heterogeneous Service Providers in a Service Supply Chain

Abstract

:1. Introduction

- (1)

- For the purpose of encouraging the SP to cooperate fully with the SI, and satisfying their reservation profits at the same time, proper auction and contracting mechanisms are established to ensure that the SP and the SI are inclined to get involved.

- (2)

- In certain circumstances, the optimal decisions deduced by the auction and contracting mechanisms are exactly the same as channel coordination optimums. Furthermore, Pareto improvement conditions are also clearly illustrated.

- (3)

- We characterize the impact of the SP’s cost variation on the optimal decisions and total supply chain profits. We find that the high-cost SP is always motivated to truthfully announce rather than distort exact cost information with the SI. This conclusion is consistent with the outcome of separate equilibrium in a signal game.

- (4)

- We derive more practical insights into the relationship between the decision makers’ risk preferences and policies. We also perform some comprehensive comparisons of the channel coordination optimums obtained in the risk-neutral system and the risk-averse one.

2. Literature Review

3. Symmetric Information Case

3.1. Supply Chain Coordination Model with Symmetric Information

3.2. Two-Part Contract Auction with Symmetric Information

- (1)

- The SI announces an order quantity function and a service price function

- (2)

- Given that reservation profit respectively, each SP in the two-part contract proposes a wholesale price and a side payment to the SI.

- (3)

- The SI selects the more profitable contract and then makes decisions on its order quantity and service price.

- (1)

- If the SI cooperates with the high-cost SP, then the SI’s profit under two-part contract auction is greater than that in the decentralized case provided that

- (2)

- If the SI cooperates with the low-cost SP, then the SI’s profit under two-part contract auction is greater than that in the decentralized case provided that

- (3)

- For the caseif the SI cooperates with the low-cost SP, the SI’s profit under two-part contract auction is greater than that in the decentralized case provided thatif the SI cooperates with the low-cost SP, the SI’s profit under two-part contract auction is greater than that in the decentralized case provided that

4. Supply Chain System with Asymmetric Information

4.1. Supply Chain Coordination Model with Asymmetric Information

- (1)

- when the low-cost SP wins the contract, the expected optimal service price, order quantity, and profit of the entire supply chain are

- (2)

- when the high-cost SP wins the contract, the expected optimal service price, order quantity, and profit of the entire supply chain are

4.2. Two-Part Contract Auction with Asymmetric Information Case

- (1)

- An order quantity function and a service price function w.r.t. wholesale price w announced by the SI as follows:where is an unknown parameter decided by the channel system.

- (2)

- The SPs compete in this two-part contract auction, in which each of them proposes a wholesale price of and a side payment of to the SI.

- (3)

- The SI chooses the more profitable contract and determines the order quantity and service price on .

- (1)

- If the SI cooperates with the high-cost SP, then the SI’s profit under two-part contract auction is greater than that in the decentralized case provided that

- (2)

- If the SI cooperates with the low-cost SP, then the SI’s profit under two-part contract auction is greater than that in the decentralized case provided that

- (3)

- Specially, for the case thatwhich is the profit of the low-cost SP in the decentralized case. The SI’s profit under two-part contract auction is greater than that in the decentralized case if and only ifFor the case thatwhich is the profit of the high-cost SP in the decentralized case. The SI’s profit under two-part contract auction is greater than that in the decentralized case if and only if

4.3. Value of Information

- (a)

- for the service’s optimal decisions, it holds that

- (a.1)

- the optimal service price decreases w.r.t. the low-cost SP’s cost variation (ε);

- (a.2)

- the optimal order quantity increases w.r.t. the low-cost SP’s cost variation (ε);

- (a.3)

- the greater the level of the low-cost SP’s cost variation, the larger the difference of service prices under information symmetry and information asymmetry cases;

- (a.4)

- the greater the level of the low-cost SP’s cost variation, the smaller the difference of the optimal order quantity under both symmetric and asymmetric information cases.

- (b)

- For the SI’s profit, it holds that

- (b.1)

- the SI’s profit decreases with the low-cost SP’s cost variation (ε);

- (b.2)

- the greater the level of the low-cost SP’s cost variation, the larger the difference of the SI’s profits under both symmetric and asymmetric information cases.

- (c)

- For the low-cost SP’s profit, it holds that

- (c.1)

- the low-cost SP’s profit increases with its own cost variation (ε);

- (c.2)

- the greater the level of the low-cost SP’s cost variation, the smaller the difference between the low-cost SP’s profit under both symmetric and asymmetric information cases;

- (d)

- and for the supply chain’s profit, it holds that

- (d.1)

- the supply chain’s profit increases with the low-cost SP’s cost variation (ε);

- (d.2)

- the greater the level of the low-cost SP’s cost variation, the smaller the difference in the supply chain’s profit under both symmetric and asymmetric information cases.

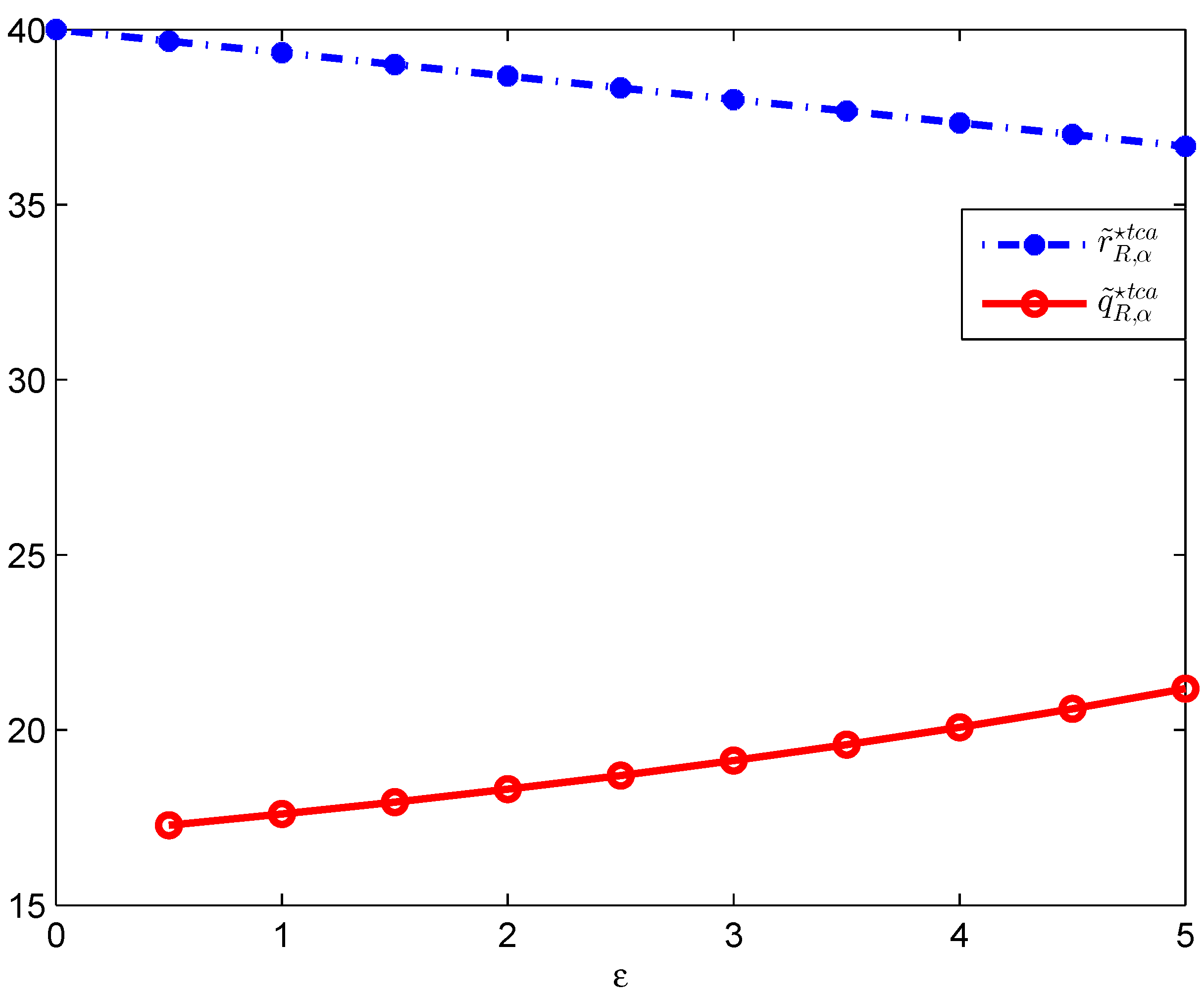

- (a)

- for the service’s optimal decisions we have that

- (a.1)

- the optimal service price increases with the high-cost SP’s cost variation (ε);

- (a.2)

- the optimal order quantity decreases with the high-cost SP’s cost variation (ε);

- (a.3)

- the greater the level of the high-cost SP’s cost variation (large ε), the smaller the difference of the service price under both symmetric and asymmetric information cases (two cases for short).

- (a.4)

- the greater the level of the high-cost SP’s cost variation (large ε), the larger the difference of the optimal order quantity under two cases.

- (b)

- for the SI’s profit we have that

- (b.1)

- the SI’s profit increases with the high-cost SP’s cost variation (ε);

- (b.2)

- the greater the level of the high-cost SP’s cost variation (large ε), the smaller the difference of the SI’s profit under two cases.

- (c)

- for the low-cost SP’s profit we have that

- (c.1)

- the low-cost SP’s profit decreases with its own cost variation (ε);

- (c.2)

- the greater the level of the high-cost SP’s cost variation (large ε), the larger the difference of the low-cost SP’s profit under two cases.

- (d)

- for the supply chain’s profit we have that

- (d.1)

- the supply chain’s profit decreases with the high-cost SP’s cost variation (ε);

- (d.2)

- the greater the level of the high-cost SP’s cost variation (large ε), the larger the difference of the supply chain’s profit under two cases.

5. The Case with a Risk Neutral SI

6. Numerical Examples and Illustrations

6.1. Comparisons of Optimal Decisions under the Symmetric and Asymmetric Information Cases

6.2. The Impact of Service Cost Variation

7. Conclusions, Practical Implications and Future Research Directions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Proof of Lemma 1

Appendix A.2. Proof of Lemma 2

Appendix A.3. Proof of Proposition 1

- (1)

- If , i.e.,then, neither of the two SPs can get their target profit, and thus this is beyond our consideration.

- (2)

- If we have , i.e.,based on the service price setting, if the low-cost SP wants to win the contract, he should set side payment which is not less than the side payment that the high-cost SP can provide, where is the maximal profit of the SI if the contract is won by high-cost SP. This means that , the SI may extract the profit by side payment . Then we can derive the optimal wholesale price , and the profit of the low-cost SP is . Accordingly, the service price and the order quantity areTherefore, in this two-part contract auction, the profits of the SP, the SI, and the total supply chain can be expressed as followsBy comparing the optimums given in Equation (1), when the SI cooperates with the low-cost SP, channel coordination can be achieved in the two-part contract auction.

- (3)

- If then , i.e.,Using a similar discussion for case (2), we know that when the high-cost SP wants to win the contract, he should set a side payment equal to the maximum side payment that the low-cost SP can provide. Thus , and the profit of the high-cost SP is . The SI can extract the profit from side payments. We can derive the optimal wholesale price from analysis above that . Accordingly, the service price and the order quantity areTherefore, in this two-part contract auction, the profits of the SP, the SI, and the total supply chain can be expressed as follows

Appendix A.4. Proof of Proposition 2

Appendix A.5. Proof of Proposition 3

Appendix A.6. Proof of Lemma 4

- (1)

- We first consider the case that low-cost SP wins the contract. Similar to the symmetric information case, the expected optimal service price, order quantity, and profit of the entire supply chain areLet , and assume that and are independent and follow the uniform distribution . Therefore, the cumulative distribution function and the probability density function of arerespectively. HenceThen, the probability density function isMoreover,and thusIf the contract is obtained by the low-cost SP, we have the following optimums:which yields Equations (4)–(6).

- (2)

- The cumulative distribution function and the probability density function of are:respectively. HenceThen, the probability density function isFurthermore,and thusIf the contract is obtained by the low-cost SP, we have the following optimums:

Appendix A.7. Proof of Lemma 5

Appendix A.8. Proof of Proposition 4

- (1)

- , i.e.,If the low-cost SP wants to win the contract, he should set side payment which is not less than the side payment , where is the maximal profit offered by the high-cost SP. This means that , the SI can extract the profit by side payment . We can derive the optimal wholesale price, the low-cost SP’s profit, and the SI’s profit as follows:Therefore, the expected optimal service price, order quantity, and supply chain profit arerespectively, where . By comparing the optimums Equations (4)–(6) with Equations (A1)–(A3), we have . Therefore, channel coordination can be achieved in the two-part contract auction.

- (2)

- , i.e.,In this case, similar to the argument for case (1), when the high-cost SP wants to win the contract, one needs to submit a side payment equal to the maximum side payment that the low-cost SP can provide.This means that , the SI can extract the profit from side payment . We can derive the optimal wholesale price, the low-cost SP’s profit, and the SI’s profit as follows:Therefore, the expected optimal service price, order quantity, and supply chain profit arewhere . By comparing the optimums (7)–(9) with Equations (A4)–(A6), when the SI cooperates with the low-cost SP, we have . Therefore, channel coordination can be achieved in the two-part contract auction.

Appendix A.9. Proof of Proposition 5

Appendix A.10

Appendix A.11. Proof of Proposition 7

- (a)

- Let . When the low-cost SP wins the contract, the expected optimal service price and order quantity arerespectively. For ease of exposition, let . Derivating with , we find thatSince , we have , which yields (a.1). For the optimal order quantity, we divide into two cases for further discussion.

- (b)

- We now analyze the SI’s profit.Let , then the SI’s profit can be rewritten as follows:

- (c)

- The low-cost SP’s profit can be rewritten as

- (d)

- The supply chain’s profit can be rewritten as follows:

Appendix A.12. Proof of Proposition 8

- (a)

- When the high-cost SP wins the contract, Let , then the expected optimal service price and the expected optimal order quantity can be written as

- (b)

- Let , then the SI’s profit is

- (c)

- The high-cost SP’s profit can be rewritten:

- (d)

- The supply chain’s profit can be rewritten

Appendix A.13. Proof of Proposition 9

- (a)

- We outline a proof by contradiction. Suppose that . Then using the fact that is unimodal in r for , one has . Therefore,Since , it follows thatand thusThis leads to a contradiction. Therefore .

- (b)

- It holds that

References

- Sousa, R.; da Silveira, G.J. The relationship between servitization and product customization strategies. Int. J. Oper. Prod. Manag. 2019, 39, 454–474. [Google Scholar] [CrossRef]

- Wang, Y.; Wallace, S.W.; Shen, B.; Choi, T.M. Service supply chain management: A review of operational models. Eur. J. Oper. Res. 2015, 247, 685–698. [Google Scholar] [CrossRef]

- Cachon, G. Supply chain coordination with contracts. In Handbooks in Operations Research and Management Science: Supply Chain Management; de Kok, A.G., Graves, S.C., Eds.; North-Holland: Amsterdam, The Netherlands, 2003; pp. 229–339. [Google Scholar]

- Chiu, C.H.; Choi, T.M.; Tang, C.S. Price, rebate, and returns supply contracts for coordinating supply chains with price-dependent demand. Prod. Oper. 2011, 20, 81–91. [Google Scholar] [CrossRef]

- Tsay, A.A.; Lovejoy, W.S. Quantity flexibility contracts and supply chain performance. Manuf. Serv. Oper. Manag. 1999, 1, 89–111. [Google Scholar] [CrossRef]

- Choi, S.; Andrzej, R. A risk-averse newsvendor with law invariant coherent measures of risk. Oper. Res. Lett. 2008, 36, 77–82. [Google Scholar] [CrossRef] [Green Version]

- Choi, S.; Andrzej, R.; Zhao, Y. A multiproduct risk-averse newsvendor with law-invariant coherent measures of risk. Oper. Res. 2001, 59, 346–364. [Google Scholar] [CrossRef] [Green Version]

- Choi, S.; Andrzej, R. A multi-product risk-averse newsvendor with exponential utility function. Eur. J. Oper. Res. 2011, 214, 78–84. [Google Scholar] [CrossRef] [Green Version]

- Olson, D.L.; Wu, D. Value at Risk Models. In Enterprise Risk Management Models. Springer Texts in Business and Economics; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Paul, E.; Liu, H.; Wang, R. Quantile-Based Risk Sharing. Oper. Res. 2018, 66, 936–949. [Google Scholar]

- Corbett, C.J.; Zhou, D.; Tang, C.S. Designing supply contracts: Contract type and information asymmetry. Manag. Sci. 2004, 50, 550–559. [Google Scholar] [CrossRef]

- Chung, W.; Talluri, S.; Narasimhan, R. Quantity flexibility contract in the presence of discount incentive. Decis. Sci. 2014, 45, 49–79. [Google Scholar]

- Gan, X.; Sethi, S.P.; Yan, H. Channel coordination with a risk-neutral supplier and a downside-risk-averse retailer. Prod. Oper. Manag. 2005, 14, 80–89. [Google Scholar] [CrossRef]

- Jin, M.; Wu, S.D. Supply Chain Coordination in Electronic Markets Auction and Contracting Mechanisms; Department of Industrial and System Engineering, Lehigh University: Bethlehem, PA, USA, 2001. [Google Scholar]

- Jin, M.; Yu, A. Procurement auctions and supply chain performance. Int. J. Prod. Econ. 2015, 162, 192–200. [Google Scholar] [CrossRef]

- Liu, W.; Shen, X.; Wang, D. The impacts of dual overconfidence behavior and demand updating on the decisions of port service supply chain: A real case study from China. Ann. Oper. Res. 2020, 291, 591–604. [Google Scholar] [CrossRef]

- Bernstein, F.; Federgruen, A. Coordination mechanisms for supply chains under price and service competition. Manuf. Serv. Oper. Manag. 2007, 9, 242–262. [Google Scholar] [CrossRef] [Green Version]

- Sethi, S.P.; Yan, H.; Zhang, H.; Zhou, J. A supply chain with a service requirement for each market signal. Prod. Oper. Manag. 2007, 16, 322–342. [Google Scholar] [CrossRef]

- Sieke, M.A.; Seifert, R.W.; Thonemann, U.W. Designing service level contracts for supply chain coordination. Prod. Oper. Manag. 2012, 21, 698–714. [Google Scholar]

- Xiao, T.; Xu, T. Coordinating price and service level decisions for a supply chain with deteriorating item under vendor managed inventory. Int. J. Prod. Econ. 2013, 145, 743–752. [Google Scholar] [CrossRef]

- Heydari, J. Coordinating supplier’s reorder point: A coordination mechanism for supply chains with long supplier lead time. Comput. Oper. Res. 2014, 48, 89–101. [Google Scholar] [CrossRef]

- Cakanyildirim, M.; Gan, X.; Sethi, S. Contracting and coordination under asymmetric production cost information. Prod. Oper. Manag. 2012, 21, 345–360. [Google Scholar] [CrossRef]

- Ha, A.Y. service provider-buyer contracting: Asymmetric cost information and cutoff level policy for buyer participation. Nav. Res. Logist. 2001, 48, 41–64. [Google Scholar] [CrossRef]

- Ha, A.Y.; Tong, S. Contracting and information sharing under supply chain competition. Manag. Sci. 2008, 54, 701–715. [Google Scholar] [CrossRef]

- Van Ryzin, G.; Vulcano, G. Optimal auctioning and ordering in an infinite horizon inventory-pricing system. Oper. Res. 2004, 52, 346–367. [Google Scholar] [CrossRef] [Green Version]

- Abhishek, V.; Hajek, B.; Williams, S.R. Auctions with a profit sharing contract. Games Econ. Behav. 2013, 77, 247–270. [Google Scholar] [CrossRef] [Green Version]

- Jain, V.; Panchal, G.; Kumar, S. Universal service provider selection via multi-dimensional auction mechanisms for two-way competition in oligopoly market of supply chain. Omega 2014, 47, 127–137. [Google Scholar] [CrossRef]

- Huang, M.; Qian, X.; Fang, S.C.; Wang, X. Winner determination for risk aversion buyers in multi-attribute reverse auction. Omega 2016, 592, 184–200. [Google Scholar] [CrossRef]

- Chen, J.; Feng, J.; Whinston, A.B. Keyword auctions, unit-price contracts, and the role of commitment. Prod. Oper. Manag. 2007, 19, 30–321. [Google Scholar] [CrossRef]

- Iyengar, G.; Kumar, A. Optimal procurement mechanisms for divisible goods with capacitated suppliers. Rev. Econ. Des. 2008, 12, 129–154. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.J.; Vulcano, G. Effects of information disclosure under first- and second-price auctions in a supply chain setting. Manuf. Serv. Oper. Manag. 2008, 11, 299–316. [Google Scholar] [CrossRef]

- Che, Y.K. Design competition through multi-dimensional auctions. RAND J. Econ. 1993, 24, 668–680. [Google Scholar] [CrossRef]

- Branco, F. The design of multidimensional auctions. RAND J. Econ. 1997, 28, 63–81. [Google Scholar] [CrossRef]

- Parkes, D.; Kalagnanam, J. Models for iterative multiattribute procurement auctions. Manag. Sci. 2005, 51, 435–451. [Google Scholar] [CrossRef] [Green Version]

- Chen, K. Procurement strategies and coordination mechanism of the supply chain with one manufacturer and multiple suppliers. Int. J. Prod. Econ. 2012, 138, 125–135. [Google Scholar] [CrossRef]

- Arcelus, F.J.; Satyendra, K.; Srinivasan, G. Inventory model with stochastic lead-time and price dependent demand incorporating advance payment. Int. Trans. Oper. Res. 2006, 13, 209–227. [Google Scholar] [CrossRef]

- Leng, M.; Parlar, M. Game-Theoretic Analyses of Decentralized Assembly Supply Chains: Non-Cooperative Equilibria vs. Coordination with Cost-Sharing Contracts. Eur. J. Oper. Res. 2010, 204, 96–104. [Google Scholar] [CrossRef]

- Mathewson, F.; Winter, R.A. Buyer groups. Int. J. Ind. Organ. 1997, 15, 137–164. [Google Scholar] [CrossRef]

- Gans, J.S.; King, S.P. Exclusionary contracts and competition for large buyers. Int. J. Ind. Organ. 2002, 20, 1363–1381. [Google Scholar] [CrossRef]

| Notation | Definition |

|---|---|

| r: | service price; |

| q: | order quantity; |

| c: | the SI’s holding cost; |

| : | side payment of SP i, for ; |

| : | the SP i’s wholesale price; |

| : | the SP i’s service cost, stands for low cost, stands for high cost, ; |

| : | the SI’s profit when ; the entire supply chain’s profit when ; |

| the low-(high-)cost SP’s profit when ; | |

| : | the confidence level for the SI’s risk measure; |

| : | the SP i’s reservation profit, . |

| ↓ | ↑ | ↓ | ↑ | ↑ | |

| ↑ | ↓ | ↑ | ↓ | ↓ |

| ↑ | ↓ | ↑ | ↓ | ↓ | |

| ↓ | ↑ | ↓ | ↑ | ↑ |

| Cooperation | Demand Disturbance∼Exponential | Demand Disturbance∼Normal | |||||||

|---|---|---|---|---|---|---|---|---|---|

| with the | Symmetric | Asymmetric | Symmetric | Asymmetric | |||||

| Low-Cost SP | Information | Information | Information | Information | |||||

| 0.9 | 10 | 25.58 | 30.00 | 17.94 | 36.67 | 58.67 | 30.00 | 41.14 | 36.67 |

| 12 | 19.92 | 34.00 | 45.67 | 34.00 | |||||

| 14 | 15.95 | 38.00 | 36.57 | 38.00 | |||||

| 0.95 | 10 | 33.29 | 30.00 | 23.34 | 62.67 | 30.00 | 43.95 | ||

| 12 | 25.91 | 34.00 | 48.79 | 34.00 | |||||

| 14 | 20.75 | 38.00 | 39.06 | 38.00 | |||||

| 0.99 | 10 | 51.17 | 30.00 | 35.89 | 70.33 | 30.00 | 49.33 | ||

| 12 | 39.84 | 34.00 | 54.76 | 34.00 | |||||

| 14 | 31.89 | 38.00 | 43.84 | 38.00 | |||||

| Cooperation | Demand Disturbance∼Exponential | Demand Disturbance∼Normal | |||||||

|---|---|---|---|---|---|---|---|---|---|

| with the | Symmetric | Asymmetric | Symmetric | Asymmetric | |||||

| High-Cost SP | Information | Information | Information | Information | |||||

| 0.9 | 16 | 13.05 | 42.00 | 12.76 | 43.33 | 29.93 | 42.00 | 29.26 | 43.33 |

| 18 | 10.88 | 46.00 | 24.95 | 46.00 | |||||

| 20 | 9.21 | 50.00 | 21.12 | 50.00 | |||||

| 0.95 | 16 | 16.98 | 42.00 | 16.60 | 43.33 | 31.97 | 42.00 | 31.26 | 43.33 |

| 18 | 14.16 | 46.00 | 26.65 | 46.00 | |||||

| 20 | 11.98 | 50.00 | 22.56 | 50.00 | |||||

| 0.99 | 16 | 26.11 | 42.00 | 25.52 | 35.88 | 42.00 | 35.08 | ||

| 18 | 21.76 | 46.00 | 29.91 | 46.00 | |||||

| 20 | 18.42 | 50.00 | 25.32 | 50.00 | |||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cao, J.; Ma, C. Procurement Strategies and Auction Mechanism for Heterogeneous Service Providers in a Service Supply Chain. Sustainability 2022, 14, 9201. https://doi.org/10.3390/su14159201

Cao J, Ma C. Procurement Strategies and Auction Mechanism for Heterogeneous Service Providers in a Service Supply Chain. Sustainability. 2022; 14(15):9201. https://doi.org/10.3390/su14159201

Chicago/Turabian StyleCao, Jifeng, and Cheng Ma. 2022. "Procurement Strategies and Auction Mechanism for Heterogeneous Service Providers in a Service Supply Chain" Sustainability 14, no. 15: 9201. https://doi.org/10.3390/su14159201

APA StyleCao, J., & Ma, C. (2022). Procurement Strategies and Auction Mechanism for Heterogeneous Service Providers in a Service Supply Chain. Sustainability, 14(15), 9201. https://doi.org/10.3390/su14159201