3.1. Research Simulation

3.1.1. Indonesia’s Total Electricity Demand

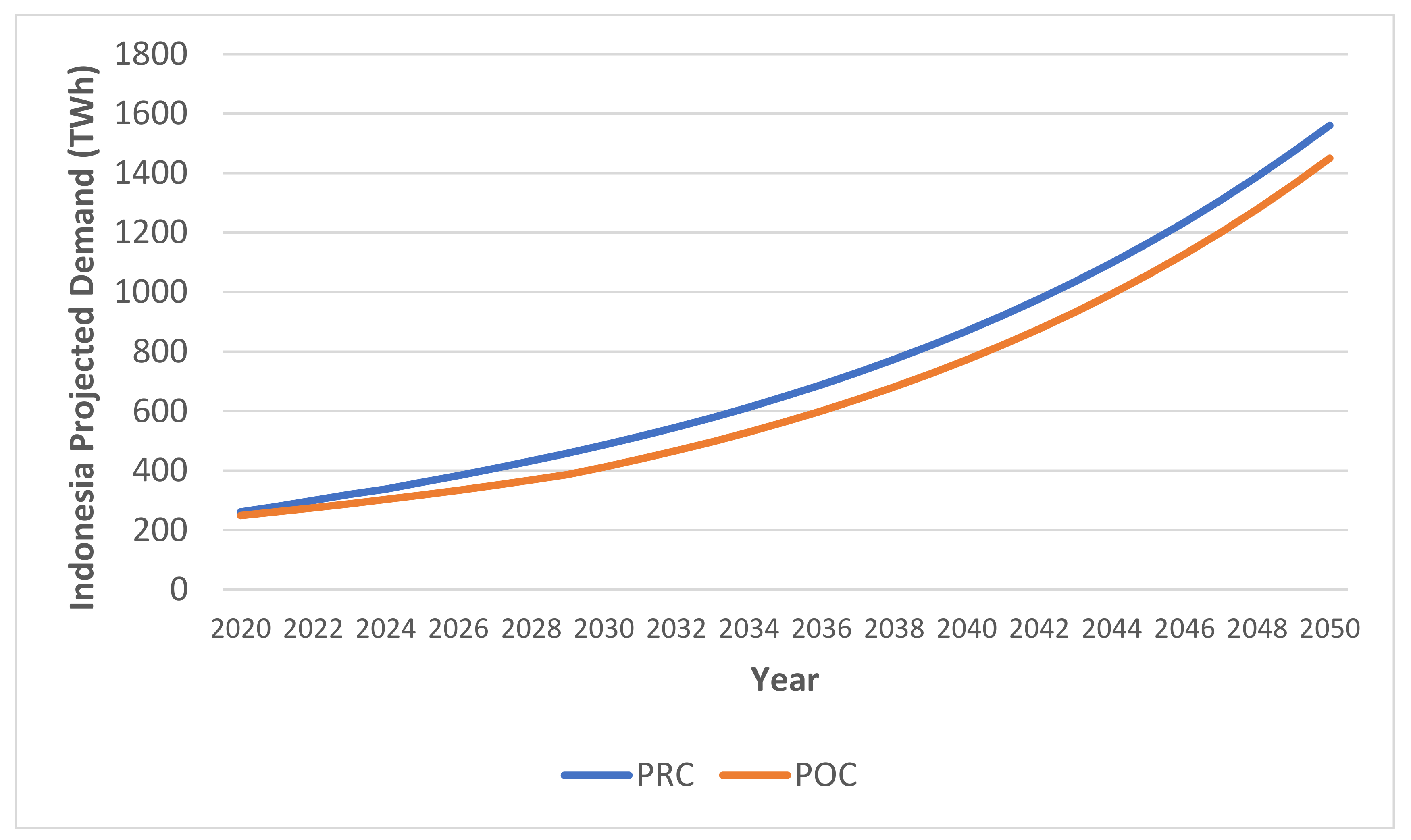

The total electricity demand for both the PRC and POC assumptions from 2020 to 2050 is depicted in

Figure 7. In PRC conditions, Indonesia’s electricity demand is projected to reach 360.9 TWh by 2025 and 1561 TWh by 2050. However, COVID-19 is reducing the demand for electricity. The year 2020 saw a 243.5 TWh overall demand for electricity in Indonesia [

15]. The predicted total power demand in 2025 under the POC demand assumption will be 318 TWh, which is 12% less than the demand under the BAU scenario for the same year. The overall power demand for Indonesia in 2050 will be 1450.5 TWh if, after 2030, the demand for electricity can recover to an average increase of 6.5 percent each year.

3.1.2. Business as Usual (BaU) Scenario

The BAU scenario projection results indicate that, in the absence of a renewable energy target constraint on Indonesia’s future power generating expansion, coal and natural gas power plants will have the largest capacity in the country’s energy mix. In the BAU scenario, the total projected power generated output will increase from 283.5 TWh in 2020 to 390.2 TWh in 2025, 832.0 TWh in 2038, and 1678.7 TWh in 2050, as shown in

Figure 8. Indonesia’s total power generation capacity will be 105.59 GW, 169.5 GW, and 332.29 GW in 2025, 2038, and 2050, respectively, as shown in

Figure 9.

In 2025, the entire output of BAU power generation will be 390.2 TWh. The energy mix is made up of hydropower (9.92%), geothermal (11.87%), biomass (0.19%), solar photovoltaics (0.68%), wind (0.78%), natural gas (0%), coal (76%), and oil (0.0%). As for 2025, there will be 105.59 GW of total power generation capacity, made up of hydropower (10.78 GW), geothermal (6.61 GW), biomass (0.17 GW), solar photovoltaic (1.38 GW), wind (1.24 GW), natural gas (27.42 GW), coal (50.53 GW), and oil (7.46 GW).

The total power generation output by 2038 will be 832.0 TWh. The energy mix consists of hydro (5.54%), geothermal (5.77%), biomass (0.14%), solar PV (0.32%), wind (0.38%), natural gas (41.60%), coal (46.24%), and oil (0%). In 2038, the total capacity will be 169.5 GW, consisting of hydro 12.84 GW, geothermal 6.86 GW, biomass 0.17 GW, solar PV 1.38 GW, wind 1.3 GW, natural gas 84.41 GW, coal 54.9 GW, and oil 7.64 GW.

The energy mix in 2050 consists of hydro (2.75%), geothermal (2.86%), biomass (0.07%), solar PV (0.16%), wind (0.19%), natural gas (28.48%), coal (65.49%), and oil (0%). In 2050, the total capacity will be 333.29 GW, consisting of hydro 12.84 GW, geothermal 6.86 GW, biomass 0.17 GW, solar PV 1.38 GW, wind 1.3 GW, natural gas 104.21 GW, coal 156.87 GW, and oil 48.66 GW.

The simulation reveals that the BAU scenario, which corresponds with PLN’s Electricity Business Plan 2019–2028, is still on track to achieve a 23 percent renewable energy objective by 2025, even if it lacks a renewable energy target. However, if the development of power generation is based on the least-cost approach, coal and natural gas will continue to be the most dominant energy sources through 2050. The simulation also indicates that there will be an overcapacity in power generation, which would cause the reserve margin to increase to a maximum of 76.7 percent between 2020 and 2031, as shown in

Figure 10.

The potential overcapacity between 2020 and 2031 will make PLN financially inefficient. PLN will be required to pay for the construction of power plants that were outlined in the PLN Electricity Business Plan 2019–2028 [

3], despite the fact that the demand can be met with the existing capacity until 2031. The overall cost of producing power under the BAU scenario up to 2050 will be 180.5 billion USD, as shown in

Figure 11. For the years 2020–2050, the BAU scenario will need a 3.5 billion USD investment in power generation annually.

3.1.3. Cost Optimization (CO) Scenario

The CO scenario is set to achieve the renewable energy targets at the lowest cost possible. The scenario offers an intriguing insight that Indonesia might be able to attain its renewable energy target at a reasonable cost by combining geothermal, biomass, hydroelectric, and wind power. As can be seen in

Figure 12, the total power generated output will be 343.8 TWh in 2025, 732.5 TWh in 2038, and 1559.5 TWh in 2050. In

Figure 13, the total power generation capacity for Indonesia will be 70.37 GW, 148.71 GW, and 347.4 GW in 2025, 2038, and 2050, respectively.

The energy mix in 2025 consists of hydro (5.2%), geothermal (17.32%), biomass (0.35%), solar PV (0.04%), wind (0.9%), natural gas (17.1%), coal (59.9%), and oil (0%). The total power generation capacity in 2025 will be 70.36 GW, which consists of hydro 4.98 GW, geothermal 8.49 GW, biomass 0.17 GW, solar PV 0.06 GW, wind 0.13 GW, natural gas 20.95 GW, coal 29.4 GW, and oil 6.18 GW.

The energy mix in 2038 consists of hydro (2.44%), geothermal (25.33%), biomass (0.16%), solar PV (0.02%), wind (0.04%), natural gas (43.87%), coal (28.13%), and oil (0%). Meanwhile, in 2038, the total capacity will be 148.71 GW, which consists of hydro 4.98 GW, geothermal 26.48 GW, biomass 0.17 GW, solar PV 0.06 GW, wind 0.13 GW, natural gas 81.30 GW, coal 29.4 GW, and oil 6.18 GW.

The energy mix in 2050 consists of hydro (1.15%), geothermal (12.81%), biomass (7.51%), solar PV (0.01%), wind (9.53%), natural gas (26.06%), coal (42.94%), and oil (0%). Meanwhile, in 2050, the total capacity will be 347.7 GW, which consists of hydro 4.98 GW, geothermal 28.5 GW, biomass 16.71 GW, solar PV 0.06 GW, wind 60.6 GW, natural gas 91.62 GW, coal 95.5 GW, and oil 49.42 GW.

As shown in

Figure 14, the CO scenario’s up until 2050, total cost of power production will be 89.21 billion USD. For the years 2020–2050, the CO scenario required an investment of 1.8 billion USD in power generation annually. However, more research on the power system is required to ascertain whether it is feasible to rely on renewable energy sources in large quantities, taking into account their availability and the power system’s reliability. The intermittent nature of renewable energy will also drastically decrease its availability. Power dispatchers may also experience difficulties controlling the power system due to the comparatively low proportion of natural gas in the energy mix, especially when the system is transitioning from off-peak to peak load. In order to address the change in demand for electricity, the output of a natural gas power plant can be increased or decreased rapidly. The natural gas power plants’ capability to adjust their output quickly will help power dispatchers in controlling the power system [

18,

20].

3.1.4. National Plan (NP) Scenario

The NP scenario aims to maintain a balance between fossil fuels and renewable energy to ensure the reliability and security of the electricity supply based on the National Electricity Plan 2019–2038.

Figure 15 shows the total power generated output for the NP scenario, which is 343.8 TWh in 2025, 732.5 TWh in 2038, and 1559.5 TWh in 2050. In 2025, 2038, and 2050 the NP’s total power generation capacity will reach 70.61 GW, 152 GW, and 347.44 GW, respectively, as can be seen in

Figure 16.

The energy mix in 2025 consists of hydro (5.2%), geothermal (17.32%), biomass (0.35%), solar PV (0.04%), wind (0.09%), natural gas (22.04%), coal (54.96%), and oil (0%). The total power generation capacity in 2025 will be 70.61 GW, which consists of hydro 4.98 GW, geothermal 9.71 GW, biomass 0.17 GW, solar PV 0.06 GW, wind 0.13 GW, natural gas 22.6 GW, coal 26.96 GW, and oil 6 GW.

The energy mix in 2038 consists of hydro (2.44%), geothermal (23.86%), biomass (0.16%), solar PV (0.02%), wind (1.52%), natural gas (25.19%), coal (46.81%), and oil (0%). Meanwhile, in 2038, the total capacity will be 151.97 GW, which consists of hydro 4.98 GW, geothermal 28.5 GW, biomass 0.17 GW, solar PV 0.06 GW, wind 4.53 GW, natural gas 58.81 GW, coal 48.92 GW, and oil 6 GW.

The energy mix in 2050 consists of hydro (1.15%), geothermal (11.21%), biomass (9.11%), solar PV (0.01%), wind (9.53%), natural gas (8.64%), coal (60.36%), and oil (0%). Meanwhile, in 2050, the total capacity will be 347.4 GW, which consists of hydro 4.98 GW, geothermal 28.5 GW, biomass 20.27 GW, solar PV 0.06 GW, wind 60.6 GW, natural gas 89.76 GW, coal 137.27 GW, and oil 6 GW.

Figure 17 shows that up until 2050, the NP scenario’s total cost of power production will be 124.63 billion USD. The NP scenario requires an annual investment in electricity generation of 2.7 billion USD on average from 2020 to 2050. The entire cost of producing power under the NP is 35.42 billion USD, which is 39.7% more expensive than under the CO scenario. In order to maintain Indonesia’s energy security while attaining the renewable energy objective, there will be a financial trade-off in the NP scenario, increasing the overall cost of production and investment.

3.1.5. Zero-Carbon (ZC) Scenario

The ZC scenario seeks to give a comprehensive view of Indonesia’s expansion of power generation in terms of achieving 100 percent renewable energy by 2050. In the ZC scenario, as shown in

Figure 18, the total power generated output is 343.8 TWh in 2025, 732.5 TWh in 2038, and 1559.5 TWh in 2050. In

Figure 19, the ZC’s total power generation capacity will reach 79.51 GW, 172.71 GW, and 789.11 GW in 2025, 2038, and 2050, respectively.

The energy mix in 2025 consists of hydro (23.07%), geothermal (10.77%), biomass (0.26%), solar PV (0.04%), wind (0.09%), natural gas (8.88%), coal (56.88%), and oil (0%). The total power generation capacity in 2025 will be 79.51 GW, which consists of hydro 22.08 GW, geothermal 6.04 GW, biomass 0.17 GW, solar PV 0.06 GW, wind 0.13 GW, natural gas 16.56 GW, coal 28.47 GW, and oil 6 GW.

The energy mix in 2038 consists of hydro (28.99%), geothermal (11.59%), biomass (0.16%), solar PV (0.02%), wind (0.04%), natural gas (32.03%), coal (27.18%), and oil (0%). Meanwhile, in 2038, the total capacity will be 172.71 GW, which consists of hydro 59.13 GW, geothermal 13.84 GW, biomass 0.17 GW, solar PV 0.06 GW, wind 0.13 GW, natural gas 58.61 GW, coal 28.41 GW, and oil 12.36 GW.

The energy mix in 2050 consists of hydro (17.61%), geothermal (11.21%), biomass (4.7%), solar PV (56.95%), wind (9.53%), natural gas (0%), coal (0%), and oil (0%). Meanwhile, in 2050, the total capacity will be 789.1 GW, which consists of hydro 93.3 GW, geothermal 28.5 GW, biomass 32.6 GW, solar PV 460.86 GW, wind 60.6 GW, natural gas 58.61 GW, coal 28.41 GW, and oil 26.2 GW.

As shown in

Figure 20, the ZC scenario’s overall cost of power production up until 2050 will be 134.06 billion USD. For the years 2020–2050, the ZC scenario will need a 3.7 billion USD investment in power generation annually. According to the modeling results, the ZC scenario will require 789.1 GW of power generation capacity by 2050, which is 227% more than what is required by the CO and NP scenarios. Furthermore, the results demonstrated that Indonesia’s existing renewable energy potential is insufficient to supply the required amount of power by 2050. As of now, Indonesia has a 441.7 GW potential for renewable energy [

21]. Meanwhile, the ZC scenario requires 675.89 GW of renewable energy generating capacity, with solar PV accounting for the largest generator at 460.86 GW. For Indonesia to be carbon-free by 2050, there is a gap in available renewable energy sources of up to 234.19 GW. Indonesia will need to explore new renewable energy potentials and introduce cutting-edge renewable energy technologies to increase the effectiveness of renewable energy conversion.