Recovering from Financial Implications of Flood Impacts—The Role of Risk Transfer in the West African Context

Abstract

1. Introduction

- (1)

- What are the flood impacts with financial implications for households?

- (2)

- What measures are available to households to address these impacts, and can they be classified as risk transfer?

- (3)

- How long do affected households take, on average, to recover financially from various types of flood impacts with financial implications?

- (4)

- What are the associations of existing measures with financial recovery, and what are the limitations of such measures?

2. Background

2.1. Risk Transfer

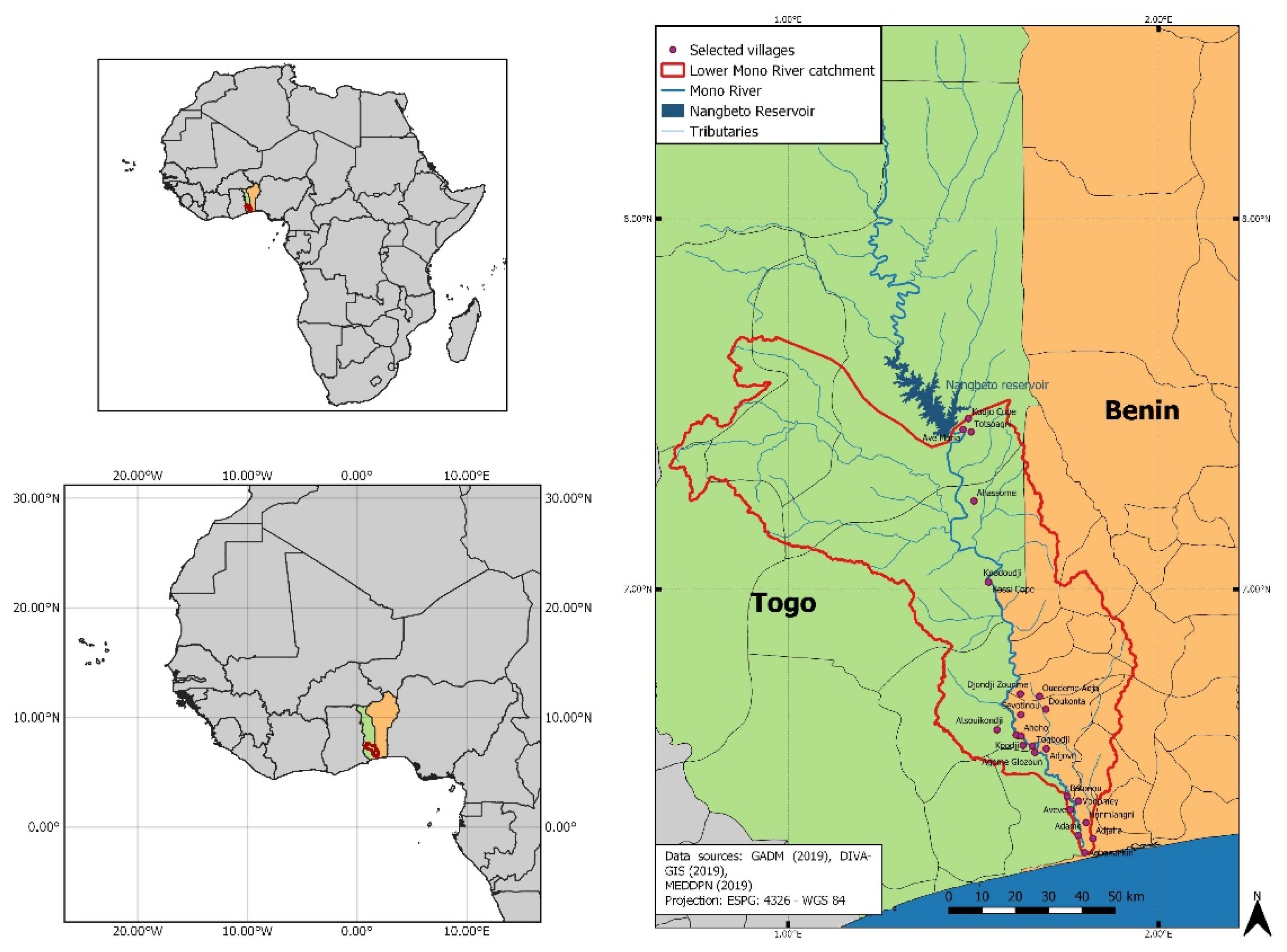

2.2. Case Study Area: Lower Mono River Basin

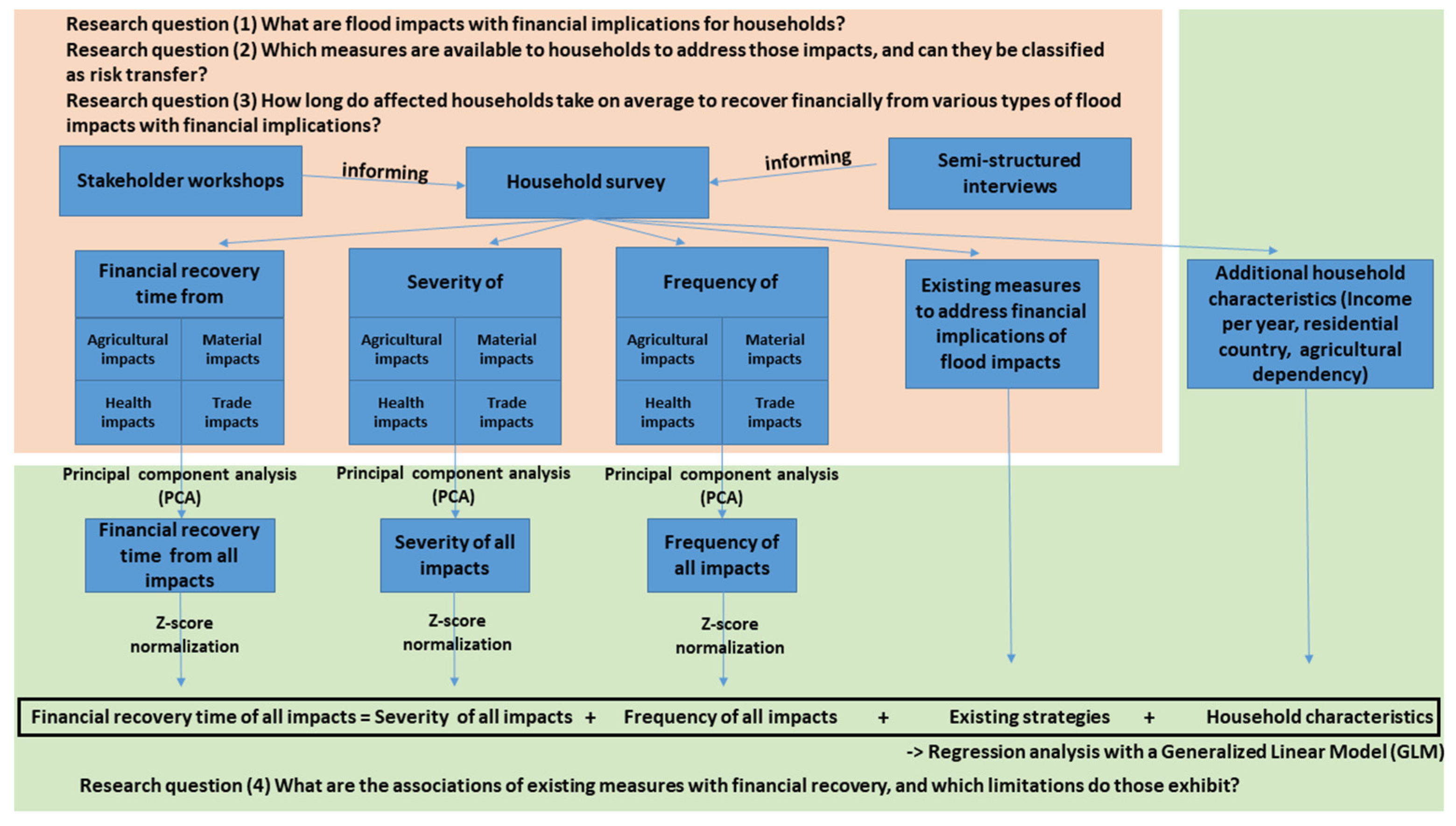

2.3. Data Collection and Analysis

2.3.1. Workshop/Semi-Structured Interviews

2.3.2. Household Survey

2.3.3. Principal Component Analysis

2.3.4. Generalized Linear Regression Model

3. Results

3.1. Characteristics and Prevalence of Flood Impacts with Financial Implications on the Household Level in the LMRB

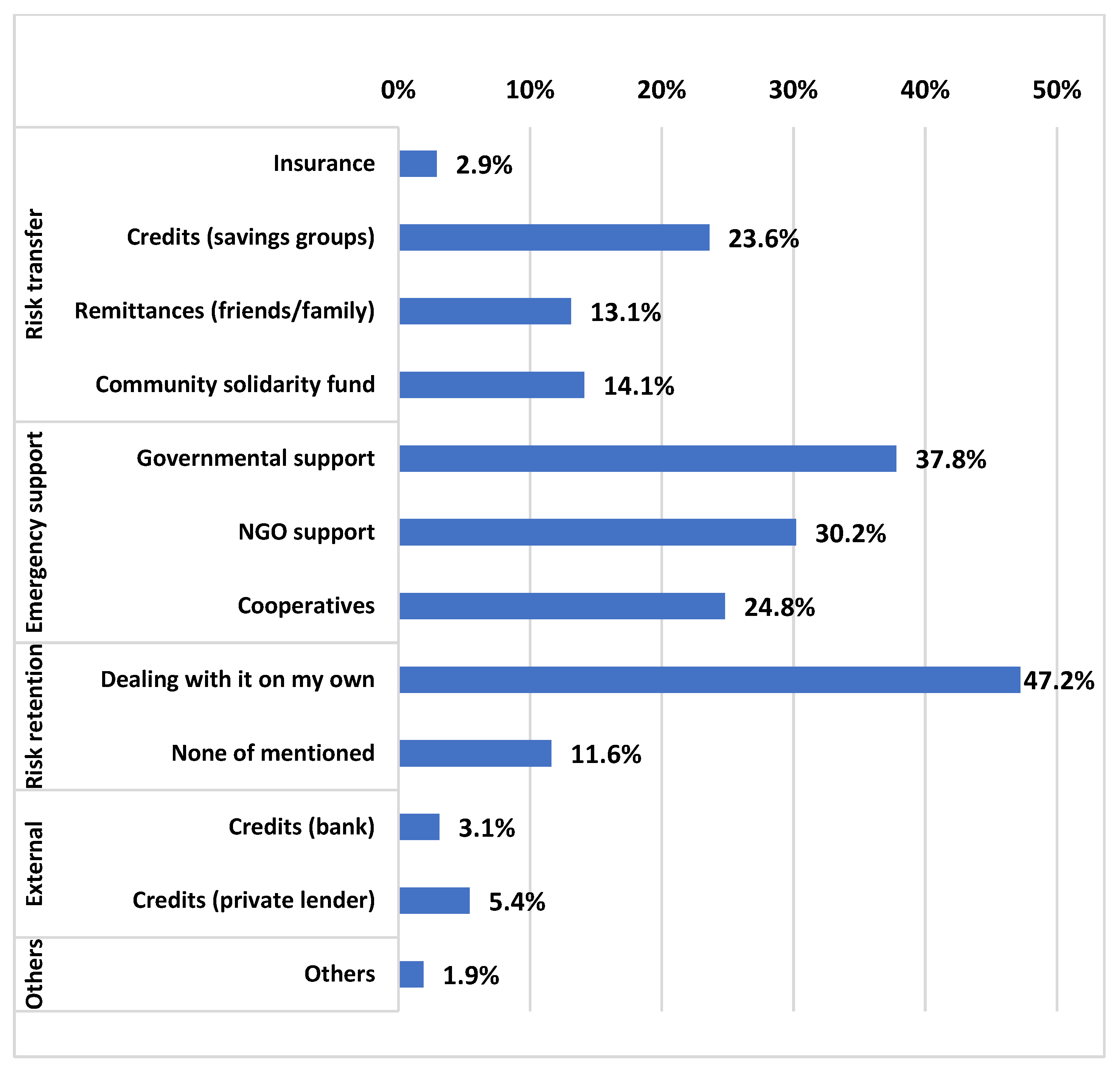

3.2. Financial Coping Strategies

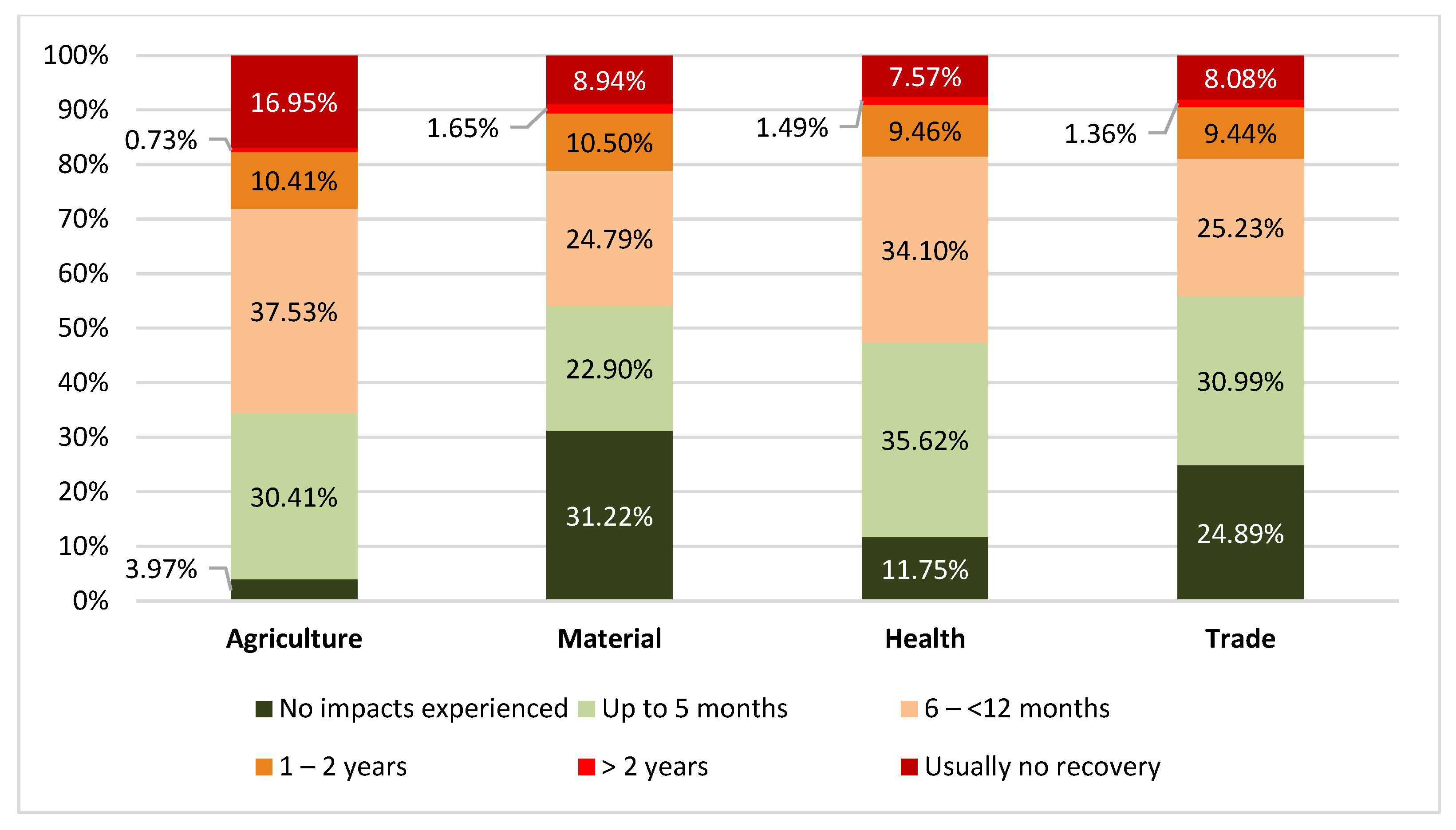

3.3. Financial Recovery Times of Households from Flood Impacts

3.4. Limitations of Existing Financial Coping Strategies

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

References

- Badou, F.D.; Hounkpè, J.; Yira, Y.; Ibrahim, M.; Bossa, A.Y. Increasing devastating flood events in West Africa: Who is to blame? In Regional Climate Change Series: Floods; Adegoke, J., Sylla, M.B., Bossa, A.Y., Ogunjobi, K., Adounkpe, J., Eds.; WASCAL Publishing: Accra, Ghana, 2019; pp. 84–90. [Google Scholar]

- Aich, V.; Koné, B.; Hattermann, F.; Paton, E. Time Series Analysis of Floods across the Niger River Basin. Water 2016, 8, 165. [Google Scholar] [CrossRef]

- Komi, K.; Amisigo, B.; Diekkrüger, B. Integrated Flood Risk Assessment of Rural Communities in the Oti River Basin, West Africa. Hydrology 2016, 3, 42. [Google Scholar] [CrossRef]

- Komi, K.; Amisigo, B.; Diekkrüger, B.; Hountondji, F. Regional Flood Frequency Analysis in the Volta River Basin, West Africa. Hydrology 2016, 3, 5. [Google Scholar] [CrossRef]

- Amoussou, E.; Awoye, H.; Totin Vodounon, H.S.; Obahoundje, S.; Camberlin, P.; Diedhiou, A.; Kouadio, K.; Mahé, G.; Houndénou, C.; Boko, M. Climate and Extreme Rainfall Events in the Mono River Basin (West Africa): Investigating Future Changes with Regional Climate Models. Water 2020, 12, 833. [Google Scholar] [CrossRef]

- Floodlist. Togo and Benin—Mono River Flooding Affects 50,000. Available online: https://floodlist.com/africa/togo-benin-mono-river-floods-october-november-2019 (accessed on 30 September 2021).

- Floodlist. Togo—Thousands Affected by Oti River Floods in North. Available online: https://floodlist.com/africa/togo-oti-river-floods-october-2020 (accessed on 30 September 2021).

- Floodlist. West Africa—Floods Hit Burkina Faso and Northern Ghana. Available online: https://floodlist.com/africa/west-africa-burkinafaso-ghana-september-2020 (accessed on 30 September 2021).

- Floodlist. West Africa—More Floods in Niger, Death Toll Rises in Burkina Faso. Available online: https://floodlist.com/africa/floods-niger-burkinafaso-september-2020 (accessed on 30 September 2021).

- Masson-Delmotte, V.; Zhai, P.; Pirani, A.; Connors, S.L.; Péan, C.; Berger, S.; Caud, N.; Chen, Y.; Goldfarb, L.; Gomis, M.I.; et al. Summary for Policymakers. In Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC, Ed.; Cambridge University Press: Cambridge, UK, 2021. [Google Scholar]

- Tiepolo, M.; Galligari, A. Urban expansion-flood damage nexus: Evidence from the Dosso Region, Niger. Land Use Policy 2021, 108, 105547. [Google Scholar] [CrossRef]

- Güneralp, B.; Güneralp, İ.; Liu, Y. Changing global patterns of urban exposure to flood and drought hazards. Glob. Environ. Chang. 2015, 31, 217–225. [Google Scholar] [CrossRef]

- Padonou, E.A.; Gbaï, N.I.; Kolawolé, M.A.; Idohou, R.; Toyi, M. How far are mangrove ecosystems in Benin (West Africa) conserved by the Ramsar Convention? Land Use Policy 2021, 108, 105583. [Google Scholar] [CrossRef]

- Asenso Barnieh, B.; Jia, L.; Menenti, M.; Zhou, J.; Zeng, Y. Mapping Land Use Land Cover Transitions at Different Spatiotemporal Scales in West Africa. Sustainability 2020, 12, 8565. [Google Scholar] [CrossRef]

- Okoye, C. Risk Management Options for Flood Mitigation in West Africa. Available online: https://futureafricaforum.org/2020/06/11/risk-management-options-for-flood-mitigation-in-west-africa/ (accessed on 28 September 2021).

- Wagner, S.; Souvignet, M.; Walz, Y.; Balogun, K.; Komi, K.; Kreft, S.; Rhyner, J. When does risk become residual? A systematic review of research on flood risk management in West Africa. Reg. Environ. Chang. 2021, 21, 84. [Google Scholar] [CrossRef]

- Yazdani, M.; Mojtahedi, M.; Loosemore, M.; Sanderson, D. A modelling framework to design an evacuation support system for healthcare infrastructures in response to major flood events. Prog. Disaster Sci. 2022, 13, 100218. [Google Scholar] [CrossRef]

- Quesada-Román, A. Flood risk index development at the municipal level in Costa Rica: A methodological framework. Environ. Sci. Policy 2022, 133, 98–106. [Google Scholar] [CrossRef]

- Granados-Bolaños, S.; Quesada-Román, A.; Alvarado, G.E. Low-cost UAV applications in dynamic tropical volcanic landforms. J. Volcanol. Geotherm. Res. 2021, 410, 107143. [Google Scholar] [CrossRef]

- Pinos, J.; Quesada-Román, A. Flood Risk-Related Research Trends in Latin America and the Caribbean. Water 2022, 14, 10. [Google Scholar] [CrossRef]

- EM-Dat. The Emergency Events Database—Universite Catholique de Louvain (UCL). Available online: https://public.emdat.be/ (accessed on 28 September 2021).

- Ajibade, I.; McBean, G.; Bezner-Kerr, R. Urban flooding in Lagos, Nigeria: Patterns of vulnerability and resilience among women. Glob. Environ. Chang. 2013, 23, 1714–1725. [Google Scholar] [CrossRef]

- Afriyie, K.; Ganle, J.K.; Santos, E. ‘The floods came and we lost everything’: Weather extremes and households’ asset vulnerability and adaptation in rural Ghana. Clim. Dev. 2018, 10, 259–274. [Google Scholar] [CrossRef]

- Kheradmand, S.; Seidou, O.; Konte, D.; Barmou Batoure, M.B. Evaluation of adaptation options to flood risk in a probabilistic framework. J. Hydrol. Reg. Stud. 2018, 19, 1–16. [Google Scholar] [CrossRef]

- Haer, T.; Botzen, W.J.W.; Aerts, J.C.J.H. Advancing disaster policies by integrating dynamic adaptive behaviour in risk assessments using an agent-based modelling approach. Environ. Res. Lett. 2019, 14, 44022. [Google Scholar] [CrossRef]

- Mai, T.; Mushtaq, S.; Reardon-Smith, K.; Webb, P.; Stone, R.; Kath, J.; An-Vo, D.-A. Defining flood risk management strategies: A systems approach. Int. J. Disaster Risk Reduct. 2020, 47, 101550. [Google Scholar] [CrossRef]

- Treby, E.J.; Clark, M.J.; Priest, S.J. Confronting flood risk: Implications for insurance and risk transfer. J. Environ. Manag. 2006, 81, 351–359. [Google Scholar] [CrossRef]

- Surminski, S.; Oramas-Dorta, D. Flood insurance schemes and climate adaptation in developing countries. Int. J. Disaster Risk Reduct. 2014, 7, 154–164. [Google Scholar] [CrossRef]

- Jongman, B.; Hochrainer-Stigler, S.; Feyen, L.; Aerts, J.C.J.H.; Mechler, R.; Botzen, W.J.W.; Bouwer, L.M.; Pflug, G.; Rojas, R.; Ward, P.J. Increasing stress on disaster-risk finance due to large floods. Nat. Clim. Chang. 2014, 4, 264–268. [Google Scholar] [CrossRef]

- Thieken, A.H.; Kienzler, S.; Kreibich, H.; Kuhlicke, C.; Kunz, M.; Mühr, B.; Müller, M.; Otto, A.; Petrow, T.; Pisi, S.; et al. Review of the flood risk management system in Germany after the major flood in 2013. Ecol. Soc. 2016, 21, 51. [Google Scholar] [CrossRef]

- Hochrainer-Stigler, S.; Linnerooth-Bayer, J.; Lorant, A. The European Union Solidarity Fund: An assessment of its recent reforms. Mitig. Adapt. Strateg. Glob. Chang. 2017, 22, 547–563. [Google Scholar] [CrossRef]

- Prettenthaler, F.; Albrecher, H.; Asadi, P.; Köberl, J. On flood risk pooling in Europe. Nat. Hazards 2017, 88, 1–20. [Google Scholar] [CrossRef]

- Kron, W.; Eichner, J.; Kundzewicz, Z.W. Reduction of flood risk in Europe—Reflections from a reinsurance perspective. J. Hydrol. 2019, 576, 197–209. [Google Scholar] [CrossRef]

- Islam, A.; Leister, C.M.; Mahmud, M.; Raschky, P.A. Natural disaster and risk-sharing behavior: Evidence from rural Bangladesh. J. Risk Uncertain 2020, 61, 67–99. [Google Scholar] [CrossRef]

- Panman, A.; Madison, I.; Kimacha, N.N.; Falisse, J.-B. Saving Up for a Rainy Day? Savings Groups and Resilience to Flooding in Dar es Salaam, Tanzania. Urban Forum 2021, 33, 13–33. [Google Scholar] [CrossRef]

- Hallegatte, S.; Bangalore, M.; Bonzanigo, L.; Fay, M.; Kane, T.; Narloch, U.; Rozenberg, J.; Treguer, D.; Vogt-Schilb, A. Shock Waves: Managing the Impacts of Climate Change on Poverty; World Bank Publications: Washington, DC, USA, 2016; Available online: https://documents1.worldbank.org/curated/en/260011486755946625/pdf/ShockWaves-FullReport.pdf (accessed on 24 January 2022).

- Germanwatch & MCII. Climate Risk Insurance and Informal Risk-Sharing: A Critical Literature Appraisal. Available online: https://climate-insurance.org/wp-content/uploads/2020/05/Climate_risk_insurance_and_ISRA_Discussion_Paper_No_4_FINAL-2.pdf (accessed on 30 September 2021).

- UNDRR. Risk Transfer: Terminology. Available online: https://www.undrr.org/terminology/risk-transfer (accessed on 30 September 2021).

- Cissé, J.D. Climate and Disaster Risk Financing Instruments: An Overview; United Nations University Institute for Environment and Human Security: Bonn, Germany, 2021; Available online: https://climate-insurance.org/wp-content/uploads/2021/05/Climate-and-Disaster-Risk-Financing-Instruments.pdf (accessed on 30 January 2022).

- Radermacher, R.; Dror, I.; Noble, G. Challenges and strategies to extend health insurance to the poor. In Protecting the Poor: A Microinsurance Compendium; Churchill, C., Ed.; Munich Re Foundation: Munich, Germany, 2006; pp. 66–93. [Google Scholar]

- Schinko, T.; Mechler, R.; Hochrainer-Stigler, S. The Risk and Policy Space for Loss and Damage: Integrating Notions of Distributive and Compensatory Justice with Comprehensive Climate Risk Management. In Loss and Damage from Climate Change: Concepts, Methods and Policy Options, Climate Risk Management, Policy and Governance; Mechler, R., Bouwer, L.M., Schinko, T., Surminski, S., Linnerooth-Bayer, J., Eds.; Springer: Cham, Switzerland, 2019; pp. 83–110. [Google Scholar]

- Bouwer, L.M. Observed and Projected Impacts from Extreme Weather Events: Implications for Loss and Damage. In Loss and Damage from Climate Change: Concepts, Methods and Policy Options, Climate Risk Management, Policy and Governance; Mechler, R., Bouwer, L.M., Schinko, T., Surminski, S., Linnerooth-Bayer, J., Eds.; Springer: Cham, Switzerland, 2019; pp. 63–82. [Google Scholar]

- Ridolfi, E.; Di Francesco, S.; Pandolfo, C.; Berni, N.; Biscarini, C.; Manciola, P. Coping with Extreme Events: Effect of Different Reservoir Operation Strategies on Flood Inundation Maps. Water 2019, 11, 982. [Google Scholar] [CrossRef]

- Tourment, R.; Beullac, B.; Poulain, D. Management and Safety of Flood Defense Systems. In Floods; Vinet, F., Ed.; Elsevier: Amsterdam, The Netherlands, 2017; pp. 31–44. ISBN 9781785482694. [Google Scholar]

- Pinter, N.; Huthoff, F.; Dierauer, J.; Remo, J.W.; Damptz, A. Modeling residual flood risk behind levees, Upper Mississippi River, USA. Environ. Sci. Policy 2016, 58, 131–140. [Google Scholar] [CrossRef]

- Christophers, B. The allusive market: Insurance of flood risk in neoliberal Britain. Econ. Soc. 2019, 48, 1–29. [Google Scholar] [CrossRef]

- Surminski, S.; Eldridge, J. Flood insurance in England—An assessment of the current and newly proposed insurance scheme in the context of rising flood risk. J. Flood Risk Manag. 2017, 10, 415–435. [Google Scholar] [CrossRef]

- Thomas, A.; Leichenko, R. Adaptation through insurance: Lessons from the NFIP. Int. J. Clim. Chang. Strateg. Manag. 2011, 3, 250–263. [Google Scholar] [CrossRef]

- UN OCHA. OCHA Natural Disaster Bulletin: N° 8/Octobre 2007. Available online: https://reliefweb.int/sites/reliefweb.int/files/resources/0CDEFF8F9C8A732185257392005B3B60-Full_Report.pdf (accessed on 10 July 2021).

- UN OCHA. West Africa—Floods: As of 27 September 07. Available online: https://reliefweb.int/sites/reliefweb.int/files/resources/2A3EBB3602FF36418525736400536822-ocha_FL_wa070927.pdf (accessed on 10 July 2021).

- United Nations. Bénin: Les Inondations Continuent, L’aide Parvient Aux Sinistrés. Available online: https://news.un.org/fr/story/2010/11/200062-benin-les-inondations-continuent-laide-parvient-aux-sinistres (accessed on 10 May 2021).

- United Nations Economic Commission for Africa. Rapport D’evaluation Sur L’intégration et la Mise en Oeuvre des Mesures de Réduction des Risques de Catastrophe au Togo. Available online: https://archive.uneca.org/sites/default/files/uploaded-documents/Natural_Resource_Management/drr/drr-in-togo_french_final.pdf (accessed on 10 May 2021).

- Vert Togo. Togo/Inondations: Le Débordement du Fleuve du Mono Fait un Mort à Klikamé. Available online: https://vert-togo.com/togo-inondations-le-debordement-du-fleuve-du-mono/ (accessed on 10 May 2021).

- Hounkpêvi, A.F. URGENT—Débordement du Fleuve Mono: 15 Villages Sous L’eau à Athiémé. Available online: http://lautrefigaro.over-blog.com/2019/10/urgent-debordement-du-fleuve-mono-15-villages-sous-l-eau-a-athieme.html (accessed on 10 May 2021).

- Vigan, D.C. Débordement du Fleuve Mono: Au Moins Trois Communes en Proie Aux Inondations. Available online: https://lanation.bj/debordement-du-fleuve-mono-au-moins-trois-communes-en-proie-aux-inondations/ (accessed on 10 July 2021).

- Agence Bénin Presse. Environnement/Près de 70,000 Populations Affectées Par L’inondation du Fleuve Mono Dans les Communes D’ATHIÉMÉ et de Grand-Popo Selon la PDRRC-ACC. Available online: https://www.agencebeninpresse.info/web/depeche/63/pres-de-70-000-populations-affectees-par-l-inondation-du-fleuve-mono-dans-les-communes-d-athieme-et-de-grand-popo-selon-la-pdrrc (accessed on 10 July 2021).

- Ntajal, J.; Lamptey, B.L.; Mahamadou, I.B.; Nyarko, B.K. Flood disaster risk mapping in the Lower Mono River Basin in Togo, West Africa. Int. J. Disaster Risk Reduct. 2017, 23, 93–103. [Google Scholar] [CrossRef]

- African Development Bank. Benin/Togo Nangbeto Hydroelectric Dam Project Performance Evaluation Report (PPER). Available online: https://www.afdb.org/en/documents/document/multinational-nangbeto-hydroelectric-dam-benin-togo-9679 (accessed on 10 June 2021).

- Amoussou, E.; Tramblay, Y.; Totin, H.S.; Mahé, G.; Camberlin, P. Dynamique et modélisation des crues dans le bassin du Mono à Nangbéto (Togo/Bénin). Hydrol. Sci. J. 2014, 59, 2060–2071. [Google Scholar] [CrossRef]

- Ntajal, J.; Lamptey, B.L.; Mianikpo Sogbedjic, J.; Kpotivid, W.-B.K. Rainfall trends ad flood frequency analyses in the Lower Mono River Basin in Togo, West Africa. Int. J. Adv. Res. 2016, 4, 2320–9186. [Google Scholar]

- Nato, G. Risques de Catastrophe Liés aux Inondations dans le Mono: L’Anpc Alerte et Sensibilise la Plateforme de Lokossa. Available online: https://actubenin.com/risques-de-catastrophe-lies-aux-inondations-dans-le-monolanpc-alerte-et-sensibilise-la-plateforme-de-lokossa (accessed on 10 July 2021).

- Toussounon, A. Nangbéto: Quand la Source D’énergie Devient Source de Malheurs. Available online: https://www.podcastjournal.net/Nangbeto-Quand-la-source-d-energie-devient-source-de-malheurs_a5882.html (accessed on 10 July 2021).

- Mike, M. Crue du Fleuve Mono: Probables Lâchées D’eau Depuis Nangbéto. Available online: https://matinlibre.com/2021/08/31/crue-du-fleuve-mono-probables-lachees-deau-depuis-nangbeto/ (accessed on 10 July 2021).

- Parkoo, E.N.; Thiam, S.; Adjanou, K.; Kokou, K.; Verleysdonk, S.; Adounkpe, J.G.; Villamor, G.B. Comparing Expert and Local Community Perspectives on Flood Management in the Lower Mono River Catchment, Togo and Benin. Water 2022, 14, 1536. [Google Scholar] [CrossRef]

- Hounguè, N.R.; Ogbu, K.N.; Almoradie, A.D.S.; Evers, M. Evaluation of the performance of remotely sensed rainfall datasets for flood simulation in the transboundary Mono River catchment, Togo and Benin. J. Hydrol. Reg. Stud. 2021, 36, 100875. [Google Scholar] [CrossRef]

- Wetzel, M.; Schudel, L.; Almoradie, A.; Komi, K.; Adounkpè, J.; Walz, Y.; Hagenlocher, M. Assessing flood risk dynamics in data-scarce environments—Experiences from combining participatory Impact Chains with Bayesian Network Analysis in the Lower Mono River Basin, Benin. Front. Water 2022, 4, 837688. [Google Scholar] [CrossRef]

- Thiam, S.; Salas, E.A.L.; Hounguè, N.R.; Almoradie, A.D.S.; Verleysdonk, S.; Adounkpe, J.G.; Komi, K. Modelling Land Use and Land Cover in the Transboundary Mono River Catchment of Togo and Benin Using Markov Chain and Stakeholder’s Perspectives. Sustainability 2022, 14, 4160. [Google Scholar] [CrossRef]

- Kissi, A.E.; Abbey, G.A.; Agboka, K.; Egbendewe, A. Quantitative Assessment of Vulnerability to Flood Hazards in Downstream Area of Mono Basin, South-Eastern Togo: Yoto District. J. Geogr. Inf. Syst. 2015, 7, 607–619. [Google Scholar] [CrossRef][Green Version]

- The World Bank. Small but Smart: Benin and Togo Cooperate to Ensure Water Security. Available online: https://www.worldbank.org/en/news/feature/2018/01/25/small-but-smart-benin-and-togo-cooperate-to-ensure-water-security (accessed on 10 June 2021).

- Agbédoufio, P. Risques des Catastrophes dans le Mono: Lokossa en État D’alerte. Available online: https://matinlibre.com/2020/09/04/risques-des-catastrophes-dans-le-mono-lokossa-en-etat-dalerte/ (accessed on 10 June 2021).

- Deutsche Klimafinanzierung. Die InsuResilience Initiative und Global Partnership. Available online: https://www.deutscheklimafinanzierung.de/instrument/insuresilience/ (accessed on 15 November 2021).

- InsuResilience Global Partnership. InsuResilience Global Partnership Vision 2025. Available online: https://www.insuresilience.org/wp-content/uploads/2021/11/vision2025_211022.pdf (accessed on 15 November 2021).

- Lokonon, B.O.K. Urban households’ attitude towards flood risk, and waste disposal: Evidence from Cotonou. Int. J. Disaster Risk Reduct. 2016, 19, 29–35. [Google Scholar] [CrossRef]

- Meton, A. Gestion des Risques et Catastrophes: L’assurance Comme une Priorité, Selon le Professeur Théodore Adjakpa. Available online: https://lanation.bj/gestion-des-risques-et-catastrophes-lassurance-comme-une-priorite-selon-le-professeur-theodore-adjakpa/ (accessed on 10 June 2021).

- Livelihoods Centre. Brochure de L’approche des «Clubs des Mères». Available online: https://www.livelihoodscentre.org/documents/114097690/114438848/LRC.+Brochure+approche+Club+de+Me%CC%80res.pdf/823cdbe8-0649-3c0d-4947-7267693c5673?t=1580204839368 (accessed on 10 July 2021).

- Levy, P.S.; Lemeshow, S. Sampling of Populations: Methods and Applications, 4th ed.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2008; ISBN 0470374594. [Google Scholar]

- Sabharwal, C.L.; Anjum, B. Data Reduction and Regression Using Principal Component Analysis in Qualitative Spatial Reasoning and Health Informatics. Polibits 2016, 53, 31–42. [Google Scholar] [CrossRef][Green Version]

- Rothmann, K.J. Epidemiology: An Introduction, 2nd ed.; Oxford University Press: Oxford, UK, 2012; ISBN 978-0-19-975455-7. [Google Scholar]

- Jolliffe, I.T.; Cadima, J. Principal component analysis: A review and recent developments. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2016, 374, 20150202. [Google Scholar] [CrossRef] [PubMed]

- Vidal, R.; Ma, Y.; Sastry, S.S. Generalized Principal Component Analysis; Springer: New York, NY, USA, 2016; ISBN 978-0-387-87810-2. [Google Scholar]

- Babyak, M.A. What You See May Not Be What You Get: A Brief, Nontechnical Introduction to Overfitting in Regression-Type Models. Psychosom. Med. 2004, 66, 411–421. [Google Scholar] [PubMed]

- Kastellec, J.P.; Leoni, E.L. Using Graphs Instead of Tables in Political Science. Perspect. Politics 2007, 5, 755–771. [Google Scholar] [CrossRef]

- Cissé, J.D.; Kreft, S.; Toepper, J.; Stadtmueller, D. From Innovation to Learning: A Strategic Evidence Roadmap for Climate and Disaster Risk Finance and Insurance; Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH: Bonn/Eschborn, Germany, 2021; Available online: https://climate-insurance.org/wp-content/uploads/2021/10/Strategic-CDRFI-Evidence-Roadmap.pdf (accessed on 17 March 2022).

- Schäfer, L.; Waters, E.; Kreft, S.; Zissener, M. Making Climate Risk Insurance Work for the Most Vulnerable: Seven Guiding Principles; UNU-EHS Publication Series Policy Report No. 1; Munich Climate Insurance Initiative: Bonn, Germany, 2016; Available online: http://collections.unu.edu/eserv/UNU:5830/MCII_ProPoor_161031_Online_meta.pdf (accessed on 2 March 2022).

- Kousky, C.; Shabman, L.; Linder-Baptie, Z.; St. Peter, E. Perspectives on Flood Insurance Demand Outside the 100-Year Floodplain; Issue Brief; Wharton University of Pennsylvania: Philadelphia, PA, USA, 2020; Available online: https://riskcenter.wharton.upenn.edu/wp-content/uploads/2020/05/Perspectives-on-Flood-Insurance-Demand-Outside-the-100-Year-Floodplain.pdf (accessed on 21 June 2022).

- Berg, E.; Blake, M.; Morsink, K. Risk sharing and the demand for insurance: Theory and experimental evidence from Ethiopia. J. Econ. Behav. Organ. 2022, 195, 236–256. [Google Scholar] [CrossRef]

- Will, M.; Groeneveld, J.; Frank, K.; Müller, B. Informal risk-sharing between smallholders may be threatened by formal insurance: Lessons from a stylized agent-based model. PLoS ONE 2021, 16, e0248757. [Google Scholar] [CrossRef]

- Riley, E. Mobile money and risk sharing against village shocks. J. Dev. Econ. 2018, 135, 43–58. [Google Scholar] [CrossRef]

- Quesada-Román, A.; Ballesteros-Cánovas, J.A.; Granados-Bolaños, S.; Birkel, C.; Stoffel, M. Improving regional flood risk assessment using flood frequency and dendrogeomorphic analyses in mountain catchments impacted by tropical cyclones. Geomorphology 2022, 396, 108000. [Google Scholar] [CrossRef]

- Kousky, C.; Lingle, B.; Kunreuther, H.; Shabman, L. Moving the Needle on Closing the Flood Insurance Gap; Wharton University of Pennsylvania: Philadelphia, PA, USA, 2019; Available online: https://riskcenter.wharton.upenn.edu/wp-content/uploads/2019/02/Moving-the-Needle-on-Closing-the-Flood-Insurance-Gap.pdf (accessed on 21 June 2022).

- Bin, O.; Bishop, J.; Kousky, C. Does the National Flood Insurance Program Have Redistributional Effects? B.E. J. Econ. Anal. Policy 2017, 17, 20160321. [Google Scholar] [CrossRef]

- Yore, R.; Walker, J.F. Microinsurance for disaster recovery: Business venture or humanitarian intervention? An analysis of potential success and failure factors of microinsurance case studies. Int. J. Disaster Risk Reduct. 2019, 33, 16–32. [Google Scholar] [CrossRef]

| Involved Parties | Coverage of | Types | Conditions | Exchanges |

|---|---|---|---|---|

|

|

|

|

|

| Variables | Unit | Description | Reason for Inclusion |

|---|---|---|---|

| Financial recovery time of a household (all impact types, dependent variable) | Months (z-score based on PCA) | Self-reported average period that a household needed over the past 20 years to cover the flood-related expenses after experiencing a flood event | Expression of a household’s average financial recovery time |

| Frequency of reoccurrence (all impact types as PCA score) | Years (z-score based on PCA) | Self-reported average frequency of reoccurrence of flood events over the past 20 years by the household | Accounting for the influence of flood frequency in the recovery time of a household |

| Severity of reoccurrence (all impact types as PCA score) | Low, Medium, High (z-score based on PCA) | Self-reported average severity of reoccurrence of flood events over the past 20 years by the household | Accounting for the influence of flood severity in the recovery time of a household |

| Existing strategies: Cooperatives, NGO support, Insurance, Community solidarity fund, Dealing with own resources, Governmental support, Credits (bank), Credits (savings groups), Credits (private lender), Remittances (family and friends), None | Yes, No | Prevalence of existing measures to deal with the financial implications of flood impacts; multiple responses possible | Primary measures to address the financial implications of flood impacts |

| Level of agricultural dependency of the household | Percentage | Expression of to what degree the income of a household is dependent on agricultural activities | Agriculture is the main livelihood and source of income in the LMRB; the survey sample contains agriculture-dependent households |

| Household income per year | CFA (z-score) | Self-reported yearly income of the household | This reflects the household’s financial capacity to recover financially within their own means |

| Residential country | Togo, Benin | The country in which a household resides | To account for differences between the two countries of the transboundary basin |

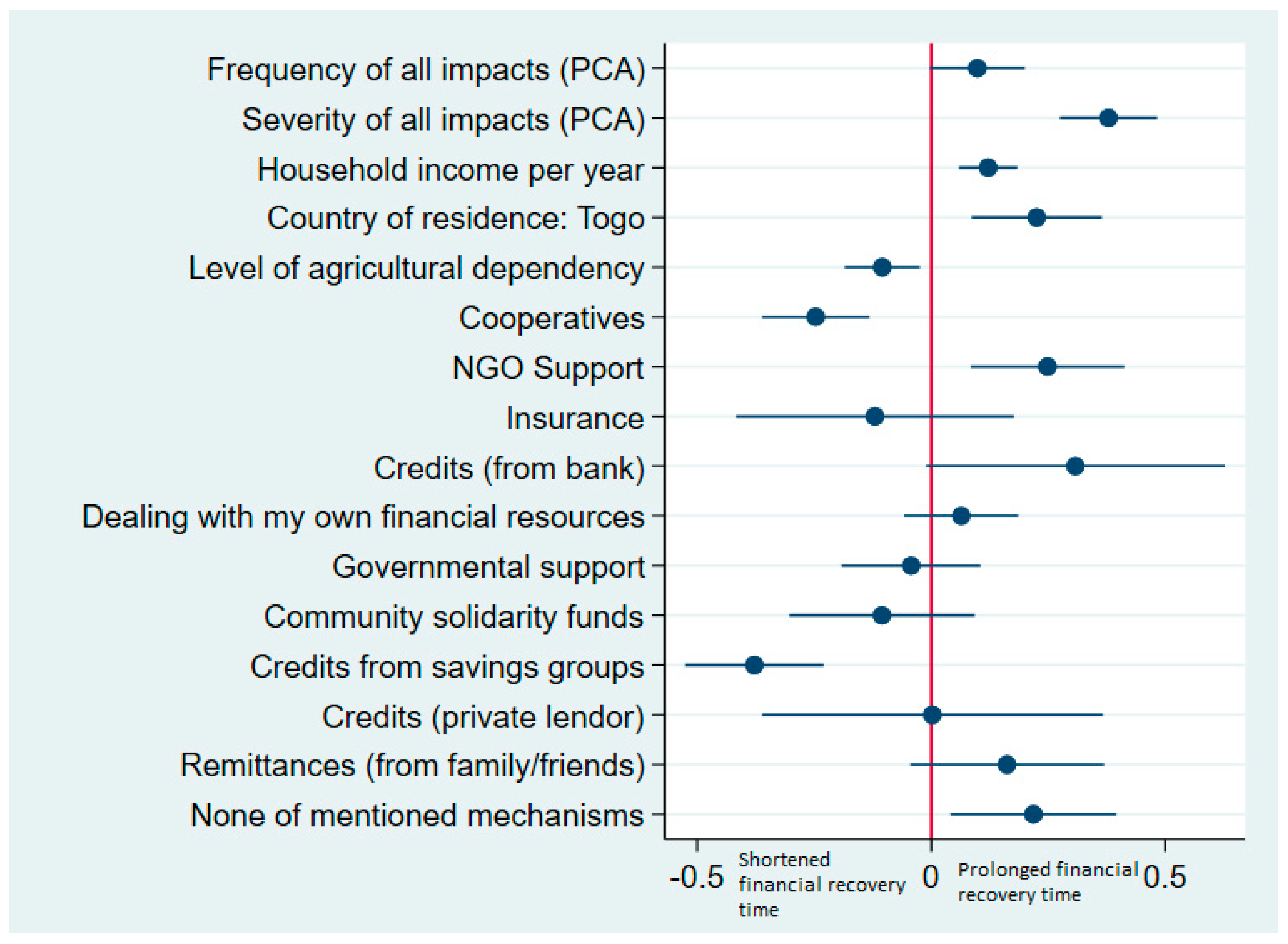

| Generalized Linear Model (GLM) | |||||

| Survey: Linear regression | |||||

| Number of strata = 24 Number of obs = 724 Number of PSUs = 724 Population size = 6920.6052 Design df = 700 F(16, 685) = 25.89 Prob > F = 0.0000 R-squared = 0.2700 | |||||

| LinearizedDependent: Financial Recovery Time (All Impact Types) | Coefficient | Std. Error | p-Value | (95% Conf. Interval) | |

| Frequency (all flood impacts types) | 0.0986015 | 0.0517094 | 0.057 | −0.0029225 | 0.2001255 |

| Severity (all flood impacts types) | 0.3786982 | 0.0529141 | 0.000 *** | 0.2748089 | 0.4825876 |

| HH income per year | 0.1215589 | 0.0318714 | 0.000 *** | 0.0589838 | 0.1841339 |

| Residence Country: Togo | 0.2253541 | 0.0709726 | 0.002 *** | 0.0860094 | 0.3646987 |

| Level of HH’s agricultural dependency | −0.1045096 | 0.0409899 | 0.011 *** | −0.1849874 | −0.0240317 |

| Cooperatives | −0.2469127 | 0.0584784 | 0.000 *** | −0.3617267 | −0.1320987 |

| NGO support | 0.2484345 | 0.0835508 | 0.003 *** | 0.0843943 | 0.4124746 |

| Insurance | −0.1202624 | 0.1514003 | 0.427 | −0.4175156 | 0.1769907 |

| Credits (from a bank) | 0.307972 | 0.1623919 | 0.058 | −0.0108615 | 0.6268054 |

| Using my own resources | 0.0641535 | 0.062116 | 0.302 | −0.0578025 | 0.1861095 |

| Governmental Support | −0.0429331 | 0.0755487 | 0.570 | −0.1912623 | 0.1053961 |

| Community Solidarity Funds | −0.1051181 | 0.1008933 | 0.298 | −0.3032078 | 0.0929715 |

| Credits (from savings groups) | −0.3779169 | 0.0754657 | 0.000 *** | −0.5260831 | −0.2297508 |

| Credits (from a private lender) | 0.0024999 | 0.185543 | 0.989 | −0.3617875 | 0.3667874 |

| Remittances (from friend or family) | 0.1620053 | 0.1053559 | 0.125 | −0.0448462 | 0.3688568 |

| None of the abovementioned options | 0.2183191 | 0.0902753 | 0.016 *** | 0.0410762 | 0.395562 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wagner, S.; Thiam, S.; Dossoumou, N.I.P.; Hagenlocher, M.; Souvignet, M.; Rhyner, J. Recovering from Financial Implications of Flood Impacts—The Role of Risk Transfer in the West African Context. Sustainability 2022, 14, 8433. https://doi.org/10.3390/su14148433

Wagner S, Thiam S, Dossoumou NIP, Hagenlocher M, Souvignet M, Rhyner J. Recovering from Financial Implications of Flood Impacts—The Role of Risk Transfer in the West African Context. Sustainability. 2022; 14(14):8433. https://doi.org/10.3390/su14148433

Chicago/Turabian StyleWagner, Simon, Sophie Thiam, Nadège I. P. Dossoumou, Michael Hagenlocher, Maxime Souvignet, and Jakob Rhyner. 2022. "Recovering from Financial Implications of Flood Impacts—The Role of Risk Transfer in the West African Context" Sustainability 14, no. 14: 8433. https://doi.org/10.3390/su14148433

APA StyleWagner, S., Thiam, S., Dossoumou, N. I. P., Hagenlocher, M., Souvignet, M., & Rhyner, J. (2022). Recovering from Financial Implications of Flood Impacts—The Role of Risk Transfer in the West African Context. Sustainability, 14(14), 8433. https://doi.org/10.3390/su14148433