1. Setting the Scene

1.1. Introduction

Since its accession to the EU, Romania has exhibited considerable economic and spatial dynamics. The country is still facing a significant urban–rural dichotomy. The Romanian national economy is on its way to reducing the gap that separates it from the developed European countries. With GDP growth rates that exceed 3% per year starting in 2013 (with a peak of 7% in 2017) and projected growth rates of over 4% in subsequent years, the growth engines remain both Bucharest, the capital city, and a number of growth poles in the country that include seven municipalities and their surrounding areas. According to the Romanian Constitution and law of local public administration, cities that have populations over a certain threshold (25,000 inhabitants) and have superior public utility networks as well as social and educational infrastructure can be declared municipalities. This creates both obligations as well as rights for the cities that aspire to be declared municipalities. In the context of the continuous growth of public expenditures, the national economy’s ability to grow is threatened by pending big infrastructure projects and by low rates of investment from the national government. The negative expectancies emerging recently, the projected shifts in production technology and consumer preferences, combined with development imbalances among Romanian regions and the rising inequality make the economy vulnerable to future economic shocks. Due to a negative demographic trend and high rates of emigration, Romanian communities (community is a general term that we use in this study to designate an inhabited/populated administrative area, no matter if it is an urban or rural one) ought to become much more resilient. Given the experience of the economic crisis in 2008 when some communities managed to remain competitive and stable, the need to increase the resilience of Romanian local economies has become imperative; consequently, research in this area is both actual and relevant.

Although there has been a high interest in measuring resilience in recent years, at the national level the topic appears to be generally less interesting for researchers. Also, there is a low level of interest from policymakers in evaluating the impact of the crisis at the local level, in designing and implementing resilience improvement strategic plans and policies, or in identifying the drivers that make communities robust in the face of downturns. Clearly, resilient communities show the ability to stay stable and competitive and provide citizens with a high quality of life.

Research on the topic of resilience focused on Romanian regions or local communities has been concentrated (with some exceptions) simply on defining the concept, on assessing the evolution of certain key indicators, and on studying a limited number of case studies with no intention of analyzing or identifying the basic factors that explain the ability to resist downturns. In the international literature the focus has evolved over time towards composing overall resilience indicators or specific indexes. These types of studies have an increased potential to identify the factors that truly make a community resilient, to evaluate the level of its resilience, but also to monitor eventual progress in its evolution.

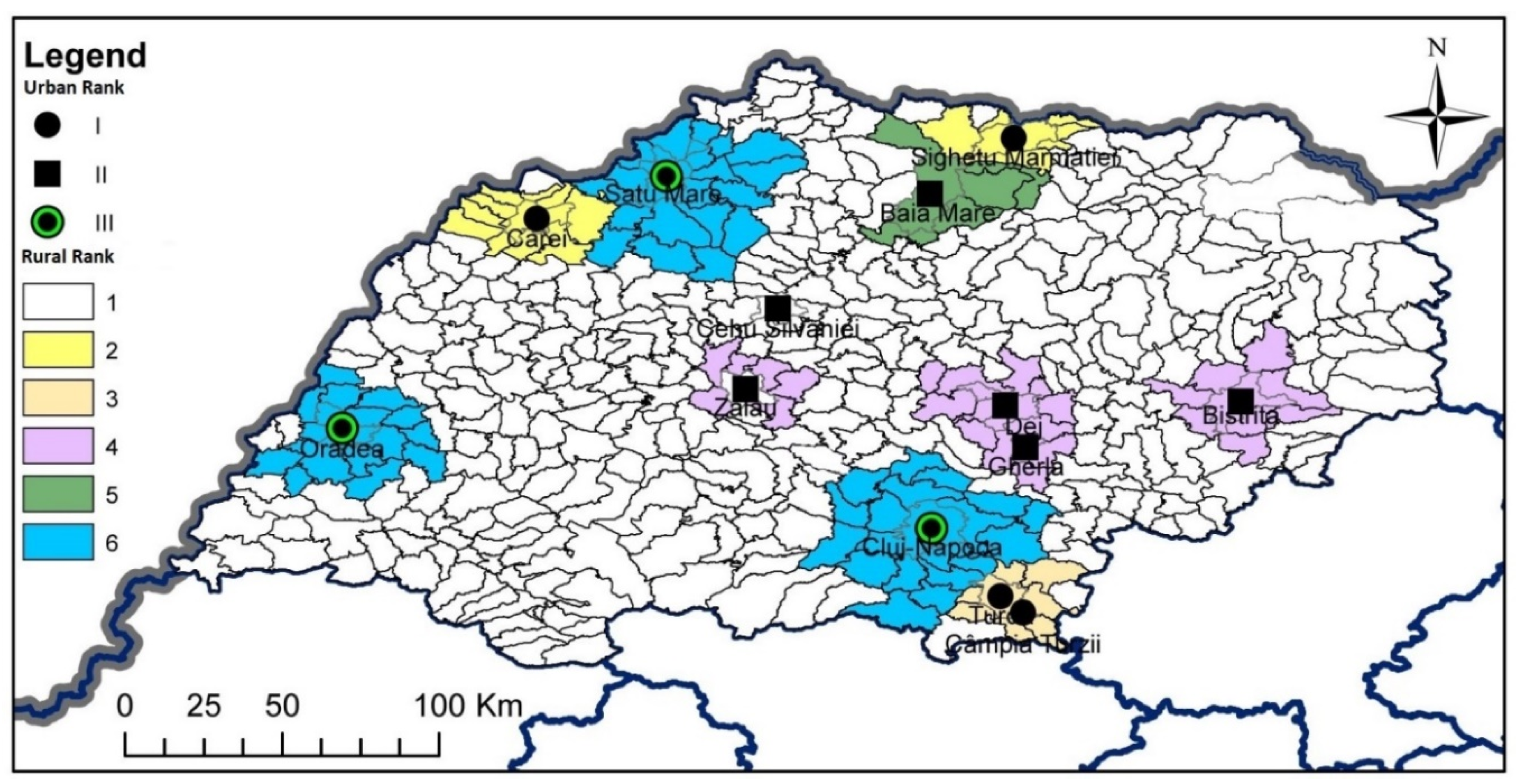

Our study aims to measure the economic resilience of a series of rural (403) and urban (43) communities from the North-West (NW) region of Romania. The research assesses the differences between—and identifies resilience drivers for—urban and rural communities in the region. The shock taken into consideration in our study is the financial crisis of 2007-2008, whose effects became significant starting in 2009 (at least in this part of Europe). Our aim is to test an explanatory model as a tool for measuring economic resilience and to identify the resilience drivers for local communities (urban and rural) from the NW region. The NW region of Romania has been established as a NUTS II development region since 1998 (NUTS = Nomenclature of Territorial Units for Statistics - a geocode standard for referencing the subdivisions of countries for statistical purposes), and comprises six counties (NUTS III units—Bihor, Bistriţa-Năsăud, Cluj, Maramureş, Satu-Mare, and Sălaj). The surface area is more than 34,000 square kilometers while the population slightly exceeds 2.6 million. The region stretches from the Hungarian and Ukraine border to the Carpathian Mountains.

The present study is organized as follows.

Section 1 will offer an introduction into the nature and scope of the research, with a particular focus on resilience at the local level.

Section 2 will describe the database and the overall methodology, while

Section 3 will present and interpret the empirical results. The study will be concluded with a discussion and outlook of the present research.

1.2. Economic Resilience

Resilience is a concept that originated with scientific approaches that aimed to identify features of equilibrium in other disciplinary fields like physics, psychology, etc. The concept was next adapted to economics in order to describe the ability of an economy to face shocks or disruptive events. Di Caro defines economic resilience as ‘the capacity of given places to resist shocks, recover from unexpected events and sustain a long-term developmental growth path’ [

1]. Thus, economic resilience is interpreted as a dynamic process of robustness and adaptability, where the interdependence of spatial and temporal elements influences the way economies react to adverse events. Therefore, it is crucial to understand the connections between the spatial effects of a particular crisis and the evolution of a local economy, in both the short and the long runs [

1]. Subsequently, Giacometti et al. [

2] state that economic and social resilience ‘is not only about regions’ ability to resist and repel shocks, but also their capacity to adapt and reorient their structural organization towards new economic, social and cultural paths’, while Polèse [

3] argues that economic resilience is the capacity for the region to preserve itself and keep development vitality in times of crisis.

Martin and Sunley [

4] provide a comprehensive definition that refers to ‘the capacity of a regional or local economy to withstand or recover from market, competitive and environmental shocks to its developmental growth path, if necessary by undergoing adaptive changes to its economic structures and its social and institutional arrangements, so as to maintain or restore its previous developmental path, or transit to a new sustainable path characterized by a fuller and more productive use of its physical, human and environmental resources’. And, from a systemic point of view, Rose and Lim [

5] argue that economic resilience is the system’s inherent capacity to respond and adapt itself to the disasters it confronts, and that individual and communities need to adopt appropriate strategies (behaviouristics) to cope with negative effects during the occurrence of an external impact or its aftermath to avoid potential losses. It is also noteworthy that Hill et al. [

6] define economic resilience as ‘the ability of a region … to recover successfully from shocks to its economy that either throw it off its growth path or have the potential to throw it off its growth path’. Finally, according to Martin et al. [

7], measuring regional economic resilience can be viewed as comprising four sequential (and recursive) steps: the risk (or vulnerability) of firms, industries, workers and institutions to shocks; the resistance of those firms, industries, workers and institutions to the impact of shocks; the ability or otherwise of the region’s firms, industries, workers and institutions to undergo the adjustments and adaptations necessary to resume core functions and performances, what one might call (adaptive) reorientation; and, finally, the degree and nature of recoverability from the shock [

7].

In the course of time, several instruments were created in order to asses resilience, in particular, RCI—the Resilience Capacity Index [

8]—and the REI—the Resilience Employment Index [

9], while many other proxies that can be used for measurement comprise economic indicators of employment in different sectors (local, regional, national), structure assessment and structural evolution of the economy (location quotients, shift–share analyses, the Lilien Indexes of structural change), existing skills/specialisation, level of entrepreneurship, diversification indices (e.g., the Hachman Index), access to markets (accessibility), etc.

In the wide European landscape, Romania as an Eastern European country is a special case. Being confronted with the major shock of the Iron Curtain’s fall and rapid deindustrialization in the years to follow, a reshaping of local economies was necessary, and the North-West Region was no exception. Studies focusing on the Romanian case identify the factors that affect the resilience capacity of communities: migration, aging, and a decrease in the number of employees are the factors that reduce resilience capacities and enhance urban decline [

10]. Other studies on resilience approach the issue from a different perspective, either examining the capacity of creative industries to act as a bulwark against economic crises or to boost recovery [

11], pointing out different regional reactions to the global economic shocks [

12,

13], or testing if either diversification or specialization in local economies is the key in coping with the hardships triggered by the recent recession [

14].

Most of Romanian economic resilience research focuses either on the national, regional or county level, or on empirical analysis of urban areas. An intra-regional approach, or a focus on rural areas, is missing, and our research serves to fill in this gap in the literature.

Our research does not aim to construct an additional or novel resilience measure per se, but uses and refines a multifaceted instrument validated in a previous research, so as to observe the response of an economic system to a shock.

1.3. Local Economic Development

Measuring local economic development (LED) is in general a real challenge because of the many variables that could or should be taken into consideration. Definitions of LED distinguish often between product and process: the product of economic development can be measured by jobs, wealth, investment, standard of living, or working conditions, while proxies for the process are inter alia: industry support, development of infrastructure, labour force, or market operation [

15]. For example, a study conducted at the level of local authority districts in England [

16] identifies 11 generic factors considered to be important to local economic development: locational, physical, infrastructural, industrial, capital and finance factors, business culture, knowledge and technology, human resources, factors, quality of life, community identity and institutional capacity. The latter study aggregates data for more than 60 indicators.

An important policy issue is related to the difference in development level between urban and rural areas and asks whether there should be a different set of measures in the case of local economic development, or a different competitiveness level. Porter et al. [

17] assume that rural communities develop, or fail to do so, based on the same principles as other areas/regions, the expectation being that factors explaining economic growth or decline are the same. Their study finds that rural regions in the United States in many situations show a strong link to nearby metropolitan regions, thus confirming location as an important developmental factor. Along the same lines, Aldrich and Kushmin [

18] identify a series of critical factors related to U.S. communities’ growth in the 1980s (in this case referring to rural areas): access to transportation networks, attractiveness to retirees, right-to-work laws, rates of high school completion, and a high level of public education expenditures. The role of educational factors in economic development is the subject of a study conducted by Benhabib and Spiegels [

19] surveying data for 42 countries and identifying a positive role of human capital (average year of schooling of the labour force) in explaining economic growth.

North and Smallbone [

20,

21,

22] address the industrial composition and underline the importance of SMEs (Small and Medium Enterprises) in rural economic development; they also emphasise the role of innovation in rural enterprises. Their research shows that the employment and external income generation of innovative firms contribute significantly to rural economies’ growth. In a more general sense, economic and human capital determinants of economic performance were identified by Agarwal et al. [

23]; the authors found that determinants like spatial factors (peripherality and accessibility), productivity (skills, investment, and enterprise), and other key factors (economic structure, government infrastructure, road infrastructure, and occupational health) clearly favour economic performance in rural areas (149 English rural districts).

1.4. Traditional Perspectives Regarding Resilience and Economic Growth

Several perspectives on economic growth and resilience have developed over time, most of them with a strong connection to well-known economic development theories. One of the initial approaches was connected to the neoclassical theory/growth model that was based on two major concepts: the equilibrium of economic systems and the mobility of capital; the idea behind the theory being that all economic systems will eventually reach a natural equilibrium, which is possible only if capital flows without restrictions [

24]. Martin [

9] makes the assumption that the ‘economy is assumed to be self-equilibrating: any shock that moves the economy from its equilibrium state automatically activates compensating adjustments that bring it back to that equilibrium. It may be that those compensating, self-correcting adjustments take a while to have an effect, but the assumption nevertheless is that the economy will sooner or later return to its pre-shock equilibrium state.’

In a Schumpeterian perspective, shocks might coincide with the occasional historic shifts in the technological regime that set off ‘gales of creative destruction’ across the economic landscape. The process of creative destruction (‘industrial mutation’) is considered to be ‘the essential fact about capitalism. It is what capitalism consists in and what every capitalist concern has got to live in’ [

25]. The way in which economies (central, local, and regional) react and respond to such ‘shocks’ will depend on their adaptability to the new technologies and the industrial transformations these shocks generate [

4].

A number of authors [

26] have presented regional development and growth as driven by the life cycles of their constituent industries and technologies. The basis of this idea rests on the product life-cycle theory of growth (one of the most important local economic development theories) originally developed by Raymond Vernon in 1966. The theory pursues the notion that a local economy’s evolution often follows the progression of a product’s market presence, an evolution that is similar to organic life. A product’s life cycle has four key life stages that a product passes through from inception to death—introduction, growth, maturity, and decline. In a similar manner, the life cycles of their local/regional industries and technologies are assumed to move through a sequence of emergence, youth, growth, and maturity. As industries mature (in terms of either technology or markets), they lose their dynamism and competitiveness, and as a result become less flexible: in short, their potential resilience, and hence that of the regional economy in which they are located, declines. Both the industries and the region then become particularly vulnerable to, and less able to resist and absorb, major shocks. Under this model, the capacity of the region to move into new industries and technologies is vital [

4].

Another theory, called ‘adaptive cycle’ theory, assumes the development through a life cycle of emergence, growth, and consolidation. In this case, a system develops through these three phases, and its resources become progressively locked into a particular structure, the internal connectedness of the system increases, its flexibility and adaptability declines, and its potential resilience is correspondingly reduced. When a major shock occurs, resources are ‘released’ and the system may either reorganize itself and develop a new cycle of development, or become maladapted in some sense [

27].

In the light of the discussion above, the aims of the present study are

To assess differences in the economic resilience of rural and urban communities in the North-West region of Romania;

To identify the drivers of economic resilience for local communities from rural and urban areas in the North-West region of Romania.

Having these objectives in mind, our research starts from the following assumptions to be tested:

The economic crisis has affected urban communities differently compared with rural ones;

Rural communities are less resilient than urban communities;

The resilience of communities is influenced by location, size, and the level of economic development;

The resilience of communities may be explained by a series of economic and cultural characteristics like religion, ethnic diversity, connectivity, public capital investment, and economic diversity.

After this sketch of the contours of our research, we will in the next section focus the attention on the specific features of our resilience study for the North-West region in Romania.

3. Empirical Results

3.1. Economic Crisis and the Evolution of Economic Development: General View

The economic and financial crisis affected the U.S. and western European countries starting in 2007. In the case of the North-West region of Romania, the economic crisis seemed to strike the urban communities at different times, compared with rural ones.

In the urban area, the first effects of the crisis seemed to be obvious starting in 2008, while in rural areas only starting in 2010. This result was also revealed by the evolution of the relative values of the composite indicator (

Table 6): the value for each year in relation to the previous year (percentage).

The values indicated that for both urban and rural communities, the largest decline rate of the local economy was reached in 2010, even if the decline started in urban communities in 2009, while in rural communities it started in 2010.

Regarding the rural communities in the region, this finding was rather surprising, considering previous studies [

28,

29]. In these previous studies, the crisis seemed to affect rural communities in the region starting already in 2009. There are various explanations for these different results: the number of indicators used in the aggregation (five instead of 10) and the aggregation method. Based on the methodology used [

38], the weights were established in a different way, while one indicator (average number of employees/1000 inhabitants) was removed from the aggregation process.

The graph in

Figure 2 shows a decrease in the case of urban communities starting in 2009, while in the case of rural communities, the first year of decrease was 2010. While in the case of urban communities the general trend seemed to be a decline after the shock, for rural communities the general trend after the economic shock seemed to be growth. That is why the graph also reveals another relevant finding: while before the economic crisis the difference (in the level of economic development) between urban and rural communities was significantly higher in the case of urban communities, this difference seemed to decline after the shock, and that trend continued until 2018.

A deeper look into the data (see

Table 7) shows that apart from two cases, all urban communities (99% of urban population) were affected by the crisis, the values during the crisis being lower than the pre-crisis values. Only 12 urban communities (towns–small urban communities—28.25% of the total urban population) registered positive values in the most recent period (recovery), compared with the crisis period. Compared with pre-crisis level, only four urban areas registered higher values in the most recent period (medium-run performers), all of them belonging to the smallest urban communities in the region.

Rural communities were less affected by the crisis compared with urban ones—92 rural communities (18.66% of the total rural population of the region) had positive values during the crisis period compared with the pre-crisis period. Additionally, 327 rural communities (81.6% of the total rural population) recovered—in the most recent period, they had positive values compared with the crisis period. In total, 257 rural communities (58.3% of the total rural population) were medium-run performers; in the most recent period, they registered higher values compared with the pre-crisis level.

A clearer image regarding the pre-crisis and post-crisis levels of local economic development, but also regarding the impact of the crisis, the recovery, and medium-run performance (compared with the pre-crisis level) of the urban and rural communities in the region is offered in

Appendix A.

3.2. Resilience Drivers for Urban and for Rural Communities (2006–2018 Period)

One of our research aims was to identify and compare the economic resilience drivers for local urban and rural communities from the North-West region of Romania. For a solid statistical–econometric analysis, we used linear regression models (cross-sectional) separately for urban and for rural communities. For urban communities (

Table 8), we included in the model seven possible explanatory variables or resilience drivers. Even though the number of urban communities was low (43), all models appeared to be statistically significant (Sig. value/p-value < 0.05) and efficient (F-ratio or F), being greater than 1 for all of them. Regression models for urban communities had a weak-to-medium strength (R Square was higher than 0.03, but lower than 0.7), while for rural communities (general—all 403 communities, and Rank 1—209 communities) they were weak (R Square < 0.3). The low values of R Square registered were explained by a low variance of the independent variables having high explanatory power, as, for example, the share (very small) of university graduates, Protestants, and atheists in rural communities.

In order to compare the goodness-of-fit of this set of distinct but rather similar linear regression models, we used the R Square as a useful test statistic, which is often used in this context. This was certainly justified, as our regression models had a similar specification and used similar databases, the only difference being the type of communities (urban or rural, Rank 1 or Rank 6).

In the case of urban communities, when observing the impact of the crisis—the dependent variable being the difference between the worst level (2009–2011 average) and the pre-crisis level (2006–2008 average) of the LED composite indicator—communities with high shares of university graduates were the most affected by the crisis (Sig. < 0.05/Standardized Beta Coefficient, Beta being the strength of the effect of each individual independent variable to the dependent variable). These urban communities absorbed most of the economic shock. Meanwhile, urban communities with the highest share of Protestants (the only independent variable, with Sig. < 0.05) recovered less after the shock (recovery—the difference between the most recent values (2016–2018 average) and the worst level (2009–2011 average) of the LED composite indicator).

Perhaps the most surprising finding was the low recovery rate (medium-run performance) of the urban communities’ medium-term performance, the difference between the most recent level (2016–2018 average) and pre-crisis level (2006–2008 average) of the LED composite indicator. On the basis of these results, we were not able to identify significant resilience drivers for the urban communities’ resilience. None of the independent variables/predictors appeared to have stimulated the economic recovery or to have bounced forward the economy of the urban communities. Moreover, it seemed that the share of Protestants was a negative predictor for economic recovery, while the share of university graduates was a negative predictor for the medium-run performance of the local economy of these urban communities.

The collinearity diagnostic revealed that there was no collinearity between independent variables: the tolerance collinearity was higher than 0.1 (the lowest value was 0.329) and the variance inflation factor (VIF) was no greater than 10 (the max value was 3.04). Meanwhile, if we eliminated from the models the independent variables having Sig. value/p-value > 0.05, the strength of the models decreased (R Square = 0.306—Impact regression model, R Square = 0.268—Recovery regression model, R Square = 0.250—Medium-run performance regression model), but it remained statistically significant (Sig. < 0.05). It meant that the model was a satisfactory predictor of the outcome (based on an ANOVA test). At the same time, the strength of the effect of the significant predictors decreased as well (Standardized Beta Coefficient—Beta), but still remained significant (Sig. < 0.05).

In the case of rural communities (

Table 9), those communities with the highest share of university graduates, those directly connected to the E-Road Network, and the biggest communities were the ones most affected by the shock—impact being the difference between the worst level (2010–2011 average) and the pre-crisis level (2007–2009 average) of the rural LED index.

Meanwhile, ethnicity and religion (the share of atheists, the share of Hungarian ethnics in the population), and population size seemed to be negative predictors for economic recovery (Recovery—the dependent variable being the difference between the most recent value (2016–2018 average) and the worst level (2010–2011 average) of the LED composite indicator), while rank, the share of university graduates, and direct connection to the E-Road Network were predictors of economic recovery or resilience drivers for rural communities.

Compared with the pre-crisis level, the share of atheists, the share of Hungarian ethnics, and the population size appeared to be all negative predictors for the economic growth of rural communities, while the rank (location near a big city) was a resilience driver, predicting the medium-run performance/bounce forward of rural communities (Medium-run performance—the difference between the most recent value (2016–2018 average) and pre-crisis value (2007–2009 average) of the LED composite indicator).

None of the regression models registered collinearity between independent variables; if we eliminated independent variables having Sig. value (2-tailed)/p-value > 0.05, the models remained statistically significant (Sig. < 0.05). The strength of the effect of the significant predictors decreased too, but still remained significant.

We used the same linear regression models for Rank 1 and Rank 6 rural communities (communes) from the region (see

Appendix B). We chose these communes because only their numbers were statistically large enough for linear regression: 297 Rank 1 communes and 51 Rank 6 communes.

In the case of Rank 1 communes, the communes with the highest share of atheists, the highest share of university graduates, and those directly connected to the E-Road Network were the most affected by the crisis (impact/absorption). When discussing recovery and medium-run performance, the share of Hungarian ethnics and population size were negative predictors, with no other resilience driver being identified in this case. There was no collinearity between independent variables and, if we eliminated the independent variable, the models were still significant and the predictors’ effects were significant as well.

In the case of Rank 6 communes, those with the highest share of atheists and those with the largest population size were the ones most affected by the crisis, while the Rank 6 communes directly connected to the E-Road Network were the least affected. As in the case of Rank 1 communes, in Rank 6 communes, the highest share of Hungarian ethnics and the largest population were negative predictors for economic recovery. Considering the pre-crisis level, the share of atheists, the share of Hungarian ethnics, and the largest population were negative predictors for the medium-run performance of Rank 6 communes, while university graduates and direct connection to the National Roads Network were predictors or resilience drivers. There was no collinearity between independent variables and, if we eliminated the independent variable, the models were still significant; so the predictors’ effects were significant (excepting one independent variable—Direct connection to the National Roads Network).

We also analysed the correlation between population size (pre-crisis and post-crisis levels), population change, impact, recovery, and medium-run performance values of the LED composite indicator. Population change was calculated as the difference between post-crisis population size (2016–2018 average population size) and the pre-crisis population size (2006–2009 average population size). While in the case of urban communities, there were no relevant findings, in the case of rural communities (communes of all ranks), the population change was negatively correlated with the impact of the crisis, the high values of the population change being correlated with negative values of the impact. This means that population decreased more in the most (negatively) impacted communes. It is interesting that high values of the population change were correlated with high values of recovery, meaning that the population decreased more in the communes that recovered the most after the crisis. The analysis revealed also that high values of pre-crisis population were positively correlated with the high values of the population change, meaning that the largest communes’ populations decreased the most. At the same time, the high values of the pre-crisis population size were negatively correlated with the impact, meaning that the largest communes in the region were the most affected by the crisis. Moreover, the high values of the pre-crisis population size were negatively correlated with medium-run recovery, meaning that the largest communes did not succeed in bouncing back (economically) after the economic shock.

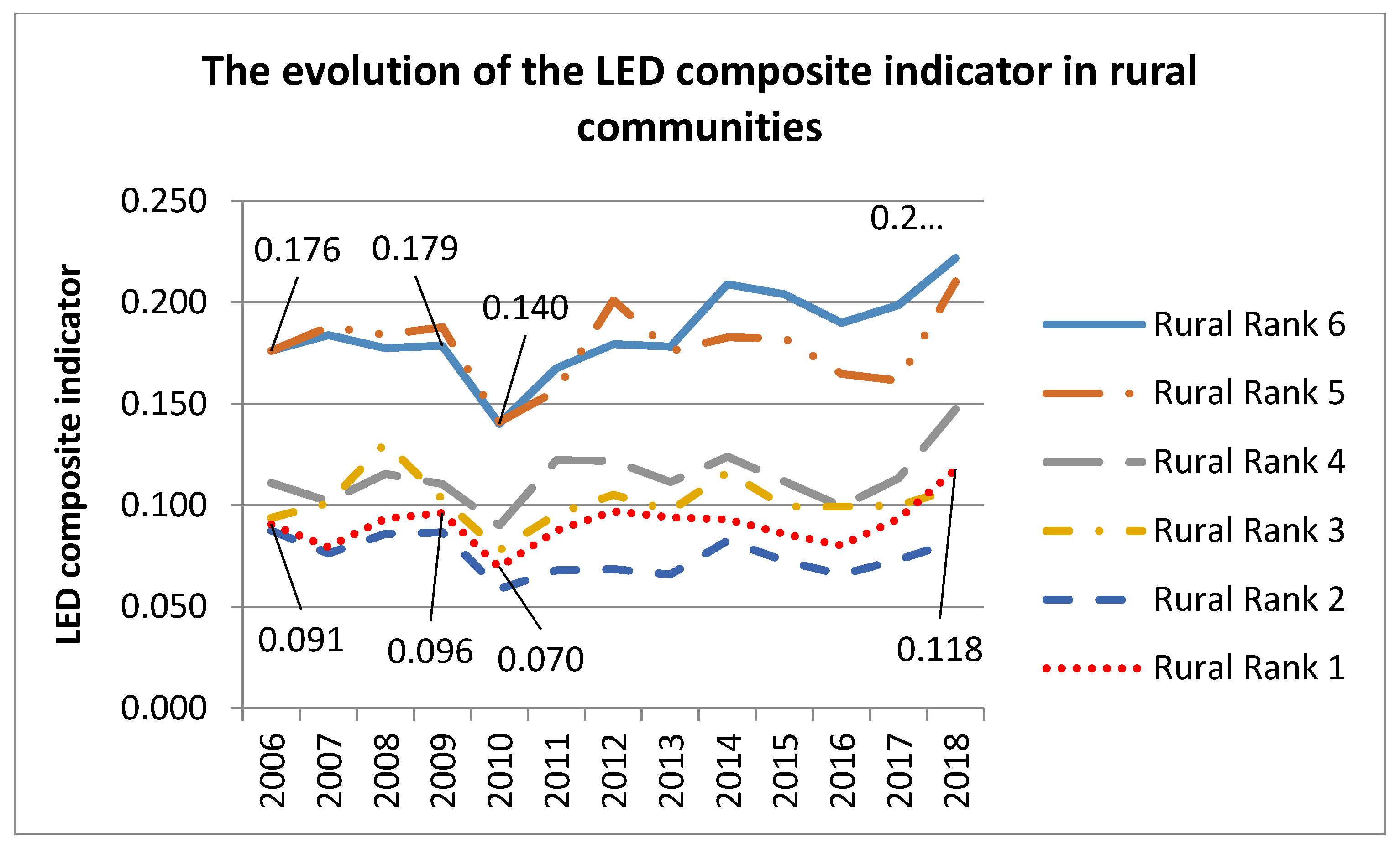

The next step in our study analysed the evolution of the composite indicator by considering the rank of the communities.

Figure 3 and

Figure 4 show the evolution for both urban and rural communities.

It was observed that, no matter the rank, all urban communities were affected by the crisis starting in 2009, and that they had not yet reached their pre-crisis level. Meanwhile, looking at the rural communities and considering their rank (we excluded the Ranks 5, 3, and 2 due to their low number and because statistically they were not representative), there was a big difference between communes situated near the largest city in the region (Rank 6) and communes situated outside the area of influence of any city (Rank 1).

The economic crisis struck all the communes (no matter their rank), starting in 2010, but Rank 6 communes (the most developed) were the most affected, the level of impact being comparable with Rank 3 urban communities, the cities in whose influencing area these communes were located.

Compared with urban communities, in the case of rural communities, no matter the rank, the decreasing trend changed suddenly (in 2011) and the growth trend continued, with some small fluctuations. But maybe the most relevant fact was that the existing difference in 2006 between Rank 6 and Rank 1 communes increased until 2018, even if the impact of the economic crisis was higher in Rank 6. From this perspective, the economic shock seemed to act as a trigger of economic development for the communes located in the influencing area of the biggest cities in the region.

3.3. Structural Shifts

Looking at medium-run regional performance, based on the absolute values of each of the indicators, we evaluated the pre-crisis structure of the regional economy (outcomes of local economy). We used in this analysis absolute values for the following indicators: turnover, employees, number of active business, number of newly created enterprises, and number of dwellings completed during the year concerned. Considering the rank of the communities, we computed the share of each indicator in the total economy for the pre-crisis period (average level for 2006–2008) and for the most recent data (average level for 2016–2018 period). In the last step, we aggregated the shares of all five indicators into a composite indicator of their shares (equal weights). The results are revealed in

Table 10.

Table 10 shows that, at the level of entire region, the share of the urban economy in the total economy decreased from 76% to 70% (compared with the pre-crisis), while the share of the rural economy increased from 24% to 30%. Rank 3 urban communities (the three biggest cities in the region) and the communes located in their areas of influence (Rank 6) were those whose post-crisis economic share in the total regional economy was higher than it was before the crisis. Moreover, the post-crisis share of Rank 6 communes was almost double than before the crisis, equaling the Rank 2 cities’ share in the regional economy. The indicators whose share increased the most in Rank 6 communes were the dwellings completed during the year (from 17% to 34%), active business (from 5% to 10%), and newly created enterprises (from 7% to 12%). In the case of Rank 3 cities, the indicators whose share in the total regional economy increased were dwellings completed during the year (from 28% to 43%) and number of employees (from 43% to 46%), while the share of turnover, the active business, and newly created enterprises clearly decreased. These structural shifts were more obvious if we looked at the changes (%) in the (absolute) values of the indicators (see

Appendix C). The values were obtained by dividing the values of the crisis period to the pre-crisis period (impact), the values of the most recent period to the crisis period (recovery), and the values of the most recent period to the pre-crisis period (medium-run performance).

3.4. Resilience and Economic Diversity in Urban and Rank 6 Rural Communities

Using the values of the composite indicator, we evaluated the impact, recovery, and medium-run performance for the urban communities and Rank 6 rural communities (51 communes located in the influencing areas of the three biggest cities in the region), taking into account the level of economic diversity.

Based on the impact result, we constructed the ranking (classification) of the urban communities, and of the Rank 6 communes (see

Appendix D). In the case of urban communities, with some exceptions, the largest cities of the regions, Rank 3 and 2 cities (those with the highest level of economic diversity in 2008), were the ones most affected by the economic crisis. The least diversified, inherently small-sized, and least-developed urban communities were less affected. At the same time, a change in the economic structure seemed to have occurred after the crisis. The share of services in the total economy increased in the most affected urban communities, while the share of industries apparently decreased. The situation was the opposite in the less affected urban communities after the crisis.

Looking at the recovery of the urban communities, except for an outlier (the largest and most developed city in the region), the highest recovery was registered in the less impacted urban communities. At the same time, the largest and most developed urban communities in the region (Rank 3 and 2) seemed to have recovered the least after the crisis.

Looking at the economic diversity, no trend or structural path was identified in urban communities. Compared with the pre-crisis level (medium-run performance), the situation was the same as in the case of recovery. The only significant observation concerned the change in the structure of the local economy in the case of all three Rank 3 cities (the biggest cities in the region), where the share of services in the local economy was (the most recent years) higher compared with the pre-crisis level.

In the case of Rank 6 communes, with some exceptions, the communes with the highest level of economic diversity (computed using the Hachman Index) in 2008 were the ones most affected by the crisis. In terms of diversification of economic structure, no relevant changes occurred in the analysis period, the communes with the highest economic diversity being the same ones at the beginning as well as in 2017. In terms of structural shifts, an increase in the share of services sectors (+9.17% from 2008 to 2017), agriculture (+2.1%) and industry (+1.7%) occurred, at the expense of construction and trade sectors.

Rank 6 communes with the highest bounce-back values were the ones with the highest level of diversification recorded in 2008. Meanwhile, the highest recovery was registered in the communes with the highest increase in services sector share. This was valid and more accentuated in the case of medium-run performers—those communes were the ones with the highest growth of the share of the services sector.

The changes and shifts produced in the structure of the economy of the urban communities and of the most developed rural communities (Rank 6 communes—those located nearest the largest cities in the region) were more obvious if we looked at the absolute values of the employees in the last year before the crisis (2008) and the most recent year (2018).

Table 11 reveals better these changes:

In the case of urban communities, all the sectors except the services sector registered in 2018 a lower number of employees than in 2008. Meanwhile, in the communes located near the largest and most developed cities in the region, the number of employees increased significantly in industry (+64.00%) and services (+89.63%) sectors.

4. Discussion

In light of the findings above, the engines for economic recovery in the region seem to be the communes located near the largest cities. These communes bounced forward, changing their local economic structure by increasing the shares of services, industry, and agriculture sectors. Meanwhile, the largest cities in the region changed their economic structure, as well, the services sector becoming the most important sector in the local economy. Thus, the largest cities became service centres (financial and economic, education, health, research, culture and recreation, etc.) or creative industry centres of the region. Hence, the communes located in their vicinity became virtual spread areas for the expansion of the economic activity of urban/metropolitan areas to be ‘economically contaminated’, becoming preferred destination locations for industries and service activities.

From a policy perspective, the findings of the study can be used as a base for future regional development plans, national sectoral development policy, sustainable urban mobility, transport infrastructure policy (highways and railways for connectivity), education policy, rural development policy, etc. Clearly, the spatial context/pattern of interactions in the case of production, distribution, or consumption systems matters, as well as the importance of the management, planning, and forecasting of spatial development [

68].

At the local level, our findings may be relevant for the decision-making process, considering the structural changes of the local economies of the biggest cities and the communes in their vicinity. In the light of the last economic crisis, it seems likely that the biggest cities and the communes around them might be vulnerable to the next crisis, but also that they have the potential to recover the most and to bounce their economy forward by adapting to the global trend and new challenges, changing the structure of their local economies, and using the opportunities created by global changes more efficiently.

5. Conclusions

The aim of this study was to assess the differences in the economic resilience of rural and urban communities from the North-West region of Romania and to identify the drivers of economic resilience for these communities. Using a composite indicator that aggregates proxies (mainly outcomes) for different components of the local economic development, namely, the strength of economic activity, the level of productivity, the intensity of economic activity, entrepreneurial initiatives, and real estate market and attractiveness, we addressed the following questions: How much has the financial and economic crisis affected local communities? How well have communities recovered from the crisis? What is the current situation in the communities compared with the pre-crisis one?

Our study both confirms and rejects—fully or partially—various assumptions. The first assumption is fully confirmed: the economic crisis hit urban communities earlier than the rural communities. While the rural communities were less and later affected, they started to recover earlier and more than urban communities, the difference between urban and rural gradually narrowing after the crisis. But a supplementary explanation is necessary here. A deeper analysis into rural communities reveals that not all rural communities were affected in an equal manner by the economic shock. Thus, rural communities located nearest the biggest cities in the region (Rank 6 communes), were strongly affected by the economic crisis, while the most isolated rural communities (Rank 1 communes) were the least affected.

The second assumption is entirely rejected, as rural communities appear to be more resilient than urban ones, but there are some important exceptions. Not all rural communities have the same level of resilience. Rural communities located in the influencing area/vicinity of the biggest cities in the region were affected the most by the crisis, but, at the same time, they grew the most when compared with their crisis and pre-crisis levels, being the high performers of the period. At the same time, the isolated rural communities (less developed, small and medium-size, beyond any city’s influence area) were the least affected by the crisis, but their growth rate was the lowest. An explanation could be the pre-existent level of economic development (predominantly agrarian and mainly autarchic/self-sufficient) and a low level of interconnectedness with the global economy.

The third assumption is fully confirmed in the case of rural communities and partially confirmed in the case of urban communities. Moreover, their rank is a resilience driver for rural communities: those located in the influencing area/vicinity of the biggest cities in the region grew the most compared with their crisis and pre-crisis levels, being the high performers of the period. The economies of these communes bounced apparently forward.

Regarding the fourth hypothesis, there are some relevant findings and conclusions to be mentioned: whether or not urban or rural communities with the highest share of university graduates were significantly affected by the economic crisis.

In the case of urban communities, the share of Protestants seemed to be a negative predictor for the recovery after the crisis, while the share of university graduates seemed to be a negative predictor for the economic growth compared with the pre-crisis level.

Rural communities with the highest share of university graduates, those connected to the E-Road Network, and those with the largest population were the most significantly affected by the crisis.

In the case of the rural communities, the share of Protestants, the share of atheists, the size of the population, and the share of university graduates were negative predictors, for both the crisis level (recovery) and the pre-crisis level (medium-run performance), while the rank of the communes and direct connection to the E-Road Network were predictors for growth compared with the crisis level; the direct connection to E-Road Network was a resilience driver for rural communities, which have the highest growth compared with their pre-crisis level.

Whether urban or rural, and no matter the rank of the community, the capital investment of local authorities did not succeed in mitigating the impact of the crisis, nor in stimulating recovery or medium-run performance.

Economic diversity did not appear as a resilience driver for urban communities. Moreover, it seems that the cities with diversified economies were affected the most by the crisis; in these cities the share of services in the total economy increased after the crisis, while the share of industry decreased.

In line with our findings regarding the recovery rate, [

34] stress that regions that performed well before the crisis were not able to achieve a quicker recovery, while [

12] observe that developed counties recover more quickly after the economic shocks, but the typology of economic recovery illustrates a variety of situations, depending on the indicator taken into consideration as a measure for resilience (GDP or employment). However, our analysis goes deeper into the administrative layering, attempting to identify resilient administrative units at the lowest level.

The results concerning the share of university graduates are not similar to other research on Romania, which reconfirmed its positive role in the economic performance of the regions [

14], but at the same time they could be explained by the findings of the same study [

14], which show that developed administrative units (counties in this case) were the most affected by economic crisis. In these counties, the international trade and the investment inflows dropped sharply during the crisis. Concerning diversification, the same research found that the more diversified the Romanian counties were, the better they were at coping with the economic shocks, but one of the limits of this research was the fact that the analysis was made from an aggregated regional perspective. The proxies used for the level of regional development (GDP, industrialization, and urbanization) prompted a higher vulnerability level to economic shocks for the more developed counties—supporting our findings related to the impact of the crisis inside the North-West region. Another source of differentiation between the results (less likely, though) might be the instrument used in assessing diversity (Hachman index vs. Krugman and Herfindahl). Although when choosing the variable we assumed that a high percentage of the Protestant religion population might be a descriptor for resilience, the results show that the indicator was a negative predictor for the communities’ recovery. Our results are opposite to post-Weberian findings of other research showing that Protestantism is associated with higher levels of economic development/lower unemployment rates/labor force participation [

41], or identifying significant differences in economic outcomes of Romanians according to religious affiliation [

42].

In the same manner, we considered that the percentage of Hungarians could be a predictor, as they are known to have a work ethic superior to other ethnic groups in the region, compounded by the fact that the majority of them are of Reformed religion (Protestants). Analysing the situation from both perspectives would have allowed us to better understand the situation, as long as the large majority of Hungarian ethnics are of Reformed (Protestant) religion. This would have helped us to control for inconsistent results, if one of the variables turned out to be a resilience driver (e.g., Hungarian ethnics’ share of the population).

One explanation for the results could be the population breakdown of the Protestant religion, with Pentecostals representing the second largest part, after the Reformed. As Foszto and Kiss [

69] noticed, based on an analysis of statistical data, the Pentecostal population is concentrated in the North-West region, especially in the border counties, with an overrepresentation of rural population (60%) and of Roma ethnics, suggesting that disadvantaged population classes are unevenly distributed compared to the other ones. Those two categories are associated with higher levels of poverty.

One of the most important findings of the study is related to the shift in terms of the economic structure. The crisis triggered a structural change in the economy of the region, whereby part of the activity was relocated from the urban to the rural areas (especially those located in the vicinity of large cities). However, there is no proof that this was a response to a shock or just the natural evolution of the metropolitan areas (in this context the role of the metropolitan areas is more important than ever). From a resilience perspective, this could be similar to Martin’s adaptive resilience—‘the ability of a system to implement reorganization of the system’s structure, so as to minimize the extent of the disturbance affecting the system, or to take advantage of the shock to achieve renewal of the system’ [

9].

It may finally be noted that public organisations (including communes and regions) are expected to perform at high levels while constantly improving and adapting to the changing dynamics of the socioeconomic environment [

68,

70], including addressing and mitigating shocks. In light of our findings we may argue that strategic planning is an essential tool in developing the capacities of communities to respond to external factors [

71]. Strategic approaches should be concentrated on specific areas, like entrepreneurship and support for SMEs (see [

72]).

As communities with a stronger bonding capital may be able to overcome periods of distress more easily [

73], a lesson for local authorities may be to strengthen the ties and tolerance among the residents in order to increase their resilience level. This is a valid approach, especially in the North-West region, which has a high level of ethnic and religious diversity.

Clearly, there are also some main limitations in our research. The first concerns the metrics used for measuring the resilience. As we mentioned, one of the most important issues in the field is whether to use a single proxy or a composite indicator to measure resilience. Another limitation may be the use of the indicator ‘Number of dwellings completed during the year (per 1000 inhabitants)’. This is a lagging indicator due to the necessary time of completion, and therefore the impact of the crisis in this case may not be immediately visible. This limitation is mitigated by the fact that after a period of continuing growth (2006–2008), in 2009, compared with 2008, this indicator registered a significantly lower value, whether for urban (−11.08%) or rural (−18.42%) communities. The adapted JRC approach for measuring resilience based only on outcomes could be another limitation of our research. Using different variables for rural and for urban communities might be another limitation of the study, as well as the absence of a spatial model for a more appropriate analysis of the economic resilience of local communities, considering the location factor. Moreover, a pooled estimation model with panel data would get more accuracy in our research results. But these will be the new endeavours and opportunities for future research in the field.

Most of the results of our study may be extrapolated to other local communities from Romania. There are some explanatory variables that could or should be replaced with others, for example, the share of Hungarian ethnics or the share of Protestants, because Hungarians represent a strong ethnic group in three out of all eight development regions of Romania.

Future research is necessary to examine whether the bounce-forward phenomenon of the communes located in the influencing areas of the largest cities is caused by resilience, or whether native ‘prosilience’ represents a general trend for southeastern European/ex-communist countries, whose urbanisation process was begun during the communist period. Moreover, when analysing the evolution of the economic structure of the communes positioned in the immediate vicinity of large cities, it is necessary to provide a more comprehensive and significant explanation for the changes that occurred in their economic path. The big cities and the communes around them were not naturally (from an economic and urbanistic point of view) interconnected and integrated as a functional metropolitan area. They were artificially separated by the urban communities nearby, which, in the context of free market and globalisation, is generally not efficient. It is clear that the study on resilience of urban–rural systems needs insights from various branches of geography: social, urban, rural, economic, and cultural.