1. Introduction

We are currently in a global situation that favors the use of various forms of renewable energy, the decarbonization of energy production, and the promotion of electric vehicles, with the aim of reducing pollutant emissions and protecting the environment. In Spain, this approach is endorsed by the National Energy and Climate Plan, which has set out its objectives for the new configuration of the national energy mix system for 2021–2030. Among other goals, this plan has set a target of 110 GW of renewable energy generation out of a total of 157 GW of total new electricity generation, which means that 70% of the power mix will be made up of renewable energy by 2030. The expectations created for renewable generation have been so great that, for solar photovoltaic energy alone, there are more than 100 GW of renewable projects in the pipeline, a figure that is well above the 37 GW that was envisaged in the Plan Nacional Integrado de Energía y Clima (PNIEC) 2021–2030.

During this phase of the process, as work progresses, more data and information about projects become available, which allows for a quantitative evaluation to be made. In particular, it becomes possible to conduct a study on the influence of the risks identified at an early stage to determine their effects on the main financial parameters of each project.

In the literature, there are many studies about the quantitative analysis related to the main financial parameters: [

1] analyzes three evaluation techniques for assessing the profitability of renewable projects, net present value (NPV), qualitative multicriteria decision-making, and analysis of real options; [

2] studies the influence of risk over development costs; [

3] seeks to optimize Japan’s global energy portfolio using an internal rate of return (IRR) analysis and the Monte Carlo method; [

4] conducts an economic analysis on the implementation of wind turbines on German farms using NPV analysis; [

5] establishes a new methodology based on fuzzy logic to predict the cash flow variations over the course of a construction project; [

6] studies the risk impact and risk likelihood on 48 commercial construction projects; and [

7] uses fuzzy sets theory for the assessment of working capital requirements.

Studies employing fuzzy sets for risk assessments can also be found in the literature. For instance, [

8] applies fuzzy sets for risk assessments of complex construction projects; also in [

9], the fuzzy sets theory has been applied for risk assessments involving the rehabilitation project of the Polytechnic University of Cartagena, [

10] established a risk assessment methodology based on fuzzy analytic hierarchy process (AHP) for public–private partnership (PPP) projects in China, whilst [

11] proposes a model based on the fuzzy analytic hierarchy process (FAHP) to improve the efficiency of contractor bidding decisions. Additionally, [

12] uses fuzzy sets for risk assessments in nuclear systems, [

13] applies fuzzy sets for green product development, and [

14] conducts risk assessments of construction projects based on the multi-attribute decision-making methods. Studies employing fuzzy logic can also be found in renewable energy research. For instance, [

15] analyzed risk policies for prioritizing renewable energy projects, [

16] used fuzzy analytic network process (ANP) to analyze marine wind park operation risks, [

17] used fuzzy logic for risk assessments in wind farm construction projects, [

18] studied the use of risk analysis in photovoltaics integration building projects in China, [

19] applied fuzzy logic in an attempt to minimize costs, deadlines, blockage, and environmental impacts in a hydroelectric construction project, and [

20] identified and assessed a biomass gasification system using bow-tie analysis, enabling the identification of the causes and consequences of gas leakage.

A combination of fuzzy sets and probabilistic analysis using Monte Carlo simulation has also been employed in numerous studies, such as that of [

21] in which both of these methods were used to predict peak power and to plan power systems. Additionally, [

22] used fuzzy sets to study the likelihood of favorable wind conditions in certain areas and used Monte Carlo simulation to predict the quantity of thermal energy that would be produced by a wind turbine, while [

23] studied the appropriate error measures for the estimation of fuzzy linear regression model parameters using the Monte Carlo method.

To study the influence of risks on the main profitability project parameters, in this work, based on the previously identified risks, an expert panel was asked to provide judgments on the influence of risks on the main economic items of a project in terms of its cost, time, and scope.

Applying the fuzzy methodology, these judgments were then transformed into triangular numbers which, through the use of Monte Carlo simulation, make it possible to determine the influence of risks on a project’s main financial parameters in terms of the overall project framework, as well as its cost, time, and project scope. These risks can then be classified to plan an appropriate risk response strategy. This comprehensive analysis also allows planning, at a later stage, of the risk response for any given project based on the project management team’s preferred approach to risk management.

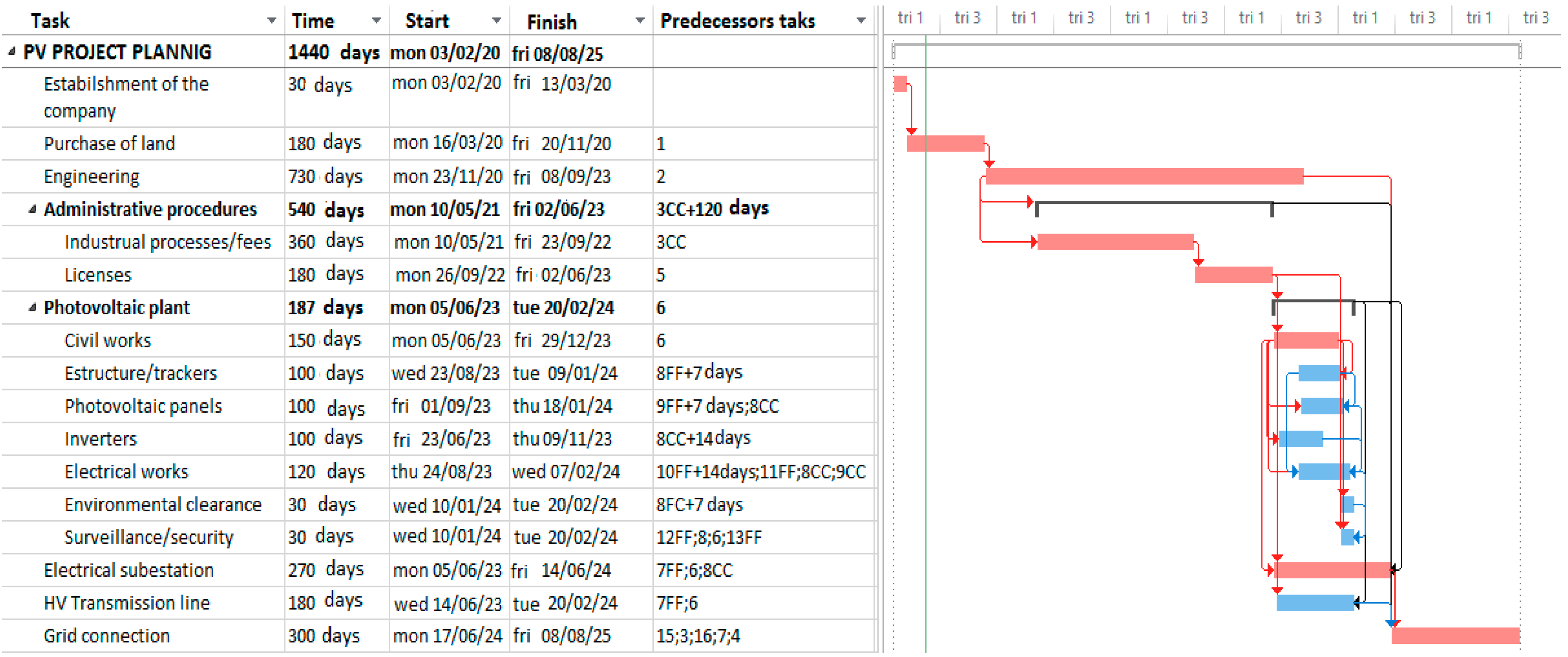

To test the functionality of the model, we applied the methodology to the case study of a construction project for a 250 MW solar photovoltaic plant located in the Spanish region of Murcia.

2. Methodology

Both risk assessment and management have been extensively studied in [

24], where definitions and risk metrics are discussed, as well as the ways of addressing issues such as uncertainty, robustness, and resilience.

For carrying out the quantitative risk analysis, a model is proposed, based on the following steps:

Establishing a panel of experts.

Preparing and sending out surveys.

Defining the distribution function of opinions.

Prioritizing risks.

2.1. Establishing a Panel of Experts

For qualitative risk analysis, a risk assessment group was established, which was composed of people with extensive experience in construction projects that use renewable photovoltaic energy [

25].

The experts must be selected from professionals who have been involved in the development, design, and construction of photovoltaic solar plants, with the aim of covering the greatest possible number of profiles involved in such projects. In particular, the expert panel for qualitative analysis must cover at least the following profiles: Project Manager, Site Manager, Operation and Maintenance Manager, Developer, Administrative Processing Technician, and Plant Supervisor.

2.2. Preparing and Sending Out Surveys

The questionnaires used to gather the experts’ opinions included the following sections:

Instructions for completing the questionnaire.

General description of the project.

Expert opinions on the economic and temporal aspects of the project.

Expert opinions on the impact of the risk on the economic and temporal aspects in terms of cost, time, and scope of the project.

These questionnaires had been developed in the following phases:

First phase: the experts were asked to question both items with their initial assessments, where they could propose to include, eliminate, or modify both the items and their amounts.

Second phase: once the responses had been received and the opinions considered, the experts were asked to approve the items resulting from the first phase. Once this approval had been obtained, they were asked to formulate their opinions on which items were affected by each of the risks identified in [

26], from the point of view of cost, project time, and scope, indicating the maximum and minimum values of each item for each risk.

Third phase: as a result of the second phase, new items were affected. These items were again included in the questionnaires and sent to the experts for review and assessment. This third phase was repeated as many times as necessary until obtaining the approval of the 10 experts, at which point the survey collection phase was considered to be complete.

2.3. Defining the Distribution Function of the Opinions

As a result of gathering the experts’ opinions, three values were obtained, namely, the minimum value, the expected value, and the maximum value that an item can reach due to the impact of a given risk. Consequently, a triangular distribution function was obtained that behaves in a similar way to a fuzzy number. Following the research carried out by [

27], the triangular function was used to analyze the identified risks.

According to fuzzy set theory [

9,

28,

29], in a universal set X, a fuzzy subset A of X is defined by a membership function μA (x), which assigns each element x in X to a real number in the interval [0, 1].

The value of the function μA (x) is the membership grade of x in A. When μA (x) is large, this indicates a strong membership grade of x in A.

Fuzzy numbers are defined as A = {x, μA (x)}, where x is the value in the R interval and its membership function μA: R → [0, 1], with the following properties:

Constant in (−∞, a]: μA (x) = 0 Ɐ × є (−∞, a],

Strictly increasing in [a, b]

Strictly decreasing in [b, c],

Constant in [c, ∞): μA (x) = 0 Ɐ × є [c, ∞),

where, a, b, and c are real numbers.

If μLA is defined as the left part of the membership function of a fuzzy number A, defining μLA(x) = μA (x), for all x [a,b], and μRA as the right part of the membership function of the fuzzy number A, defining μRA(x) = μA (x), for all x [b,c], then the triangular fuzzy number is identified as A = (a,b,c), and its membership function defined in Equation (1), where a, b, and c are real numbers, in this case a ≤ b = 0 ≤ c.

Figure 1 shows an example of a triangular fuzzy number.

2.4. Risk Prioritization

Once the survey collection phase had been completed, the opinions of the experts were aggregated using the geometric mean, which allows for defining triangular distribution functions for these final opinions on the influence of the identified risks on the items considered. The triangular distribution functions were entered into the @Risk tool (Palisade LLC, Ithaca, NY, USA) for subsequent analysis using Monte Carlo simulation [

30].

Using the @Risk tool, 100 Monte Carlo simulations were carried out, each with 10,000 iterations, to obtain results that were representative of the sample.

These simulations yielded a value for the main parameters used to evaluate the profitability of a project, that is, net present value (NPV), payback period (PB), and internal rate of return (IRR). This result was obtained from the emergence of all the risks in the project.

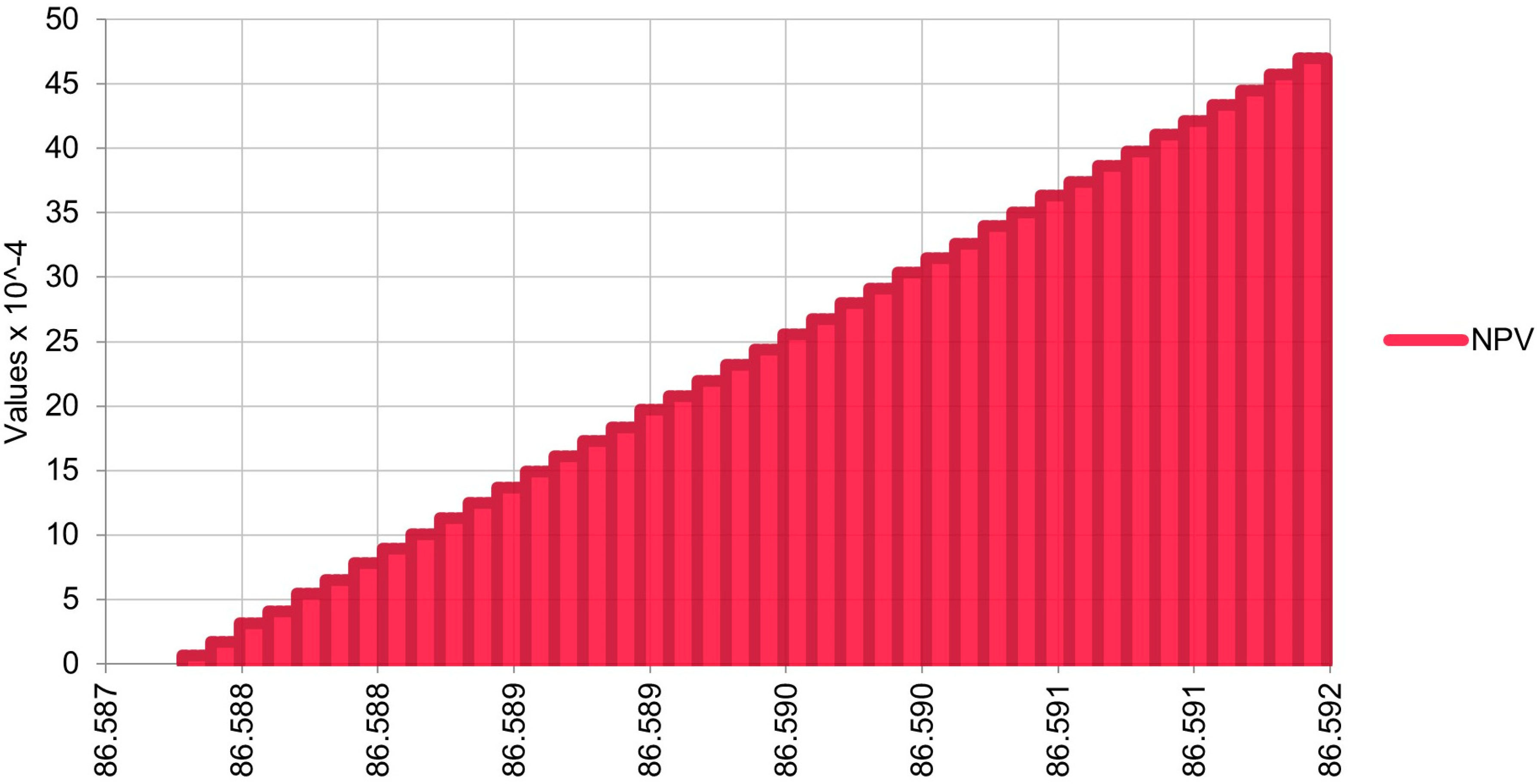

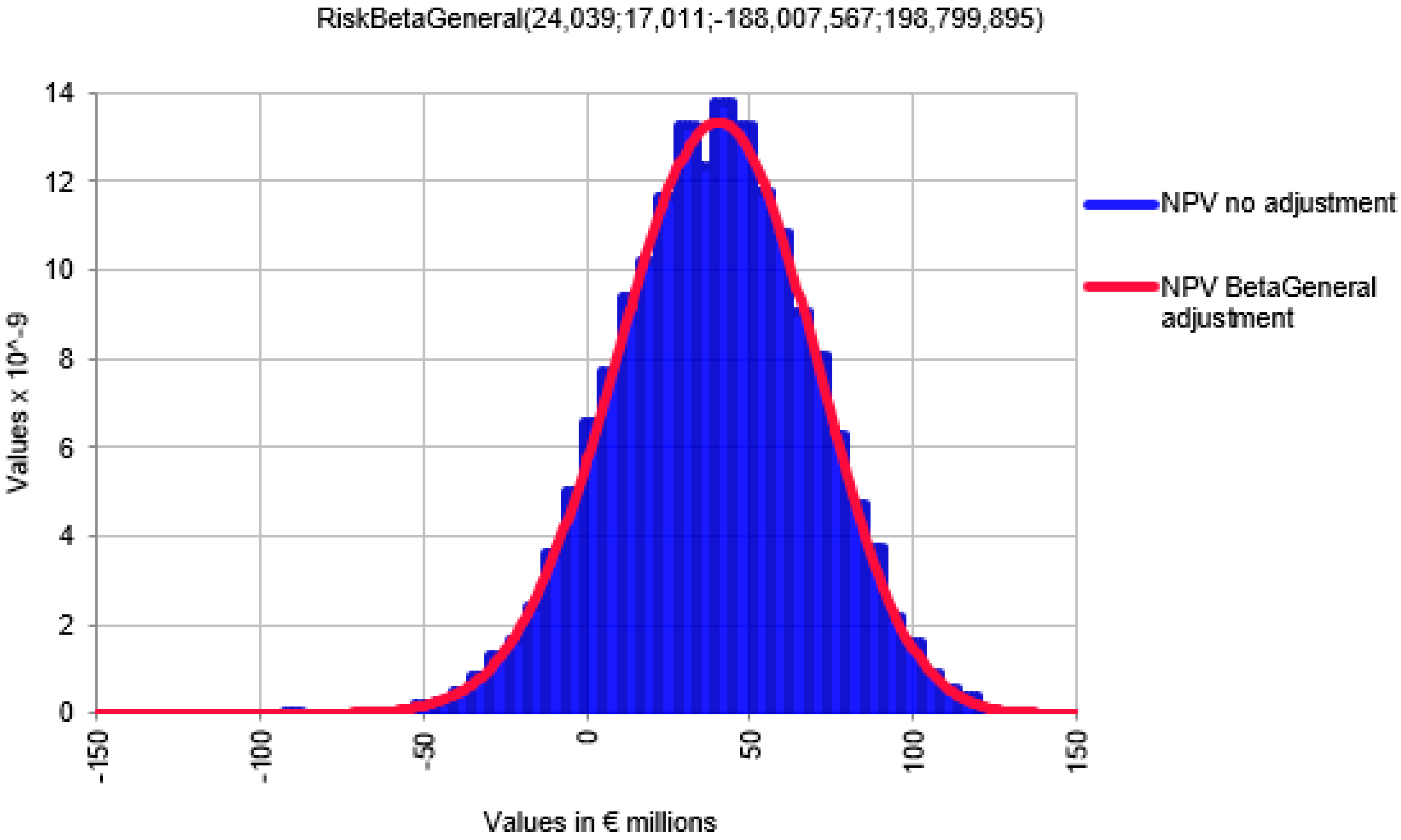

The simulation also allows for determining a range of values for NPV, PB, and IRR with respect to the mode for each identified risk. This range, obtained from the sensitivity analysis, shows the capacity of a given risk to influence each of the economic or temporal items of the project. Thus, the greater the range of values of a parameter with respect to its mode, the more dispersed the function resulting from the simulation, the less predictable its behavior, and, therefore, the more influential the risk, as can be seen in

Figure 2 and

Figure 3.

In the case of risks affecting only one item, the result obtained will be the result of the influence of the risk on the profitability of the project. In the case of risks affecting more than one item, the results of the simulation for the different items affected by the same risk should be aggregated. To do this, three study scenarios are proposed:

SUM: All risks emerge in the project and their effect on the project items is cumulative. The ranges of variation in NPV, PB, and IRR for each item influenced by a given risk are summed. The SUM criterion is suitable for project management team profiles with a high aversion to risk. This criterion penalizes risks that influence one or two items, although, these are decisive risk factors, such as those that directly affect the project’s income.

MAXIMUM INTERVAL: All risks emerge in the project, but when this criterion is adopted, the range of values of the items affected by a risk is included within the maximum range for each risk. The main drawback of this criterion is that it does not consider the entire sample of those risks that influence more than one economic item.

GEOMETRIC MEAN: All risks emerge in the project, but the geometric mean of the variation intervals is considered to represent the most probable value of a risk’s influence on the parameters of economic analysis. The geometric mean is chosen over the mean or arithmetic average as it is less sensitive to the outliers of the sample. The GEOMETRIC MEAN criterion is suitable for those project management teams that do not believe that “everything could go wrong”. This criterion considers the entire sample and does not discriminate between risks with influence on one item and those with influence on multiple items.

For each of the four previously described scenarios, a final classification of risks will be made according to their influence on the NPV, PB, and IRR, considering both the general framework of the project and the influence of these risks on the cost, time, or scope of the project. Based on this classification, an effective risk response strategy can be planned, along with the tasks that will be undertaken to monitor and control such risks.

4. Results

To study the influence of risks on the project parameters, we worked with the range of values with respect to the mode, the results of the sensitivity analysis with Monte Carlo simulations conducted with 10,000 iterations for each of the 100 simulations, the basic parameters of economic analysis (NPV, PB, and IRR), and the resulting influence of the identified risks on the investment items. These simulations made it possible to evaluate the combined impact of all risks on the project.

The results of the simulations provided different ranges of values for NPV, PB, and IRR in each simulation. To work with the results of the simulation, it was necessary to work with a single value. Thus, the geometric mean was calculated for each item of the 100 simulations. The geometric mean was chosen in preference to the arithmetic mean or average because it is less sensitive to outliers of the distribution of values. Using all of the above, the NPV, PB, and IRR values of the project were calculated considering the effect of the identified risks.

In the first analysis, as expected, the overall impact of the risks on the project was negative, since NPV was reduced by 54.87%, PB increased by 75.76%, and IRR was reduced by 25.95%, as can be observed in

Table 6.

The effects of the risks appeared to be more pronounced for NPV and PB, since these variables have a stronger impact on the cash flow-related items of the project: In Year 1 there was a 34.10% reduction in annual performance. The most significant factor in the reduction in annual performance was total income, which accounted for 49.52% of this reduction. The lower variation in the IRR can be explained by the lower influence of risks on the initial investment in Year 0, which increased by 9.04%.

To plan an adequate risk response strategy, it is necessary to classify the influence of these risks. The sample of risks with the capacity to influence the general framework of the project is not equivalent to the total 55 risks identified, since the experts believed that 2.2.6 “Possibility of the existence of alternative energy generation systems” has no influence on the fundamental economic parameters of this project.

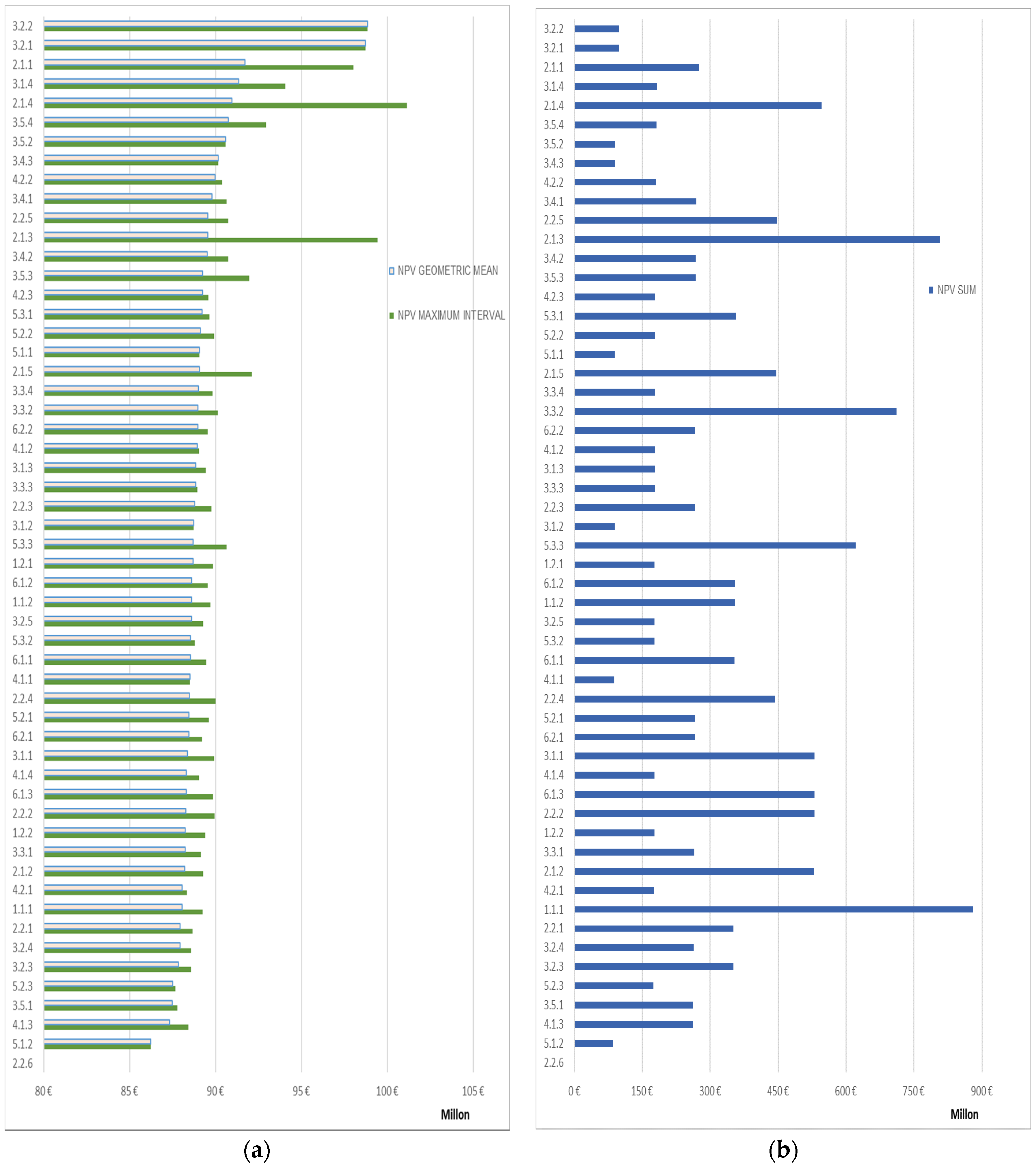

Comparing the value ranges of the NPV for each of the four criteria under study, and ranking these according to the SUM criterion, it appears that the SUM criterion is completely different from the remaining criteria. This is also the case for the value ranges of the PB and the IRR. The MAXIMUM INTERVAL and GEOMETRIC MEAN criteria produced similar rankings for the most influential risks, since, among the 12 most influential risks, 8 of these were shared, among which were the 5 most influential risks for each of the 3 criteria, as shown in

Figure 5.

Another effect that should be highlighted is that the range of values obtained following the Monte Carlo simulation did not differ significantly, which explains the fact that with small differences in the value ranges, there were large changes in the position of the ranking with the MAXIMUM INTERVAL criterion and, to a greater extent, with the GEOMETRIC MEAN criterion, since the latter considers the extreme values of the sample. Taking into account the 12 most influential risks for each criterion, for the SUM criterion, ordered by the ranges of values of the NPV, no disparity was observed between the rankings for NPV, PB, or IRR; therefore, it can be concluded that, with the SUM criterion for maximum risk aversion, the risks shown in

Table 7 are those for which a more exhaustive response strategy should be planned.

For the MAXIMUM INTERVAL criterion, no disparity was observed between the rankings of NPV, PB, or IRR among the first eight risks. It is thus concluded that, with the MAXIMUM INTERVAL criterion, a combined response strategy can only be planned for the first eight risks in the ranking regarding the three economic parameters.

For the GEOMETRIC MEAN criterion, no disparity was observed between the rankings of NPV, PB, or IRR among the first seven risks. Therefore, as in the case of the MAXIMUM INTERVAL criterion, a combined response strategy can only be planned for the first seven risks of the ranking with regard to the three economic parameters, and the response to the remaining identified risks should be planned independently for each parameter.

The above analysis was conducted for the cost, time, and scope of the project, considering the fact that the number of risks influencing each of these three aspects of the project was decreasing.

Thus, the sample of risks with an influence on the project cost was reduced to 42, ruling out the risks due to delays, certain legal risks, and the risk already mentioned in 2.2.6 “Possibility of the existence of alternative energy generation systems”.

When comparing the variation in ranges of the NPV for each of the three criteria under study, and sorting them according to the SUM criterion, it was established that, as in the assessment of the influence on the overall project framework, the SUM criterion differs considerably from the rest of the criteria. The MAXIMUM INTERVAL and GEOMETRIC MEAN criteria present similar rankings for the most influential risks, since, among the nine most influential risks, seven of these are shared and between the MAXIMUM INTERVAL criterion and the GEOMETRIC MEAN, the five most influential risks are shared.

For the GEOMETRIC MEAN criterion, when sorting according to the variation in ranges of the NPV, no disparity was observed between the ranking by NPV, PB, or IRR among the first three risks, as can be observed in

Table 8. Therefore, only a joint response can be planned (with nuances) for the three economic assessment parameters for the first three risks of the ranking, in terms of its influence on the cost, and an independent plan will be required for each parameter in response to the other risks identified in the project.

In the case of project time, the sample of risks was reduced to 32, ruling out 5 technological risks, 12 of the economic risks, some legal risks, and the social risks related to plant operations. The MAXIMUM INTERVAL and GEOMETRIC MEAN criteria present identical rankings for the seven most influential risks and share three risks with the SUM criterion.

Table 9 shows, for the GEOMETRIC MEAN criterion, that there was no disparity between the ranking by NPV, PB, or IRR among the first four risks. Therefore, only a joint response can be planned for the three economic assessment parameters for the first four risks of the ranking.

Finally, the sample of risks with the capacity to influence project scope was reduced to 13, with five technological risks, four economic risks, three legal risks, and one political risk, thus ruling out social risks and risks due to delays.

When comparing the variation in ranges of the NPV, and sorting them according to the SUM criterion, it was found that risk 1.1.1 “Level of political stability” and risk 2.1.3 “Estimation of effective solar radiation” appear among the four most influential risks for the three evaluation criteria. The MAXIMUM INTERVAL and GEOMETRIC MEAN criteria presented similar rankings for the three most influential risks.

For the GEOMETRIC MEAN criterion, a certain disparity was observed between the ranking by NPV, PB, or IRR, primarily for positions 3 and 4 of the ranking. Therefore, only a joint response can be planned (with nuances) for the three economic assessment parameters and the first two risks of the ranking, as can be observed in

Table 10.