Abstract

The use of microfinance in poverty alleviation and, by extension, as an instrument for sustainable social and economic development, represents a novel idea in sustainable finance. This study employed science mapping to examine 4049 Scopus-indexed documents explicitly concerned with microfinance. The goals of the review were to document the distribution of microfinance literature by type, volume, time, and geography, and to identify influential authors, articles, and a potential intellectual structure of this knowledge base. The first microfinance research was conducted in 1989, but the field attracted increased attention only after 2006, when the Nobel Peace Prize was awarded to microfinance pioneer Muhammad Yunus. This study does not find any single dominant school of thought in the field of microfinance, but rather identified three thematic research clusters: (1) a concentration on institutional aspects of microfinance, (2) scholars who used sophisticated research methods to evaluate the impact of microfinance, and (3) groundbreaking microfinance literature related to social justice more generally. As the first-ever, comprehensive bibliometric review of research on microfinance, this study provides benchmarks against which to assess the future evolution of this literature, a reference for scholars entering this domain, and targets for future development of this field of sustainability scholarship.

1. Introduction

Microfinance originated to provide the poor in the developing world a basis for self-determination through entrepreneurship, and to motivate them to move towards new goals and a sustainable future. Consequently, microfinance can be conceptualized as a powerful preventive mechanism through which societies can reduce problems that threaten social, cultural, and economic sustainability, such as forced human migration, cultural conflicts, and political unrest [1].

Microfinance first emerged in the 1970s but attracted scant attention for the next three decades [2,3,4,5]. It was the Bangladeshi Nobel Peace Prize winner, Muhammad Yunus, who first popularized the concept in the beginning of the twenty-first century. Yunus founded one of the first significant microfinance institutions (MFIs) in Bangladesh, which served as a model that spread throughout the world. Today microfinance is perceived as a financial instrument that contributes to sustainable social and economic development [1,4,6,7,8,9,10,11,12,13,14,15,16,17,18]. In the last four years, the use of microfinance has migrated into the domain of environmental sustainability (‘green microfinance’) as well [19,20,21,22,23,24,25,26,27,28,29,30,31]. Microfinance aims to help the poor on their path to an independent life and to achieve social justice. Hence, microfinance is an important tool within the broader academic domains of finance and sustainability.

The significance of microfinance was further underscored by the United Nations’ (UN) adoption of microfinance within its global Sustainable Development Goals (SDGs) of 2012 [32]. SDG 1 incorporates access to financial products and services, and SDG 17 targets the local availability of financial resources as foundations for sustainable development [33]. The SDGs are also part of the UN Agenda 2030 [32]. The UN Capital Development Fund supports several specific initiatives, such as ‘last mile finance’, women’s empowerment through credit availability, and rural development with micro-financed investment and the entrepreneurship to implement these SDGs [34].

Long before the SDGs succeeded the UN Millennium Development Goals in 2012, the UN Economics and Social Council had declared the year 2005 as the “International Year of Microcredit” [35]. According to Jonathan Morduch, chair of the UN Expert Group on poverty statistics, “microfinance stands as one of the most promising and cost-effective tools in the fight against global poverty” [36].

The purpose of this review of research is to document the growth and evolution of research on microfinance. It aims to analyze a significant portion of the accumulated knowledge base published on microfinance. More specifically, this review addresses the following research questions:

- RQ1:

- How is the global microfinance literature distributed by type and volume over time, and by geography?

- RQ2:

- Which authors have the most significant influence on global microfinance research, and what is the intellectual structure of the knowledge base?

- RQ3:

- Which publications have the most significant influence on global microfinance research?

This study is the first comprehensive bibliometric review of research on microfinance based on documents extracted from the Scopus database [37,38]. We examined 4049 Scopus-indexed documents related to microfinance. Bibliometric methods were used to analyze meta-data associated with these documents. Analyses included descriptive statistics, citation analysis, and co-citation analysis.

The review builds explicitly on another recent review of microfinance research [39]. The current report is distinguished through its examination of a larger database of documents covering a broader topical definition, over a longer span of time. Thus, this study seeks to provide a set of bibliometric benchmarks against which the future evolution of research on microfinance can be assessed.

2. Materials and Methods

Bibliometric reviews generate a comprehensive picture of the existing knowledge base within a broad discipline or a more narrowly defined line of inquiry (e.g., microfinance) [40,41,42]. While bibliometric review, also known as science mapping, has been applied across an increasing range of disciplines [37,43,44,45], applications in finance and sustainability are quite recent. In this review, the quantitative tools of science mapping, a special form of bibliometric analysis [21,46,47], are applied to analyze the global knowledge base on microfinance.

2.1. Search Criteria and Identification of Sources

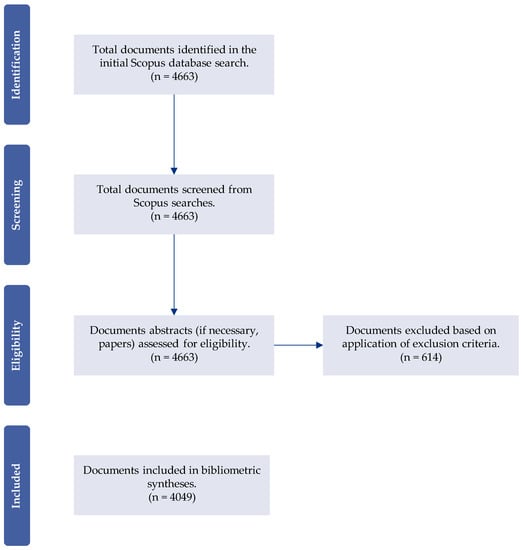

Using the ‘Preferred Reporting Items for Systematic Reviews and Meta-Analyses’ (PRISMA) guidelines for systematic research reviews [48], the document identification and selection process for the dataset is shown in Figure 1. Journal articles, books, book chapters, conference proceedings, and trade publications were included in the search.

Figure 1.

PRISMA flow diagram detailing steps in the screening of sources for the global microfinance review.

Initially, there were 4491 search results using the search string “TITLE-ABS-KEY (microfinance OR microcredit)”. The search string “TITLE-ABS-KEY (microenterprise AND credit)” was also applied, which generated 172 additional articles. All other variations of the search terms, such as “micro finance”, “micro-finance”, and synonyms, like “microenterprise” and “micro-entrepreneur”, or “microbank” and “microfinance institution”/“MFI” were used as well.

“Microinsurance” was not searched, as it is a specific field that is not concerned with financing entrepreneurship to fight poverty. Thus, given this review’s interest in sustainability, the term was not used. “Financial inclusion” was also not used, since it connotes a broader scope than “microfinance” and includes the provision of basic financial services (e.g., access to a bank account). Similarly, the keyword “financial cooperatives” was included. Financial cooperatives are intermediaries owned by its members, while they can engage in microfinance activities, but do not necessarily do so. Thus, searches based on this keyword were considered inappropriate. For the sake of simplicity, the term “microfinance” is used throughout this paper to describe the results of the applied searches.

The abstracts of all papers in this search list were reviewed to examine whether the research is clearly related to microfinance. Where the abstract analysis did not yield clear results, the entire papers were analyzed. For instance, papers with the words “that the current financial crisis offers banks the possibility to rethink their societal role and move from a compliance approach to CSR to a more strategic one” [49] (p. 1) or “risks associated with income variability can also be reduced by diversifying farm production between crops and livestock, on the one hand, and between a mix of different crops (cereals, vegetables, fruits), on the other” [50] (p. 1) appeared in the initial search results, but were removed from further analysis because no clear link to the topic ‘microfinance’ could be identified.

2.2. Data Extraction

Scopus limits the number of documents in ‘saved lists’ to 2000. Owing to the large volume of documents in the database and the use of various search strings, four saved lists were exported from Scopus as comma-separated value (csv) files. Next, the copies of the csv files were saved as Excel spreadsheets, to conduct further analysis (e.g., distribution of the microfinance research over time, search for co-cited document titles).

Since bibliometric analysis relies on meta-data downloaded from Scopus, the reliability of all data analyses depends on the quality of these bibliographic data. One threat to the reliability of bibliometric analyses lies in the lack of consistency in names of authors, references, nations, and other data meta-data exported from Scopus. Thus, the author developed thesaurus files designed to ‘disambiguate’ the data. For example, it is quite common to find Peter R. Jones referred to variously as ‘Jones, P.’ and ‘Jones, P.R.’, or the United States referred to variously as ‘USA’, ‘United States’, ‘United States of America’, and ‘America’ in a downloaded Scopus database. Thus, the author created a set of thesaurus files for insertion into the analytical software in order to ensure accurate results.

2.3. Data Analysis

Descriptive analysis and science mapping were the quantitative tools used for the analysis. Descriptive analysis illustrates the composition of a database by type, volume, and over time. Science mapping performs both citation and co-citation analysis. Citation analysis identifies the total number of document citations by other Scopus-indexed documents. This is often accepted as a measure of scholarly influence. In this review, a ‘citations per document’ (CPD) metric was also calculated in order to compensate for differences in the length of time a document (or author) has had to accumulate citations.

VOSviewer ( Centre for Science and Technology Studies, Leiden University, Leiden, Netherlands; version 1.6.10; 10 January 2019), the main software program used for this bibliometric review, conducts a variety of social network analyses that visualize similarities (VOS) among documents, authors, journals or topics that comprise a literature. VOSviewer has been used widely in order to gain insights into the structural features of disciplines [42].

One type of VOS analysis employed in this review was ‘co-citation analysis’. Co-citation is defined as the frequency with which two documents or two authors are cited together in other sources [47]. Consider for example, documents co-citation analysis. If three documents—X, Y, and Z—each cite papers A and B, then A and B are treated as co-cited documents. In this example, documents A and B would each accumulate three co-citations [42]. Although co-citation analysis can be applied to documents, authors, or journals, in this review its application was limited to authors and documents.

Two important features distinguish co-citation analysis from citation analysis. First, co-citation analysis examines the reference lists of all documents included in the reviewer’s database (e.g., 4049 documents). It then creates a matrix of all these references as the basis for the calculation of co-citations. Thus, co-citation analysis captures a far larger portion of the literature than citation analysis which is limited to documents included in the selected document repository. This suggests that it offers a much broader assessment of scholarly influence.

Second, frequent co-citation of two documents by other documents (i.e., scholars) indicates a similarity in intellectual affiliation between the two documents. If we assume, for example, that two documents or authors have been co-cited together 5, 50, 100, or 300 times by other documents or authors, it would suggest different degrees of intellectual affiliation. Thus, co-citation has also been used to develop measures of ‘similarity’ between authors, or documents.

Co-citation has been widely used to scientifically map the knowledge base of various academic disciplines [40,41,43,44,45,51,52]. VOSviewer not only generates ‘co-citation counts’ that can be used as measures of scholarly influence, but also ‘co-citation maps’ that ‘visualize’ similarities among authors, or documents. For example, author co-citation analysis maps can be used to highlight the different research clusters that comprise the intellectual structure of the knowledge base. Both uses of co-citation analysis are used in this review. Finally, it should be noted that citation and co-citation analysis, when used together, provide a powerful complementary means of gaining insights into a body of knowledge.

3. Results

This section presents the science mapping of the knowledge base on microfinance. The results are highlighted according to the three research questions that guide this paper.

3.1. Distribution of Microfinance Literature by Type, Volume, Time, and Geography

The knowledge base selected for this review is comprised of 3396 journal articles (84%), 476 books or book chapters (12%), 154 conference proceedings (4%), and 23 trade publications or documents of undefined type (1%). This represents a substantial corpus of studies, especially when one considers the fairly narrow scope of this review (i.e., microfinance) and that most of this literature has accumulated in the past 20 years.

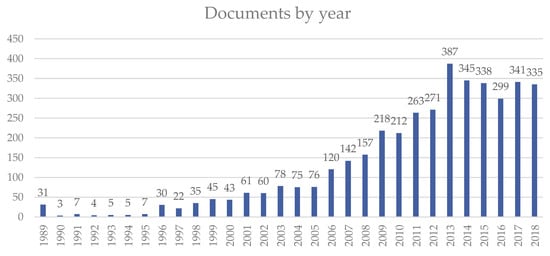

RQ1 seeks to trace the history of microfinance research around the world. A total of 4015 documents in the database represent the entire body of microfinance knowledge until the end of 2018 (Figure 2).

Figure 2.

Distribution of Scopus-indexed microfinance literature by volume and time 1989–2018.

The first Scopus-indexed research on microfinance was published in 1989. The literature was launched in a series of book chapters linking women’s empowerment and microfinance in the book “Women’s Ventures” [53,54,55,56,57,58,59,60,61,62,63,64,65,66] and in several related conference proceedings on “Microenterprises in developing countries” [67,68,69,70,71,72,73,74,75,76,77,78,79,80,81,82]. Subsequently, however, only a handful of studies were published annually until 1996 (see Figure 2). Slow, gradual increase in the annual volume of publications was observed for the next decade, until 2006, when the Nobel Peace Prize was awarded to the microcredit pioneer Muhammad Yunus. Yunus was a social entrepreneur and founder of Grameen Bank [83] in Bangladesh, one of the first market-based MFIs. Yunus and his colleagues were recognized “for their efforts through microcredit to create economic and social development from below” [84]. After this, there was a surge in the number of scholarly publications in the field of microfinance. Microfinance is a relatively new domain in scholarly studies. During the past decade, there have been almost 300 publications published on average per year.

The ‘heat map’ in Figure 3 reveals a clear dominance of authors affiliated in the United States. They contribute over one fourth to the whole body of worldwide microfinance knowledge. Together with scholars from the United Kingdom, the share amounts even to 37%, and to 44% including the two other Anglo-American countries, Canada and Australia. Authors based in India account for 9%, in Malaysia for 5%, and in France, Germany, and Belgium each for 4% of the knowledge base. Furthermore, the contributions from Bangladesh are remarkable. A total of 124 publications (3%) originate from the pioneering country of microfinance. Thereby, it is ranked ninth in the history of microfinance research. Apart from those societies, we find a global dispersion of the literature’s origin across all continents, covering altogether 139 countries worldwide.

Figure 3.

Global distribution of the microfinance literature, 1989–2019 (n = 4049).

3.2. Analysis of Influential Authors and Intellectual Structure of the Knowledge Base

RQ2 addresses the intellectual structure of the microfinance knowledge base through analysis of influential scholars [40,47]. The analytical strategy used for this research question was first to conduct citation analysis of author impact, followed by co-citation analysis of author impact and, finally, analysis of an author co-citation map which displays the social network of key authors in this field.

Table 1 lists the most highly-cited authors in the field of microfinance based on Scopus citation analysis.

Table 1.

Rank order of the 20 most highly-cited authors on microfinance, 1989–2019 (n = 4049).

First, the relative level of total citations of these top-ranked authors is quite high. It should be noted that this table only displays citations that accrue from the authors’ publications in the microfinance papers included in our Scopus-indexed review database. This implies that the authors’ full citation profiles would be substantially higher. These results further affirm the size and impact of this literature.

Second, the majority of authors listed in Table 1 are noted for their research on microfinance within the broader field of finance and sustainability. Morduch [85,86,87], Mersland [88,89,90], Cull [85,87], Demirguc-Kunt [85,87], Hartarska [91,92], Lensink [93,94], and Hermes [93,94,95] have been conducting specific research on institutional issues. Hulme [96,97], Khandker [98,99], Mosley [97,100], and Rutherford [101,102] are publishing research on microfinance and its use for poverty alleviation in general, and Karlan [103,104] on its impact. Others have published specialized research on linking microfinance to particular health-related issues, namely Phetla [105,106], Busza [107,108], Hargreaves [105,109], Kim [108,109], Morison [105,110], and Watts [106,108], or to the topic of women’s empowerment, for example, Rankin [111,112].

A very homogenous picture emerges in terms of the geographical distribution of the key scholars. Sixteen out of the 20 most highly-productive authors are located in North America or the UK, two in the Netherlands, and one each in Norway and South Africa. These findings are in concert with the global ‘heat map’ analyzed above (Figure 3), which showed a share of more than 40% North American or UK-based microfinance scholarship in history. Additionally (not specifically listed in the table), five of the top-cited scholars are affiliated with non-university institutions that explicitly engage in catalyzing sustainable development, namely The World Bank and the UN [33,34,35,113].

Next, co-citation analysis was used to identify the highly influential scholars. As noted earlier, co-citation analysis has the capacity to capture a broader literature by analyzing the reference lists of the 4049 documents in our review database. The results displayed in Table 2 show that the total co-citations and total link strength (a measure of connections of authors to other authors) are quite substantial. This offers further evidence of the interconnectedness (i.e., high level of co-citation among authors) of this literature.

Table 2.

Rank order of the 20 most highly co-cited authors on microfinance, 1989–2019.

Moreover, because co-citation analysis goes beyond documents in the underlying database, Table 2 identifies a number of additional influential authors in the microfinance literature (i.e., Armendariz, Banerjee, Hashemi, Yunus, Duflo, Stiglitz, Pitt, Kabeer, and Schreiner). For example, Stiglitz is listed here because of his publication on Peer monitoring and credit markets [114], which was not included in the review dataset. This highly-cited paper from 1990 examined research on peer lending and was subsequently cited frequently by scholars investigating microfinance.

Synthesis of the results shown in Table 1 and Table 2 allow us to identify influential authors through the complementary perspectives offered by citation and co-citation analysis. First we wish to note the asterisked authors in Table 2, highlighting scholars who were among the top 20 authors in both citation and co-citation analysis. These include Morduch [86,87,115], Khandker [98,116], Karlan [103,117], Mersland [90,118], Demirguc-Kunt [87,119], Hulme [96,100], Mosley [83,100], Cull [87,120], Lensink [93,95], Hartaska [91,92], and Hermes [93,95]. We can conclude that these have been particularly influential scholars in this literature.

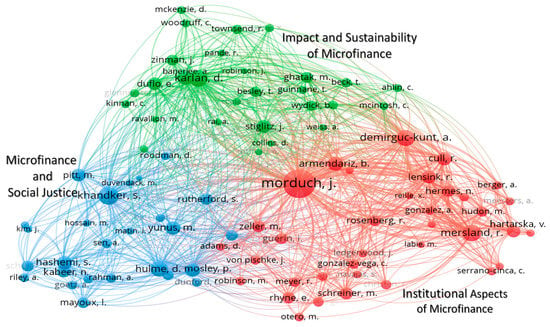

Next, we used VOSviewer to generate an author co-citation map. The author co-citation network derived from the review database consisted of 70,988 authors. Using a threshold of at least 20 co-citations per author we set VOSviewer to display the 90 most highly co-cited authors in a social network map (see Figure 4). The software organizes authors in the co-citation network into clusters based on their level of co-citation. Authors who are frequently co-cited are closer to one another in proximity. These connections are also indicated by the ‘links’ between specific nodes. Node size reflects the relative number of author co-citations. Finally, the software creates ‘clusters’ of authors based upon analysis of co-citation frequency. The clusters are interpreted as schools of thought that together comprise the intellectual structure of the knowledge base [40].

Figure 4.

Author co-citation analysis of the global microfinance literature, 1989–2019 (threshold 20 co-citations, 70,988 cited authors in the network, display 90 authors).

The largest node on the map belongs to Morduch [2,86,115] reflecting the high level of co-citations of his scholarship with other scholars in this literature. Morduch’s central location on map and high density of links to authors in all three clusters (see also ‘link strength’ in Table 2) affirm his status as the key ‘boundary-spanning scholar’ in this literature [40]. Boundary-spanning scholars play a key role in the development of a knowledge base by interpreting and synthesizing ideas across different schools of thought.

The author co-citation map is comprised of three coherent, distinct, but densely interconnected clusters. We conclude that this literature is comprised of clearly defined schools of thought, consisting of authors whose scholarship is frequently co-cited. These schools of thought include ‘Impact and Sustainability of Microfinance’ (green cluster), ‘Institutional Aspects of Microfinance’ (red cluster), and ‘Microfinance and Social Justice’ (blue cluster).

The red cluster is comprised of scholars whose scholarship has focused on Institutional Aspects of Microfinance. Intellectual leadership within this school of thought has come from Morduch [85,86,87], Mersland [88,89,90], Demirguc-Kunt [85,87], Armendariz [2,121], Cull [85,87], Lensink [93,94], Hartarska [91,92], Schreiner [122,123], and Hermes [93,94,95] (see Figure 4 and Table 2). Research associated with this School has focused on institutional, governance, and organizational aspects of microfinance (e.g., on Microfinance Institutions or MFIs) and how they impact poverty alleviation. Table 3 lists a selection of key documents that illustrate the thematic contributions of scholars located in this school of thought.

Table 3.

Illustrative selection of highly-cited documents authored by scholars in the school of thought focusing on Institutional Aspects of Microfinance.

The green cluster consists of authors associated with research that has sought to evaluate the Impact and Sustainability of microfinance initiatives, policies, and practices. Key scholars in this school of thought include Karlan [103,117], Banerjee [124,125], Duflo [124,126], and Stiglitz [114] (see Figure 4 and Table 2). Scholars located in this school of thought are notable for their use of sophisticated research designs (e.g., experimental economics, randomized impact evaluations, longitudinal panel studies) and advanced quantitative methods to evaluate the impact of different microfinance initiatives and practices on poverty alleviation. Table 4 lists a selection of influential documents authored by scholars associated with this school of thought.

Table 4.

Illustrative selection of highly-cited documents authored by scholars in the school of thought focusing on the Impact of Microfinance.

The blue cluster is comprised of scholars whose scholarship has focused on a constellation of issues concerned with how microfinance initiative and practices impact Social Justice. Key authors within this school of thought include Hulme [96,97], Mosley [97,100], Khandker [98,116], Hashemi [127,128], Yunus [129,130], Pitt [116,131], and Kabeer [132,133]. We note that many of these scholars are among the pioneers of research and practice in the field of microfinance. Broadly conceived, their scholarship aims to understand how microfinance can be employed to poverty-related problems in that plagued rural communities and women in developing societies. More specifically, these scholars have examined how microfinance impacts women’s empowerment [127,128,131,133] and a range of persisting social and medical issues that trap women in a cycle of poverty [128,134,135]. Notably, when compared with the green cluster, scholarship in this school has relied somewhat more on conceptual analysis and less advanced quantitative research. Table 5 lists illustrative articles authored by influential scholars in this school.

Table 5.

Illustrative selection of highly-cited documents authored by scholars in the school of thought focusing on Microfinance and Social Justice.

3.3. Analysis of Influential Documents

The final research question (RQ3) inquired into the most influential papers written on microfinance. Table 6 lists the 20 most highly-cited documents on microfinance. Morduch’s groundbreaking conceptual research The microfinance promise [115] is at the top of the list. Although the top-cited papers are split almost evenly between conceptual and empirical papers, the empirical studies tend to be of more recent vintage. Given the significant amount of sophisticated empirical research contained in this knowledge base, only one review of research was listed among the top-cited documents [140]. That paper focused solely on the relationship between poverty and mental disorder. We conclude a gap in the literature.

Table 6.

Rank order of the 20 most highly-cited documents on microfinance, 1989-2019 (n = 4049).

The list of key documents does not demonstrate a dominant topical focus. Six of them are grounded in a comprehensive view on microfinance and MFIs, five in overall poverty, three each in environmental issues and women’s empowerment, two in medical issues, and one in the topic of migration.

In the next step, documents co-citation analysis was conducted to complement the initial findings from citation analysis. For this analysis we relied on the document co-citation to reveal highly co-cited documents and additional relational features of the microfinance knowledge base [41]. The majority of co-cited documents listed in Table 7 is empirical (16 of 20). Consequently, most of the documents focus on ‘Impact and Sustainability’ (red cluster; nine out of ten). Six publications concentrate on ‘Microfinance and Social Justice’ (blue cluster), and the remaining five investigate ‘Group/Peer Lending and Repayment’. The three microfinance clusters are distributed over all the ranks of the table, which is why there is no influential focus that stands out.

Table 7.

Rank order of the 20 most highly co-cited documents on microfinance, 1989–2019.

Synthesis of the results shown in Table 6 and Table 7 allow us to identify influential documents through the complementary perspectives offered by citation and co-citation analysis. The asterisked documents in Table 7 mark those documents that were among the top 20 documents in both citation and co-citation analysis. These include three conceptual contributions from the early years of microfinance research, namely The microfinance promise [115] and The microfinance schism [86] (both authored by Morduch), as well as Finance against poverty [100] from Mosley and Hulme. Additionally, five empirical reports mostly linking microfinance and social justice are top-ranked in both Table 6 and Table 7. Those papers leading the lists of citation and co-citation analysis demonstrate an outstanding role across the whole body of microfinance publications.

Analogous to the co-citation analysis of influential authors, Stiglitz’s Peer monitoring and credit markets [114] is listed in Table 7, but was not identified in the microfinance dataset. Co-citation analysis also captures sources from outside the review dataset and Scopus. Stiglitz’s groundbreaking research on peer lending in a broad sense turned out to be remarkably influential for the narrower perspective of microfinance.

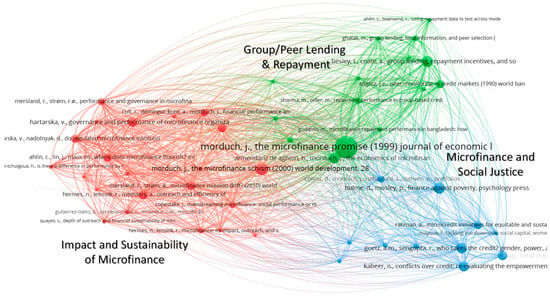

Document co-citation maps are used to reveal the cognitive structure of a knowledge base [44]. In a document co-citation map, each document is treated as an ‘idea’. Clusters of frequently co-cited documents reflect common sets and are interpreted as representing themes or sub-fields within the literature. Interpretation of the document co-citation map follows similar guidelines as the author co-citation map with respect to nodes, links, proximity, and cluster structure.

The microfinance document co-citation network consisted of 128,284 cited references extracted from the 4049 documents in our review database. The VOSviewer citation threshold was set at 20 citations with a display of 50 cited references. The document co-citation map (see Figure 5) reveals three distinctive clusters that comprise the cognitive structure of the global microfinance literature.

Figure 5.

Document co-citation analysis of the global microfinance literature, 1989–2019 (threshold 20 co-citations, 128,284 cited references in the network, display 50 documents).

- Publications focusing on efficiency, outreach, performance, and sustainability of microfinance and MFIs (red cluster, ’Impact and Sustainability of Microfinance’)

- Research dealing with the repayment performance of group and peer lending (green cluster, ‘Group/Peer Lending and Repayment’)

- Documents on poverty alleviation, rural development, as well as equality, empowerment, and gender issues (blue cluster, ‘Microfinance and Social Justice’)

These three clusters bear a striking resemblance to those surfaced through the author co-citation analysis. Indeed, two of the cluster themes are identical (i.e., ‘Impact and Sustainability of Microfinance’ and ‘Microfinance and Social Justice’). Notably, this degree of overlap is not always the case. Thus, this result suggests the stability, coherence, and significance of these themes within the microfinance literature.

Morduch’s The microfinance promise [115] shows the maximum influence as denoted by the largest dot and is located in the center of the map in a triangle showing all three topical clusters. His paper The microfinance schism [86] with the second largest dot, has a similar cross-cluster role. The documents ranked third [145] and fourth [100] are positioned peripherally on the map, rather than centrally within their respective clusters. Once again, it is Morduch, who co-authored the fifth most influential paper [2] (with Armendariz), located right in the center—between the two of his other mentioned documents. Even though the three clusters show a high internal density of document co-citation, they are densely interconnected (especially the red and green nodes).

4. Discussion

Microfinance stands as one of the most significant global financial initiatives undertaken to alleviate poverty in developing societies. From the outset, microfinance was conceptualized as a means of creating sustainable income production for women and families living in poor rural communities. Thus, it holds a special place among the range of strategies engaged to foster social and economic sustainability.

This research review employed science mapping to enhance our understanding of the knowledge base in microfinance. The review employed bibliometric analysis of 4049 Scopus-indexed documents in order to gain insights into the evolution of research on microfinance. It should be noted that science mapping reviews neither examine the quality of specific studies, nor do they seek to synthesize substantive findings from a body of literature. Instead, they aim to document the composition and intellectual structure of the knowledge base that has evolved over time. Therefore, an important goal of science mapping is to identify productive directions for future research.

Descriptive analyses of the microfinance knowledge base revealed a substantial body of knowledge consisting of just over four thousand Scopus-indexed documents. Given the rather narrow definition used to guide the selection of documents for this review, this represents an impressive corpus. Moreover, given the delimitation of this review to Scopus, our database does not even represent the entire knowledge base. Longitudinal analysis of the database found that although the first articles on microfinance were authored in 1989, 87% of the 4049 Scopus-indexed documents were published since 2005. This is, without question, a sub-field of finance and sustainability research that has gained acceptance among a significant group of finance and economics scholars. These conclusions drew further support from the copious citation analysis conducted in this review. Both citation and co-citation analyses of authors and documents confirmed a pattern of strong citation impact.

The ‘heat map’ of global microfinance scholarship indicates a clear pattern in which the microfinance literature is dominated by scholars in the US and the UK. While this has yielded considerable progress to date, the recruitment of more scholars located in the societies where this research is being conducted could be a relevant priority in this field. In addition to the US and the UK, there is some minor concentration in India, Malaysia, France, Canada, Australia, Germany, Belgium, and Bangladesh. All the mentioned societies altogether account for almost one half of the global scholarship on microfinance. Regarding the other half, we see a relatively wide dispersion over the world. The comprehensive Anglo-American dominance could also be confirmed by identifying the 20 most highly-cited authors. Sixteen of those key scholars are affiliated in North America or the UK.

The main goals of this review were to identify key authors and documents, and then to analyze the intellectual structure of the knowledge base on microfinance. In terms of influential scholars, two stand out. First, Muhammad Yunus deserves recognition as the pioneering scholar in this field. His early work that won the Nobel Prize does not, however, represent his only contribution [75,130,149,150,151,152,153,154]. The second scholar whose contributions deserve special recognition is Jonathan Morduch who was the most highly-cited and co-cited scholar in the microfinance knowledge base. This was further affirmed by the author co-citation map where his central position highlighted his role as the key ‘boundary-spanning scholar’ connecting the three schools of thought that comprise the microfinance knowledge base. These findings were complemented by a similar pattern of results from the document citation and co-citation analyses. Not only did Morduch rise to the top of both document citation lists (see Table 6 and Table 7), but his groundbreaking conceptual paper, The microfinance promise [115], also held the central position on the document co-citation map. This level of influence is somewhat unusual in science mapping studies.

In addition to Yunus and Morduch, several other key authors were identified as highly influential through the multiple citation analyses conducted in this study. These include Khandker, Karlan, Mersland, Demirguc-Kunt, Hulme, Mosley, Cull, Lensink, Hartaska, and Hermes. Key documents identified in this literature were highlighted in Table 6 and Table 7. Documents worthy of special mention include Microfinance: Its impact, outreach, and sustainability [94], Finance against poverty [100], or Do regulated microfinance institutions achieve better sustainability and outreach? [92]. Those reports represent prime examples of scholarship linking sustainability and microfinance as a special form of financing.

Several of the most highly-cited documents do not appear in the co-citation analysis ranking. Those deal with comparably specific but nonetheless prominent topics, such as conservation [17,18], building sustainable hybrid organizations [141], micro-finance investments to fight medical and partner violence issues [106,140], migrants and transformation [142], sustainability and African agriculture [143], or microfinance in the context of neoliberalism and “rational economic women” [112]. Consequently, this does not necessarily lead to co-citations in the overall research of microfinance.

The author and document co-citation maps revealed a stable coherent structure for the microfinance knowledge base. The three schools of thought underlying microfinance research were: (1) the institutional aspects of microfinance and performance of MFIs, (2) a group of microfinance scholars using sophisticated research methods to study the impact and sustainability of microfinance practices and initiatives, and (3) a concentration of early microfinance publications on poverty alleviation and social justice.

It should be emphasized that this review employed systematic empirical means of documenting the long-term intellectual contributions of these scholars and documents to discourse on microfinance. These scholars deserve recognition for shaping the field. However, there is also practical value to be derived from the results of these citation analyses. Specifically, both the data tables (i.e., Table 1, Table 2, Table 3, Table 4, Table 5, Table 6 and Table 7) and co-citation maps presented in this review can point scholars entering the field of microfinance towards key scholars and documents, thereby reducing the time needed to understand this literature.

This study conducted science mapping of the global knowledgebase on microfinance, and is the first-ever, comprehensive review of quality research (Scopus database) undertaken on this topic. Scholars that earlier examined this domain [39] followed a different approach by adopting narrower document selection criteria and also included other document sources.

It is hoped that the findings of this study will guide future research on sustainable finance and microfinance in institutions, politics, and society.

Funding

This research was funded by a grant (008/2561) from the Thailand Sustainable Development Foundation, Bangkok, Thailand.

Acknowledgments

Cordial thanks to Philip Hallinger who provided an introduction to the methodology and expertise that greatly guided the project.

Conflicts of Interest

There is no conflict of interest to declare.

References

- Mebratu, D. Sustainability and sustainable development: Historical and conceptual review. Environ. Impact Assess. Rev. 1998, 18, 493–520. [Google Scholar] [CrossRef]

- Armendariz, B.; Morduch, J. The Economics of Microfinance, 2nd ed.; The MIT Press: Cambridge, MA, USA, 2010. [Google Scholar]

- Hudon, M. Should access to credit be a right? J. Bus. Ethics 2009, 84, 17–28. [Google Scholar] [CrossRef]

- Robinson, M.S. The Microfinance Revolution: Sustainable Finance for the Poor; The World Bank: Washington, DC, USA, 2001. [Google Scholar]

- Bharti, N.; Shylendra, H.S. Microfinance and sustainable micro entrepreneurship development. In Proceedings of the 7th Biennial Conference on Entrepreneurship, Entrepreneurship Development Institute of India, Gujarat, India, 21–23 March 2007. [Google Scholar]

- García-Pérez, I.; Muñoz-Torres, M.-J.; Fernández-Izquierdo, M.-Á. Microfinance literature: A sustainability level perspective survey. J. Clean. Prod. 2017, 142, 3382–3395. [Google Scholar] [CrossRef]

- Arbolino, R.; Carlucci, F.; Cirà, A.; Yigitcanlar, T.; Ioppolo, G. Mitigating regional disparities through microfinancing: An analysis of microcredit as a sustainability tool for territorial development in Italy. Land Use Policy 2018, 70, 281–288. [Google Scholar] [CrossRef]

- García-Pérez, I.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Microfinance institutions fostering sustainable development. Sustain. Dev. 2018, 26, 606–619. [Google Scholar] [CrossRef]

- Lopatta, K.; Tchikov, M.; Jaeschke, R.; Lodhia, S. Sustainable Development and Microfinance: The Effect of Outreach and Profitability on Microfinance Institutions’ Development Mission. Sustain. Dev. 2017, 25, 386–399. [Google Scholar] [CrossRef]

- Mohammed, E.Y.; Uraguchi, Z.B. Financial Inclusion for Poverty Alleviation: Issues and Case Studies for Sustainable Development; Sustainable Markets Group, International Institute for Environment and Development (IIED), Taylor and Francis: London, UK, 2017. [Google Scholar]

- Ramaswamy, A.; Krishnamoorthy, A. The Nexus Between Microfinance Sustainable Development: Examining the Regulatory Changes Needed for Its Efficient Implementation. Eur. J. Sustain. Dev. 2016, 5, 453–460. [Google Scholar]

- Jimenez, L.E. Microfinance and housing for immigrants in the U.S.A.: A sustainable tool. Rev. INVI 2015, 30, 183–210. [Google Scholar]

- Manta, O. Countryside microfinance opportunity for sustainable rural development. In Proceedings of the 25th International Business Information Management Association Conference—Innovation Vision 2020: From Regional Development Sustainability to Global Economic Growth, IBIMA 2015, Amsterdam, The Netherlands, 7–8 May 2015; pp. 1446–1450. [Google Scholar]

- Mazumder, M.S.U. Role of Microfinance in Sustainable Development in Rural Bangladesh. Sustain. Dev. 2015, 23, 396–413. [Google Scholar] [CrossRef]

- Warnecke, T. “Greening” gender equity: Microfinance and the sustainable development agenda. J. Econ. Issues 2015, 49, 553–562. [Google Scholar] [CrossRef]

- Senanayake, S.M.P.; Premaratne, S.P. Micro-finance for accelerated development. Sav. Dev. 2006, 30, 143–168. [Google Scholar]

- Pretty, J. Social Capital and the Collective Management of Resources. Science 2003, 302, 1912–1914. [Google Scholar] [CrossRef] [PubMed]

- Pretty, J.; Ward, H. Social capital and the environment. World Dev. 2001, 29, 209–227. [Google Scholar] [CrossRef]

- Nugroho, L.; Utami, W.; Akbar, T.; Arafah, W. The challenges of microfinance institutions in empowering micro and small entrepreneur to implementating green activity. Int. J. Energy Econ. Policy 2017, 7, 66–73. [Google Scholar]

- Shammi, M.; Hasan, N.; Rahman, M.M.; Begum, K.; Sikder, M.T.; Bhuiyan, M.H.; Uddin, M.K. Sustainable pesticide governance in Bangladesh: Socio-economic and legal status interlinking environment, occupational health and food safety. Environ. Syst. Decis. 2017, 37, 243–260. [Google Scholar] [CrossRef]

- Forcella, D.; Hudon, M. Green Microfinance in Europe. J. Bus. Ethics 2016, 135, 445–459. [Google Scholar] [CrossRef]

- Forcella, D.; Servet, J.-M. Finance as a Common: From Environmental Management to Microfinance and Back. Critical Studies on Corporate Responsibility, Governance and Sustainability; Centre for European Research in Microfinance, Emerald Group Publishing Ltd.: Brussels, Belgium, 2016. [Google Scholar]

- Moser, R.M.B.; Gonzalez, L. Green microfinance: A new frontier to inclusive financial services. Rae Rev. De Adm. De Empresas 2016, 56, 242–250. [Google Scholar] [CrossRef]

- Archer, G.R.; Jones-Christensen, L. Entrepreneurial value creation through green microfinance: Evidence from Asian microfinance lending criteria. Asian Bus. Manag. 2011, 10, 331–356. [Google Scholar] [CrossRef]

- Bastiaensen, J.; Huybrechs, F.; Forcella, D.; Van Hecken, G. Microfinance plus for ecosystem services: A territorial perspective on Proyecto CAMBio in Nicaragua. Enterp. Dev. Microfinance 2015, 26, 292–306. [Google Scholar] [CrossRef]

- Gonzalez, L.; Moser, R.M.B. Green microfinance: The case of the cresol system in Southern Brazil. Rev. De Adm. Publica 2015, 49, 1039–1058. [Google Scholar] [CrossRef]

- Huybrechs, F.; Iaensen, J.B.; Forcella, D. Guest editorial: An introduction to the special issue on green microfinance. Enterp. Dev. Microfinance 2015, 26, 211–214. [Google Scholar] [CrossRef]

- Mahbouli, H.; Fortes, D. Is green microfinance “investment ready”? Perspective of an international impact investor. Enterp. Dev. Microfinance 2015, 26, 222–229. [Google Scholar] [CrossRef]

- Moser, R.M.B.; Gonzalez, L. Microfinance and climate change impacts: The case of agroamigo in Brazil. Rae Rev. De Adm. De Empresas 2015, 55, 397–407. [Google Scholar] [CrossRef]

- Shahidullah, A.K.M.; Haque, C.E. Green microfinance strategy for entrepreneurial transformation: Validating a pattern towards sustainability. Enterp. Dev. Microfinance 2015, 26, 325–342. [Google Scholar] [CrossRef]

- Hall, J.; Collins, L.; Israel, E.; Wenner, M. The Missing Bottom Line: Microfinance and the Environment; GreenMicrofinance: Philadelphia, PA, USA, 2008. [Google Scholar]

- Sachs, J.D. From millennium development goals to sustainable development goals. Lancet 2012, 379, 2206–2211. [Google Scholar] [CrossRef]

- United Nations. Sustainable Development Goals; United Nations: New York, NY, USA; Available online: https://sustainabledevelopment.un.org/sdgs (accessed on 20 March 2019).

- United Nations Capital Development Fund. UNCDF and the SDG; United Nations Capital Development Fund: New York, NY, USA; Available online: https://www.uncdf.org/uncdf-and-the-sdgs (accessed on 20 March 2019).

- United Nations Department of Economic and Social Affairs. International Year of Microcredit 2005; United Nations Department of Economic and Social Affairs: New York, NY, USA; Available online: https://www.yearofmicrocredit.org/ (accessed on 20 March 2019).

- Dey, P.; Steyart, C. Tracing and theorizing ethics in entrepreneurship: Toward a critical hermeneutics of imagination. In The Routledge Companion to Ethics, Politics and Organizations; Pullen, A., Rhodes, C., Eds.; Routledge: New York, NY, USA, 2015; pp. 231–248. [Google Scholar]

- Mongeon, P.; Paul-Hus, A. The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics 2016, 106, 213–228. [Google Scholar] [CrossRef]

- Falagas, M.E.; Pitsouni, E.I.; Malietzis, G.A.; Pappas, G. Comparison of PubMed, Scopus, Web of Science, and Google Scholar: Strengths and weaknesses. FASEB J. 2008, 22, 338–342. [Google Scholar] [CrossRef] [PubMed]

- Gutierrez-Nieto, B.; Serrano-Cinca, C. 20 years of research in microfinance: An information management approach. Int. J. Inf. Manag. 2019, 47, 183–197. [Google Scholar] [CrossRef]

- White, H.D.; McCain, K.W. Visualizing a discipline: An author co-citation analysis of information science, 1972-1995. J. Am. Soc. Inf. Sci. 1998, 49, 327–355. [Google Scholar]

- Zupic, I.; Čater, T. Bibliometric Methods in Management and Organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- van Eck, N.J.; Waltman, L. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 2017, 111, 1053–1070. [Google Scholar] [CrossRef] [PubMed]

- Hallinger, P. Science mapping the knowledge base on educational leadership and management from the emerging regions of Asia, Africa and Latin America, 1965–2018. Educ. Manag. Adm. Leadersh. 2019. [Google Scholar] [CrossRef]

- Hallinger, P.; Kovačević, J. A Bibliometric Review of Research on Educational Administration: Science Mapping the Literature, 1960 to 2018. Rev. Educ. Res. 2019, 89, 335–369. [Google Scholar] [CrossRef]

- Hallinger, P.; Suriyankietkaew, S. Science Mapping of the Knowledge Base on Sustainable Leadership, 1990–2018. Sustainability 2018, 10, 4846. [Google Scholar] [CrossRef]

- Small, H. Visualizing science by citation mapping. J. Am. Soc. Inf. Sci. 1999, 50, 799–813. [Google Scholar] [CrossRef]

- McCain, K.W. Mapping authors in intellectual space: A technical overview. J. Am. Soc. Inf. Sci. 1990, 41, 433–443. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. BMJ 2009, 339, 332–336. [Google Scholar] [CrossRef] [PubMed]

- Condosta, L. How banks are supporting local economies facing the current financial crisis: An Italian perspective. Int. J. Bank Mark. 2012, 30, 485–502. [Google Scholar] [CrossRef]

- Lerman, Z. Rural livelihoods in Tajikistan: What factors and policies influence the income and well-being of rural families? In Rangeland Stewardship in Central Asia: Balancing Improved Livelihoods, Biodiversity Conservation and Land Protection; Springer: Cham, The Netherlands, 2012; pp. 165–187. [Google Scholar]

- Pilkington, A.; Meredith, J. The evolution of the intellectual structure of operations management-1980-2006: A citation/co-citation analysis. J. Oper. Manag. 2009, 27, 185–202. [Google Scholar] [CrossRef]

- Nerur, S.P.; Rasheed, A.A.; Natarajan, V. The intellectual structure of the strategic management field: An author co-citation analysis. Strateg. Manag. J. 2008, 29, 319–336. [Google Scholar] [CrossRef]

- Berger, M. An introduction: Women’s ventures. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 1–18. [Google Scholar]

- Lycette, M.; White, K. Improving women’s access to credit in Latin America and the Caribbean: Policy and project recommendations. In Women’s Ventures; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 19–44. [Google Scholar]

- Mezzera, J. Excess labor supply and urban informal sector: An analytical framework. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 45–64. [Google Scholar]

- Escobar, S. Small-scale commerce in the city of La Paz, Bolivia. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 65–82. [Google Scholar]

- Otero, M. Solidarity group programs: A working methodology for enhancing the economic activities of women in the informal sector. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 83–101. [Google Scholar]

- McKean, C.S. Training and technical assistance for small and microbusiness: A review of their effectiveness and implications for women. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 102–120. [Google Scholar]

- Placencia, M.M. Training and credit programs for microentrepreneurs: Some concerns about the training of women. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 121–131. [Google Scholar]

- Reichmann, R. Women’s participation in two PVO credit programs for microenterprise: Cases from the Dominican Republic and Peru. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 132–160. [Google Scholar]

- Abreu, L.M. The experience of MUDE Dominicana in operating a women-specific credit program. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 161–173. [Google Scholar]

- Women’s World Banking. The credit guarantee mechanisms for improving women’s access to bank loans. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 174–184. [Google Scholar]

- Guzman, M.M.; Castro, M.C. From a women’s guarantee fund to a bank for microenterprise: Process and results. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 185–200. [Google Scholar]

- Arias, M.E. The Rural Development Fund: An integrated credit program for small and medium entrepreneurs. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 201–213. [Google Scholar]

- Landivar, J.F. Credit and development for women: An introduction to the Ecuadorian Development Foundation. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 214–221. [Google Scholar]

- Buvinic, M.; Berger, M.; Jaramillo, C. Impact of a credit project for women and men microentrepreneurs in Quito, Ecuador. In Women’s Ventures; Berger, M., Buvinic, M., Eds.; Kumarian Press Library of Management for Development: Sterling, VA, USA, 1989; pp. 222–246. [Google Scholar]

- De Soto, H. Structural adjustment and the informal sector. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 3–12. [Google Scholar]

- Tokman, V.E. Micro-level support for the informal sector. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 13–25. [Google Scholar]

- Tendler, J. Whatever happened to poverty alleviation? In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 26–56. [Google Scholar]

- Nowak, M. The role of microenterprises in rural industrialization in Africa. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 57–75. [Google Scholar]

- Chandavarkar, A.G. Informal credit markets in support of microbusiness. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 79–96. [Google Scholar]

- Seibel, H.D. Linking informal and formal financial institutions in Africa and Asia. In Microenterprises in Developing Countries, and Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 97–118. [Google Scholar]

- Meyer, R.L. Financial services for microenterprises: Programmes or markets? In Microenterprises in Developing Countries, and Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 121–130. [Google Scholar]

- Jackelen, H.R. Banking on the informal sector. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 131–143. [Google Scholar]

- Yunus, M. Grameen Bank: Organization and operation. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 144–161. [Google Scholar]

- Carr, M. Institutional aspects of microenterprise promotion. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 165–176. [Google Scholar]

- Harper, M. Training and technical assistance for microenterprises. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 177–188. [Google Scholar]

- Gamser, M.; Almond, F. The role of technology in microenterprise development. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 189–201. [Google Scholar]

- Carvajal, J. Microenterprise as a social investment. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 202–207. [Google Scholar]

- Otero, M. Benefits, costs and sustainability of microenterprise assistance programmes. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 211–223. [Google Scholar]

- Timberg, T.A. Comparative experience with microenterprise projects. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 224–239. [Google Scholar]

- Okelo, M.E. Support for women in microenterprises in Africa. In Microenterprises in Developing Countries, Proceedings of an International Conference Held in Washington, DC, USA, 6–9 June 1988; Intermediate Technology Publications: London, UK, 1989; pp. 240–250. [Google Scholar]

- Mosley, P.; Hulme, D. The story of the Grameen Bank: From subsidized microcredit to market based microfinance. In Microfinance; Arun, T., Hulme, D., Eds.; Routledge: New York, NY, USA, 2008. [Google Scholar]

- The Nobel Foundation. The Nobel Peace Prize for 2006; The Nobel Foundation: Stockholm, Sweden; Available online: https://www.nobelprize.org/prizes/peace/2006/press-release/ (accessed on 20 March 2019).

- Cull, R.; Demirguc-Kunt, A.; Morduch, J. Banks and Microbanks. J. Financ. Serv. Res. 2014, 46, 1–53. [Google Scholar] [CrossRef]

- Morduch, J. The microfinance schism. World Dev. 2000, 28, 617–629. [Google Scholar] [CrossRef]

- Cull, R.; Demirguc-Kunt, A.; Morduch, J. Financial performance and outreach: A global analysis of leading microbanks. Econ. J. 2007, 117, F107–F133. [Google Scholar] [CrossRef]

- Golesorkhi, S.; Mersland, R.; Piekkari, R.; Pishchulov, G.; Randøy, T. The effect of language use on the financial performance of microfinance banks: Evidence from cross-border activities in 74 countries. J. World Bus. 2019, 54, 213–229. [Google Scholar] [CrossRef]

- Lensink, R.; Mersland, R.; Vu, N.T.H.; Zamore, S. Do microfinance institutions benefit from integrating financial and nonfinancial services? Appl. Econ. 2018, 50, 2386–2401. [Google Scholar] [CrossRef]

- Mersland, R.; Oystein Strom, R. Performance and governance in microfinance institutions. J. Bank. Financ. 2009, 33, 662–669. [Google Scholar] [CrossRef]

- Hartarska, V. Governance and performance of microfinance institutions in Central and Eastern Europe and the Newly Independent States. World Dev. 2005, 33, 1627–1643. [Google Scholar] [CrossRef]

- Hartarska, V.; Nadolnyak, D. Do regulated microfinance institutions achieve better sustainability and outreach? Cross-country evidence. Appl. Econ. 2007, 39, 1207–1222. [Google Scholar] [CrossRef]

- Hermes, N.; Lensink, R. The empirics of microfinance: What do we know? Econ. J. 2007, 117, F1–F10. [Google Scholar] [CrossRef]

- Hermes, N.; Lensink, R. Microfinance: Its Impact, Outreach, and Sustainability. World Dev. 2011, 39, 875–881. [Google Scholar] [CrossRef]

- Hermes, N.; Lensink, R.; Meesters, A. Outreach and Efficiency of Microfinance Institutions. World Dev. 2011, 39, 938–948. [Google Scholar] [CrossRef]

- Hulme, D.; Shepherd, A. Conceptualizing chronic poverty. World Dev. 2003, 31, 403–423. [Google Scholar] [CrossRef]

- Mosley, P.; Hulme, D. Microenterprise finance: Is there a conflict between growth and poverty alleviation? World Dev. 1998, 26, 783–790. [Google Scholar] [CrossRef]

- Khandker, S.R. Microfinance and poverty: Evidence using panel data from Bangladesh. World Bank Econ. Rev. 2005, 19, 263–286. [Google Scholar] [CrossRef]

- Khandker, S.R. Fighting Poverty with Microcredit: Experience in Bangladesh; Oxford University Press, for the World Bank: Oxford, UK, 1998. [Google Scholar]

- Hulme, D.; Mosley, P. Finance against Poverty. Volume 1–2; Routledge: New York, NY, USA, 1996. [Google Scholar]

- Matin, I.; Hulme, D.; Rutherford, S. Finance for the poor: From microcredit to microfinancial services. J. Int. Dev. 2002, 14, 273–294. [Google Scholar] [CrossRef]

- Collins, D.; Morduch, J.; Rutherford, S.; Ruthven, O. Portfolios of the Poor: How the World’s Poor Live on $2 a Day; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Karlan, D.S. Using experimental economics to measure social capital and predict financial decisions. Am. Econ. Rev. 2005, 95, 1688–1699. [Google Scholar] [CrossRef]

- Karlan, D.; Zinman, J. Microcredit in theory and practice: Using randomized credit scoring for impact evaluation. Science 2011, 332, 1278–1284. [Google Scholar] [CrossRef] [PubMed]

- Jan, S.; Ferrari, G.; Watts, C.H.; Hargreaves, J.R.; Kim, J.C.; Phetla, G.; Morison, L.A.; Porter, J.D.; Barnett, T.; Pronyk, P.M. Economic evaluation of a combined microfinance and gender training intervention for the prevention of intimate partner violence in rural South Africa. Health Policy Plan. 2011, 26, 366–372. [Google Scholar] [CrossRef] [PubMed]

- Pronyk, P.M.; Hargreaves, J.R.; Kim, J.C.; Morison, L.A.; Phetla, G.; Watts, C.; Busza, J.; Porter, J.D. Effect of a structural intervention for the prevention of intimate-partner violence and HIV in rural South Africa: A cluster randomised trial. Lancet 2006, 368, 1973–1983. [Google Scholar] [CrossRef]

- Pronyk, P.M.; Kim, J.C.; Abramsky, T.; Phetla, G.; Hargreaves, J.R.; Morison, L.A.; Watts, C.; Busza, J.; Porter, J.D. A combined microfinance and training intervention can reduce HIV risk behaviour in young female participants. AIDS 2008, 22, 1659–1665. [Google Scholar] [CrossRef]

- Hargreaves, J.; Hatcher, A.; Strange, V.; Phetla, G.; Busza, J.; Kim, J.; Watts, C.; Morison, L.; Porter, J.; Pronyk, P.; et al. Process evaluation of the Intervention with Microfinance for AIDS and Gender Equity (IMAGE) in rural South Africa. Health Educ. Res. 2010, 25, 27–40. [Google Scholar] [CrossRef] [PubMed]

- Kim, J.C.; Watts, C.H.; Hargreaves, J.R.; Ndhlovu, L.X.; Phetla, G.; Morison, L.A.; Busza, J.; Porter, J.D.H.; Pronyk, P. Understanding the impact of a microfinance-based intervention on women’s empowerment and the reduction of intimate partner violence in South Africa. Am. J. Public Health 2007, 97, 1794–1802. [Google Scholar] [CrossRef] [PubMed]

- Pronyk, P.M.; Kim, J.C.; Hargreaves, J.R.; Makhubele, M.B.; Morison, L.A.; Watts, C.; Porter, J.D.H. Microfinance and HIV prevention - Emerging lessons from rural South Africa. Small Enterp. Dev. 2005, 16, 26–38. [Google Scholar] [CrossRef]

- Rankin, K.N. Social capital, microfinance, and the politics of development. Fem. Econ. 2002, 8, 1–24. [Google Scholar] [CrossRef]

- Rankin, K.N. Governing development: Neoliberalism, microcredit, and rational economic woman. Econ. Soc. 2001, 30, 18–37. [Google Scholar] [CrossRef]

- The World Bank. Sustainable Development Goals (SDGs) and the 2030 Agenda; The World Bank: Washington, DC, USA; Available online: http://www.worldbank.org/en/programs/sdgs-2030-agenda (accessed on 14 May 2019).

- Stiglitz, J.E. Peer monitoring and credit markets. World Bank Econ. Rev. 1990, 4, 351–366. [Google Scholar] [CrossRef]

- Morduch, J. The microfinance promise. J. Econ. Lit. 1999, 37, 1569–1614. [Google Scholar] [CrossRef]

- Pitt, M.M.; Khandker, S.R. The Impact of Group-Based Credit Programs on Poor Households in Bangladesh: Does the Gender of Participants Matter? J. Political Econ. 1998, 106, 958–996. [Google Scholar] [CrossRef]

- Karlan, D.; Zinman, J. Expanding credit access: Using randomized supply decisions to estimate the impacts. Rev. Financ. Stud. 2010, 23, 433–464. [Google Scholar] [CrossRef]

- Mersland, R.; Oystein Strom, R.O. Microfinance Mission Drift? World Dev. 2010, 38, 28–36. [Google Scholar] [CrossRef]

- Cull, R.; Demirguc-Kunt, A.; Morduch, J. Microfinance meets the market. J. Econ. Perspect. 2009, 23, 167–192. [Google Scholar] [CrossRef]

- Cull, R.; Demirguc-Kunt, A.; Morduch, J. Does Regulatory Supervision Curtail Microfinance Profitability and Outreach? World Dev. 2011, 39, 949–965. [Google Scholar] [CrossRef]

- Armendariz, B.; Szafarz, A. On mission drift in microfinance institutions. In The Handbook of Microfinance; World Scientific Publishing Co.: London, UK, 2011; pp. 341–366. [Google Scholar]

- Schreiner, M.; Woller, G. Microenterprise development programs in the United States and in the developing world. World Dev. 2003, 31, 1567–1580. [Google Scholar] [CrossRef]

- Schreiner, M. A cost-effectiveness analysis of the Grameen bank of Bangladesh. Dev. Policy Rev. 2003, 21, 357–382. [Google Scholar] [CrossRef]

- Banerjee, A.; Chandrasekhar, A.G.; Duflo, E.; Jackson, M.O. The diffusion of microfinance. Science 2013, 341, 1236498. [Google Scholar] [CrossRef] [PubMed]

- Banerjee, A.V.; Besley, T.; Guinnane, T.W. Thy neighbor’s keeper: The design of a credit cooperative with theory and a test. Q. J. Econ. 1994, 109, 491–515. [Google Scholar] [CrossRef]

- Banerjee, A.; Duflo, E.; Glennerster, R.; Kinnan, C. The miracle of microfinance? Evidence from a randomized evaluation. Am. Econ. J. Appl. Econ. 2015, 7, 22–53. [Google Scholar] [CrossRef]

- Hashemi, S.M.; Schuler, S.R.; Riley, A.P. Rural Credit Programs and Women’s Empowerment in Bangladesh. World Dev. 1996, 24, 635–653. [Google Scholar] [CrossRef]

- Schuler, S.R.; Hashemi, S.M. Credit programs, women’s empowerment, and contraceptive use in rural Bangladesh. Stud. Fam. Plan. 1994, 25, 65–76. [Google Scholar] [CrossRef]

- Yunus, M.; Moingeon, B.; Lehmann-Ortega, L. Building social business models: Lessons from the Grameen experience. Long Range Plan. 2010, 43, 308–325. [Google Scholar] [CrossRef]

- Yunus, M. Credit for the poor: Poverty as distant history. Harv. Int. Rev. 2007, 29, 20–24. [Google Scholar]

- Pitt, M.M.; Khandker, S.R.; Cartwright, J. Empowering women with micro finance: Evidence from Bangladesh. Econ. Dev. Cult. Chang. 2006, 54, 791–831. [Google Scholar] [CrossRef]

- Kabeer, N. Assessing the “Wider” Social impacts of microfinance services: Concepts, methods, findings. Ids Bull. 2003, 34, 106–114. [Google Scholar] [CrossRef][Green Version]

- Kabeer, N. Conflicts over credit: Re-evaluating the empowerment potential of loans to women in rural Bangladesh. World Dev. 2001, 29, 63–84. [Google Scholar] [CrossRef]

- Schuler, S.R.; Hashemi, S.M.; Badal, S.H. Men’s violence against women in rural Bangladesh: Undermined or exacerbated by microcredit programmes? Dev. Pract. 1998, 8, 148–157. [Google Scholar] [CrossRef] [PubMed]

- Schuler, S.R.; Hashemi, S.M.; Riley, A.P. The influence of women’s changing roles and status in Bangladesh’s fertility transition: Evidence from a study of credit programs and contraceptive use. World Dev. 1997, 25, 563–575. [Google Scholar] [CrossRef]

- Navajas, S.; Schreiner, M.; Meyer, R.L.; Gonzalez-Vega, C.; Rodriguez-Meza, J. Microcredit and the poorest of the poor: Theory and evidence from Bolivia. World Dev. 2000, 28, 333–346. [Google Scholar] [CrossRef]

- Schreiner, M. Aspects of outreach: A framework for discussion of the social benefits of microfinance. J. Int. Dev. 2002, 14, 591–603. [Google Scholar] [CrossRef]

- Caudill, S.B.; Gropper, D.M.; Hartarska, V. Which microfinance institutions are becoming more cost effective with time? Evidence from a mixture model. Pers. Psychol. 2009, 62, 651–672. [Google Scholar] [CrossRef]

- Banerjee, A.; Karlan, D.; Zinman, J. Six randomized evaluations of microcredit: Introduction and further steps. Am. Econ. J. Appl. Econ. 2015, 7, 1–21. [Google Scholar] [CrossRef]

- Patel, V.; Kleinman, A. Poverty and common mental disorders in developing countries. Bull. World Health Organ. 2003, 81, 609–615. [Google Scholar] [PubMed]

- Battilana, J.; Dorado, S. Building sustainable hybrid organizations: The case of commercial microfinance organizations. Acad. Manag. J. 2010, 53, 1419–1440. [Google Scholar] [CrossRef]

- Vertovec, S. Migrant transnationalism and modes of transformation. Int. Migr. Rev. 2004, 38, 970–1001. [Google Scholar] [CrossRef]

- Pretty, J.; Toulmin, C.; Williams, S. Sustainable intensification in African agriculture. Int. J. Agric. Sustain. 2011, 9, 5–24. [Google Scholar] [CrossRef]

- Rahman, A. Micro-credit initiatives for equitable and sustainable development: Who pays? World Dev. 1999, 27, 67–82. [Google Scholar] [CrossRef]

- Besley, T.; Coate, S. Who takes the credit? Gender, power, and control over loan use in rural credit programs in Bangladesh. J. Dev. Econ. 1995, 46, 1–18. [Google Scholar] [CrossRef]

- Goetz, A.-M.; Sen Gupta, R. Who takes the credit? Gender, power, and control over loan use in rural credit programs in Bangladesh. World Dev. 1996, 24, 45–63. [Google Scholar] [CrossRef]

- Ahlin, C.; Lin, J.; Maio, M. Where does microfinance flourish? Microfinance institution performance in macroeconomic context. J. Dev. Econ. 2011, 95, 105–120. [Google Scholar] [CrossRef]

- Sharma, M.; Zeller, M. Repayment performance in group-based credit programs in Bangladesh: An empirical analysis. World Dev. 1997, 25, 1731–1742. [Google Scholar] [CrossRef]

- Yunus, M.; Sibieude, T.; Lesueur, E. Social business and big business: Innovative, promising solutions to overcome poverty? Field Actions Sci. Rep. 2012, 4, 68–74. [Google Scholar]

- Yunus, M. The Story of Micro-credit: Grameen Bank and Social Business. In Democracy, Sustainable Development, and Peace: New Perspectives on South Asia; Oxford University Press: Oxford, UK, 2013. [Google Scholar]

- Yunus, M.; Zeitinger, C.-P. Money matters. In Uberpreneurs: How to Create Innovative Global Businesses and Transform Human Societies; Palgrave Macmillan: Basingstoke, UK, 2013; pp. 217–231. [Google Scholar]

- Yunus, M. Alleviating poverty through technology. Science 1998, 282, 409–410. [Google Scholar] [CrossRef]

- Yunus, M.; Dalsace, F.; Menascé, D.; Faivre-Tavignot, B. Reaching the rich world’s poorest consumers. Harv. Bus. Rev. 2015, 93, 12. [Google Scholar]

- Yunus, M. Halving poverty by 2015-we can actually make it happen. Round Table 2003, 92, 363–375. [Google Scholar] [CrossRef]

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).