1. Introduction

In 2016, the UK government set its target of building one million net new homes by 2020 [

1]. This was in response to long-term structural failures in housing supply, especially at the affordable level. At the same time, the construction sector faces potential post-Brexit skills shortages and an ongoing technological revolution. One outcome of these trends has been a growing interest in homes constructed offsite using automated and modular systems. Offsite construction refers to the broad spectrum of design, fabrication and build activity that takes place beyond the point of installation or assembly. It is not a new concept—perhaps most famously associated in the UK with the iconic post-war ‘prefab’ home [

2]—but it is one with growing influence in UK house-building. In 2004, the offsite construction industry was valued at £2,200,000 (€2,500,000) [

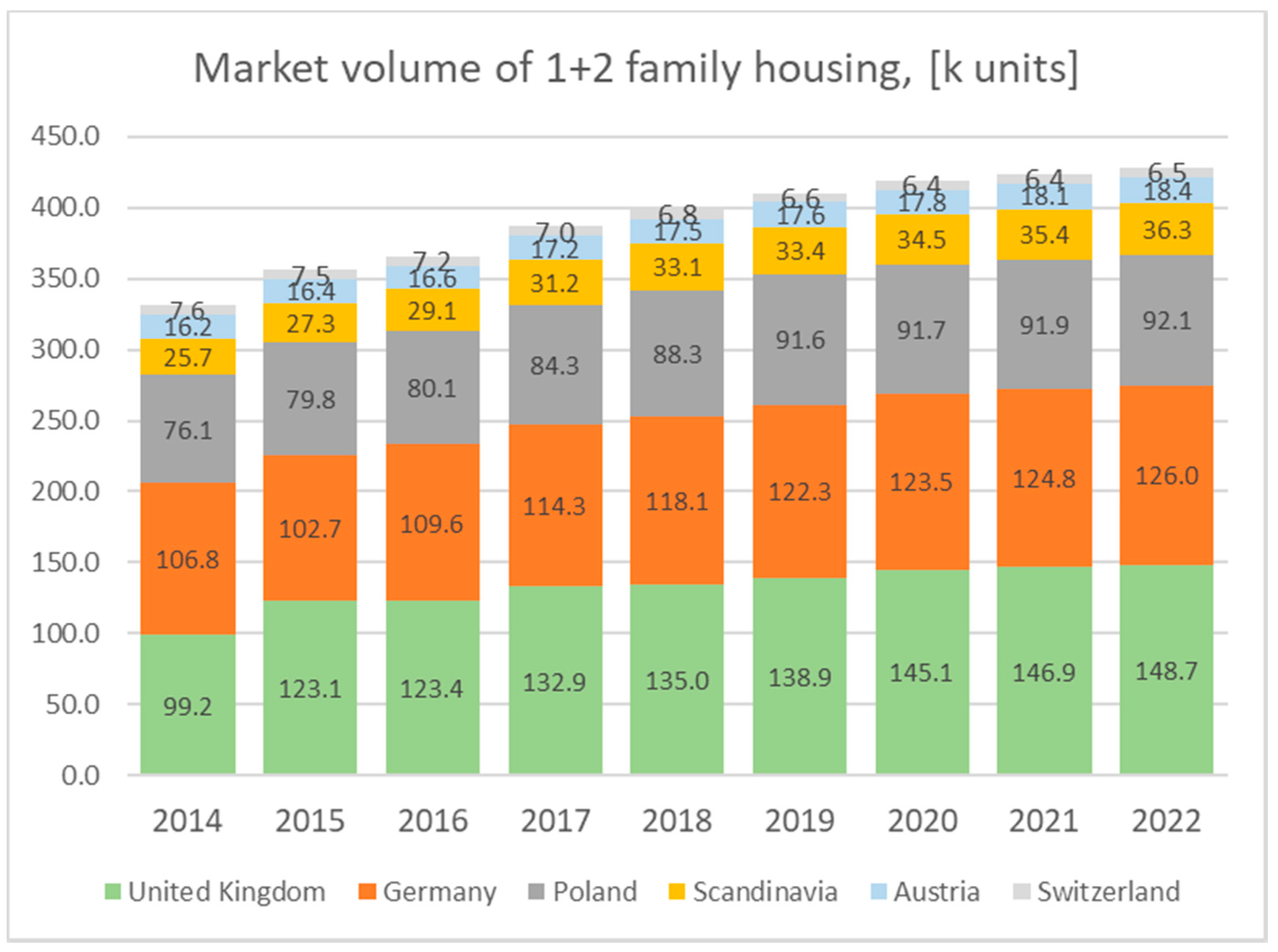

3], and recently, the market has expanded rapidly. If compared with other European countries, offsite represents an increasing share of the construction market in Germany, Poland, Scandinavia, Austria and Switzerland, with, in particular, the UK offsite trends for family houses very similar to Germany [

4] in terms of volume (

Figure 1). The degree of ‘prefabrication’ of a home can vary, and the technical and aesthetic range of offsite built homes is wide. The variety includes timber frames and structurally insulated panels (SIP), structural steel core and modularised systems, concrete panel systems, timber frames and straw bale, and cross-laminated timber, to cite but a few. Offsite is a “synonym” of standardisation and modularisation, and it offers a fertile ground for the development of digitised building information, through the use of building information modelling (BIM), as well as robotic and digital fabrication. It also offers a fascinating challenge to established methods of housing construction in the UK (onsite build using classic ‘bricks and mortar’ formulations), the policy levers and commercial arrangements through which this build method is calibrated and normalised (the dominance of volume house builders, a propensity to ‘bank’ land, the treating of housing as a commercial asset) and the social, economic and environmental limitations of this orthodoxy. That said, offsite constructed housing is perhaps ambiguous, politically speaking, seemingly in alignment with transient ‘pop-up’ urban design innovations that can breed precarious and uncertain relationships with ‘home’ [

5,

6] but also opening new opportunities for bold experiments in community self-build and sustainable place-shaping [

7,

8].

The two key aims of this specific investigation were to (i) map and understand the technological innovations being deployed by offsite firms and (ii) unpack how offsite firms are interacting with the physical, economic, political and social geographies that shape the house-building process. These aims were designed to establish the potential for and ramifications of offsite house-building now and in the future. Regarding the first aim, offsite house building has globally evolved substantially in recent decades—from heavy prefabrication methods to lightweight constructions with high added value [

9,

10,

11] functional to the rapidity of production cycle and with a lower use of resources [

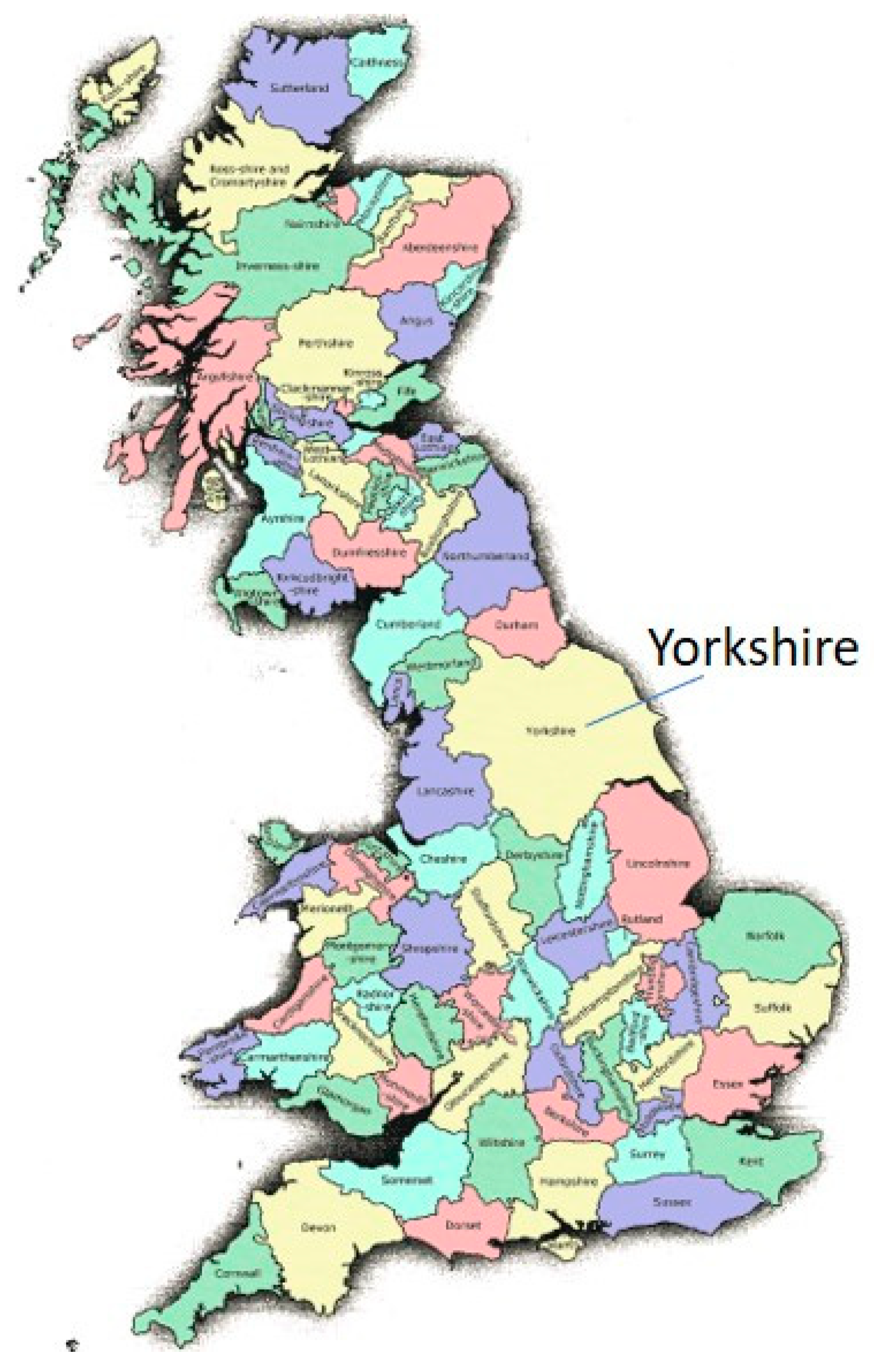

12], easily mountable and adaptable to context variability. However, this has increased the complexity of the supply chain and raised questions about what skills and technologies are required to sustain this still-young industry. The second of our aims involved exploring the landscape of offsite construction: where are firms located, what kind of offsite production ecologies or competitive spaces are emerging, how are firms interacting with their local built environments and what kind of strategic (e.g., planning, procurement) policy encounters are firms experiencing as they look to secure land and financing. To anchor these particular investigations in place, we decided to focus on one geographical region: Yorkshire (

Figure 2) in the North of England. Home to over 5 million people, Yorkshire currently has a significant housing supply crisis, including at an affordable level, with obvious consequences for economic and social cohesion in the region [

13,

14]. These housing supply problems overlie a socioeconomically diverse region but one which has been significantly deindustrialised since the 1970s, resulting in a further weakening of its position, alongside much of the rest of the English North and Midlands, vis a vis the historic economic, political and cultural dominance of Southern England [

15]. Recession and the Conservative government’s fiscal austerity programme, ongoing since 2010, has intensified these weaknesses in parts of the North by cutting government grants, hollowing out public sector employment and reducing household incomes [

16,

17]. These sedimented inequities have stimulated ongoing debates about what kinds of place-sensitive investments and innovations are required—including in local infrastructure—to achieve more sustainable and inclusive social economies and places across parts of the North [

18], debates made all the more urgent by widespread support for Brexit across the region during the 2016 EU referendum [

19]. We were keen to understand how offsite construction is interacting with these challenges in the particular region in which we live and work. Can it, for example, address housing supply problems or provide new forms of economic activity or help to ‘unlock’ more sustainable places and cities through low carbon emissions and sensitive place-shaping [

20]? As it happens, Yorkshire has emerged as one, but not the only, significant location for the UK’s nascent offsite housing construction industry [

21]. A number of firms that are developing offsite products and solutions have been established across the region in recent years from small, innovative architectural practices to multinational firms [

22]. This concentration of firms presented us with an opportunity to efficiently conduct some site visits, undertake industry mapping and set up a new network for interdisciplinary knowledge exchange, bringing together expertise from engineering, architecture, social science, sustainable construction and public policy from across the public and private sectors. We began this work in spring 2018, and this paper is informed by our mix of methods but reports primarily on insights gained from our knowledge exchange work. We focus on three key themes: technical transformations and challenges (

Section 3), environmental sustainability (

Section 5) and social/political implications (

Section 6). Our intention is to expand understandings of what is a growing but still-nascent industry and to inform the burgeoning architectural, environmental and sociological debates stimulated by offsite housing construction.

2. Methodology

The aim of this research was to map the emergence and impact of offsite construction as a feature of the UK’s and specifically Yorkshire’s (i) housing supply system in a period of housing ‘crisis’, (ii) urban place-making strategy and (iii) social, economic and environmental sustainability. To meet this aim, the research adopted three interlinking methods. First, a database of key industry stakeholders in Yorkshire was compiled starting from personal communications and analysis of online literature (media reports, government documents, company websites). Then, informal discussions were conducted with them as well as (for commercial offsite firms) site visits to observe prototypes and factories. Second, key secondary literature [

23,

24,

25,

26] was analysed to develop a template of key issues and challenges that offsite is said to be eliciting for industry and society. This second phase was essential to define the themes in light of our phase one discussions and visits. Third, throughout 2018, three expert knowledge exchange workshops were organised. Each workshop aimed to assemble a carefully selected group of industry innovators and specialists (architects, designers, engineers) emerging in the North of England, together with public authorities from across the region (town planners, municipal decision-makers) and academic researchers (see

Table 1 for an overview of our participants).

Each workshop was designed to share knowledge, encourage critical thinking and explore the possibility and impact of offsite construction across Yorkshire. The workshops aimed to understand technological variety and scale, typologies of factories, market formation, commercial challenges and the deeper social, economic and environmental implications of offsite construction. The workshops utilised a range of methods including formal presentations, focus groups and discussions in a world cafe format. This activity allowed us to divide the participants in three groups, each of them investigating a specific topic in depth and allowing three rounds of data collections. The main three questions where: 1. technological innovations and challenges; 2. environmental sustainability; and 3. social/political implications, specifically for patterns of inequality and democracy. The researchers facilitated the discussions and were responsible for taking notes, prompting discussions and summarising key points pertinent to the aims of the project. In terms of data analysis, emergent theme analysis was applied to the notes taken [

27]. Prior to the third workshop, a briefing paper was drafted [

28], based on insights gathered during workshops one and two, and shared with workshop attendees. This was presented and discussed with attendees, enabling feedback on the points made to ensure they were accurately reported and to refine them further. The case study examples included within the briefing paper are summarised in

Table 2.

4. Technical Innovation

Offsite construction is enabling the construction industry to change the way it builds for the first time in over 40 years, and it is set to grow. During 2018, the Transforming Construction Challenge in the UK enabled £170 m (€190 m) of investment from UK Research Innovation (UKRI) with £250 m (€280 m) match industry funding [

29]. This is planned to enable new construction processes, such as the development of offsite modular components. UKRI [

30] forecast this to enable buildings to be constructed 50% more quickly, 33% more cheaply and with half the lifetime carbon emissions.

Technical innovation factors include the use of digital design, transformative production process, manufacturing space, adaptable designs and mass scale. Digital design processes include the use of building information processes (BIM), open access design software and trials connecting this to computer numerical control production systems. Production processes include the equipment used to produce the components. Manufacturing spaces include factory spaces: temporary (including flying) or permanent.

Table 2 shows that while all companies are innovating, cases 1 and 2 scored highest for innovation in this category and are detailed further in this section.

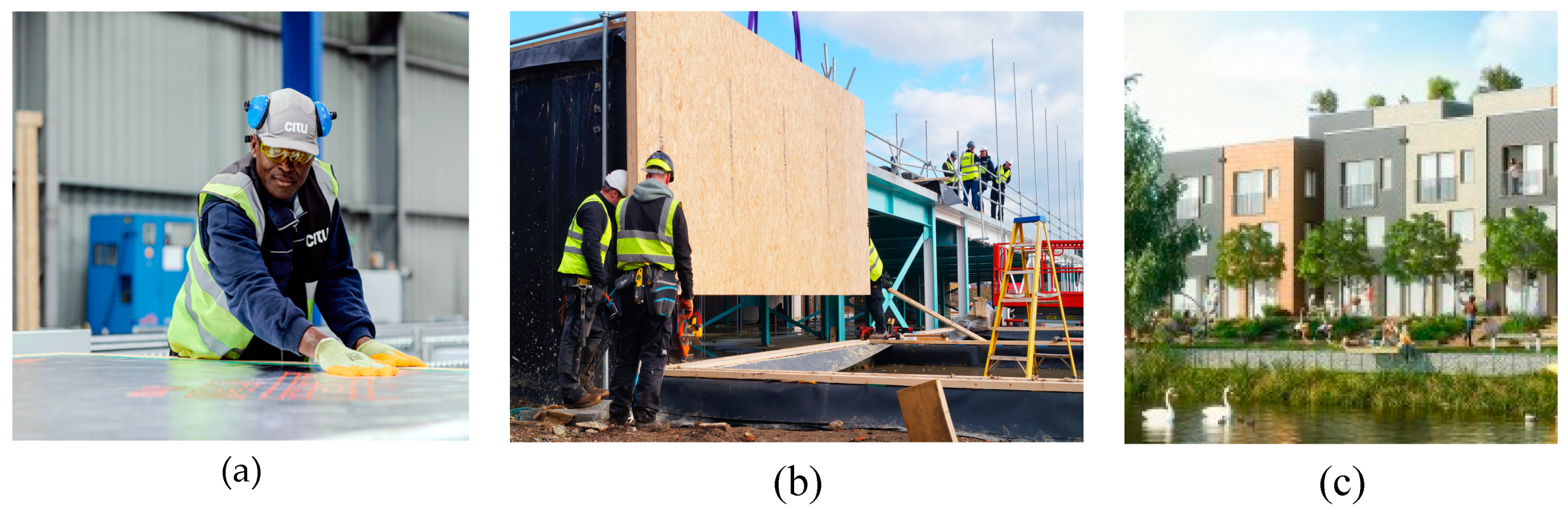

Case study 1 (

Figure 3) is based on a lightweight steel construction system, for which the mass manufacturer has recently received funding support to continue the research collaboration in developing an optimised structural system utilising novel techniques to improve the performance, safety and cost of current modular housing design. The system consisting of full volumetric modules (

Figure 4) is developed under a controlled environment in factories across the UK and provides precise engineering houses. The modules are delivered fully finished to the construction site, where they are installed on pre-prepared foundations at a rate of up to 6 homes a day. The overall design and production are developed in a building information modelling (BIM) environment to maximise precision, quality of the product and reduce waste. Their industry fully embraces the vision to become a smart factory, moving from a standardised process (characteristic of an industry 2.0), towards an automated production process (industry 3.0), up to integrating augmented reality and internet of the things (industry 4.0). As indicated by Whyte et al. (2017) [

31], where construction is seen as a manufacturing process, the BIM agenda can be fully delivered and interpreted in relation to the fourth industrial revolution. It could allow the development of digital twins, i.e., a digital version of the building assets, and being used throughout the entire life-time of the building, in order to obtain an optimised maintenance procedure during both the life-time as well as at the end of the life.

Case study 2 is a more unconventional system and represents a bespoke system. It is a user-centred building system combining the benefits of mass production and bespoke design. The process is digitally enabled and draws on BIM to create adaptable designs. The primary superstructure is constructed using structural cassettes fabricated from engineering boards such as orientated strand board or plywood (

Figure 5) cut using computer numerical control (CNC) in an easy to assemble way.

These two systems, among the many others discussed in the workshops and spread in North of England, can synthetise some key features of the technological development of prefab in the recent years. They both are strongly based around digital design, in particular with the adoption of BIM, to design and classify each component and to fabricate it. Case 1 already represents a large-scale manufacturer, capable of scaling its productivity to answer fast to a growing housing demand. Case 2 uses the digital platform up to the fabrication process, with the adoption of CNC techniques for the component fabrication. It also demonstrates the new prefab trend that moves from a mass production, which characterised the previous housing crisis during and after the wars, to a mass customisation process, which brings the client at the centre of the project. Indeed, the household can potentially input into the 3D modelling and visualisation processes of their bespoke self-build home. One of the innovations that this project also shows is the development of ‘flying factories’ (

Figure 6); temporary factory spaces which can be set up close to an assembly site and moved easily. They envisage, indeed, bringing CNC machines next to the construction sites so that most of the components can be fabricated close to the site, with the obvious effect of simplifying transportation burdens, reducing environmental costs and increasing the efficiency of product delivery. The scale of the bespoke timber capacity is due to be demonstrated, and we should see the first prototype being built soon after this publication date.

5. Environmental Innovation

Environmental innovation factors look at building performance, embodied carbon, material waste and other sustainable factors. Building performance is typically considered in this work in terms of space heating demand, with higher performance leading to lower demand. Embodied carbon is attributed to the structural materials used. Smart systems encompass the use of digital technology to enable sustainable design, build and operation processes. Other sustainability factors include consideration of the space around the housing development, such as green space or enabling less traffic and more wildlife.

Table 2 shows that case studies 3 and 4 are particularly innovative in this aspect, for innovating in building performance and embodied carbon, respectively. In addition, cases 1, 2, 3 and 5 are innovating in smart systems, as detailed at the end of this section.

According to the Construction Leadership Council [

32], sustainable buildings are designed and constructed to high environmental standards to minimise energy requirements, reduce water consumption, use materials which are resource-efficient and of low environmental impact (low embodied energy or carbon), reduce wastage, conserve and enhance the natural environment and safeguard human well-being. The International Energy Agency (IEA) [

33] reports that buildings and building construction sectors account for 36% of global final energy use and nearly 40% of direct and indirect CO

2 emissions. The IEA (2019) states that, on average, buildings could be around ‘40% more efficient’ by 2040. They highlight the importance of implementing stringent energy-saving requirements and efficient heating technologies for new buildings and retrofit. As a result, the demanding legislation concerning the reduction of the energy consumption of buildings has been challenging for both the construction sector and the research community to develop new high-efficient products and construction techniques, as well as to set up new methodologies for assessing the energy demand of buildings during each stage of their life cycle [

34].

However, there is often an energy performance gap between designed and as-built buildings [

35], which can delay carbon reductions being achieved. The construction industry is complex and interconnected with uncertain processes, and developing sustainable buildings requires knowledge to be diffused through a highly fragmented industry supply chain [

36]. The offsite sector, in particular, is embracing the challenges of delivering energy-efficient houses, by looking at reducing both embodied carbon and operational energy. Offsite construction has the potential to consistently and reliably produce offsite homes, once design and quality control measures are optimised [

37]. This can reduce the building performance gap. According to Krug and Miles (2013) [

38], who took a broad approach in assessing the sustainability credentials of 20 case study offsite projects, offsite is good in sustainability terms. This was attributed to 90% reduced waste, up to 80% reduced energy used on site, up to 60% reduced traffic movements and up to 25% reduce energy-in-use, when compared to ‘conventional construction’. On the other side, embodied carbon, i.e., the energy required for the material production, the construction process and end-of-life disposal is often prominent in the overall energy balance [

12,

39,

40,

41] and not always considered as carefully as in-use carbon emissions.

To date, there is little peer-reviewed literature that actually measures or tests the performance of offsite construction in use. The design and testing stage is, indeed, crucial as one post-occupancy evaluation doctoral study on offsite buildings showed [

37]. That study focused on two case-study residential block buildings of light-gauge steel construction and found that the buildings had increased energy use, poor thermal comfort and overheating issues. This indicates that evaluating in-use performance of offsite is a critical issue that future research should explore.

During our workshops, one the key policy stakeholders, i.e., Leeds City Council (LCC) exposed the strategy that this council in West Yorkshire is adopting to push towards the implementation of environmental sustainability and energy efficiency. Specifically, LCC developed a Leeds Standard in 2014, which is a quality specification including energy efficiency development to be used for new build council houses with an aim of influencing wider housing (LCC, 2016). The Standard specifies orientation, fabric, heating and hot water standards, including maximising solar gain, taking a fabric first approach with U-values of 0.15W/m

2 K or lower for walls, floor and roof and 0.8W/m

2 K for windows, aiming for 1 air change per hour or less and ‘low levels of heating’ with electric only properties to be explored and solar hot water for larger houses. To achieve this goal, local construction teams need to be equipped with sustainable construction expertise in the form of lean thinking, building performance and social skills [

42]. The reality, as testified in the workshops, is that the current construction sector is facing challenges in meeting the targets. An LCC representative stated that house-building contractors, adopting onsite construction methods, would confirm at tender stage that they can meet it, and when performance has been measured in terms of air leakage, for instance, the performance targets are often missed. Therefore, LCC is looking at offsite to achieve the required standards, since offsite homes, in theory, should enable consistent delivery once designs have been found to achieve standards, reducing contractor error and uncertainty.

The industry workshop attendees clearly indicated that producing homes, which can achieve designed targets for high levels of building energy performance at a lower cost, with an improved environmental and aesthetic value, are key points in the agenda of all offsite manufactures. To achieve this, the main applied strategies are the use of low embodied carbon materials, the optimisation of structural systems, the careful selection of finishing and the use of passive strategies for internal temperature control.

Among the industrial representatives, participating in the workshops, case study 3 can be highlighted as a pioneering developer in Leeds responsible for a pioneering sustainable development (PSD) (

Figure 7). This is transforming brownfield land, previously an industrial area that has been neglected over time, into a new-build urban environment. The PSD is based on the integration of high-energy-efficient modular housing schemes in an area that enables walking, cycling and interaction with nature and neighbours through a no-car zone. Case 3 adopts a ‘lean approach’ and a vertical supply chain to their manufacture and build processes to minimise waste of materials and time during construction. They have set up their own factory close to PSD to manufacture their timber frame homes, aiming to be both zero-carbon in use and have negative embodied carbon from the material sourcing. The homes are designed to be well-insulated, with high levels of air-tightness using mechanical ventilation with heat recovery. With regard to embodied carbon, the case 3 manufacturer published results gained using the RICS whole life carbon assessment method, which includes CO

2 sequestered from timber, other material emissions, transport of materials, factory operation, transport to site and construction. This led to a negative carbon factor of over 23 CO

2t, which over a 60-year life will emit around 250 tCO

2 less than a ‘typical new home’ [

43].

Another example of offsite construction, where the use of low carbon materials is at the core of the developed system, is shown by case 4 (

Figure 8). This is built using natural materials, such as timber-framed walls insulated with strawbale and finished with lime. This adopted system can reduce the CO

2 emitted during construction and enables the absorption and storage of around 12.25 tCo2. The Low Impact Living Affordable Community (LILAC) in Leeds development is an example of case 4 application. LILAC was conceived during the last economic crisis in 2008 as a co-housing community of 20 eco-build houses. It combines environmental sustainability with social sustainability through the development of innovative finance strategies to ensure the housing is sustainable and affordable.

The use of standardisation and BIM plays a significant role in enabling sustainable construction. BIM is at the core of all the offsite systems that have been discussed during the workshops. Case studies 1, 2, 3 and 5 develop their architectural, structural, mechanical and manufacturing system in an information modelling platform that allows design and manufacturing control at every stage, with some of them using BIM also for the control in the use-phase. This ensures that building performance meets designed targets and allows future maintenance to be planned at the design stage [

31]. In this perspective, case study 1 demonstrated how to not only fully integrate the mechanical system but also to develop a smart house by using augmented reality for verification and maintenance of the water, and electrical system, placing the house owner at the centre of the process. The owner can visualise all the pipework and boiler system within the house and verify the maintenance procedure. Other offsite manufactures are making pioneering use of virtual reality for communicating designs to clients, as shown in case study 5 [

44], which developed a user-friendly interface to allow individuals without specialist construction knowledge to select predesigned elements and assemble in a way that suits them, whilst satisfying UK Building Regulations and/or EU Construction Standards for structural safety.

6. Social Innovation and Opportunities

Social innovation has variable meanings for clients, the public and business. For clients, this incorporates the option for bespoke designs or involvement in the build process; for the public, it might include more affordable housing and positive places to live. For business, it relates to novel construction and assembly teams, procurement practices or business models which perhaps promote collaboration and knowledge sharing. Case study 2 is pioneering innovation in terms of offering clients adaptable designs; case study 3 allows clients to get involved in the build process; case 5 in terms of allowing clients to design their own house using user-friendly software interfaces. None of the companies were pioneering innovation for the public, although cases 1, 2 and 4 appear to have a particular drive for minimising the consequences of climate change. In business practices, all were innovating new approaches, including enabling collaboration for all, trialling new procurement routes and employing tradespeople directly.

With this potential for innovation comes a set of questions regarding the implications of offsite housing for socioeconomic sustainability and inequality. Perhaps most obvious is the growing influence of automation—happening across the construction sector—for work, skills and incomes [

45], particularly in regions with high poverty rates and concentrations of low skills [

46]. These were not questions we discussed in detail with our stakeholders, although some contributors argued offsite and open source technology could open up new, democratised ecologies of manufacturing and production at local levels. Another obvious question is whether offsite methods can be used to address sluggish low starter and completion rates in UK housing construction [

47] which, in part, lead to overcrowding and help to push house prices and rents beyond the reach of low-income households. The focus groups did attempt to explore these issues in some detail.

Our participants argued that offsite homes will be increasingly cheaper to buy and manage (e.g., through lower energy bills) but only a few firms, at this stage, spoke explicitly about their products being designed to address affordable housing shortages or being available at affordable rental levels. This, for many, was a problem that lay at the door of others: with money lenders who will not offer mortgages on ‘prefab’ homes, with volume house builders who ‘bank’ land rather than build efficiently and who lobby government powerfully to maintain market share and with policymakers and planners who will not risk ‘disrupting’ the norms of the industry. These factors all heighten barriers to entry and, it was claimed, require government intervention in relevant markets (land, materials, utilities, supply chains, labour). Sure enough, local authority managers expressed wariness, in an era of ongoing austerity, about procuring market and social rental homes from offsite manufacturers and acknowledged a tendency for risk-aversion in the public sector. That said, it was asserted that, at a national government level, there is burgeoning interest in offsite through, for example, the 2016 Farmer Review and the 2018/2019 Parliamentary Inquiry into Modern Methods of Construction, although it remains to be seen how these will, if at all, effect reforms that might address affordable housing shortages and chronically high social housing waiting lists [

48]. If offsite is to be used to resolve housing affordability crises and reduce the huge waiting lists for social housing we find in most British cities, then, political and policy levers have to be aligned to ensure appropriate subsidies and incentives are in place. For one of our participants, offsite builders also have a role to play by prioritising low income groups and argued that if developments start from the ‘bottom–up’ with social rented homes as their ‘core business’ rather than a mere additional, it is possible to increase the supply of affordable housing.

In the meantime, some offsite firms are being drawn into new-build developments, notably the ‘build to rent’ market in London. This raises the question of how more efficient build methods might be exploited by those financial investment houses and corporate landlords looking to expand and profit from a burgeoning private rental sector that is taking much of the strain of the UK’s housing crisis [

49]. We have also seen offsite gain prominence through its association with homelessness accommodation [

6], again linking it with reactive policy and planning decisions rather than more sustainable planning. The longer housing shortages continue, there is a risk that offsite construction becomes further linked with transient living as desperate municipal authorities look for cheap and mobile units to house their poorest and most challenging residents.

Further questions emerged around the capacity of offsite to democratise home-building/place-shaping processes. Again, the configuration of land ownership and volume building was interpreted as a barrier here, acting to minimise or discourage community-driven innovations regarding ownership, landscaping and place-shaping. This was linked to the expense of finding and cleaning up land and persuading planners to trust community alternatives to established industry relationships. To some degree, offsite is argued to offer a chance to open up these structures and introduce new ways of thinking about planning home and place. For example, the efficiency of methods and the opening up of digital technology could reduce barriers to market, thereby encouraging microenterprises in manufacturing, 3D printing or design. These could, if appropriately incentivised and organised, be embedded in localised supply-chains within communities, encouraging and facilitating a built and social environment more attuned to local needs. As offsite methods and infrastructures improve, the relative inefficiency of onsite construction could be exposed which may open up space for new models of community-led development. However, the potential for these new models depends on who can access the tools and knowledge, i.e., the extent to which offsite heralds a democratisation of construction and development. Given that large firms such as Legal and General have entered the market from other sectors, it remains far from clear that this vision of a more autonomous construction ecology will emerge.

Overall, it was considered that the UK’s systemic problems in land ownership and housing supply systems also permeate the offsite sector, albeit there are opportunities with new technology to develop new models, including community-led housing. How these might be scaled and what the role of offsite will be within this process remains to be seen.

7. Conclusions

Offsite construction is going under a revolutionary period of innovations and developments. Building on the historical standardised processes, it is embracing new technologies in order to develop systems that are faster to be built, cheaper and with high added values. This paper focused on the North of England, with a lens on the Yorkshire region, because it is showing to be fertile ground for new innovative companies that work at different scale of prefabrication. The North of England, also known as Northern Powerhouse, has been identified as the one region in the UK outside London that can see the major impacts in terms of productivity from the increased use of offsite, at the point that an increment of gross value added (GVA) of about £960 million (1060 million Euros) a year has been estimated [

50]. This project aimed to investigate, through stakeholder engagement workshops, interviews and factory visits, the role that offsite construction can play in the current housing crisis, as well as provide an opportunity for stakeholders to get together and define a roadmap for the development and application of offsite across the North of England regions.

Through the discussion of the main key points of our knowledge exchange network, we have clarified some of the key issues and opportunities faced by the offsite construction sector. We have investigated 5 case studies and ranked their technology, environmental and social innovations. We have demonstrated the role that offsite construction can play in achieving the digital and low carbon agenda, and how industry practitioners are prioritising this. These will help offsite firms to reflect on the technical, environmental, social and strategic implications and directions of their practice. It will also help policymakers and planners to demystify the offsite sector, reflect on how they might use this construction capacity and build trust between these two actors, both of whom will be critical in resolving the UK’s housing supply problems. Finally, we have provided a space for activists and practitioners to reflect on how they might adopt offsite methods as they seek alternative visions for communities that are not reliant on established ownership, design and financing patterns.