Assessing the Current State of Electric Vehicle Infrastructure in Mexico

Abstract

1. Introduction

2. Methodology

3. Current Status of Charging Infrastructure in Mexico

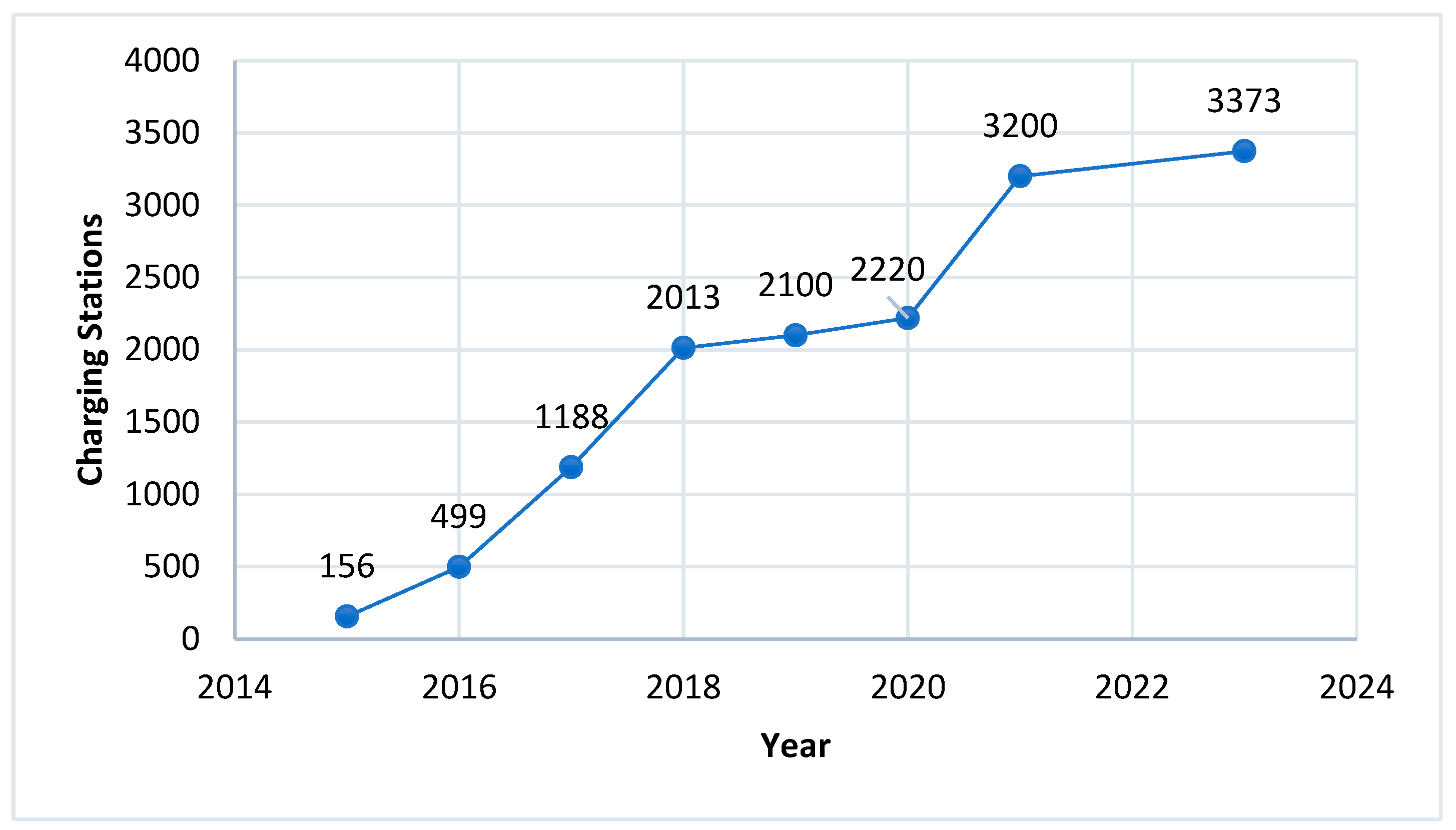

3.1. Stations Quantitative Data and Trends

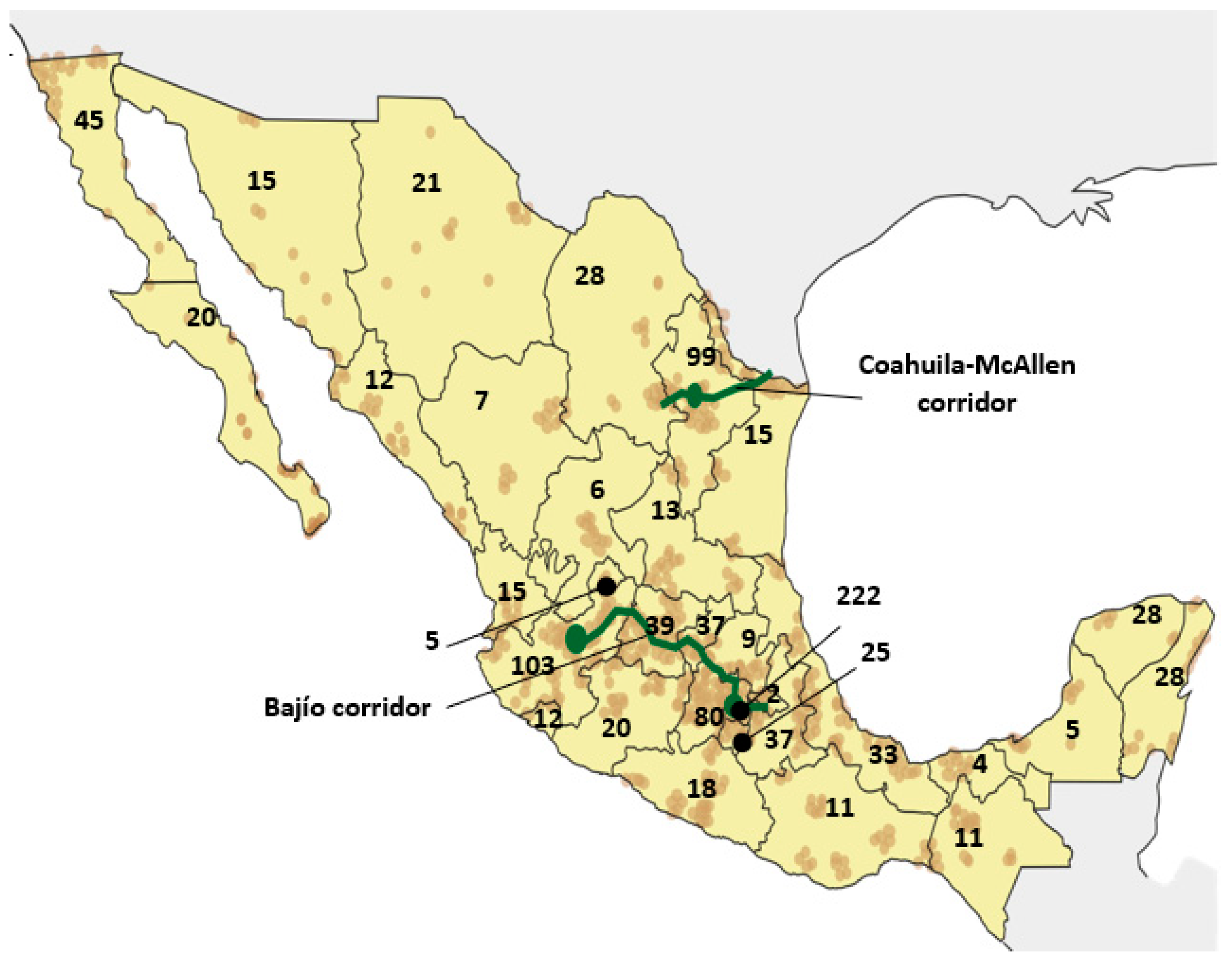

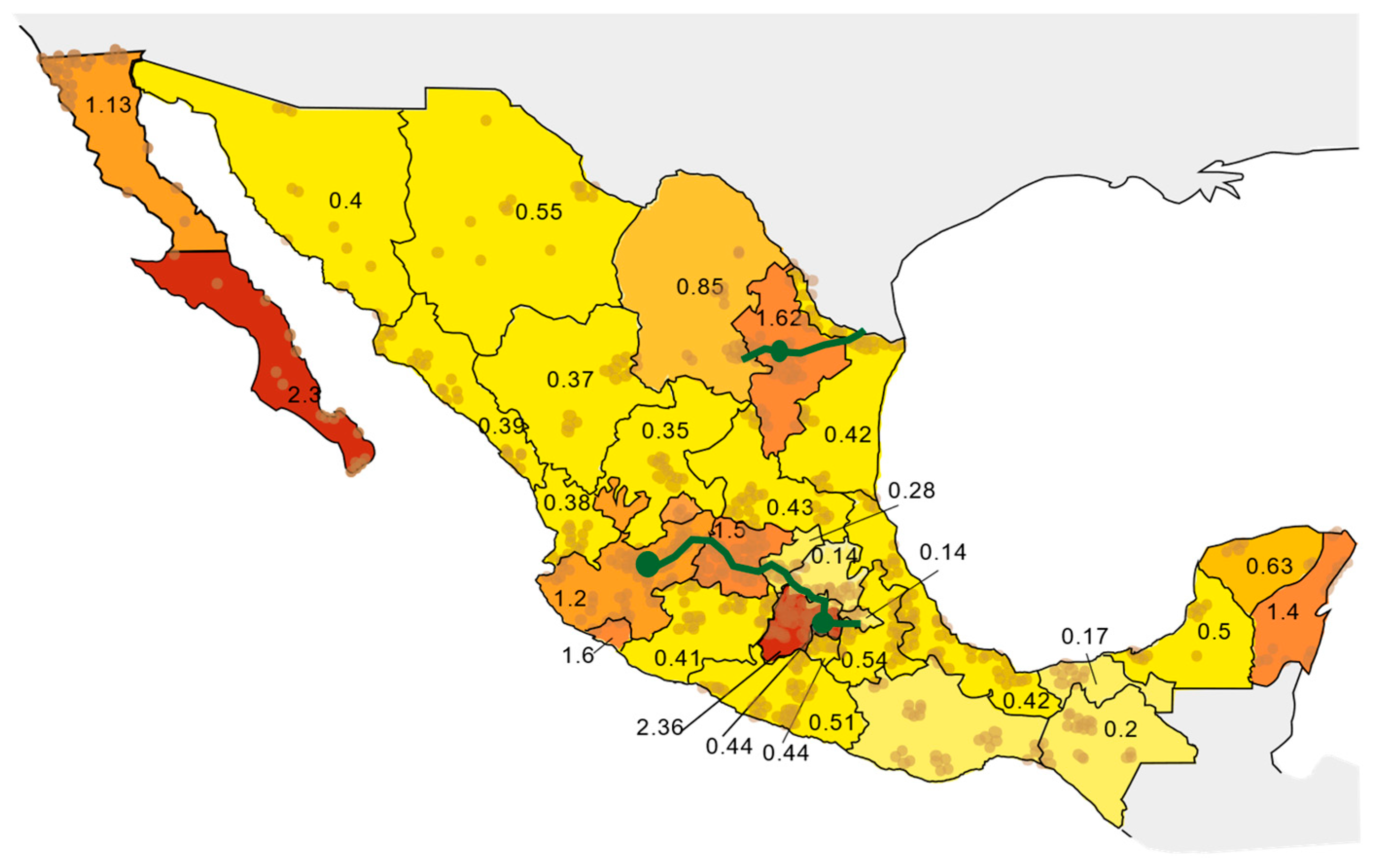

3.2. Existing Infrastructure

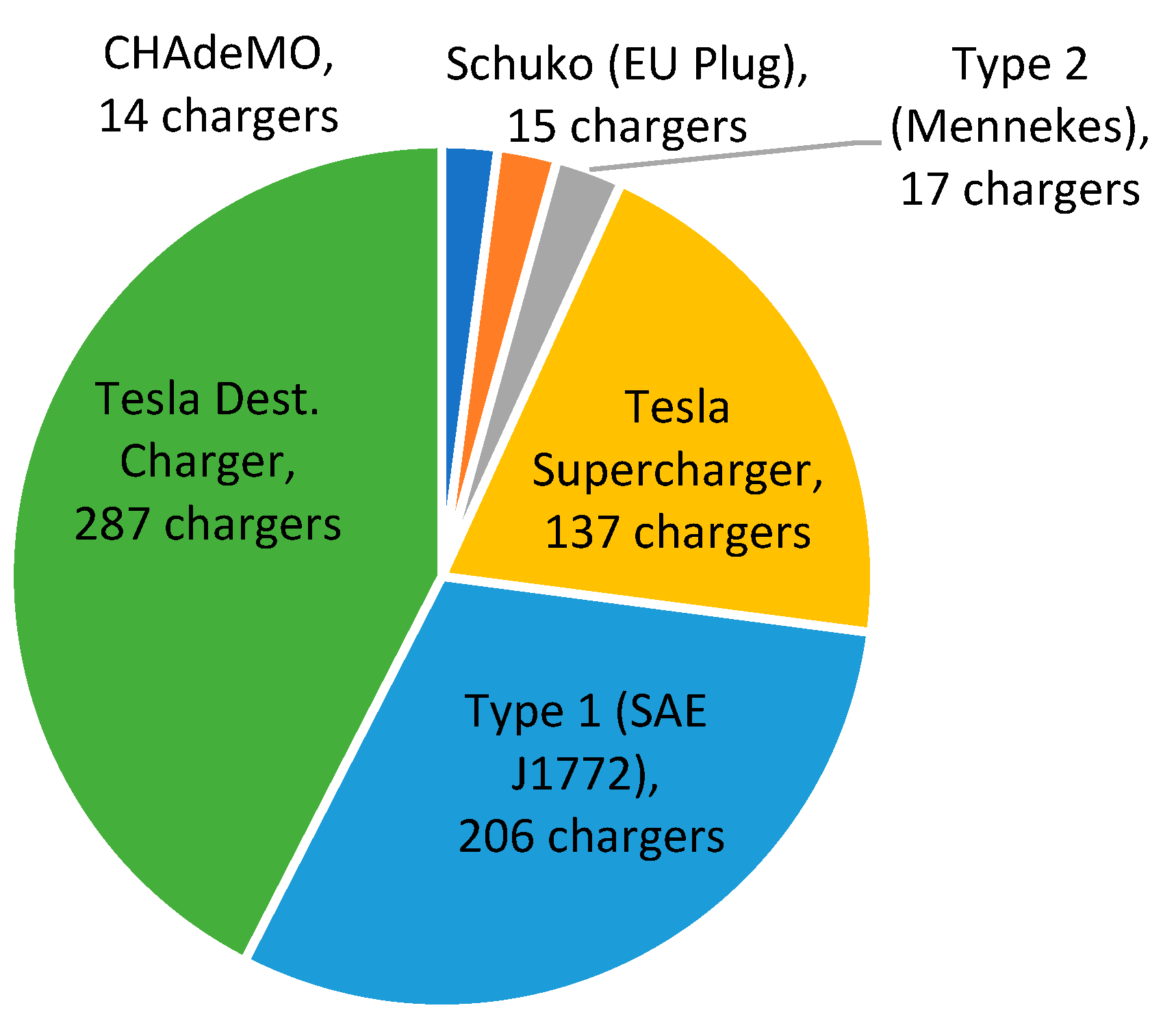

3.3. Types of Charging Points

3.4. Mobile Applications and Digital Platforms

3.5. Payment Models

- Free or Low-Cost Charging: In businesses such as hotels, restaurants, and shopping centres, electric vehicle charging is offered as a complementary service to attract customers, encourage extended visits, and generate indirect sales. Some stations, such as those provided by the Comisión Federal de Electricidad (CFE) and specific local initiatives, offer free charging or variable rates. However, free charging is becoming less common as the number of EVs continues to grow [52,70,71].

- Paid charging: Companies like ChargePoint, EVgo, and Blink Charging typically charge for their services. Pricing can depend on usage time or kWh consumed. Tesla’s Superchargers also charge based on kWh or per minute, although some Tesla owners may have access to free charging through specific promotions [52,70,71].

- Subscription models: Watts by Vemo, which has a strong presence in Mexico City, Jalisco, and Nuevo León, uses a system that allows users to avoid worrying about finding an empty station.

- Manufacturer incentives: Automakers such as Nissan and BMW may offer free charging stations to their customers.

4. Challenges of the Current Infrastructure

- (i)

- Limited Geographic Coverage and Urban–Rural Disparities

- (ii)

- High Installation and Maintenance Costs

- (iii)

- Lack of Incentives and Coherent Policies

- (iv)

- Technological Integration and Compatibility

- (v)

- Limited Grid Capacity and Integration

- (vi)

- Public Awareness and Consumer Trust

- (vii)

- Lack of Data and Monitoring Systems

5. Opportunities and Strategies for Future Development

5.1. Ongoing Programmes and Public Policies

5.2. Public–Private Partnerships and Financing

- (i)

- Nissan and BMW Charging Stations

- Nissan primarily offers Level 2 chargers, which are compatible with its vehicles, such as the Nissan LEAF. These chargers utilise Type 1 (J1772) connectors and provide a charging speed of approximately 7 kW, enabling a full charge within several hours.

- BMW also offers Level 2 chargers, suitable for vehicles like the BMW i3. These stations are compatible with both Type 1 and Type 2 connectors, with charging speeds ranging from 7 kW to 22 kW, ensuring fast and efficient charging [52].

- (ii)

- Comisión Federal de Electricidad (CFE)

- In 2017, the CFE installed 100 charging stations, bolstering the country’s electric charging network. By 2019, this number grew to 500 chargers nationwide.

- CFE’s infrastructure includes Level 2 and Level 3 chargers, equipped with Type 1 and Type 2 connectors. Charging speeds range from 7 kW to 22 kW, making them suitable for a variety of electric vehicles [88].

- (iii)

- ChargePoint [77]

- In Mexico, ChargePoint offers numerous Level 2 and some Level 3 charging points. Charging speeds vary from 7 kW for standard chargers to over 50 kW for fast chargers, catering to diverse user needs.

- (iv)

- Tesla Charging Stations

- The first Tesla Supercharger in Mexico and Latin America was inaugurated in Cuernavaca in June 2016. It features six charging positions for Model S and X vehicles.

- Tesla Superchargers provide exceptional charging speeds, offering up to 320 kilometres of range in just 15 min, with power outputs of 145 kW (V2) and 250 kW (V3).

- (v)

- Others

5.3. Regulatory Framework

- (i)

- Service Request: This chapter outlines the procedure operators must follow to request the electrical supply needed for their charging stations. If the property receives a basic supply at low or medium voltage, end users are required to submit a formal application to the Energy Regulatory Commission (CRE) to obtain a new service contract, separate from any existing contract. This ensures that each charging station has an adequate and specific power supply, avoiding interference with other electrical consumption [88].

- (ii)

- Installation and Signage of Charging Stations: The installation and signage of electric vehicle charging stations must be carried out in strategic locations to maximise accessibility, prioritising areas with high vehicular and pedestrian density, such as shopping centres, service stations, and urban zones with a high concentration of electric vehicles.

- (iii)

- Digital Platform: A digital platform will be created to monitor the charging infrastructure in real time, providing information on connector types, availability, and prices. This platform must be operational within 24 months of its publication.

- (iv)

- Technical Requirements: The stations must offer at least two types of connectors to accommodate different electric vehicle models. All chargers must be equipped with separate metres to ensure precise control of the electrical supply.

5.4. Success Stories and Lessons Learned from Other Latin American Countries

- (i)

- Chile: Driving Progress Through Incentives and Public–Private Partnerships

- (ii)

- Brazil: Standardisation and Effective Regulation

- (iii)

- Colombia: Promoting Renewable Energy Use and Community Support

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Charging Station Availability by State

| State | Stations | Population | Stations per 100,000 Inhabitants |

|---|---|---|---|

| Mexico City | 222 | 9,400,000 | 2.36 |

| Jalisco | 103 | 8,600,000 | 1.20 |

| Nuevo León | 99 | 6,100,000 | 1.62 |

| Mexico State | 80 | 18,200,000 | 0.44 |

| Baja California | 45 | 4,000,000 | 1.13 |

| Guanajuato | 39 | 6,400,000 | 0.61 |

| Puebla | 37 | 6,800,000 | 0.54 |

| Querétaro | 37 | 2,500,000 | 1.48 |

| Veracruz | 33 | 7,900,000 | 0.42 |

| Coahuila | 28 | 3,300,000 | 0.85 |

| Quintana Roo | 28 | 2,000,000 | 1.40 |

| Chihuahua | 21 | 3,800,000 | 0.55 |

| Baja California Sur | 20 | 850,000 | 2.35 |

| Michoacán | 20 | 4,900,000 | 0.41 |

| Guerrero | 18 | 3,500,000 | 0.51 |

| Aguascalientes | 15 | 1,500,000 | 1.00 |

| Tamaulipas | 15 | 3,600,000 | 0.42 |

| Yucatán | 15 | 2,400,000 | 0.63 |

| San Luis Potosí | 13 | 3,000,000 | 0.43 |

| Colima | 12 | 750,000 | 1.60 |

| Sinaloa | 12 | 3,100,000 | 0.39 |

| Sonora | 12 | 3,000,000 | 0.40 |

| Chiapas | 11 | 5,600,000 | 0.20 |

| Oaxaca | 11 | 4,200,000 | 0.26 |

| Hidalgo | 9 | 3,200,000 | 0.28 |

| Durango | 7 | 1,900,000 | 0.37 |

| Zacatecas | 6 | 1,700,000 | 0.35 |

| Campeche | 5 | 1,000,000 | 0.50 |

| Nayarit | 5 | 1,300,000 | 0.38 |

| Tabasco | 4 | 2,400,000 | 0.17 |

| Tlaxcala | 2 | 1,400,000 | 0.14 |

References

- International Energy Agency. Global EV Outlook 2023: Accelerating Ambitions Despite Cost Pressures. 2023. Available online: https://www.iea.org/reports/global-ev-outlook-2023 (accessed on 30 May 2025).

- Wang, Z. Overview of the Development of New Energy Vehicle Market in 2022. In Annual Report on the Big Data of New Energy Vehicle in China; Springer: Singapore, 2024; pp. 1–27. [Google Scholar] [CrossRef]

- International Energy Agency. Global EV Outlook 2024: Trends in Electric Cars. Available online: https://www.iea.org/reports/global-ev-outlook-2024 (accessed on 29 May 2025).

- Figenbaum, E.; Assum, T.; Kolbenstvedt, M. Electromobility in Norway: Experiences and opportunities. Res. Transp. Econ. 2015, 50, 29–38. [Google Scholar] [CrossRef]

- Aasness, M.A.; Odeck, J. The increase of electric vehicle usage in Norway—Incentives and adverse effects. Eur. Transp. Res. Rev. 2015, 7, 34. [Google Scholar] [CrossRef]

- Mastoi, M.S.; Zhuang, S.; Munir, H.M.; Haris, M.; Hassan, M.; Usman, M.; Ro, J.S. An in-depth analysis of electric vehicle charging station infrastructure, policy implications, and future trends. Energy Rep. 2022, 8, 11504–11529. [Google Scholar] [CrossRef]

- Chen, T.; Zhang, X.P.; Wang, J.; Li, J.; Wu, C.; Hu, M.; Bian, H. A review on electric vehicle charging infrastructure development in the UK. J. Mod. Power Syst. Clean Energy 2020, 8, 193–205. [Google Scholar] [CrossRef]

- Javadnejad, F. Analyzing incentives and barriers to electric vehicle adoption in the United States. Environ. Syst. 2024, 44, 575–606. [Google Scholar] [CrossRef]

- Hossain, M.S.; Kumar, L.; El Haj Assad, M.; Alayi, R. Advancements and future prospects of electric vehicle technologies: A comprehensive review. Complexity 2022, 2022, 3304796. [Google Scholar] [CrossRef]

- Sanguesa, J.A.; Torres-Sanz, V.; Garrido, P.; Martinez, F.J.; Marquez-Barja, J.M. A review on electric vehicles: Technologies and challenges. Smart Cities 2021, 4, 372–404. [Google Scholar] [CrossRef]

- Li, Y.; Taghizadeh-Hesary, F. The economic feasibility of green hydrogen and fuel cell electric vehicles for road transport in China. Energy Policy 2022, 160, 112703. [Google Scholar] [CrossRef]

- Wirasingha, S.G.; Schofield, N.; Emadi, A. Plug-in hybrid electric vehicle developments in the US: Trends, barriers, and economic feasibility. In Proceedings of the IEEE Vehicle Power and Propulsion Conference, Harbin, China, 3–5 September 2008. [Google Scholar] [CrossRef]

- Hawkins, T.R.; Gausen, O.M.; Strømman, A.H. Environmental impacts of hybrid and electric vehicles—A review. Int. J. Life Cycle Assess. 2012, 17, 997–1014. [Google Scholar] [CrossRef]

- Held, M.; Baumann, M. Assessment of the environmental impacts of electric vehicle concepts. In Towards Life Cycle Sustainability Management; Springer: Berlin/Heidelberg, Germany, 2011; pp. 535–546. [Google Scholar] [CrossRef]

- Ayoade, I.A.; Longe, O.M. A comprehensive review on smart electromobility charging infrastructure. World Electr. Veh. J. 2024, 15, 286. [Google Scholar] [CrossRef]

- Mohammed, A.; Saif, O.; Abo-Adma, M.; Fahmy, A. Strategies and sustainability in fast charging station deployment for electric vehicles. Sci. Rep. 2024, 14, 283. [Google Scholar] [CrossRef] [PubMed]

- Kumar, M.; Panda, K.P.; Naayagi, R.T.; Thakur, R.; Panda, G. Comprehensive review of electric vehicle technology and its impacts: Detailed investigation of charging infrastructure, power management, and control techniques. Appl. Sci. 2023, 13, 8919. [Google Scholar] [CrossRef]

- Dua, R.; Almutairi, S.; Bansal, P. Emerging energy economics and policy research priorities for enabling the electric vehicle sector. Energy Rep. 2024, 12, 1836–1847. [Google Scholar] [CrossRef]

- Sadeghian, O.; Oshnoei, A.; Mohammadi-ivatloo, B.; Vahidinasab, V.; Anvari-Moghaddam, A. A comprehensive review on electric vehicles smart charging: Solutions, strategies, technologies, and challenges. J. Energy Storage 2022, 54, 105241. [Google Scholar] [CrossRef]

- Cardona, M.; Aldana-Aguilar, J.; Morataya, C.; Flores, M.A.; Serrano, F.E. Advancing Electromobility in Central America: An Analysis of Policies and Regulations. In Proceedings of the 2024 IEEE 42nd Central America and Panama Convention (CONCAPAN XLII), San Jose, Costa Rica, 27–29 November 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Cruz, R.A. Mexico’s Electric Vehicle Performance in 2023. Global Fleet. 2024. Available online: https://www.globalfleet.com/en/manufacturers/latin-america/features/mexicos-electric-vehicle-performance-2023 (accessed on 30 May 2025).

- BBC Mundo. Tesla llega a México: Las Ventajas del País para ser el Mayor Productor de Vehículos Eléctricos en América Latina. BBC News Mundo. 2023. Available online: https://www.bbc.com/mundo/noticias-america-latina-64819256 (accessed on 30 May 2025).

- Mexico Business News. Mexico’s EV and PHEV Sales Surge 83.8% in 2024. Electro Mobility Association. 2025. Available online: https://mexicobusiness.news/automotive/news/mexicos-ev-and-phev-sales-surge-838-2024 (accessed on 30 May 2025).

- Vanguardia Industrial 2024. Crece 23% Infraestructura de Recarga para Vehículos Eléctricos en el Segundo Trimestre de 2024. Available online: https://www.vanguardia-industrial.net/crece-23-infraestructura-de-recarga-para-vehiculos-electricos-en-el-segundo-trimestre-de-2024/ (accessed on 30 May 2025).

- Martínez-Gómez, J.; Espinoza, V.S. Challenges and Opportunities for Electric Vehicle Charging Stations in Latin America. World Electr. Veh. J. 2024, 15, 583. [Google Scholar] [CrossRef]

- García, J.; López, M. La llegada del auto eléctrico a México y su impacto en el país. Rev. Estud. Automot. Mex. 2023, 12, 45–67. Available online: https://www.gob.mx/cms/uploads/attachment/file/681674/Impacto_del_auto_el_ctrico.final_JGO_JL_final.pdf (accessed on 30 May 2025).

- Mordor Intelligence. Mexico Electric Car Market—Analysis and Forecast 2025–2029. 2025. Available online: https://www.mordorintelligence.ar/industry-reports/mexico-electric-car-market (accessed on 30 May 2025).

- Martinez, N.; Terrazas-Santamaria, D. Beyond nearshoring: The political economy of Mexico’s emerging electric vehicle industry. Energy Policy 2024, 195, 114385. [Google Scholar] [CrossRef]

- Vallarta-Serrano, S.I.; Santoyo-Castelazo, E.; Ramirez-Mendoza, R.A.; Bustamante-Bello, R. Overview of Mexico’s transport sector: Current situation, emissions trend and electromobility. In Proceedings of the 2022 International Symposium on Electromobility (ISEM), Puebla, Mexico, 17–19 October 2022. [Google Scholar] [CrossRef]

- Maldonado, J.; Jain, A.; Castellanos, S. Assessing the impact of electric vehicles in Mexico’s electricity sector and supporting policies. Energy Policy 2024, 191, 114152. [Google Scholar] [CrossRef]

- Tal, G.; Pares, F.; Busch, P.; Chandra, M. Implications of Global Electric Vehicle Adoption Targets for the Light Duty Auto Industry in Mexico; UCDAVIS Electric Vehicle Research Center: Davis, CA, USA, 2023. [Google Scholar]

- Liu, C.C.; Boothman, S.G.; Graham, J.D. The Rise and Recent Decline of Tesla’s Share of the US Electric Vehicle Market. World Electr. Veh. J. 2025, 16, 90. [Google Scholar] [CrossRef]

- Vásquez, L.O.P.; Chavarría-Hernández, J.C.; Trinidad, A.A.; Ordóñez-López, L.C.; Sosa, S.F.; Pool, P.Y.C.; Barrera-Cabrera, J.N. Life cycle assessment of electric and gasoline moto-taxis in Yucatán, México: Impact of battery technology and social considerations. Energy Sustain. Dev. 2025, 85, 101614. [Google Scholar] [CrossRef]

- Romo, L.O.J. Analysis of Public Policies for the Development of the Electric Car Market in Mexico. Master’s Thesis, Centro de Investigacion y Docencia Economicas, Aguascalientes, Mexico, 2021. [Google Scholar]

- Ruiz-Barajas, F.; Ramirez-Nafarrate, A.; Olivares-Benitez, E. Decarbonization in Mexico by extending the charging stations network for electric vehicles. Results Eng. 2023, 20, 101422. [Google Scholar] [CrossRef]

- Méndez, N.A.P.; García, J.A.J.; Sánchez, N.G. Avances en la Implementación de la Electromovilidad en México Progress in the Implementation of Electromobility in Mexico. Diotima 2024, 9, 108. [Google Scholar]

- Altamirano, J.-C. Achieving Mexico’s Climate Goals: An Eight-Point Action Plan; Working Paper; World Resources Institute: Washington, DC, USA, 2016; pp. 1–47. [Google Scholar]

- Supercool Center. Mexico Accelerates EV Charging Infrastructure. 2025. Available online: https://www.supercool.center/en/blog/noticias/movilidad-electrica-estaciones-carga-mexico (accessed on 2 November 2024).

- Mexico Business News. Mexico Sees 9.3% Growth in Charging Stations in Q3 2024. 2024. Available online: https://mexicobusiness.news/automotive/news/mexico-sees-93-growth-charging-stations-q324-ema?tag=ministry-environment-0 (accessed on 27 November 2024).

- Statistica 2024 Número de Estaciones de Carga para Vehículos Eléctricos en México de 2015 a 2020. Available online: https://es.statista.com/estadisticas/1186114/estaciones-de-carga-vehiculos-electricos-mexico/ (accessed on 27 November 2024).

- Instituto Mexicano del Transporte. Actualidad Sobre las Estaciones de Recarga para Vehículos Eléctricos 2023. Available online: https://imt.mx/resumen-boletines.html?IdArticulo=595&IdBoletin=207#:~:text=Por%20otro%20lado%2C%20M%C3%A9xico%20cuenta,7%20a%2025%20minutos%2C%20dependiendo (accessed on 27 November 2024).

- Evergo. Evergo llega a México para Revolucionar la Movilidad Eléctrica con más de 15,000 Estaciones de Carga. 2022. Available online: https://evergo.com/evergo-llega-a-mexico-para-revolucionar-la-movilidad-electrica-con-mas-de-15000-estaciones-de-carga/ (accessed on 29 May 2024).

- MEXICONOW. BMW Group Mexico and Evergo to Install 4000 Electric Vehicle Chargers in the Country. 2023. Available online: https://mexico-now.com/bmw-group-mexico-and-evergo-to-install-4000-electric-vehicle-chargers-in-the-country/ (accessed on 29 May 2024).

- Electrive.com. Volvo Cars & Evergo to Install 2295 Chargers in Mexico. 2023. Available online: https://www.electrive.com/2023/09/04/volvo-cars-evergo-to-install-2295-chargers-in-mexico/ (accessed on 29 May 2024).

- Asociación Mexicana de la Industria Automotriz (AMIA). Recomendaciones para una Política Nacional de Electromovilidad 2023. Available online: https://www.amda.mx/wp-content/uploads/amia_estudio-completo_230911.pdf (accessed on 10 November 2024).

- El Economista. Puntos de Carga para Autos Eléctricos Crecieron 23%. Available online: https://www.eleconomista.com.mx/empresas/Puntos-de-carga-para-autos-electricos-crecieron-23-20240718-0124.html (accessed on 9 November 2024).

- Sánchez Devanny. National Electric Mobility Strategy. Available online: https://sanchezdevanny.com/en/trending/reports-and-legal-articles/national-electric-mobility-strategy (accessed on 14 November 2024).

- INEGI. Venta de Vehículos Híbridos y Eléctricos por Entidad Federativa. Available online: https://www.inegi.org.mx/app/tabulados/interactivos/?px=RAIAVL_11&bd=RAIAVL (accessed on 8 November 2024).

- Mexico Business News. Mexico Requires US$1.7 Billion Annual EV Charging Investment. 2024. Available online: https://mexicobusiness.news/automotive/news/mexico-requires-us17-billion-annual-ev-charging-investment (accessed on 10 November 2024).

- Mexico Business News. Only 8% of EV Charging Points in Mexico Are Public: EMA. 2024. Available online: https://mexicobusiness.news/automotive/news/only-8-ev-charging-points-mexico-are-public-ema (accessed on 8 November 2024).

- LATAM Mobility. ¿Cuántos Cargadores Necesita México para Cumplir Proyecciones? Available online: https://latamobility.com/cuantos-cargadores-necesita-mexico-para-cumplir-proyecciones/ (accessed on 15 November 2024).

- Enerlink. Guía de Electrolineras en México para Recarga de Coches Eléctricos. 2024. Available online: https://blog.enerlink.com/guia-de-electrolineras-en-mexico-para-recarga-de-coches-electricos (accessed on 22 November 2024).

- Salgado-Conrado, L.; Álvarez-Macías, C.; Loera-Palomo, R.; García-Contreras, C.P. Progress, Challenges and Opportunities of Electromobility in Mexico. Sustainability 2024, 16, 3754. [Google Scholar] [CrossRef]

- INEGI. Densidad de Población por Entidad Federativa, Serie de años Censales de 1990 a 2020. Available online: https://www.inegi.org.mx/app/tabulados/interactivos/?pxq=Poblacion_Poblacion_07_fb7d5132-39f0-4a6c-b6f6-4cbe440e048d (accessed on 13 November 2024).

- ENIGH. Encuesta Nacional de Ingresos y Gastos de los Hogares (ENIGH). 2022 Nueva Serie. Available online: https://www.inegi.org.mx/programas/enigh/nc/2022/#tabulados (accessed on 13 November 2024).

- González Gutiérrez, J. La distribución del ingreso en México (2008–2020). Rev. Econ. 2023, 40, 1–19. [Google Scholar] [CrossRef]

- Statistica 2024 Household Average Current Income per Quarter in Mexico in 2022, by State. Available online: https://www.statista.com/statistics/1399158/household-average-current-income-by-state-mexico/ (accessed on 17 November 2024).

- INEGI. Parque Vehicular. Available online: https://www.inegi.org.mx/temas/vehiculos/#informacion_general (accessed on 20 November 2024).

- Grupo de Consultores Eléctricos Especializados. Available online: https://grupoors.com.mx/2022/11/18/deberia-comprar-un-auto-electrico-ventajas-y-desventajas-en-mexico-2022/ (accessed on 20 November 2024).

- Mexico ¿Cómo Vamos? 2023. Available online: https://mexicocomovamos.mx/animal-politico/2023/07/el-futuro-de-las-electrolineras-en-mexico-y-la-normativa-electrica-que-las-acompanara/ (accessed on 20 November 2024).

- Barómetro de Electromovilidad 2024. Available online: https://emasociacion.org/download/barometro-de-electromovilidad-mexico-tercer-trimestre-2024/ (accessed on 25 November 2024).

- Statistica 2024. Number of Connectors at Electric Vehicle Charging Stations in Mexico as of July 2022, by Type. Available online: https://www.statista.com/statistics/1176455/types-electric-vehicle-charging-station-connectors-mexico/ (accessed on 27 November 2024).

- Tesla, Inc. Supercharger. Tesla. 2025. Available online: https://www.tesla.com/es_mx/supercharger (accessed on 9 January 2025).

- Chargemap. Chargemap: Mapa de Estaciones de Carga para Vehículos Eléctricos. 2025. Available online: https://es.chargemap.com/ (accessed on 9 January 2025).

- PlugShare: Encuentra Estaciones de Carga para Vehículos Eléctricos. 2025. Available online: https://www.plugshare.com/es (accessed on 9 January 2025).

- Electromaps. Puntos de Recarga. 2025. Available online: https://www.electromaps.com/es/puntos-carga (accessed on 9 January 2025).

- Google Maps. 2025. Available online: https://www.google.com.mx/maps/preview (accessed on 9 January 2025).

- Evergo. Cargadores para Vehículos Eléctricos. 2025. Available online: https://evergo.com/ (accessed on 9 January 2025).

- Open Charge Map. 2024. Available online: https://play.google.com/store/apps/details?id=com.webprofusion.openchargemap&hl=es_MX&pli=1 (accessed on 2 June 2025).

- Carrillo, J.; de los Santos Gómez, J.S.; Biones, J. Hacia una Electromovilidad Pública en México. Available online: https://repositorio.cepal.org/server/api/core/bitstreams/a9f6dc15-7e04-4d75-b676-b131e99b3c44/content (accessed on 30 November 2024).

- El Universal. Cuánto Cuesta Cargar un Auto Eléctrico en México. Available online: https://www.eluniversal.com.mx/autopistas/cuanto-cuesta-cargar-un-auto-electrico-en-mexico/ (accessed on 10 December 2024).

- Blink Charging. Pricing in Mexico. 2023. Available online: https://www.blinkcharging.com (accessed on 2 June 2025).

- EVgo. Mexico Charging Network. 2024. Available online: https://www.evgo.com (accessed on 2 June 2025).

- Vemo. Watts Subscription Plans. 2024. Available online: https://www.vemo.mx (accessed on 2 June 2025).

- Volta Charging. 2023. Available online: https://www.voltacharging.com (accessed on 2 June 2025).

- Comisión Federal de Electricidad (CFE) 2023. Tarifas Eléctricas para Usuarios Domésticos (DAC). Gobierno de México. Available online: https://www.cfe.mx (accessed on 3 June 2025).

- ChargePoint. Modelos de Precios en Estaciones Públicas Mexicanas. 2023. Available online: https://www.chargepoint.com (accessed on 2 June 2025).

- Secretaría de Energía (SENER). Guía Técnica Para Instalación de Cargadores Residenciales (240 V). Gobierno de México. 2022. Available online: https://www.gob.mx/sener (accessed on 3 June 2025).

- XATAKA Mexico. Available online: https://www.xataka.com.mx/automovil/seis-anos-le-tomo-a-bmw-nissan-tener-700-estaciones-carga-mexico-su-plan-electrificacion (accessed on 30 December 2024).

- Business Plan Templates. Vehicle Charging Station Network Running Costs. 2025. Available online: https://businessplan-templates.com/es/blogs/running-costs/vehicle-charging-station-network (accessed on 3 June 2025).

- Cercalux. ¿Cuánto Cuesta Instalar Cargadores de Autos Eléctricos? 2025. Available online: https://cercalux.com/cuanto-cuesta-instalar-cargadores-de-autos-electricos (accessed on 3 June 2025).

- Idaho National Laboratory 2023. Customer Experience at Public Charging Stations. Available online: https://inl.gov/content/uploads/2023/07/Customer-Experience-at-Public-Charging-Stations_INLRPT-23-74951_12-12-23_Optimized-1.pdf (accessed on 3 June 2025).

- Cabeza Santillana, F.M. Promoción de la Electromovilidad Sustentable. CFE. Available online: https://www.gob.mx/cms/uploads/attachment/file/395711/1_CFE_DesarInfRecVE.pdf (accessed on 15 December 2024).

- Agencia de Energía del Estado de Puebla. Plan para el Despliegue de Cargadores de Vehículos Eléctricos en el Estado de Puebla. 2022. Available online: https://agenciadeenergia.puebla.gob.mx/images/plan-de-despliegue-de-cargadores.pdf (accessed on 21 December 2024).

- Instituto Mexicano del Transporte (IMT) 2022. Movilidad Eléctrica en México: Avances y Retos en Infraestructura de Recarga. Secretaría de Infraestructura, Comunicaciones y Transportes. Available online: https://www.imt.mx/ (accessed on 3 June 2025).

- Comisión Federal de Electricidad (CFE). Programa para la Promoción de la Electromovilidad por medio de la Inversión en Infraestructura de Recarga (PEII). Gobierno de México. 2022. Available online: https://www.cfe.mx/ (accessed on 3 June 2025).

- Curiel-Ramirez, L.A.; Ramirez-Mendoza, R.A.; Bustamante-Bello, M.R.; Morales-Menendez, R.; Galvan, J.A.; Lozoya-Santos, J.d.J. Smart Electromobility: Interactive ecosystem of research, innovation, engineering, and entrepreneurship. Int. J. Interact. Des. Manuf. 2020, 14, 1443–1459. [Google Scholar] [CrossRef]

- CONAMER. Available online: https://www.cofemersimir.gob.mx/portales/resumen/56697 (accessed on 30 December 2024).

- Sánchez Vela, L.G.; de Jesús Fabela Gallegos, M.; Jiménez, J.R.H.; Centeno, O.F.; Vega, D.V.; Acevedo, M.E.C. Estado del Arte de la Movilidad Electrica en Mexico; Publicación Técnica: Mexico. 2020. Available online: https://imt.mx/archivos/Publicaciones/PublicacionTecnica/pt596.pdf (accessed on 11 June 2025).

- International Council on Clean Transportation (ICCT). Fuel Economy Standards and Zero-Emission Vehicle Targets in Chile. 2022. Available online: https://theicct.org/wp-content/uploads/2022/08/lat-am-lvs-hvs-chile-EN-aug22.pdf (accessed on 1 June 2025).

- Latam Mobility 2022. Chilean Senate Introduces Incentives Project to Promote Electromobility. Available online: https://latamobility.com/en/chilean-senate-introduces-incentives-project-to-promote-electromobility/ (accessed on 2 June 2025).

- CMS Law. Electric Vehicle Regulation and Law in Chile. Available online: https://cms.law/en/int/expert-guides/cms-expert-guide-to-electric-vehicles/chile (accessed on 2 June 2025).

- Pan American Finance. Chile. En Global EV Transportation Report 2023. 2023. Available online: https://panamericanfinance.com/insights/energy-transition/global-ev-transporation-report-2023/key-regional-markets/chile/ (accessed on 1 June 2025).

- Simão, M.S.; Vicente, I.; Cardoso, B.B.; Gianesini, M.A.; Dobes, M.I.; Kinceler, R.; Jeremias, T. Regulations and standards for electric vehicle charging infrastructure: A comparative analysis between Brazil and leading countries in electromobility. Sustain. Energy Technol. Assess. 2025, 73, 104119. [Google Scholar] [CrossRef]

- CharIN. CharIN Advance Electric Mobility Infrastructure in Brazil. 2024. Available online: https://www.charin.global/news/charin-advance-electric-mobility-infrastructure-in-brazil (accessed on 1 June 2025).

- Cappellucci, J.; Weigl, D.; Esterly, S.; Lucas, H. USAID Colombia Young Leaders Workforce Training Program Action Plans: Planning for Electric Vehicle Charging Infrastructure in Bogota; National Renewable Energy Laboratory: Golden, CO, USA, 2023. [Google Scholar] [CrossRef]

- ACOMOVES 2025. Colombia Accelerates Toward Electric Mobility: ACOMOVES Reveals Challenges and Advances in the Sector. Latam Mobility. Available online: https://latamobility.com/en/colombia-accelerates-toward-electric-mobility-acomoves-reveals-challenges-and-advances-in-the-sector/ (accessed on 1 June 2025).

- Bitencourt, L.; Dias, B.; Soares, T.; Borba, B.; Quirós-Tortós, J.; Costa, V. Understanding business models for the adoption of electric vehicles and charging stations: Challenges and opportunities in Brazil. IEEE Access 2023, 11, 63149–63166. [Google Scholar] [CrossRef]

- Universidad Externado de Colombia. Movilidad Eléctrica: Retos y Deficiencias Enmarcadas desde la Infraestructura y Marco Regulatorio en Colombia. 2023. Available online: https://bdigital.uexternado.edu.co/bitstreams/4b26ef87-9482-4fe1-bd1f-513ef696a0ea/download (accessed on 1 June 2025).

- Ministerio de Energía de Chile. Estrategia Nacional de Electromovilidad. 2021. Available online: https://www.energia.gob.cl/consultas-publicas/estrategia-nacional-de-electromovilidad (accessed on 1 June 2025).

- Secretaría de Medio Ambiente y Recursos Naturales (SEMARNAT). Estrategia Nacional de Movilidad Eléctrica (ENME). Gobierno de México. 2022. Available online: https://www.gob.mx/cms/uploads/attachment/file/832517/2.3.ENME.pdf (accessed on 1 June 2025).

- Ministerio de Transportes y Telecomunicaciones de Chile, GIZ. Estrategia Nacional de Movilidad Sostenible de Chile. 2023. Available online: https://www.subtrans.gob.cl/wp-content/uploads/2022/11/Documento-oficial-ENMS-2023-SECTRA.pdf (accessed on 3 June 2025).

- Yu, J.; Yang, P.; Zhang, K.; Wang, F.; Miao, L. Evaluating the effect of policies and the development of charging infrastructure on electric vehicle diffusion in China. Sustainability 2018, 10, 3394. [Google Scholar] [CrossRef]

- Comisión Económica para América Latina y el Caribe (CEPAL). Movilidad Eléctrica en América Latina y el Caribe: Estado de Avance y Políticas Públicas. 2022. Available online: https://www.cepal.org/es/publicaciones (accessed on 4 June 2025).

- Campos, L.; Pérez, M. Desafíos y Oportunidades en la Infraestructura de Carga para Vehículos Eléctricos en América Latina y el Caribe. Rev. Latinoam. Movil. Sosten. 2021, 12, 45–67. Available online: https://dialnet.unirioja.es/descarga/articulo/10004585.pdf (accessed on 4 June 2025).

- Organización Latinoamericana de Energía (OLADE). Movilidad Eléctrica en América Latina y el Caribe; Nota Técnica; OLADE: Quito, Ecuador, 2024; Available online: https://www.olade.org/wp-content/uploads/2024/09/Nota-Tecnica-Movilidad-electrica-en-America-Latina-y-el-Caribe-DEFINITIVA.pdf (accessed on 4 June 2025).

| Year/ Vehicles | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 * |

|---|---|---|---|---|---|---|---|---|---|---|

| HEVs | 7490 | 9349 | 16,022 | 23,964 | 22,139 | 42,447 | 40,859 | 54,368 | 92,026 | 34,150 |

| PHEVs | 521 | 968 | 1584 | 1339 | 1817 | 3492 | 4375 | 5778 | 7994 | 3364 |

| EVs | 254 | 237 | 201 | 305 | 449 | 1140 | 5631 | 14,172 | 24,283 | 6017 |

| Total | 8264 | 10,554 | 17,804 | 25,608 | 24,405 | 47,079 | 51,065 | 74,318 | 124,303 | 45,531 |

| App Name | Description | Advantages | Disadvantages |

|---|---|---|---|

| Tesla App [63] | A digital tool for Tesla vehicle owners, available on iOS and Android. It helps locate Tesla charging stations, manage payments, and track vehicle performance. |

|

|

| Charge maps [64] | An app for locating EV charging stations in multiple countries, providing real-time info on availability, type of connectors, and payment options. |

|

|

| PlugShare [65] | A popular EV charging locator app with station details, ratings, and payment features. Offers community-based input on station quality. |

|

|

| ElectroMaps [66] | A Spanish app with global reach, providing EV station locations, ratings, connector info, and real-time station statuses. |

|

|

| Google Maps [67] | Well-known navigation app that also includes EV charging station locations, availability, and connector types. |

|

|

| Evergo [68] | A Mexican app designed for locating and managing charging stations. Offers payment options and route planning. |

|

|

| Open Charge Maps [69] | A global open-source map for finding EV charging stations, providing station details, ratings, and photos. |

|

|

| Type of Charger | Tesla App | Charge Maps | PlugShare | ElectroMaps | Google Maps | Evergo | Open Charge Maps |

|---|---|---|---|---|---|---|---|

| Tesla Dest Charger | 1033 | 1418 | 227 | 990 | 1061 | ||

| Type 1 J1772 | 19 | 1641 | 165 | 443 | 44 | ||

| Tesla Supercharger | 124 | 172 | 96 | 21 | 107 | ||

| CCS1 | 2 | 139 | 3 | 41 | 14 | ||

| CC2 | 2 | 24 | |||||

| Type 2 | 69 | 24 | 28 | 2 | |||

| GB/T | 5 | 124 | 8 | 4 | |||

| Chademo | 2 | 43 | 16 | 36 | 5 | ||

| Nema 14–50 | 48 | 2 | 1 | ||||

| Nema 5–15 (US Plug) | 1 | ||||||

| Nema 5–20 (US Plug) | |||||||

| Nema TT-30 | 3 | ||||||

| Schuko | 14 | ||||||

| Type I (AU, NZ, CN Plug) | 1 | ||||||

| Type J (CH, LI, RW Plug) | 4 | ||||||

| Scame (Type 3a) | 1 | ||||||

| Tesla (Roaster) | 5 | ||||||

| Wall | 26 | ||||||

| Total | 1157 | 200 | 3513 | 619 | 1559 | 48 | 1239 |

| Challenge | Impact on Expansion |

|---|---|

| Urban–Rural Disparities | Limited coverage in rural areas; reduced mobility and lower EV adoption in underserved zones. |

| High Installation and Maintenance Costs | Decreased public and private investment; slower deployment of new charging stations. |

| Lack of Incentives and Coherent Policies | Reduced private sector interest; delays in long-term planning and infrastructure strategy. |

| Technological Diversity and Lack of Standardisation | User difficulties; low interoperability and reduced trust in the system. |

| Regulatory and Investment Barriers | Implementation delays; higher costs; reduced investment and slower network growth. |

| Lack of Data and Monitoring Systems | Insufficient performance evaluation and planning; difficulty identifying priority areas for infrastructure. |

| Public Awareness and Consumer Trust | Limited public knowledge and scepticism toward EV technology hinder mass adoption and infrastructure use. |

| Limited Grid Capacity and Integration | Electrical grid limitations restrict the deployment of fast chargers and large-scale station networks. |

| Opportunity | Strategy | Proposals/Recommendations |

|---|---|---|

| Government initiatives supporting EV adoption (e.g., PAESE and PEII) | Expand and strengthen public infrastructure for EV charging |

|

| Collaboration between CFE, SENER, and local authorities | Continue coordinated planning and investment in national EV infrastructure |

|

| Partnerships between automakers (Nissan, BMW) and utilities (CFE) to install chargers | Promote and incentivise multi-sector collaboration to finance and operate charging networks |

|

| Diverse charging technologies (Level 2, Level 3, Tesla Superchargers) | Support diversification of charging options to meet different user needs |

|

| Establishment of General Administrative Provisions (DACG) to regulate EV charging | Ensure comprehensive and clear regulatory environment |

|

| Aspect | Mexico | Chile | Brazil |

|---|---|---|---|

| Incentives |

|

|

|

| Regulatory Framework |

|

|

|

| Coverage/Deployment |

|

|

|

| Social Inclusion |

|

|

|

| Local Manufacturing |

|

|

|

| 2030 Targets |

|

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Published by MDPI on behalf of the World Electric Vehicle Association. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salgado-Conrado, L.; Álvarez-Macías, C.; Esmeralda-Gómez, A.; Tadeo-Rosas, R. Assessing the Current State of Electric Vehicle Infrastructure in Mexico. World Electr. Veh. J. 2025, 16, 333. https://doi.org/10.3390/wevj16060333

Salgado-Conrado L, Álvarez-Macías C, Esmeralda-Gómez A, Tadeo-Rosas R. Assessing the Current State of Electric Vehicle Infrastructure in Mexico. World Electric Vehicle Journal. 2025; 16(6):333. https://doi.org/10.3390/wevj16060333

Chicago/Turabian StyleSalgado-Conrado, Lizbeth, Carlos Álvarez-Macías, Alma Esmeralda-Gómez, and Raúl Tadeo-Rosas. 2025. "Assessing the Current State of Electric Vehicle Infrastructure in Mexico" World Electric Vehicle Journal 16, no. 6: 333. https://doi.org/10.3390/wevj16060333

APA StyleSalgado-Conrado, L., Álvarez-Macías, C., Esmeralda-Gómez, A., & Tadeo-Rosas, R. (2025). Assessing the Current State of Electric Vehicle Infrastructure in Mexico. World Electric Vehicle Journal, 16(6), 333. https://doi.org/10.3390/wevj16060333