1. Introduction

The liberalization of electricity markets has been a dominant policy objective across the European Union for over two decades, driven by the belief that competitive mechanisms can deliver efficiency gains, lower prices, and innovation benefits compared to vertically integrated monopolies [

1]. The EU’s Target Model, established through successive directives and regulations, provides a harmonized framework for implementing Competitive Electricity Markets across member states and connected regions. However, the application of this market design framework to small, geographically isolated electricity systems presents distinct challenges not encountered in large, interconnected markets.

Cyprus’s launch of its Competitive Electricity Market on 1 October 2025 represents a significant milestone in the nation’s energy policy trajectory and also presents an important empirical case study of market liberalization challenges in small, isolated systems [

2]. The island’s 2025 market launch occurred after extended delays, reflecting the complexities of market design implementation and the coordination challenges required across regulatory, transmission, and market operator functions.

The timing of Cyprus’s market launch coincided with accelerating renewable energy penetration (approaching 30% of installed capacity) and increasing grid flexibility challenges. Simultaneously, critical infrastructure deficits, particularly the continued absence of natural gas infrastructure and utility-scale energy storage, create structural constraints on market efficiency. These conditions provide an important empirical foundation for understanding how market design features interact with physical infrastructure constraints and renewable integration challenges in small systems.

This work presents a comprehensive analysis of Cyprus’s newly launched Competitive Electricity Market, focusing on its inaugural month of operation in October 2025. The analysis encompasses an in-depth examination of market structure and participant composition, mechanisms of price formation and distinctive volatility patterns, the evolving generation mix with regard to renewable energy integration, critical infrastructure weaknesses, and fundamental challenges in market design. The investigation further projects wholesale price trajectories under different infrastructure and regulatory development scenarios. The methodology draws on comprehensive operational market data, established regulatory frameworks, and comparative benchmarks from similar international markets.

The contributions of this work are multifold, sharpening the understanding of electricity market liberalization in small, isolated systems. First, it offers robust empirical documentation of how the chosen market design functions amidst severe infrastructural constraints, demonstrating technically successful trading and settlement while identifying market inefficiencies based on early operational data. Second, it clarifies possible channels through which structural obstacles, such as high market concentration, shallow liquidity, and inflexible must-run generation mandates, undermine the realization of competitive benefits. Third, scenario analysis quantifies how the rollout of natural gas infrastructure and utility-scale storage could mitigate wholesale prices and reduce volatility. Fourth, policy recommendations are developed that directly address the unique requirements of an islanded market, moving beyond standard EU Target Model prescriptions to propose tailored, context-appropriate reforms.

The structure of the paper is organized as follows.

Section 2 details the design of the Cyprus Competitive Electricity Market, explains participant composition, and describes the data sources and methodological approach.

Section 3 analyzes wholesale price formation and intraday volatility patterns.

Section 4 discusses the generation mix, renewable integration barriers, and investment signals.

Section 5 highlights principal operational, infrastructure, and market design challenges.

Section 6 presents scenario-based projections of future wholesale prices based on alternative infrastructure and market development assumptions.

Section 7 provides actionable policy recommendations and implementation priorities for market maturation. The conclusions are summarized in

Section 8.

2. Cyprus Electricity Market Framework

The drive for electricity market liberalization is fundamentally rooted in the premise that competitive markets foster allocative and productive efficiency, as well as dynamic innovation, as opposed to the outcomes typical of regulated monopolies. As highlighted by Joskow [

3], both theoretical and practical considerations reveal that tangible consumer benefits are tightly linked to details of market design, regulatory quality, and the adequacy of supporting infrastructure. Empirical research has yielded mixed outcomes: while studies such as Steiner [

4] report a general association between restructuring and lower prices, or higher capacity utilization, others (e.g., Hattori [

5]) show these results are highly sensitive to model assumptions and contextual factors, so that realized market outcomes depend critically on the specifics of reform implementation.

The evidence further emphasizes that the gains from liberalization are most robust in markets with deep reforms, ample generation capacity, interconnected networks, and responsive demand-side participation. For example, a cross-country analysis by Erdogdu [

6] finds stronger price reductions under more advanced liberalization regimes, but also documents substantial differences between countries. Complementary infrastructure—adequate generation, interconnectors, and active demand response—is identified as essential for market functionality [

7]. Related work on high-efficiency economic dispatch in hybrid AC/DC networked microgrids using convex optimization [

8] illustrates how advanced optimization techniques can support computationally efficient market clearing in systems with complex converter dynamics.

A clear distinction is drawn between regulatory and technological requirements: while markets with surplus generation, technology diversity, and well-developed trading platforms can yield competitive results despite moderate concentration, structurally constrained systems face challenges even when many participants are present [

9].

The Cyprus Competitive Electricity Market is designed around a sequential structure encompassing four integrated market segments: the Forward Market (FM), Day-Ahead Market (DAM), Integrated Scheduling Process (ISP), and Real-Time Balancing Market (RTBM) [

2]. Consistent with EU Target Model principles [

10], this framework facilitates transparent price formation and efficient market operation through half-hourly bidding, market clearing, and system settlement mechanisms. The Cyprus Stock Exchange (CSE) operates as the designated Clearing Authority, with Eurobank Greece serving as General Clearing Member for financial settlements. Market management, including price determination and system dispatch schedules, is the responsibility of the Transmission System Operator of Cyprus (TSOC), while the Cyprus Energy Regulatory Authority (CERA) provides regulatory oversight and ensures market compliance with the EU internal energy market requirements.

The market commenced operations on 1 October 2025, with an initial cohort of seventeen registered participants, including the incumbent state utility Electricity Authority of Cyprus (EAC), independent power producers, renewable aggregators, retail suppliers, and specialized service providers. Must-run obligations applied to conventional thermal units, obliging their continuous operation for grid stability and reliability, and shaping both system costs and energy mix. Transactions in the Forward Market can be concluded bilaterally or via exchange, with pricing subject to regulatory safeguards to mitigate market power risks.

The analysis draws upon three principal data sources: operational data from TSOC, which includes half-hourly market-clearing prices, segment-specific energy volumes, participant bidding behaviors, and energy mix breakdowns; CERA regulatory documents and frameworks that determine market rules, participant licensing, and settlement protocols; and Cyprus historical electricity system records defining demand patterns, renewable capacity, and characteristics of the conventional generation fleet. The sample period, October 2025, covers 1488 half-hourly intervals and serves as the baseline for price pattern analysis, with market-clearing and energy mix data distinguishing between conventional categories and renewables (primarily solar, with minor wind and biomass). The methodological approach integrates several analytical techniques. Descriptive statistical analysis provides characterization of market prices, diurnal variation, and volatility, employing indicators such as mean, median, standard deviation, and range at differing time scales and market subsegments. Time-series techniques elucidate autocorrelation structures and facilitate anomaly detection, enabling identification of outliers and the persistence of price spikes or drops.

It is important to recognize several limitations. The reliance on one month of operational data constrains insight into long-term seasonal effects, unusual weather-driven demand or supply impacts, and structural market evolution. The restricted availability of detailed participant-level cost and bidding information limits the ability to precisely quantify market power and to rigorously evaluate the market against perfect competition. Long-term scenario projections rest on infrastructure and policy implementation schedules that remain susceptible to delays and technical uncertainties.

3. Wholesale Price Formation and Volatility Patterns

The evolution of Cyprus’s electricity market in October 2025 was marked by pronounced price volatility, a feature typical of small, isolated systems with significant renewable penetration but persistent structural constraints. The average Day-Ahead Market (DAM) clearing price reached 162.72 EUR/MWh, with observed prices spanning the broad range from zero to 500 EUR/MWh throughout the month. The monthly wholesale price index, aggregating Forward Market, must-run unit, and DAM transactions, converged to 167.78 EUR/MWh as detailed in

Table 1.

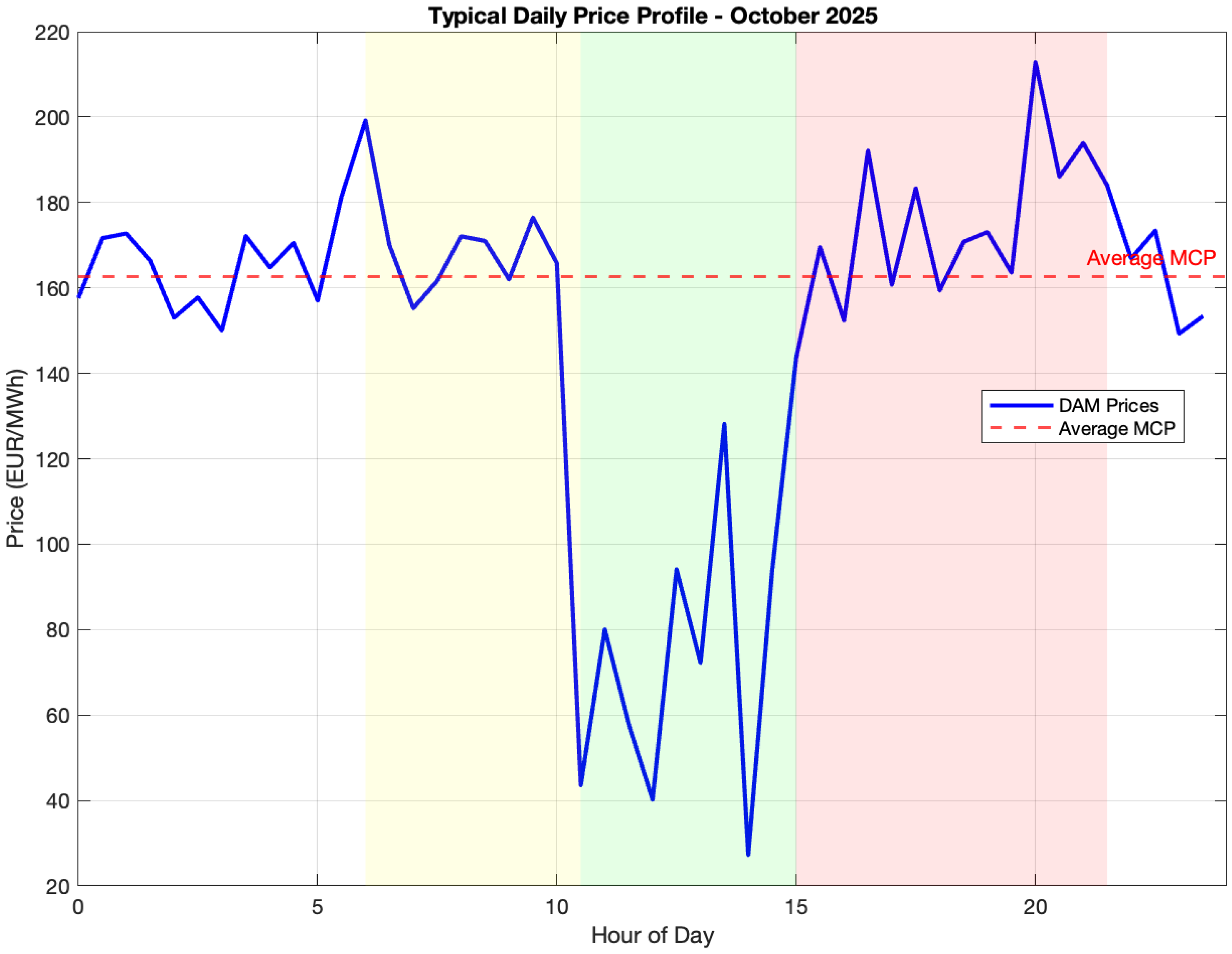

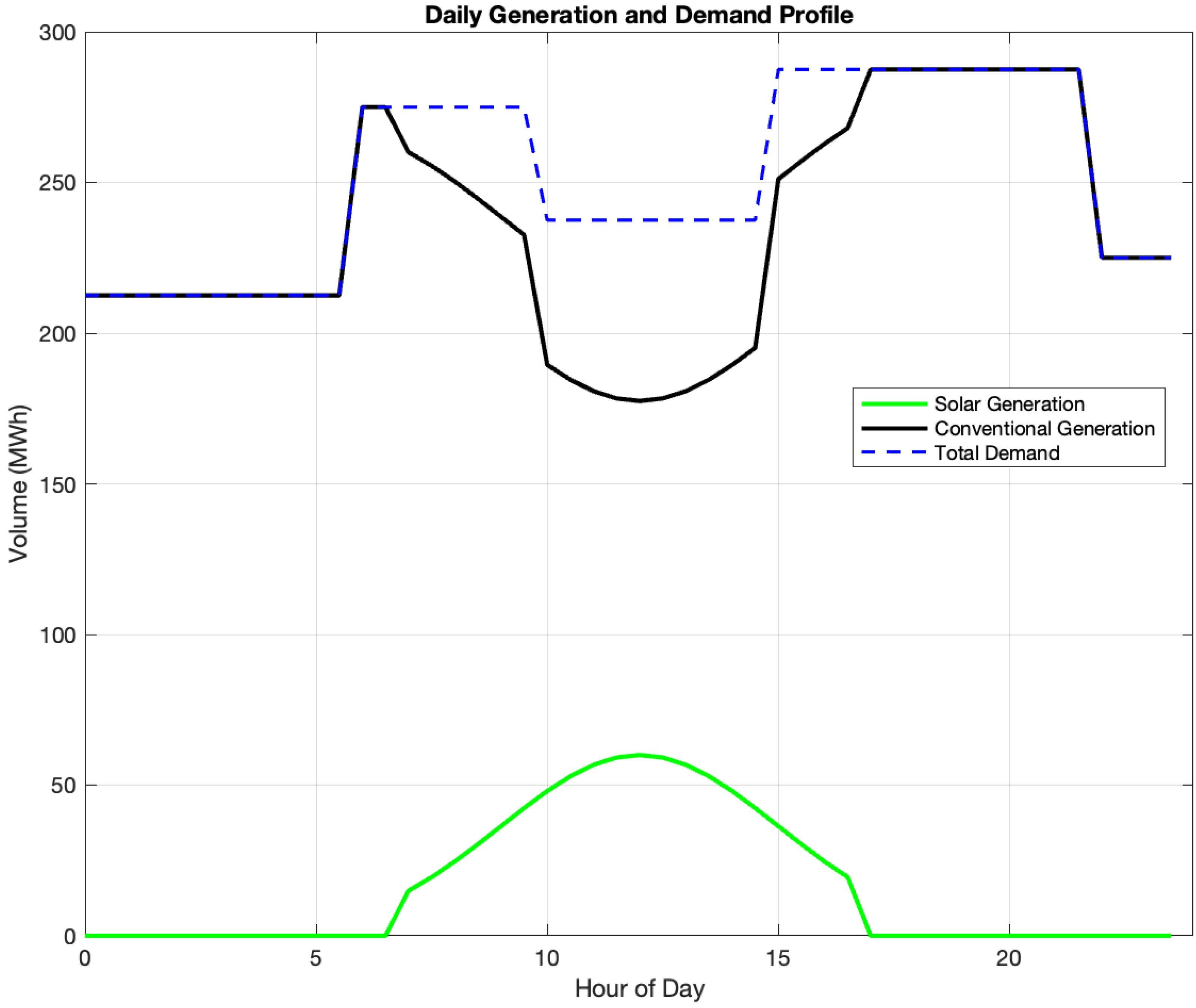

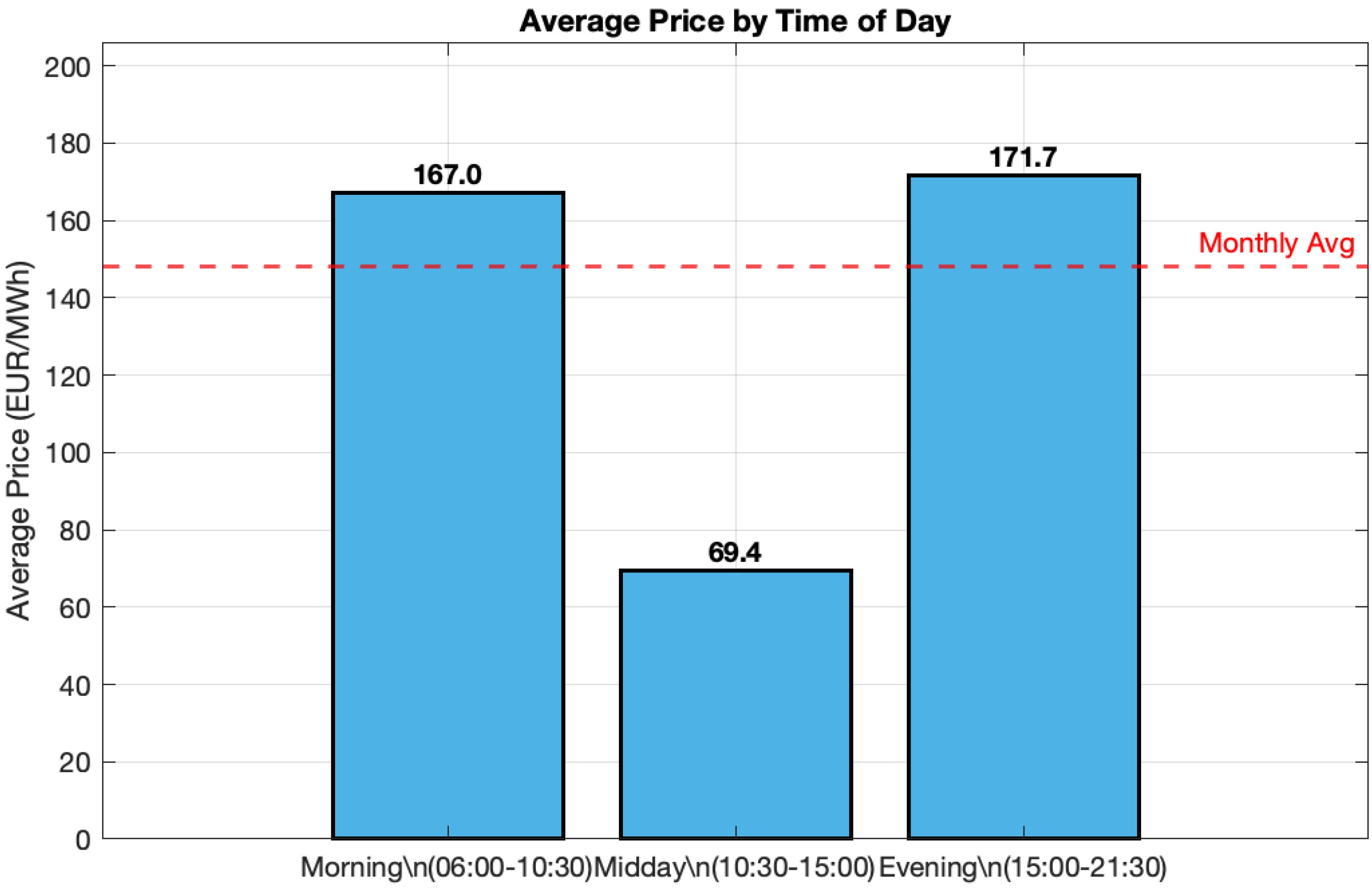

The market demonstrated a pronounced diurnal pattern driven by the daily cycle of solar generation. Three distinct time periods characterized average price behavior: morning peaks between 06:00 and 10:30 averaged 167.0 EUR/MWh, corresponding with the early hours when demand rises and solar output has yet to reach full contribution. Midday valleys, spanning 10:30 to 15:00 and dominated by solar generation, averaged only 69.4 EUR/MWh. Evening peak prices (15:00–21:30), reflecting a shift back to conventional oil-fired generation, averaged 171.7 EUR/MWh. These patterns are illustrated in

Figure 1 and

Figure 2. The two-speed market behavior, with low prices during solar abundance and high prices reverting to thermal dependence, introduces both revenue uncertainty for conventional generators and complexity for supplier risk management and hedging strategies.

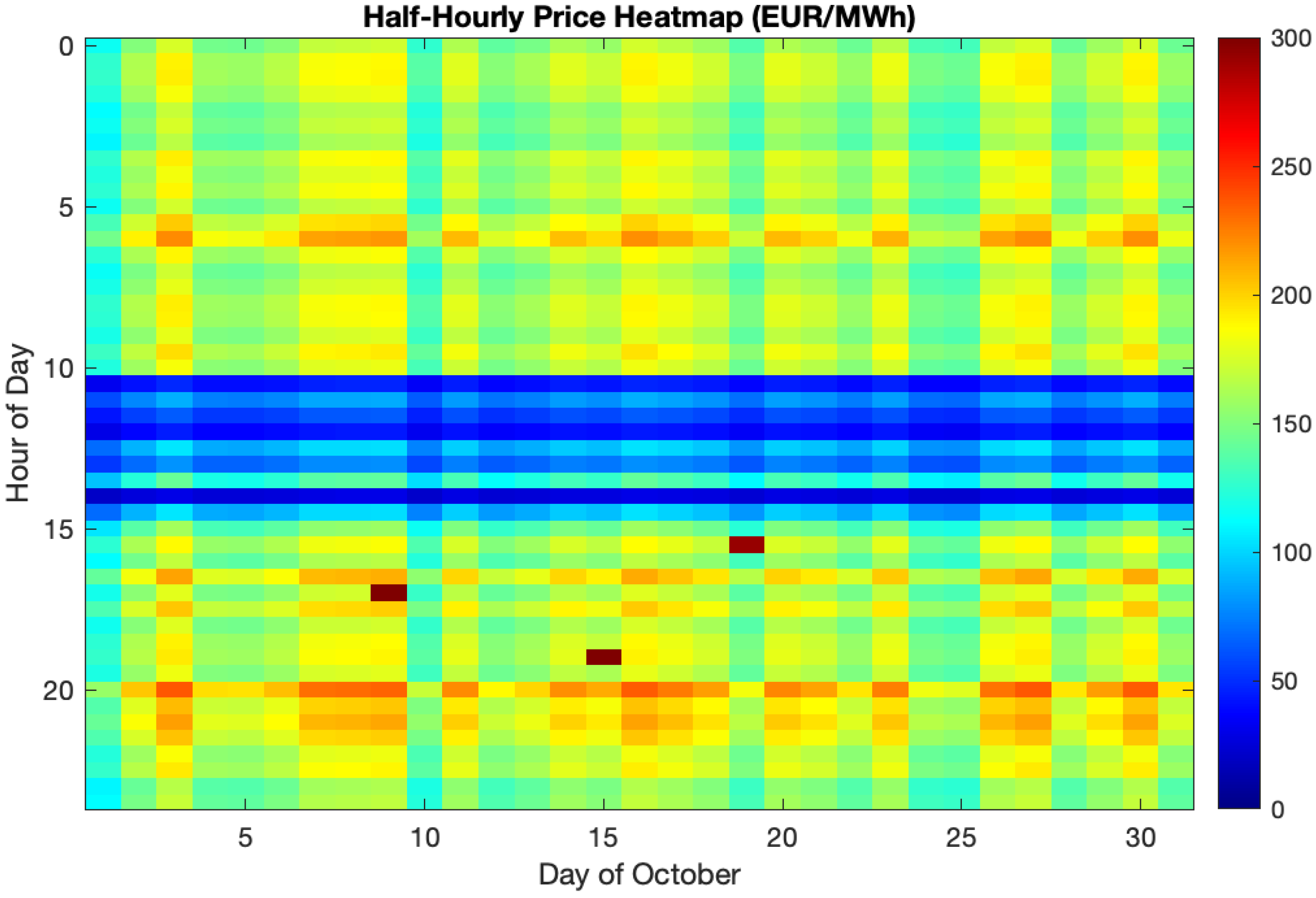

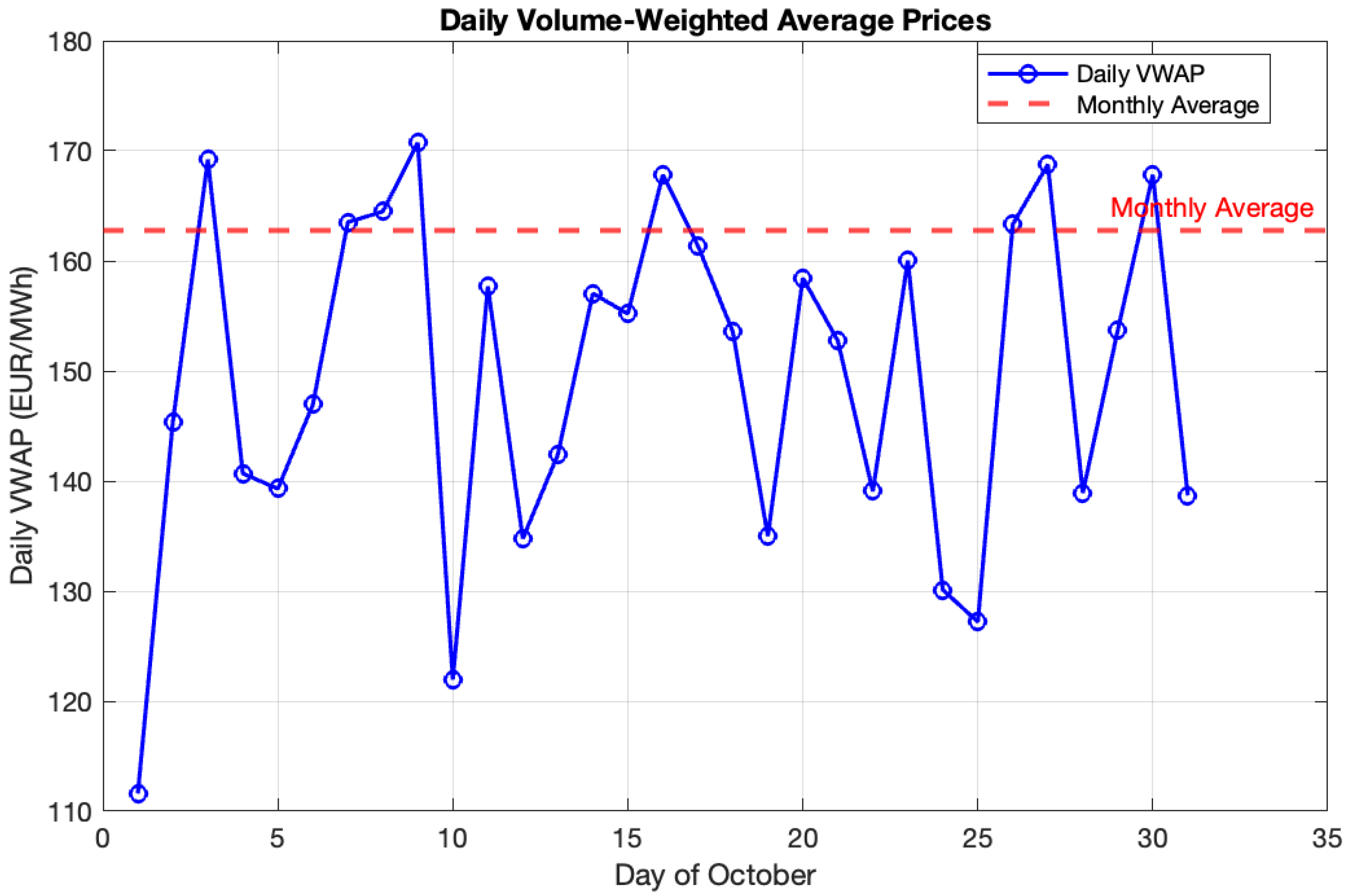

The heatmap in

Figure 3 clearly reveals the recurring midday valley period, during which prices drop sharply and even reach zero in certain intervals between 11:00 and 15:00. On a day-to-day basis, volume-weighted average prices also displayed pronounced volatility, with values fluctuating from approximately 112 EUR/MWh to 170 EUR/MWh across the month (

Figure 4).

The daily volume-weighted average prices (

) are calculated to weight the price by the cleared volume, reflecting the true cost to suppliers:

where

d is the day index (

for October),

t is the settlement period index (

for 30 min intervals),

is the Market Clearing Price at period

t on day

d (EUR/MWh), and

is the cleared energy volume at period

t on day

d (MWh). The volatility for the month is quantified using the standard deviation (

) of the hourly prices:

where

N is the total number of periods (1488 for October) and

is the mean monthly price.

Analysis of the market price distribution, as shown in

Figure 5, demonstrates a pronounced positive skew. While most trading periods clear at moderate prices, there is a substantial share of intervals with very low prices and an evident tail of extreme spike events [

11]. The average midday price collapse, resulting from solar merit-order effects and system design (notably must-run conventional units), is juxtaposed with short-lived but extreme high-price periods when renewable output declines and system flexibility is limited.

Disaggregated by time of day,

Figure 6 illustrates persistent volatility: prices are highest during the morning and evening peaks (167.0 and 171.7 EUR/MWh, respectively) and are lowest during the solar-abundant midday valley (69.4 EUR/MWh). Night prices stabilize near 163 EUR/MWh, as steady thermal generation prevails. The standard deviation of hourly prices in October 2025 was 67.4 EUR/MWh, equating to 40% of the mean price and exceeding volatility coefficients typical of larger EU markets [

12].

These observed patterns are attributable to the interplay of renewable output, must-run obligations, a lack of energy storage, and limited grid flexibility. The approximately 102.3 EUR/MWh spread between midday valley and evening peak creates significant theoretical arbitrage opportunities for storage, yet, in its absence, these opportunities remain unrealized. Price distribution characteristics are further shaped by the requirement for continuous thermal generation, which sets a floor above zero, and by the inability to export or absorb renewables fully when supply is abundant [

13].

The cost implications of this price formation are highlighted by the observed supplier cost structure. Suppliers source electricity from a mix of Forward Market purchases (representing 34% of energy and clearing at 190 EUR/MWh), Day-Ahead Market purchases (52%, averaging 162.72 EUR/MWh), and renewable energy via National Grant Payment arrangements provided through feed-in tariff (FiT) schemes (14%, typically at negligible supplier cost). The volume-weighted effective supplier cost thus reached approximately 171 EUR/MWh, representing a 7% premium over the monthly wholesale price index and a 1.9% premium over the DAM average. These cost differentials, primarily attributable to must-run procurement obligations, inhibit the ability of suppliers to offer competitive tariffs or pass on cost savings to consumers. As a consequence, the must-run structure effectively establishes a cost floor incompatible with the realization of meaningful benefits from market competition in the short term.

4. Energy Mix, Integration Barriers, and Investment Signals

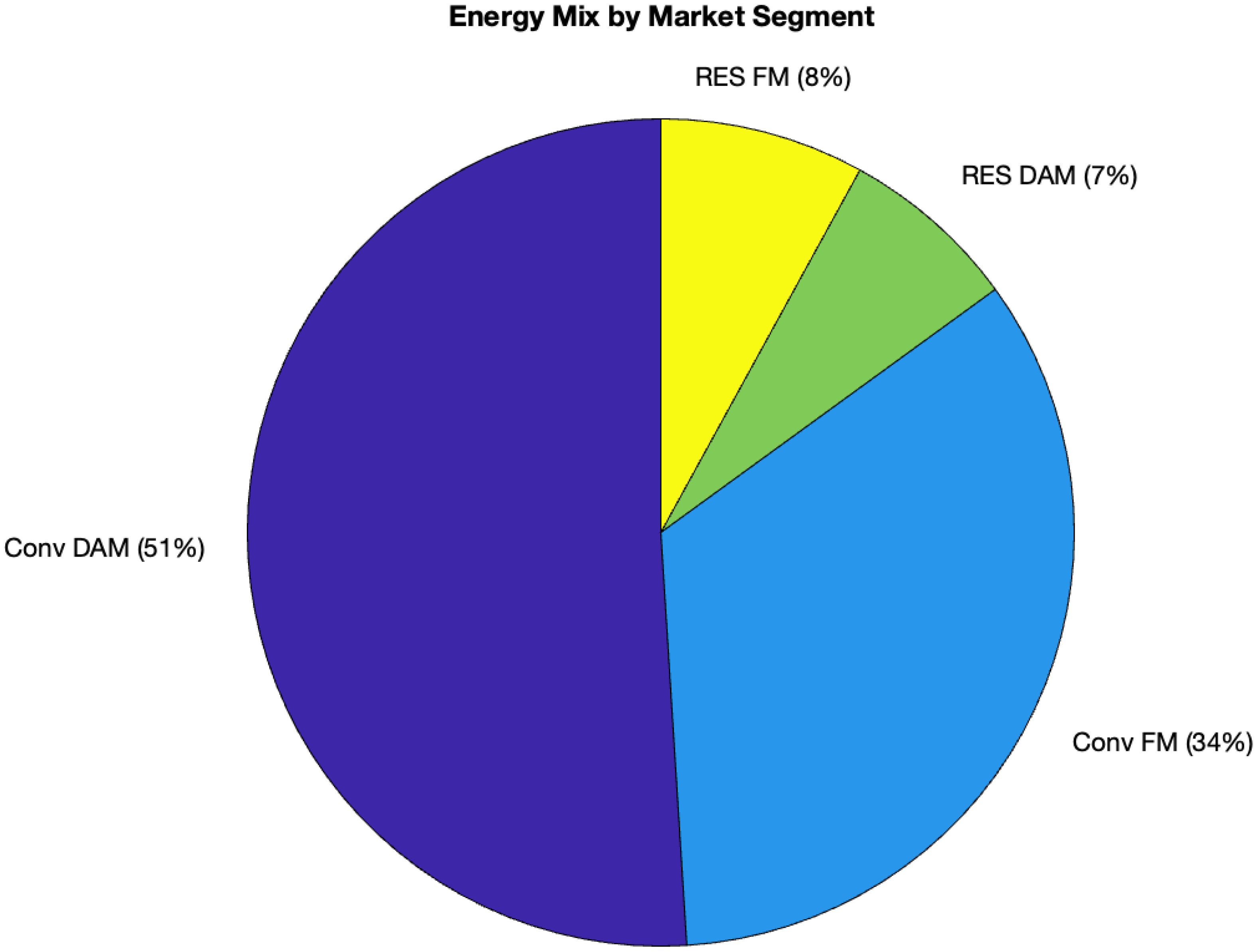

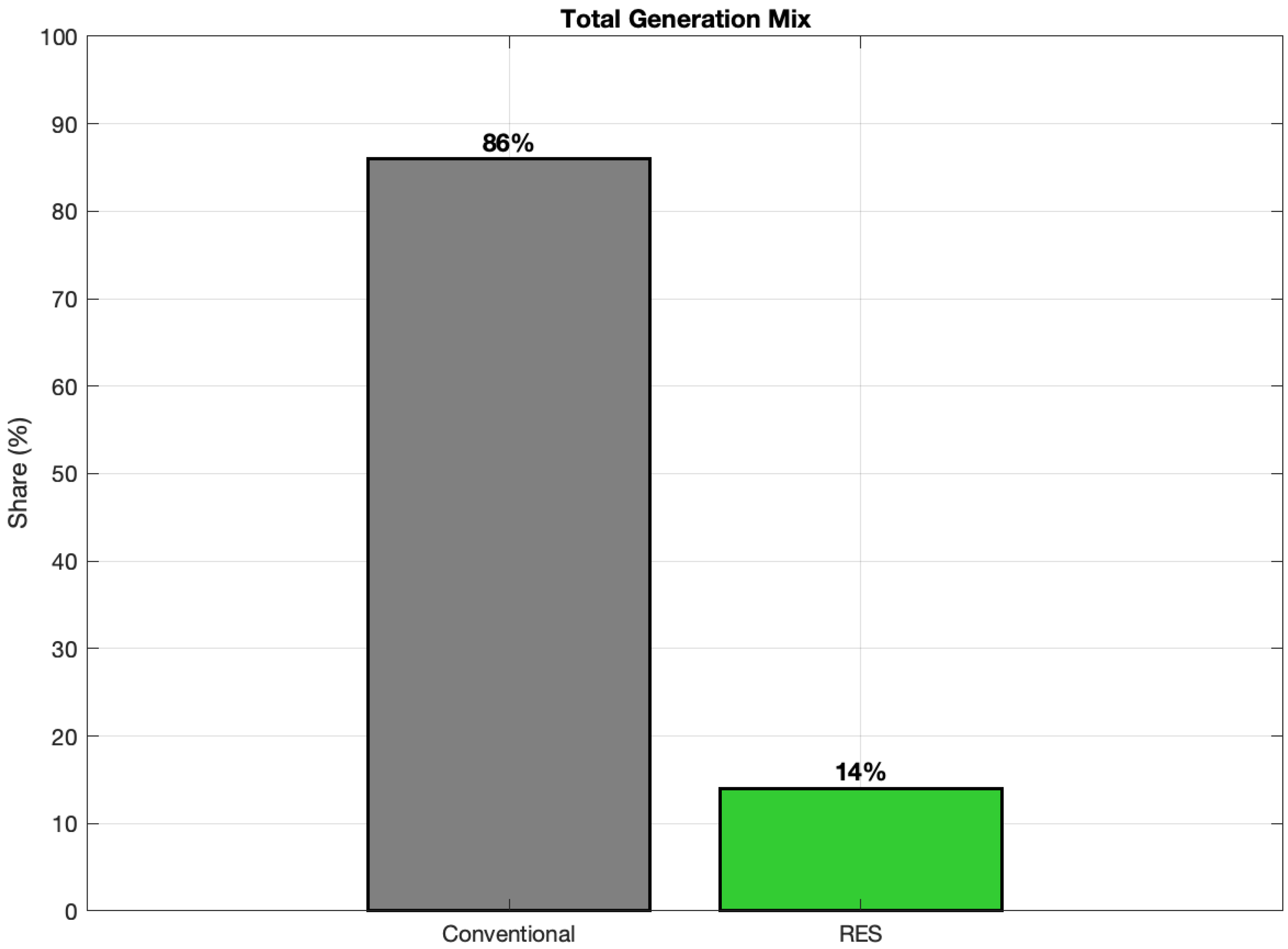

The October 2025 energy mix in Cyprus presents a picture of persistent heavy dependence on conventional generation, despite the presence of substantial installed renewable capacity. As shown in

Table 2, conventional sources accounted for 86% of total delivered energy: 51% through the DAM and an additional 34% via the Forward Market arrangements, which largely comprise must-run units under regulatory mandate. Renewable sources contributed only 14%, with 7% supplied via competitive DAM transactions and 8% through the Forward Market, supported by the National Grant Payments scheme provided through feed-in tariff (FiT) schemes.

Figure 7 and

Figure 8 illustrate the pronounced dominance of conventional generation across both market segments and highlight the overall generation mix. This low level of renewable penetration stands in sharp contrast to Cyprus’s installed renewable capacity, solar alone exceeds 900 MW, roughly equivalent to annual peak demand, accompanied by approximately 150 MW of wind capacity. The observed gap between installed capacity and actual supply contribution underscores underlying absorption barriers.

Several factors collectively constrain renewable integration. Must-run obligations require conventional thermal units to operate at or above minimum technical output, even during periods when renewable generation could otherwise meet demand, thus curtailing renewables during solar peaks. The absence of utility-scale energy storage further limits the ability to absorb and shift midday solar production to evening peaks, reducing the system’s capacity to exploit temporal arbitrage opportunities. In addition, Cyprus’s electrical isolation precludes export of surplus renewable generation during periods of abundance and import during scarcity, depriving the market of geographic and temporal diversity benefits that interconnected systems enjoy.

A further challenge arises from the market’s lack of compensation mechanisms for involuntary renewable curtailment. When system constraints necessitate curtailment, renewable generators may lose production revenue, often without market-clearing compensation. This risk stands in contrast to the guaranteed procurement and payment provided to conventional units for ancillary services, resulting in investment risk asymmetry that discourages further renewable development.

These barriers collectively restrict effective renewable integration to 14–20% of annual supply, absent transformative infrastructure upgrades, namely grid-scale storage and interconnection [

14], or regulatory changes such as curtailment compensation and market design evolution [

15]. Achieving Cyprus’s national targets of 28–30% renewable supply will require synchronized advancement of physical and regulatory frameworks.

Investment signals for renewable generators remain problematic under the current system. Revenue streams are bifurcated: competitive DAM sales occur at highly volatile midday prices (averaging 69.4 EUR/MWh but frequently dropping to zero), while NGP scheme payments are subject to regulatory review and uncertainty. As a result, standalone renewable projects face heightened financial risk due to inadequate and uncertain DAM revenue, whereas projects dependent on National Grant Payments support provided through feed-in tariff (FiT) schemes remain vulnerable to policy changes. The insufficient participation rate in October 2025, 14% of total supply, reflects these constraints.

Barriers to entry further restrict the deepening of market competition [

16]. Prospective entrants face a combination of technical (requirements for advanced market and communication systems, forecasting tools), financial (credit guarantees, working capital commitments), and regulatory barriers (licensing, compliance procedures, participant training). These factors disproportionately disfavor small independents and regional operators. International experience from comparable EU markets suggests that a period of 18 to 30 months is typically required before competition broadens and diversification of participant composition becomes material, a trajectory likely to be mirrored in Cyprus.

5. Critical Challenges and Structural Constraints

The initial stages of Cyprus’s Competitive Electricity Market have revealed a series of persistent and interconnected barriers that significantly constrain both the realization of competitive market outcomes and progress toward national energy objectives. This section critically examines the principal structural challenges, spanning infrastructure deficits, market concentration, regulatory limitations, and operational bottlenecks, which shape the market’s economic viability, renewable integration, and long-term development trajectory. Each of the following subsections analyzes a distinct area of concern, highlighting their impacts and identifying priority areas for strategic intervention and policy support.

5.1. Delays in Natural Gas Infrastructure and Generation Cost

Natural gas infrastructure is integral to market cost structure and flexibility. The International Energy Agency [

17] highlights that combined-cycle gas plants deliver substantial fuel savings, typically 20–30% over oil-fired generation, making infrastructure access a principal determinant of baseline costs. Detailed modeling by [

18] indicates that natural gas infrastructure investment can produce 10–20% wholesale price reductions in oil–dependent systems. Ref. [

19] emphasizes the dual effects of such investment: reducing oil dependence and enhancing flexibility, but also exposing small markets to new fuel price risks.

Cyprus faces a significant infrastructure delay in natural gas infrastructure development, which fundamentally compromises the economic viability of its Competitive Electricity Market and impedes progress toward national decarbonization objectives. The persistent inability of the government to implement decisive action on natural gas infrastructure has created a critical constraint, inhibiting both generation cost reduction and energy security.

The core bottleneck is the repeatedly delayed Floating Storage and Regasification Unit (FSRU) project, which remains unresolved after years of postponement. As a result, Cyprus continues to rely exclusively on heavy fuel oil and diesel for thermal generation, sustaining fuel costs that are approximately 20–30% higher than those achievable with natural gas-fired combined-cycle plants. This disadvantage is not a temporary market anomaly but a direct consequence of delayed governmental decisions on key infrastructure, despite clear strategic and economic imperatives.

Benchmarking against international norms highlights the economic impact: the current wholesale electricity price of 167.78 EUR/MWh, as reported in

Table 1, is substantially determined by the high cost of oil-based generation. In contrast, marginal costs associated with natural gas combined-cycle technology could reduce thermal unit costs to 110 EUR–130 EUR/MWh, potentially lowering wholesale market prices to a 130 EUR–150 EUR/MWh range. This price gap of 37 EUR–50 EUR/MWh translates into an annual retail electricity cost burden of EUR 47–EUR 64 million for an estimated 500,000 customers.

The inability to introduce natural gas is indicative of deeper deficiencies encompassing insufficient project management, implementation challenges, and failures in international coordination. Comparative cases from other Mediterranean island nations and similar economies demonstrate that effective gas infrastructure development is feasible, underscoring the gap between Cyprus’s announced policy objectives and actual execution. The delayed FSRU project and stalled conversion of conventional units to natural gas have left the market structurally dependent on costly and volatile oil imports.

This strategic failure extends beyond the electricity sector: it undermines industrial competitiveness, perpetuates vulnerability to global oil market fluctuations, and calls into question Cyprus’s commitment to EU decarbonization objectives. Most critically, the absence of natural gas infrastructure forestalls the realization of a 20–30% reduction in wholesale electricity costs, the single most impactful market reform available. Until the FSRU becomes operational and generation units transition to natural gas combustion, the Cyprus Competitive Electricity Market will remain fundamentally constrained by an oil-based cost structure, incompatible with competitive regional prices and long-term decarbonization ambitions.

5.2. Energy Storage Market Framework

Although regulatory decisions have established a comprehensive framework for both utility-scale and distributed energy storage participation within the Cyprus electricity market [

20], progress toward implementation is currently hampered by significant delays in the modification and upgrade of the TSOC’s Market Management System (MMS). These upgrades are essential to enable the full integration of storage as a distinct market resource [

21,

22].

The regulatory storage framework, as published by CERA [

20], encompasses system licensing, technical requirements, market rules, and revenue mechanisms. Despite this technically complete foundation, developers and investors remain unable to proceed confidently with deployment, as the TSOC’s MMS is not yet capable of processing and settling transactions related to storage. As such, critical functions, including operational activation, interconnection procedures, and market-based compensation, are blocked by the absence of necessary software and operational enhancements.

This disconnect creates a paradox: while the regulatory regime supports the integration of energy storage, the market’s operational infrastructure cannot currently accommodate it. These TSOC-driven delays now constitute a substantial barrier to storage deployment, investment planning, and the achievement of market flexibility and decarbonization objectives.

The consequences of these operational setbacks are evident in the shifting timelines for expected storage deployment. Projections for 100–150 MW of new storage capacity have slipped from 2026 to 2027, with further delays possible should TSOC MMS modifications remain incomplete. Expedited and accountable action from TSOC is thus essential to unlock the transformative benefits of energy storage, including enhanced system flexibility, reliability, and renewable integration. Only with the swift completion of these infrastructure upgrades will the regulatory framework become truly effective, enabling the full realization of storage potential in the Cyprus electricity market.

5.3. Market Concentration and Limited Participant Diversity

The Cyprus electricity market remains highly concentrated with limited participant depth. Only 17 participants entered the market at launch, with the incumbent utility EAC retaining dominant positions in generation, supply, and market knowledge. This concentration constrains genuine price competition and limits suppliers’ ability to differentiate retail offerings [

23].

Shallow market liquidity prevents efficient price discovery and hedging opportunities. The limited participant pool reduces bidding strategy diversity and business model innovation. Entry of additional participants, particularly a second major conventional generator and multiple retail suppliers, represents a critical milestone for reducing market concentration. However, entry barriers remain substantial, particularly for smaller market participants.

Market concentration metrics substantiate these observations. In October 2025, the Herfindahl–Hirschman Index (HHI) for generation reached 6590, representing pronounced concentration well above thresholds (2500) related to competitive markets and approaching monopolistic conditions. Retail supply HHI similarly exceeded 2500, with EAC accounting for roughly 90% of retail customers [

24].

International experience from comparable EU member states indicates that meaningful competitive depth requires 18–30 months development post-launch. Cyprus should expect similar maturation timelines before competitive dynamics produce measurable consumer benefits in retail pricing.

5.4. Smart Metering Infrastructure and Demand Response

The role of smart metering and demand response in liberalized electricity markets is increasingly recognized [

25]. Ref. [

26] emphasizes demand flexibility as a substitute for investment in both generation and network expansion in high-renewable contexts, while [

27] document the typical challenges encountered during smart meter rollout, chief among these are protracted procurement processes, technical integration issues, and consumer resistance. Their findings reinforce that a multi-year time frame is often required to realize the full benefits of smart metering for market functionality [

28].

Although CERA has established regulatory framework and mandates for advanced metering infrastructure rollout [

29], implementation responsibility rests solely with the Distribution System Operator (DSO). Substantial and repeated delays by the DSO in executing the smart meter installation program have impeded the realization of critical infrastructure enabling demand response, time-of-use tariffs, and consumer market participation.

The slow pace of DSO smart meter deployment represents a recognized bottleneck for Cyprus’s electricity market modernization. Accelerated DSO action and increased accountability are urgently required to achieve targets in the national rollout plan, which have been repeatedly missed despite regulatory readiness. Without smart metering infrastructure, consumer participation in demand response programs remains restricted to industrial and large commercial users, limiting system flexibility benefits [

30].

5.5. Electricity Grid Modernization and Redesign

CERA has mandated both the TSOC and the DSO to jointly complete the necessary studies and propose effective measures for electricity grid modernization, redesign, and management reforms to support high renewable energy integration [

31]. This includes comprehensive assessments on investment standards for distribution and transmission networks, voltage profile management, congestion management procedures, storage, and mechanisms for demand response integration.

Despite regulatory expectations, there have been persistent delays in the completion of these studies and the formulation of actionable proposals by both the TSOC and DSO. The lack of coordinated and timely implementation planning hampers regulatory progress and means that grid modernization, infrastructure upgrades, and systematic improvements are not advancing at the required pace. This has left the grid architecture and planning in a state of limbo, preventing the deployment of necessary upgrades for increased renewable penetration, decentralized generation, and energy storage integration.

Accelerated and coordinated action by both system operators, with increased accountability and periodic reporting, is essential to unlock the necessary regulatory progress and investment required for a resilient, flexible, and future-ready Cypriot electricity grid.

5.6. Electrical Isolation and Electricity Interconnections

A distinctive body of the literature addresses the implementation of competitive frameworks in small, isolated electricity systems. Ref. [

32] identifies salient constraints, including restricted market entry due to high sunk costs, inadequate technology diversity, and persistent challenges in achieving generation adequacy. Ref. [

33] explores specific cases, including Cyprus and other islanded systems, documenting the prevalence of pronounced price volatility, persistent market power, and inefficiencies linked to scale. These studies report a characteristic “two-tier” price outcome: during favorable renewable output, prices are often at or near zero, while in less favorable periods, conventional generation commands elevated premiums.

Broader European Commission analysis [

34] corroborates that small systems typically encounter structural market power, difficulty attracting entrants despite formal regulatory openness, and limited liquidity for hedging. The degree of interconnection is found to be a defining factor in determining market dynamics and access to competitive benefits. Cyprus remains electrically isolated without interconnections to neighboring systems. The Great Sea Interconnector linking Cyprus with Greece represents the primary planned connection, but faces massive delays primarily due to geopolitical actors’ concerns, such, as uncertainties related to regional maritime boundary disputes and cross-border energy infrastructure governance. Electrical isolation eliminates cross-border competition benefits and emergency supply options available to interconnected markets.

An operational interconnector would enable importing electricity during scarcity periods and exporting during renewable surplus, expanding effective generation diversity and reducing reliance on internal conventional generation. The interconnector would also enable participating in the pan-European electricity market, accessing deeper liquidity and more diverse generation resources [

14]. Expected GSI interconnector commissioning has shifted to 2030–2031 at the earliest, with substantial uncertainty remaining. The extended delay perpetuates Cyprus’s isolation and limits market development potential. Accelerated interconnector development represents a critical long-term infrastructure priority, though insufficient for addressing near-term market challenges.

5.7. Systemic Impacts of the Must-Run Obligation

The provision of ancillary services, such as inertia and frequency regulation, presents a particular challenge in small markets with high renewable input. Ref. [

35] analyzes how must-run obligations for conventional generation can support system stability but introduce economic inefficiencies relative to market-based mechanisms. Ref. [

36] contrasts mandatory and competitive procurement of ancillary services, finding the latter can reduce costs, especially where technology diversity grows, but also noting the prerequisites of infrastructure investment and institutional maturity. The IEEE Power and Energy Society [

37] underscores that while must-run obligations provide a transitional solution, long-term resilience will require grid-forming inverters, synthetic inertia, and expanded demand-side participation.

The must-run obligation constitutes a structural distortion within the Cyprus electricity market. Owing to the absence of interconnections, utility-scale storage, and advanced technologies that provide system inertia and frequency regulation, conventional thermal units are required to remain continuously online to maintain grid stability. These units supply essential ancillary services, including inertia, frequency control, and reserve capacity, yet their costs are allocated across all suppliers rather than compensated via market-based ancillary service mechanisms.

As a result, suppliers must source approximately 34–38% of their total energy portfolio from must-run units, incurring an average cost of 190 EUR/MWh for this portion. This obligation drives the effective wholesale supplier cost to roughly 171 EUR/MWh, as summarized in

Table 1, amounting to a 7% premium relative to the average wholesale price of 167.78 EUR/MWh. The imposed cost premium significantly restricts suppliers’ ability to offer differentiated or competitive retail tariffs, as the must-run cost component is unavoidable regardless of DAM bidding strategies.

Comparative international experience indicates that market-based, service-activation models, whereby conventional units receive compensation only when specific ancillary services are actually required, enable both substantial cost reductions and improved renewable integration [

38]. By contrast, Cyprus’s current fixed must-run approach establishes a persistent systemic cost floor, undermining the core principles of competitive market operation and constraining the potential for lower-cost, flexible market evolution.

5.8. Renewable Energy Integration Barriers

Integrating renewables in small power markets adds notable complexity, as operational flexibility needs escalate due to limited system scale, a narrow demand base, and lack of generation diversity [

39]. Small and isolated systems with renewable penetration above 20% and minimal interconnection face disproportionately high storage needs per unit of renewable energy, driving up integration costs in comparison to larger, interconnected markets [

40]. Furthermore, renewable support mechanisms originally crafted for large, interconnected power systems can induce market distortions when directly transplanted to small contexts, such as increased curtailment, persistently zero or negative prices, and unpredictable revenue streams, underscoring the importance of tailored integration strategies for such environments [

41].

Despite significant renewable capacity installation, RES contributed only 14% of October’s total energy, indicating severe absorption constraints. The must-run requirement limits the available capacity margin for renewable integration, as conventional units must maintain minimum technical outputs even when renewable generation could meet demand [

42]. This structural limitation forces renewable curtailment without compensation, discouraging investment and undermining decarbonization objectives [

13].

The market design provides no dedicated curtailment compensation mechanism for renewable producers, creating investment uncertainty and risk asymmetry. When solar generation exceeds the system’s absorption capacity during midday hours, renewable units may face involuntary curtailment or zero clearing prices without compensation for lost production opportunities. This contrasts with ancillary services provided by conventional units, which receive guaranteed procurement and payment [

43].

The absence of storage infrastructure exacerbates RES integration challenges. Without battery systems to arbitrage the pronounced midday valley–evening peak price differential (typically 102.3 EUR/MWh spread between 69.4 EUR/MWh and 171.7 EUR/MWh), renewable energy cannot be temporally shifted to high-value periods. The midday price collapse to 69.4 EUR/MWh average, with frequent zero prices, provides insufficient revenue certainty for standalone renewable projects.

5.9. Settlement and Operational Issues

While settlement processes commenced on 2 October 2025 as planned, the actual operational status of comprehensive financial settlement remains uncertain. No definitive information is currently available to confirm whether complete financial settlement procedures, including participant reconciliation, billing finalization, and payment verification systems, are fully operational. The first month represents a transitional period requiring operational calibration, and the TSOC and market participants need time to fully optimize settlement mechanisms, market clearing algorithms, and wholesale trading systems. Early transitional challenges include settlement timing coordination, reconciliation procedures, and system communication interfaces.

Automated validation and reconciliation systems require refinement to reduce manual intervention and disputes. The complexity of coordinating half-hourly clearing results across the DAM, balancing markets, and ancillary services creates data management challenges, particularly for smaller participants lacking sophisticated back-office systems.

6. Scenario-Based Wholesale Price Projections for 2026–2027

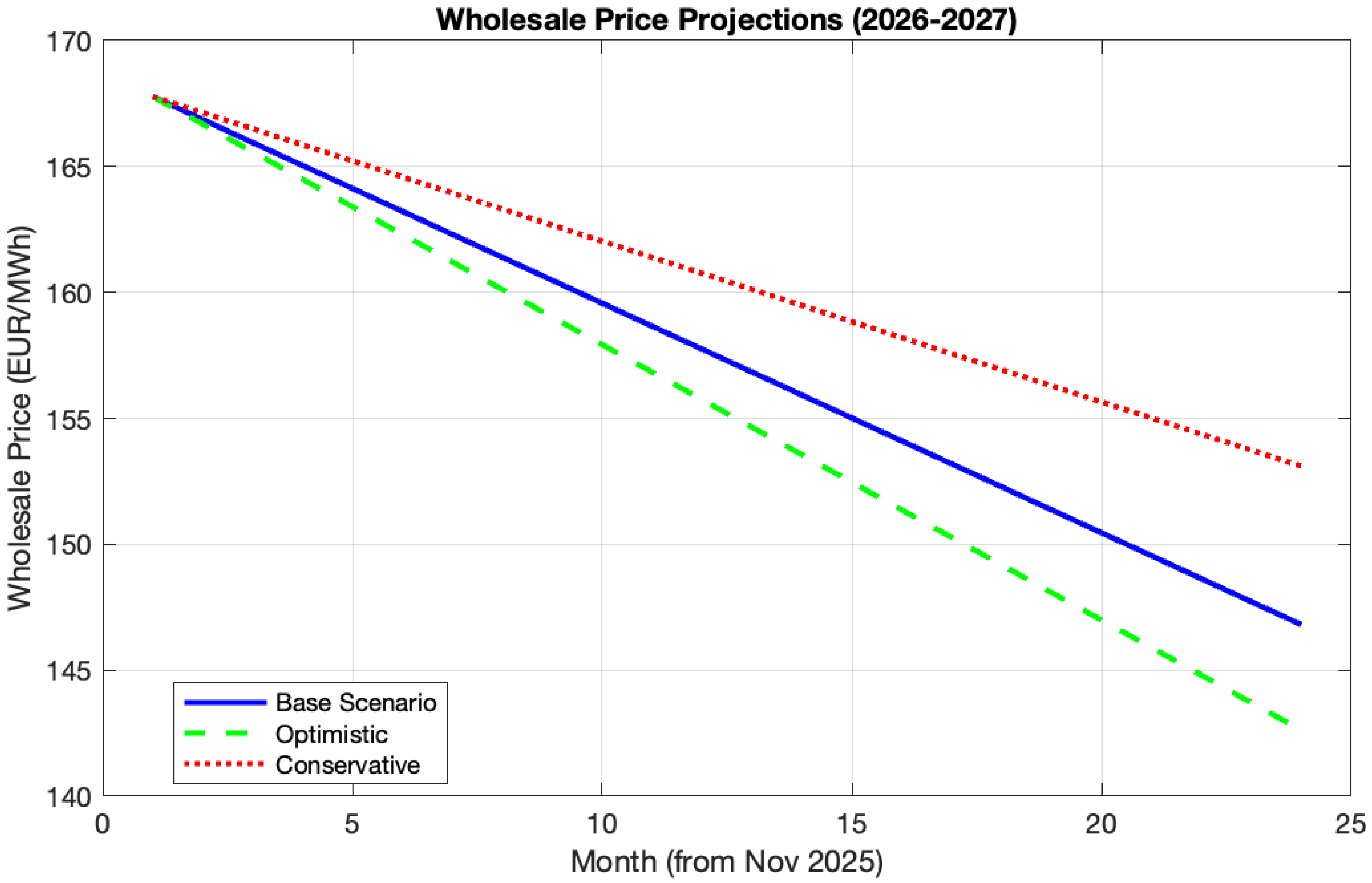

Wholesale electricity price projections for Cyprus are developed using a scenario analysis methodology, wherein three distinct development pathways are modeled: base, optimistic, and conservative. These scenarios are structured around three key variables: (1) timing of natural gas infrastructure commissioning; (2) utility-scale storage deployment capacity and schedule; and (3) pace of market development and participant entry.

The base scenario assumes that natural gas combined-cycle plants become operational by mid-2026, yielding a 34% reduction in fuel costs relative to oil-fired generation; 100–150 MW of storage are deployed by end-2026; the market expands to 25–30 participants by 2027; must-run requirements gradually decrease via ancillary services market development; and renewable penetration rises to 18–20% by 2027.

The optimistic scenario models accelerated natural gas commissioning (early 2026), deployment of 200+ MW storage by 2027, more rapid market participant entry (reaching 35+ by 2027), fully developed ancillary services markets, and increased renewable penetration up to 22–25%.

Conversely, the conservative scenario projects further delays in natural gas infrastructure (late 2026 or 2027), slower storage deployment (50–100 MW by 2027), a more gradual market expansion (20–25 participants), sustained must-run obligations, and stagnation in renewable penetration at 14–16%.

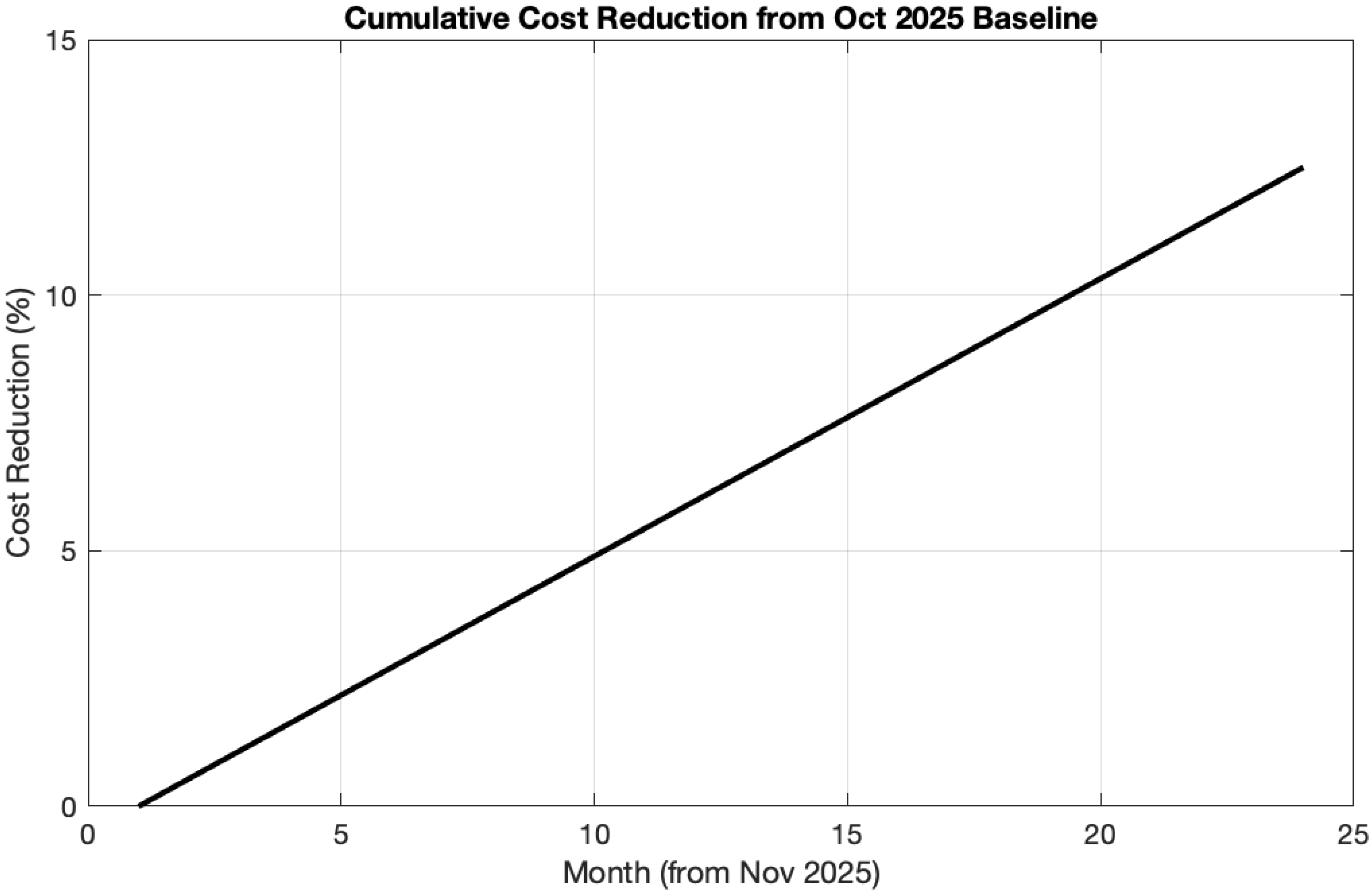

Under the base scenario, wholesale prices are expected to decline from the November 2025 baseline (167.78 EUR/MWh) to approximately 146.81 EUR/MWh by December 2027, a cumulative reduction of 12.5%. This reduction is attributable to three primary drivers: an estimated 8 EUR/MWh from natural gas fuel substitution, 7 EUR/MWh from storage-enabled arbitrage and lower must-run costs, and 6 EUR/MWh from progressive market maturation and increasing competitive pressure.

The optimistic scenario suggests a decline to 142.61 EUR/MWh by end-2027, corresponding to a 15% reduction, enabled by earlier infrastructure deployments and heightened renewable and storage integration. In contrast, the conservative scenario anticipates a more modest decrease to 153.10 EUR/MWh (8.8% reduction), due largely to extended project timelines and inhibited market development.

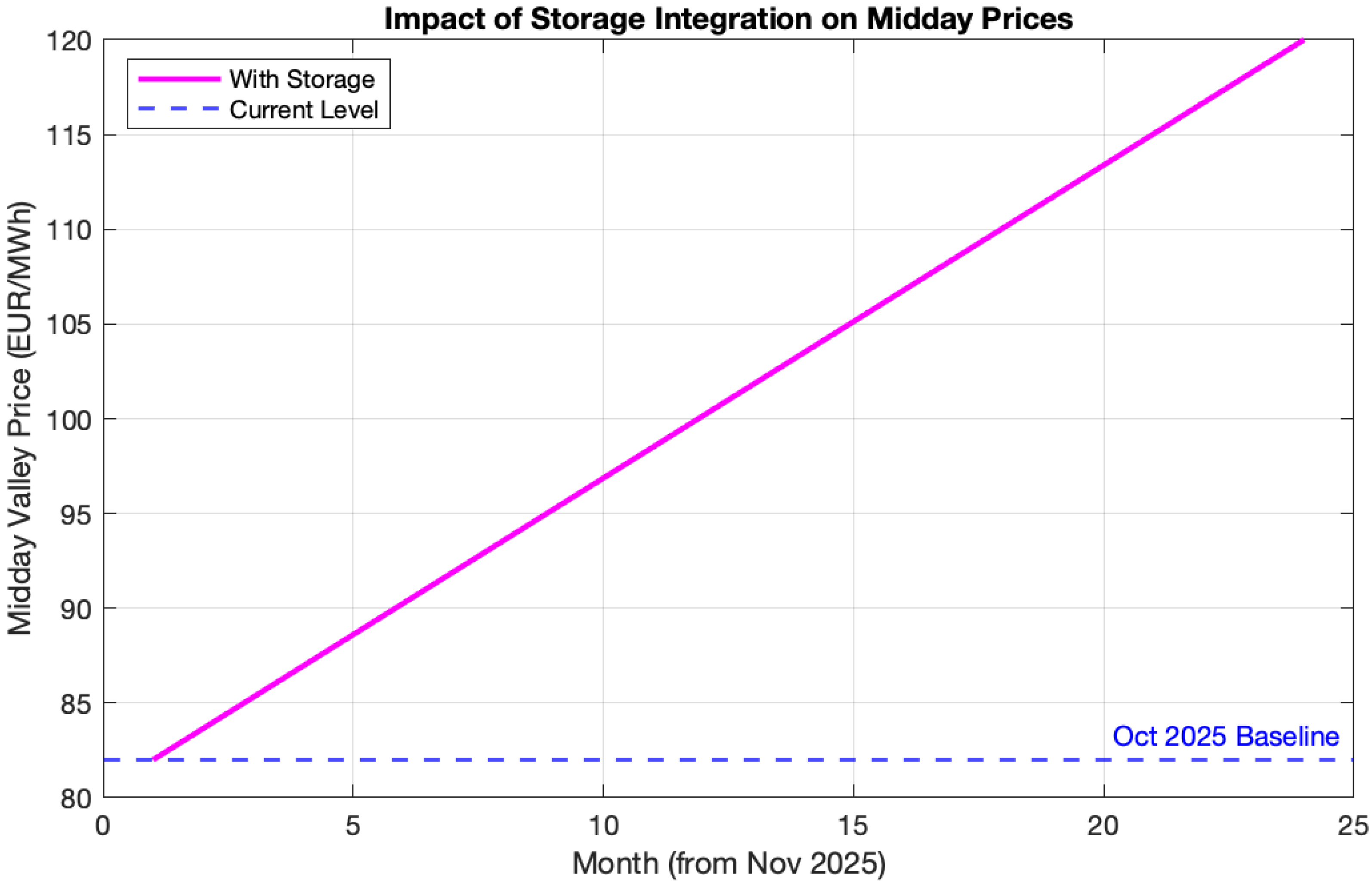

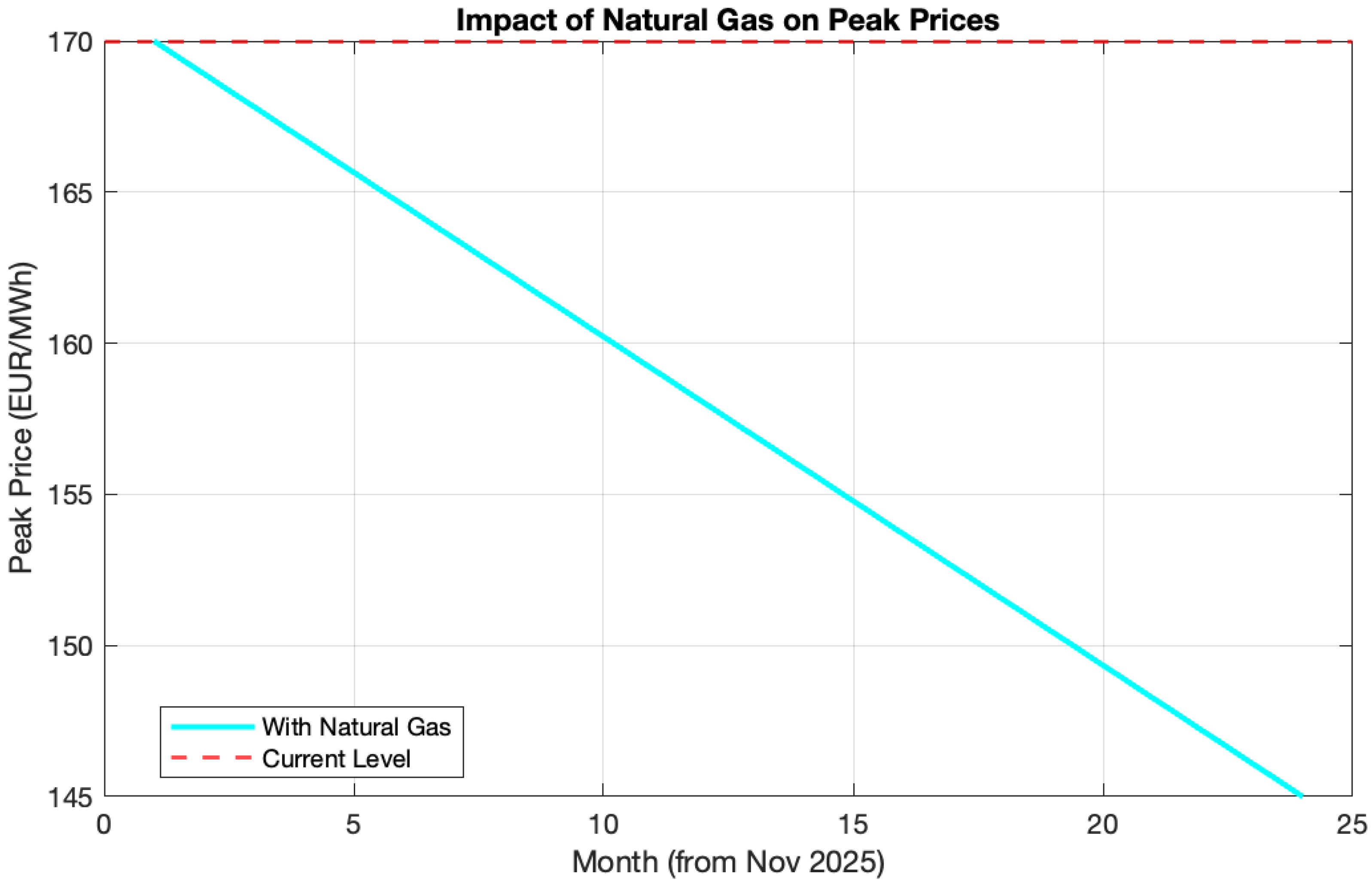

Figure 9 visualizes the three price trajectory scenarios for 2026–2027. The projected impacts of storage integration on midday price suppression (

Figure 10), natural gas entry on peak price moderation (

Figure 11), and overall cumulative cost reduction (

Figure 12) are clearly illustrated.

Table 3 summarizes key price milestones and percentage reductions across scenarios.

In summary, scenario-based analysis indicates that, subject to the timing and scale of infrastructure deployment and market maturation, Cyprus’s wholesale electricity prices are projected to decline by 8.8–15% by end-2027 relative to October 2025 baseline levels. The results underscore the central importance of coordinated progress in natural gas infrastructure commissioning, storage deployment, and market development for achieving cost reductions and enhancing market resilience.

While the scenario-based projections illustrate the potential direction of wholesale price changes under infrastructure deployment, the realized outcomes are subject to important risks. In particular, natural gas commissioning may expose the market to fuel-price volatility and supply risks, while implementation delays (e.g., settlement and ancillary service arrangements) can postpone or dilute expected benefits. In addition, utility-scale storage may underperform relative to assumptions due to availability constraints, operational limits, or slower-than-expected deployment, which would reduce the anticipated dampening of price volatility and renewable curtailment.

6.1. Impact of Storage Integration on Market Price Dynamics

The deployment of utility-scale battery storage is poised to fundamentally reshape Cyprus’s electricity market price dynamics by enabling effective energy arbitrage across the pronounced intraday price cycle. Presently, there is a substantial spread between average midday valley prices (69.4 EUR/MWh) and evening peak prices (171.7 EUR/MWh), offering an arbitrage margin of approximately 102.3 EUR/MWh per daily cycle.

Storage systems capitalize on this differential by absorbing excess solar generation during low-price midday periods (charging at roughly 69 EUR/MWh) and discharging during high-price evening periods (selling at around (171 EUR/MWh). Even after accounting for an average roundtrip efficiency of 80%, gross arbitrage revenue remains significant, at about 77 EUR/MWh per complete storage cycle.

Increased deployment of storage is projected to gradually elevate midday valley prices, rising from 69.4 EUR/MWh towards 120 EUR/MWh by December 2027, as curtailment decreases and renewable integration improves. Concurrently, evening peak prices are expected to decline, from 171.7 EUR/MWh toward 155 EUR/MWh, as stored energy is released to meet peak demand, thereby reducing the reliance on expensive thermal generation.

The net effect of widespread storage adoption will be a substantial reduction in daily price volatility, enhanced revenue stability for renewable generators, and diminished peak price exposure for both suppliers and consumers. Moreover, as storage provides alternative sources of frequency regulation and reserve capacity, it can also mitigate must-run requirements for conventional units, facilitating further integration of renewables. The stabilizing influence of storage on midday prices is illustrated in

Figure 10.

6.2. Impact of Natural Gas Integration on Wholesale Market Costs

The introduction of natural gas represents the most impactful near-term strategy for reducing wholesale electricity costs in Cyprus. Transitioning from heavy fuel oil and diesel to natural gas combined-cycle generation is projected to lower fuel expenses by 20–30%, directly reducing the marginal costs of thermal units and driving down evening and morning peak prices, which currently average 170 EUR/MWh.

Under base scenario assumptions, with natural gas infrastructure commissioned by mid-2026, evening peak prices are expected to decline from their present 171.7 EUR/MWh to approximately 142 EUR/MWh by the end of 2027, an effective reduction of 30 EUR/MWh, as detailed in

Figure 11. Morning peak prices, starting at a lower baseline (167 EUR/MWh), are projected to decrease more modestly to around 150 EUR/MWh. These reductions reflect both direct fuel cost savings and improvements in operational efficiency.

Natural gas plants offer substantial secondary benefits, including superior ramping capabilities, enhanced operational flexibility, and lower emissions compared to existing oil-fired units. These attributes facilitate the integration of variable renewable generation and may reduce must-run requirements by contributing to grid stabilization. Such system-level gains are estimated to contribute an additional 3–5 EUR/MWh to overall cost reductions.

6.3. Market Maturation and Competitive Pressure Effects

As the Cyprus electricity market evolves, expansion of the participant base and development of market liquidity are expected to drive competitive pressure, thereby reducing participant margins and enhancing overall market efficiency. International experience from comparable EU markets demonstrates that such market maturation effects typically yield wholesale price reductions in the range of 4–8 EUR/MWh over 24–30 months, as entry barriers fall and price discovery mechanisms strengthen.

In the base scenario, market maturation is projected to contribute approximately 6 EUR/MWh to price reductions during 2026–2027. This is attributed to accelerating participant entry, improved competitive bidding strategies, and greater market transparency. Unlike more tangible infrastructure effects from natural gas and storage, these benefits are less predictable as they depend on the pace of regulatory reform and market evolution.

Cumulatively, base scenario projections indicate a 12.5% reduction in wholesale prices by the end of 2027, with a monthly trajectory declining from 167.78 EUR/MWh in November 2025 to 163.22 EUR/MWh in April 2026, 157.75 EUR/MWh in October 2026, 152.28 EUR/MWh in April 2027, and ultimately reaching 146.81 EUR/MWh by December 2027.

Figure 12 depicts this cost reduction trajectory from the October 2025 baseline.

Sensitivity analysis underscores the importance of infrastructure deployment timing. A six-month delay in natural gas commissioning reduces cumulative price reductions from 12.5% to approximately 9%, while equivalent storage deployment delays lower the effect to 10.5%. Combined delays could bring the total reduction to 7–8%. Conversely, accelerated deployment in the optimistic scenario could lead to price reductions approaching 15%, provided aggressive project execution for natural gas and storage procurement is achieved. Thus, the timing of infrastructure mobilization is recognized as a decisive factor in cost reduction outcomes.

Market depth and liquidity require an extended timeline for meaningful development. The initial 17 participants represent a minimal critical mass for competitive functioning, but substantial expansion, including the entry of additional generators and a second or third conventional producer beyond the incumbent EAC, remains necessary to reduce market concentration. Regulatory progress toward ancillary services markets, intraday trading, and sophisticated risk management instruments will be pivotal for deepening competition.

International experience reveals Cyprus’ relative position among small island electricity markets. For example, renewable energy sources penetration of 14% lags behind all comparator markets, particularly Ireland (42%) and Hawaii (35%). Also, market concentration exceeds recommended competitive thresholds (<2500). International benchmarks suggest Cyprus should anticipate similar maturation timelines to other small European markets, with competitive dynamics and measurable consumer benefits emerging 18–30 months post-launch. Comprehensive regulatory updates and capacity building among market participants will be required before meaningful retail price differentiation can be achieved, primarily expected in 2027.

7. Policy Recommendations and Implementation Priorities

Effective realization of the Cyprus Competitive Electricity Market’s potential requires a coordinated set of regulatory, infrastructural, and market reforms that address persisting economic and technical constraints. This section outlines targeted policy recommendations and implementation priorities, organized by immediate, medium-term, and longer-term timelines. The proposed measures are intended to reinforce market transparency, drive infrastructure investment, broaden stakeholder participation, and promote greater system flexibility and renewable integration, thereby facilitating the transition from technical operability to sustained economic benefit.

7.1. Immediate Actions (0–6 Months)

The immediate actions (0–6 months) for Cyprus electricity market reform are tabulated in

Table 4. Regulatory transparency and monitoring can be enhanced through the introduction of comprehensive monthly market reports from CERA. These reports should detail price formation, participant behavior, market concentration, renewable curtailment data, and settlement status. Clear and accessible public reporting will support stakeholder confidence and provide a foundation for further policy refinement, while also enabling academic research and external assessment. Monitoring should track intramarket price variation, identify price anomalies, and illuminate trends in renewable energy participation.

Clarification of settlement procedures is equally important. Publication of detailed updates on the operational status of the financial settlement system, identifying any remaining gaps and remediation timelines, will reduce uncertainty and participant risk. Documentation should encompass the specifics of settlement processes, reconciliation mechanisms, collateral management, and dispute resolution procedures, enabling market participants to develop appropriate back-office systems and improving regulatory credibility.

A gradual reform of the must-run obligation should be initiated through regulatory proceedings, with the objective of shifting from fixed cost socialization toward market-based activation of ancillary services. Creating ancillary service markets would encourage competition among conventional and renewable generators in providing inertia, frequency regulation, and reserves according to their technical capabilities and cost structures, thereby reducing systemic cost premia and supporting renewable integration.

Acceleration of regulatory decisions relating to storage participation, smart metering, and grid modernization is also essential. Expedited closure of outstanding regulatory issues will unlock investment, as well as provide clarity for infrastructure developers and market stakeholders. Firm deadlines for establishing technical and market requirements are needed to facilitate planning and overcome investment paralysis.

7.2. Medium-Term Priorities (6–18 Months)

The medium-term priorities (6–18 months) for Cyprus electricity market reform are tabulated in

Table 5. Intraday market development remains a priority for improving renewable integration and managing forecast uncertainty. Implementation of intraday trading mechanisms will allow market participants to adjust supply positions closer to real time, reducing imbalance risk and supporting the integration of variable renewables—following successful models from other EU markets.

Renewable energy integration should be strengthened through targeted optimization of must-run requirements, expanding renewable absorption capacity and curtailment management. Transparent compensation mechanisms for renewable curtailment, defined as a fraction of the previous day’s average market price, will ensure fair risk allocation and maintain system incentives.

Demand response programs are needed to foster consumer participation in peak load management. Development of time-of-use tariff structures and dynamic pricing, supported by smart metering infrastructure, can target significant reductions in peak demand, especially among industrial and commercial consumers. Completion of smart metering rollout remains a prerequisite for extending demand response to residential customers.

Market participant entry should be facilitated by lowering regulatory and financial barriers, streamlining licensing and collateral requirements, and supporting the development of bilateral power purchase agreements between renewables and large consumers. Such measures will drive market diversification and enable greater certainty for renewable investment outside traditional schemes.

7.3. Critical Infrastructure Investments (12–36 Months)

The long-term critical infrastructure investments (12–36 months) for Cyprus electricity market reform are tabulated in

Table 6. Acceleration of natural gas infrastructure development is paramount, with the commissioning of the FSRU and conversion of conventional units representing priority projects for wholesale cost reduction. Establishment of robust project governance and coordination with regional partners and suppliers will be crucial for ensuring timely completion and alignment with national energy policy objectives.

Utility-scale energy storage deployment should be advanced through streamlined licensing, interconnection procedures, and appropriate financial support. Storage delivers energy arbitrage, frequency regulation, and renewable firming, providing valuable flexibility and supporting market integration. Investment procurement mechanisms should be established to ensure systematic deployment within the 24-month time frame.

Electrical interconnection development, such as the Great Sea Interconnector, should be accelerated to enable cross-border trading and emergency supply options. Overcoming geopolitical challenges and establishing cooperative governance with Greek authorities will be necessary to realize operational status by 2028–2029. Interim capacity agreements may be required if delays persist.

Smart metering infrastructure implementation should be closely managed, with accountability and public reporting for the DSO. Specific penetration targets and consequence mechanisms for missed milestones will support consumer participation in demand response and broader market engagement.

Finally, comprehensive grid modernization studies should be completed, specifying distribution network upgrades, voltage and demand management, storage integration, and flexibility requirements for higher renewable penetration. These studies should inform both investment roadmaps and regulatory tariff setting, aligning system development with market competitiveness and decarbonization goals.

Evaluation of capacity market designs should be undertaken to complement the energy-only framework and ensure the long-term adequacy of generation and incentives for system flexibility, drawing from experience in similar isolated systems such as Ireland.

8. Conclusions

The launch of Cyprus’s Competitive Electricity Market on 1 October 2025 represents an important milestone toward alignment with EU liberalization frameworks and confirms that the core market architecture can operate in practice. During the first month, market clearing and operational coordination functioned without major technical disruption; however, technical operability does not, by itself, imply that competitive outcomes and consumer benefits will materialize in the near term.

The empirical evidence from October 2025 highlights that current outcomes are primarily shaped by structural features typical of small isolated systems: high market concentration and shallow liquidity, mandatory must-run procurement and cost socialization, limited flexibility, and constrained renewable absorption due to the absence of storage and interconnection. These features produce pronounced intraday price swings (solar-driven midday depressions followed by high thermal-driven peaks) and restrict suppliers’ ability to translate wholesale dynamics into stable, competitive retail offers.

Accordingly, the central insight of this study is that market “maturation” in Cyprus depends less on further refinement of trading rules alone and more on the parallel evolution of enabling infrastructure and flexibility mechanisms. In particular, cost competitiveness and reduced volatility require (i) a lower-cost thermal benchmark through fuel switching, (ii) system flexibility through storage and demand response, and (iii) a transition away from rigid must-run arrangements toward more market-consistent procurement of ancillary services, as these changes directly address the physical constraints that currently dominate price formation and renewable curtailment.

Because the future trajectory is scenario-dependent, the scenario analysis is used here primarily to illustrate directionality and conditionality rather than to restate numeric endpoints. The key implication is that potential improvements are contingent on timely execution and coordinated regulatory implementation, while delays in infrastructure delivery can prolong the current state of technical functionality without commensurate economic benefit.

Finally, the Cyprus case offers transferable insights for other small, isolated or weakly interconnected electricity systems implementing Target-Model-style market designs: institutional liberalization can establish transparent trading and settlement, but the realization of competitive benefits requires concurrent investment in flexibility, credible mechanisms for system services, and a regulatory pathway that reduces concentration risks and supports efficient renewable integration. Future work should extend the empirical base beyond the first month by incorporating additional seasons, and, subject to data availability, should examine bidding behavior and market power using participant-level submissions and settlement outcomes.