Evaluation of the Possibility of Using a Home Wind Installation as Part of the Operation of Hybrid Systems—A Selected Case Study of Investment Profitability Analysis

Abstract

1. Introduction

2. Literature Review of the Problem

3. Materials and Methods

3.1. Characteristics of a Wind Turbine with a Rated Power of up to 2 kW

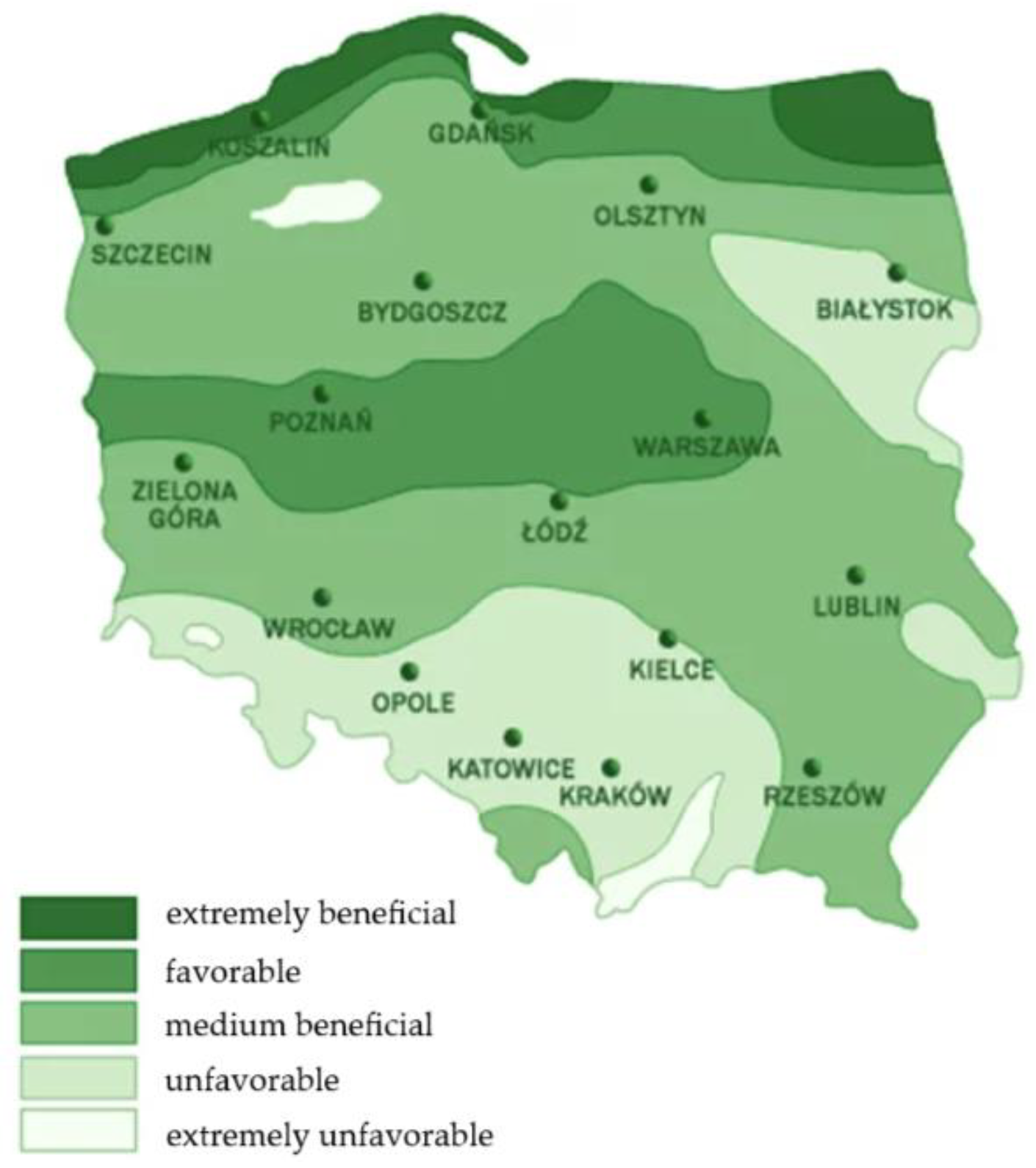

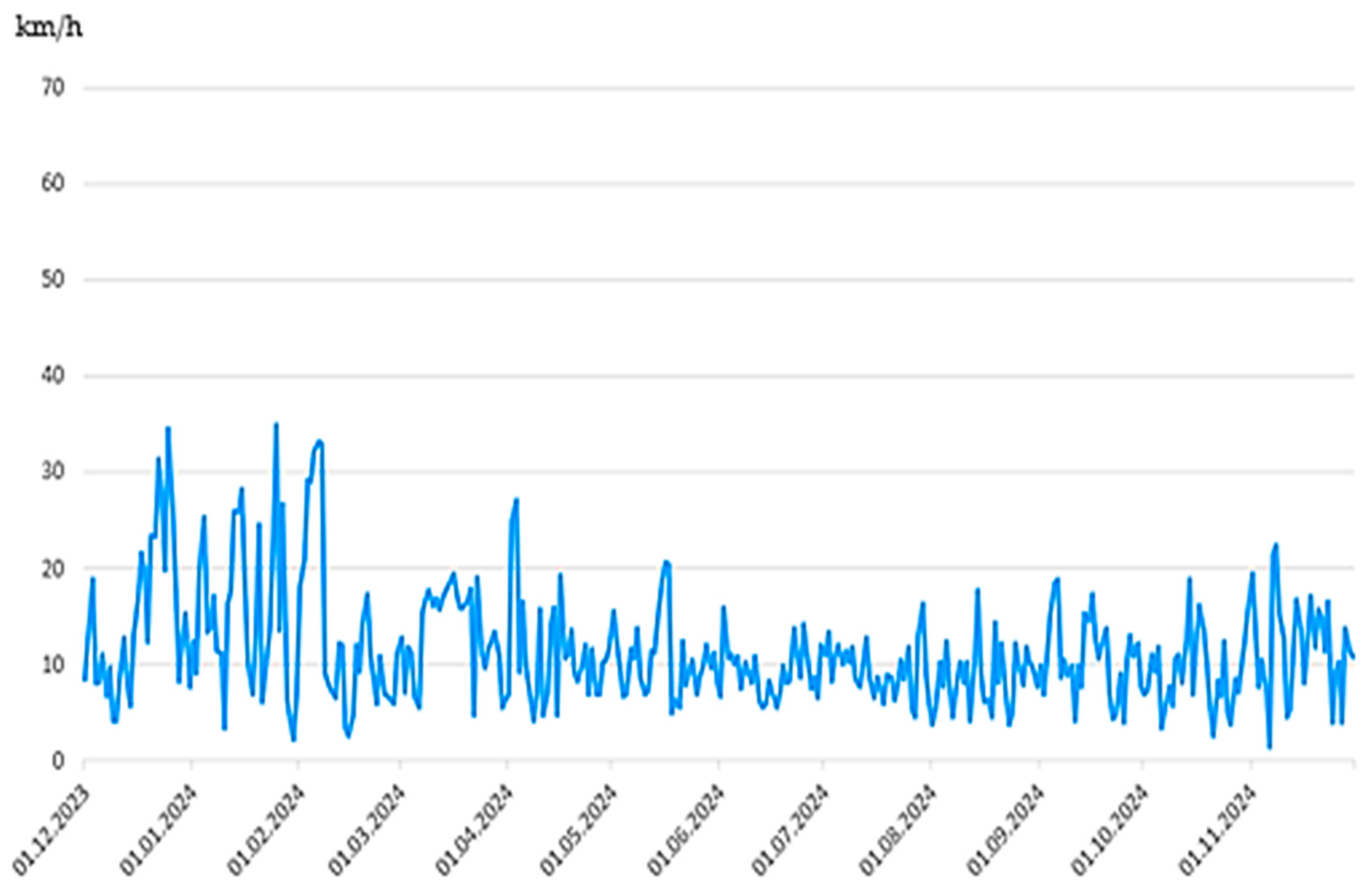

3.2. Estimation of Energy Production Based on Available Meteorological Data

- P—output power, (W),

- ρ—air density (approximately 1.225 kg/m3 at sea level),

- A—surface swept by the blades,

- v—wind speed, (m/s),

- η—turbine efficiency (usually around 30–45%).

3.3. Investment and Operating Costs

- Wind installation:

- co-financing of up to 50% of eligible costs;

- the maximum rate is EUR 1150 for each 1 kW of rated powe;

- for installations with a capacity of 2 kW, the maximum amount of support is EUR 2300.

- Energy storage:

- co-financing of up to 50% of eligible costs;

- the maximum rate is EUR 1380 for each 1 kWh of storage capacity;

- for a warehouse with a capacity of 7.5 kWh, the maximum support is EUR 3910 (despite the higher theoretical rate resulting from the capacity).

3.4. The Economic Dimension of the Analysis of Investments in a Wind System

- Estimate the future cash flows associated with the project.

- Select an appropriate discount rate that reflects the cost of capital and risk of the project.

- Discount future cash flows to present value.

- Sum the discounted cash flows.

- Subtract the initial investment outlay from the sum of the discounted flows to obtain the NPV.

- NPV—net present value,

- NCFt—net financial flows in subsequent calculation periods,

- COt—discount factor,

- t = 0, 1, 2, 3, …, n—subsequent years of the calculation period.

- CFt—cash flows in period t,

- r—discount rate,

- n—number of periods,

- l0—initial outlays.

- IRR—internal rate of return,

- i1—the value of the interest rate, where NPV > 0,

- i2—the value of the interest rate where NPV < 0,

- —NPV value calculated according to ,

- —NPV value calculated according to .

4. Results and Discussion

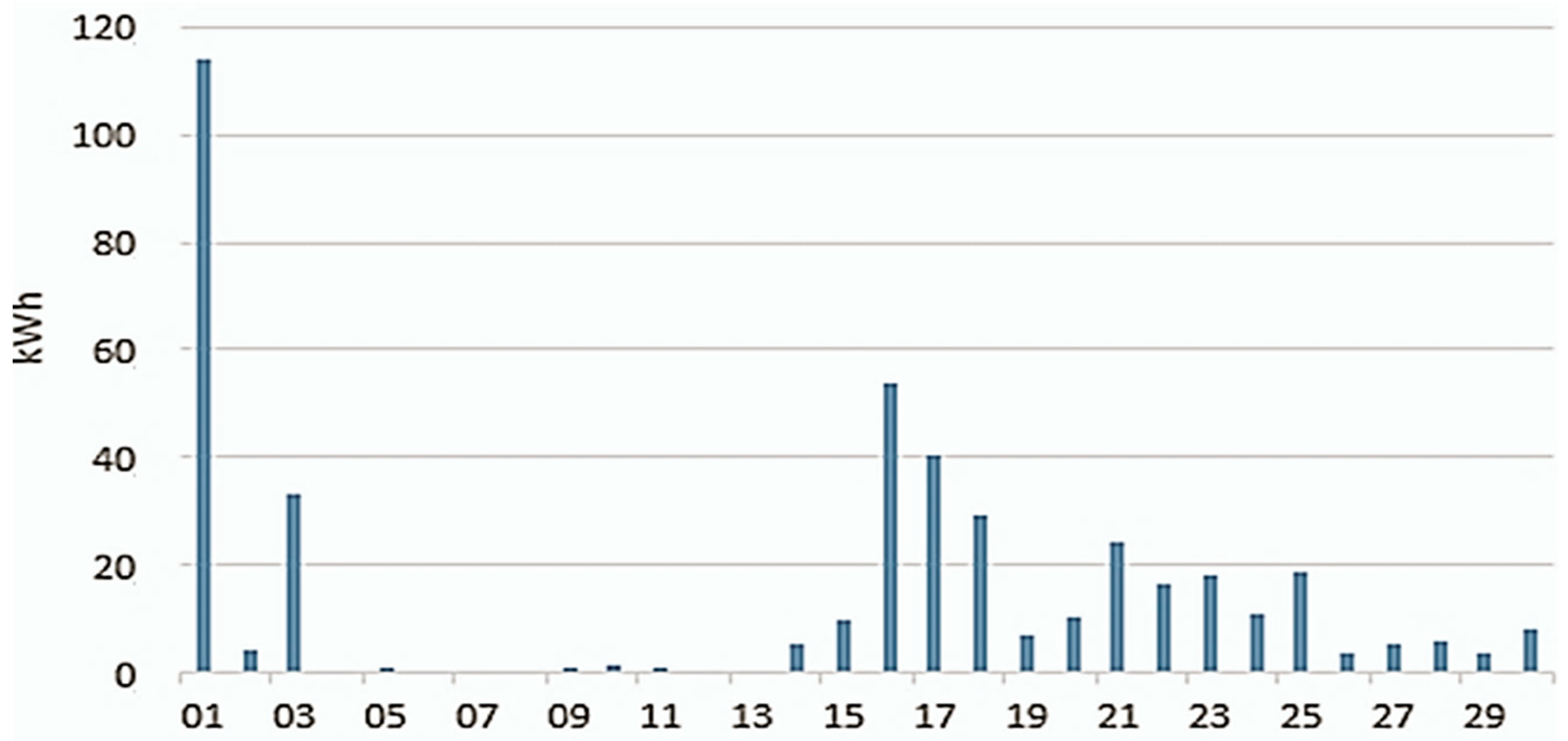

4.1. Electricity Calculations Based on Meteorological Data

4.2. Comparison of the Costs of Energy from a Wind Installation with the Costs of Energy from the Grid

- annual electricity yield from the 0th year of operation of the installation—4102.03 kWh;

- installation efficiency—40%;

- element wear factor—5%;

- total investment cost with energy storage— EUR 9568;

- total co-financing for the installation— EUR 6207;

- wind installation service costs—EUR 230 per year;

- insurance costs—EUR 49 per year;

- planned period of use—25 years;

- electricity purchase price—EUR 0.34/kWh;

- price of energy sales to the grid—EUR 0.18/kWh;

- inflation—5%;

- household energy demand—2500 kWh per year.

4.3. Comparison of Investment Costs for the Analyzed Investments

4.4. Analysis of the Profitability of Investing in a Wind Turbine Using the NPV and IRR Method for the Studied Locations

- —payment for the period i,

- n—number of periods,

- IRR—one-year interest rate.

- —cash flows from investment,

- t—number of periods in which the flow occurs,

- r—internal rate of return.

4.5. Summary of the Profitability Assessment of the Tested Investment Model

5. Conclusions

- The analysis of NPV and IRR indicators for investments in home micro wind installations, carried out in the work, confirms the validity of investing capital in this type of project, demonstrating their high profitability and attractive rates of return, which results from the effective use of renewable energy sources;

- The analysis showed that the payback period is 7 years thanks to financial support from the “ My Wind Farm” program and tax reliefs. Without this support, the payback period would be longer, but still profitable. The return period applies only to the Pomeranian location because the second tested location is not profitable;

- The use of energy storage increases the efficiency of the system by optimizing auto consumption. Investing in such a system is particularly beneficial in regions with moderate wind conditions;

- Government support programs such as “Moja Elektrownia Wiatrowa” thermal modernization relief, significantly increase the availability and profitability of investments in renewable energy sources. Continued support of this type is expected to encourage new investment in the future.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Espinoza, A. Visitors Get a Glimpse of Block Island Wind Farm in the Test Phase. 2016. Available online: https://www.wnpr.org/post/visitors-get-glimpse-block-island-wind-farm-test-phase (accessed on 17 January 2025).

- Rasmussen, N.B.; Enevoldsen, P.; Xydis, G. Transformative multi-value business models: A bottom-up perspective on the hydrogen-based green transition for modern wind power cooperatives. Int. J. Energy Res. 2020, 44, 3990–4007. [Google Scholar] [CrossRef]

- Noman, A.A.; Tasneem, Z.; Sahed, M.F.; Muyeen, S.M.; Das, S.K.; Alam, F. Towards next generation Savonius wind turbine: Artificial intelligence in blade design trends and framework. Renew. Sustain. Energy Rev. 2022, 168, 112531. [Google Scholar] [CrossRef]

- Kwok, K.C.S.; Hu, G. Wind energy system for buildings in an urban environment. J. Wind Eng. Ind. Aerodyn. 2023, 234, 105349. [Google Scholar] [CrossRef]

- Dobrovolska, O.; Hartmann, W.; Podosynnikov, S.; Halynskyi, D.; Miniailo, A. Start-Ups and Entrepreneurship in Renewable Energy: Investments and Risks. Financ. Mark. Inst. Risks 2024, 8, 213–240. [Google Scholar] [CrossRef]

- Krause, J.; Myroshnychenko, I.; Tiutiunyk, S.; Latysh, D. Financial Instruments of the Green Energy Transition: Research Landscape Analysis. Financ. Mark. Inst. Risks 2024, 8, 198–212. [Google Scholar] [CrossRef]

- Koscis, G.; Xydis, G. Repair process analysis for Wind Turbines equipped with Hydraulic Pitch mechanism on the U.S. market in the focus of cost optimization. Appl. Sci. 2019, 9, 3230. [Google Scholar] [CrossRef]

- Schoolman, E.D.; Shriberg, M.; Schwimmer, S.; Tysman, M. Green cities and ivory towers: How do higher education sustainability initiatives shape millennials’ consumption practices? J. Environ. Stud. Sci. 2016, 6, 490–502. [Google Scholar] [CrossRef]

- Nanaki, E.A.; Kiartzis, S.; Xydis, G.A. Are only demand-based policy incentives enough to deploy electromobility? Policy Stud. 2020, in press. [Google Scholar] [CrossRef]

- Kurbatova, T.; Sidortsov, R.; Trypolska, G.; Hulak, D.; Sotnyk, I. Maintaining Ukraine’s grid reliability under rapid growth of renewable electricity share: Challenges in the pre-war, war-time, and post-war periods. Int. J. Sustain. Energy Plan. Manag. 2024, 40, 41–54. [Google Scholar] [CrossRef]

- Vakulenko, I.; Saher, L.; Shymoshenko, A. Systematic literature review of carbon-neutral economy concept. SocioEcon. Chall. 2023, 7, 139–148. [Google Scholar] [CrossRef]

- Li, Y.; Zhao, S.; Qu, C.; Tong, G.; Feng, F.; Zhao, B.; Kotaro, T. Aerodynamic characteristics of Straight-bladed Vertical Axis Wind Turbine with a curved-outline wind gathering device. Energy Convers. Manag. 2020, 203, 112249. [Google Scholar] [CrossRef]

- Kalluvila, J.B.S.; Sreejith, B. Numerical and experimental study on a modified Savonius rotor with guide blades. Int. J. Green Energy 2018, 15, 744–757. [Google Scholar] [CrossRef]

- Xydis, G.; Mihet-Popa, L. Wind Energy Integration via Residential Appliances. Energy Effic. 2016, 10, 319–329. [Google Scholar] [CrossRef]

- Haynes, D.; Corns, S. Improving Grid Network Operations Through an Improved Energy Market. EMJ Eng. Manag. J. 2020, 32, 208–218. [Google Scholar] [CrossRef]

- Soudagar, M.E.M.; Ramesh, S.; Yunus Khan, T.; Almakayeel, N.; Ramesh, R.; Nazri, N.; Ghazali, N.; Cuce, E.; Shelare, S. An Overview of the Existing and Future State of the Art Advancement of Hybrid Energy Systems Based on PV-Solar and Wind. Int. J. Low-Carbon 2024, 19, 207–216. [Google Scholar] [CrossRef]

- Kabeyi, M.; Olanrewaju, O. The levelized cost of energy and modifications for use in electricity generation planning. Energy Rep. 2023, 9, 495–534. [Google Scholar] [CrossRef]

- Panagiotidis, P.; Effraimis, A.; Xydis, G. An R-focused Forecasting Approach for Efficient Demand Response Strategies in Autonomous Micro Grids. Energy Environ. 2019, 30, 63–80. [Google Scholar] [CrossRef]

- Tasneem, Z.; Noman, A.A.; Das, S.K.; Saha, D.K.; Islam, M.R.; Ali, M.F.; Badal, M.F.R.; Ahamed, M.H.; Moyeen, S.I.; Alam, F. An analytical review on the evaluation of wind resource and wind turbine for urban application: Prospect and challenges. Dev. Built Environ. 2020, 4, 100033. [Google Scholar] [CrossRef]

- Tominaga, Y. CFD Prediction for Wind Power Generation by a Small Vertical Axis Wind Turbine: A Case Study for a University Campus. Energies 2023, 16, 4912. [Google Scholar] [CrossRef]

- Prokopenko, O.; Telizhenko, O.; Kovalenko, Y.; Lytvynenko, S.; Nych, T.; Kovalskyi, A. Promising Directions of Increasing Energy Efficiency and Development of Green Energy in the Household Sector of Ukraine. Rev. Stud. Sustain. 2024, 2, 107–127. [Google Scholar] [CrossRef]

- Kurbatova, T.; Sotnyk, I.; Prokopenko, O.; Bashynska, I.; Pysmenna, U. Improving the feed-in tariff policy for renewable energy promotion in Ukraine’s households. Energies 2023, 16, 6773. [Google Scholar] [CrossRef]

- Wang, W.; Wei, K.; Kubatko, O.; Piven, V.; Chortok, Y.; Derykolenko, O. Economic Growth and Sustainable Transition: Investigating Classical and Novel Factors in Developed Countries. Sustainability 2023, 15, 12346. [Google Scholar] [CrossRef]

- Enevoldsen, P.; Xydis, G. Examining the trends of 35 years growth of key wind turbine components. Energy Sustain. Dev. 2019, 50, 18–26. [Google Scholar] [CrossRef]

- Hansen, J.M.; Xydis, G. Rural Electrification in Kenya. A useful case for remote areas in Sub-Saharan Africa. Energy Effic. 2020, 13, 257–272. [Google Scholar] [CrossRef]

- Zhao, P.; Jiang, Y.; Liu, S.; Stoesser, T.; Zou, L.; Wang, K. Investigation of the fundamental mechanism leading to the performance improvement of vertical axis wind turbines by the deflector. Energy Convers. Manag. 2021, 247, 114680. [Google Scholar] [CrossRef]

- Hashem, I.; Mohamed, M.H. Aerodynamic performance enhancements of H-rotor Darrieus wind turbine. Energy 2018, 142, 531–545. [Google Scholar] [CrossRef]

- Farghali, M.; Osman, A.I.; Chen, Z.; Abdelhaleem, A.; Ihara, I.; Mohamed, I.M.A.; Yap, P.-S.; Rooney, D.W. Social, Environmental, and Economic Consequences of Integrating Renewable Energies in the Electricity Sector: A Review. Environ. Chem. Lett. 2023, 21, 1381–1418. [Google Scholar] [CrossRef]

- Calautit, K.; Johnstone, C. State-of-the-art review of micro to small-scale wind energy harvesting technologies for building integration. Energy Convers. Manag. 2023, 20, 100457. [Google Scholar] [CrossRef]

- Olasunkanmi, O.G.; Roleola, O.A.; Alao, P.O.; Oyedeji, O.; Onaifo, F. Hybridization energy systems for a rural area in Nigeria. IOP Conf. Ser. Earth Environ. Sci. 2019, 331, 012007. [Google Scholar] [CrossRef]

- Hadjidj, M.S.; Bibi-Triki, N.; Didi, F. Analysis of the reliability of photovoltaic-micro-wind based hybrid power system with battery storage for optimized electricity generation at Tlemcen, north-west Algeria. Arch. Thermodyn. 2019, 40, 161–185. [Google Scholar]

- Hassan, Q.; Algburi, S.; Sameen, A.Z.; Salman, H.M.; Jaszczur, M. A Review of Hybrid Renewable Energy Systems: Solar and Wind-Powered Solutions: Challenges, Opportunities, and Policy Implications. Results Eng. 2023, 20, 101621. [Google Scholar] [CrossRef]

- Al-Rawashdeh, H.; Al-Khashman, O.; Bdour, A.; Gomaa, M.R.; Rezk, H.; Marshall, A.; Arrfou, L.M.; Louzazni, M. Performance Analysis of a Hybrid Renewable-Energy System for Green Buildings to Improve Efficiency and Reduce GHG Emissions with Multiple Scenarios. Sustainability 2023, 15, 7529. [Google Scholar] [CrossRef]

- Mohamed, O.S.; Ibrahim, A.A.; Etman, A.K.; Abdelfatah, A.A.; Elbaz, A.M.R. Numerical investigation of Darrieus wind turbine with slotted airfoil blades. Energy Convers. Manag. 2020, 5, 100026. [Google Scholar] [CrossRef]

- Al-Ghriybah, M.; Fadhli, Z.M.; Hissein, D.D.; Mohd, S. The effect of spacing between inner blades on the performance of the Savonius wind turbine. Sustain. Energy Technol. Assess. 2021, 43, 100988. [Google Scholar] [CrossRef]

- Saad, A.S.; Elwardany, A.; El-Sharkawy, I.I.; Ookawara, S.; Ahmed, M. Performance evaluation of a novel vertical axis wind turbine using twisted blades in multistage Savonius rotors. Energy Convers. Manag. 2021, 235, 114013. [Google Scholar] [CrossRef]

- Al-Kodmany, K.; Xue, Z.; Sun, C. Reconfiguring Vertical Urbanism: The Example of Tall Buildings and Transit-Oriented Development (TB-TOD) in Hong Kong. Buildings 2022, 12, 197. [Google Scholar] [CrossRef]

- Niekurzak, M. Forecasting wind capacity using Gauss regression models based on nuclear functions. Energy Mark. 2022, 4, 61–71. [Google Scholar]

- Chong, W.-T.; Wong, K.-H.; Wang, C.-T.; Gwani, M.; Chu, Y.-J.; Chia, W.-C.; Poh, S.-C. Cross-axis wind turbine: A complementary design to push the limit of wind turbine technology. Energy Procedia 2017, 105, 973–979. [Google Scholar] [CrossRef]

- Prokopenko, O.; Prokopenko, M.; Chechel, A.; Marhasova, V.; Omelyanenko, V.; Orozonova, A. Ecological and Economic Assessment of the Possibilities of Public-private Partnerships at the National and Local Levels to Reduce Greenhouse Gas Emissions. Econ. Aff. 2023, 68, 33–142. [Google Scholar] [CrossRef]

- Davy, J.L.; Burgemeister, K.; Hillman, D.; Carlile, S. A Review of the Potential Impacts of Wind Turbine Noise in the Australian Context. Acoust. Aust. 2020, 48, 181–197. [Google Scholar] [CrossRef]

- Canale, T.; Ismail, K.A.R.; Lino, F.A.M.; Arabkoohsar, A. Comparative Study of New Airfoils for Small Horizontal Axis Wind Turbines. J. Sol. Energy Eng. 2020, 142, 041004. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Trypolska, G.; Sokhan, I.; Koshel, V. Research trends on the development of energy efficiency and renewable energy in households: A bibliometric analysis. Environ. Econ. 2023, 14, 13–27. [Google Scholar] [CrossRef]

- Avgoustaki, D.; Xydis, G. Indoor Vertical Farming in the Urban Nexus Context: Business Growth and Resource Savings. Sustainability 2020, 12, 1965. [Google Scholar] [CrossRef]

- Kuang, L.; Su, J.; Chen, Y.; Han, Z.; Zhou, D.; Zhang, K.; Zhao, Y.; Bao, Y. Wind-capture-accelerate device for performance improvement of vertical-axis wind turbines: External diffuser system. Energy 2022, 39, 122196. [Google Scholar] [CrossRef]

- Tian, W.; Mao, Z.; Ding, H. Numerical study of a passive-pitch shield for the efficiency improvement of vertical axis wind turbines. Energy Convers. Manag. 2019, 183, 732–745. [Google Scholar] [CrossRef]

- Chygryn, O.; Shevchenko, K. Energy industry development: Key trends and the core determinants. SocioEcon. Chall. 2023, 7, 115–128. [Google Scholar] [CrossRef]

- Niekurzak, M.; Kubińska-Jabcoń, E. Analysis of the return on investment in solar collectors on the example of a household: The case of Poland. Front. Energy Res. 2021, 9, 660140. [Google Scholar] [CrossRef]

- Hosseini, A.; Goudarzi, N. Design and CFD study of a hybrid vertical-axis wind turbine by employing a combined Bach-type and H-Darrieus rotor systems. Energy Convers. Manag. 2019, 189, 49–59. [Google Scholar] [CrossRef]

- Egilmez, G.; Oztanriseven, F.; Gedik, R. The energy climate water nexus: A global sustainability impact assessment of U.S. manufacturing. Eng. Manag. J. 2020, 32, 298–315. [Google Scholar] [CrossRef]

- Nazir, M.S.; Wang, Y.; Bilal, M.; Sohail, H.M.; Kadhem, A.A.; Nazir, H.M.R.; Abdalla, A.N.; Ma, Y. Comparison of Small-Scale Wind Energy Conversion Systems: Economic Indexes. Clean Technol. 2020, 2, 144–155. [Google Scholar] [CrossRef]

- Ahsan, S.; Ahmmed, T.; Alam, F. The COVID-19, power generation and economy—A case study of a developing country. Electr. J. 2022, 35, 107145. [Google Scholar] [CrossRef]

- Badreddine, A.; Larbi Cherif, H. Public health improvement by reducing air pollution: A strategy for the transition to renewable energy. Health Econ. Manag. Rev. 2024, 5, 1–14. [Google Scholar] [CrossRef]

- Noman, A.A.; Tasneem, Z.; Abhi, S.H.; Badal, F.R.; Rafsanzane, M.; Islam, M.R.; Alam, F. Savonius wind turbine blade design and performance evaluation using ANN-based virtual clone: A new approach. Heliyon 2023, 9, e156729. [Google Scholar] [CrossRef]

- Rezaeiha, A.; Montazeri, H.; Blocken, B. A framework for preliminary large-scale urban wind energy potential assessment: Roof-mounted wind turbines. Energy Convers. Manag. 2020, 214, 112770. [Google Scholar] [CrossRef]

- Calhoun, A.; Pian-Smith, M.; Shah, A.; Levine, A.; Gaba, D.; DeMaria, S.; Goldberg, A.; Meyer, E.C. Exploring the boundaries of deception in simulation: A mixed-methods study. Clin. Simul. Nurs. 2020, 40, 7–16. [Google Scholar] [CrossRef]

- Karmakar, S.D.; Chattopadhyay, H. A review of augmentation methods to enhance the performance of vertical axis wind turbine. Sustain. Energy Technol. Assess. 2022, 53, 102469. [Google Scholar] [CrossRef]

- Onde Flow. Turbiny Wiatrowe–Budowa, Zasada Działania, Eksploatacja Oraz Uszkodzenia. Onde Flow. Available online: https://ondeflow.pl/artykuly/turbiny-wiatrowe-budowa-zasada-dzialania-eksploatacja-oraz-uszkodzenia/ (accessed on 12 March 2025).

- Consor Energia. Turbina Wiatrowa Falcon Silence 2 kW (FNSW-2kW). Consor Energia. Available online: http://www.consorenergia.pl/ (accessed on 12 March 2025).

- Charakterystyka Warunków Wiatrowych w Polsce. Available online: https://ekologiaprace.wordpress.com/2013/03/15/charakterystyka-warunkow-wiatrowych-w-polsce/ (accessed on 12 March 2025).

- Termomedia. Cennik Falcon I 2024. Termomedia. Available online: https://www.termomedia.pl/index.php/turbiny-wiatrowe/zestawy/164-zestaw-falcon-silence-2kw-3800kwh-on-grid?pid=27 (accessed on 12 March 2025).

- Yilmaz, I.C.; Yilmaz, D.; Ince, I.T.; Mancuhan, E. Techno-Economic Feasibility of Installing Wind Turbines in the Region of Eastern Thrace. Sustainability 2025, 17, 2159. [Google Scholar] [CrossRef]

- Zemite, L.; Kozadajevs, J.; Jansons, L.; Bode, I.; Dzelzitis, E.; Palkova, K. Integrating Renewable Energy Solutions in Small-Scale Industrial Facilities. Energies 2024, 17, 2792. [Google Scholar] [CrossRef]

- Peng, H.; Li, S.; Shangguan, L.; Fan, Y.; Zhang, H. Analysis of Wind Turbine Equipment Failure and Intelligent Operation and Maintenance Research. Sustainability 2023, 15, 8333. [Google Scholar] [CrossRef]

- Yildiz, N.; Hemida, H.; Baniotopoulos, C. Operation, Maintenance, and Decommissioning Cost in Life-Cycle Cost Analysis of Floating Wind Turbines. Energies 2024, 17, 1332. [Google Scholar] [CrossRef]

- Niekurzak, M. The potential of using renewable energy sources in Poland takes into account the economic and ecological conditions. Energies 2021, 14, 7525. [Google Scholar] [CrossRef]

- Data Based on Institute of Meteorology and Water Management—National Research Institute (IMGW-PIB). Available online: https://danepubliczne.imgw.pl/data/dane_pomiarowo_obserwacyjne/dane_meteorologiczne/miesieczne/synop/2023 (accessed on 12 March 2025).

| Turbine Technical Specifications | Value |

|---|---|

| propeller diameter, (m) | 3.2 |

| rated power, (W) | 2000 |

| maximum power, (W) | 3060 |

| operating voltage AC, (V) | 230 |

| average annual production (with wind 5 m/s), (kWh) | 3832 |

| minimum and maximum wind speed, (m/s) | 2.5–40 |

| noise level, (dBA) | 30 |

| work in the temperature range (at a distance of 50 m with a wind of 8 m/s), (°C) | −40 to +60 |

| turbine weight, (kg) | 68 |

| Date | Minimum Temperature (°C) | Temperature Max (°C) | Maximum Temperature (°C) | Wind Speed Min (km/h) | Maximum Wind Speed (km/h) | Average Wind Speed (km/h) | Precipitation (mm) |

|---|---|---|---|---|---|---|---|

| 01.12.2023 | −4.2 | 2.7 | −0.2 | 2.5 | 27.4 | 13 | 2.2 |

| 02.12.2023 | −0.3 | 1.5 | 0.4 | 2.5 | 14.4 | 6 | 2.3 |

| … | … | … | … | … | … | … | … |

| 27.11.2024 | 2.9 | 5.7 | 4.8 | 4 | 23 | 17.1 | 0 |

| 28.11.2024 | 4.7 | 7.3 | 6 | 6.1 | 29.9 | 17.9 | 4.4 |

| 29.11.2024 | 4.5 | 7.4 | 5.7 | 8.6 | 25.9 | 15.2 | 4.8 |

| 30.11.2024 | 2.5 | 5.4 | 4 | 13.3 | 26.3 | 20 | 4.8 |

| Element | Cost |

|---|---|

| Wind turbine FALCON SILENCE 2 kW FNSW-2 kW, (EUR) | 2516 |

| Inverter FALCON FNI20/48, (EUR) | 645 |

| Controller with built-in resistor FALCON FNW20/48, (EUR) | 1140 |

| Installation, (EUR) | 182 |

| Price of energy storage, (EUR) | 5058 |

| Element | Value |

|---|---|

| Number of modules | 3 |

| Power (nominal/real), (kWh) | 9.7/7.5 |

| Nominal voltage, (V) | 155 |

| Final voltage (charging/discharging), (V) | 175/170 |

| Capacity (nominal), (Ah) | 62.7 |

| Maximum charge/discharge current (3 s), (A) | 29/40 |

| Maximum discharge power (3 s)/discharge, (kW) | 6.2/4.6 |

| Weight, (kg) | 107 |

| Operating temperature during discharging, (°C) | −15 to 55 |

| Operating temperature when loading/storing the warehouse, (°C) | 0–45/−20–60 |

| Cell chemistry | Li-Ion NMC |

| Discharge depth (depending on nominal capacity), % | 80 |

| Number of complete cycles (with capacity remaining at 60% or 80%) | 5000 or 3000 |

| Guarantee | 10 year |

| Date | Average Wind Speed (km/h) | Average Wind Speed (m/s) | P-Electricity Produced (W) | Electricity Produced (kWh) |

|---|---|---|---|---|

| 01.12.2023 | 13 | 3.62 | 92.76 | 2.23 |

| 02.12.2023 | 6 | 1.67 | 45.27 | 1.09 |

| … | … | … | … | … |

| 27.11.2024 | 17.1 | 4.76 | 211.12 | 5.07 |

| 28.11.2024 | 17.9 | 4.98 | 242.15 | 5.81 |

| 29.11.2024 | 15.2 | 4.23 | 148.27 | 3.56 |

| 30.11.2024 | 20 | 5.56 | 337.77 | 8.11 |

| Year | Energy Consumption | Purchase Price of Electricity | Energy Cost | Discounted Sum |

|---|---|---|---|---|

| (kWh) | (EUR) | (EUR/kWh) | (EUR) | |

| 0 | 2500 | 0.34 | −844.83 | −844.83 |

| 1 | 2500 | 0.36 | −887.07 | −852.95 |

| 2 | 2500 | 0.37 | −931.42 | −861.15 |

| 3 | 2500 | 0.39 | −977.99 | −869.43 |

| 4 | 2500 | 0.41 | −1026.89 | −877.79 |

| 5 | 2500 | 0.43 | −1078.24 | −886.23 |

| 6 | 2500 | 0.46 | −1132.15 | −894.75 |

| 7 | 2500 | 0.48 | −1188.76 | −903.36 |

| 8 | 2500 | 0.51 | −1248.20 | −912.04 |

| 9 | 2500 | 0.53 | −1310.60 | −920.81 |

| 10 | 2500 | 0.55 | −1376.14 | −929.67 |

| 11 | 2500 | 0.60 | −1444.94 | −938.61 |

| 12 | 2500 | 0.62 | −1517.19 | −947.63 |

| 13 | 2500 | 0.64 | −1593.05 | −956.74 |

| 14 | 2500 | 0.69 | −1672.70 | −965.94 |

| 15 | 2500 | 0.71 | −1756.34 | −975.23 |

| 16 | 2500 | 0.76 | −1844.15 | −984.61 |

| 17 | 2500 | 0.78 | −1936.36 | −994.08 |

| 18 | 2500 | 0.83 | −2033.18 | −1003.63 |

| 19 | 2500 | 0.87 | −2134.84 | −1013.29 |

| 20 | 2500 | 0.92 | −2241.58 | −1023.03 |

| 21 | 2500 | 0.94 | −2353.66 | −1032.86 |

| 22 | 2500 | 1.01 | −2471.34 | −1042.80 |

| 23 | 2500 | 1.06 | −2594.91 | −1052.82 |

| 24 | 2500 | 1.10 | −2724.65 | −1062.94 |

| Year | The Amount of Electricity Generated | Amount of Electricity Needed | The Amount of Electricity Transferred to the Grid | Funding | Installation Cost | Service Costs | Insurance | Putting Electricity into the Grid | Sum | Cumulative Cash Flow |

|---|---|---|---|---|---|---|---|---|---|---|

| (kWh) | (kWh) | (kWh) | (EUR) | (EUR) | (EUR) | (EUR) | (EUR) | (EUR) | (EUR) | |

| 0 | 4102.03 | 2500 | 1602.03 | 6207 | −9568 | −48.8 | 541.37 | −2867.94 | −2867.94 | |

| 1 | 3896.92 | 2500 | 1396.92 | −48.8 | 495.67 | 429.06 | −2421.00 | |||

| 2 | 3702.0.8 | 2500 | 1202.08 | −48.8 | 447.86 | 367.83 | −2021.88 | |||

| 3 | 3516.97 | 2500 | 1016.97 | −48.8 | 397.84 | 308.86 | −1672.78 | |||

| 4 | 3341.13 | 2500 | 841.13 | −48.8 | 345.50 | 252.06 | −1376.02 | |||

| 5 | 4102.03 | 2500 | 1602.03 | −230 | −48.8 | 690.95 | 336.20 | −963.69 | ||

| 6 | 3896.92 | 2500 | 1396.92 | −48.8 | 632.61 | 457.03 | −379.82 | |||

| 7 | 3702.08 | 2500 | 1202.08 | −48.8 | 571.59 | 392.90 | 143.04 | |||

| 8 | 3516.97 | 2500 | 1016.97 | −48.8 | 507.75 | 331.13 | 602.06 | |||

| 9 | 3341.13 | 2500 | 841.13 | −48.8 | 440.95 | 271.63 | 994.28 | |||

| 10 | 4102.03 | 2500 | 1602.03 | −230 | −48.8 | 881.84 | 401.04 | 1597.50 | ||

| 11 | 3896.92 | 2500 | 1396.92 | −48.8 | 807.39 | 484.20 | 2356.15 | |||

| 12 | 3702.08 | 2500 | 1202.08 | −48.8 | 729.51 | 417.12 | 3036.93 | |||

| 13 | 3516.97 | 2500 | 1016.97 | −48.8 | 648.04 | 352.51 | 3636.23 | |||

| 14 | 3341.13 | 2500 | 841.13 | −48.8 | 562.78 | 290.27 | 4150.27 | |||

| 15 | 4102.03 | 2500 | 1602.03 | −230 | −48.8 | 1125.48 | 459.07 | 4997.13 | ||

| 16 | 3896.92 | 2500 | 1396.92 | −48.8 | 1030.46 | 510.89 | 5978.85 | |||

| 17 | 3702.08 | 2500 | 1202.08 | −48.8 | 931.06 | 440.80 | 6861.18 | |||

| 18 | 3516.97 | 2500 | 1016.97 | −48.8 | 827.08 | 373.29 | 7639.52 | |||

| 19 | 3341.13 | 2500 | 841.13 | −48.8 | 718.27 | 308.26 | 8309.05 | |||

| 20 | 4102.03 | 2500 | 1602.03 | −230 | −48.8 | 1436.43 | 511.75 | 9466.86 | ||

| 21 | 3896.92 | 2500 | 1396.92 | −48.8 | 1315.15 | 537.37 | 10,733.28 | |||

| 22 | 3702.08 | 2500 | 1202.08 | −48.8 | 1188.30 | 464.20 | 11,872.84 | |||

| 23 | 3516.97 | 2500 | 1016.97 | −48.8 | 1055.58 | 393.73 | 12,879.69 | |||

| 24 | 3341.13 | 2500 | 841.13 | −48.8 | 916.71 | 325.85 | 13,747.66 |

| Year | Average Wind Speed (km/h) | Average Wind Speed (m/s) | P-Electricity Produced (W) | Electricity Produced (kWh) |

|---|---|---|---|---|

| 01.12.2023 | 8.5 | 2.4 | 51.2 | 0.7 |

| 02.12.2023 | 14.8 | 4.2 | 136.9 | 3.3 |

| … | … | … | … | … |

| 27.11.2024 | 4.1 | 1.2 | 23.4 | 0.4 |

| 28.11.2024 | 13.7 | 3.9 | 108.6 | 2.7 |

| 29.11.2024 | 11.5 | 3.2 | 64.3 | 1.6 |

| 30.11.2024 | 10.9 | 3.1 | 54.7 | 1.4 |

| Year | The Amount of Electricity Generated | Amount of Electricity Needed | Amount of Electricity Purchased | Funding | Installation Cost | Service Costs | Insurance | Buying Electricity from the Grid | Sum | Cash Flow |

|---|---|---|---|---|---|---|---|---|---|---|

| (kWh) | (kWh) | (kWh) | (EUR) | (EUR) | (EUR) | (EUR) | (EUR) | (EUR) | (EUR) | |

| 0 | 1059.72 | 2500 | −1440.28 | 6207 | −9568 | −49 | −486.71 | −3896.03 | −3896.03 | |

| 1 | 1006.73 | 2500 | −1493.27 | −49 | −529.85 | −555.44 | −4302.51 | |||

| 2 | 956.40 | 2500 | −1543.60 | −49 | −575.10 | −574.93 | −4713.80 | |||

| 3 | 908.58 | 2500 | −1591.42 | −49 | −622.56 | −593.92 | −5129.28 | |||

| 4 | 863.15 | 2500 | −1636.85 | −49 | −672.35 | −612.45 | −5548.39 | |||

| 5 | 10,590.72 | 2500 | −1440.28 | −230 | −49 | −621.19 | −733.68 | −6074.56 | ||

| 6 | 1006.73 | 2500 | −1493.27 | −49 | −676.24 | −567.48 | −6413.88 | |||

| 7 | 956.40 | 2500 | −1543.60 | −49 | −733.99 | −588.17 | −6762.00 | |||

| 8 | 908.58 | 2500 | −1591.42 | −49 | −794.56 | −608.35 | −7118.11 | |||

| 9 | 863.15 | 2500 | −1636.85 | −49 | −858.11 | −628.02 | −7481.47 | |||

| 10 | 1059.72 | 2500 | −1440.28 | −230 | −49 | −792.81 | −712.32 | −7917.54 | ||

| 11 | 1006.73 | 2500 | −1493.27 | −49 | −863.07 | −581.95 | −8205.32 | |||

| 12 | 956.40 | 2500 | −1543.60 | −49 | −936.77 | −603.83 | −8505.27 | |||

| 13 | 908.58 | 2500 | −1591.42 | −49 | −1014.09 | −625.15 | −8816.45 | |||

| 14 | 863.15 | 2500 | −1636.85 | −49 | −1095.18 | −645.94 | −9137.94 | |||

| 15 | 1059.72 | 2500 | −1440.28 | −230 | −49 | −101185 | −699.54 | −9503.03 | ||

| 16 | 1006.73 | 2500 | −1493.27 | −49 | −1101.52 | −598.60 | −9751.66 | |||

| 17 | 956.40 | 2500 | −1543.60 | −49 | −1195.59 | −621.65 | −10,015.40 | |||

| 18 | 908.58 | 2500 | −1591.42 | −49 | −1294.26 | −644.10 | −10,293.13 | |||

| 19 | 863.15 | 2500 | −1636.85 | −49 | −1397.76 | −666.00 | −10,583.81 | |||

| 20 | 1059.72 | 2500 | −1440.28 | −230 | −49 | −1291.40 | −693.95 | −10,893.28 | ||

| 21 | 1006.73 | 2500 | −1493.27 | −49 | −1405.86 | −617.22 | −11,112.63 | |||

| 22 | 956.40 | 2500 | −1543.60 | −49 | −1525.91 | −641.43 | −11,349.65 | |||

| 23 | 908.58 | 2500 | −1591.42 | −49 | −1651.84 | −665.02 | −11,603.09 | |||

| 24 | 863.15 | 2500 | −1636.85 | −49 | −1783.94 | −688.01 | −11,871.79 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lewicki, W.; Niekurzak, M.; Koniuszy, A. Evaluation of the Possibility of Using a Home Wind Installation as Part of the Operation of Hybrid Systems—A Selected Case Study of Investment Profitability Analysis. Energies 2025, 18, 2016. https://doi.org/10.3390/en18082016

Lewicki W, Niekurzak M, Koniuszy A. Evaluation of the Possibility of Using a Home Wind Installation as Part of the Operation of Hybrid Systems—A Selected Case Study of Investment Profitability Analysis. Energies. 2025; 18(8):2016. https://doi.org/10.3390/en18082016

Chicago/Turabian StyleLewicki, Wojciech, Mariusz Niekurzak, and Adam Koniuszy. 2025. "Evaluation of the Possibility of Using a Home Wind Installation as Part of the Operation of Hybrid Systems—A Selected Case Study of Investment Profitability Analysis" Energies 18, no. 8: 2016. https://doi.org/10.3390/en18082016

APA StyleLewicki, W., Niekurzak, M., & Koniuszy, A. (2025). Evaluation of the Possibility of Using a Home Wind Installation as Part of the Operation of Hybrid Systems—A Selected Case Study of Investment Profitability Analysis. Energies, 18(8), 2016. https://doi.org/10.3390/en18082016