1. Introduction

Climate change has long ceased to be a distant threat, and in the modern period, it has become the leading cause of natural disasters, disrupting the delicate balance of our ecosystems and communities. To put it into more practical terms, this issue is highlighted by the rising frequency of severe weather events, which lead to catastrophes that destabilise economies, increase recovery costs, and mount public health challenges.

With the EU’s ongoing reputation as a fighter against climate change and its effects, we can assess that it takes the spotlight in the complex interplay between climate change risks and environmental governance. All issues related to climate change, including extreme weather events that lead to shifting ecosystems and subsequent economic disruptions, represent the butterfly effect dangers that require a coordinated, well-executed response. In contemporary times, the EU has been able to make significant progress towards well-thought-out and efficient environmental policies in a way to promote sustainability, with initiatives like the European Green Deal, the Emissions Trading System (ETS), and several renewable energy legislations demonstrating the EU’s commitment to lowering greenhouse gas emissions and transitioning to a low-carbon economy.

In response to these critical challenges, and given the EU’s ambitious goals in this area, we have decided to investigate the extent to which environmental fiscal measures serve as a practical and impactful tool for the European Union in its journey toward a more sustainable, low-carbon future. With this effort in mind, aided by economic and policy mechanisms, we aim to understand how fiscal measures can both deter harmful environmental practices and incentivise cleaner, greener alternatives.

While each perspective provides a thorough understanding on its own, interpreting the relationship between policy implementation and research activities is complex. The study of policies provides insight into how environmental fiscal measures are developed and implemented, while academic analysis demonstrates how the research community approaches the concepts of environmental taxation, decarbonization, and transition. Each alone lacks sufficient validity but combining the two permits this analysis to uncover a research need in the comparative assessment of environmental taxes, energy transition, and their larger socioeconomic implications.

Although the existing literature has deepened exploration of the role of environmental fiscal measures in reducing emissions or boosting renewable energy, studies such as those by Aydin and Esen [

1] have examined how green taxes specifically influence carbon reduction. Another noteworthy effort is the study by Andersson [

2], which focused on Sweden’s carbon tax as a single-country case. This pattern can be seen in many past efforts that investigated the link between fiscal policy and clean energy investments, mainly, again, from a national perspective. Furthermore, the majority of previous studies focused more on the effects of green taxes at the national level, avoiding the comparative dynamics among EU member states. Moreover, existing research pays limited attention to the correlation between environmental tax revenues, the macroeconomic context and the energy transition. This gap is essential because fiscal policies produce systemic effects that extend beyond the strict ecological sphere and influence other areas. Our study directly addresses this gap by employing an integrated approach that combines econometric analysis, a comprehensive policy review, and bibliometric mapping to offer a more expansive view of how environmental taxation actively supports the EU’s strategic shift toward a low-carbon, resilient economy.

Unlike prior research that concludes isolated factors, the uniqueness of this paper lies in its integrative approach, which combines panel data econometrics, bibliometric contextualization, and policy process analysis to assess the impact of environmental tax revenues on harmful emissions across EU member states. We offer a more comprehensive understanding of green fiscal policy within the context of climate-driven economic transformation. The double-faceted sword of our contribution: in terms of empiricism, it provides nuanced insights into the differentiated effects of environmental taxation on Carbon dioxide (CO2) emissions; and conceptually, it advances the understanding of fiscal-environmental trade-offs by highlighting the complex relationship between green taxation, employment in the environmental sector, and macroeconomic conditions. A key novelty is the implementation of a robust panel-data econometric framework, which enables us to assess the persistence and effectiveness of pollution-driven fiscal measures in promoting green economic sectors and advancing the transition to renewable energy. Additionally, our analysis uniquely incorporates macroeconomic context and market responses to environmental taxation, an often-overlooked aspect in environmental fiscal studies. By conducting a policy process analysis, we further examine the influence of global environmental governance, particularly the Paris Agreement, on the evolution of national fiscal strategies. A bibliometric review was employed to ground our empirical findings within the broader academic landscape, offering a meta-perspective on the discourse surrounding ecological governance and sustainable fiscal policy. Its goal is to provide policymakers, stakeholders, and researchers committed to creating a resilient and sustainable Europe with relevant insights and recommendations. The research underscores that well-targeted environmental taxes have a palpable impact on emissions. In this way, it can catalyse the transition to low-carbon economies and foster systemic change across sectors. Ultimately, this study contributes to the evolving discourse on green fiscal policy and its capacity to balance planetary costs with fiscal gains in the age of climate change.

To better integrate this study into the environmental landscape, we can place it within four fundamental theoretical perspectives. We begin with the Ecological Economics framework discussed by [

3], which focuses on integrating environmental constraints into economic decision-making and asserts that sustainable development must operate within ecological limits. This framework aligns with our study, as we assess how environmental tax revenue serves as both a fiscal and ecological tool to reduce emissions while supporting broader sustainability goals in the EU. Following this, the Policy Instrument Theory [

4] outlines the design governments use to implement fiscal instruments, which is relevant to our study, as it evaluates the effectiveness of environmental taxes as policy tools for emission reduction and sustainable economic transition. Lastly, the Just Transition Theory stresses equitable and inclusive pathways to a safe green transition. This perspective informs our research efforts, as it considers the long-term implications of fiscal environmental strategies within the framework of EU policies such as the Just Transition Mechanism, which will be discussed more thoroughly in the following section of this paper. Finally, the Pigouvian Tax Theory [

5] justifies the mandatory taxation of activities that generate negative externalities. Building on this foundation, our analysis assesses the impact of environmental tax revenues on pollutant emissions, reflecting the internalisation of environmental costs and its effectiveness in mitigating harmful emissions across EU member states.

Drawing on established theoretical perspectives in ecological economics, policy instrument theory, the principles of a just transition, and the economic framework of Pigouvian taxation, this study seeks to address a notable lacuna in existing literature. We aim to systematically connect environmental tax revenues with broader macroeconomic and socio-environmental dynamics across the diverse landscape of EU member states. Prior research, while valuable, has often focused on examining isolated effects, such as the impact of carbon pricing or the uptake of renewable energy. It has not comprehensively integrated fiscal instruments, their role in emissions reduction, and their broader implications for the labour market within a comparative European Union framework. To address this gap, the study formulates its core inquiries by investigating (Q1) “the impact of environmental tax revenues on CO2 across EU member states during 2012–2023”, and (Q2) “how macroeconomic conditions and social dimensions, influence the effectiveness of environmental taxation in reducing emissions”.

Drawing on the theoretical framework and empirical context, the study subsequently tests several hypotheses.

H1: Environmental tax revenues are negatively correlated with CO2, indicating that higher taxation contributes to lower pollution levels.

H2: Environmental tax revenues are positively associated with the share of renewables in the energy mix, thereby supporting the transition towards sustainable energy sources.

This study aims to add a valuable input to the literature and policy debate in three distinct ways. First, it seeks to address a research gap by evaluating the relationship between environmental tax revenues, renewable energy adoption, and emissions levels in a comparative EU framework, using a novel dataset covering 27 member states from 2012 to 2023. Second, we opted to connect ecological economics theories with policy design, and Pigouvian taxation in mind, to strengthen the theoretical foundation and provide a broader view of the balance between fiscal policy and environmental goals. Third, we aimed to provide a guide with practical intent for policymakers by demonstrating that tax revenues from environmental concerns can be successfully channelled into renewable energy production, technological innovation, and job creation, thereby promoting a just and sustainable energy transition. By combining these three pillars, the study proposes fresh empirical findings while directly addressing key EU priorities such as the European Green Deal, post-Paris climate commitments, and current concerns over energy security. Some questions that have arisen in our efforts are whether these taxes encourage higher adoption and consumption of renewable and waste-based energy. How do GDP per capita and employment in green sectors influence the effectiveness of environmental taxation in reducing emissions? As we examine this at the EU level, it is crucial to determine if there are notable differences between EU countries in how environmental taxation supports decarbonization and energy transition.

The existing literature on environmental taxation and the energy transition within the European Union can be broadly divided into two complementary strands. The first strand focuses on policy and institutional analysis, investigating multi-level legislative frameworks and how fiscal instruments can aid the EU’s transition toward a low-carbon economy. The second strand focuses on academic and scientific research, aiming to explore how the scholarly community conceptualises and evaluates environmental taxation, decarbonisation, and the energy transition.

This comprehensive literature review is thus structured to reflect these two dimensions. The following section explores the world of policy analysis, aiming to understand the intricate dynamics of the EU governance framework and the instruments it uses to facilitate environmental fiscal policy. Up next, our bibliometric analysis of

Section 2.2. would aid in creating an academic map that follows trends and highlights existing gaps in scholarly discourse.

While each perspective offers a comprehensive insight on its own, it provides an interpretation of the interconnection between policy implementation and research efforts. Policy analysis offers insight into the mechanisms of creating and using environmental fiscal measures. The academic analysis demonstrates how the research community approaches the concepts of environmental taxation, decarbonization, and transition. Each alone doesn’t hold enough validity, but by integrating both, this review is able to identify the research gap concerning the comparative assessment of environmental taxation, the energy transition, and their broader socio-economic impacts.

Following the introductory part, this research is backed by a literature review that finds divided into two sections. The first part presents a policy breakdown that addresses the key elements of global climate governance, while the second part provides a bibliometric analysis covering the period from 2015 to 2025, as many climate agreements and carbon targets use 2015 as a reference year (e.g., the 2015 Paris Agreement). In the methodology of our panel data model, we employed additional analytical tools, including graphical descriptive analysis, a correlation matrix, OLS regression analysis, and the Hausman test. Finally, we reached a culmination of our efforts in the last section, where we presented the conclusions.

2. Literature Review

2.1. Policy Analysis

The pathway to a sustainable Europe lies in implementing environmental tax regulations. To answer this, we analysed the main EU-level governance frameworks, focusing on their relevance to our research questions and hypotheses. A safe transition towards a sustainable Europe will require implementing various policies to ensure a low-carbon economy. From rebranding harmful activities to implementing targeted incentives and penalties, the EU aims to create a greener, brighter future. In this section, we have structured the discussion under clear subheadings and emphasised analytical connections, focusing on how each policy affects emissions, fiscal revenues, renewable energy adoption, and socio-economic outcomes, rather than providing a purely descriptive narrative.

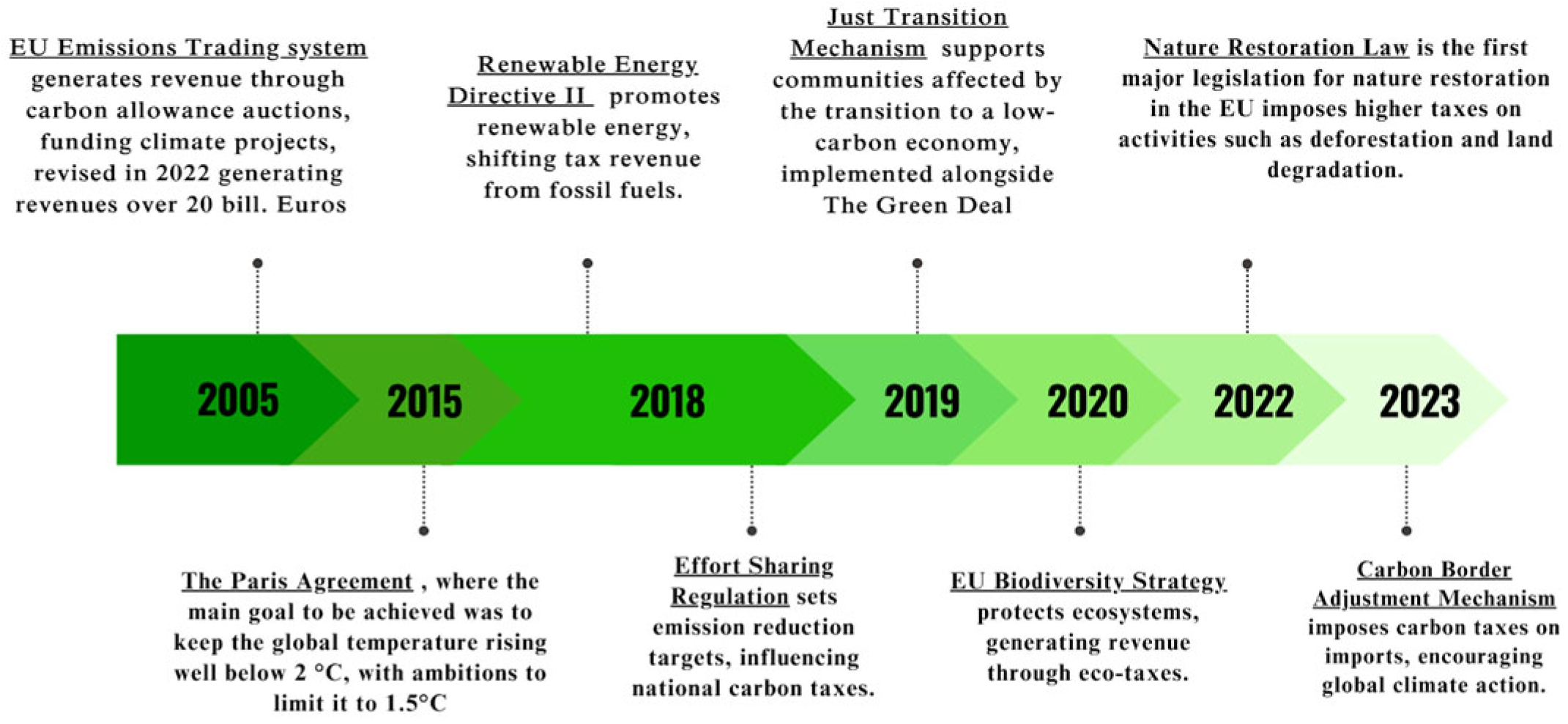

Figure 1 showcases the implemented policies within the European Union from 2005 until 2023.

The European Union is implementing key policies to transition toward a sustainable, low-carbon economy, focusing on financial incentives, regulatory measures, and equitable socio-economic mechanisms. The theoretical framework guiding our analysis is based on Policy Implementation & Effectiveness (Sabatier & Mazmanian, 1980) and Multi-Level Governance (Hooghe & Marks, 2001) [

6,

7]. These theories inform our assessment of EU environmental tax policies, considering both their implementation and effectiveness across multiple levels of governance, including the roles of various economic actors beyond the government.

A selection of the most relevant implemented policies has been thoroughly chosen based on their effectiveness and applicability to the scope of this study, particularly their links to environmental tax revenues, emissions, and energy transition.

The Just Transition Mechanism (JTM) [

8] originated as a progressive movement established in the US in the 1980s to assist workers and businesses transitioning to a greener economy. Unlike other mechanisms that primarily target emissions through market-based pricing, such as ETS or CBAM, JTM focuses on the social and labour dimensions of decarbonisation, ensuring equity and inclusion in the transition. It provides financial support, retraining programs, and social protection for regions and employees transitioning from high-emitting industries.

Following discussions about smoother transition modalities post-Paris Agreement (2015), which aimed to keep global temperature rising well below 2 °C, with the ambition to limit it to 1.5 °C, the world is now facing significant challenges. The 2016 European Commission initiative promised clean energy for all EU citizens. Following the Paris Agreement (2015), the EU launched the Renewable Energy Directive (EU) 2018/2001; Renewable Energy Directive (RED II) to accelerate the transition from fossil fuels to renewable energy sources. Unlike JTM, which addresses social aspects, RED II focuses on technological and investment drivers of decarbonisation, thus informing (H2) on the positive relationship between environmental tax revenues and renewable energy deployment.

Moreover, the EU Emissions Trading System (EU ETS) incentivises member states to trade carbon allowances, generating revenue (over €20 billion in 2022). Members can access these funds to support countries facing challenges in transitioning to cleaner technologies. Compared to RED II, which sets renewable production targets, ETS functions as a fiscal tool, using market-based incentives to internalise environmental costs, directly impacting (Q1) CO2, and supporting (H1), which proposes a negative correlation between environmental tax revenues and emissions. We highlight the mechanisms of revenue recycling and fiscal efficiency here, demonstrating how carbon dividends or targeted reinvestment can reinforce policy effectiveness. Together with RED II, ETS illustrates the dual nature of EU climate governance—combining regulatory and fiscal mechanisms.

Complementing ETS, the Effort Sharing Regulation (ESR) sets targets for GHG emission reduction by 2030 for all EU states. The state is encouraged to implement customised carbon taxes for specific industries not covered by the EU ETS, such as energy efficiency regulations, higher fuel taxes to encourage cleaner modes of transportation, levies on high-emission buildings, and agricultural policies that lower emissions of nitrogen oxide and methane. Unlike ETS, which operates at the supranational level, ESR decentralises responsibility, requiring member states to design national-level carbon-pricing and taxation strategies. This makes it a key example of multi-level governance in action. This exemplifies multi-level governance in action and directly relates to (Q1) and (H1) by focusing on national efforts to reduce emissions through varied fiscal and regulatory measures.

The EU has also committed to the Biodiversity Strategy for 2030 and implemented the Nature Restoration Law, which expands environmental governance beyond emissions, introducing fiscal mechanisms to promote sustainable land use and prevent ecosystem degradation. This policy framework is directly connected to the study’s research questions (Q1), as it explores how fiscal mechanisms influence not only emissions reduction but also broader socio-environmental outcomes. Specifically, it aligns with (H1) by contributing indirectly to the reduction of CO2 through improved land-use practices, and with (H2) by supporting the sustainable management of natural resources that complement renewable energy expansion.

As a final point, the Carbon Border Adjustment Mechanism (CBAM) was designed to ensure that all goods intended for import are subject to the same carbon price as products made within the EU. This is intended to serve as a protective device for domestic industries against disadvantages in their pursuit of environmental regulations, thereby creating a level playing field and ensuring that carbon-related taxes remain within the EU. Acting as a contrast to the internally oriented ETS and ESR, CBAM expands fiscal environmental power externally, addressing competitiveness and carbon leakage. By extending fiscal environmental regulation beyond EU borders, CBAM directly relates to (Q1) and (H1) through its role in reducing global CO2 and indirectly supports (H2) by reinforcing incentives for cleaner production and renewable energy adoption within the EU.

These policies reflect the logic of multi-level governance, where EU, national, and regional actors interact, and their effectiveness depends on combining fiscal incentives, regulation, and social protection. Together, they illustrate how climate strategies balance economic, environmental, and social objectives to support a fair and sustainable transition. Overall, we can conclude that while ETS and CBAM represent instruments of the fiscal market, ESR introduces decentralised national responsibility, RED II targets renewable supply, and JTM ensures social fairness. Together, they form a complementary policy mix linking taxation, emissions reduction, and socio-economic transition. A summarisation of the key EU environmental policies is presented in

Table 1.

Together, these policies illustrate how distinct fiscal and governance mechanisms support Europe’s decarbonisation, directly linking to our research questions and hypotheses on emissions (Q1/H1), and renewable energy (Q2/H2).

2.2. Bibliometric Analysis: Trends, Clusters, and Emerging Topics in Environmental Taxation

Building on the insights from the policy review, which detailed multi-level governance, fiscal mechanisms, and socio-economic dimensions of EU environmental policies, we complement this qualitative perspective with a bibliometric analysis. While the policy review identifies and interprets the practical and regulatory context, the bibliometric analysis systematically maps the academic landscape, revealing dominant research themes, emerging topics, and gaps in the literature. Together, these approaches provide a comprehensive understanding of both policy implementation and scholarly discourse, ensuring that our empirical study is grounded in robust theoretical, practical, and research-based evidence.

The literature on environmental issues is vast and complex, yet it provides valuable insights by synthesising existing knowledge and facilitating research efficiency. We aim to assess the current state of knowledge in this field and conduct a detailed bibliometric analysis as a starting point for future research. This literature is often contextualised within global climate change governance and related policy frameworks. To understand why world governments are struggling in their battle against climate change, we introduce key terms related to its primary drivers.

Therefore, we decided to adopt the bibliometric analysis method, which, according to IGI Global (2014), involves the quantitative assessment of the academic quality of journals or authors using statistical techniques, such as citation rates. Although bibliometric analysis offers multiple mapping techniques such as co-citation, bibliographic coupling, and co-authorship networks, this study deliberately focuses on keyword analysis. This choice is based on two primary reasons. Firstly, keyword mapping enables a direct identification of dominant research themes and conceptual clusters in environmental fiscal policy, which aligns with our interest in linking fiscal revenues, emissions, and renewable energy. Secondly, it is particularly effective for synthesising a fragmented body of literature and visualising its thematic structure, thereby complementing the preceding policy analysis by providing a conceptual map.

While keyword analysis offers a quick and straightforward overview of the thematic framework, it is essential to acknowledge its limitations. This approach does not capture the epistemological relationships or the genealogy of ideas (as co-citation analysis would), nor does it reveal collaboration networks between authors or countries. However, for the specific objectives of this study, which prioritise identifying dominant themes and conceptual gaps, these aspects are considered secondary. Its primary value lies in highlighting where the literature concentrates (e.g., on CO2, carbon tax, renewable energy) and, crucially, in pinpointing research gaps directly related to our research questions and hypotheses (Q1–Q2, H1). For instance, it can reveal whether critical policy dimensions, such as “employment” or “just transition,” appear only marginally in academic discourse, despite their centrality in EU policy frameworks.

The first step in this analysis involves defining precise quality criteria, followed by implementing suitable methods and selecting the proper empirical analysis. However, some missteps in understanding quality can occur. This is why we wanted to choose the most pertinent contributions in this field. Among all the tools capable of aiding this research, the VOSviewer 1.6.20 software was used to organise the articles produced in this research area, as it is the most sought-after among modern research methods. VOSviewer was chosen for this bibliometric analysis due to its accessible interface, strong compatibility with major academic databases, robust capabilities for visualising keyword citation networks, and its purpose-built nature for bibliometric mapping.

Keyword mapping does not expose the epistemological relationships or the historical development of ideas, as co-citation analysis would, nor does it reflect collaboration networks between authors or countries. Nevertheless, for the objectives of this study, these aspects are considered secondary. In our case, the keyword mapping serves as a magnifying glass to reveal where the literature of interest concentrates.

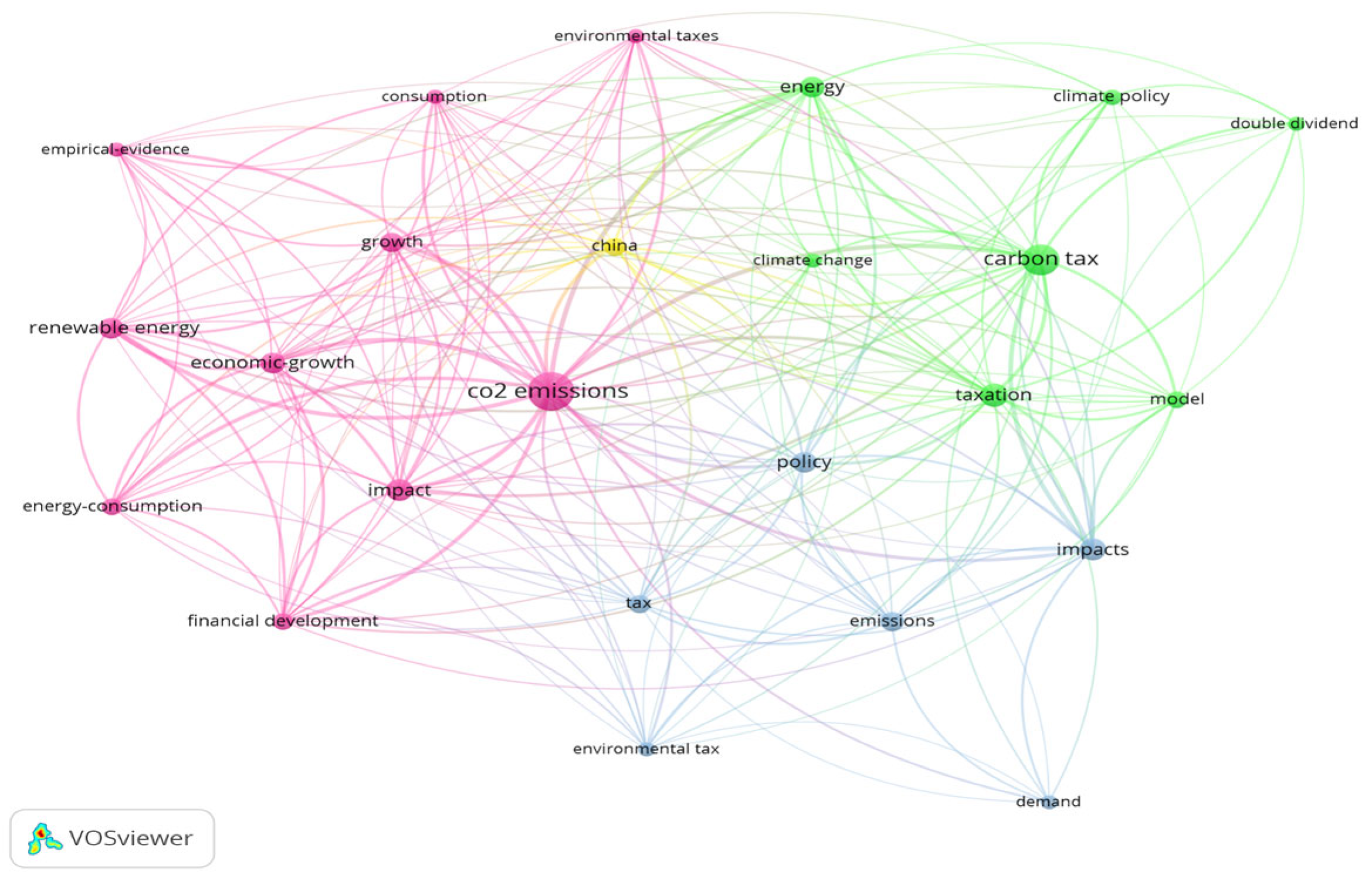

Figure 2 illustrates the entire process through which the articles are compiled and used to create bibliometric networks. Using the Web of Science Core Collection database, we identified three key concepts: “CO

2 Emissions”, “Impact”, and “Environmental tax revenue”. We then selected “Articles” as the document type, yielding an initial result of 546 records. Finally, the analysis period was defined as 2015–2025, as many climate agreements and carbon targets use 2015 as a reference year (e.g., the Paris Agreement, signed in 2015). Selecting the 2015–2025 window helps track progress toward those goals. Therefore, this refinery’s Web of Science results offer 171 entries, which are downloaded as a .txt file, entered into the VOSviewer application, and analysed according to the procedure (

Figure 2).

Although bibliometric analysis encompasses a range of science-mapping techniques, this study focuses exclusively on keyword mapping. This selective approach allows us to efficiently capture the main research themes, trends, and knowledge structure in environmental fiscal policy, providing a targeted complement to the preceding policy analysis. Keyword analysis helps us count and expose the most frequently occurring keywords. The primary objective of this procedure is to extract the words most commonly used by authors in the context of environmental fiscal revenue related to noxious emissions. Using the keywords “CO

2 emissions”, “Impact”, and “Environmental tax revenue” in the initial search, the VOSviewer software also highlights us other keywords frequently encountered in these articles, such as: “economic growth”, “policy”, “climate change”; “renewable energy”, and “consumption”, all of which show high occurrence levels.

Figure 3 illustrates these keywords and their connections, along with additional information. This figure represents the most important keywords and their connections. The knots and the more prominent keywords indicate the frequency of occurrence of those words in the articles. Moreover, their connection is much weaker when the distance between the knots is greater. Thicker lines also mean a higher frequency of coincidences.

The word groups are roughly similar in size. However, the largest cluster is the pink one, which contains keywords such as “CO

2 emissions”, “financial development”, “renewable energy”, and “growth”, reflecting a strong focus on the environmental and economic impacts of emissions, directly informing (Q1, H1) on fiscal–emissions linkages. The next group by size is the green one. This cluster emphasises the policy-oriented aspects of environmental governance, including terms such as “climate change”, “carbon tax”, “taxation”, and “climate policy”, and highlights regulatory and fiscal measures relevant to (H2) on renewable energy and fiscal instruments. The following blue cluster encompasses keywords such as “impact”, “policy”, or “demand”. These terms represent broader conceptual and analytical perspectives, linking the empirical and theoretical dimensions of environmental taxation and emission effects. The last cluster, represented by the colour yellow, consists of a single keyword, “China.” This indicates a significant geographical focus in the literature, as China is frequently studied as a major emitter and case study in environmental fiscal policy research. The following table,

Table 2, can help further understand the figure:

The bibliometric analysis demonstrates that the selected keywords influence all clusters and reveals a strong interconnectedness among core terms, with each thematic cluster contributing uniquely to the broader discourse on environmental sustainability and economic impact, revealing where academic attention aligns or diverges from EU policy priorities, such as employment and just transition. Notably, the recurring presence of terms such as carbon footprint, climate policy, and carbon tax across clusters highlights the central issues under discussion. The appearance of “China” as a standalone cluster reflects the country’s central role in current research, serving as a gateway to the geographical dimension of analysis.

This keyword mapping reflects broader societal and policy concerns, including institutional responsiveness, structural adaptation, and the tangible influence of environmental fiscal revenue on emissions. The relevance of our research topic continues to grow, particularly in examining the impact of environmental taxes on noxious emissions in the EU, especially in the context of recent socio-political changes. This integration underscores the complementarity between bibliometric and econometric analyses, clarifying how literature trends, thematic clusters, and gaps directly inform variable selection, empirical design, and hypothesis testing in the subsequent econometric section, ensuring a coherent mixed-methods approach.

This bibliometric analysis not only maps the intellectual structure of research on environmental taxation but also establishes the conceptual foundation for the econometric investigation that follows. By identifying dominant themes, clusters, and research gaps, the bibliometric results directly inform the study’s empirical framework. Specifically, the clusters centred on “CO2 emissions”, “carbon tax”, and “renewable energy” align with our research questions (Q1–Q2) and hypotheses (H1–H2), guiding the operationalisation of key variables, including fiscal revenues, emission intensity, and renewable energy uptake. The bibliometric insights thus provide theoretical validation for the econometric model, ensuring that the quantitative analysis builds upon established scholarly discourse rather than isolated empirical assumptions. This integration underscores the complementarity between the bibliometric and econometric components, demonstrating how qualitative mapping and quantitative testing jointly contribute to a comprehensive understanding of environmental fiscal policies and their socio-economic outcomes.

3. Materials and Methods

3.1. Methodology

The primary objective of this inquiry is to investigate the complex relationship between environmental tax revenue and harmful emissions. Beyond this core relationship, the study seeks to explore the effects of this type of fiscal regulation, particularly in mitigating the impact of climate change, ensuring social needs are met, and supporting the transition towards a low-carbon economy. To achieve these objectives, our econometric model extends beyond just environmental tax revenue by incorporating several key control variables. GDP per capita to account for the effect of economic growth on emissions, employment in the environmental goods and services sector to capture the social dimension and just transition considerations, and renewable energy consumption to reflect the decoupling of emissions from energy production. These choices are rooted in extensive literature demonstrating the influence of economic activity on emissions, the social implications of climate policies, and the role of renewable energy in decarbonization efforts.

Our analysis utilises panel data for the 27 European Union member states over the period 2012–2023. This specific timeframe was selected because it captures a critical phase in EU climate governance, including pre- and post-Paris Agreement implementation, the launch of the European Green Deal, and responses to the 2021–2022 energy crisis. This allows for the analysis of both policy evolution and fiscal impacts. All quantitative variables were checked for outliers and, where appropriate, transformed to ensure linearity and normality assumptions for the regression analysis.

Furthermore, thematic graphical representations illustrate the geographical distribution and intensity of selected variables across the EU, highlighting differences among member states. Our graphical visualisations and econometric analysis were created using Excel and EViews 12 software and R 4.5.2., respectively.

As a next step, we used a correlation matrix, a tool designed to identify relationships, collinearity, and interaction patterns among key variables, thereby informing further modelling. This step is mandatory for understanding preliminary associations and for informing subsequent econometric modelling, particularly to avoid multicollinearity issues.

Following this, we have also employed an OLS regression analysis to assess the significance levels of our primary variable, environmental tax revenue, across all employed indicators. To determine the appropriateness of the Fixed Effects versus the Random Effects model, we conducted a Hausman specification test. This test is designed to compare the consistency of these two types of models, yielding a p-value that is well below the 5% significance threshold. Additionally, we test for autocorrelation, heteroscedasticity, multicollinearity, and variable stationarity to ensure the robustness of our results.

To ensure the robustness and validity of our econometric results, several diagnostic tests were performed: Panel unit root tests (Im–Pesaran–Shin) were conducted to assess the stationarity of all variables, preventing spurious regression results. Tests for serial correlation (Wooldridge test for panel data) will be applied to detect the presence of autocorrelation within panels, and the Breusch-Pagan test will be used to check for heteroscedasticity, indicating non-constant variance of the error terms. The outcomes of these tests will guide necessary adjustments to the models (e.g., using robust standard errors and transforming variables) to ensure the reliability and efficiency of the estimates. To address the importance of fully documenting these checks, the detailed results of all relevant diagnostic tests are now included in

Appendix A.

To give a more palpable view, the general OLS model is presented as follows:

The elements in our first equation can be interpreted as follows: Y is the dependent variable, 0 is the intercept, and the values from 1 to n are the coefficients of the independent variables. X1 to Xn represent the explanatory variables, and ε is the error term. OLS estimates the coefficients by minimising the sum of squared residuals, providing a baseline for examining the relationships between variables.

In empirical panel data analysis, OLS is often used as a baseline, but unobserved heterogeneity can bias its results [

9]. To overcome this issue, fixed effects (FE) and random effects (RE) models are often used. The FE technique is beneficial when unobserved, time-invariant attributes vary across nations since it accounts for these individual-specific effects and helps to avoid endogeneity difficulties [

10]. In contrast, the RE model implies that country-specific characteristics are uncorrelated with the explanatory variables, making it more efficient when this assumption holds.

Given that the EU Member States studied exhibited both structural differences and common characteristics, it is essential to test both the FE and RE specifications. This allows us to capture country-specific variability while also considering the possibility that some of this heterogeneity is due to random factors.

With all these criteria in mind, we are now prepared to test the influence of environmental fiscal revenues on CO

2 emissions through regression analysis. We have also added three more independent variables to make the model more practical. We intend to examine the robustness of our results by testing various regression models, including ordinary least squares (OLS), fixed effects (FE), and random effects (RE) models. The basic form of the regression equations tested (2) is outlined as follows:

To make this model more understandable, we can acknowledge that CO2 it acts as the dependent variable, with 0 as the intercept specific to each country (i = 1,…, 27), and the observed period from t = 2012 to 2023. From 1 to 4, we display our estimated coefficients corresponding to the four explanatory variables, and the last one stands for the error term.

We implemented log-transformations for several variables to meet the assumptions of the econometric models, stabilise variance, reduce skewness, and address potential non-linear relationships. We acknowledge that the exact application for each variable was not explicitly detailed, and this omission will be rectified by clearly stating the transformed variables.

Specifically, CO

2 emissions, GDP per capita, Environmental Tax Revenue, and Renewables Supply were all transformed using the natural logarithm. The general form of our econometric model, incorporating these transformations, is now presented as follows:

This explicit representation clarifies the functional form of the relationships being investigated, particularly highlighting where coefficients can be interpreted as elasticities, offering greater precision in our analysis.

The tools used to generate our graphical depictions and econometric analysis were Excel and EViews, respectively. Excel is primarily a graphical tool, while EViews serves as both the main tool for econometric analysis and an aid for graphical representations.

This approach provides a clearer understanding of the effectiveness of environmental taxation policies and identifies areas that require adjustments. Ultimately, the analysis aims to support policymakers and stakeholders in making evidence-based decisions that increase the effectiveness of policies and contribute to a more sustainable future.

3.2. Data

The primary objective of our research is to provide a meticulous breakthrough in understanding how environmental fiscal policies shape the level of emissions. The indicators chosen for this study were carefully selected for their direct relevance to both the measurable outcomes of emissions and the specific instruments of fiscal policy.

To better understand our indicators, their representation, and the units of measure, we have presented these facts in

Table 3. To gather the yearly data needed to build the dataset, all indicators were collected from Eurostat due to its comprehensive coverage of the European Union, the central geographical focus of our study. Specific Eurostat datasets utilised include: “Environmental taxes by economic activity”, “Greenhouse gas emission statistics”, “Renewable energy statistics”, “Employment in environmental goods and services sector”, and “GDP and main components”. The resulting database is a panel-type dataset, covering annual data for all 27 EU member states from 2012 to 2023. This timeframe was chosen explicitly as it captures a phase in EU climate governance, including the pre- and post-Paris Agreement implementation, the launch of the European Green Deal, and the responses to the 2021–2022 energy crisis. This period also allowed us to ensure optimal data availability and consistency across all 27 EU member states for the specific variables central to our analysis (CO

2 footprint, environmental tax revenue, GDP per capita, and the supply and transformation of renewables). This period allows us to capture a contemporary and relevant decade of environmental policy development and economic shifts within the European Union, following major economic adjustments and preceding significant climate policy acceleration. Ensuring comprehensive and harmonized data series for all variables across a diverse set of countries like the EU27 naturally constrained the optimal starting and ending points, thereby maximizing the robustness and comparability of our panel dataset.

All the aforementioned indicators were harmonised to ensure comparability. GDP per capita values were adjusted for constant prices to account for inflation, while other variables were converted into consistent measurement units where necessary. Missing data were addressed through interpolation when feasible (linear interpolation for minimal gaps); otherwise, incomplete observations for specific country-year instances were removed, leading to a broadly balanced panel. While our dataset provides a robust foundation for the econometric analysis, we acknowledge certain data-related considerations that inform our interpretation and potential avenues for future research. One inherent limitation pertains to unobserved heterogeneity across EU member states. Although the Fixed Effects model effectively controls for time-invariant, country-specific characteristics, thereby mitigating bias, it implies that certain nuanced national specificities or long-standing structural differences may not be fully captured by our observed covariates alone. This underscores the complexity of cross-country analyses and the persistent challenge of fully accounting for diverse institutional and economic frameworks.

Table 3. contains the operational definitions of key indicators, including the unit and the source for each indicator.

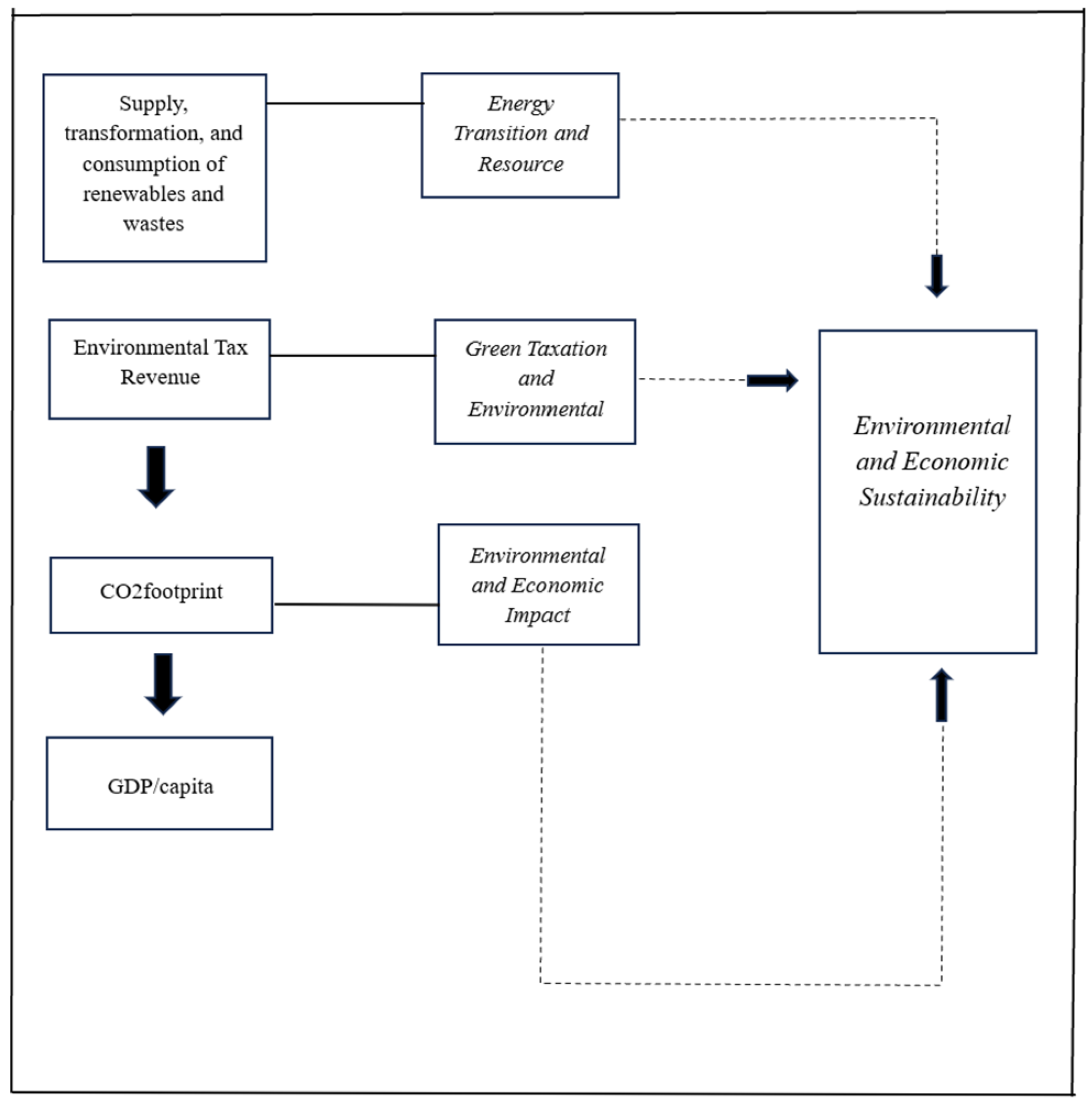

To enhance the clarity of our analysis, these indicators have been thoughtfully organised into three foundational pillars. The first pillar, Energy Transition and Sustainability, is the supply, transformation and consumption of renewable energy and waste. Moreover, it captures the dynamics of renewable energy adoption, the integration of waste-derived energy, and the overall progress of the EU’s energy transition. The second pillar, Environmental Fiscal Policies, is measured through environmental tax revenue, which reflects the magnitude and evolution of fiscal instruments aimed at internalising environmental externalities and steering behaviour towards low-carbon and energy-efficient practices. The third pillar, Environmental and Socio-Economic Impacts, combines both outcome and control variables. CO2 footprints serve as the primary environmental outcomes, measuring the extent to which fiscal and regulatory frameworks succeed in reducing harmful emissions. Employment in the environmental goods and services sector captures the socio-economic effects of the green transition, particularly in renewable energy and sustainable industries. At the same time, GDP per capita serves as a macroeconomic control variable, reflecting a nation’s capacity to implement effective policies.

The availability and completeness of data for this exact period were decisive in its selection, ensuring consistency across all indicators and enabling a balanced panel structure in which each country has observations for all years.

Figure 4. A detailed visual representation of these indicators.

By structuring the dataset around these three pillars, the study not only provides a coherent framework for understanding the interplay among fiscal measures, the energy transition, and environmental outcomes but also lays a strong foundation for applying a multidimensional methodological approach. The dotted lines in the figure generally represent feedback loops, or secondary effects between variables, in contrast to the solid arrows, which show influential relationships.

All quantitative variables were meticulously checked for outliers. Where appropriate, variables such as GDP per capita and environmental tax revenues were log-transformed to ensure linearity, address potential heteroscedasticity, and promote normality assumptions required for robust regression analysis. Regarding missing data, Eurostat’s high data quality and the chosen period indicate that the panel dataset is mainly balanced. Any sporadic missing observations were addressed through linear interpolation when feasible and when the proportion of missing data was minimal (less than 5% for a given series), to maintain data integrity without introducing significant bias. Series with substantial gaps were excluded or carefully considered for alternative measures.

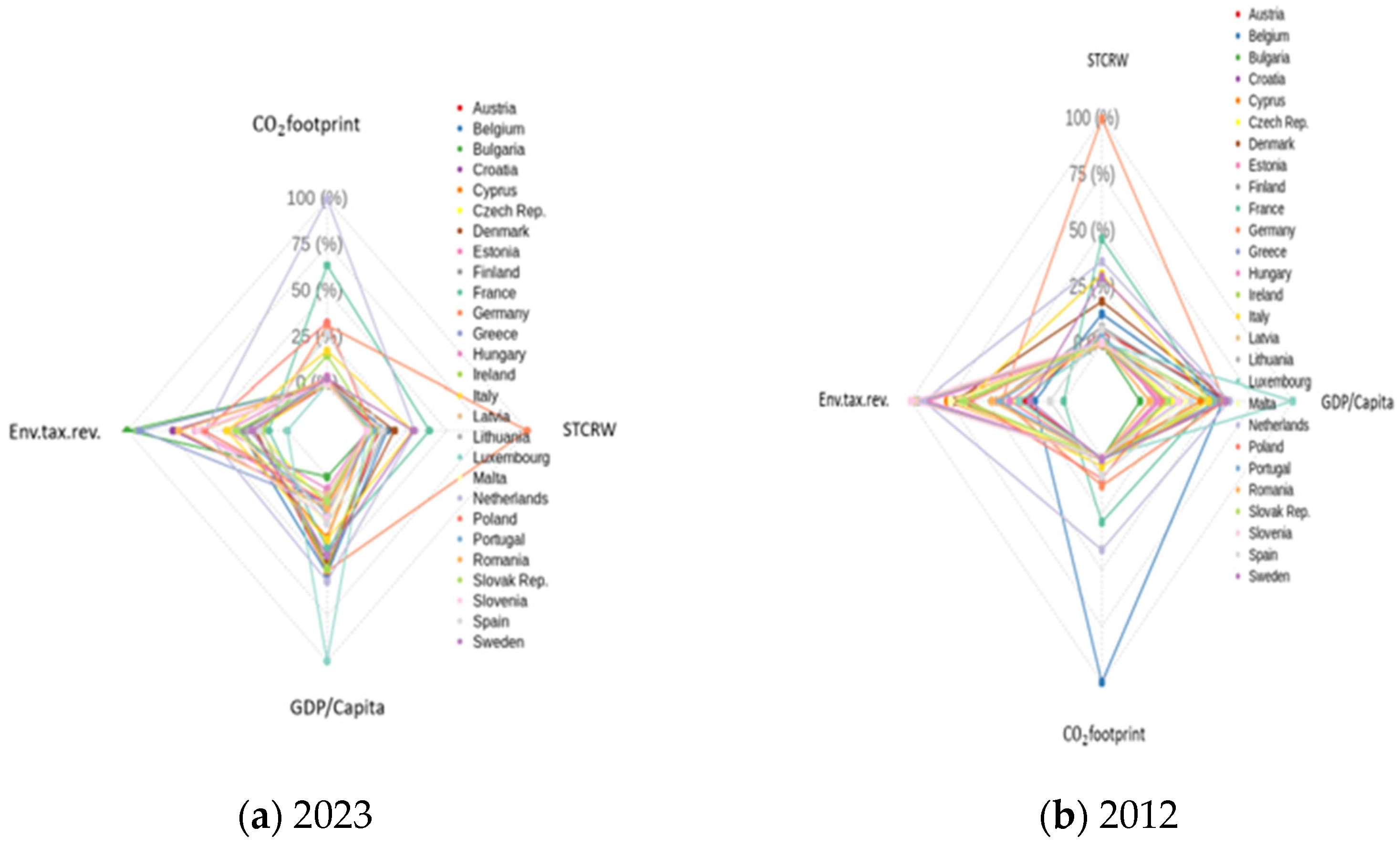

Figure 5 illustrates the visual representation of indicators, highlighting trends and distributions.

A visual examination of

Figure 5, comparing data from 2012 and 2023, unveils a dynamic landscape where country-specific disparities persist, yet their manifestations have evolved across various dimensions. We observe that certain nations consistently exhibit higher GDP per capita values and, regionally, stronger environmental tax revenue. This not only highlights ongoing economic disparities but also reflects the varying maturity levels of environmental fiscal instruments among member states, as presented by Castiglione et al. [

11]. Furthermore, noticeable peaks in CO

2 footprint and greenhouse gas emissions suggest distinct energy intensities and diverse sectoral structures, implying varied decarbonization trajectories across the analysed countries, as seen in Kryk & Guzowska [

12]. Conversely, elevated figures in the supply, transformation, and consumption of renewables and wastes signal a more advanced energy transition in specific states. This transition is driven by sustained investments and robust policies that have fostered the accelerated adoption of renewable energy sources and waste utilisation, as related by Bórawski et al. [

13]. Collectively, these patterns reveal a complex interplay of moderate convergence in some aspects and pronounced structural differentiation in others, with advancements selectively observed across both economic and sustainability metrics throughout this period.

We expect to gain a general understanding of the levels of EU countries across three key indicators: carbon dioxide emissions, GDP/capita, and the supply, transformation, and consumption of renewables. For this reason, we have decided to implement graphical representations depicted in

Figure 6,

Figure 7 and

Figure 8. They are generated for the most recently analysed year, 2023, to uncover valuable insights into environmental governance, sustainability, and economic activities related to environmental protection. The selection was intended to highlight the vital role our indicators play in environmental governance and climate change mitigation.

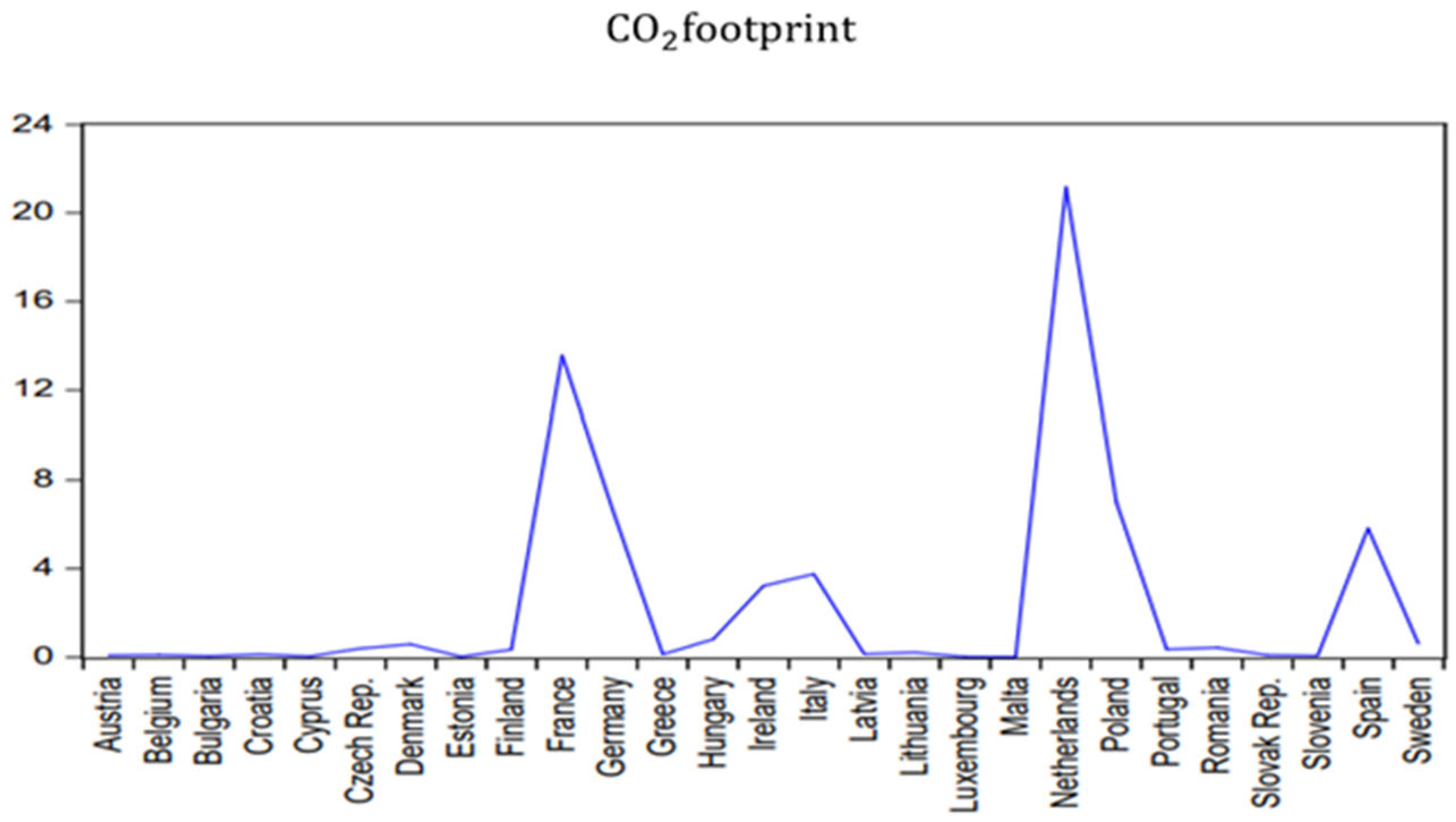

Figure 6 illustrates the CO

2 footprint across EU member states in 2023. This indicator, representing the total volume of carbon dioxide generated directly and indirectly by various activities, is central to our assessment of the effects of environmental tax revenues. The graphic reveals a clear variation in CO

2 levels across the EU. Countries like the Netherlands and Finland, followed by Sweden and France, exhibit higher CO

2 footprints. This suggests significant differences in energy mix, industrial intensity, and consumption patterns among member states, factors that the Fixed Effects model helps to control for in our econometric analysis.

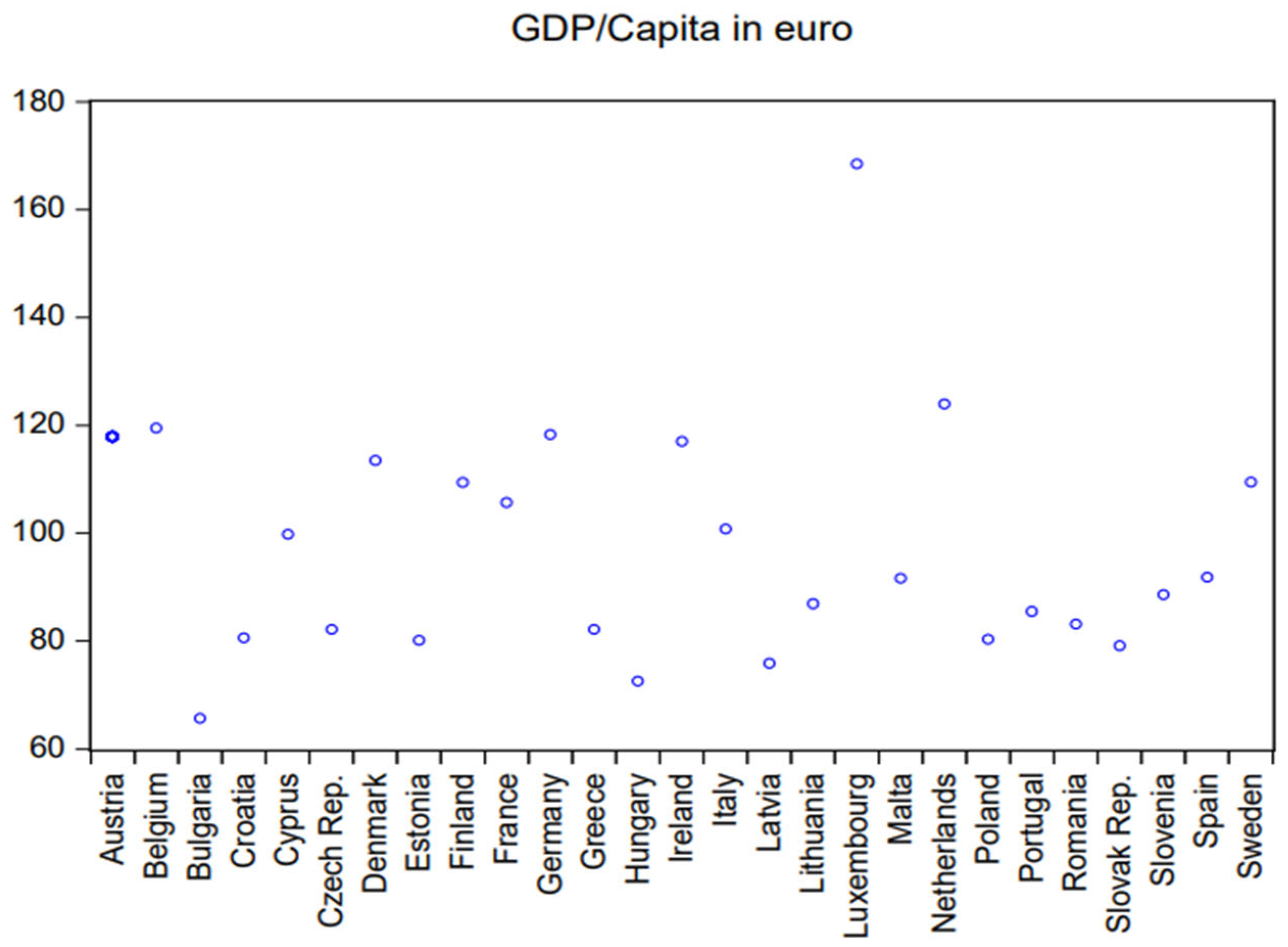

Up next,

Figure 7, the scatter plot depicted above reveals the levels of GDP/Capita. Luxembourg stands out as a clear outlier with the highest figure, reflecting its strong financial sector and small population. Other high-income countries, such as Ireland, the Netherlands, Austria, and Sweden, also show significantly higher GDP per capita. In contrast, Southern and Eastern European countries, including Bulgaria, Romania, Greece, and Latvia, record much lower GDP per capita (ranging from approximately 70 to 85). Most countries cluster in a moderate-income range (between 80 and 120). This chart highlights a significant wealth disparity across the EU, with richer Western members contrasting sharply with lower-income Eastern and Southern members. This economic gap is an essential control variable in our regression analysis, as it can influence countries’ capacity to invest in renewables and implement effective environmental policies.

Figure 8 illustrates the supply, transformation, and consumption of renewable energy and waste (measured as a percentage of gross final energy consumption) at the EU level in 2023. This is a relevant indicator for our analysis, as it illustrates the cycle of matter from waste to renewal. Germany dominates by far, with the highest renewable and waste energy use, reflecting its large economy and Energiewende policies. France, Sweden, Italy, and Spain follow with substantial renewable use. Many smaller or less industrialised economies, such as Malta, Cyprus or Luxembourg, show very low values. Eastern European countries, such as Poland, Romania, and Bulgaria, remain at the lower end, indicating slower adoption of renewable energy.

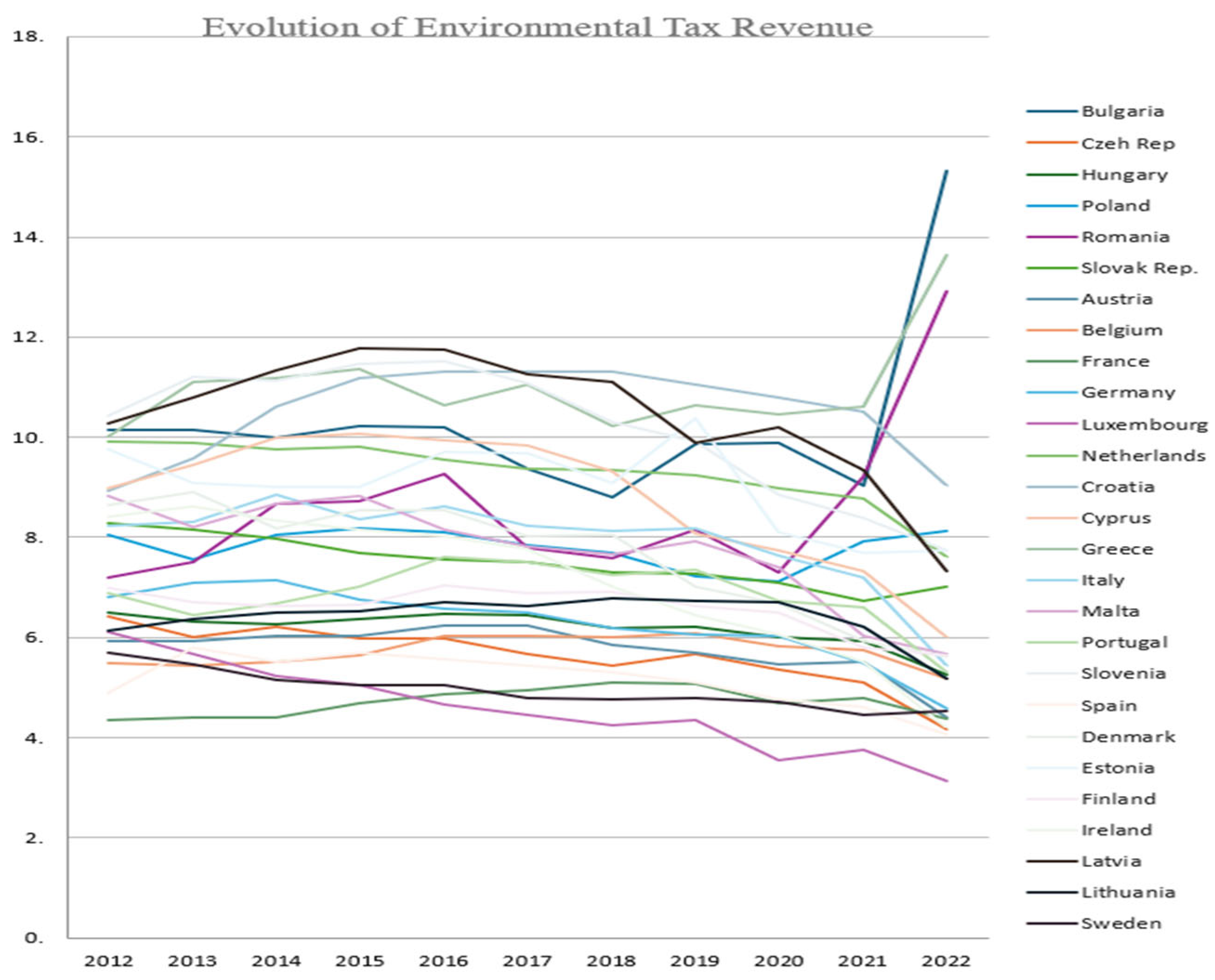

To better understand the evolution of our primary indicator, environmental tax revenue, we examine

Figure 9, which shows the indicator’s evolution over time across all states. Environmental tax revenue serves as a vital instrument within the European Union, aiming to deter environmental degradation and contribute to the sustainable development agenda. Its modifications over time reflect evolving environmental goals and increasing commitment to ecological responsibility. Since its implementation, this revenue has been modified to align with changing environmental goals and an increasing commitment to ecological responsibility. Here, we can gain a better understanding of each country’s evolution in terms of environmental tax revenue. Notably, the most developed countries appear to have the highest environmental tax revenues, as levels of CO

2 emissions, pollution, and other environmentally harmful activities tend not to rank at the top on charts.

The chart in

Figure 9 shows the evolution of environmental tax revenues across EU countries from 2012 to 2023. Countries like Germany, Italy, and France show prominent trends, with Germany and Italy experiencing strong growth after 2014, and France exhibiting a particularly sharp surge after 2020. Poland also records a notable increase starting in 2014, accelerating significantly by 2022. Belgium and the Czech Republic display steady growth, while most other countries remain relatively stable with lower revenue levels. These shifts likely reflect significant policy changes in 2014, possibly linked to EU green taxation strategies, and the sharp increases after 2020 suggest the combined effects of post-COVID economic recovery and higher energy-related taxes during the energy crisis. Smaller economies generally show less fluctuation and lower revenue levels throughout the period. This temporal evolution is critical for our panel data analysis, allowing us to capture the dynamic impact of environmental fiscal policies on emissions.

4. Results and Discussions

To establish a preliminary understanding of the relationships between our key variables, we first conducted a correlation analysis. The correlation matrix provided in

Table 4 below offers insights into the interrelationships between key environmental and economic variables within the European Union context for the period 2012–2023. Each row and column within the matrix represents specific aspects of environmental policy, energy consumption, and economic activity. We employed the Pearson model, where the coefficient (r) measures both the direction and strength of the linear relationship between variable pairs. Values close to 0 indicate little or no correlation, values near −1 indicate a strong negative correlation, and values near 1 indicate a strong positive correlation. Recognising the resulting relations is an essential step for policymakers, researchers, and businesses interested in developing and testing effective measures against climate change. The results of the Pearson correlation is showcased in

Table 4.

A positive but relatively weak correlation exists between CO2 footprint and GDP per capita (r = 0.25). This suggests that, on average, higher-income states tend to exhibit slightly higher carbon-intensive consumption patterns. This observation is consistent with the Environmental Kuznets Curve hypothesis, which posits that economic growth initially increases emissions until structural changes and technological innovation begin to counterbalance them in later stages of development. For policymakers, this indicates that while economic prosperity is desired, it does not automatically translate into lower emissions in the EU context without targeted interventions.

A notable negative correlation exists between CO

2 footprint and environmental tax revenue (r = −0.16565). This suggests that environmental taxes have a mild deterrent effect on emissions. While the correlation is not strong, its negative sign implies that increased environmental taxation is associated with a reduction in CO

2 emissions, supporting the view that such fiscal charges can influence corporate and consumer behaviour. This underscores the potential for environmental tax revenue to act as an instrument for mitigating carbon pollution, although its direct impact might be limited without complementary policies. Farooq et al. (2021) [

14] support this interpretation, arguing that additional fiscal charges can influence corporate decision-making.

One of the strongest correlations observed is the negative relationship between Environmental Tax Revenue and GDP per capita (r = −0.51385). This indicates that countries with higher GDP per capita tend to have a lower proportion of their GDP derived from environmental taxes. This could suggest that more developed economies may rely less on environmental taxes as a significant revenue source, possibly due to more mature regulatory frameworks or a greater capacity to invest in cleaner technologies that naturally reduce emissions.

Furthermore, the supply, transformation, and consumption of renewables and wastes (as a percentage of gross final energy consumption) (r = 0.395444). This reflects a dual effect: higher economic prosperity is associated with increased emissions, but also with substantial investments in renewable energy. This “paradoxical” coexistence highlights the ongoing energy transition, where economic growth simultaneously drives demand (and potentially emissions) while also funding the shift towards cleaner energy sources. For policymakers, this implies that economic growth alone is insufficient to guarantee decarbonization; active policies are required to ensure renewables substitute for, rather than merely complement, fossil fuels. Based on the preliminary correlation analysis, the first hypothesis (H1), which posits a negative correlation between environmental tax revenues and both CO2, was partially supported.

Overall, the correlation analysis suggests that while economic growth and the expansion of renewables present opportunities for a green transition, the current role of environmental taxes appears limited. Policymakers should therefore reconsider eco-tax revenues not solely as punitive instruments, but as potential channels for reinvesting in employment, renewable energy deployment, and innovation in the environmental sector. Evidence from Metcalf & Stock (2023) [

15] shows that CO

2 pricing in the EU did not undermine GDP, suggesting that, if properly designed, environmental taxes can be reframed as drivers of sustainable development rather than mere deterrents.

Following the preliminary correlation analysis, we move to a more rigorous econometric examination using the Panel Least Squares method. This approach allows us to estimate the causal effects of our independent variables on CO2 footprint while controlling for unobserved heterogeneity across countries and over time. This regression analysis, using the Panel Least Squares method with 295 observations, suggests that the model explains approximately 46% of the variance in the dependent variable, indicating moderate explanatory power. The F-statistics are highly significant, indicating that the model as a whole is meaningful. Model diagnostics were conducted to ensure the robustness of the regression results. Since the Durbin–Watson statistic (0.356026) indicated the presence of autocorrelation, corrections were applied by estimating robust standard errors (Newey–West) The Durbin-Watson statistic for our initial OLS model exhibited an exceptionally low value, strongly indicative of severe positive autocorrelation. To counteract this in our OLS analysis, which primarily served as a preliminary diagnostic stag, we diligently applied Heteroscedasticity and Autocorrelation Consistent standard errors. These robust standard errors, carefully calculated, were instrumental in adjusting for both heteroscedasticity and autocorrelation, thereby ensuring that our coefficient estimates remained unbiased and, critically, that their statistical significance could be reliably interpreted.

If we consider

Table 5, the panel regression results offer important insights into the triggering factors of CO

2 footprint levels between 2012 and 2023 across all 27 EU member states. Supply and transformation of renewables have a very strong, positive, and highly significant effect (

p < 0.01). In contrast, both Environmental Tax Revenue and GDP/capita have adverse and statistically significant effects at the 5% level. As is customary in this type of analysis, the constant term is not statistically significant (

p = 0.7875).

The first relevant finding is the negative and statistically significant effect of environmental tax revenue on the CO2 footprint (−0.847, p < 0.05). This indicates that an increase in environmental tax collection is directly associated with a decrease in CO2 emissions. From an economic perspective, this confirms our hypothesis regarding the corrective role of such fiscal instruments: environmental taxes discourage polluting activities by increasing their cost, thereby incentivising cleaner production and consumption patterns. This finding underscores the economic legitimacy of eco-taxation as a core tool in reducing emissions. Implementing and scaling such fiscal tools can drive behavioural changes towards a greener economy. However, to ensure public acceptance and equity, the revenues generated must be transparently recycled and reinvested into green technologies, public infrastructure, and job creation within the environmental sector.

Another important finding is the negative relationship between GDP/capital and emissions (−0.962,

p < 0.05). Baranzini & Carattini [

16] argue that higher income levels often correlate with cleaner production and consumption choices, which could reduce the levels of carbon emissions, as wealthier populations have an easier time adopting green technologies, meaning wealthier countries have the opportunity to enjoy smaller levels of CO

2 per capita. Socio-economically, this implies that as countries become more affluent, their citizens may demand higher environmental standards, leading policymakers to adopt greener policies and technologies that benefit society as a whole. When discussing states, it is pertinent to note that regional differences within the EU, such as those between Western and Eastern member states, may influence this relationship. Controlling these heterogeneities or including additional covariates may provide a clearer picture of the income-emissions nexus.

In contrast to the significantly negative relations we encountered so far, there is a positive and highly significant coefficient for the supply, transformation, and consumption of renewables and waste (+0.725,

p < 0.001). This result may initially seem paradoxical, as intuitively, one would expect an increase in renewable energy supply to lead to a reduction in the CO

2 footprint. However, this finding consistently appeared across various models, including OLS regression, Fixed Effects, and in additional robustness checks such as DOLS and FMOLS, as detailed in our robustness analysis section. This persistent positive coefficient therefore reflects a transitional effect, rather than an inconsistency: many countries continue to expand their use of renewables in parallel with fossil fuel consumption, rather than achieving direct substitution. This indicates that, while investments in renewables are substantial, their growth can, in this transitional phase, coincide with persistently high CO

2 emissions, underscoring that active policies are required to ensure that renewables substitute, rather than merely complement, fossil fuels. This observation aligns with the research of Saidi & Omri [

17], who argue that renewable expansion without simultaneous reductions in fossil energy can fail to deliver immediate emissions reductions.

Although several coefficients are statistically significant, their economic relevance needs to be carefully examined. We acknowledge that environmental tax revenue has an adverse effect on emissions; however, the magnitude suggests that substantial fiscal effort and reinvestment are needed for a meaningful impact. Similarly, the adverse effect of GDP/capita shows an organic shift toward a clearer economy; however, in reality, this effect varies between EU regions. Even the positive coefficient for renewable supply, while significant, underlines a transitional stage rather than the immediate substitution of fossil fuels. Thus, significance in the model does not automatically translate into substantial policy impact.

To draw a comprehensive conclusion from the relationships presented in this section, we can confirm that environmental taxation and economic development can both contribute to reducing CO2 footprints, provided that tax revenues are effectively reinvested in sustainable infrastructure and social support mechanisms. At the same time, renewable energy policies must move beyond capacity expansion toward structural transformation, ensuring that renewable deployment displaces fossil fuels rather than merely complementing them. For policymakers, this means that eco-taxes should be reframed from being seen solely as punitive fiscal tools to becoming instruments that fund green innovation, protect vulnerable communities, and promote sustainable employment in the environmental goods and services sector.

At this stage, we can assess empirical results against the initial research objectives. On the one hand, the fixed effects estimates show a statistically significant negative coefficient for environmental tax revenues, confirming the hypothesis that environmental aid instruments function as corrective tools capable of reducing CO2 emissions. This finding is directly aligned with the study’s central objective of evaluating the fiscal dimension of climate policy. On the other hand, we can see that the coefficient for GDP per capita is positive but statistically insignificant, which only partially supports the Environmental Kuznets Curve (EKC) hypothesis. While discussing theory, the framework suggests that higher income levels should lead to lower emissions over time.

The results illustrated in

Table 6 indicate that income effects are heterogeneous across EU member states. This fact deepens the gap between the delimiting regions of the EU, as reliance on non-fiscal instruments, such as regulation and subsidies, may weaken the income–emissions link. Lastly, the supply, transformation, and consumption of renewables display a positive but marginally significant association with emissions. This finding contradicts the initial expectation that renewable expansion would reduce the carbon footprint. The result is best interpreted as a transitional effect, where this type of matter is perceived as such. In terms of research objectives, this nuance highlights that renewable energy deployment must be coupled with structural policies to reduce fossil fuel use and achieve measurable decarbonization.

To determine the most appropriate estimation method for the panel data used in this study, a Hausman specification test was performed to evaluate whether the Fixed Effects (FE) or Random Effects (RE) model would provide more reliable and consistent results. The Hausman test examines whether the unique errors (i.e., the unobserved individual-specific characteristics) are correlated with the explanatory variables. If such a correlation exists, the assumptions underpinning the RE model are ignored, and the FE model becomes the more suitable choice. Our results indicated that the Fixed Effects model was indeed more appropriate. Firstly, we can assess that a higher level of footprint is negatively associated with environmental tax revenue. Therefore, as environmental taxes increase, emissions tend to decrease, confirming that eco-fiscal measures are functioning, at least partially, as deterrents to polluting activities. However, the size of the effect is moderate. According to the polluter-pays principle, fiscal measures should increase in proportion to environmental harm. To ensure the robustness of this chosen Fixed Effects model, further diagnostic checks were performed. While the Durbin-Watson statistic for our Fixed Effects model (1.220719) still hinted at potential residual autocorrelation. To ensure the robustness of the Fixed Effects model as well, we similarly applied HAC standard errors. The results of this specific test, which assesses first-order autocorrelation in the idiosyncratic errors of a panel model, provide a more appropriate and accurate diagnostic for our FE specification, yielding robust standard errors.

Therefore, the effectiveness of eco-taxation hinges not just on its existence but on its strength and scope of implementation. In the case of GDP/capita, the coefficient is positive but insignificant. This suggests that income levels are not strongly linked to the carbon footprint once country-specific effects are controlled for. One possible explanation is that wealthier economies may rely more on non-tax measures such as direct subsidies, regulations, and innovation incentives rather than environmental taxation. Kalaš et al. [

18] found a similar negative link between GDP per capita and environmental tax intensity in the EU, partly due to structural shifts toward cleaner industries and a greater reliance on regulatory tools over fiscal ones. The role of supply, transformation, and consumption of renewables is positive but only marginally significant. This suggests that the use of renewables may still coexist with higher emissions in the short run, either due to parallel fossil fuel use or transitional inefficiencies.

However, its positive sign suggests that renewable expansion may also indirectly broaden the tax base, for example, through the emergence of carbon markets, green bonds, or new climate-related fiscal policies. Mundaca & Richter [

19] argue that renewable deployment serves as a lever to reshape consumption patterns, suggesting that over time, renewables can reinforce green fiscal frameworks.

The RE model was applied as an intermediate step because it allows for more efficient estimations under the assumption that unobserved heterogeneity is uncorrelated with the explanatory variables. However, to verify this assumption, the Hausman test was performed and is listed in

Table 7. The results indicated that the FE model provides more consistent estimates. Therefore, the final interpretation of results is based on the Fixed Effects model, while the RE model is reported only as part of the robustness and model selection process.

This outcome suggests a statistically significant correlation between the individual effects and the independent variables, rendering the RE model inconsistent and thus unsuitable for this dataset. Given this result, the Fixed Effects model is preferred, as it effectively controls for time-invariant heterogeneity across cross-sectional units (such as differences in institutional frameworks or long-standing environmental policies among countries). In addition to the statistical justification provided by the Hausman test, the Fixed Effects model also demonstrated a substantially better fit in terms of explanatory power, with an R-squared value of approximately 0.045774 compared to only 0.079 in the Random Effects model. Based on the econometric analysis utilising the Fixed Effects model, Hypothesis 1 (H1), which posits that environmental tax revenues are negatively correlated with CO2 emissions, is confirmed.

The Hausman specification test presented in

Table 8 provides insight into the presence of correlation between the unobserved individual effects and the explanatory variables. Consequently, the RE estimator is inconsistent, making the FE model the more appropriate choice for this dataset. From an economic perspective, this finding suggests that differences across EU member states, such as long-standing institutional frameworks or structural economic models, systematically influence the relationship between taxation, GDP/capita, renewables, and emissions. These findings support the conclusion that the Fixed Effects model not only aligns more closely with the underlying data structure but also offers more robust and interpretable coefficient estimates for the variables of interest. This ensures that the influence of unobserved, time-invariant characteristics is appropriately accounted for and that the estimated effects of environmental tax revenues and other explanatory variables of emissions are not biased by omitted individual impact.

This study strengthened previous empirical findings, confirming the robustness of the initial estimate through FMOLS, DOLS, and Robust Least Squares Regression analyses. The results displayed in

Table 9 for DMOLS and FMOLS further support the earlier conclusions from OLS, fixed-effects, and random-effects models, indicating the significance of the factors examined in explaining economic development within the EU-27 economies.

We conducted a robust least squares regression analysis to validate our findings. As shown in

Table 10, the results demonstrate that digitalisation has a positive and statistically significant impact on economic development within the EU member states. This further corroborates that the selected factors are essential in accounting for the variation in GDP per capita across EU economies.

Our research significantly enriches the existing literature by providing an interdisciplinary evaluation of environmental taxation within the European Union’s climate policy. Our econometric findings, which utilised OLS, Fixed Effects, and Random Effects models guided by the Hausman test, consistently show that environmental taxes correlate with lower emissions. This aligns with previous studies that highlight the effectiveness of fiscal instruments in environmental protection, such as those by Savranlar et al. [

20]. This further cements the EU’s strategic objectives for a smooth green transition, confirming that such measures can serve as corrective tools to reduce environmental harm. The ultimate goal of this study is, after all, to reveal that environmental taxes can be perceived as a potent tool for emission reduction, especially when well-designed national policies back them. When consistently enforced, it aligns with broader initiatives that enhance institutional capabilities and promote coordination across sectors, as highlighted by Avgousti et al. [

21].

5. Conclusions

This research has provided valuable insights into the environmental performance of EU countries by comprehensively examining how environmental tax revenues affect harmful emissions across the European Union, thereby highlighting the role of fiscal policy in mitigating environmental degradation. Using a multidimensional methodological framework that combines econometric modelling, bibliometric analysis, and policy evaluation, the results demonstrate that environmental taxation is an essential instrument for reducing CO2 while supporting economic resilience.

The results of the panel analysis confirm that environmental tax revenues significantly reduce CO2. The negative and statistically significant coefficient associated with these revenues demonstrates their effectiveness as a tool for mitigating environmental degradation. However, causality is inferred rather than fully revealed, and the observed relationships should be interpreted with this limitation in mind. GDP per capita has different effects across eastern and western EU states, suggesting that the impact of economic growth on emissions is context-dependent. The positive correlation between renewable energy and emissions, although apparently paradoxical, indicates a temporary coexistence between green sources and fossil fuels, rather than a complete substitution. This “transitional paradox” underscores the need for further discussion and highlights the importance of policies that accelerate the transition to clean energy, ensuring that renewable deployment substitutes rather than complements fossil fuel use. The results of the Hausman test confirmed the relevance of the fixed effects model, indicating that the effectiveness of environmental policies varies across countries, limiting the applicability of a uniform EU-level approach.

The same results are supported by the analysis of implemented European policies and strategies, which show that EU sustainability measures, such as the Carbon Border Adjustment Mechanism, the Effort Sharing Regulation, and other forms of environmental taxation, are effective when integrated into a coherent policy mix. While the policy implications are valid, it is essential to differentiate between short-term fiscal effects and long-term structural outcomes, as the full impact of environmental taxation depends on reinvestment in green infrastructure, innovation, and complementary regulatory measures. Their success does not rely solely on tax design but also on institutional capacity, quality of governance, and international coordination, particularly within frameworks such as the Paris Agreement.

Also, the bibliometric analysis confirms the growing academic and political relevance of fiscal instruments, with a global focus on large emitters, such as China. However, in the EU context, institutional diversity and governance capacity remain critical determinants of policy effectiveness, suggesting that environmental tax revenues primarily function as corrective mechanisms, whose long-term impact depends on coherent policy implementation.

Overall, our results suggest that the efficiency of environmental taxation depends on reinvesting revenues in green infrastructure and innovation, accelerating the substitution of fossil fuels, adapting policies to the national context and ensuring their continued coordination at the EU level. A uniform fiscal strategy across all member states is unlikely to succeed; instead, differentiated, context-sensitive, and innovation-driven fiscal policies are required to align economic growth with the goals of a sustainable and low-carbon European future.