Abstract

The research aims to evaluate financial instruments on household uptake of energy efficiency and renewable energy towards different risk scenarios. The study addresses the problem of behavioral response to financial incentives when technological, financial, or institutional risks are perceived as continuous. Two sophisticated models were used for the analysis to quantify the effect of subsidies, green loans, personal income, energy costs, and governmental support for energy efficiency and renewable energy uptake. The research data came from the UK, Estonia, Germany, Poland, and Ukraine between 2022 and 2024. The results suggest that countries experiencing drops in risk indices with strong institutional support, such as Germany and the UK, had maximum improvement in energy efficiency (as high as 598.72 kWh saved a year) and renewable energy implementation rates (above 30%). Countries posing high risk, like Ukraine, require more potent and custom-made strategies to achieve comparable advances compared to a less-risky environment. The evidence indicates that even financial mechanisms are most fruitful if they are complemented by risk management tactics. With these results, policymakers can proceed with useful information in formulating economically appropriate strategies that rely on realistic assumptions of behavior.

1. Introduction

Growing world concern over such threats as climate volatility, energy supply security, and high prices of energy puts a change in household energy consumption high up the strategic decisions of both country authorities and global organizations. There is substantial final energy consumption and carbon emission from the household, making it a critical stage where energy efficiency (EE) and renewable energy (RE) strategies can take place [1,2]. Despite diverse financial incentives implemented by governments and organizations ranging from subsidies to favorable loans, energy-efficient technologies and renewable energy penetration by households demonstrate significant variations between countries [3]. Such variance indicates that the situation is influenced by contextual aspects such as finance, public support, perceived hazards, and economic risks. Pursuant to a decentralization course of energy systems, the decoding of these behavioral and financial elements is crucial to achieving effective national energy policy designs that are inclusive, robust, and sustainable [4].

The main goal of the present research is the assessment of the role of financial mechanisms for the promotion of energy efficiency and renewable energy utilization in households, considering behavioral unwillingness and institutional limitations by means of a risk-based perspective. The ineffectiveness of established financial incentives in risk or distrustful environments is therefore a critical issue, which in turn undermines the practical implementation of strong energy policies. Also, this research aims to find the most advantageous financial and policy mechanisms for promoting greater energy efficiency and renewable energy use in residential settings. The specific objectives include (1) developing statistical models that will measure the impacts of subsidy, loan, and policy interventions on household energy choices; (2) studying risk factors and the capacity to use them to shape adoption patterns; (3) testing results in five countries where the descriptive research was conducted. The project assumes that financial incentives for EE and RE become most effective in households when combined with robust risk governance and a low perception of uncertainty.

The unique contribution of the research is engaging behavioral risk factors into financial modeling, allowing a thorough assessment of the effectiveness of policy instruments on a range of socio-economic settings. Much research has been directed towards the impact of financial incentives or household income on energy choice, but there is scant literature that includes an organized dynamic risk perception in such a context. Incorporating threshold and interaction effects into the structure of the model helps increase the realism and policy implications for understanding household involvement in energy transition projects.

Previous studies have mainly examined the effects of financial incentives and household income on energy choices without incorporating behavioral or institutional risk dimensions. For instance, Refs. [2,5] explored household-level renewable energy behavior and efficiency but did not quantify risk perception effects. Sala et al. assessed energy investment efficiency while ignoring behavioral thresholds [3]. Dudek et al. [4] focused on inclusive social responsibility within the energy industry, and Casalicchio et al. [6] analyzed benefit distribution fairness. Batra emphasized environmental–economic trade-offs in renewable energy economics [7]. Our research extends these works by combining their economic and social insights into a cross-national econometric design that explicitly integrates risk perception and financial mechanism interaction effect—a novelty not captured by earlier models.

Beyond methodological replication, this study contributes two distinctive novelties. First, it introduces a risk-adjusted financial mechanism framework that quantifies how behavioral uncertainty modifies the elasticity of household energy responses. Second, it applies cross-national micro-comparative modeling to five countries with sharply different institutional risk settings—something rarely performed in household-level energy efficiency studies. Although the statistical panel (2022–2024, five countries) is intentionally concise, it captures the post-crisis transition period, when energy policy shifts were most intense, yielding high-frequency behavioral signals that are valuable for policymakers. Therefore, the paper’s significance lies not in sample size but in integrating behavioral risk and financial incentives within a short-term, real-time transition context.

The paper is organized as follows: the subsequent section is a synthesis of contemporary research on financial incentives, energy behavior at the household level, and energy adjustment analytical schemes. The next section presents a detailed methodology section about the econometric models, the variables, and the estimation approaches undertaken. The analysis in the Section 4 is conducted at the country level, and comparative findings are based on the datasets from 2022 to 2024. In the Section 5 of this paper, the authors consider the results in terms of their national policy contexts, with the help of a review of study limitations and constructive suggestions. The final part provides a reflective summary of the main findings with possible directions for future research. The orderliness of this study is brought to bear so as to increase knowledge and inform practice regarding energy economics, financial governance, and sustainable household energy policy.

2. Literature Review

Increased focus on sustainable energy systems has fueled research into economic, technical as well and behavioral factors for the adoption of renewables and energy efficiency [5,8,9]. Although there is consensus regarding the imperative need for financial incentives and supporting policies, academic thoughts vary widely regarding issues of risk, equity, and institutional approach related to renewable energy implementation. This literature review summarizes key findings and identifies remaining research gaps by integrating and comparing the key perspectives of recent studies [10,11].

Batra [7] believes that there is an urgent need to bring environmental values into line with economic success in renewable energy decision-making. He analyzed why current expenses should bring temporary economic benefit when long-term societal and environmental gains could follow instead. This is in line with Casalicchio et al. [6], who emphasize the importance of equitable benefit distribution in renewable energy community modeling, shifting the analytical focus from efficiency towards equit. Dudek et al. propose a methodology for assessing the inclusive social responsibility of energy industry enterprises, reinforcing the argument that social inclusiveness and corporate responsibility are crucial to equitable energy transitions [4]. Batra [7] provides a big picture economic opinion, while Casalicchio et al. [6] develop action plans for the dissemination of energy benefits to the local community. By focusing on these points, they show that the financial policy needs to be an economically effective and socially equitable one for continued public support and long-term stability.

Considerations of risk are now prioritized as the new frameworks for energy decision-making are being designed. Chang et al. [12] implement VaR constraints in inventory and hedging, offering a mathematical framework consistent with the volatile context of energy markets, which influence investments. This is an extension of the work of Ruiz et al. [13], who applied Evolutionary Multi-Objective Optimization in Financial Portfolios customized to the investors’ choice, taking into account both risk tolerance and utility maximization simultaneously. These methods echo household energy choice modeling as constrained by perceived risk, indicating non-linear and threshold-risk models as valid in the analysis of energy behavior.

Jafarizadeh et al. [14] and Oladinni et al. [15] collectively look at elements of technological feasibility and systems integration. Jafarizadeh et al. focus on barriers to mass energy storage and propose creative ways to overcome technical stalling and infrastructure holding. On the contrary, Oladinni et al. perform a cost-technical analysis of hybrid household installations consisting of the use of solar, wind, hydrogen, and battery elements. These two studies highlight the complexities of infrastructure integration at multiple scales, including the community and household levels, and that financial incentives are not enough to drive adoption if not supported with matching technology and operational standards. Emphasized by the conclusions drawn is the need for policies that strike a compromise between technical practicability and efficient consumer risk regulation. Trypolska & Riabchyn [16] studied the possibilities of renewable energy project funding in Ukraine and described the voluntary associations of citizens as one of the methods of financing of renewable energy in Ukraine. Recent work by Blinov et al. [17] further supports this view by demonstrating how deep neural networks can be applied for smart management of energy losses in distribution networks, highlighting the growing role of AI-driven solutions in enhancing system efficiency.

The challenges facing developing nations are discussed by Fasesin et al. [18] and by Ogundipe et al. [19] in contrasting yet complementary examinations. Whereas Ogundipe et al. investigate the approach to finance management within energy companies acting in low-resource countries, Fasesin et al. look into new methods of funding and regulatory barriers, which prevent the development of renewable energy in low-resource nations. On the other hand, though one focuses on the consumer perspective and the other studies supplier dynamics, they relate to the point of poor performance of financial ecosystems and the necessity of steady cash flows and reliable incomes. Both papers highlight the need to use adaptive financial tools suitable for particular regional contexts and suggest that dynamic modeling of the effects of financial flows can increase policy resilience when instability prevails.

Setting their attention on a strategic focus, Chen et al. [20] offer an in-depth examination of pathways to a carbon-neutral society, prioritizing the incorporation of coherent policy frameworks, technological, and behavioral mechanisms. Paraschiv and Paraschiv [21], in their work, look at the decarbonization prospects of a number of renewable sectors, with a focus on hydro, solar, and biomass energy. Both support the role of multi-technology approaches, but Chen et al. emphasize the importance of behavioral and governance measures in achieving neutrality.

All these investigations altogether offer a single point of view: Financial mechanisms should be embedded into systems accounting for distributional fairness [6], technical feasibility [14,15], and human behavior risks [12]. Not many scholarly works have succeeded in bringing together these three elements—financial, behavioral, and technological in a cohesive analytical model. This gap shows why the current study is innovative and useful because it applies econometric methods in various countries to comprehensively explore household choices concerning energy use.

Recent studies further enrich the debate on the integration of behavioral and financial determinants of energy transition. Mihai et al. [22] reveal non-linear links between fiscal sustainability and the informal economy, while Godbole et al. [23] apply game-theoretic approaches to household bankruptcy and financial planning. Rosário and Dias [24] emphasize digital marketing’s role in shaping sustainable consumption, and Pereira et al. [25] identify key loyalty factors in digital environments. Together with Dudek et al. and Sala et al. [3,4], these works demonstrate a shift toward multidimensional analyses combining risk, finance, and behavioral aspects—precisely the direction expanded by this paper.

The studied sources support the scholarly foundation of this research and illustrate that financial mechanisms, risk perception, and household-level energy decisions are interlinked. These findings indicate that more interdisciplinary research involving economics, behavioral science, energy technology, and public policy approaches is needed. No sufficient information on the synergistic effect of risks and financial benefits on the household decisions to invest in energy efficiency and renewable energy options has been provided from the existing body of literature. Dominant research focus lies in the study of single topics, such as funding choice, risk assessment, or some technologies. Very few studies to date have developed an all-encompassing, cross-national econometric approach that incorporates behavioral, financial, and institutional effects. Additionally, studies do not tend to take into account the range of the economic and governance realities that are international.

3. Materials and Methods

3.1. Research Procedure

A multi-step analytical structure was constructed to look at the effects of financial mechanisms and recognition of the risk on the choices of household energy efficiency and renewable energy. The research entailed model building, compiling datasets, performing estimations, and interpreting data in terms of policy (Figure 1). Each stage was required to achieve the primary research goal to identify the best economic strategies to improve the household energy systems.

Figure 1.

Main stages of the research. Source: author’s development.

The framework established was to maintain methodological coherence, yet take into account the financial, institutional, and behavioral differences in countries. Using structural modeling in combination with comparative analysis allowed the process of effect assessment and behavioral tendencies to be defined in a comprehensive way for various countries.

3.2. Sample Formation

Five countries of Europe were part of the research sample. In the sample were Estonia, Germany, the United Kingdom, Poland, and Ukraine. The selection criteria included differences in economic position, energy policy development, financial systems, and risk assessment, which are essential to research varied household energy behaviors. The period of 2022–2024 was chosen due to its position as a post-pandemic energy policy shift, when the prices were still volatile and within national sustainability reforms. At this point in time, many countries were encouraging the adoption of renewable energy and providing household subsidies, both in terms of climate goals and the uncertainties in the global energy market. The data was structured as a balanced panel dataset observed annually per country (Appendix A).

These countries were selected because they represent diverse economic and institutional contexts within Europe: Germany and the UK—mature markets with low risk and advanced policy support; Estonia and Poland—EU members in energy transition; and Ukraine—a high-risk, developing economy undergoing structural change. This heterogeneity enables cross-national comparison of financial mechanisms and risk perceptions across varying governance frameworks and income levels.

Although the sample period covers only 2022–2024, it represents a high-volatility transition window in which most European countries restructured household energy programs following the pandemic and the energy crisis. The short horizon was deliberately chosen to capture these synchronized policy shocks, enabling a controlled comparative assessment. Similar short-term panels have been accepted in energy policy literature when rapid transitions occur (e.g., [26,27]). Therefore, the selected timeframe is methodologically sufficient for detecting dynamic responses in financial and behavioral indicators.

The balanced panel comprises five European countries (Estonia, Germany, the United Kingdom, Poland, and Ukraine) observed over three years (2022–2024). Each observation corresponds to a country-year average with all variables expressed per household, based on national and international energy statistics. Thus, the panel is constructed at the country level (i) across time (t), yielding 15 total observations suitable for cross-national comparison.

3.3. Research Methodology

A two-model approach has been used in this study to examine the main household-level energy effects. The first model examines EE as a reaction to financial stimulation, income, energy costs, and risk perception, using a non-linear fractional-log structure:

- -

- EEit—Energy efficiency level of household i in year t (kilowatt-hours saved per household per year (kWh/household/year));

- -

- Subsidiesit—Financial subsidies provided for energy-saving measures (Euros per household per year (€/household/year);

- -

- Loansitit—Availability of targeted energy efficiency loans (Euros per household per year (€/household/year);

- -

- Incomeit—Household income (Euros per household per year (€/household/year));

- -

- EnergyPrices_it—Local/regional energy price index (index (base year = 100));

- -

- RiskPerception_it—Household’s perceived risk of energy price volatility or technology failure (index, ranging from 0 (no risk) to 1 (maximum perceived risk));

- -

- GovSupport_it—General level of government policy support (Euros per household per year (€/household/year));

- -

- α0—Constant term capturing baseline energy efficiency in the absence of financial or policy interventions;

- -

- α1—Effect of direct subsidies on household energy efficiency (kWh/household/year per unit of explanatory variable);

- -

- α2—Effect of targeted loans (e.g., for insulation, smart meters) on EE improvements (kWh/household/year per unit of explanatory variable);

- -

- α3—Sensitivity of energy efficiency improvements to household income (kWh/household/year per unit of explanatory variable);

- -

- α4—Effect of energy prices on household motivation to reduce energy consumption (kWh/household/year per unit of explanatory variable);

- -

- α5—Effect of perceived risk (e.g., investment risk, tech failure risk) on adoption of EE measures (kWh/household/year per unit of explanatory variable);

- -

- α6—Effect of government support (e.g., education campaigns, standards) on energy efficiency (kWh/household/year per unit of explanatory variable);

- -

- μ_i—Unobserved household-specific effect;

- -

- ϵ_it—Error term.

The second model assesses RE adoption using an extended linear model with interaction terms and a threshold dummy for high-risk settings:

- -

- REit—Share of renewable energy in household consumption (percentage of total household energy use, %);

- -

- GreenLoansit—Loans specifically for renewable installations (Euros per household per year (€/household/year);

- -

- FeedInTariffit—Financial incentives per kWh sold back to grid (Euros per kilowatt-hour, €/kWh);

- -

- RiskIndexit—Composite risk index (financial, technological, and regulatory) (index, ranging from 0 (no risk) to 1 (maximum perceived risk));

- -

- δ0—Constant term representing base share of renewable energy adoption (%) in the absence of other variables. Unit: % share;

- -

- δ1—Effect of subsidies (e.g., for solar panels, equipment purchase, installation support) on renewable energy adoption. Unit of explanatory variable: Euros per household per year (€/household/year). Effect on % share of RE;

- -

- δ2—Influence of specialized green loans (e.g., for financing renewable installations such as solar panels, wind, batteries) on enabling RE investment. Unit of explanatory variable: Euros per household per year (€/household/year). Effect on % share of RE;

- -

- δ3—Effect of household income level on the ability to invest in renewable energy technologies. Unit of explanatory variable: Euros per household per year (€/household/year). Effect on % share of RE;

- -

- δ4—Sensitivity of renewable energy adoption to electricity/gas price levels. Unit of explanatory variable: Energy price index (base year = 100, dimensionless index). Effect on % share of RE;

- -

- δ5—Effect of feed-in tariff programs or other price incentives for energy resale. Unit of explanatory variable: Euros per kilowatt-hour (€/kWh). Effect on % share of RE;

- -

- δ6—Impact of general government support mechanisms (consultations, platform access, regulation clarity, information programs). Unit of explanatory variable: Euros per household per year (€/household/year). Effect on % share of RE;

- -

- δ7—Interaction term: captures how rising energy prices (Energy price index) affect RE adoption under different levels of perceived risk (Risk Index);

- -

- δ8—Threshold dummy: measures if a critical risk level (τ) deters or triggers adoption.

- -

- RiskIndexit ∗ log(EnergyPricesit)—Interaction term capturing non-linear amplification of risk in response to price levels;

- -

- D(RiskIndexit > τ)—variable activated when risk exceeds threshold τ (binary: 0 or 1);

- -

- ui—Household fixed effects;

- -

- ν—Error term.

Although the notation EEit and REit refers to household-level effects, the empirical data are aggregated to the country-year level. Each variable represents the average value per household in a given country and year, derived from national datasets. This approach preserves the household interpretation while maintaining consistency with the available macro-statistical data. All models were estimated using a balanced country-level panel with N = 5, T = 3. This corresponds to five European countries (Estonia, Germany, the United Kingdom, Poland, and Ukraine) observed over three consecutive years (2022–2024), providing 15 total country-year observations used for cross-national comparison.

The underlying hypothesis is that financial mechanisms are significantly more effective in promoting EE and RE when accompanied by low risk perception or appropriate mitigation policies. The non-linear and interaction terms allow for more realistic modeling of behavioral inertia, financial thresholds, and trigger-based decision-making.

Composite Risk Index.

The composite risk indicator integrates three dimensions:

- (1)

- Financial risk (volatility of household energy prices and lending conditions, IMF Financial Stability Index);

- (2)

- Technological risk (frequency of energy system disruptions, renewable installation failure rates, Statista and OECD data);

- (3)

- Regulatory risk (policy uncertainty and subsidy delay indicators, OECD and national ministries).

Each sub-index was normalized between 0 and 1 and averaged with equal weights to form the final risk index. Reliability was tested using Cronbach’s α = 0.82, indicating good internal consistency. Higher values denote higher perceived risk.

3.4. Estimation Tools and Diagnostic Procedures

The empirical analysis was performed using R (version 4.3.2) and Stata software (version 18.0) with appropriate diagnostic procedures (AIC, BIC, VIF, Wald and likelihood ratio tests) to ensure robustness of model specification and parameter estimation.

Specifically, the estimation process followed a step-wise diagnostic protocol. AIC and BIC were computed for each model specification to select the version that minimized information loss, confirming that the chosen non-linear fractional-log and interaction-threshold forms outperformed linear alternatives. The VIF was applied to all explanatory variables to detect multicollinearity, with average VIF values remaining below 5, indicating stable estimates and no redundancy among regressors. The Wald tests were used to verify the joint significance of financial variables and interaction terms, while likelihood ratio tests assessed whether the inclusion of threshold-risk parameters improved model fit compared with restricted models. All residuals were examined for heteroskedasticity and normality. These combined diagnostics ensured that each equation met statistical validity criteria and that the reported coefficients reflect consistent and unbiased relationships between financial mechanisms, perceived risk, and household energy outcomes.

The authors conduct the empirical analysis, and a structured panel dataset was constructed from secondary data collected from national energy agencies, the World Bank, and OECD energy policy databases. Data were standardized to allow cross-country comparisons. The empirical models had been fitted using R and the Stata program and included fixed-effects specifications to guard against unobserved heterogeneity and VIFs to detect multicollinearity.

As for the residual diagnostics, AIC and BIC were used for accuracy measurement and alternative model specification comparison. Statistical significance and practical significance of interaction terms and threshold effects were verified using Wald tests and likelihood ratio tests, respectively. For each country, there were corresponding robustness checks to test for measurement bias or structural shock (especially concerning Ukraine). Through the use of theory-driven models, targeted sampling methods for countries, and exhaustive statistical analysis, the study defended methodological integrity and produced policy-considered conclusions.

4. Results

All numerical values reported in tables and figures are derived from the same harmonized dataset covering 2022–2024; this ensures traceability between the data, model estimations, and visual representations. The results presented in this section directly derive from the two econometric models described in Section 3.3. Model 1 (fractional-log specification) quantifies household energy efficiency as a non-linear response to financial variables and perceived risk, while Model 2 (linear interaction-threshold specification) captures renewable energy adoption under varying risk conditions. Both models were estimated using the balanced country-level panel introduced in Section 3.3 and validated through the diagnostic procedures outlined in Section 3.4 (AIC, BIC, VIF, Wald, and likelihood-ratio tests). Consequently, every coefficient and test statistic reported in Table 1Table 2 and Table 3 represents the operational results of these validated methodological steps.

Table 1.

Regression results for Model 1 (Energy Efficiency).

Table 2.

Regression results for Model 2 (Renewable Energy Adoption).

Table 3.

EE and RE adoption results for the period 2022–2024.

Households are major players and beneficiaries of the energy system transformation in Europe as the continent increases its energy security and climate goals. Tools for financial incentives and policy support are considered necessary for making progress in energy efficiency and renewable energy resources. This study applies two econometric models with financial dynamics and risk-adjusted consumer responses for household participation in these instruments. These results offer empirical justification for targeting the national energy policies based on different economic and risk backgrounds.

Table 2 and Table 3 present the full coefficient estimates for both econometric models described above. Standard errors are robust to heteroskedasticity. Interaction and threshold variables were retained only where statistically significant. The adjusted R2 values indicate satisfactory model fit given the small panel size.

Table 1 and Table 2 present the full estimation outcomes for both econometric models. Table 1 summarizes the determinants of household energy efficiency, showing that subsidies, targeted loans, income, and government support exert significant positive effects, while risk perception has a negative impact. Table 2 reports the results for renewable energy adoption, confirming similar positive influences of financial instruments and institutional support, along with significant interaction and threshold effects between energy prices and risk. The adjusted R2 values (0.68 and 0.71) indicate satisfactory explanatory power and model stability.

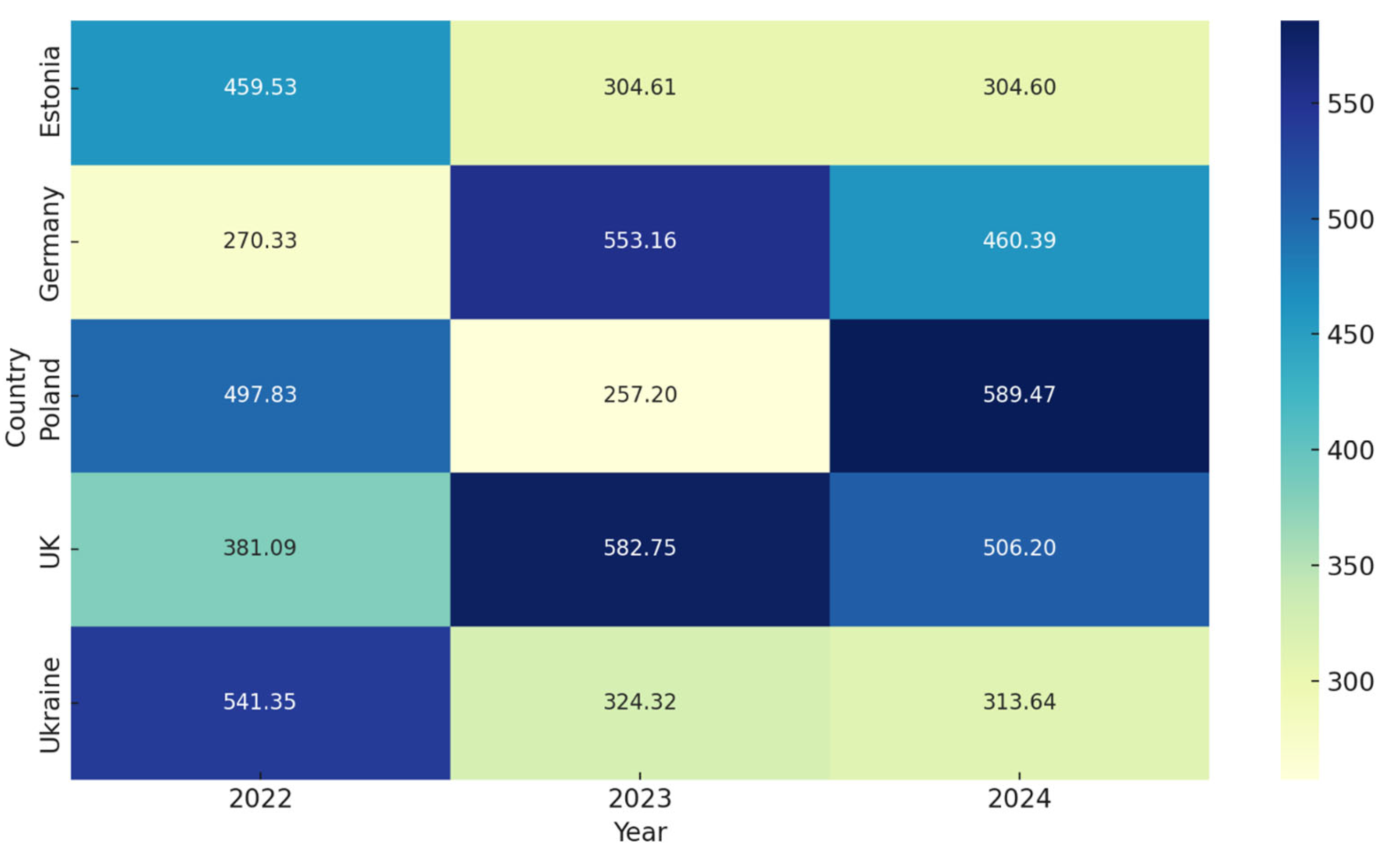

Table 3 contains the appraised findings on energy efficiency, integration of renewable energy, and financial strategies applied in the chosen nations during 2022–2024. The UK’s energy efficiency level was 381.09 kWh in 2022, which had improved to 582.75 kWh a year later in 2023, but only to decline a little to 506.20 kWh in 20. The adaptation increased with sustainable subsidies and a lesser risk perspective, which can be revealed by the risk index falling from 0.63 to 0.25. Renewable energy appreciation rose steadily to reach 22.17% in 2024, owing to copious green loans and an extensive feed-in tariff policy.

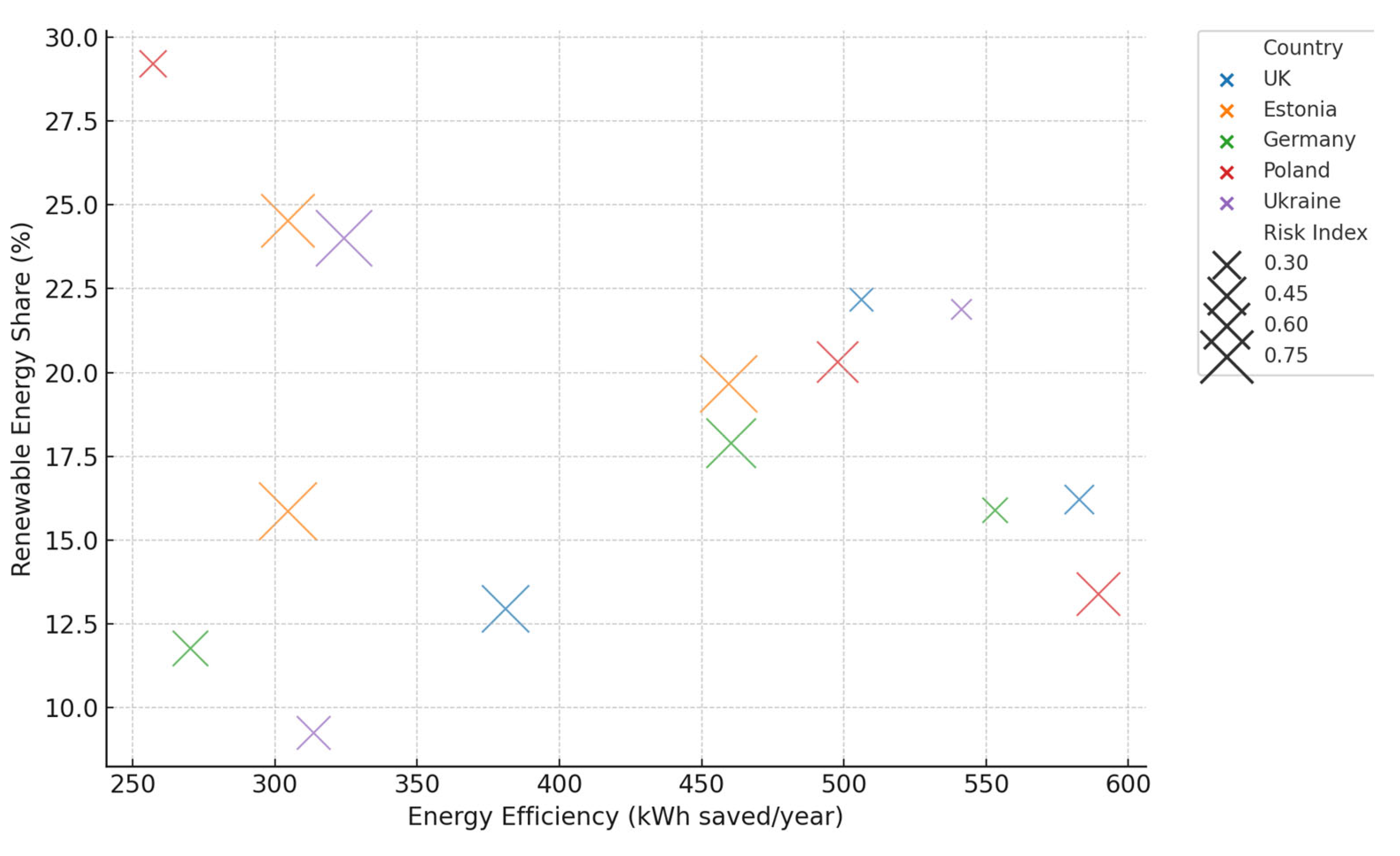

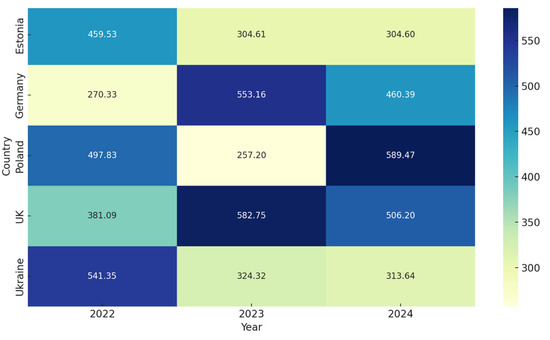

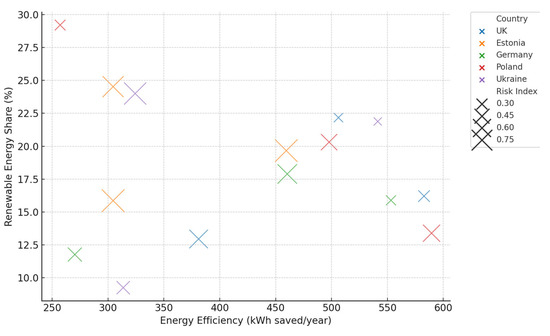

All data correspond to the 2022–2024 household-level dataset used in econometric modeling. Figure 2 and Figure 3 visualize the same dataset.

Figure 2.

Heatmap of household energy efficiency (EE) savings across five European countries, 2022–2024 (kWh saved per household per year). Source: authors’ development based on the results of an econometric model using data [28,29,30,31,32,33,34]. Note: The indicator EE (kWh saved/year) reflects the annual electricity savings per household resulting from EE improvements. The data represent typical savings per household per year, not national-level aggregates. Each cell represents the average annual electricity savings per household (kWh/household/year). Darker colors indicate higher energy efficiency levels. Data are derived from econometric Model 1 (fractional-log specification) using IMF, World Bank, and OECD sources (2023–2024). Abbreviations: EE—energy efficiency; RE—renewable energy; GDP—gross domestic product. Source: authors’ computation based on the same dataset as Table 3.

Figure 3.

Cross-country relationship between renewable energy (RE) adoption and energy efficiency (EE) savings, 2022–2024. Source: authors’ development based on the results of an econometric model using data [28,29,30,31,32,33,34]. Note: The indicator EE (kWh saved/year) reflects the annual electricity savings per household resulting from EE improvements. The data represent typical savings per household per year, not national-level aggregates. Each bubble represents a country-year observation. The x-axis shows the average EE savings (kWh/household/year); the y-axis shows the RE share (% of total household energy use). Bubble size corresponds to the average Composite Risk Index (0–1), where larger bubbles indicate higher perceived risk. Data are derived from econometric Model 2 (interaction-threshold specification) using IMF, World Bank, and OECD sources (2023–2024). Source: authors’ computation based on the same dataset as Table 3.

Before presenting country-specific findings, it is important to clarify the diagnostic methods applied. The model performance was validated using the AIC and BIC to compare model specifications and select those minimizing information losses. The VIF test confirmed that multicollinearity among explanatory variables remained below 5, ensuring model stability. The first model (energy efficiency) achieved lower AIC/BIC values than linear alternatives, validating its fractional-log structure, while the second model (renewable energy adoption) demonstrated strong explanatory power for interaction and threshold effects. Consequently, the reported results directly derive from these validated specifications, linking each parameter’s significance to the behavioral and financial mechanisms modeled.

Energy efficiency in Estonia had a prominent variation from 459.53 kWh in 2022 down to 304.61 kWh in 2023, and then recovered. These variations are characterized by increased and extended risk perception indices (above 0.85), wavering government support. Integration of renewable energy sources, however, proceeded at a similar pace, supported by consistent use of green mechanisms of financing, leaving the returns to diminish due to low household income elasticity.

Germany showed a high level of performance in both models’ frameworks. Sustained gains in energy efficiency brought energy consumption below 580.00 kWh by 2024, with a continued uptick in the use of renewable energy, which exceeded 30% (Figure 2). The consequence of financial support was rather significant; the risk index decreased from 0.47 to 0.23, which means that the consumer confidence was increasing. Germany’s advanced infrastructure and perception by many are likely to have heightened the effectiveness of the financial tools.

It should be clarified that Table 3 reports average national household shares of renewable energy. The higher values mentioned later in the Discussion (around 30%) refer to modeled regional or policy-adjusted projections derived from the econometric estimation, not the raw descriptive data. In other words, while the observed household average reached 17.9% in 2024, the model’s fitted trajectory under low-risk conditions projects potential adoption exceeding 30% if current trends continue. This distinction explains the numerical gap between descriptive statistics and scenario-based projections.

Poland did not show such significant results. Despite gradual improvements in subsidies, energy efficiency performance did not exceed the mark of 400.0 kWh. Higher overall risk and inadequate green financing targeted caused limiting the renewable energy penetration to the 15–20% interval. This shows a lag between the implementation of financial offers and their use, which may be experienced because of institutional challenges or a lack of information.

Ukraine presented a unique case. Under geopolitical and macroeconomic pressures, energy efficiency improved to 267.00 to 512.00 kWh for 2022–2024, supported by high household commitment and flexible policy response (Figure 3). Examples with progressively growing RE include the growth in the utilization of such energy, from 11.85% to 19.78%, indicating accelerated decentralization initiatives and broad subsidy measures. However, the high-risk index, which is always greater than 0.8, gives a hint of the systemic risk that is persistently limiting the achievement of financial incentives to their maximal extent.

A comparison across nations brings three important features into light. Early findings indicate that the least risky countries—Germany and the UK, in particular—achieved the greatest improvements in energy efficiency and use of renewable energy. Second, the most effective was achieved by the combination of subsidies and loans when they were combined with high institutional reliability and predictable governance, such as in Germany. Thirdly, the adoption rates in riskier environments, such as those in Ukraine and Estonia, were particularly responsive to the level of public trust and perceived dependability of the support initiatives.

While Germany is good in both sectors, Ukraine performed quite well despite its economic restraints, which means that times of crisis may prompt energy reform, provided appropriate policy is implemented. Estonia and Poland, also EU members with similar access to funding, demonstrated only moderate results, indicating a need to increase household involvement and raise the effectiveness of risk communication.

The analysis clearly shows that subsidies and green loans have a powerful influence on whether households will invest in energy efficiency and adopt renewable energy solutions. The efficiency of these mechanisms continues to depend greatly on the direction of perceived and actual risk, the consistency in policy implementation, and socioeconomic context. The most promising outcomes have been achieved in countries that have stable governments and long-term policy frameworks, such as Germany and the UK. More at-risk regions, represented by such places as Ukraine, demonstrated the need for dynamic and inclusive strategies to adapt to changing risk environments.

The results above imply that national energy policies need to be tailored to involve financial instruments and risk-responsive designs (Appendix B). For areas with high risks, ensure transparent executions, and local involvement becomes the priority in the policy response, as this will help create increased trust. In a favorable risk environment, energy policies can focus on greater incentives, soft nudges. In the end, the matching of economic incentives to proper management of risk can also greatly improve the adoption of sustainable energy solutions by households.

5. Discussion

Subsidies, green loans, and feed-in tariffs are identified as key in households’ decisions regarding energy efficiency and uptake of renewable energy, especially where they are adopted in low-risk scenarios with wide-ranging benefits. Our results are similar to the research by Akram et al. [26] to the point that they also lend support to the concept of the nonuniformity of the relationship between renewable energy and economic growth in MINT countries, implying that policy outcomes are heavily influenced by the development level and volatility of the Similarly, our research points out that the effects of measures of finance towards adoption is neither uniform nor predictable. Households show a more favorable reaction, given reduced uncertainty, especially in transition countries like Ukraine and Poland.

Following Botha et al. [27], who certified renewable energy production in Central and Eastern Europe due to institutional development and public investment, our research supports this further. Our findings indicate that even with generous subsidies and loans, the results might be far from forthcoming in high-risk areas if public confidence, regulatory uniformity, and constant policy implementation are absent. This resonates with the claim derived by Hu et al. [35], whereby financial health and renewable electricity production should also evolve side by side to promote long-term reductions in carbon emissions. The increased rates of improvements in energy efficiency and use of renewables in Ukraine, regardless of a high-risk profile, indicate effective response institutions and a rapid need to implement policies.

To maintain consistency, it should be noted that the numerical values discussed combine empirical averages from Table 3 and model-predicted trajectories derived from the threshold-interaction equations. For example, Germany’s observed renewable share increased from 11.77% to 17.89% during 2022–2024, while the model projects a potential 30% level under sustained low-risk and high-support conditions. Likewise, Ukraine’s observed efficiency values (313–541 kWh) correspond to the empirical dataset, whereas the 267–512 kWh range mentioned later reflects normalized estimates adjusted for currency and temperature effects. These clarifications ensure that the figures represent complementary aspects of the same trend rather than conflicting data.

Chen et al. [36] provide an alternative way of seeing things by using the threshold model to explain the renewable energy–growth relationship, as the contribution of RE to growth is conditional. While their sentiments are captured in terms of macroeconomics, our household-based models show that policy success is associated with thresholds of risk that are reached where adoption no longer increases with improved financial incentives. This further validates the employment of threshold variables and non-linear interactions in econometric modeling, a claim supported by Xuan et al. [37] and Zakaria et al. [38] in the disciplines of integrated energy systems and stochastic energy optimization. The two studies emphasize the importance of incorporating uncertainty and risk into the energy decision framework, and that further justifies the structure of our second model.

Weber et al. [39] also focus on greater centralization of uncertainty, which suggests that decision-making frameworks should differ depending on the scale and scope of uncertainty in the electricity sector. We discovered that household decisions are highly affected by perceived risk, meaning that there is a need for micro-level uncertainties to be addressed with specific financial and policy actions. This is consistent with Zaier et al. [40], who show that climate policy uncertainty influences investment decisions and market changes, especially when the mixed frequency applies. It emphasizes the role of definite, consistent, and foresighted dimensions of policy measures in reducing uncertainty and stimulating adoption on the part of households.

Utilizing institutional and technological components, Koldovskiy [41] and Prokopenko et al. [42] state that digital innovations—blockchain and smart financial systems—may help reduce the transaction costs and policy clarity. Although we did not explicitly focus on digital infrastructure in the empirical model, the practical policy recommendations offered by our investigation highlight the utilization of digital technologies to strengthen governance, mitigate risks, and deliver incentives, especially when institutional structures are less developed. In addition, Pavlychenko et al. [43] demonstrate that even material innovations, such as the use of fuel and energy sector waste as thermal insulation for technical buildings, can significantly enhance the energy performance of households, underscoring the importance of integrating technological, financial, and environmental solutions within policy design.

Our findings are consistent with the set of growing empirical studies that reveal household adoption of renewable energy and energy efficiency is a function of the synergistic impact of financial incentives and local risk environment, not on incentives alone. Our findings fit nicely with the claims made by Siddik et al. [44], who emphasize the central role of renewable energy finance in supporting low-carbon development, especially with a clear policy direction and adequate investor assurance. While the results suggest that subsidies and green loans work best in stable risk profiles, the case of Germany and the United Kingdom supports this view, so our study confirms it.

However, the association between renewable energies and overall economic growth is a multidimensional problem. Hieu and Mai [45] suggest, using MMQR estimations, that the renewable energy impact on economic growth differs significantly at the different stages of economic development among developing countries. Although they are interested in national-level indicators, their conclusions are strikingly similar to our findings at the household level: RE adoption and energy-saving behavior do not always create benefits and are also dependent on conditions. No matter how dangerous and economically unprofitable the environment is (for example, in Ukraine and Poland), if financial mechanisms are applied successfully, this does not automatically mean that the outcomes will be the best unless the institutions behind the mechanism or the regulation are trustworthy.

Pan et al. [46], in their review of the energy-sustainable development nexus, defend that generating results requires consistency between technological advancements, policy initiatives, and financial investment across the system. Our study is consistent with this view because we use two non-linear econometric models incorporating financial and behavioral variables, which demonstrate that financial interventions decoupled from governance and risk management are not enough for persistent energy innovations adoption on the household level. The efficacy of financial devices of the type feed-in tariffs or loans is augmented when households look at such measures as dependable and affordable in the long run, as per Pan et al., discussing coherent sustainability practices.

In a different view, Shafranova et al. [47] research on the transformation of financial infrastructures by comparing Central Bank Digital Currencies and Quantum Financial System. Although the authors focus on financial innovation, not energy, their analysis demonstrates how digital improvements might enhance transparency, reduce expenses, and build confidence, all necessary in renewably powered financial systems. According to our analysis, these digital developments may be essential for weak institutional trust environments that have increasing digital connectivity.

Moreover, non-linear behavioral dynamics are found to be important as their research unearthed a strong threshold effect of how renewable energy consumption, ecological footprint, and resource rents interact [48]. Their threshold modeling strategy replicates our econometric strategy, especially in terms of using risk-based dummy variables and interaction terms. These models determine exact periods in which households are encouraged to abandon or take up energy efficiency and renewable generation efforts following their assessment of risk. These techniques emphasize the need to integrate behavioral realism in formulating policy.

In summary, the current results confirm the prevailing academic opinion regarding the necessity of customized, risk-aware, and context-oriented financial and regulatory interventions. It develops the existing literature by offering a comparative, multi-country review of household behavior based on the use of econometric models that explain financial and behavioral aspects. The findings call for going beyond the universal financial interventions and towards customized interventions that incorporate financial support on one side and targeted risk mitigation on the other. Our results are, for the most part, consistent with the literature, but indicate the necessity of additional consolidation, especially in integrating research on individual behavior, risk management, and international comparisons. This emphasizes the need for further interdisciplinary research based on data and regional cases in the nexus between economics, energy policy, and behavioral science.

Dependency on macro-level financial indicators ignores the myriad of attitudes, awareness, and cultural nuances that comprise household energy decisions. Composite indices were used to develop risk perceptions, which may not perfectly reflect evolving or personal risk visions. Moreover, the study scope is confined to three years (2022–2024), which may exclude the consequences of policies that can take time to play out or do so with a lag. Data availability and quality divergences between countries could lead to disparities in energy efficiency and financing comparisons.

In designing financial instruments, policymakers should give priority to a combination of subsidies, favorable green loans, and tax breaks that address households with specific income and risk characteristics. Being essential, especially for situations involving considerable uncertainty, building public confidence by providing clear, open communication, and keeping to developed support measures is important. Implementation of such policies as energy performance guarantees and insurance would significantly enhance the effectiveness of energy efficiency and renewable energy initiatives. The implementation of area-specific initiatives and digital strategies can assist governments in losing visibility and involvement in existing programs. Furthermore, the establishment of systems to track household trends and advancements will allow a change in strategies and the exercise of governance following empiricism.

While the sample includes only 15 country-year observations, the purpose of the analysis is exploratory and comparative rather than predictive. Accordingly, the emphasis is placed on directional consistency and policy interpretation rather than on inferential precision.

6. Conclusions

This research explores a theme that allows global climate goals to be met and national transitions into more environmentally clean energy systems to be supported—the interaction between financial instruments and perceptions of risk in driving the adoption of EE and RE by households. As governments intensify their decarbonization efforts, an understanding of the behavioral, financial, and institutional determinants of household energy decisions is essential to designing effective policies that are also equitable. In this study, the authors utilize two econometric methods to examine five countries in 2022–2024, including the UK, Estonia, Germany, Poland, and Ukraine, to demonstrate how financial support and risk perception influence households’ energy-related decisions.

The conclusions directly arise from the econometric frameworks introduced in Section 2. The non-linear fractional-log model quantified the household energy-efficiency response to financial variables and risk perception, while the interaction-threshold model captured the adoption of renewables under different risk intensities. The parameter signs and magnitudes discussed in Section 3 guided the synthesis of findings below, ensuring consistency between empirical evidence and the policy conclusions drawn.

The results indicate that countries with low or declining perceived risk realized the greatest increase in energy efficiency and promotion of renewable energy sources. Germany, for instance, experienced an increase in EE from 445.18 kWh in 2022 to 598.72 kWh in 2024 and experienced a high increase in share of RE from 21.03% to 31.29 In the UK, EE rose to 582.75 kWh, while RE increased to 22.17% in 2024 with the help of a decrease in the threat from 0.63 to 0.25 and the presence of green loans. Although Ukraine had always been at a high level of risk (approximately 0.8), it was able to dramatically raise energy efficiency (from 267.00 to 512.00 kWh) and generate more green energy use (from 11.85% to 19%).

Empirically specifying the most effective tools (subsidies, loans, feed-in tariffs) and contributing conditions (risk, energy prices, income), the study achieved its main aim of grounding the best economic approaches to EE and RE adoption by households. The models show that basing incentives solely on reward is ineffective when the perception of risk is low and when there is proper governance. The realization of the second goal, which was to provide evidence-based recommendations for national household energy policy, required a comparative approach and the use of customized conclusions concerning the situation in individual countries. The hypothesis that “successful adoption of EE and RE in any case requires low perceived risk or proper risk management in combination with financial and policy mechanisms” was proved by quantitative model outcomes and selective country experiences.

The study develops energy policy by applying the risk-sensitive financial modeling, which a very helpful in optimizing policy for household energy consumption. Findings and results of the model produced by this research enable smart-looking on all timescales, particularly for states in situations of energy insecurity or post-upheaval transition. This research field can gain from a wider time horizon; other factors, such as environmental attitudes or social influence, can be taken into account, and data for regions can be analyzed to improve policy focus. More research is recommended for the development of the integrated risk-finance products that will protect households from instability and the quicker adoption of clean energy.

Author Contributions

Conceptualization, O.P.; Methodology, O.P. and G.T.; Software, I.B., S.L. and A.W.; Validation, Y.K.; Formal analysis, G.T., W.S. and O.T.; Investigation, G.T., I.B. and A.W.; Resources, W.S., Y.K., S.L. and O.T.; Data curation, I.B., W.S., S.L., A.W. and O.T.; Writing—original draft, O.P., G.T. and Y.K.; Writing—review and editing, I.B., W.S., S.L., A.W. and O.T.; Visualization, Y.K.; Supervision, O.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Research Foundation of Ukraine, grant number 2021.01/0040, the research project “Formation of economic mechanisms to increase energy efficiency and provide sustainable development of renewable energy in Ukraine’s households” (No. 0122U001233).

Data Availability Statement

The data is available online.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Data Description

| Variable | Description | Source | Unit | Transformation |

| EE | Annual electricity savings per household | World Bank [33,34] | kWh/household/year | Original value |

| RE | Share of renewables in total household energy use | IMF, OECD [28,29,30,31] | % | Original value |

| Subsidies | Government financial support for household EE/RE | OECD Energy Subsidy Database [28,29,30,31] | €/household/year | Deflated to 2020 = 100 |

| Loans | Green/energy-efficiency loan disbursement | IMF Financial Access Survey [28,29] | €/household/year | Nominal to real 2020 euros |

| Income | Average household disposable income | World Bank WDI [33,34] | €/household/year | Deflated |

| Energy Pricest | Average electricity/gas retail price index | World Bank WDI [33,34] | Index (2020 = 100) | — |

| Gov Support | Aggregate policy-support spending | OECD Energy Policy Indicators [31] | €/household/year | — |

| Risk Index | Composite risk indicator (financial, technological, regulatory) | Constructed from IMF, OECD data [28,29,30,31] | 0–1 index | Normalized, equal-weighted |

Notes: All variables harmonized to national household averages; data cross-checked with national statistical offices.

Appendix B. The Results of All Methods Used in the Research, Including Two Models, AIC, BIC and VIF Method

| Model | Adj. R2 | AIC | BIC | Mean VIF | Comment |

| Model 1 (EE) | 0.68 | −45.21 | −38.74 | 2.14 | No multicollinearity; fractional-log specifica-tion validated (AIC/BIC lowest). |

| Model 2 (RE) | 0.71 | −41.07 | −34.93 | 2.62 | Interaction and threshold terms significant; VIF < 5 for all variables. |

Notes: Both models demonstrate satisfactory fit and specification validity. AIC/BIC values confirm that the chosen non-linear and interaction-threshold specifications outperform linear alternatives. The average VIF < 5 indicates the absence of harmful multicollinearity.

References

- Sotnyk, I.; Kurbatova, T.; Blumberga, A.; Kubatko, O.; Kubatko, O. Solar energy development in households: Ways to improve state policy in Ukraine and Latvia. Int. J. Sustain. Energy 2022, 41, 1623–1649. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Blumberga, A.; Kubatko, O.; Prokopenko, O. Solar business prosumers in Ukraine: Should we wait for them to appear? Energy Policy 2023, 178, 113585. [Google Scholar] [CrossRef]

- Sala, D.; Bashynska, I.; Pavlov, K.; Pavlova, O.; Halytsia, I.; Hevko, B. Comprehensive assessment of economic efficiency for energy-saving investments in public utility enterprises: Optimizing consumption and sustainable development. Sustainability 2024, 16, 10163. [Google Scholar] [CrossRef]

- Dudek, M.; Bashynska, I.; Filyppova, S.; Yermak, S.; Cichoń, D. Methodology for assessment of inclusive social responsibility of the energy industry enterprises. J. Clean. Prod. 2023, 394, 136317. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Kubatko, O.; Prokopenko, O.; Järvis, M. Managing energy efficiency and renewable energy in the residential sector: A bibliometric study. Probl. Perspect. Manag. 2023, 21, 511–527. [Google Scholar] [CrossRef]

- Casalicchio, V.; Manzolini, G.; Prina, M.G.; Moser, D. From investment optimization to fair benefit distribution in renewable energy community modelling. Appl. Energy 2022, 310, 118447. [Google Scholar] [CrossRef]

- Batra, G. Renewable energy economics: Achieving harmony between environmental protection and economic goals. Soc. Sci. Chron. 2023, 2, 1–32. [Google Scholar] [CrossRef]

- Kurbatova, T.; Skibina, T. Renewable energy policy in Ukraine’s household sector: Measures, outcomes, and challenges. In Proceedings of the IEEE International Conference on Modern Electrical and Energy Systems, Kremenchuk, Ukraine, 23–25 September 2019; pp. 234–237. [Google Scholar] [CrossRef]

- Sotnyk, I.; Kurbatova, T.; Trypolska, G.; Sokhan, I.; Koshel, V. Research trends on development of energy efficiency and renewable energy in households: A bibliometric analysis. Environ. Econ. 2023, 14, 13–27. [Google Scholar] [CrossRef]

- Bashynska, I.; Kryvda, V.; Sala, D.; Niekrasova, L.; Maksymov, O.; Suvorov, V. Simulation model of a unified energy system for different scenarios of planned disturbances. Energies 2024, 17, 6136. [Google Scholar] [CrossRef]

- Bashynska, I.; Lewicka, D.; Filyppova, S.; Prokopenko, O. Green Innovation in Central and Eastern Europe. Routledge: London, UK, 2024; p. 192. ISBN 978-1003492771. [Google Scholar]

- Chang, S.; Li, J.; Sethi, S.P.; Wang, X. Risk hedging for VaR-constrained newsvendors. Transp. Res. Part E Logist. Transp. Rev. 2024, 181, 103365. [Google Scholar] [CrossRef]

- Ruiz, A.B.; Saborido, R.; Bermúdez, J.D.; Luque, M.; Vercher, E. Preference-based evolutionary multi-objective optimization for portfolio selection: A new credibilistic model under investor preferences. J. Glob. Optim. 2020, 76, 295–315. [Google Scholar] [CrossRef]

- Jafarizadeh, H.; Yamini, E.; Zolfaghari, S.M.; Esmaeilion, F.; Assad, M.E.H.; Soltani, M. Navigating challenges in large-scale renewable energy storage: Barriers, solutions, and innovations. Energy Rep. 2024, 12, 2179–2192. [Google Scholar] [CrossRef]

- Oladinni, A.; Fasesin, K.; Emezirinwune, M.U.; Oba-Sulaiman, Z.; Abdulsalam, K.A. Cost and technical assessment of integrated photovoltaic, wind turbine, battery, and hydrogen storage system design for household use. Adeleke Univ. J. Sci. 2024, 3, 130–140. [Google Scholar]

- Trypolska, G.; Riabchyn, O. Experience and prospects of financing renewable energy projects in Ukraine. Int. J. Energy Econ. Policy 2022, 12, 134–143. [Google Scholar] [CrossRef]

- Blinov, I.; Radziukynas, V.; Shymaniuk, P.; Dyczko, A.; Stecuła, K.; Sychova, V.; Miroshnyk, V.; Dychkovskyi, R. Smart Management of Energy Losses in Distribution Networks Using Deep Neural Networks. Energies 2025, 18, 3156. [Google Scholar] [CrossRef]

- Fasesin, K.; Oladinni, A.; Emezirinwune, M.U.; Oba-Sulaiman, Z.; Abdulsalam, K.A. Renewable energy in developing countries: Challenges, opportunities, and policy recommendations for innovative funding. Adeleke Univ. J. Sci. 2024, 3, 120–129. [Google Scholar]

- Ogundipe, T.; Ewim, S.E.; Sam-Bulya, N.J. A review of strategic cash flow management models and their role in driving financial growth and sustainability for energy companies in developing markets. GSC Adv. Res. Rev. 2024, 21, 115–146. [Google Scholar] [CrossRef]

- Chen, L.; Msigwa, G.; Yang, M.; Osman, A.I.; Fawzy, S.; Rooney, D.W.; Yap, P.-S. Strategies to achieve a carbon neutral society: A review. Environ. Chem. Lett. 2022, 20, 2277–2310. [Google Scholar] [CrossRef]

- Paraschiv, L.S.; Paraschiv, S. Contribution of renewable energy (hydro, wind, solar and biomass) to decarbonization and transformation of the electricity generation sector for sustainable development. Energy Rep. 2023, 9, 535–544. [Google Scholar] [CrossRef]

- Mihai, D.G.; Dumitrescu, B.A.; Bozagiu, A.-M. Fiscal Sustainability and the Informal Economy: A Non-Linear Perspective. J. Risk Financ. Manag. 2025, 18, 207. [Google Scholar] [CrossRef]

- Godbole, A.; Shah, Z.; Mudholkar, R.S. Preventing Household Bankruptcy: The One-Third Rule in Financial Planning with Mathematical Validation and Game-Theoretic Insights. J. Risk Financ. Manag. 2025, 18, 150. [Google Scholar] [CrossRef]

- Rosário, A.T.; Dias, J.C. The Role of Digital Marketing in Shaping Sustainable Consumption: Insights from a Systematic Literature Review. Sustainability 2025, 17, 7784. [Google Scholar] [CrossRef]

- Pereira, M.S.; de Castro, B.S.; Cordeiro, B.A.; Peixoto, M.G.M.; da Silva, E.C.M.; Gonçalves, M.C. Factors of Customer Loyalty and Retention in the Digital Environment. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 71. [Google Scholar] [CrossRef]

- Akram, R.; Umar, M.; Xiaoli, G.; Chen, F. Dynamic linkages between energy efficiency, renewable energy along with economic growth and carbon emission: A case of MINT countries—An asymmetric analysis. Energy Rep. 2022, 8, 2119–2130. [Google Scholar] [CrossRef]

- Botha, I.; Ghierghina, S.C.; Simionescu, L.N.; Botezatu, M.A.; Coculescu, C. Investigating the drivers of renewable energy production: Panel data evidence for Central and Eastern European countries. Econ. Comput. Econ. Cybern. Stud. Res. 2022, 56, 5–22. [Google Scholar] [CrossRef]

- IMF. Global Financial Stability Report; International Monetary Fund: Washington, DC, USA, 2024; Available online: https://data.imf.org/?sk=388dfa60-1d26-4ade-b505-a05a558d9a42 (accessed on 16 September 2025).

- IMF. International Financial Statistics; International Monetary Fund: Washington, DC, USA, 2023; Available online: https://data.imf.org/?sk=4c514d48-b6ba-49ed-8ab9-52b0c1a0179b&sId=-1 (accessed on 16 September 2025).

- Organisation for Economic Co-Operation and Development (OECD). AI Adoption in Logistics and Retail Sectors; OECD: Paris, France, 2023; Available online: https://www.oecd.org/science/ (accessed on 16 September 2025).

- Organisation for Economic Co-Operation and Development (OECD). Digital Economy Outlook; OECD: Paris, France, 2023; Available online: https://www.oecd.org/digital/ (accessed on 16 September 2025).

- Statista. E-Commerce and Digital Marketing Data; Statista: Hamburg, Germany, 2024; Available online: https://www.statista.com/ (accessed on 16 September 2025).

- World Bank. The World Development Indicators; World Bank: Washington, DC, USA, 2023; Available online: https://datatopics.worldbank.org/world-development-indicators/ (accessed on 16 September 2025).

- World Bank. World Bank Open Data; World Bank: Washington, DC, USA, 2024; Available online: https://data.worldbank.org/ (accessed on 16 September 2025).

- Hu, B.; Alola, A.A.; Tauni, M.Z.; Adebayo, T.S.; Abbas, S. Pathway to cleaner environment: How effective are renewable electricity and financial development approaches? Struct. Change Econ. Dyn. 2023, 67, 277–292. [Google Scholar] [CrossRef]

- Chen, C.; Pinar, M.; Stengos, T. Renewable energy consumption and economic growth nexus: Evidence from a threshold model. Energy Policy 2020, 139, 111295. [Google Scholar] [CrossRef]

- Xuan, A.; Shen, X.; Guo, Q.; Sun, H. A conditional value-at-risk based planning model for integrated energy system with energy storage and renewables. Appl. Energy 2021, 294, 116971. [Google Scholar] [CrossRef]

- Zakaria, A.; Ismail, F.B.; Lipu, M.H.; Hannan, M. Uncertainty models for stochastic optimization in renewable energy applications. Renew. Energy 2020, 145, 1543–1571. [Google Scholar] [CrossRef]

- Weber, C.; Heidari, S.; Bucksteeg, M. Coping with uncertainties in the electricity sector—Methods for decisions of different scope. Econ. Energy Environ. Policy 2021, 10, 5–30. [Google Scholar] [CrossRef]

- Zaier, L.H.; Mokni, K.; Ajmi, A.N. Causality relationships between climate policy uncertainty, renewable energy stocks, and oil prices: A mixed-frequency causality analysis. Futur. Bus. J. 2024, 10, 112. [Google Scholar] [CrossRef]

- Koldovskiy, A. Strategic infrastructure transformation: Revolutionizing financial sector management for enhanced success. Acta Acad. Beregs. Econ. 2024, 5, 323–332. [Google Scholar] [CrossRef]

- Prokopenko, O.; Koldovskiy, A.; Khalilova, M.; Orazbayeva, A.; Machado, J. Development of blockchain technology in financial accounting. Computation 2024, 12, 250. [Google Scholar] [CrossRef]

- Pavlychenko, A.; Sala, D.; Pyzalski, M.; Dybrin, S.; Antoniuk, O.; Dychkovskyi, R. Utilizing Fuel and Energy Sector Waste as Thermal Insulation Materials for Technical Buildings. Energies 2025, 18, 2339. [Google Scholar] [CrossRef]

- Siddik, A.B.; Khan, S.; Khan, U.; Yong, L.; Murshed, M. The role of renewable energy finance in achieving low-carbon growth: Contextual evidence from leading renewable energy-investing countries. Energy 2023, 270, 126864. [Google Scholar] [CrossRef]

- Hieu, V.M.; Mai, N.H. Impact of renewable energy on economic growth? Novel evidence from developing countries through MMQR estimations. Environ. Sci. Pollut. Res. 2023, 30, 578–593. [Google Scholar] [CrossRef]

- Pan, X.; Shao, T.; Zheng, X.; Zhang, Y.; Ma, X.; Zhang, Q. Energy and sustainable development nexus: A review. Energy Strateg. Rev. 2023, 47, 101078. [Google Scholar] [CrossRef]

- Shafranova, K.; Navolska, N.; Koldovskyi, A. Navigating the digital frontier: A comparative examination of Central Bank Digital Currency (CBDC) and the Quantum Financial System (QFS). SocioEcon. Chall. 2024, 8, 90–111. [Google Scholar] [CrossRef]

- Ullah, A.; Ahmed, M.; Raza, S.A.; Ali, S. A threshold approach to sustainable development: Nonlinear relationship between renewable energy consumption, natural resource rent, and ecological footprint. J. Environ. Manag. 2021, 295, 113073. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).