Regional Disparities, Spatial Effects, and the Dynamic Evolution of Distorted Energy Prices in China

Abstract

1. Introduction

2. Literature Review and Theoretical Framework

2.1. Literature Review

- (1)

- Measurement Methods of Energy Price Distortion

- (2)

- Economic Impacts of Energy Price Distortion

- (3)

- Environmental Impacts of Energy Price Distortion

- (4)

- Spatial Analysis of Energy Price Distortion

2.2. Theoretical Framework

3. Research Methodology and Data Processing

3.1. Research Methodology

- (1)

- C-D Production Function

- (2)

- Theil T Index (GE(1))

3.2. Data Processing

4. Empirical Analysis

4.1. Baseline Measurements

4.2. Regional Disparities

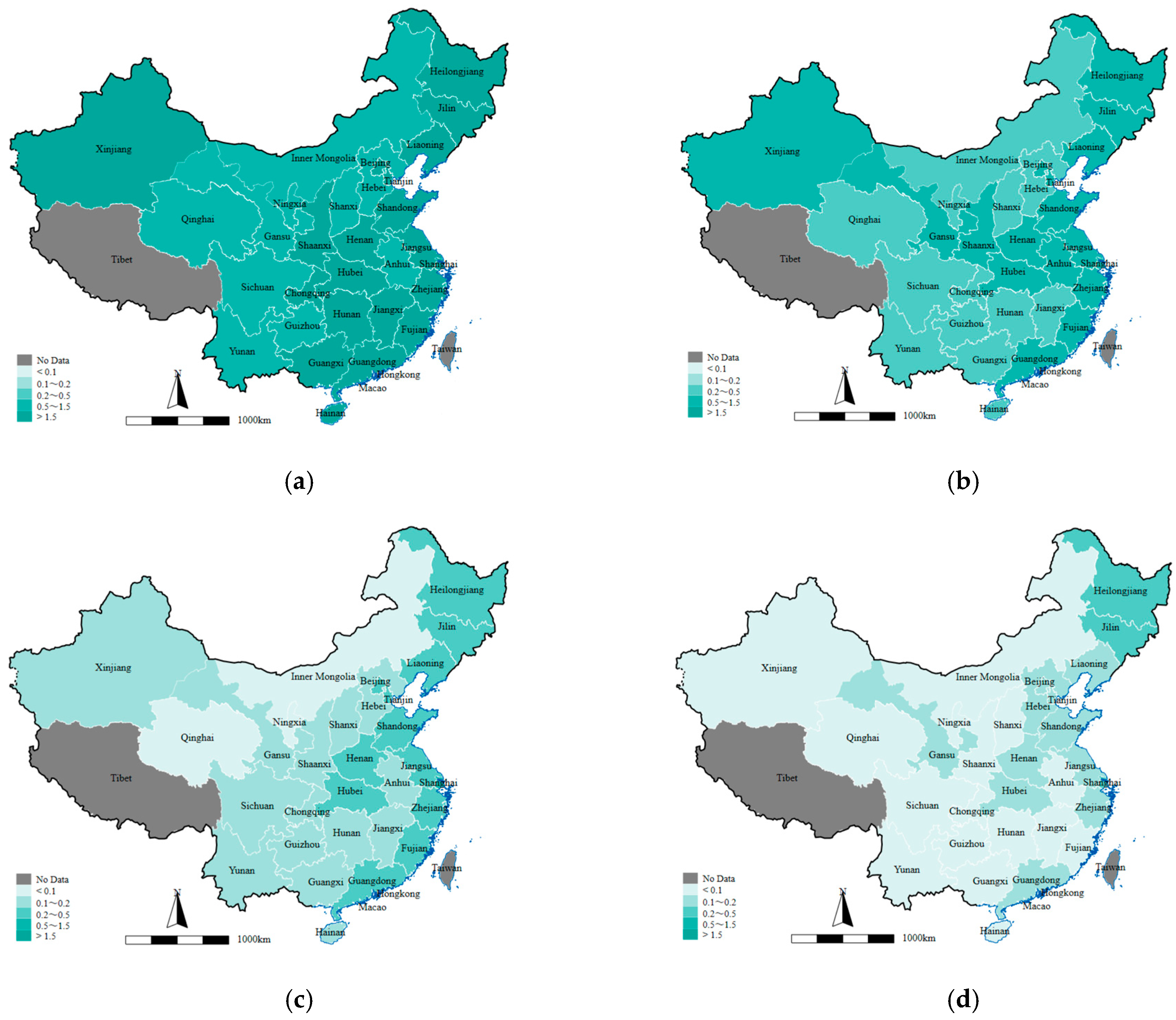

4.3. Spatial Distribution

4.4. Dynamic Evolution

4.5. Robustness Checks

5. Conclusions and Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ouyang, X.; Sun, C. Energy savings potential in China’s industrial sector: From the perspectives of factor price distortion and allocative inefficiency. Energy Econ. 2015, 48, 117–126. [Google Scholar] [CrossRef]

- Ju, K.; Su, B.; Zhou, D.; Wu, J. Does energy-price regulation benefit China’s economy and environment? Evidence from energy-price distortions. Energy Policy 2017, 105, 108–119. [Google Scholar] [CrossRef]

- Xu, J.; Wang, E. The path to energy savings and CO2 emission reductions in China’s industrial sector from the perspective of factor price distortions correction–Based on an extended capital vintage model. Energy 2024, 313, 134004. [Google Scholar] [CrossRef]

- Wang, X.; Liao, B.; Cheng, L.; Li, J.; Yang, X.; Wang, X. Energy Price Distortions and Urban Carbon Emission Efficiency: Evidence from China’s Energy-Intensive Sectors. Sustainability 2024, 16, 9351. [Google Scholar] [CrossRef]

- Sun, Y.; Li, H.; Zhu, B. Factor market distortion, total factor energy efficiency and energy shadow price: A case of Chinese manufacturing industry. Energy 2024, 307, 132739. [Google Scholar] [CrossRef]

- Wu, L.; Xu, C.; Zhu, Q.; Zhou, D. Multiple energy price distortions and improvement of potential energy consumption structure in the energy transition. Appl. Energy 2024, 362, 122992. [Google Scholar] [CrossRef]

- Ju, K.; Wang, Q.; Liu, L.; Zhou, D. Measurement of the price distortion degree for exhaustible energy resources in China: A discount rate perspective. Emerg. Mark. Financ. Trade 2019, 55, 2718–2737. [Google Scholar] [CrossRef]

- Sha, R.; Li, J.; Ge, T. How do price distortions of fossil energy sources affect China’s green economic efficiency? Energy 2021, 232, 121017. [Google Scholar] [CrossRef]

- Qiao, S.; Zhao, D.H.; Guo, Z.X.; Tao, Z. Factor price distortions, environmental regulation and innovation efficiency: An empirical study on China’s power enterprises. Energy Policy 2022, 164, 112887. [Google Scholar] [CrossRef]

- Sun, X.; Loh, L.; Chen, Z.; Zhou, X. Factor price distortion and ecological efficiency: The role of institutional quality. Environ. Sci. Pollut. Res. 2020, 27, 5293–5304. [Google Scholar] [CrossRef]

- Zhang, S.; Chen, C.; Huang, D.; Hu, L. Measurement of factor price distortion: A new production function method with time-varying elasticity. Technol. Forecast. Soc. 2022, 175, 121363. [Google Scholar] [CrossRef]

- Peng, C.; Zhang, J.; Xu, Z. Does Price Distortion Affect Energy Efficiency? Evidence from Dynamic Spatial Analytics of China. Energies 2022, 15, 9576. [Google Scholar] [CrossRef]

- Wang, X.; Wang, H.; Liang, S.; Xu, S. The Influence of Energy Price Distortion on Region Energy Efficiency in China’s Energy-Intensive Industries from the Perspectives of Urban Heterogeneity. Sustainability 2021, 14, 88. [Google Scholar] [CrossRef]

- Xu, M.; Tan, R. Removing energy allocation distortion to increase economic output and energy efficiency in China. Energy Policy 2021, 150, 112110. [Google Scholar] [CrossRef]

- Zamani, R.; Tash, M.N.S.; Norouzi, A.; Hosseinzadeh, R. Impact of energy price reform on energy intensity in Iranian manufacturing industries. Energy Effic. 2024, 17, 71. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Darbaz, I. The causal linkage between energy price and food price. Energies 2021, 14, 4182. [Google Scholar] [CrossRef]

- Punzi, M.T. The impact of energy price uncertainty on macroeconomic variables. Energy Policy 2019, 129, 1306–1319. [Google Scholar] [CrossRef]

- Croonenbroeck, C.; Hüttel, S. Quantifying the economic efficiency impact of inaccurate renewable energy price forecasts. Energy 2017, 134, 767–774. [Google Scholar] [CrossRef]

- Li, K.; Xu, C.; Tang, L. The important of eliminating energy market distortions: The perspective of industrial green productivity. Energy Econ. 2024, 132, 107472. [Google Scholar] [CrossRef]

- Gao, K.; Yuan, Y. Does market-oriented reform make the industrial sector “Greener” in China? Fresh evidence from the perspective of capital-labor-energy market distortions. Energy 2022, 254, 124183. [Google Scholar] [CrossRef]

- Gao, B.; Huang, Z.; Zhang, T.; Sun, X.; Song, M. Exploring the impact of industrial land price distortion on carbon emission intensity: Evidence from China. Land 2022, 12, 92. [Google Scholar] [CrossRef]

- Wang, X.; Bai, M.; Xie, C. Investigating CO2 mitigation potentials and the impact of oil price distortion in China’s transport sector. Energy Policy 2019, 130, 320–327. [Google Scholar] [CrossRef]

- Anselin, L. A local indicator of multivariate spatial association: Extending Geary’s C. Geogr. Anal. 2019, 51, 133–150. [Google Scholar] [CrossRef]

- Chen, Y. Spatial autocorrelation equation based on Moran’s index. Sci. Rep. 2023, 13, 19296. [Google Scholar] [CrossRef]

- Paelinck, J.H.; Klaassen, L.H.; Ancot, J.; Verster, A.; Wagenaar, S. Spatial Econometrics; Saxon House: Wendouree, Australia, 1979. [Google Scholar]

- Baltagi, B.H.; Pace, R.K.; LeSage, J.P.; Liesenfeld, R.; Richard, J.F.; Vogler, J.; Craioveanu, M.; Terrell, D.; Egger, P.H.; Kesina, M.; et al. Spatial Econometrics: Qualitative and Limited Dependent Variables; Emerald Group Publishing: Bingley, UK, 2016. [Google Scholar]

- Elhorst, J.P. Spatial Econometrics: From Cross-Sectional Data to Spatial Panels; Springer: Heidelberg, Germany, 2014; Volume 479. [Google Scholar]

- Wu, J.; Abban, O.J.; Boadi, A.D.; Charles, O. The effects of energy price, spatial spillover of CO2 emissions, and economic freedom on CO2 emissions in Europe: A spatial econometrics approach. Environ. Sci. Pollut. Res. 2022, 29, 63782–63798. [Google Scholar] [CrossRef]

- Burnett, J.W.; Bergstrom, J.C.; Dorfman, J.H. A spatial panel data approach to estimating US state-level energy emissions. Energy Econ. 2013, 40, 396–404. [Google Scholar] [CrossRef]

- LeSage, J.; Pace, R.K. Introduction to Spatial Econometrics; Chapman and Hall/CRC: New York, NY, USA, 2009. [Google Scholar]

- Kelejian, H.H.; Prucha, I.R. Specification and estimation of spatial autoregressive models with autoregressive and heteroskedastic disturbances. J. Econom. 2010, 157, 53–67. [Google Scholar] [CrossRef]

- Hua, Q.; Liu, G.; Sun, D.; Zhu, L. Spatial effects of technology market development on energy efficiency: Heterogeneity analysis based on the characteristics of technology market. Technol. Forecast Soc. 2022, 185, 122008. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, Z.; Ji, Y.; Liang, S. Dynamic evolution of spatial distribution of energy factor allocation efficiency: Industrial sector in China. Environ. Dev. Sustain. 2024, 27, 13883–13901. [Google Scholar] [CrossRef]

- Li, W.; Sun, W.; Li, G.; Jin, B.; Wu, W.; Cui, P.; Zhao, G. Transmission mechanism between energy prices and carbon emissions using geographically weighted regression. Energy Policy 2018, 115, 434–442. [Google Scholar] [CrossRef]

- Wang, J.; Enilov, M.; Kizys, R. Does M&A activity spin the cycle of energy prices? Energy Econ. 2024, 137, 107781. [Google Scholar]

- Sha, R.; Qian, J.; Li, C.; Ge, T. A win-win opportunity for economic growth and carbon emissions reduction in China: The perspective from correcting energy price distortions. Energy Strateg. Rev. 2024, 53, 101406. [Google Scholar] [CrossRef]

- Xu, S.; Song, Y.; Yang, Y. Embedded carbon emissions in the inter-industrial sectors of China: A new analysis of total factor productivity and capacity utilization. J. Environ. Manag. 2025, 388, 125970. [Google Scholar] [CrossRef]

- Li, C. Climate change impacts on rice production in Japan: A Cobb-Douglas and panel data analysis. Ecol. Indic. 2023, 147, 110008. [Google Scholar] [CrossRef]

- Theil, H. Economics and Information Theory; North-Holland Publishing Company: Amsterdam, The Netherlands, 1967. [Google Scholar]

- Shorrocks, A.F. The class of additively decomposable inequality measures. Econom. J. Econom. Soc. 1980, 48, 613–625. [Google Scholar]

- Barro, R.J.; Sala-i-Martin, X. Convergence. J. Political Econ. 1992, 100, 223–251. [Google Scholar] [CrossRef]

- Quah, D.T. Convergence empirics across economies with (some) capital mobility. J. Econ. Growth 1996, 1, 95–124. [Google Scholar] [CrossRef]

- Quah, D.T. Twin peaks: Growth and convergence in models of distribution dynamics. Econ. J. 1996, 106, 1045–1055. [Google Scholar] [CrossRef]

| Area | 2000 | 2008 | 2016 | 2022 | Mean | Area | 2000 | 2008 | 2016 | 2022 | Mean |

|---|---|---|---|---|---|---|---|---|---|---|---|

| China | 2.030 | 0.552 | 0.232 | 0.115 | 0.620 | Henan | 1.944 | 0.558 | 0.283 | 0.194 | 0.636 |

| Liaoning | 2.233 | 0.833 | 0.414 | 0.162 | 0.855 | Shaanxi | 1.910 | 0.501 | 0.173 | 0.088 | 0.541 |

| Jilin | 2.497 | 0.729 | 0.444 | 0.223 | 0.842 | Middle Yellow River | 5.894 | 1.568 | 0.652 | 0.372 | 1.739 |

| Heilongjiang | 1.664 | 0.864 | 0.410 | 0.222 | 0.778 | Anhui | 1.420 | 0.505 | 0.190 | 0.091 | 0.506 |

| Northeast Comprehensive | 6.394 | 2.427 | 1.268 | 0.607 | 2.474 | Jiangxi | 1.552 | 0.494 | 0.187 | 0.083 | 0.509 |

| Beijing | 2.056 | 0.643 | 0.314 | 0.157 | 0.707 | Hubei | 2.153 | 0.609 | 0.296 | 0.144 | 0.700 |

| Tianjin | 3.324 | 0.832 | 0.268 | 0.140 | 0.952 | Hunan | 1.599 | 0.341 | 0.170 | 0.084 | 0.432 |

| Hebei | 1.395 | 0.460 | 0.173 | 0.112 | 0.482 | Middle Yangtze | 6.724 | 1.948 | 0.843 | 0.401 | 2.147 |

| Shandong | 2.560 | 0.562 | 0.245 | 0.133 | 0.713 | Guangxi | 1.713 | 0.486 | 0.193 | 0.086 | 0.538 |

| Northern Coast | 9.335 | 2.497 | 1.001 | 0.543 | 2.854 | Chongqing | 1.618 | 0.320 | 0.147 | 0.066 | 0.422 |

| Shanghai | 4.422 | 1.136 | 0.554 | 0.270 | 1.352 | Sichuan | 1.419 | 0.351 | 0.170 | 0.080 | 0.414 |

| Jiangsu | 4.324 | 0.908 | 0.368 | 0.178 | 1.182 | Guizhou | 0.643 | 0.266 | 0.112 | 0.053 | 0.246 |

| Zhejiang | 3.288 | 0.750 | 0.317 | 0.141 | 0.904 | Yunnan | 1.335 | 0.375 | 0.142 | 0.061 | 0.405 |

| Eastern Coast | 12.034 | 2.793 | 1.240 | 0.589 | 3.439 | Southwest | 6.728 | 1.799 | 0.764 | 0.345 | 2.025 |

| Fujian | 2.793 | 0.547 | 0.212 | 0.095 | 0.743 | Gansu | 1.243 | 0.520 | 0.199 | 0.121 | 0.499 |

| Guangdong | 3.983 | 0.761 | 0.329 | 0.164 | 1.018 | Qinghai | 1.190 | 0.313 | 0.093 | 0.066 | 0.343 |

| Hainan | 1.926 | 0.396 | 0.122 | 0.048 | 0.490 | Ningxia | 0.993 | 0.252 | 0.082 | 0.026 | 0.235 |

| Southern Coast | 8.702 | 1.703 | 0.663 | 0.307 | 2.252 | Xinjiang | 1.673 | 0.750 | 0.168 | 0.077 | 0.608 |

| Shanxi | 0.788 | 0.308 | 0.110 | 0.061 | 0.276 | Greater Northwest | 5.099 | 1.835 | 0.542 | 0.290 | 1.685 |

| Inner Mongolia | 1.253 | 0.201 | 0.086 | 0.029 | 0.287 |

| Year | 2000 | 2008 | 2016 | 2022 | Change | |

|---|---|---|---|---|---|---|

| Between-Region Gap and Contribution (%) | 0.0757 | 0.0508 | 0.0839 | 0.0765 | 0.0008 | |

| (71.76) | (62.08) | (70.23) | (57.45) | (−14.31) | ||

| Within-Region Gap and Contribution (%) | Northeast Comprehensive | 0.0137 | 0.0026 | 0.0007 | 0.0102 | −0.0035 |

| (1.36) | (0.47) | (0.10) | (1.34) | (−0.02) | ||

| Northern Coast | 0.0465 | 0.0234 | 0.0216 | 0.0071 | −0.0394 | |

| (6.76) | (4.31) | (2.60) | (0.83) | (−5.93) | ||

| Eastern Coast | 0.0085 | 0.0144 | 0.0294 | 0.0371 | 0.0286 | |

| (1.58) | (2.97) | (4.38) | (4.75) | (3.17) | ||

| Southern Coast | 0.0423 | 0.0347 | 0.0752 | 0.1101 | 0.0678 | |

| (5.74) | (4.36) | (5.98) | (7.35) | (1.61) | ||

| Middle Yellow River | 0.0572 | 0.0709 | 0.105 | 0.2105 | 0.1533 | |

| (5.25) | (6.59) | (8.22) | (17.05) | (11.80) | ||

| Middle Yangtze | 0.0133 | 0.0201 | 0.026 | 0.0299 | 0.0166 | |

| (1.39) | (2.89) | (2.63) | (2.61) | (1.22) | ||

| Southwest | 0.0449 | 0.02 | 0.016 | 0.0156 | −0.0293 | |

| (4.70) | (2.65) | (1.47) | (1.17) | (−3.53) | ||

| Greater Northwest | 0.0183 | 0.0892 | 0.0676 | 0.1178 | 0.0995 | |

| (1.45) | (12.07) | (4.40) | (7.43) | (5.98) | ||

| Within-Region Total | 0.0298 | 0.031 | 0.0356 | 0.0566 | 0.0268 | |

| (28.24) | (37.92) | (29.77) | (42.55) | (14.31) | ||

| Overall Gap | 0.1055 | 0.0818 | 0.1195 | 0.1331 | 0.0166 | |

| Year | Moran’s I | p-Value | Year | Moran’s I | p-Value |

|---|---|---|---|---|---|

| 2000 | 0.401 *** | 0.000 | 2012 | 0.271 *** | 0.006 |

| 2001 | 0.427 *** | 0.000 | 2013 | 0.251 *** | 0.010 |

| 2002 | 0.388 *** | 0.000 | 2014 | 0.271 *** | 0.006 |

| 2003 | 0.378 *** | 0.000 | 2015 | 0.277 *** | 0.005 |

| 2004 | 0.389 *** | 0.000 | 2016 | 0.277 *** | 0.005 |

| 2005 | 0.330 *** | 0.001 | 2017 | 0.133 * | 0.078 |

| 2006 | 0.296 *** | 0.003 | 2018 | 0.269 *** | 0.006 |

| 2007 | 0.282 *** | 0.005 | 2019 | 0.260 *** | 0.008 |

| 2008 | 0.260 *** | 0.008 | 2020 | 0.248 *** | 0.010 |

| 2009 | 0.282 *** | 0.005 | 2021 | 0.230 ** | 0.015 |

| 2010 | 0.258 *** | 0.009 | 2022 | 0.203 ** | 0.026 |

| 2011 | 0.253 *** | 0.009 |

| Quadrant | I | II | III | IV |

|---|---|---|---|---|

| 2000 | Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Beijing | Hainan, Anhui, Jiangxi, Hebei | Shanxi, Guizhou, Inner Mongolia, Ningxia, Qinghai, Yunnan, Sichuan, Xinjiang, Chongqing, Shaanxi, Gansu, Henan, Heilongjiang, Guangxi, Hunan | Liaoning, Hubei, Tianjin, Guangdong, Jilin |

| 2008 | Shanghai, Jiangsu, Zhejiang, Jilin, Beijing, Tianjin, Shandong | Inner Mongolia, Qinghai, Hebei, Jiangxi, Fujian, Anhui, Hainan | Shanxi, Chongqing, Ningxia, Guizhou, Sichuan, Yunnan, Hunan, Guangxi, Shaanxi, Gansu | Liaoning, Guangdong, Heilongjiang, Xinjiang, Hubei, Henan |

| 2016 | Shanghai, Jiangsu, Zhejiang, Jilin, Heilongjiang, Liaoning, Shandong, Tianjin | Hainan, Anhui, Fujian, Jiangxi, Inner Mongolia, Hebei | Qinghai, Chongqing, Guizhou, Yunnan, Ningxia, Gansu, Sichuan, Shaanxi, Guangxi, Xinjiang, Shanxi, Hunan | Beijing, Henan, Hubei, Guangdong |

| 2022 | Shanghai, Jiangsu, Jilin, Heilongjiang, Liaoning, Beijing, Tianjin, Zhejiang, Shandong | Hainan, Anhui, Fujian, Jiangxi, Inner Mongolia, Hebei | Ningxia, Guizhou, Yunnan, Qinghai, Xinjiang, Chongqing, Shaanxi, Shanxi, Hunan, Guangxi, Sichuan | Henan, Hubei, Guangdong, Gansu |

| Neighborhood Context | t/(t + 1) | I | II | III | Observations | |

|---|---|---|---|---|---|---|

| Traditional | I | 0.9944 | 0.0000 | 0.0056 | 178 | |

| II | 0.1408 | 0.8592 | 0.0000 | 206 | ||

| III | 0.0036 | 0.1087 | 0.8877 | 276 | ||

| Spatial | I | I | 1.0000 | 0.0000 | 0.0000 | 126 |

| II | 0.3243 | 0.6757 | 0.0000 | 37 | ||

| III | 0.0000 | 0.0000 | 0.0000 | 0 | ||

| II | I | 1.0000 | 0.0000 | 0.0000 | 49 | |

| II | 0.1181 | 0.8819 | 0.0000 | 127 | ||

| III | 0.0000 | 0.2889 | 0.7111 | 45 | ||

| III | I | 0.6667 | 0.0000 | 0.3333 | 3 | |

| II | 0.0476 | 0.9524 | 0.0000 | 42 | ||

| III | 0.0043 | 0.0736 | 0.9221 | 231 |

| Group | Coefficient | t-Value | p-Value | Convergence Pattern |

|---|---|---|---|---|

| High Distortion | −0.033 *** | −7.79 | 0.000 | Convergence |

| Medium Distortion | −0.017 *** | −10.16 | 0.000 | Convergence |

| Low Distortion | −0.015 *** | −10.90 | 0.000 | Convergence |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, Z.; Jia, Z.; Hao, Y. Regional Disparities, Spatial Effects, and the Dynamic Evolution of Distorted Energy Prices in China. Energies 2025, 18, 3465. https://doi.org/10.3390/en18133465

Gao Z, Jia Z, Hao Y. Regional Disparities, Spatial Effects, and the Dynamic Evolution of Distorted Energy Prices in China. Energies. 2025; 18(13):3465. https://doi.org/10.3390/en18133465

Chicago/Turabian StyleGao, Zhiyuan, Ziying Jia, and Yu Hao. 2025. "Regional Disparities, Spatial Effects, and the Dynamic Evolution of Distorted Energy Prices in China" Energies 18, no. 13: 3465. https://doi.org/10.3390/en18133465

APA StyleGao, Z., Jia, Z., & Hao, Y. (2025). Regional Disparities, Spatial Effects, and the Dynamic Evolution of Distorted Energy Prices in China. Energies, 18(13), 3465. https://doi.org/10.3390/en18133465