Transformation of the Energy Market in Poland in the Context of the European Union over the Last 20 Years

Abstract

1. Introduction

- Identification of the main systemic problems: dependence on coal, low system flexibility, obsolete infrastructure, dominance of state-owned concerns.

- Analysis of EU regulations: 2020 and 2030 climate packages, EU ETS, Green Deal, Fit for 55.

- Assessment of RES development in Poland against the EU average.

- Analysis of transmission grid modernization and digitalization of the energy system.

- Description of market trends and future scenarios (electrification, hydrogen, EU market integration).

- Identification of challenges: technological, social, legal and financial.

- -

- Purchasing behaviour (loyalty to suppliers, reluctance to change);

- -

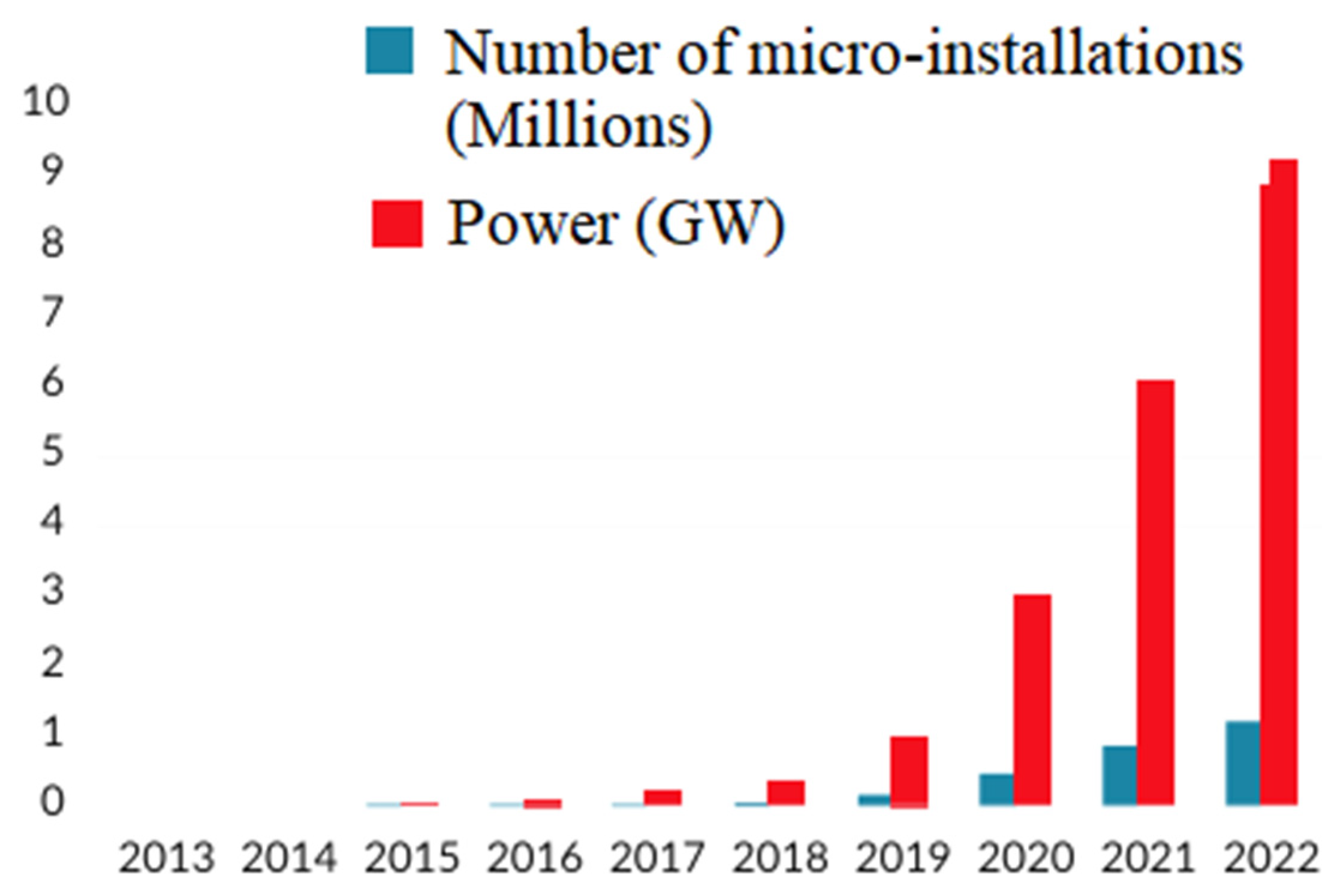

- Investment decisions (PV micro-installations, heat pumps);

- -

- Social attitudes (acceptance or resistance to new technologies);

- -

- Expectations regarding prices and security of supply.

- The lack of a comprehensive review of Poland’s energy transition in a long-term context (2005–2025) against the EU;

- The lack of a combination of technical, economic, social and regulatory aspects—analyses to date have often been limited to one of these areas;

- Insufficient examination of the role of EU policy as a catalyst for change—the authors indicate how support mechanisms (e.g., modernization funds, Just Transition Fund) shaped national decisions;

- Neglect of analysis of systemic barriers (e.g., low network flexibility, ownership structure, social resistance) in previous work.

2. Research Methodology

- -

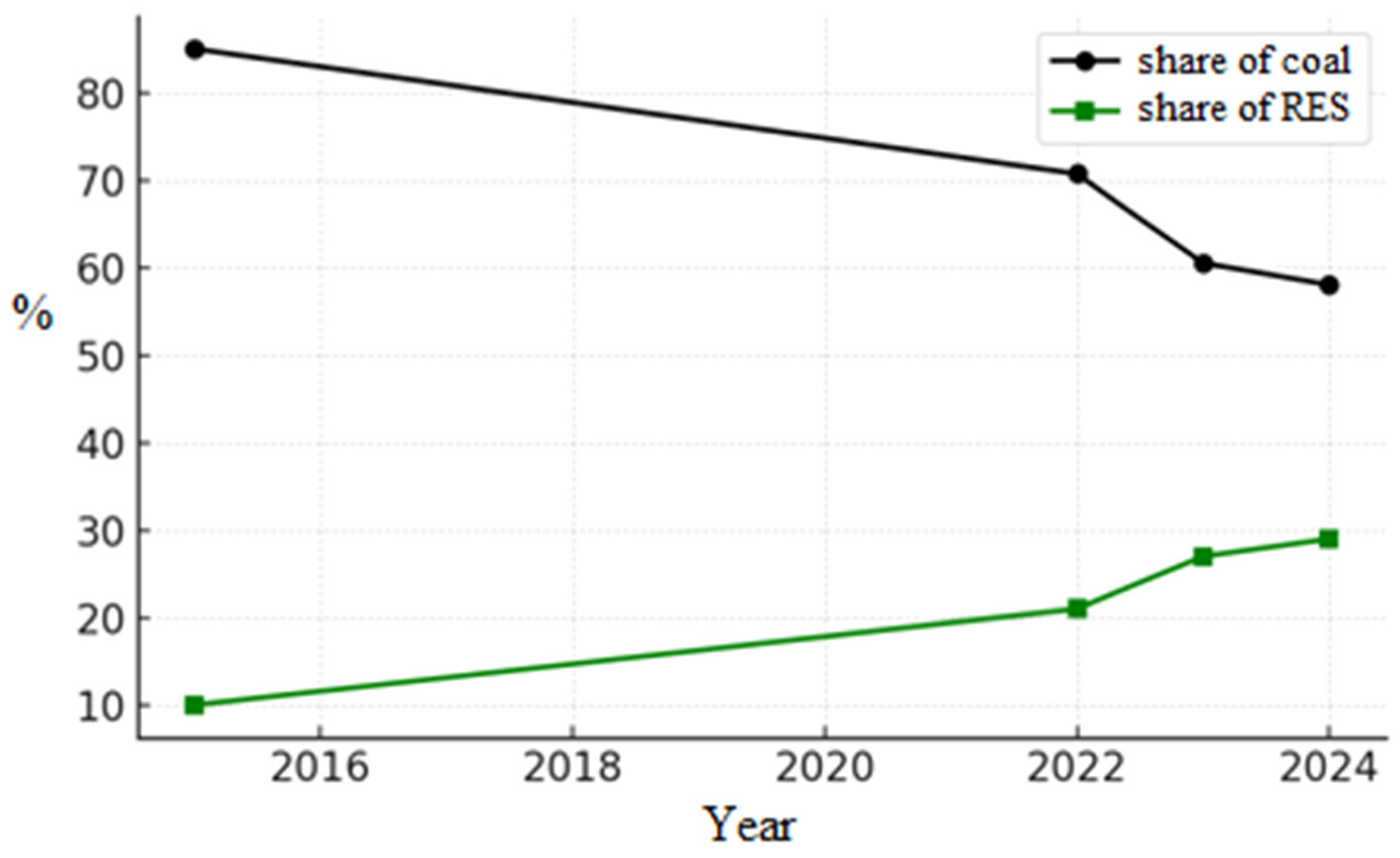

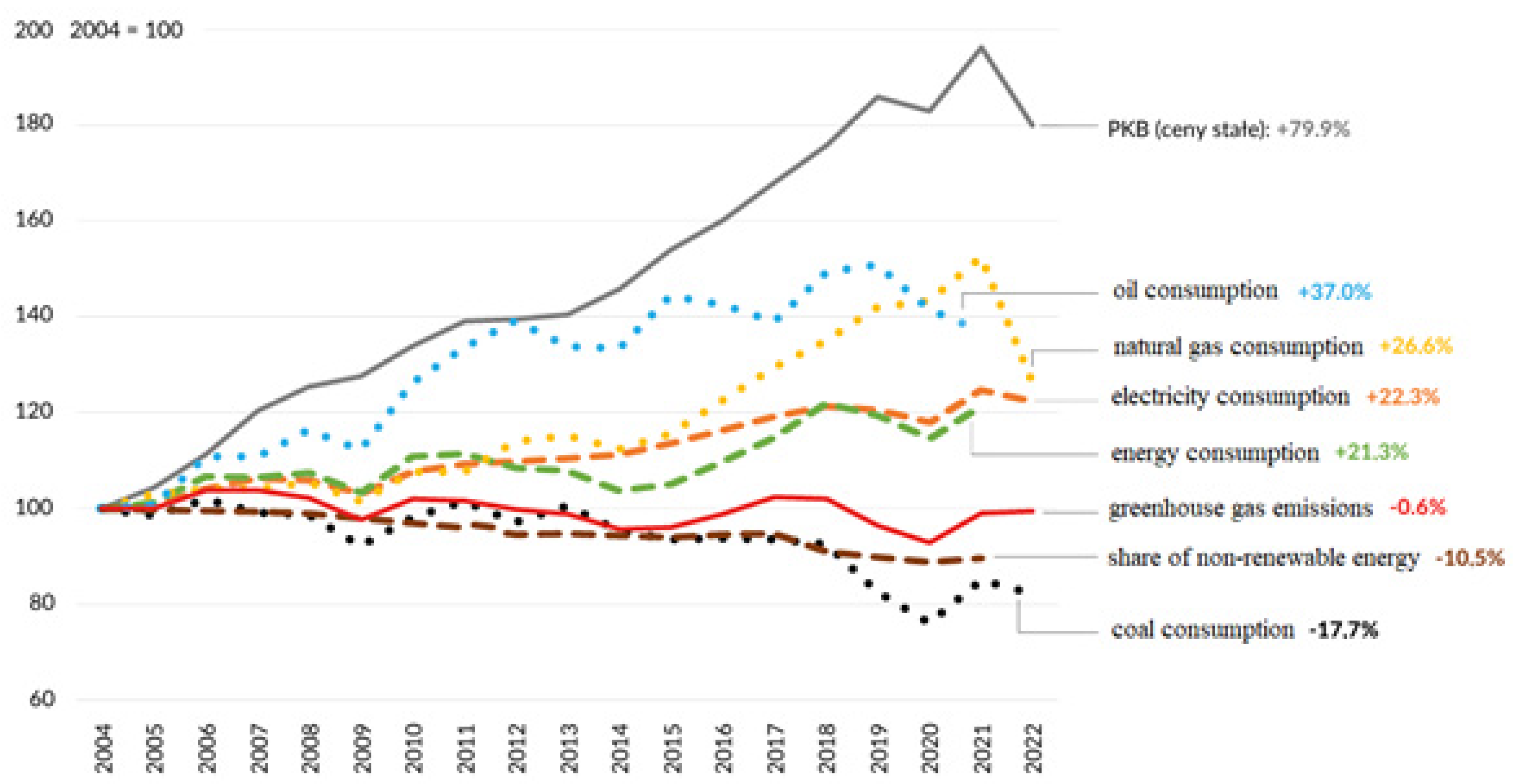

- Comparative analysis of quantitative data on energy mix, CO2 emissions, RES share;

- -

- Assessment of the impact of EU regulations (climate and energy packages, EU ETS, Green Deal);

- -

- Analysis of trends and barriers at the technological, social and institutional level;

- -

- Presentation of data in the form of graphs and time structures (e.g., change in the share of coal and RES).

3. Systemic Problems of the Polish Energy Market

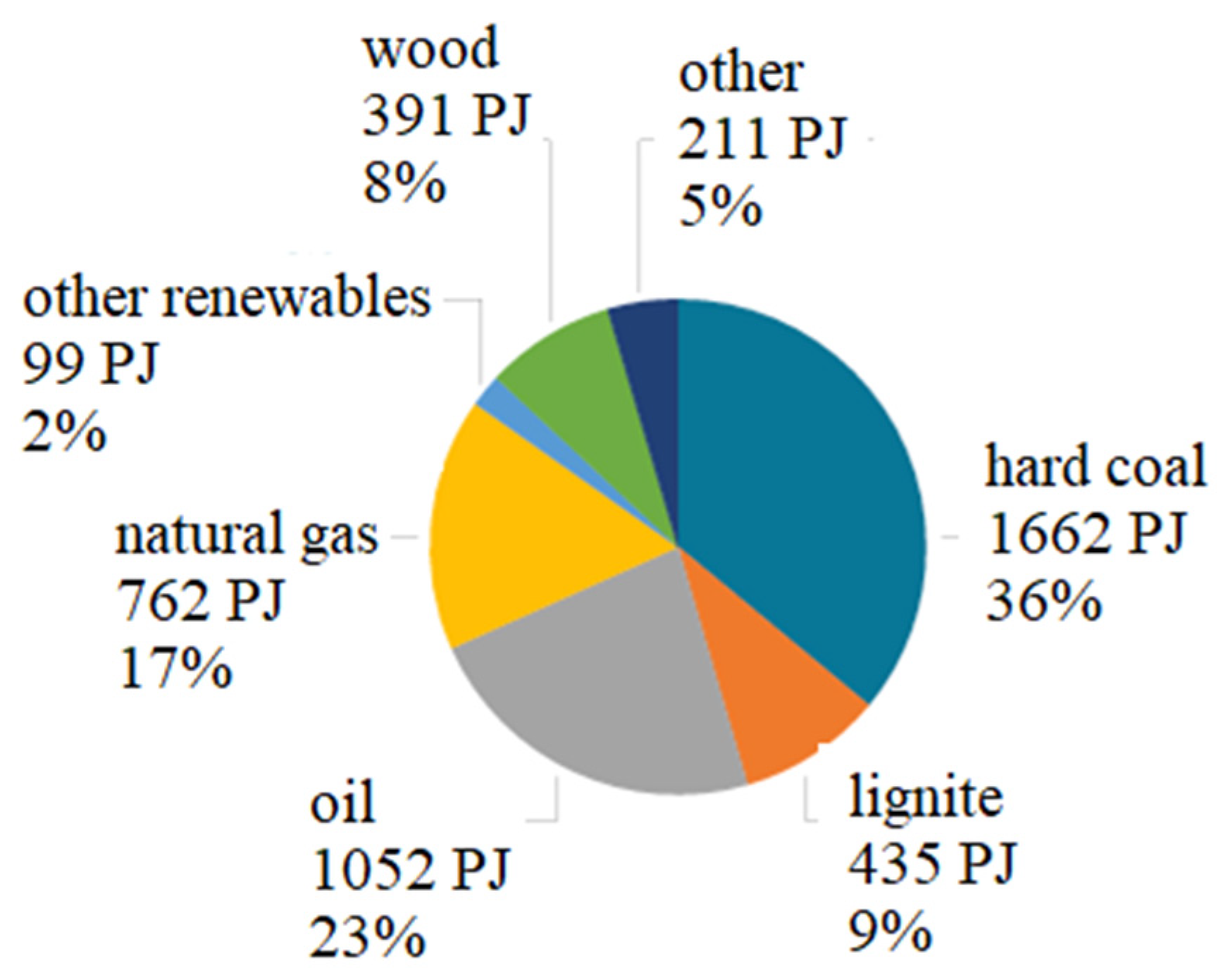

3.1. Dependence on Coal

3.2. Insufficient Flexibility of the System and Infrastructure

3.3. Ownership Structure and Market Conditions

- -

- Inhibition of competition—private investors have difficult access to transmission infrastructure and the power market.

- -

- Limited flexibility—investment decisions are often dependent on current government policy.

- -

- Slower pace of innovation—state-owned entities are less likely to take technological risks (e.g., new energy storage models, hydrogen, SMR).

- -

- Marginalisation of the role of start-ups and the prosumer (an energy consumer who also generates energy, typically via rooftop photovoltaic systems) sector—despite the potential for growth, there is a lack of market space and regulatory support.

3.4. Energy Security vs. Transformation

4. Impact of EU Initiatives and Regulations on the Transition in Poland

- The 2020 climate and energy package, adopted in 2008, involved the 3 × 20 target (by 2020, a 20% reduction in CO2 emissions, a 20% increase in the share of RES, and a 20% improvement in energy efficiency). Poland has been assigned national targets that take into account its lower starting point: a 15% share of RES in final energy consumption in 2020 and the possibility of a 14% increase in emissions in non-ETS sectors (relative to 2005) as part of the community’s reduction effort [4]. These targets become the driving force behind the first major transformation efforts in Poland—support for RES was developed, co-firing of biomass in power generation was increased and coal-fired power plants were modernised to improve efficiency. Nonetheless, Poland approached the 15% RES target with some difficulty—ultimately, the RES share in 2020 was around 12.9% (against the target of 15%), which meant failure to meet the commitment [33]. The need to implement the missing RES volume became the subject of negotiations under cooperation mechanisms (transfers of statistical surpluses from other countries). However, the 2020 package initiated an increase in investments in wind power plants in Poland (2008–2016) and projects aimed at improving energy efficiency in industry.

- The EU Emissions Trading Scheme (EU ETS)—launched in 2005—covered power plants and energy-intensive industries, introducing the cost of CO2 emissions as an economic factor [34,35,36,37,38,39,40]. For Poland, which relies on coal for ~70–90% of its energy production, the ETS has become a key driver of the transition. In the initial stages of the ETS, Poland negotiated important concessions including free allowances for the electricity sector for modernisation (derogation from Article 10c of the ETS Directive) and the establishment of the Modernisation Fund, a mechanism to support low-carbon investments financed by the sale of part of the allowances (Poland is the largest beneficiary of this fund). Nevertheless, since around 2018, the price of ETS allowances began to rise sharply, exceeding 50 EUR/t and, in 2021–2022, even 80–90 EUR/t [4]. This dramatically worsened the economics of coal-fired power plants, as the cost of CO2 became comparable to or higher than the cost of fuel. In 2022, the Polish power sector incurred some of the highest emission costs in the EU, which translated into higher wholesale energy prices. The government tried to mitigate the effects of the ETS by keeping the national emission fee low (in 2021, only EUR 0.07/t compared to ~89/t in the ETS market) and subsidising companies, among other things, through the aforementioned capacity market. Nevertheless, the pressure of the EU ETS has become a decisive factor forcing the closure of the oldest and least efficient coal-fired units. According to analyses, after 2025, there may be a rapid increase in coal-fired unit shutdowns; i.e., once their capacity contracts expire and in the absence of further subsidies, up to 8 GW may be withdrawn from the market around 2026, and another ~6 GW by 2030. [4]. This is a direct result of stricter EU rules—from July 2025, power plants emitting >550 g CO2/kWh will not be eligible for support under the capacity market. When negotiating the Commission’s approval for its capacity market, Poland had to accept this mechanism (550 g CO2/kWh), which effectively set a cut-off date for coal subsidies. In this way, the ETS and related regulations are forcing the accelerated decarbonisation of the Polish power sector.

- The 2030 climate and energy policy framework—agreed in 2014 (and tightened in 2018)—set new targets for 2030: at least a 40% reduction in GHG emissions (later increased to 55%), a 32% share of RES and a 32.5% improvement in efficiency [41]. For Poland, this meant, among other things, the need to update its energy strategy, which took the form of the adoption in 2021 of the Energy Policy of Poland until 2040 (PEP2040—a strategic government document outlining Poland’s energy policy goals and directions until 2040). However, the 2021 version of PEP2040 was considered an inadequate document, as it only envisaged a 30% reduction in emissions by 2030 relative to 1990 levels (EU: −55%) and based the transition mainly on replacing part of coal with natural gas and introducing nuclear energy [42]. It assumed, among other things, an increase in the share of gas in power generation from ~4% to 9.3% in 2030 and only moderate development of RES. No specific measures to reduce emissions in non-ETS sectors were specified either, with only rather vague proposals being put forward. Meanwhile, at the EU level, regulatory momentum accelerated, with the European Green Deal announced in 2019 and the “Fit for 55—an EU legislative package aiming to reduce greenhouse gas emissions by 55% by 2030” package proposed in 2021, which increases reduction targets and RES. As part of its alignment with the new EU targets, the European Commission proposed a mandatory 17.7% reduction in non-ETS emissions for Poland by 2030 (compared to 2005) [4] and estimated that in order for the EU to reach the 40% RES target, Poland should achieve a 25% share of RES in final energy consumption by 2030. These figures far exceeded the ambitions of PEP2040. As a result, the Polish government was obliged to revise PEP2040 already in 2023. The updated assumptions (published in Q2 2023) announced an acceleration of RES development and efficiency, while extending the operation of some coal-fired units to reduce natural gas consumption (which was a response to the 2022 energy crisis) [43]. The clear impact of EU regulations is easy to see here, as Poland was faced with the need to increase its climate targets in order to meet the EU’s shared ambitions.

- Increasing the RES target to 42.5% by 2030, including the development of biomethane, PV and offshore wind energy produced at sea, offering higher efficiency than onshore wind power.

- Reform of ETS 2 (for transportation and buildings)—shielding measures for households will be necessary.

- Expansion of electricity grids to allow connection of new RES.

- Simplification of administrative procedures—currently the waiting time for an environmental decision for RES reaches up to several years.

- Decarbonization of the heating industry—currently more than 70% of system heat in Poland comes from coal.

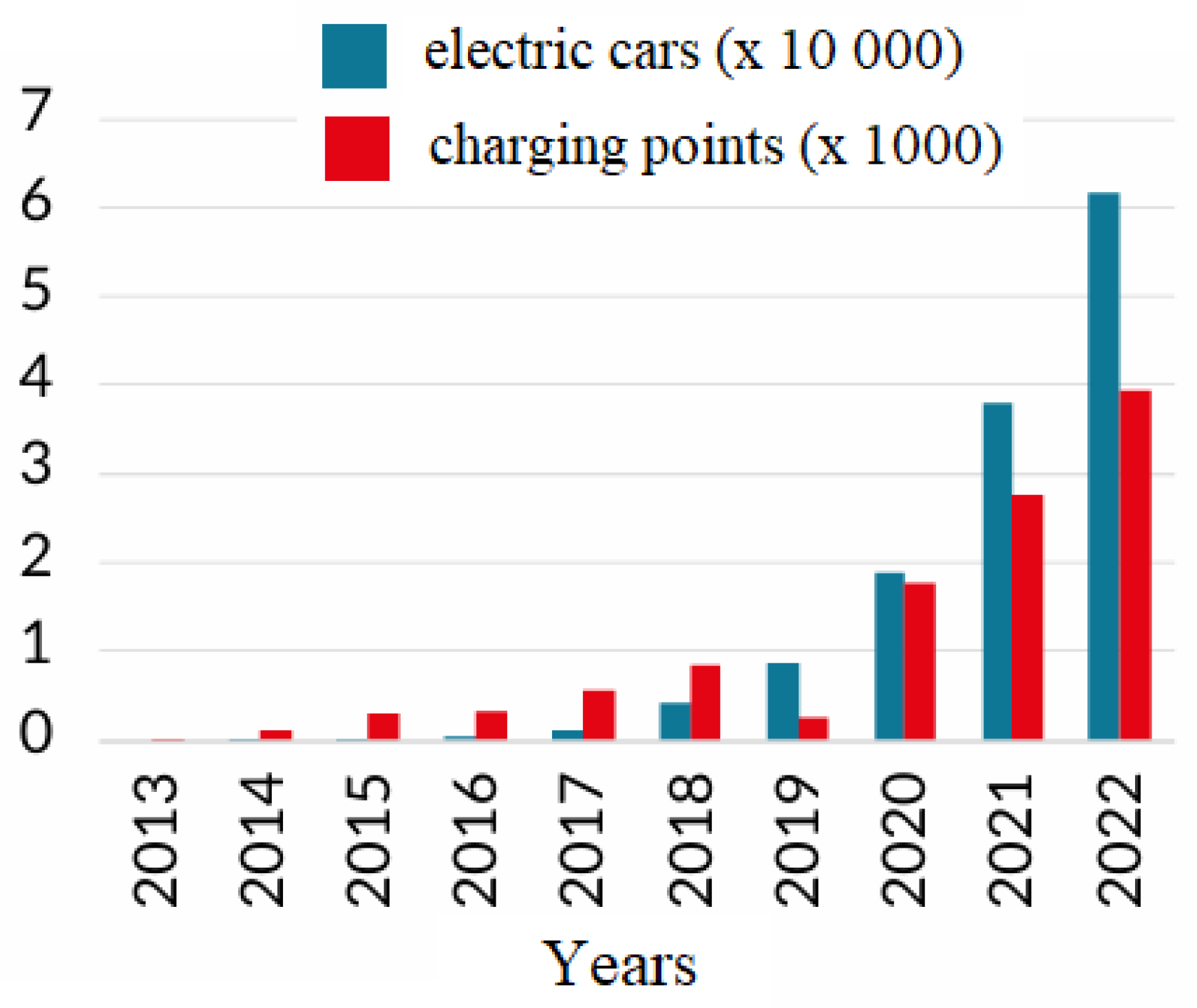

- Development of green transport and electromobility—Fit for 55 assumes 100% zero-emission vehicles after 2035.

- The European Green Deal (EGL) and Climate Neutrality Policy 2050—The EGL, announced at the end of 2019, set a target of achieving EU climate neutrality by 2050 [44,45,46,47,48,49,50]. Initially, Poland was the only country that did not support this target at the EU summit (December 2019), arguing in favour of greater financial support and a longer timeframe for its transition. In response, the EU proposed a Just Transition Fund, from which Poland (especially mining regions such as Silesia) was to receive significant funding to mitigate the social impact of the transition away from coal. Ultimately, Poland committed to the neutrality target, which is binding for the entire EU. The EGL also introduced support mechanisms: in addition to the aforementioned Just Transformation Fund, it also increased the Modernisation Fund, provided preferential financing from the EIB or launched programmes such as REPowerEU (after 2022) to reduce the dependence on fuels from Russia. These initiatives mean that Poland will have access to billions of euros for the transition, provided that projects are implemented in line with climate targets. The EGL also resulted in a number of directives and regulations (the “Clean Energy for All Europeans” package of 2019) that Poland had to implement, including the amendment to the RES Directive (raising the requirements for the share of green energy), the Market Directive (integration of day-ahead and balancing markets at the EU level), and regulations introducing the requirement to gradually phase out regulated prices for end users. All these legal acts are gradually changing the operating environment of the Polish energy sector, forcing greater competition, innovation and market openness.

5. Development of Renewable Energy Sources in Poland Compared to the EU

5.1. Dynamics of RES Growth in Poland

5.2. Share of RES in the Energy Mix and the EU Average

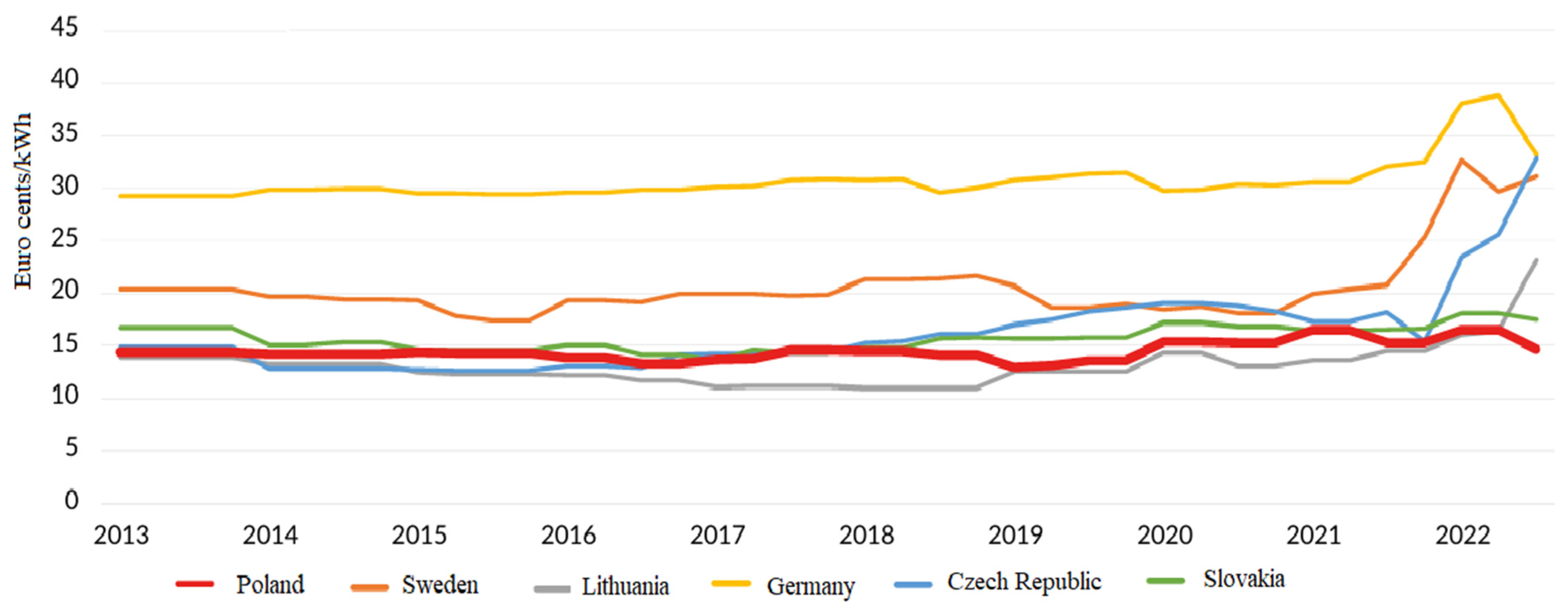

5.3. Comparison with Other EU Countries

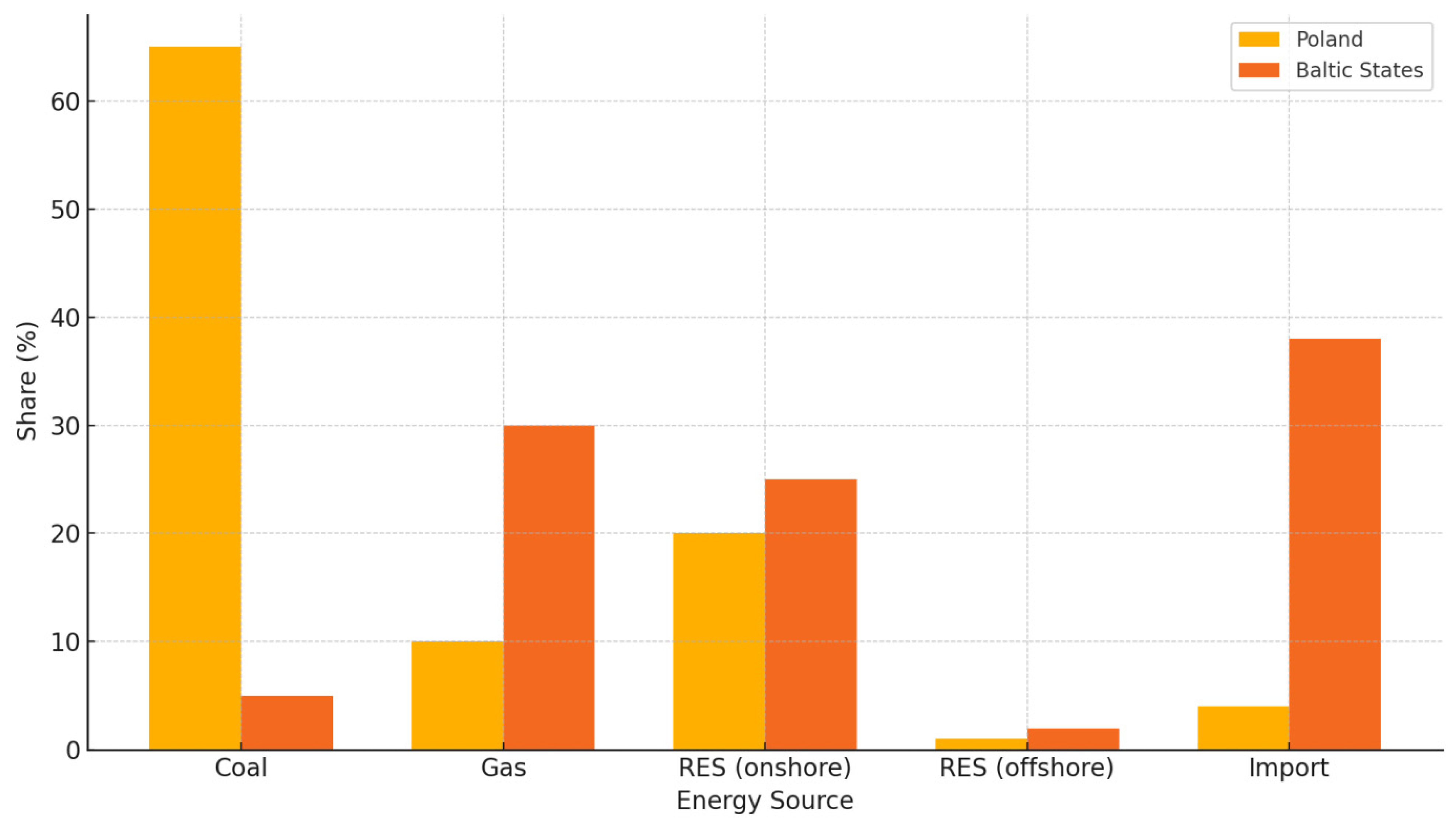

5.4. Situation of Poland Against the Background of the Baltic Countries

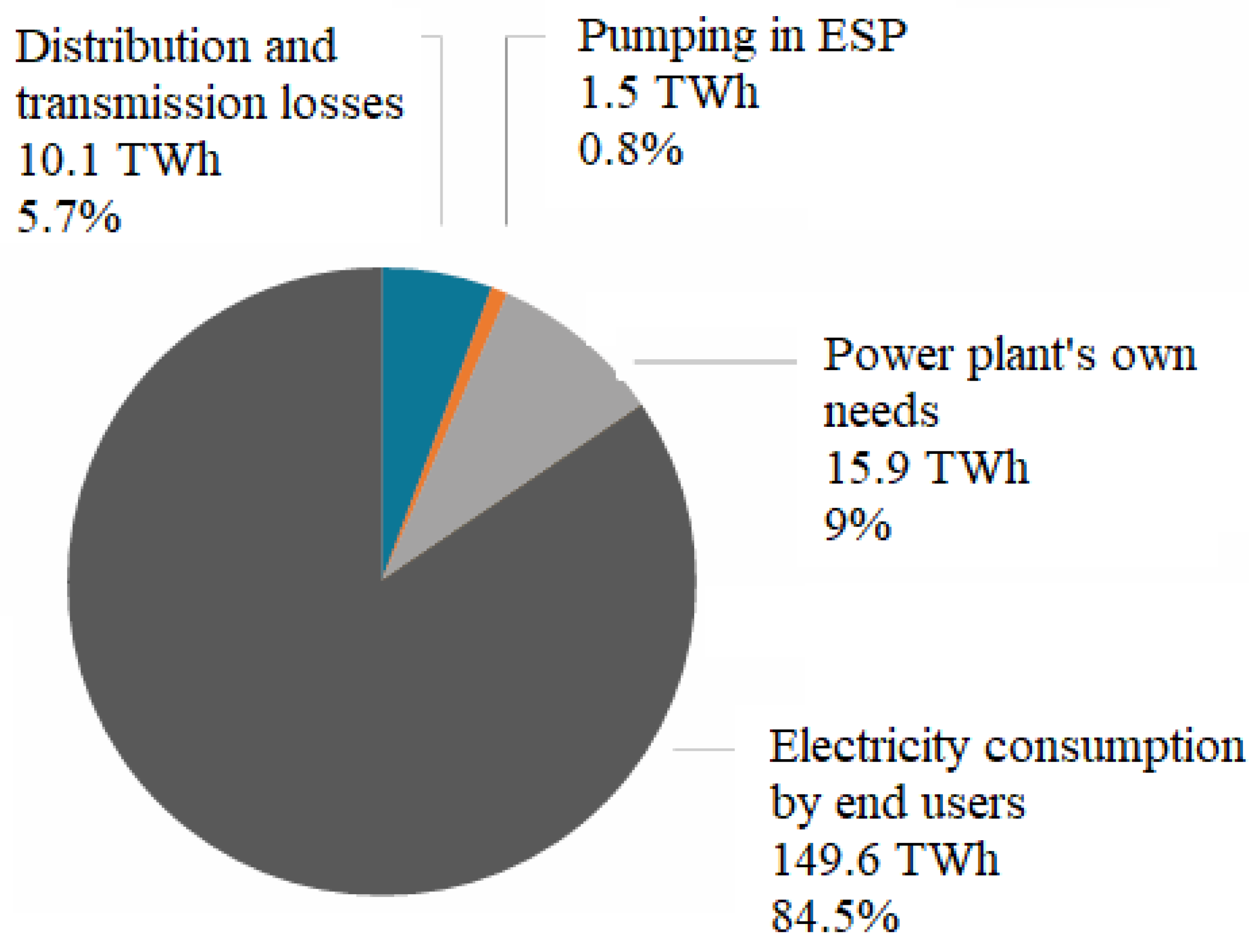

6. Transformation of Energy Networks—Modernisation, Digitalisation, Smart Grids

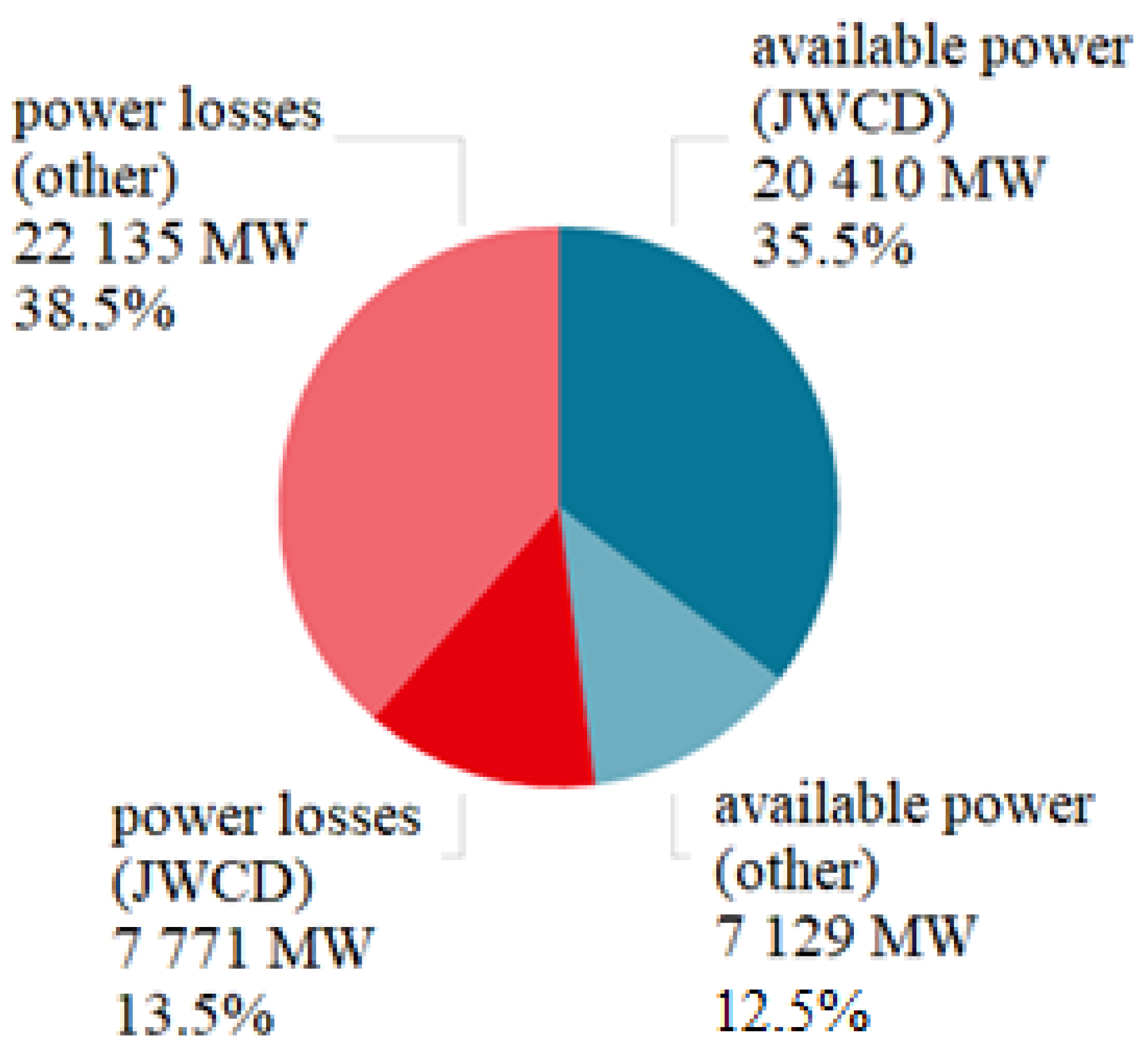

6.1. Transmission Network (400/220 kV)

6.2. Distribution Networks and Smart Solutions

6.3. Market Integration and Cross-Border Infrastructure

6.4. Modernisation Challenges

6.5. Digitisation and New Technologies

7. Current and Future Trends in the Energy Market in Poland and the EU

7.1. Accelerated Decarbonisation and Transition Away from Coal

7.2. Nuclear Energy as a New Element in the Mix

7.3. Electrification of Heating and Transport

7.4. Integration of the Energy Market at the EU Level

7.5. New Energy Market Models

8. Major Challenges and Barriers to the Transformation in Poland

8.1. Socio-Political Challenges

8.2. Technological and Infrastructure Barriers

8.3. Regulatory and Legal Challenges

8.4. Economic and Financial Challenges

8.5. External and Global Risks

9. Summary and Conclusions

- Heterogeneity of data sources, as the data considered and the article come from different institutions (CSO, ARE, Eurostat, PSE), which may use different methodologies. In addition, there is a lack of standardised time series—which hinders comparability and modelling of long-term trends.

- Unpredictability of political conditions—frequent changes in national and EU law (e.g., changes in the RES support system, feed-in tariff policy). Disputes around EU climate targets and their national implementation can disrupt the stability of the system.

- The impact of geopolitical factors—the war in Ukraine has changed the directions of raw material imports and accelerated the process of moving away from gas from Russia. In turn, the increase in energy and raw material prices significantly distorted the investment cost assumptions.

- Limitations of technological modelling are due to the fact that the conclusions drawn in the work are based on trend analysis, not mathematical predictions.

Author Contributions

Funding

Conflicts of Interest

References

- Jonek-Kowalska, I. Towards the reduction of CO2 emissions. Paths of pro-ecological transformation of energy mixes in European countries with an above-average share of coal in energy consumption. Resour. Policy 2022, 77, 102701. [Google Scholar] [CrossRef]

- Miłek, D.; Nowak, P.; Latosińska, J. The Development of Renewable Energy Sources in the European Union in the Light of the European Green Deal. Energies 2022, 15, 5576. [Google Scholar] [CrossRef]

- Rybak, A.; Rybak, A.; Joostberens, J.; Kolev, S.D. Cluster Analysis of the EU-27 Countries in Light of the Guiding Principles of the European Green Deal, with Particular Emphasis on Poland. Energies 2022, 15, 5082. [Google Scholar] [CrossRef]

- Available online: https://www.iea.org/reports/poland-2022/executive-summary (accessed on 26 April 2025).

- Rokicki, T.; Perkowska, A.; Klepacki, B.; Bórawski, P.; Bełdycka-Bórawska, A.; Michalski, K. Changes in Energy Consumption in Agriculture in the EU Countries. Energies 2021, 14, 1570. [Google Scholar] [CrossRef]

- Marciniuk-Kluska, A.; Kluska, M. Forecasting Energy Recovery from Municipal Waste in a Closed-Loop Economy. Energies 2023, 16, 2732. [Google Scholar] [CrossRef]

- European Commission. Circular Economy Action Plan. Available online: https://ec.europa.eu/environment/circular-economy (accessed on 23 April 2025).

- Lopes, E.J.; Queiroz, N.; Yamamoto, C.I.; Costa Neto, P.R. Evaluating the emissions from the gasification processing of municipal solid waste followed by combustion. Waste Manag. 2018, 73, 504–510. [Google Scholar] [CrossRef]

- Ratner, S.; Gomonov, K.; Revinova, S.; Lazanyuk, I. Eco-design of Energy Production Systems: The Problem of Renewable Energy Capacity Recycling. Appl. Sci. 2020, 10, 4339. [Google Scholar] [CrossRef]

- Available online: https://www.forum-energii.eu/en/yearbook-energy-data-1 (accessed on 25 April 2025). (In Poland).

- Donati, F.; Aguilar-Hernandez, G.A.; Sigüenza-Sánchez, C.P.; de Koning, A.; Rodrigues, J.F.; Tukker, A. Modeling the circular economy in environmentally extended input-output tables: Methods, software and case study. Resour. Conserv. Recycl. 2020, 152, 104508. [Google Scholar] [CrossRef]

- Boer, E.D.; Jędryczak, A.; Kowalski, Z.; Kulczycka, J.; Szpadt, R. A review of municipal solid waste composition and quantities in Poland. Waste Manag. 2010, 30, 369–377. [Google Scholar] [CrossRef]

- Szul, T.; Knaga, J.; Nęcka, K. Application of rough set theory to establish the amount of waste in Households in Rural Areas. Ecol. Chem. Eng. 2017, 24, 311–325. [Google Scholar] [CrossRef]

- Marciniuk-Kluska, A.; Kluska, M. Energy Recovery from Municipal Biodegradable Waste in a Circular Economy. Energies 2025, 18, 2210. [Google Scholar] [CrossRef]

- Tałałaj, I.A.; Walery, M. The effect of gender and age structure on municipal waste generation in Poland. Waste Manag. 2015, 40, 3–8. [Google Scholar] [CrossRef] [PubMed]

- Available online: https://www.gov.pl/afttachmen (accessed on 13 April 2025). (In Poland)

- Available online: https://www.gov.pl/attachment/3c8a2fd6-a0a4-4b7f-b301-0b8569f1eaf7 (accessed on 13 April 2025). (In Poland)

- Klimek, P. Evaluation of the energy potential of municipal waste depending on the disposal technology used. Nafta-Gaz 2013, 12, 909–914. (In Poland) [Google Scholar]

- Available online: https://ec.europa.eu/eurostat (accessed on 30 April 2025). (In Poland).

- Available online: https://www.statista.com/topics/4961/renewable-energy-in-europe (accessed on 10 February 2025).

- Available online: https://stat.gov.pl/obszary-tematyczne/srodowisko-energia/energia/energia-ze-zrodel-odnawialnych-w-2023-roku,10,7.html (accessed on 30 April 2025). (In Poland)

- Pietrzak, M.B.; Igliński, B.; Kujawski, W.; Iwański, P. Energy transition in Poland—assessment of the renewable energy sector. Energies 2021, 14, 2046. (In Poland) [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R.; Grebski, W.W. An econometric model of the operation of the steel industry in Poland in the context of process heat and energy consumption. Energies 2022, 15, 7909. [Google Scholar] [CrossRef]

- Available online: https://www.iea.org/reports/poland-2022 (accessed on 13 April 2025). (In Poland).

- Rybak, A.; Rybak, A.; Kolev, S.D. Analysis of the EU-27 countries energy markets integration in terms of the sustainable development SDG7 implementation. Energies 2021, 14, 7079. [Google Scholar] [CrossRef]

- Kuc-Czarnecka, M.; Markowicz, I.; Sompolska-Rzechuła, A.; Stundziene, A. Assessing sustainable development goal 7 implementation and its nexus with social, economic and ecological factors in EU countries. Sustain. Dev. 2025, 33, 847–860. [Google Scholar] [CrossRef]

- Commission Implementing Decision (EU). 2019/1004 of 7 June 2019 Laying down Rules for the Calculation, Verification and Reporting of Data on Waste in Accordance with Directive 2008/98/EC of the European Parliament and of the Council and Repealing Commission Implementing Decision C(2012) 2384 (OJ L 163, 20.6.2019, pp. 66–100). Available online: https://eur-lex.europa.eu/eli/dec_impl/2019/1004/oj/eng (accessed on 30 January 2025).

- Commission Directive (EU). 2015/1127 of 10 July 2015 Amending Annex II to Directive 2008/98/EC of the European Parliament and of the Council on Waste and Repealing Certain Directives (OJ L 184, 11.7.2015, pp. 13–15). Available online: https://eur-lex.europa.eu/eli/dir/2015/1127/oj/eng (accessed on 30 March 2025).

- Commission Delegated Decision (EU). 2019/1597 of 3 May 2019 Supplementing Directive 2008/98/EC of the European Parliament and of the Council as Regards a Common Methodology and Minimum Quality Requirements for the Uniform Measurement of Levels of Food Waste(OJL248,27.9.2019, pp. 77–85). Available online: https://eur-lex.europa.eu/eli/dec_del/2019/1597/oj/eng (accessed on 30 March 2025).

- Commission Implementing Decision (EU). 22019/2000 of 28 November 2019 Laying down a Format for Reporting of Data on Food Waste and for Submission of the Quality Check Report in Accordance with Directive 2008/98/EC of the European Parliament and of the Council (OJ L 310, 2.12.2019, pp. 39–45). Available online: https://eur-lex.europa.eu/eli/dec_impl/2019/2000/oj/eng (accessed on 30 April 2025).

- Commission Decision 2000/532/EC of 3 May 2000 Replacing Decision 94/3/EC Establishing a List of Wastes Pursuant to Article 1(a) of Council Directive 75/442/EEC on Waste and Council Decision 94/904/EC Establishing a List of Hazardous Waste Pursuant to Article 1 of Council Directive 91/689/EEC on Hazardous Waste (OJ L 226, 6.9.2000, pp. 3–24). Available online: https://eur-lex.europa.eu/eli/dec/2000/532/oj/eng (accessed on 30 March 2025).

- Commission Implementing Decision (EU). 2021/19 of 18 December 2020 Laying down a Common Methodology and a Format for Reporting on Reuse in Accordance with Directive 2008/98/EC of the European Parliament and of the Council (OJ L 10, 12.1.2021, pp. 1–7). Available online: https://eur-lex.europa.eu/eli/dec_impl/2021/19/oj/eng (accessed on 20 February 2025).

- Fura, B.; Skrzypek, E. Progressing Sustainable Development Goal 7 via Energy Access: Results from the 27 EU Member States. Energies 2025, 18, 2720. [Google Scholar] [CrossRef]

- Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets_en (accessed on 20 April 2025).

- Halkos, G.E.; Gkampoura, E.-C. Evaluating the effect of economic crisis on energy poverty in Europe. Renew. Sustain. Energy Rev. 2021, 144, 110981. [Google Scholar] [CrossRef]

- Gogu, E.; Radu, C.; Deaconu, A.; Frasineanu, C.; Triculescu, M.; Mișu, S.; Toma, S. Assessing the impact of clean energy on sustainable economic growth in European Union member states. Econ. Comput. Econ. Cybern. Stud. Res. 2021, 55, 183–197. [Google Scholar] [CrossRef]

- Trindade, A.B.; Palácio, J.C.E.; González, A.M.; Orozco, D.J.R.; Lora, E.E.S.; Renó, M.L.G.; Olmo, O.A. Advanced exergy analysis and environmental assessment of the steam cycle of an incineration system of municipal solid waste with energy recovery. Energy Convers. Manag. 2018, 157, 195–214. [Google Scholar] [CrossRef]

- Soares, R.R.; Miyamaru, E.S.; Martins, G. Environmental performance of the allocation and urban solid waste treatment with energetic reuse through life cycle assessment at CTR-Caieiras. Eng. Sanitária Ambient. 2017, 22, 993–1003. [Google Scholar] [CrossRef]

- Balezentis, T. Shrinking ageing population and other drivers of energy consumption and CO2 emission in the residential sector: A case from Eastern Europe. Energy Policy 2020, 140, 111433. [Google Scholar] [CrossRef]

- Kumar, A.; Samadder, S.R. A review of technological options of waste to energy for effective management of municipal solid waste. Waste Manag. 2017, 69, 407–422. [Google Scholar] [CrossRef]

- United Nations (UN). Targets & Indicators. Available online: https://www.un.org/en/energy/page/sdg7-targets-indicators (accessed on 14 April 2025).

- Skica, T.; Rodzinka, J.; Zaremba, U. The application of a synthetic measure in the assessment of the financial condition of LGUs in Poland using the TOPSIS method approach. Econ. Soc. 2020, 13, 297–317. [Google Scholar] [CrossRef]

- Elavarasan, R.M.; Pugazhendhi, R.; Irfan, M.; Mihet-Popa, L.; Campana, P.E.; Khan, I.A. A novel Sustainable Development Goal 7 composite index as the paradigm for energy sustainability assessment: A case study from Europe. App. Energy 2022, 307, 118173. [Google Scholar] [CrossRef]

- European Comission. Renewable Energy Targets. Available online: https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en (accessed on 23 March 2025).

- Kukharets, V.; Hutsol, T.; Kukharets, S.; Glowacki, S.; Nurek, T.; Sorokin, D. European Green Deal: The Impact of the Level of Renewable Energy Source and Gross Domestic Product per Capita on Energy Import Dependency. Sustainability 2023, 15, 11817. [Google Scholar] [CrossRef]

- Mohammadi, H.; Saghaian, S.; Zandi Dareh Gharibi, B. Renewable and Non-Renewable Energy Consumption and Its Impact on Economic Growth. Sustainability 2023, 15, 3822. [Google Scholar] [CrossRef]

- Kashour, M. A step towards a just transition in the EU: Conclusions of a regression-based energy inequality decomposition. Energy Policy 2023, 183, 113816. [Google Scholar] [CrossRef]

- Chudy-Laskowska, K.; Pisula, T. Forecasting Household Energy Consumption in European Union Countries: An Econometric Modelling Approach. Energies 2023, 16, 5561. [Google Scholar] [CrossRef]

- Bertoldi, P. Policies for Energy Conservation and Sufficiency: Review of Existing Policies and Recommendations for New and Effective Policies in OECD Countries. Energy Build. 2022, 264, 112075. [Google Scholar] [CrossRef]

- Karasek, A.; Fura, B.; Zajączkowska, M. Assessment of Energy Efficiency in the European Union Countries in 2013 and 2020. Sustainability 2023, 15, 3414. [Google Scholar] [CrossRef]

- Bartoszczuk, P. Circular economy and its restriction. Econ. Environ. 2023, 86, 469–482. [Google Scholar] [CrossRef]

- Available online: https://www.statista.com/statistics/1066239/poland-power-installed-in-pv-panels (accessed on 13 May 2025).

- Available online: https://www.statista.com/statistics/1039499/poland-energy-production-mix (accessed on 14 May 2025).

- Bajan, B.; Łukasiewicz, J.; Mrówczyńska-Kamińska, A. Energy Consumption and Its Structures in Food Production Systems of the Visegrad Group Countries Compared with Eu-15 Countries. Energies 2021, 14, 3945. [Google Scholar] [CrossRef]

- Available online: https://www.statista.com/statistics/1064034/poland-installed-electricity-capacity (accessed on 15 May 2025).

- Available online: https://www.statista.com/topics/12139/renewable-energy-in-poland/#topicOverview (accessed on 15 May 2025).

- Chomać-Pierzecka, E. Investment in Offshore Wind Energy in Poland and Its Impact on Public Opinion. Energies 2024, 17, 3912. [Google Scholar] [CrossRef]

- Andriuškevičius, K.; Štreimikienė, D. Energy M&A Market in the Baltic States Analyzed through the Lens of Sustainable Development. Energies 2022, 15, 7907. [Google Scholar] [CrossRef]

- Kuo, W.C.; Lasek, J.; Słowik, J.; Głód, K.; Jagustyn, B.; Li, Y.H.; Cygan, A. Low-temperature pre-treatment of municipal solid waste for efficient application in combustion systems. Energy Convers. Manag. 2019, 196, 525–535. [Google Scholar] [CrossRef]

- Available online: https://www.rcc.int/greenagenda (accessed on 18 May 2025).

- Available online: https://columbusenergy.pl/blog/odnawialne-zrodla-energii-w-polsce (accessed on 18 May 2025). (In Poland).

- Grzesik, K.; Zabochnicka, M.; Oleniacz, R.; Kozakiewicz, R. Quantifying Resource and Energy Losses from Waste Fires in Poland: A Barrier to Circular Economy Transition. Energies 2025, 18, 2731. [Google Scholar] [CrossRef]

- Available online: https://homodigital.pl/smart-grid-jak-dziala-inteligentna-siec-energetyczna (accessed on 18 May 2025). (In Poland).

- Available online: https://www.kierunekenergetyka.pl/artykul,111419,nowoczesne-inwestycje-cieplownicze-w-dabrowie-gorniczej-tauron-ujawnil-ambitne-plany.html (accessed on 10 May 2025). (In Poland).

- Available online: https://www.trade.gov/market-intelligence/poland-smart-metering#:~:text=Poland%20is%20complying%20with%20an%20EU%20directive%20to,system%2C%20collecting%20and%20processing%20information%20and%20metering%20data (accessed on 10 May 2025). (In Poland)

- Beal, C.M.; King, C.W. The zero-emissions cost of energy: A policy concept. Prog. Energy 2022, 3, 023001. [Google Scholar] [CrossRef]

- Li, P.; Wang, D.; Zafar, Q.; Waheed, H. Strategic resource management for economic sustainability: Assessing the impact of technological advancement and energy efficiency. Resour. Policy 2024, 89, 104631. [Google Scholar] [CrossRef]

- Lyulyov, O.; Chygryn, O.; Pimonenko, T.; Zimbroff, A.; Makiela, Z.; Kwilinski, A. Green competitiveness forecasting as an instrument for sustainable business transformation. Forum Sci. Oecon. 2024, 12, 8–20. [Google Scholar]

- Available online: https://www.forum-energii.eu/en/from-2025-coal-will-leave-the-polish-energy-system-in-waves#:~:text=After%202025%2C%20when%20public%20support%20ends%2C%20the%20first,be%20shut%20down%20due%20to%20age%20and%20costs (accessed on 25 May 2025).

- Rossi, D.; Lermen, F.H.; Fernandes, S.d.C.; Echeveste, M.E.S. Exploring business model strategies to achieve a circular bioeconomy from a waste valorization perspective. Environ. Dev. Sustain. 2024, 12, 5223. [Google Scholar] [CrossRef]

- Wolde-Rufael, Y.; Weldemeskel, E.M. Environmental policy stringency, renewable energy consumption and CO2 emissions: Panel cointegration analysis for BRIICTS countries. Int. J. Green Energy 2020, 17, 568–582. [Google Scholar] [CrossRef]

- European Environment Agency (EEA). Bio-Waste in Europe—Turning Challenges into Opportunities; EEA Report No 4/2020; Publications Office of the European Union: Luxembourg, 2020. [Google Scholar]

- Rincón-Moreno, J.; Ormazábal, M.; Álvarez, M.J.; Jaca, C. Advancing circular economy performance indicators and their application in Spanish companies. J. Clean. Prod. 2021, 279, 123605. [Google Scholar] [CrossRef]

- Available online: https://businessinsider.com.pl/gospodarka/polska-energetyka-jadrowa-wyzwania-i-szanse-na-lata-20252050/5e1vfsh#:~:text=Podczas%20konferencji%20FISA%20Euradwaste%202025%20w%20Warszawie%2C%20ministra,sektor%20energetyczny%2C%20ale%20r%C3%B3wnie%C5%BC%20stworzy%C4%87%20tysi%C4%85ce%20miejsc%20pracy (accessed on 25 May 2025). (In Poland).

- Toleikyte, A.; Lecomte, E.; Volt, J.; Lyons, L.; Roca Reina, J.C.; Georgakaki, A.; Letout, S.; Mountraki, A.; Wegener, M.; Schmitz, A. Clean Energy Technology Observatory: Heat Pumps in the European Union—2024 Status Report on Technology Development, Trends, Value Chains and Markets; Publications Office of the European Union: Luxembourg, 2024. [Google Scholar] [CrossRef]

- Available online: https://mediarun.com/pl/trendy/technologie/elektryczny-transport-w-miastach-co-nas-czeka-w-2025-roku.html (accessed on 25 May 2025). (In Poland).

- Stanciu, C.V.; Mitu, N.E. Price Behavior and Market Integration in European Union Electricity Markets: AVECM Analysis. Energies 2025, 18, 770. [Google Scholar] [CrossRef]

- Paientko, T.; Amakude, S. Interconnected Markets: Unveiling Volatility Spillovers in Commodities and Energy Markets through BEKK-GARCH Modelling. Analytics 2024, 3, 194–220. [Google Scholar] [CrossRef]

- Tehrani, S.; Juan, J.; Caro, E. Electricity Spot Price Modeling and Forecasting in European Markets. Energies 2022, 15, 5980. [Google Scholar] [CrossRef]

- Available online: https://commission.europa.eu/topics/energy/repowereu_en (accessed on 25 May 2025).

- Sikorska-Pastuszka, M.; Papież, M. Dynamic volatility connectedness in the European electricity market. Energy Econ. 2023, 127, 107045. [Google Scholar] [CrossRef]

| Category | Poland | UE-27 |

|---|---|---|

| New PV (photovoltaic) capacity | ~4 GW | 65.5 GW |

| Total PV capacity | ~21 GW | ~338 GW |

| New wind (onshore) capacity | ~0.5 GW | 12.9 GW |

| Total RES capacity | 27.2 GW (PV + wind + biomass + hydro) | EU to expand its RES capacity by ~78 GW in 2024. |

| RES share of energy production | 28.8% (of which: PV 11%, wind 15%) | ~45% from electricity generation |

| Aspect | Poland | Baltics |

|---|---|---|

| Offshore potential | Very large (11 GW planned) | Moderate |

| M&A market | Large, integration-oriented | Small, dispersed |

| Dominant sector | Coal + RES development | Imports + modernization of sources |

| Regional leader | Yes—PKN Orlen, large projects | No—no large energy companies |

| Public support | Intensive but variable | Stable but financially constrained |

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Access to the Baltic Sea and favourable wind | Limited grid transmission | EU energy transition and European Green Deal | Public opposition and locality |

| Growing technological experience (partnerships with Ørsted, Equinor) | Complex administrative | Rising demand for green | Regulatory and policy |

| Political support and EU | Lack of local turbine and offshore technology manufacturers | Development of ports and maritime | High investment costs and inflation |

| Year | Semi-Annual Average 1st Half | Semi-Annual Average 2nd Half |

|---|---|---|

| 2013 | ~250 | ~260 |

| 2014 | ~255 | ~265 |

| 2015 | ~260 | ~270 |

| 2016 | ~270 | ~275 |

| 2017 | ~275 | ~280 |

| 2018 | ~280 | ~285 |

| 2019 | ~285 | ~290 |

| 2020 | ~295 | ~300 |

| 2021 | ~310 | ~325 |

| 2022 | ~470 | ~590 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Marciniuk-Kluska, A.; Kluska, M. Transformation of the Energy Market in Poland in the Context of the European Union over the Last 20 Years. Energies 2025, 18, 3410. https://doi.org/10.3390/en18133410

Marciniuk-Kluska A, Kluska M. Transformation of the Energy Market in Poland in the Context of the European Union over the Last 20 Years. Energies. 2025; 18(13):3410. https://doi.org/10.3390/en18133410

Chicago/Turabian StyleMarciniuk-Kluska, Anna, and Mariusz Kluska. 2025. "Transformation of the Energy Market in Poland in the Context of the European Union over the Last 20 Years" Energies 18, no. 13: 3410. https://doi.org/10.3390/en18133410

APA StyleMarciniuk-Kluska, A., & Kluska, M. (2025). Transformation of the Energy Market in Poland in the Context of the European Union over the Last 20 Years. Energies, 18(13), 3410. https://doi.org/10.3390/en18133410