Agricultural Value Added, Renewable Energy, and the Environmental Kuznets Curve: Evidence from Turkey

Abstract

1. Introduction

2. Theoretical Background

3. Research Methodology

3.1. Stationary Test

3.2. ARDL Bounds Testing Approach

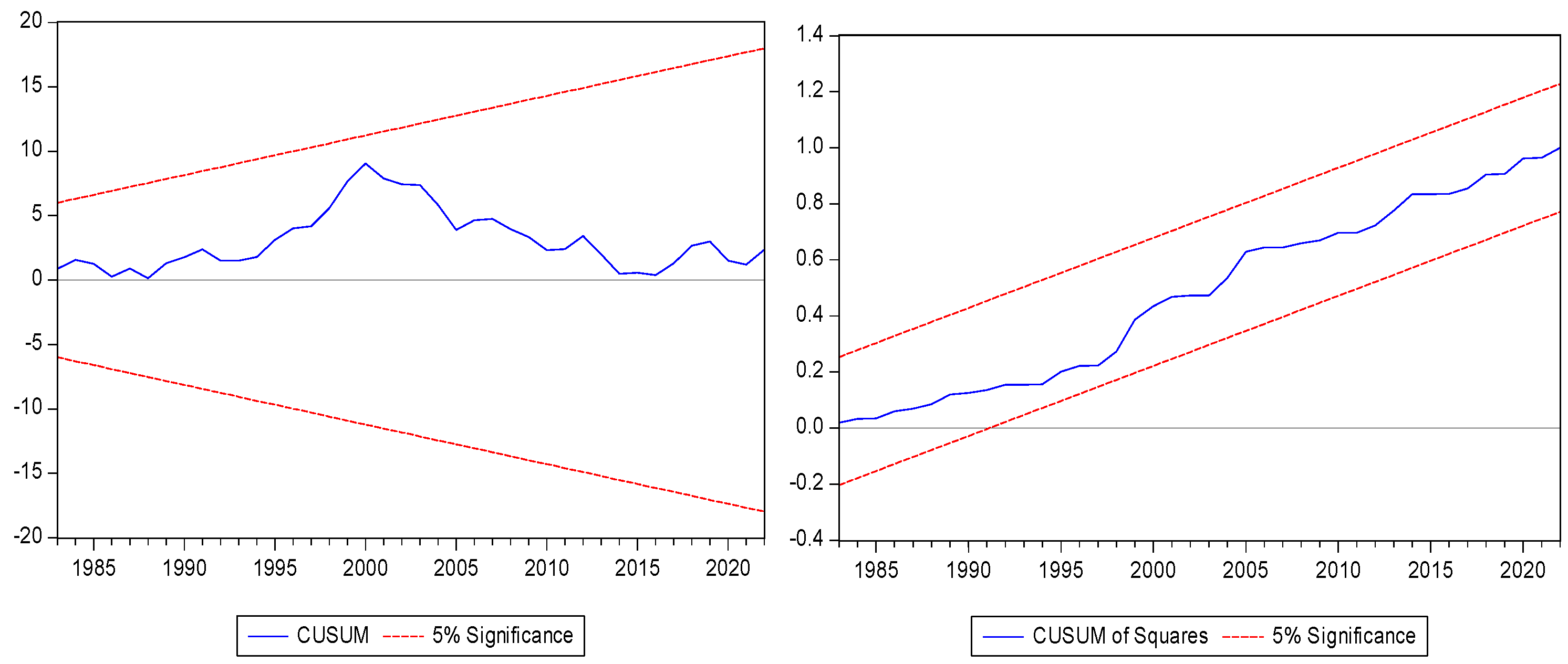

3.3. Robustness Check

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Virgens, N.d.; Silva, S.; Laranjeira, E. Applications of the circular economy to the second-hand textile and clothing market: The case of Humana in Portugal. Int. J. Fash. Des. Technol. Educ. 2023, 16, 214–223. [Google Scholar] [CrossRef]

- Ahrens, D.; Benedikter, S.; Giessen, L. Rethinking synergies and trade-offs at the forest–sustainable development goals (SDGs) nexus—A systematic review. Sustain. Dev. 2025. Early View. [Google Scholar] [CrossRef]

- Emezirinwune, M.U.; Adejumobi, I.A.; Adebisi, O.I.; Akinboro, F.G. Synergizing hybrid renewable energy systems and sustainable agriculture for rural development in Nigeria. Adv. Electr. Eng. Electron. Energy 2024, 6, 100492. [Google Scholar] [CrossRef]

- Paramati, S.R.; Sinha, A.; Dogan, E. The significance of renewable energy use for economic output and environmental protection: Evidence from the Next 11 developing economies. Environ. Sci. Pollut. Res. 2017, 24, 13546–13560. [Google Scholar] [CrossRef]

- Panayotou, T. Empirical Tests and Policy Analysis of Environmental Degradation at Different Stages of Economic Development; International Labour Office Technology World Employment Programme Working Paper WP238; International Labour Office: Geneva, Switzerland, 1993. [Google Scholar]

- Yıldırım, E.; Şükrüoğlu, D.; Aslan, A. Energy consumption and economic growth in the next 11 countries: The bootstrapped autoregressive metric causality approach. Energy Econ. 2014, 44, 14–21. [Google Scholar] [CrossRef]

- Shahbaz, M.; Mahalik, M.K.; Shah, S.H.; Sato, J.R. Time-varying analysis of CO2 emissions, energy consumption, and economic growth nexus: Statistical experience in next 11 countries. Energy Policy 2016, 98, 33–48. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic welfare: A panel data application. Energy Econ. 2014, 53, 58–63. [Google Scholar] [CrossRef]

- Ministry of Commerce. Tarım Sektörü Raporu. 2023. Available online: https://www.ticaret.gov.tr/ihracat/sektorler/tarim-ve-gida (accessed on 19 February 2025).

- Akca, H. Environmental Kuznets curve and financial development in Turkey: Evidence from augmented ARDL approach. Environ. Sci. Pollut. Res. 2021, 28, 69149–69159. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F.; Li, R. Revisiting the Environmental Kuznets Curve hypothesis in 208 countries: The roles of trade openness, human capital, renewable energy, and natural resource rent. Environ. Res. 2023, 216, 114637. [Google Scholar] [CrossRef]

- Şerifoğlu, M.M.; Öge Güney, P. Is the environmental Kuznets curve (EKC) hypothesis still valid for OECD countries? A comprehensive analysis across multiple sources. Qual. Quant. 2025, 59, 547–573. [Google Scholar] [CrossRef]

- Badeeb, R.A.; Lean, H.H.; Shahbaz, M. Are too many natural resources to blame for the shape of the environmental Kuznets curve in resource-based economies? Resour. Policy 2020, 68, 101694. [Google Scholar] [CrossRef]

- Erdogan, S.; Okumus, I.; Guzel, A.E. Revisiting the environmental Kuznets curve hypothesis in OECD countries: The role of renewable, non-renewable energy, and oil prices. Environ. Sci. Pollut. Res. 2020, 27, 23655–23663. [Google Scholar] [CrossRef] [PubMed]

- Jahanger, A.; Hossain, M.R.; Onwe, J.C.; Ogwu, S.O.; Awan, A.; Balsalobre-Lorente, D. Analyzing the N-shaped EKC among top nuclear energy generating nations: A novel dynamic common correlated effects approach. Gondwana Res. 2023, 116, 73–88. [Google Scholar] [CrossRef]

- Biala, M.I.; Adeniyi, T.A. Economic growth and environmental sustainability: Assessing the validity of the environmental Kuznets curve in Nigeria. J. Econ. Allied Res. (JEAR) 2024, 9, 323–338. Available online: https://jearecons.com/index.php/jearecons/article/view/480 (accessed on 10 January 2025).

- Bölük, G.; Mert, M. Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU countries. Energy 2014, 74, 439–446. [Google Scholar] [CrossRef]

- Bekun, F.V.; Gyamfi, B.A.; Onifade, S.T.; Agboola, M.O. Beyond the environmental Kuznets curve in E7 economies: Accounting for the combined impacts of institutional quality and renewables. J. Clean. Prod. 2021, 314, 127924. [Google Scholar] [CrossRef]

- Aguir Bargaoui, S. The impact of energy efficiency and renewable energies on environmental quality in OECD countries. J. Knowl. Econ. 2022, 13, 3424–3444. [Google Scholar] [CrossRef]

- Shahbaz, M.; Aydin, M.; Degirmenci, T.; Bozatli, O. The role of agriculture-forestry-fisheries sectors, biodiversity expenditures, and renewable energy on environmental quality for The Netherlands: Evidence from novel Fourier ARDL. Nat. Resour. Forum 2024, 2024, 1–20. [Google Scholar] [CrossRef]

- Voumik, L.C.; Hossain, M.I.; Rahman, M.H.; Sultana, R.; Dey, R.; Esquivias, M.A. Impact of Renewable and Non-Renewable Energy on EKC in SAARC Countries: Augmented Mean Group Approach. Energies 2023, 16, 2789. [Google Scholar] [CrossRef]

- Hayaloğlu, P. İklim değişikliğinin tarım sektörü ve ekonomik büyüme üzerindeki etkileri. Gümüşhane Üniversitesi Sos. Bilim. Enstitüsü Elektron. Derg. 2018, 9, 51–62. Available online: https://dergipark.org.tr/en/pub/gumus/issue/42294/452409 (accessed on 10 January 2025).

- Afzal, M.; Ahmed, T.; Ahmed, G. Empirical Assessment of Climate Change on Major Agricultural Crops of Punjab, Pakistan (MPRA Paper No. 70958). Munich Personal RePEc Archive. 2016. Available online: https://mpra.ub.uni-muenchen.de/70958/ (accessed on 11 April 2025).

- Başoğlu, A.; Telatar, O.M. İklim değişikliğinin etkileri: Tarım sektörü üzerine ekonometrik bir uygulama. Karadeniz Teknik Üniversitesi Sos. Bilim. Enstitüsü Sos. Bilim. Derg. 2013, 3, 7–25. Available online: https://web.archive.org/web/20180508110028id_/http://www.ktu.edu.tr/dosyalar/sbedergisi_e88c5.pdf (accessed on 10 January 2025).

- Belloumi, M. Investigating the Impact of Climate Change on Agricultural Production in Eastern and Southern African Countries; AGRODEP Working Paper 0003; International Food Policy Research Institute (IFPRI): New Delhi, India, 2014; Available online: https://cgspace.cgiar.org/items/1f266be5-21a1-4c5b-a272-9102548c43e0 (accessed on 24 February 2025).

- Masud, M.M.; Rahman, M.S.; Al-Amin, A.Q.; Kari, F.; Filho, W.L. Impact of climate change: An empirical investigation of Malaysian rice production. Mitig. Adapt. Strateg. Glob. Change 2014, 19, 431–444. [Google Scholar] [CrossRef]

- Raihan, A. An econometric evaluation of the effects of economic growth, energy use, and agricultural value added on carbon dioxide emissions in Vietnam. Asia-Pac. J. Reg. Sci. 2023, 7, 665–696. [Google Scholar] [CrossRef]

- Pata, U.K. Linking renewable energy, globalization, agriculture, CO2 emissions and ecological footprint in BRIC countries: A sustainability perspective. Renew. Energy 2021, 173, 197–208. [Google Scholar] [CrossRef]

- Eştürk, Ö.; Aydın, F.F.; Levent, C. Tarım ve sanayi sektörlerinin çevre kirliliği üzerindeki etkisi: Seçilmiş OECD üyesi ülkelerde ekonometrik bir uygulama. Ardahan Üniversitesi İktisadi Ve İdari Bilim. Fakültesi Derg. 2023, 5, 109–116. [Google Scholar] [CrossRef]

- Khurshid, N.; Khurshid, J.; Shakoor, U.; Ali, K. Asymmetric effect of agriculture value added on CO2 emission: Does globalization and energy consumption matter for Pakistan. Front. Energy Res. 2022, 10, 1053234. [Google Scholar] [CrossRef]

- Raihan, A.; Tuspekova, A. Dynamic impacts of economic growth, energy use, urbanization, tourism, agricultural value-added, and forested area on carbon dioxide emissions in Brazil. J. Environ. Stud. Sci. 2022, 112, 794–814. [Google Scholar] [CrossRef]

- Ahmed, S.; Abdi, A.H.; Sodal, M.; Yusuf, O.A.; Mohamud, M.H. Assessing the energy-economy-environment nexus in Somalia: The impact of agricultural value added on CO2 emissions. Int. J. Energy Econ. Policy 2025, 15, 221–232. [Google Scholar] [CrossRef]

- Agboola, M.O.; Bekun, F.V. Does agricultural value-added induce environmental degradation? Empirical evidence from an agrarian country. Environ. Sci. Pollut. Res. 2019, 26, 24733–24743. [Google Scholar] [CrossRef]

- Ali, S.; Ying, L.; Shah, T.; Tariq, A.; Ali Chandio, A.; Ali, I. Analysis of the nexus of CO2 emissions, economic growth, land under cereal crops and agriculture value-added in Pakistan using an ARDL approach. Energies 2019, 12, 4590. [Google Scholar] [CrossRef]

- Wang, Y.; Ali, A.; Chen, Z. Dynamic relationships between environment-related technologies, agricultural value added, transport infrastructure and environmental emissions in the five most populous countries. Sci. Rep. 2025, 15, 2308. [Google Scholar] [CrossRef] [PubMed]

- Çetin, M.; Saygın, S.; Demir, H. Tarım sektörünün çevre kirliliği üzerindeki etkisi: Türkiye ekonomisi için bir eşbütünleşme ve nedensellik analizi. Tekirdağ Ziraat Fak. Derg. 2020, 17, 329–345. [Google Scholar] [CrossRef]

- Baş, T.; Kara, F.; Alola, A.A. The environmental aspects of agriculture, merchandize, share, and export value-added calibrations in Turkey. Environ. Sci. Pollut. Res. 2021, 28, 62677–62689. [Google Scholar] [CrossRef]

- Oğul, B. Tarım sektöründeki gelişmeler çevresel kirliliği etkiliyor mu? Türkiye üzerine ampirik bulgular. MANAS Sos. Araştırmalar Derg. 2023, 12, 1016–1026. [Google Scholar] [CrossRef]

- Okumuş, İ. Türkiye’de yenilenebilir enerji tüketimi, tarım ve CO2 emisyonu ilişkisi. Eskişehir Osman. Üniversitesi İktisadi Ve İdari Bilim. Derg. 2020, 15, 21–34. [Google Scholar] [CrossRef]

- Bölük, G.; Karaman, S. The impact of agriculture, energy consumption and economic growth on ecological footprint: Testing the agriculture-induced EKC for Türkiye. Environ. Dev. Sustain. 2024, 26, 31817–31837. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: Testing EKC hypothesis with structural breaks. J. Clean. Prod. 2018, 187, 770–779. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Global Footprint Network. National Footprint Accounts. Available online: https://data.footprintnetwork.org/#/countryTrends?cn=223&type=BCpc,EFCpc (accessed on 10 January 2025).

- World Bank. World Development Indicators Online Database; World Bank Group: Washington, DC, USA, 2025; Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 10 January 2025).

- Our World in Data. Per Capita Energy Consumption from Renewables, 1965 to 2023. 2025. Available online: https://ourworldindata.org/grapher/per-capita-renewables?tab=chart&country=~TUR (accessed on 10 January 2025).

- Gujarati, D.N.; Porter, D.C. Basic Econometrics, 5th ed.; McGraw-Hill: New York, NY, USA, 2009. [Google Scholar]

- Mushtaq, R.; SSRN. Augmented Dickey Fuller Test. 2011. Available online: https://ssrn.com/abstract=1911068 (accessed on 15 March 2025).

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Pata, U.K.; Yurtkuran, S.; Kalça, A. Türkiye’de enerji tüketimi ve ekonomik büyüme: ARDL sınır testi yaklaşımı. Marmara Univ. J. Econ. Adm. Sci. 2016, 38, 255–271. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis; Department of Economics Working Paper Series, No. 9514; University of Cambridge: Cambridge, UK, 1995. [Google Scholar]

- Narayan, P.K. Fiji’s tourism demand: The ARDL approach to cointegration. Tour. Econ. 2004, 10, 193–206. [Google Scholar] [CrossRef]

- Gençoğlu, P.; Kuşkaya, S. Türkiye’de sağlığın eğitim üzerindeki etkileri: ARDL sınır testi yöntemi ile bir değerlendirilme. İşletme ve İktisat Çalışmaları Dergisi 2017, 5, 1–11. Available online: https://dergipark.org.tr/en/pub/iicder/issue/49867/639268 (accessed on 10 January 2025).

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. What determines migration flows from low income to high-income countries? An empirical investigation of Fiji-US migration 1972–2001. Contemp. Econ. Policy 2006, 24, 332–342. [Google Scholar] [CrossRef]

- Sünbül, E. Dış ticaret hacmi ve döviz kuru ilişkisinin ARDL sınır testi ile analizi (Türkiye örneği). J. Bank. Financ. Res. 2021, 8, 1–16. Available online: https://dergipark.org.tr/tr/pub/jobaf/issue/59603/802918 (accessed on 10 January 2025).

- Bıtrak, O.O. Türkiye kağıt sanayisinde selüloz ithalatı: Eşbütünleşme için artırılmış otoregresif dağıtılmış gecikmeli (ARDL) model ile sınır testi yaklaşımı. Alanya Akad. Bakış 2023, 7, 1043–1061. Available online: https://dergipark.org.tr/en/pub/alanyaakademik/issue/80135/1191253 (accessed on 10 January 2025).

- Alam, I.; Quazi, R. Determinants of capital flight: An econometric case study of Bangladesh. Int. Rev. Appl. Econ. 2003, 17, 85–103. [Google Scholar] [CrossRef]

- Gülmez, A. Türkiye’de dış finansman kaynakları ekonomik büyüme ilişkisi: ARDL sınır testi yaklaşımı. Ekon. Ve Sos. Araştırmalar Derg. 2015, 11, 139–152. Available online: https://dergipark.org.tr/en/pub/esad/issue/38966/456083 (accessed on 10 January 2025).

- Raihan, A.; Voumik, L.C.; Mohajan, B.; Rahman, M.S.; Zaman, M.R. Economy-energy-environment nexus: The potential of agricultural value-added toward achieving China’s dream of carbon neutrality. Carbon Res. 2023, 2, 43. [Google Scholar] [CrossRef]

- Phillips, P.C.; Hansen, B.E. Statistical inference in instrumental variables regression with I (1) processes. Rev. Econ. Stud. 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. A simple estimator of cointegrating vectors in higher order integrated systems. Econom. J. Econom. Soc. 1993, 61, 783–820. [Google Scholar] [CrossRef]

- Saikkonen, P. Asymptotically efficient estimation of cointegration regressions. Econom. Theory 1991, 7, 1–21. [Google Scholar] [CrossRef]

- Dallı, T.; Kütükçü, E. Türkiye’de tarım, yenilenebilir ve yenilenemez enerji tüketimi, doğrudan yabancı sermaye girişi ve CO2 emisyonu ilişkisi: ARDL analizi. Osman. Korkut Ata Üniversitesi Fen Bilim. Enstitüsü Derg. 2023, 6, 2154–2170. [Google Scholar] [CrossRef]

- Bölük, G.; Mert, M. The renewable energy, growth and environmental Kuznets curve in Turkey: An ARDL approach. Renew. Sustain. Energy Rev. 2015, 52, 587–595. [Google Scholar] [CrossRef]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for testing the constancy of regression relationships over time. J. R. Stat. Soc. Ser. B Stat. Methodol. 1975, 37, 149–192. [Google Scholar] [CrossRef]

- Lawal, A.I.; Nwanji, T.I.; Asaleye, A.; Ahmed, V. Economic growth, financial development and trade openness in Nigeria: An application of the ARDL bound testing approach. Cogent Econ. Financ. 2016, 4, 1258810. [Google Scholar] [CrossRef]

- Radulescu, M.; Simionescu, M.; Kartal, M.T.; Mohammed, K.S.; Balsalobre-Lorente, D. The impact of human capital, natural resources, and renewable energy on achieving sustainable cities and communities in European Union countries. Sustainability 2025, 17, 2237. [Google Scholar] [CrossRef]

- Ridzuan, N.H.A.M.; Marwan, N.F.; Khalid, N.; Ali, M.H.; Tseng, M.-L. Effects of agriculture, renewable energy, and economic growth on carbon dioxide emissions: Evidence of the environmental Kuznets curve. Resour. Conserv. Recycl. 2020, 160, 104879. [Google Scholar] [CrossRef]

- Li, R.; Wang, Q.; Li, L. Does renewable energy reduce per capita carbon emissions and per capita EF? New evidence from 130 countries. Energy Strategy Rev. 2023, 49, 101121. [Google Scholar] [CrossRef]

- Akpanke, T.A.; Deka, A.; Ozdeser, H.; Seraj, M. EF in the OECD countries: Do energy efficiency and renewable energy matter? Environ. Sci. Pollut. Res. 2024, 31, 15289–15301. [Google Scholar] [CrossRef] [PubMed]

- Lamharher, R.; Ritahi, O.; Echaoui, A. The ınterconnected dynamics of agricultural growth, employment, renewable energy, and carbon emissions: Evidence from Morocco. Afr. J. Commer. Stud. 2025, 6, 174–186. [Google Scholar] [CrossRef]

- Doğan, M.; Georgescu, I.; Çeştepe, H.; Sümerli Sarıgül, S.; Ergün Tatar, H. Renewable energy consumption and the ecological footprint in Denmark: Assessing the influence of financial development and agricultural contribution. Agriculture 2025, 15, 835. [Google Scholar] [CrossRef]

- Christensen, J.L.; Hain, D.S. Knowing where to go: The knowledge foundation for investments in renewable energy. Energy Res. Soc. Sci. 2017, 25, 124–133. [Google Scholar] [CrossRef]

- Tur, F.; Toprakçı, B. Karbondan Krediye: Onarıcı Tarım ve Karbon Kredileri. Türkiye Sınai Kalkınma Bankası. 2024. Available online: https://www.tskb.com.tr/uploads/file/karbondan-krediye-onarici-tarim-ve-karbon-kredileri.pdf (accessed on 10 April 2025).

- Ağır, S.; Karakoç, U.; Topal, A. Yeşil Dönüşüm ve Türkiye’de Gıda ve Tarım Sektörü; Maliye Hesap Uzmanları Vakfı Yayınları: İstanbul, Turkey, 2023. [Google Scholar]

- Ongan, S.; Gocer, I.; Işık, C. Introducing the new ESG-based Sustainability Uncertainty Index (ESGUI). Sustain. Dev. 2025, 33, 4457–4467. [Google Scholar] [CrossRef]

- Doğan, B.; Tiwari, A.; Bergougui, B.; Balsalobre-Lorente, D. Green innovation and fiscal spending: Decoding the path to sustainable development. Sustain. Dev. 2025. Early View. [Google Scholar] [CrossRef]

- Bergougui, B. Asymmetric impact of patents on green technologies on ecological footprint in Algeria: Evidence from NARDL and wavelet coherence. J. Environ. Manag. 2024, 355, 120426. [Google Scholar] [CrossRef]

- Bergougui, B. Algeria’s pathway to COP28 and SDGs: Do environmental technology, energy productivity, and resource efficiency matter for sustainability? Energy Strategy Rev. 2024, 55, 101541. [Google Scholar] [CrossRef]

- Bergougui, B.; Satrovic, E. Towards eco-efficiency of OECD countries: How does environmental governance restrain the destructive ecological effect of the excess use of natural resources? Ecol. Inform. 2025, 87, 103093. [Google Scholar] [CrossRef]

- Bergougui, B.; Mehibel, S.; Boudjana, R.H. Asymmetric nexus between green technologies, policy uncertainty and environmental sustainability in Algeria: Evidence from NARDL. J. Environ. Manag. 2024, 360, 121172. [Google Scholar] [CrossRef]

- Bergougui, B. Investigating the relationships among green technologies, financial development, and ecological footprint in Algeria: Evidence from Fourier ARDL. Sustain. Cities Soc. 2024, 112, 105621. [Google Scholar] [CrossRef]

- Bergougui, B. Moving toward environmental mitigation in Algeria: Do renewable energy and technological shocks matter for CO2 emissions? Energy Strategy Rev. 2023, 51, 101281. [Google Scholar] [CrossRef]

| The Symbol | Variable Name | Definition | Source |

|---|---|---|---|

| CO2 | Emissions of carbon | Per capita (metric tons) | Global Footprint Network [44] |

| GDP | Gross domestic product | Per capita (constant 2015 USD) | World Bank (WDI) [45] |

| REW | Renewable energy consumption | Per capita (kWh) | Our World in Data [46] |

| AGRI | Agricultural added value | At constant prices (percentage of GDP) | World Bank (WDI) [45] |

| lnCO2 | lnGDP | lnREW | lnAGRI | |

|---|---|---|---|---|

| Mean | 0.106258 | 8.712519 | 7.089166 | 2.657173 |

| Median | 0.158690 | 8.655083 | 7.289702 | 2.724388 |

| Maximum | 0.702991 | 9.550741 | 8.359624 | 3.727795 |

| Minimum | −0.892514 | 8.069710 | 5.388940 | 1.710866 |

| Std. Dev. | 0.445196 | 0.423007 | 0.783811 | 0.632076 |

| Skewness | −0.392169 | 0.350538 | −0.576747 | 0.173185 |

| Kurtosis | 2.112708 | 2.005981 | 2.631408 | 1.710175 |

| Jarque–Bera | 3.214005 | 3.390710 | 3.360517 | 4.087464 |

| Jarque–Bera probability | 0.200488 | 0.183534 | 0.186326 | 0.129544 |

| Observations | 55 | 55 | 55 | 55 |

| Model | Variables | ADF | PP | ADF | PP | Decision |

|---|---|---|---|---|---|---|

| I (0) | I (1) | |||||

| Fixed Model | lnCO2 | −2.13 [0] (0.23) | −0.23 [1] (0.19) | −8.14 [0] (0.00) * | −8.14 [2] (0.00) * | For I (1) refuse |

| lnGDP (lnGDP2) | 0.89 [0] (0.99) | 1.15 [4] (0.99) | −6.98 [0] (0.00) * | −6.98 [3] (0.00) * | ||

| lnREW | −1.13 [0] (0.69) | −0.94 [5] (0.76) | −8.27 [0] (0.00) * | −8.74 [5] (0.00) * | ||

| lnAGRI | −1.20 [0] (0.66) | −1.40 [7] (0.57) | −7.28 [0] (0,00) * | −7.46 [6] (0.00) * | ||

| Fixed and Trendy Model | lnCO2 | −3.12 [0] (0.11) | −3.06 [2] (0.12) | −8.44 [0] (0.00) * | −8.44 [1] (0.00) * | |

| lnGDP (lnGDP2) | −1.66 [0] (0.75) | −1.74 [1] (0.71) | −7.09 [0] (0.00) * | −7.14 [4] (0.00) * | ||

| lnREW | −2.71 [0] (0.23) | −2.71 [0] (0.23) | −8.20 [0] (0.00) * | −8.67 [5] (0.00) * | ||

| lnAGRI | −2.37 [0] (0.38) | −2.37 [0] (0.38) | −7.31 [0] (0.00) * | −7.74 [7] (0.00) * | ||

| Test Statistic | Value | Signif. | I (0) | I (1) |

|---|---|---|---|---|

| F-statistic | 7.581204 | 10% | 2.345 | 3.28 |

| K | 4 | 5% | 2.763 | 3.813 |

| 1% | 3.738 | 4.947 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| lnGDP | 19.206 | 1.711 | 11.221 | 0.000 * |

| lnGDP2 | −1.011 | 0.091 | −11.097 | 0.000 * |

| lnREW | −0.163 | 0.034 | −4.807 | 0.000 * |

| lnAGRI | 0.153 | 0.075 | 2.038 | 0.048 ** |

| C | −89.533 | 8.011 | −11.175 | 0.000 * |

| Turning point | $13,396 | |||

| Diagnostic Tests | Test Statistic | p Values | ||

| BG-LM | 1.108 | 0.340 | ||

| BPG | 1.197 | 0.318 | ||

| Ramsey reset | 0.011 | 0.990 | ||

| Jarque–Bera | 0.264 | 0.876 | ||

| F-statistic | 445.548 | 0.000 * | ||

| Durbin–Watson | 1.923 | |||

| R2 | 0.992 | |||

| Adjusted R2 | 0.990 | |||

| Variable | Coefficient | Std. Error | t-Statistic | p Values |

|---|---|---|---|---|

| D (lnGDP) | 6.132 | 2.751 | 2.229 | 0.031 ** |

| D (lnGDP (−1)) | −0.395 | 0.138 | −2.852 | 0.006 * |

| D (lnGDP2) | −0.268 | 0.155 | −1.726 | 0.091 *** |

| D (lnREW) | −0.110 | 0.029 | −3.743 | 0.000 * |

| D (lnREW (−1)) | 0.083 | 0.029 | 2.887 | 0.006 * |

| D (lnAGRI) | 0.179 | 0.071 | 2.491 | 0.017 ** |

| D (lnAGRI (−1)) | −0.152 | 0.069 | −2.194 | 0.034 ** |

| CointEq (−1) * | −0.752 | 0.105 | −7.153 | 0.000 * |

| R-squared | 0.781 | |||

| Adjusted R-squared | 0.747 | |||

| Log likelihood | 102.563 | |||

| Durbin–Watson stat | 1.923 | |||

| FMOLS | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| lnGDP | 19.183 | 1.235 | 15.521 | 0.000 * |

| lnGDP2 | −1.007 | 0.066 | −15.235 | 0.000 * |

| lnREW | −0.137 | 0.024 | −5.634 | 0.000 * |

| lnAGRI | 0.173 | 0.050 | 3.453 | 0.001 * |

| C | −89.876 | 5.746 | −15.639 | 0.000 * |

| Turning point | $13,853 | |||

| R-squared | 0.988 | |||

| Adjusted R-squared | 0.987 | |||

| DOLS | Coefficient | Std. Error | t-Statistic | Prob. |

| lnGDP | 20.259 | 1.501 | 13.492 | 0.000 * |

| lnGDP2 | −1.064 | 0.079 | −13.331 | 0.000 * |

| lnREW | −0.178 | 0.027 | −6.486 | 0.000 * |

| lnAGRI | 0.176 | 0.066 | 2.650 | 0.012 ** |

| C | −94.594 | 7.045 | −13.425 | 0.000 * |

| Turning point | $13,687 | |||

| R-squared | 0.993 | |||

| Adjusted R-squared | 0.990 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Koç, N.; Koç, Ö.E.; Virlanuta, F.O.; Bıtrak, O.O.; Çiçek, U.; Kovacs, R.O.; Vasile, V.-A.; Vrabie, T. Agricultural Value Added, Renewable Energy, and the Environmental Kuznets Curve: Evidence from Turkey. Energies 2025, 18, 3291. https://doi.org/10.3390/en18133291

Koç N, Koç ÖE, Virlanuta FO, Bıtrak OO, Çiçek U, Kovacs RO, Vasile V-A, Vrabie T. Agricultural Value Added, Renewable Energy, and the Environmental Kuznets Curve: Evidence from Turkey. Energies. 2025; 18(13):3291. https://doi.org/10.3390/en18133291

Chicago/Turabian StyleKoç, Neslihan, Özgür Emre Koç, Florina Oana Virlanuta, Orhan Orçun Bıtrak, Uğur Çiçek, Radu Octavian Kovacs, Valentina-Alina Vasile (Dobrea), and Tincuta Vrabie. 2025. "Agricultural Value Added, Renewable Energy, and the Environmental Kuznets Curve: Evidence from Turkey" Energies 18, no. 13: 3291. https://doi.org/10.3390/en18133291

APA StyleKoç, N., Koç, Ö. E., Virlanuta, F. O., Bıtrak, O. O., Çiçek, U., Kovacs, R. O., Vasile, V.-A., & Vrabie, T. (2025). Agricultural Value Added, Renewable Energy, and the Environmental Kuznets Curve: Evidence from Turkey. Energies, 18(13), 3291. https://doi.org/10.3390/en18133291