Abstract

As global sustainability imperatives increase, understanding how green finance policies and technological innovation influence corporate environmental performance has become a relevant issue. This study examines the impact of green finance on corporate environmental practices, particularly focusing on how innovation enhances sustainable energy transitions. A difference-in-differences (DID) approach was employed. This research compares corporate environmental performance before and after the implementation of green finance policies across treated and control groups. This method allows for isolating the effect of green finance by controlling for temporal and individual factors, providing robust insights into policy efficacy. Our findings indicate a statistically significant improvement in environmental performance, particularly among larger, state-owned enterprises in China’s eastern regions. The findings also underscore the moderating role of innovation in optimizing green finance outcomes. Finally, important implications for policymakers aiming to drive corporate sustainability are offered.

1. Introduction

Globally, the transition to sustainable energy systems has become a critical challenge for governments, corporations, and societies as they face mounting pressures to mitigate the adverse impacts of climate change [1,2]. In this context, green finance and technological innovation have emerged as key drivers in enhancing corporate environmental performance, in order to promote energy efficiency, and facilitate the shift toward cleaner energy sources [3]. Moreover, green finance plays an instrumental role in advancing renewable energy production and promoting sustainability particularly through mechanisms like green bonds [4,5]. It encompasses various financial instruments designed to fund environmentally beneficial projects while also generating financial returns [6]. Factors such as technological capacity, emission levels, and the development of credit markets influence the overall efficacy of green finance [4]. In brief, green finance and technological innovation are increasingly seen as essential tools for fostering sustainable business practices, as the former focus on environmental benefits, and the latter drives breakthroughs in renewable energy and resource efficiency [7,8].

Despite the importance of green finance and technological innovation in driving sustainability being widely recognized, the pathways through which they impact corporate environmental performance remain underexplored [9,10]. Particularly, debates persist regarding how to integrate these instruments within corporate strategies [11]. Some researchers argue that green finance alone may generate significant environmental benefits by directing capital toward eco-friendly projects, while others emphasize the importance of coupling financial mechanisms with robust technological advancements to achieve long-term sustainability [12,13]. Moreover, certain studies have questioned the true effectiveness of green finance, raising concerns about greenwashing and the misallocation of funds [14,15].

Here are the hypotheses proposed:

Hypothesis 1.

Green finance policies promote the improvement of corporate environmental performance.

Hypothesis 2.

Innovation input has a positive moderating effect on the impact of green finance policies on corporate environmental performance.

Hypothesis 3.

Green technology innovation has a positive moderating effect on the impact of green finance policies on corporate environmental performance.

In light of the increase in global sustainability goals, this study examines the impact of green finance policies and technological innovation on corporate environmental performance. It focuses on the role in promoting energy transitions in China’s A-share listed companies. This study employs a DID method, a robust econometric approach that compares the environmental performance of companies affected by green finance policies with those unaffected, allowing us to isolate the effect of policy implementation from other temporal and individual factors. China’s rapidly evolving green finance landscape and its prominence as a global economic powerhouse make it an ideal context for studying the impact of these policies on environmental performance, particularly as China has pledged to reach carbon neutrality by 2060. The study is structured as follows: First, it introduces the concepts of green finance and technological innovation within the context of corporate environmental performance. Second, it reviews the relevant literature and research hypotheses. Third, it presents the data and methodology. Fourth, it details the empirical findings, including a heterogeneity analysis by firm size, ownership, and region. Finally, it concludes with policy implications and recommendations for future research. This research not only fills a gap in understanding how green finance policies function within China’s unique economic and regulatory landscape but also provides valuable insights for policymakers aiming to drive sustainable energy transitions globally.

2. Literature Review and Theoretical Analysis

2.1. Literature Review

2.1.1. Definition of Green Finance in Global Literature

The concept of green finance has emerged due to the growing global consensus on sustainable development. Green finance generally refers to financial activities that support sustainable environmental projects, including renewable energy, pollution control, and biodiversity conservation, with the overarching aim of reducing environmental impact. Key references include studies by Bhatia and Jakhar (2023) and Zhang et al. (2020), which outline the principles and objectives that characterize green finance across different economies [7,16]. Green finance encompasses economic initiatives aimed at enhancing environmental quality, combating climate change, and promoting the efficient use of resources [17,18]. Its policies include a range of measures that direct financial resources toward environmentally beneficial industries, such as environmental protection, energy efficiency, clean energy, and sustainable transportation. It serves as a financial foundation for projects and technologies focused on energy conservation and environmental preservation. Broadly, green finance facilitates ecological preservation through economic and social measures, playing a crucial role in driving sustainable economic growth and development by providing support for eco-friendly progress through cost- and risk-sharing mechanisms [19].

2.1.2. Impact of Green Finance on Environmental Outcomes

Existing studies that examine the influence of green finance on corporate environmental performance are summarized. Research in this area consistently shows that green finance policies contribute to reduced emissions, energy efficiency, and improved resource management. For example, studies in the European context (e.g., Flammer, 2021) show that green bonds and environmental subsidies have promoted sustainable investments across industries, while American studies highlight the role of green finance in driving innovation within the energy sector [20,21].

Within the central bank framework, Dikau and Volz illuminate the evolving landscape shaped by sustainability imperatives, emphasizing global contextual variations and political factors that influence the roles of central banks [22]. Their work underscores the importance of central banks addressing climate risk for macro-financial stability, asserting that neglecting this responsibility contradicts their core functions. Madaleno, Dogan, and Taskin contribute to this literature by examining the complex interactions among green finance, clean energy, environmental responsibility, and green technology [18]. Their time-varying causality test reveals bidirectional relationships, suggesting that, while green finance aligns with the need for clean energy, the influence of clean energy on green finance is even more profound [23]. These studies highlight the urgent need for comprehensive policies promoting sustainability, green finance, and environmentally responsible practices, offering valuable insights into addressing global challenges related to climate change and sustainable development.

From a micro perspective, green credit policies facilitate green innovation in enterprises, particularly in areas such as energy conservation and environmental protection [24], contributing to their overall high-quality development [25]. This impact is especially pronounced in small- and medium-sized enterprises (SMEs) [26]. However, for heavily polluting enterprises, green credit policies impose significant financing penalties and inhibit investment [27]. This approach incentivizes enterprises to adopt environmentally friendly practices, thereby fostering the transition to low-carbon strategies [28]. Research indicates that green credit policies create favorable financing conditions for green innovation, significantly enhancing the level of innovation in environmentally conscious enterprises [29]. Nevertheless, there is a risk of “greenwashing”, where enterprises may not engage in substantial green innovation despite obtaining low-cost financing [30]. The effectiveness of green credit policies in driving green innovation depends on strengthening regional environmental law enforcement, intellectual property protection, and the disclosure of environmental information [31]. Additionally, studies have explored the impact of pilot emissions trading programs (ETPs) and various environmental regulation tools on enterprises’ green innovation [32]. Flammer’s [20] research, involving 1189 companies from China, the United States, France, Sweden, and other countries, demonstrates that issuing green bonds attracts investors focused on environmental protection and sustainable development, prompting enterprises to enhance their environmental performance [31].

Other research has conducted quasi-natural experiments to demonstrate that financial allocations can steer green development through the implementation of green credit policies. This suggests that green credit policies have, to a certain extent, exerted a positive influence on resource reallocation, though they have not fully realized the Porter effect [32]. An analysis of the short-term market impact of green bonds reveals positive outcomes, benefiting issuers and indicating promising market prospects [33]. However, it is essential to address unresolved issues within the domain of green insurance, highlighting the critical role the green insurance sector plays in promoting China’s circular economy [34,35,36,37].

In China, the progression of green finance policies reflects the country’s strategic response to mounting environmental challenges. Chinese A-share companies are increasingly recognizing the importance of integrating environmental performance into their business models. Research by Zhang and Wang [38] points to a growing corporate commitment to sustainability, particularly through the adoption of eco-friendly technologies [39]. This shift is driven by multiple factors, including heightened consumer demand for environmentally responsible products and the necessity to comply with stringent environmental regulations. As a result, the corporate focus on achieving environmental excellence has intensified. Studies, such as that by Wang et al. [40], demonstrate a positive relationship between proactive engagement in green finance initiatives and improved environmental performance in companies [39]. Favorable policies and incentives further encourage investments in green projects, technological advancements, and the adoption of environmentally sustainable business strategies.

2.1.3. Role of Technological Advances in Enhancing Environmental Performance:

Technological innovation is highlighted as a critical factor in maximizing the impact of green finance. Prior studies indicate that investments in clean technology and energy-efficient processes are essential for achieving environmental performance goals [41]. The adoption of technologies such as carbon capture, renewable energy systems, and AI-driven resource management has proven effective in markets where green finance is readily available.

2.1.4. Comparative Analysis on American, European, and Asian Markets

An overview of the distinct approaches to green finance and environmental performance across these regions is provided. In the American markets, emphasis has been placed on private sector investment in green technologies, with notable progress in renewable energy finance and an increasing issuance of green bonds. The European markets are known for comprehensive regulatory frameworks that support green finance, including the EU Green Deal, which integrates environmental targets with financial incentives to accelerate sustainable development [21]. In the Asian market, China’s unique policy-driven approach is highlighted, combining government support with corporate responsibility [41]. Japan offers another example, focusing on integrating green finance with technological innovation across various sectors [21].

2.2. Theoretical Analysis

2.2.1. Green Finance Policy and Corporate Environmental Performance

Green finance is an effective measure for improving environmental performance by implementing the theory of sustainable financial development and encouraging enterprises to assume social responsibility for environmental protection by transferring environmental externalities to enterprises [42]. Under the theory of sustainable financial development, financial institutions actively develop green finance, consider environmental risks in related financial services, vigorously support the development of green enterprises, promote the improvement of environmental performance through green output, and raise the financing threshold of the three high enterprises so that they can bear the costs caused by environmental factors. In other words, green finance converts external environmental characteristics into corporate environmental governance costs. In addition, financial institutions have gradually attached importance to the environment under green financing. Under such pressure, enterprises must carry out technological innovation, industrial transformation, and upgrading, and then assume the social responsibility of environmental protection to improve environmental performance [41].

2.2.2. Green Finance Policy, Innovation Input, and Corporate Environmental Performance

Green finance policies have the potential to enhance corporate environmental performance by promoting increased investment in innovation. These policies offer direct economic incentives that encourage enterprises to allocate more resources toward innovation activities. According to the theory of production factor endowment, innovation output rises with increased investment in production factors, such as capital and labor. This implies that higher innovation input, particularly in research and development (R&D), will ultimately lead to greater innovation output, which contributes to overall corporate performance, including environmental performance [43].

During the process of transforming innovation input into output, it is crucial to consider how enterprises manage this transformation. Specific input factors, such as R&D investment and the involvement of skilled personnel, play a pivotal role in driving innovation. The development of effective mechanisms within enterprises is essential for translating innovation input into tangible outcomes, such as new products or processes. As these innovations emerge, they directly improve the company’s performance, including its environmental impact. Hence, the generation of novel products, technologies, and processes leads to enhanced environmental performance.

2.2.3. Green Finance Policy, Green Technology Innovation, and Corporate Environmental Performance

Green finance policies can incentivize enterprises to engage in green technology innovation through mechanisms such as capital subsidies or green credit, ultimately enhancing their environmental performance. In response to green finance regulations, enterprises tend to adopt strategies aimed at strengthening technological innovation and upgrading technologies to maximize economic gains, lower financing costs, and improve capital liquidity. To achieve sustainable development, enterprises must balance the utilization of natural resources with environmental protection. This involves not only the recycling of resources to meet environmental goals but also optimizing economic benefits, all of which are inherently linked to technological innovation and progress.

In this context, the interconnection between energy and financial development becomes crucial. Studies by Samour et al., Usman et al., Musa et al., and Shahbaz et al. [44,45,46,47] demonstrate that financial development positively influences the demand for renewable energy. Similarly, research by Zioło et al. [48] highlights that the impact of financial development on sustainable energy varies across countries, particularly those at the forefront of the green transition. Enterprises that adopt new technologies to enhance energy resource efficiency, increase the use of renewable energy, lower energy consumption, and reduce pollutant emissions not only realize economic and environmental benefits but are further incentivized to pursue continued green technological innovation.

The primary goal of green technology innovation is to improve corporate environmental performance by reducing pollutant emissions, optimizing resource utilization, advancing energy transitions, and enhancing environmental quality [43]. Yan and Wan [49] suggest that enterprises adopt innovative technologies to save energy and accelerate industrial upgrading. Moreover, energy trading policies can stimulate green technology innovation, enabling enterprises to control emissions, reduce energy consumption, and, ultimately, enhance environmental performance. Therefore, this paper posits that, in China, the development of green finance drives the energy transformation of enterprises through green technology innovation, thereby improving their environmental performance.

3. Research Design

3.1. Data Source and Justification

In this study, panel data from China’s A-share listed companies spanning the period from 2008 to 2021 were utilized. The financial data for the listed companies were sourced from the CSMAR Database, with companies having missing data related to ST status, financial indicators, or other financial information excluded from the sample. As a result, a total of 1193 sample observations were collected for analysis.

The study period was selected for several key reasons. First, this timeframe captures significant developments in China’s green finance policies, which began to take shape following the global financial crisis of 2008. This period marks the gradual emergence of green finance as a policy priority, with notable policies introduced to support environmental sustainability. Second, in 2017, China established its first set of national green finance guidelines, marking a pivotal year for green finance and corporate environmental performance, and allowing us to effectively analyze pre- and post-policy effects. Finally, the period up to 2021 enables us to examine the most recent data, while providing a sufficiently long span to analyze trends and the impacts of green finance on environmental outcomes within a dynamic regulatory and economic environment.

3.2. Model Construction

The objective of this study is to assess the effectiveness of green finance policies, focusing on how well these policies align with corporate environmental performance. Specifically, the study aims to investigate the impact and mechanisms through which green finance policies influence corporate environmental outcomes. Following the implementation of green finance policies, any observed improvements in environmental performance may result either from the policy itself or from temporal factors. The DID modeling approach was selected for this study due to its robustness in estimating causal effects in policy evaluation. DID compares changes in outcomes over time between a treatment group and a control group, effectively controlling for time-invariant unobserved heterogeneity. In the context of this study, DID allows us to isolate the effect of green finance policies by accounting for baseline differences in environmental performance between treated and untreated firms, as well as common trends affecting all firms.

To validate the hypothesis and address potential endogeneity concerns, the DID model is constructed to evaluate the net effect of green finance policies:

where i represents the enterprise, t stands for the year, lnEP stands for corporate environmental performance, and Treat is a group dummy variable, which takes 1 if the enterprise is in the heavy pollution industry and 0 otherwise. Post is a time dummy variable that takes 1 for the period after the policy was officially implemented (after 2017) and 0 before. Control represents a set of control variables; μt represents time fixed effects; εit represents the random disturbance term; and α1 is a differential coefficient to measure the impact of green finance policy implementation on the environmental performance of enterprises in the experimental group.

3.3. Variable Definition

This section delves into the critical task of defining the variables used in the study, with a detailed explanation of the key variables that are central to the research, as presented in Table 1. Particular emphasis is placed on the explained variable, which, in this case, is corporate environmental performance—a crucial measure for evaluating a company’s commitment to and effectiveness in achieving environmental sustainability.

Table 1.

Variable definitions.

Explained variable: The explained variable in this study is corporate environmental performance (lnEP). In existing literature, environmental performance is commonly measured using methods such as a comprehensive index, pollution discharge data, or environmental tax figures. However, the comprehensive index approach involves subjective scoring, which may introduce bias, while pollution discharge data can be challenging to standardize across different units. Additionally, data for the Environmental Tax Act are difficult to obtain, as pollutant charge data are used prior to 2018, with environmental tax data available only from 2018 onwards.

Environmental investment, as a quantifiable sub-index within corporate environmental performance indices, provides a practical and objective measure of a company’s commitment to environmental sustainability. This study draws on the research of Yang Dongyun and Xie Yang (2019), who also use environmental investment as a proxy for corporate environmental performance [50]. Their research highlights that environmental investment expenditure effectively captures the financial resources companies allocate toward pollution control, waste treatment, and other environmental protection initiatives. Higher levels of environmental investment generally indicate a stronger commitment to sustainable practices and pollution mitigation, reflecting improved corporate environmental performance. Thus, environmental investment expenditure serves as a measurable indicator of the emphasis a company places on sustainability and environmental protection.

This approach aligns with prior studies that use environmental investment as a proxy for performance, where higher investments are associated with positive environmental outcomes [7,16]. While direct performance metrics, such as emissions reduction data, would ideally be used, data limitations and consistency issues make environmental investment a practical alternative that strongly correlates with actual environmental impact. This proxy allows us to measure performance through observable, quantitative investment in environmental initiatives.

Given these challenges, this study employs the natural logarithm of a firm’s environmental investment as a proxy for its environmental performance (lnEP). This indicator is positively correlated: higher environmental protection investment reflects better environmental performance, and vice versa.

Explanatory variables: The green finance policy (Treat × Post) serves as the explanatory variable in this study. The research design categorizes heavy polluters as the experimental group and non-heavy polluters as the control group. This classification aims to assess the environmental impact of green finance policies. The following three variables are constructed: (1) group variable (Treat), which takes the value of 1 when the enterprise is a heavy polluter and 0 otherwise; (2) time variable (Post), which takes the value of 1 when the time is the year of the pilot implementation of green finance policy and subsequent years, otherwise 0; and (3) green financial policy (Treat × Post), which refers to the cross-multiplication term of the grouping and time variables.

Control variables: With reference to existing literature, the following variables are controlled for in this study: enterprise size (Size), that is, the logarithm of total assets; asset–liability ratio (Lev), the ratio of total liabilities to total assets; return on assets (ROA), which is the ratio of net profit to total assets; operating capacity of assets (ATO), which is revenue divided by total assets; and enterprise growth (Growth), the increase in operating income divided by the previous period’s operating income.

4. Empirical Results and Analysis

4.1. Descriptive Statistics

This study utilizes data from China’s A-share listed companies over the period of 2008 to 2021, comprising a total of 1193 observations. As shown in Table 2, the mean value of the explained variable, corporate environmental performance, is 17.02, with a standard deviation of 2.331, indicating significant variation in environmental investment expenditures across enterprises. The explanatory variable, represented by the interaction term of the grouping variable and the time variable, has a mean value of 0.342 and a standard deviation of 0.475.

Table 2.

Descriptive statistics.

4.2. Benchmark Regression

Benchmark regression is performed according to the above model, and the following results are obtained. The values in Table 3 refer to Treat × Post. At the 1% significance level, green finance policy has a promoting effect on corporate environmental performance. Hypothesis 1 is supported. Column (2) shows that only the time fixed effect is controlled, with a coefficient of 1.014, which is significant at the 1% level. Column (4) shows that the time fixed effect is controlled and the control variable is added, with a coefficient of 1.422, which is significant at the 1% level.

Table 3.

Reference regression results.

4.3. Mechanism Analysis

In Table 4, column (1) presents the results for the moderating effects of R&D input, while column (2) displays the results for the moderating effects of R&D personnel. When using R&D input and R&D personnel as proxy variables for innovation input, the interaction coefficient in column (1) is 13.494, which is positively significant at the 1% level. Similarly, the interaction coefficient in column (2) is 0.098, also positively significant at the 1% level. These results indicate that both R&D investment and R&D personnel exert a significant positive moderating effect on corporate environmental performance, thus supporting Hypothesis 2. Column (3) examines the moderating effect of independent applications for green patents, while column (4) focuses on the moderating effect of joint applications for green patents. In this study, the number of independent and joint green patent applications are used as proxy variables for green technology innovation. The interaction coefficient in column (3) is 0.117, which is positively significant at the 10% level, whereas the coefficient in column (4) is 0.514, showing a positive significance at the 1% level. These findings suggest that green technology innovation has a significant positive moderating effect on corporate environmental performance.

Table 4.

Mechanism analysis.

4.4. Heterogeneity Analysis

4.4.1. Firm Size Heterogeneity

Enterprise size is determined based on the median size of firms in the sample. To ensure that the classification reflects actual conditions, the division is conducted annually, with large enterprises assigned a value of 1 and others assigned 0. The regression results, presented in Table 5, are obtained through this grouping. As indicated in Table 5, green finance policies significantly enhance the environmental performance of both large enterprises and small- to medium-sized enterprises (SMEs) at the 1% significance level. The coefficient in column (1) is 1.453, while the coefficient in column (2) is 1.375, suggesting that the positive effect of green finance policies on the environmental performance of large enterprises is greater than that of SMEs. This may be attributed to the fact that large enterprises have greater asset scales and are more comprehensively influenced by green finance policies, leading to higher investment in environmental protection and, consequently, a more pronounced improvement in environmental performance.

Table 5.

Firm size heterogeneity.

4.4.2. Firm Nature Heterogeneity

The regression results in Table 6, which classify the sample enterprises into state-owned and non-state-owned categories, demonstrate significant coefficients. In column (1), the coefficient for state-owned enterprises is 2.050, significant at the 1% level, while, in column (2), the coefficient for non-state-owned enterprises is 1.051, also significant at the 1% level. A seemingly uncorrelated test is conducted to assess the differences between the groups, producing a p-value of 0.0041, which is significant at the 1% level. The comparative analysis suggests that green finance policies exert a greater impact on the environmental performance of state-owned enterprises compared to non-state-owned enterprises. This disparity may be attributed to the strong policy support and government backing that state-owned enterprises receive, enabling them to invest more heavily in environmental protection, thereby resulting in a more substantial improvement in their environmental performance.

Table 6.

Firm nature heterogeneity.

4.4.3. Regional Heterogeneity

Based on the provinces where the sample enterprises are located, the regions are divided into three categories. The eastern region consists of 11 provinces and cities, including Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan. The central region comprises eight provinces: Shanxi, Jilin, Heilongjiang, Henan, Hubei, Hunan, Anhui, and Jiangxi. The western region includes 12 provinces, municipalities, and autonomous regions (self-governed areas): Inner Mongolia Autonomous Region, Chongqing Municipality, Sichuan Province, Guangxi Zhuang Autonomous Region, Guizhou Province, Yunnan Province, Shaanxi Province, Gansu Province, Qinghai Province, Ningxia Hui Autonomous Region, Xinjiang Uyghur Autonomous Region, and Tibet Autonomous Region.

The regression analysis (a statistical method for understanding relationships between variables) results are presented in Table 7. Column (1) shows that the environmental performance of enterprises in the eastern region has a coefficient of 1.446, which is statistically significant at the 1% level (meaning there is a very low probability that this result is due to chance). Column (2) reflects the environmental performance of enterprises in the central region, with a coefficient of 1.413, significant at the 5% level. Column (3) represents the environmental performance of enterprises in the western region, where the results are not statistically significant (indicating no strong evidence of an effect).

Table 7.

Regional heterogeneity.

These findings suggest that green finance policies (financial measures aimed at supporting environmental sustainability) significantly enhance the environmental performance of enterprises in the eastern region, and, to a lesser extent, in the central region. However, the impact is less noticeable in the western region. This may be due to the higher economic development of the eastern region, where enterprises are more likely to receive support from green finance policies, enabling a greater investment in environmental protection, and, consequently, a more marked improvement in environmental performance compared to enterprises in the central and western regions.

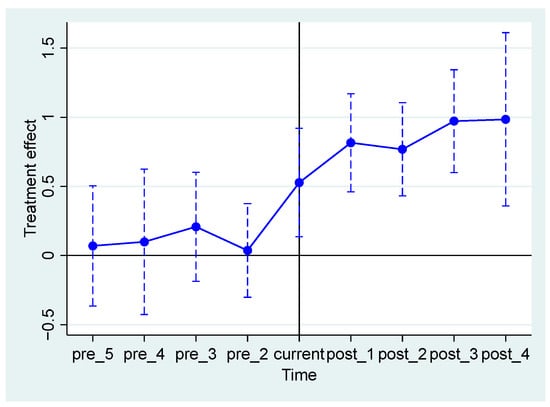

4.4.4. Parallel Trend Test

The results of the differential estimation satisfy the consistency requirement that the experimental and control groups adhere to the parallel trend hypothesis, meaning that, in the absence of policy intervention, the development trends of both groups are aligned. Figure 1 illustrates the regression results, using 2017 as the time-dividing line, and presents the estimated coefficients within a 90% confidence interval. The coefficients for the years 2013 to 2016 are not statistically significant, indicating no notable difference between the experimental and control groups prior to the policy implementation, thus confirming the validity of the parallel trend hypothesis. As shown in Table 8, following the implementation of the policy in 2017, the estimated coefficient becomes significant at the 1% level, suggesting that green finance policies have an immediate and enduring impact on corporate environmental performance.

Figure 1.

Parallel trend test chart.

Table 8.

Parallel trend test.

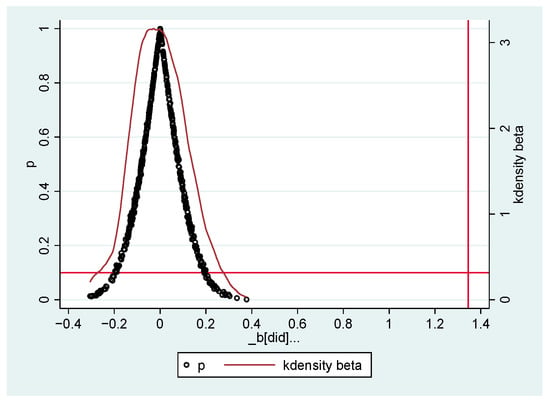

4.4.5. Placebo Test

This study proposes that the moderating effect of innovation input positively influences the relationship between green finance policies and corporate environmental performance, as illustrated in Figure 2. This hypothesis is based on the existing literature [34], which highlights the dynamic interaction between innovation strategies and environmental management within corporate settings. The study aims to empirically explore and validate this hypothesis, thereby contributing to a deeper understanding of the complex relationships between innovation, financial policies, and environmental outcomes in corporate contexts.

Figure 2.

Placebo test.

4.4.6. PSM-DID

To ensure the robustness of the regression results, this study utilizes the propensity score matching with difference-in-differences (PSM-DID) methodology to evaluate the effect of green finance pilot policies on corporate financing costs. For comparison, the previously mentioned firm-level control variables are employed to estimate the likelihood of each enterprise being located in a pilot zone. Techniques such as nearest neighbor matching, kernel matching, and radius matching are then applied to align the experimental group with the control group, minimizing pre-policy differences between the two groups. This rigorous approach is designed to address potential endogeneity issues stemming from self-selection biases in the creation of green finance pilot zones. Based on this framework, the net effect of green finance policies on corporate environmental performance is determined using Formula (1).

Column (1) of Table 9 displays the estimated results of the fixed-effects Difference-in-Differences (DID) model for the full sample. The coefficient of the policy dummy variable is positive and statistically significant at the 1% level. Columns (2)–(4) present the results derived from the Propensity Score Matching Difference-in-Differences (PSM-DID) method: column (2) shows the estimates using 1:1 nearest neighbor matching, column (3) reports the estimates using kernel matching, and column (4) presents the results using radius matching. The findings in columns (2)–(4) reveal that the signs of the coefficients obtained through the PSM-DID approach are consistent with the benchmark estimates for the entire sample.

Table 9.

PSM-DID results.

5. Discussion and Implications

5.1. Discussion

In comparing our findings with existing literature, significant alignment with studies highlighting the positive role of green finance policies in enhancing corporate environmental performance is observed. For instance, Zhang et al. (2020) demonstrated that green finance policies provide critical incentives for firms to invest in environmentally sustainable practices, a result consistent with our finding that green finance policies significantly improve corporate environmental outcomes [16]. Similarly, Bhatia and Jakhar (2023) showed that companies with access to green finance tend to increase their investments in energy-efficient technologies, which supports our observation of a positive correlation between green finance policies and innovation in sustainable technologies [7]. Additionally, studies by Madaleno et al. (2022) emphasize the role of firm size and ownership structure in moderating the effects of green finance policies, corroborating our findings that larger enterprises and state-owned firms exhibit more pronounced improvements in environmental performance [48]. The results thus reinforce and extend the established understanding in the literature by offering a focused analysis within China’s regional and firm-specific contexts, further suggesting that tailored policy interventions may enhance the effectiveness of green finance across diverse economic environments.

Although research findings indicate that green finance policies can positively impact corporate environmental performance, the potential issue of greenwashing needs careful consideration. While green finance aims to drive environmental progress, some firms may exploit these policies to project a sustainable image without genuinely engaging in innovation or environmental improvements. Previous studies suggest that companies can manipulate environmental disclosures to attract green finance, hiding minimal progress in sustainability [51,52,53]. This issue suggests that future research should focus on regulatory oversight to ensure that green finance is directed toward genuine environmental advancements. To mitigate this risk, transparent reporting and stringent environmental performance audits may better support meaningful green progress rather than allowing it to be undermined by deceptive practices. Furthermore, while larger enterprises and state-owned firms demonstrate more pronounced improvements, smaller firms, which may have fewer resources, are less likely to engage in greenwashing. This suggests that green finance policies might not fully benefit smaller firms. Future improvements could focus on addressing these disparities through regionally targeted policies or subsidies to prevent green finance from disproportionately favoring larger, more established firms.

Followed by concerns over greenwashing, the findings also raise significant points about energy transitions. While green finance has been instrumental in driving renewable energy adoption, some companies may resort to ‘greenwashing’ to attract investment without genuinely transitioning to cleaner energy sources [54,55]. Such practices, unfortunately, divert attention from the critical goal of reducing the reliance on fossil fuels and advancing renewable energy initiatives. Therefore, safeguard measures, such as stringent regulatory mechanisms, are essential in order to ensure that the capital raised through green finance is directly allocated to energy-efficient projects. There is a recent study that highlights how technology can facilitate better regulatory oversight to ensure that resources and funds are allocated effectively with the alignment of environmental goals. This supports the notion that advanced technological solutions, along with robust regulatory frameworks, can play a crucial role in mitigating issues like greenwashing and ensuring genuine progress in energy transitions [56].

Moreover, it is interesting to note that more incentives for boosting green finance policies are observed in the eastern region, which may indicate that policy interventions must be tailored to different energy profiles. Regions with less developed energy infrastructure may require additional support to facilitate the adoption of renewable energy technologies. This implies the need for policies that not only promote green finance but also ensure that it is effectively integrated with regional energy strategies, addressing gaps in renewable energy production and consumption [57,58].

In response to concerns about greenwashing within green finance, we have expanded our discussion to outline specific regulatory measures that could enhance the integrity of green finance initiatives. One essential approach is to implement enhanced transparency requirements, obligating companies to provide detailed, standardized disclosures on the environmental impact and specific use of green finance funds. Additionally, third-party audits conducted by independent entities could verify the environmental claims made by firms, ensuring that green finance is genuinely allocated toward sustainable projects rather than superficial “green” branding. Performance-based incentives could further align green finance with actual environmental outcomes, whereby companies achieving verifiable improvements in environmental performance receive additional financial or regulatory benefits. Finally, providing public access to environmental performance data through digital platforms can increase accountability, allowing investors and the public to assess whether green finance is driving genuine sustainability advancements. These measures collectively aim to minimize greenwashing risks, thereby enhancing the effectiveness of green finance policies in promoting real environmental progress.

5.2. Implication

The findings of this study highlight the significant role of green finance policies and technological innovation in enhancing corporate environmental performance. Based on our analysis, we recommend the following practical measures for companies in the sector to improve their sustainability efforts: Firstly, green finance should be actively leveraged for innovation. Companies are encouraged to pursue green finance options, such as green bonds and low-interest green loans, to fund investments in clean technology and energy-efficient processes. This approach not only reduces the environmental impact but also aligns firms with evolving regulatory standards. Secondly, environmental performance indicators should be integrated into reporting frameworks. Companies should implement measurable environmental performance indicators, including targets for emissions reduction, energy savings, and resource efficiency, to maximize the impact of green finance. Such indicators will help track progress and demonstrate accountability to investors and stakeholders. Thirdly, collaboration with financial institutions should be strengthened. Companies should clearly communicate their environmental goals to attract funding aligned with sustainability initiatives, particularly those supporting long-term environmental outcomes. Finally, regional policy incentives should be utilized. Firms in regions with strong policy support for green finance should take advantage of available incentives, such as tax breaks or grants, to offset environmental investment costs. Tailoring environmental strategies to leverage these regional policies can enhance corporate performance and establish competitive advantages.

6. Conclusions

This study provides clear evidence of the positive impact that green finance policies have on corporate environmental performance. The employment of a DID model highlights the effectiveness of green finance in driving corporate environmental outcomes, particularly through the integration of technological innovation. Firstly, mechanism analysis reveals that both innovation input and green technology innovation play a crucial moderating role in enhancing the relationship between green finance policies and environmental performance. Secondly, heterogeneity analysis further emphasizes that the positive effects are more pronounced among larger enterprises, state-owned firms, and companies located in the more economically developed eastern region. These findings advise that factors such as enterprise size, ownership structure, and regional context are critical in understanding the differential impacts of green finance policies on corporate environmental outcomes. Finally, the robustness checks confirm the reliability and robustness of the results, reinforcing the study’s conclusions. While green finance and technological innovation have proven to be key drivers of corporate environmental performance, the ultimate goal of facilitating sustainable energy transitions requires avoiding greenwashing to ensure equitable access to green finance and support genuine energy transformation efforts. Future research should focus on developing policy frameworks that more explicitly link green finance to energy efficiency and renewable energy goals, while minimizing the risk of greenwashing through stronger regulatory oversight.

Author Contributions

Conceptualization, X.X. and S.C.-i.C.; methodology, X.X.; software, X.X.; validation, X.X., S.C.-i.C. and C.-M.O.; formal analysis, X.X.; resources, C.-M.O.; data curation, X.X.; writing—original draft preparation, X.X.; writing—review and editing, S.C.-i.C.; visualization, X.X.; supervision, S.C.-i.C. funding acquisition, S.C.-i.C. and C.-M.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by Qingdao University under grant number DC2100001487, and by the project “Financial Technology Security and Regulatory Planning System Based on RSA Encryption Algorithm” under grant number RH2200003783.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available upon request.

Acknowledgments

We thank Qingdao University’s support and ChatGPT for assisting with the proofreading of this manuscript.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Kandpal, V.; Jaswal, A.; Santibanez Gonzalez, E.D.; Agarwal, N. Challenges and Opportunities for Sustainable Energy Transition and Circular Economy. In Sustainable Energy Transition: Circular Economy and Sustainable Financing for Environmental, Social and Governance (ESG) Practices; Springer: Cham, Switzerland, 2024; pp. 307–324. [Google Scholar]

- Sovacool, B.K.; Griffiths, S.; Kim, J.; Bazilian, M. Climate change and energy security: A novel and adaptive policy framework. Energy Policy 2021, 158, 112544. [Google Scholar] [CrossRef]

- Zhou, M.; Li, X. Influence of green finance and renewable energy resources over the sustainable development goal of clean energy in China. Resour. Policy 2022, 78, 102816. [Google Scholar] [CrossRef]

- Alharbi, S.S.; Al Mamun, M.; Boubaker, S.; Rizvi, S.K.A. Green finance and renewable energy: A worldwide evidence. Energy Econ. 2023, 118, 106499. [Google Scholar] [CrossRef]

- Bhattacharyya, R. Green finance for energy transition, climate action and sustainable development: Overview of concepts, applications, implementation and challenges. Green Financ. 2022, 4, 1–35. [Google Scholar] [CrossRef]

- Mavlutova, I.; Spilbergs, A.; Verdenhofs, A.; Kuzmina, J.; Arefjevs, I.; Natrins, A. The Role of Green Finance in Fostering the Sustainability of the Economy and Renewable Energy Supply: Recent Issues and Challenges. Energies 2023, 16, 7712. [Google Scholar] [CrossRef]

- Bhatia, M.S.; Jakhar, S.K. Green finance and sustainable development: Empirical evidence from emerging economies. J. Clean. Prod. 2023, 384, 135369. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. The critical contribution of green finance towards sustainable development: Evaluating the model of technological innovation and sustainability in developing economies. Environ. Sci. Pollut. Res. 2022, 29, 8290–8303. [Google Scholar]

- Wang, Y.; Chen, Y.; Zhang, L.; Zhao, D. The impact of green finance on corporate environmental performance: Evidence from a systematic review and future research agenda. J. Clean. Prod. 2021, 311, 127637. [Google Scholar] [CrossRef]

- Calza, F.; Parmentola, A.; Tutore, I. Green technological innovation and environmental performance: The moderating role of stakeholder engagement. Bus. Strategy Environ. 2021, 30, 4001–4015. [Google Scholar] [CrossRef]

- Zhang, S.; Yu, X.; Zhao, L. Exploring the integration of green finance and innovation within corporate strategies: A case of China’s manufacturing sector. J. Environ. Manag. 2021, 302, 113979. [Google Scholar] [CrossRef]

- Cai, R.; Guo, J. Finance for the Environment: A Scientometrics Analysis of Green Finance. Mathematics 2021, 9, 1537. [Google Scholar] [CrossRef]

- Hesary-Taghizadeh, F.; Yoshino, N. Analyzing the Characteristics of Green Bond Markets to Facilitate Green Finance in the Post-COVID-19 World. Sustainability 2021, 13, 5719. [Google Scholar] [CrossRef]

- Musciano, C.B. Is Your Socially Responsible Investment Fund Green or Greedy? How a Standard ESG Disclosure Framework Can Inform Investors and Prevent Greenwashin. Ga. L. Rev. 2022, 57, 427. [Google Scholar]

- Zhang, L. The Role of Regulatory Oversight in Ensuring the Efficacy of Green Finance Investments. J. Environ. Res. 2022, 35, 145–160. [Google Scholar]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Shih, Y.-C.; Chiu, Y.-H. Green finance and climate change adaptation: Empirical evidence from Asia. J. Clean. Prod. 2021, 326, 129313. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. Sustainable solutions for green finance and the challenges faced by the renewable energy sector. Int. J. Financ. Econ. 2021, 27, 412–430. [Google Scholar] [CrossRef]

- Babic, M. Green finance in the global energy transition: Actors, instruments, and politics. Energy Res. Soc. Sci. 2024, 111, 103482. [Google Scholar] [CrossRef]

- Flammer, C. Corporate green bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Sharma, G.D.; Verma, M.; Shahbaz, M.; Gupta, M.; Chopra, R. Transitioning green finance from theory to practice for renewable energy development. Renew. Energy 2022, 195, 554–565. [Google Scholar] [CrossRef]

- Dikau, S.; Volz, U. Central Bank mandates, sustainability objectives and the promotion of green finance. Ecol. Econ. 2021, 184, 107022. [Google Scholar] [CrossRef]

- Bei, J.; Wang, C. Renewable energy resources and sustainable development goals: Evidence based on green finance, clean energy and environmentally friendly investment. Resour. Policy 2023, 80, 103194. [Google Scholar] [CrossRef]

- Zheng, C.; Deng, F.; Zhuo, C.; Sun, W. Green credit policy, institution supply and enterprise green innovation. Econ. Anal. 2022, 1, 20–34. [Google Scholar] [CrossRef]

- Wu, K.; Bai, E.; Zhu, H.; Lu, Z.; Zhu, H. Can green credit policy promote the high-quality development of China’s heavily-polluting enterprises? Sustainability 2023, 15, 8470. [Google Scholar] [CrossRef]

- Chien, F.S.; Ngo, Q.T.; Hsu, C.C.; Chau, K.Y.; Iram, R. Assessing the mechanism of barriers towards green finance and public spending in small and medium enterprises from developed countries. Environ. Sci. Pollut. Res. Int. 2021, 28, 60495–60510. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, K.; Wei, W.; Ma, W.; Abedin, M.Z. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Fan, H.; Peng, Y.; Wang, H.; Xu, Z. Greening through finance? J. Dev. Econ. 2021, 152, 102683. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- Li, S.; Zhang, W.; Zhao, J. Does green credit policy promote the green innovation efficiency of heavy polluting industries?—Empirical evidence from China’s industries. Environ. Sci. Pollut. Res. Int. 2022, 29, 46721–46736. [Google Scholar] [CrossRef]

- Guo, J. Impact of environmental regulation on green technological innovation: Chinese evidence of the Porter effect. China Fin. Econ. Rev. 2019, 8, 96–115. [Google Scholar]

- Luo, S.; He, G. Research on the influence of emission trading system on enterprises’ green technology innovation. Discret. Dyn. Nat. Soc. 2022, 2022, 1694001. [Google Scholar] [CrossRef]

- Zhu, J.; Fan, C.; Shi, H.; Shi, L. Efforts for a circular economy in China: A comprehensive review of policies. J. Ind. Ecol. 2019, 23, 110–118. [Google Scholar] [CrossRef]

- Chen, Q.; Ning, B.; Pan, Y.; Xiao, J. Green finance and outward foreign direct investment: Evidence from a quasi-natural experiment of green insurance in China. Asia Pac. J. Manag. 2021, 39, 899–924. [Google Scholar] [CrossRef]

- Chen, H.; Yao, M.; Chong, D. Research on institutional innovation of China’s green insurance investment. J. Ind. Integr. Mgmt. 2019, 04, 1950003. [Google Scholar] [CrossRef]

- Hu, Y.; Du, S.; Wang, Y.; Yang, X. How does green insurance affect green innovation? Evidence from China. Sustainability 2023, 15, 12194. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, H. The relationship between corporate environmental performance and environmental disclosure in China. Bus. Strategy Environ. 2019, 28, 471–482. [Google Scholar]

- Wang, Z.; Xu, L.; Du, J. How does green finance impact environmental performance? Evidence from China. J. Clean. Prod. 2020, 258, 120711. [Google Scholar]

- Liu, R.; He, F.; Ren, J. Promoting or inhibiting? The impact of enterprise environmental performance on economic performance: Evidence from China’s large iron and steel enterprises. Sustainability 2021, 13, 6465. [Google Scholar] [CrossRef]

- Tao, H.; Zhuang, S.; Xue, R.; Cao, W.; Tian, J.; Shan, Y. Environmental finance: An interdisciplinary review. Technol. Forecast. Soc. Change 2022, 179, 121639. [Google Scholar] [CrossRef]

- Sharma, G.D.; Verma, M.; Shahbaz, M.; Gupta, M.; Chopra, R. Green technological innovation, green finance, and financial development and their role in green total factor productivity: Empirical insights from China. J. Clean. Prod. 2023, 382, 135131. [Google Scholar]

- Xu, B.; Li, S.; Afzal, A.; Mirza, N.; Zhang, M. The impact of financial development on environmental sustainability: A European perspective. Resour. Policy 2022, 78, 102814. [Google Scholar] [CrossRef]

- Wang, L.; Long, Y.; Li, C. Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manag. 2022, 322, 116127. [Google Scholar] [CrossRef] [PubMed]

- Samour, A.; Baskaya, M.M.; Tursoy, T. The impact of financial development and FDI on renewable energy in the UAE: A path towards sustainable development. Sustainability 2022, 14, 1208. [Google Scholar] [CrossRef]

- Usman, O.; Alola, A.A.; Akadiri, S. Saint Effects of Domestic Material Consumption, Renewable Energy, and Financial Development on Environmental Sustainability in the EU-28: Evidence from a GMM Panel-VAR. Renew. Energy 2022, 184, 239–251. [Google Scholar] [CrossRef]

- Musa, M.S.; Jelilov, G.; Iorember, P.T.; Usman, O. Effects of Tourism, Financial Development, and Renewable Energy on Environmental Performance in EU-28: Does Institutional Quality Matter? Environ. Sci. Pollut. Res. 2021, 28, 53328–53339. [Google Scholar] [CrossRef]

- Shahbaz, M.; Topcu, B.A.; Sarıgül, S.S.; Vo, X.V. The Effect of Financial Development on Renewable Energy Demand: The Case of Developing Countries. Renew. Energy 2021, 178, 1370–1380. [Google Scholar] [CrossRef]

- Zioło, M.; Bąk, I.; Spoz, A. Sustainable Energy Sources and Financial Development Nexus—Perspective of European Union Countries in 2013–2021. Energies 2024, 17, 3332. [Google Scholar] [CrossRef]

- Yan, Q.; Wan, K. Energy-Consuming Right Trading Policy and Corporate ESG Performance: Quasi-Natural Experimental Evidence from China. Energies 2024, 17, 3257. [Google Scholar] [CrossRef]

- Yang, D.; Xie, Y. Corporate Social Responsibility, Green Innovation Capability, and Corporate Environmental Performance. Financ. Account. Mon. 2019, 6, 100–104. [Google Scholar] [CrossRef]

- de Freitas Netto, S.V.; Sobral, M.F.F.; Ribeiro, A.R.B.; da Luz Soares, G.R. Concepts and forms of greenwashing: A systematic review. Environ. Sci. Eur. 2020, 32, 19. [Google Scholar] [CrossRef]

- Santos, C.; Coelho, A.; Marques, A. A systematic literature review on greenwashing and its relationship to stakeholders: State of art and future research agenda. Manag. Rev. Q. 2024, 74, 1397–1421. [Google Scholar] [CrossRef]

- Chen, S.C.-I.; Xu, X.; Lu, S.; Jiang, W. Leveraging Information Technology and Data Analytics for Sustainable Corporate Practices: A Case Study on the Impact of Green Finance Policies. In Proceedings of the 2023 13th International Conference on Information Technology in Medicine and Education (ITME), Wuyishan, China, 24–26 November 2023; pp. 730–733. [Google Scholar] [CrossRef]

- Madaleno, M.; Nogueira, M.C. How Renewable Energy and CO2 Emissions Contribute to Economic Growth, and Sustainability—An Extensive Analysis. Sustainability 2023, 15, 4089. [Google Scholar] [CrossRef]

- Madaleno, M.; Dogan, E.; Taskin, D. A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 2022, 109, 105945. [Google Scholar] [CrossRef]

- Zhang, G.; Chen, S.C.-I.; Yue, X. Blockchain Technology in Carbon Trading Markets: Impacts, Benefits, and Challenges—A Case Study of the Shanghai Environment and Energy Exchange. Energies 2024, 17, 3296. [Google Scholar] [CrossRef]

- Fu, C.; Lu, L.; Pirabi, M. Advancing green finance: A review of climate change and decarbonization. Digit. Econ. Sustain. Dev. 2024, 2, 1. [Google Scholar] [CrossRef]

- Hou, H.; Wang, Y.; Zhang, M. Green finance drives renewable energy development: Empirical evidence from 53 countries worldwide. Environ. Sci. Pollut. Res. 2023, 30, 80573–80590. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).