Wind Power Bidding Based on an Ensemble Differential Evolution Algorithm with a Problem-Specific Constraint-Handling Technique

Abstract

1. Introduction

- (1)

- A risk-aware scenario-based bidding strategy considering battery operation costs is developed. To account for the temporal correlation of wind power generation and electricity prices, a number of scenarios are generated using a copula-based approach. Moreover, the conditional value at risk (CVaR) is applied to control the financial risk of bidding strategy. More importantly, a more practical but nonlinear battery operation cost function is considered to derive an appropriate battery operation regime.

- (2)

- The power bidding strategy is formulated as a constrained nonlinear stochastic programming. To solve the constrained nonlinear optimization problem, an ensemble differential evolution (EDE) algorithm is proposed, in which an ensemble of mutant operators is used to generate mutant vectors for the better exploration of the decision space. In addition, a problem-specific constraint-handling approach is developed to handle the constraint in the bidding problem.

- (3)

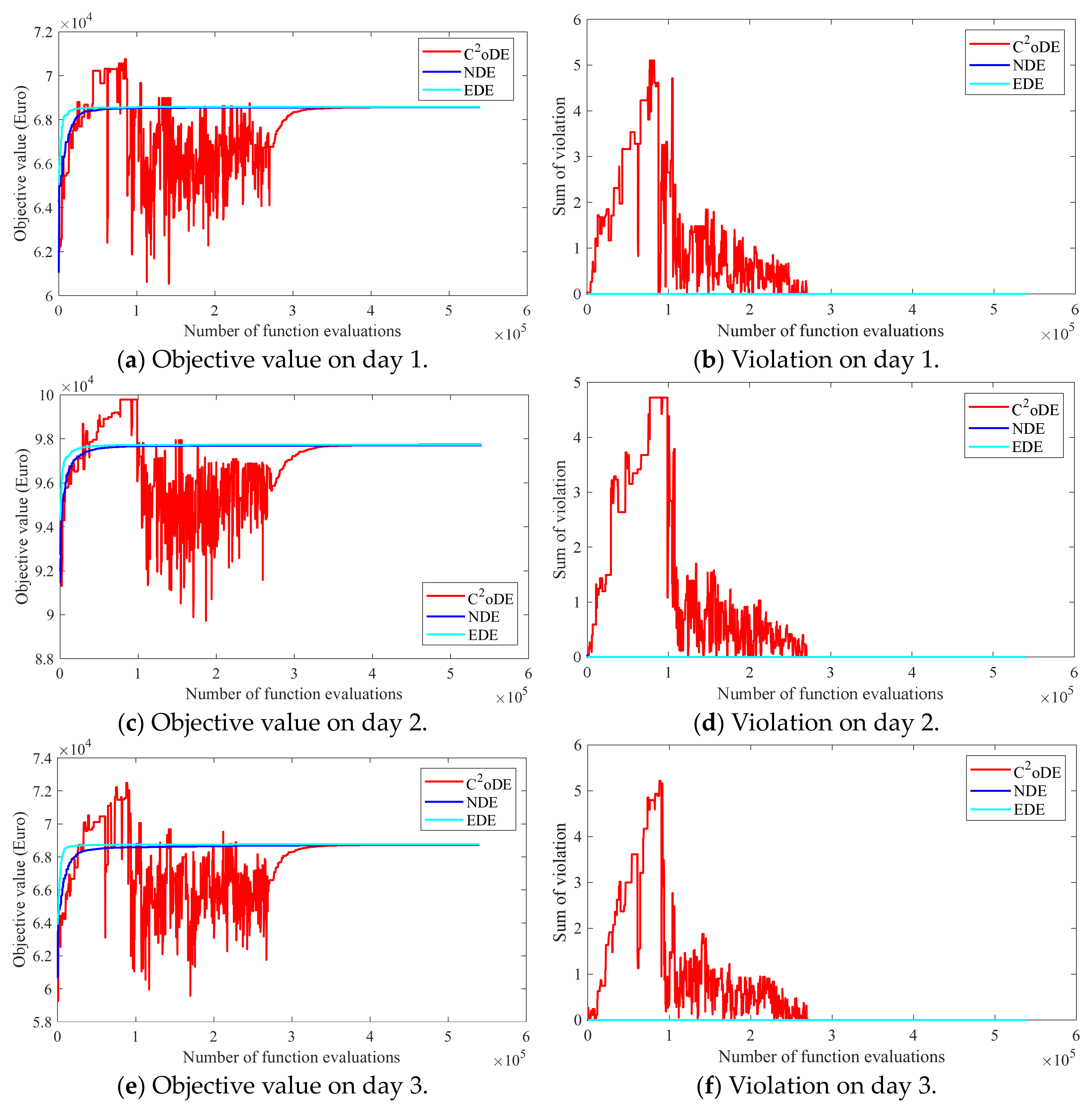

- To validate the effectiveness of the proposed EDE algorithm in finding the optimal bidding strategy, the proposed EDE algorithm is compared with state-of-the-art DE-based algorithms for constrained optimization problems. The experimental results illustrate that the proposed EDE algorithm is much more reliable and much faster in finding a better bidding strategy.

2. Methods and Materials

2.1. Power Bidding in the Electricity Market

2.2. Battery Energy Storage System’s Operational Costs

2.3. Risk-Aware Bidding Optimization Problem

2.4. Optimization Algorithm

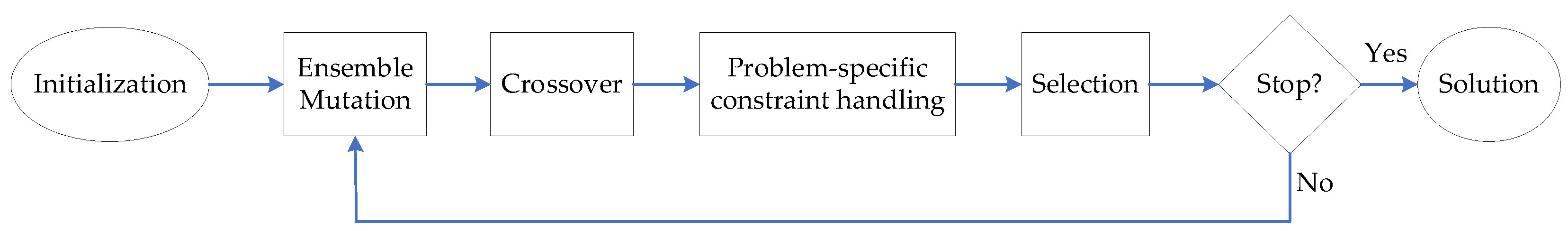

2.4.1. Ensemble Differential Evolution Algorithm

2.4.2. Constraint-Handling Technique

| Algorithm 1: Ensemble differential evolution |

| Input: Np: the population size; [Fl, Fu]: the boundary of mutation factor; ξ1, ξ2: control parameters for mutation factor and crossover rate; max_FES: maximum number of function evaluations; Initialization: Set g = 1; /* the number of generation */ Randomly generate an initial population from the decision space, i.e., ; Randomly initialize the mutation factor from [Fl, Fu]; Randomly initialize the crossover rate from [0, 1]; for i = 1 : Np do if violates the constraints then as per the proposed constraint handling technique; Evaluate the objective function, ; end Select the best individual from the population; Set FES = Np; /*FES denotes the number of function evaluations */ Population Evolution: for i = 1 : Np do if then generate mutant vector following DE/rand/1 strategy; if then generate mutant vector following DE/current-to-best/1 strategy; if then generate mutant vector following DE/current-to-random/1 strategy; if violates the constraints then reset as per the proposed constraint handling technique; Apply the crossover operation to generate trial vector ; Evaluate the objective function, ; Apply the selection operation; end Select the best individual from the population; Update mutation factor; Update crossover rate; Set FES = FES + Np; Set g = g + 1; Stop Criterion: If FES > max_FES then stop the algorithm and output best individual in the population; Else repeat the “Population Evolution” process. |

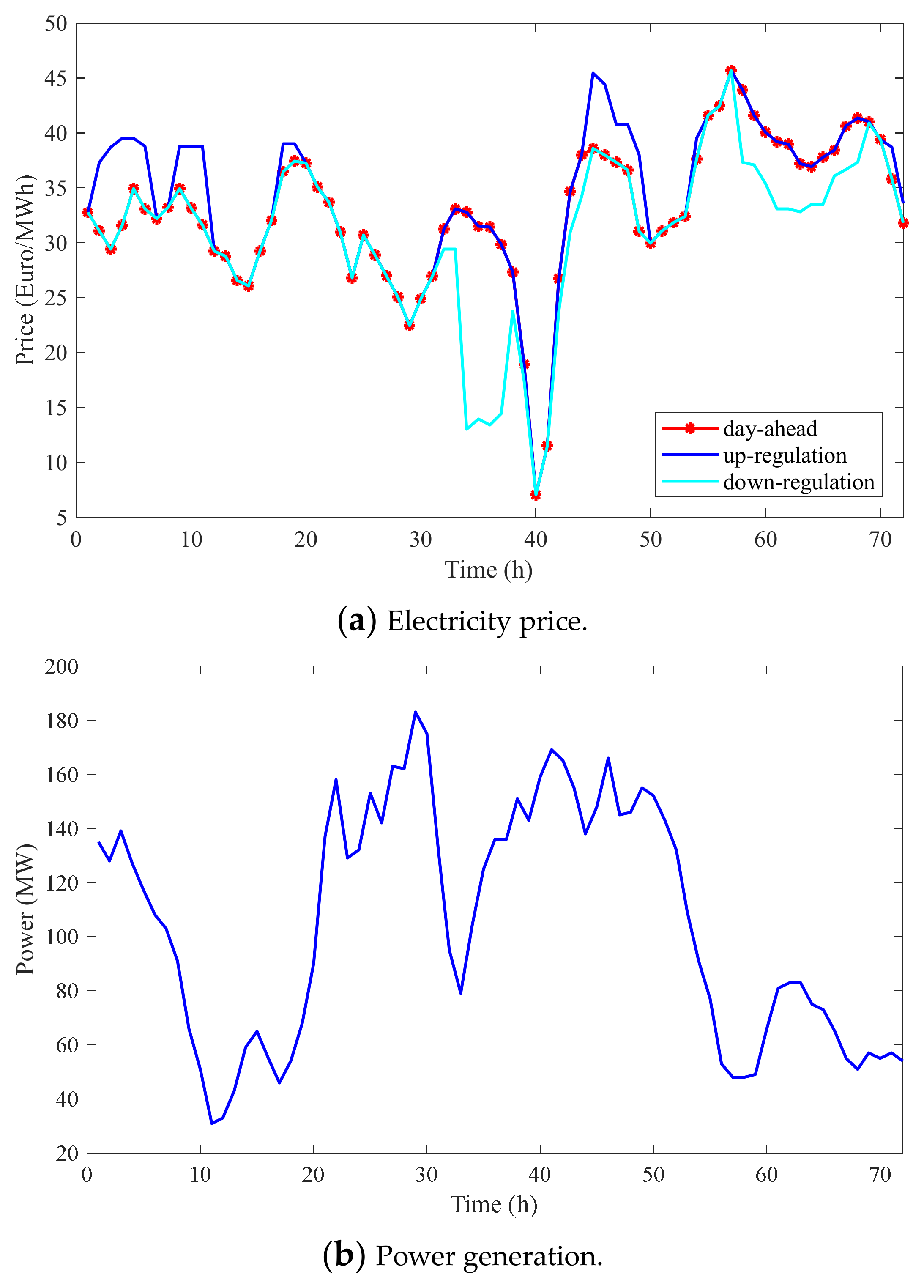

2.5. Experimental Materials

3. Results

4. Conclusions and Discussions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- IEA. Net Zero by 2050: A Roadmap for the Global Energy Sector; International Energy Agency: Paris, France, 2021. [Google Scholar]

- Shafiekhani, M.; Ahmadi, A.; Homaee, O.; Shafie-khah, M.; Catalao, J.P. Optimal bidding strategy of a renewable-based virtual power plant including wind and solar units and dispatchable loads. Energy 2022, 239, 122379. [Google Scholar] [CrossRef]

- Singh, S.; Fozdar, M.; Malik, H.; Khan, I.A.; Al Otaibi, S.; Albogamy, F.R. Impacts of Renewable Sources of Energy on Bid Modeling Strategy in an Emerging Electricity Market Using Oppositional Gravitational Search Algorithm. Energies 2021, 14, 5726. [Google Scholar] [CrossRef]

- Gomes, J.G.; Jiang, J.; Chong, C.T.; Telhada, J.; Zhang, X.; Sammarchi, S.; Wang, S.; Lin, Y.; Li, J. Hybrid solar PV-wind-battery system bidding optimisation: A case study for the Iberian and Italian liberalised electricity markets. Energy 2023, 263, 126043. [Google Scholar] [CrossRef]

- Huang, J.; Koroteev, D.D.; Rynkovskaya, M. Building energy management and forecasting using artificial intelligence: Advance technique. Comput. Electr. Eng. 2022, 99, 107790. [Google Scholar] [CrossRef]

- Zheng, J.; Du, J.; Wang, B.; Klemeš, J.J.; Liao, Q.; Liang, Y. A hybrid framework for forecasting power generation of multiple renewable energy sources. Renew. Sustain. Energy Rev. 2023, 172, 113046. [Google Scholar] [CrossRef]

- Lee, D.; Shin, H.; Baldick, R. Bivariate Probabilistic Wind Power and Real-Time Price Forecasting and Their Applications to Wind Power Bidding Strategy Development. IEEE Trans. Power Syst. 2018, 33, 6087–6097. [Google Scholar] [CrossRef]

- Antoniadou-Plytaria, K.; Steen, D.; Carlson, O.; Mohandes, B.; Ghazvini, M.A.F. Scenario-based Stochastic Optimization for Energy and Flexibility Dispatch of a Microgrid. IEEE Trans. Smart Grid 2022, 13, 3328–3341. [Google Scholar] [CrossRef]

- Darvishi, S.; Sheisi, G.; Aghaei, J. Bidding strategy of hybrid power plant in day-ahead market as price maker through robust optimization. Int. Trans. Electr. Energy Syst. 2020, 30, e12426. [Google Scholar] [CrossRef]

- Aguilar, J.; Bordons, C.; Arce, A. Chance constraints and machine learning integration for uncertainty management in virtual power plants operating in simultaneous energy markets. Int. J. Electr. Power 2021, 133, 107304. [Google Scholar] [CrossRef]

- Maneesha, A.; Swarup, K.S. Stochastic Optimal Bidding Strategy for Energy and Ancillary Services in Microgrid. IEEE Trans. Ind. Appl. 2021, 57, 5698–5705. [Google Scholar] [CrossRef]

- Dong, J.; Dou, X.; Liu, D.; Bao, A.; Wang, D.; Zhang, Y. Energy Trading Strategy of Distributed Energy Resources Aggregator in Day-Ahead Market Considering Risk Preference Behaviors. Energies 2023, 16, 1629. [Google Scholar] [CrossRef]

- Hosseini, S.A.; Toubeau, J.F.; Grève, Z.D.; Wang, Y.; Amjady, N.; Vallée, F. Data-Driven Multi-Resolution Probabilistic Energy and Reserve Bidding of Wind Power. IEEE Trans. Power Syst. 2023, 38, 85–99. [Google Scholar] [CrossRef]

- Singh, S.; Fozdar, M.; Almutairi, A.; Alyami, S.; Malik, H. Strategic Bidding in the Presence of Renewable Sources for Optimizing the Profit of the Power Suppliers. IEEE Access 2021, 9, 70221–70232. [Google Scholar] [CrossRef]

- Toubeau, J.F.; Bottieau, J.; Vallee, F.; De Greve, Z. Deep Learning-Based Multivariate Probabilistic Forecasting for Short-Term Scheduling in Power Markets. IEEE Trans. Power Syst. 2019, 34, 1203–1215. [Google Scholar] [CrossRef]

- Zhang, R.F.; Jiang, T.; Li, F.X.; Li, G.Q.; Chen, H.H.; Li, X. Coordinated Bidding Strategy of Wind Farms and Power-to-Gas Facilities Using a Cooperative Game Approach. IEEE Trans. Sustain. Energy 2020, 11, 2545–2555. [Google Scholar] [CrossRef]

- Cao, D.; Hu, W.H.; Xu, X.; Dragicevic, T.; Huang, Q.; Liu, Z.; Chen, Z.; Blaabjerg, F. Bidding strategy for trading wind energy and purchasing reserve of wind power producer—A DRL based approach. Int. J. Electr. Power 2020, 117, 105648. [Google Scholar] [CrossRef]

- Wei, X.; Xiang, Y.; Li, J.; Zhang, X. Self-Dispatch of Wind-Storage Integrated System: A Deep Reinforcement Learning Approach. IEEE Trans. Sustain. Energy 2022, 13, 1861–1864. [Google Scholar] [CrossRef]

- Ghavidel, S.; Ghadi, M.J.; Azizivahed, A.; Aghaei, J.; Li, L.; Zhang, J. Risk-Constrained Bidding Strategy for a Joint Operation of Wind Power and CAES Aggregators. IEEE Trans. Sustain. Energy 2020, 11, 457–466. [Google Scholar] [CrossRef]

- AlAshery, M.K.; Xiao, D.; Qiao, W. Second-Order Stochastic Dominance Constraints for Risk Management of a Wind Power Producer’s Optimal Bidding Strategy. IEEE Trans. Sustain. Energy 2020, 11, 1404–1413. [Google Scholar] [CrossRef]

- Wang, B.; Zhang, C.; Dong, Z.Y. Interval Optimization Based Coordination of Demand Response and Battery Energy Storage System Considering SOC Management in a Microgrid. IEEE Trans. Sustain. Energy 2020, 11, 2922–2931. [Google Scholar] [CrossRef]

- Xie, Y.; Guo, W.; Wu, Q.; Wang, K. Robust MPC-based bidding strategy for wind storage systems in real-time energy and regulation markets. Int. J. Electr. Power 2021, 124, 106361. [Google Scholar] [CrossRef]

- Nitsch, F.; Deissenroth-Uhrig, M.; Schimeczek, C.; Bertsch, V. Economic evaluation of battery storage systems bidding on day-ahead and automatic frequency restoration reserves markets. Appl. Energy 2021, 298, 117267. [Google Scholar] [CrossRef]

- Huang, C.; Zhang, H.C.; Song, Y.H.; Wang, L.; Ahmad, T.; Luo, X. Demand Response for Industrial Micro-Grid Considering Photovoltaic Power Uncertainty and Battery Operational Cost. IEEE Trans. Smart Grid 2021, 12, 3043–3055. [Google Scholar] [CrossRef]

- Del Ser, J.; Osaba, E.; Molina, D.; Yang, X.-S.; Salcedo-Sanz, S.; Camacho, D.; Das, S.; Suganthan, P.N.; Coello, C.A.C.; Herrera, F. Bio-inspired computation: Where we stand and what’s next. Swarm Evol. Comput. 2019, 48, 220–250. [Google Scholar] [CrossRef]

- Peng, F.; Hu, S.; Gao, Z.; Zhou, W.; Sun, H.; Yu, P. Chaotic particle swarm optimization algorithm with constraint handling and its application in combined bidding model. Comput. Electr. Eng. 2021, 95, 107407. [Google Scholar] [CrossRef]

- Wang, Z.; Zhai, C. Evolutionary approach for optimal bidding strategies in electricity markets. Comput. Electr. Eng. 2022, 100, 107877. [Google Scholar] [CrossRef]

- Janke, L.; McDonagh, S.; Weinrich, S.; Murphy, J.; Nilsson, D.; Hansson, P.-A.; Nordberg, Å. Optimizing power-to-H2 participation in the Nord Pool electricity market: Effects of different bidding strategies on plant operation. Renew. Energy 2020, 156, 820–836. [Google Scholar] [CrossRef]

- Sanayha, M.; Vateekul, P. Model-based deep reinforcement learning for wind energy bidding. Int. J. Electr. Power 2022, 136, 107625. [Google Scholar] [CrossRef]

- Drouilhet, S.; Johnson, B.; Drouilhet, S.; Johnson, B. A battery life prediction method for hybrid power applications. In Proceedings of the 35th Aerospace Sciences Meeting and Exhibit, Reno, NV, USA, 6–9 January 1997; p. 948. [Google Scholar]

- Ju, C.Q.; Wang, P.; Goel, L.; Xu, Y. A Two-Layer Energy Management System for Microgrids With Hybrid Energy Storage Considering Degradation Costs. IEEE Trans. Smart Grid 2018, 9, 6047–6057. [Google Scholar] [CrossRef]

- Moreno, M.A.; Bueno, M.; Usaola, J. Evaluating risk-constrained bidding strategies in adjustment spot markets for wind power producers. Int. J. Electr. Power 2012, 43, 703–711. [Google Scholar] [CrossRef]

- Hong, T.; Pinson, P.; Fan, S.; Zareipour, H.; Troccoli, A.; Hyndman, R.J. Probabilistic energy forecasting: Global Energy Forecasting Competition 2014 and beyond. Int. J. Forecast. 2016, 32, 896–913. [Google Scholar] [CrossRef]

- Zhang, H.; Yan, J.; Liu, Y.; Gao, Y.; Han, S.; Li, L. Multi-Source and Temporal Attention Network for Probabilistic Wind Power Prediction. IEEE Trans. Sustain. Energy 2021, 12, 2205–2218. [Google Scholar] [CrossRef]

- Das, S.; Suganthan, P.N. Differential Evolution: A Survey of the State-of-the-Art. IEEE Trans. Evol. Comput. 2011, 15, 4–31. [Google Scholar] [CrossRef]

- Wang, B.C.; Li, H.X.; Li, J.P.; Wang, Y. Composite Differential Evolution for Constrained Evolutionary Optimization. IEEE Trans. Syst. Man Cybern. 2019, 49, 1482–1495. [Google Scholar] [CrossRef]

- Brest, J.; Greiner, S.; Boskovic, B.; Mernik, M.; Zumer, V. Self-adapting control parameters in differential evolution: A comparative study on numerical benchmark problems. IEEE Trans. Evol. Comput. 2006, 10, 646–657. [Google Scholar] [CrossRef]

- Mallipeddi, R.; Suganthan, P.N. Ensemble of Constraint Handling Techniques. IEEE Trans. Evol. Comput. 2010, 14, 561–579. [Google Scholar] [CrossRef]

- Wang, Y.; Cai, Z.X. Combining Multiobjective Optimization with Differential Evolution to Solve Constrained Optimization Problems. IEEE Trans. Evol. Comput. 2012, 16, 117–134. [Google Scholar] [CrossRef]

- Mohamed, A.W. A novel differential evolution algorithm for solving constrained engineering optimization problems. J. Intell. Manuf. 2018, 29, 659–692. [Google Scholar] [CrossRef]

- Liang, J.; Runarsson, T.P.; Mezura-Montes, E.; Clerc, M.; Suganthan, P.N.; Coello, C.C.; Deb, K. Problem definitions and evaluation criteria for the CEC 2006 special session on constrained real-parameter optimization. J. Appl. Mech. 2006, 41, 8–31. [Google Scholar]

| Bidding Day | Algorithm | FR | Best | Mean | Median | Worst | Std. |

|---|---|---|---|---|---|---|---|

| Day 1 | C2oDE [36] | 1 | 6.8595 × 104 | 6.8577 × 104 | 6.8574 × 104 | 6.8561 × 104 | 1.0116 × 101 |

| NDE [40] | 1 | 6.8594 × 104 | 6.8571 × 104 | 6.8573 × 104 | 6.8551 × 104 | 1.2398 × 101 | |

| EDE | 1 | 6.8606 × 104 | 6.8583 × 104 | 6.8581 × 104 | 6.8572 × 104 | 8.6052 × 100 | |

| Day 2 | C2oDE [36] | 1 | 9.7789 × 104 | 9.7747 × 104 | 9.7751 × 104 | 9.7686 × 104 | 3.1887 × 101 |

| NDE [40] | 1 | 9.7778 × 104 | 9.7699 × 104 | 9.7704 × 104 | 9.7539 × 104 | 5.4927 × 101 | |

| EDE | 1 | 9.7763 × 104 | 9.7730 × 104 | 9.7727 × 104 | 9.7709 × 104 | 1.4013 × 101 | |

| Day 3 | C2oDE [36] | 1 | 6.8804 × 104 | 6.8754 × 104 | 6.8746 × 104 | 6.8717 × 104 | 2.3752 × 101 |

| NDE [40] | 1 | 6.8778 × 104 | 6.8728 × 104 | 6.8728 × 104 | 6.8690 × 104 | 2.2401 × 101 | |

| EDE | 1 | 6.8807 × 104 | 6.8766 × 104 | 6.8763 × 104 | 6.8720 × 104 | 2.5149 × 101 |

| Bidding Day | Algorithm | SR | Best | Mean | Median | Worst | Std. |

|---|---|---|---|---|---|---|---|

| Day 1 | C2oDE [36] | 1 | 334,980 | 366,660 | 359,820 | 414,360 | 17,550 |

| NDE [40] | 1 | 97,020 | 169,236 | 153,540 | 287,640 | 49,104 | |

| EDE | 1 | 32,040 | 45,900 | 45,540 | 63,900 | 7596 | |

| Day 2 | C2oDE [36] | 0.96 | 339,840 | 376,398 | 364,500 | 449,100 | 29,250 |

| NDE [40] | 0.72 | 63,000 | 243,414 | 228,240 | 540,000 | 125,064 | |

| EDE | 1 | 32,400 | 78,840 | 69,300 | 171,900 | 31,482 | |

| Day 3 | C2oDE [36] | 0.72 | 353,700 | 427,086 | 409,860 | 510,840 | 55,476 |

| NDE [40] | 0.28 | 140,940 | 271,008 | 251,100 | 407,700 | 86,454 | |

| EDE | 0.88 | 58,680 | 156,078 | 111,960 | 335,160 | 91,746 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, C.; Zhao, Z.; Li, Q.; Luo, X.; Wang, L. Wind Power Bidding Based on an Ensemble Differential Evolution Algorithm with a Problem-Specific Constraint-Handling Technique. Energies 2024, 17, 380. https://doi.org/10.3390/en17020380

Huang C, Zhao Z, Li Q, Luo X, Wang L. Wind Power Bidding Based on an Ensemble Differential Evolution Algorithm with a Problem-Specific Constraint-Handling Technique. Energies. 2024; 17(2):380. https://doi.org/10.3390/en17020380

Chicago/Turabian StyleHuang, Chao, Zhenyu Zhao, Qingwen Li, Xiong Luo, and Long Wang. 2024. "Wind Power Bidding Based on an Ensemble Differential Evolution Algorithm with a Problem-Specific Constraint-Handling Technique" Energies 17, no. 2: 380. https://doi.org/10.3390/en17020380

APA StyleHuang, C., Zhao, Z., Li, Q., Luo, X., & Wang, L. (2024). Wind Power Bidding Based on an Ensemble Differential Evolution Algorithm with a Problem-Specific Constraint-Handling Technique. Energies, 17(2), 380. https://doi.org/10.3390/en17020380