Abstract

In the backdrop of the ongoing reforms within the electricity market and the escalating integration of renewable energy sources, power service providers encounter substantial trading risks stemming from the inherent uncertainties surrounding market prices and load demands. This paper endeavors to address these challenges by proposing a credibility theory-based information gap decision theory (CTbIGDT) to improve robustness of electricity trading under uncertainties. To begin, we establish credibility theory as a foundational risk assessment methodology for uncertain price and load, incorporating both necessity and randomness measures. Subsequently, we advance the concept by developing the CTbIGDT optimization model, grounded in the consideration of expected costs, with the primary aim of fortifying the robustness of electricity trading practices. The ensuing model is then transformed into an equivalent form and solved using established standard optimization techniques. To validate the efficacy and robustness of our proposed methodology, a case study is conducted utilizing a modified IEEE 33-node distribution network system. The results of this study serve to underscore the viability and potency of the CTbIGDT model in enhancing the effectiveness of electricity trading strategies in an uncertain environment.

1. Introduction

In light of the global imperative to achieve “carbon neutrality,” particularly in China, and acknowledging the pivotal role of electricity as a primary secondary energy source, the low-carbon operation of electricity has become a critical concern [1]. While renewable energy sources offer the promise of clean and abundant power, challenges persist, notably encompassing the issues of substantial market volatility and significant deviations in predictive accuracy [2]. The modern power industry, propelled by deregulation and the evolution of electricity market dynamics, has engendered a competitive landscape for global power entities. This transformation not only augments the integration of renewable energy into consumption patterns but also propels enhancements in system efficiency and the quality of power supply [3]. Within the backdrop of an increasingly permeable renewable energy market, the task of ensuring the secure and economically viable operation of the electricity market, replete with myriad energy transactions, becomes notably intricate [4]. This complexity is starkly manifested in heightened uncertainty in electricity price fluctuations, directly impacting market transactions [5]. Serving as the intermediary between end users and power generation enterprises, electricity service providers (ESP) assume a pivotal role within the electricity market [6]. Presently, the pivotal concern for ESP, when contemplating electricity procurement from the trading market, centers on judiciously apportioning the purchase volume in response to market dynamics. This endeavor seeks to curtail the risks posed by fluctuations in price and load, thereby amplifying operational revenues [7].

Now, many scholars have carried out extensive research on the market operation environment of ESP. In [8], researchers harnessed the conditional value-at-risk methodology to quantitatively assess the price fluctuation risks encountered by ESP, culminating in the formulation of an electricity purchase strategy optimization model. Building upon this foundation, Reference [9] delved into the interplay between monthly power deviation assessments and time-of-use electricity pricing, offering insights into the determination of ESP’s optimal power purchase ratios across distinct market scenarios. Further expanding the horizon, [10] explored the influence of controllable loads and electricity mutual insurance strategies, culminating in the development of an ESP pricing model tailored to mitigate the divergence in electricity assessments. While significant contributions have been made, challenges persist in the electricity market trading process, notably stemming from the uncertainties surrounding end-user load demand and the volatility of spot market prices. Consequently, the development of optimal trading strategies for ESP that considers multiple uncertainties remains an area with ongoing imperfections. This research endeavors to bridge this crucial gap by conducting a thorough analysis and formulating optimal trading strategies within this context of dual uncertainty.

The pervasive presence of uncertainty within energy systems exerts a profound influence on optimal decision-making, contingent upon problem structure and data accuracy. The energy system encompasses diverse input parameters that harbor uncertainties, thereby posing operational challenges to system operators and ESP. Furthermore, this uncertainty introduces novel complexities to the decision-making processes of pertinent ESP, thereby shaping their planning endeavors [11]. A notable contribution, documented in [12], introduces the scenario analysis method to grapple with electricity price uncertainty, culminating in an energy scheduling model tailored to enhance risk aversion for smart grid retailers. Notably, the accuracy of the scenario-based approach is intricately tied to the number of scenarios employed, with increased accuracy stemming from a greater number, albeit at the cost of computational efficiency. Recognizing these nuances, [13] advocates for a robust optimization approach to tackle uncertainty and conduct risk analysis of market prices. Further enriching the discourse, [14] delineates a transaction optimization model for retailers, reliant on scenarios to delineate the stochastic variables inherent in the electricity market. The conditional value at risk (CVaR) emerges as a salient risk assessment index for electricity purchasing and selling, underpinned by the twin tenets of robust optimization and CVaR. However, conventional approaches often overlook the inherent intricacies related to decision makers’ risk preferences. While these methodologies have showcased effectiveness in evaluating uncertainty risk and reducing operational costs for ESP, they are inherently dependent on the availability of precise and abundant data. This reliance presents limitations, particularly in scenarios characterized by restricted information, as observed in China’s electricity market [15]. This study comprehensively investigates these methodologies within the context of China’s electricity market, aiming to clarify both their suitability and potential constraints.

The Information Gap Decision Theory (IGDT), pioneered by Ben Haim, offers a robust framework for quantifying uncertainty within contexts characterized by unknown probability distributions and fluctuation ranges. Particularly relevant in scenarios where data are sparse, IGDT maximizes parameter perturbations to assess decision outcomes surpassing expected targets. This theory’s applicability thrives in contexts of limited information and heightened uncertainty, orchestrating a nuanced integration of decision makers’ risk attitudes to derive strategies that encompass risk avoidance and risk seeking, thereby broadening their decision landscape [16]. Leveraging the tenets of IGDT, Ref. [17] formulates a decision-making model catering to power retailers, facilitating electricity procurement and sales across diverse retail contract modalities, whilst navigating the volatility of market-clearing prices. Furthering the discourse, Ref. [18] devises a bidding strategy model for microgrid operators, cognizant of the fluidity of upstream power grid prices. The far-reaching utility of IGDT extends to encompass multifarious aspects of power systems, encompassing the realms of renewable energy generation, spot market pricing, and load dynamics [19]. The integration of IGDT empowers system operators and decision makers with an enhanced grasp of uncertainties, underpinning effective quantification and enabling the formulation of informed risk management strategies. However, prior IGDT optimization-based work on uncertain electricity price mainly focuses on the random characteristic of price, while the fuzzy characteristic is not considered in addressing the human incomplete knowledge caused by the environment, weather, and operational conditions. Therefore, this paper not only expounds upon the conceptual credibility theory into IGDT to describe the random and fuzzy characteristics of electricity price but also explores its pervasive application across diverse domains within electricity trading under multiple uncertainties, accentuating its role in optimizing decision-making processes amidst an uncertain and evolving landscape.

The electricity market landscape is marked by substantial price fluctuations and a notable degree of uncertainty pertaining to both electricity prices and user loads. This may result in high and unnecessary costs for ESP. Consequently, devising apt bidding and scheduling strategies emerges as a formidable challenge for participants within the electricity market. In response to this intricate milieu, this study endeavors to mitigate the multifaceted impact of uncertainties inherent in power market transactions. To this end, we adopt the IGDT framework to model the uncertainty associated with spot market electricity prices and power loads and develop a credibility theory-based IGDT (CTbIGDT) to improve robustness of electricity trading under uncertainties. Our approach is underscored by an earnest commitment to accommodating the risk preference characteristics intrinsic to decision makers. By navigating the terrain of multi-uncertainty, we formulate an innovative power market trading strategy. This strategy is meticulously crafted to harmonize diverse uncertainties while ensuring that operating costs are controlled within the expected range. The overarching objective is to amplify the robustness of ESP within the realm of power trading. This research contributes a comprehensive and adaptable framework that not only embraces the realities of uncertainty within the electricity market but also empowers ESPs to make informed and strategic decisions in the pursuit of optimized power trading outcomes.

2. The Optimization Model of ESP with Multiple Market Transactions

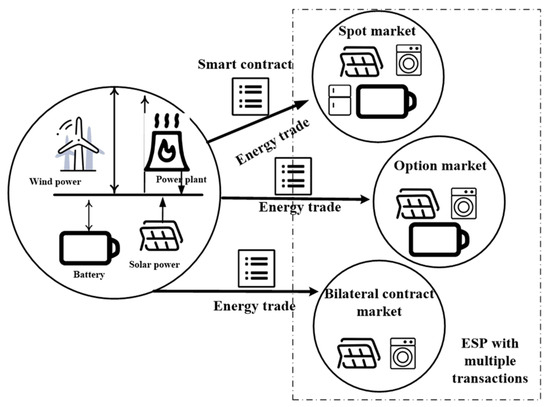

In the pursuit of mitigating the adverse impact of uncertainty, ESP navigates an intricate landscape of electricity market transactions to procure power through a versatile array of approaches. This paper introduces a comprehensive spectrum of electricity market trading methods, encompassing the spot market, option market, and bilateral contract market. To fortify the operational framework, we integrate energy storage units (ESUs) and self-generated power generation equipment, such as gas turbines (GTs), into the system architecture. The ESUs effectively accumulate surplus electrical energy, while synchronized GT output facilitates peak shaving during periods characterized by elevated electricity prices, thereby ameliorating electricity procurement costs. This amalgamation of strategies empowers ESPs with the flexibility to adeptly tailor power purchase approaches to the unique exigencies of distinct scenarios.

Figure 1 graphically illustrates the trading structure of the ESP market, underpinning the multifaceted nature of the adopted strategies. Through this synthesized approach, ESPs stand poised to engender heightened resilience and optimization in power procurement dynamics. The detailed optimization model of ESP with spot market, option market, and bilateral contract market is presented below. It should be mentioned that while our approach indeed utilizes call option contracts as part of a conservative trading strategy, it is important to recognize that this strategy is tailored to address the complexities of spot price uncertainty in the specific environment considered in this study. We acknowledge that in a power system featuring variable renewable energy sources, the assumption of continuously increasing energy prices may not always hold true. However, the use of call options offers a tool for risk management in this dynamic environment, allowing market participants to make informed decisions based on their individual risk tolerance, market expectations, and the need to balance potential costs and benefits. The selection of diverse trading methods offers traders greater flexibility in crafting their trading strategies, enabling them to mitigate the effects of electricity price uncertainties to a certain extent.

Figure 1.

ESP with multiple transaction structure.

2.1. Objective Function

The objective of the model is to minimize the operating cost of an ESP, taking into consideration various cost components. These components include the cost of purchasing electricity from the power market, the operating cost of GTs, and the operating cost of ESUs. The expression for the operating cost function is as follows:

where CESP denotes the system operation cost of ESP; Cm represents the cost of electricity purchase in the electricity market; CGT is the output cost of GT; and CESU is the operating cost of ESUs. The explicit mathematical expressions representing each of these costs are provided as follows:

- (1)

- Transaction cost of ESP under multiple markets

In this paper, T periods are considered. T1 and T2 are the sets of off-peak and peak hours of power demand, respectively, satisfying T = T1 + T2. Market transaction costs are the aggregate of transactions at the spot market, option contracts and bilateral contracts. While it is true that buyers of call option contracts may face a disadvantage if the prices fall instead of rise, resulting in the actual price being significantly below the fixed price previously contracted, it is crucial to note that the implementation of these options is typically a strategic decision aimed at mitigating the potential price risk in situations where prices are anticipated to rise. The use of call options involves a trade-off between the potential costs and benefits, and it is essential for market participants to make informed decisions based on their risk tolerance and market expectations. The rationale behind applying the call option exclusively during the peak hours, despite it representing a constant and fixed trading volume, lies in its optimal ability to mitigate price risk within the spot market during periods of heightened electricity consumption [20,21]. Therefore, it is assumed that call option contracts are utilized exclusively during the peak period of electricity consumption, and the trading volume does not change over time. The specific representation of the cost of each transaction mode is given by the following formula:

where denotes a collection of periods; designates a set of optional bilateral contracts; CS represents the spot market cost of electricity; CK indicates the transaction cost of a bilateral contract; COC corresponds to the option transaction cost; characterizes the spot market price at time t; denotes the spot market trading volume at time t; corresponds to the electricity price attributed to the kth bilateral contract; represents the trading volume of the kth bilateral contract at time t; and and are the exercise price and option price of the call option, respectively. If , ESP executes the option contract to purchase electricity at a fixed price; if , ESP does not execute option contracts, and the acquisition of electricity is undertaken through transactions at the spot market price.

- (2)

- Gas turbine output cost

- (3)

- Operating cost of ESUs

2.2. Constraint Condition

The parameters governing the secure operation of the ESP encompass an amalgamation of constraints emanating from multiple facets, including the electricity market trading, power flow dynamics within the electrical network, and the inherent limitations of the energy storage system. The formulations detailing these constraints are articulated as follows.

- (1)

- Electricity market transaction constraints

- (2)

- Power flow constraints of the electrical network

Preserving the operational integrity and stability of the power network constitutes an imperative objective. To this end, the scheduling of power market transactions necessitates strict adherence to the power flow security constraints inherent within the distribution network. In practical terms, this mandates a comprehensive consideration and fulfillment of the power flow limitations characteristic of the distribution network during the course of power trading and scheduling endeavors. The fundamental rationale behind this approach is to ensure that the transmission of electrical energy within the distribution network remains well within the capacity limits of the network’s transmission lines.

By accommodating these constraints, the aim is to avert the occurrence of any detrimental power flow phenomena, such as overloading, voltage deviations, or any other adverse ramifications stemming from power flow imbalances. Such meticulous adherence contributes decisively to upholding the operational safety and stability of the overarching power system.

where denotes the set of power lines; I denotes injection, and o represents release; and are, respectively, the active and reactive power of n nodes injected into the power grid at time t; represents the reactive power output of GT to n nodes at time t; and are the active and reactive power of the node n injected by the power line l at time t, respectively; and are the active and reactive power flowing from node n to line l at time t, respectively; the active and reactive loads of node n at time t are designated as and , respectively; Rl and Xl are the resistance and reactance of power line l, respectively. The reference voltage of the slack bus is signified by U0. Additionally, and correspond to the initial and terminal voltages associated with power line l, respectively.

- (3)

- Energy storage constraints

In summation, when both spot price and load demand are predicted values, the ESP trading model under the deterministic environment is

In this deterministic model, the objective function is to minimize the total cost of ESP, and Equations (5)–(7) represent power market transaction constraints, power network flow constraints, and energy storage constraints, respectively.

3. CTbIGDT Model for ESP under Uncertain Environment

Subjected to the various influences of a myriad of factors, the operational landscape of power market transactions is inherently rife with a plethora of uncertainties. A prominent illustration of this uncertainty stems from the involvement of intermittent renewable energy sources with variable predictability, culminating in pronounced undulations in electricity prices within the market. Furthermore, the unpredictability inherent in user-side load variations exerts a substantial sway over the deliberations guiding the ESP’s engagement in electricity market transactions [22].

It is noteworthy that the ESP trading model, as expounded in the preceding section, regrettably overlooks the risks engendered by this intricate nexus of uncertainties [23]. Consequently, a pivotal imperative arises to construct an ESP transactional decision model within the purview of this section, one that adeptly accommodates the ramifications of electricity market transactional risk and the intricate fabric of multiple uncertainties. This endeavor is underpinned by the theoretical framework of credibility theory and IGDT, ushering forth a comprehensive and robust model calibrated to navigate the intricate terrains of uncertainty-laden contexts.

3.1. Credibility Theory

The theory of credibility measures based on measure theory address a limitation in possibility measures by introducing self-duality [24]. This advancement furnishes a novel tool for investigating fuzzy decision problems, circumventing the potential pitfalls in decision-making arising from conventional membership degree calculations.

Credibility measures can be represented using the least upper bound of variables in a fuzzy event set. For any given set , the credibility measure of a fuzzy variable is defined as follows [25]:

In this context, and respectively denote the possibility measure and necessity measure of set . The complement of set is represented by and represents the membership function of the fuzzy variable , and denotes the upper bound. Notably, the coefficient 1/2 in the equation ensures the establishment of self-duality. Furthermore, for any non-empty set Θ, Equation (9) follows four axioms. The four axioms and a brief introduction are given by Appendix A Axiom A1. The detailed proof process can be found in Reference [25].

3.2. Credibility Theory-Based Information Gap Decision Theory

In light of the intricate web of uncertainties encompassing electricity prices and user loads, the ESP can adeptly embrace a risk-averse strategy in orchestrating its electricity market trading blueprint. In this paper, we establish credibility theory as a foundational risk assessment methodology for uncertain price and load, incorporating both necessity and randomness measures. Subsequently, we advance the concept by developing the CTbIGDT optimization model, grounded in the consideration of expected costs, with the primary aim of fortifying the robustness of electricity trading practices. Through the manipulation of diverse anticipated cost targets, CTbIGDT emerges as a potent instrument, capably quantifying distinct risk inclinations. This methodology effectively engenders power market trading strategies that are uniquely aligned with the diverse risk preferences exhibited by ESPs.

Distinguished from alternative methods of uncertainty modeling, CTbIGDT demonstrates a distinctive attribute: it circumvents the need for an extensive corpus of data to enact uncertainty modeling. Rather than demanding an exorbitant volume of data, CTbIGDT harnesses existing information on uncertainty parameters to optimize within the permissible bounds of uncertainty, all while adhering to predefined objectives. By doing so, CTbIGDT furnishes operators with insights into both potential favorable and adverse outcomes that may transpire due to uncertainty. These insights enable operators to make judicious and reasoned choices, grounded in safety or calculated risk. Unlike stochastic programming and chance-constrained methodologies, CTbIGDT-driven approaches sidestep the necessity of comprehending the probability distribution function of uncertain parameters. Notably, CTbIGDT distinguishes itself from the realm of fuzzy uncertainty modeling by obviating the requirement to ascertain or assign membership functions to uncertain parameters.

At the crux of CTbIGDT lies the exploration of plausible ramifications attributable to uncertain parameters while upholding preset objectives. In this context, “information” pertains to the gamut of uncertain factors that impact the objective function, while the term “gap” serves to demarcate the differential expanse between what is known and what remains undisclosed. Notably, this approach eschews the need for an exhaustive comprehension of intricate probability distributions tied to uncertain parameters, operating rather within the confines of upper and lower bounds. In essence, the application of CTbIGDT furnishes ESPs with a robust and adaptable methodology that navigates the intricate landscape of uncertainty, underpinning the decision-making process and facilitating optimal outcomes while respecting predetermined parameters.

CTbIGDT stands as a judicious decision-making approach tailored to address intricate uncertainties. Within this framework, two discernible strategies come to the fore: the Risk Averse Strategy (RAS) and the Risk Seeker Strategy (RSS). RAS embarks on the construction of a robust function by accentuating the amplification of uncertainty’s influence on the resultant solutions. On the contrary, RSS endeavors to extract the utmost potential gains from uncertain risks, thereby constructing an opportunity function of maximal returns. Considering the focal objective of this paper—to mitigate the sway of uncertainty emanating from electricity prices and load demand on ESP operational outcomes—RAS is judiciously adopted to architect a CTbIGDT-based robust optimization model [26]. The overarching design of the CTbIGDT robust model assumes the form as elucidated below:

where symbolizes the parameter of uncertainty, referred to as the “uncertainty radius.” This parameter serves as an indicator of the oscillation scope inherent inthe uncertain variable under consideration. F denotes the objective function, while s represents the decision variable. The variable w embodies the actual value attributed to the uncertain parameter, whereas signifies the anticipated value of said uncertain parameter. The term encapsulates the optimal solution yielded by the deterministic model, designated as F0. Furthermore, FC assumes the role of the maximum anticipated value deemed acceptable by the decision-making entity. is the deviation factor, indicating the degree of deviation between the expected robust optimization target value and the deterministic model. indicates equality constraints, including power balance constraints shown by (5), energy storage constraints at adjacent moments given by (6), and energy balance constraints in market transactions illustrated by (7). Conversely, represents inequality constraints, consisting of the upper and lower limits of energy transaction, energy storage charging and discharging, node voltage, and GT outputs. Importantly, represents the amplitude of fluctuations attributed to the uncertain variables, contributing a pivotal layer to the formulation’s nuanced framework.

3.3. CTbIGDT Model for ESP under Price and Load Uncertainty

In order to assess the likelihood of uncertain events, Zadeh introduced the concept of possibility measures in [27] and necessity measures in [28]. While both measures have been demonstrated to satisfy the properties of normality, non-negativity, and monotonicity, they are not dual, meaning that the sum of possibilities or necessities for an uncertain event and its complement does not equal one, as discussed in [29]. To address this limitation, the authors in [29] introduced the use of credibility measures to capture the uncertainty arising from the linguistic vagueness of possible values associated with uncertain variables. To this end, we extend this theory by developing a credibility theory-based IGDT framework to enhance the robustness of electricity trading under conditions of uncertainty, particularly with respect to uncertain spot prices and load demands. Drawing upon the preceding discourse, this study designates the electricity price and load demand within the electricity market as pivotal uncertain variables. The scope of oscillation inherent to these variables can be succinctly articulated as follows:

where and are, respectively, the predicted values of spot market electricity price and load. and denote the credibility measures associated with electricity price and load calculated by Equation (9) to study the risk brought by uncertain price and load, respectively.

As a result, the CTbIGDT model for optimizing ESP decisions within an uncertain context is derived as presented below:

where C0 denotes the objective function value derived from Equation (8) within a deterministic environment and symbolizes the factor of robust deviation.

Considering the intricate nature of the model described above, which operates within the framework of a bi-level multi-objective optimization, solving it directly presents a formidable challenge. To address this complexity, we initiate the optimization process by transforming the objective function into using robust optimization principles. Additionally, it is important to highlight that in typical scenarios, the simultaneous presence of peak spot prices and increased electrical load demand in the electricity market results in the highest aggregate operating costs for ESP. Therefore, the term within the robust model can be equivalently expressed as .

In summation, the robust optimization framework governing ESP trading within an uncertain context can be succinctly expressed as follows:

4. Case Study

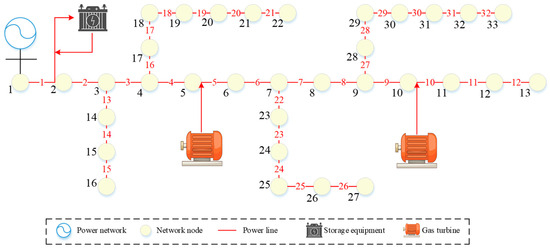

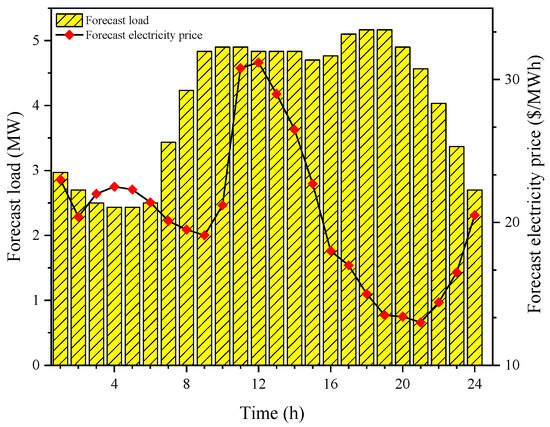

This paper undertakes a comprehensive numerical investigation within the context of a modified IEEE 33-node distribution network system. The distinct topology of the network is visually depicted in Figure 2. Notably, two GTs are interconnected with nodes 5 and 10, respectively, serving as sources of power for end users. The ESU is integrated into the system at node 2. This paper assumes the presence of ten bilateral contracts available for selection. Contracts 1–5 are applicable during off-peak periods, while contracts 6–10 are suitable for selection during peak periods. The strike price and option price of call options are 52.1$/MWh and 3.2$/MWh, respectively. Moreover, for a comprehensive view of the detailed data, please refer to the specifics outlined in Reference [30]. Comprehensive information regarding bilateral contracts and specifications for GT units can be found in Appendix A Table A1 and Table A2, respectively. Furthermore, Figure 3 delineates the anticipated spot price trends and electric load projections. In this paper, a mathematical model is formulated using the MATLAB platform, and we utilize the SCIP solver within the YALMIP toolbox to solve the optimization problem.

Figure 2.

Topology of modified IEEE 33-node distribution network.

Figure 3.

Forecast spot electricity price and electricity load.

4.1. Analysis of ESP Electriticy Trading Strategy under Different Markets

Initially, we assume that the deterministic environment mirrors the actual electricity price, and the predicted load serves as the baseline. The uncertain environment is represented when the robust deviation factor β is 0.1. The costs under both the deterministic and uncertain environments have been organized systematically in Table 1 for reference within the narrative. From the table, we can see that compared with the deterministic environment cost, the main increasing cost in an uncertain environment happens in electricity trading, which increases by 10%. Under the proposed optimization framework, ESP enhances the robustness of system operations by accepting certain costs considering the uncertain electricity price.

Table 1.

Cost comparison under different environments.

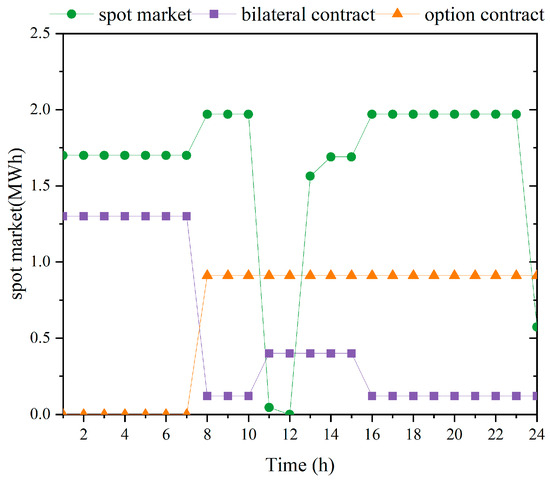

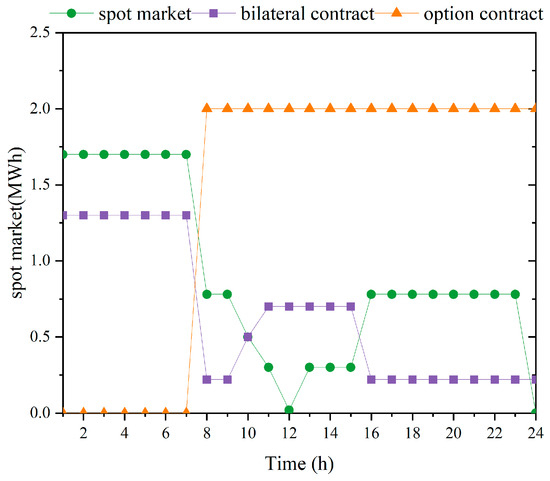

In the deterministic environment, the corresponding trading strategies for electricity purchases in different electricity markets are intuitively represented in Figure 4. As gleaned from Figure 4, a discernible pattern emerges wherein the electricity market activities of ESP display distinct preferences across different time periods. During off-peak intervals, the prevailing modus operandi of ESP’s electricity market interactions predominantly centers on spot market involvement coupled with bilateral contract engagements. In contrast, as peak hours ensue, the primary focus shifts to a blend of spot market participation and option contract negotiations. Notably, during specific time slots, namely at 11:00 and 12:00, the conspicuous escalation in spot prices instigates a strategic response from ESP. Driven by the objective of curbing electricity procurement expenses, ESP adeptly adjusts its transactional approach by tempering the volume of spot market transactions while concurrently augmenting the volume of transactions executed through the more economically advantageous bilateral contracts.

Figure 4.

Trading strategy of ESP with different markets in deterministic environment.

In the broader spectrum, the comprehensive breakdown of transactions reveals that electricity procurement from the spot market totals 39.13 MWh. Simultaneously, the volume of bilateral contract transactions amounts to 12.54 MWh, whereas option contracts contribute substantially, amounting to 15.47 MWh. This strategic utilization profile, discernible from the insights gleaned from Figure 4, underscores the dynamic and astute decision-making employed by ESP in navigating the intricate landscape of electricity market dynamics. The nuanced blend of spot market, bilateral contracts, and option contracts attests to ESP’s strategic acumen in optimizing cost efficiencies aligned with real-time market fluctuations.

The strategic blueprint governing ESP’s electricity market transactions within an uncertain milieu is illustrated in Figure 5. For further insight into the specifics of distinct bilateral contract procurements within both certain and uncertain environments, readers are directed to Appendix A Table A3.

Figure 5.

Trading strategy of ESP with different markets under uncertainty environment.

According to Figure 5, distinct patterns emerge in ESP’s electricity market transactions across varying time periods. During off-peak intervals, the predominant mode of transaction centers around both the spot market and the bilateral contract arena. In contrast, as peak hours ensue, a shift occurs wherein electricity market dealings pivot towards a combination of option contracts and bilateral contracts. A conspicuous observation emerges when comparing ESP’s electricity market purchasing strategy in a certain environment with that within an uncertain environment. Evidently, ESP displays an inclination to elevate the trading volume of option contracts and bilateral contracts in the face of uncertainty. This strategic shift can be attributed to ESP’s deliberate efforts in mitigating the ramifications of multiple uncertainties. By opting for comparatively more stable bilateral contracts and option contracts, ESP effectively mitigates exposure to uncertain spot market dynamics, thus leading to a reduction in transaction volume within this realm.

In broader terms, the delineation of transactions reveals a procurement of 21.42 MWh from the spot market, while the bilateral contract transactions contribute a volume of 15.52 MWh. Significantly, the option contract transactions emerge as a prominent component, amounting to 34 MWh. This strategic recalibration of transactional volumes, evident from Figure 5, underscores ESP’s proactive approach in confronting uncertainty, strategically leveraging bilateral contracts and option contracts to curtail exposure to volatile spot market conditions.

4.2. ESP Trading Strategy Analysis under Uncertainties

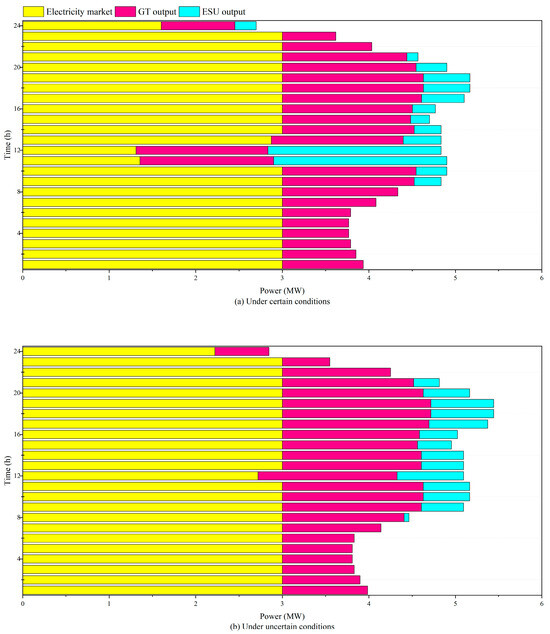

The trading strategies adopted by ESP within deterministic and uncertain environments are visually depicted in Figure 6.

Figure 6.

ESP trading strategies under deterministic and uncertain environments.

The insights gleaned from Figure 6a reveal ESP’s strategic maneuvers within the off-peak period, whereby a strategic decision is made to accumulate surplus electricity within the ESU. A distinct contrast emerges during peak hours, particularly within the 11:00–12:00 timeframe, where the pronounced escalation in spot prices compels ESP to significantly curtail its spot market electricity procurement. Driven by the imperative of cost minimization, ESP strategically opts to truncate electricity purchases from the market while concurrently amplifying GT output and tapping into the stored energy reserves within the ESU, especially during off-peak intervals.

Turning attention to Figure 6b, a conspicuous departure is discernible in comparison to Figure 6a. Here, ESP’s modus operandi maintains a more pronounced emphasis on electricity market transactions during peak periods. When contextualized with Figure 5, this strategic shift can be attributed to ESP’s heightened engagement in bilateral contracts and option contracts. The rationale underpinning this shift is grounded in the fixed pricing nature of bilateral contracts and option contracts, serving as a strategic hedge against the volatility inherent in spot prices. In navigating the uncertainty-laden environment, ESP adeptly leverages these contracts to secure load demand while meticulously managing operational risks arising from multifaceted uncertainties. This nuanced adaptation, elucidated through Figure 6a,b, underscores ESP’s dynamic responsiveness to the prevailing market dynamics and its strategic acumen in mitigating risks within an intricate and uncertain energy landscape.

4.3. The Influence of Robust Deviation Factor and Uncertainty on ESP Trading Strategy

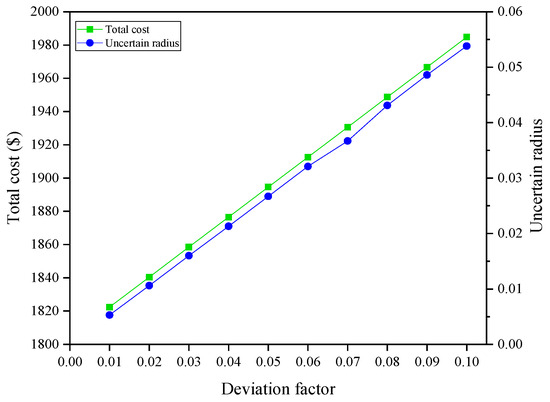

Under different robust deviation factors, the operating cost of ESP and the corresponding change of uncertainty radius are shown in Figure 7.

Figure 7.

The operating cost and uncertainty radius of ESP under different robust deviation factors.

Figure 7 unveils a discernible trend wherein the escalation of the deviation factor corresponds to an augmentation in the uncertainty radius, consequently driving an increase in ESP’s operational cost. This shift can be attributed to decision makers harboring a pessimistic outlook, apprehending the adverse repercussions of uncertainty in spot electricity prices and load dynamics on cost optimization. Remarkably, the application of CTbIGDT ensures that the system’s scheduling cost remains below the anticipated value even in the face of fluctuating uncertainties. This, in turn, guarantees the secure and stable operation of the system. Hence, in real-world operation, ESP must adeptly strike a balance between safety and economy, devising a power market transaction scheduling strategy tailored to the prevailing circumstances to optimally fulfill operational requisites.

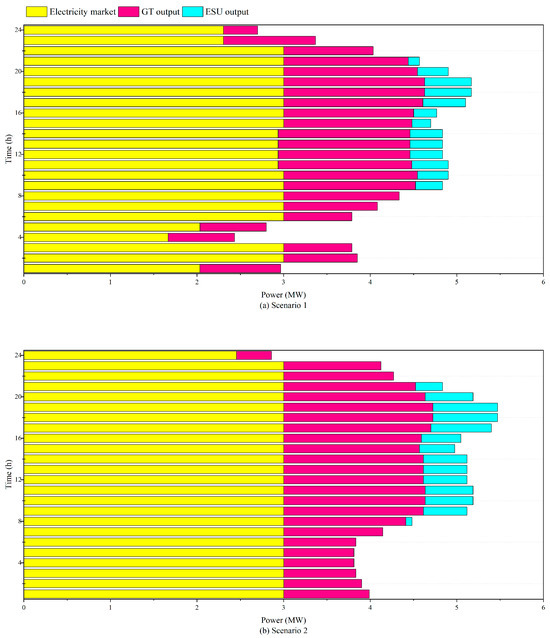

To validate the efficacy of the ESP optimization model grounded in IGDT in bolstering the robustness of ESP’s power market transactions, this study embarks upon the following scenarios. Scenario 1: Only addressing the uncertainty of spot price. Scenario 2: Only considering the uncertainty of electrical load. Scenario 3: Simultaneously accounting for the uncertainty of spot electricity price and electrical load.

Across these diverse scenarios, Table 2 meticulously delineates the altering cost and uncertainty radius for distinct facets of ESP, contingent on the robust deviation factor. The strategic scheduling strategies for scenarios 1 and 2, where the robust deviation factor is set at 0.1, are visually portrayed in Figure 8a,b, respectively. The scheduling strategy of Scenario 3 is portrayed in Figure 6b above, and to avoid repetition, further analysis pertaining to this scenario has been omitted.

Table 2.

The influence of robust deviation factor on cost in different scenarios.

Figure 8.

Comparison of electricity transactions of ESP under Scenarios 1 and 2.

A comprehensive analysis of Table 1 underscores a recurring pattern: within the same scenario, an escalation in the robust deviation factor invariably precipitates an expansion of the uncertainty radius. This compelling observation serves as a testament to the capacity of CTbIGDT to not only mitigate risks but also enhance its resistance to uncertainties. In essence, this amplifies the system’s robustness, exemplifying the potency of CTbIGDT in bolstering resilience. Turning attention to Figure 8, a nuanced panorama comes into focus, revealing distinct deviation radius magnitudes engendered by diverse uncertain factors under identical deviation factors. Additionally, these variances in uncertain factors concurrently yield disparate power trading strategies.

Scenario 1 exclusively contemplates the uncertainty associated with electricity prices. Under this circumstance, ESP strategically opts to pare down electricity market transactions, thereby curtailing costs prior to satisfying load demand. In contrast, Scenario 2 solely addresses the uncertainty linked to load demand. Here, ESP opts to amplify electricity market transactions, ensuring alignment with load demand imperatives. Furthermore, during off-peak intervals, ESP judiciously stockpiles energy within the ESU to act as a safeguard against the potential impact of uncertain load demand during peak periods. In summation, ESP must meticulously harmonize its risk aversion proclivity with the enhancement of transactional robustness, all while steadfastly upholding economic considerations. This orchestration ensures a judicious equilibrium, custom-tailored to ESP’s unique operational context.

In a context where generation availability is uncertain and price fluctuations can be volatile, it is essential to emphasize that adopting a conservative approach does not always guarantee lower costs, as is often the case in financial trading. Our optimization suggestion extends beyond the realms of academic exercise. It is specifically designed to navigate the intricate landscape of uncertainty, delivering tangible benefits not only to the system’s stability but also to the economic considerations of market participants. By embracing a balanced approach that carefully considers risk and return, our methodology serves as a practical tool to assist both system operators and market participants in making well-informed decisions that can yield both cost-efficiency and system reliability.

5. Conclusions

Aligned with the multifaceted uncertainties arising from spot electricity prices and user load demand, which pose significant challenges to power service providers during operational activities in power trading, this study introduces an ESP power trading optimization framework rooted in CTbIGDT. Through empirical illustration, the findings accentuate a discernible trend: a rise in the robust deviation factor corresponds to an elevation in the anticipated cost, paralleled by an expanded uncertainty radius. Consequently, with a heightened focus on mitigating the negative impact of multiple uncertain risks, ESP enhances the robustness of system operations by accepting certain costs. Notably, when confronted with these uncertain risks, ESP opts to amplify the trading volume associated with bilateral contracts and option contracts within its market trading strategy while concurrently reducing involvement in the spot market. This strategic adjustment effectively enhances the resilience of system optimization operations.

The ESP optimization model, forged on the foundations of CTbIGDT, scrupulously embraces the risk inclination of decision makers. This comprehensive approach culminates in the derivation of transactional and systemic scheduling strategies adeptly calibrated to attain predefined cost targets. This pivotal step invariably enhances ESP’s robustness within the realm of power trading. By amalgamating these nuanced elements, the model effectively equips power service providers with innovative tools and conceptual paradigms, thereby furnishing valuable insights to guide risk-informed decision-making within the intricate domain of power trading participation. This pioneering approach provides a new approach and pragmatic solution for power service providers facing complex risk-related dilemmas, reducing the high cost risks that uncertainty factors may bring while navigating the multi-faceted environment of power transactions.

Author Contributions

X.Z.: investigation, writing—original draft. P.W.: writing—original draft, supervision. Q.L.: writing—original draft, conceptualization. Y.L.: writing—original draft, validation. Z.L.: writing—original draft, investigation; L.F.: writing—original draft, investigation, supervision. J.C.: writing—original draft, validation. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by a grant from the Science and Technology Program of State Grid Shandong Electric Power Company (520625230011).

Informed Consent Statement

Not applicable.

Data Availability Statement

Images used can be shared by contacting the corresponding author.

Conflicts of Interest

The authors declare that they have no known competing financial interest or personal relationships that could have appeared to influence the work reported in this paper.

Appendix A

Axiom A1:

Axiom 1 says that the trustworthiness measure of the entire nonempty set is equal to 1; Axiom 2 states that if , then their trustworthiness measure satisfies . Axiom 3 indicates that the trustworthiness measure of set A and the trustworthiness measure of its complement add to 1. Axiom 4 says that if , then is satisfied.

Table A1.

GT unit parameters.

Table A1.

GT unit parameters.

| GT | (MW) | (MVar) | ($/MW2) | ($/MW) | |

|---|---|---|---|---|---|

| GT1 | [0, 1.5] | [0, 0.5] | 0.12 | 20.0 | 0 |

| GT2 | [0, 2.0] | [0, 1.0] | 0.09 | 15.0 | 0 |

Table A2.

Bilateral contract parameters.

Table A2.

Bilateral contract parameters.

| Contract Number | Time (h) | Minimum Value (MW) | Maximum Value (MW) | Contract Price ($/MWh) |

|---|---|---|---|---|

| 1 | peak absence | 0.06 | 0.15 | 17 |

| 2 | peak absence | 0.08 | 0.2 | 16.5 |

| 3 | peak absence | 0.1 | 0.25 | 15 |

| 4 | peak absence | 0.1 | 0.3 | 14 |

| 5 | peak absence | 0.12 | 0.4 | 13 |

| 6 | peak period | 0.06 | 0.15 | 25 |

| 7 | peak period | 0.08 | 0.2 | 24.5 |

| 8 | peak period | 0.1 | 0.25 | 23.5 |

| 9 | peak period | 0.1 | 0.3 | 23 |

| 10 | peak period | 0.12 | 0.4 | 22 |

Table A3.

Comparison of bilateral contract transaction volume in different environments.

Table A3.

Comparison of bilateral contract transaction volume in different environments.

| Contract Number | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Deterministic environment | 0 | 0 | 1.15 MW | 1.50 MW | 2.80 MW | 0 | 0 | 0 | 0 | 4.56 MW |

| Uncertain environment | 0.78MW | 1.04 MW | 1.75 MW | 2.10 MW | 2.80 MW | 0 | 0 | 0 | 0 | 5.96 MW |

References

- Wang, L.; Li, K. Research on renewable energy consumption and emission reduction in power market based on bi-level decision making in China. Energy 2022, 260, 125119. [Google Scholar] [CrossRef]

- Li, G.; Li, G.; Zhou, M. Market transaction model design applicable for both plan and market environment of China’s renewable energy. Front. Energy Res. 2022, 10, 862653. [Google Scholar] [CrossRef]

- Sreenivasulu, G.; Sahoo, N.C.; Balakrishna, P. A coordinated stochastic dispatch model for hybrid energy markets with renewable energy uncertainties using moth flame optimization. Energy Syst. 2022, 12667, 1–41. [Google Scholar] [CrossRef]

- Goodarzi, S.; Perera, H.N.; Bunn, D. The impact of renewable energy forecast errors on imbalance volumes and electricity spot prices. Energy Policy 2019, 134, 110827. [Google Scholar] [CrossRef]

- Rai, A.; Nunn, O. On the impact of increasing penetration of variable renewables on electricity spot price extremes in Australia. Econ. Anal. Policy 2020, 67, 67–86. [Google Scholar] [CrossRef]

- Yang, H.; Yang, S.; Xu, Y.; Cao, E.; Lai, M.; Dong, Z. Electric vehicle route optimization considering time-of-use electricity price by learnable partheno-genetic algorithm. IEEE Trans. Smart Grid 2015, 6, 657–666. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, X.; Li, H.; Peng, D.; Ren, B. Ability model of the influence of demand response on electricity demand. Proc. CSU-EPSA 2017, 29, 115–121. [Google Scholar]

- Yan, G.J.; Chen, J.J.; Liu, J.Y.; Chen, W.; Xu, B. Random clustering and dynamic recognition-based operation strategy for energy storage system in industrial park. J. Energy Storage 2023, 73, 109192. [Google Scholar] [CrossRef]

- Feng, L.; Zhang, I.; Li, G.; Zhang, B. Cost reduction of a hybrid energy storage system considering correlation between wind and PV power. Prot. Control Mod. Power Syst. 2016, 1, 11. [Google Scholar] [CrossRef]

- Furkan, A.; Mohammand, S.A.; Mohammand, A. Developments in xEVs charging infastructure and energy management system for smart microgrids including xEVs. Sustain. Cities Soc. 2017, 35, 552–564. [Google Scholar]

- Majidi, M.; Mohammadi-Ivatloo, B.; Soroudi, A. Application of information gap decision theory in practical energy problems: A comprehensive review. Appl. Energy 2019, 249, 157–165. [Google Scholar] [CrossRef]

- Wang, X.; Gong, Y. Air conditioner fast dispatching model based on load aggregator and direct load control. J. Eng. 2017, 13, 2535–2538. [Google Scholar] [CrossRef]

- Nojavan, S.; Nourollahi, R.; Pashaei-Didani, H.; Zare, K. Uncertainty-based electricity procurement by retailer using robust optimization approach in the presence of demand response exchange. Int. J. Electr. Power Energy Syst. 2019, 105, 237–248. [Google Scholar] [CrossRef]

- Yang, S.; Tan, Z.; Tan, Z.; Liu, Z.; Lin, H.; Ju, L.; Zhou, F.; Li, J. A multi-objective stochastic optimization model for electricity retailers with energy storage system considering uncertainty and demand response. J. Clean Prod. 2020, 277, 124017. [Google Scholar] [CrossRef]

- Jiang, X.; Li, Y.; Yu, S.; Lin, Z.; Ji, C.; Zhang, Z. Power purchasing optimization of electricity retailers considering load uncertainties based on information gap decision theory. Energy Rep. 2022, 8, 693–700. [Google Scholar] [CrossRef]

- Sun, B.; Wu, X.; Xie, J.; Sun, X. Information gap decision theory-based electricity purchasing optimization strategy for load aggregator considering demand response. Energy Sci. Eng. 2021, 9, 200–210. [Google Scholar] [CrossRef]

- Najafi-Ghalelou, A.; Nojavan, S.; Zare, K. Robust thermal and electrical management of smart home using information gap decision theory. Appl. Therm. Eng. 2018, 132, 221–232. [Google Scholar] [CrossRef]

- Moradi-Dalvand, M.; Mohammadi-Ivatloo, B.; Amjady, N.; Zareipour, H.; Mazhab-Jafari, A. Self-scheduling of a wind producer based on Information Gap Decision Theory. Energy 2015, 81, 588–600. [Google Scholar] [CrossRef]

- Mohammadi-Ivatloo, B.; Zareipour, H.; Amjady, N.; Ehsan, M. Application of information-gap decision theory to risk-constrained self-scheduling of GenCos. IEEE Trans. Power Syst. 2012, 28, 1093–1102. [Google Scholar] [CrossRef]

- Deng, S.J.; Oren, S.S. Electricity derivatives and risk management. Energy 2006, 31, 940–953. [Google Scholar] [CrossRef]

- Azevedo, F.; Vale, Z.A.; de Moura Oliveira, P.B. A decision-support system based on particle swarm optimization for multiperiod hedging in electricity markets. IEEE Trans. Power Syst. 2007, 22, 995–1003. [Google Scholar] [CrossRef]

- Liu, J.; Chen, J.; Yan, G.; Chen, W.; Xu, B. Clustering and dynamic recognition based auto-reservoir neural network: A wait-and-see approach for short-term park power load forecasting. iScience 2023, 26, 107456. [Google Scholar] [CrossRef] [PubMed]

- Zheng, J.H.; Guo, J.C.; Li, Z.; Wu, Q.H.; Zhou, X.X. Optimal design for a multi-level energy exploitation unit based on hydrogen storage combining methane reactor and carbon capture, utilization and storage. J. Energy Storage 2023, 62, 106929. [Google Scholar] [CrossRef]

- Shao, L.P.; Chen, J.J.; Pan, L.W.; Yang, Z.J. A Credibility Theory-Based Robust Optimization Model to Hedge Price Uncertainty of DSO with Multiple Transactions. Mathematics 2022, 10, 4420. [Google Scholar] [CrossRef]

- Liu, B. A survey of credibility theory. Fuzzy Optim. Decis. Mak. 2006, 5, 387–408. [Google Scholar] [CrossRef]

- Peng, C.; Chen, L.; Zhang, J. Multi-objective optimal allocation of energy storage in distribution network based on classified probability chance constraint information gap decision theory. Proc. CSEE 2020, 40, 2809–2819. [Google Scholar]

- Zadeh, L.A. Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst. 1978, 1, 3–28. [Google Scholar] [CrossRef]

- Zhou, J.; Li, X.; Pedrycz, W. Mean-semi-entropy models of fuzzy portfolio selection. IEEE Trans. Fuzzy Syst. 2016, 24, 1627–1636. [Google Scholar] [CrossRef]

- Huang, X. Mean-entropy models for fuzzy portfolio selection. IEEE Trans. Fuzzy Syst. 2008, 16, 1096–1101. [Google Scholar] [CrossRef]

- Li, R.; Wei, W.; Mei, S.; Hu, Q.; Wu, Q. Participation of an energy hub in electricity and heat distribution markets: An MPEC approach. IEEE Trans. Smart Grid 2018, 10, 3641–3653. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).