A Voltage-Aware P2P Power Trading System Aimed at Eliminating Unfairness Due to the Interconnection Location

Abstract

1. Introduction

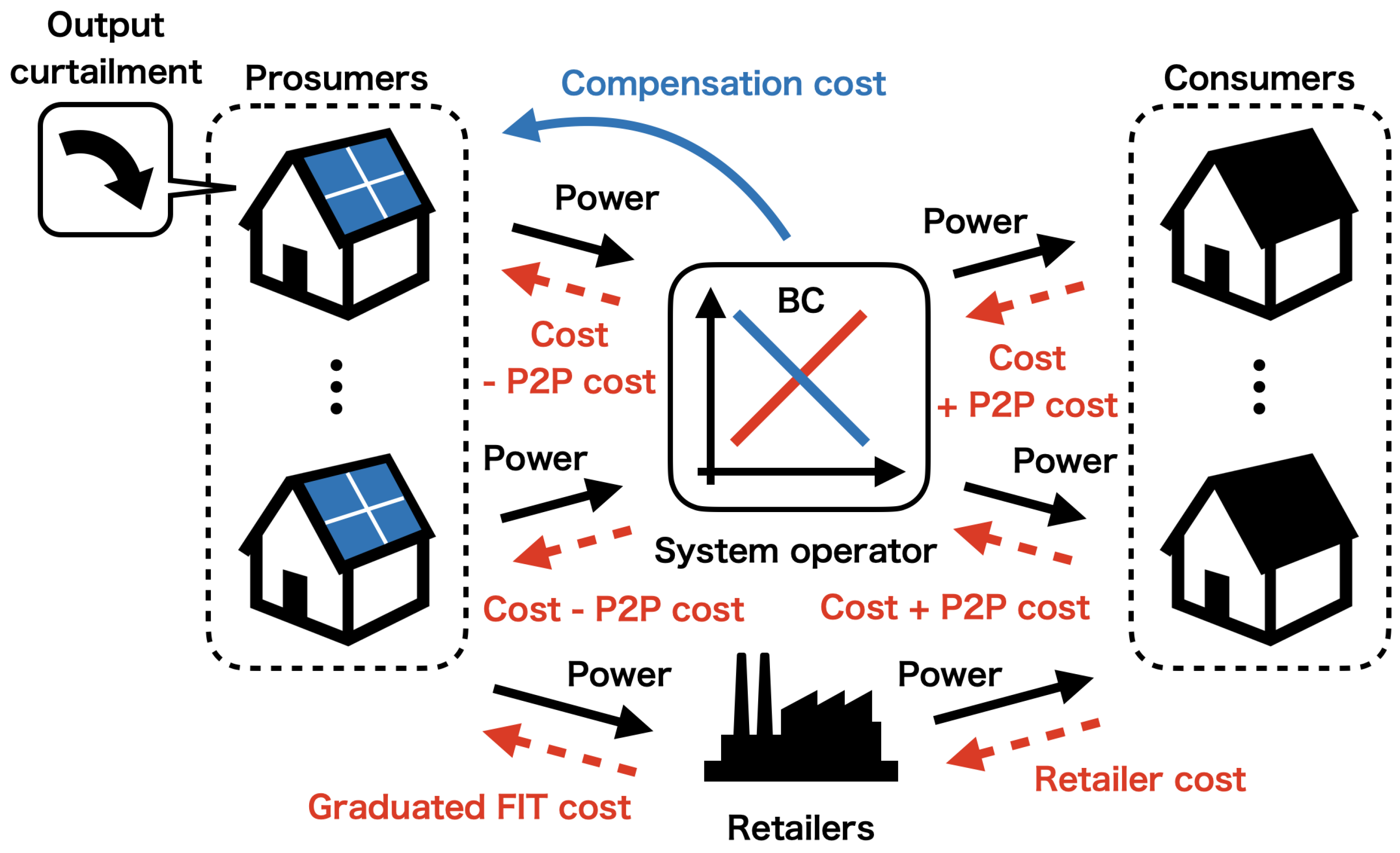

2. Proposed P2P Power Trading System

2.1. Outline

2.2. Contract Scheme

2.3. Calculation of Output Curtailment

2.4. P2P Cost Determination Method

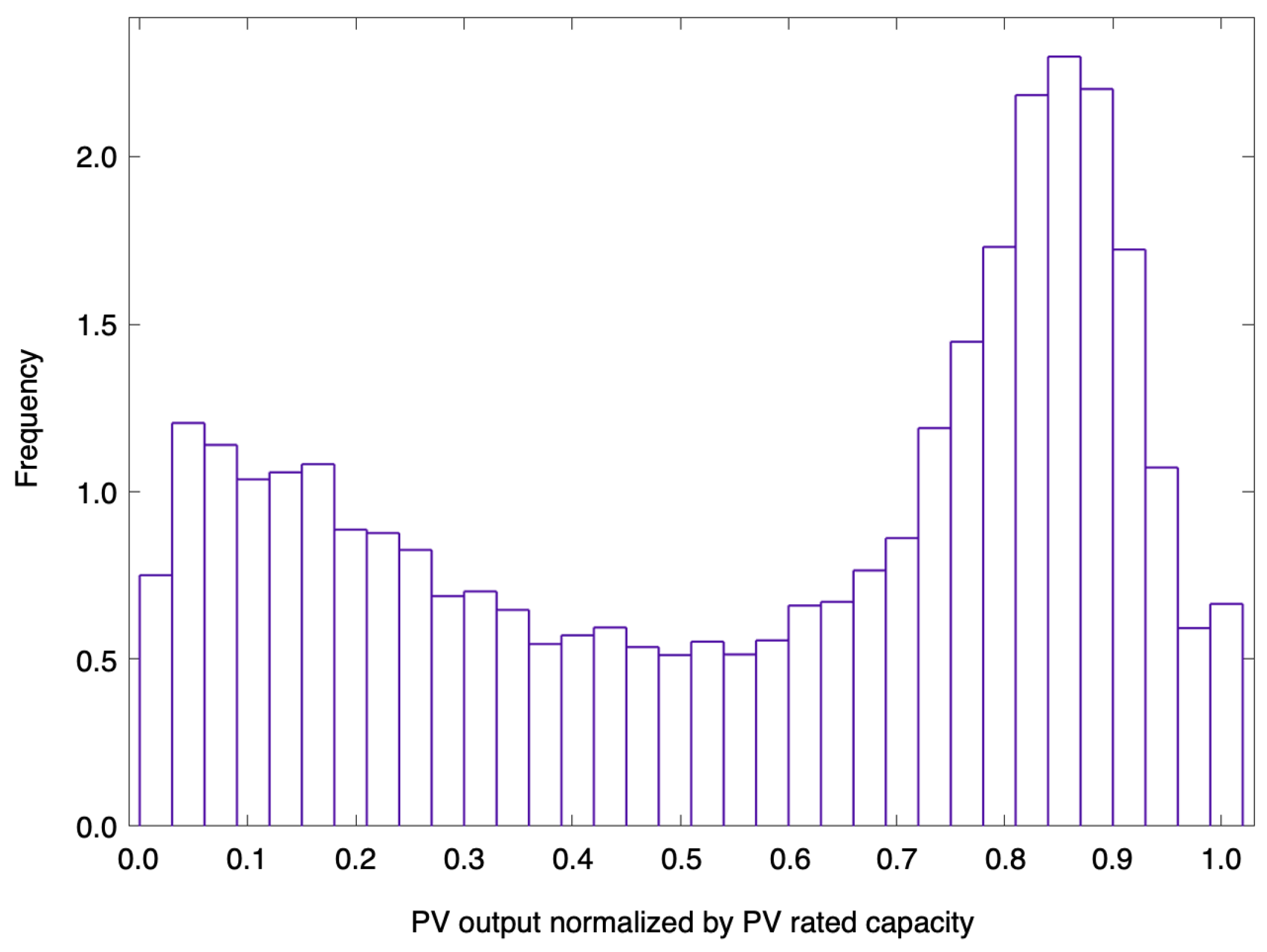

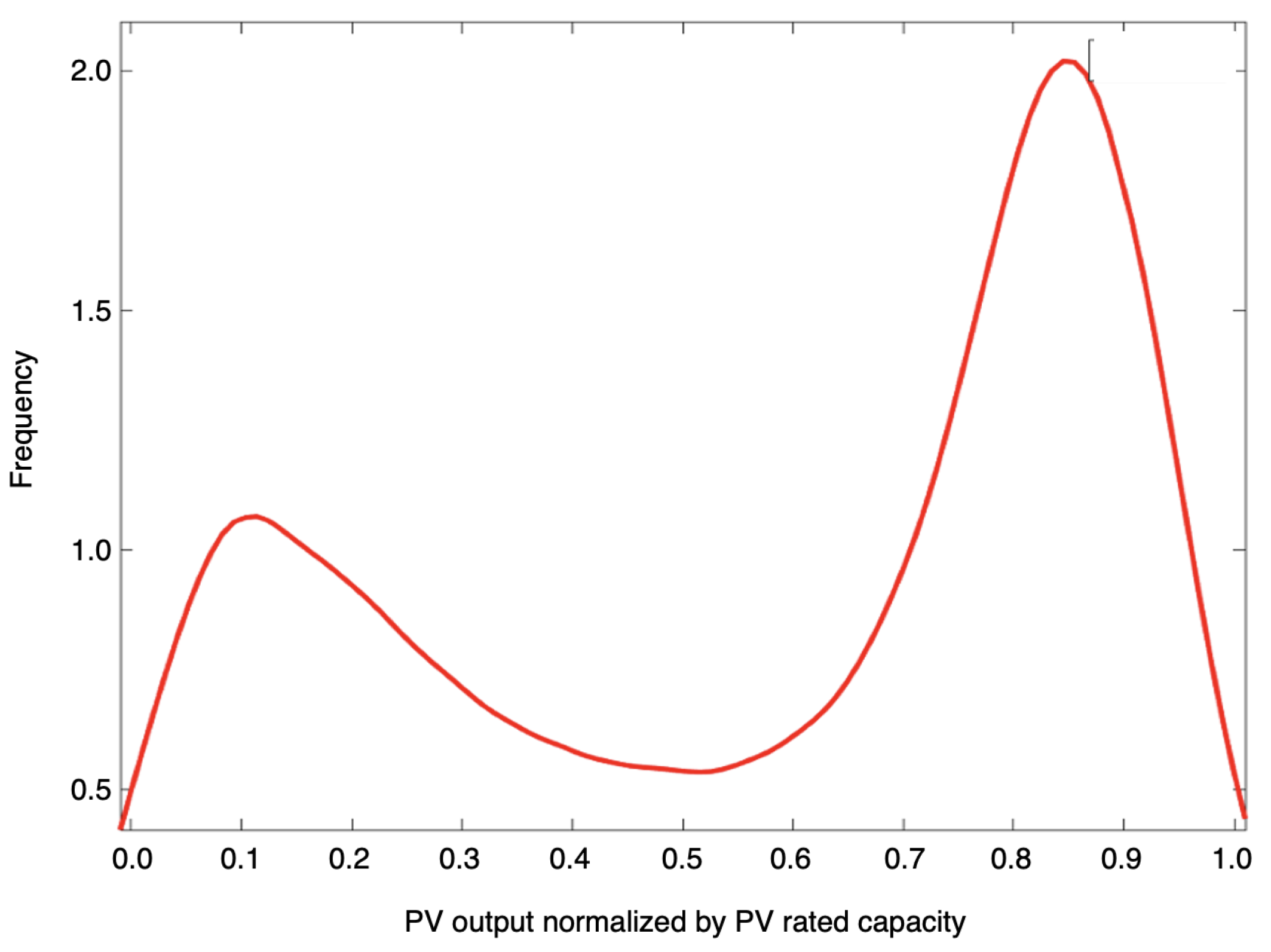

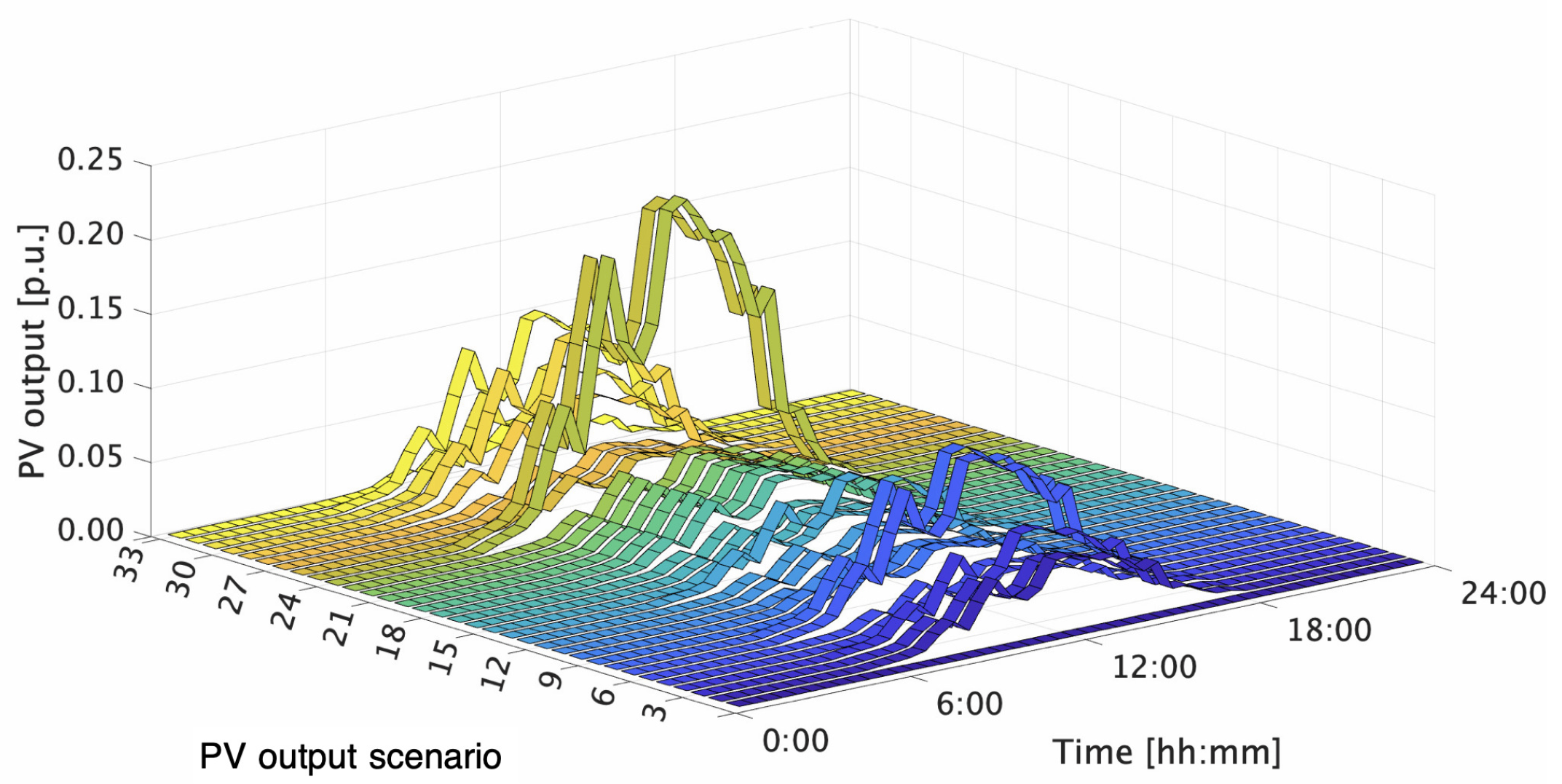

3. Generation of Scenario of PV Output

4. Numerical Verification

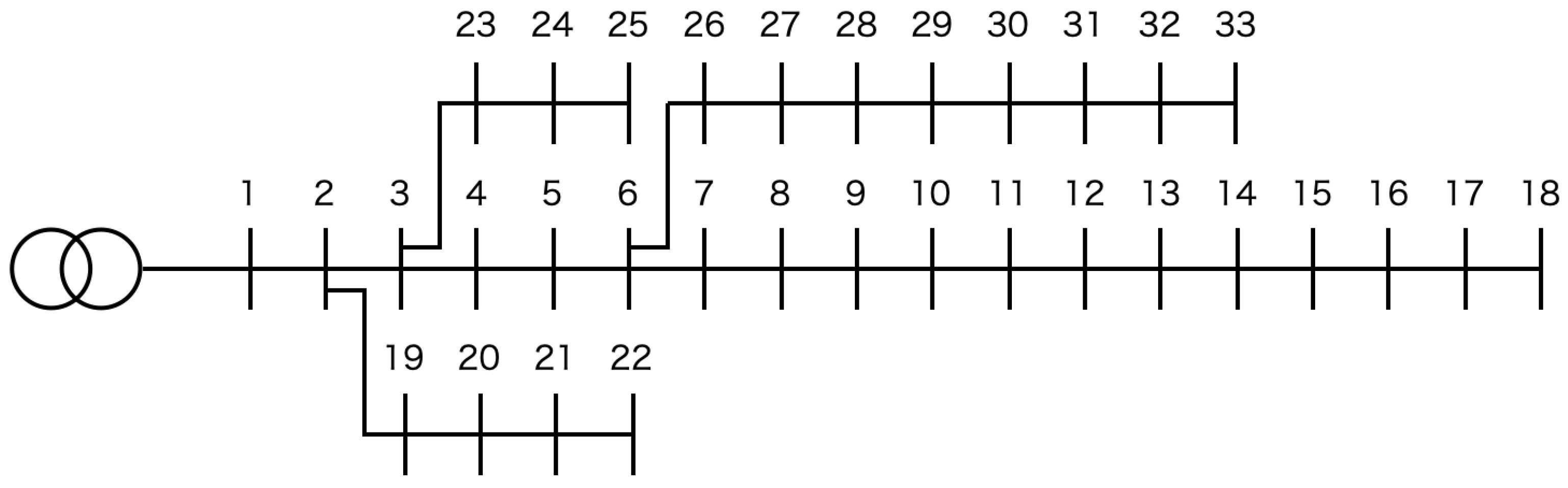

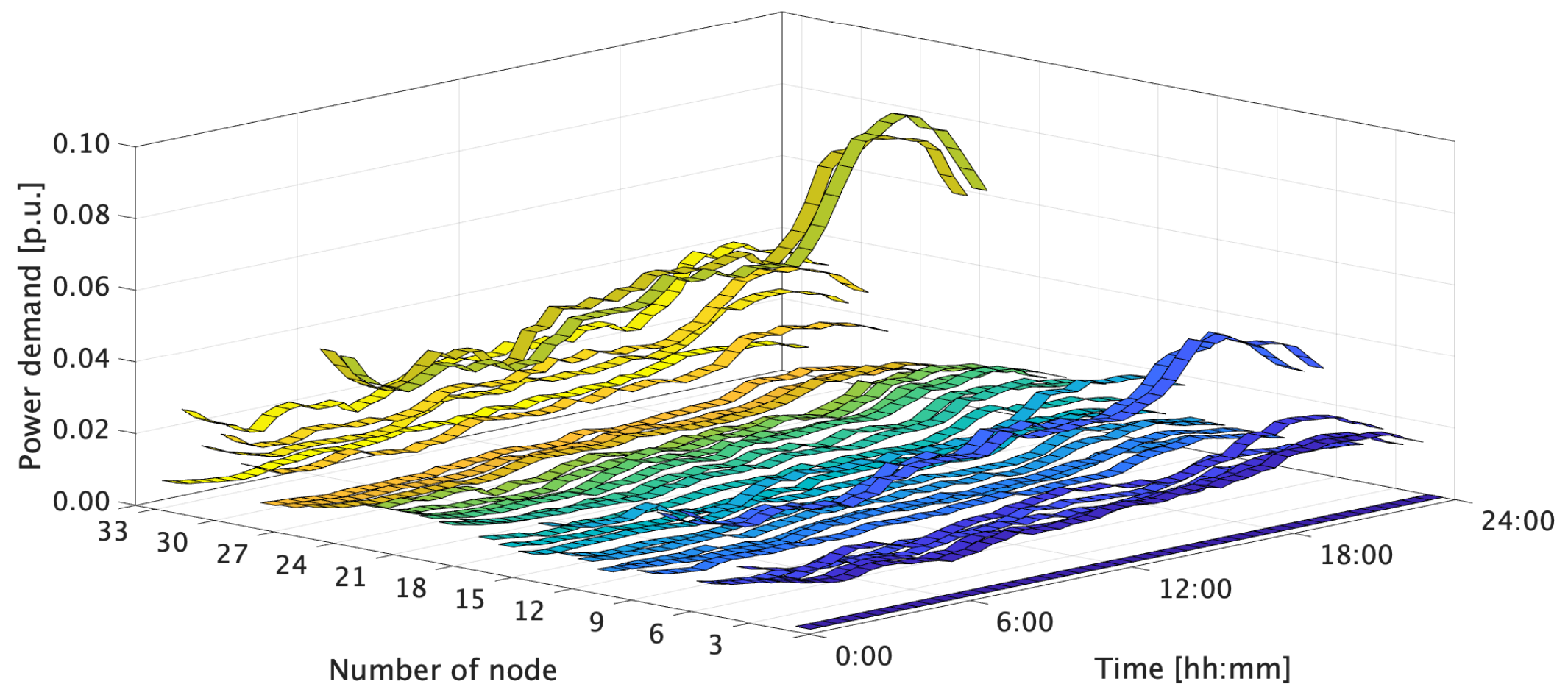

4.1. Simulation Conditions for the Distribution Network

4.2. Simulation Conditions for the P2P Power Trading

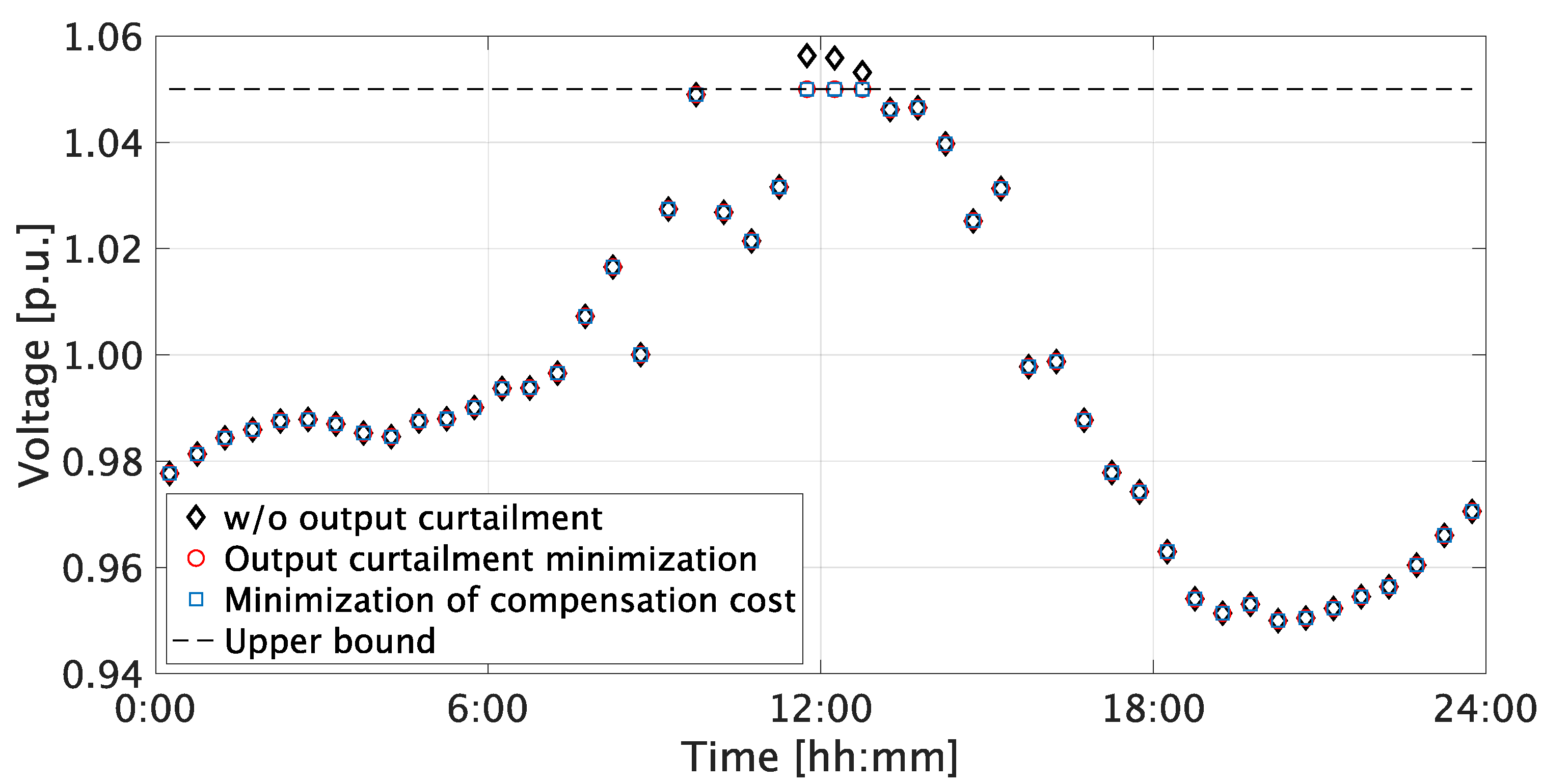

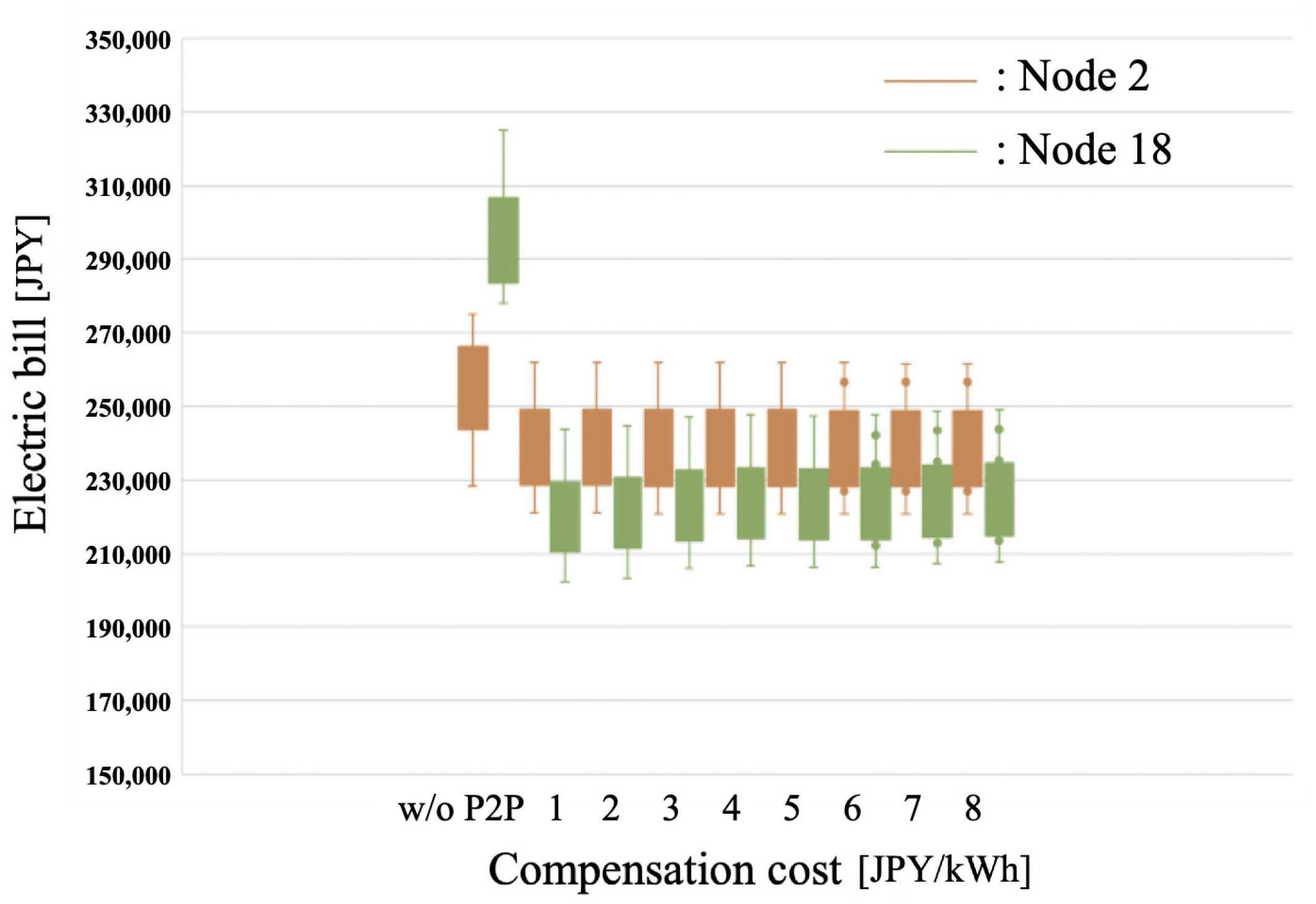

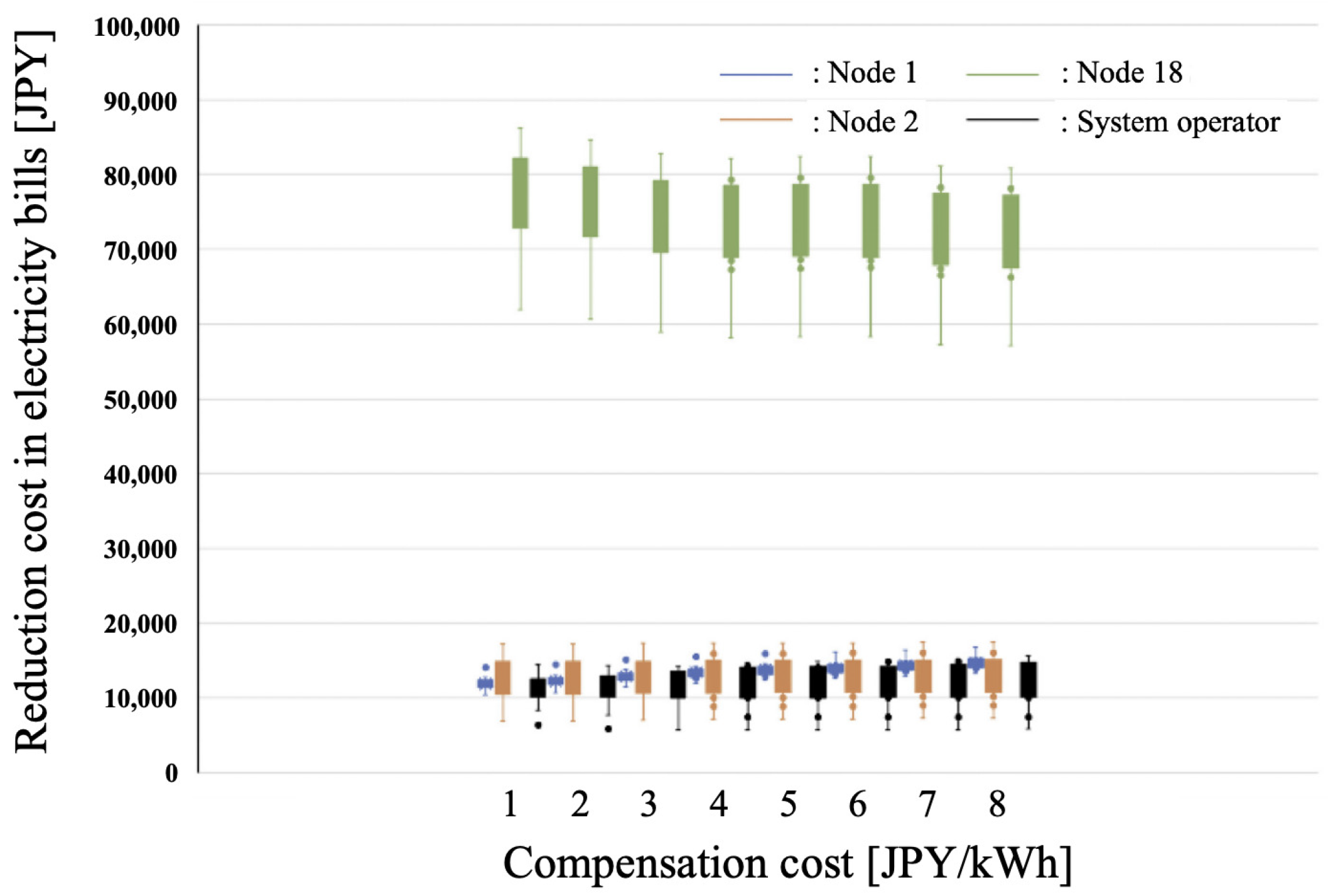

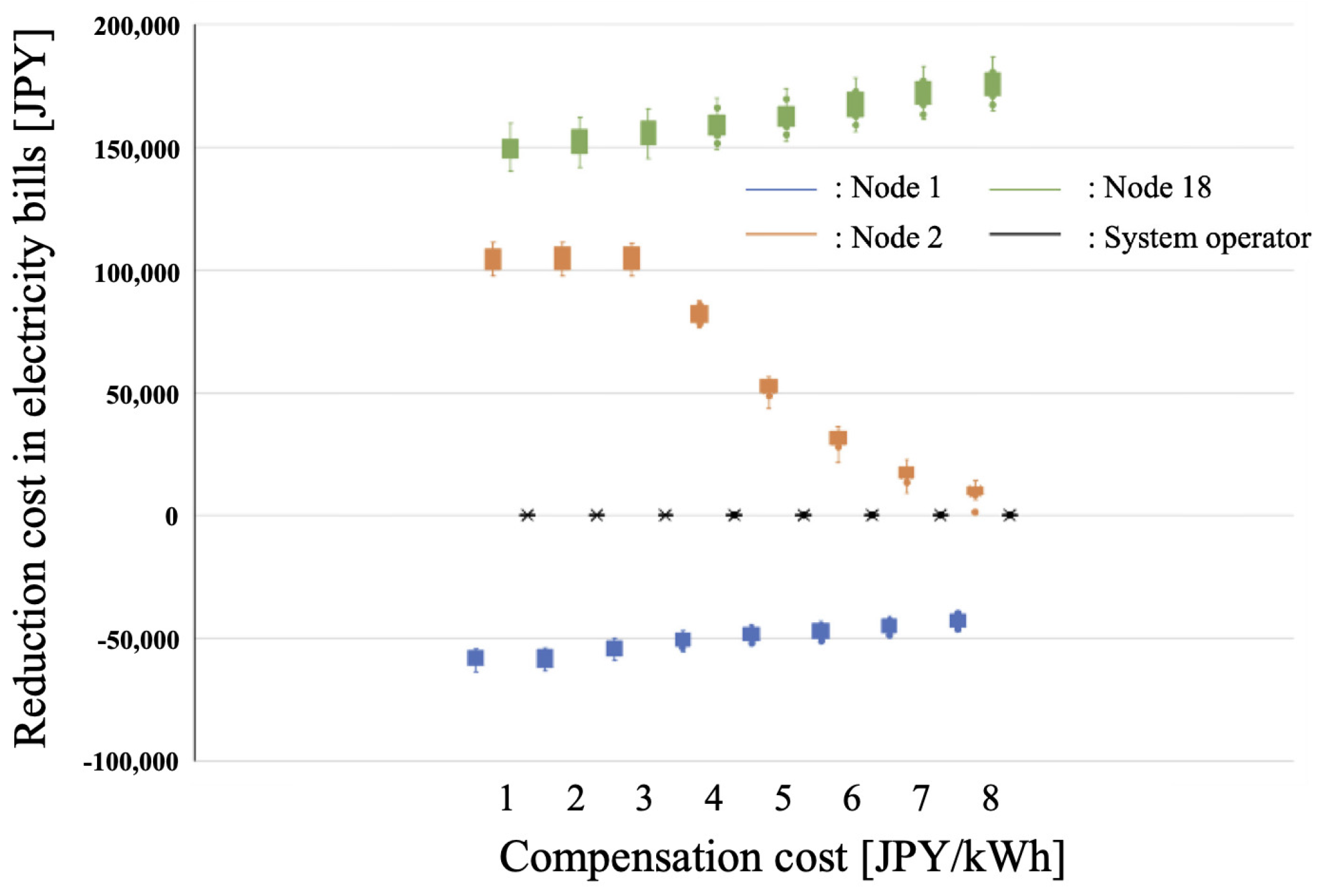

4.3. Simulation Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Kimura, K. Feed-in Tariffs in Japan: Five Years of Achievements and Future Challenges; Renewable Energy Institute: Minato, Japan, 2017. [Google Scholar]

- IEA. World Energy Outlook 2022. Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 28 December 2023).

- Khubrani, M.M.; Alam, S. Blockchain-Based Microgrid for Safe and Reliable Power Generation and Distribution: A Case Study of Saudi Arabia. Energies 2023, 16, 5963. [Google Scholar] [CrossRef]

- Eltamaly, A.M.; Ahmed, M.A. Performance Evaluation of Communication Infrastructure for Peer-to-Peer Energy Trading in Community Microgrids. Energies 2023, 16, 5116. [Google Scholar] [CrossRef]

- Damisa, U.; Nwulu, N.I.; Siano, P. Towards Blockchain-Based Energy Trading: A Smart Contract Implementation of Energy Double Auction and Spinning Reserve Trading. Energies 2022, 15, 4084. [Google Scholar] [CrossRef]

- Matsuda, Y.; Yamazaki, Y.; Oki, H.; Takeda, Y.; Sagawa, D.; Tanaka, K. Demonstration of Blockchain Based Peer to Peer Energy Trading System with Real-Life Used PHEV and HEMS Charge Control. Energies 2021, 14, 7484. [Google Scholar] [CrossRef]

- Nagatsuka, T.; Sano, M.; Yamaguchi, N. Experiment of Execution Time in Decentralized Transaction System of Surplus PV Output using Bloackchain. IEEJ Trans. Power Energy 2019, 3, 176–185. (In Japanese) [Google Scholar] [CrossRef]

- Yokoyama, A. Toward Deregulated, Smart and Resilient Power Systems with Massive Integration of Renewable Energy in Japan. IEEJ Trans. Elec. Electron. Eng. 2022, 17, 1242–1254. [Google Scholar] [CrossRef]

- Paudel, A.; Khorasany, M.; Gooi, H.B. Decentralized local energy trading in microgrids with voltage management. IEEE Trans. Ind. Inform. 2021, 17, 1111–1121. [Google Scholar] [CrossRef]

- Azim, M.I.; Tushar, W.; Saha, T.K. Regulated P2P energy trading: A typical Australian distribution network case study. In Proceedings of the IEEE Power and Energy Society General Meeting, Montreal, QC, Canada, 2–6 August 2020; pp. 1–5. [Google Scholar]

- Guerrero, J.; Chapman, A.C.; Gregor, V. Decentralized P2P Energy Trading Under Network Constraints in a Low-Voltage Network. IEEE Trans. Smart Grid 2019, 10, 5163–5173. [Google Scholar] [CrossRef]

- Park, S.W.; Cho, K.S.; Son, S.Y. Voltage management method of distribution system in P2P energy transaction environment. IFAC-PapersOnLine 2019, 52, 324–329. [Google Scholar] [CrossRef]

- Azim, M.I.; Wayes, T.; Saha, T.K. Coalition Graph Game-based P2P Energy Trading with Local Voltage Management. IEEE Trans. Smart Grid 2021, 12, 4389–4402. [Google Scholar] [CrossRef]

- Qiu, D.; Wang, J.; Wang, J.; Strbac, G. Multi-Agent Reinforcement Learning for Automated Peer-to-Peer Energy Trading in Double-Side Auction Market. In Proceedings of the Thirtieth International Joint Conference on Artificial Intelligence, Montreal, QC, Canada, 19–27 August 2021; pp. 2913–2920. [Google Scholar]

- Wand, M.P.; Jones, M.C. Kernel Smoothing; Taylor and Francis: Abingdon, UK, 1994. [Google Scholar]

- Trashchenkov, S.; Pimentel, S.P.; Astapov, V.; Annuk, A.; Marra, E.G. Kernel Density Estimation for Stochastic Modeling of PV Power Output. In Proceedings of the 2018 7th International Conference on Renewable Energy Research and Applications (ICRERA), Paris, France, 14–17 October 2018; pp. 1179–1183. [Google Scholar] [CrossRef]

- Dolatabadi, S.H.; Ghorbanian, M.; Siano, P.; Hatziargyriou, N.D. An Enhanced IEEE 33 Bus Benchmark Test System for Distribution System Studies. IEEE Trans. Power Syst. 2021, 36, 2565–2572. [Google Scholar] [CrossRef]

- Ma, D.; Liu, M.; Zhang, H.; Wang, R.; Xie, X. Accurate Power Sharing and Voltage Regulation for AC Microgrids: An Event-Triggered Coordinated Control Approach. IEEE Trans. Cybern. 2022, 52, 13001–13011. [Google Scholar] [CrossRef] [PubMed]

| [%] | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| Prosumer | 4.42 | 4.36 | 4.25 | 4.17 | 4.11 | 4.08 | 4.03 | 3.97 |

| Consumer | 39.8 | 39.2 | 38.3 | 37.6 | 37.1 | 36.7 | 36.2 | 35.7 |

| [JPY] | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| Participants | 340 | 343 | 352 | 360 | 365 | 368 | 373 | 376 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Takayama, S.; Ishigame, A. A Voltage-Aware P2P Power Trading System Aimed at Eliminating Unfairness Due to the Interconnection Location. Energies 2024, 17, 841. https://doi.org/10.3390/en17040841

Takayama S, Ishigame A. A Voltage-Aware P2P Power Trading System Aimed at Eliminating Unfairness Due to the Interconnection Location. Energies. 2024; 17(4):841. https://doi.org/10.3390/en17040841

Chicago/Turabian StyleTakayama, Satoshi, and Atsushi Ishigame. 2024. "A Voltage-Aware P2P Power Trading System Aimed at Eliminating Unfairness Due to the Interconnection Location" Energies 17, no. 4: 841. https://doi.org/10.3390/en17040841

APA StyleTakayama, S., & Ishigame, A. (2024). A Voltage-Aware P2P Power Trading System Aimed at Eliminating Unfairness Due to the Interconnection Location. Energies, 17(4), 841. https://doi.org/10.3390/en17040841