1. Introduction

The relevance of the problem of integrated assessment of companies and the compilation of an investor’s portfolio is beyond doubt, being the central problem of investing in high-tech companies in Russia. In the first instance, the task arises of building a rating of investment attractiveness of companies using an algorithmic procedure. The authors propose the use of a new methodology, namely, a model of a minimax approach and hierarchical data analysis. In the context of modern digital data processing systems, the problem of integral ranking of important targeted financing indicators of financial, economic, intermediary, and marketing activities of companies in Russia’s leading industries comes to the fore. The business–economy–society relationship influences important values of public welfare. A consequence of the introduction of integral indexing technologies is the development of a mathematical apparatus for cost optimization, which is facilitated by the minimax optimization approach, allowing use of new risk assessments of a company’s sub-portfolio in a circular convolution mode.

Considering oil and gas companies in Russia, several problems should be noted that stand in the way of using standard methods of integral indexing and portfolio investment. With integral indexing, it is necessary to consider the whole range of financial indicators of important groups, such as liquidity, financial stability and risk, business activity, and profitability. At the same time, investors can often “hide” behind technical analysis tools using only the dynamics of market indicators. The development of the company depends on the investor being interested in the growth of the company’s capitalization and successful activities, from which it is possible to receive dividends; therefore, the investor chooses the capital investment sector and forms (revises) their portfolio no more than 2–6 times a year. To do this, it is necessary to perform a calculation taking into account the parameters of the portfolio of interest.

The existing methods applied for the integral assessment of the financial indicators of the state and sustainable development of the company have, as a rule, a drawback associated with the incomparability of indicators in terms of the degree of influence on the level of development of the company in the group.

The use of optimization of the portfolio structure for the inclusion of promising companies based on the construction of an integral rating based on the results of hierarchical analysis enables avoidance of the disadvantages of other methods. The approach proposed in this article has not been previously considered in the literature.

The main parameter of the risk assessment investment model is a company’s rating. At the moment, the methodological tools for the rating assessment of Russian companies are at an early stage of development, although such studies across the world have provided a good foundation, thanks to leading rating agencies that have their own sound methodologies for rating companies. Until mid-2017, when developing investment strategies for the development of Russian industry giants, the opinions of the “big three” international rating agencies, Standard and Poor’s, Fitch Ratings or Moody’s and Forbes magazine experts, were taken into account. However, due to the reduction in foreign expertise in Russia, it became necessary to develop and implement its own rating methodology for assessing the investment attractiveness of companies. The current rating approach (e.g., through accredited agencies, such as Expert RA, NRA, NKR, ACRA), needs a new and mathematically sound approach to building a rating that optimizes the investment process of the most important high-tech projects by taking into account the priority of indicators and circular convolution into a single index. An important feature of the developed method is the use of a mathematical apparatus, which includes a hierarchical analysis of the ranked indicators of financial and economic activity of companies, considering their priority, and the use of a minimax approach to obtain a rating assessment of companies by circular convolution. The algorithmic base follows from the priority of indicators, then groups are formed, with the highest and lowest priority in the list of companies identified. The boundary groups are then removed from the analytical base and the “internal” groups are subjected to the same method, in a circle of analytical refinement of the rating. This approach has not been considered in the literature. Further, a significant development of the research topic is carried out, the mode of “convolution of indicators in a circle” into an integral index is justified, and the prospects for development are indicated. The purpose of the article is to develop a procedure for the integral indexing of financial indicators in a circular convolution mode using a minimax model to optimize the investor’s portfolio in order to increase the investment attractiveness and competitiveness of the business. The subject of the study is financial quantitative indicators, optimization and hierarchical models of companies’ activities. The objects of the research are the leading companies in the oil and gas industry of the Russian economy.

2. Literature Foundations

A comprehensive assessment of the competitive advantages of the world giants of the leading economic sectors in the oil and gas industry requires a systematic analysis and ranking of investment criteria for the effectiveness of the companies in question.

There are a variety of approaches to assessing the competitive advantages of oil companies. For example, the experience of reforming the management system and introducing innovative practices in PetroChina [

1] is based on the development of six elements: balancing between the existing reserves and new developments, the state dynamic distribution of rights for the extraction and reservation of minerals, the assessment of new territories, the management of benefits, the assessment of the value of the company’s reserves, and the expansion of cooperation.

Another competitive advantage is digitalization, or rather the introduction of blockchain technology and smart contracts in Iraq [

2]. The article assesses the impact of this technology from the point of individual, environmental and organizational factors of competitiveness. The data is analyzed using structural equation modeling (PLS). The results indicate that introduction of the technology increases the stability of work, grows the organizational culture and the long-term development goals of oil companies are achieved more effectively.

The Malaysian experience in assessing and ranking competitiveness is based on the application of innovation opportunity scaling [

3]. The main opportunities for increasing competitiveness are assessed from the standpoint of greening and the application of eco-innovations. The authors present a three-dimensional structure of innovation policy with nine detailed elements. It is noted that the design of eco-innovations is seen in product service management, pollution prevention, and commitment to sustainable development. As part of another study of oil and gas companies in Malaysia [

4], a hierarchical model is built by prioritizing core competencies in relation to the financial performance of companies. The authors used an analytical hierarchical process (AHP) and a mathematical model approach, which were synthesized using the Super Decisions software. The proposed toolkit can be used as a benchmark for prioritizing core competencies in relation to the competitive advantages of a company in the analyzed sector of the economy. As part of increasing the competitiveness of Thai companies, a formal industrial commercialization model is also being developed, which is suitable for the commercialization of inventions in the field of oil industry products and processes [

5].

Evidently, the specifics of the industry-based assessment of companies differ significantly according to the scale of their activities. According to the author, it is necessary to introduce a complex ABC-criteria (assets, revenue, equity) data ranking methodology, which is presented in this paper for the first time. The consonance of the indicators is accidental; it is possibly an intuitive coincidence that was not planned by the author and can be revised if there are strong arguments in favor of other indicators.

The author’s methodology allows for the selection of “leaders” by ABC criteria, as well as companies whose ABC indicators in the considered group are significantly lower than average (the study uses the term “closing group”). The average group of companies is subject to further analysis according to the author’s methodology (if there are more than 10 companies), or final ranking by D criteria (net profit). After ranking by indicator D, companies of the middle group are “embedded” in the environment from leaders to the closing group (they are also ranked by D taking into account the subordination of the circular convolution of groups).

It should be noted that ABC analysis has not been used in such studies in this way. Alternative approaches, which were not ultimately applied in the framework of this study, are represented by the following scientific studies described. One of the approaches is based on integral ranking using decision-making methods, analytical network process (ANP), DEMATEL and analytical hierarchical process (AHP), as well as a combination of methods that the authors [

6] termed hybrid fuzzy ANP-DEMATEL-AHP. The approach assumed the use of 7 main criteria and 39 sub-criteria as indicators of rating and multi-ranking of data. Other studies [

7,

8,

9] have approached the issue from the standpoint of ranking investment performance criteria. This approach uses capital rationing metrics and impact analysis for IOR/EOR projects. The various combinations of oil companies’ investment portfolios, as well as the experience of the Norwegian oil sector taxation system’s impact on restrictions and reductions in the marginality of IOR/EOR projects, are studied. Finally, another approach considered [

10] is based on a comparative methodology by AHP and fuzzy TOPSIS criteria. AHP is used to determine the criteria weights and the fuzzy TOPSIS method is used to obtain the final rating.

The feasibility of the author’s methodological approach to the circular ranking of companies, which was used, for example, to select a supplier in the petrochemical industry [

11,

12,

13] is based on several theses.

Firstly, most of the indicators used are subject to high volatility of the internal state of industry parity, so it is advisable to use several indicators responsible for the main financial data flows within the company [

14,

15].

Secondly, the indicators are considered as static parameters in the high volatility model; therefore, it is necessary to use fundamental analytics, taking into account the quality of the audit and the peculiarities of profit management in the oil and gas industry [

16]. The main sources of reliable information are the balance sheet and financial results report, but not the market price of the company’s shares [

17,

18,

19].

Thirdly, the risk associated with the volatility of technical analysis indicators must be stabilized to the level of real balance sheet indicators. Therefore, it is necessary to apply the portfolio approach [

20,

21]; the portfolio will be built according to the indicators specified by investors, adjusted to the level of the company’s rating in the given group of competing companies. The paper considers the oil and gas industry as the basis for the formation of a competitive investor portfolio [

22,

23].

Data rating and multi-ranking are gaining particular popularity [

24,

25,

26], while an important goal is a comprehensive assessment of portfolio investments [

27]. Complex strategic and financial analysis, in terms of multi-ranking and hierarchical assessment of development indexes in groups, is gaining particular popularity [

28,

29]. For a full-fledged analysis, it becomes necessary to take into account many important indicators of the financial and economic activities of companies and to scale them up to perform a comprehensive assessment.

It is necessary to conduct a financial analysis based on evaluating the ratio standards (e.g., liquidity, financial stability, profitability, business activity); as a result, it can be concluded that the business is reliable and promising, having competitive strength and the potential for innovative developments [

30,

31].

3. Materials and Methods

3.1. Methodology for Constructing an Integral Rating of the Competitiveness of Russian Companies

The construction of the integral index is implemented in a multi-stage system, which includes at least five stages:

- (1)

formation and systematization of indicators of financial and economic activity used in assessment models for analysis and optimization of capital investments in oil and gas companies in Russia;

- (2)

normalization of the values of indicators, taking into account linear scaling and ranking of data, and calculation of aggregates (sub-indexing) according to the original or scaled indicators;

- (3)

formation of company groups according to the adopted aggregate or quantitative indicators in a circular convolution mode;

- (4)

integral ranking by groups taking into account the adopted circular classification of data;

- (5)

decision on the structure of the investment portfolio and the minimax criterion of optimality.

System analysis is carried out based on evaluation, quantitative indexes modeling up to sub-indexing level within the groups of companies obtained by circular convolution, after which the system of aggregation indexes is defined using multi-ranking, hierarchical analysis, and a new data filtering algorithm (in the circular convolution of business competitiveness indicators).

The feasibility of the hierarchical procedure is contained in the mathematical system of a circular convolution of financial business competitiveness indicators, among which certain indicators are primary.

This approach essentially and fundamentally differs from the existing methods of analyzing hierarchies, since the rules of fuzzy logic of decision-making “what-if” are replaced by a justified subordination of ranked financial indicators (sub-indexes) and ranking in a circular convolution mode.

3.2. Theory

At the first stage of analyzing the business competitiveness, quantitative volumetric business development indicators are used (e.g., balance sheet assets, revenue, equity).

At the second stage, the capital investments assessment is optimized. For this, the relative profitability and risk indicators, the return on equity (the ratio of net profit to equity) and financial leverage (the ratio of borrowed funds to equity) are applied.

The groups of leaders and closing companies (in this sample) are selected considering three ABC indicators. The remaining regions are combined into a new subgroup, among which leaders and closing groups are distinguished, or a linear ranking is performed by indicator D.

At each new stage, new groups are ranked after excluding the leaders and closing groups, switching the rating mode to the “center of the circular convolution of data”, the procedure-stopping mode—the presence of one or two groups of leaders and the closing groups without the possibility of selecting the middle group.

A company-rating model is based on circular convolution and hierarchical data analysis. In building groups at each stage of hierarchical analysis and circular convolution, the article uses the following important indicators of the company’s performance: assets (A), revenue (B), and equity (C). In the construction of the integral index based on the results of the grouping, the ranking is made by net profit indicator (D), taking into account the subordination of the groups: the best indexes for the group of leaders (at the beginning, the first stage and until the last, after the middle group is ranked, then the companies of the closing groups from the last (internal) closing group to the first closing one (boundary)).

N—the total number of analyzed companies.

Ranking the indicators, A, B, C, D for companies through

a,

b,

c,

d, respectively, taking into account indexes, so

ai is the rank of indicator A for company

i. It is clear that:

3.3. Minimax Optimality Criterion

Let us assume that the investor’s capital is distributed for n companies (oil and gas).

where

Vi—financial leverage ratio of i company,

η1, …, ηn—the return on equity of these companies (oil and gas industry),

θi—is the investment share of i company.

To calculate the investment shares of companies in the portfolio, the following problem is solved

where

For the solution, the following formulas are applied

Next, share Corrections (3) are applied, the return on equity is used

To obtain the optimal investment shares, the final revision of Shares (4) is performed according to the integral rating method (marked by IR), Formula (5).

As a result, the optimal solution for the portfolio will be achieved using the author’s circular assessment approach by grouping, rating and hierarchical data assessment.

The method of circular convolution of large companies contains two main stages, with the first stage proceeding in a hierarchical mode.

At the first stage, two groups are identified: leaders (ABC indicators are above average) and closing group (ABC is below average).

The rest of the companies form a middle-ranking group, which is subject to further ranking according to the principle: from the borders to the center of the circle, when a signal to stop the process is received, the presence of one or two groups of leaders and closing group without the possibility of identifying the middle group.

At the second stage, an

integral rating is built. The indicator D is first applied for all leading groups, from the first to the last, then in the central group based on the results of the hierarchical analysis, and then, for the closing groups, from the last to the first (boundary) (

Figure 1):

4. Results

Computational experiment: an integral rating of the companies’ competitiveness. The seven largest oil and gas companies in Russia (2019) participated in the experiments in terms of assets. The reliability assessment was carried out according to the recommendations from [

32], the correlations of the ABC group indicators are not contradictory and indicate significant differences (estimates of the pair correlation coefficients within the group for the indicated indicators were at least 0.23, on average 0.37, with a maximum of 0.8, which is consistent with the standard). Initial data and analysis of average values for all indicators are presented in

Table 1; the integral rating for each year is shown in

Table 2.

It should be noted that Gazprom is a stable leader in the oil and gas industry in Russia followed by Surgutneftegaz taking into account the strong growth of its funds and balance sheet assets [

33,

34].

Next, according to the rating, the 3rd place is taken by Rosneft (the largest company that solidly strengthened its positions due to the purchase of Bashneft shares in 2018); Bashneft is consistently ranked 7th in the top ten oil and gas companies.

Changes affected Novatek and Tatneft, the latter company yielding 5th place to Novatek in 2019 (

Table 2).

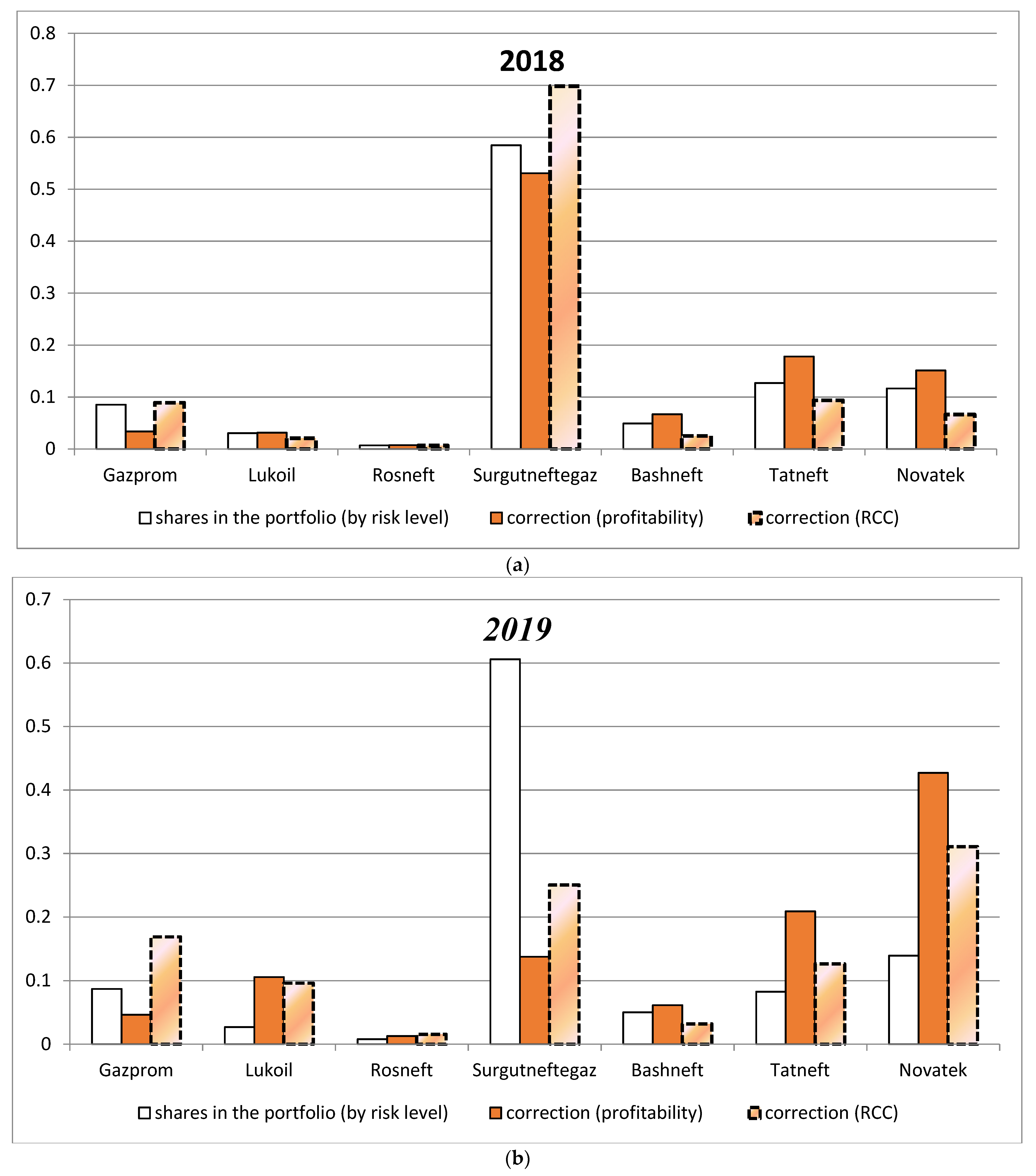

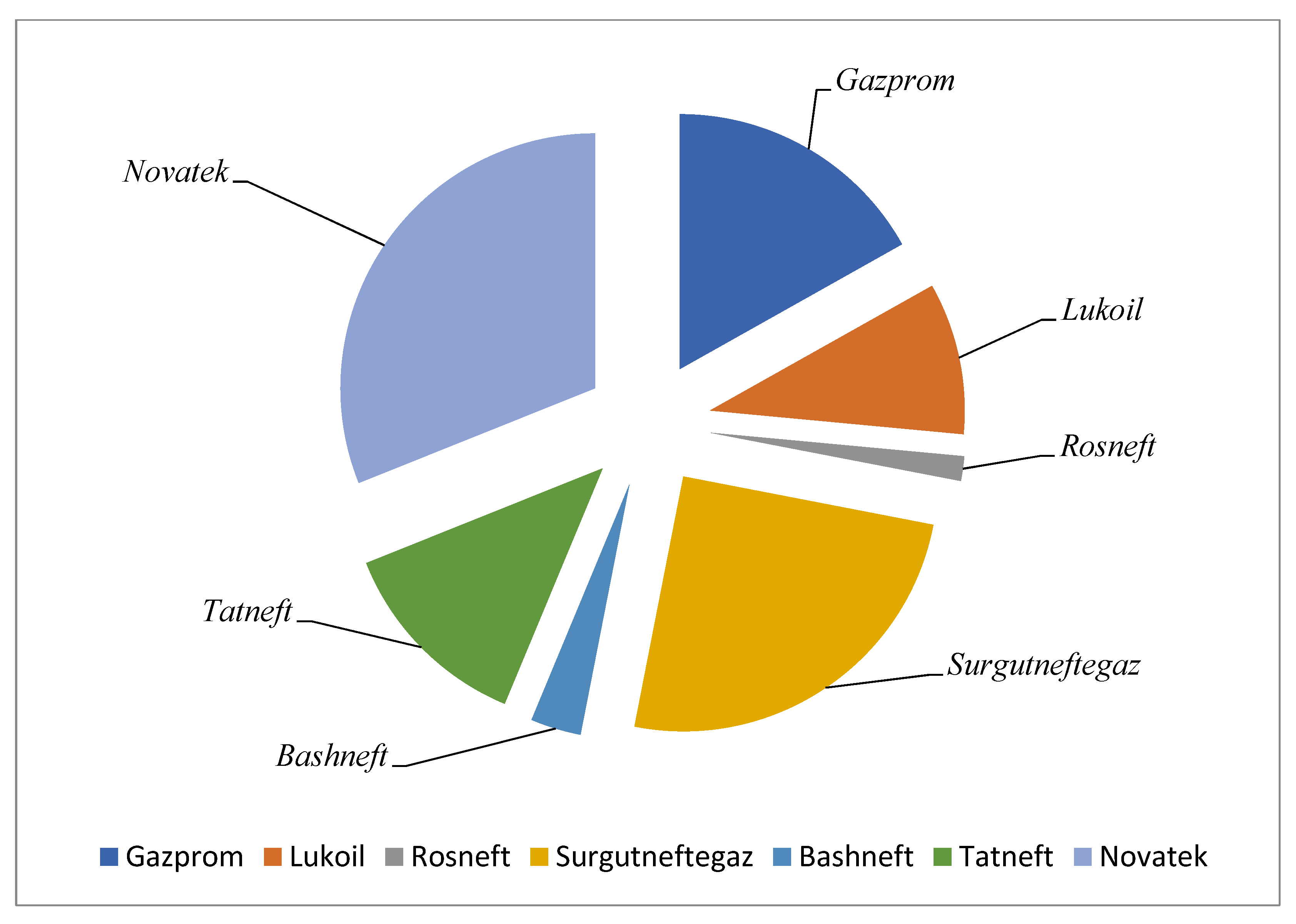

Computational experiment: the formation of an investor’s portfolio according to the optimal model. Taking into account the circular convolution and hierarchical assessment of important indicators, the structure of the investor’s portfolio was assessed (

Figure 2), considering Formula (3).

The IR rating made it possible to develop a portfolio rating of the RCC obtained using the minimax model in correction mode by the level of profitability (

Table 3) and rating (

Figure 3).

The use of the integral rating values as mathematical model parameters (1) allows optimization of the share structure of investment, and this approach is advisable to use in investment analysis to preserve and systematically increase the capital of the most competitive, successfully developing companies in the leading sectors of the country’s economy.

5. Discussion

Investors, creditors, and owners need to agree on rational ways to establish a company. For a small business, such a question can be solved by the CFO together with the management, but for the most important industry companies, such as Neftegaz, which occupy leading positions in ensuring the material and strategic security of Russia, to fulfil the requirement for timely and impeccable provision of services, a comprehensive study of the problem is necessary. To make a decision, investors, creditors, owners, and government agencies need a reliable quantitative base, based on which the dynamics in the group of companies and for each of them will be monitored and analyzed. The oil and gas industry is characterized by the joint influence of decision makers in building the rating. At the same time, there are factors complicating the analysis, e.g., the choice of indicators, correlations, and the presence of undisputed leaders according to the selected analysis criteria. All these shortcomings were overcome in the study by introducing an integral ranking of data by priorities applying a “top-down” and “bottom-up” approach, considering “leader-slave” groups. Large companies are taken into account and the leadership regime in the group may change, which the methodology addresses. The methodology is universal in nature; the procedures of rating and portfolio modeling are carried out taking into account the correction coefficients for the level of profitability and investment risks. Recommendations for optimal investment of companies in the selected group were obtained. The integral rating enables evaluation of the contribution of each company to high-tech development, compared to other companies. The author provides reasons for the need to use important financial indicators when considering placement in a group of companies according to an algorithm that is not swallowed up by the principles of fuzzy logic, including “leader”, “middle group”, “closing group”, with further ranking according to the net profit indicator. The main functional purpose of the proposal is investment analysis with balanced risks. It can be used for targeted financing of large-scale state projects with significant differences in the scale of financing (the methodology then has clear advantages over others due to the absence of required weights in the weight convolution, and due to correction of the investment object (i.e., qualitative or quantitative indicator)). The problem of financing oil and gas companies becomes a strategic and rationally oriented (e.g., profit, production volume, profit priority), rather than a politically oriented task. The authors successfully achieved a solution to the problem, performing an assessment of quantitative indicators, identification of priorities, selection of the indexing and ranking mode of data, and calculation of derived indicators, using the ABC method in “circular convolution” mode. As a result, a model of convolution of derived indicators into an integral rating for the companies in question was obtained and tested in practice, providing a visual representation of the result. The authors obtained an optimal ranking, which is important for investors of all levels by zones of responsible implementation and use. When building a portfolio based on the optimization principle, the paper proposes a new method of portfolio investment, which is of interest to a rational investor aimed at stable receipt of dividends as guarantees of maintaining a high standard of living. Therefore, when forming an investment portfolio, it is advisable to consider the investor’s interest in the company’s dividends, and, consequently, in the amount of its profit. At the same time, the use of models based on minimizing the risk associated with the volatility of company stocks requires knowledge of the covariance matrix of stock returns (i.e., the Markowitz model and its development). A problem arises with collecting and regularly updating the source data. Therefore, when making investment decisions, the authors apply an integrated approach developed by them, based on the construction of an integral rating of investment attractiveness by circular convolution and a portfolio of uniform risk distribution of investing funds, in which the rating points obtained are used as risk assessments. The authors assume that the methodology will be implemented in the practice of Russian investment activity until July 2022.

6. Conclusions

We have developed a method of integral indexing of large Russian companies by cyclical convolution of financial indicators into an integral index. This approach is a development of the rating school and can be applied in practice in rating agencies in Russia.

Limiting conditions include that it is necessary to prioritize indicators. In the development of the methodology, indicators of interest to the investor, lender, owner can be considered, depending on their goals. In terms of the specifics of the methodology, circular convolution is needed when evaluating large companies in various industries. Their indicators (e.g., intersectoral differences) immediately create business prospects in this industry and leading industries and closing ones in the group arise; therefore, this rating is multidimensional and allows identification of leaders at the level of corporate and industry data analysis. Cyclical ranking is carried out at the level of using ranked data on four groups of ABCD indicators (i.e., assets, revenue, equity and net profit) in the optimization model of investment analysis based on the minimax criterion.

The article presents a methodology based on quantitative assessment, hierarchical analysis and ranking of financial stability and risk indicators of the largest companies in the Russian oil and gas industry, which allows building of an integral rating and obtaining a share structure. Investment capital is considered, in which the competitiveness of the investor’s portfolio remains on the average period of data analysis (as a rule, the decision should be reviewed annually). The feasibility of practical application of the methodology for building a rating of investment attractiveness of large Russian companies in energy-intensive industries is substantiated.

The integral rating obtained as a result of the author’s approach is compared with the ratings of leading rating agencies. In contrast to existing approaches, the author’s approach enables a detailed and objective rating assessment of the current state and prospects of business development to be obtained without the need to bring the initial indicators to a comparable form, and without conducting additional research to assess the weight of the coefficients used in the analysis. The proposed approach makes it possible to build a rating based on a hierarchical procedure and an algorithm for ranking companies according to three indicators of financial and economic activity, which, according to the author, it is advisable to use when making investment decisions relating to assessment of the prospects for the development of the most important sectors of the country’s energy economy, and programs for managing the competitiveness of the energy business.