Tailored Blockchain Applications for the Natural Gas Industry: The Case Study of SOCAR

Abstract

:1. Introduction

- -

- conventional infrastructure challenges and limitations in monitoring, operating, and maintaining a large number of assets,

- -

- gas price volatilities,

- -

- gas stock tracking issues,

- -

- dependency on third parties for financial transactions and gas exploration.

- -

- prioritization of application areas of blockchain, based on the requirements or desires of The State Oil Company of the Azerbaijan Republic (SOCAR) operations,

- -

- the lack of clarity regarding the suitable blockchain solutions that would best fit natural gas sector applications.

2. Literature Review

2.1. Blockchain Types, Consensus Mechanisms, Risks, and Natural Gas Industry Applications

2.1.1. Blockchain Types

2.1.2. Consensus Mechanisms

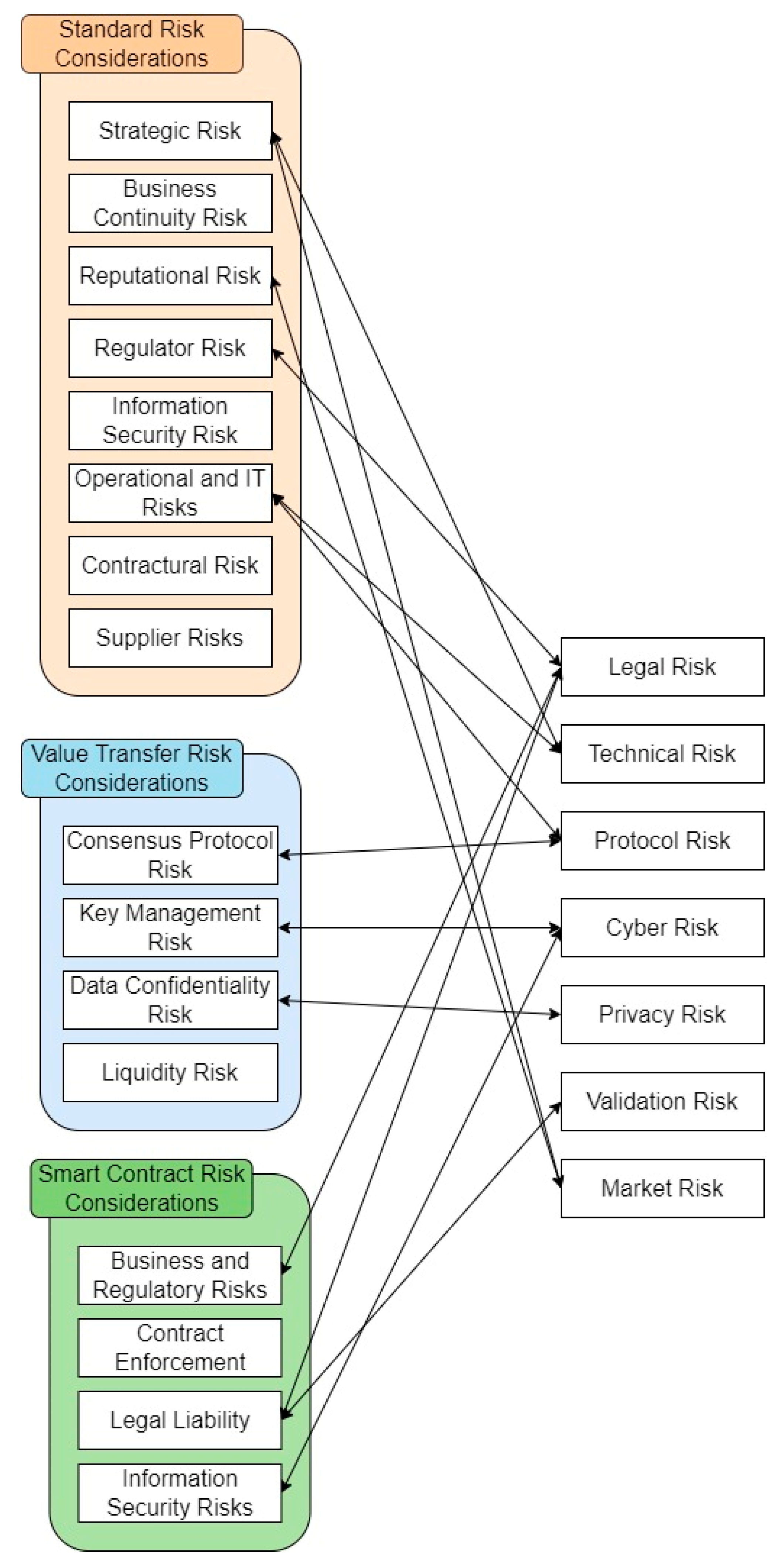

2.1.3. Risks

2.1.4. Potential Applications in the Natural Gas Industry

2.2. Related Work

- -

- prioritizing the prominent application areas of blockchain for SOCAR operations,

- -

- identifying the requirements for each use case,

- -

- and determining suitable blockchain types and consensus mechanisms specific to each application, as well as considering the operational performance, costs, and risks.

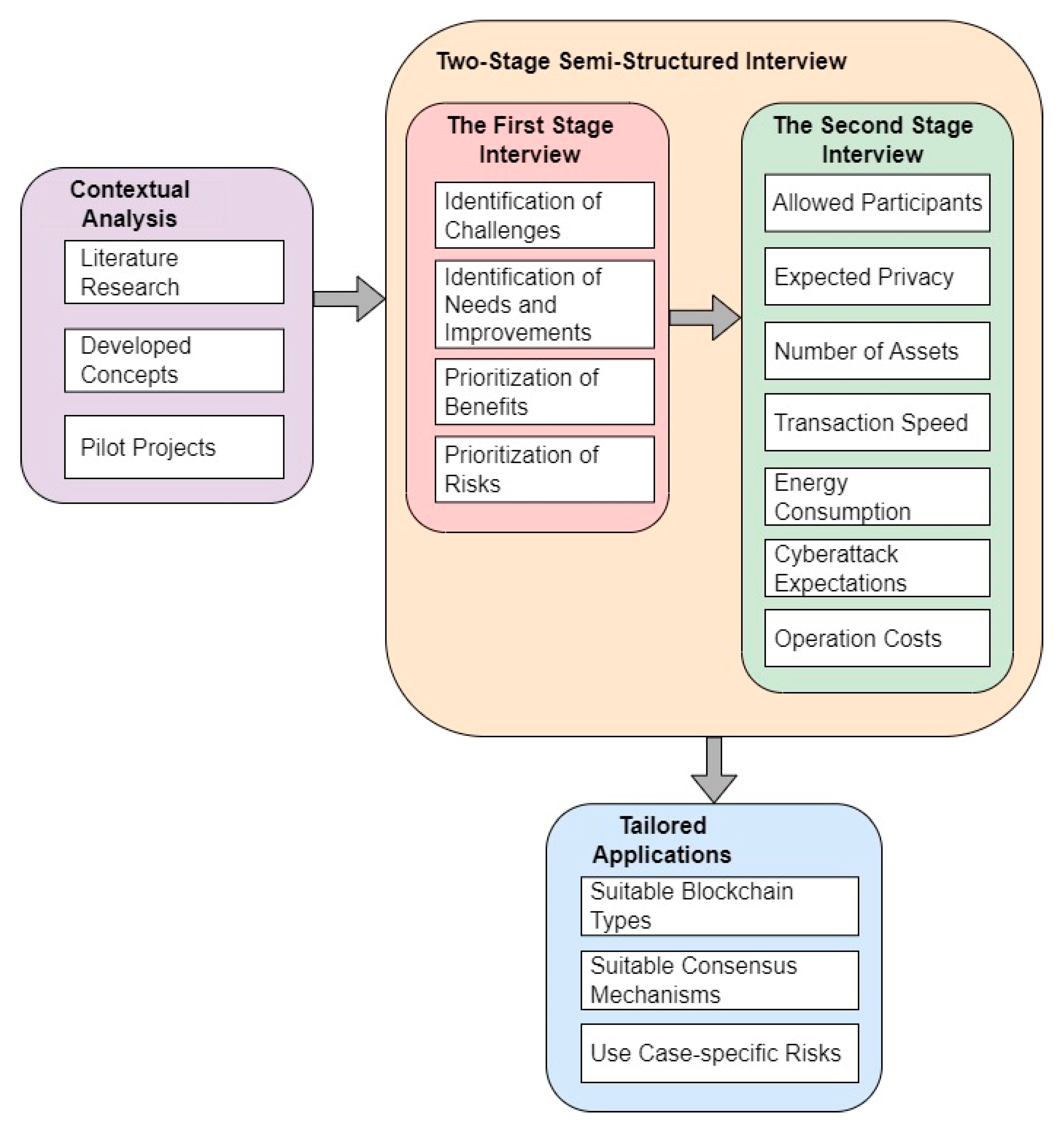

3. Methodology

- -

- identify the primary areas of use with the most urgent need or the highest potential benefits in applying blockchains,

- -

- determine the operational performance, cost, and other related requirements specific to each prioritized area of application,

- -

- tailor the most suitable blockchain solution for each identified area of use, including consensus mechanisms and considering the associated risks.

- -

- the occurrence and importance of the challenges, which can be addressed by blockchain applications, encountered in the company’s operations and processes,

- -

- the importance of the needs and potential improvements that can be achieved in the company’s operations and processes,

- -

- the sensitivities of the company’s financial operations and processes to different factors,

- -

- the importance of the potential benefits of blockchain applications for the company’s operations and processes, from the perspective of the executives,

- -

- the priority of the potential blockchain applications in the natural gas industry, from the perspective of the company’s executives,

- -

- the importance of the data that could be collected through blockchain for the company’s operations and processes,

- -

- the importance of the risks (based on the content provided in Section 2.1.3) associated with blockchain applications for the company’s operations and processes.

- -

- the network participants that will be allowed to access and view the data collected for each primary blockchain area of use identified by the company executives in the first stage of the interview,

- -

- the network participants that will be allowed to hold distributed ledger records, even those not authorized to access the information available in the records, to increase the number of copies for enhanced security for each primary blockchain area of use identified in the first stage of the interview,

- -

- the need for pseudonymity of the network participants that will hold distributed ledger records for each primary area of use identified by the company executives,

- -

- the number of assets or nodes that will be monitored, provide information to the system, and communicate with others for each identified primary area of use,

- -

- the number of transactions per second (TPS) and the transaction speed that will be needed for each identified primary area of use,

- -

- any energy consumption-related expectations of the blockchain application for each identified area of use,

- -

- the risk of being targeted by cyberattacks of the blockchain application for each identified area of use (as part of the risk considerations explained in Section 2.1.3),

- -

- the relative operational cost expectations of blockchain applications for each identified area of use.

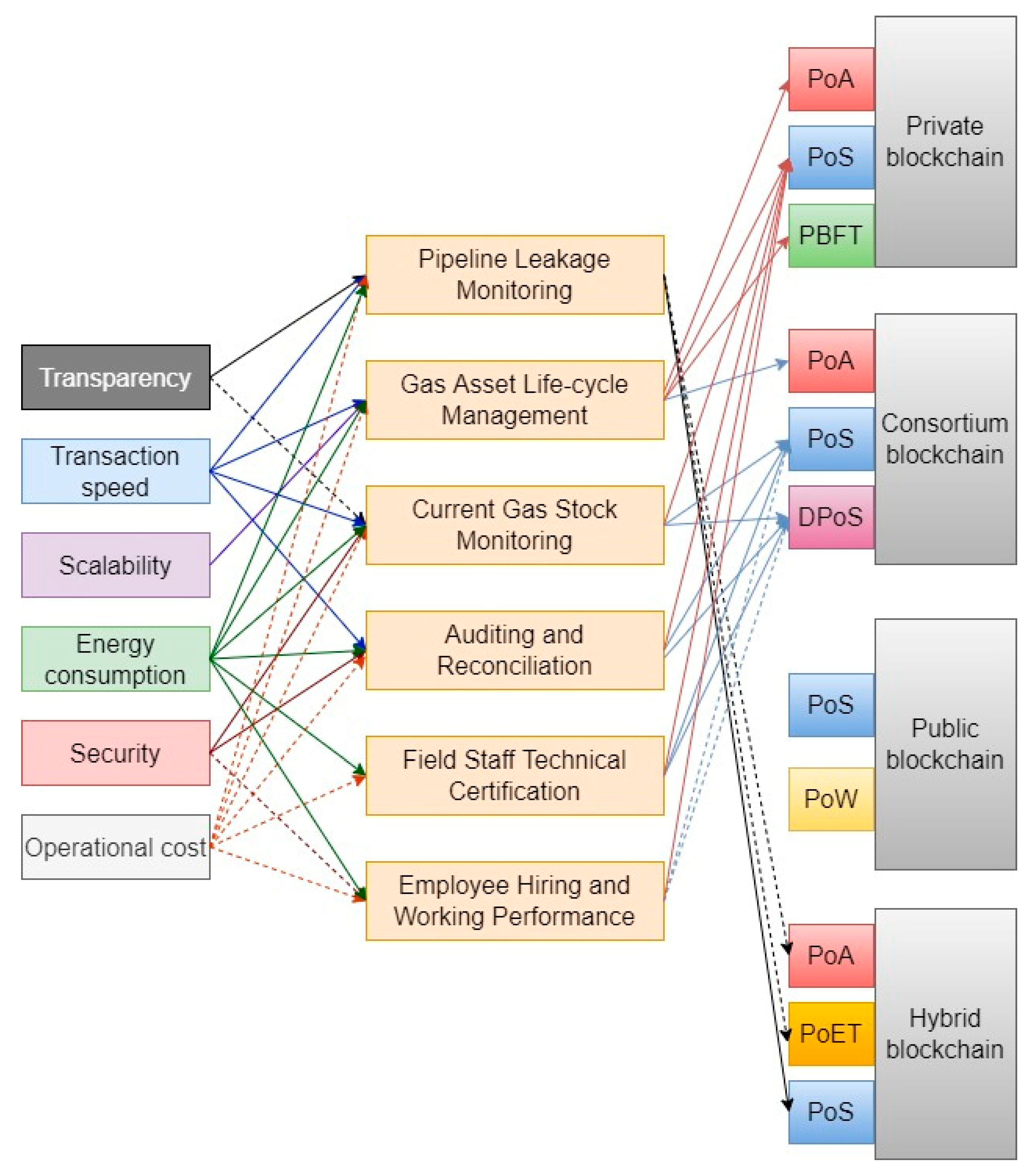

4. Case Study

- -

- pipeline leakage monitoring

- -

- gas asset life-cycle management,

- -

- current gas stock monitoring,

- -

- auditing of reconciliation,

- -

- field technical staff certification,

- -

- employee hiring and working performance.

5. Discussion and Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- International Energy Agency. Natural Gas Information: Overview. 2021. Available online: https://www.iea.org/reports/natural-gas-information-overview/production (accessed on 17 February 2022).

- International Energy Agency. Electricity Information: Overview-Electricity Production. 2021. Available online: https://www.iea.org/reports/electricity-information-overview/electricity-production (accessed on 17 February 2022).

- Miao, Y.; Zhou, M.; Ghoneim, A. Blockchain and AI-based natural gas industrial IoT system: Architecture and design issues. IEEE Netw. 2020, 34, 84–90. [Google Scholar] [CrossRef]

- IBM. Blockchain can Help Transform Supply Chain Networks in the Chemicals and Petroleum Industry. 2018. Available online: https://www.ibm.com/downloads/cas/B4OYMO5Q (accessed on 12 April 2022).

- Bazaee, G.; Hassani, M.; Shahmansouri, A. Identifying Blockchain Technology Maturity’s Levels in the Oil and Gas Industry. Pet. Bus. Rev. 2020, 4, 43–61. [Google Scholar]

- Gartner. Hype Cycle for Blockchain Business Shows Blockchain Will Have a Transformational Impact a Cross Industries in Five to 10 Years. 2019. Available online: https://www.gartner.com/en/newsroom/press-releases/2019-09-12-gartner-2019-hype-cycle-for-blockchain-business-shows (accessed on 17 February 2022).

- World Economic Forum. Digital Transformation Initiative: Oil and Gas Industry. 2017. Available online: https://reports.weforum.org/digital-transformation/wp-content/blogs.dir/94/mp/files/pages/files/dti-oil-and-gas-industry-white-paper.pdf (accessed on 9 August 2022).

- Zehir, S.; Zehir, M. Internet of things in blockchain ecosystem from organizational and business management perspectives. In Digital Business Strategies in Blockchain Ecosystems; Springer: Cham, Switzerland, 2020; pp. 47–62. [Google Scholar]

- Brookbanks, M.; Parry, G. The impact of a blockchain platform on trust in established relationships: A case study of wine supply chains. Supply Chain Manag. Int. J. 2022, 27, 128–146. [Google Scholar] [CrossRef]

- Aslam, J.; Saleem, A.; Khan, N.T.; Kim, Y.B. Factors influencing blockchain adoption in supply chain management practices: A study based on the oil industry. J. Innov. Knowl. 2021, 6, 124–134. [Google Scholar] [CrossRef]

- Karger, E.; Jagals, M.; Ahlemann, F. Blockchain for Smart Mobility—Literature Review and Future Research Agenda. Sustainability 2021, 13, 13268. [Google Scholar] [CrossRef]

- Gimenez-Aguilar, M.; De Fuentes, J.M.; Gonzalez-Manzano, L.; Arroyo, D. Achieving cybersecurity in blockchain-based systems: A survey. Future Gener. Comput. Syst. 2021, 124, 91–118. [Google Scholar] [CrossRef]

- Wang, Q.; Li, R.; Zhan, L. Blockchain technology in the energy sector: From basic research to real world applications. Comput. Sci. Rev. 2021, 39, 100362. [Google Scholar] [CrossRef]

- Górski, T. Towards Continuous Deployment for Blockchain. Appl. Sci. 2021, 11, 11745. [Google Scholar] [CrossRef]

- IBM. Blockchain. 2022. Available online: https://www.ibm.com/topics/what-is-blockchain (accessed on 21 April 2022).

- Xu, X.; Weber, I.; Staples, M. Architecture for Blockchain Applications; Springer: Cham, Switzerland, 2019; pp. 1–307. [Google Scholar]

- Górski, T. Reconfigurable Smart Contracts for Renewable Energy Exchange with Re-Use of Verification Rules. Appl. Sci. 2022, 12, 5339. [Google Scholar] [CrossRef]

- Huang, S.; Wang, G.; Yan, Y.; Fang, X. Blockchain-based data management for digital twin of product. J. Manuf. Syst. 2020, 54, 361–371. [Google Scholar] [CrossRef]

- Schmidt, C.G.; Wagner, S.M. Blockchain and supply chain relations: A transaction cost theory perspective. J. Purch. Supply Manag. 2019, 25, 100552. [Google Scholar] [CrossRef]

- Liu, L.; Tsai, W.T.; Bhuiyan, M.Z.A.; Peng, H.; Liu, M. Blockchain-enabled fraud discovery through abnormal smart contract detection on Ethereum. Future Gener. Comput. Syst. 2022, 128, 158–166. [Google Scholar] [CrossRef]

- Xu, J.; Liu, H.; Han, Q. Blockchain technology and smart contract for civil structural health monitoring system. Comput.-Aided Civ. Infrastruct. Eng. 2021, 36, 1288–1305. [Google Scholar] [CrossRef]

- Business Wire. U.S. Blockchain Consortium Launches to Lead Blockchain Adoption in the Oil and Gas Industry. 2019. Available online: https://www.businesswire.com/news/home/20190226005320/en/U.S.-Blockchain-Consortium-Launches-to-Lead-Blockchain-Adoption-in-the-Oil-and-Gas-Industry (accessed on 20 March 2022).

- Blockchain for Energy. Use Cases. 2022. Available online: https://www.blockchainforenergy.net/use-cases-1 (accessed on 21 March 2022).

- Zhao, F.; Chan, W.K.V. When Is Blockchain Worth It? A Case Study of Carbon Trading. Energies 2020, 13, 1980. [Google Scholar] [CrossRef]

- Ahmad, R.W.; Salah, K.; Jayaraman, R.; Yaqoob, I.; Omar, M. Blockchain in oil and gas industry: Applications, challenges, and future trends. Technol. Soc. 2022, 68, 101941. [Google Scholar] [CrossRef]

- Forbes. Where Blockchain Technology Can Disrupt the Oil and Gas Industry. 2022. Available online: https://www.forbes.com/sites/forbesbusinesscouncil/2021/09/27/where-blockchain-technology-can-disrupt-the-oil-and-gas-industry/?sh=2185e78714ab (accessed on 12 April 2022).

- Deloitte. Is Blockchain’s Future in Oil and Gas Transformative or Transient? 2017. Available online: https://www2.deloitte.com/content/dam/Deloitte/de/Documents/energy-resources/gx-blockchain-report-future-in-oil-and-gas.pdf (accessed on 14 April 2022).

- Lu, H.; Huang, K.; Azimi, M.; Guo, L. Blockchain technology in the oil and gas industry: A review of applications, opportunities, challenges, and risks. IEEE Access 2019, 7, 41426–41444. [Google Scholar] [CrossRef]

- Miao, Y.; Song, J.; Wang, H.; Hu, L.; Hassan, M.M.; Chen, M. Smart Micro-GaS: A cognitive micro natural gas industrial ecosystem based on mixed blockchain and edge computing. IEEE Internet Things J. 2020, 8, 2289–2299. [Google Scholar] [CrossRef]

- Xiao, W.; Liu, C.; Wang, H.; Zhou, M.; Hossain, M.S.; Alrashoud, M.; Muhammad, G. Blockchain for secure-GaS: Blockchain-powered secure natural gas IoT system with AI-enabled gas prediction and transaction in smart city. IEEE Internet Things J. 2020, 8, 6305–6312. [Google Scholar] [CrossRef]

- Blockchain Research Institute. Oil, Natural Gas, and Blockchain. 2020. Available online: https://www.blockchainresearchinstitute.org/project/oil-natural-gas-and-blockchain/ (accessed on 11 April 2022).

- Lyridis, D.V.; Andreadis, G.O.; Papaleonidas, C.; Tsiampa, V. A novel methodology using BPM to assess the implementation of blockchain in the midstream LNG supply chain. In Proceedings of the 2021 World of Shipping Portugal, Porto, Portugal, 28–29 January 2021; pp. 1–19. [Google Scholar]

- Li, M.; Lal, C.; Conti, M.; Hu, D. LEChain: A blockchain-based lawful evidence management scheme for digital forensics. Future Gener. Comput. Syst. 2021, 115, 406–420. [Google Scholar] [CrossRef]

- Albrecht, S.; Reichert, S.; Schmid, J.; Strüker, J.; Neumann, D.; Fridgen, G. Dynamics of Blockchain Implementation—A Case Study from the Energy Sector. In Proceedings of the 51st Hawaii International Conference on System Sciences, Hilton Waikoloa Village, HI, USA, 3–6 January 2018; pp. 1–10. [Google Scholar]

- Le, T.V.; Hsu, C.L.; Chen, W.X. A Hybrid Blockchain-Based Log Management Scheme with Non-Repudiation for Smart Grids. IEEE Trans. Ind. Inform. 2021, 18, 5771–5782. [Google Scholar] [CrossRef]

- Kirli, D.; Couraud, B.; Robu, V.; Salgado-Bravo, M.; Norbu, S.; Andoni, M.; Kiprakis, A. Smart contracts in energy systems: A systematic review of fundamental approaches and implementations. Renew. Sustain. Energy Rev. 2022, 158, 112013. [Google Scholar] [CrossRef]

- Oyinloye, D.P.; Teh, J.S.; Jamil, N.; Alawida, M. Blockchain consensus: An overview of alternative protocols. Symmetry 2021, 13, 1363. [Google Scholar] [CrossRef]

- Manolache, M.A.; Manolache, S.; Tapus, N. Decision Making using the Blockchain Proof of Authority Consensus. Procedia Comput. Sci. 2022, 199, 580–588. [Google Scholar] [CrossRef]

- Hu, X.; Zheng, Y.; Su, Y.; Guo, R. IoT Adaptive Dynamic Blockchain Networking Method Based on Discrete Heartbeat Signals. Sensors 2020, 20, 6503. [Google Scholar] [CrossRef] [PubMed]

- Kaur, S.; Chaturvedi, S.; Sharma, A.; Kar, J. A research survey on applications of consensus protocols in blockchain. Secur. Commun. Netw. 2021, 2021, 6693731. [Google Scholar] [CrossRef]

- Deloitte. Blockchain Risk Management: Risk Functions Need to Play an Active Role in Shaping Blockchain Strategy. 2017. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/us-fsi-blockchain-risk-management.pdf (accessed on 20 March 2022).

- Shahin, M.; Babar, M.A.; Zhu, L. Continuous integration, delivery and deployment: A systematic review on approaches, tools, challenges and practices. IEEE Access 2017, 5, 3909–3943. [Google Scholar] [CrossRef]

- Kadry, H. Blockchain applications in midstream oil and gas industry. In Proceedings of the International Petroleum Technology Conference, Dhahran, Saudi Arabia, 13–15 January 2020; OnePetro: Richardson, TX, USA, 2020. [Google Scholar]

- Yan, M.; Gan, W.; Zhou, Y.; Wen, J.; Yao, W. Projection method for blockchain-enabled non-iterative decentralized management in integrated natural gas-electric systems and its application in digital twin modelling. Appl. Energy 2022, 311, 118645. [Google Scholar] [CrossRef]

- Mamedov, Z.F.; Qurbanov, S.H.; Streltsova, E.; Borodin, A.; Yakovenko, I.; Aliev, A. Mathematical models for assessing the investment attractiveness of oil companies. SOCAR Proc. 2021, 4, 102–114. [Google Scholar] [CrossRef]

- Borodin, A.; Panaedova, G.; Frumina, S.; Kairbekuly, A.; Shchegolevatykh, N. Modeling the Business Environment of an Energy Holding in the Formation of a Financial Strategy. Energies 2021, 14, 8107. [Google Scholar] [CrossRef]

- Fedorova, E.; Lapshina, N.; Borodin, A.; Lazarev, M. Impact of information in press releases on the financial performance of Russian companies. Ekon. Polit. 2021, 16, 138–157. [Google Scholar] [CrossRef]

- SOCAR. History of SOCAR. 2022. Available online: https://socar.az/socar/en/company/about-socar/history-of-socar (accessed on 18 March 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zehir, C.; Zehir, M.; Borodin, A.; Mamedov, Z.F.; Qurbanov, S. Tailored Blockchain Applications for the Natural Gas Industry: The Case Study of SOCAR. Energies 2022, 15, 6010. https://doi.org/10.3390/en15166010

Zehir C, Zehir M, Borodin A, Mamedov ZF, Qurbanov S. Tailored Blockchain Applications for the Natural Gas Industry: The Case Study of SOCAR. Energies. 2022; 15(16):6010. https://doi.org/10.3390/en15166010

Chicago/Turabian StyleZehir, Cemal, Melike Zehir, Alex Borodin, Zahid Farrukh Mamedov, and Sadiq Qurbanov. 2022. "Tailored Blockchain Applications for the Natural Gas Industry: The Case Study of SOCAR" Energies 15, no. 16: 6010. https://doi.org/10.3390/en15166010

APA StyleZehir, C., Zehir, M., Borodin, A., Mamedov, Z. F., & Qurbanov, S. (2022). Tailored Blockchain Applications for the Natural Gas Industry: The Case Study of SOCAR. Energies, 15(16), 6010. https://doi.org/10.3390/en15166010