Labour Productivity as a Factor of Tangible Investment in Companies Producing Wind Energy Components and Its Impacts: Case of Lithuania

Abstract

1. Introduction

2. Literature Review

2.1. Concept of Labour Productivity

2.2. Impacts of Labour Productivity

2.3. Drivers of Growth in Labour Productivity

2.3.1. Human Capital

2.3.2. Capital Intensity

2.4. Factors of Slow down in Labour Productivity

2.5. Policies and Strategies for Growth in Labour Productivity

3. Research Method

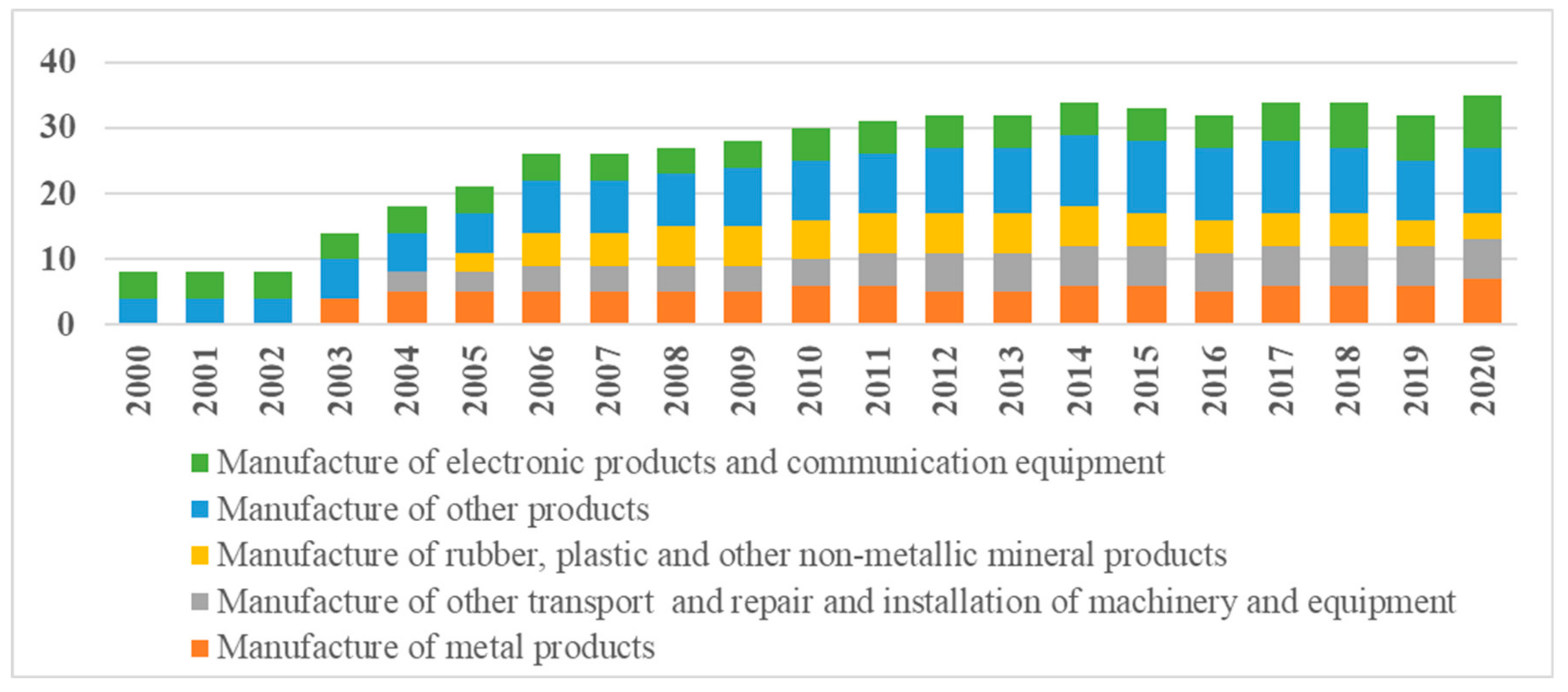

- Manufacture of metal products;

- Manufacture of rubber, plastic and other non-metallic mineral products;

- Manufacture of electronic products and communication equipment

- Manufacture of other transport and repair and installation of machinery and equipment;

- Manufacture of other products.

- Firstly, a review of EU and Lithuanian legislation was performed. Its results allowed justifying the increasing demand of economic activities performed by the WEC companies in the country.

- Secondly, the current status of the WEC companies was analysed. The business structure and finance analysis method were used to disclose the structure and scale of manufacturing activities of WEC companies in terms of VA created, persons employed and hours worked, investments made and profits (losses) earned.

- Thirdly, assumptions of WEC companies’ development were determined considering the Lithuanian Economic Development Scenario prepared by the Ministry of Finance of the Republic of Lithuania [73] and the publication of [74]. These important sources of information were used to understand the changes in LP and employment in the future. Furthermore, data were compared corresponding to the average values of WEC companies. Then, decisions were taken about assumptions for the perspective analysis of WEC companies’ development. Particularly, the Index of Prices of Sold Manufactured Products (2000 = 100%) provided by Lithuania Statistics [75] was applied to eliminate the impacts of price changes on nominal values of different indicators.

- Fourthly, the relationship between LP and investment in TA was determined, as the paper focuses on the impact of LP as a factor of investment on economic performance in terms of VA created by WEC companies. For that purpose, the ratio of change in LP to investment in TA was calculated. It showed the scale 1000 EUR of investment in TA per employee makes on a change in LP of that employee. The indicator was used to draw a curve showing the relationship between the demand of investment requested to achieve the expected value of LP.

- Fifthly, the logical economical reasoning and interdependence as a strategy was used in making forecasts of economic performance of the WEC companies with a focus on the impact of changes in LP. In detail, the number of employees was calculated based on:

4. Results

4.1. Analysis of Economic Performance of WEC Companies

4.2. Role of Real Investment in TA for Improvement in LP in Companies Manufacturing WEC

4.2.1. Ratio of Change in Labour Productivity to Investment in Tangible Assets

4.2.2. Curve of Labour Productivity to Tangible Investment

4.2.3. Expected Demand for Investment in Tangible Assets

4.2.4. Expected Development of Labour Productivity till 2030

4.3. Expected Impacts of Improvement in Labour Productivity of WEC Companies

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Our World in Data. Available online: https://ourworldindata.org/ (accessed on 5 January 2022).

- BloombergNEF. Wind Energy Is the Cheapest Source of Electricity Generation. 2019. Available online: https://windeurope.org/policy/topics/economics/ (accessed on 5 January 2022).

- IRENA. Wind Summary Charts: Typical Onshore Wind Farm Installed Cost Breakdown. 2020. Available online: https://www.irena.org/costs/Charts/Wind (accessed on 5 January 2022).

- Submission by Latvia and the European Commission on Behalf of the European Union and its Member States. Intended Nationally Determined Contribution of the EU and its Member States. 2015. Available online: https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/Lithuania%20First/LV-03-06-EU%20INDC.pdf (accessed on 5 January 2022).

- Submission by Croatia and the European Commission on behalf of the European Union and its Member States. Long-Term Low Greenhouse Gas Emission Development Strategy of the European Union and Its Member States. 2020. Available online: https://unfccc.int/sites/default/files/resource/HR-03-06-2020%20EU%20Submission%20on%20Long%20term%20strategy.pdf (accessed on 5 January 2022).

- Europos Komisija. Europos Įmonių Parengimas Ateičiai. Nauja Pasaulyje Konkurencingos, Žaliosios ir Skaitmeninės Europos Pramonės Strategija. 2020a. Available online: https://ec.europa.eu/commission/presscorner/detail/lt/ip_20_416 (accessed on 5 January 2022).

- Europos Komisija. Žiedinės Ekonomikos Veiksmų Planas. 2020. Available online: https://ec.europa.eu/commission/presscorner/detail/lt/ip_20_420 (accessed on 5 January 2022).

- Europos Komisija. Jūrų Atsinaujinančiųjų Išteklių Energijos Strategija. 2020. Available online: https://ec.europa.eu/commission/presscorner/detail/lt/ip_20_2096 (accessed on 5 January 2022).

- National Energy and Climate Action Plan of the republic of Lithuania for 2021–2030. Available online: https://ec.europa.eu/energy/sites/ener/files/documents/lt_final_necp_main_en.pdf (accessed on 5 January 2022).

- LITGRID. Development of the Lithuanian Electric Power System and Transmission Grids. 2014. Available online: http://www.leea.lt/wp-content/uploads/2015/05/Network-development-plan-2015.pdf (accessed on 17 January 2022).

- Grzegorzewska, E.; Biernacka, J.; Podobas, I. Trends in employment and labour productivity in the woodworking industry in selected EU countries. Ann. Wars. Univ. Life Sci.-SGGW For. Wood Technol. 2019, 108, 111–118. Available online: https://www.semanticscholar.org/paper/Trends-in-employment-and-labour-productivity-in-the-Grzegorzewska-Biernacka/f5d6f88edd35dd49580f42bf1ab9c520cf4d016d (accessed on 15 January 2022). [CrossRef]

- Gradzewicz, M. Capital Investment Versus Labour Productivity: Evidence from Poland. 26 March 2020. Available online: https://voxeu.org/article/capital-investment-versus-labour-productivity (accessed on 15 January 2022).

- Stundziene, A.; Baliute, A. Link between Tangible Investment Rate and Labour Productivity in the European Manufacturing Industry. Panoeconomicus 2021, 1–29. Available online: https://panoeconomicus.org/index.php/jorunal/article/view/1557/674 (accessed on 15 March 2022). [CrossRef]

- Freeman, R. Labour Productivity Indicators. OECD Statistics Directorate: 2008. p. 94. Available online: https://www.oecd.org/sdd/productivity-stats/40605524.pdf (accessed on 17 January 2022).

- Frankel, M.; Kendrick, J.W. Productivity. Encyclopedia Britannica. 2014. Available online: https://www.britannica.com/topic/productivity (accessed on 15 March 2022).

- Singh, M.K. Labour Productivity in Indian Industry; Ankur Composer at Sunil Printers: New Deli, India, 1989. [Google Scholar]

- Albirizio, S.; Nicoletti, G. Boosting Productivity: A Framework for Analysis and a Checklist for Policy. 2016, p. 35. Available online: https://www.oecd.org/global-forum-productivity/events/Boosting%20Productivity.pdf (accessed on 17 January 2022).

- Eurostat. Productivity Trends Using Key National Accounts Indicators. 2022. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Productivity_trends_using_key_national_accounts_indicators#Decomposition_of_key_labour_productivity_indicators_into_periods (accessed on 17 January 2022).

- OECD. Multifactor Productivity. Available online: https://data.oecd.org/lprdty/multifactor-productivity.htm (accessed on 17 January 2022).

- Tangen, S. Demystifying Productivity and Performance. Int. J. Product. Perform. Manag. 2005, 54, 34–46. [Google Scholar] [CrossRef]

- Saari, S. Productivity. Theory and Measurement in Business. European Productivity Conference, Espoo. 2006. Available online: http://www.mido.fi/Index_tiedostot/Productivity%202006_tiedostot/Productivity_EPC2006_Saari.pdf (accessed on 15 March 2022).

- Ross, S. Why Is Productivity Important in Economics? Investopedia. 2021. Available online: https://www.investopedia.com/ask/answers/040615/why-productivity-important-concept-economics.asp (accessed on 14 March 2022).

- Gomez-Salvador, R.; Musso, A.; Stocker, M.; Turunen, J. Labour Productivity Developments in the Euro Area. Occosional Paper Series. European Central Bank. 2006. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=923369 (accessed on 15 March 2022).

- Ark, B.; Monnikhof, E. Productivity and Unit Labour Cost Comparisons. International Labour Organization. 2000. Available online: https://www.ilo.org/wcmsp5/groups/public/---ed_emp/documents/publication/wcms_142286.pdf (accessed on 14 March 2022).

- Mahmud, M.; Rashid, A. Labor Productivity and Economic Growth, What Causes What: An Empircal Analysis. IBT J. Bus. Stud. (JBS) 2006, 2, 69–81. Available online: https://www.researchgate.net/publication/4737262_Labor_Productivity_and_Economic_Growth_What_Causes_What_An_Empirical_Analysis (accessed on 23 April 2022).

- Dong, N.T.; Diem, T.T.A.; Chinh, B.T.H.; Hien, N.T.D. The Interaction between Labor Productivity and Competitiveness in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 619–627. [Google Scholar] [CrossRef]

- Auzina-Emsina, A. Labour productivity, economic growth and global competitiveness in post-crisis period. Procedia-Soc. Behav. Sci. 2014, 156, 317–321. [Google Scholar] [CrossRef]

- Nolan, P.; Reece, P.; Guanyu, Z. Productivity by the Numbers: 2019. New Zealand Productivity Commission. 2019. Available online: www.productivity.govt.nz (accessed on 23 April 2022).

- Bagley, S. How to Calculate Productivity of Labour. 2010. Available online: http://worldwidescience.org/topicpages/l/labor+productivity.html (accessed on 14 March 2022).

- Reserve Bank of Australia. Explainers: Productivity: 2022. Available online: https://www.rba.gov.au/education/resources/explainers/productivity.html (accessed on 14 March 2022).

- New Zeeland Productivity Commission. Poor Productivity Hurts Living Standards. 2019. Available online: https://www.productivity.govt.nz/news/poor-productivity-hurts-living-standards/ (accessed on 23 April 2022).

- Korkmaz, S.; Korkmaz, O. The Relationship between Labor Productivity and Economic Growth in OECD Countries. Int. J. Econ. Financ. 2017, 9, 71. [Google Scholar] [CrossRef]

- Jasperson, H.D. What Is Labor Productivity? Investopedia. 2020. Available online: https://www.investopedia.com/terms/l/labor-productivity.asp (accessed on 28 March 2022).

- Levanon, G.; Tait, K. Twenty Year View of Labor Productivity in Advanced Countries. The Conference Board. 2013. Available online: https://www.conference-board.org/blog/postdetail.cfm?post=1426&blogid=7 (accessed on 28 March 2022).

- Tang, J.; MacLeod, C. Labour Force Ageing and Productivity Performance in Canada. Can. J. Econ. 2006, 39, 582–603. [Google Scholar] [CrossRef]

- Jorgenson, D.; Vu, K. Technology and Labor Productivity. Development Outreach. World Bank. 2011. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/6101/deor_13_1_45.pdf?sequence=1&isAllowed=y (accessed on 23 April 2022).

- Benos, N.; Zotou, S. Education and economic growth: A meta-regression analysis. World Dev. 2014, 64, 669–689. [Google Scholar] [CrossRef]

- Goldin, C. Human capital. In Handbook of Cliometrics; Diebolt, C., Haupert, M., Eds.; Springer: Berlin/Heidelberg, Germany, 2016; pp. 55–86. [Google Scholar]

- Shafuda, C.P.P.; De, U.K. Government Expenditure on Human Capital and Growth in Namibia: A Time Series Analysis. J. Econ. Struct. 2020, 9, 1–14. Available online: https://doi.org/10.1186/s40008-020-00196-3 (accessed on 23 April 2022). [CrossRef]

- MacLeod, W.B. Viewpoint: The human capital approach to inference. Can. J. Econ. 2017, 5, 5–39. [Google Scholar] [CrossRef]

- Baharin, R.; Aji, R.H.S.; Yussof, I.; Saukani, N.M. Impact of Human Resource Investment on Labor Productivity in Indonesia. Iran. J. Manag. Stud. 2020, 13, 139–164. [Google Scholar]

- Kocourek, A.; Nedomlelová, I. Three levels of education and the economic growth. Appl. Econ. 2018, 50, 2103–2116. [Google Scholar] [CrossRef]

- Nedomlelová, I.; Kocourek, A. Human Capital: Relationship between Education and Labour Productivity in the European Countries. In Proceedings of the 10th International Days of Statistics and Economics, Prague, Czech Republic, 8–10 September 2016; pp. 1315–1324. Available online: https://msed.vse.cz/msed_2016/article/271-Nedomlelova-Iva-paper.pdf (accessed on 28 March 2022).

- Le, N.H.; Duy, L.V.Q.; Ngoc, B.H. Effects of Foreign Direct Investment and Human Capital on Labour Productivity: Evidence from Vietnam. J. Asian Financ. Econ. Bus. 2019, 6, 123–130. [Google Scholar] [CrossRef]

- Katz, A.S.; Pronk, N.P.; Mclellan, D.; Dennerlein, J.; Katz, J.N. Perceived workplace health and safety climates: Associations with worker outcomes and productivity. Am. J. Prev. Med. 2019, 57, 487–494. [Google Scholar] [CrossRef]

- Haapakangas, A.; Hallman, D.M.; Erik, S.; Jahncke, H. Self-rated productivity and employee well-being in activity-based offices: The role of environmental perceptions and workspace use. Build. Environ. 2018, 145, 115–124. [Google Scholar] [CrossRef]

- Amirul, S.R.; Pazim, K.H.; Amirul, S.M.; Mail, R.; Dasan, J. Developing and Validating the Qualitative Labour Productivity Measurement in Service Industry. Qual. Quant. 2021, 251. [Google Scholar] [CrossRef]

- Roth, F. Revisiting Intangible Capital and Labor Productivity Growth, 2000–2015: Accounting for the Crisis and Economic Recovery in the EU. Intangible Capital and Growth. Contrib. Econ. 2020, 21, 17–42. [Google Scholar] [CrossRef]

- Corrado, C.; Haskel, J.; Jona-Lasinio, C.; Iommi, M. Intangible investment in the EU and US before and since the great recession and its contribution to productivity growth. J. Infrastruct. Policy Dev. 2018, 2, 11–36. [Google Scholar] [CrossRef]

- Bini, M.; Nascia, L.; Zeli, A. Industry profiles and economic performances: A firm-data-based study for Italian industries. Statitica Appl.—Ital. J. Appl. Stat. 2014, 23, 331–345. [Google Scholar]

- Heshmati, A.; Rashidghalam, M. Labour Productivity in Kenyan Manufacturing and Service Industries. Determ. Econ. Growth Afr. 2018, 259–286. [Google Scholar]

- Herzog-Stein, A.; Horn, G.A. The productivity puzzle: It’s the lack of investment, stupid! Intereconomics 2018, 53, 69–75. Available online: https://www.intereconomics.eu/contents/year/2018/number/2/article/the-productivity-puzzle-its-the-lack-of-investment-stupid.html (accessed on 23 April 2022). [CrossRef][Green Version]

- Ceccobelli, M.; Gitto, S.; Mancuso, P. ICT capital and labour productivity growth: A non-parametric analysis of 14 OECD countries. Telecommun. Policy 2012, 36, 282–292. [Google Scholar] [CrossRef]

- Roth, F. Intangible Capital and Labour Productivity Growth: A Review of the Literature. Hamburg Discussion Papers in International Economics 2019, No. 4. Available online: https://www.econstor.eu/bitstream/10419/207163/1/hdpie-no04.pdf (accessed on 27 April 2022).

- Alam, A.; Arshad, M.U.; Rajput, W. Relationship of labor productivity, foreign direct investment and economic growth: Evidence from OECD countries. J. Bus. Manag. Sci. 2013, 1, 133–138. Available online: http://pubs.sciepub.com/jbms/1/6/3 (accessed on 28 April 2022).

- Demmou, L.; Stefanescu, I.; Arquie, A. Productivity Growth and Finance: The Role of Intangible Assets—A Sector Level Analysis; OECD Economics Department Working Papers; OECD Publishing: Paris, France, 2019; p. 1547. [Google Scholar] [CrossRef]

- Adarov, A.; Stehrer, R. Tangible and Intangible Assets in the Growth Performance of the EU, Japan and the US. Research Report 2019, No. 442. Available online: https://wiiw.ac.at/tangible-and-intangible-assets-in-the-growth-performance-of-the-eu-japan-and-the-us-dlp-5058.pdf (accessed on 27 April 2022).

- Baldwin, J.R.; Gu, W.; Macdonald, R. Intangible Capital and Productivity Growth in Canada. The Canadian Productivity Review 2012 No. 29. Available online: https://ssrn.com/abstract=2093526 (accessed on 27 April 2022).

- Nakamura, K.; Kaihatsu, S.; Yagi, T. Productivity improvement and economic growth: Lessons from Japan. Econ. Anal. Policy 2019, 62, 57–79. [Google Scholar] [CrossRef]

- Dasgupta, S.; van Maanen, N.; Gosling, S.N.; Piontek, F.; Otto, C.; Schleussner, C.F. Effects of climate change on combined labour productivity and supply: An empirical, multi-model study. Lancet Planet. Health 2021, 5, e455–e465. Available online: https://www.thelancet.com/action/showPdf?pii=S2542-5196%2821%2900170-4 (accessed on 29 April 2022). [CrossRef]

- Gosling, S.N.; Zaherpour, J.; Ibarreta, D. PESETA III: Climate Change Impacts on Labour Productivity. European Commission, Joint Research Centre. 2018. Available online: https://doi.org/10.2760/07911 (accessed on 29 April 2022). [CrossRef]

- Szewczyk, W.; Mongelli, I.; Ciscar, J.C. Heat stress, labour productivity and adaptation in Europe—A regional and occupational analysis. Environ. Res. Lett. 2021, 16, 105002. [Google Scholar] [CrossRef]

- Lisi, D.; Malo, M.A. The impact of temporary employment on productivity. J. Labour Mark. Res. 2017, 50, 91–112. [Google Scholar] [CrossRef]

- Kleinknecht, A.; van Schaik, F.N.; Zhou, H. Is flexible labour good for innovation? Evidence from firm-level data. Camb. J. Econ. 2014, 38, 1207–1219. [Google Scholar] [CrossRef]

- Pariboni, R.; Tridico, P. Structural change, institutions and the dynamics of labor productivity in Europe. J. Evol. Econ. 2020, 30, 1275–1300. [Google Scholar] [CrossRef]

- Neufeind, M.; Priesmeier, C. A New Productivity Strategy for Europe. Bertelsmann Stiftung Inclusive Growth for Europe Policy Paper April 2020. Available online: http://aei.pitt.edu/103237/1/BST_PB_IW_E03lay.pdf (accessed on 17 May 2022).

- Zulu, J.J.; Banda, B.M. The impact of labour productivity on economic growth: The case of Mauritius and South Africa. S. Afr. J. Policy Dev. 2015, 2, 6. Available online: https://scholarship.law.cornell.edu/sajpd/vol2/iss1/6/ (accessed on 17 May 2022).

- Sánchez, P.E.; Benito-Hernández, S. CSR policies: Effects on labour productivity in Spanish micro and small manufacturing companies. J. Bus. Ethics 2015, 128, 705–724. Available online: https://oa.upm.es/29428/2/INVE_MEM_2013_170190.pdf (accessed on 18 May 2022). [CrossRef]

- Bassanini, A.; Venn, D. The Impact of Labour Market Policies on Productivity in OECD Countries. International Productivity Monitor. 1 September 2008. p. 17. Available online: http://www.csls.ca/ipm/17/IPM-17-bassanini.pdf (accessed on 18 May 2022).

- Abramovsky, L.; Bond, S.; Harrison, R.; Simpson, H. Productivity Policy. The Institute of Fiscal Studies. 2005. Available online: https://ifs.org.uk/uploads/publications/bns/05ebn6.pdf (accessed on 17 May 2022).

- Moss, E.; Nunn, R.; Shambaugh, J. The Slowdown in Productivity Growth and Policies That Can Restore It. 2020 June. Available online: https://www.brookings.edu/wp-content/uploads/2020/06/Productivity_Framing_LO_6.16_FINAL.pdf (accessed on 18 May 2022).

- Statistics Lithuania. Available online: https://www.stat.gov.lt/home (accessed on 19 May 2022).

- Ministry of Finance of Republic of Lithuania. Ekonominės Raidos Scenarijus. 2021. Available online: https://finmin.lrv.lt/lt/aktualus-valstybes-finansu-duomenys/ekonomines-raidos-scenarijus (accessed on 31 March 2022).

- Lithuania: Skills Forecasts up to 2025. European Centre for the Development of Vocational Training 2015. Available online: https://www.cedefop.europa.eu/lt/country-reports/lithuania-skills-forecasts-2025 (accessed on 20 May 2022).

- Statistics Lithuania. Available online: https://osp.stat.gov.lt/statistiniu-rodikliu-analize?hash=b11b44cc-e2f3-4241-a923-94f0b70259c2#/ (accessed on 22 May 2022).

- Wind Europe. How to Accelarate Permitting for Wind Energy. WindEurope’s Recommendations to RepowerEU Action Plan. 2022 May. Available online: https://windeurope.org/wp-content/uploads/files/policy/position-papers/20220517-WindEurope-position-paper-Wind-industry-permitting-recommendations.pdf (accessed on 25 June 2022).

- United Nations. Agenda for Sustainable Development. Available online: https://sdgs.un.org/2030agenda (accessed on 25 June 2022).

- Wind Europe. European Wind Energy Supply Strugling, Green Deal at Risk. 2022 February. Available online: https://windeurope.org/wp-content/uploads/files/policy/position-papers/20220222-WindEurope-letter-to-President-von-der-Leyen.pdf (accessed on 25 June 2022).

- Global Wind Turbine Manufacturing Industry Grows, Boosting the Demand of Wind Turbine Components. 22 July 2019. Available online: https://blog.technavio.org/blog/global-wind-turbine-manufacturing-industry (accessed on 24 June 2022).

- Global Wind Energy Council. Wind Turbine Suppliers See Record Year for Deliveries Despite Supply Chain and Market Pressures. 19 May 2022. Available online: https://gwec.net/wind-turbine-suppliers-see-record-year-for-deliveries-despite-supply-chain-and-market-pressures/ (accessed on 24 June 2022).

- Precedence Research. Wind Turbine Market (By Axis: Vertical, Horizontal; By Installation: Offshore, Onshore; By Components: Rotator Blade, Generator, Gearbox, Nacelle; By Application: Residential, Utility, Industrial, Commercial; By Capacity: Small, Medium, Large; By Connectivity; By Rating)—Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2022–2030. Available online: https://www.precedenceresearch.com/wind-turbine-market (accessed on 25 June 2022).

- Allied Martket Research. Wind Energy Market by Type (Offshore and Onshore) and End-User (Industrial, Commercial, and Residential): Global Opportunity Analysis and Industry Forecast, 2020–2027. Available online: https://www.alliedmarketresearch.com/wind-energy-market-A10536 (accessed on 25 June 2022).

- Imarcgroup. Wind Turbine Components Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022–2027. Available online: https://www.imarcgroup.com/wind-turbine-components-market (accessed on 25 June 2022).

- The Insight Partners. Wind Turbine Condition Monitoring Market Forecast to 2028—COVID-19 Impact and Global Analysis By Component (Hardware, Software, and Services) and Application (Rotor, Tower, Gearbox, Generator, and Others). 2022 February. Available online: https://www.theinsightpartners.com/reports/wind-turbine-condition-monitoring-market/ (accessed on 25 June 2022).

- Available online: https://www.businessmarketinsights.com/ (accessed on 25 June 2022).

- Panevezio Pletros Agentura. Mazu ir Vidutiniu Imoniu Kompetenciju Poreikio Siekiant Pasiruosti ir Iveikti PRAMONE 4.0 Issukius Analize. 2020. Available online: https://www.esf.lt/data/public/uploads/2020/07/mvi-kompetenciju-poreikio-siekiant-pasiruosti-ir-iveikti-pramone-4.0-iss....pdf (accessed on 25 June 2022).

- Dragašius, E.; Bobinaitė, V.; Čibinskienė, A.; Dumčiuvienė, D.; Jūrėnas, V.; Kavaliauskienė, L.; Marčiukaitis, M.; Krilavičius, T.; Urniežius, R. Lietuvos vėjo energetikos komponentų vertės grandinę formuojančių pramonės įmonių verslo aplinkos, konkurencingumo ir plėtros analizė. Mokslo Studija 2021. Available online: https://ktu.edu/projects/lietuvos-pramones-dalyvavimo-vejo-energetikos-komponentu-vertes-grandineje-galimybiu-tyrimas-vegrand/ (accessed on 25 June 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bobinaite, V.; Konstantinaviciute, I.; Cibinskiene, A.; Dumciuviene, D. Labour Productivity as a Factor of Tangible Investment in Companies Producing Wind Energy Components and Its Impacts: Case of Lithuania. Energies 2022, 15, 4925. https://doi.org/10.3390/en15134925

Bobinaite V, Konstantinaviciute I, Cibinskiene A, Dumciuviene D. Labour Productivity as a Factor of Tangible Investment in Companies Producing Wind Energy Components and Its Impacts: Case of Lithuania. Energies. 2022; 15(13):4925. https://doi.org/10.3390/en15134925

Chicago/Turabian StyleBobinaite, Viktorija, Inga Konstantinaviciute, Akvile Cibinskiene, and Daiva Dumciuviene. 2022. "Labour Productivity as a Factor of Tangible Investment in Companies Producing Wind Energy Components and Its Impacts: Case of Lithuania" Energies 15, no. 13: 4925. https://doi.org/10.3390/en15134925

APA StyleBobinaite, V., Konstantinaviciute, I., Cibinskiene, A., & Dumciuviene, D. (2022). Labour Productivity as a Factor of Tangible Investment in Companies Producing Wind Energy Components and Its Impacts: Case of Lithuania. Energies, 15(13), 4925. https://doi.org/10.3390/en15134925