1. Introduction

Energy use has increased exponentially in the modern era compared to earlier times. Fossil fuel-based energy production is the main contributor to greenhouse gas or carbon dioxide emissions. In recent years, carbon dioxide emissions have increased significantly and are expected to rise in the coming years [

1]. Due to environmental degradation, contemporary environmental issues in emerging and developing economies have taken the lead in debates. This raises concerns about global warming and climate change, mostly caused by greenhouse gas emissions [

2]. These changes are often associated with environmental causes (i.e., volcanic activity, solar radiation, ocean currents, and continental drifts) and direct and indirect human activity, affecting the composition of the global atmosphere and variation in natural climate. However, many scholars have argued that industrialization, global population growth, and increased human activity due to the need to face such changes are the major causes of environmental change [

3,

4].

Furthermore, deforestation for commercial purposes, agriculture, burning of fossil fuels, and changes in land use caused by population growth contribute significantly to greenhouse gas emissions. India is the second-largest CO

2 emitter in emerging economies, and we consider remittances to have a key relationship with CO

2E in India [

5]. However, such significant economic growth programs were traded off with a wide range of environmental distress. Between 2011–2016, per capita CO

2E in South Asia increased by more than 25 percent [

6], while environmental footprint (EFP) increased by almost 20 percent [

7]. Besides this, India, Pakistan, and Bangladesh are the world’s most carbon-polluted countries [

8].

The present empirical research focuses on India for several reasons. Firstly, a study by the global carbon project [

9] shows that India’s CO

2E in 2018 continues to grow at an average of 6.3%. India has the highest CO

2E due to its use of fossil fuels, such as oil (2.9%), gas (6.0%), and coal (7.1%). The same report states that India is the third-largest CO

2-emitting country after the United States and China. Moreover, India is the second-largest coal producer globally and obtains coal by open cast mining [

10]. This leads to health and environmental issues. Natural gas- and oil-based power generation are 25 GW and 48 GW, respectively [

11]. Apart from that, natural gas- and oil-based Power Generation (PG) meet 6% and 19% of India’s electricity power needs. As part of the production process, limited gas exploitation and oil reserves reduce ecological quality.

Therefore, case studies related to fossil fuel use and CO

2E in India are very necessary. The United Nations’ seventh Sustainable Development Goal [

12] calls for a global increase in renewable energy proportions in total energy use profiles to conserve the environment [

13]. As a result, India must increase its investment in renewable energy. In keeping with this, the government of India will have generated 175 GW of renewable energy by 2022. Further research is needed on the impact of such projects on India’s economic development to give concrete shape to the sustainable development agenda. To conclude, according to the IMF WEO [

14], India contributes 3.36 percent of global economic growth (at current exchange rates) and 7.98 percent of global GDP (at constant exchange rates), with a 2.24 percent share of the global population. As a result, pollution-related problems affect a huge portion of the population.

Modern-day production and consumption have given significant impetus to economic development, which is mostly responsible for the economic growth of several countries. However, climate change is the negative element of this persistent human activity. Numerous studies indicate that financial development often contributes to environmental degradation [

15,

16,

17]. The EKC hypothesis proposed by [

18] states that in the early stages of a country’s economic growth, its environmental degradation increases but gradually declines after reaching a certain level of industrialization. In the context of emerging countries, policymakers need to promote a balance between economic growth and environmental protection. Ang [

19] scrutinized the causal links among Carbon dioxide emissions (CO

2E), energy consumption (EC), and GDP for France from 1960 to 2000. The empirical findings revealed a strong long-term nexus between these variables. In terms of causality, the results showed that real GDP causes both ENU and CO

2E in the long term, while a uni-directional causality running from energy consumption to GDP was detected in the short term.

Ajmi and Inglesi-Lotz [

20] investigated the nexus between biomass energy consumption and economic growth for twenty-six OECD countries from 1980–2013. Using the panel VCE model, Granger causality was used to scrutinize the linkage; they discovered the existence of a uni-directional relationship between energy consumption and economic development in the OECD. Bouyghrissi, Berjaoui and Khanniba explained the nexus between financial development and renewable energy consumption in Morocco from 1990–2014 by applying the Granger causality test and ARDL model approach [

21]. Their findings showed a uni-directional causation link between renewable energy consumption and financial development in Morocco. Another study investigated the multidimensional relationship between financial development and urbanization across different income groups from 1991–2014 by using the Granger causality test [

22]. Their findings concluded a uni-directional causal impact of financial development on urbanization in high and higher-middle-income nations.

This study [

23] investigates the causal nexus among energy consumption, economic growth, financial development, trade openness, and CO

2E in India; it was discovered that energy consumption had a long-term positive impact on CO

2E. Similarly, research by [

24,

25] for Pakistan and [

26] for India also confirmed that financial development had long-term negative consequences for the environment. The effects of energy use, income inequality, and financial development on CO

2E in three emerging economies: India, Pakistan, and Bangladesh, were also investigated in [

27,

28]. The conceptual framework for measuring the impact of remittances, foreign direct investment, and energy usage on CO

2 emissions in Asian countries (India, Pakistan, Philippines, Bangladesh and Sri Lanka) was developed in [

29]. In their analysis for Bangladesh, [

30] investigated the causal nexus among energy consumption, GDP, and carbon emissions. The study uses annual data from 1972 to 2011. According to the study, energy consumption positively impacts economic growth, whereas carbon emissions have a negative impact on economic growth.

In Zaidi, S., & Saidi, K; Adebayo, T. S., & Akinsola, G. D [

31,

32] the relationship between renewable energy consumption, non-renewable energy and carbon emissions in Pakistan was scrutinized. They used the ARDL bound to establish long-term association between the variables. The outcome shows that renewable energy consumption does not contribute to carbon emissions, and non-renewable energy contributes to carbon emissions. In [

33], important work was carried out concerning the economic growth–environment relationship. For the first time, the study examined the asymmetric linkage between economic growth and CO

2E. The study examined the time-series dataset gathered from China from 1980 to 2014 to detect the asymmetry between economic growth and carbon emissions using the Nonlinear ARDL model approach. The study’s findings revealed that a positive change in economic growth has a significant impact on CO

2E compared to a negative change.

The main objectives of this research study are to investigate the relationship between GDP, energy use (ENU), population growth (PG), and carbon dioxide emissions (CO

2E) in India. According to several scholars, environmental degradation is caused by non-renewable energy consumption and economic expansion in industrialized countries [

34,

35,

36,

37,

38,

39]. This research study will help bridge the gaps among early research by controlling the model for GDP, ENU, PG, and CO

2E. This study used the VECM and ARDL bounds testing for long-term and short-term nexus between study variables. When the variables are stationary at the level of first-order difference, the VECM and ARDL model can be applied, whereas other cointegration approaches require the same order of integration. The different lags can be used for exogenous and endogenous variables.

3. Results and Discussion

This section describes the summary of the descriptive statistics of the variables before the logarithmic transformation was applied. The study variables after logarithmic transformation are shown in

Figure 1. Population growth decreases consistently, the trend of energy use follows the trend of CO

2 emissions, but there appear to be trend fluctuations in GDP.

Table 2 displays the descriptive statistics and correlation matrix of the variables. While the average value of CO

2E is 0.9591 with a std deviation of 0.4025, the average value of ENU is 13.828 with a std deviation of 8.2352, and the average values of GDP and PG are 6.1539 and 1.7521(with a std deviation of 1.8877 and 0.4127), respectively. The CO

2E and ENU have a long-tail (Positive Skewness), while GDP and PG have a long left-tail (Negative Skewness). Nevertheless, CO

2E, ENU, GDP, and PG indicate a platykurtic distribution since the residuals of the series are normally distributed, according to a Jarque-Bera test. The correlation coefficients matrix is shown in

Table 2. We observe that CO

2E is highly correlated with ENU. Moreover, we note that there is a positive correlation between GDP and ENU. In addition, there is a negative correlation between PG and CO

2E, ENU, and GDP.

The unit root test results of the ADF [

47] and PP [

48] are reported in

Table 3. All the series used in this study are non-stationary at their level. The test results show that the null hypothesis of the unit root for each variable is not rejected at the 5% significance level. Therefore, the test results from the first difference presented in

Table 3 show that the test statistics of the ADF and PP are statistically significant as the corresponding p-value for each test statistic is less than 0.05. Thus, all the series used in this study are I(1).

3.1. Lag Selection for VECM

Following the unit root testing, the next step is to identify the optimal lag for the vector error correction model (VECM). VAR lag order selection criteria are used to select the optimal lag to the test of co-integration in the research analysis.

Table 4 indicates VAR lag order selection criteria. The four lags are employed in this multi-variate model because the sequential modified likelihood ratio test statistic (LR), final prediction error (FRE), Akaike information criterion (AIC), Schwarz information criterion (SIC), and Hannan-Quinn information criterion (HQ) select 4 as the optimal lag shown by “*” in

Table 4.

3.2. Johansen Cointegration Test and VEC Model

This subsection focuses on using the Johansen cointegration test [

45] using the max—eigenvalue and trace methods. The results for unrestricted cointegration rank tests are presented in

Table 5. Using cointegration test specifications, information criteria such as Log_L, AIC, and SIC select linear intercept and trend for the trace and max—eigenvalue tests. The trace and max—eigenvalue tests show two cointegration equations at a 5% significant level, which rejects the null hypothesis of no cointegration among LCO

2E, LGDP, LENU, and LPG.

Table 6 shows the long-term and short-term multi-variate causalities of the error correction model.

Table 6 reveals that the coefficient of the lagged error correction term (ce1 = −0.87) was found to be statistically significant with a negative sign, which shows evidence of long-term equilibrium association running from LENU, LGDP, and LPG to LCO

2E. In addition, there is evidence of short-term equilibrium association running LENU to LCO

2E, LPG to LCO

2E, and LGDP to LCO

2E, which is statistically significant at a 5% level.

The Johansen cointegration method reveals the existence of causality between variables but fails to indicate the direction of the causal relationship. It is realistic to ascertain the causal linkage among LCO

2E, LENU, LGDP, and LPG using the Granger causality test [

49,

50].

Table 7 shows the results of the pairwise Granger causality test using VECM. The null hypotheses that LCO

2E does not Granger cause LENU, LCO

2E does not Granger cause LGDP, LCO

2E does not Granger cause LPG, LGDP does not Granger cause LENU, and LPG does not Granger cause LENU are rejected at a 5% level of significance. In other words, there is bidirectional causality running from LENU to LGDP, and unidirectional causality running from LCO

2E to LENU, LCO

2E to LGDP, LCO

2E to LPG and LPG to LENU. Evidence from joint causality running shows a unidirectional causality from LCO

2E to a joint causality of LENU, LPG, and LGDP; LENU to a joint causality of LCO

2E, LGDP, and LPG; and LGDP to a joint causality of LCO

2E, LENU, and LPG, respectively.

3.3. ARDL Cointegration Test

This study presents the ARDL-bound test cointegration proposed by Pesaran et al. (2001). The ARDL-bound test cointegration is summarised in

Table 8. The bound F-test is performed to establish a cointegration linkage among LCO

2E, LGDP, LENU, and LPG. The outcomes from

Table 8 indicate that the F-statistic lies above the 10%, 5%, 2.5%, and 1% critical values of the upper bound, meaning that the null hypothesis of no cointegration nexus between LCO

2E, LGDP, LENU, and LPG is rejected at 10%, 5%, 2.5%, and 1% significance levels.

The next step is to select an optimal model for long-term equilibrium nexus estimation using the Akaike information criterion (AIC). The ARDL regression estimation is shown in

Table 9. The error correction term (L_CO

2E = −0.70) value is negative and significant at a 5% level, indicating a long-term equilibrium linkage between GDP, ENU, and PG to CO

2E. The long-term (LT) elasticity estimation in

Table 9 shows that the 1% increase in PG in India will increase CO

2E by 1.4%. Though not statistically significant, a 1% rise in GDP in India will raise CO

2E by 0.30%, and a 1% increase in ENU in India will raise CO

2E by 0.63%. The study analyses the joint influence of the explanatory variables (LENU, LGDP, LPG) on CO

2E using a linear test parameter estimate using the individual coefficient. The joint-linear test in

Table 10 demonstrates a short-term (ST) equilibrium linkage between ENU and CO

2E, as well as GDP and CO

2E. The empirical evidence shows that the ENU in India contributes more to CO

2E than GDP in the short-term. According to [

51,

52], as of August 2021, 388,134 GW of the total capacity for power generation in India came from thermal generation with only 234 GM coming from renewable sources. Nevertheless, the energy crisis in India, as an outcome of changes in weather patterns, has led to lower returns from the generation of hydropower, which has become dependent on India’s generation of thermal power (diesel and natural gas). This has led to an increase in CO

2E. Furthermore, 63% of India’s ENU comes from biomass consumption of firewood and charcoal [

51], implying that overexploitation of forests increases CO

2 emissions.

3.4. Diagnostics Test: ARDL and VEC Models

This subsection presents the diagnostics test for ARDL and VEC models.

Table 10 indicates a VECM diagnostic test. The VEC residual normality was tested using the Jarque-Bera [

53] test, based on the null hypothesis that residuals are normally distributed. The test results reveal that the null hypothesis cannot be rejected at a 5% level of significance, meaning that the residuals are normally distributed. The VEC residual serial correlation was tested using the LM test, based on the null hypothesis that no serial correlation exists at lag order h. The results reveal that the null hypothesis cannot be rejected at a 5% level of significance, meaning that no serial correlation exists.

A diagnostic test of the ARDL model is shown in

Table 11. In some ways, the ARDL model was also subjected to several diagnostic tests. The Lagrange multiplier-test for ARCH, Breusch-Pagan-Godfrey LM test for autocorrelation, and Harvey LM test for autocorrelation utilizing powers of the fitted values of D_CO

2E are used in the ARDL diagnostic.

Table 11 demonstrates that the ARCH-test’s null hypothesis of no ARCH effects cannot be rejected at a 5% significant level, meaning that there are no ARCH effects. The Breusch-Pagan-Godfrey LM test for autocorrelation cannot reject the null hypothesis of no serial correlation at the 5% significance level, meaning that the no serial correlation exists at lag order h. The Harvey LM test cannot reject the null hypothesis of constant variance at a 5% significance level, meaning that the residuals of the ARDL model have a constant variance.

3.5. Stability Check: VECM and ARDL

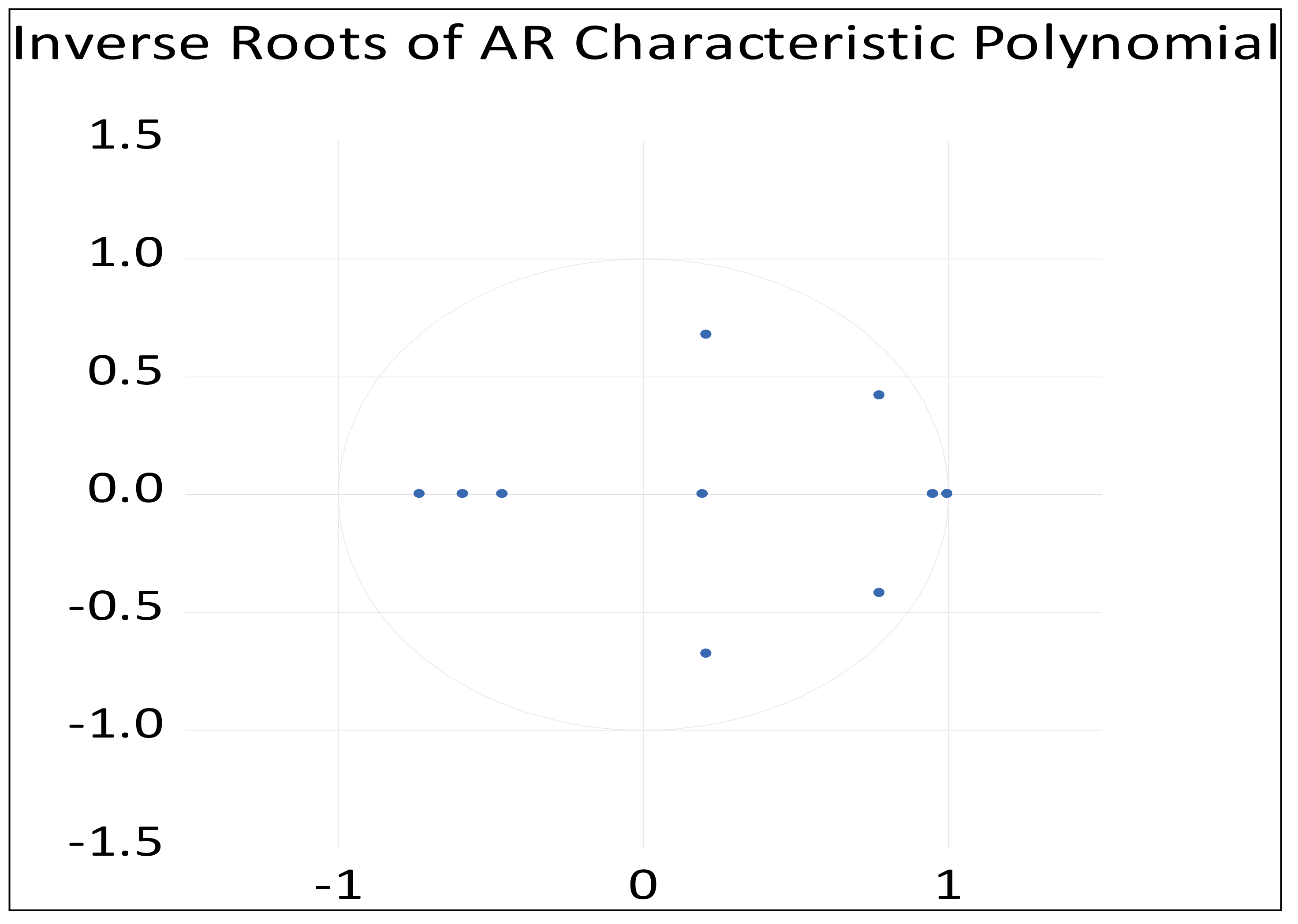

Figure 2 indicates the inverse roots of the characteristic polynomial. The roots characteristic polynomial is used to check the stability of the VECM. The vector error correction specifications impose one unit-root outside the unit circle (Eigen statistics of the respective matrix is exactly one or less); hence, the model satisfies the vector auto-regressive (VAR) stability conditions, and the VECM is acceptable in a statistical sense to make inferences.

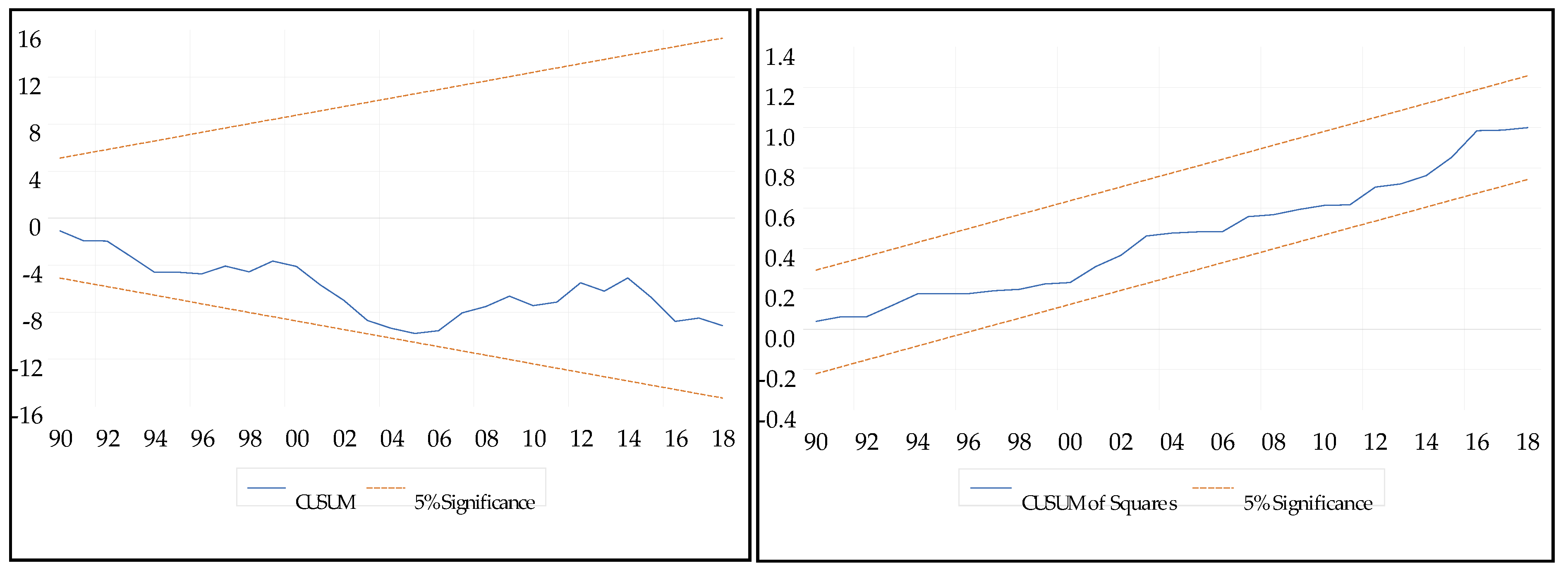

The CUSUM and CUSUMsq test for instability of parameters from the ARDL model is shown in

Figure 3. The CUSUM and CUSUMsq tests are used to ascertain the parameter instability of the equation employed in the autoregressive distributed lag model. The equation parameter is stable enough to estimate the long- and short-term causalities in the ARDL model because the plots in CUSUM and CUSUMsq tests are within the critical bound at the 5% level of significance.

3.6. Variance Decomposition Analysis

The estimated results of the variance decomposition analysis method are presented in

Table 12. The estimated results demonstrated that approximately 58.4% of the future fluctuations in LCO

2E are due to changes in LENU, 2.8% of the future fluctuations in LCO

2E are due to changes in LGDP, and 0.43% of the future fluctuations in LCO

2E are due to changes in LPG. Moreover,

Table 12 indicates that approximately 3.37% of the future fluctuations in LENU are due to changes in LGDP, 9.6% of the future fluctuations in LENU are due to changes in LCO

2E, and 0.96% of the future fluctuations in LENU are due to changes in LPG. In addition, evidence from

Table 12 shows that approximately 19.9% of the future fluctuations in LGDP are due to changes in LCO

2E, 4.95% of the future fluctuations in LGDP are due to changes in LENU, and 3.08% of the future fluctuations in LGDP are due to changes in LPG. Finally, the evidence from

Table 12 shows that approximately 13.67% of the future fluctuations in LPG are due to changes in LCO

2E, 49.81% of the future fluctuations in LPG are due to changes in LENU, and 3.01% of the future fluctuations in LPG are due to changes in LGDP.

4. Conclusion and Policy Recommendations

The study has investigated the causal nexus between carbon dioxide emissions (CO2E), GDP, energy use (ENU), and population growth (PG) in India over the period 1981 to 2018 by comparing VECM and ARDL models. For stationarity analysis of selected variables, we used unit root tests. The ADF and PP unit root tests showed that all the time series variables are stationarity at the first difference I(1). We applied VECM-based Granger causality to analyse the study variable for causal relationships. Furthermore, the study performed variance decomposition (VDC) analysis using the Cholesky method, stability, and diagnostic tests.

The VECM and ARDL models evidence shows that CO2E, ENU, GDP, and PG are cointegrated. There was evidence of bi-directional causality running from ENU to GDP and a uni-directional causality running from ENU, GDP, and PG to CO2E and PG to ENU. Evidence from joint-Granger causality shows a unidirectional causality running from CO2E to a joint of ENU, GDP, and PG; ENU to a joint of CO2E, GDP, and PG; GDP to a joint of CO2E, ENU, and PG, respectively. Moreover, the long-term (LT) elasticities indicate that the 1% increase in PG in India will increase CO2E by 1.4%, a 1% increase in GDP in India will increase CO2E by 0.30%, and a 1% increase in ENU in India will increase CO2E by 0.63%. There was also evidence of a short-term (ST) equilibrium association between ENU and CO2E as well as GDP and CO2E.

The ARDL-bound test cointegration outcomes yield evidence of a long-term equilibrium between CO2E, ENU, GDP, and PG in India. According to the variance decomposition analysis, 58.4% of the future fluctuations in CO2E are due to changes in ENU, 2.8% of the future fluctuations in CO2E are due to changes in GDP, and 0.43% of the future fluctuations in CO2E due to changes in PG. Furthermore, 3.37% of the future fluctuations in ENU are due to changes in GDP, 9.6% of the future fluctuations in ENU are due to changes in CO2E, and 0.96% of the future fluctuations in ENU are due to changes in PG. In addition, 19.9% of the future fluctuations in GDP are due to changes in CO2E, 4.95% of the future fluctuations in GDP are due to changes in ENU, and 3.08% of the future fluctuations in GDP are due to PG. In addition, 3.67% of the future fluctuations in PG are due to changes in CO2E, 49.81% of the future fluctuations in PG are due to changes in ENU, and 3.01% of the future fluctuations in PG are due to changes in GDP.

Based on our study’s findings, this experimental study also proposes the following policy recommendations for the country of India: It is worth noting that India’s ENU has a long-term effect on CO2E. India is one of the top 10 countries most severely affected by CO2E.; hence, atmospheric threats need to be addressed seriously. Specifically, the Indian government must stimulate CO2E reducing activities through increasing alternative energy resources such as solar, wind, geothermal sources, biodiesel fuel, and environmentally sensitive technologies that can be effectively supported. It is suggested that the Indian government teach local people in order to motivate them to plant trees with the forest department to enhance the proportion of forest in India and control environmental degradation.

Furthermore, the estimated results show that environmental degradation is the main reason for economic growth. Hence, it is advised that India’s economic growth policies be revised to address environmental degradation. To avoid CO2 emissions, population growth, natural resources, and the ecological system must be balanced to lower CO2 emissions. These resources might otherwise be affected by CO2 emissions. Finally, enhancing energy effectiveness and introducing energy management options nationally by making clean energy accessible will help decrease CO2E. To control long-term environmental degradation, policymakers are advised to follow policies that encourage the use of environmentally friendly equipment, vehicles, machinery, and utilities to reduce environmental degradation.