A VaR-Based Methodology for Assessing Carbon Price Risk across European Union Economic Sectors

Abstract

:1. Introduction

2. Literature Review

2.1. International Agreements’ Efficiency in Reducing GHG Emissions

2.2. The EU ETS System

2.3. Carbon Pricing Models—Drivers and Impact on Economic Sectors

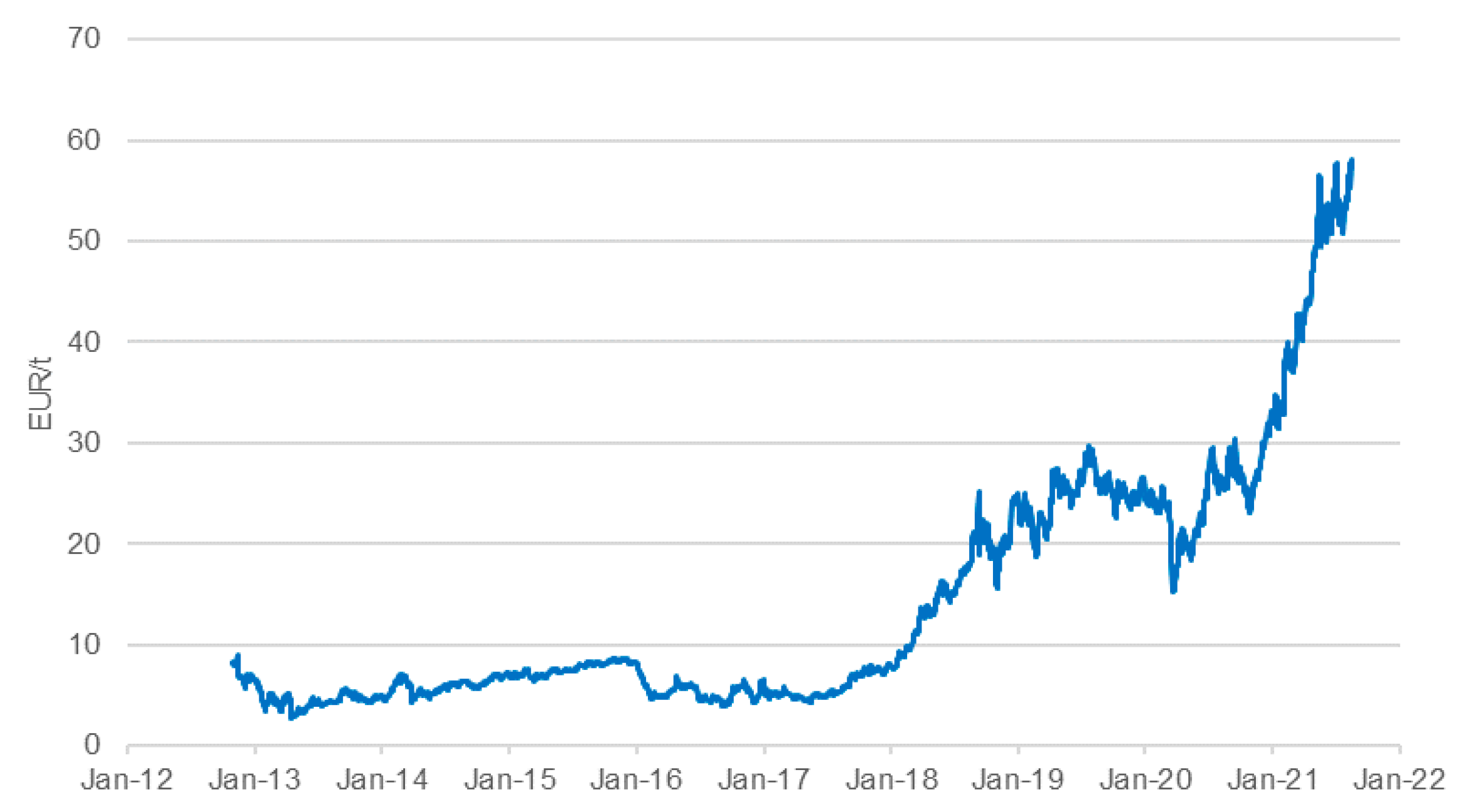

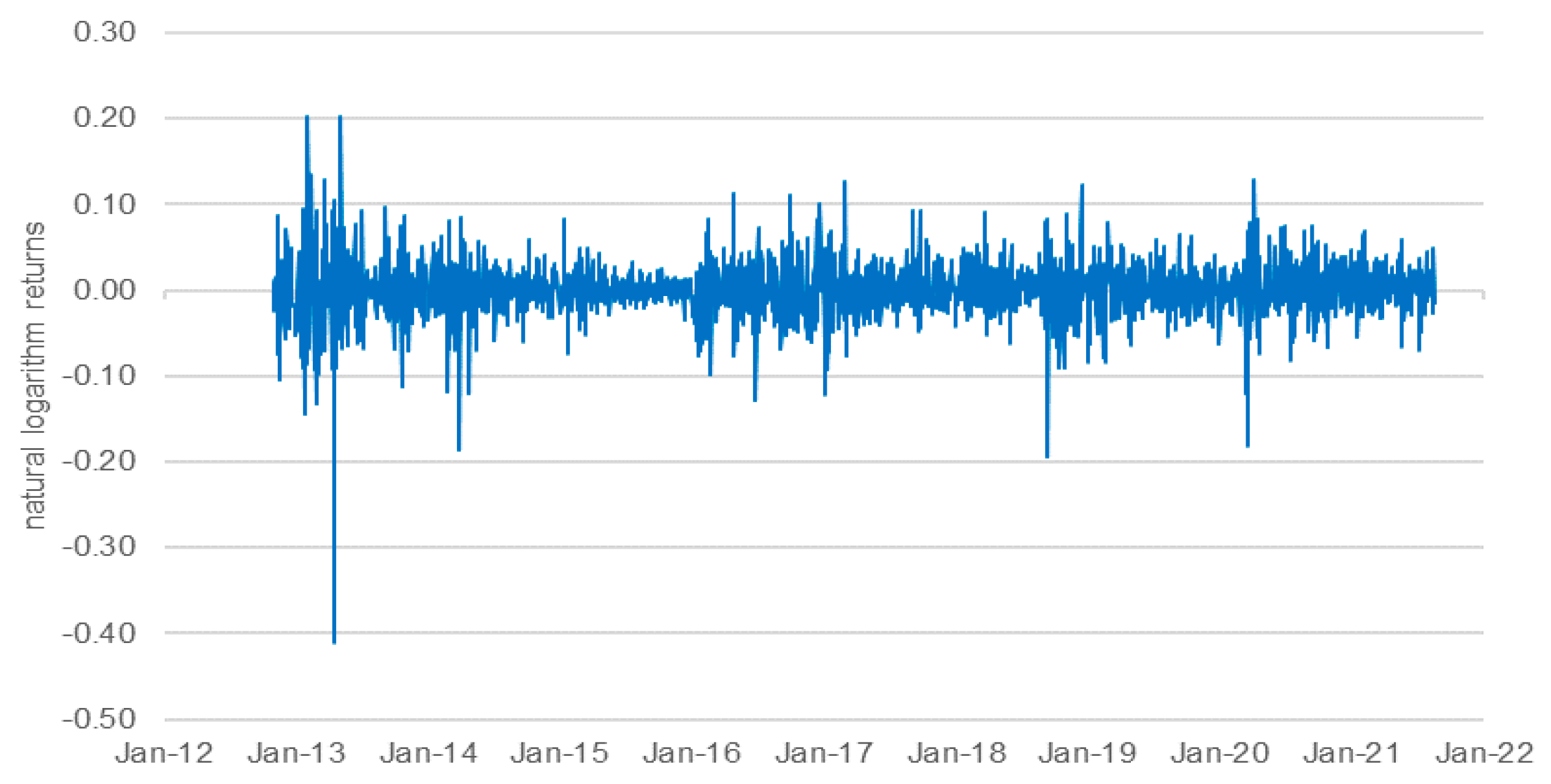

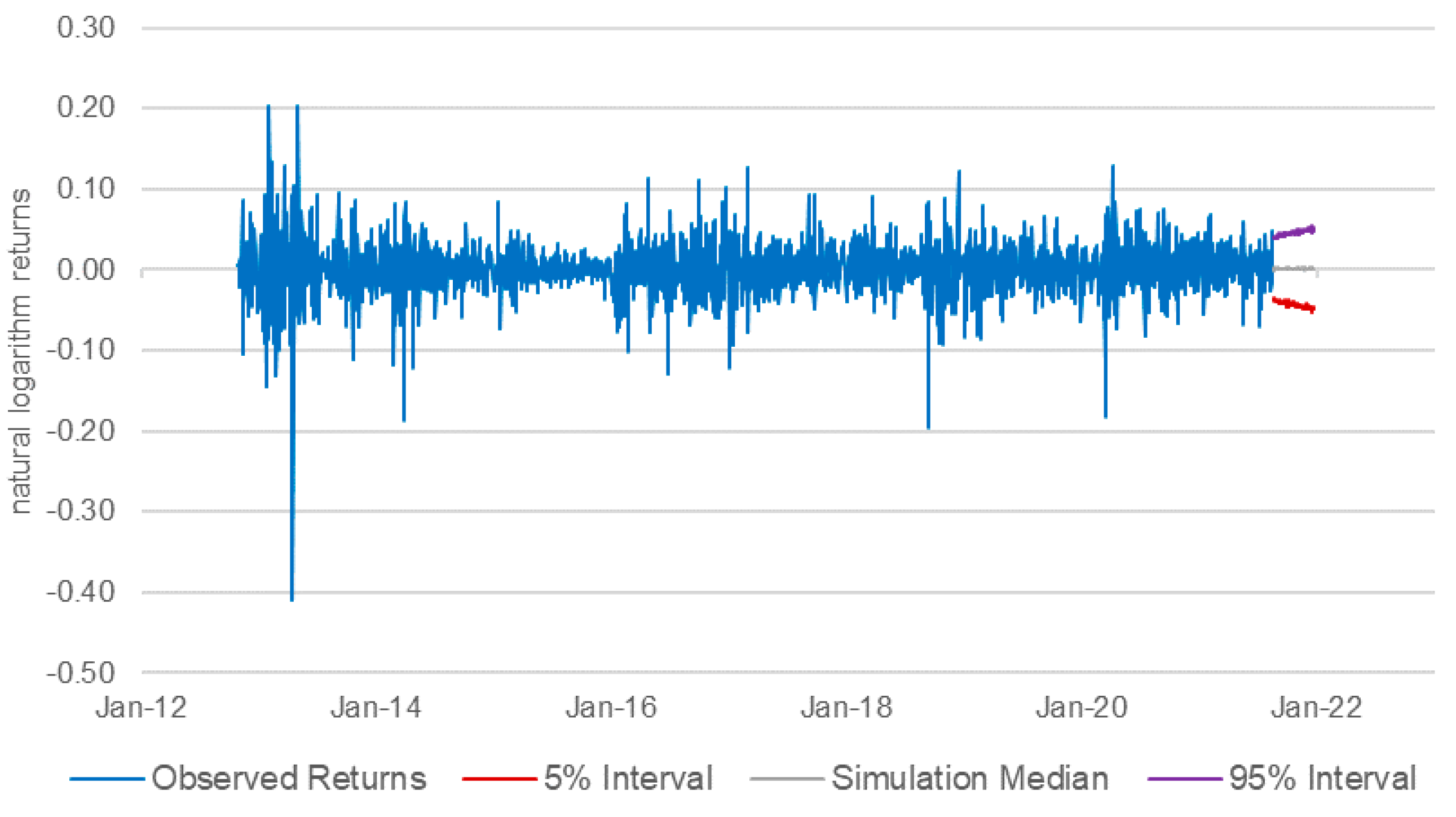

3. Materials and Methods

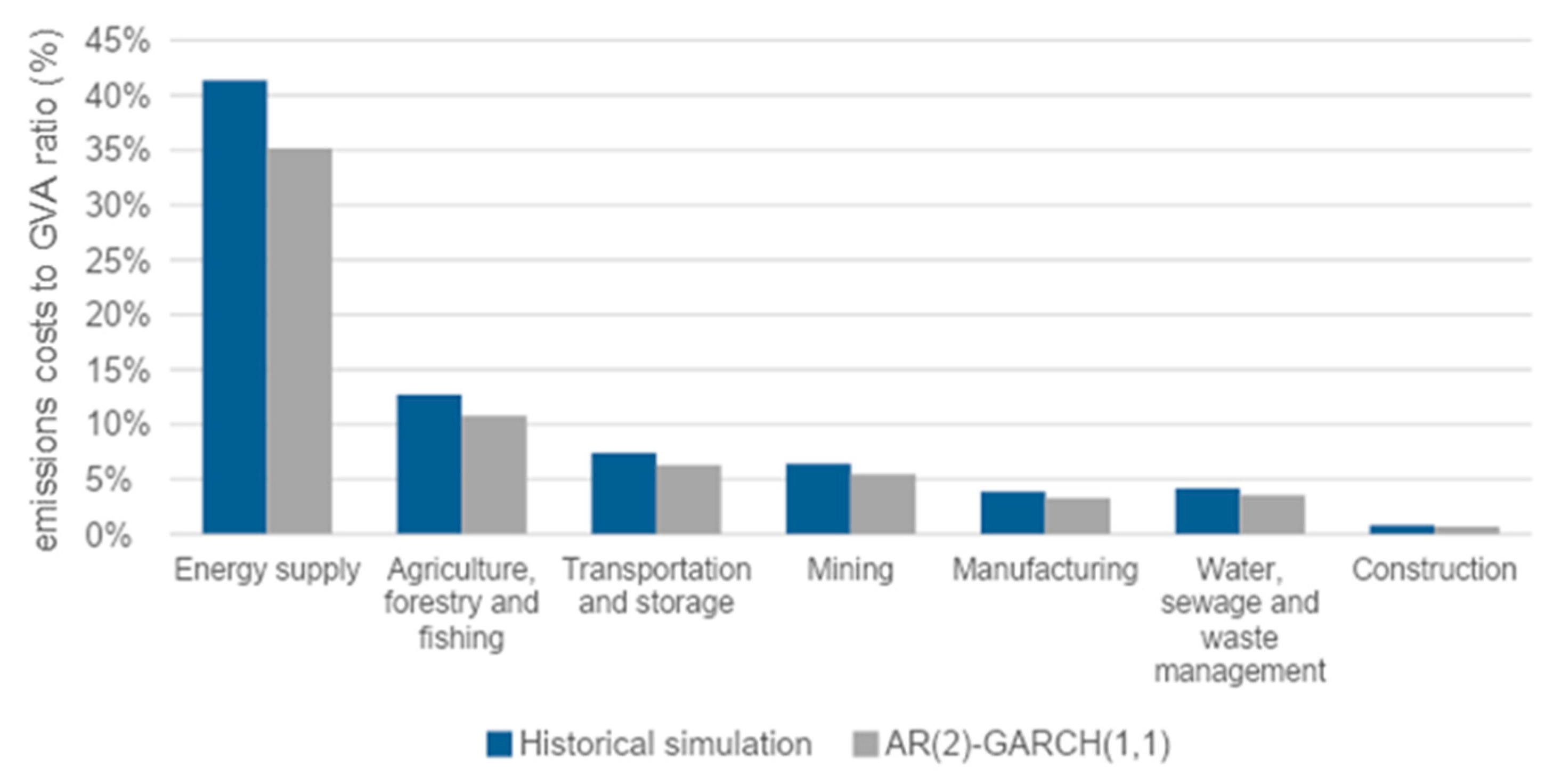

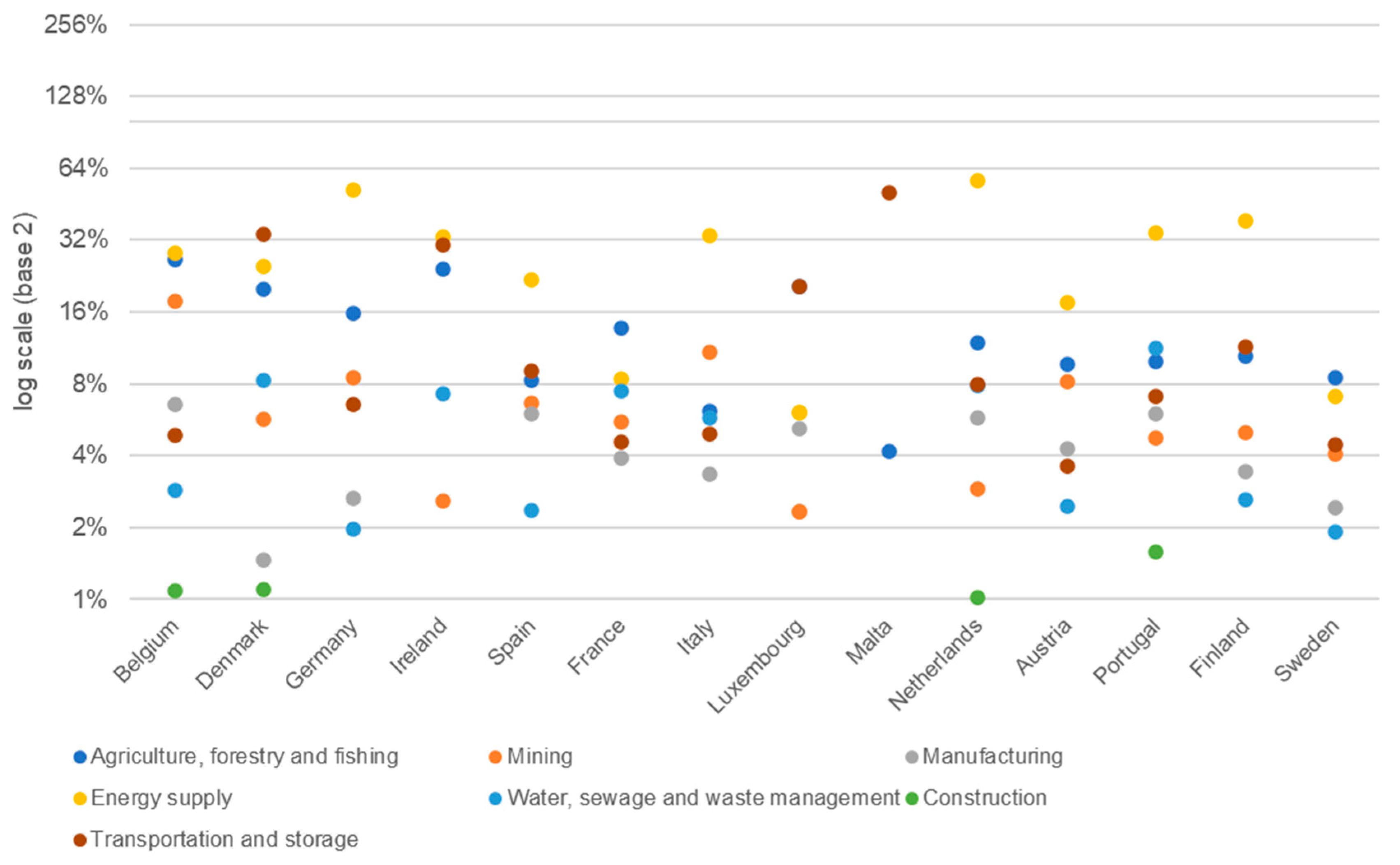

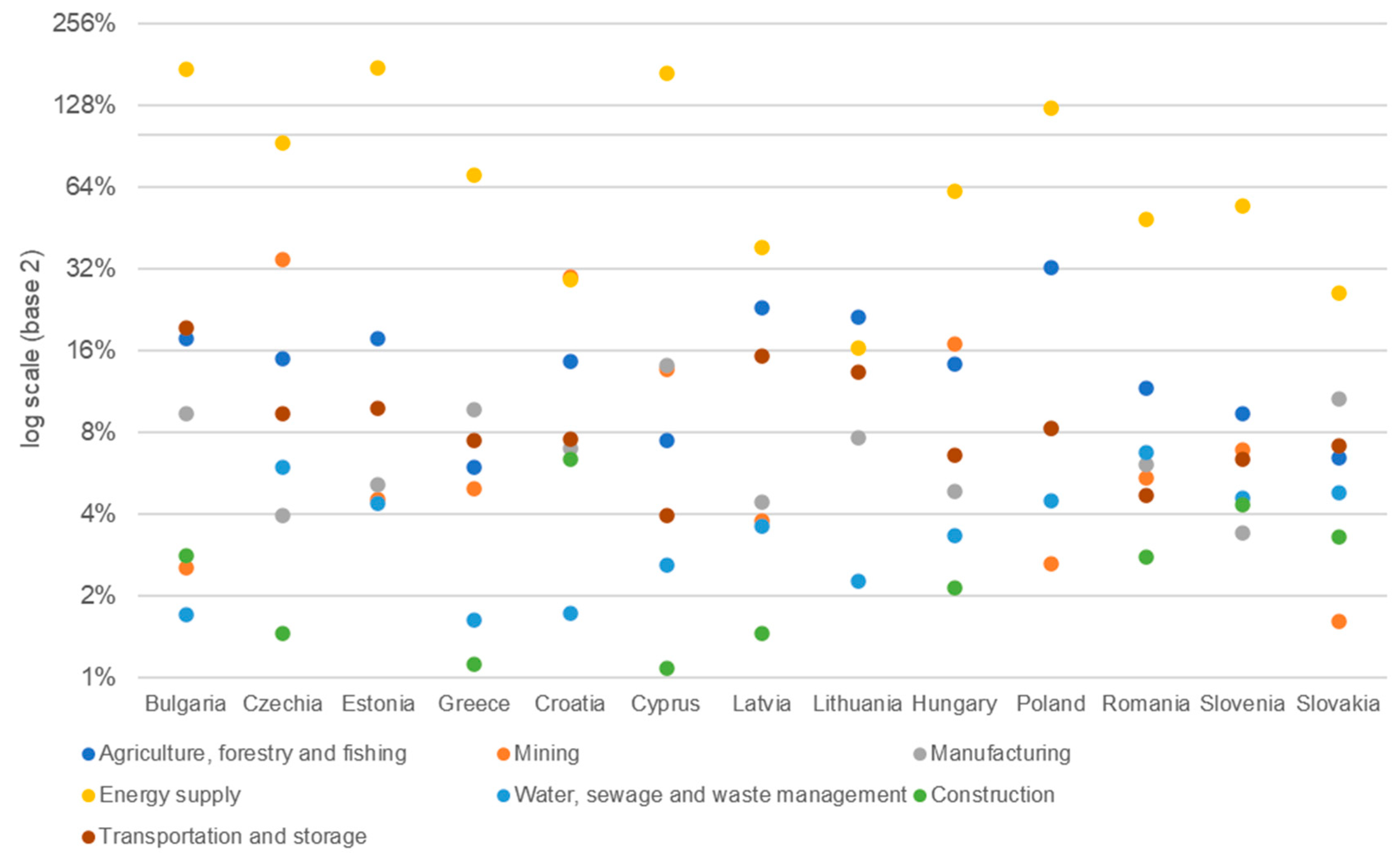

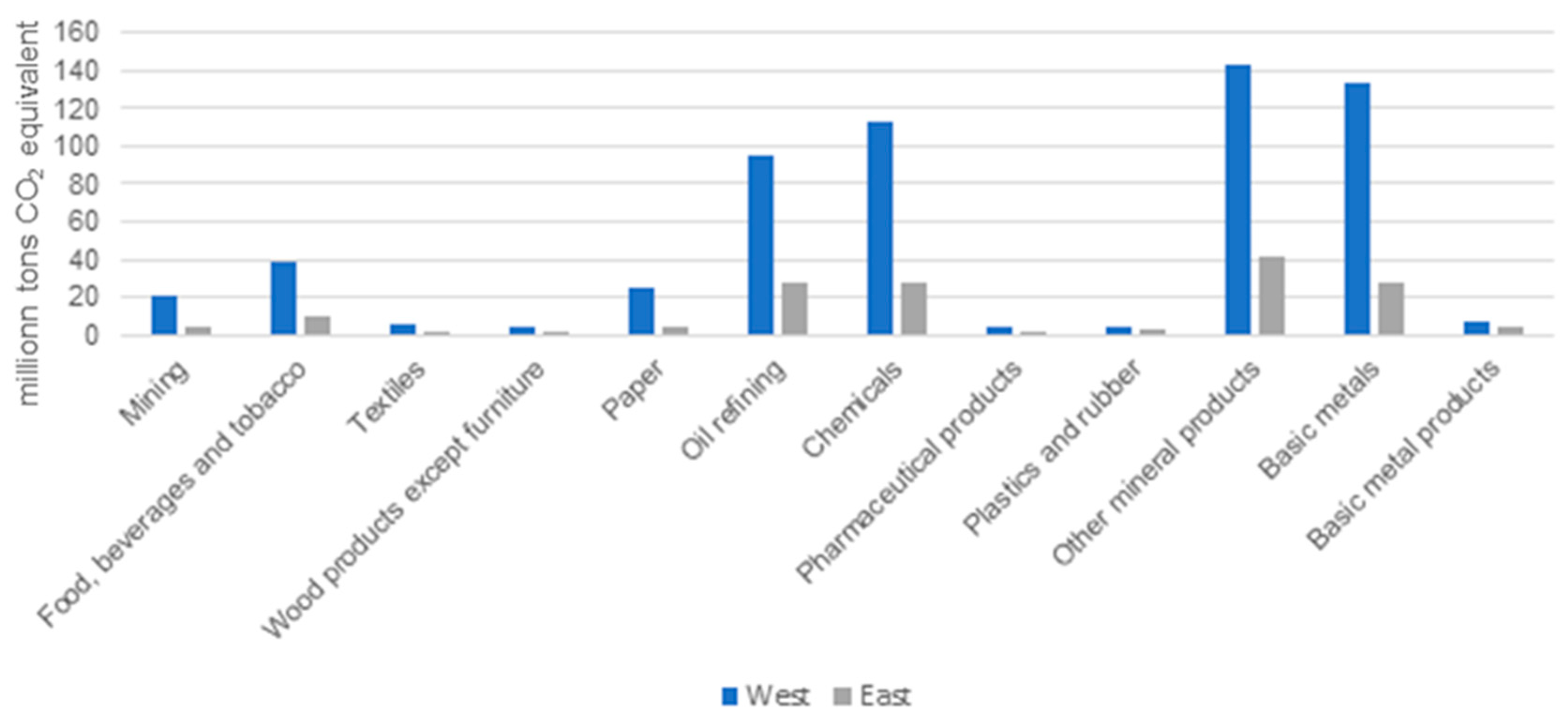

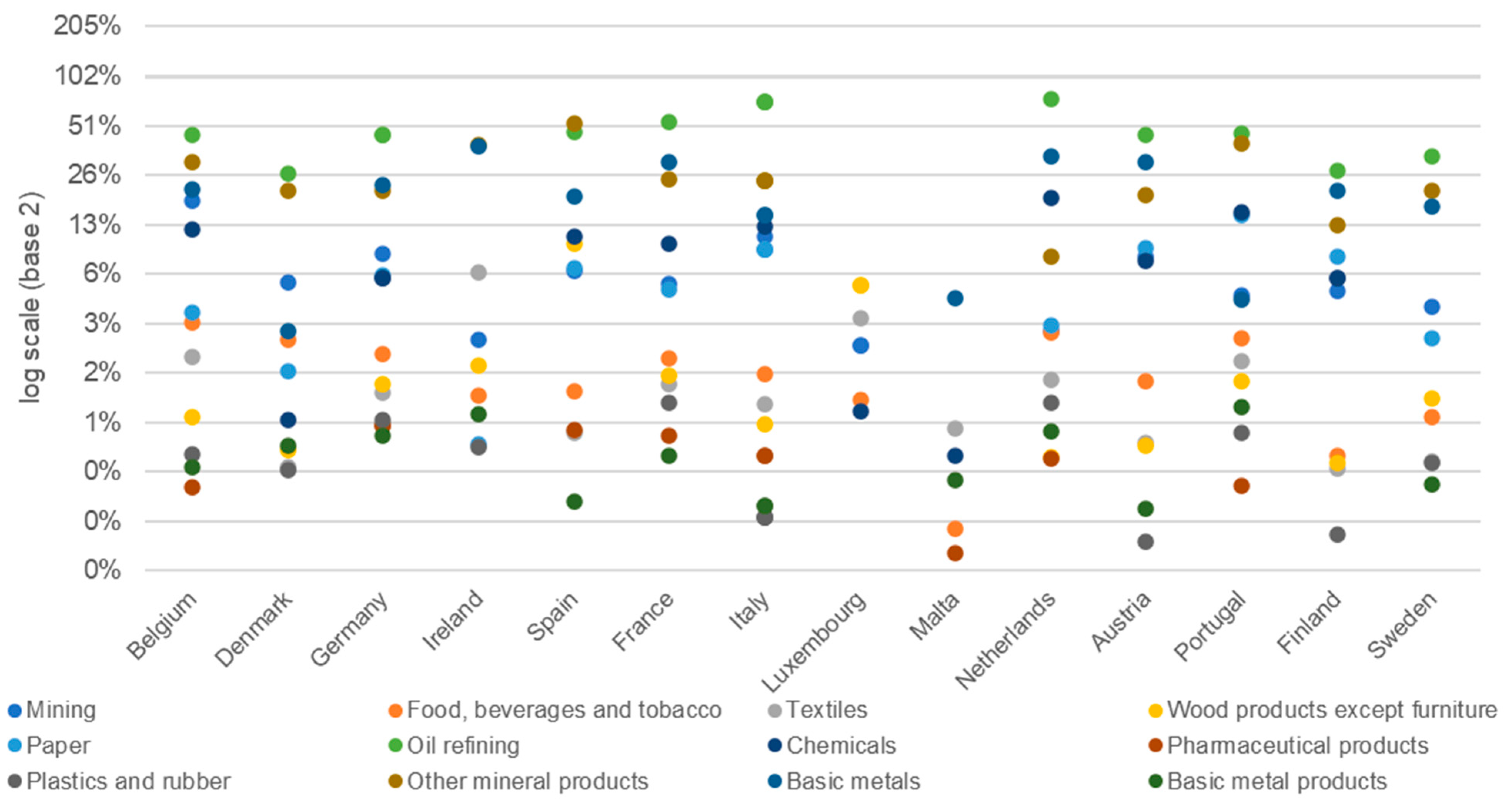

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Model | Bayesian Information Criterion (BIC) |

|---|---|

| AR1 | −8843.79 |

| AR2 | −8850.20 |

| AR3 | −8844.63 |

| ARMA11 | −8838.72 |

| ARMA21 | −8843.40 |

| ARMA31 | −8840.14 |

| ARMA12 | −8841.75 |

| ARMA13 | −8835.63 |

References

- IPCC. Climate Change 2021: The Physical Science Basis. In Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Masson-Delmotte, V.P., Zhai, A., Pirani, S.L., Connors, C., Péan, S., Berger, N., Caud, Y., Chen, L., Goldfarb, M.I., Gomis, M., et al., Eds.; Cambridge University Press: Cambridge, UK, 2021; in press. [Google Scholar]

- Tamma, P.; Schaart, E.; Gurzu, A. Europe’s Green Deal Plan Unveiled. Available online: https://www.politico.eu/article/the-commissions-green-deal-plan-unveiled/ (accessed on 2 October 2020).

- Simon, F. EU Commission Unveils ‘European Green Deal’: The Key Points. Available online: EURACTIV.com (accessed on 2 October 2021).

- Bayer, P.; Aklin, M. The European Union emissions trading system reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. USA 2020, 117, 8804–8812. [Google Scholar] [CrossRef] [Green Version]

- Guo, J.; Gu, F.; Liu, Y.; Liang, X.; Mo, J.; Fan, Y. Assessing the impact of ETS trading profit on emission abatements based on firm-level transactions. Nat. Commun. 2020, 11, 2078. [Google Scholar] [CrossRef]

- European Commission. Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 Establishing a Scheme for Greenhouse Gas Emission Allowance Trading within the Community, Official Journal of the European Union L 275/32. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32003L0087 (accessed on 2 October 2021).

- European Commission. Proposal for a Directive of the European Parliament and of the Council Amending Directive 2003/87/EC Establishing a System for Greenhouse Gas Emission Allowance Trading within the Union, Decision (EU) 2015/1814 Concerning the Establishment and Operation of a Market Stability Reserve for the Union Greenhouse Gas Emission Trading Scheme and Regulation (EU) 2015/757. 2021. Available online: https://ec.europa.eu/info/sites/default/files/revision-eu-ets_with-annex_en_0.pdf (accessed on 2 October 2021).

- Verbruggen, A.; Laes, E.; Woerdman, E. Anatomy of emissions trading systems: What is the EU ETS? Environ. Sci. Policy 2019, 8, 11–19. [Google Scholar] [CrossRef]

- Fischer, C.; Newell, R.G. Environmental and technology policies for climate mitigation. J. Environ. Econ. Manag. 2008, 55, 142–162. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.J. Research on carbon emission trading mechanisms: Current status and future possibilities. Int. J. Glob. Energy Issues 2016, 39, 89–107. [Google Scholar] [CrossRef]

- Doege, J.; Fehr, M.; Hinz, J.; Lüthi, H.J.; Wilhelm, M. Risk management in power markets: The hedging value of production flexibility. Eur. J. Oper. Res. 2009, 199, 936–943. [Google Scholar] [CrossRef]

- Fan, J.H.; Roca, E.; Akimov, A. Estimation and performance evaluation of optimal hedge ratios in the carbon market of the European Union Emissions Trading Scheme. Aust. J. Manag. 2014, 39, 73–91. [Google Scholar] [CrossRef] [Green Version]

- Zhang, F.; Zhang, Z. The tail dependence of the carbon markets: The implication of portfolio management. PLoS ONE 2020, 15, e0238033. [Google Scholar] [CrossRef]

- Edmonds, J.; Yu, S.; Mcjeon, H.; Forrister, D.; Aldy, J.; Hultman, N.; Cui, R.; Waldhoff, S.; Clarke, L.; Clara, S.D.; et al. How Much Could Article 6 Enhance Nationally Determined Contribution Ambition Toward Paris Agreement Goals Through Economic Efficiency? Clim. Chang. Econ. 2021, 12, 2150007. [Google Scholar] [CrossRef]

- Li, Y.; Wei, Y. Estimating the potential CO2 emission reduction in 97 contracting countries of the Paris Agreement. Clim. Chang. Econ. 2021, 12, 1–36. [Google Scholar] [CrossRef]

- Parry, I.; Mylonas, V.; Vernon, N. Mitigation Policies for the Paris Agreement: An Assessment for G20 Countries. J. Assoc. Environ. Resour. Econ. 2021, 8, 797–823. [Google Scholar] [CrossRef]

- European Commission. Directive 2018/410 of the European Parliament and of the Council of 14 March 2018 Amending Directive 2003/87/EC to Enhance Cost-Effective Emission Reductions and Low-Carbon Investments, and Decision (EU) 2015/1814, Official Journal of the European Union L 76/3. 2018. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0410&from=EN (accessed on 2 October 2021).

- Newbery, D.M.; Reiner, D.M.; Ritz, R.A. The Political Economy of a Carbon Price Floor for Power Generation. Energy J. 2019, 40, 1–26. [Google Scholar] [CrossRef] [Green Version]

- Koch, N.; Fuss, S.; Grosjean, G.; Edenhofer, O. Causes of the EU ETS price drop: Recession, CDM, renewable policies or a bit of everything?—New evidence. Energy Policy 2014, 73, 676–685. [Google Scholar] [CrossRef] [Green Version]

- Flachsland, C.; Pahle, M.; Burtraw, D.; Edenhofer, O.; Elkerbout, M.; Fischer, C.; Tietjen, O.; Zetterberg, L. How to avoid history repeating itself: The case for an EU Emissions Trading System (EU ETS) price floor revisited. Clim. Policy 2020, 20, 133–142. [Google Scholar] [CrossRef]

- Aldy, J.E.; Stavins, R.N. The promise and problems of pricing carbon: Theory and experience. J. Environ. Dev. 2012, 21, 152–180. [Google Scholar] [CrossRef]

- Ranson, M.; Stavins, R.N. Linkage of greenhouse gas emissions trading systems: Learning from experience. Clim. Policy 2016, 16, 284–300. [Google Scholar] [CrossRef] [Green Version]

- Dutta, A.; Jalkh, N.; Bouri, E.; Dutta, P. Assessing the risk of the European Union carbon allowance market: Structural breaks and forecasting performance. Int. J. Manag. Financ. 2019, 16, 49–60. [Google Scholar] [CrossRef]

- Viteva, S.; Veld-Merkoulova, Y.V.; Campbell, K. The forecasting accuracy of implied volatility from ECX carbon options. Energy Econ. 2014, 45, 475–484. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Sun, Y.F. The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 2016, 112, 2654–2663. [Google Scholar] [CrossRef]

- Balcılar, M.; Demirer, R.; Hammoudeh, S.; Nguyen, D.K. Risk spillovers across the energy and carbon markets and hedging strategies for carbon risk. Energy Econ. 2016, 54, 159–172. [Google Scholar] [CrossRef] [Green Version]

- Skjærseth, J.B.; Wettestad, J. Implementing EU emissions trading: Success or failure? Int. Environ. Agreem. 2008, 8, 275–290. [Google Scholar] [CrossRef]

- Zaklan, A.; Wachsmuth, J.; Duscha, V. The EU ETS to 2030 and beyond: Adjusting the cap in light of the 1.5 °C target and current energy policies. Clim. Policy 2021, 21, 778–791. [Google Scholar] [CrossRef]

- Springer, U. The market for tradable GHG permits under the Kyoto Protocol: A survey of model studies. Energy Econ. 2003, 25, 527–551. [Google Scholar] [CrossRef]

- Benz, E.; Trück, S. Modeling the price dynamics of CO2 emission allowances. Energy Econ. 2009, 31, 4–15. [Google Scholar] [CrossRef]

- Conrad, C.; Rittler, D.; Rotfuß, W. Modeling and explaining the dynamics of European Union Allowance prices at high-frequency. Energy Econ. 2012, 34, 316–326. [Google Scholar] [CrossRef] [Green Version]

- Nazifi, F. Modelling the price spread between EUA and CER carbon prices. Energy Policy 2013, 56, 434–445. [Google Scholar] [CrossRef]

- Zhu, B.; Ma, S.; Chevallier, J.; Wei, Y. Modelling the dynamics of European carbon futures price: A Zipf analysis. Econ. Model. 2014, 38, 372–380. [Google Scholar] [CrossRef]

- Carnero, M.; Olmo, J.; Pascual, L. Modelling the Dynamics of Fuel and EU Allowance Prices during Phase 3 of the EU ETS. Energies 2018, 11, 3148. [Google Scholar] [CrossRef] [Green Version]

- Hao, Y.; Tian, C.; Wu, C. Modelling of carbon price in two real carbon trading markets. J. Clean. Prod. 2020, 244, 118556. [Google Scholar] [CrossRef]

- Fang, S.; Cao, G. Modelling extreme risks for carbon emission allowances—Evidence from European and Chinese carbon markets. J. Clean. Prod. 2021, 316, 128023. [Google Scholar] [CrossRef]

- Arouri, M.E.; Jawadi, F.; Nguyen, D.K. Nonlinearities in carbon spot-futures price relationships during Phase II of the EU ETS. Econ. Model. 2012, 29, 884–892. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Gupta, R.; de Gracia, F.P. Modeling persistence of carbon emission allowance prices. Renew. Sustain. Energy Rev. 2016, 55, 221–226. [Google Scholar] [CrossRef] [Green Version]

- Gil-Alana, L.A.; Cunado, J.; Gupta, R. Persistence, Mean-Reversion and Non-linearities in CO2 Emissions: Evidence from the BRICS and G7 Countries. Environ. Resour. Econ. 2017, 67, 69–83. [Google Scholar] [CrossRef] [Green Version]

- Churchill, S.A.; Inekwe, J.; Smyth, R.; Zhang, X. R&D intensity and carbon emissions in the G7: 1870–2014. Energy Econ. 2019, 80, 30–37. [Google Scholar]

- Gianfreda, A.; Grossi, L. Quantitative analysis of energy markets. Energy Econ. 2013, 35, 1–4. [Google Scholar] [CrossRef] [Green Version]

- Alberola, E.; Chevallier, J.; Chèze, B. Price drivers and structural breaks in European carbon prices 2005–2007. Energy Policy 2008, 36, 787–797. [Google Scholar] [CrossRef]

- Chevallier, J. Carbon futures and macroeconomic risk factors: A view from the EU ETS. Energy Econ. 2009, 31, 614–625. [Google Scholar] [CrossRef]

- Mansanet-Bataller, M.; Pardo, A.; Valor, E. CO2 prices, energy and weather. Energy J. 2007, 28, 73–92. [Google Scholar] [CrossRef]

- Christiansen, A.C.; Arvanitakis, A.; Tangen, K.; Hasselknippe, H. Price determinants in the EU emissions trading scheme. Clim. Policy 2005, 5, 15–30. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Buchner, B.K. Over-allocation or abatement? A preliminary analysis of the EU ETS based on the 2005–06 emissions data. Environ. Resour. Econ. 2008, 41, 267–287. [Google Scholar] [CrossRef] [Green Version]

- Bredin, D.; Muckley, C. An emerging equilibrium in the EU emissions trading scheme. Energy Econ. 2011, 33, 353–362. [Google Scholar] [CrossRef]

- Aatola, P.; Ollikainen, M.; Toppinen, A. Price determination in the EU ETS market: Theory and econometric analysis with market fundamentals. Energy Econ. 2013, 36, 380–395. [Google Scholar] [CrossRef]

- Yu, J.; Mallory, M.L. Exchange rate effect on carbon credit price via energy markets. J. Int. Money Financ. 2014, 47, 145–161. [Google Scholar] [CrossRef]

- Chevallier, J. Evaluating the carbon-macroeconomy relationship: Evidence from threshold vector error-correction and Markov-switching VAR models. Econ. Model. 2011, 28, 2634–2656. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R.M. What explain the short-term dynamics of the prices of CO2 emissions? Energy Econ. 2015, 46, 122–135. [Google Scholar] [CrossRef]

- Bunn, D.W.; Fezzi, C. A vector error correction model of the interactions among gas, electricity and carbon prices: An application to the cases of Germany and the United Kingdom. In Markets for Carbon and Power Pricing in Europe: Theoretical Issues and Empirical Analyses; Edward Elgar Publishing Limited: Cheltenham, UK, 2008; pp. 145–159. [Google Scholar]

- Kanamura, T. Role of carbon swap trading and energy prices in price correlations and volatilities between carbon markets. Energy Econ. 2016, 54, 204–212. [Google Scholar] [CrossRef]

- Chen, Y.; Qu, F.; Li, W.; Chen, M. Volatility spillover and dynamic correlation between the carbon market and energy markets. J. Bus. Econ. Manag. 2019, 20, 979–999. [Google Scholar] [CrossRef] [Green Version]

- Markusson, N.; Kern, F.; Watson, J.; Arapostathis, S.; Chalmers, H.; Ghaleigh, N.; Heptonstall, P.; Pearson, P.; Rossati, D.; Russell, S. A socio-technical framework for assessing the viability of carbon capture and storage technology. Technol. Forecast. Soc. Chang. 2012, 79, 903–918. [Google Scholar] [CrossRef]

- Sheil, D.; Ladd, B.; Silva, L.C.; Laffan, S.W.; Van Heist, M. How are soil carbon and tropical biodiversity related? Environ. Conserv. 2016, 43, 231–241. [Google Scholar] [CrossRef]

- Carton, W. Dancing to the rhythms of the fossil fuel landscape: Landscape inertia and the temporal limits to market-based climate policy. Antipode 2017, 49, 43–61. [Google Scholar] [CrossRef]

- Hua, W.; Li, D.; Sun, H.; Matthews, P. Stackelberg game-theoretic model for low carbon energy market scheduling. IET Smart Grid 2020, 3, 31–41. [Google Scholar] [CrossRef]

- La Notte, A.; Tonin, S.; Lucaroni, G. Assessing direct and indirect emissions of greenhouse gases in road transportation, taking into account the role of uncertainty in the emissions inventory. Environ. Impact Assess. Rev. 2018, 69, 82–93. [Google Scholar] [CrossRef]

- Dey, S.; Caulfield, B.; Ghosh, B. Modelling uncertainty of vehicular emissions inventory: A case study of Ireland. J. Clean. Prod. 2019, 213, 1115–1126. [Google Scholar] [CrossRef]

- Gonçalves, D.N.; Goes, G.V.; Márcio de Almeida, D.A.; de Mello Bandeira, R.A. Energy use and emissions scenarios for transport to gauge progress toward national commitments. Energy Policy 2019, 135, 110997. [Google Scholar] [CrossRef]

- Güzel, T.D.; Alp, K. Modeling of greenhouse gas emissions from the transportation sector in Istanbul by 2050. Atmos. Pollut. Res. 2020, 11, 2190–2201. [Google Scholar] [CrossRef]

- Busch, T.; Hoffmann, V.H. Emerging carbon constraints for corporate risk management. Ecol. Econ. 2007, 62, 518–528. [Google Scholar] [CrossRef]

- Koch, N.; Bassen, A. Valuing the carbon exposure of European utilities. The role of fuel mix, permit allocation and replacement investments. Energy Econ. 2013, 36, 431–443. [Google Scholar] [CrossRef]

- Busch, T.; Weinhofer, G.; Hoffmann, V.H. The carbon performance of the 100 largest US electricity producers. Util. Policy 2011, 19, 95–103. [Google Scholar] [CrossRef]

- Tulloch, D.J.; Diaz-Rainey, I.; Premachandra, I.M. The impact of liberalization and environmental policy on the financial returns of European energy utilities. Energy J. 2017, 38, 77–106. [Google Scholar] [CrossRef]

- Bernardini, E.; Di Giampaolo, J.; Faiella, I.; Poli, R. The impact of carbon risk on stock returns: Evidence from the European electric utilities. J. Sustain. Financ. Invest. 2021, 11, 1–26. [Google Scholar] [CrossRef]

- Oestreich, A.M.; Tsiakas, I. Carbon emissions and stock returns: Evidence from the EU Emissions. J. Bank. Financ. 2015, 58, 294–308. [Google Scholar] [CrossRef]

- Moreno, B.; da Silva, P.P. How do Spanish polluting sectors’ stock market returns react to European Union allowances prices? A panel data approach. Energy 2016, 103, 240–250. [Google Scholar] [CrossRef]

- Witkowski, P.; Adamczyk, A.; Franek, S. Does Carbon Risk Matter? Evidence of Carbon Premium in EU Energy-Intensive Companies. Energies 2021, 14, 1855. [Google Scholar] [CrossRef]

- Choi, D.; Gao, Z.; Jiang, W. Measuring the Carbon Exposure of Institutional Investors. J. Altern. Invest. 2020, 23, 12–23. [Google Scholar] [CrossRef]

- Hunt, C.; Weber, O. Fossil fuel divestment strategies: Financial and carbon-related consequences. Organ. Environ. 2019, 32, 41–61. [Google Scholar] [CrossRef]

- Benz, L.; Paulus, S.; Scherer, J.; Syryca, J.; Trück, S. Investors’ carbon risk exposure and their potential for shareholder engagement. Bus. Strategy Environ. 2021, 30, 282–301. [Google Scholar] [CrossRef]

- Trucost. Carbon Risks in UK Equity Funds. Available online: http://assets.wwf.org.uk/downloads/carbonrisksinukequityfunds.pdf (accessed on 2 October 2021).

- Blyth, W.; Bradley, R.; Bunn, D.; Clarke, C.; Wilson, T.; Yang, M. Investment risks under uncertain climate change policy. Energy Policy 2007, 35, 5766–5773. [Google Scholar] [CrossRef]

- Yang, M.; Blyth, W.; Bradley, R.; Bunn, D.; Clarke, C.; Wilson, T. Evaluating the power investment options with uncertainty in climate policy. Energy Econ. 2008, 30, 1933–1950. [Google Scholar] [CrossRef]

- Aldy, J.E.; Pizer, W.A. The competitiveness impacts of climate change mitigation policies. J. Assoc. Environ. Resour. Econ. 2015, 2, 565–595. [Google Scholar] [CrossRef]

- Cyrek, M.; Cyrek, P. Does Economic Structure Differentiate the Achievements towards Energy SDG in the EU? Energies 2021, 14, 2229. [Google Scholar] [CrossRef]

- Stambaugh, F. Risk and value at risk. Eur. Manag. J. 1996, 14, 612–621. [Google Scholar] [CrossRef]

- Neath, A.A.; Cavanaugh, J.E. The Bayesian information criterion: Background, derivation, and applications. Wiley Interdiscip. Rev. Comput. 2012, 4, 199–203. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef] [Green Version]

- Wilhelmsson, A. GARCH forecasting performance under different distribution assumptions. J. Forecast. 2006, 25, 561–578. [Google Scholar] [CrossRef] [Green Version]

- Nelson, D.B. Conditional heteroskedasticity in asset returns: A new approach. Econometrica 1991, 59, 347–370. [Google Scholar] [CrossRef]

- Glosten, L.R.; Jagannathan, R.; Runkle, D.E. On the relation between the expected value and the volatility of the nominal excess return on stocks. J. Financ. 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Ginevičius, R.; Bilan, Y.; Kądzielawski, G.; Novotny, M.; Kośmider, T. Evaluation of the Sectoral Energy Development Intensity in the Euro Area Countries. Energies 2021, 14, 5298. [Google Scholar] [CrossRef]

- Andrew, R.M. Global CO2 emissions from cement production. Earth Syst. Sci. Data 2018, 10, 195–217. [Google Scholar] [CrossRef] [Green Version]

- Zuoza, A.; Pilinkienė, V. Energy efficiency and carbon emission impact on competitiveness in the European energy intensive industries. Energies 2021, 14, 4700. [Google Scholar] [CrossRef]

| ADF Test Statistic | p-Value | PP Test Statistic | p-Value | |

|---|---|---|---|---|

| Price level | 3.1269 | >0.99 | 3.0559 | >0.99 |

| Log returns | −35.6576 | <0.01 | −46.1573 | <0.01 |

| Conditional Mean—AR(2) | |||

|---|---|---|---|

| Parameter | Estimate | Standard error | p-value |

| Constant | 0.0014 | 0.0005 | 0.0026 |

| AR(2) | −0.0407 | 0.0210 | 0.0520 |

| Conditional Variance—GARCH(1,1) | |||

| Parameter | Estimate | Standard error | p-value |

| Constant | <0.0001 | <0.0001 | 0.0023 |

| GARCH(1) | 0.8965 | 0.0126 | 0 |

| ARCH(1) | 0.1012 | 0.0142 | <0.0001 |

| DoF | 5.2025 | 0.5730 | <0.0001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bulai, V.-C.; Horobet, A.; Popovici, O.C.; Belascu, L.; Dumitrescu, S.A. A VaR-Based Methodology for Assessing Carbon Price Risk across European Union Economic Sectors. Energies 2021, 14, 8424. https://doi.org/10.3390/en14248424

Bulai V-C, Horobet A, Popovici OC, Belascu L, Dumitrescu SA. A VaR-Based Methodology for Assessing Carbon Price Risk across European Union Economic Sectors. Energies. 2021; 14(24):8424. https://doi.org/10.3390/en14248424

Chicago/Turabian StyleBulai, Vlad-Cosmin, Alexandra Horobet, Oana Cristina Popovici, Lucian Belascu, and Sofia Adriana Dumitrescu. 2021. "A VaR-Based Methodology for Assessing Carbon Price Risk across European Union Economic Sectors" Energies 14, no. 24: 8424. https://doi.org/10.3390/en14248424

APA StyleBulai, V.-C., Horobet, A., Popovici, O. C., Belascu, L., & Dumitrescu, S. A. (2021). A VaR-Based Methodology for Assessing Carbon Price Risk across European Union Economic Sectors. Energies, 14(24), 8424. https://doi.org/10.3390/en14248424