Changes in the Stock Market of Food Industry Companies during the COVID-19 Pandemic—A Comparative Analysis of Poland and Germany

Abstract

1. Introduction

2. A Review of Literature

- Stage 1—disruption of the supply chain from China,

- Stage 2—introduction of lockdowns in selected sectors,

- Stage 3—complete closure of the economy,

- Stage 4—gradual loosening of restrictions,

- Stage 5—return to the new normal.

3. Methodology and Sources of Data

4. Results and Discussion

5. Conclusions

- -

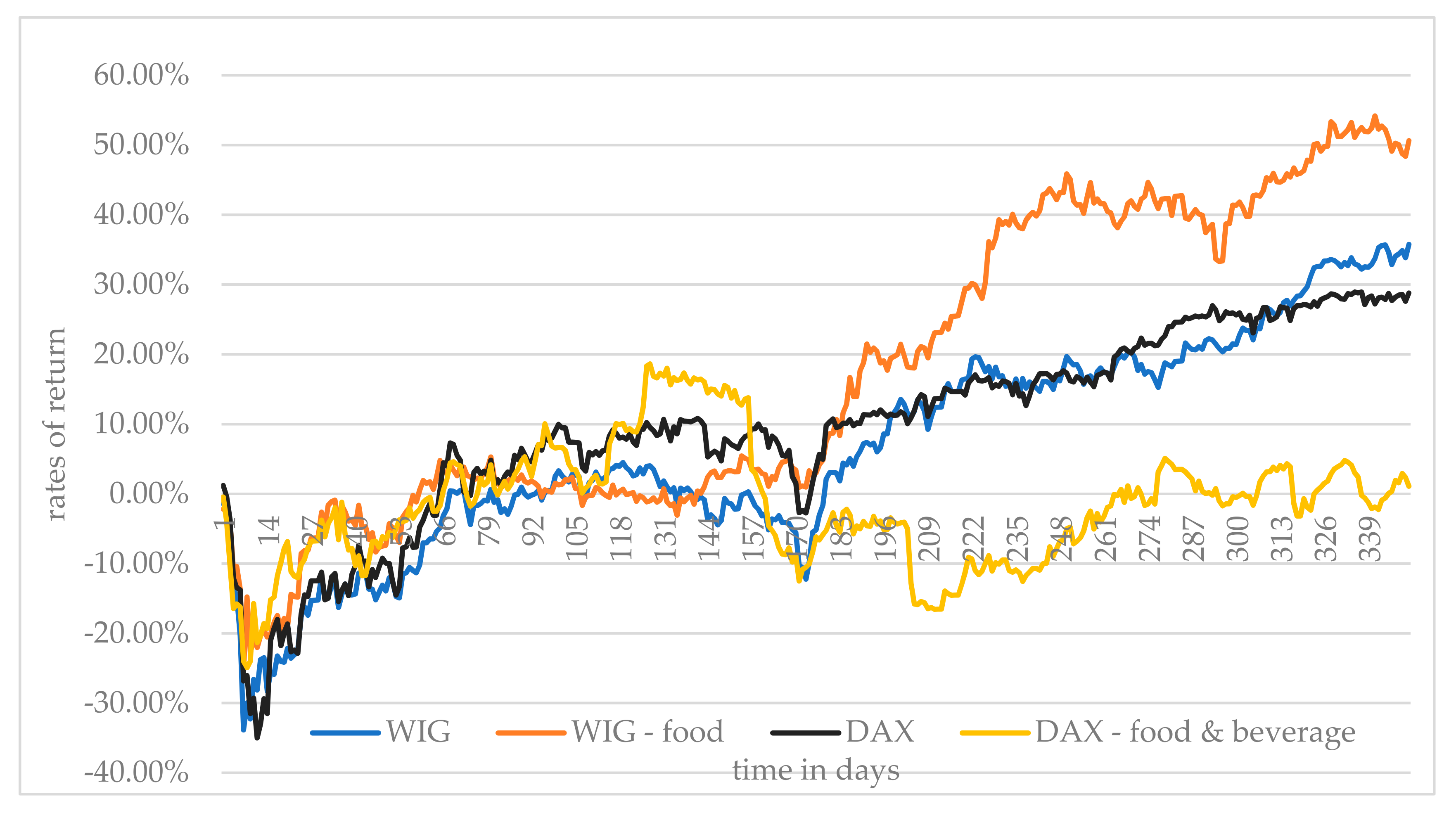

- following the detection of the coronavirus infection cases large decreases were recorded in cumulative rates of return from shares as a result of the pandemic both in Poland and in Germany, with greater reductions reported for companies comprising the WIG and DAX indexes compared to food companies listed within the WIG-food and DAX-food & beverage indexes,

- -

- despite differences in the WIG i DAX, abnormal cumulative rates of return from companies comprising these indexes in the analyzed period were to a considerable extent similar,

- -

- abnormal rates of return from companies of the WIG-food index over the entire investigated period were markedly higher compared to companies from the DAX-food & beverage index,

- -

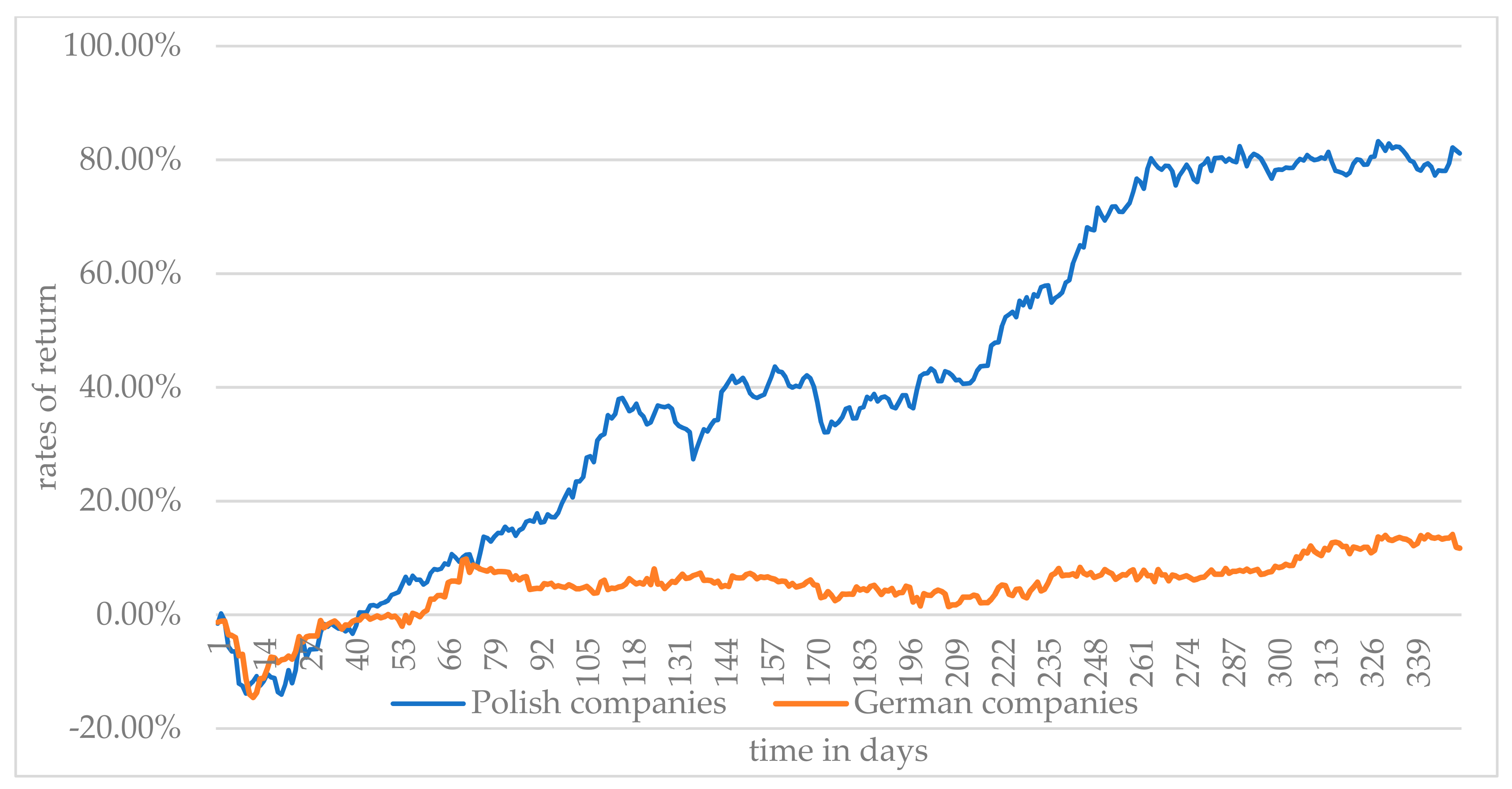

- markedly greater increases in abnormal rates of return were recorded for Polish companies from the food sector listed on the Warsaw Stock Exchange in comparison to German companies listed on several stock exchanges in Germany,

- -

- after more than 3 weeks of decreases in abnormal rates of return for companies from the food production sector in the following period marked increases were observed both in the case of Polish and German companies, with the increases being greater in the case of Polish companies,

- -

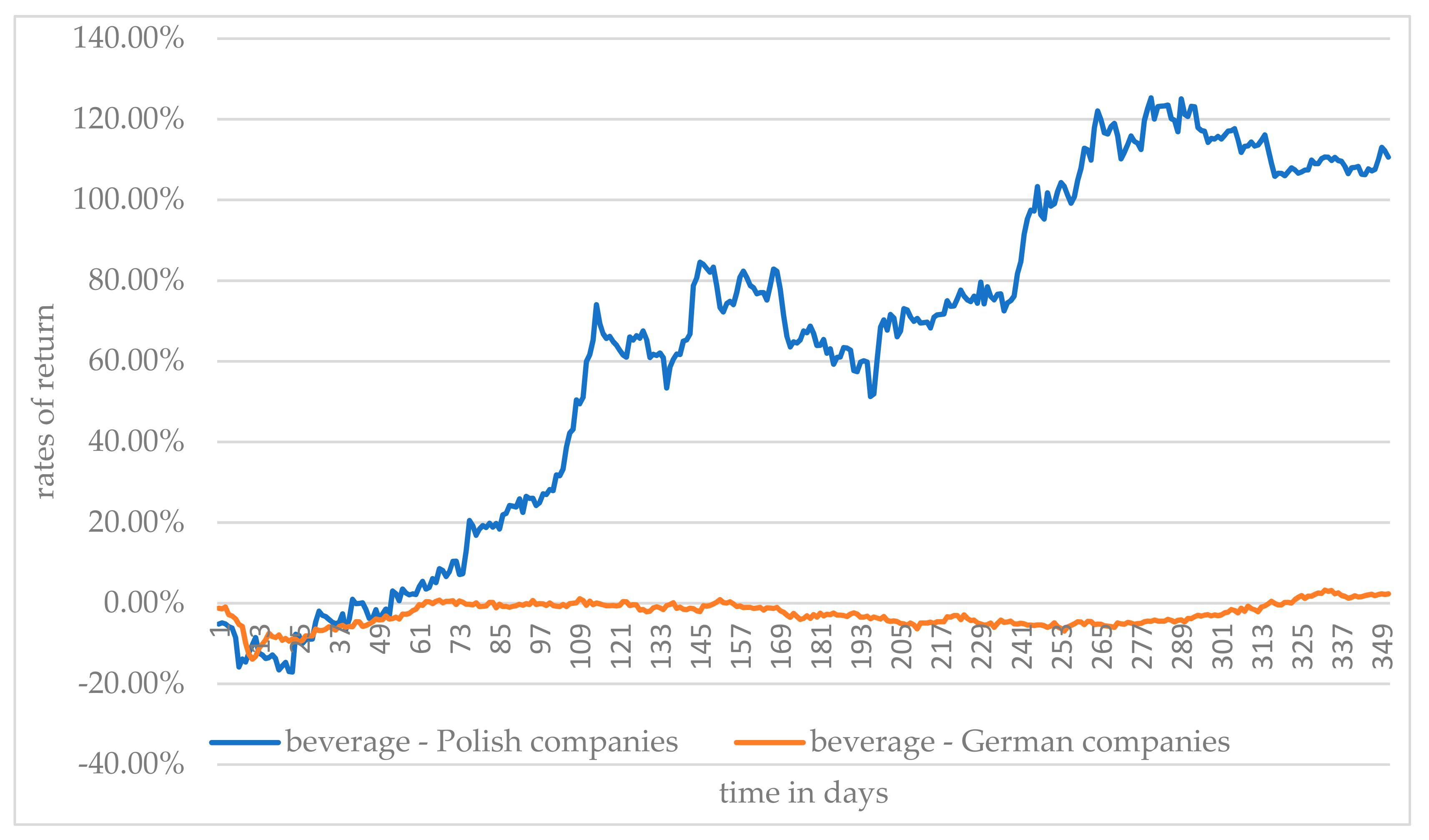

- while following the initial decreases cumulative abnormal rates of return of Polish companies in the beverages sector increased considerably in the subsequent period, no increases were recorded for German companies from this sector,

- -

- markedly greater increases in abnormal cumulative rates of return from shares of companies from the food sector in Poland than in Germany were caused by the fact that this sector plays a more important role in Poland than in Germany. Even during the coronavirus pandemic is considered by stock exchange investors on the Warsaw Stock Exchange as relatively stable and showing good prospects for the future, which was determined first of all by the increasing domestic and foreign demand for food products,

- -

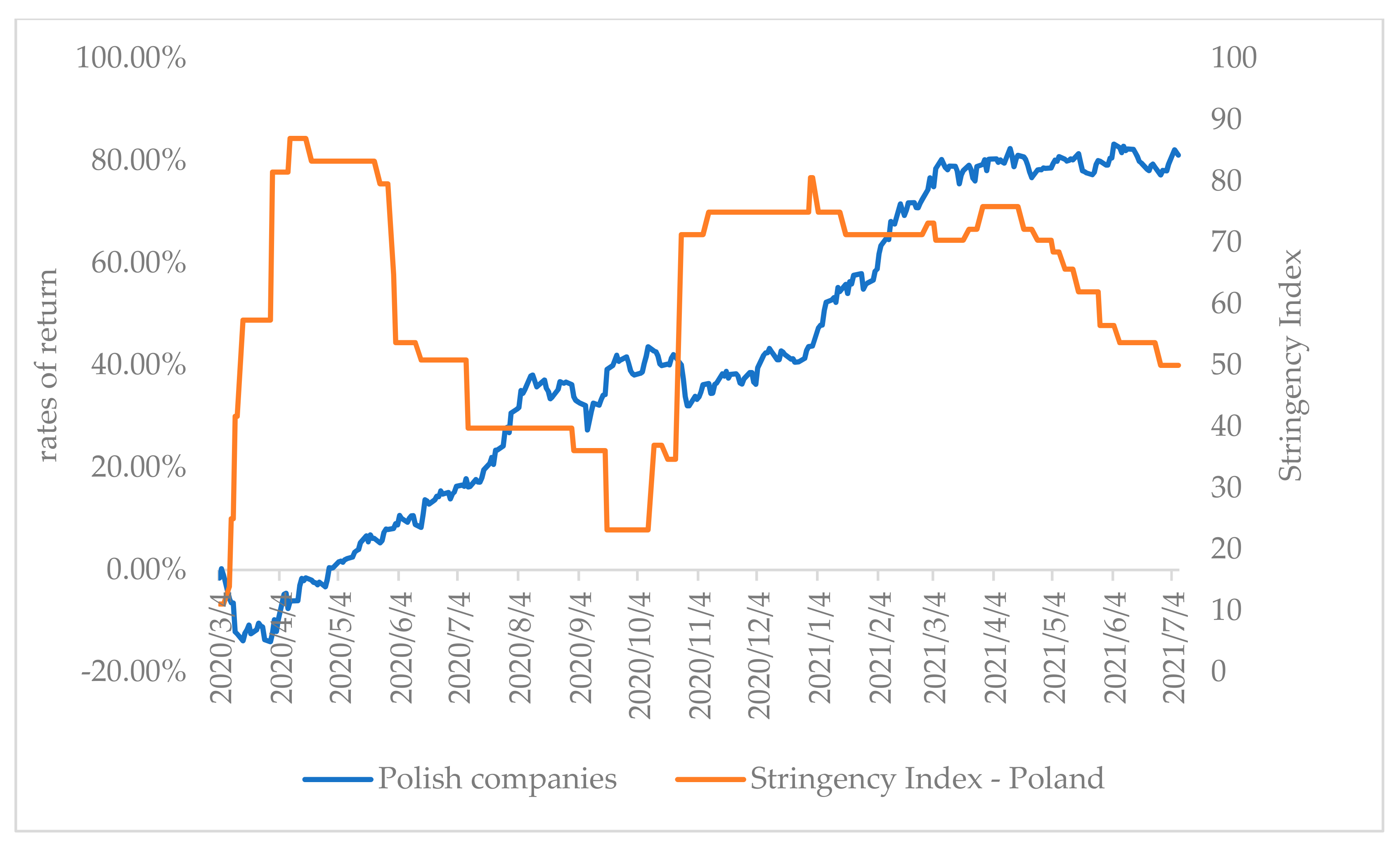

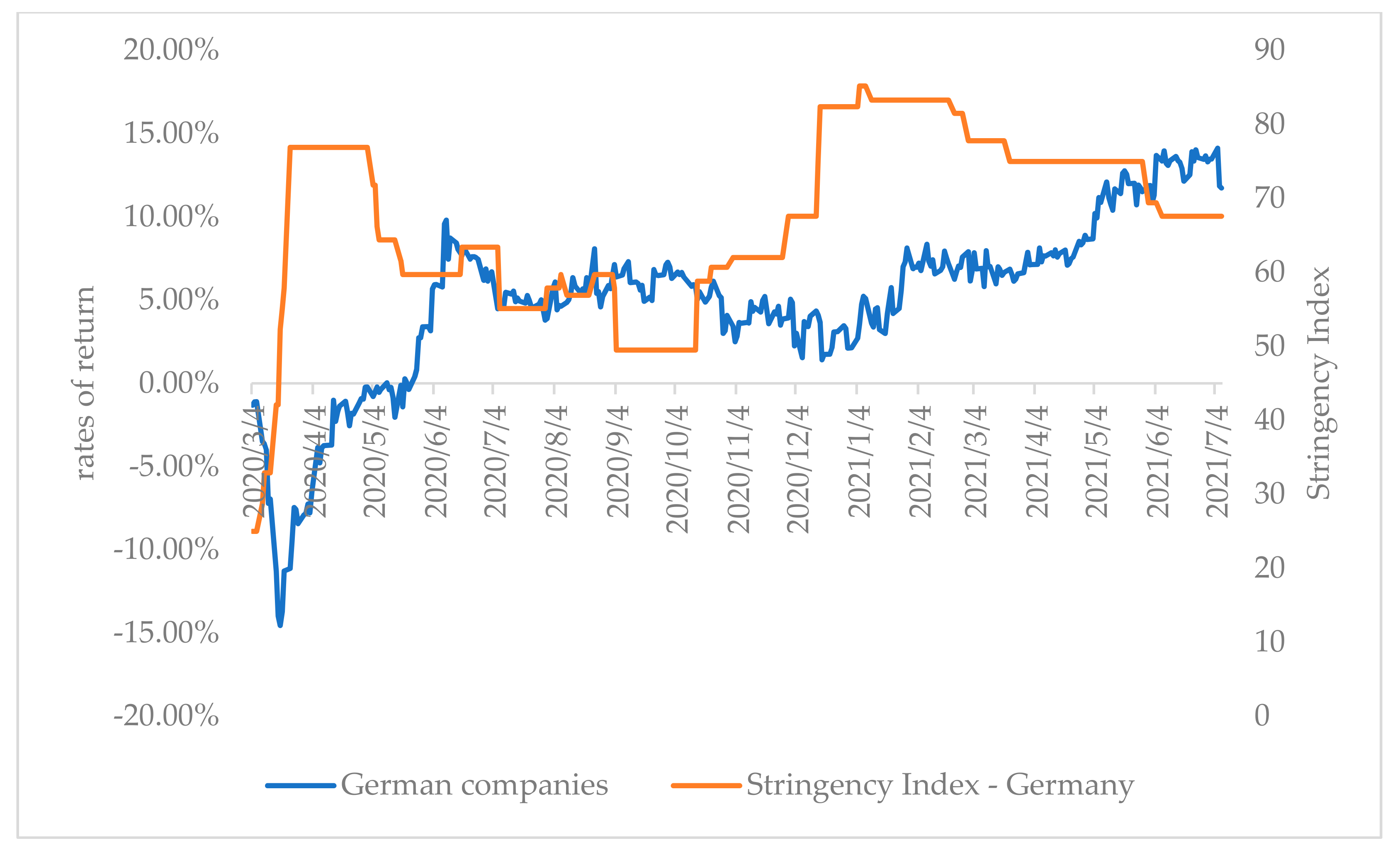

- the Stringency Index indicates that restrictions imposed by the German authorities in response to the coronavirus pandemic were slightly stricter than those introduced in Poland,

- -

- there is no evident interdependence between changes in the Stringency Index in the investigated period and changes in abnormal cumulative rates of return from shares of companies from the food sector in Poland or in Germany. It may be assumed that changes in rates of return on the market were caused to a greater extent by behavioral aspects, concerns of investors and their irrational decisions rather than actual changes in the economy, as well as restrictions imposed by the governments. Investors followed their emotions, instincts and personal beliefs. In their actions, decisions and financial behavior they were not always rational and in turn their emotions and mood had a huge impact on the stock market.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- World Health Organization (WHO). Coronavirus Disease (COVID-19) Pandemic; WHO: Geneva, Switzerland, 2020. [Google Scholar]

- Borsellino, V.; Kaliji, S.A.; Chimkent, E. COVID-19 Drives Consumer Behaviour and Agro-Food Markets towards Healthier and More Sustainable Patterns. Sustainability 2020, 12, 8366. [Google Scholar] [CrossRef]

- Severo, E.A.; De Guimarães, J.; Dellarmelin, M.L. Impact of the COVID-19 pandemic on environmental awareness, sustainable consumption and social responsibility: Evidence from generations in Brazil and Portugal. J. Clean. Prod. 2020, 286, 124947. [Google Scholar] [CrossRef]

- Hopkins, J. University & Medicine Coronavirus Resource Center. Data Stream. 2020. Available online: https://coronavirus.jhu.edu/map.html (accessed on 27 September 2021).

- Ortmann, R.; Pelster, M.; Wengerek, S.T. COVID-19 and Investor Behavior. Financ. Res. Lett. 2020, 37, 101717. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.; Sammon, M.; Viratyosin, T. The unprecedented stock market reaction to COVID-19. Rev. Asset Pricing Stud. 2020, 10, 742–758. [Google Scholar] [CrossRef]

- Saleem, A.; Bárczi, J.; Sági, J. COVID-19 and Islamic Stock Index: Evidence of Market Behavior and Volatility Persistence. J. Risk Financ. Manag. 2021, 14, 389. [Google Scholar] [CrossRef]

- Wang, F.; Zhang, R.; Ahmed, F.; Shah, S.M.M. Impact of investment behaviour on financial markets during COVID-19: A case of UK. Econ. Res. Ekon. Istraživanja 2021, 1–19. [Google Scholar] [CrossRef]

- Kacperska, E.; Kraciuk, J. The effect of COVID-19 pandemic on the Stock market of Agri-food Companies in Poland. Eur. Res. Stud. J. 2021, XXIV, 247–290. [Google Scholar] [CrossRef]

- Zhang, D.; Hu, M.; Ji, Q. Financial markets under the global pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef]

- Kelley, E.K.; Tetlock, P.C. Retail short selling and stock prices. Rev. Financ. Stud. 2016, 30, 801–834. [Google Scholar] [CrossRef]

- Garrett, T.A. Economic Effects of the 1918 Influenza Pandemic Implications for a Modern-Day Pandemic; Federal Reserve Bank of St. Louis: St. Louis, MO, USA, 2007; pp. 1–25. [Google Scholar]

- Garrett, T.A. Pandemic Economics: The 1918 Influenza and Its Modern-Day Implications; Federal Reserve Bank of St. Louis Rev. St. Louis: St. Louis, MO, USA, 2008; Volume 90, pp. 75–93. [Google Scholar]

- Huremović, D. Pandemics throughout History. In Brief History of Pandemics. Psychiatry of Pandemics: A Mental Health Response to Infection Outbreak; Springer: Berlin/Heidelberg, Germany, 2019; pp. 7–35. [Google Scholar] [CrossRef]

- Lee, J.W.; McKibbin, W. Estimating the Global Economic Cost of SARS in Learning from SARS: Preparing for the Next Disease Outbreak: Workshop Summary; National Academies Press: Washington, CA, USA, 2004; pp. 92–109. [Google Scholar]

- Grzeszak, J.; Leśniewicz, F.; Śliwowski, P.; Święcicki, I. Pandenomics. Zestaw Narzędzi Fiskalnych i Monetarnych w Dobie Kryzysów; Polski Instytut Ekonomiczny: Warszawa, Poland, 2020. [Google Scholar]

- Donadelli, M.; Ferranna, L.; Gufler, I.; Paradiso, A. Using past epidemics to estimate the macroeconomic implications of COVID-19: A bad idea! Struct. Chang. Econ. Dyn. 2021, 57, 214–224. [Google Scholar] [CrossRef]

- Shang, Y.; Li, H.; Zhang, R. Effects of Pandemic Outbreak on Economies: Evidence from Business History Context. Front. Public Health 2021, 9, 632043. [Google Scholar] [CrossRef]

- He, Q.; Liu, J.; Wang, S.; Yu, J. The impact of COVID-19 on stock markets. Econ. Polit. Stud. 2020, 8, 275–288. [Google Scholar] [CrossRef]

- Hsieh, Y.-C.; Wu, T.-Z.; Liu, D.-P.; Shao, P.-L.; Chang, L.-Y.; Lu, C.-Y.; Lee, C.-Y.; Huang, F.-Y.; Huang, L.-M. Influenza Pandemics: Past, Present and Future. J. Formos. Med. Assoc. 2006, 105, 1–6. [Google Scholar] [CrossRef]

- Barro, R.; Ursúa, J.; Weng, J. The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity. In The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Karlsson, M.; Nilsson, T.; Pichler, S. The impact of the 1918 Spanish flu epidemic on economic performance in Sweden. J. Health Econ. 2014, 36, 1–19. [Google Scholar] [CrossRef]

- Taylor, B. The Spanish Flu and the Stock Market: The Pandemic of 1919. Global Financial Data 2020. Available online: https://www.globaltrademag.com/the-spanish-flu-and-the-stock-market-the-pandemic-of-1919/ (accessed on 5 September 2021).

- Ahmad, A.; Krumkamp, R.; Reintjes, R. Controlling SARS: A review on China’s response compared with other SARS-affected countries. Trop. Med. Int. Health 2009, 14 (Suppl. S1), 36–45. [Google Scholar] [CrossRef] [PubMed]

- Noy, I.; Shields, S. The 2003 Severe Acute Respiratory Syndrome Epidemic: A Retroactive Examination of Economic Costs. Worlds Poult. Sci. J. 2019, 591. [Google Scholar] [CrossRef]

- Dénes, A.; Gumel, A.B. Modeling the impact of quarantine during an outbreak of Ebola virus disease. Infect. Dis. Model. 2019, 4, 12–27. [Google Scholar] [CrossRef] [PubMed]

- Sy, A.; Copley, A. Understanding the Economic Effects of the 2014 Ebola Outbreak in West Africa. Brookings Institution Africa in Focus Blog. 2014. Available online: http://www.brookings.edu/blogs/africa-in-focus/posts/2014/10/01-ebola-outbreak-west-africa-sy-copley (accessed on 10 September 2021).

- Dixon, S.; McDonald, S.; Roberts, J. The impact of HIV and AIDS on Africa’s economic development. BMJ 2002, 324, 232–234. [Google Scholar] [CrossRef]

- World Bank. Global Economic Prospects. World Bank Group Flagship Report. June 2020. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978-1-4648-1553-9 (accessed on 15 September 2021).

- World Bank. Global Economic Prospects. World Bank Group Flagship Report. June 2021. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/35647/9781464816659.pdf (accessed on 15 September 2021).

- Impacts of the COVID-19 Pandemic on EU Industries. European Parlament. 2021. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2021/662903/IPOL_STU(2021)662903_EN.pdf (accessed on 27 September 2021).

- Brinca, P.; Duarte, J.B.; Castro, M.F. Is the COVID-19 Pandemic a Supply or a Demand Shock? Econ. Synop. 2020, 31, 1–3. [Google Scholar] [CrossRef]

- Rudzewicz, A. Zaufanie w przedsiębiorstwie-znaczenie i pomiar. Zarządzanie Finansami 2017, 15, 291–304. [Google Scholar]

- Fama, E. Efficient Capital Markets: A Review of Theory and Empirical Work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Fama, E. Efficient Capital Markets: II. J. Financ. 1991, 46, 1575–1617. [Google Scholar] [CrossRef]

- Tepper, R.; Urbaniak, M. Wybrane Aspekty Hipotezy o Efektywności Rynku. 2020. Available online: http://mikroekonomia.net/system/publication_files/1113/original/24.pdf?1315295350 (accessed on 7 September 2021).

- Shiller, R.J. From Efficient Markets Theory to Behavioral Finance. J. Econ. Perspect. 2003, 17, 83–104. [Google Scholar] [CrossRef]

- Fromlet, H. Behavioral Finance-Theory and Practical Application: Systematic analysis of departures from the homo oeconomicus paradigm are essential for realistic financial research and analysis. Bus. Econ. 2001, 36, 63–69. [Google Scholar]

- Guttman, I.; Kadan, O.; Kandel, E. A Rational Expectations Theory of Kinks in Financial Reporting. Account. Rev. 2006, 81, 811–848. [Google Scholar] [CrossRef]

- Talib, A.A. The continuing behavioural modification of academics since the 1992 research assessment exercise. High. Educ. Rev. 2001, 33, 30–46. [Google Scholar]

- Talib, N.N. The Black Swan: The Impact of the Highly Improbable; The Random House Publishing Group, Inc.: New York, NY, USA, 2007. [Google Scholar]

- Talib, B.A.; Jani, M.F.M.; Mamat, M.N.; Zakaria, R. Impact assessment of liberalizing trade on Malaysian crude palm oil. Oil Palm Ind. Econ. J. 2007, 1, 9–17. [Google Scholar]

- Zhang, N.; Wang, A.; Haq, N.-U.; Nosheen, S. The impact of COVID-19 shocks on the volatility of stock markets in technologically advanced countries. Econ. Res. 2021, 1–26. [Google Scholar] [CrossRef]

- Brounen, D.; Derwall, J. The Impact of Terrorist Attacks on International Stock Markets. Eur. Financ. Manag. 2010, 16, 585–598. [Google Scholar] [CrossRef]

- Nguyen, A.P.; Enomoto, C.E. Acts of Terrorism and Their Impacts on Stock Index Returns And Volatility: The Cases of the Karachi and Tehran Stock Exchanges. Int. Bus. Econ. Res. J. 2009, 8, 75–86. [Google Scholar] [CrossRef]

- Arif, I.; Suleman, T. Terrorism and Stock Market Linkages: An Empirical Study from a Front-line State. Glob. Bus. Rev. 2017, 18, 365–378. [Google Scholar] [CrossRef]

- Chen, A.H.; Siems, T.F. The effects of terrorism on global capital markets. Eur. J. Political Econ. 2004, 20, 349–366. [Google Scholar] [CrossRef]

- Lanfear, M.G.; Lioui, A.; Siebert, M.G. Market anomalies and disaster risk: Evidence from extreme weather events. J. Financ. Markets 2018, 46, 100–477. [Google Scholar] [CrossRef]

- Rengasamy, E. Sovereign debt crisis in the euro zone and its impact on the BRICS’s stock index returns and volatility. Econ. Financ. Rev. 2012, 2, 37–46. [Google Scholar]

- Al-Rjoub, S.A.; Azzam, H. Financial crises, stock returns and volatility in an emerging stock market: The case of Jordan. J. Econ. Stud. 2012, 39, 178–211. [Google Scholar] [CrossRef]

- Mollick, A.V.; Assefa, T.A.U.S. Stock returns and oil prices: The tale from daily data and the 2008–2009 financial crisis. Energy Econ. 2013, 36, 1–18. [Google Scholar] [CrossRef]

- Yin, Z.C.; Lu, H.Z.; Pan, B.X. The impact of the Sino-US trade war on China’s stock market: An event-based analysis. J. Manag. 2020, 33, 18–28. [Google Scholar] [CrossRef]

- Ma, C.; Rogers, J.H.; Zhou, S. Global economic and financial effects of 21st century pandemics and epidemics. SSRN Electron. J. 2020, 5, 56–78. [Google Scholar] [CrossRef]

- Schwert, G.W. Stock volatility during the recent financial crisis. Eur. Financ. Manag. 2011, 17, 789–805. [Google Scholar] [CrossRef]

- Righi, M.B.; Ceretta, P.S. Analyzing the structural behavior of volatility in the major European markets during the Greek crisis. Econ. Bull. 2011, 31, 3016–3029. [Google Scholar] [CrossRef]

- Gil-Alana, L.A.; Monge, M. Crude oil prices and COVID-19: Persistence of the shock. Energy Res. Lett. 2020, 1, 13200. [Google Scholar] [CrossRef]

- Liu, M.; Choo, W.; Lee, C. The Response of the Stock Market to the Announcement of Global Pandemic. Emerg. Mark. Financ. Trade 2020, 56, 3562–3577. [Google Scholar] [CrossRef]

- Kaplanski, G.; Levy, H. Sentiment and stock prices: The case of aviation disasters. J. Financ. Econ. 2010, 95, 174–201. [Google Scholar] [CrossRef]

- Ragin, M.A.; Halek, M. Market expectations following catastrophes: An examination of insurance broker returns. J. Risk Insur. 2016, 83, 849–876. [Google Scholar] [CrossRef]

- Al-Rjoub, S.A.M. Business cycles, financial crises, and stock volatility in Jordan stock exchange. Soc. Sci. Electron. Publ. 2009, 31, 127–132. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Al-Awadhi, A.M.; Alsaifi, K.; Al-Awadhi, A.; Alhammadi, S. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. J. Behav. Exp. Financ. 2020, 27, 100326. [Google Scholar] [CrossRef]

- He, P.; Sun, Y.; Zhang, Y.; Li, T. COVID–19’s Impact on Stock Prices across Different Sectors—An Event Study Based on the Chinese Stock Market. Emerg. Mark. Financ. Trade 2020, 56, 2198–2212. [Google Scholar] [CrossRef]

- Chen, M.-H.; Jang, S.; Kim, W.G. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. Int. J. Hosp. Manag. 2007, 26, 200–212. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.R.; Bloom, N.; Davis, J.; Kost, K. Policy News and Stock Market Volatility; National Bureau of Economic Research: Cambridge, MA, USA, 2019; pp. 1–54. [Google Scholar]

- Iyke, B.N. The Disease Outbreak Channel of Exchange Rate Return Predictability: Evidence from COVID-19. Emerg. Mark. Financ. Trade 2020, 56, 2277–2297. [Google Scholar] [CrossRef]

- Sobieralski, J.B. COVID-19 and airline employment: Insights from historical uncertainty shocks to the industry. Transp. Res. Interdiscip. Perspect. 2020, 5, 100–123. [Google Scholar] [CrossRef]

- Guidolin, M.; Hansen, E.; Pedio, M. Cross-asset contagion in the financial crisis: A bayesian time-varying parameter approach. J. Financ. Mark. 2019, 45, 83–114. [Google Scholar] [CrossRef]

- Saadat, S.; Rawtani, D.; Hussain, C.M. Environmental perspective of COVID-19. Sci. Total. Environ. 2020, 728, 138–870. [Google Scholar] [CrossRef]

- FAO. COVID-19, Agricultural Markets and Trade and FAO’s Response. 2020. Available online: thehttp://www.fao.org/3/nf041en/nf041en.pdf (accessed on 27 July 2021).

- FAO. Food Security. Policy Brief. Available online: http://www.fao.org/fileadmin/templates/faoitaly/documents/pdf/pdf_Food_Security_Cocept_Note.pdf (accessed on 23 July 2021).

- Norman, V.L.; Sanghi, A.; Shaharuddin, N.; Wuester, L. Recovery from the Pandemic Crisis: Balancing Short-Term Long-Term, Concerns, Research and Policy Brief. World Bank, Washington, DC. 2020. Available online: https://openknowledge.worldbank.org/handle/10986/34462 (accessed on 25 September 2021).

- Skawińska, E.; Zalewski, R. Impact of Coronavirus COVID-19 on the Food System. Acta Sci. Polonorum. Oeconomia 2020, 19, 121–129. [Google Scholar] [CrossRef]

- Pawlak, K. Food Security Situation of Selected Highly Developed Countries against Developing Countries. J. Agribus. Rural Dev. 2016, 40, 385–398. [Google Scholar] [CrossRef]

- Zielińska-Chmielewska, A.; Mruk-Tomczak, D.; Wielicka-Regulska, A. Qualitative Research on Solving Difficulties in Maintaining Continuity of Food Supply Chain on the Meat Market during the COVID-19 Pandemic. Energies 2021, 14, 5634. [Google Scholar] [CrossRef]

- Rivington, M.; King, R.; Duckett, D.; Iannetta, P.; Benton, T.G.; Burgess, P.J.; Hawes, C.; Wellesley, L.; Polhill, J.G.; Aitkenhead, M.; et al. UK Food and Nutrition Security during and after the COVID-19 Pandemic. Nutr. Bull. 2021, 46, 88–97. [Google Scholar] [CrossRef]

- The Global Economic Outlook during the COVID-19 Pandemic: A Changed World. Available online: https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world (accessed on 27 September 2021).

- Zielińska-Chmielewska, A.; Olszańska, A.; Kaźmierczyk, J.; Andrianova, E.V. Advantages and Constraints of Eco-Efficiency Measures: The Case of the Polish Food Industry. Agronomy 2021, 11, 299. [Google Scholar] [CrossRef]

- Chakrobarty, S.; Rasheduzzaman, M.; Basunia, A.K. The Impact of COVID-19 on Bangladesh’s Food Security: A Review. IUP J. Supply Chain Manag. 2020, 17, 7–23. [Google Scholar]

- Eichhorst, W.; Marx, P.; Rinne, U. Manoeuvring through the Crisis: Labour Market and Social Policies during the COVID-19 Pandemic. Intereconomics Rev. Eur. Econ. Policy 2020, 55, 375. [Google Scholar] [CrossRef]

- Siddiqi, S.M.; Cantor, J.; Dastidar, M.G.; Beckman, R.; Richardson, A.S.; Baird, M.D.; Dubowitz, T. SNAP Participants and High Levels of Food Insecurity in the Early Stages of the COVID-19 Pandemic. Public Health Rep. 2021, 136, 457–465. [Google Scholar] [CrossRef] [PubMed]

- Koltai, J.; Toffolutti, V.; McKee, M.; Stuckler, D. Prevalence and Changes in Food-Related Hardships by Socioeconomic and Demographic Groups during the COVID-19 Pandemic in the UK: A Longitudinal Panel Study. Lancet Reg. Health Eur. 2021, 6, 100125. [Google Scholar] [CrossRef] [PubMed]

- Total Volume of Foreign Trade in Goods and Volume of Trade in Goods for Individual Countries in the Period of January–December 2020. Główny Urząd Statystyczny. 2021. Available online: https://stat.gov.pl/obszary-tematyczne/ceny-handel/handel/obroty-towarowe-handlu-zagranicznego-ogolem-i-wedlug-krajow-w-okresie-styczen-grudzien-2020-roku,1,101.html (accessed on 29 September 2021).

- Polish Foreign Trade in Agri-Food Products in 2020. Ministry of Agriculture and Rural Development 2021. Available online: https://www.gov.pl/web/rolnictwo/polski-handel-zagraniczny-artykulami-rolno-spozywczymi-w-2020-r (accessed on 29 September 2021).

- Polish-German Relations at the End of Angela Merkel Term. Available online: https://www.dw.com/pl/relacje-polsko-niemieckie-na-koniec-rz%C4%85d%C3%B3w-angeli-merkel/a-59127843 (accessed on 28 October 2021).

- Neuman, A. Mergers and Merger-like Business Combinations with Special Consideration of Financial Aspects; P. Haupt.: Bern, Switzerland, 1994. [Google Scholar]

- Lewandowski, M. (Ed.) Mergers and Acquisitions in Poland against the Backdrop of Global Trends; WIG-Press: Warsaw, Poland, 2001. [Google Scholar]

- Szyszka, A. Reakcja inwestorów na publiczne wezwania do sprzedaży akcji, Materiały Konferencyjne, Międzynarodowa Konferencja Finansów; Uniwersytet Szczeciński: Międzyzdroje, Poland, 2002; pp. 333–355. [Google Scholar]

- Ebneth, O.; Theuvsen, L. Internationalization and Corporate Success-Event Study Evidence on M&As of European Brewing Groups. In Proceedings of the 15th Annual World Food and Agribusiness Symposium and Forum, Chicago, IL, USA, 23–27 August 2005. [Google Scholar]

- Firth, M. Takeovers in New Zealand: Motives, stockholder returns, and executive share ownership. Pac. Basin Financ. J. 1997, 5, 419–440. [Google Scholar] [CrossRef]

- Loderer, C.; Zimmermann, H. Stock offerings in a different institutional setting: The Swiss case, 1973–1983. J. Bank. Financ. 1988, 12, 353–378. [Google Scholar] [CrossRef]

- COVID-19: Stringency Index. 2021. Available online: https://ourworldindata.org/grapher/covid-stringency-index (accessed on 10 September 2021).

- Oxford COVID-19 Government Response Stringency Index. Available online: https://data.humdata.org/dataset/oxford-covid-19-government-response-tracker (accessed on 13 September 2021).

- Liu, H.; Manzoor, A.; Wang, C.; Zhang, L.; Manzoor, Z. The COVID-19 outbreak and affected countries stock markets response. Int. J. Environ. Res. Public Health 2020, 17, 2800. [Google Scholar] [CrossRef] [PubMed]

- Ahmar, A.; Val, E. Sutte ARIMA: Short-term forecasting method, a case: COVID-19 and stock market in Spain. Sci. Total. Environ. 2020, 729, 138883. [Google Scholar] [CrossRef]

- Ngwakwe, C.C. Effectof COVID-19 Pandemic on Global Stock Market Values. Differ. Analysis. Econ. 2020, 16, 255–269. [Google Scholar]

- Estrella, A.; Mishkin, F.S. Predicting US recessions: Financial variables as leading indicators. Rev. Econ. Stat. 1998 80, 45–61.

- Wang, Z.; Salin, V.; Hooker, N.H.; Leathham, D. Stock market reaction to food recalls: A GARCH application. Appl. Econ. Lett. 2002, 9, 979–987. [Google Scholar] [CrossRef][Green Version]

- Ichev, R.; Marinč, M. Stock prices and geographic proximity of information: Evidence from the Ebola outbreak. Int. Rev. Financ. Anal. 2018, 56, 153–166. [Google Scholar] [CrossRef]

- Yan, C. COVID-19 Outbreak and Stock Prices: Evidence from China. SSRN Electron. J. 2020, 1–32. [Google Scholar] [CrossRef]

- Rogers, R.T.; Sexton, R.J. Assessing the importance of oligopsony power in agricultural markets. Am. J. Agric. Econ. 1994, 76, 1143–1150. [Google Scholar] [CrossRef]

- Pozytywne Tendencje w Polskim Eksporcie Artykułów Rolno-SpożYwczych w 2020 r. NSCA. 2021. Available online: https://www.kowr.gov.pl/biuro-prasowe/aktualnosci/pozytywne-tendencje-w-polskim-eksporcie-artykulow-rolno-spozywczych-w-2020-r (accessed on 7 September 2021).

- Katchova, A.L.; Enlow, S.J. Financial performance of publicly-traded agribusinesses. Agric. Financ. Rev. 2013, 73, 58–73. [Google Scholar] [CrossRef]

- Alfaro, L.; Chari, A.; Greenland, A.N.; Schott, P.K. Aggregate and Firm-Level Stock Returns During Pandemics, in Real Time; National Bureau of Economic Research: Cambridge, MA, USA, 2020; Volume 10, pp. 2–24. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kacperska, E.; Kraciuk, J. Changes in the Stock Market of Food Industry Companies during the COVID-19 Pandemic—A Comparative Analysis of Poland and Germany. Energies 2021, 14, 7886. https://doi.org/10.3390/en14237886

Kacperska E, Kraciuk J. Changes in the Stock Market of Food Industry Companies during the COVID-19 Pandemic—A Comparative Analysis of Poland and Germany. Energies. 2021; 14(23):7886. https://doi.org/10.3390/en14237886

Chicago/Turabian StyleKacperska, Elżbieta, and Jakub Kraciuk. 2021. "Changes in the Stock Market of Food Industry Companies during the COVID-19 Pandemic—A Comparative Analysis of Poland and Germany" Energies 14, no. 23: 7886. https://doi.org/10.3390/en14237886

APA StyleKacperska, E., & Kraciuk, J. (2021). Changes in the Stock Market of Food Industry Companies during the COVID-19 Pandemic—A Comparative Analysis of Poland and Germany. Energies, 14(23), 7886. https://doi.org/10.3390/en14237886