Abstract

The use of geothermal energy to produce heat and electricity has become increasingly important in recent years. This is mainly due to environmental issues and the need to ensure energy security. The aim of the article was to analyse and compare the ability to maintain cash balance of selected geothermal companies in Poland. The following were taken for verification: Przedsiębiorstwo Energetyki Cieplnej PEC Geotermia Podhalańska S.A., Geotermia Poddębice Sp. z o.o., Geotermia Mazowiecka S.A., Geotermia Pyrzyce Sp. z o.o. and Geotermia Czarnków Sp. z o.o. The adopted research methodology, combining accrual and cash recognition, allowed the analysis of the ability to create cash flows and maintain cash stability in 2016–2019. The study used financial data from the financial statements of the analysed companies. The analysis shows that the highest cash flows from assets defined as Free Cash Flow to Firm FCFF (over PLN 11,318 thousand) and the highest cash flows for owners Free Cash Flow to Equity FCFE (over PLN 10,005 thousand) are generated by Geotermia Mazowiecka S.A. At the same time, the balance between cash flows meeting the inequality FCFF ≥ FCFE + FCD, where FCD Free Cash Flow to Debt, determines the ability of assets to generate cash covering the current distribution of capital for its donors. Consequently, there is an increase in the value of cash resources identified in investments in the management balance sheet. Such a situation occurred in the case of Geotermia Poddębice Sp. z o.o. and Geotermia Mazowiecka S.A. The reverse situation, i.e., FCFF < FCFE + FCD is characteristic for cash imbalance. In such conditions there is a decrease in cash resources identified in the management balance. This occurred in PEC Geotermia Podhalańska S.A., Geotermia Pyrzyce Sp. z o.o. and Geotermia Czarnków Sp. z o.o.

1. Introduction

Sustainable development (SD) is one of the most important concepts of the second half of the 20th century, underpinned by a belief in the need to shape the right relationship between economic growth, the environment and people [1,2,3,4]. At the same time, a further focus mentioned in sustainable development is to meet the needs of future generations [1,5], which, in the context of maintaining economic, environmental and social and cultural vitality, provides an integral link to renewable energy [6]. Transferring the idea of sustainable development to the field of energy resulted in the creation of the concept of sustainable energy. Sustainable energy development (SED) is a strategic goal to create an efficient and reliable energy system that guarantees cohesion in SD areas [7,8,9].

Sustainable energy development is the practical implementation of Sustainable Development Goal 7—Affordable and Clean Energy. According to Bluszcz and Manowska, activities related to sustainable energy development focus primarily on increasing the use of renewable energy sources in the energy mix [10]. Lior, on the other hand, primarily points to the importance of improving energy efficiency [11], while studies emphasise the reduction of greenhouse gas emissions and air pollutants [12,13,14]. The paper [15] identifies four interrelated themes of energy sustainability: affordable access to modern energy services, sustainable energy supply, sustainable energy consumption and energy security. Gunnarsdottir et al. [15] point to the need for transformation of the current energy system to reduce its harmful effects. However, they emphasise the existing economic barriers to this transformation in the form of a shortage of competitively priced technologies or changes in energy prices. In turn, according to Golušin et al. [16], sustainable energy development is about the need to harmonise the energy development of humanity in accordance with the possibilities—natural energy resources. Like many previous authors, they also point to the need to revise the current way of managing energy, both globally and locally. As they agree, changes are needed in the traditional way of thinking, doing business and dealing with energy at all levels.

An interesting perspective on energy sustainability is also presented in the work [17], in which the authors present a set of energy indicators grouped into three dimensions: social, economic and environmental.

Mitchell indicates that a sustainable energy system should be “based on a mix of renewable energy technologies, renewable fuel transport, renewable heat, demand reduction, efficiency of use, and cogeneration of energy production” [18]. According to [19,20], the recognition of sustainability as a key solution for sustainable energy and the need to build a responsible energy mix mean that renewable energy sources can be relatively defined as sustainable.

As Sobczyk and Sobczyk point out, the European Union’s policy of limiting carbon dioxide emissions in recent years has imposed the need for member states to take various measures to develop low-emission energy [14]. Poland, as a member state, in order to meet the EU energy policy objectives domestically, implemented new climate protection regulations on 2 February 2021 by approving the Energy Policy of Poland 2040 (EPP 2040). According to the EPP 2040, the pillars of Poland’s energy policy until 2040 are [21]:

- a just transition, providing new development opportunities for the most affected regions in connection with a low-carbon energy transition;

- a zero-carbon energy system, based on the deployment of nuclear and offshore wind energy and increasing the role of distributed and civic energy;

- good air quality.

The adopted strategy assumes an increase in the share of renewable energy sources (RES) in all sectors and technologies. According to EPP 2040, in 2030, the share of RES in gross final energy consumption will be at least 23%—no less than 32% in electricity (mainly through wind and photovoltaic power), 28% in heating, and 14% in transport with a large contribution from electromobility. In addition, the reduction of the share coal in the production of electricity to 56% in 2030 and the deployment of nuclear power in 2033 was taken as a global measure of the EPP 2040 target [21].

The Energy Policy of Poland until 2040 responds to the most important challenges facing Poland in meeting energy demand in the coming decades and sets out the directions for the development of the energy sector, taking into account the tasks to be implemented in the short-term and medium-term. The EPP 2040 also aims to ensure the country’s raw material security by continuously expanding the resource base of raw materials, including energy resources, and intensifying activities in the exploration, recognition and development (exploitation) of geothermal water deposits and dry rock heat. The specific objectives of EPP 2040 are also oriented around the development and use of geothermal potential in the country, which is the subject of this paper [21].

Geothermal energy is based on using the thermal energy of rocks found in the interior of the Earth [22]. Geothermal energy escapes to the Earth’s surface naturally, with a capacity determined at around 46 TW [23]. The average geothermal flux is not very large, but given the enormous volume of the Earth, its geothermal resources are almost inexhaustible. Geothermal energy is heat extracted from the Earth’s interior in the form of hot water or steam, at a temperature of at least 20 °C. Available in the form of heat stored in rocks, trapped steam, water or brine, geothermal energy can be used directly for heating or to produce electricity.

The economic use of thermal water is one of the most environmentally friendly renewable energy sources. The geothermal energetics industry is developing in such a way that, in many cases, it is no longer present on a niche market only but is an increasingly important part of the mix renewable energy sources area. With the potential to provide clean and safe heating and cooling solutions (heat pumps are increasingly used not only for heating but also for cooling, extending their operating time and increasing their economic efficiency), geothermal is seen as almost completely emission-free at the point of operation. Analyses of the impact of the use of geothermal energy on the environment highlight, in many cases, a dramatic reduction in air pollution due to a reduction in the content of, among others, carbon dioxide, sulphur, nitrogen oxide, and carbon and ash in the air, or a marked improvement in the purity of surface waters [24,25]. This is due to the fact that the environmental effect for both existing and newly designed geothermal heat plants compared to conventional energy is very favourable, regardless of whether the comparative analysis is performed for central heating plants or individual heat sources [26].

The primary factor necessary for the development of geothermal energy is the existence of geothermal resources and favourable conditions determining the profitability of geothermal energy, but this alone does not yet determine the use of these resources. In the reality of broadly understood sustainability, an important element which conditions the start of geothermal investments is also the appropriate state of social acceptance, both among potential consumers and decision-makers. Sustainable development of the town and region based on the use of this resource is not possible without a positive public opinion on geothermal activities. Increasing public awareness of the numerous opportunities offered by the economic exploitation of geothermal water means that more and more local communities are seeing an opportunity for the social and economic development of geothermal areas. This is primarily related to the development of spa tourism and recreation, which directly improves the quality of life of the local community. According to numerous studies, positive public opinions are mainly due to the implementation of numerous associated investments, tourist services, functional transformations, and changes in the physiognomy of the development [27,28]. Due to the development of infrastructure and the tourist and spa offer, local communities gain more employment opportunities in the service sector and increase the quality of services. A region rich in high-temperature deposits is at the same time becoming more attractive to outside investors and entrepreneurs. For this reason, an increasing number of local societies are becoming convinced of this type of energy and stress its importance in the dynamic social and economic development of a region and in improving the attractiveness of tourism. Showing an attitude of support and acceptance towards local government representatives and managers of geothermal-related companies in relation to their geothermal activities indicates a high degree of identification with the directions chosen by decision-makers [27]. Moreover, also of great importance for development are the numerous programmes under which funding can be obtained for operating and investment activities.

The acquisition of these funds reflects the financial activity of the company, while their involvement in fixed assets or current assets must be linked to the maintenance of a cash balance between the investment and operational area and the financial area. In the light of the above, the authors of the article decided to analyse the cash balance in geothermal enterprises in Poland, which, showing certain specificities, require investments in assets.

The aim of the article is to present the condition of the geothermal industry in Poland in the context of the analysis of cash balance generated in individual enterprises ensuring the maintenance of dynamic financial liquidity. It is treated in the set of company objectives as the main short-term objective ensuring survival in a competitive market.

The high investment requirements of these companies in Polish conditions, with low profitability, determine the need to raise capital from outside, which consequently leads to their excessive indebtedness.

The aim of the article was achieved through analyses presented in several areas.

The Introduction includes literature analysis of geothermal energy use in the energy mix. Particular reference was made to the EPP 2040 programme adopted for implementation in Poland in the aim to diversify the energy generation sources with an increased share of renewable energy, including geothermal.

In the next section, the sector of energy generation from geothermal sources in the world and in Poland is characterized. It presented the determinants of its development in referring to the problem of its financing. Working out capital from its own sources and other outside activities in the context of acquiring external financing are important determinants of the current investments operation in the enterprises, both in the short-term context related to liquidity, and in the long-term context related to building economic value based on discounted cash flows.

The Materials and Methods section presents a methodology for assessing the balance between cash flows related to the efficiency of Free Cash Flow to Firm FCFF assets and their distribution towards owners as Free Cash Flow to Equity FCFE and to financial institutions as Free Cash Flow to Debt FCD.

The Results section presents calculations based on the five largest geothermal companies in Poland and indicates the balance in cash creation between operational, investment and financial areas.

The Discussion section presents the link between operational results and cash flows for the owner, who can allocate the generated funds for further development or consume them through dividend payments. Obviously, the strategy adopted by the owner is reflected in the final cash balance of the company.

The whole article ends with conclusions that synthetically summarize the conducted research and analysis.

2. A Conceptual Framework: State of the Use of Geothermal Energy in the World and in Poland

Geothermal energy is currently used in 88 countries around the world. According to the World Energy Assessment (WEA) report, the highest potential value to geothermal energy of all forms of renewable energy sources has been confirmed [29]. This potential is so far only marginally developed. According to International Energy Agency, geothermal energy covered only 4.3% of global electricity demand in 2016 [30].

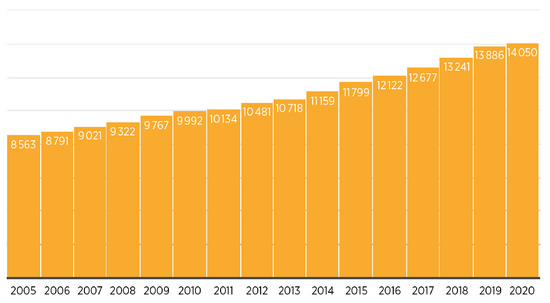

According to [31], the development of geothermal energy is currently still lagging behind wind and photovoltaic. Wind and photovoltaic energy show accelerated growth with a clear exponential trend, while the growth of geothermal development is more or less linear (steady but slow growth—only a few percent increase per year) (Figure 1).

Figure 1.

Global geothermal energy capacity from 2005 to 2020 (MWe). Source: Reprinted from [32].

Younger suggested that the under-utilisation of geothermal potential is mainly due to uncertainty about the availability of resources in poorly explored fields and the concentration of full lifetime costs in capital expenditure (capex) at an early stage [33].

However, recent advances in drilling technology and management have the potential to reduce exploration uncertainty and lower initial capital expenditure [33]. Therefore the use of geothermal energy is expected to expand further in many countries in the coming years. Lund and Toth identified the following areas as particularly important and promising: district heating (especially in Europe), agriculture, industrial applications, balneotherapy and recreation, and electricity generation, especially when talking about truly low-carbon or even zero-carbon energy [34].

Today, the energy of the interior of Earth is the most important source of energy for countries such as Iceland (around 90%) and the Philippines (around 60%).

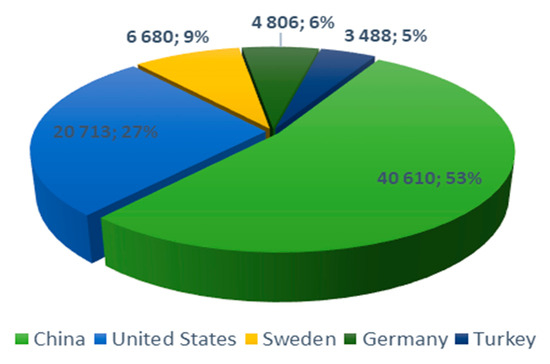

Considering the largest installed capacity, the top five countries using geothermal energy directly are: China, the USA, Sweden, Germany and Turkey, which together account for 71.1% of world capacity (Figure 2). Top countries with the highest annual geothermal energy consumption are China, the USA, Sweden, Turkey and Japan, respectively, accounting for 73.4% of annual consumption worldwide [34].

Figure 2.

Worldwide leaders in the direct-use of geothermal energy including geothermal heat pumps in 2019 (MW). Source: Own study on the basis of: [34].

Analysis of the data in terms of population shows that smaller countries, especially the Nordic countries, dominate. Among the leading countries in terms of installed capacity (MW/inhabitant), the following stand out in particular: Iceland, Sweden, Finland, Switzerland and Norway. Among the leading giants in the use of geothermal, significant contributions from Indonesia, Mexico, Italy and New Zealand are also noted [34].

When considering the use of geothermal energy on European soil, according to data from 2016, geothermal energy accounts for approximately 3% of total primary renewable energy production in the European Union. Europe’s geothermal resources make it possible to exploit them much more extensively than hitherto [35]. According to the Joint Research Centre of the European Commission, the EU has the fourth largest geothermal energy capacity in the world—just over 1 GW, enough to power about 2 million homes [36].

Poland is also among the European countries using renewable energy. The structure of obtaining energy from renewable sources for Poland results primarily from the geographical conditions specific to the country and the resources that can be developed. According to the Central Statistical Office, energy obtained from renewable sources in Poland in 2018 comes predominantly from solid biofuels (69.26%), wind energy (12.40%) and liquid biofuels (10.20%). The total energy value of acquired primary energy from renewable sources in Poland in 2018 was 371,588 TJ [37].

The importance of geothermal energy in Poland is, so far, marginal and its share in 2018 was only 0.3%, the share of heat pumps (of all types) was about 0.6%. However, a positive sign is the gradual increase in the use of geothermal energy, especially over the period between 2014 and 2018. In 2018, its consumption was 17.0% higher than in 2014. Geothermal energy was mainly used to meet heat demand, in 2018—75.0% of consumption in households and 25.0% in trade and services [37].

Poland has great potential to develop geothermal energy due to its very good geothermal conditions, even though it lies outside volcanic areas. More than 80% of the country is covered by three geothermal provinces: Central European (Polish Lowlands), Ciscarpathian, and Carpathian. The water temperature for these areas ranges from 30–130 °C and the depth of occurrence in sedimentary rocks ranges from 1 to 10 km. However, only water with temperatures above 80 °C can be used as an independent heat source; below this temperature they must be reheated for use in district heating, particularly in winter. The existing geological and hydrogeological conditions in Poland determine the occurrence of low-temperature geothermal resources (low-enthalpy geothermal) [38,39]. Low-temperature geothermal uses natural heat stored in shallow parts of the Earth’s crust. The Geological and Mining Act specifies that geothermal heat of low enthalpy may be carried only by water whose temperature measured at the outflow from the borehole does not exceed 20 °C [40]. Low-temperature geothermal does not offer the possibility of using the Earth’s heat directly—it requires the use of supporting equipment, commonly called geothermal (ground source) heat pumps (GCHP), which bring the energy to a higher thermodynamic level. Therefore, at present, geothermal energy is used in Poland mainly for heating purposes, e.g., in the Podhale region, which has a rich offer of thermal pools, spas and recreational centres.

Selected information on the largest geothermal heat plants in Poland is given in Table 1.

Table 1.

The largest thermal power stations in Poland, 2018.

At the end of 2018, the total installed geothermal heat capacity of the six listed heat plants was 74.6 MW (total 138.2 MW) and the total geothermal heat production was around 868 TJ. Each of the district heating installations shown in Table 1 is different, both in terms of the characteristics of the water extracted (temperature, mineralisation, pressure) and the type of installation, the technical solutions used, and the heat consumers. At present, the district heating plants are working on modernizing and expanding their facilities, with the result that their capacity, production and heat sales are constantly increasing.

3. Materials and Methods

There are different views in the literature on determining the size of an enterprise [41,42]. Additionally, calculating the value of an enterprise is proposed differently [43]. There are differing views on the basis that should be used to determine the size of companies. In business valuation, cash flow reflects the economic value of the business as a strategic measure of its performance. At the same time, valuation based on economic value also takes into account intangible drivers of value creation and is considered the most methodologically correct. This cannot be said of the valuation based on the value of assets regarding the methodology of adjusted net assets, which focuses only on tangible aspects. The value of a business is built on tangible and intangible areas, and cash flow reflects both.

The concept of free cash flows appears in the literature most often as part of the approach to value creation, which is a key element of any company’s business strategy [44]. According to Mielcarz and Mlinarič [45], the FCFE model is one of the most important methods for valuing a company, while they also point out the risks, noting the danger of over-investment. The authors also state that FCFF discounted with a company’s Weighted Average Cost of Capital WACC, should be indicated as an appropriate solution from the value management point of view [45]. Dagnino et al. [46] point out that the FCFE method belongs among the primary sources for managerial approaches and evaluations from the perspective of potential investors. According to Georgios and Chris [47], the FCFE method views the company as a living organism regardless of the size of the assets and analyses future expected returns rather than past returns. Moreover, it is claimed that the FCF value reflects all decisions made by managers [48].

According to Koller [49], free cash flow FCF is crucial to the valuation process, but it cannot be calculated directly from a company’s reported financial statements, which combine operating results, non-operating results and capital structure. Therefore, to calculate FCF, accounting financial statements must first be reorganised into new statements that separate operating items, non-operating items and capital structure.

A company’s cash flow reflects decision-making in three areas, related to operating, investing and financing activities. Joint flows to and at the disposal of the owner are derived from the ability to generate cash from assets, which reflect the ability to create cash in an operating and investment context, as well as from liabilities related to capital treated as sources of interest-bearing financing.

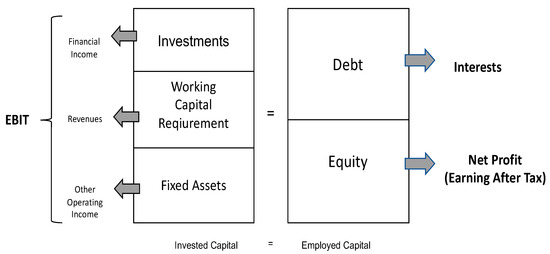

The creation of flows from assets is equated with FCFF (free cash flow to firm), which is based on the determination of Earnings Before Interests and Taxes EBIT, operational performance, which is then adjusted by flows from investing activities relating to fixed assets, as well as from operating activities relating to net working capital requirements. Thus, a link is made between the accrual recognition of the ability to create financial result from EBIT assets and its cash equivalent identified with FCFF [49].

At the same time, FCFF cash flow must secure cash for debt payment FCD (free cash flow to debt) and cash for the owner FCFE (free cash flow to equity), who can use it for dividends or invest it in the company for further growth. FCD cash flows are related on an accruals basis to the financial cost of servicing interest-bearing debt and include the cash change in value of debt whose repayment is effected by capital instalments. FCFE flows, in turn, form the basis for the payment of potential dividends, which, as is well known, are not a cost to the company but are an expense reflecting the owner’s cost of equity.

The link between the accrual streams that shape financial performance and the areas of corporate decision-making is shown in Figure 3.

Figure 3.

Analysis of a model based on free cash flows. Source: Own study on the basis of: [50].

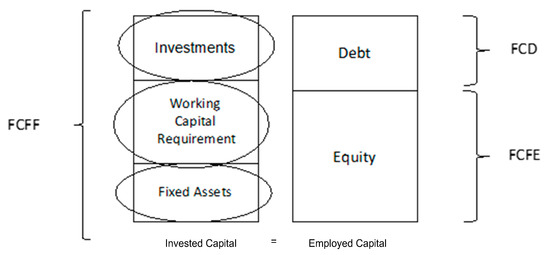

On the basis of accrual streams, i.e., revenues and costs, which shape accounting efficiency and are linked to the respective performance categories, a cash basis reflecting the cash flows corresponding to the respective decision areas can be constructed (Figure 4).

Figure 4.

Linking decision-making areas to cash flow. Source: Own study on the basis of: [50]. Legend: FCFF—Free Cash Flow to Firm; FCFE—Free Cash Flow to Equity; FCD—Free Cash Flow to Debt.

The general relationship between the flows presented can be represented with the following equation:

FCFF = FCD + FCFE

Payment of borrowing costs together with repayment of the capital itself, as well as dividend payments, must be linked to the ability to generate cash from assets through FCFF.

In the of dividend distributions, if they turn out to be greater than the FCFE flows generated, the level of cash generated in previous periods decreases and the financial investment held decreases. Of course, increased dividend payments over and above the FCFE earned can be offset by increased debt, which will have an impact on FCD flows. In the opposite situation, the lower value of dividends paid or the complete absence of dividends in relation to FCFE earned results in an increase in cash in assets on the balance sheet.

The methodologies for determining the different categories of cash flows are presented in Table 2.

Table 2.

Method of determining free cash flow FCF.

The overall relationship between FCFF flows and FCFE and FCD shows the ability to generate cash from owned assets and identifies the distribution of cash to financial institutions, as well as the owner. On the other hand, an analysis of the FCFE earned and the dividends actually paid makes it possible to assess the owner’s behaviour with regard to reinvestment and ensuring the company’s development from the equity built up on the retention of earnings.

The impact of the presented research should be seen in the possibility of solving managerial problems and analyses related to short-term liquidity and the evaluation of long-term investments, as well as the analysis of the economic value of the company. The stability between FCFF, FCFE and FCD allows us to identify the effectiveness of decision-making areas in terms of cash generation and its distribution to donors, such as owners or external financial institutions. At the same time, the analysis of the company by internal business segments and responsibility centres will allow a realistic estimation of profitability and liquidity in maintaining flows in internal units that do not formally report their results.

Managerial implications related to the presented research have an impact in the management reporting that supports decision-making functions in the company. They are related to the implementation of tasks in managerial finance and controlling, which are focused on planning cash in current activities and its control for internal needs. This approach, with appropriate access to data, can be fulfilled in short time horizons (e.g., monthly) by observing the cash balance between FCFF, FCFE and FCD. On this basis, budgeting can be done and then, at the budget execution stage, the level of its execution comparing to plans may be monitored. In the long term, planning and estimating cash flows especially in the methodology of FCFF and FCFE can be used to build an economic value strategy for the company based on cash flow maximization and their discounting at the present moment.

Such decisions cannot be made on the basis of financial reporting from traditional accounting, which formally includes the balance sheet and profit and loss account, because these reports are made at longer intervals and at legal requirements. They do not serve the purpose of decision making and management.

4. Results

This part verifies the cash flows for stakeholders on the example of selected geothermal companies in Poland. The financial statements of five companies involved in geothermal heat production were empirically examined. The following entities were included in the verification: PEC Geotermia Podhalańska S.A., Geotermia Poddębice Sp. z o.o., Geotermia Mazowiecka S.A., Geotermia Pyrzyce Sp. z o.o. and Geotermia Czarnków Sp. z o.o. The research methodology, combining accrual and cash treatment, allowed for an analysis in terms of the ability to create flows and maintain cash balance in 2016–2019. The study was based on data from publicly available financial statements of the entities.

The starting point for the analysis was the transformation of companies’ classic accounting balance sheets to their managerial form, which provides a more useful tool for measuring the relationship between operational and investment decisions and their financial consequences. Next, the cash flows typical of each group of interests, i.e., FCFF, FCFE and FCD, were verified and the values were determined and presented in graphs, indicating the trends of their changes.

The managerial balance sheet of the first company analysed is shown in Table 3.

Table 3.

Managerial balance sheet of PEC Geotermia Podhalańska S.A. (PLN thousand).

When analysing the performance of PEC Geotermia Podhalańska S.A. in 2016–2019, it should be noted that the demonstrated ability to generate operating profits at the level of EBIT from assets did not clearly translate into the ability to generate cash flows identified as FCFF. Thus, the profitability of the business did not clearly translate into liquidity (Table 4).

Table 4.

Shaping of FCFF, FCFE and FCD flows and the components affecting them in PEC Geotermia Podhalańska S.A. (PLN thousand).

In 2016, the profitability of EBIT after taxation supported by the favourable impact of depreciation and the reduction in net working capital requirements was reflected in the level of cash generated, which was only harmed by expenses from provisions released. Nevertheless, this period saw the highest level of cash generated at PLN 13,509 thousand.

In 2018, EBIT profitability supported by positive cash flow from the reduction in net working capital requirements, together with the value adjusting the result by the level of provisions set aside, maintained a positive level of FCFF cash generation, even with ongoing investments in fixed assets at PLN 14,511 thousand.

Only in the two years analysed, i.e., 2016 and 2018, FCFF cash flow was positive: PLN 13,509 thousand in 2016, and PLN 2116 thousand in 2018. At the same time, no positive FCFF was reported in the other two years with EBIT operating profitability. In 2016, this was mainly influenced by an increase in net working capital requirements by PLN 44,425 thousand related to the management of current assets and current liabilities. At the same time, even the level of increase in provisions by PLN 38,639 thousand did not prevent negative FCFF cash flows. The increase in provisions (provisioning for future expenses), although costly in nature, has a positive effect on cash flows.

In turn, in 2019, negative flows were significantly influenced by investments in fixed assets, which involved capital expenditures of PLN 11,759 thousand. Increased net working capital requirements and the release of provisions for expenses generated were also adversely affected.

When comparing the efficiency of cash generated from FCFF assets, it is worth to analyse their distribution towards FCD debt payment and potential FCFE payments to the owner, which should safeguard the interests of shareholders, e.g., in the form of dividends.

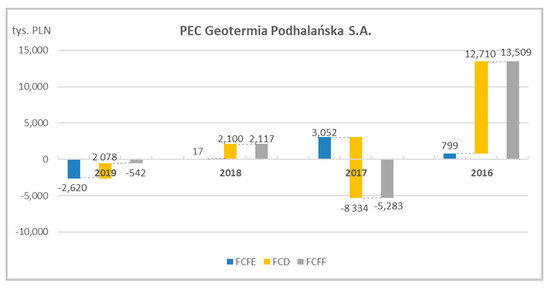

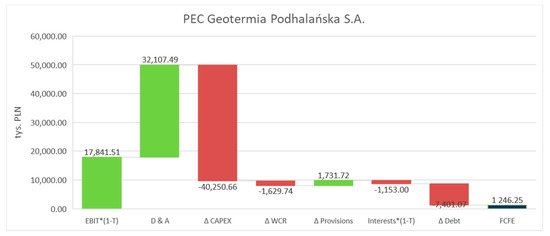

In 2016, positive flows from FCFF assets were consumed by financing activities, as they were used to repay debt to external financial institutions, i.e., FCD, amounting to PLN 12,710 thousand (Figure 5). This expense has resulted in a significant depletion of FCFE cash placed at the disposal of the owner, which amounted to only PLN 779 thousand.

Figure 5.

Formation of FCFE, FCD and FCFF in PEC Geotermia Podhalańska S.A. Source: Own study on the basis of: [51].

In contrast, in 2018, the positive flows for the owner of FCFE were a consequence of raising capital and getting indebted, which resulted in an inflow of FCD of PLN 8334 thousand. Even with the negative cash generation capacity of FCFF assets in this period amounting to PLN—5283 thousand, such a cash injection led to a positive generated balance for the owner of PLN 3052 thousand. In 2018, it can be considered that the entire flow from FCFF assets was used to pay FCD debt, which consequently led to a cash balance for the owner of FCFE of just over PLN 16,000.

In the last year of the analysis, it is possible to identify a condition where the highest EBIT operating profitability in the period 2016–2019 does not translate to cash flow. Cash deficit on FCFF of PLN—542 thousand and repayment of capital resulting from FCD debt payment of—PLN 2078 thousand leads to an estimated cumulative negative cash flow for the owner of FCFE of PLN—2620 thousand.

To sum up the analysis of PEC Geotermia Podhalańska S.A., it can be concluded that the overall satisfactory operating efficiency measured by the generated operating profits did not directly translate into the state of financial liquidity reflected by the ability to generate cash flows.

Compared to PEC Geotermia Podhalańska S.A., the entity Geotermia Poddębice Sp. z o.o. is a relatively smaller entity both in installed geothermal capacity and in invested capital (IC) and employed capital (EC), reflected in adjusted assets and liabilities presented in the management balance sheet (Table 5).

Table 5.

Managerial balance sheet of Geotermia Poddębice Sp. z o.o. (PLN thousand).

In the case of Geotermia Poddębice Sp. z o.o., it can be noted that operating profitability from assets, based on EBIT, correlates with the ability to generate cash from FCFF assets in virtually every year of the analysis, i.e., in the period 2016–2019 (Table 6).

Table 6.

Formation of FCFF, FCFE and FCD flows and the components affecting them in Geotermia Poddębice Sp. z o.o. (PLN thousand).

Analysing the operating results achieved in the case of the entity Geotermia Poddębice Sp. z o.o., one can notice their positive level in each of the analysed periods in 2016–2019. The lowest level of EBIT was realised in 2016, PLN 579 thousand, while the highest was in 2017, PLN 884 thousand.

Their stability translated into positive cash flows from assets as measured by FCFF, which were also positive. The highest level of FCFF was realised in 2017 and amounted to PLN 1248 thousand. In addition to the operating profits, stable depreciation and amortisation charges were the source of these cash flows, which were favourably cash flowing and at the same time higher than the CAPEX investment in fixed assets. This imbalance in the long term leads to decapitalisation of physical assets and does not ensure their reproduction, which is not advantageous but ensures cash efficiency in the short term. FCFF cash flows were adversely affected by released provisions, the release of which may indicate cash outflows related to the materialisation of liabilities for which they were assumed in earlier periods. FCFF flows were also adversely affected by increased net working capital requirements. In 2018 alone, there was a reduction in net working capital requirements which translated into cash benefits of PLN 377 thousand.

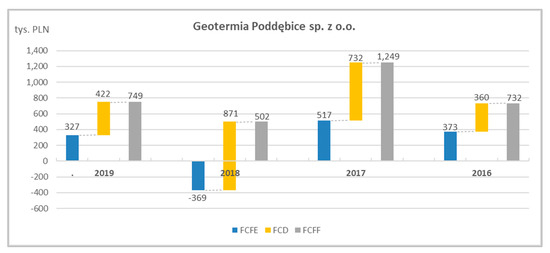

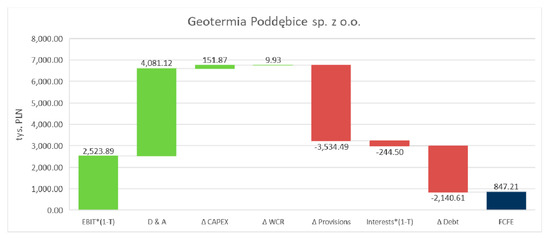

Financial stability between the operational investment and financial areas requires a comparison between the flows and distribution of money generated from assets towards securing payments to external capital donors FCD and the owner FCFE (Figure 6).

Figure 6.

Formation of FCFE, FCD and FCFF in Geotermia Poddębice Sp. z o.o. Source: Own study on the basis of: [52].

A stable policy of maintaining cash flow between decision-making areas can be seen in 2016–2019. It is characterised by a situation in which the FCFF flows generated from the assets are sufficient to cover the debt payment of the FCD, and the remaining part is at the disposal of the owner in the form of FCFE. The only exception is 2018, in which FCFF flows generated, of PLN 502 thousand, were not sufficient to cover debt payment in the amount of PLN 871 thousand. As a result, the FCFE balance for the owner amounted to PLN—369 thousand and this was the only situation in which operational efficiency and the ability to generate cash from assets did not translate into a cash balance for the owner.

The third entity analysed is Geotermia Mazowiecka S.A., which is the smallest of the analysed entities in terms of installed geothermal heat capacity. At the same time, the analysis of invested capital and its sources of financing shows a gradual increase in invested capital (IC) and employed capital (EC), which translates to a strengthening of the balance sheet structure and a strengthening of financial positions (Table 7).

Table 7.

Managerial balance sheet of Geotermia Mazowiecka S.A. (PLN thousand).

For the years 2016–2019 analysed, EBIT operating results show positive values indicating profitable operations. Only the declining level of these profits, which in the last of the analysed years, i.e., 2019, were the smallest and amounted to PLN 1647 thousand, may be alarming (Table 8).

Table 8.

Formation of FCFF, FCFE and FCD flows and the components affecting them in Geotermia Mazowiecka S.A. (PLN thousand).

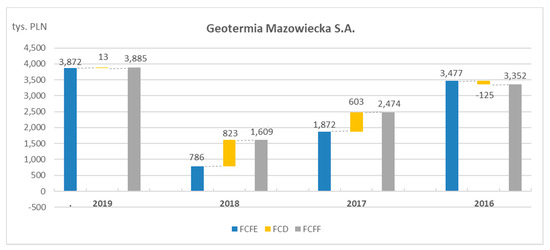

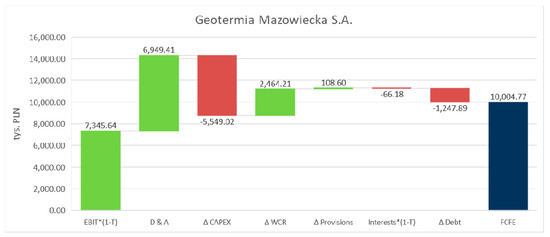

Positive operating results translated into positive FCFF asset flows. For the years 2016–2019 analysed, EBIT operating results show positive values indicating profitable operations. The only worrying thing may be the year-on-year decrease in the level of the aforementioned profits, which in the last of the analysed years, i.e., 2019, were the lowest and amounted to PLN 1647 thousand (Table 8). FCFF asset flows were positive in every year, with high levels especially in 2016, of PLN 3477 thousand, and 2019, of PLN 3872 thousand due to the favourable cash proceed of depreciation and a reduction in net working capital requirements, which significantly freed up cash—PLN 1670 thousand in 2016 and PLN 2589 thousand in 2019. The links between FCFF flows and flows for capital donors, i.e., FCD and FCFE, are shown in Figure 7.

Figure 7.

Formation of FCFE, FCD and FCFF in Geotermia Mazowiecka S.A. Source: Own study on the basis of: [53].

The positive FCFF cash flow allowed FCD debt payments to external capital donors in each year. In 2016 alone, with a cash surplus from FCFF, the balance from FCD was negative, which meant that the company injected around PLN 125 thousand in external capital. Thus, this amount caused the FCFE balance for the owner to be higher than the flow earned from FCFF assets alone. In the remaining years, i.e., 2017–2019, the company stably paid the debt from the generated FCFF flows, leaving the FCFE flow available to the owner. The highest level of cash from FCFE was recorded in 2019 and amounted to PLN 3872 thousand.

In contrast to those described earlier, Geotermia Pyrzyce has relatively less geothermal thermal capacity but a higher level of assets and funding sources with respect to the management approach identifying capital invested and employed (Table 9).

Table 9.

Managerial balance sheet of Geotermia Pyrzyce Sp. z o.o (PLN thousand).

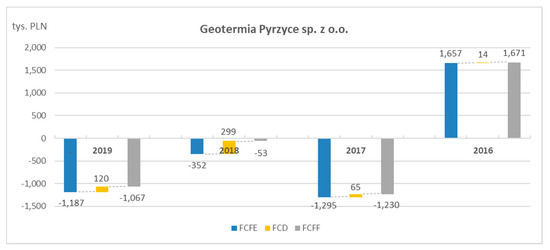

Analysing the managerial balance sheet (Table 9) and compiling the information from the managerial cash flow statement, it can be seen that there is a systematic decline in the cash resources held in the analysed years 2016–2019. This is the result of the negative flows from FCFF assets in the last three years, which are not able to cover the flows for the external financiers of FCD and for the owner FCFE. Only in one year, i.e., 2016, positive FCFF flows were recorded and they amounted to PLN 1671 thousand (Table 10).

Table 10.

Formation of FCFF, FCFE and FCD flows and the components affecting them in Geotermia Pyrzyce Sp. z o.o. (PLN thousand).

At the same time, with declining cash and negative cash flows at both FCFF and FCFE levels, Geotermia Pyrzyce Sp. z o.o. operates profitably at the EBIT operating level.

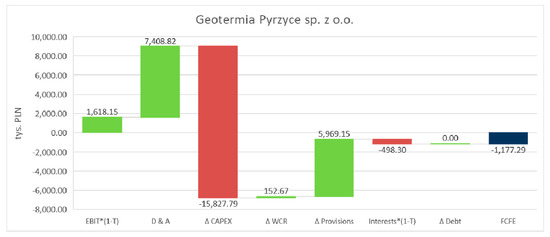

Negative FCFF cash flows were recorded between 2017 and 2019. In 2017, significantly high CAPEX capital expenditure of PLN 15,757 thousand negatively impacted operating liquidity despite the favourable reallocation of expenditure and the creation of provisions for future liabilities in the amount of PLN 11,324 thousand. In addition, the positive impact from depreciation and amortisation, as well as provisions made, did not compensate for the negative FCFF balance.

According to Figure 8, positive FCFF flows occurred only in 2016. In the other years, there is a lack of ability to generate cash from assets. While repayments to FCD’s external financial institutions remain constant, there is an increase in the negative cash balance for the owner. This is offset by a decrease in cash held in the management balance sheet which presents a decrease in this item in invested capital, reflecting adjusted assets.

Figure 8.

Formation of FCFE, FCD and FCFF in Geotermia Pyrzyce Sp. z o.o. Source: Own study on the basis of: [54].

The smallest of the enterprises discussed in this article is Geotermia Czarnków Sp. z o.o. It is characterised by the lowest value of invested capital (IC) and employed capital (EC) in the analysed years 2016–2019 (Table 11).

Table 11.

Managerial balance sheet of Geotermia Czarnków Sp. z o.o. (PLN thousand).

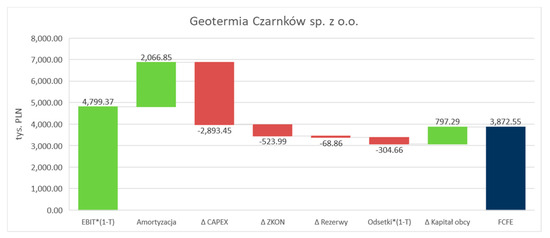

Analysing the operating profitability of Geotermia Czarnków Sp. z o.o., it is possible to notice in each year a positive value of the operating result EBIT, with the highest result the company recorded in 2016 PLN −3991 thousand.

With positive EBIT, the company shows positive FCFF flows from assets. The only year in which FCFF flows were negative is 2018, influenced by significant CAPEX capital expenditure, which was the highest in the whole period and amounted to over PLN 3377 thousand. At the same time, it should be noted that in the same year, such a large cash loss from assets was largely compensated by financing from external financial entities, which translated into the value of FCD in the amount of over PLN 3068 thousand. As a result, the flow for FCFE owners was negative and amounted to PLN −258 thousand. Negative FCFE was still recorded by the company in 2019, in which positive FCFF flow of over PLN 493 thousand went entirely to repayment of financial liabilities and interest in the form of FCD, of PLN 496 thousand. At the same time, FCFE flows amounted to PLN −2510 thousand.

Precise calculations of flows and their mutual coherence are shown in Table 12.

Table 12.

Formation of FCFF, FCFE and FCD flows and the components affecting them in Geotermia Czarnków Sp. z o.o. (PLN thousand).

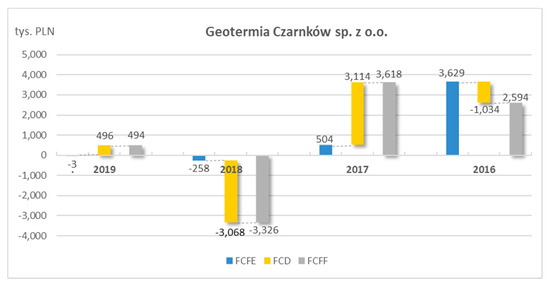

The correlation between the different cash flows is also shown in Figure 9.

Figure 9.

Formation of FCFE, FCD and FCFF in Geotermia Czarnków Sp. z o.o. Source: Own study on the basis of: [55].

In Geotermia Czarnków Sp. z o.o., the flows to the owner of FCFE were positive between 2016 and 2017, with the flows in 2016 resulting from the generation of a positive balance from assets in the form of FCFF and an external inflow through FCD. In contrast, in 2017, a relatively high level of FCFF cash was used to repay FCD debt, leaving little to the owner in the form of FCFE.

In 2018–2019, flows to the owner of FCFE were negative, with this being the result of a trend related to the fact that the positive balance of flows from FCFF assets was used entirely to repay financial debt in the form of FCD, and at the same time not enough to cover all liabilities. The negative balance of FCFE flows translates into a decrease in cash in the managerial balance sheet in the area of capital invested IC (Table 11).

5. Discussion

This section is divided into two parts. The first part refers to previous literature analyses on geothermal considered from the point of view of cost-effectiveness and future possibilities of its development. The second part presents a comparative analysis of the main cash flow determinants for individual geothermal companies in Poland in the context of the model proposed in Section 2. At the same time, FCFs were diversified from the point of view of different interest groups, indicating which of the companies analysed generates the most value in a given type of flow.

5.1. Economic Limitations on Geothermal Energy Use

According to literature studies, the development of geothermal energy covers a very wide range of capacities—from shallow, single wells for which heat pumps are used, to deep petrothermal systems. Correspondingly, the range of costs for research, evaluation, development, operation and decommissioning is also very wide [56]. For this reason, an economic analysis of the feasibility of exploiting the energy potential from the point of view of different plant capacities and at each stage of development is extremely important. All analyses indicate that even at the initial stage of development, geothermal energy is very costly due to high investment costs. According to references, this is mainly due to the need to drill boreholes, which significantly increases the cost of producing geothermal energy, even though the process is not very costly at the exploitation stage [57]. Among the main barriers to the development of geothermal energy, the reluctance of investors to build geothermal cogeneration plants is also indicated due to the long return period for the investment and the very high cost of water extraction [58]. Additionally, the use of geothermal energy is hampered by its high capex/opex ratio. One of the main reasons for this high rate is the scale and uncertainty of resource characterization [33]. The percentage breakdown of resource estimation costs for an onshore wind farm, by comparison, requires only 1% of the total project costs, while for geothermal it is about 47% [56].

On the other hand, analyses conducted on a national basis for individual consumers and small communities are optimistic. Under specific conditions, the profitability of geothermal investments carried out with external financing, regardless of the locations considered, is indicated for the needs of individual consumers [54]. It was also found that geothermal investments are viable for towns with 20,000 or more inhabitants when a 4-year income is available. Under certain conditions, such investments can be profitable for cities of 15,000 inhabitants [59].

Observation of market trends between 2005 and 2020 indicates that the cost of geothermal energy production is gradually falling. Currently, the cost varies between 40–80 EUR-MWh-1 [57]. This is mainly influenced by progress in drilling technology and management. Operating expenses are further reduced by more efficient management of reservoirs, supported by robust models and increasingly efficient systems for converting geothermal energy into electricity [33]. In order to provide the full exploitation of the potential of medium and low enthalpy geothermal resources, government support and incentives seem to be effective and not as required. Even so, according to the trends presented, broader prospects than hitherto are opening up for countries with high geothermal potential but insufficient geological conditions, for which until now, due to the great depth of most deposits, the production of geothermal energy has been unprofitable.

Numerous researches and analyses devoted to geothermal energy are mainly focused on new perspectives of development, exploitation methods, modelling of water treatment processes or ways of optimal water application [31,33,39,56,57,58,59].

There are also issues related to the high barriers that cause geothermal energy to still lag behind other renewable sources [60]. However, a knowledge gap arises in the case of geothermal energy due to incomplete coverage, partial analyses and insufficient focus on the components affecting the value of geothermal companies. In this context and due to the gaps in empirical research on the determinants affecting the value of geothermal companies, the authors have made a partial attempt to identify them on a national basis. At the same time, observing the gaps in this area, significant potential for further research was observed in order to obtain a more comprehensive financial analysis of geothermal companies.

5.2. Comparative Analysis in the Context of the FCFF Model in the Example of Geothermal Enterprises in Poland

A comparative analysis of the largest geothermal companies in Poland for the years 2016–2019 allows us to formulate the following conclusions:

- -

- Geotermia Podhalańska S.A. showed the highest operating profitability in total, in the analysed years, with PLN 17,842 thousand, while the lowest was Geotermia Pyrzyce Sp. z o.o., with PLN 1618 thousand.

- -

- Total depreciation and amortization costs treated as unspent and affecting flows in a favourable view are the highest in Geotermia Podhalańska S.A., at PLN 32,107 thousand. The lowest level of depreciation was recorded in Geotermia Czarnków Sp. z o.o., at PLN 2067 thousand. The level of depreciation depends on the capital invested in the form of tangible and intangible fixed assets.

- -

- The highest cumulative CAPEX incurred in Geotermia Podhalańska S.A., at PLN 40,251 thousand. As a consequence of such investments, fixed assets have the highest value in the form of invested capital. On the other hand, Geotermia Poddębice Sp. z o.o. has a positive balance on investments connected with fixed assets, which may mean their disinvestment.

- -

- Demand for net working capital in total was a source of cash creation in FCFE flows in three out of five analyzed companies, while the highest impact on this account was identified in Geotermia Mazowiecka S.A. and amounted to PLN 2464 thousand. The highest negative impact of demand on cash flows occurred in Geotermia Podhalańska S.A. and amounted to PLN −1630 thousand.

- -

- Analysis of provisions and accruals shows that the highest positive impact of this item on cash flows of FCFE occurred in Geotermia Pyrzyce and amounted to PLN 5969 thousand. This positive impact represents an increase in provisions that are costly in nature and have a negative impact on financial performance. Due to the fact that these are unspent costs, they affect the increase in the balance of generated cash flows for the analysed period. The largest negative impact of released or used provisions occurred in Geotermia Poddębice Sp. z o.o. and amounted to PLN −3534 thousand.

- -

- The highest level of repaid financial liabilities with interest in total was identified in Geotermia Podhalańska S.A., and amounted to PLN −8554 thousand. In turn, a positive balance in relations with external financing institutions was recorded by Geotermia Czarnków Sp. z o.o., which increased cash flows to the owner of FCFE by PLN 797 thousand.

In conclusion, Geotermia Podhalańska SA can be considered the largest of the analysed companies in the light of both being reported operating profitability at the EBIT level, and also incurring the highest expenditures in the area of investment activity as well as in the financial area due to debt payment.

However, examining the cumulative FCFE in the analysed period 2016–2019, it can be seen that the highest value is shown by Geotermia Mazowiecka S.A., with PLN 10,005 thousand.

Detailed analysis of FCFE cash flows and their sources is presented in Figure 10, Figure 11, Figure 12, Figure 13 and Figure 14.

Figure 10.

FCFF cash flows generated by PEC Geotermia Podhalańska S.A. in 2016–2019. Source: Own study on the basis of: [51].

Figure 11.

FCFF cash flows generated by Geotermia Poddębice Sp. z o.o. in 2016–2019. Source: Own study on the basis of: [52].

Figure 12.

FCFF cash flows generated by Geotermia Mazowiecka S.A. in 2016–2019. Source: Own study on the basis of: [53].

Figure 13.

FCFF cash flows generated by Geotermia Pyrzyce Sp. z o.o. in 2016–2019. Source: Own study on the basis of: [54].

Figure 14.

FCFF cash flows generated by Geotermia Czarnków Sp. z o.o. in 2016–2019. Source: Own study on the basis of: [55].

6. Conclusions

In Poland, energy production from geothermal sources is marginal and in recent years has not exceeded one percent. It should be stressed, however, that its systematic development can be seen, but it is determined by financial outlays for the identification of deposits and the study of their geothermal properties in the light of limiting future investment risks.

Investment opportunities and further development of the geothermal energy sector therefore depend on the possibility of financing its development through cash generated in the course of operating activities or its acquisition from external capital providers related to the financial market.

The research methodology presented in the article is based on the relationship between the management flows identified with cash from FCFF assets, which at the same time must service the repayment of debt to external entities and provide cash to the owner of FCFE. An imbalance between the ability of FCFF assets to generate cash can translate into a lower cash in balance sheet when the distribution in the form of FCFE and FCD is greater than the value of FCFF generated. In the opposite situation, it may lead to accumulation of cash in assets.

A clear trend of increasing the level of cash was present in Geotermia Mazowiecka S.A. and Geotermia Poddębice Sp. z o.o., while decreasing cash (cash imbalance) was noticeable in smaller geothermal enterprises from Czarnków and Pyrzyce, as well as in PEC Geotermia Podhalańska S.A. (Table 3, Table 5, Table 7, Table 9 and Table 11).

The analyses carried out for the period 2016–2019 and covering the five largest geothermal companies in Poland show that in terms of operating profitability at the level of EBIT cumulated over the entire analysis period, the highest value of this result is identified in Geotermia Podhalańska S.A. (Figure 10). It also has the largest fixed assets and invests the highest financial outlays in them. As a consequence, depreciation write-offs are a cost, but in cash terms they have a positive effect on cash flows. At the same time, it should be noted that the investment process is carried out with a large amount of external capital, which is shown in the cash flows for external financing parties FCD.

When it comes to assets’ ability to generate cash, Geotermia Mazowiecka S.A. shows the highest cumulative value in the analysis period (over PLN 11,318 thousand). The same entity can also boast the highest level of cash flow for FCFE owners (over PLN 10,005 thousand); this meant that Geotermia Mazowiecka had the highest potential to generate cash (Figure 12).

In conclusion, it can be said that large geothermal plants in Poland certainly have higher assets and sources of financing, which translates into profit-creating potential. At the same time, smaller geothermal plants, while functioning in a flexible manner, have a higher potential to generate cash.

The analyses presented can be used to create both short-term and long-term managerial strategies.

Short-term strategies refer to building a cash balance between FCFF and FCFE and FCD flows that will provide stability and financial liquidity. This will be important in shorter horizons, e.g., monthly, in which it will be possible to review operating budgets and take corrective action to ensure that budgets adopted for annual periods are met. Of course, the adopted flows can be decomposed into internal business segments in accordance with the organizational model. The decomposition of cash flows into an internal structure will make it possible to assess and evaluate the separate cash flow-generating centres.

In the long-term strategy, the inclusion of cash flows and their prediction will provide the possibility of assessing the creation of economic value of enterprises based on discounting cash flows, which in traditional terms can be captured under the name DCF. Capturing flows on an FCFF and FCFE basis and ensuring stability between them will provide a basis for maximizing value and referring to other measures such as Cash Flow Return on Investment CFROI.

Author Contributions

Conceptualization, A.K. and S.L.; methodology, A.K. and S.L.; software, S.L.; validation, A.K. and S.L.; formal analysis, A.K. and S.L.; investigation, A.K. and S.L.; resources, S.L.; data curation, A.K.; writing—original draft preparation, S.L.; writing—review and editing, A.K.; visualisation, A.K. and S.L.; supervision, A.K. and S.L.; project administration, A.K.; funding acquisition, A.K. All authors have read and agreed to the published version of the manuscript.

Funding

Research results presented in this paper are an element of the statutory research 16.16.100.215.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The financial data used in the article were taken from the financial statements of the analysed enterprises for the years 2015–2019.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Barbier, E.B. The concept of sustainable economic development. Environ. Conserv. 1987, 14, 101–110. [Google Scholar] [CrossRef]

- Barbier, E.B.; Burgess, J.C. The sustainable development goals and the systems approach to sustainability. Economics 2017, 11, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Holmberg, J.; Sandbrook, R. Sustainable development: What is to be done? In Policies for a Small Planet: From the International Institute for Environment and Development (19–38); Holmberg, J., Ed.; Earthscan Publications: London, UK, 1992. [Google Scholar]

- United Nations. The Sustainable Development Goals Report. 2020. Available online: https://unstats.un.org/sdgs/report/2020 (accessed on 1 July 2021).

- Udo, V.; Pawlowski, A. Human Progress towards Equitable Sustainable Development, part II: Empirical Exploration. Probl. Sustain. Dev. 2011, 6, 33–62. [Google Scholar]

- Dincer, I. Renewable Energy and Sustainable Development: A Crucial Review. Renew. Sustain. Energy Rev. 2000, 4, 157–175. [Google Scholar] [CrossRef]

- Kung, C.-C.; McCarl, B.A. Sustainable Energy Development under Climate Change. Sustainability 2018, 10, 3269. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.; Zhan, L. Assessing the sustainability of renewable energy: An empirical analysis of selected 18 European countries. Sci. Total Environ. 2019, 692, 529–545. [Google Scholar] [CrossRef]

- Augutis, J.; Krikštolaitis, R.; Martišauskas, L.; Urbonienė, S.; Urbonas, R.; Barbora Ušpurienė, A. Analysis of energy security level in the Baltic States based on indicator approach. Energy 2020, 199, 117427. [Google Scholar] [CrossRef]

- Bluszcz, A.; Manowska, A. Panel Analysis to Investigate the Relationship between Economic Growth, Import, Consumption of Materials and Energy. IOP Conf. Ser. Earth Environ. Sci. 2019, 362, 012153. [Google Scholar] [CrossRef] [Green Version]

- Lior, N. Thoughts about future power generation systems and the role of exergy analysis in their development. Energy Convers. Manag. 2002, 43, 1187–1198. [Google Scholar] [CrossRef]

- Rybak, A.; Rybak, A.; Sysel, P. Modeling of Gas Permeation through Mixed-Matrix Membranes Using Novel Computer Application MOT. Appl. Sci. 2018, 8, 1166. [Google Scholar] [CrossRef] [Green Version]

- Bekun, F.V.; Alola, A.A.; Sarkodie, S.A. Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and non-renewable energy in 16-EU countries. Sci. Total Environ. 2019, 657, 1023–1029. [Google Scholar] [CrossRef]

- Sobczyk, W.; Sobczyk, E.J. Varying the Energy Mix in the EU-28 and in Poland as a Step towards Sustainable Development. Energies 2021, 14, 1502. [Google Scholar] [CrossRef]

- Gunnarsdottir, I.; Davidsdottira, B.; Worrellb, E.; Sigurgeirsdottirc, S. Sustainable energy development: History of the concept and emerging themes. Renew. Sustain. Energy Rev. 2021, 141, 110770. [Google Scholar] [CrossRef]

- Golušin, M.; Dodić, S.; Popov, S. Sustainable Energy Management; Elsevier Science Publishing Co Inc.: Oxford, UK, 2013. [Google Scholar]

- Ligus, M.; Peternek, P. The Sustainable Energy Development Index—An Application for European Union Member States. Energies 2021, 14, 1117. [Google Scholar] [CrossRef]

- Mitchell, C. The Political Economy of Sustainable Energy; Palgrave Macmillan: London, UK, 2010; p. 9. [Google Scholar]

- Project Definition of Sustainable Energy, LG Action. Available online: https://www.acrplus.org/images/pdf/LG_Action_Final_Public_Report-www.pdf (accessed on 1 July 2021).

- Our Common Future, World Commission on Environment and Development, United Nations. 1987. Available online: http://www.un-documents.net/wced-ocf.htm (accessed on 3 July 2021).

- Report: Polityka Energetyczna Polski do 2040. Available online: https://www.gov.pl/web/klimat/polityka-energetyczna-polski (accessed on 20 June 2021).

- Stober, I.; Bucher, K. History of geothermal energy use. In Geothermal Energy: From Theoretical Models to Exploration and Development; Stober, I., Bucher, K., Eds.; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Hollenbach, D.F.; Herndon, J.M. Deep-Earth reactor: Nuclear fission, helium, and the geo-magnetic field. Proc. Natl. Acad. Sci. USA 2001, 20, 11085–11090. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lipiński, K. Wpływ wykorzystania energii geotermalnej na stan środowiska naturalnego Gminy Pyrzyce. In Proceedings of the International Scientific Conference “Geothermal Energy in Underground Mines”, Ustroń, Poland, 21–23 November 2001. [Google Scholar]

- Ślimak, C. PEC Geotermia Podhalańska—Stan obecny, perspektywy rozwoju. Instal 2016, 2, 6–8. Available online: https://www.cire.pl/pliki/2/9141art.pdf (accessed on 25 June 2021).

- Kaczmarczyk, M. Potential of existing and newly design geothermal heating plants in limiting of low emissions in Poland. E3S Web Conf. 2018, 44, 62. [Google Scholar] [CrossRef] [Green Version]

- Smętkiewicz, K. Opinia społeczna o wykorzystaniu wód geotermalnych na przykładzie mieszkańców gminy i odwiedzających w Uzdrowisku Uniejów. Tech. Poszuk. Geol. 2016, 1, 53–65. [Google Scholar]

- Report on Public Acceptance—Public Acceptance of Geothermal Electricity Production. 2013. Available online: http://www.geoelec.eu/wp-content/uploads/2014/03/D-4.4-GEOELEC-report-on-public-acceptance.pdf (accessed on 7 June 2021).

- World Energy Assessment (WEA), World Energy Assessment (WEA) Report: Energy and the Challenge of Sustainability; United Nations Development Programme (UNDP), Bureau for Development Policy, One United Nations Plaza: New York, NY, USA, 2000; Available online: https://sustainabledevelopment.un.org/content/documents/2423World_Energy_Assessment_2000.pdf (accessed on 1 June 2021).

- International Energy Agency. Renewables. Available online: https://www.iea.org/topics/renewables/ (accessed on 2 June 2021).

- Rybach, L. Geothermal Power Growth 1995–2013—A Comparison with Other Renewables. Energies 2014, 7, 4802–4812. [Google Scholar]

- GGA Brochure: Tap into Geothermal Insights and Experience. Available online: https://www.globalgeothermalalliance.org/About/-/media/Files/IRENA/GGA/About/GGA_Brochure_2021_Final.ashx (accessed on 18 November 2021).

- Younger, P.L. Geothermal Energy: Delivering on the Global Potential. Energies 2015, 8, 11737–11754. [Google Scholar] [CrossRef] [Green Version]

- Lund, J.W.; Toth, A.N. Direct utilization of geothermal energy 2020 worldwide review. Geothermics 2021, 90, 101915. [Google Scholar] [CrossRef]

- Geothermal District Heating. Available online: http://geodh.eu/ (accessed on 10 May 2021).

- Earth’s Geothermal Hotspots: New Dataset Launched. Available online: https://ec.europa.eu/jrc/en/news/earths-geothermal-hotspots-new-dataset-launched (accessed on 11 June 2021).

- Energia ze źródeł Odnawialnych w 2018 r. Available online: https://stat.gov.pl/files/gfx/portalinformacyjny/pl/defaultaktualnosci/5485/3/13/1/energia_ze_zrodel_odnawialnych_2018.pdf (accessed on 5 May 2021).

- Szulc-Wrońska, A.; Tomaszewska, B. Low Enthalpy Geothermal Resources for Local Sustainable Development: A Case Study in Poland. Energies 2020, 13, 5010. [Google Scholar] [CrossRef]

- Kępińska, B. Geothermal Energy Use—Country Update for Poland, 2016–2018. In Proceedings of the European Geothermal Congress, The Hague, The Netherlands, 11–14 June 2019. [Google Scholar]

- Prawo Geologiczno-Górnicze, Dz.U. z 2005 r., nr 228, poz. 1947 as Amended. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20111630981/U/D20110981Lj.pdf (accessed on 10 November 2021).

- Dang, C.; Li, F.; Yang, C. Measuring Firm Size in Empirical Corporate Finance. J. Bank. Financ. 2018, 86, 159–176. [Google Scholar] [CrossRef]

- Coles, J.; Li, F. Managerial Attributes, Incentives, and Performance. SSRN Electron. J. 2013, 10, 2139. [Google Scholar]

- Kopecky, K.J.; Li, Z.; Sugrue, T.F.; Tucker, A.L. Revisiting M&M with Taxes: An Alternative Equilibrating Process. Int. J. Financ. Stud. 2018, 6, 10. [Google Scholar] [CrossRef] [Green Version]

- Fernández, P. Valuing companies by cash flow discounting: Ten methods and nine theories. Managerial Finance. Emerald Group Publ. 2007, 33, 853–876. [Google Scholar]

- Mielcarz, P.; Mlinarič, F. The superiority of FCFF over EVA and FCFE in capital budgeting. Econ. Res.—Ekon. Istraživanja 2014, 27, 559–572. [Google Scholar] [CrossRef] [Green Version]

- Dagnino, G.B.; Giachetti, C.; La Rocca, M.; Picone, P.M. Behind the curtain of international diversification: An agency theory perspective. Glob. Strat. J. 2019, 9, 555–594. [Google Scholar] [CrossRef]

- Georgios, P.N.; Chris, G. Employing valuation tools for public and private companies. The food sector in Greece. In Procedia Economics and Finance, Proceeding of the Economies of Balkan and Eastern Europe Countries in the Changed World, Kavala, Greece, 8–10 May 2015; Karasavoglou, A.G., Kyrkilis, D., Polychronidou, P., Eds.; Elsevier: Amsterdam, The Netherlands, 2015. [Google Scholar]

- Gołębiowski, G.; Szczepankowski, P. Analiza Wartości Przedsiębiorstwa; Difin: Warszawa, Poland, 2007. [Google Scholar]

- Koller, T.; Geodhart, M.; Wessels, D. Valuation: Measuring and Managing the Value of Companies, 5th ed.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2010. [Google Scholar]

- Hawawini, G.; Viallet, C. Finance for Executives: Managing for Value Creation, 4th ed.; South-Western Cengage Learning: Boston, MA, USA, 2009; pp. 110–114. [Google Scholar]

- Financial Statements of PEC Geotermia Podhalańska S.A for the Years 2009–2018. Available online: https://www.emis.com/pl (accessed on 10 July 2021).

- Financial Statements of Geotermia Poddębice. Sp. z o.o. for the Years 2009–2018. Available online: https://www.emis.com/pl (accessed on 10 July 2021).

- Financial Statements of Geotermia Mazowiecka S.A for the Years 2009–2018. Available online: https://www.emis.com/pl (accessed on 10 July 2021).

- Financial Statements of Geotermia Pyrzyce Sp. z o.o. for the years 2009–2018. Available online: https://www.emis.com/pl (accessed on 10 July 2021).

- Financial Statements of Geotermia Czarnków Sp. z o.o. for the Years 2009–2018. Available online: https://www.emis.com/pl (accessed on 10 July 2021).

- Harber, A. Study into the Potential for Deep Geothermal Energy in Scotland; Scottish Government Project Number: AEC/001/11; AECOM/Scottish Government: Edinburgh, UK, 2013; Volume 1, p. 216. Available online: http://www.gov.scot/Publications/2013/11/2800/9 (accessed on 3 July 2021).

- Kurpaska, S.; Janowski, M.; Gliniak, M.; Krakowiak-Bal, A.; Ziemiańczyk, U. The Use of Geothermal Energy to Heating Crops under Cover: A Case Study of Poland. Energies 2021, 14, 2618. [Google Scholar] [CrossRef]

- Boguniewicz-Zabłocka, J.; Łukasiewicz, E.; Guida, D. Analysis of the Sustainable Use of Geothermal Waters and Future Development Possibilities—A Case Study from the Opole Region, Poland. Sustainability 2019, 11, 6730. [Google Scholar] [CrossRef] [Green Version]

- Maliszewski, N. Profitability of geothermal energy use in localities of various population. In Proceedings of the International Geothermal Days Poland 2004, Zakopane, Poland, 13–17 September 2004; International Summer School of Direct Application of Geothermal Energy, Polish Geothermal Association: Zakopane, Poland, 2004. Available online: https://www.geothermal-energy.org/pdf/IGAstandard/ISS/2004Poland/4_4__maliszewski.pdf (accessed on 30 October 2021).

- Colmenar-Santos, A.; Palomo-Torrejón, E.; Rosales-Asensio, E.; Borge-Diez, D. Measures to Remove Geothermal Energy Barriers in the European Union. Energies 2018, 11, 3202. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).