“Green” Transformation of the Common Agricultural Policy and Its Impact on Farm Income Disparities

Abstract

:1. Introduction

2. Materials and Methods

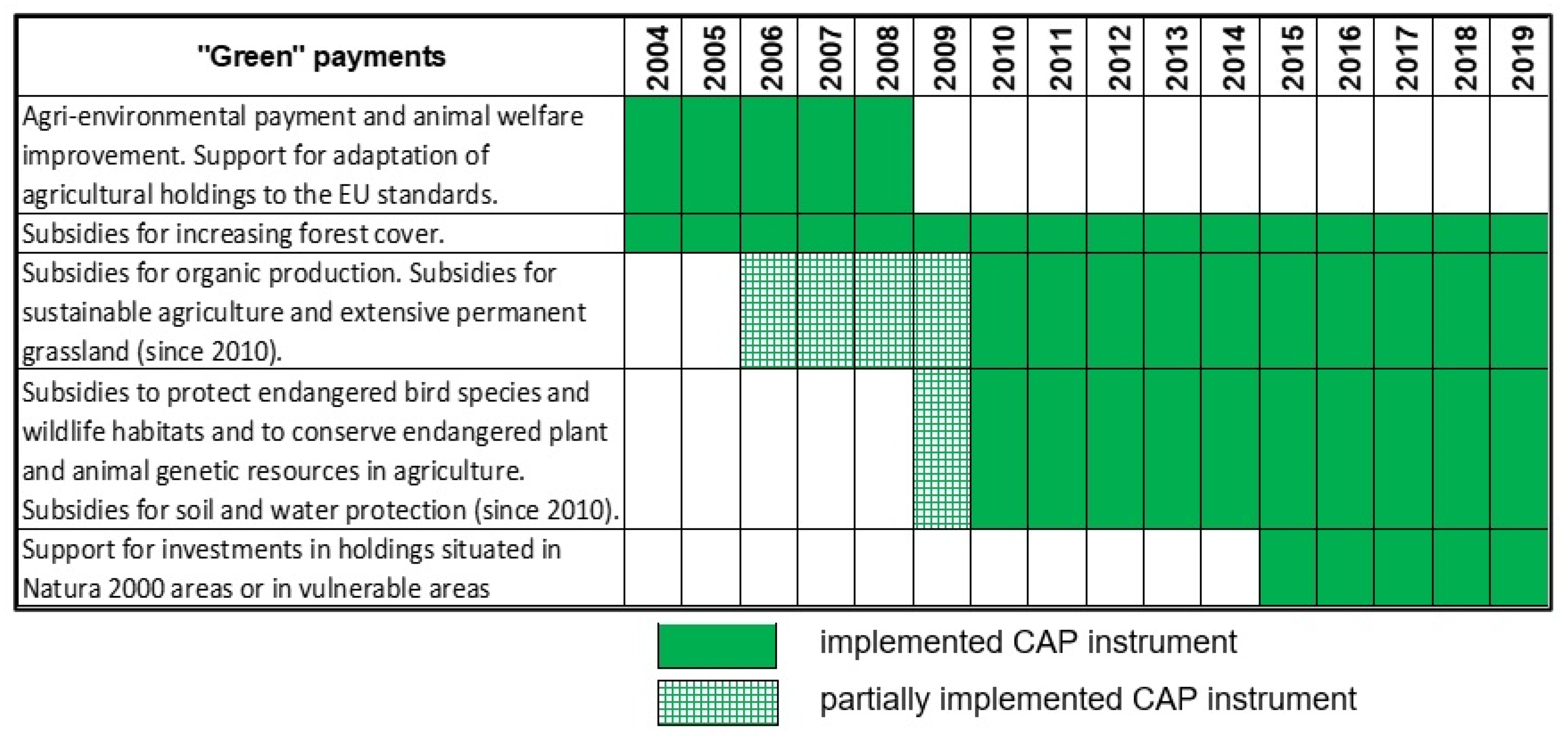

2.1. Data and “Green” CAP Payments Definition

2.2. Distribution of Farm Income in Polish Farms

2.3. Measuring the Impact of “Green” CAP Payments on Farm Income

2.4. Measuring Income Inequality Level under the “Green” CAP Transformation

+ β6SiNatura2000 + β7Siother + εi

3. Results

4. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- European Commission. The EU’s 2021–2027 long-term Budget and Next Generation EU. FACTS AND FIGURES; Publications Office of the European Union: Luxembourg, 2021.

- Hall, P.A. Policy Paradigms, Social Learning and the State: The Case of Economic Policy making in Britain. Comp. Politics 1993, 25, 275–297. [Google Scholar] [CrossRef]

- Kay, A. Path dependency and the CAP. J. Eur. Public Policy 2003, 10, 405–420. [Google Scholar] [CrossRef]

- Daugbjerg, C.; Feindt, P.H. Post-exceptionalism in public policy: Transforming food and agricultural policy. J. Eur. Public Policy 2017, 24, 1565–1584. [Google Scholar] [CrossRef]

- Matthews, A. Implications of the New Redistributive Payment. CAP Reform Blog. Available online: https://capreform.eu/implications-of-the-new-redistributive-payment/ (accessed on 23 August 2021).

- Daugbjerg, C.; Swinbank, A. Three Decades of Policy Layering and Politically Sustainable Reform in the European Union’s Agricultural Policy. Governance 2016, 29, 265–280. [Google Scholar] [CrossRef]

- European Environment Agency. The European Environment—State and Outlook 2020. Knowledge for Transition to a Sustainable Europe; Publications Office of the European Union: Luxembourg, 2019.

- European Parliament. Luxembourg European Council, Presidency Conclusions, 12–13 December 1997. Available online: https://www.europarl.europa.eu/summits/lux1_en.htm#up (accessed on 23 August 2021).

- O’Connor, D.; Renting, H.; Gorman, M.; Kinsella, J. The Evolution of Rural Development in Europe and the Role of EU Policy. In Driving Rural Development: Policy and Practice in Seven EU Countries; O’Connor, D., Renting, H., Eds.; Royal Van Grocum: Assen, The Netherlands, 2006; pp. 1–22. [Google Scholar]

- Almås, R.; Campbell, H. Introduction: Emerging Challenges, New Policy Frameworks and the Resilience of Agriculture. In Rethinking Agricultural Policy Regimes: Food Security, Climate Change and the Future Resilience of Global Agriculture; Almås, R., Campbell, H., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2012; Volume 18, pp. 1–22. [Google Scholar]

- Burton, R.J.F.; Wilson, G.A. The Rejuvenation of Productivist Agriculture: The Case for Cooperative Neo-Productivism. In Rethinking Agricultural Policy Regimes: Food Security, Climate Change and the Future Resilience of Global Agriculture; Almås, R., Campbell, H., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2012; Volume 18, pp. 51–72. [Google Scholar]

- Wilson, G.A.; Burton, R.J.F. ‘Neo-produvtivist’ agriculture: Spatio-temporal versus structuralist perspectives. J. Rural. Stud. 2015, 38, 52–64. [Google Scholar] [CrossRef]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. A Farm to Fork Strategy for a Fair, Healthy and Environmentally-Friendly Food System; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Grochowska, R.; Kosior, K. EU budget negotiations in the shadow of the juste retour rule. Probl. Agric. Econ. 2016, 349, 3–23. [Google Scholar] [CrossRef]

- European Commission. European Commission—Budget. Allocation of 2004 EU expenditure by Member State; European Commission: Brussels, Belgium, September 2005; p. 144. [Google Scholar]

- European Commission. Direct Payments to Agricultural Producers—Graphs and Figures. Financial Year 2018; Agricultural and Rural Development: Brussels, Belgium, 2018; pp. 1–65. [Google Scholar]

- Scown, M.W.; Brady, M.V.; Nicholas, K.A. Billions in Misspent EU Agricultural Subsidies Could Support the Sustainable Development Goals. One Earth 2020, 3, 237–250. [Google Scholar] [CrossRef] [PubMed]

- Grochowska, R.; Pawłowska, A.; Skarżyńska, A. Searching for more balanced distribution of direct payments among agricultural farms in the CAP post-2020. Agric. Econ. (Czech) 2021, 67, 181–188. [Google Scholar] [CrossRef]

- Ciliberti, S.; Frascarelli, A. The CAP 2013 reform of direct payments: Redistributive effects and impacts on farm income concentration in Italy. Agric. Food Econ. 2018, 6, 19. [Google Scholar] [CrossRef] [Green Version]

- Minviel, J.J.; Latruffe, L. Effect of Public Subsidies on Farm Technical Efficiency: A Meta-Analysis of Empirical Results. Appl. Econ. 2017, 49, 213–226. [Google Scholar] [CrossRef]

- Rizov, M.; Pokrivcak, J.; Ciaian, P. CAP Subsidies and Productivity of the EU Farms. J. Agric. Econ. 2013, 64, 537–557. [Google Scholar] [CrossRef]

- Czyżewski, B.; Guth, M. Impact of Policy and Factor Intensity on Sustainable Value of European Agriculture: Exploring Trade-Offs of Environmental, Economic and Social Efficiency at the Regional Level. Agriculture 2021, 11, 78. [Google Scholar] [CrossRef]

- Banga, R. Impact of Green Box Subsidies on Agricultural Productivity, Production and International Trade; Background Paper No. RVC-11; Unit of Economic Cooperation and Integration Amongst Developing Countries (ECIDC): Genève, Switzerland, 2014; pp. 15–21. [Google Scholar]

- Czyżewski, B.; Matuszczak, A.; Guth, M. The impact of the CAP “green” programmes on farm productivity and its social contribution. Problemy Ekorozwoju 2018, 13, 173–183. [Google Scholar]

- Louhichi, K.; Ciaian, P.; Espinosa, M.; Perni, A.; Paloma, S.G. Economic impacts of CAP greening: Application of an EU-wide individual farm model for CAP analysis (IFM-CAP). Eur. Rev. Agric. Econ. 2018, 45, 205–238. [Google Scholar] [CrossRef]

- European Court of Auditors. Greening: A More Complex Income Support Scheme, Not Yet Environmentally Effective; Special Report no 21; European Court of Auditors: Luxembourg, 2017.

- Czyżewski, B.; Matuszczak, A.; Grzelak, A.; Guth, M.; Majchrzak, A. Environmental sustainable value in agriculture revisited: How does Common Agricultural Policy contribute to eco-efficiency? Sustain Sci. 2021, 16, 137–152. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The central role of the propensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Imbens, G. Nonparametric estimation of average treatment effects under exogeneity, A review. Rev. Econ. Stat. 2004, 86, 4–29. [Google Scholar] [CrossRef]

- Pan, W.; Bai, H. Propensity Score Analysis. Fundamentals and Developments; The Guilford Press: New York, NY, USA, 2015. [Google Scholar]

- Hirano, K.; Imbens, G.; Ridder, G. Efficient estimation of average treatment effects using the estimated propensity score. Econometrica 2003, 71, 1161–1189. [Google Scholar] [CrossRef] [Green Version]

- McCaffrey, D.F.; Ridgeway, G.; Morral, A.R. Propensity score estimation with boosted regression for evaluating causal effects in observational studies. Psychol. Methods 2004, 9, 403–425. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Fields, G.S. Accounting for income inequality and its change: A new method, with application to the distribution of earnings in the United States. In Worker Well-Being and Public Policy; Polachek, S.W., Ed.; Emerald Group Publishing Limited: Bingley, UK, 2003; Volume 22, pp. 1–38. [Google Scholar]

- Shorrocks, A.F. Inequality decomposition by factor components. Econometrica 1982, 50, 193–211. Available online: http://www.jstor.org/stable/1912537 (accessed on 23 August 2021). [CrossRef] [Green Version]

- Ridier, A.; Ben El Ggali, M.; Nguyen, G.; Kephaliacos, C. The role of risk aversion and labor constraints in the adoption of low input practices supported by the CAP green payments in cash crop farms. Rev. Agric. Environ. Stud. 2013, 94, 195–219. [Google Scholar] [CrossRef]

- Lastra-Bravo, X.; Hubbard, C.; Garrod, G.; Tolon-Becerra, A. What drives farmers’ participation in EU agri-environmental schemes?: Results from a qualitative meta-analysis. Environ. Sci. Policy 2015, 54, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Bartkowski, B.; Droste, N.; Ließ, M.; Sidemo-Holm, W.; Weller, U.; Brady, M.V. Payments by modelled results: A novel design for agri-environmental schemes. Land Use Policy 2021, 102, 105230. [Google Scholar] [CrossRef]

- Dobbs, T.L.; Pretty, J.N. Agri-environmental stewardship schemes and “multifunctionality”. Appl. Econ. Perspect. Policy 2004, 26, 220–237. [Google Scholar] [CrossRef]

- Tyllianakis, E.; Martin-Ortega, J. Agri-environmental schemes for biodiversity and environmental protection: How we are not yet “hitting the right keys”. Land Use Policy 2021, 109, 105620. [Google Scholar] [CrossRef]

- McGurk, E.; Hynes, S.; Thorne, F. Participation in agri-environmental schemes: A contingent valuation study of farmers in Ireland. J. Environ. Manag. 2020, 262, 110243. [Google Scholar] [CrossRef]

- Kahneman, D. Maps of bounded rationality: Psychology for behavioural economics. Am. Econ. Rev. 2003, 93, 1449–1475. Available online: https://www.jstor.org/stable/3132137 (accessed on 23 August 2021). [CrossRef] [Green Version]

- Dessart, F.J.; Barreiro-Hurlé, J.; van Bavel, R. Behavioural factors affecting the adoption of sustainable farming practices: A policy-oriented review. Eur. Rev. Agric. Econ. 2019, 46, 417–471. [Google Scholar] [CrossRef] [Green Version]

- Dessart, F.J.; Rommel, J.; Barreiro-Hurlé, J.; Thomas, F.; Rodríguez-Entrena, M.; Espinosa-Goded, M.; Zagórska, K.; Czajkowski, M.; van Bavel, R. Farmers and the New Green Architecture of the EU Common Agricultural Policy: A Behavioural Experiment; Publications Office of the European Union: Luxembourg, 2021. [CrossRef]

- Swinnen, J. The Political Economy of the 2014–2020 Common Agricultural Policy. An Imperfect Storm; Rowman and Littlefield: London, UK, 2015. [Google Scholar]

- Primdahl, J.; Peco, B.; Schramek, J.; Andersen, E.; Oñate, J.J. Environmental effects of agri-environmental schemes in Western Europe. J. Environ. Manag. 2003, 67, 129–138. [Google Scholar] [CrossRef]

- Erjavec, K.; Erjavec, E. “Greening the CAP”—Just a fashionable justification? A discourse analysis of the 2014-2020 CAP reform documents. Food Policy 2015, 51, 53–62. [Google Scholar] [CrossRef]

- European Court of Auditors. Is Cross Compliance an Effective Policy; Special Report No 8; Office for Official Publications of the European Communities: Luxembourg, 2008. [Google Scholar]

- European Court of Auditors. Is Agri-Environment Support Well Designed and Managed? Special Report No 7; Office for Official Publications of the European Communities: Luxembourg, 2011. [Google Scholar]

- European Court of Auditors. Making Cross Compliance More Effective and Achieving Simplification Remains Challenging; Special Report No 26; Office for Official Publications of the European Communities: Luxembourg, 2016. [Google Scholar]

- Severini, S.; Tantari, A. The distributional impact of agricultural policy tools on Italian farm household incomes. J. Policy Model. 2015, 37, 124–135. [Google Scholar] [CrossRef]

- Halberg, N. Assessment of the environmental sustainability of organic farming: Definitions, indicators and the major challenges. Can. J. Plant Sci. 2012, 92, 981–996. [Google Scholar] [CrossRef]

- Sadowski, A.; Wojcieszak-Zbierska, M.; Zmyślona, J. Economic situation of organic farms in Poland on the background of the European Union. Probl. Agric. Econ. 2021, 367, 101–118. [Google Scholar] [CrossRef]

- Łuczka, W.; Kalinowski, S.; Shmygol, N. Organic Farming Support Policy in a Sustainable Development Context: A Polish Case Study. Energies 2021, 14, 4208. [Google Scholar] [CrossRef]

| Number of Farms | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|---|

| Sample | 11,104 | 11,774 | 11,823 | 12,038 | 12,298 | 12,258 | 11,004 | 10,890 |

| Beneficiaries of “green” payments | 61 | 204 | 2180 | 2161 | 2712 | 3058 | 3113 | 2794 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Sample | 10,909 | 12,117 | 12,123 | 12,104 | 12,104 | 12,103 | 12,032 | 11,985 |

| Beneficiaries of “green” payments | 2591 | 3363 | 3027 | 1891 | 1868 | 1585 | 1535 | 1549 |

| Agri-environmental payment and animal welfare improvement. Support for adaptation of agricultural holdings to the EU standards | ||||||||

| Statistics | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Min | 0 | 0 | 0 | 0 | 0 | - | - | - |

| Max | 285 | 50,930 | 84,796 | 86,277 | 66,004 | - | - | - |

| Mean | 10 | 2509 | 4727 | 2972 | 2871 | - | - | - |

| SD | 47 | 5580 | 4999 | 4692 | 4542 | - | - | - |

| Subsidies for increasing forest cover | ||||||||

| Statistics | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Max | 5253 | 14,020 | 41,872 | 57,407 | 120,943 | 31,526 | 63,333 | 31,262 |

| Mean | 1448 | 809 | 161 | 217 | 178 | 109 | 134 | 125 |

| SD | 1342 | 1836 | 1531 | 2132 | 2586 | 1029 | 1491 | 1045 |

| Statistics | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Max | 50,513 | 37,883 | 38,064 | 38,067 | 36,495 | 18,838 | 18,838 | 18,663 |

| Mean | 140 | 103 | 96 | 131 | 128 | 122 | 130 | 111 |

| SD | 1423 | 1075 | 1032 | 1123 | 1048 | 781 | 820 | 746 |

| Subsidies for organic production. Subsidies for sustainable agriculture and extensive permanent grassland (since 2010) | ||||||||

| Statistics | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Min | - | - | 0 | 0 | 0 | 0 | 0 | 0 |

| Max | - | - | 15,820 | 26,893 | 108,636 | 127,383 | 77,814 | 86,383 |

| Mean | - | - | 149 | 263 | 345 | 482 | 1293 | 2094 |

| SD | - | - | 840 | 1434 | 2706 | 3346 | 3643 | 4385 |

| Statistics | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Max | 37,896 | 76,938 | 47,466 | 37,973 | 39,576 | 39,449 | 27,852 | 31,416 |

| Mean | 2407 | 2796 | 2670 | 2540 | 2402 | 2273 | 2133 | 2040 |

| SD | 3774 | 4400 | 3797 | 3517 | 3272 | 3045 | 3101 | 3220 |

| Subsidies to protect endangered bird species and wildlife habitats and to conserve endangered plant and animal genetic resources in agriculture. Subsidies for soil and water protection (since 2010) | ||||||||

| Statistics | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Min | - | - | - | - | - | 0 | 0 | 0 |

| Max | - | - | - | - | - | 37,255 | 39,410 | 36,450 |

| Mean | - | - | - | - | - | 2275 | 1896 | 1389 |

| SD | - | - | - | - | - | 3466 | 3152 | 2348 |

| Statistics | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Max | 39,429 | 34,026 | 87,043 | 35,084 | 32,969 | 45,962 | 31,033 | 37,973 |

| Mean | 1243 | 1363 | 1334 | 1249 | 1142 | 1185 | 1198 | 1587 |

| SD | 2300 | 2501 | 2887 | 2466 | 2565 | 2661 | 2626 | 3589 |

| Support for investments in holdings situated in Natura 2000 areas or in vulnerable areas | ||||||||

| Statistics | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Min | 0 | 0 | 0 | 0 | 0 | |||

| Max | 27,566 | 0 | 0 | 61,900 | 46,512 | |||

| Mean | 15 | 0 | 0 | 462 | 427 | |||

| SD | 634 | 0 | 0 | 4192 | 3797 | |||

| Statistics | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Beneficiaries of “green” payments | ||||||||

| Min | −806 | −415 | −1318 | −1711 | −2848 | −1827 | −6705 | −289 |

| Max | 1467 | 135,975 | 5422 | 8967 | 16,206 | 17,190 | 11,892 | 64,815 |

| Mean | 249 | 1222 | 485 | 513 | 483 | 379 | 575 | 680 |

| SD | 311 | 9797 | 409 | 518 | 570 | 534 | 578 | 1442 |

| Other farms | ||||||||

| Min | −3248 | −600 | −52,363 | −22,638 | −453,935 | −52,718 | −64,288 | −74,027 |

| Max | 234,572 | 725,526 | 1,065,228 | 1,325,726 | 248,737 | 678,210 | 206,445 | 303,140 |

| Mean | 779 | 1028 | 1424 | 1515 | 1175 | 1193 | 1221 | 1160 |

| SD | 6093 | 9293 | 13,505 | 15,851 | 922 | 11,015 | 6911 | 7105 |

| Statistics | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Beneficiaries of “green” payments | ||||||||

| Min | −1578 | −1113 | −1326 | −204 | −2012 | −73 | −1935 | −1717 |

| Max | 23,312 | 186 | 64,016 | 10,808 | 8064 | 9276 | 7725 | 10,448 |

| Mean | 641 | 593 | 517 | 473 | 660 | 630 | 511 | 587 |

| SD | 687 | 59 | 1241 | 540 | 593 | 631 | 591 | 650 |

| Other farms | ||||||||

| Min | −77,518 | −5844 | −60,389 | −53,573 | −39,425 | −12,976 | −42,185 | −3585 |

| Max | 389,146 | 338,504 | 415,912 | 506,266 | 287,930 | 245,411 | 253,070 | 139,654 |

| Mean | 1157 | 115 | 984 | 895 | 1024 | 990 | 926 | 996 |

| SD | 8516 | 8041 | 760 | 7346 | 5701 | 4628 | 5446 | 4502 |

| ATT Estimate | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| ATT | −358 | 383 | −63 | −128 | −19 | −79 | −60 | −5 |

| SE(ATT) | 102 | 425 | 19 | 47 | 25 | 48 | 21 | 42 |

| t | −3.50 | 0.90 | −3.38 | −2.707 | −0.763 | −1.659 | −2.805 | −0.118 |

| p-value | <0.01 | 0.368 | <0.01 | <0.01 | 0.445 | 0.097 | <0.01 | 0.906 |

| ATT Estimate | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| ATT | −41 | −19 | −55 | −67 | −26 | −60 | −66 | 5 |

| SE(ATT) | 23 | 27 | 39 | 35 | 39 | 35 | 44 | 42 |

| t | −1.812 | −0.731 | −1.415 | −1.908 | −0.655 | −1.697 | −1.501 | 0.126 |

| p-value | 0.07 | 0.465 | 0.157 | 0.056 | 0.512 | 0.09 | 0.133 | 0.9 |

| Income Decomposition | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Gini coefficient | 0.794 | 0.764 | 0.737 | 0.724 | 0.693 | 0.828 | 0.596 | 0.582 |

| Market income | 0.1499 | 0.1517 | 0.0777 | 0.0497 | 0.1215 | 0.0904 | 0.1423 | 0.1153 |

| “Green” payments | 0.0001 | −0.0005 | 0.0006 | 0.0008 | 0.0024 | 0.0031 | 0.0015 | 0.0029 |

| Other payments | 0.0081 | 0.0158 | 0.0172 | 0.0064 | 0.0047 | 0.0022 | 0.0100 | 0.0216 |

| Residuals | 0.8420 | 0.8330 | 0.9046 | 0.9431 | 0.8715 | 0.9043 | 0.8463 | 0.8602 |

| Income decomposition | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Gini coefficient | 0.607 | 0.664 | 0.700 | 0.698 | 0.620 | 0.640 | 0.708 | 0.685 |

| Market income | 0.1293 | 0.0923 | 0.1263 | 0.1014 | 0.1697 | 0.1331 | 0.1493 | 0.1305 |

| “Green” payments | 0.0007 | 0.0027 | 0.0010 | 0 | 0.0005 | 0.0001 | 0 | 0.0016 |

| Other payments | −0.005 | 0.0012 | 0.0121 | 0.0077 | 0.0519 | 0.0416 | 0.0184 | 0.0070 |

| Residuals | 0.8750 | 0.9039 | 0.8606 | 0.8910 | 0.7779 | 0.8252 | 0.8323 | 0.8609 |

| Income Decomposition | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Market income | 0.1499 | 0.1510 | 0.0776 | 0.0496 | 0.1208 | 0.0892 | 0.1416 | 0.1155 |

| Adaptation to EU standards | 0 | 0.0003 | 0.0001 | 0.0001 | 0.0003 | X | X | X |

| Increasing forest cover | 0 | 0 | 0 | 0 | 0.0002 | 0 | 0 | 0.0001 |

| Organic production | X | X | 0.0002 | 0 | 0.0001 | 0.0002 | 0.0003 | 0.0004 |

| Conservation of plant and animal resources | X | X | X | X | X | 0.0001 | 0 | 0.0002 |

| Investments in Natura 2000/vulnerable areas | X | X | X | X | X | X | X | X |

| Other payments | 0.0080 | 0.0158 | 0.0171 | 0.0064 | 0.0047 | 0.0031 | 0.0101 | 0.0217 |

| Residuals | 0.8421 | 0.8329 | 0.9050 | 0.9439 | 0.8738 | 0.9075 | 0.8480 | 0.8621 |

| Income decomposition | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Market income | 0.12923 | 0.0918 | 0.1263 | 0.1013 | 0.1696 | 0.1332 | 0.1493 | 0.1303 |

| Adaptation to EU standards | X | X | X | X | X | X | X | X |

| Increasing forest cover | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0.0012 |

| Organic production | 0.0005 | 0.0006 | 0.0001 | 0.0003 | 0.0001 | 0.0002 | 0 | 0.0005 |

| Conservation of plant and animal resources | 0 | 0.0001 | 0.0002 | 0.0003 | 0 | 0 | 0 | 0 |

| Investments in Natura 2000/vulnerable areas | X | X | X | 0 | X | X | 0 | 0 |

| Other payments | −0.0050 | 0.0012 | 0.0121 | 0.0077 | 0.0520 | 0.0415 | 0.0184 | 0.0071 |

| Residuals | 0.8752 | 0.9063 | 0.8613 | 0.8905 | 0.7783 | 0.8251 | 0.8323 | 0.8610 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pawłowska, A.; Grochowska, R. “Green” Transformation of the Common Agricultural Policy and Its Impact on Farm Income Disparities. Energies 2021, 14, 8242. https://doi.org/10.3390/en14248242

Pawłowska A, Grochowska R. “Green” Transformation of the Common Agricultural Policy and Its Impact on Farm Income Disparities. Energies. 2021; 14(24):8242. https://doi.org/10.3390/en14248242

Chicago/Turabian StylePawłowska, Aleksandra, and Renata Grochowska. 2021. "“Green” Transformation of the Common Agricultural Policy and Its Impact on Farm Income Disparities" Energies 14, no. 24: 8242. https://doi.org/10.3390/en14248242

APA StylePawłowska, A., & Grochowska, R. (2021). “Green” Transformation of the Common Agricultural Policy and Its Impact on Farm Income Disparities. Energies, 14(24), 8242. https://doi.org/10.3390/en14248242