Abstract

Selecting an appropriate contract price between electric vehicle aggregators and electric vehicle owners is an uncertain, multi-criteria decision-making issue. In addition, the results can cause strong conflict due to different aims: the optimal value for increasing electric vehicle aggregator (EVA) profit negatively affects the cost for owners. The value of the contract price can change the optimal scheduling of EVAs in the day-ahead market. Taking into consideration this context, the current paper proposes to solve the multi-objective scheduling problem of an aggregator with a goal programming approach. The presented approach sets a satisfaction level for each goal according to decision-makers’ preference. Numerical results illustrate the validity of this approach to balance different performance measures. Furthermore, optimal scheduling of electric vehicle aggregators in the day-ahead market is created.

1. Introduction

1.1. Motivation

Transportation fleets play a significant role in the rise of greenhouse gases and global warming. The use of electric vehicles (EVs) is one of the substantial measures to address these environmental issues. Simultaneously, EVs can be utilized as a flexible load to improve the operation of grids, with respect to their charging schedules. This kind of action can lead to obvious improvements if the EVs’ loads are anticipated and coordinated through an aggregation agent [1]. In other words, a huge number of EVs could be a solution to alleviate climate change issues stemming from greenhouse gas emissions [2,3,4]. Some subjects, such as mitigating energy crises and the employment of sustainable resources, could increase interest in the use of EVs among individuals and governments; however, high EV penetration in power systems could create problems in terms of security and the economy [5,6,7]. To deal with these challenges, many researchers have suggested the coordinated and smart charging of electric vehicles [8,9]. In the literature, to allocate resources efficiently, a flexible load of EVs is envisioned to be coordinated via an aggregator [1]. Coordinated and smart charging can be achieved either through direct load control (DLC) or indirect load control (ILC). To implement the former method, e.g., a central agency specifies charging schedules via a single objective function [10,11,12,13,14]. To meet this aim, one can consider selling electricity at a fixed rate to EV owners and requiring the agency to fulfill certain requirements, such as delivering EVs with the maximum state of charge (SOC) of batteries at departure time [14]. In these research areas, electric vehicle aggregators (EVAs) play a key intermediary role between EV owners and power systems. Aggregators can actually participate in electricity markets as the EV owners’ representatives [15]. They, however, must manage various uncertainties to operate practically in the electricity market. Taking these issues into account, the impacts of uncertainties with respect to both driving patterns and electricity prices on scheduling problems should be investigated. Note that most papers in this area of research have considered a fixed rate contract price between EVAs and EV owners.

In the ILC method, however, the process of decision making is distributed over more than one player, considering the effects of prices on final customers. In other words, EV owners behave as retail customers [8] utilizing an agent-based model to decrease their costs. In this study, the incentive-based model has been proposed to reduce the owners’ costs by charging their vehicle with renewable-based generators. To the best of the authors’ knowledge, there is little literature on applying hybrid methods that consider both of the players’, EVAs and EV owners, preferences. Moreover, they have calculated the cost of purchased energy (i.e., contract price) through the constant rate, while the value of contract price can affect the selecting of EVAs by EV owners. Indeed, a high contract price should be regarded as a double-edged sword by EVAs. On one hand, it can significantly boost EVAs’ profits; on the other hand, in a competitive environment it can limit the number of customers. Hence, in this paper, the authors have proposed a multi-objective framework to address both problems: computing reasonable contract prices and scheduling the operation of EVAs optimally in the day-ahead market. Therefore, finding an optimal contract price for the players can lead to a more practical charging schedule.

1.2. Literature Review

The scheduling problems of EVAs have been assessed in a number of recent papers that evaluate the impact of EVAs on various problems, including: the effects of a high EV penetration in the electricity market [16,17,18,19], modeling driving behaviors and fluctuation of electricity prices [20,21], and applying risk-based strategies [22,23].

Carpinelli et al [24] suggested a multi-objective function is suggested to optimize the scheduling problem of micro-grids equipped with renewable resources and a high penetration of EVs. Dynamic programming is proposed Škugor and Deur [25] to achieve optimal operation of EVAs. In this paper, batteries can be charged with variable electricity prices from the grid and renewable energy plants. Jannati and Nazarpour [26] presented a bi-objective optimization method to address the scheduling problems of parking lots equipped with photovoltaic panels. Meanwhile, to mitigate both environmental and economic concerns, demand response programs have been applied. The authors of [27] have investigated the coordinated charging control of EVAs to comply with the goal of reducing charging cost and power losses through varying degrees of electricity demand. An interrupted load pricing approach is suggested by Xia et al [28] to arrange charging intervals. A bi-level method is introduced to set the EVA’s scheduling problem in the day-ahead market by Vayá and Andersson [29]. In this study, the upper level was responsible for minimizing the cost of the EVA, while the lower level cleared the electricity market. Contrary to the referenced papers, Momber et al [30] implemented a bi-level method is to solve the EVAs’ scheduling problem alongside setting retail pricing. In this research, the proposed formula considers the detailed modeling of both sets of agents (EVAs and EV owners) in interaction. Aliasghari et al [31] evaluated the profit from EVAs’ participation in both day-ahead and reserve markets. In this paper, a renewable energy sources-based micro-grid (RMG) with a parking lot was considered. The owner of the RMG played the role of aggregator to utilize the potential of integrated EVs in the day-ahead and reserve markets. The RMG was equipped with a parking lot in order to control and aggregate EVs. The objective was to minimize the cost through generating power with its local generators and trading energy with the power market, considering the market price. A risk-based method is used to evaluate the profit of EVAs regarding two opposing points of view [32,33]: risk-averse and risk-taker. To address this scheduling problem, the robustness and opportunity functions of the information gap decision theory (IGDT) approach are employed. In the reviewed papers, a constant price was used to charge batteries, which can be considered a weakness during the scheduling process.

1.3. Objectives

In the current study, we utilize a multi-objective approach in order to consider both of the players as beneficiaries, while the uncertainties in driving patterns are taken into account. The first objective is to maximize the profit of EVAs by managing the charging/discharging program and contract price. By contrast, the second objective is to reduce the cost to EV owners by finding a reasonable value for retail pricing. To solve the proposed multi-objective problem, goal programming (GP) approaches are introduced as an appropriate method to achieve a balanced solution between EVAs and EV owners, by considering all possible objectives of the players. Indeed, GP is based on Herbert Simon’s “satisficing” principle [34]. Consequently, GP searches for a satisfactory solution from the point of view of all players instead of an optimal solution for just one [35].

1.4. Paper Highlights

- A multi-objective function is provided to solve the EVA’s scheduling problem. The structure of the function is based on mixed-integer linear programming and is solved in the GAMS software environment.

- To model the uncertainties in driving behavior, a scenario-based model is used. In the process of generating scenarios, the uncertainties of arrival time, departure time and initial SOC are considered. Meanwhile, an appropriate scenario reduction method is applied to reduce the number of scenarios according to their probability.

- To solve the proposed multi-objective problem, a method based on a goal programming approach has been proposed. The strength of the GP method is in calculating a balanced solution for contract price in response to both players’ concerns about their profits.

- An optimal scheduling of the EVA’s operation in the day-ahead market is carried out based on the extracted contract prices.

1.5. Paper Organization

2. Goal Programming

Many real problems in the world should be solved as a multi-objective function. One of the most practical methods to deal with this kind of problem is the goal programming approach. The GP method is an appropriate model to establish a balanced solution among all involved beneficiaries in a multi-objective problem. In this technique, a distinct function is defined for each goal with a desired level. Note that all goals cannot be optimized simultaneously. These desired levels specify a minimum or a maximum threshold that must be provided as a solution to satisfy the criteria of decision-makers. Next, to obtain a solution based on players’ preferences, the weighted sum of the deviations related to the desired levels is minimized.

There are different types of GP methods such as Weighted Goal Programming (WGP), Extended Goal Programming (EGP), and Chebyshev or MINMAX Goal Programming (CGP) [36]. A generic GP is formulated as (1), where . depicts the different considered goals.

where fg represents the objective function of each goal g. Terms Sg and are the positive and negative deviational variables from the target level Ψg for each goal determined by decision-makers. According to (2), if the object function g is a maximization problem, Ψg is lower than the optimal value of fg, depicted by . Since terms Sg and are non-negative variables, only can take a value, and vice versa. Term Ψg is higher than if the aim is to minimize fg. As a result, Sg could be higher than zero. The summation of negative and positive deviational variables should be found as follows:

Constraint:

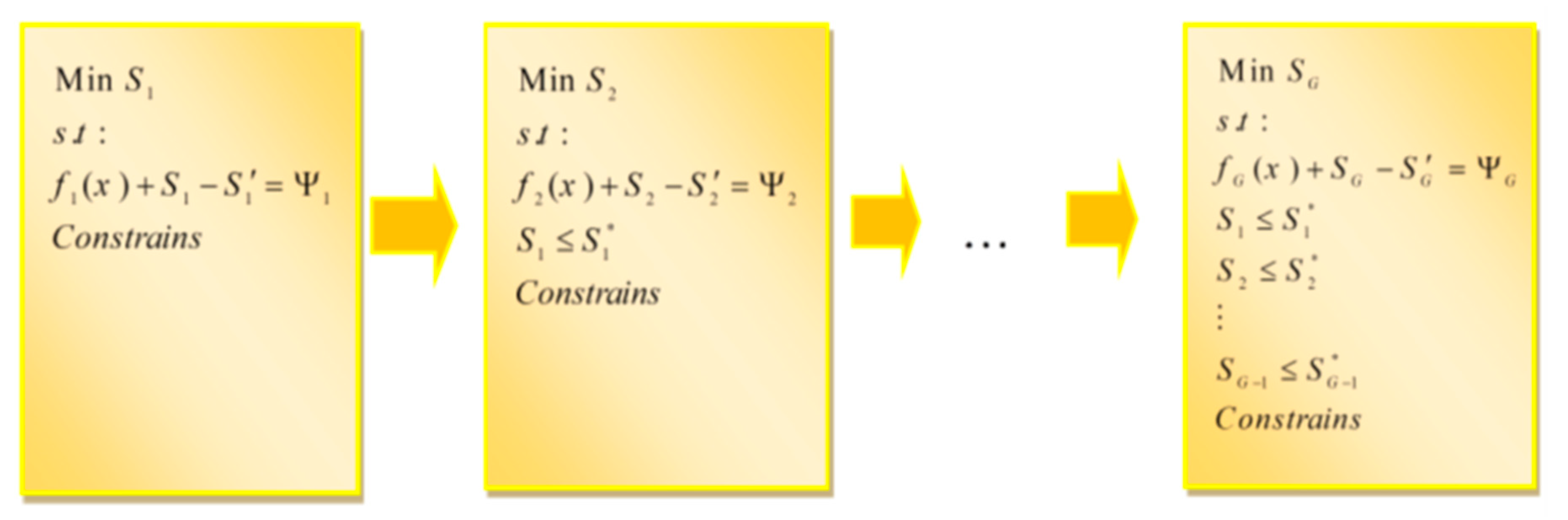

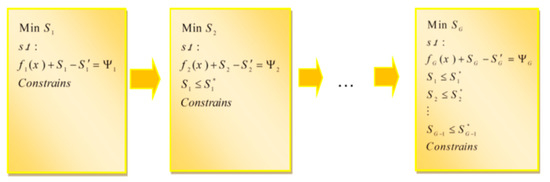

where ug and are binary variables that show that only one of Sg or can be higher than zero. To solve the objective function (2), there are different methods. In this study, we use the Sequential Linear Goal Programming (SLGP) method to solve a linear GP function, as shown in Figure 1.

Figure 1.

Sequential linear goal programming framework.

3. Mathematical Model of the Problem

3.1. Modeling of EV Aggregator

An EVA acts as a load-serving agent and manages charge and discharge hours of EVs. Indeed, the aggregator is the representative of EV owners in the electricity market to buy or sell power, regarding the characteristics of EVs [37]. Note that the schedules of charging and discharging for each EV are determined with the purpose of bringing profit to both EV owners and power grids.

In this paper, a stochastic scheduling framework is presented to simulate the participation of the EVA in the day-ahead market, which is programmed based on the fluctuation of electricity prices, battery capacity, and charging and discharging abilities of EVs. It is assumed that the EVA is a price taker, as its load is relatively small in comparison with the other market players. In terms of EVAs, the goal is to maximize its profit with respect to the EV owners’ satisfaction. On the other hand, vehicles should be charged/discharged based on the initial charging level, arrival time (AT) and departure time (DT), while the final state of charge would be equal to 100%. In the current study, the uncertainties of SOC, AT and DT are modeled via a scenario-based method. The participation model of EVAs in the day-ahead market is mathematically formulated as follows:

Constraints:

Equation (4) determines the profit function of the EVA, which is equal to the minus of revenue and cost. The EVA purchases and sells from and to the market for scenario s. In other words, they depict the charging and discharging energy at hour h and vehicle e, respectively. The exchange of electricity between the EVA and the market is transacted by λ(h) depicting the day-ahead electricity price for each hour. The amount of power purchased by EV owners from EVAs for each scenario, , is traded by the contact price, λCon. Terms ne depicts the number of EVs from the group e that have the same AT and DT as well as initial SOC. The probability of scenario s is specified by πs. Equation (5) is used to update the state of energy of scenario s, SOCs, for vehicles in group e at hour h. Note that SOCs is restricted by the minimum and maximum values of battery capacity demonstrated by and , in turn. This restriction is enforced by Equation (6). It is worth mentioning that to decrease the effect of V2G on battery lifespan, is considered to be 20%. Minimum and maximum limits of charging and discharging power are satisfied through Constraints (7) and (8), respectively. Two auxiliary binary variables and are used to set the technical restriction through (9). That is to say, a battery cannot be charged and discharged at the same time. Finally, Constraint (10) shows that each EV should be delivered with a fully charged battery at the departure time.

3.2. Objective Function of EV Owners

The inclination of EV owners is towards cost-optimal charging to fulfill their energy requirement. Indeed, the amount of cost leads end users to choose the most competitive EVA. This selection of an EVA would be similar to selecting a retailer for electricity [38]. Preferences for this selection may be different from user to user. In the current study, the willingness to pay a lower contract price and charge batteries up to the maximum SOC at departure time are considered as vital factors. Hence, in order to account for the customer side, the following mathematical formulation is suggested.

As can be seen, the objective function, Equation (11), is to minimize EV owners’ payments for purchased energy. Constraint (12) shows the SOC of batteries at departure time. Moreover, the best retail price for EV owners is that which can provide energy according to real-time prices. This limit is determined via (13).

3.3. Goal Programming for Contract Price

The aim is to reach the optimal scheduling of EVAs alongside satisfying the preferences of both the abovementioned players. For this purpose, a goal programming model is proposed to solve their respective objective functions. The proposed approach is particularly well-suited for solving the described multi-objective problem. The objective functions follow two opposite directions; EVAs prefer to increase contract price. By contrast, EV owners try to decrease the amount of the contract to reduce their costs. Hence, the value of the contract price has a direct influence on the amounts of both the EVA’s profit and the EV owner’s costs. The goal programming for the mentioned problem is derived as follows:

Step 1:

Constraints:

As seen, in the first step, only the maximization of the profit of the EVA is considered. In this regard, a predetermined aspiration level, , is equal to or lower than the optimal solution, BEVA. Due to the non-negative values of SEVA and , the amount of must be equal to zero in (15). According to the descriptions in Section 2, the first goal is to minimize the amount of SEVA in order to meet the first function’s satisfaction. Constraints (16)–(21) are explained in detail in Section 3.1. By taking into account as an optimal solution in the first step, the second step can be modeled as follows:

Step 2:

Constraints:

By the same logic, the aim of EV owners is to minimize their costs. Therefore, in Equation (23), SEVs is zero and should be minimized, so CEVs cannot be lower than the predetermined aspiration of cost level, , in (23). Equations (24)–(29) are the same as (16)–(21) and should be enforced in the second step. Finally, (30) is used to satisfy the fulfillment achieved in the first step. Note that in this paper, the proposed model of goal programming is modeled in the GAMS environment as a mixed-integer linear problem.

4. Numerical Results

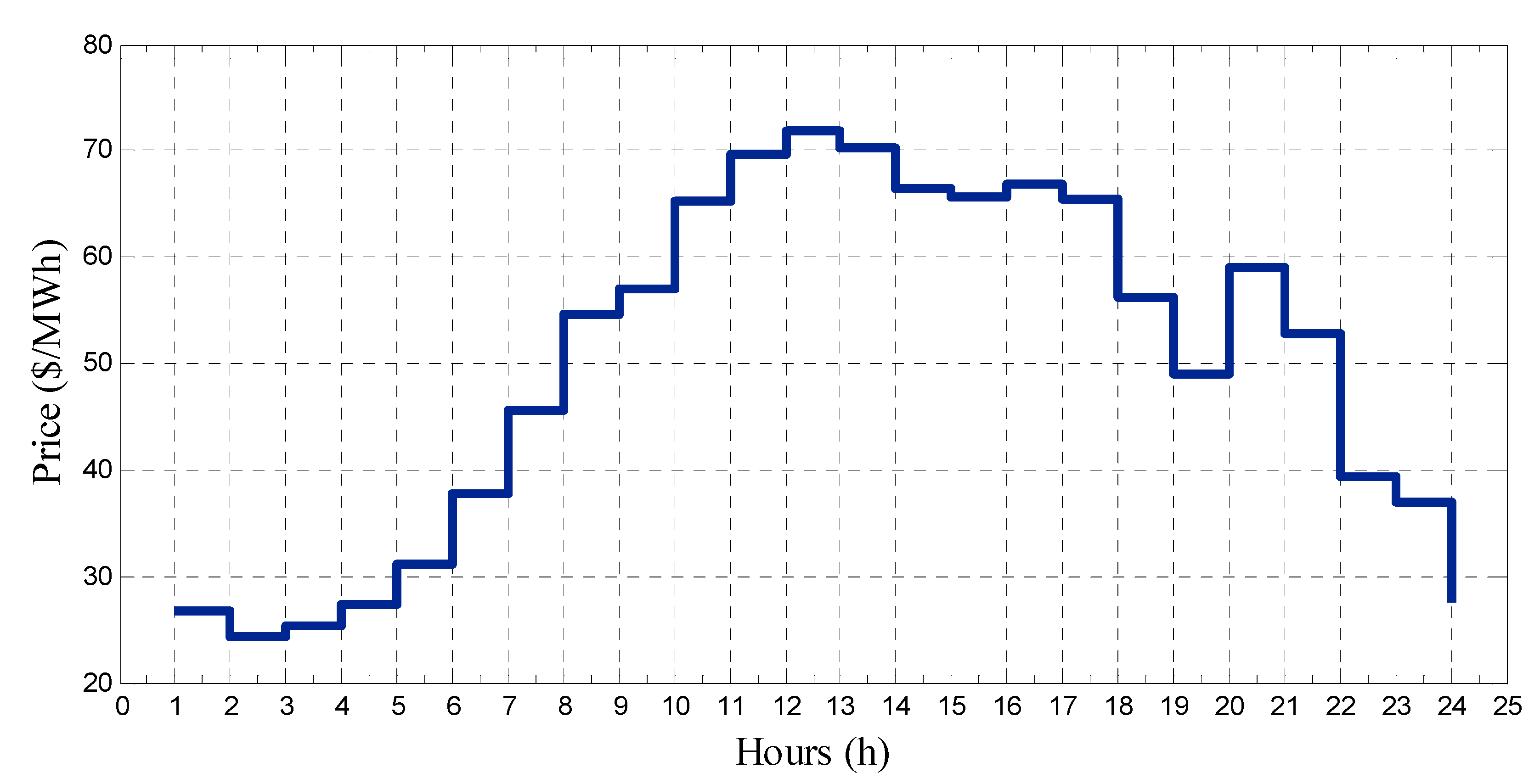

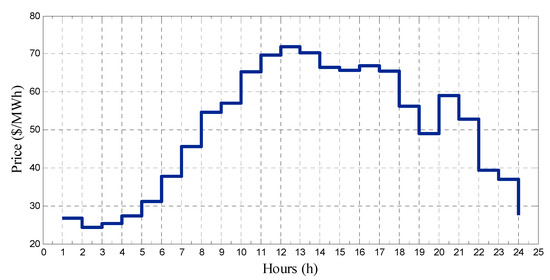

The proposed model is applied to find not only optimal charging schedules of EVs over 24 hours, but also to find a satisfying value for the contract price by considering the benefits for both sides of the contract. Clearly, EV owners’ driving patterns affect the scheduling process and the value of the contract price. To model the uncertainty in driving patterns more effectively, factors including initial SOC, arrival time and departure time are simulated by scenarios generated via the models proposed by Vagropoulos et al [39] and Aliasghari et al [31], as illustrated in Table 1 and Table 2. Note that truncated Gaussian distribution (TGD) is bounding either upper or lower limits (or both) for random variables. In this study, it is used to satisfy the upper and lower limits for the initial levels of SOC, AT and DT. For example, the mean value of DT is 7:00 o’clock with a standard deviation of 2 hours. In this regard, individual EV owner does not leave home earlier than 5:00 or later than 12:00. In the scenario generation process, 2000 scenarios are produced in total. Following this, the SCENRED tool, an appropriate scenario reduction tool, is used to reduce scenarios to the 20 with the highest probability of occurrence. The information of the final 20 scenarios is summarized in Table 3, and the electricity price profile is shown in Figure 2. Additionally, the efficiencies of charging and discharging are equal to 0.95 and 0.94, respectively. It is assumed that the EVAs are parked in workplaces, including administrative-commercial buildings. Therefore, EVs are accessible during the workday determined by departure times (when EV owners leave their homes). Note that EVs are directly driven to the workplace, and other places such as parking outside of the home or workplace are not taken into account.

Table 1.

Modified probability distribution of an electric vehicle (EV)’s driving pattern, adapted from [39].

Table 2.

Simulation of different EVs [31]. Reprint with permission [31]; 2018, Elsevier.

Table 3.

Final scenarios of EV driving patterns. Reprint with permission [31]; 2018, Elsevier.

Figure 2.

Electricity price profile.

To validate the effectiveness of the suggested method, some numerical results are reported by running the proposed GP model on an EVA with the potential for gathering 10,000 vehicles. In the first step of the simulation, the GP model has been run for each scenario, as reported in Table 3. Note that in this step, the aim is to maximize the EVA’s profit by satisfying the constraint related to the desired level of profit. It is assumed that the desired profit level is computed by using the average electricity prices over 24 hours as a contract price for each scenario. The EV aggregator also sets the state of charging or discharging of EVs’ batteries in such a way as to satisfy their available time restrictions. Following this, to fulfill the satisfaction of EV owners, their desired contract price is determined using the GP model presented in Section 3. It is worth mentioning that to calculate the desired cost of EV owners, the real-time electricity prices are used in the computations. The extracted contract prices are reported in Table 4.

Table 4.

Calculated contract price via goal programming (GP).

Looking at Table 3 and Table 4, the contract price for scenarios with lower availability hours are higher. In addition, the initial SOC is also an effective factor. For instance, the contract price for Scenarios 9 and 19 has higher values, at $0.071 and $0.072 per kWh, respectively. As seen from Table 3, in Scenario 9, vehicles are available only for 7 hours and should be fully charged up to hour 18. In Scenario 7, the available hours are higher, at 12 hours, but the initial SOC is low. Moreover, the availability of EVs during the peak or off-peak hours is one of the influential factors. By contrast, Scenario 6, with the lowest contract price, has the highest hours of availability for the aggregator.

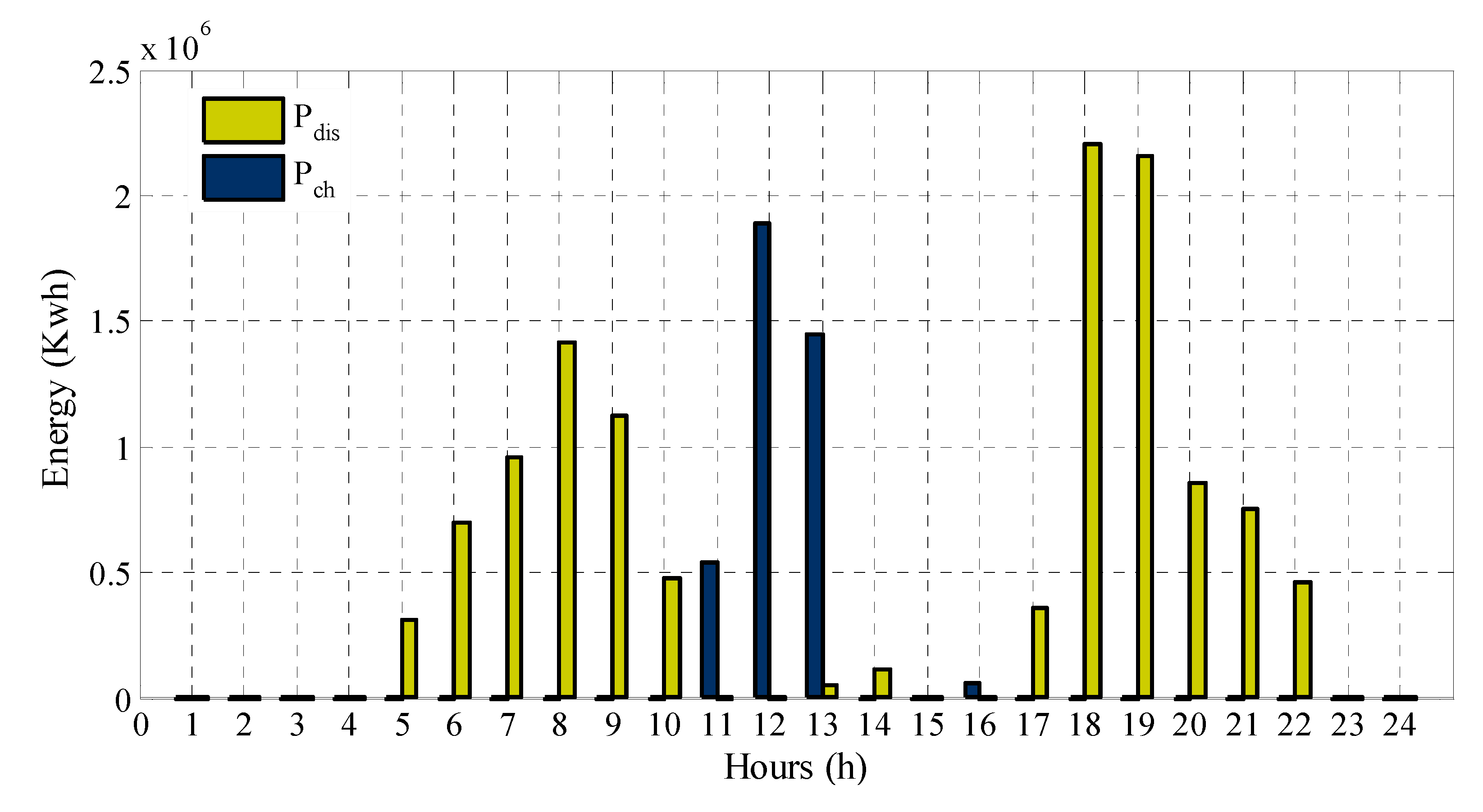

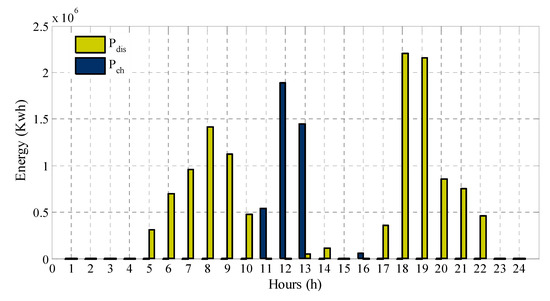

To optimize the scheduling of the EVA in the day-ahead market, the expected value of contract price has been utilized, which is equal to $0.056 per kWh. By taking into account this value as a final contract price, the expected profit for the aggregator is computed as equal to $3375.381, and the optimal scheduling of EVAs is depicted in Figure 3. According to the figure, the aggregator tends to charge batteries with low energy prices while selling stored power during peak periods.

Figure 3.

Expected charging and discharging powers of EVs.

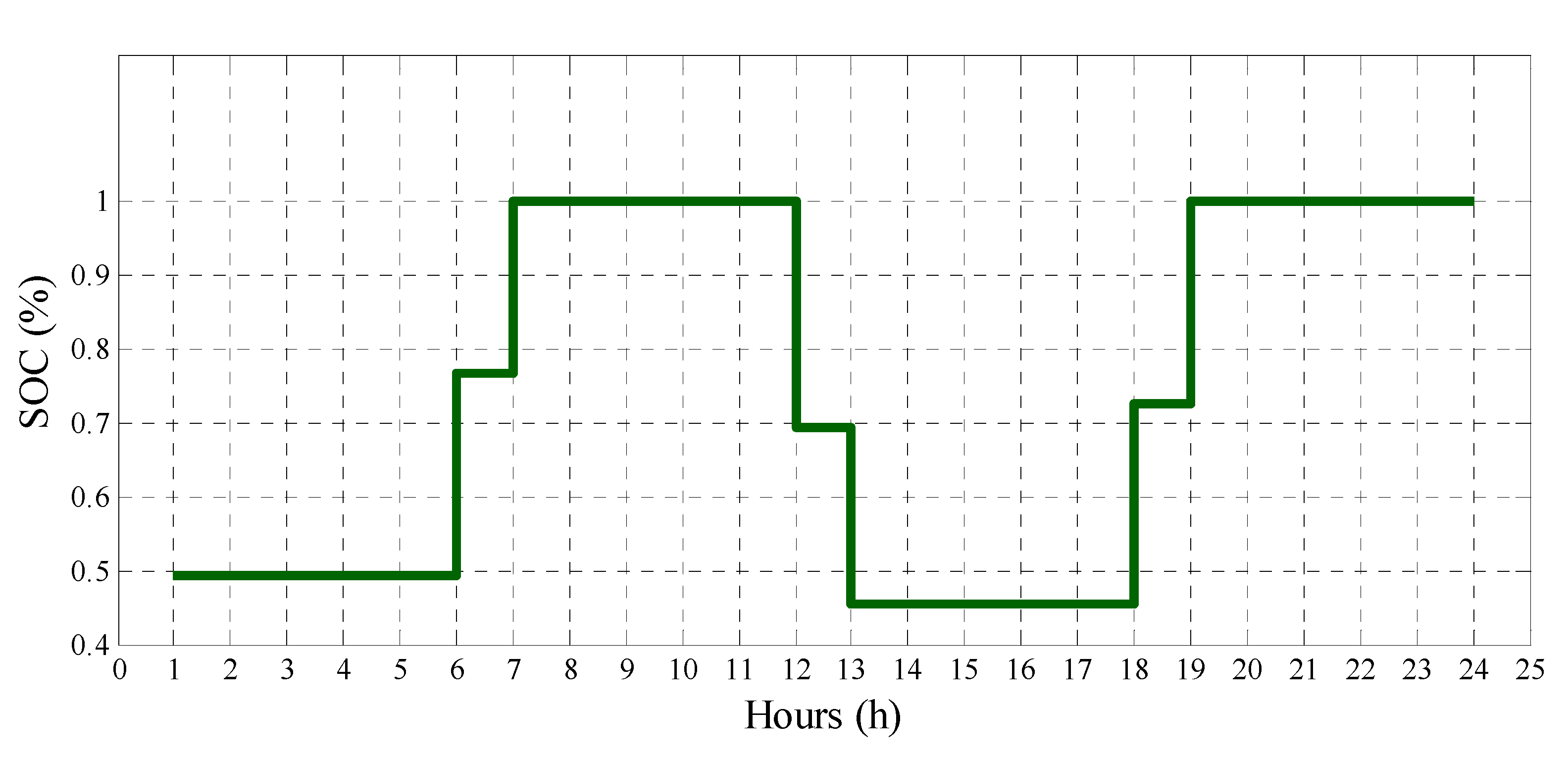

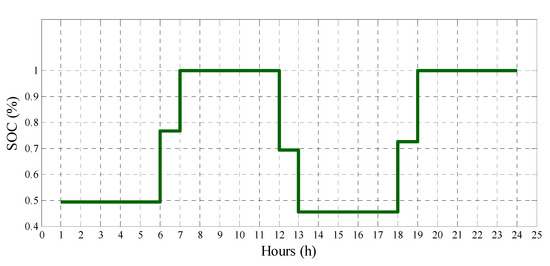

Additionally, the state of charge for EV type 1 in Scenario 4 is shown in Figure 4. As seen, the SOC is not lower than the minimum constraint, and eventually, the value of SOC is equal to 100% at the end of the available time. Moreover, the battery is charged at lower prices, and then it is discharged during hours 12 and 13 when the price of energy is high. The battery stays idle for 4 hours, and then at hours 18 and 19 is charged to be delivered with 100 percent of SOC at departure time.

Figure 4.

Energy level of battery electric vehicle type 1 in Scenario 4.

5. Conclusions

The current study has investigated the optimal scheduling problem of electric vehicle aggregators (EVAs) in the day-ahead market. The value of contract price can affect the selection of EVAs by EV owners. Contract price influences the final cost to EV owners and EVAs’ profits. Having said that, the EV owners aim to reduce their costs, seeking low contract prices, while EVAs want to sell energy at high prices. Due to the existing conflict between the objectives of the EVAs and EV owners over contract price, in this paper, a multi-objective framework has been formulated to cover both players’ preferences. To address the multi-objective problem, an approach based on goal programming methods has been proposed to find a satisfactory solution by taking into account the benefits to two sides. Meanwhile, the uncertainty in driving patterns has been modeled via a stochastic-based model. The numerical results show that the availability of electric vehicles can be a contributing factor to the contract price. More availability leads to lower contract prices. Eventually, an optimal scheduling of EVAs in the day-ahead market was created via the determined contract prices.

Author Contributions

Methodology, P.A. and B.M.-I.; mathematical modelling, simulations and analyses, P.A. and B.M.-I.; results evaluating, M.A., A.A. and A.E. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmadian, A.; Mohammadi-Ivatloo, B.; Elkamel, A. A Review on Plug-In Electric Vehicles: Introduction, Current Status, and Load Modeling Techniques. J. Mod. Power Syst. Clean Energy 2020. [Google Scholar] [CrossRef]

- Zhao, F.; Liu, F.; Liu, Z.; Hao, H. The correlated impacts of fuel consumption improvements and vehicle electrification on vehicle greenhouse gas emissions in China. J. Clean. Prod. 2019, 207, 702–716. [Google Scholar] [CrossRef]

- Ahmadian, A.; Sedghi, M.; Fgaier, H.; Mohammadi-ivatloo, B.; Golkar, M.A.; Elkamel, A. PEVs data mining based on factor analysis method for energy storage and DG planning in active distribution network: Introducing S2S effect. Energy 2019, 175, 265–277. [Google Scholar] [CrossRef]

- Bigerna, S.; Bollino, C.A.; Micheli, S.; Polinori, P. Revealed and stated preferences for CO2 emissions reduction: The missing link. Renew. Sustain. Energy Rev. 2017, 68, 1213–1221. [Google Scholar] [CrossRef]

- Schneider, K.; Gerkensmeyer, C.; Kintner-Meyer, M.; Fletcher, R. Impact assessment of plug-in hybrid vehicles on pacific northwest distribution systems. In Proceedings of the Power and Energy Society General Meeting-Conversion and Delivery of Electrical Energy in the 21st Century, Pittsburgh, PA, USA, 20–24 July 2008; pp. 1–6. [Google Scholar]

- Kintner-Meyer, M.; Schneider, K.; Pratt, R. Impacts Assessment of Plug-in Hybrid Vehicles on Electric Utilities and Regional US Power Grids, Part 1: Technical Analysis; Pacific Northwest National Laboratory: Benton County, OR, USA, 2007; Volume 1.

- Ahmadian, A.; Sedghi, M.; Mohammadi-Ivatloo, B.; Elkamel, A.; Golkar, M.A.; Fowler, M. Cost-benefit analysis of V2G implementation in distribution networks considering PEVs battery degradation. IEEE Trans. Sustain. Energy 2017, 9, 961–970. [Google Scholar] [CrossRef]

- Ahmadian, A.; Asadpour, M.; Mazouz, A.; Alhameli, F.; Mohammadi-ivatloo, B.; Elkamel, A. Techno-Economic Evaluation of PEVs Energy Storage Capability in Wind Distributed Generations Planning. Sustain. Cities Soc. 2020, 56, 102–117. [Google Scholar] [CrossRef]

- Sortomme, E.; El-Sharkawi, M.A. Optimal scheduling of vehicle-to-grid energy and ancillary services. IEEE Trans. Smart Grid 2012, 3, 351–359. [Google Scholar] [CrossRef]

- Momber, I.; Siddiqui, A.; Roman, T.G.S.; Söder, L. Risk averse scheduling by a PEV aggregator under uncertainty. IEEE Trans. Power Syst. 2015, 30, 882–891. [Google Scholar] [CrossRef]

- Bessa, R.J.; Matos, M.A. Optimization models for EV aggregator participation in a manual reserve market. IEEE Trans. Power Syst. 2013, 28, 3085–3095. [Google Scholar] [CrossRef]

- Ortega-Vazquez, M.A.; Bouffard, F.; Silva, V. Electric vehicle aggregator/system operator coordination for charging scheduling and services procurement. IEEE Trans. Power Syst. 2012, 28, 1806–1815. [Google Scholar] [CrossRef]

- Xi, X.; Sioshansi, R. Using price-based signals to control plug-in electric vehicle fleet charging. IEEE Trans. Smart Grid 2014, 5, 1451–1464. [Google Scholar] [CrossRef]

- Wu, D.; Aliprantis, D.C.; Ying, L. Load scheduling and dispatch for aggregators of plug-in electric vehicles. IEEE Trans. Smart Grid 2011, 3, 368–376. [Google Scholar] [CrossRef]

- Bessa, R.J.; Matos, M. Global against divided optimization for the participation of an EV aggregator in the day-ahead electricity market. Part I: Theory. Electr. Power Syst. Res. 2013, 95, 309–318. [Google Scholar] [CrossRef]

- Vatandoust, B.; Ahmadian, A.; Golkar, M.A.; Elkamel, A.; Almansoori, A.; Ghaljehei, M. Risk-averse optimal bidding of electric vehicles and energy storage aggregator in day-ahead frequency regulation market. IEEE Trans. Power Syst. 2018, 34, 2036–2047. [Google Scholar] [CrossRef]

- Tabatabaee, S.; Mortazavi, S.S.; Niknam, T. Stochastic scheduling of local distribution systems considering high penetration of plug-in electric vehicles and renewable energy sources. Energy 2017, 121, 480–490. [Google Scholar] [CrossRef]

- Lin, H.; Liu, Y.; Sun, Q.; Xiong, R.; Li, H.; Wennersten, R. The impact of electric vehicle penetration and charging patterns on the management of energy hub–A multi-agent system simulation. Appl. Energy 2018, 230, 189–206. [Google Scholar] [CrossRef]

- Ghahramani, M.; Nojavan, S.; Zare, K.; Mohammadi-Ivatloo, B. Short-term Scheduling of Future Distribution Network in High Penetration of Electric Vehicles in Deregulated Energy Market. In Operation of Distributed Energy Resources in Smart Distribution Networks; Academic Press: Amsterdam, The Netherlands, 2018; pp. 139–159. [Google Scholar]

- Kim, Y.; Kong, S.; Joo, S.-K. Stochastic Charging Coordination Method for Electric Vehicle (EV) Aggregator Considering Uncertainty in EV Departures. J. Electr. Eng. Technol. 2016, 11, 1049–1056. [Google Scholar] [CrossRef]

- Karfopoulos, E.; Marmaras, C.E.; Hatziargyriou, N. Charging control model for electric vehicle supplier aggregator. In Proceedings of the 2012 3rd IEEE PES International Conference and Exhibition on Innovative Smart Grid Technologies (ISGT Europe), Berlin, Germany, 14–17 October 2012; pp. 1–7. [Google Scholar]

- Jahangir, H.; Tayarani, H.; Ahmadian, A.; Aliakbar Golkar, M.; Miret, J.; Tayarani, M.; Oliver Gao, H. Charging demand of Plug-in Electric Vehicles: Forecasting travel behavior based on a novel Rough Artificial Neural Network approach. J. Cleaner Prod. 2019, 229, 1029–1044. [Google Scholar] [CrossRef]

- Alipour, M.; Mohammadi-Ivatloo, B.; Moradi-Dalvand, M.; Zare, K. Stochastic scheduling of aggregators of plug-in electric vehicles for participation in energy and ancillary service markets. Energy 2017, 118, 1168–1179. [Google Scholar] [CrossRef]

- Carpinelli, G.; Caramia, P.; Mottola, F.; Proto, D. Exponential weighted method and a compromise programming method for multi-objective operation of plug-in vehicle aggregators in microgrids. Int. J. Electr. Power Energy Syst. 2014, 56, 374–384. [Google Scholar] [CrossRef]

- Škugor, B.; Deur, J. Dynamic programming-based optimisation of charging an electric vehicle fleet system represented by an aggregate battery model. Energy 2015, 92, 456–465. [Google Scholar] [CrossRef]

- Jannati, J.; Nazarpour, D. Optimal performance of electric vehicles parking lot considering environmental issue. J. Clean. Prod. 2019, 206, 1073–1088. [Google Scholar] [CrossRef]

- Xu, J.; Wong, V.W. An approximate dynamic programming approach for coordinated charging control at vehicle-to-grid aggregator. In Proceedings of the 2011 IEEE International Conference on Smart Grid Communications (SmartGridComm), Brussels, Belgium, 17–20 October 2011; pp. 279–284. [Google Scholar]

- Xia, M.; Lai, Q.; Zhong, Y.; Li, C.; Chiang, H.-D. Aggregator-based interactive charging management system for electric vehicle charging. Energies 2016, 9, 159. [Google Scholar] [CrossRef]

- Vayá, M.G.; Andersson, G. Optimal bidding of plug-in electric vehicle aggregator in day-ahead and regulation markets. Int. J. Electr. Hybrid Veh. 2015, 7, 209–232. [Google Scholar] [CrossRef]

- Momber, I.; Wogrin, S.; Román, T.G.S. Retail pricing: A bilevel program for PEV aggregator decisions using indirect load control. IEEE Trans. Power Syst. 2015, 31, 464–473. [Google Scholar] [CrossRef]

- Aliasghari, P.; Mohammadi-Ivatloo, B.; Alipour, M.; Abapour, M.; Zare, K. Optimal scheduling of plug-in electric vehicles and renewable micro-grid in energy and reserve markets considering demand response program. J. Clean. Prod. 2018, 186, 293–303. [Google Scholar] [CrossRef]

- Aliasghari, P.; Mohammadi-Ivatloo, B.; Abapour, M. Risk-based scheduling strategy for electric vehicle aggregator using hybrid Stochastic/IGDT approach. J. Clean. Prod. 2020, 248, 119–270. [Google Scholar] [CrossRef]

- Zhao, J.; Wan, C.; Xu, Z.; Wang, J. Risk-based day-ahead scheduling of electric vehicle aggregator using information gap decision theory. IEEE Trans. Smart Grid 2015, 8, 1609–1618. [Google Scholar] [CrossRef]

- Simon, H.A. A behavioral model of rational choice. Q. J. Econ. 1955, 69, 99–118. [Google Scholar] [CrossRef]

- Broz, D.; Vanzetti, N.; Corsano, G.; Montagna, J.M. Goal programming application for the decision support in the daily production planning of sawmills. For. Policy Econ. 2019, 102, 29–40. [Google Scholar] [CrossRef]

- Romero, C. Handbook of Critical Issues in Goal Programming; Elsevier: Amsterdam, The Netherlands, 2014. [Google Scholar]

- Pantos, M. Exploitation of electric-drive vehicles in electricity markets. IEEE Trans. Power Syst. 2011, 27, 682–694. [Google Scholar] [CrossRef]

- Carrión, M.; Arroyo, J.M.; Conejo, A.J. A bilevel stochastic programming approach for retailer futures market trading. IEEE Trans. Power Syst. 2009, 24, 1446–1456. [Google Scholar] [CrossRef]

- Vagropoulos, S.I.; Kyriazidis, D.K.; Bakirtzis, A.G. Real-time charging management framework for electric vehicle aggregators in a market environment. IEEE Trans. Smart Grid 2016, 7, 948–957. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).