Research on Bidding Mechanism for Power Grid with Electric Vehicles Based on Smart Contract Technology

Abstract

1. Introduction

- (a)

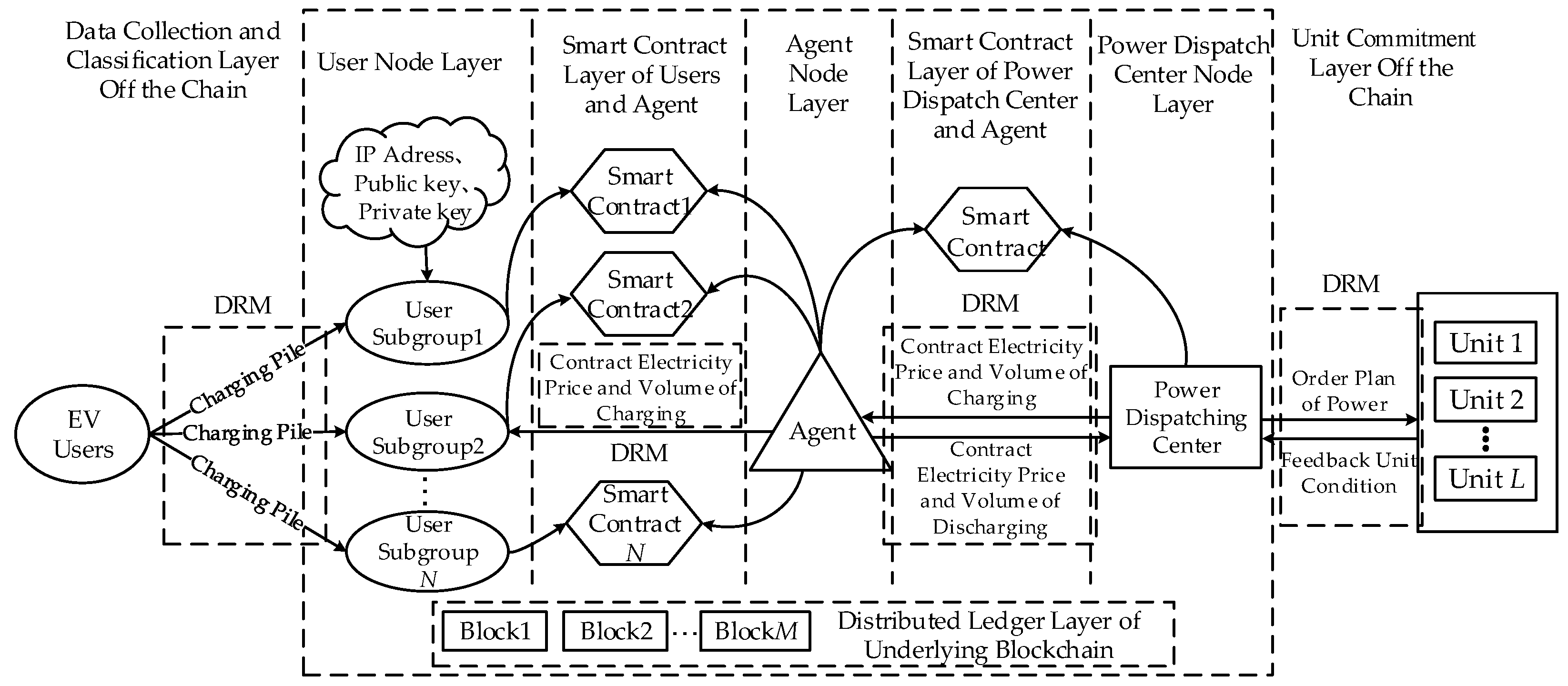

- Different from the traditional blockchain trading architecture with a single chain, this paper innovatively proposes the on and off chain architecture considering the applicability and bottleneck of smart contract technology. The bidding relationship among market subject is only used as the logic of contract on the chain to realize distributed trading. Off the chain, EV cluster classification and unit commitment still adopt centralized dispatching.

- (b)

- Different from the traditional centralized bidding of EVs, this paper classifies EVs with different driving characteristics in a unified cluster and adopts a different DRM. This method fully excavates the diverse charging–discharging demands of different users and provides a more real demand response for bidding in the market.

- (c)

- Based on the literatures [16,17], the traditional user–side and grid–side DRM have been extended to introduce the concept of EV agent. The smart contract interaction between EV users and agent is taken as the user side in a broad sense. The smart contract interaction between EV agent and power dispatching center is taken as the power grid side in a broad sense. On the whole, this paper will achieve economic win–win results based on the demand response of the three parties.

- (d)

- Based on the traditional EV charging bidding, the demand response and economic impact brought by discharging are considered. Moreover, a reasonable and effective bidding mechanism and algorithm are designed, which obtains better optimal scheduling and economic benefit than bidding only containing charging.

2. Materials and Methods

2.1. Overview of System Model

2.1.1. Relationship between Blockchain and Smart Contract

2.1.2. Overall Framework of Trading Mechanism

2.2. Smart Contract Model between EV Users and Agent

2.2.1. Classification Method of EVs

2.2.2. Analysis of Demand Contract

Constraints of EV Users

Analysis of Demand Contract for EV Users

Analysis of Demand Contract for EV Agent

2.2.3. Analysis of Target Contract

2.3. Smart Contract Model of EV Agent and Power Dispatching Center

2.3.1. Analysis of Target Contract

2.3.2. Analysis of Demand Contract

2.3.3. Analysis of Constraints

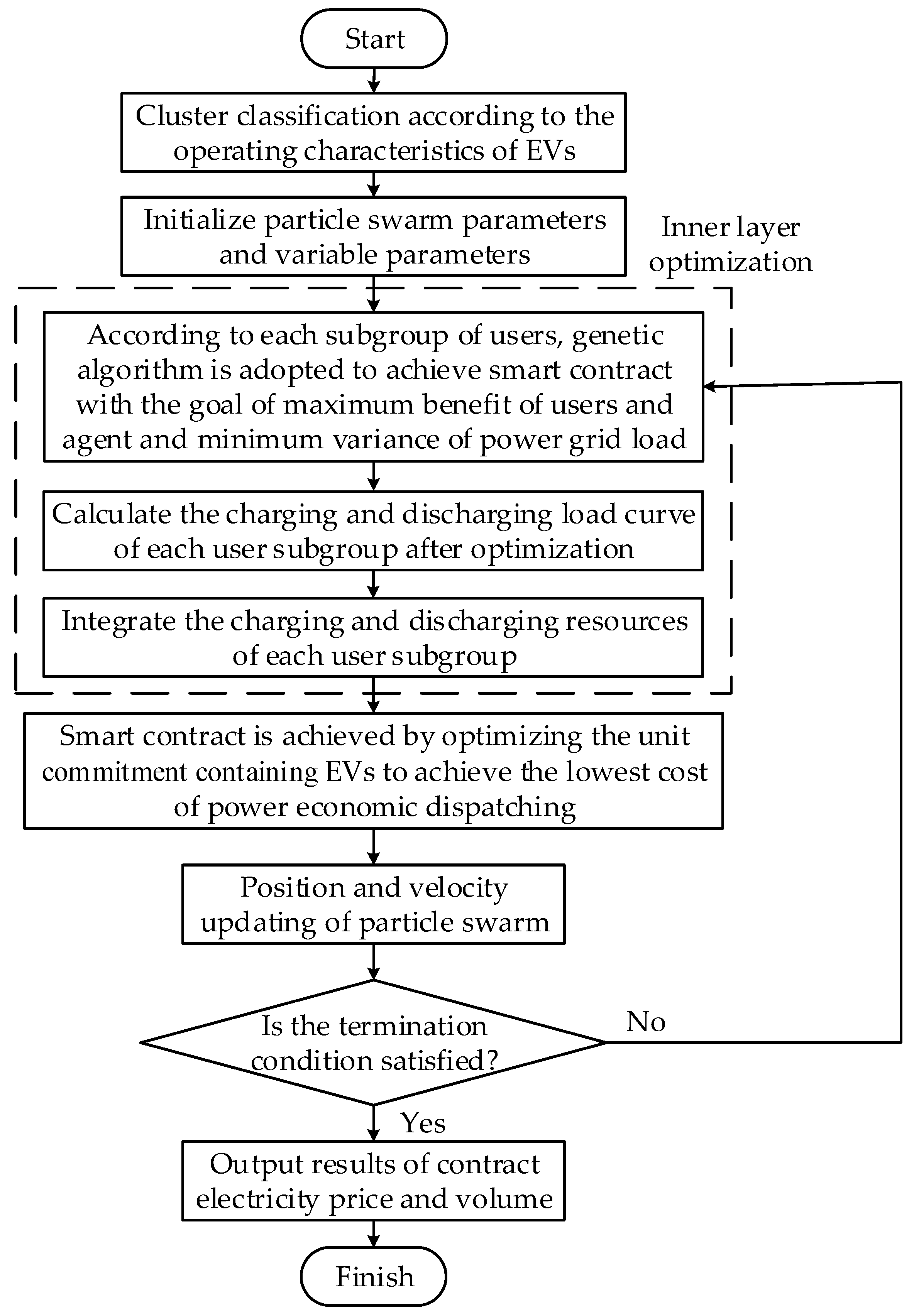

2.4. Solution of Smart Contract Model

3. Results and Discussion

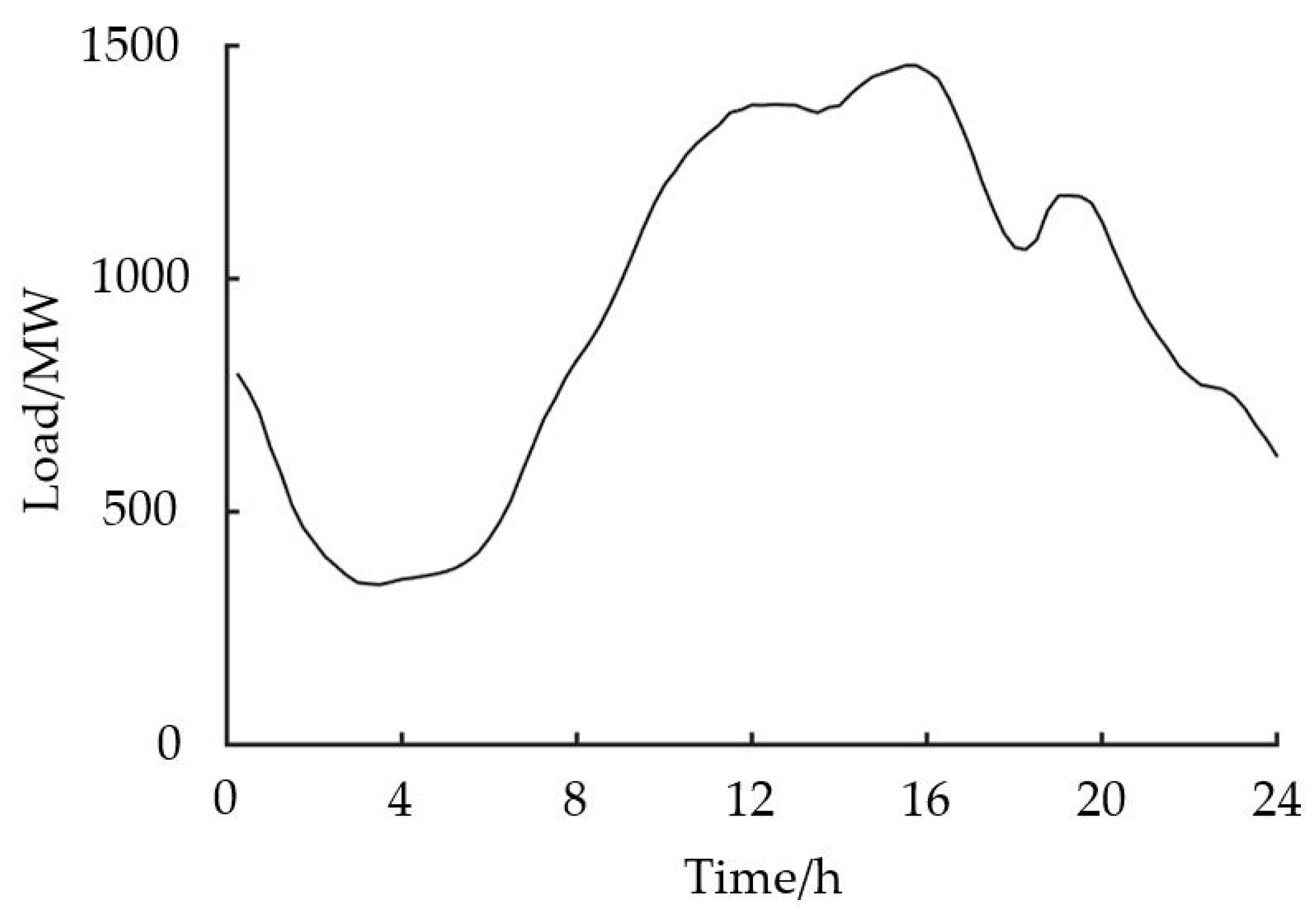

3.1. The Example Data

- The total number of cars is 1 million, and the penetration rate of EVs is 5%. All users participate in day–ahead market bidding through the V2G dispatching of agent. Specific EV parameters are shown in Table 1.

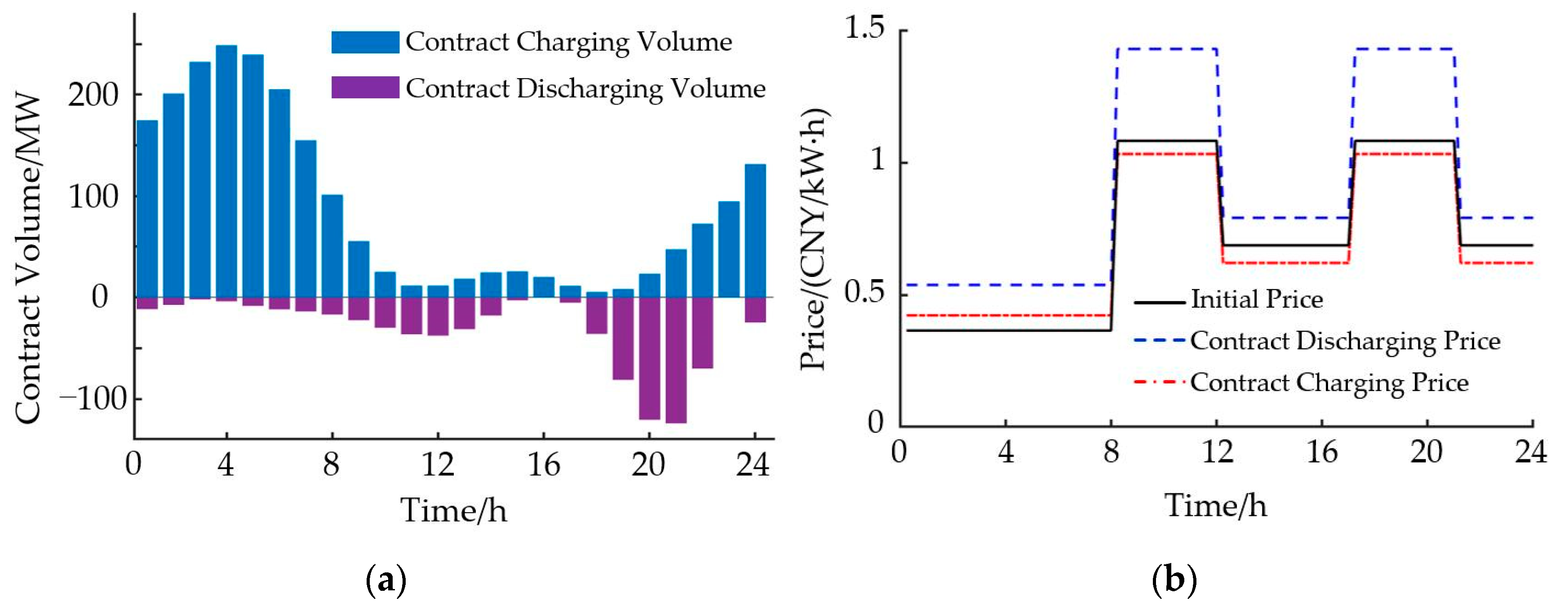

- The ending and starting time of the user’s travel is taken as the starting and ending time of the schedule. EVs are charged once a day. Also, 15 min is one dispatching period, and 1 h is one electricity price period. Peak–valley time–of–use price without EV bidding is shown in Table 2. The range of charging price containing bidding of EV is shown in Table 3. Considering the cost of storage, transportation, and loss of energy, the discharging price range is 1.3 times of the charging price range [25].

- According to the charging–discharging power, the agent pays CNY 0.5/(kW·h) for the unit discharging compensation. According to the charging–discharging depth of the EVs in this example, the unit loss cost of the battery is CNY 0.14/(kW·h) [26]. The unit energy storage and operation cost of the agent is CNY 0.1/(kW·h).

- The profit sharing ratio given by agent to users is 0.1; the employment fee provided by the users to the agent is CNY 0.1/one vehicle/a day.

- Since the smart contract relationship is based on the flexible charging–discharging resources, the optimal scheduling control based on the total load peak–cutting and valley–filling is particularly important. The weight coefficients of the three objective functions in the smart contracts between the users and the agent are λ1 = λ2 = 0.25, λ3 = 0.5: Objective functions of users and agent have the same importance; the target with the smallest load variance is the most important.

3.2. Results of Smart Contract between EV Users and Agent

3.3. Results of Smart Contract between EV Agent and Power Dispatching Center

3.4. Analysis of Economic Benefits of Market Subjects

4. Conclusions and Future Work

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Constants: | |

| B | capacity of the battery |

| Δt | length of a scheduling period |

| total number of scheduling hours in a day | |

| r | profit sharing proportion that the agent gives to the users |

| weight coefficients of each objective function respectively | |

| Variables: | |

| the power demand SOC of the vehicle i in the user subgroup k | |

| the minimum and maximum power demand SOC expected by the users | |

| Charging–discharging state of the vehicle i in the user subgroup k in time period t | |

| the starting and ending scheduling time of the vehicle i in the user subgroup k | |

| SOC of the vehicle i in the user subgroup k at the end of time period t | |

| charging and discharging power of the vehicle i in the user subgroup k in period t | |

| purchasing power cost from the agent for the user subgroup k | |

| contract charging price within time period t | |

| number of EVs in the user subgroup k | |

| battery loss cost of the user subgroup k | |

| unit loss cost of the battery in time period t | |

| charging or discharging power of the vehicle i in the user subgroup k in period t | |

| cost of hiring agent for the user subgroup k | |

| dispatch hire fee that the users gives the agent per vehicle | |

| agent’s revenue by discharging power into the grid through the user subgroup k | |

| contract discharging price within time period t | |

| energy storage and operation cost of agent for the user subgroup k | |

| unit cost of energy storage and operation of agent in time period t | |

| agent’s discharging compensation fee for the user subgroup k | |

| unit compensation cost of discharging within time period t | |

| agent’s total revenue to the user subgroup k | |

| total power purchase cost of the user subgroup k | |

| profit sharing that the agent gives to the user subgroup k | |

| grid load variance containing the user subgroup k | |

| load value of the basic power grid excluding EVs in time period t | |

| average load value of the grid containing EVs in the total time period | |

| cost of the whole power economic dispatching | |

| unit commitment cost of the power system excluding EVs | |

| unit commitment cost of the power system containing EVs | |

| cost of grid company by purchasing discharging volume from the user subgroup k | |

| revenue of grid company by selling charging volume to the user subgroup k | |

| system total cost of the unit commitment | |

| total optimization time of the unit commitment | |

| number of thermal power units involved in optimization | |

| fuel cost function of the unit j | |

| unit output of the unit j in the time period t | |

| fuel cost coefficient of the unit j | |

| startup cost of the unit j | |

| continuous outage time before starting unit j | |

| allowed minimum stop time of the unit j | |

| cold start time of the unit j | |

| binary integer variable of the unit j in the on–off state during the time period t | |

| total charging and discharging loads of all EVs in time period t | |

| the minimum and maximum output of unit j in the time period t | |

| standby demand of the system in time period t | |

| cumulative startup and shutdown time of the unit j in time period t | |

| single objective function of the user subgroup k after multi–objective normalization | |

| purchasing cost of power when the user subgroup k is unordered charging | |

| grid load value when the user subgroup k is unordered charging |

References

- Dong, Z.; Luo, F.; Liang, G. Blockchain: A secure, decentralized, trusted cyber infrastructure solution for future energy systems. J. Mod. Power Syst. Clean Energy 2018, 6, 958–967. [Google Scholar] [CrossRef]

- Mwasilu, F.; Justo, J.J.; Kim, E.K.; Do, T.D.; Jung, J.W. Electric vehicles and smart grid interaction: A review on vehicle to gridand renewable energy sources integration. Renew. Sustain. Energy Rev. 2014, 34, 501–516. [Google Scholar] [CrossRef]

- Alladi, T.; Chamola, V.; Rodrigues, J.J.; Kozlov, S.A. Blockchain in smart grids: A review on different use cases. Sensors 2019, 19, 4862. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Kang, J.; Yu, R.; Ye, D.; Deng, Q.; Zhang, Y. Consortium blockchain for secure energy trading in industrial Internet of Things. IEEE Trans. Ind. Inform. 2018, 14, 3690–3700. [Google Scholar] [CrossRef]

- Habib, S.; Kamran, M.; Rashid, U. Impact analysis of vehicle-to-grid technology and charging strategiesof electric vehicles on distribution networks—A review. J. Power Sources 2015, 277, 205–214. [Google Scholar] [CrossRef]

- Kim, M.; Park, K.; Yu, S.; Lee, J.; Park, Y.; Lee, S.W.; Chung, B. A secure charging system for electric vehicles based on blockchain. Sensors 2019, 19, 3028. [Google Scholar] [CrossRef]

- Liu, W.J.; Chi, M.; Liu, Z.W.; Guan, Z.H.; Chen, J.; Xiao, J.W. Distributed optimal active power dispatch with energy storage units and power flow limits in smart grids. Int. J. Electr. Power Energy Syst. 2019, 105, 420–428. [Google Scholar] [CrossRef]

- Ahl, A.; Yarime, M.; Tanaka, K.; Sagawa, D. Review of blockchain-based distributed energy: Implications for institutional development. Renew. Sustain. Energy Rev. 2019, 107, 200–201. [Google Scholar] [CrossRef]

- Pop, C.; Cioara, T.; Antal, M.; Anghel, I.; Salomie, I.; Bertoncini, M. Blockchain based decentralized management of demand response programs in smart energy grids. Sensors 2018, 18, 162. [Google Scholar] [CrossRef]

- Van Cutsem, O.; Dac, D.H.; Boudou, P.; Kayal, M. Cooperative energy management of a community of smart-buildings: A blockchain approach. Int. J. Electr. Power Energy Syst. 2020, 117, 105643. [Google Scholar] [CrossRef]

- Pee, S.J.; Kang, E.S.; Song, J.G.; Jang, J.W. Blockchain based smart energy trading platform using smart contract. In Proceedings of the International Conference on Artificial Intelligence in Information and Communication, Okinawa, Japan, 11–13 February 2019; pp. 322–325. [Google Scholar]

- Liu, C.; Chai, K.K.; Zhang, X.; Lau, E.T.; Chen, Y. Adaptive Blockchain-based electric vehicle participation scheme in smart grid platform. IEEE Access 2018, 6, 25657–25665. [Google Scholar] [CrossRef]

- Zhang, T.; Pota, H.; Chu, C.C.; Gadh, R. Real-time renewable energy incentive system for electric vehicles using prioritization and cryptocurrency. Appl. Energy 2018, 226, 582. [Google Scholar] [CrossRef]

- Vayá, M.G.; Andersson, G. Optimal bidding strategy of a plug-in electric vehicle aggregator in day-ahead electricity markets under uncertainty. IEEE Trans. Power Syst. 2015, 30, 2375–2385. [Google Scholar] [CrossRef]

- Shafie-Khah, M.; Heydarian-Forushani, E.; Golshan, M.E.H.; Siano, P.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Catalão, J.P.S. Optimal trading of plug-in electric vehicle aggregation agents in a market environment for sustainability. Appl. Energy 2016, 162, 601–612. [Google Scholar] [CrossRef]

- Apostolopoulos, P.A.; Tsiropoulou, E.E.; Papavassiliou, S. Demand response management in smart grid networks: A two-stage game-theoretic learning-based approach. Mob. Netw. Appl. 2018, 1–14. [Google Scholar] [CrossRef]

- Chai, B.; Chen, J.; Yang, Z.; Zhang, Y. Demand response management with multiple utility companies: A two-level game approach. IEEE Trans. Smart Grid 2014, 5, 722. [Google Scholar] [CrossRef]

- Wang, J.; Wang, Q.; Zhou, N.; Chi, Y. A novel electricity transaction mode of microgrids based on blockchain and continuous double auction. Energies 2017, 10, 1971. [Google Scholar] [CrossRef]

- Thomas, L.; Zhou, Y.; Long, C.; Wu, J.; Jenkins, N. A general form of smart contract for decentralized energy systems management. Nat. Energy 2019, 4, 140. [Google Scholar] [CrossRef]

- Giungato, P.; Rana, R.; Tarabella, A.; Tricase, C. Current trends in sustainability of bitcoins and related blockchain technology. Sustainability 2017, 9, 2214. [Google Scholar] [CrossRef]

- Zheng, J.; Wang, X.; Men, K.; Zhu, C.; Zhu, S. Aggregation model-based optimization for electric vehicle charging strategy. IEEE Trans. Smart Grid 2013, 4, 1058–1066. [Google Scholar] [CrossRef]

- He, X.; Rao, Y.; Huang, J. A novel algorithm for economic load dispatch of power systems. Neurocomputing 2016, 171, 1454–1461. [Google Scholar] [CrossRef]

- Christidis, K.; Devetsikiotis, M. Blockchains and smart contracts for the internet of things. IEEE Access 2016, 4, 2292–2303. [Google Scholar] [CrossRef]

- 2017 National Household Travel Survey. Available online: http://nhts.ornl.gov (accessed on 2 March 2018).

- Wu, C.; Mohsenian-Rad, H.; Huang, J. Vehicle-to-aggregator interaction game. IEEE Trans. Smart Grid 2012, 3, 434–442. [Google Scholar] [CrossRef]

- Peterson, S.B.; Apt, J.; Whitacre, J.F. Lithium-ion battery cell degradation resulting from realistic vehicle and vehicle-to-grid utilization. J. Power Sources 2010, 195, 2385–2392. [Google Scholar] [CrossRef]

- Wang, Y.; Yang, Z.; Mourshed, M.; Guo, Y.; Niu, Q.; Zhu, X. Demand side management of plug-in electric vehicles and coordinated unit commitment: A novel parallel competitive swarm optimization method. Energy Convers. Manag. 2019, 196, 935–949. [Google Scholar] [CrossRef]

| Initial SOC | Expected SOC | Power of Charging and Discharging/kW | Battery Capacity/(kW·h) |

|---|---|---|---|

| N(0.3, 0.42) | 0.9~1 | 7.5 | 36 |

| Type | Period | Initial Price/(CNY/(kW·h)) |

|---|---|---|

| Peak | 8:00–12:00, 17:00–21:00 | 1.082 |

| Ordinary | 12:00–17:00, 21:00–24:00 | 0.687 |

| Valley | 0:00–8:00 | 0.365 |

| Type | Ceil of Charging Price/(CNY/(kW·h)) | Floor of Charging Price/(CNY/(kW·h)) |

|---|---|---|

| Peak | 1.2 | 0.9 |

| Ordinary | 0.5 | 0.3 |

| Valley | 0.8 | 0.6 |

| Cluster Index | Ending Time of Scheduling/h | Starting Time of Scheduling/h |

|---|---|---|

| Main Cluster1 | 9.04 | 13.32 |

| Main Cluster2 | 14.04 | 18.75 |

| Main Cluster3 | 7.60 | 19.03 |

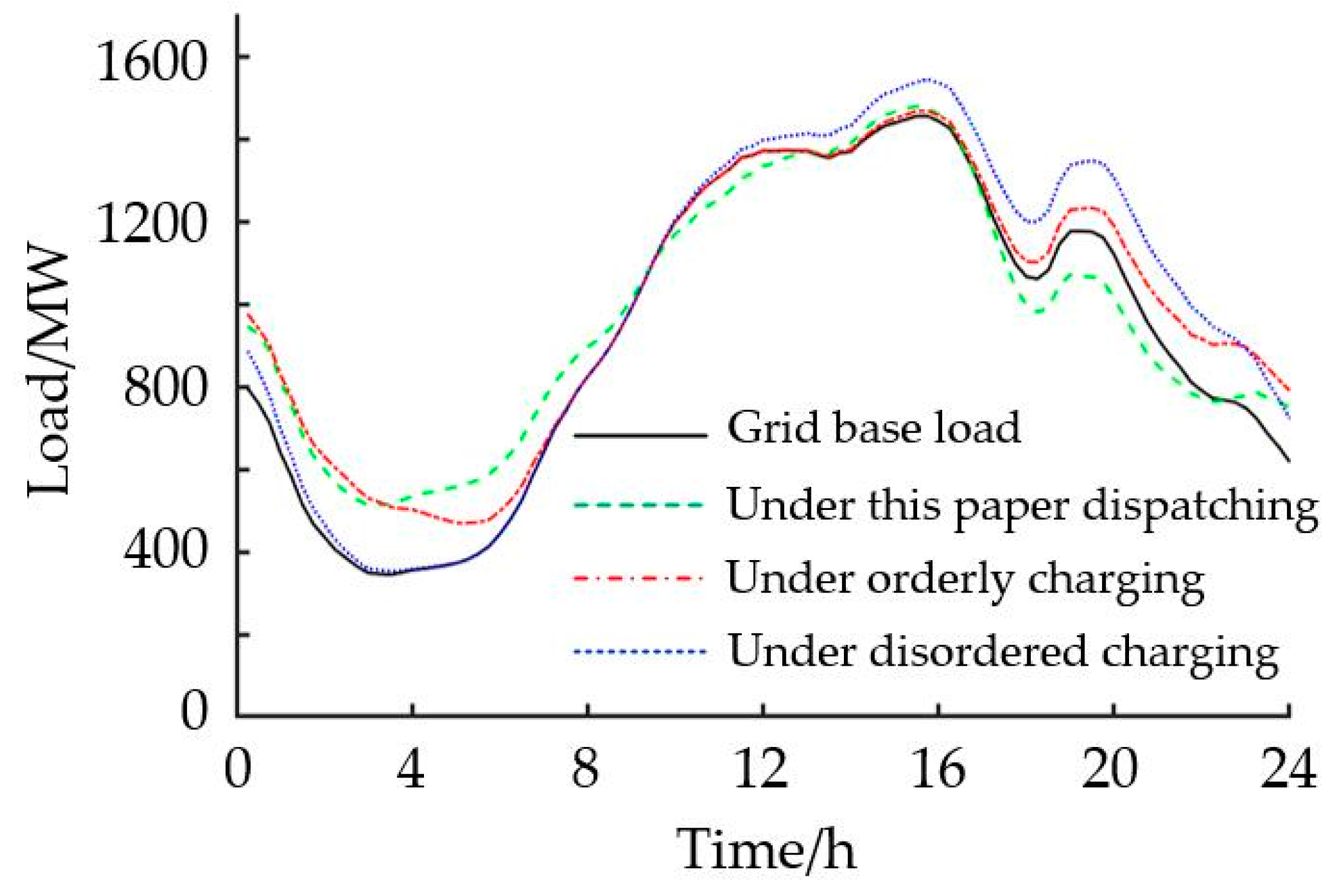

| Scheduling Strategy | Cost of Economic Dispatching/CNY Ten Thousand | Cost of User Battery Loss/CNY Ten Thousand | Total Cost of User/CNY Ten Thousand | Total Revenue of Agent/CNY Ten Thousand |

|---|---|---|---|---|

| Strategy of This Paper | 76.02 | 39.95 | 108.50 | 13.26 |

| Orderly Charging | 112.27 | 22.88 | 113.43 | 0 |

| Disordered Charging | 160.55 | 22.88 | 157.48 | 0 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, B.; Liu, W.; Wang, M.; Shen, W. Research on Bidding Mechanism for Power Grid with Electric Vehicles Based on Smart Contract Technology. Energies 2020, 13, 390. https://doi.org/10.3390/en13020390

Wang B, Liu W, Wang M, Shen W. Research on Bidding Mechanism for Power Grid with Electric Vehicles Based on Smart Contract Technology. Energies. 2020; 13(2):390. https://doi.org/10.3390/en13020390

Chicago/Turabian StyleWang, Bing, Weiyang Liu, Min Wang, and Wangping Shen. 2020. "Research on Bidding Mechanism for Power Grid with Electric Vehicles Based on Smart Contract Technology" Energies 13, no. 2: 390. https://doi.org/10.3390/en13020390

APA StyleWang, B., Liu, W., Wang, M., & Shen, W. (2020). Research on Bidding Mechanism for Power Grid with Electric Vehicles Based on Smart Contract Technology. Energies, 13(2), 390. https://doi.org/10.3390/en13020390