Stationary Energy Storage System for Fast EV Charging Stations: Simultaneous Sizing of Battery and Converter

Abstract

1. Introduction

- In contrast to the existing studies, where sequential sizing of the battery and converter is considered, simultaneous sizing of the battery and converter is proposed in this study for deploying ESS in fast charging stations. The proposed method has the potential to avoid the under and oversizing of converters by sizing them together with batteries.

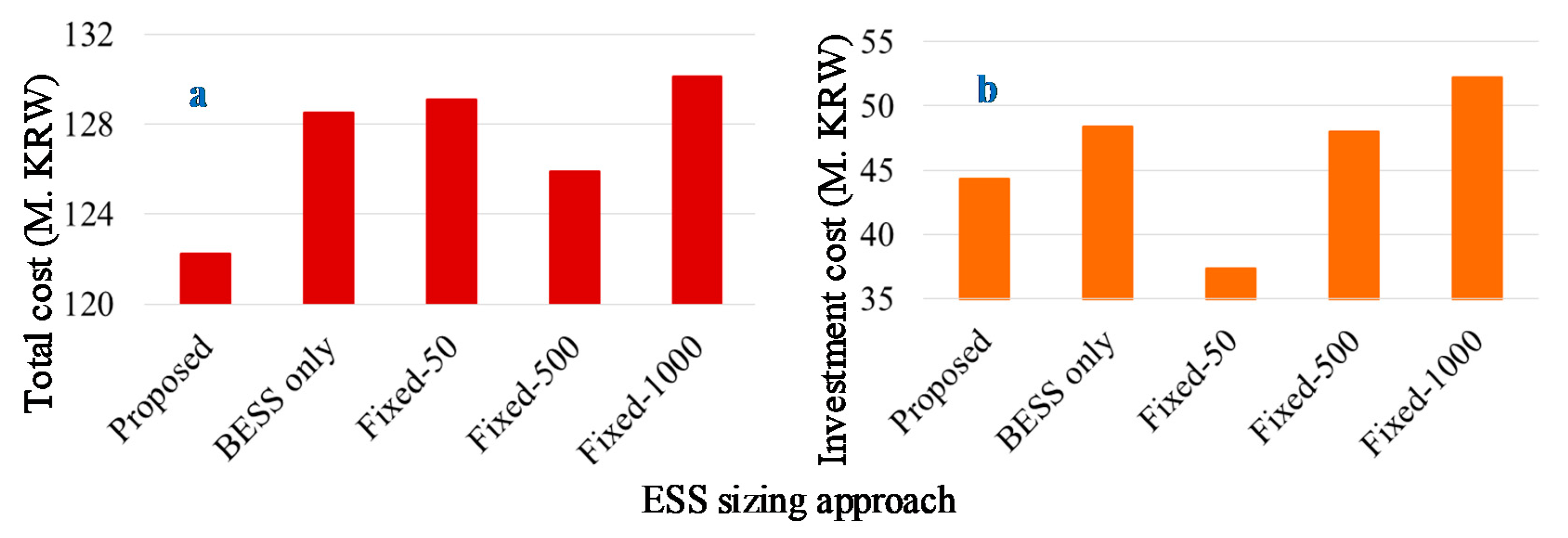

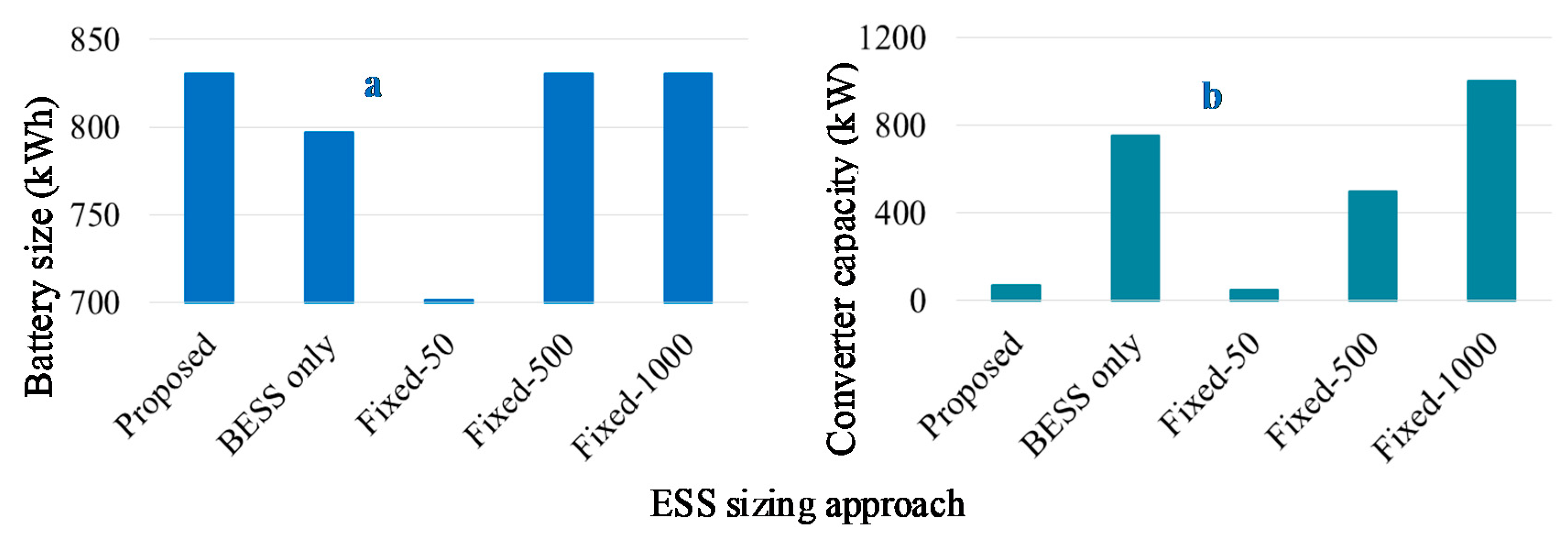

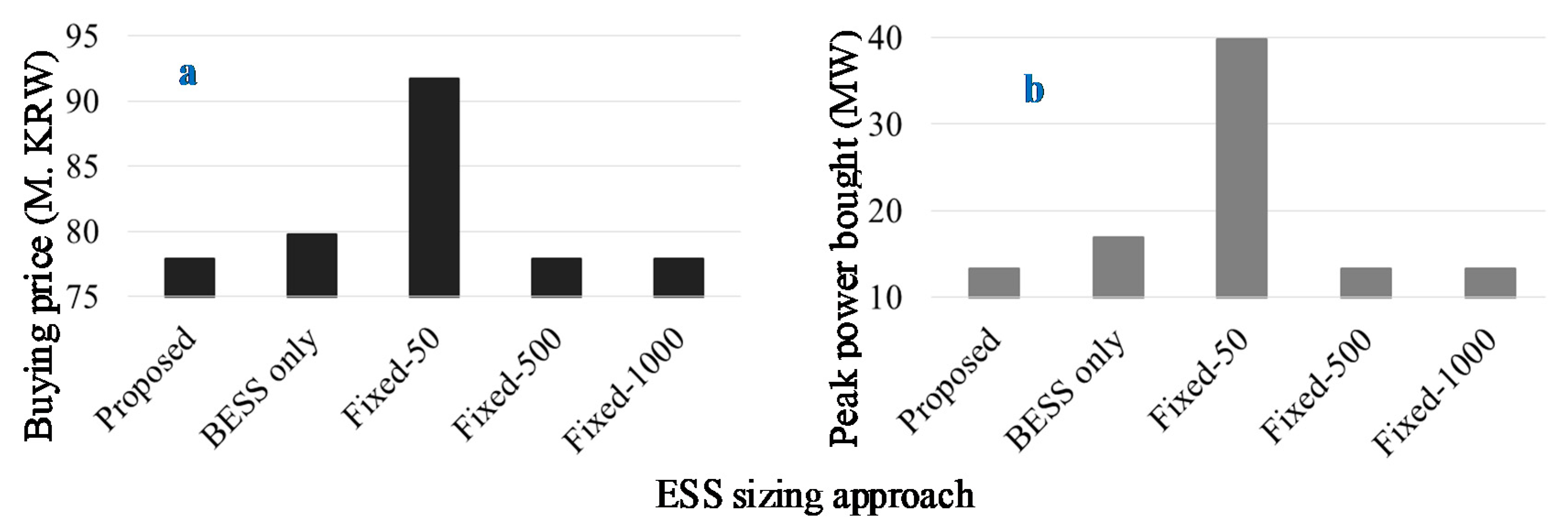

- The performance of the proposed method has been compared with the commonly utilized sizing methods, which are available in the literature. The total yearly cost of the charging station, the investment cost of ESS, the amount of power bought during system peak intervals, and the cost of buying power from the grid have been compared. The proposed method has outperformed the existing methods in terms of reducing the total yearly cost of the charging station.

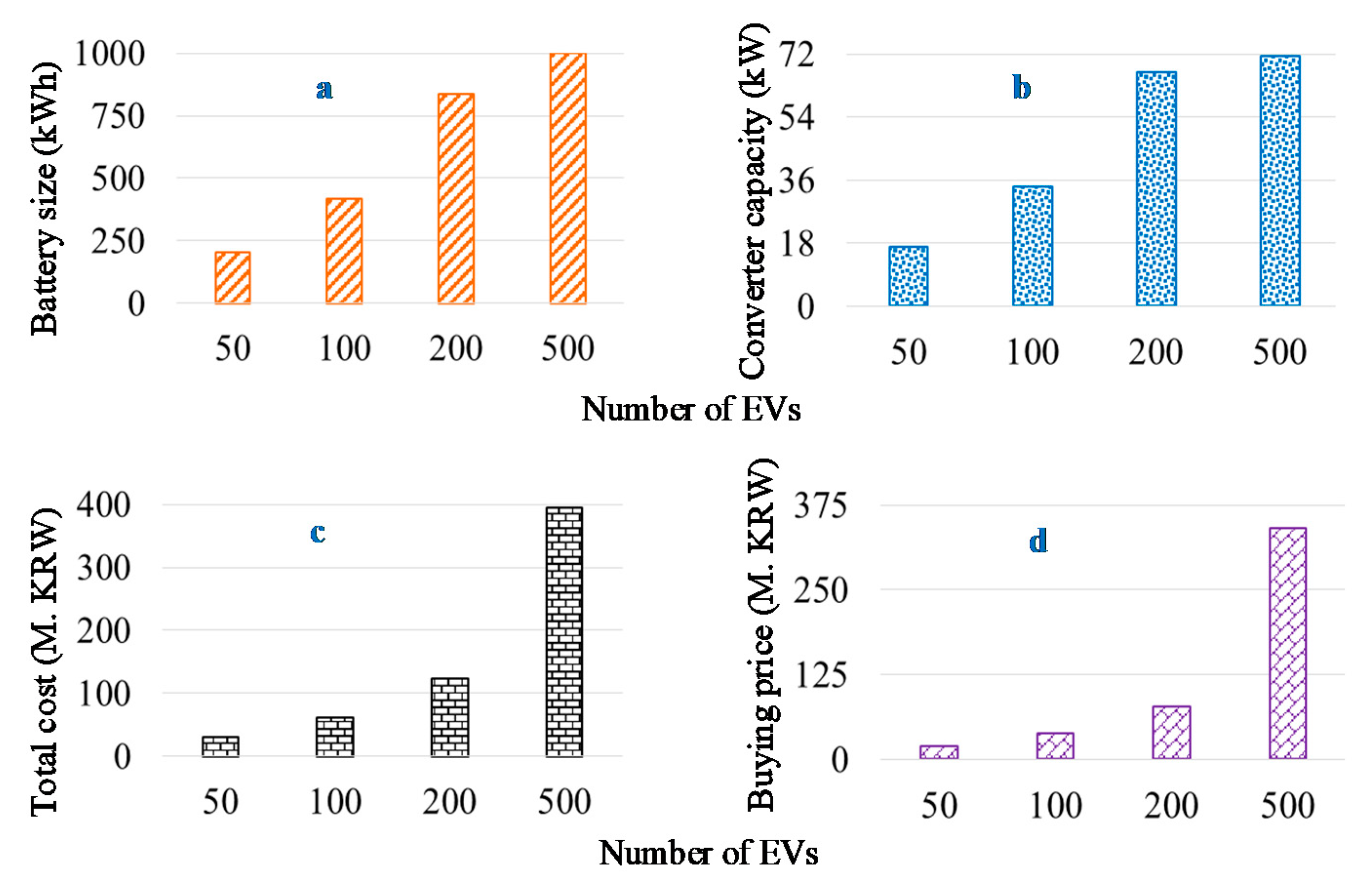

- In order to evaluate the impact of several system parameters on the size of battery and converter, sensitivity analysis is carried out. The impact of the number of EVs registered with the charging station, uncertainty in return time of EVs to the charging station, percentage of useable energy range of ESS, and ratio of commercial to private vehicles in the fleet are analyzed.

2. Network Configuration and Proposed Sizing Method

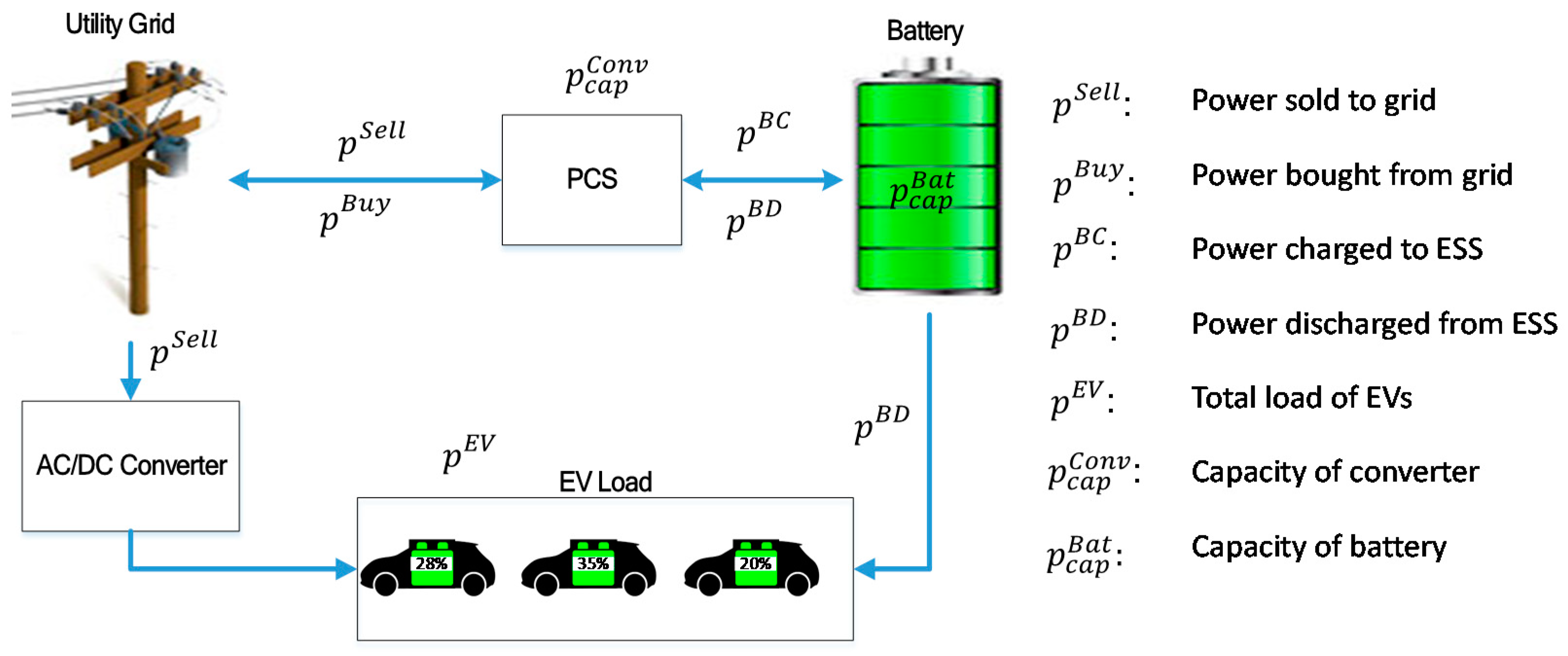

2.1. Network Configuration

2.1.1. EV Load

2.1.2. Energy Storage System (ESS)

2.1.3. Utility Grid

2.1.4. Power Conversion System (PCS)

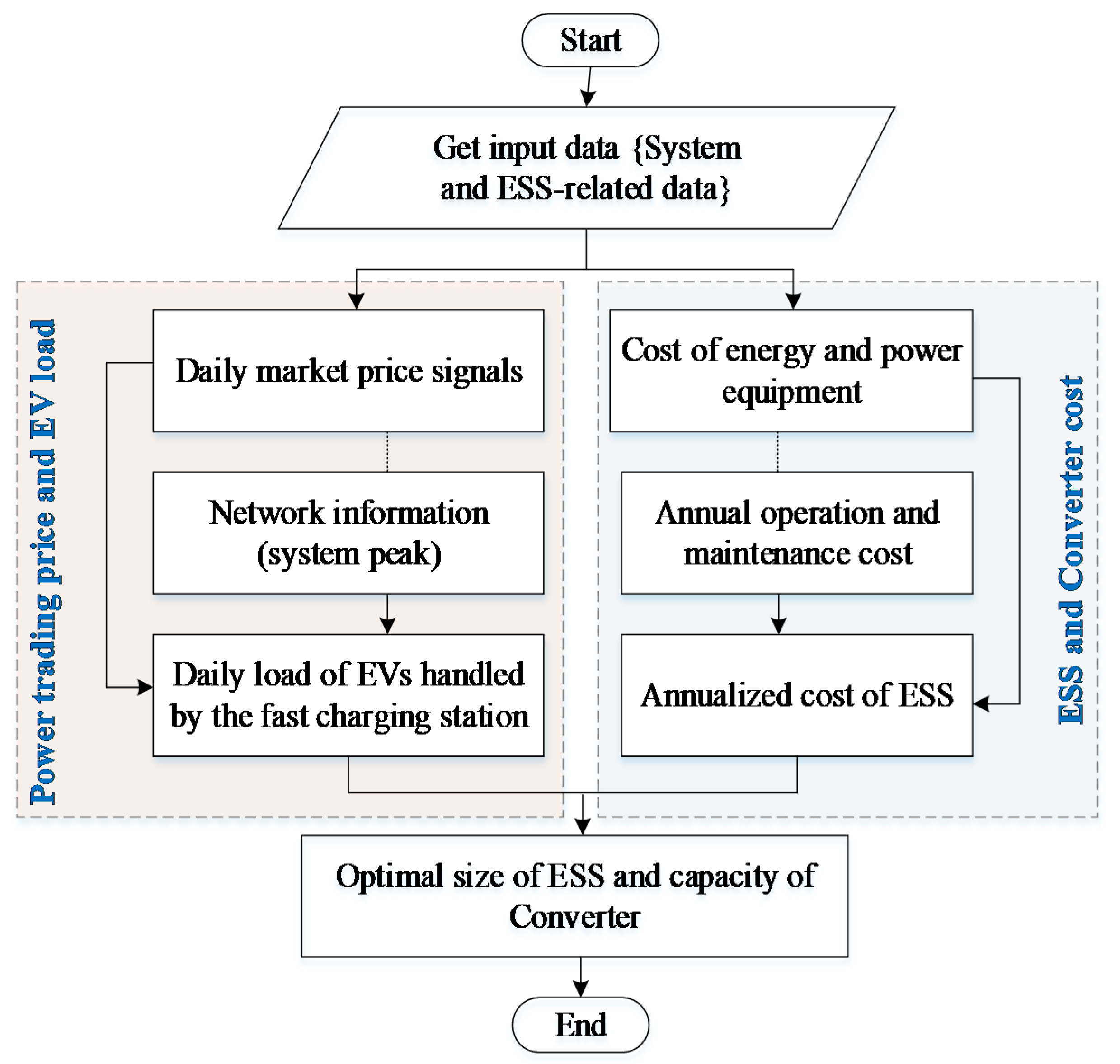

2.2. Proposed Sizing Method

3. Mathematical Modeling

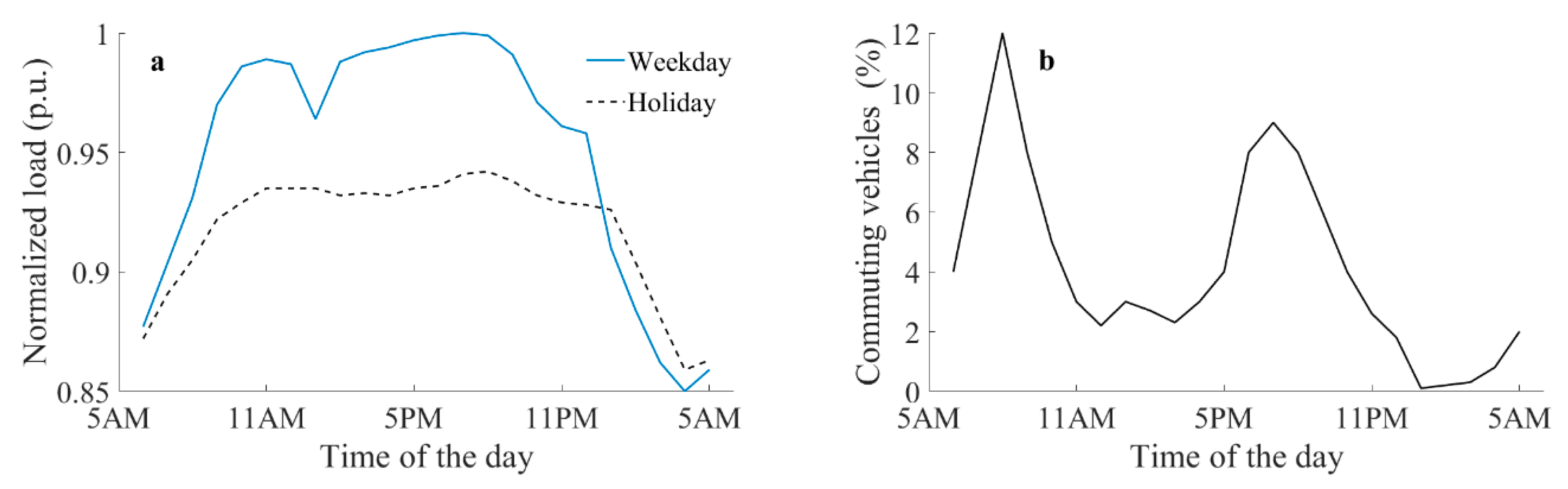

3.1. Modeling of Charging Station Load

3.2. Modeling for Simultaneous Sizing of ESS and Converter

3.2.1. Objective Function

3.2.2. Power Balancing Constraints

3.2.3. ESS and Converter Constraints

4. Simulation Results

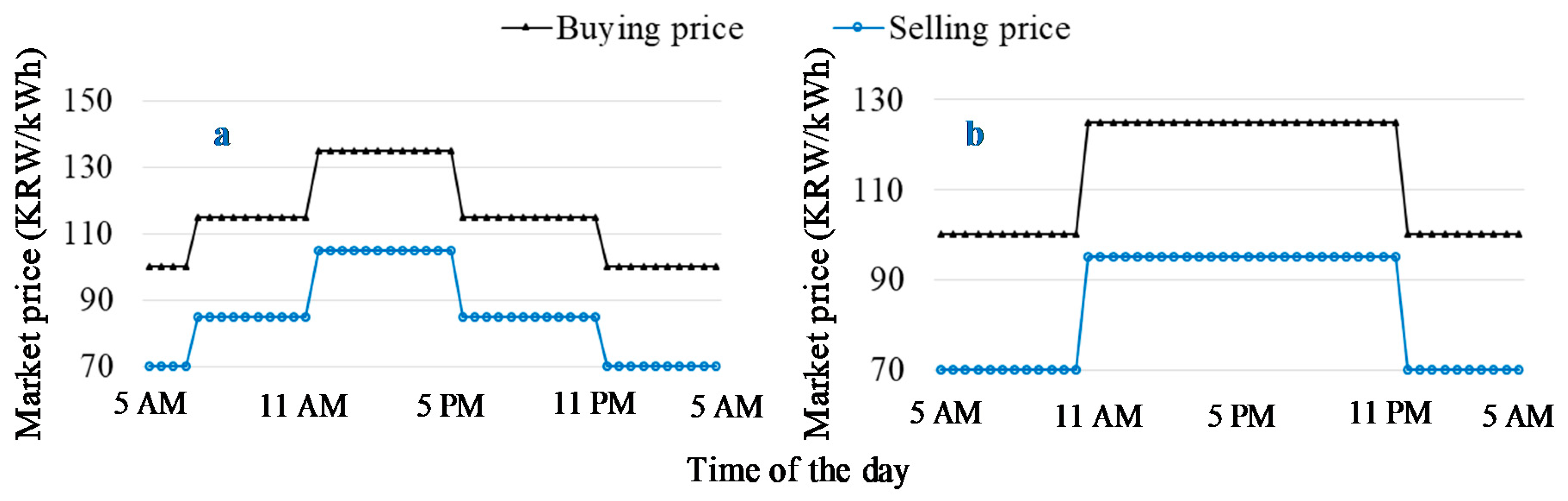

4.1. Input Data

4.2. Performance Comparison

5. Discussion

5.1. Number of EVs

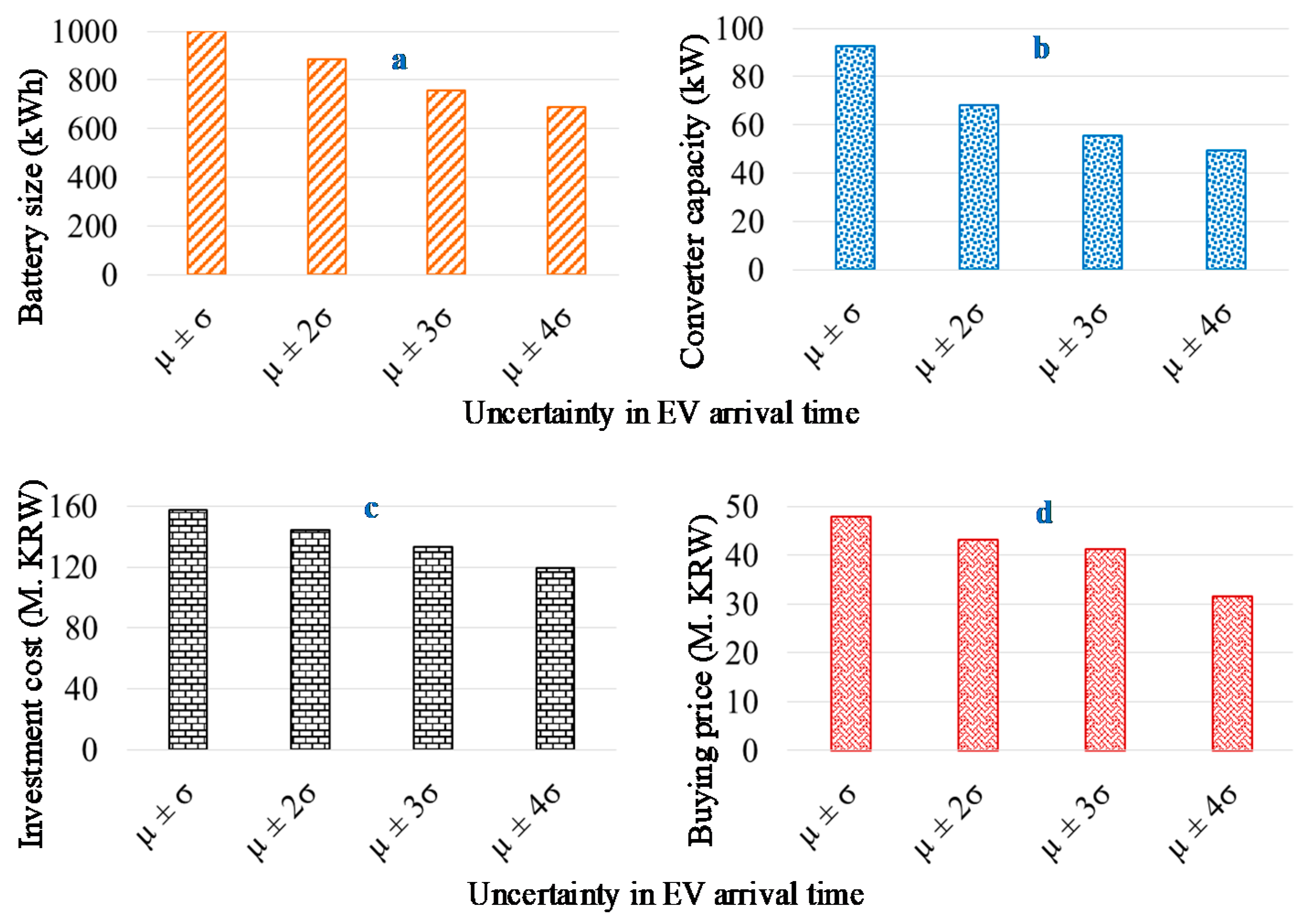

5.2. Uncertainty in Return Time of EVs

5.3. ESS Useable Energy Range

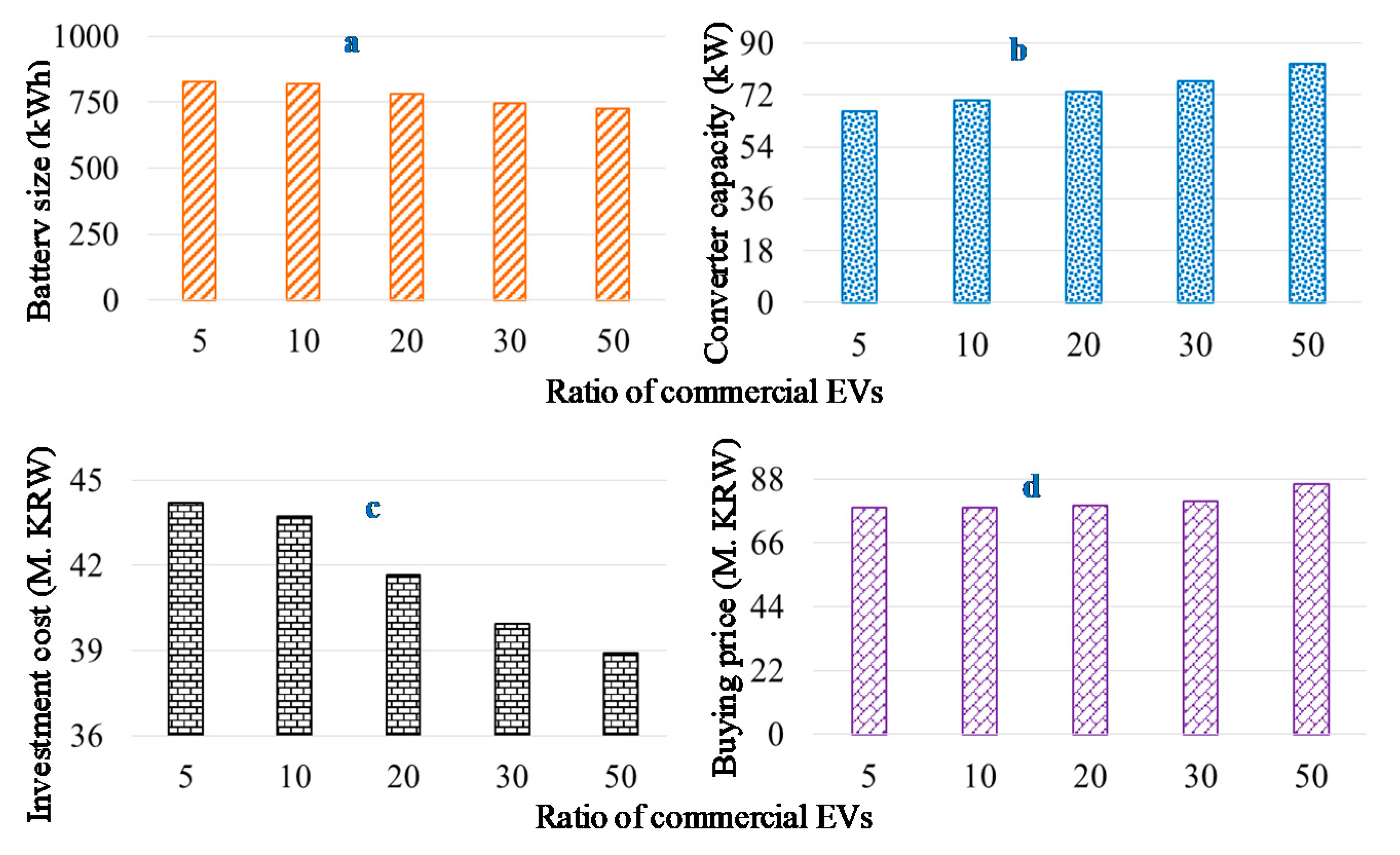

5.4. Ratio Between Commercial and Private EVs

6. Conclusions

- The proposed method has reduced the yearly cost (investment and operation) of the fast charging station by 5% in comparison with the battery following case. Similarly, cost reductions of up to 6% have been observed when compared with the fixed capacity converter case. In the case of the fixed-converter method, the investment cost is lower in one case (Fixed 50) than the proposed method. However, in that case, the amount of power bought during peak intervals has increased by about 200%, which is against the objective of deploying ESS in fast charging stations.

- It has been observed from simulation results that the proposed method avoids under or oversizing of the converter by sizing it simultaneously with the battery, which was the major drawback of the existing methods.

- It has been observed that the size of the converter does not increase significantly with an increase in the number of vehicles due to enough time for charging and discharging of the battery in the case of charging stations. In addition, a direct relationship between the uncertainties in return time of vehicles and the size of the battery and converter has been observed.

- It also has been observed that when the useable energy range of the battery is reduced, the optimization algorithm chooses to buy directly from the grid while battery and converter sizes are reduced. This will result in the inability to reduce the peak load and is thus not suitable for charging stations.

- Finally, with an increase in the percentage of commercial vehicles in the fleet, the battery size decreases while converter size increases. However, the reduction in battery size is more significant and thus the investment cost reduces.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Nomenclature

| Identifiers and Binary Variable | |

| The identifier for a day, running from 1 to D. | |

| The identifier for a time interval, running from 1 to T. | |

| The identifier for electric vehicles, running from 1 to V. | |

| , | Identifiers for daily peak beginning and peak ending time intervals. |

| A binary variable for identifying the presence or absence of battery in the parking station. | |

| , | Mean and standard deviation of daily commuting profiles. |

| , | Factors for determining the minimum and maximum operation range of ESS. |

| Parameters and Variable | |

| Power required by vth vehicle and whole EV fleet at time t, respectively. | |

| The time interval in hours and charging level of EV in kW, respectively. | |

| Probability of return time of EV and probability of recharge required, respectively. | |

| , | Cost for trading power and cost for buying power during peak period, respectively. |

| , | Cost of ESS and penalty price buying power during peak intervals, respectively. |

| Price for buying and selling power during day d and time t, respectively. | |

| Amount of power bought and sold during day d and time t, respectively. | |

| , | Cost recovery factor for converter and battery, respectively. |

| , | The capacity of the converter and size of the battery, respectively. |

| , | Per unit cost of PCS and yearly operation & maintenance cost of the battery, respectively. |

| Per unit cost of battery and balance of plant, respectively. | |

| , | Amount of power charger and discharged to/from the battery at t, respectively. |

| , | Lower and upper operation bound of battery SOC, respectively. |

| SOC of battery at time t. | |

| , | Charging efficiency and discharging efficiency of the battery, respectively. |

| , | Initial SOC and SOC at the end of each operation day, respectively. |

References

- Dale, H.; Nic, L. Emerging Best Practices for Electric Vehicle Charging Infrastructure; The International Council on Clean Transportation (ICCT): Washington, DC, USA, 2017. [Google Scholar]

- Matthew, M.; Clément, R.; Eric, W. Meeting 2025 Zero Emission Vehicle Goals: An Assessment of Electric Vehicle Charging Infrastructure in Maryland. Available online: https://www.nrel.gov/docs/fy19osti/71198.pdf (accessed on 15 October 2019).

- Hannan, M.A.; Hoque, M.M.; Hussain, A.; Yusof, Y.; Ker, P.J. State-of-the-Art and Energy Management System of Lithium-Ion Batteries in Electric Vehicle Applications: Issues and Recommendations. IEEE Access 2018, 6, 19362–19378. [Google Scholar] [CrossRef]

- Deepak, R.; Apoorva, K.; Sheldon, S.W. Extreme Fast Charging Technology—Prospects to Enhance Sustainable Electric Transportation. Energies 2019, 12, 3721. [Google Scholar]

- Song, J.; Toliyat, A.; Turtle, D.; Kwasinski, A. A Rapid Charging Station with an Ultracapacitor Energy Storage System for Plug-In Electrical Vehicles. In Proceedings of the International Conference on Electrical Machines and Systems, Jeju, Korea, 1–5 October 2010. [Google Scholar]

- Liu, G.; Kang, L.; Luan, Z.; Qiu, J.; Zheng, F. Charging Station and Power Network Planning for Integrated Electric Vehicles (EVs). Energies 2019, 12, 2595. [Google Scholar] [CrossRef]

- Ding, H.; Hu, Z.; Song, Y. Value of the Energy Storage System in an Electric Bus Fast Charging Station. Appl. Energy 2015, 157, 630–639. [Google Scholar] [CrossRef]

- Ehsan, A.; Yang, Q. Active Distribution System Reinforcement Planning with EV Charging Stations-Part I: Uncertainty Modelling and Problem Formulation. IEEE Trans. Sustain. Energy 2019. [Google Scholar] [CrossRef]

- Bao, Y.; Luo, Y.; Zhang, W.; Huang, M.; Wang, L.; Jiang, J. A Bi-Level Optimization Approach to Charging Load Regulation of Electric Vehicle Fast Charging Stations Based on a Battery Energy Storage System. Energies 2018, 11, 229. [Google Scholar] [CrossRef]

- Sbordone, D.; Bertini, I.; Di, P.B.; Falvo, M.C.; Genovese, A.; Martirano, L. EV Fast Charging Stations and Energy Storage Technologies: A Real Implementation in the Smart Micro Grid Paradigm. Electr. Power Syst. Res. 2015, 120, 96–108. [Google Scholar] [CrossRef]

- Bryden, T.S.; Hilton, G.; Dimitrov, B.; de León, C.P.; Cruden, A. Rating a Stationary Energy Storage System within a Fast Electric Vehicle Charging Station Considering User Waiting Times. IEEE Trans. Transp. Electr. 2019. [Google Scholar] [CrossRef]

- Ligen, Y.; Vrubel, H.; Girault, H. Local Energy Storage and Stochastic Modeling for Ultrafast Charging Stations. Energies 2019, 12, 1986. [Google Scholar] [CrossRef]

- Yan, Y.; Wang, H.; Jiang, J.; Zhang, W.; Bao, Y.; Huang, M. Research on Configuration Methods of Battery Energy Storage System for Pure Electric Bus Fast Charging Station. Energies 2019, 12, 558. [Google Scholar] [CrossRef]

- Longo, L. Optimal Design of an EV Fast Charging Station Coupled with Storage in Stockholm. Master’s Thesis, KTH School of Industrial Engineering and Management, Brinellvägen, Stockholm, 2017. [Google Scholar]

- Negarestani, S.; Fotuhi-Firuzabad, M.; Rastegar, M.; Rajabi-Ghahnavieh, A. Optimal Sizing of Storage System in a Fast Charging Station for Plug-In Hybrid Electric Vehicles. IEEE Trans. Transp. Electif. 2016, 2, 443–453. [Google Scholar] [CrossRef]

- Qian, K.; Zhou, C.; Allan, M.; Yuan, Y. Modeling of Load Demand due to EV Battery Charging in Distribution Systems. IEEE Trans. Power Syst. 2010, 26, 802–810. [Google Scholar] [CrossRef]

- Zhang, P.; Qian, K.; Zhou, C.; Stewart, B.G.; Hepburn, D.M. A Methodology for Optimization of Power Systems Demand due to Electric Vehicle Charging Load. IEEE Trans. Power Syst. 2012, 27, 1628–1636. [Google Scholar] [CrossRef]

- Choi, J.; Lee, W.D.; Park, W.H.; Kim, C.; Choi, K.; Joh, C.H. Analyzing Changes in Travel Behavior in Time and Space Using Household Travel Surveys in Seoul Metropolitan Area over Eight Years. Travel Behav. Soc. 2014, 1, 3–14. [Google Scholar] [CrossRef]

- Börjesson, P.; Larsson, P. Cost Models for Battery Energy Storage Systems. Bachelor’s Thesis, KTH School of Industrial Engineering and Management, Brinellvägen, Stockholm, 2018. [Google Scholar]

- Poonpun, P.; Jewell, W.T. Analysis of the Cost Per Kilowatt Hour to Store Electricity. IEEE Trans. Energy Convers. 2008, 23, 529–534. [Google Scholar] [CrossRef]

- Tsiropoulos, I.; Tarvydas, D.; Lebedeva, N. Li-ion Batteries for Mobility and Stationary Storage Applications Scenarios for Costs and Market Growth; JCR Science for Policy Report; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Asif, A.; Singh, R. Further cost reduction of battery manufacturing. Batteries 2017, 3, 17. [Google Scholar] [CrossRef]

- IBM ILOG CPLEX V12.6 User’s Manual for CPLEX 2015, CPLEX Division; ILOG: Incline Village, NV, USA, 2015.

- Fu, R.; Remo, T.W.; Margolis, R.M. 2018 US Utility-Scale Photovoltaics-Plus-Energy Storage System Costs Benchmark (No. NREL/TP-6A20-71714); National Renewable Energy Lab. (NREL): Golden, CO, USA, 2018. [Google Scholar]

- Trading Economics: South Korea Interest Rate. Available online: https://tradingeconomics.com/south-korea/interest-rate (accessed on 25 November 2019).

- Vector Limited. Battery Energy Storage Systems: Independent Review of Lithium Ion Battery Lives; Vector Limited: Denver, CO, USA, 2017. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Kim, H.M. Fuzzy Logic-Based Operation of Battery Energy Storage Systems (BESSs) for Enhancing the Resiliency of Hybrid Microgrids. Energies 2017, 10, 271. [Google Scholar] [CrossRef]

| Parameter | Value | Unit | Parameter | Value | Unit | Reference |

|---|---|---|---|---|---|---|

| Total EVs | 200 | - | PCS cost | 77,000 | ₩ 1/kW | [24] |

| Commercial EVs | 5 | % | Battery cost | 229,900 | ₩ 1/kWh | [24] |

| Private EVs | 95 | % | O&M cost | 18,700 | ₩ 1/kW/yr | [24] |

| Maximum SOC | 90 | % | BOP cost | 53,900 | ₩ 1/kWh | [19] |

| Minimum SOC | 10 | % | Interest rate | 1.75 | % | [25] |

| Initial SOC | 20 | % | Lifetime (battery, converter) | 10, 15 | years | [26] |

| EV charger rating | 40 | kW | Efficiency | 90 | % | [26] |

| Sizing Approach | Total Cost (Million KRW) | Difference (%) | Peak Buy (MW) | Difference (%) |

|---|---|---|---|---|

| Proposed | 122.26 | 0.00 | 13.34 | 0.00 |

| BESS only | 128.51 | 5.11 | 16.91 | 26.75 |

| Fixed 50 | 129.12 | 5.61 | 39.83 | 198.55 |

| Fixed 500 | 125.90 | 2.98 | 13.34 | 0.00 |

| Fixed 1000 | 130.13 | 6.44 | 13.34 | 0.00 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hussain, A.; Bui, V.-H.; Baek, J.-W.; Kim, H.-M. Stationary Energy Storage System for Fast EV Charging Stations: Simultaneous Sizing of Battery and Converter. Energies 2019, 12, 4516. https://doi.org/10.3390/en12234516

Hussain A, Bui V-H, Baek J-W, Kim H-M. Stationary Energy Storage System for Fast EV Charging Stations: Simultaneous Sizing of Battery and Converter. Energies. 2019; 12(23):4516. https://doi.org/10.3390/en12234516

Chicago/Turabian StyleHussain, Akhtar, Van-Hai Bui, Ju-Won Baek, and Hak-Man Kim. 2019. "Stationary Energy Storage System for Fast EV Charging Stations: Simultaneous Sizing of Battery and Converter" Energies 12, no. 23: 4516. https://doi.org/10.3390/en12234516

APA StyleHussain, A., Bui, V.-H., Baek, J.-W., & Kim, H.-M. (2019). Stationary Energy Storage System for Fast EV Charging Stations: Simultaneous Sizing of Battery and Converter. Energies, 12(23), 4516. https://doi.org/10.3390/en12234516