1. Introduction

A consecutive growth of the number and volume of transactions in the intraday electricity markets has been observed since the introduction of these markets. This results in a higher concern of researchers regarding the intraday electricity markets. Both Uniejewski et al. [

1] and Narajewski and Ziel [

2] consider a very short-term point electricity price forecasting (EPF) of the

-Price index in the German Intraday Continuous market. In Andrade et al. [

3] and Monteiro et al. [

4], the authors conducted research regarding the electricity price forecasting in the Iberian intraday electricity market. They performed a probabilistic electricity price forecasting and a point EPF using artificial neural networks, respectively. Both Ziel [

5] and Kulakov and Ziel [

6] examine the impact of renewable energy forecasts, i.e., wind and solar energy, on the intraday electricity prices. The relationship between the fundamental regressors and the price formation in the intraday markets is studied by many other scientists, e.g., González-Aparicio and Zucker [

7], Pape et al. [

8], Kath and Ziel [

9].

Due to the continuity of the intraday markets, an important aspect is the bidding behaviour of the market participants. This problem has been already examined by, among others, Kiesel and Paraschiv [

10] and Aïd et al. [

11]. In the following paper, we take a closer look at the transaction arrivals in the intraday electricity market.

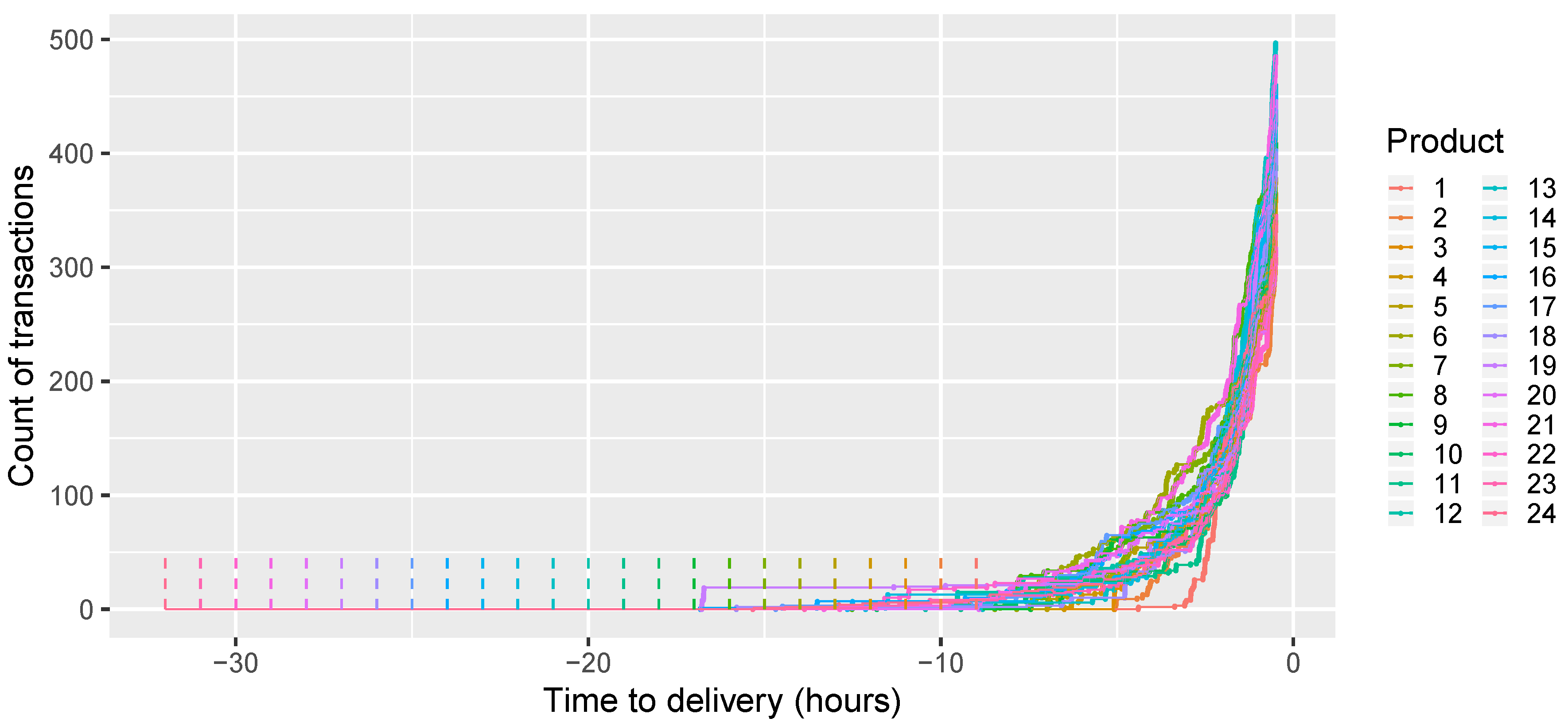

Figure 1 shows the trajectories of the counting processes that correspond to the transaction time arrivals. In the exercise, we assume that the transactions arrive in accordance with some time-dependent intensity function. Moreover, assuming the parametric probability distribution of the inter-arrival times, we can perform a maximum likelihood estimation of the parameters and then a meaningful forecasting study. In the exercise, we use a rolling window study, following the recommendations of Diebold [

12].

Our approach to the transactions in the intraday electricity markets is, to the best of our knowledge, an innovative one despite its simplicity. In Graf von Luckner et al. [

13], the authors modelled the intensities of the buy/sell orders in a more complex manner, but they do not perform any forecasting study.

The outcome of the study is very satisfying despite the simplicity of utilized methods. The paper contributes to the literature by

- (1)

filling the gap in the literature regarding the intensity estimation of transaction arrivals and is a major contribution to the topic,

- (2)

proposing a novel modelling approach for inter-arrival times using a time-varying generalized F distributions to capture the underlying uncertainties,

- (3)

presenting a procedure to simulate trajectories from the estimated processes,

- (4)

discussing functional evaluation criterion in forecasting studies for stochastic processes, especially counting processes,

- (5)

presenting a rigorous forecasting study for the German Intraday Continuous electricity market data.

Note that the methodology can be easily applied to any other continuous intraday electricity market.

The paper is structured as follows. In the next sections, we present the setting and the modelling details. Then, we explain the estimation and simulation methods. In the next section, we briefly describe the German Intraday Continuous market. The sixth section introduces the forecasting study design and the evaluation measures are described in detail. Next, the empirical forecasting results are presented. The paper is concluded with a discussion of the results and further development possibilities.

2. Setting

In the majority of all continuous intraday markets there are S products traded for each day of delivery, e.g., in a market with hourly products. For a certain day of delivery d a product is traded in the trading period prior to the beginning of the delivery. Here denotes the beginning of the trading and the end of the trading. Both and potentially depend on the day of trading d and the considered product s. However, in the majority of European intraday markets the end of trading does not depend on the product s but the beginning of trading does. Furthermore, if not mentioned otherwise all times are measured in hours.

During the trading period

we observe a series of

intraday transaction times

satisfying

,

for

and

. An example of trajectories of corresponding counting processes is presented in

Figure 1 for

products in the German Intraday Continuous market. As mentioned, the beginning of trading time differs for each product. For instance, the trading period in the German Intraday Continuous market for the hourly product

with delivery starting at 00:00 is

and for the hourly product

with delivery starting at 23:00 is

.

Let us note that most of the transactions take place in the last hours of the trading period. The reason for this behaviour is the design of the intraday electricity market, i.e., its main purpose is to let the market participants react to the changes in production prediction. In the first hours of trading in the intraday market usually there is not much more information, when comparing to the day ahead market, but in the last hours before the delivery the difference is significant, and thus it is the most traded time period in this market. This pattern justifies the decision to parametrize the time in such a manner that the last hours of trading are indexed in the same way, disregarding the delivery time, as in

Figure 1.

3. Modelling and Estimation

In the purpose of estimating transaction arrivals, we consider the series of inter-arrival times

, where

,

is the number of transactions on day

d and product

s and

is the beginning of trading. As pointed out in

Figure 1, only the latter hours of trading are of major interest for modelling. Hence, we focus on modelling only the part

by choosing

such that

. In the example

Figure 1, a reasonable choice for

could be, for example,

,

or

. Denote

all inter-arrival times after

, so they satisfy

. Further, let

be the smallest index such that

holds.

Now, we assume that the series of inter-arrival times

is independent and follows a probability distribution with a parametric density function

. Therefore, knowing that the inter-arrival times are independent, we can perform the maximum likelihood estimation of the unknown vector of parameters

Naturally, to make the estimation less biased, we can estimate the parameters using more than one day of history of the transaction arrival times. Assuming the independence between them and that we estimate based on

D days of history, we get the following maximum likelihood estimator

The maximum likelihood problem stated in Equation (

2) is solved using

Rsolnp package in

R, which was implemented by Ghalanos and Theussl [

14], based on the algorithm of Ye [

15], which is the general non-linear augmented Lagrange multiplier method. Since the likelihood function may contain local maxima, it is very important to set correctly the lower and upper bounds and the starting parameters. The algorithm should handle with no big problem up to 10-parametric optimization, so in purpose of our study it is satisfactory. Nevertheless, the choice of the maximum likelihood optimization tool is not crucial as we have a low dimensional problem.

In the case of German Intraday Continuous market, we assume four distributions of the inter-arrival times: exponential, gamma, generalized gamma and generalized F. Each of the consecutive distributions is an extension of the previous one. The distributions are parametrized as follows:

exponential distribution Exp() with rate parameter ,

gamma distribution Gamma() with shape and rate parameters and ,

generalized gamma distribution GenGam() with location, scale and shape parameters and ,

generalized F distribution GenF() with location and scale parameters and , and shape parameters and .

The exponential and gamma distributions are well-know and thus do not need any special introduction. The exponential distribution has the following density function

and the gamma distribution has the density function defined by

Let us remind that the exponential distribution is a special case of the gamma distribution, i.e., if , then .

The generalized gamma distribution is an extension of the gamma distribution by Stacy et al. [

16], but in the study we use the parametrisation of Prentice [

17], which is stated above. If

and

, then

follows the generalized gamma distribution with probability density function

The relationship between the gamma and generalized gamma distributions parametrized in such a manner is as follows. If , then .

The last and the most general distribution that we assume is the generalized F distribution described by Prentice [

18]. Define

and

, where

. If

, then the probability density function of

x is given by

where

is the beta function. Let us note that if we possess a random variable

, then

. We see clearly that all the consecutive distributions are superior to the previous ones.

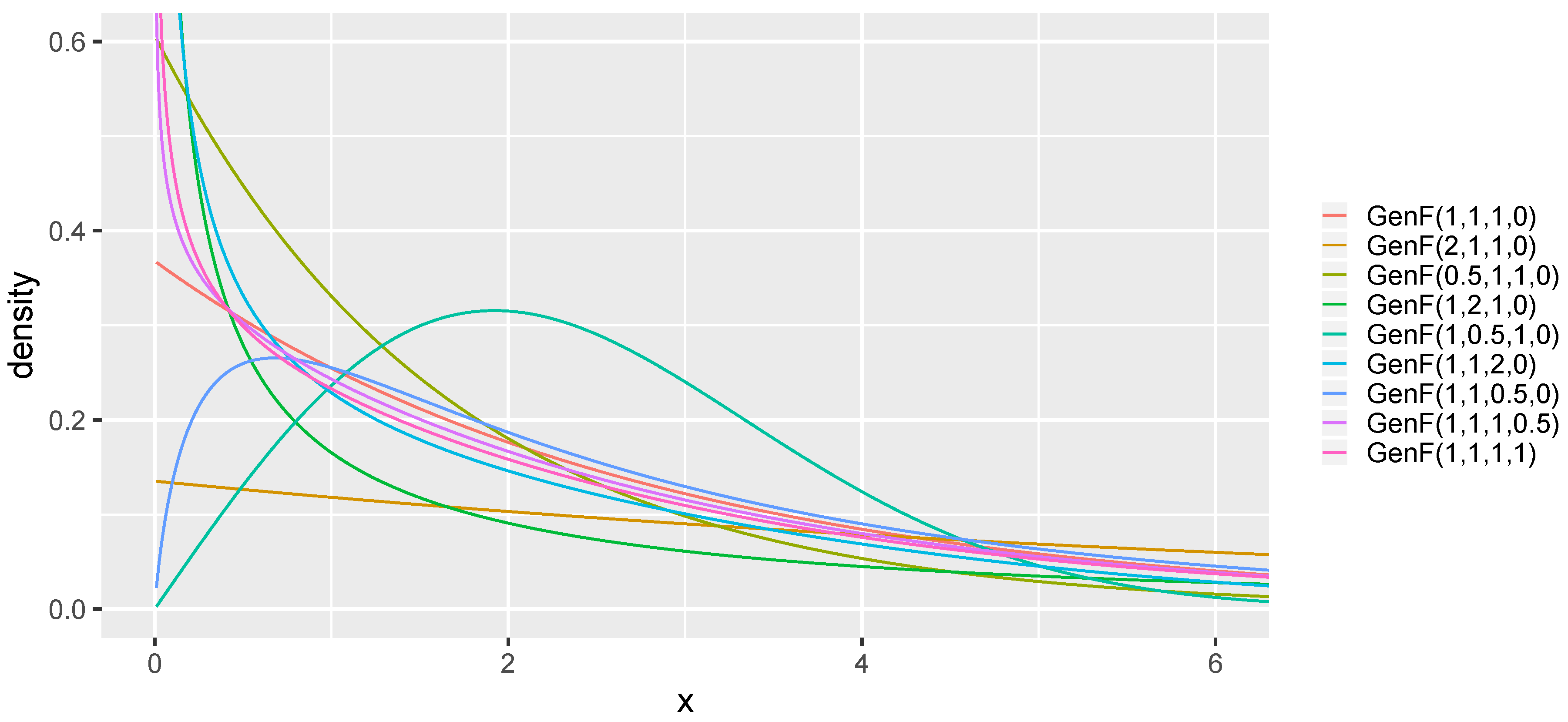

Figure 2 presents densities of exemplary GenF distributions. In the exercise, we use the

flexsurv package in

R by Jackson [

19], which contains the implementation of the generalized gamma and F distributions.

We assume that the rate parameter , the rate and shape parameters and , and the location and scale parameters and are some deterministic functions dependent on time t and unknown vector of parameters . Thus, we model them using the following functions:

constant—, where ,

linear—, where ,

quadratic—, where ,

exponential—, where .

In the estimation of the parameters of generalized gamma and F distributions, we make use of the relationship between gamma and generalized gamma distributions, i.e., and . Moreover, we assume that cannot be more complex than and that the Q and P parameters are constant over time to delivery. By complexity of a function, we mean the number of parameters. Using this criteria, quadratic and exponential functions are equally complex.

The study consists in total of 37 models of the inter-arrival times process : four models with the assumption of the exponential distribution and 11 models for each other considered distribution. We abbreviate them by X.Y.Z, where X stands for the distribution and Y and Z stand for the types of the and functions, respectively. For instance, Gamma.Lin.Const stands for a model with assumed gamma distribution, linear and constant . Let us note that for the model with exponential distribution and the corresponding counting process is a homogeneous Poisson process and this model is our basic benchmark. Making the intensity function non-constant is the first extension of the benchmark and changing the distribution to the more general one is the further extension. Moreover, in this study for non-constant rate and shape functions we actually assume that the functions are constant in short intervals, e.g., for exponential distribution, is assumed to be the intensity on the time interval . This means that the corresponding counting process of a model with exponential distribution is a mixture of homogeneous Poisson processes.

Let us note that the models contain not more than eight parameters, so their estimation should not be a problem.

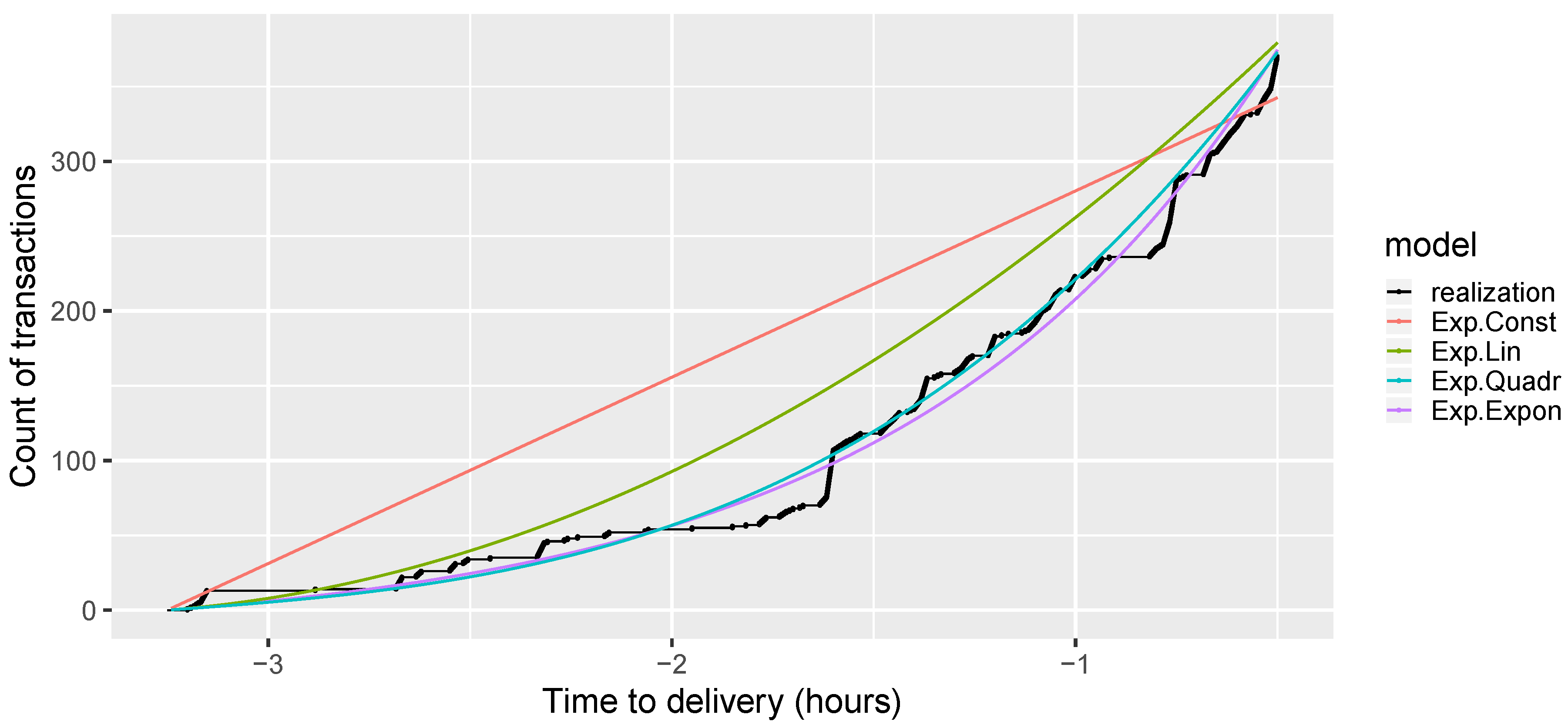

Figure 3 shows an example of fitting the aforementioned models assuming the exponential distribution to one day of data for one product. The figure presents the observed trajectory and estimated cumulative intensity functions

. The time to delivery range is

, because in this particular exercise we aim to forecast the transaction arrivals during the

-Price period. This approach to the German Intraday Continuous was taken also by other researchers ([

1,

2]). Based on

Figure 3, we may expect that considering the exponential distribution models, the models with quadratic and exponential intensity functions have similar performance in our problem.

5. German Intraday Continuous Market

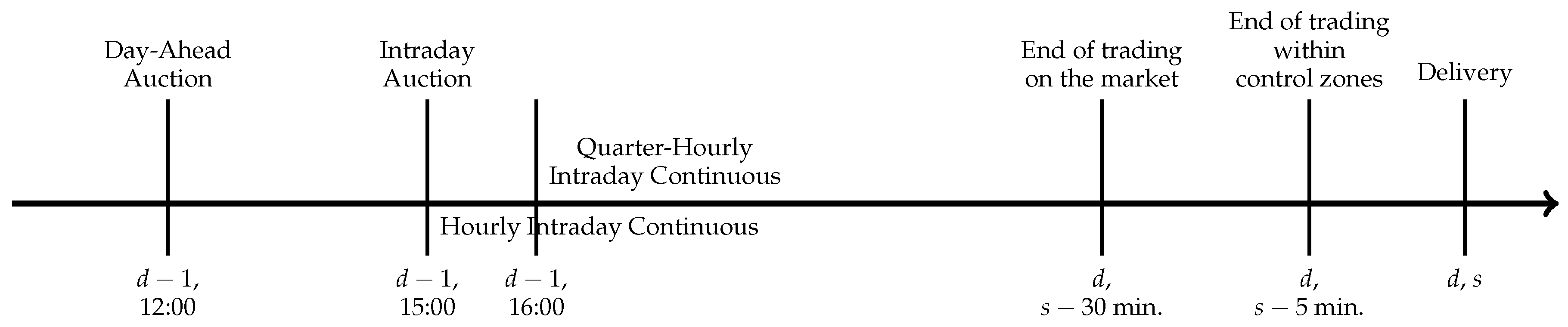

As mentioned, in the exemplary study we consider the German Intraday Continuous market. Trading in this market starts every day at 15:00 for hourly and at 16:00 for quarter-hourly products of the following day. Market participants can trade electricity until 30 min before the delivery in the whole market and until 5 min before the delivery in respective control zones.

Figure 5 presents briefly the German electricity spot market, for more details see Viehmann [

20].

An important measure in the German Intraday Continuous market is the ID

-Price index. The index is a volume-weighted price of all transactions taking place in the time interval between 3 h and 30 min before the delivery and it is calculated separately for each intraday product. The importance of the ID

-Price has been already noticed by the researchers and is a subject to modelling and forecasting by Uniejewski et al. [

1] and Narajewski and Ziel [

2]. In the latter paper, one can find a broader description and analysis of the ID

-Price and the German Intraday Continuous market. In both papers, the authors performed a very short-term point EPF of the ID

-Price. The outcome of Narajewski and Ziel [

2] is the efficiency of the market, i.e., the volume-weighted price of the transactions in the last 15 min before forecasting appears to be the best model for the ID

-Price. In our study, we aim to forecast the time arrivals during the ID

-Price time interval. Naturally, we leave ourselves some time for calculation and decision-making and therefore the considered time frame is

which is exactly the same as in Narajewski and Ziel [

2].

In Europe the majority of intraday electricity markets features a similar structure to the German intraday market. This holds especially for all markets that participate in the Cross-Border Intraday Project (XBID), see e.g., Kath [

21]. It allows various participating electricity markets (e.g., Germany, France, Spain) to bid across borders, if inter-connector capacity allows doing so. From the modelling perspective it might be relevant to note that all electricity markets which participate in XBID close their markets for each product the same amount of time before delivery. Even though this is not always half an hour before delivery as in the German case an application to XBID markets should be no problem.

6. Data, Forecasting Study and Evaluation

In the following paper, as an example we perform a rolling window forecasting study based on the data from the German Intraday Continuous market. We consider a -day window size with the initial in-sample data from 03.09.2017 to 30.09.2017 and forecast the next day arrivals, starting on 01.10.2017. We forecast the arrivals between 3 h 15 min and 30 min before the delivery. Our out-of-sample study is of size , thus it spans the data range from 01.10.2017 to 30.09.2018. During each out-of-sample iteration trajectories are simulated. In the study, a multivariate approach is taken, which means that we create 24 separate models, each for every hourly product.

The data that we utilize in the study was obtained from EEX Transparency, and it consists of information regarding: the date of the delivery, the product type, market area, volume of the traded energy, price in EUR/MWh, the transaction ID and the time of the transaction. In our case, the only relevant informations are the date of the delivery, the product type and of course the time of the transaction. A small inconvenience regarding the data is the fact that the transaction times have minute grid. This makes many transactions have identical time arrival even if they weren’t made at the same time, e.g., four transactions with timestamp of 30.09.2017 16:01:00. We deal with the problem by distributing the transactions with the same timestamp T uniformly in the time range . Using the aforementioned timestamp as an example, the new timestamps are: 30.09.2017 16:01:00, 16:01:15, 16:01:30, 16:01:45.

Due to the lack of literature regarding the intensity estimation in the intraday markets, we cannot use any literature benchmark models or literature evaluation measures. Thus, in the study we simply compare the results of simulation of all the considered models and as evaluation measures we use the functional: bias (Bias), mean absolute error (MAE), root mean squared error (RMSE) and continuous ranked probability score (CRPS). We abbreviate the functional measures in a standard way, but the calculation is a little different. That is to say, let us denote by the counting process of the true transactions on day d for product s and by the m-th simulation of the counting process .

Let

a loss function with

,

,

and

as indicator function. Then we define

the sample

-estimate of the corresponding simulation sample

. The special case

in (

8) corresponds to ordinary least squares (OLS) and

to median regression. Thus,

is the sample mean process,

the sample median process and similarly

the sample

-quantile process on which we focus especially. Now, we define the evaluation criteria

on a time range

.

J is the length of a grid of the time range

with

and

. The grid is defined by the jumps of both of the counting processes. Let us note that the transition from the integral to the sum is possible, because the difference of counting processes is a simple function. Moreover, we approximate the values of the evaluation measures by using a minute grid instead of the one defined by the jumps to reduce computational costs.

Now, we define the special cases of the evaluation measures which lead to the functional bias (Bias), the functional MAE, functional RMSE and functional pinball (PB) loss (or quantile loss) with respect to a probability

:

We may observe that

. Additionally, we use the pinball loss to approximate the functional continuous ranked probability score (CRPS) by

for an equidistant grid of probabilities

r between 0 and 1 of size

R, see e.g., Nowotarski and Weron [

22]. We choose

of size

. In the purpose of comparing the models’ forecasting performance, we calculate the functional Bias, MAE, RMSE and CRPS based on

trajectories in

out-of-sample iterations and for all

with

products. For creating summaries, it may be useful to average across all products and define

for the considered criteria

.

To draw significant conclusions on the outperformance of the forecasts of the considered models, we also calculate the Diebold and Mariano [

23] test, which tests forecasts of model

A against forecasts of model

B. In the following paper, we compute the multivariate version of the DM test as in Ziel and Weron [

24]. The multivariate DM test results in only one statistic for each model that is computed based on the

S-dimensional vector of losses for each day. Therefore, denote

and

the vectors of the out-of-sample losses for day

d of the models

A and

B, respectively. By

we mean the CRPS

loss for day

d of model

Z, formally we choose

with

. In the DM test we consider only the CRPS loss as it is the most important measure in our study. The multivariate loss differential series

defines the difference of losses in

norm, i.e.,

, where

in our case. For each model pair, we compute the

p-value of two one-sided DM tests. The first one is with the null hypothesis

, i.e., the outperformance of the forecasts of model B by the forecasts of model A. The second test is with the reverse null hypothesis

, i.e., the outperformance of the forecasts of model A by those of model B. Let us note that these tests are complementary, and we perform them using two norms:

and

. Naturally, we assume that the loss differential series is covariance stationary.

7. Results

Table 1 presents the Bias, MAE, RMSE and CRPS measures (see Equation (

15)) of the considered models on the interval

which was used for estimation. In the table, we observe that the lowest MAE and RMSE are obtained for model

Gamma.Expon.Lin. At the same time we see that the values for the other models with gamma distribution and exponential rate function have similar performance, as well as model

Exp.Expon, which appears to be the second best in terms of MAE and RMSE. These values indicate that most likely the difference in the performance of modelling the median and mean of models

Gamma.Expon.Lin and

Exp.Expon is not statistically significant. The models with generalized gamma and generalized F distributions clearly have difficulties in modelling the central parts of the distribution, but they handle the probabilistic forecasting well. The best performing model in terms of CRPS is

GenGam.Quadr.Expon. The CRPS values of other models are mostly satisfying despite the models with constant parameters. These give the worst forecasts in terms of all considered measures.

On the other hand, the values of bias are interesting. We see there that the best models underestimate the true counting process. The reason for such an underestimation may be the fact that the German Intraday Continuous is constantly developing and the number of trades is growing every day. This suggests that there is still some space for improvement of the errors. In the remaining part of this section, we consider only selected best performing models: two best models per distribution and from each of the distributions, we choose also the best model with exponential rate function.

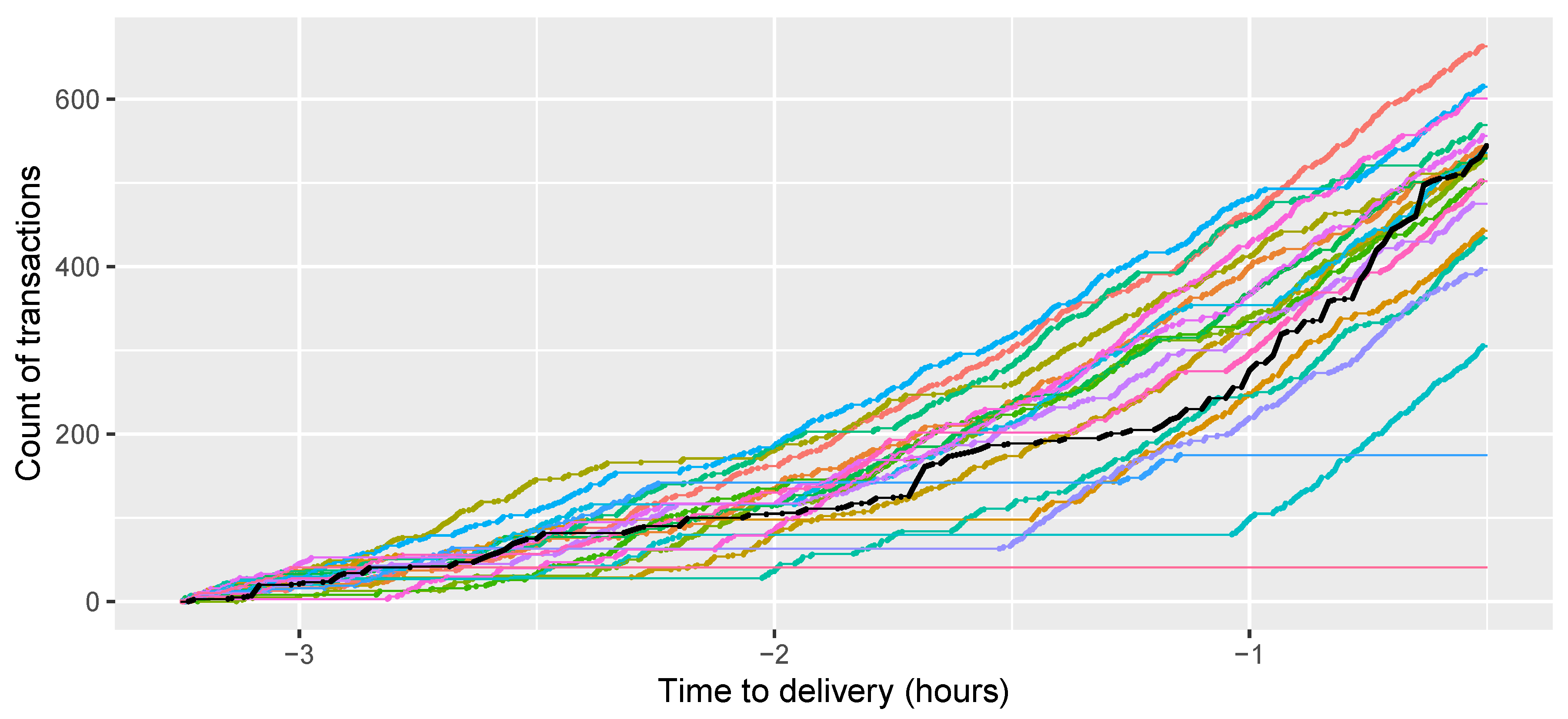

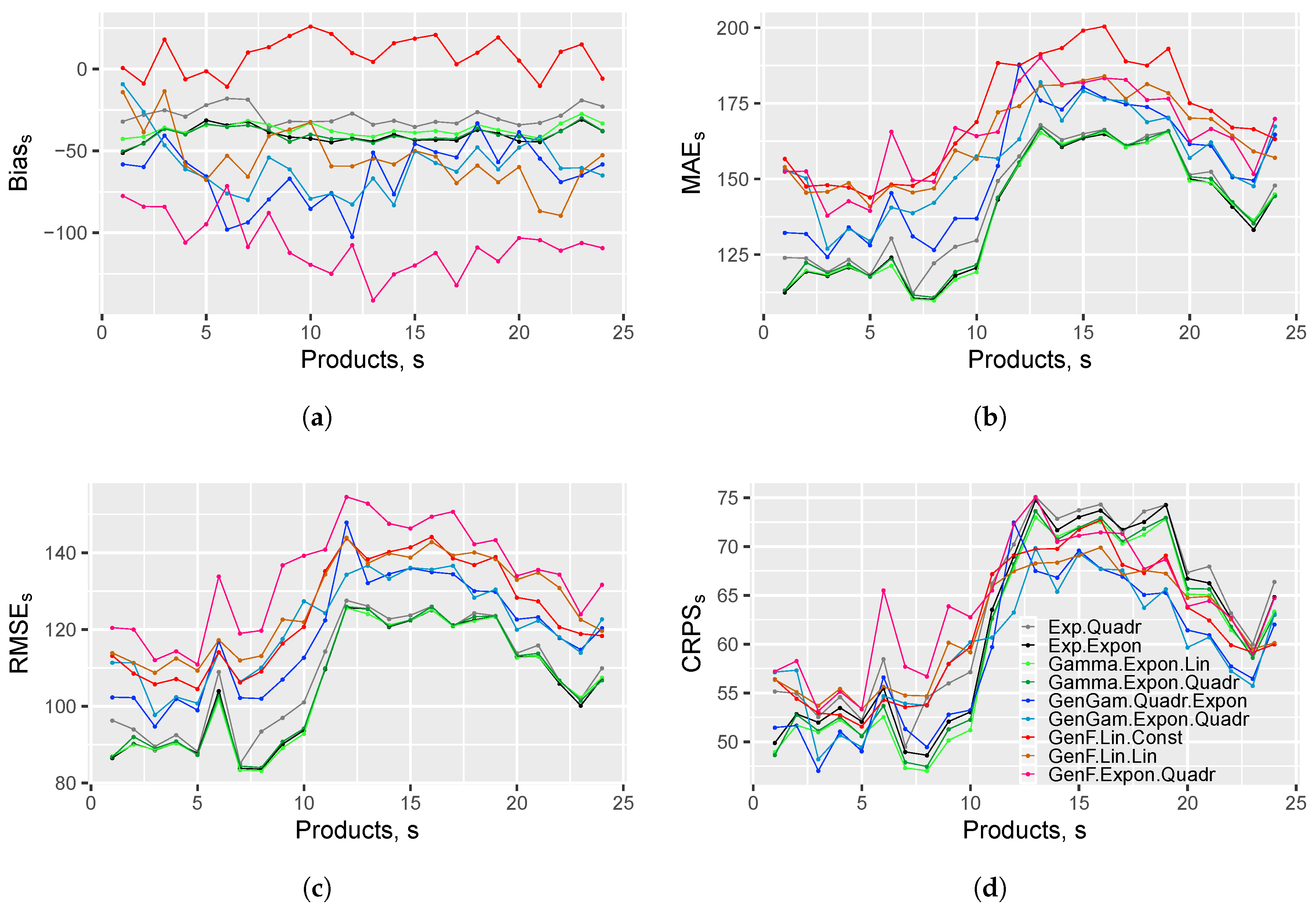

Figure 6 contains four graphs that present the performance of the selected models’ forecasts over products

. In

Figure 6a, we observe that all the models despite the

GenF.Lin.Const underestimate the true trajectory for all products. There is no clear pattern of the underestimation, but we see that the bias of best models in terms of MAE and RMSE is almost constant over products, whereas the bias of the best model in terms of CRPS varies significantly.

Figure 6b–d show that all models handle the simulation of night hours’ transactions better than the simulation of the day hours’ transactions. An interesting spike in both measures can be observed for

. The reason for that might be some outliers as the spike is higher in terms of RMSE than in terms of MAE or CRPS. Furthermore, we see that the models with exponential and gamma distribution are clearly better than the others across all products in terms of MAE and RMSE. It is different for CRPS, where for most hours the best models are the GenGam models, but between hours 6 and 10 the gamma distributed models appear to be better.

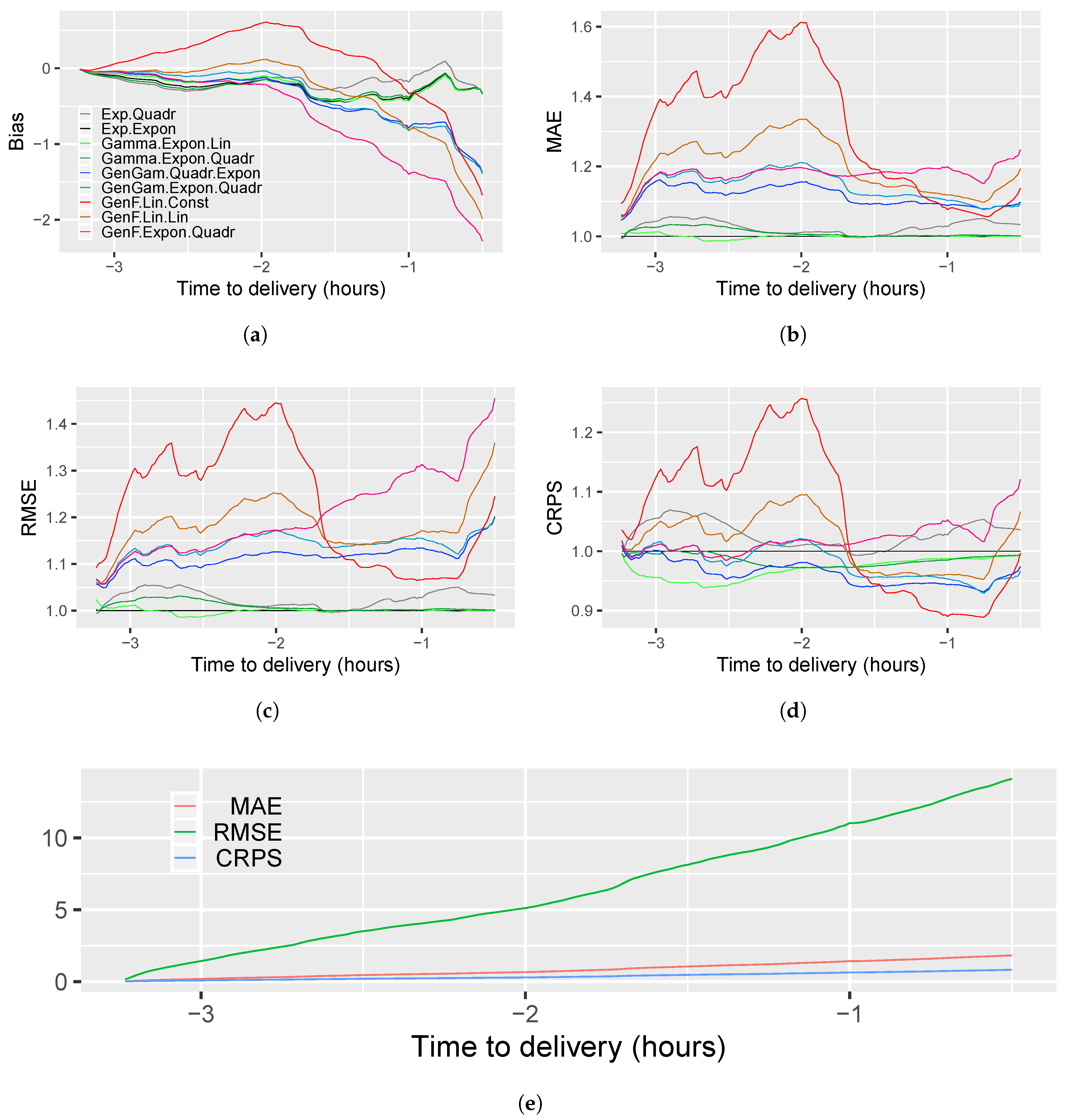

Figure 7 is analogous to

Figure 6, but the measures are calculated over the time to delivery. This means that we calculate the values (see Equation (

15)) on many short time intervals, i.e., we apply a minute grid of the time-frame

. This way we can understand which part of the trajectory is forecasted the most and the least precisely.

Figure 7a shows that the most underestimated is the last 1.5 h of the counting process, but the models with gamma and exponential distribution handle this period better than the GenGam and GenF models.

Figure 7b,c show again the Gamma and Exp models with exponential rate function give mostly the lowest MAE and RMSE. In

Figure 7d, we see that

Gamma.Expon.Lin model has lowest CRPS in the first half of the forecasting horizon and, surprisingly, in the second half the lowest CRPS value is obtained for model

GenF.Lin.Const. The performance of

GenGam.Quadr.Expon is mostly stable over the time to delivery.

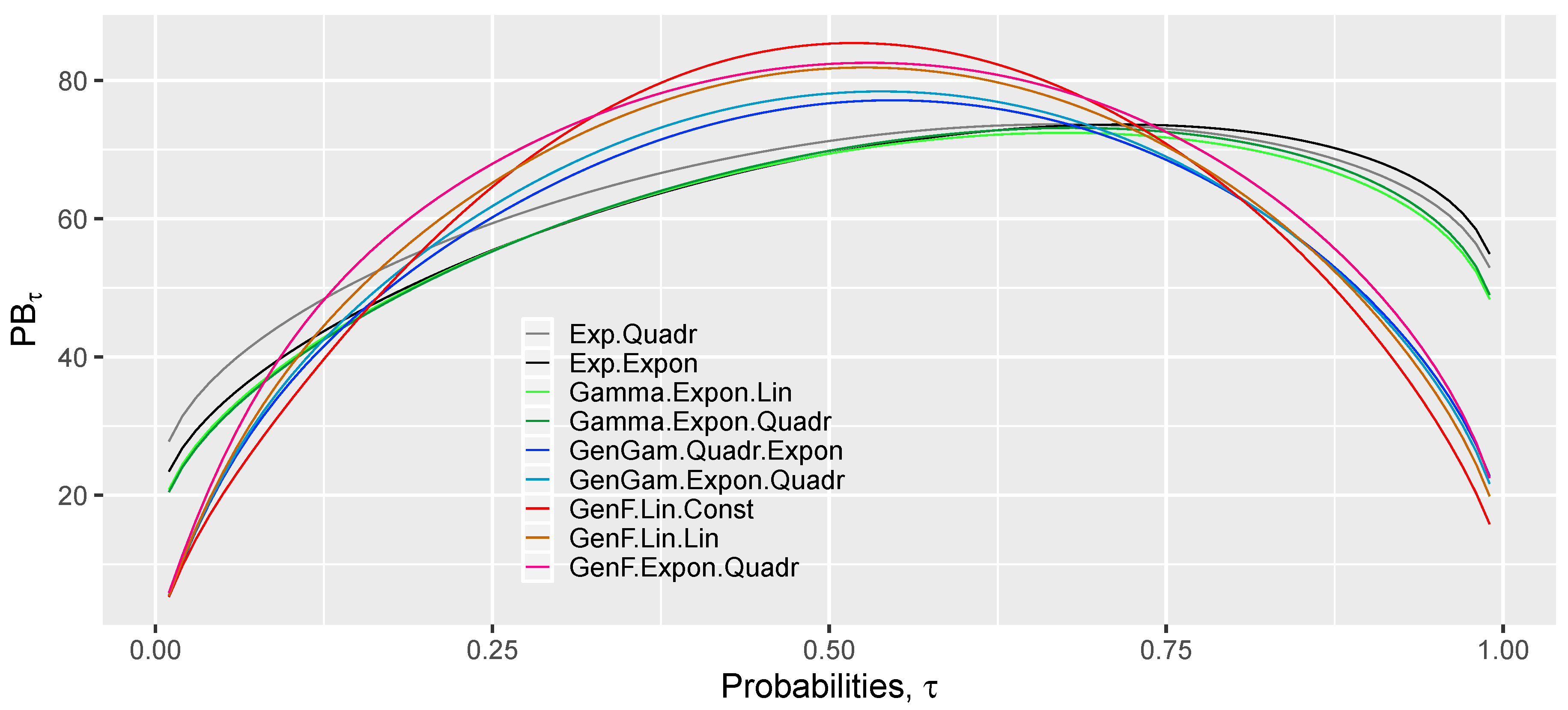

Figure 8 shows the pinball loss results of the models over probability values. Based on it, it is clear that the Gamma and Exp models forecast better the central quantiles, i.e., between 0.2 and 0.7, whereas the others are better forecasted by GenGam and GenF models. The figure indicates that the overall CRPS performance can be significantly improved.

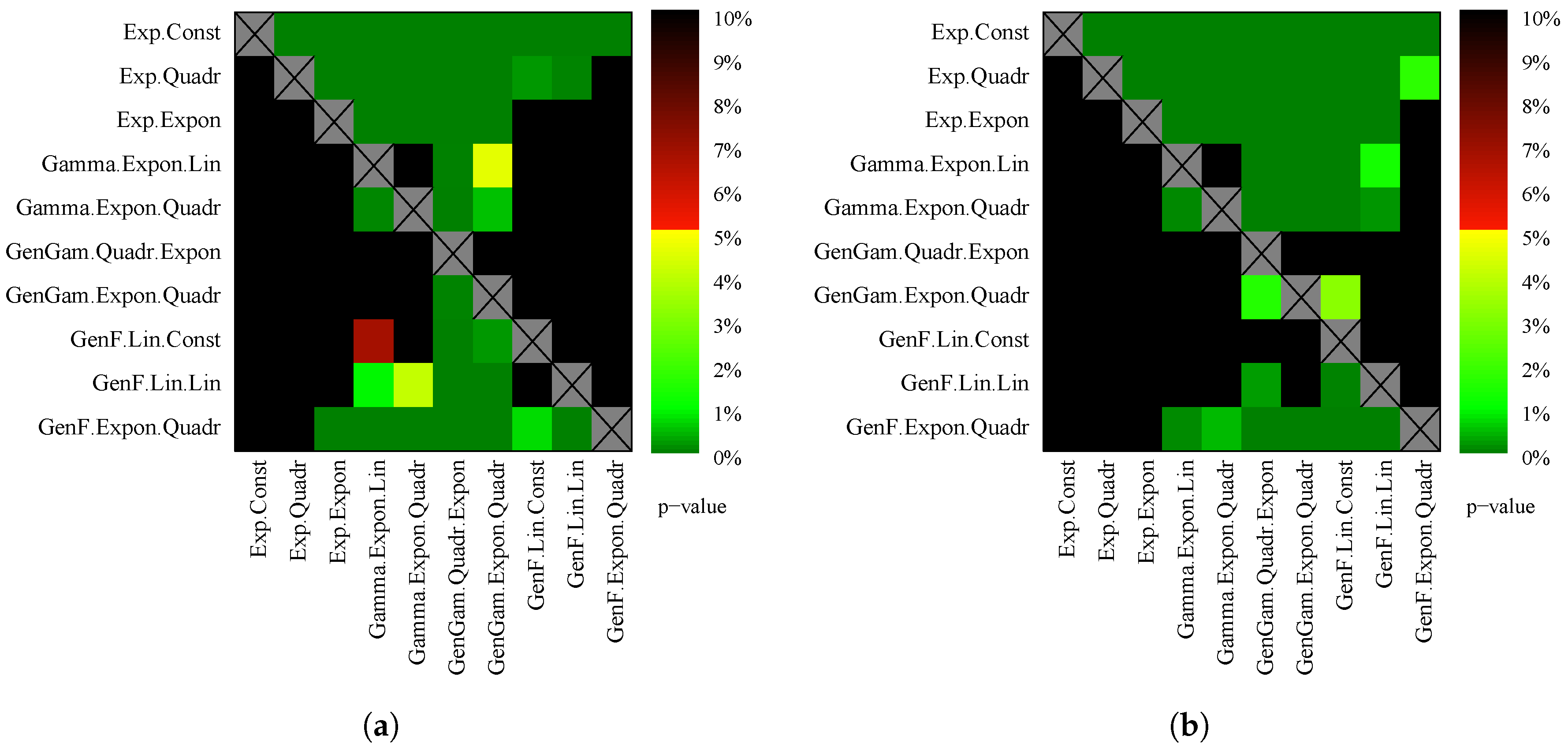

To draw statistically significant conclusions, we perform a Diebold-Mariano test. The results are presented in

Figure 9. Let us remind that we use the CRPS as the loss series as we believe that it is the most important measure in this study. Based on it, it is clear that the

GenGam.Quadr.Expon model is significantly the best. Interestingly, the test in norm

indicates a very good performance of the GenF models. Although, in this norm none of the other models is significantly better than the

GenGam.Quadr.Expon.

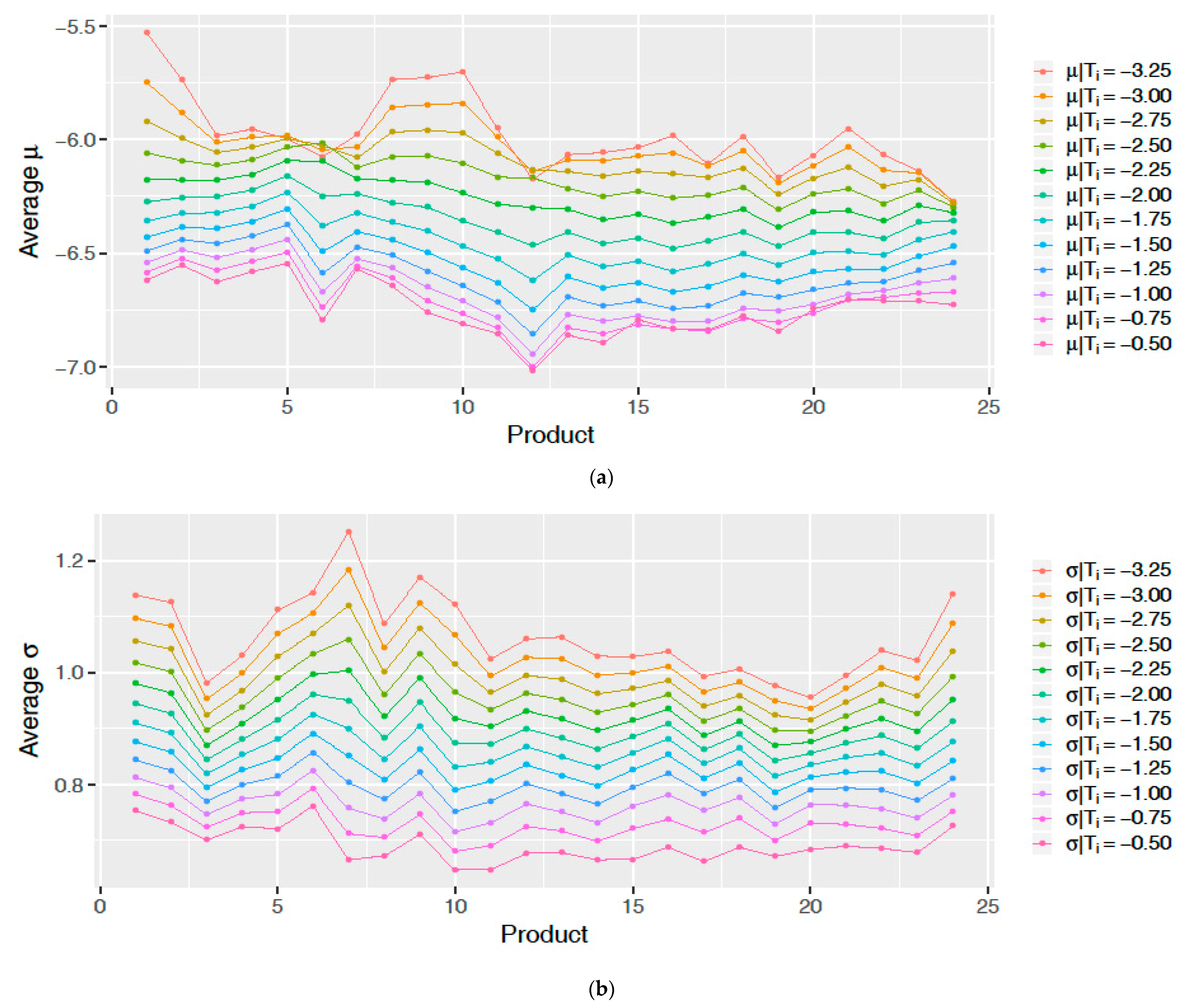

Let us now take a look at the values of the time-varying coefficients of the model

GenGam.Quadr.Expon. Let us recall that in this model we estimate the inter-arrival time

assuming generalized gamma distribution with the time-varying coefficients

and

and constant

Q, where

and

are the rate and shape parameters of the standard gamma distribution. In this model

is a quadratic function and

is an exponential function. In

Figure 10, we analyse the behaviour of

and

parameters over products at different time.

Figure 10a shows the values of

are similar over products, but differ significantly over time. That is to say, the closer we are to the gate closure, the lower the location coefficient, which means that the transactions appear more often.

Figure 10b shows a very similar behaviour for the scale parameter

. In this case the closer we are to the gate closure, the less vary the inter-arrival times.

8. Conclusions

We described the novel problem of estimation and simulation of the transaction arrival process in intraday electricity markets. The approach is not complicated and the presented methods are easy to implement. The paper fills the gap in the literature regarding the estimation and simulation of the transaction arrival process in the intraday electricity markets and thus is a major contribution to this field of research. The outcome of the conducted study is very satisfying.

Using the aforementioned approach, we utilized an exemplary rolling window forecasting study based on the German Intraday Continuous market. We assumed four probability distributions of the inter-arrival times: exponential, gamma, generalized gamma and generalized F distributions. We performed the maximum likelihood estimation of the distributions, assuming time-dependence of some of their coefficients. Then, using the estimated distributions we simulated new trajectories which we evaluated using the functional bias, MAE, RMSE and CRPS.

The results showed that the forecasting error can be significantly reduced, comparing to the most standard benchmark, which was the homogeneous Poisson process. The best in terms of forecasting of the central part of the distribution of the transaction arrivals, i.e., the mean or median are the exponential and gamma distributions with exponential rate function. In terms of the more meaningful and thus more important CRPS significantly the best forecasts were obtained from the generalized gamma model with quadratic rate function and exponential shape function.

This field of research can be easily developed further. A possible direction is considering other probability distributions of the inter-arrival times. Another possibility would be using more complex distributions’ parameter functions, such as Hawkes process-like, which is widely applied to modelling the transaction time arrivals in the financial markets, see, for example, Hewlett [

25] or Bacry et al. [

26]. The parameter functions could be also modelled using smoothing kernel or splines. To avoid overestimation, regularization methods should be considered.