Abstract

In recent years, blockchain technology has received increasing attention in the real estate literature. Moreover, recent evidence suggests that blockchains could provide some added benefits for the real estate sector even in the current hybrid settings, where blockchain is usually just an add-on to existing systems. This research provides an up-to-date and systematic understanding of blockchain’s theoretical potential, pros, and cons for the real estate sector. The research aims to understand why and where to apply blockchain in real estate by conducting a systematic review that identified 296 relevant documents and performed a thematic content analysis. The identified blockchain adoption proposals were classified using standardized real estate vocabulary. Most of the literature focused on blockchain possibilities within land administration, followed by property transactions, real estate investment, leasing and renting, and real estate administration. However, real estate development and real estate maintenance did not appear as attractive real estate subsectors for blockchain. This paper provides a detailed analysis of blockchain technology’s possibilities for each real estate subsector, i.e., blockchain merits, and discusses the pros and cons. Last, this review provides suggestions for future research directions.

1. Introduction

Blockchain technology has received increasing attention in the real estate literature, especially in the past five years [1]. Recent evidence suggests that blockchain applications could provide some added benefits for the real estate sector even in the current small-scale, hybrid settings where blockchain acts mainly as an add-on to existing systems [1]. This exciting finding signals that despite all the excitement around blockchains, continuing to understand blockchain’s overall potential and nuances for the real estate sector is a meaningful endeavor. After all, the real estate sector has remarkable societal, environmental, and economic relevance, as it accounts for around 60% of the world’s wealth [2], 37% of global energy-related carbon dioxide emissions, and 36% of the worldwide final energy consumption [3]. This paper defines real estate as a unit of ownership for a land or water area, including buildings, benefits, and easements, registered in the land register [4]. The real estate sector is here defined as containing both land administration and real estate business comprising multiple subsectors: real estate development, real estate investment, property transaction, leasing, real estate administration, and real estate maintenance [4].

Regardless of the vast amount of literature and previous reviews, an up-to-date and systematic understanding of blockchain’s theoretical potential for the whole real estate sector is lacking [5]. This paper aims to synthesize the blockchain literature to understand why and where to apply blockchain technology in the real estate sector. The objective is to highlight the possibilities blockchain technology could bring to the real estate sector in the long term. Another objective of this paper is to analyze blockchain’s advantages and disadvantages for the real estate sector. This paper broadens the scope of Saari et al.’s recent paper [1] on real-world blockchain applications in the real estate sector by providing a thorough overview of the big-picture, longer-term theoretical blockchain potential for the broad real estate sector.

While various definitions of the blockchain have been suggested and terminological confusion exists, this paper broadly uses the term “blockchain” to refer to permissioned and permissionless blockchains. Permissioned blockchains may be referred to as distributed ledger technologies, and permissionless blockchains as open blockchains. Blockchain is thus defined as a decentralized transaction and data management technology [6] where the sequence of digital records or “blocks” are linked using cryptography. The blocks are verifiable, practically immutable, distributed, and usually managed in a peer-to-peer network [6]. Blockchains may enable new innovative solutions, as they provide transparent, tamper-proof, and secure systems [7].

Moreover, blockchain technology allows so-called smart contracts, tokenization of assets, and non-fungible tokens (NFTs), which play fundamental roles in blockchain solutions. Smart contracts are automatable and enforceable agreements, where the automation is provided by a computer (though some parts may require human input and control), and are enforceable either by enforcement of rights and obligations or via tamper-proof execution of computer codes [8]. Tokenization of assets refers to digitizing tangible and intangible assets so that each blockchain token represents a particular share of the asset ownership, which can be traded on secondary markets, similar to securities [9]. Tokenization may transfer an asset’s information, value, and associated rights onto the blockchain [9]. An NFT, on the other hand, is a specific type of unique and indivisible token that cannot be exchanged like-for-like, making it suitable for identifying something or someone in a unique way [10].

A considerable amount of literature has been published on blockchain technology in the real estate sector. A significant share of the published literature presents technical concepts [1]. Moreover, most of the studies have only focused on one of the real estate subsectors, such as land administration [11,12,13,14,15] or tokenization [16,17,18]. Others have examined blockchain’s opportunities and challenges in the real estate sector from a single perspective, such as a legal one [19,20]. Overall, there is a lack of systematic reviews providing an up-to-date and thorough overview of blockchain potential for the whole real estate sector [5].

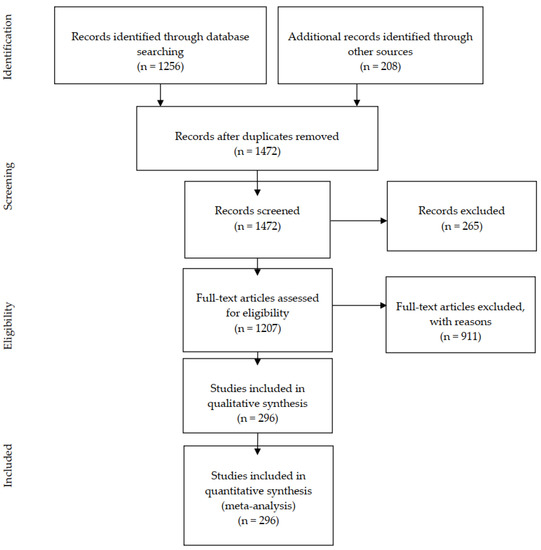

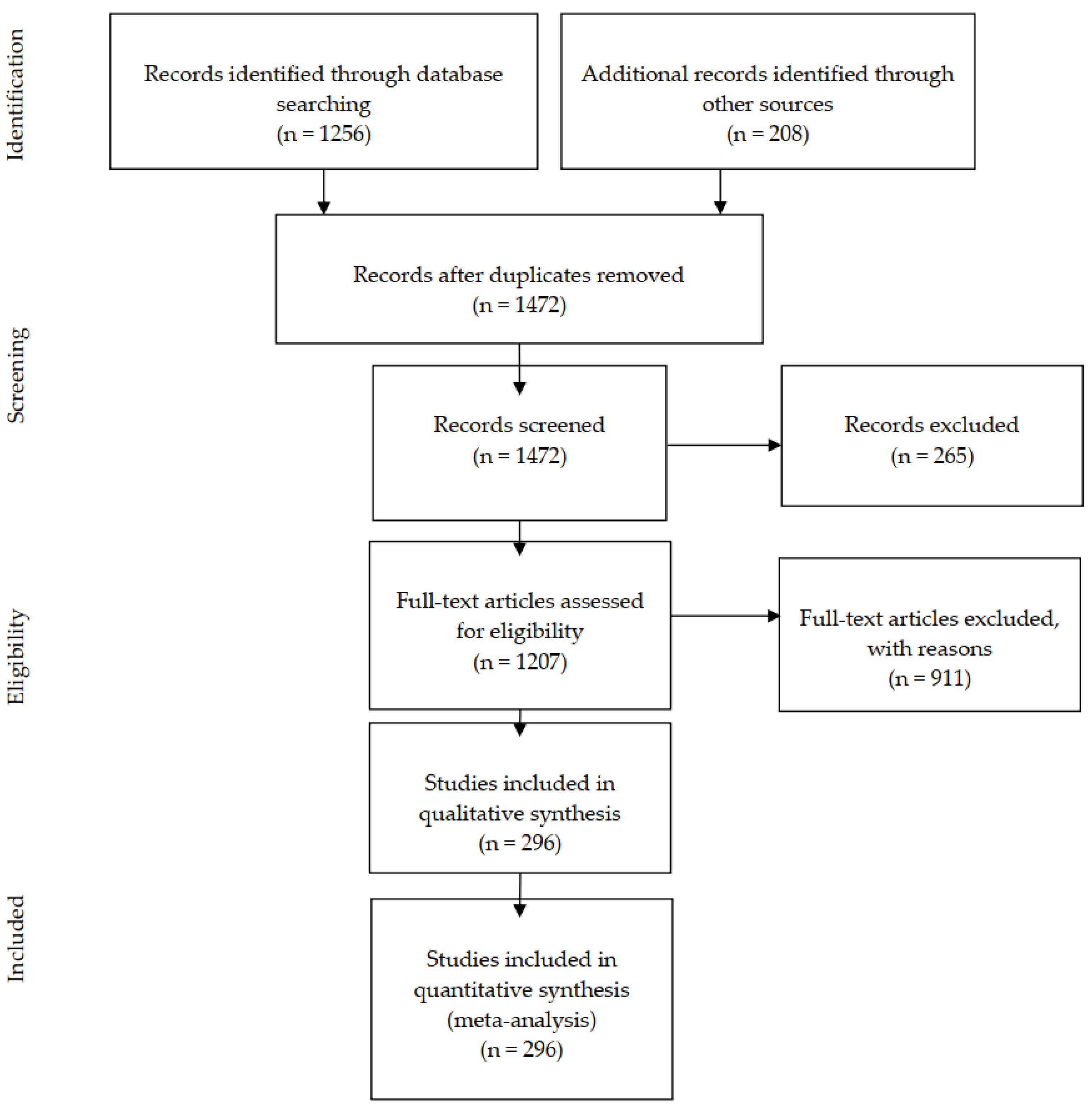

The current study uses a multi-step systematic review to provide a state-of-the art overview of blockchain’s potential for the real estate sector. The first step was defining the research questions. The next step was using the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) method [21] and identifying 296 relevant documents. The following steps consisted in using a formalized thematic content analysis to identify blockchain adoption proposals in the real estate sector. The current issues the blockchain adoption proposals could help solve and blockchain pros and cons were separately coded in the text. Initially, the themes were assigned descriptive codes, and they were later merged into more conceptual code categories. The research used the definitions of the Vocabulary of Real Estate Business [4] to categorize the identified blockchain adoption proposals under eight real estate subsectors to provide an overview of blockchain merits for the whole industry. Similarly, the theoretical blockchain pros and cons were analyzed from the entire real estate sector’s perspective.

The remaining part of the paper proceeds as follows: Section 2 describes the methodology used in this research. Section 3 presents the results by providing a bibliometric and document analysis, followed by a detailed description of blockchain possibilities for each real estate category and examining the pros and cons. Section 4 discusses the results. Finally, Section 5 provides conclusions.

2. Methodology

The primary research methodology of this research was a systematic review, which collects, investigates, and summarizes what is known and what is not known about a “specific practice-related question” [22]. Systematic reviews comprise several steps as follows.

2.1. Defining Research Questions

The first step of systematic reviews is the definition of research questions [22]. This research aims to provide an overview of why and where the literature proposes blockchain possibilities in the real estate sector. Thus, this research defined two research questions:

RQ1: Which possibilities could blockchain offer for the real estate sector and where?

This research question aims to understand the possibilities blockchain technology offers for the sector, i.e., to capture the blockchain merits for the sector. Additionally, the question seeks to map more precisely in which real estate subsectors these blockchain merits exist.

RQ2: What blockchain-related pros and cons have been recognized in the real estate sector?

The second research question assesses the advantages and disadvantages of blockchain technology in the real estate sector.

2.2. Conducting the Literature Search

The literature search process began from the following databases: Scopus, Proquest, Web of Science, and Science Direct. It used the search terms (blockchain OR block chain” OR “distributed ledger” OR “DLT”) AND “real estate.” The searches were conducted multiple times: from 9–15 June 2020, on 31 December 2020, from 5 November 2021–31 December 2021, and on 16 September 2022. Additionally, Google Scholar searches were run on August 2020, screening 36 results pages, on 31 December 2021, and 16 September 2022, filtering 10 results pages. From Google Scholar, the documents whose title or abstract directly referred to real estate were included. The final literature comprises academic literature, some reports, theses, and magazine articles to form a wide knowledge basis for the research.

2.3. Screening and Selecting Relevant Articles

The literature search and study selection process is reported according to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) method [21], shown in Figure A1 in Appendix A. The study selection first screened document records and excluded nonrelevant documents, e.g., with a focus on construction, cryptocurrency, energy, supply chain, smart city, and the Internet of things (IoT). The study selection continued by screening the full-text documents. The main exclusion reason in the full-text phase was that the paper did not discuss blockchain and real estate in the same context, accounting for half of the excluded articles. This phase also excluded documents not providing concrete examples or justifications for blockchain in the real estate sector. The resulting final literature consists of 296 papers, as shown in Figure A1 in Appendix A.

2.4. Coding, Analyzing, and Keywording the Data

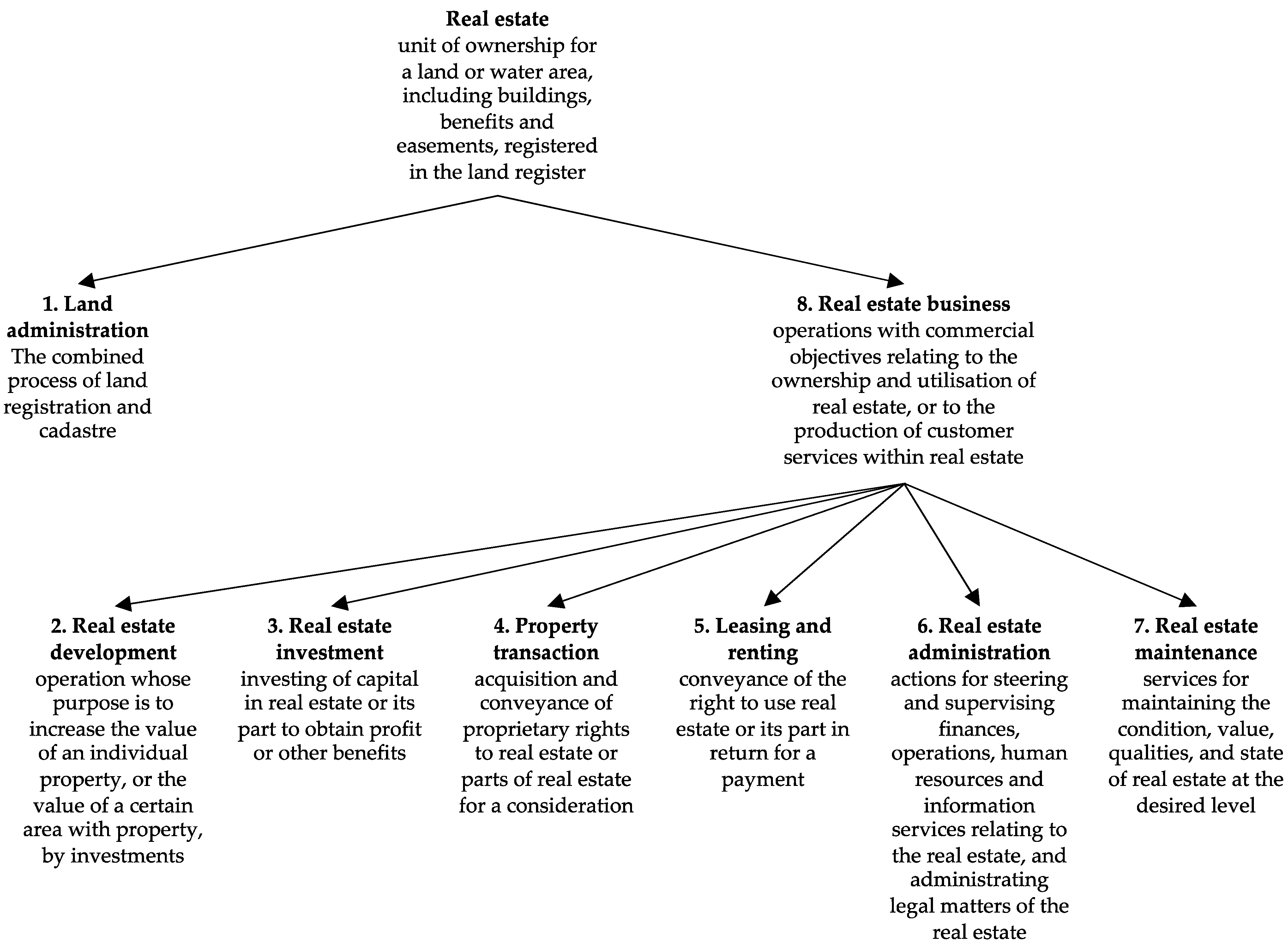

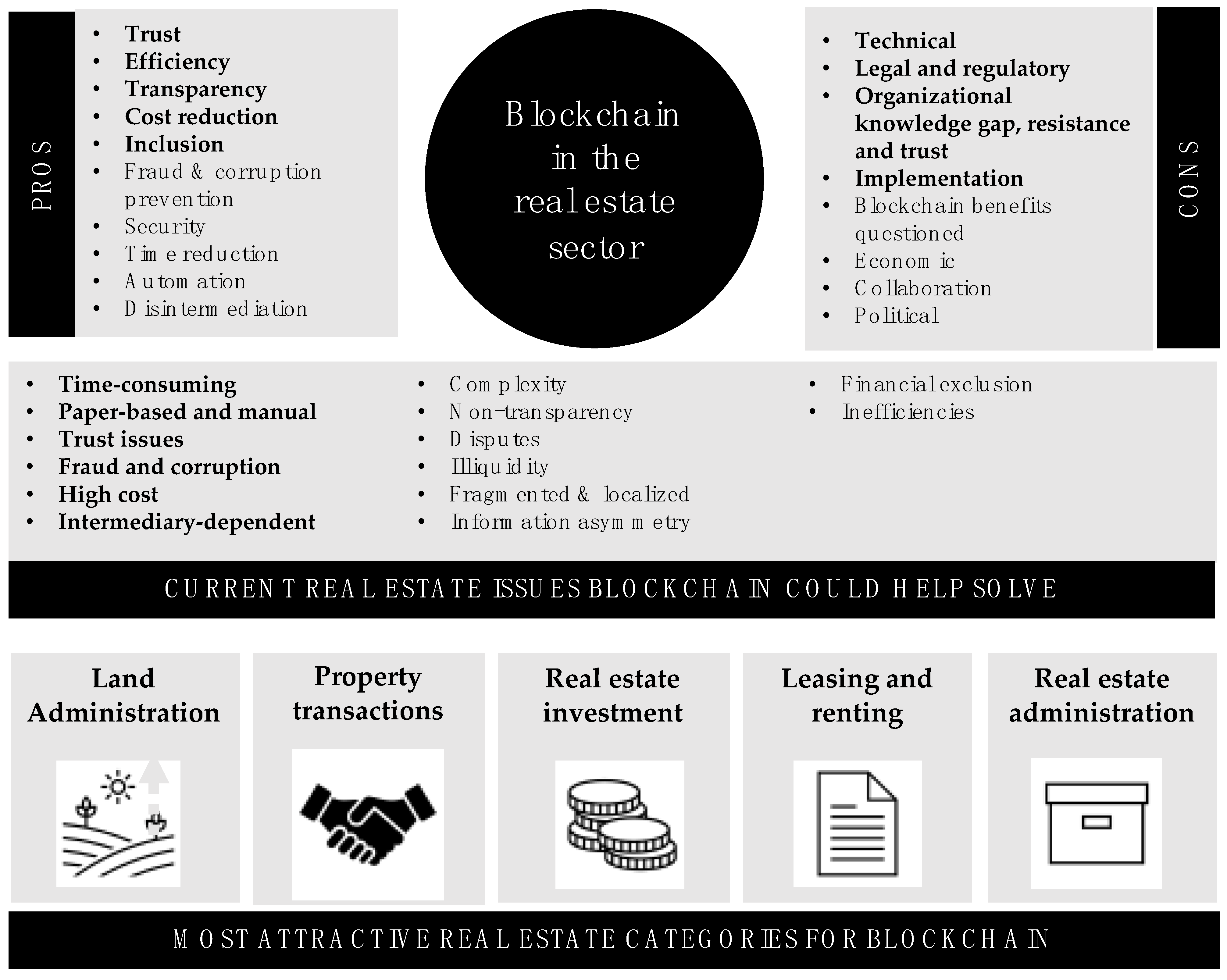

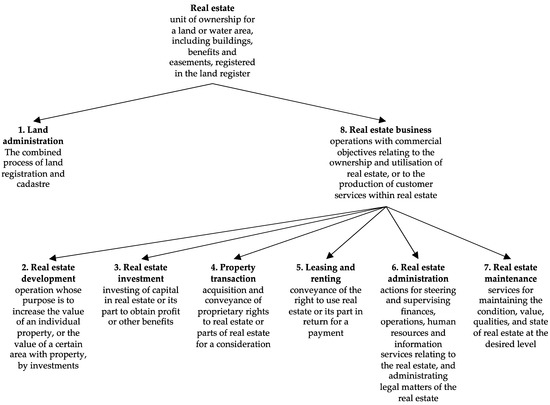

This research phase used a formalized thematic content analysis and qualitative data analysis software, ATLAS.ti versions 8.4.4 and 22.2, to code the data. The study began by assessing the documents, marking all the sentences describing blockchain adoption proposals, and assigning preliminary codes to describe the usage. The current issues the blockchain adoption proposals could help solve and the pros and cons were separately coded. Initially, the three themes (current issues, pros, and cons) were assigned descriptive codes and later merged into more conceptual code categories as proposed in [23]. The blockchain adoption proposals identified in the literature were then categorized under eight distinct real estate subsectors: (1) land administration, (2) real estate development, (3) real estate investment, (4) property transaction, (5) leasing, (6) real estate administration, (7) real estate maintenance, (8) real estate business. Concepts 2–7 are defined as the real estate business subsectors as described in the Vocabulary of Real Estate Business [4], as illustrated in Figure 1. The ninth subsector definition in the Vocabulary of Real Estate Business, i.e., building management, is excluded from this research, as the term refers to operations that are of the same type as real estate business but are not necessarily conducted for commercial objectives. As an overlapping term content-wise, building management is thus excluded from this research.

Figure 1.

The conceptual schema of the real estate subsectors used in categorizing the blockchain literature with real estate merits. Adapted with permission from Ref. [4]. 2012, The Finnish Terminology Center and from Ref. [24].

Some blockchain adoption proposals could have fallen under multiple real estate subsectors, but the aspect highlighted the most was chosen as the relevant subsector in the categorization. The categorization by the real estate business vocabulary definitions provides more structure. The categorization also allows us to correctly answer the question of where the literature proposes blockchain merits in real estate. The documents that discussed blockchain possibilities for multiple real estate subsectors equally without a particular focus were organized under the eighth category, real estate business. As a rule of thumb, all blockchain possibilities that defined a link to land administration systems (e.g., cadaster, real estate registry, real estate registration) or discussed property rights were categorized under land administration.

Additionally, the authors’ keywords were separately coded for keyword analysis. First, the plural and singular forms and spelling variants of the keywords were merged (e.g., a transaction with transactions and decentralised with decentralized) to identify the ten most-often-used keywords. Second, the top ten most-often-used keywords were identified. The specified keywords, altogether 520, were grouped into keyword groups, i.e., themes, to understand the themes or viewpoints from which the literature assessed blockchain in the real estate sector. After grouping the keywords into theme groups, the groups were analyzed using Atlas.ti’s network feature, which allows visual mapping. The keyword themes grouping enriches understanding of the context in which the literature discussed blockchain for the real estate sector.

The real estate subsectors and ATLAS.ti’s queries, code grouping, document grouping, networks, research memo features, and visual networks assisted in answering the research questions.

3. Results

The following section provides the analysis of the literature, categorized by publication year, principal authors’ locations, type of publication, and primary publication field. The section also classifies the papers by real estate subsectors and paper type.

3.1. Bibliometric and Document Analysis

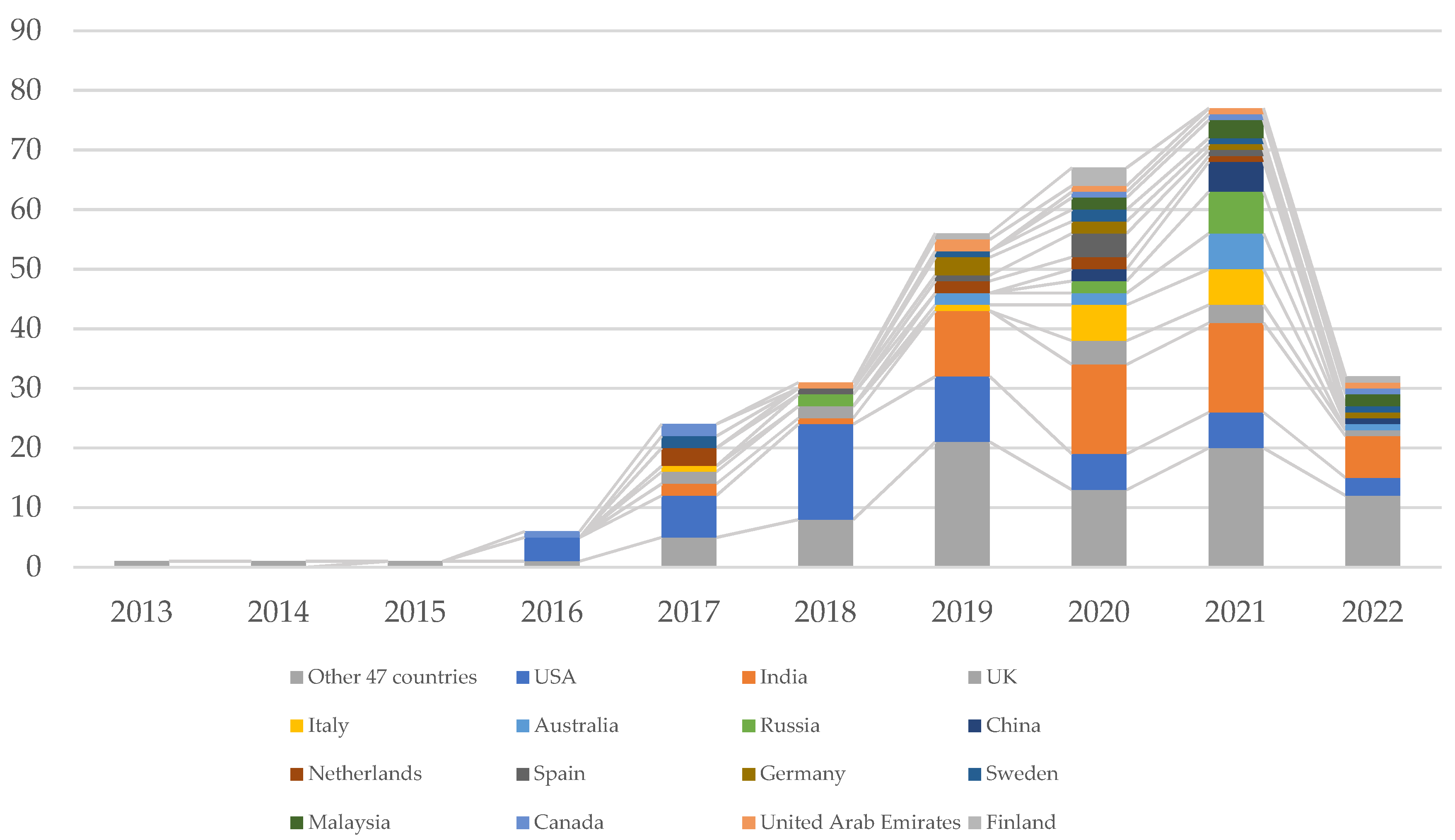

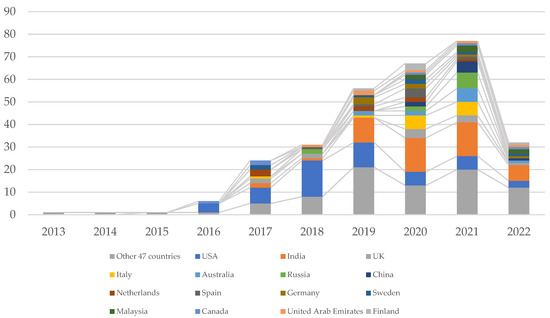

The theme has received increasing attention in the past five years, as the literature presented by publishing years in Figure 2 shows. The empirical papers are still a minority of all papers. Figure 2 also shows how the topic has received global attention. The principal authors’ locations include more than 50 countries. The five most active countries are the USA, India, the UK, Italy, Australia, and Russia. Interestingly, the USA most actively published papers in 2018–2019, whereas India’s publications present an increasing trend.

Figure 2.

Literature by publishing year and principal authors’ locations. (Search conducted until 16 September 2022).

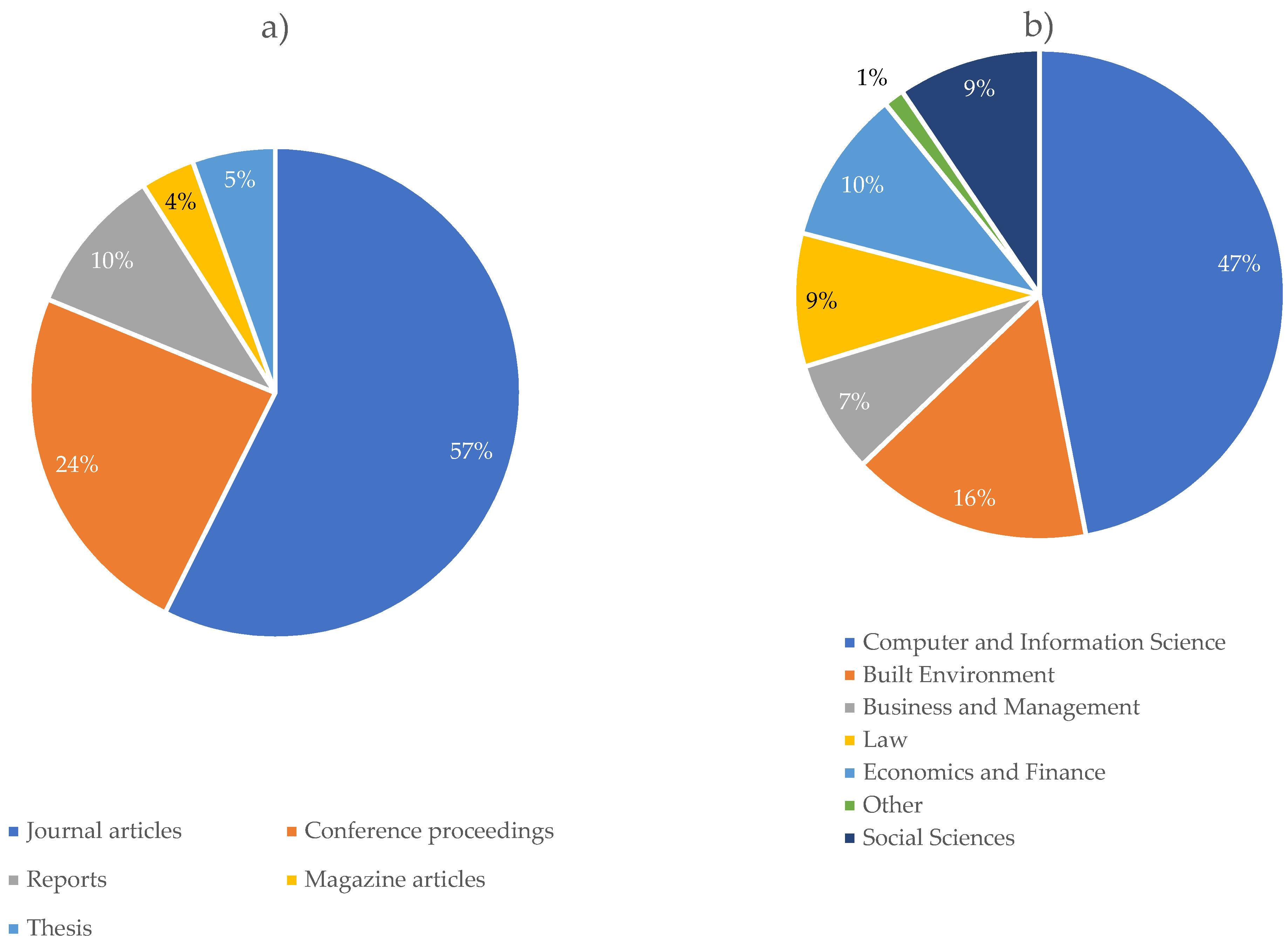

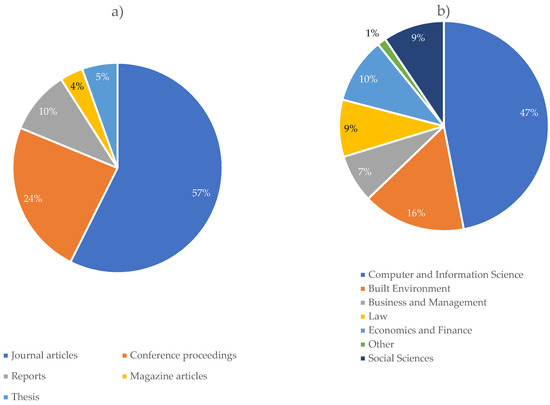

The publication types in Figure 3 illustrate that more than half of the literature was journal articles, followed by conference proceedings and reports. Magazine articles and Master’s and Ph.D. theses formed the rest of the literature. The publishing fields in Figure 3 show that computer and information sciences have published the largest literature share, followed by the built environment, economics and finance, law, and business and management.

Figure 3.

Literature by (a) publication types and (b) publishing fields.

Table 1 below shows the literature’s ten most-often-used author keywords. Unsurprisingly, “blockchain,” “smart contract,” and “real estate” were the most-often-used keywords. Author keywords existed for 64% of the documents, as many document types, such as book sections, do not typically show any keywords. Altogether, the literature contained 187 different keywords.

Table 1.

Literature’s ten most-often-used author keywords.

In addition to analyzing the keywords as they emerged in the literature, the keyword theme analysis revealed that 39% of all appearing keywords were related to blockchains and their types and features, such as smart contracts, distributed ledgers, privacy, or consensus mechanisms. The second-most-prominent keyword theme, with an 8% share, was real estate, including references to different types of real estate (housing, commercial, rental) and the real estate industry and markets. The third-largest keyword theme group was land administration which also contained keywords, e.g., land registry and registration and cadaster. Keywords describing the advantages, such as transparency, security, and trust, formed the fourth-largest keyword group, representing 4% of all used keywords. Keywords with references to other technologies (e.g., IoT and interplanetary file system (IPFS)), public administration, and governance and tokenization formed the following largest keyword theme groups, with shares of 3% each.

3.2. Blockchain Merits in the Real Estate Sector

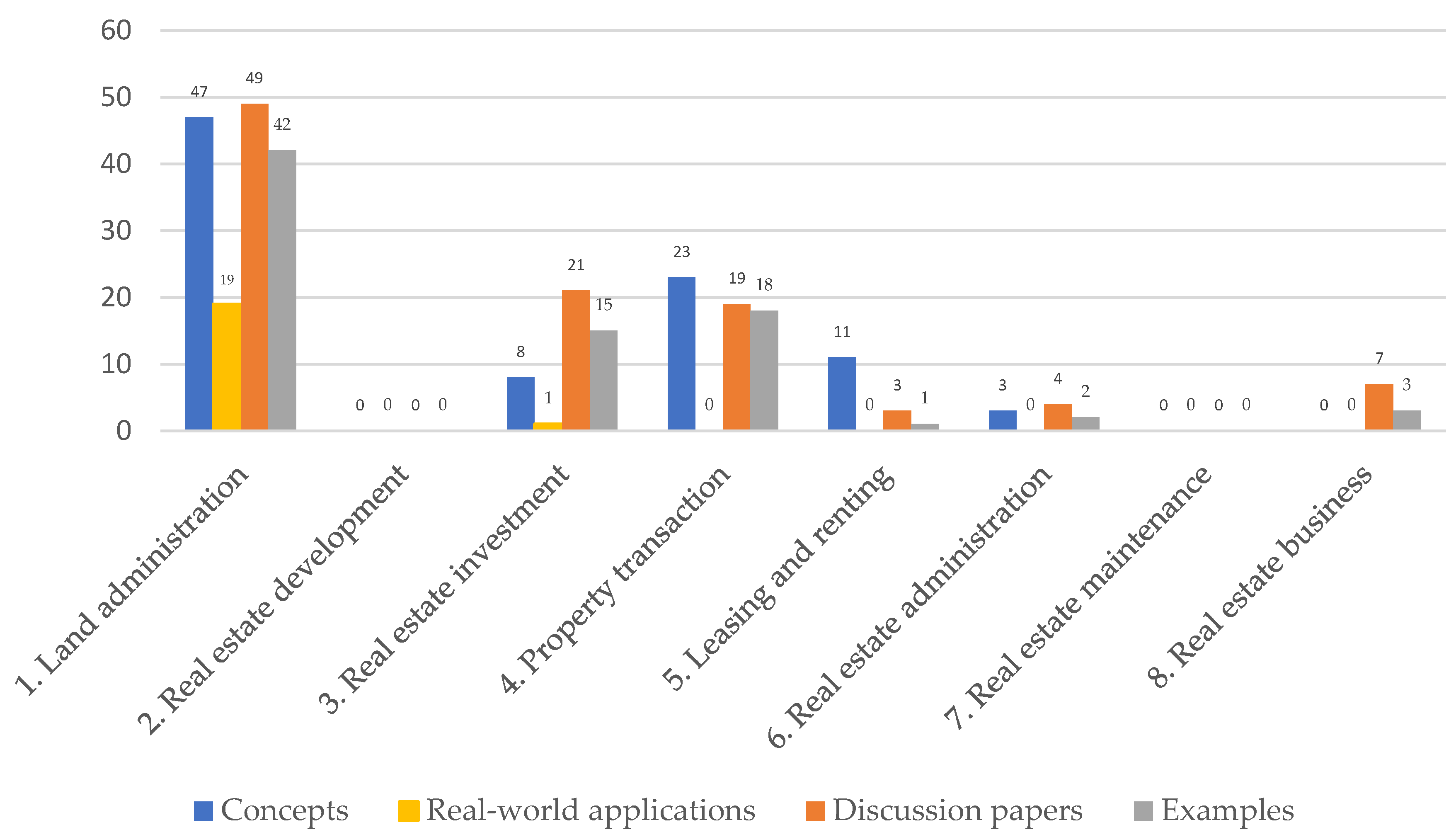

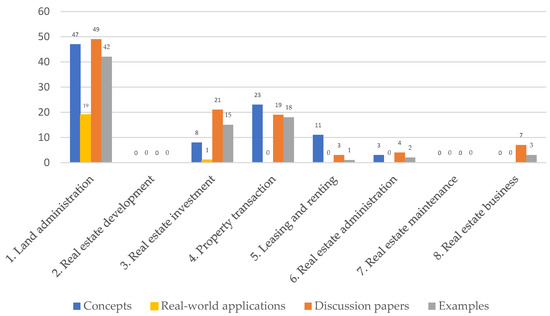

This review used the eight real estate subsector definitions to classify the identified blockchain adoption proposals: land administration, real estate development, real estate investment, real estate transactions, leasing and renting, real estate administration, real estate maintenance, and real estate business, as Figure 4 illustrates. The following subsections below provide clear definitions for each real estate subsector.

Figure 4.

Document classification by real estate subsectors and paper types.

The papers heavily focused on land administration, representing 58% of the articles. The property transactions subsector contained 22% of the documents, followed by real estate investments (16%). Leasing and renting, real estate administration, and real estate business only contributed 6%, 4%, and 4% of the papers, respectively—none of the documents focused on real estate development or real estate maintenance.

This research recognized that the papers also fall into four paper types: (1) blockchain concept, (2) real-world blockchain application, (3) discussion paper, and (4) blockchain example. A blockchain concept is a paper that presents a blockchain concept, framework, or model for the real estate sector. The real-world blockchain application category includes all the papers that report real-world applications. A discussion paper examines blockchain in the real estate sector as its central theme. The last category, blockchain examples, consists of documents whose primary focus is somewhere else but contain real-world or hypothetical blockchain examples in the real estate sector. Overall, the reports formed the largest share of the literature (39%), followed by almost equally large shares of discussion papers (35%) and examples (31%). In contrast, real-world applications only represented 8% of the total literature.

The following subsections describe each real estate subsector and portray the main pros and cons blockchain could provide in that subsector. Each subsection also outlines which current real estate issues blockchain could help solve.

3.2.1. Blockchain in Land Administration

Land administration is the process of recording and distributing information about the ownership, value, and use of land and its associated resources [24]. Accordingly, this research categorized all proposed, examined, or conceptual blockchain adoption proposals in the literature that specified links to the land, title, or deed registries or discussed property rights under land administration. This classification likely explains why the largest share of the papers focused on land administration, as real estate blockchain adoption proposals often specify links to land or title registries or discuss property rights.

The land administration discussion papers, which formed the most significant paper type within land administration, tackled the blockchain in land administration from multiple viewpoints. One stream of the reports on land administration discussed country-specific circumstances (see, e.g., [25,26,27,28,29]). Another stream considered the legal aspects of blockchain in the land administration domain (e.g., [30,31,32,33,34,35]). Some reports examined blockchain in land administration from the viewpoint of the public sector or governance (e.g., [36,37,38]). The concept papers in land administration often developed general technical blockchain concepts, sometimes tailored to a specific country (e.g., [39,40,41,42]) and usually aiming to improve the security of land registration and administration (e.g., [39,43,44,45,46,47,48,49,50]). The example documents in land administration either provided blockchain land administration as a general example or mentioned some real-world blockchain applications in land administration. Moreover, all but two of the real-world application papers of the total literature concerned land administration [11,14,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66].

The literature suggested that the main issues blockchain could help solve within land administration are inefficiency, fraud and corruption, and trust issues. Inefficiencies manifest in multiple ways. The land and title registries seem inefficient in their coverage: World Bank estimates that around 70% of the global population does not have official land titles [67]. The large share of unregistered land is a worldwide inequality issue that de Soto [68] argues to be the root source of poverty in developing nations, accounting for “dead capital,” estimated around USD 9.3–10 trillion globally, leading to restricted economic development [25,69,70,71,72]. Another category of land administration inefficiency stems from paper-based records and manual, time-consuming processes [13,25,67,73,74], which make records prone to tampering [67,75,76] and errors [77,78] and may lead to lost documents [79].

The intermediary-dependent title registration process leads to high costs [67,74,80,81]. Corruption within land administration often links to developing countries, but fraud also exists in developing countries. Overall, land registry trust issues, fraud, and corruption lead to disputes [42,82], unprotected civil rights [82,83], and high costs [67,69,84,85]. The literature attributes blockchain efficiency to reducing intermediaries’ roles [86,87,88,89,90]. Furthermore, the decentralization provided by blockchain land records would allow removing duplicate tasks and processes, enabling synchronicity [67,78,85,91], removing friction [28], and reducing time and costs [12,18,25,67,74,88,91,92,93,94,95].

A blockchain land registry could correspond with the title- and deed-centric title registration methods [31], creating a single source of truth for title data [42]. The trust in the overall land registry system could increase [77], as blockchain could provide a decentralized [74,96], immutable [25,42,74,77,78,97], transparent [67,74,76,77,86,97], time-stamped [67,74,98], accessible [25,67,74,76,89,96,99,100,101,102], verifiable [25,42,69,74,78,89,96,103,104,105], and up-to-date registration of land records [25,76,77,78,100,101,103] and confirm property ownership [42,74,97]. Immutable and decentralized blockchain records could also prevent fraud [12,25,36,42,89,90,98,104,106,107,108,109], tampering with records, human errors [31,67,78,81,90,110,111], loss of records [78,112], tax evasion [86], and corruption [29,31,67,69,77,111,112]. Thus, blockchain land records could also protect and enforce property rights [74,77,83,96,113], especially in developing countries [70,80,110,114].

Despite the many potential pros, applying blockchain in land registries remains challenging due to legal, implementation, and technical reasons. First, implementing blockchain within land administration requires good-quality digitalized data [12,96,115]. Overall, blockchain seems unable to resolve the primary land administration challenge in many emerging economies: how to initially bring citizens and properties into the formal land registry system [13,15,80]. The technical difficulties of blockchain land administration include public–private key administration and potential loss of keys [51,67,78,96,115,116], transaction speed [96,117], interoperability [78,96,117], scalability [13,15,18,31,77,117], and long-term data preservation [51,116].

Although blockchain systems are often justified as more secure than traditional systems, they also face cyber threats [51,116]. Legal recognition of blockchain-based land registries, in general, would require updating the current legislation [70,96,118,119,120] and standardization [15,42,96]. These changes would require political will [120]—a challenge, especially in countries whose corrupted public administration benefit from current non-transparent systems [29,31,85]. In addition to governmental support, implementing blockchain land registries requires collaboration with many stakeholders [96] and changing current processes [59]. Last, some have questioned whether centralized “permissioned” blockchains provide any benefits over traditional centralized governmental registries that governments have used for land registry purposes for decades [57,91].

3.2.2. Blockchain in Real Estate Development

Real estate development’s purpose is to increase the value of an individual property or the value of a particular area within the property through investments. The object of real estate development may be a land or water area forming raw land for real estate, a plot within the real estate, or a building or its parts within a plot. Real estate development can focus on existing real estate and its parts or on the part of real estate under planning [4]. Real estate development is also called property development [4]. None of the papers fell into the real estate development subsector. However, the real-estate-related keywords used in this research and the exclusion of construction-related articles might have contributed to real estate development not being covered in the final literature of this research.

However, a few documents in other subsectors contained the BitRent platform’s example of blockchain application in the real estate development [84,89]. BitRent was a developers’ and real estate investors’ collaboration platform using blockchain, smart contracts, building information model (BIM), and radio frequency identification (RFID) tags to monitor the early stages of construction and automate payments as tasks complete [84,89]. However, the BitRent project seems to have paused in 2019, and its status is unknown.

3.2.3. Blockchain in Real Estate Investment

Real estate investment refers to investing capital in real estate or its parts to obtain profit or other benefits. Real estate investment may be direct or indirect, e.g., through a real estate investment company or funds [4]. Indirect real estate investment does not give the investor control over the real estate or the right to possess the property [4]. Real estate investment was the third-most-popular real estate subsector for blockchain. Most real estate investment papers were reports [16,17,114,121,122], followed by examples and some concepts [87,123,124,125]. One of the papers was a real-world blockchain application describing the BrickMark tokenization case [126]. Given the real estate sector’s tremendous environmental burden, it is not surprising that recently, some blockchain applications in green real estate investment have emerged. For example, some suggestions have been made of blockchain-based tokenized securities for green real estate bonds tied to environmental objectives [127,128].

Primarily, the blockchain benefits for real estate investors come through tokenization. The literature proposed both direct and indirect real estate investment solutions via tokenization. The primary real estate investment benefits of tokenization are inclusion and efficiency while providing better liquidity and cost reductions. Inclusion refers to blockchain’s ability to fractionalize and democratize traditionally lumpy real estate investments, lower entry barriers, and allow more investors to join the real estate market [12,17,80,87,95,114,129,130,131]. This larger pool of potential global opportunities might lead to lower capital-raising costs and better valuation for corporate real estate buyers and sellers [90]. The fractionalization and customizability of tokenized real estate assets would also offer greater diversification possibilities [87,114,129,130,131].

Tokenization also allows customizing new investment and utility products and opens doors to new opportunities. Overall, tokenization could provide greater liquidity for the real estate market [80,87,129,130,131], both by creating efficient secondary markets [17,129] and by increasing the potential pool of investors and global investor base [17,114,129]. Combined with smart contracts, the tokens could allow faster [17] and cheaper investment transactions with greater transparency [114,129,130] and accessibility [17,129], as smart contracts could automate steps such as compliance, document verification, trading, and escrow [17,114].

Real estate investment tokenization suffers similar legal challenges to blockchain-based property transactions. Regulatory uncertainty, ambiguity, and terminological differences exist [80,114,131]. In general, directly tokenizing real estate assets is not possible in most jurisdictions, requiring intermediate structures, such as special purpose vehicles (SPV) or real estate funds [17,129]. While real estate generally is not a regulated asset (e.g., in the US or UK), tokenized security that offers access to a real estate asset, debt, or fund would be [17]. Token classification is important from the regulatory perspective, as security tokens must meet strenuous regulatory criteria [131]. Additionally, firms carrying specified security token activities require correct permissions and must follow relevant rules and requirements [129].

Real estate investment tokenization might also have some unwanted economic consequences. The fear is that the liquidity improvements through primary and secondary markets and fractionalization could damage real estate returns, as the illiquidity premium of real estate may be diminished [17]. Another fear of increased liquidity is increased price volatility and a more extensive bid–offer spread [17]. Furthermore, if there is no demand in the market to purchase the real estate investment tokens, the assets remain illiquid; the liquidity benefits would require large enough participants to materialize [125]. Most current real estate investment players are large institutional investors providing most of the liquidity of the real estate investment market. Institutional investors are interested not in obtaining single-asset tokens but in funds fitting into their investment and risk profile as part of their overall portfolio allocation [126]. Last, the economic equation of tokenizing single real estate assets seems thus far to be questionable, mainly due to untested demand for such a product and management of fractionalized assets [17].

3.2.4. Blockchain in the Property Transaction

Property transaction is the acquisition and conveyance of proprietary rights to real estate or its parts [4]. Property transaction covers actions relating to the buying and selling of real estate, e.g., real estate purchase, real estate sale, exchange of real estate, real estate transactions, and real estate valuation. Property transaction is also known as the conveyance of real property or conveyance of property [4]. The property transaction papers were mainly concepts, followed by reports and examples.

The primary property transaction issue that blockchain could help solve is that of intermediary-dependent, paper-based, manual, costly, and time-consuming processes. Primarily paper-based processes [106,114,132], manual transmission of data between participants, and the required verification of data residing in siloed systems [85,88,90,91,133,134,135,136] make transactions time-consuming [17,73,88,89,91,106,114,134,137,138,139] and prone to errors [17,88,93,114,136,137,139] and fraud [82,139,140]. The other property transaction market inefficiencies include illiquidity [17,88,95,114,129,135,141,142], non-transparency [17,69,80,95,138,141,143,144,145], information asymmetry [80,137,146], personal biases [137,141], and heterogeneity [19,88,91,145]. The main blockchain pros for property transactions lie in blockchain’s ability to reduce the intermediaries’ role, simplifying the transaction process and reducing cost and time.

The general idea is that blockchain could function as a single [25,94,96,139,141], distributed [17,134,147,148], accessible [15,25,88,89,94,99,100,101,102,106,134,138,139,149,150,151], transparent [15,25,77,80,88,89,95,106,109,129,134,135,137,143,145,147,150], up-to-date [15,17,89,93,99,101,102,138], verifiable [78,89,93,96,135,147,150,152,153,154,155], and immutable [95,96,137,139,143,148,156] data platform, allowing many activities, tasks, and formalities to be conducted simultaneously [25,139,148]. Additionally, blockchain-enabled smart contracts could help to automate and digitize the process, making transactions faster [17,88,89,101,137,147,148], less erroneous [81,119], and secure [75,80,88,93,101,137,140,147]. Combined, peer-to-peer transactions would be possible [78,87,96,142], and the intermediaries’ role could diminish [95]. Last, blockchain property transactions could facilitate cross-border operations [94,147,157], in line with the EU’s foundational goals of free movement of persons and capital, i.e., a “digital single market” [94].

The main challenges of applying blockchain in property transactions include regulatory uncertainty [91], as it would require data standardization [145,148] and collaboration with many stakeholders [91,139,145,148]. Even if smart contracts could streamline many current tasks and activities, some of the current transaction processes might be too complex to translate into computer code and algorithms [73,94,119]. Saull et al. [148] highlight that substantial improvements in real estate transaction processes can only occur through industry-wide collaboration. Changing laws and regulations would also touch on many established players’ economic benefits [88], requiring a change in tradition and culture [35]. Thus far, the real estate industry has not been willing to share information and make investments in such technology openly [148], since blockchain technology is complex and requires special skills and competencies [88,139].

3.2.5. Blockchain for Leasing and Renting

Leasing is the conveyance of the right to use real estate or its parts in return for payment, including lease–purchase, apartment renting, and land renting. Transactions related to apartment renting are apartment rental services. Similarly, renting is acquiring the right to use real estate through payment [4]. Leasing and renting papers were the fourth largest literature segment and mainly included concepts aiming to ease current leasing issues, such as inefficiencies, intermediary dependencies, and trust issues [134,136,146,158,159]. Most of the papers discussed apartment rental services.

The leasing process is often paper-based [114], time-consuming, and manual, contributing to high costs, non-transparency, information asymmetry, and fraud. The leading blockchain benefit for leasing is automation provided by smart contracts that could automate, e.g., cash flows between the landlord, tenant, and property managers [90,123,136,146,160,161,162,163]. Cost reductions could also stem from, e.g., replacing the current real estate brokers and fragmented information services with a trustworthy blockchain platform providing real-time information with distributed access, complemented with a multiple listing service (MLS) [89,136,138,146]. Moreover, blockchain rental platforms could help prevent fraud [136,141,146,164] and black-market activities if the rental platforms were connected to the systems of, e.g., tax officials and other relevant officials for compliance purposes [19]. If the lease agreement terms were standardized in the smart contract, they could also provide consumer protection [19].

3.2.6. Blockchain for Real Estate Administration

Real estate administration refers to actions for steering and supervising finances, operations, human resources, and information services relating to real estate and administering legal matters in real estate [4]. Real estate administration may be regarded broadly as the administration of the entire real estate business and building management or, more narrowly, as the administration of actions included in the larger concepts [4]. This research only identified a few papers that could be classified under the real estate administration subsector. Some blockchain examples in real estate administration were also mentioned in documents classified under other real estate subsectors.

The primary blockchain idea in real estate administration relates to storing real estate data. Storing all the information related to a building and produced during its lifecycle on a blockchain would allow a trustworthy, fraud-resistant, verifiable, single source of validated data that can cut duplicate costs, reducing standalone record-keeping and the role of intermediaries. [117,165,166,167]. Some proposals add a BIM model to the concept and call the blockchain-based real estate information database “the building/property passport”, which could be transferred with the asset when the ownership changes [168]. Another idea is to use blockchain to facilitate peer-to-peer voting and record the property owners’ votes securely and conveniently [80]. Blockchain solutions’ main advantages in real estate administration are increased efficiency, automation, and trust.

3.2.7. Blockchain in Real Estate Maintenance

Real estate maintenance is the service for maintaining the condition, value, qualities, and state of real estate at the desired level. Real estate maintenance includes energy management, technical services, facility services, waste management, cleaning services, and outdoor area maintenance [4]. None of the papers explicitly focused on real estate maintenance. However, blockchain could be helpful in securely storing real estate maintenance data in the property passport introduced above [169,170]. Devices and monitoring systems could log the maintenance operations automatically to the blockchain database [171]. Two significant blockchain research domains, energy management and IoT applications, are in practice related to real estate maintenance. However, interestingly, the real estate literature has not identified these blockchain merits in the real estate maintenance subsector, even if blockchain merits in energy management (and IoT applications) are extensively covered in academic literature elsewhere (see, e.g., [7,172,173,174,175]).

3.2.8. Blockchain in the Real Estate Business

Real estate business consists of the operations with commercial objectives relating to the ownership and utilization of real estate or the production of customer services within real estate. The central idea of real estate business is to establish services producing added value for real estate users and, thus, owners and investors during the real estate lifecycle. [4] Real estate business includes all the subsectors in Section 3.2.2, Section 3.2.3, Section 3.2.4, Section 3.2.5, Section 3.2.6 and Section 3.2.7. This research grouped documents and blockchain adoption proposals in the more specific real estate subsectors described in Section 3.2.1, Section 3.2.2, Section 3.2.3, Section 3.2.4, Section 3.2.5, Section 3.2.6 and Section 3.2.7. However, if a paper covered many real estate business subsectors equally without an apparent concentration, it was categorized under the broader real estate business subsector.

Only a handful of documents covered multiple real estate subsectors equally, which is why only a few documents were classified under the real estate business subsector. For example, Shtofman illustrated blockchain possibilities and challenges in real estate documentation, owning and managing commercial or real estate property, and unlocking corporate real estate liquidity [90]. Another recent study mapped the most recent blockchain developments in land administration, real estate transactions, real estate maintenance, and tokenization to conclude that based on the current real-world applications, land administration is the only domain in which the theoretical blockchain benefits may presently be assessed. Overall, the examined real-world applications showed that the real estate sector is currently far from being disrupted by the blockchain [1].

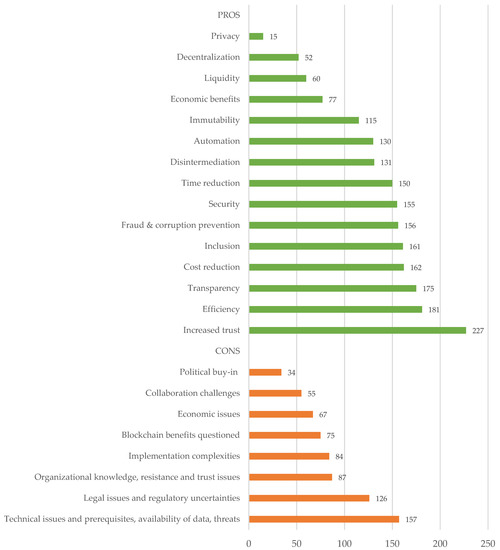

3.3. Theoretical Blockchain Pros and Cons in Real Estate

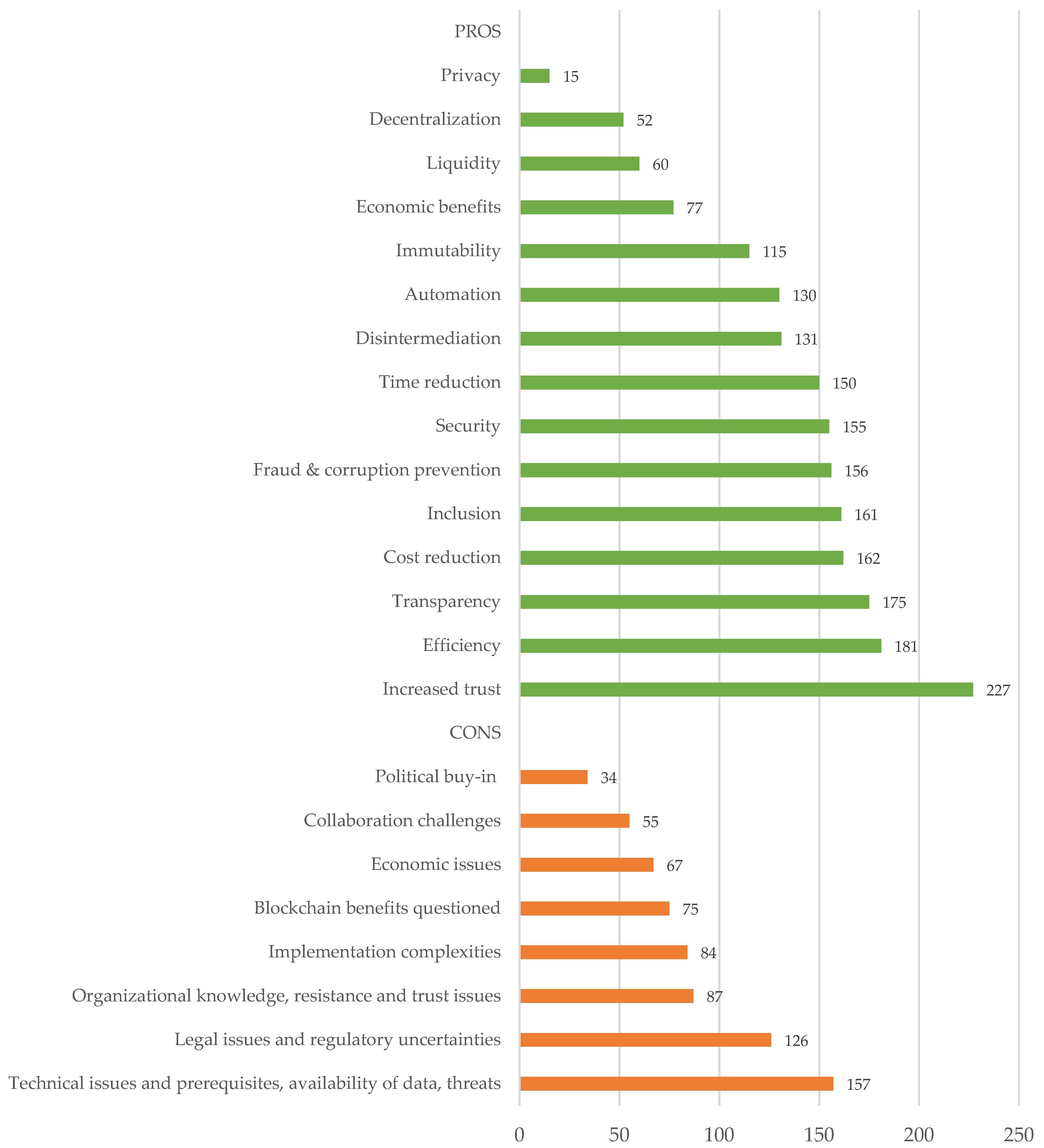

The main advantages the literature suggested for blockchain in the real estate sector included enhanced trust, efficiency, transparency, cost reduction, inclusion, prevention of fraud and corruption, security, time reduction, automation, and disintermediation, as Figure 5 shows. The trust is suggested to be enhanced, as blockchain provides verifiability. The data on the blockchain are traceable, up-to-date, and validated, increasing the overall confidence in the blockchain as a data storage solution. The increased trust also stems from reduced human errors and increased accountability. Blockchain’s transparency and immutability are crucial in increasing confidence and are often proposed as among the leading blockchain benefits in the real estate sector. The transparency and immutability of blockchain solutions also reduce fraud and corruption in the real estate sector, which the literature regards as a remarkable benefit, as it eases one of the sector’s inherent systematic issues.

Figure 5.

Theoretical blockchain pros and cons in the real estate sector. The number represents the number of documents.

The literature proposes that blockchain’s efficiency advantages in the real estate context originate from process-related (paperless) simplifications. Blockchains allow many configurations, and this customizability also contributes to efficiency. Moreover, blockchain solutions’ customizability allows new economic opportunities to arise with blockchain solutions, most often linked with tokenization in the real estate investment context. Efficiency advantages also arise from automation, as blockchain’s mainly digital processes could allow, e.g., automatic tax notifications to officials, which then contribute to compliance efficiency. These efficiency advantages lead to time and cost reductions, which the literature highlight as significant blockchain advantages for the real estate sector.

Blockchain adoption within the real estate sector is not without cons, as almost 70% of all documents discussed some. Figure 5 highlights the most often identified challenges and disadvantages. Technical challenges related to, e.g., the early stage and immaturity of blockchain technology, digital identity and signatures, unavailability of good-quality digital data, public–private keys, immutability, scalability, cyber-attacks, and threats, as well as interoperability and integration with legacy systems. Legal issues and regulatory uncertainties also included requirements to update regulations and laws, a lack of standards, legal validity, and consumer protection. Organizational knowledge, resistance, and trust issues were other challenges to blockchain adoption in the real estate sector.

The real estate sector was often portrayed as a conservative sector whose established players benefit from the current information asymmetries, which creates resistance to change [27,78,91,174]. Many blockchain adoption proposals would likely cause new power shifts, requiring conflicting interests to be re-aligned. The knowledge gap was yet another organizational challenge. Implementing blockchain in real estate is also very complex and time-consuming, requiring new processes to be agreed upon. Implementation also requires the real estate sector players to collaborate with many stakeholders, which is a challenge, as there are trust issues. Additionally, collaboration often requires governmental coordination in the real estate sector.

Interestingly, despite how often the literature proposes blockchain to remove or at least reduce the role of intermediaries in the real estate sector, the literature very often notes that the benefit of disintermediation does not materialize. Instead, intermediaries are very often still needed. Similarly, blockchain may not remove manual phases required in the real estate processes. Overall, the literature constantly questions blockchain’s pros in the real estate sector, stating that current technologies solve flaws or work well enough and that the advantages stem from digitalization—not blockchain.

4. Discussion

This section discusses the results and answers the research questions. Then, this section discusses the limitations and validity of the study.

The publication trend suggests increasing global interest in blockchain technology in the real estate sector. The current study found that the literature often justifies blockchain adoption in the real estate sector by referring to the current issues that blockchain is proposed to solve or ease. Interestingly, many of the real estate sector’s current issues that the literature highlights, such as inequality, inefficiency, fraud and corruption, and complexity, seem multi-dimensional and systematic, generating the question: how could any single technology be the answer to such complex issues?

Another important finding of the current research was that most of the exponentially increasing literature proposing blockchain for the real estate sector continues to be technically focused, as revealed by the keyword analysis. Conceptual papers overall form a significant share of the literature. Many of the abstract blockchain proposals for the real estate sector could even be described as idealistic or overly simplistic—and, as such, seem very far from practical applications. Will most idealistic conceptual blockchain proposals for the real estate sector ever see daylight? Moreover, most of the concepts—especially in land administration—are technically focused and lack attention to the organizational and environmental contexts of the adoption. These findings also stress the importance of understanding the blockchain implementation challenges to develop successful applications.

Many of the blockchain proposals discussed in the literature, especially the examples that formed a significant share of the literature, only contain little detail. This research mainly consisted of literature retrieved from academic databases, so the results should be interpreted to capture the academic viewpoint. Generally, real estate is under-researched compared to the asset class size. Specifically, research on some subsectors, e.g., real estate administration, is typically limited. On the other hand, compared to the available real-estate-related research, the recent exponentially increasing interest in blockchains appears noteworthy, signaling that real-estate-focused blockchain research attracts interest from multiple other fields, as supported by the document analysis. Interestingly, although energy management and IoT are prevalent blockchain research and application domains related to real estate maintenance, the real estate literature has yet to recognize blockchain potential in this subsector.

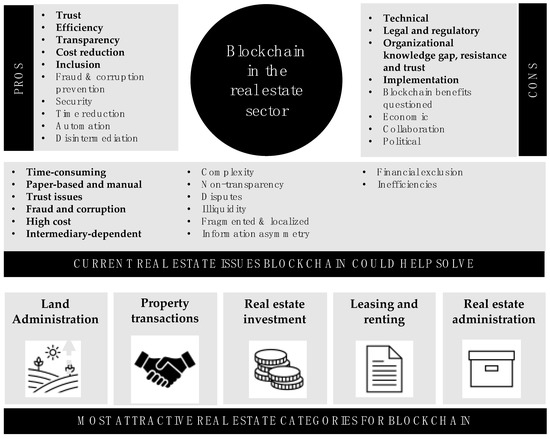

Figure 6 provides a visual overview of the results and answers the research questions, illustrating the current real estate issues blockchain could ease, the most attractive real estate subsectors for blockchain, and blockchain pros and cons in the real estate sector.

Figure 6.

Blockchain’s grand promise for the real estate sector: the most attractive real estate subsectors for blockchain, current real estate issues, and blockchain pros and cons.

RQ1: Which possibilities could blockchain offer for the real estate sector and where?

The real estate subsector analysis above provides a thorough overview of the current emphasis on blockchain possibilities in the real estate sector. As shown in Figure 6 below, the most attractive real estate subsectors for blockchain emerging in the literature were land administration, property transactions, real estate investment, leasing and renting, and real estate administration. More than half of the papers discussed blockchain within land administration, which might partly be explained by the fact that all documents specifying a link to the land registry or cadaster or discussing property rights were classified under land administration.

On the other hand, creating tokenized indirect real estate investment products [16,17,114] and blockchain-based residential rental service platforms [90,91,136,159,161,175] seem to be other possible routes for blockchain applications to materialize in the real estate sector—based on the literature’s emphasis. In indirect real estate investment and leasing, the current regulatory frameworks and the related uncertainties do not appear as significant barriers as in most other real estate applications [19,90,91]. Similarly, property transactions generally attract interest as an area for blockchain application (see., e.g., [106,133,137,145,148,155]).

RQ2: What are the main blockchain pros and cons in the real estate sector?

Figure 6′s upper left side compiles the main blockchain pros in the real estate sector. Generally, blockchain could bring more trust and security to the real estate sector [19,63,67,74,78,85,89,96,134,137,174,175,176,177], which is often plagued with fraud and corruption [74,79,106,116,176,178]. Blockchain could bring efficiency and transparency by replacing traditional paper-based and manual processes that depend on many intermediaries [17,106,114,137,176,177]. Smart contracts powered by the blockchain could automate the processes and provide disintermediation, saving time and costs [17,19,41,63,88,89,94,96,114,158]. Blockchain could also help develop a more inclusive real estate sector by allowing the fractionalization of property ownership and investments, creating efficient secondary markets for blockchain-based real estate tokens [17,122,179]. Blockchain could also encourage financial inclusion by providing access to trustworthy, transparent, and tamper-resistant property registration systems to more people, which is lacking, especially in many developing countries [77,78,89,137,176,177].

Figure 6′s upper right side represents the main blockchain cons in the real estate sector. Contrary to how blockchain has been generally described as a technology to replace intermediaries, the literature here recognized that blockchain in the real estate sector would still likely require intermediation and intermediaries [1,14,19,32,52,63,118]. Replacing the governmental centralized land administration registries seems unlikely, at least in the short term [32,34,41,80,118,180]. Blockchain is also technically immature, and many technical challenges will need to be solved before the technology is scalable, secure, and interoperable enough to be implemented in a disruptive way in the real estate context [15,51,78,96,116]. Moreover, digital identity solutions need to be developed and tested [19,32,51,56,96,181]. The unavailability of reliable real estate data is yet another significant implementation barrier [51,78,96,116]. Moreover, implementing blockchain technology in the real estate sector would be complex and require considerable collaboration, training, and governmental buy-in [14,15,17,54,66,96,177]. Resistance and trust issues would be expected [27,66,88,119,133,182].

5. Conclusions

This research aimed to provide an up-to-date understanding of why and where to apply blockchain in the real estate sector and highlight the pros and cons presented in the literature. This research answered these questions by reviewing 296 relevant documents and performing a thematic content analysis. The identified blockchain adoption proposals and papers were classified using standardized real estate vocabulary. Interestingly, most of the literature was focused on blockchain within land administration. Overall, the blockchain potential in the real estate sector still appears underexploited compared with all the potential for tackling real estate sector challenges recognized in the literature. Blockchain potential in the traditional real estate sector is just beginning to emerge, as only the land administration sub-sector has some practical solutions in place. The results of this research form a basis for future research as follows:

- Future empirical blockchain research should aim to estimate, measure, and effectively communicate the benefits of real-life blockchain applications in the real estate sector. Moreover, the effects should be examined at the ecosystem level, including the potential power redistribution effects. The benefits from decentralization especially require more attention, as the literature currently questions the value of decentralization in the real estate sector context. Similarly, the application challenges in complex real-life settings require further research. Both successful and unsuccessful blockchain applications should thus be analyzed.

- More interdisciplinary studies on blockchain possibilities should be conducted in the real estate sector, including the technical perspective and bridging it with, e.g., political, governmental, economic, environmental, organizational, legal, educational, and behavioral aspects. Real estate is a fundamental asset class with significant social, ecological, and financial magnitude. As the sector has inherent resistance to change, an interdisciplinary approach is likely required to encourage progress. Here, design science research strategies and similar methods involving some real estate market players could be helpful.

- Overall, as the real estate sector is resistant to change, and many market players, especially the intermediaries, base their business models on the sector’s information asymmetries and inefficiencies, the potential blockchain benefits—as grand as they can be—may not be enough to provoke large-scale adoption in the real estate sector in the short term, as implementation is very complex. Thus, multiple pathways to blockchain adoption in the real estate sector are worth examining. Larger-scale blockchain adoption may not arise within the real estate sector. Instead, external factors, pressures, and developments in other arenas may initiate larger-scale blockchain adoption in the real estate context. For example, developments in digital identities and security token regulations are likely to open opportunities. Here, cross-country regulations and standards are the most influential change drivers that should be investigated. Similarly, governments’ digitalization efforts within land administration could create novel opportunities for blockchain platforms to build on.

- Last, a prominent research area is exploring blockchains’ potential to solve climate and environmental issues in the real estate sector. Given the real estate sector’s significant ecological burden, novel climate and sustainability-related innovations and solutions must be urgently developed. As a trustworthy and decentralized database, blockchain could provide new opportunities, encourage collaboration, and help develop more sustainable industry-wide solutions, which could provide added value in, e.g., the EU Taxonomy and the proposed revisions to the Corporate Sustainability Reporting Directive’s implementation.

Author Contributions

A.S.: Conceptualization, Data Curation, Formal analysis, Investigation, Methodology, Writing—Original draft preparation, Writing—Reviewing and Editing. S.J.: Conceptualization, Writing—Reviewing and Editing, Supervision. J.V.: Conceptualization, Writing—Reviewing and Editing, Supervision. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by Aalto University’s Smartland project which is funded by the Finnish Strategic Research Council at the Academy of Finland (decision No. 327800) and the Smart-Ready Buildings project, funded by Business Finland (decision No. 5979/31/2021).

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study, in the collection, analyses, or interpretation of data, in the writing of the manuscript, or in the decision to publish the results.

Abbreviations

The following abbreviations are used in this manuscript:

| NFT | Non-fungible token |

| PRISMA | Preferred Reporting Items for Systematic Reviews and Meta-Analyses |

| IoT | Internet of things |

| IPFS | Interplanetary file system |

| BIM | Building information model |

| MLS | Multiple listing service |

Appendix A

Figure A1.

PRISMA flow chart summarizing the literature retrieval process.

Figure A1.

PRISMA flow chart summarizing the literature retrieval process.

References

- Saari, A.; Vimpari, J.; Junnila, S. Blockchain in real estate: Recent developments and empirical applications. Land Use Policy 2022, 121, 106334. [Google Scholar] [CrossRef]

- Savills. SAVILLS WORLD RESEARCH. 2016. Available online: https://pdf.euro.savills.co.uk/global-research/around-the-world-in-dollars-and-cents-2016.pdf (accessed on 27 September 2022).

- United Nations Environment Programme. 2021 Global Status Report for Buildings and Construction; Global Alliance of Buildings and Construction: Nairobi, Kenya, 2021. [Google Scholar]

- The Finnish Terminology Centre. Vocabulary of Real Estate Business, 2nd ed.; RAKLI ry: Helsinki, Finland, 2012. [Google Scholar]

- Ferreira, F.S. Blockchain for Real Estate: A Systematic Literature Review. In Proceedings of the 29th International Conference on Information Systems Development, Valencia, Spain, 15 April 2021; p. 12. [Google Scholar]

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where Is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Clack, C.D.; Bakshi, V.A.; Braine, L. Smart Contract Templates: Foundations, design landscape and research directions. arXiv 2017, arXiv:1608.00771. [Google Scholar]

- Tian, Y.; Lu, Z.; Adriaens, P.; Minchin, R.E.; Caithness, A.; Woo, J. Finance infrastructure through blockchain-based tokenization. Front. Eng. Manag. 2020, 7, 485–499. [Google Scholar] [CrossRef]

- Wang, Q.; Li, R.; Wang, Q.; Chen, S. Non-Fungible Token (NFT): Overview, Evaluation, Opportunities and Challenges. arXiv 2021, arXiv:2105.07447. [Google Scholar]

- Bennett, R.; Miller, T.; Pickering, M.; Kara, A.-K. Hybrid Approaches for Smart Contracts in Land Administration: Lessons from Three Blockchain Proofs-of-Concept. Land 2021, 10, 220. [Google Scholar] [CrossRef]

- Bennett, R.M.; Pickering, M.; Sargent, J. Transformations, transitions, or tall tales? A global review of the uptake and impact of NoSQL, blockchain, and big data analytics on the land administration sector. Land Use Policy 2019, 83, 435–448. [Google Scholar] [CrossRef]

- Anand, A.; MCKibbin, M.; Pichel, F. Colored Coins: Bitcoin, Blockchain, and Land Administration; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Rodima-Taylor, D. Digitalizing land administration: The geographies and temporalities of infrastructural promise. Geoforum 2021, 122, 140–151. [Google Scholar] [CrossRef]

- Vos, J.; Lemmen, C.; Beentjes, B. Blockchain-Based Land Administration Feasible, Illusory or a Panacae? In Proceedings of the 2017 World Bank Conference on Land and Poverty, Washington, DC, USA, 21 March 2017; The World Bank: Washington, DC, USA, 2017; p. 32. [Google Scholar]

- Baum, A. Tokenization—The Future of Real Estate Investment? J. Portf. Manag. 2021, 47, 41–46. [Google Scholar] [CrossRef]

- Baum, A. Tokenisation: The Future of Real Estate Investment? The Future of Real Estate Initiative; Saïd Business School, University of Oxford: Oxford, UK, 2020; p. 61. [Google Scholar]

- Konashevych, O. General Concept of Real Estate Tokenization on Blockchain. Eur. Prop. Law J. 2020, Forthcoming. [Google Scholar] [CrossRef]

- Garcia-Teruel, R.M. Legal challenges and opportunities of blockchain technology in the real estate sector. J. Prop. Plan. Environ. Law 2020. ahead-of-print. [Google Scholar] [CrossRef]

- von Wangenheim, G. Blockchain-Based Land Registers: A Law-and-Economics Perspective. In Disruptive Technology, Legal Innovation, and the Future of Real Estate; Lehavi, A., Levine-Schnur, R., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 103–122. ISBN 978-3-030-52387-9. [Google Scholar]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; Group, T.P. Preferred Reporting Items for Systematic Reviews and Meta-Analyses: The PRISMA Statement. PLOS Med. 2009, 6, e1000097. [Google Scholar] [CrossRef] [PubMed]

- Briner, R.B.; Denyer, D.; Rousseau, D.M. Evidence-based management: Concept cleanup time? Acad. Manag. Perspect. 2009, 23, 19–32. [Google Scholar] [CrossRef]

- Friese, S. Qualitative Data Analysis with ATLAS.ti, 3rd ed.; Sage: London, UK, 2019; ISBN 978-1-5264-5498-0. [Google Scholar]

- UN Economic Commission of Europe. Land Administration Guidelines With Special Reference to Countries in Transition|UNECE; United Nations: Geneva, Switzerland, 1996. [Google Scholar]

- Bal, M. Securing Property Rights in India through Distributed Ledger Technology; ORF Occasional PAPER # 105; Observer Research Foundation: Delhi, India, 2017; p. 22. [Google Scholar]

- Colindres, J.C.; Panting, G. 2016 IPRI—Case Study: Using Blockchain to Secure Honduran Land Titles; 2016 International Property Rights Index; Fundacion Eleutra: San Pedro Sula, Honduras, 2016; p. 15. [Google Scholar]

- Proskurovska, A. Postponed Blockchain Transformation of Land and Property Markets. The Case of Sweden. In Third FIBREE Global Industry Report—Blockchain & Real Estate; Jedelsky, A., Ed.; Global Industry Report; FIBREE: Vienna, Austria, 2021; pp. 12–13. [Google Scholar]

- Kshetri, N.; Voas, J. Blockchain in Developing Countries. IT Prof. 2018, 20, 11–14. [Google Scholar] [CrossRef]

- Kshetri, N. Will blockchain emerge as a tool to break the poverty chain in the Global South? Third World Q. 2017, 38, 1710–1732. [Google Scholar] [CrossRef]

- Konashevych, O. Comparative Analysis of the Legal Concept of Title Rights in Real Estate and the Technology of Tokens: How Can Titles Become Tokens? In Proceedings of the Financial Cryptography and Data Security, Christ Church, Barbados, 7 March 2014; Zohar, A., Eyal, I., Teague, V., Clark, J., Bracciali, A., Pintore, F., Sala, M., Eds.; Springer: Berlin/Heidelberg, Germany, 2019; pp. 339–351. [Google Scholar]

- Konashevych, O. Constraints and Benefits of the Blockchain Use for Real Estate and Property Rights. J. Prop. Plan. Environ. Law Forthcom. 2020, Forthcoming. [Google Scholar] [CrossRef]

- Verheye, B. Land Registration in the Twenty-First Century: Blockchain Land Registers from a Civil Law Perspective. In Disruptive Technology, Legal Innovation, and the Future of Real Estate; Lehavi, A., Levine-Schnur, R., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 123–135. ISBN 978-3-030-52387-9. [Google Scholar]

- Sandberg, H. Why Blockchain Technology Will Never Replace The Land Registry Office. SSRN J. 2021. [Google Scholar] [CrossRef]

- Lehavi, A. The Future of Property Rights: Digital Technology in the Real World. In Disruptive Technology, Legal Innovation, and the Future of Real Estate; Lehavi, A., Levine-Schnur, R., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 59–79. ISBN 978-3-030-52387-9. [Google Scholar]

- Garcia-Teruel, R.M.; Simón-Moreno, H. The digital tokenization of property rights. A comparative perspective. Comput. Law Secur. Rev. 2021, 41, 105543. [Google Scholar] [CrossRef]

- Berryhill, J.; Bourgery, T.; Hanson, A. Blockchains Unchained: Blockchain Technology and its Use in the Public Sector; OECD Working Papers on Public Governance; OECD: Paris, France, 2018. [Google Scholar]

- Quiniou, M. Chapter 5.5: The renewal of the cadastral system by the blockchain. In Blockchain: The Advent of Disintermediation; Wiley: London, UK, 2019; ISBN 978-1-119-62957-3. [Google Scholar]

- Ekemode, B.G.; Olapade, D.; Shiyanbola, E. Resolving the Land Title Registration Debacle: The Blockchain Technology Option. In Proceedings of the Environmental Design and Management International Conference, Ile-Ife, Nigeria, 27 June 2019. [Google Scholar]

- Sheikh, M.A.; Khattak, F.; Khan, G.Z.; Hussain, F.K. Secured Land Title Transfer System in Australia using VPN based Blockchain Network. In Proceedings of the 2022 24th International Conference on Advanced Communication Technology (ICACT), PyeongChang Kwangwoon_Do, Korea, 13–16 February 2022; pp. 125–131. [Google Scholar]

- Yapicioglu, B.; Leshinsky, R. Blockchain as a tool for land rights: Ownership of land in Cyprus. J. Prop. Plan. Environ. Law 2020, 12, 171–182. [Google Scholar] [CrossRef]

- Sladic, G. A Blockchain Solution for Securing Real Property Transactions: A Case Study for Serbia. ISPRS Int. J. Geo-Inf. 2021, 10, 35. [Google Scholar] [CrossRef]

- Thakur, V.; Doja, M.N.; Dwivedi, Y.K.; Ahmad, T.; Khadanga, G. Land records on Blockchain for implementation of Land Titling in India. Int. J. Inf. Manag. 2019, 52, 101940. [Google Scholar] [CrossRef]

- Balaji, S. BlockChain based Secure Smart Property Registration Management System and Smart Property Cards. Eng. Technol. Appl. Sci. Res. 2019, 7, 1259–1267. [Google Scholar] [CrossRef]

- Nandi, M.L.; Nandi, S.; Moya, H.; Kaynak, H. Blockchain technology-enabled supply chain systems and supply chain performance: A resource-based view. Supply Chain. Manag. Int. J. 2020, 25, 841–862. [Google Scholar] [CrossRef]

- Ramya, U.M.; Sindhuja, P.; Atsaya, R.; Bavya Dharani, B.; Manikanta Varshith Golla, S. Reducing Forgery in Land Registry System Using Blockchain Technology. In Proceedings of the Advanced Informatics for Computing Research, Shimla, India, 14–15 July 2018; Luhach, A.K., Singh, D., Hsiung, P.-A., Hawari, K.B.G., Lingras, P., Singh, P.K., Eds.; Springer: Singapore, 2019; pp. 725–734. [Google Scholar]

- Soner, S.; Litoriya, R.; Pandey, P. Exploring Blockchain and Smart Contract Technology for Reliable and Secure Land Registration and Record Management. Wirel. Pers. Commun. 2021, 121, 2495–2509. [Google Scholar] [CrossRef]

- Nandini, K.; Girisha, G.S. Proof of Authentication for Secure and Digitalization of Land Registry Using Blockchain Technology. In Computer Communication, Networking and IoT; Bhateja, V., Satapathy, S.C., Travieso-Gonzalez, C.M., Flores-Fuentes, W., Eds.; Springer: Singapore, 2021; pp. 283–293. [Google Scholar]

- Humdullah, S.; Othman, S.H.; Razali, M.N.; Mammi, H.K.; Javed, R. An Improved Blockchain Technique for Secure Land Registration Data Records. Int. J. Innov. Comput. 2021, 11, 89–94. [Google Scholar] [CrossRef]

- Shuaib, M.; Alam, S.; Daud, S.M. Improving the Authenticity of Real Estate Land Transaction Data Using Blockchain-Based Security Scheme. In Advances in Cyber Security; Anbar, M., Abdullah, N., Manickam, S., Eds.; Communications in Computer and Information Science; Springer: Singapore, 2021; Volume 1347, pp. 3–10. ISBN 978-981-336-834-7. [Google Scholar]

- Affognon, L.; Saho, N.J.G.; Ezin, E.C. Secure Land System Based on the Ethereum Blockchain: Benin Case Study. In Proceedings of the International Conference on e-Infrastructure and e-Services for Developing Countries, Zanzibar, Tanzania, 1–3 December 2022; Springer: Berlin/Heidelberg, Germany, 2022; pp. 93–106. [Google Scholar]

- Lemieux, V.L. Evaluating the Use of Blockchain in Land Transactions: An Archival Science Perspective. Eur. Prop. Law J. 2017, 6, 392–440. [Google Scholar] [CrossRef]

- Lemieux, V.; Rowell, C.; Seidel, M.-D.L.; Woo, C.C. Caught in the middle? Strategic information governance disruptions in the era of blockchain and distributed trust. Rec. Manag. J. 2020, 30, 301–324. [Google Scholar] [CrossRef]

- Alketbi, A.; Nasir, Q.; Abu Talib, M. Novel blockchain reference model for government services: Dubai government case study. Int. J. Syst. Assur. Eng. Manag. 2020, 11, 1170–1191. [Google Scholar] [CrossRef]

- Ameyaw, P.D.; de Vries, W.T. Toward Smart Land Management: Land Acquisition and the Associated Challenges in Ghana. A Look into a Blockchain Digital Land Registry for Prospects. Land 2021, 10, 239. [Google Scholar] [CrossRef]

- Shang, Q.; Price, A. A Blockchain-Based Land Titling Project in the Republic of Georgia: Rebuilding Public Trust and Lessons for Future Pilot Projects. Innov. Technol. Gov. Glob. 2018, 12, 72–78. [Google Scholar] [CrossRef]

- Kempe, M. The Land Registry in the Blockchain—Testbed; Kairos Future: Stockholm, Sweden, 2017. [Google Scholar]

- Goderdzishvili, N.; Gordadze, E.; Gagnidze, N. Georgia’s Blockchain-powered Property Registration: Never blocked, Always Secured: Ownership Data Kept Best! In Proceedings of the 11th International Conference on Theory and Practice of Electronic Governance, Galway, Ireland, 4–6 April 2018; ACM: Galway, Ireland, 2018; pp. 673–675. [Google Scholar]

- McMurren, J.; Young, A.; Verhulst, S. Addressing Transaction Costs through Blockchain and Identity in Swedish Land Transfers; Blockchain Technologies for Social Change: New York, NY, USA, 2018; p. 13. [Google Scholar]

- Benbunan-Fich, R.; Castellanos, A. Digitalization of Land Records: From Paper to Blockchain. In Proceedings of the Thirty Ninth International Conference on Information Systems, San Francisco, CA, USA, 13–16 December 2018; p. 10. [Google Scholar]

- Lazuashvili, N.; Norta, A.; Draheim, D. Integration of Blockchain Technology into a Land Registration System for Immutable Traceability: A Casestudy of Georgia. In Business Process Management: Blockchain and Central and Eastern Europe Forum; Di Ciccio, C., Gabryelczyk, R., García-Bañuelos, L., Hernaus, T., Hull, R., Indihar Štemberger, M., Kő, A., Staples, M., Eds.; Lecture Notes in Business Information Processing; Springer International Publishing: Cham, Switzerland, 2019; Volume 361, pp. 219–233. ISBN 978-3-030-30428-7. [Google Scholar]

- Eder, G. Digital Transformation: Blockchain and Land Titles. In Proceedings of the OECD Global Anti-Corruption & Integrity Forum, Paris, France, 20–21 March 2019; p. 12. [Google Scholar]

- Konashevych, O. ‘GoLand Registry’ Case Study: Blockchain/DLT Adoption in Land Administration in Afghanistan. In Proceedings of the DG.O2021: The 22nd Annual International Conference on Digital Government Research, Omaha, NE, USA, 9–11 June 2021; ACM: Omaha, NE, USA, 2021; pp. 489–494. [Google Scholar]

- Allessie, D.; Sobolewski, M.; Vaccari, L.; Pignatelli, F. Blockchain for Digital Government—An Assessment of Pioneering Implementations in Public Services; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar]

- Akhmetbek, Y.; Špaček, D. Opportunities and Barriers of Using Blockchain in Public Administration: The Case of Real Estate Registration in Kazakhstan. NISPAcee J. Public Adm. Policy 2021, 14, 41–64. [Google Scholar] [CrossRef]

- Kshetri, N. Blockchain as a tool to facilitate property rights protection in the Global South: Lessons from India’s Andhra Pradesh state. Third World Q. 2022, 43, 371–392. [Google Scholar] [CrossRef]

- Proskurovska, A.; Dörry, S. The blockchain challenge for Sweden’s housing and mortgage markets. Environ. Plan. A 2022, 54, 1569–1585. [Google Scholar] [CrossRef]

- Shuaib, M.; Daud, S.M.; Alam, S.; Khan, W.Z. Blockchain-based framework for secure and reliable land registry system. TELKOMNIKA 2020, 18, 2560–2571. [Google Scholar] [CrossRef]

- de Soto, H. A tale of two civilizations in the era of Facebook and blockchain. Small Bus. Econ. 2017, 49, 729–739. [Google Scholar] [CrossRef]

- Kundu, D. Blockchain and Trust in a Smart City. Environ. Urban. ASIA 2019, 10, 31–43. [Google Scholar] [CrossRef]

- Laurence, T. Blockchain For Dummies; John Wiley & Sons: Hoboken, NJ, USA, 2019; ISBN 978-1-119-55501-8. [Google Scholar]

- Natarajan, H.; Krause, S.; Gradstein, H. Distributed Ledger Technology and Blockchain; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Werbach, K. Trust, but verify: Why the blockchain needs the law. Berkeley Technol. Law J. 2018, 33, 64. [Google Scholar]

- Laarabi, M.; Maach, A.; Hafid, A.S. Smart contracts and over-enforcement: Analytical considerations on Smart Contracts as Legal Contracts. In Proceedings of the 2020 1st International Conference on Innovative Research in Applied Science, Engineering and Technology (IRASET), Meknes, Morocco, 16–19 April 2020; pp. 1–6. [Google Scholar]

- Themistocleous, M. Blockchain Technology and Land Registry. Cyprus Rev. 2018, 30, 8. [Google Scholar]

- Ali, T.; Nadeem, A.; Alzahrani, A.; Jan, S. A Transparent and Trusted Property Registration System on Permissioned Blockchain. In Proceedings of the 2019 International Conference on Advances in the Emerging Computing Technologies (AECT), Al Madinah Al Munawwarah, Saudi Arabia, 10 February 2020; pp. 1–6. [Google Scholar]

- Kumar, R.; Sarhyajith, R.; Naveen Kumar, U.; Pushpalatha, M. A performance comparison of different security hashing in a blockchain based system that enables a more reliable and swift registration of land. Int. J. Adv. Sci. Technol. 2020, 29, 1–6. [Google Scholar]

- Ameyaw, P.D.; de Vries, W.T. Transparency of Land Administration and the Role of Blockchain Technology, a Four-Dimensional Framework Analysis from the Ghanaian Land Perspective. Land 2020, 9, 491. [Google Scholar] [CrossRef]

- Spielman, A. Blockchain: Digitally Rebuilding the Real Estate Industry. Ph.D. Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2016. [Google Scholar]

- Ponmalar, A.; Poovarasan, M.; Keerthana, G.; Yogesh, A.; Dhanakoti, V. Efficient Registration of Land using Block Chain Technology. IJRTE 2019, 8, 77–82. [Google Scholar] [CrossRef]

- Kalyuzhnova, N. Transformation of the real estate market on the basis of use of the blockchain technologies: Opportunities and problems. MATEC Web Conf. 2018, 212, 06004. [Google Scholar] [CrossRef][Green Version]

- Kiu, M.S.; Chia, F.C.; Wong, P.F. Exploring the potentials of blockchain application in construction industry: A systematic review. Int. J. Constr. Manag. 2020, 1–10. [Google Scholar] [CrossRef]

- Joshi, S.M.; Rajeswari, K. Efficient and Accurate Property Title Retrieval Using Ethereum Blockchain. In Sustainable Communication Networks and Application; Karrupusamy, P., Chen, J., Shi, Y., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 424–438. [Google Scholar]

- Al-Saqaf, W.; Seidler, N. Blockchain technology for social impact: Opportunities and challenges ahead. J. Cyber Policy 2017, 2, 338–354. [Google Scholar] [CrossRef]

- Khalafi, A. Blockchain and Real Estate Industry. Master’s Thesis, Metropolia University of Applied Sciences, Helsinki, Finland, 2019. [Google Scholar]

- Veuger, J. Dutch blockchain, real estate and land registration. J. Prop. Plan. Environ. Law 2020. [Google Scholar] [CrossRef]

- Bhatia, K.; Vij, J.; Kumar, H.; Sharma, Y. Exploration of Blockchain Based Solution for Real-Estate. IJSRCSEIT 2019, 957–962. [Google Scholar] [CrossRef]

- Latifi, S.; Zhang, Y.; Cheng, L.-C. Blockchain-Based Real Estate Market: One Method for Applying Blockchain Technology in Commercial Real Estate Market. In Proceedings of the 2019 IEEE International Conference on Blockchain (Blockchain), Atlanta, GA, USA, 14–17 May 2019; pp. 528–535. [Google Scholar]

- Nijland, M.; Veuger, J. Influence of Blockchain in the Real Estate Sector. Int. J. Appl. Sci. 2019, 2, 22. [Google Scholar] [CrossRef]

- Pankratov, E.; Grigoryev, V.; Pankratov, O. The blockchain technology in real estate sector: Experience and prospects. IOP Conf. Ser. Mater. Sci. Eng. 2020, 869, 062010. [Google Scholar] [CrossRef]

- Shtofman, K. Blockchain technology for corporate real estate: Separating hype from reality. Corp. Real Estate J. 2019, 8, 253–264. [Google Scholar]

- Baum, A. PropTech 3.0: The Future of Real Estate; University of Oxford Research: Oxford, UK, 2017. [Google Scholar]

- Al-Naji, F.H.; Zagrouba, R. A survey on continuous authentication methods in Internet of Things environment. Comput. Commun. 2020, 163, 109–133. [Google Scholar] [CrossRef]

- Hewa, T.; Ylianttila, M.; Liyanage, M. Survey on blockchain based smart contracts: Applications, opportunities and challenges. J. Netw. Comput. Appl. 2020, 177, 102857. [Google Scholar] [CrossRef]

- Nasarre-Aznar, S. Collaborative housing and blockchain. Administration 2018, 66, 59–82. [Google Scholar] [CrossRef]

- Stoica, M.; Ghilic-Micu, B.; Mircea, M. Restarting the Information Society Based on Blockchain Technology. Inform. Econ. Buchar. 2019, 23, 39–48. [Google Scholar] [CrossRef]

- Graglia, J.M.; Mellon, C. Blockchain and Property in 2018: At the End of the Beginning. Innov. Technol. Gov. Glob. 2018, 12, 90–116. [Google Scholar] [CrossRef]

- Patil, M. Land Registry on Blockchain. Master’s Thesis, San José State University, San José, CA, USA, 2020. [Google Scholar]

- Torky, M.; Hassanein, A.E. Integrating blockchain and the internet of things in precision agriculture: Analysis, opportunities, and challenges. Comput. Electron. Agric. 2020, 178, 105476. [Google Scholar] [CrossRef]

- Chavez-Dreyfuss, G. Sweden Tests Blockchain Technology for Land Registry. Available online: https://www.reuters.com/article/us-sweden-blockchain-idUSKCN0Z22KV (accessed on 17 June 2020).

- Kakavand, H.; Kost De Sevres, N.; Chilton, B. The Blockchain Revolution: An Analysis of Regulation and Technology Related to Distributed Ledger Technologies; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Morkunas, V.J.; Paschen, J.; Boon, E. How blockchain technologies impact your business model. Bus. Horiz. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Verman, A.; Khanna, V.; Tanwar, P. Design of Blockchain System for a Real Estate (a Revolution). In Proceedings of the 5th International Conference on Cyber Security & Privacy in Communication Networks (ICCS), Rochester, NY, USA, 29–30 November 2019; Social Science Research Network: Rochester, NY, USA, 2019. [Google Scholar]