Abstract

This paper reports an extension of schema incongruity theory to a service form of fast-moving consumer goods (FMCG) distributed via a digital platform. According to this theory, an FMCG brand’s service form would be incongruent compared to its traditional form available via supermarkets. Based on the relevancy and expectancy dimensions, the level of incongruence for such a service was classed as moderately incongruent. The study used qualitative research to investigate whether the moderate incongruence appealed to modern-day customers. The findings revealed that a subscription to receive a regular supply of the FMCG test brand appealed to the respondents. The moderate incongruity employed in this study was of an optimal stimulation level, enabling respondents to see the added values offered. The values recognised included convenience, family bonding, health and variety. The study observed schema incongruity theory operating for the service form of the FMCG brand. As the study used a qualitative methodology, the findings are specific to the brand and context tested. However, the high interest observed suggests schema incongruity theory could serve as a framework for using a digital distribution system to market service forms of FMCG brands.

1. Introduction

Online distribution is a hallmark of modern society. The global sales via this channel totalled 4.28 trillion US dollars in 2020 and are expected to reach 5.4 trillion in 2022 [1]. The sector driving online sales is fast-moving consumer goods (FMCG), reportedly growing four times faster than in-store sales [2]. This growth was further propelled by COVID19, with online grocery sales increasing threefold at the start of the pandemic [3]. The popularity of this channel is because of its convenience [4,5]. It appeals to a broad range of consumers, including high-income earners, individuals with disabilities and parents with young children [6,7].

Consequent to customers’ approval of shopping from online stores, many firms have integrated a digital channel into their existing channels, forming a multi- or omni-channel distribution system [8,9]. FMCG organisations can also use this type of distribution to reach their target market. However, they need to innovate their offerings to provide substantial additional values that appeal to customers. This paper investigated schema incongruity theory for innovating FMCG offerings into service forms that can be distributed via a digital channel. The study used a well-known New Zealand FMCG brand specialising in breakfast cereal. Using an exploratory approach, the study enquired respondents about their approval and willingness to purchase a service form of the brand from a digital portal, which was the moderate incongruity tested. The study was undertaken to primarily understand the operation of schema incongruity theory in a digital environment for a category usually not aligned with this channel. The findings suggest the theory could serve as a framework for digitising the distribution of FMCGs. The paper first traces the development of using a digital channel for distributing FMCGs. Next, it discusses a service form for FMCG brands. This is followed by a literature review on schema incongruity theory. The paper then reports a study that tested this theory for a service form of an FMCG brand, distributed using a digital distribution channel. It is envisaged that such FMCG-based services will grow in popularity as they meet the needs of modern-day customers not met by the traditional channels.

2. Development of a Digital Channel

The co-existence of online and offline channels has led to customers using multiple channels when shopping [10,11]. One study reported this multi-channel shopping behaviour for 65% of online shoppers [6]. Another study, across seven countries (US, UK, France, Switzerland, The Netherlands, Germany and China), found this behaviour prevalent for more than half of the sample (54%) [12]. The multi-channel shopping behaviour of consumers has prompted firms to adopt a multi-channel strategy comprising online and offline channels [9,13].

Firms employing the multi-channel strategy reported an overall increase in turnover [14], explained by the complementarity theory [15,16]. Initially, complementarity between the channels mainly provided product information, referred to as a billboard effect [16]. The complementarity has evolved, forming different types of multi-channel distribution. Beck and Rygl (2015) [17] provided a classification that included multi-channel, cross-channel and omni-channel distribution. Their classification was based on how the system allowed customers and firms to interact simultaneously between the channels. What is currently gaining popularity is omni-channel distribution, which claims to seamlessly integrate all channels [8,18,19]. The integration connects the channels to a master database allowing firms to have the same pricing strategy and assortment across all the channels. In this distribution structure, customers can initiate a purchase on one channel and complete the same on another without losing the transaction.

3. Omni-Channel Distribution

Omni-channel distribution integrates multiple channels that include all or a combination of catalogue, brick-and-mortar stores, telemarketing and online portal to provide customers with a seamless shopping experience [20]. This distribution enhanced the customer experience through the synergy between the channels and customer touchpoints [9,21]. Customers ubiquitously moved between the channels to research and make informed decisions [22,23]. Thus omni-channel distribution enhanced customer experience and freedom to make informed decisions, resulting in a substantial increase in demand in the channels [24,25]. The synergy of the channels explains the increase in the overall turnover researchers have reported [15,16]. Even firms that started online increased their turnover when they expanded to omni-channel distribution. For example, Pauwels and Neslin reported a 20% increase in the overall revenue for an online retail store when it opened a physical outlet [26].

A key success factor external to an omni-channel distribution system is the fast delivery of goods to remote locations. The system achieved this by holding stocks in warehouses close to the marketplace [27]. One study reported that opening a distribution centre increased online sales by $3.8 million and in-store sales by $8.6 million [28]. In the current environment, courier companies are innovating to provide logistic support for firms [29]. For example, DHL, FedEx and the US Postal Service have developed technology that can plug into an omni-channel distribution system to provide fast delivery without a glitch [30,31,32]. Thus, small and medium-sized enterprises can now outsource their digital distribution to the courier and logistic service providers.

In addition to increasing the turnover, omni-channel distribution systems generate big data that can be mined for advanced analytics [33,34]. Such omni-channel-based analytics enables firms to make customer-centric marketing and sales decisions [35]. Moreover, the cost of accessing and using their own big data would be relatively low compared to the typical cost of brand scan or scanner data obtained from data integrators.

The benefits of an omni-channel distribution system and the multi-channel shopping behaviour of customers have prompted firms to integrate digital distribution into their physical outlets [36,37]. Supermarkets were the earliest firms to integrate online channels into their distribution mix [6,38,39]. Many have successfully adopted Tesco’s channel structure of home delivery [5] and the click-and-collect format [40]. One French supermarket successfully implemented a click-and-drive format to avoid home delivery [41]. These structures suggest considerable flexibility in integrating online to the existing distribution to form an omni-channel distribution.

4. Challenges FMCG Organisations Are Facing

FMCG firms are often reluctant to sell directly to customers, let alone start their own digital distribution system. One common reason for this is not to upset channel intermediaries. Typically, these firms also lack the breadth of product assortment required to attract enough customers to buy from their outlets. Furthermore, there needs to be a more compelling value proposition than just convenience to get customers to shop at their online or offline stores. While these reasons are genuine, there is also an urgency for FMCG organisations to establish their channel, mainly because they are losing market control and thus profit margins to supermarket chains. For example, Walmart is the single dominant player in the US. In many small cities like Atchison in Kansas (95% market share), Portale in New Mexico (95% market share) and Sterling in Colorado (91% market share), Walmart is the leading supplier of grocery [42]. Canada has five players (Loblaws, Sobeys, Metro, Costco, and Walmart) who control 62% of the grocery market [43]. The trend is the same for smaller economies, except the dominant players practically control the market. For example, in New Zealand, Foodstuff and Progressive Enterprise control 97% of the national food retail market [44]. Because of the sheer size, supermarkets control the access to customers within the grocery sector.

In addition to the size, supermarket chains promote their labels that have grown in popularity [45,46]. The high demand for supermarket labels means they take up more shelf space [47]. As such, shelf space available to FMCG brands is declining [48,49]. Furthermore, customer awareness and satisfaction with supermarket labels are on the rise, which in turn is changing the low-quality perception they previously had [50]. This change in perception is almost nullifying the marketing efforts of FMCG brands. For example, a pricing strategy to convey quality no longer works because of the high approval rate of supermarket labels [51]. The reduced access to customers and shelf space, combined with the paralysing of marketing strategy, has resulted in some FMCG brands vanishing off the shelves [52,53]. It is also causing FMCG organisations to shy away from costly product innovation [54].

5. Pathway Forward for FMCG Organisations

FMCG organisations need not remain in a state of doldrums. Several socio-economic changes with the modern-day consumers are opening new service opportunities for these organisations. In particular, the changes observed in consumer lifestyle are worth noting. For example, a ‘responsible or sustainable lifestyle’ is increasing in popularity with consumers [55,56]. This lifestyle is about people living harmoniously with one another and the environment, making them frugal with their consumption choices. These customers valued purchasing package-free products delivered to their homes [57]. One study observed that offering to supply package-free products enabled establishing a relationship between the firm and customers because of the shared value [58].

Another change is the growth of conscious consumers, who want to be socially responsible [59] and environmentally friendly [60] with their consumption behaviour. One US study reported that such individuals are more concerned about issues affecting their well-being (e.g., safe drinking water, clean air and cures for diseases) than global issues [61]. This type of consumer has given rise to green brands that promote sustainable consumption [62].

Some consumers need a regular supply of speciality products because of their health. For example, In the US alone, approximately 1.8 million people have Celiac Disease [63]. About 1 in 100 people worldwide suffer from this disease [64]. The treatment for this disease is a strict gluten-free diet. Hence, a service essential for household members with Celiac Disease is a regular supply of gluten-free whole grains (e.g., quinoa, brown rice, oats).

By shifting from a product to a service orientation, FMCG manufacturers could cater to the unique needs of present-day consumers such as the ones mentioned above. The service could be accessed via a digital portal. The system supporting the digital portal can be made accessible from multiple locations (e.g., brick-and-mortar, online ad links and telemarketing), evolving into an omni-channel distribution system. Thus, FMCG organisations can take up the supply of products within their product category that promotes health and wellness that cannot be obtained from traditional retail outlets. The development of a supply service distributed via a digital channel needs a theoretical framework. At the time of developing this research, no theoretical framework for this was established in the relevant literature. Hence, the study reported in this paper investigated Mandler’s schema incongruity theory for innovating FMCG brands into service forms that can be distributed via a digital channel [65].

6. Schema Incongruity Theory

A schema is a mental network of information that represents knowledge. New information gets tagged to the schema network to expand one’s knowledge base [66]. When new information is congruent to what is already known, it integrates into the schema. On the contrary, when the information is incongruent, it results in cognitive dissonance. Sometimes incongruent information could result in cognitive consonance. In the latter instances, the information integrates with the existing schema, despite the incongruence. Hyundai’s Santa Fe 4WD advertisement observed these two types of reactions. This advertisement used a ‘baby in a nappy’ metaphor to convey the ease of driving this SUV. The ad was well-received in New Zealand, even getting the Fair Go viewers award for the most popular ads, whereas in Australia, it received complaints resulting in it being banned [67]. Mandler proposed schema incongruity theory to explain how the human mind responds to incongruency [65]. According to this theory, the human mind initiates a deeper cognition to resolve the incongruency. The cognitive process would result in one of the two outcomes (accept or reject), as observed for the Santa Fe 4WD advertisement.

Mandler postulated that incongruence effectively incorporated the information into one’s schema network [65]. In some instances, incongruence may generate a new schema, and the idea is accepted without resistance. The challenge, however, is to know beforehand whether the incongruence will be accepted or not. Lee and Schumann [68] provided a framework for understanding this in advance by combining the elaboration likelihood model (ELM) of persuasion proposed by Petty and Cacioppo [69] with schema incongruity theory. The framework comprises two cognitive pathways that individuals use to persuade themselves of something. One is a central pathway that requires careful evaluation of the information, usually adopted by motivated individuals. The other is a peripheral pathway that relies on cues found in the environment. The schema incongruity-ELM framework provides three possible outcomes [68]. The first outcome uses the central pathway, which leads to information (relating to attitudes or solutions) gaining acceptance, thereby getting integrated into the schema network. The second uses the peripheral pathway and the information receives temporal approval but remains susceptible to alteration [69]. The third outcome is the rejection of the information, primarily because of minimal or no cognitive engagement. Layering ELM onto schema incongruity theory explained what it takes for the information to gain acceptance.

The activation of the central pathway is pivotal for the acceptance of an incongruence, requiring an optimal stimulation level (OSL) [70]. While incongruence itself can provide the stimulation, it needs to be mentioned that a below-OSL would not attract the attention of individuals. In contrast, too much stimulation would be viewed as risky and hence ignored [71]. The studies reviewed investigated the congruence-incongruence continuum, using treatments defined as congruent, moderately incongruent and extremely incongruent [72]. Considering that incongruence itself provides stimulation, the treatments mentioned provide three levels of stimulation. These studies have all reported an inverted U-shape curve suggesting that further incongruence exhibited diminishing effectiveness after an optimal level (at the top of the inverted U). The inverted U shape relationship was reported for advertisements (e.g., [73,74]) and new products (e.g., [75,76]). Consequent to the nature of the treatments used in these studies, the precise OSL could not be ascertained. These treatments may be viewed as representing points or areas on the inverted U-shape curve with different levels of stimulation. That is, the congruent area is located at the start of the curve, the moderately incongruent area at the top, and the extremely incongruent area at the terminal end. The effectiveness of the three levels of stimulation may be explained as (1) congruent being predictable, hence would be ignored and not effective, (2) moderately incongruent arouses curiosity and offers novelty, thereby stimulating cognition, hence would be accepted and effective, and (3) extremely incongruent would be risky, hence would be rejected and not effective. As mentioned above, moderate incongruent was observed to be effective for advertisements and new products. Whether this result can be reproduced for other categories needs to be investigated. This is because the effectiveness can be known only after implementation. While the explanation of stimulation based on the inverted U shape curve was straightforward, in practice, the success of schema incongruity theory seems to remain a trial-and-error process.

Based on relevancy and expectancy, Heckler and Childers provided an explanation for defining OSL [77]. These two dimensions can be viewed as the coordinates of OSL required for the incongruence theory to work. The relevancy dimension relates to the extent the stimulation was consistent or inconsistent with the information or topic. The expectancy dimension relates to how the stimulation aligns with the prevailing meaning conjured by the topic. Individuals would assign valences for the two dimensions based on the existing norms or their schema associated with the topic. Based on the two dimensions, the stimulation produced by incongruity could be defined as (1) relevant and expected (congruent or low incongruent), (2) irrelevant and expected or relevant and unexpected (moderately incongruent), and (3) irrelevant and unexpected (extremely incongruent). The two-dimensional framing of incongruity confirmed moderate incongruity was effective for modifying attitudes [78] and recalling messages [77].

The literature reviewed supports the relevancy-expectancy dimensions to frame incongruent themes. In the case of advertising, the moderate incongruity themes were framed as relevant and unexpected to provide the required OSL. Whether the same results can be observed for other categories remains open to investigation. Hence, new research is warranted to identify the OSL when applying the incongruity theory to different categories. This is crucial as the cognitive loading required for processing incongruence varies with the context. The current study focused on identifying the OSL for extending schema incongruity theory to a service form of an FMCG brand distributed via a digital channel.

7. Extending Schema Incongruity Theory to Service Forms of FMCG Brands

There are many success stories of product offerings that were initially incongruent with the digital channel. One such success story is airline companies adopting the digital channel for selling their tickets. Airline companies used to rely heavily on travel agents operating from physical premises. This was because travel arrangements required making several decisions (e.g., travel dates, accommodation, transit). Buying an air ticket was a highly involved purchase, needing the help of travel agents. There was a time when the digital channel was incongruent for this sector. This, however, has changed with online travel sites now able to provide helpful information in near-real-time for customers to make informed travel decisions. Today, the digital channel is the preferred option for making air travel arrangements.

Unlike air travelling, purchasing FMCG products is not a high-involvement decision. Nevertheless, it could be made into a high-involvement decision by making it a service that offers high-level values relating to health and well-being. With time, the success of airline companies in using a digital channel could be experienced by FMCG organisations. The plausibility of this happening is evident in the growing demand for home delivery services of grocery products [79]. Schema incongruity theory, if found appropriate, could provide a framework for FMCG organisations to develop their own digital channels. This study tested the theory for a service form of brand extension for FMCG organisations. Such a service could be distributed via a digital channel that can evolve into an omni-channel distribution system.

8. Service Forms of FMCG Offerings

The primary purpose of branding is to give customers the confidence to make a purchase decision. In the case of FMCGs, this purpose extends to encouraging repeat purchases. Service-based businesses have successfully used digital channels to achieve repeat purchases using subscriptions (e.g., mobile phone plans and insurance). More recently, firms have used subscriptions to distribute perishable products (e.g., vegetables and meat) via a digital channel. For example, My Food Bag successfully used its e-commerce website as a digital channel to distribute ready-to-prepare meals [80]. The business model for this firm comprises selling ready-to-prepare meals via its website delivered to homes. The value offered includes meeting customers’ lifestyle and health needs, which has led My Food Bag to flourish, growing in a few years into a $100 million business [81]. Such services have diffused into most modern economies, suggesting consumers are ready to purchase FMCGs from digital portals.

Service forms of FMCG brands could be achieved by innovating the pricing structure. My Food Bag, as mentioned above, used a subscription plan that feeds a set number of individuals for a given period. For example, their subscription package, My Family, is claimed to be sufficient to feed two adults and 2–3 children for a week, priced at $179.99 [82]. The firm announces its subscription plans online, collects payments via an online portal, and the logistics provider delivers the product to households. Using such a subscription plan, service forms of FMCG brands could be distributed using a digital channel.

According to schema incongruity theory, service forms of FMCG brands would be incongruent from their traditional forms. From the customers’ perspective, substituting a service form for a physical product would seem irrelevant. The incongruity, however, would support using a subscription-based pricing strategy. Such services are currently distributed via a digital portal (e.g., airline tickets), and hence, customers would expect the service forms of FMCG brands to be available via a digital portal. Based on the relevancy and expectancy dimensions, a service form of an FMCG brand would be irrelevant and expected, hence would be of moderate incongruity [71,77,78].

The moderate incongruity described above for an FMCG-based service would offer the OSL required for customers to see its value [65,83]. It is expected that the OSL would help customers make the trade-off between the perceived risk and value [84]. Once customers have made the trade-off in favour of the value, this service form would get integrated into their knowledge schema. After this, purchasing FMCG brands as a service via a digital channel would become an accepted practice, like buying airline tickets, as explained earlier. This study explores whether schema incongruity theory would favour a service form of brand extension for FMCGs that can be transacted via a digital channel. The study was a qualitative investigation carried out to establish the OSL required for this incongruence. The focus was to determine whether schema incongruity theory could explain customers’ preference for a service form of an FMCG brand distributed via a digital channel. In this context, the study sets out to research the following question:

RQ: What is the OSL or optimal extent of incongruency that will encourage customers to purchase a service form of an FMCG brand from a digital channel?

The study employed an exploratory approach, comprising unstructured questions. The unstructured format encouraged respondents to answer the question at length, as in in-depth interviews. The remainder of the paper provides the methodology and discusses the results.

9. Methodology

This study investigated schema incongruity theory using Harraways Oats single sachets. The brand has been a New Zealand household name since 1867 [85]. As such, the brand had sufficient awareness in the market to be used in this investigation. The study used an exploratory approach comprising unstructured questions (see below) presented to respondents in the Facebook environment. The unstructured questions encouraged respondents to express their views at length. Harraways Oats single sachets target women aged 25–35, who are the typical grocery shoppers. The study approached women in this age category via Facebook from the Auckland and Wellington regions of New Zealand. The respondents selected themselves to participate in this study from their locations. The study used a prize draw to win a Harraways Oats hamper to encourage participation.

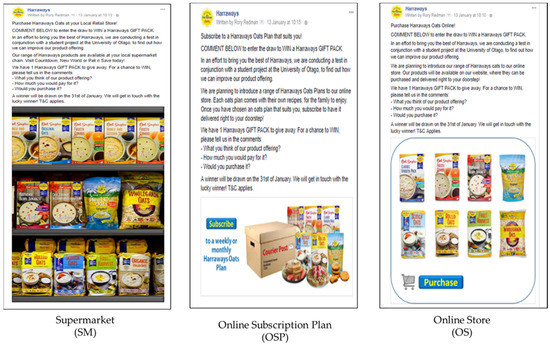

As respondents self-administered the questions, it was crucial to minimise item-order-effect. For this reason, the questions were made into three Facebook posts (see Figure 1). The graphics in the posts made the questions asked relative to the channels represented. The posts were presented to an identical target market from separate postal code areas in Auckland and Wellington. The method prevented participants from accidental exposure to multiple posts.

Figure 1.

Posts with questions about the three shopping channels.

The unstructured questions (shown below) made into the Facebook posts in Figure 1 will be referred to as different treatments for the ease of explaining them. Each post reflected purchasing the test brand from one of the channel options. The posts represented congruence, moderate, and extreme incongruence based on the relevancy and expectancy dimensions. They were depicted purchasing the test brand (1) from a supermarket, here on abbreviated to SM, (2) as a subscription plan, here on referred to as Online Subscription Plan and abbreviated to OSP, and (3) from an Online Store, here on abbreviated to OS (see Figure 1). The treatments are elaborated on below.

9.1. Treatment 1: Supermarket (SM)

Harraways Oats single sachets are purchased by customers while grocery shopping. It is, therefore, a relevant product to include when doing the weekly shopping. As an FMCG, it is expected to be available at most supermarkets. The stimulation is relevant and expected based on the relevancy and expectancy dimensions. Hence buying this product from a supermarket required minimal or below-OSL. This treatment, therefore, was classed as congruent for this study.

9.2. Treatment 2 Online Subscription Plan (OSP)

Harraways Oats single sachets are physical products, hence, a subscription plan is irrelevant. Innovating a service form of this brand would adapt it for distribution using a digital channel. Such services are usually available to customers via a digital portal, making it an expected distribution channel. Based on the relevancy and expectancy dimensions, the stimulation in this treatment is irrelevant and expected. Hence this offering provides the OSL for activating a deep cognitive process. For this study, this treatment was classed as moderately incongruent.

9.3. Treatment 3: Online Store (OS)

Customers purchase Harraways Oats single sachets in small quantities but frequently. Purchasing this product by itself from an online store, therefore, is not practical. The risk associated with such a purchase would be high, making the proposition irrelevant. Consequent to the nature of the purchase, one would not expect to buy this product from an online store. Based on the relevancy and expectancy dimensions, the stimulation in this treatment is irrelevant and unexpected, making the offering extremely incongruent. For this study, this treatment was classed as extremely incongruent.

The three treatments were implemented using Facebook posts and presented to women aged 25–35 in the Auckland and Wellington regions. The posts used visual depiction to convey the respective channels (see Figure 1), along with the following unstructured questions:

What do you think of the offering?

How much would you pay for it?

Would you purchase it?

The posts were presented to separate treatment groups of respondents using Facebook Ads. The study ran for 40 days, covering five weekly shopping cycles. At the end of the study period, data for investigating the research question was obtained from the comment sections of the posts. As the data was qualitative, the study needed to eliminate all possible researcher biases. This was crucial for the study as the researchers could organise the themes to interpret the results in a certain way. For this reason, the study employed a text mining methodology based on an unsupervised machine learning approach in SAS Enterprise Miner version 14.2. The method extracted the themes without the input of the researchers.

10. Thematic Analysis Using Unsupervised Machine Learning

The responses from the comment section of each post were extracted and separately analysed for themes. The text mining methodology first processed the responses to retain only the meaning-making terms (defined as the corpus). This process comprised text parsing, stemming and assigning information weights [86]. The text parsing retained only the meaning-carry terms and assigned them appropriate grammar roles. The terms were stemmed and made into root terms (e.g., “retailing” and “retails” were stemmed to “retail”). A text filtering step then assigned information weights to the terms based on the corpus-term frequencies using the inverse document frequency (IDF) method [87]. The weights ranked the terms by importance. Terms carrying no meaningful information levels were filtered out from the analysis.

The corpora from the three treatments (Facebook posts) comprising stemmed, meaning-carrying terms were subjected to thematic analysis using unsupervised machine learning. Each corpus was first transformed into a term-by-response matrix. The matrix was subjected to data reduction using the singular value decomposition (SVD) method [88]. The SVD technique extracted all strongly supported multiple orthogonal dimensions or themes in the corpus. The terms included in each theme were assigned a theme-term-weight based on their occurrence in each theme. A cut-off score was computed (mean theme-term-weight less one standard deviation) and used to retain the theme’s highly related terms or keywords [86].

The responses included in each theme were separately assigned a “theme-response-weight” based on the occurrence of the keywords (identified by the above procedure) in each response. Again, a cut-off weight was established (mean theme-response-weight plus one standard deviation) to identify the responses for inclusion in the respective theme (refer to Response Cut-Off in Table 1) [86]. The researchers evaluated the keywords, reviewed the exemplar high-ranked complete responses, and assigned meaningful labels to the themes.

Table 1.

Participation by the channel options.

Sentiment analysis was carried out separately for the comments given for the three levels of incongruity represented in the treatments. The researchers reviewed each response and scored them either as a positive or negative sentiment. This analysis helped the researchers to gain a deeper understanding of the views expressed by the respondents. The research question for this study was answered by examining the meaning of the themes and the sentiments expressed for the channels in the treatments.

11. Results

11.1. Data Summary

The study used Facebook Ads to present the three posts to separate treatment groups. The total cost for the ads was $540. As Facebook managed the Ads, there were some differences in the prices and impressions across the three posts (see Table 1). The reach was comparable for the three posts, which produced 83 individual participants for this study. This was a qualitative investigation, and more importantly, the text mining methodology meant the number of respondents provided sufficient textual data needed for making the inferences.

11.2. Engagement with the Posts

The Facebook metrics available for the posts included Comments, Likes, and Shares. The Comments comprised responses given by unique respondents. The numbers of Comments or responses given to the questions in the treatments are shown in Table 2. Likes are a form of passive engagement, but some early inferences arose when considered along with the sentiment expressed in the responses (see Table 2 and Table 3). There were no Shares for any of the posts. This confirmed that none outside the target market viewed the posts, eliminating possible data contamination.

Table 2.

Engagement with the posts.

Table 3.

Sentiment analysis.

11.3. Sentiment Analysis

The sentiment analysis of the responses assessed the strength of the expressed views. Table 3 provides the results of the sentiment analysis.

As shown in Table 3, all the responses received for SM were positive, suggesting the respondents were favourable to the brand’s offerings supplied via supermarkets. The following is a sample response reflecting the good disposition respondents had for the test product:

“Awesome offering. The range is huge and yummo.”[R114]

There were 30 positive comments for OSP, comparable to the positive comments obtained for SM. Below is a typical positive response explaining why the respondent valued this offering.

“Really like it! Such a great, convenient idea. I also love that you can choose different options and also recipe ideas. Perfect to get the kids in the kitchen helping.”[R347]

Respondents were forthcoming with suggestions for this channel option (OSP). They rationalised the idea of a subscription plan in their minds, indicating the activation of a cognitive process. For example, one respondent made the following assertion:

“This could be an awesome idea for people that would like to try different flavours and experiment a bit instead of going for their “usual” at the supermarket. Maybe if you could align yourselves with another brand that ties in with oats to pop in the box, too, something breakfasty that could work as a topper for oats or even as an ingredient for smoothies. I like the idea of it being delivered also.”[R313]

The negative comments for OSP also revealed the activation of a cognitive process. Following is an archetype of the negative comments:

“It’s an interesting concept, but I am not sure it works as a subscription service…What if you were to align yourselves with 2–3 other compatible brands and expand the offering? I would subscribe to an oat-predominant box if I could expect sample or full-size products from other breakfast or baking brands.”[R316]

The responses received for OS indicated the involvement of a cognitive process. For example, the following positive responses provided a context where this option could be appropriate:

“It’s a cool idea, especially for rural people who want good food.”[R236]

The cognitive process was further evident in OS’s negative responses, which were critical about purchasing the product from an online store. Below is an example of the negative sentiment expressed for buying the product from an online store.

“As a parent, I do the groceries every week, so I would not buy online unless it were something that the supermarket does not offer as it would not be worth paying for the postage.”[R214]

As explained in the methodology section, the text mining retained only the terms that carried meaning. The terms were weighted based on their frequency using the inverse document frequency or IDF method. A simple way to interpret the weighting is in terms of ‘importance’. The higher the weighting, the more important that term is in the corpus context (Table 4)

Table 4.

Keywords and their weightings.

11.4. Thematic Analysis

The themes in the corpora were extracted using the SVD method, using unsupervised machine learning. The themes produced for the three channels with the labels, keywords and archetypes are shown in Table 5. The labels were assigned by reviewing the keywords and archetypes.

Table 5.

Themes, key terms and archetype responses.

12. Discussion

This study investigated whether schema incongruity theory could provide a framework for a service form of an FMCG brand distributed using a digital channel. Specifically, the study identified the level of incongruity required for the theory to work. The test brand used to answer the research question was Harraways Oats single sachets. Using an exploratory approach, women aged 25–35 were approached to find their views on purchasing the test brand from alternative channels, representing three levels of incongruity. The channels were the traditional form of buying from a supermarket (SM), depicting congruity, a subscription plan (OSP), depicting moderate incongruity and an online store (OS), depicting extreme incongruity. The study, carried out on Facebook, obtained responses from 83 women aged 25–35 from Auckland and Wellington. The respondents provided detailed answers to the questions presented to them via separate Facebook posts.

The total number of unique engagements was highest for SM (124), followed by OSP (108) and then OS (49) (see Table 2). SM had the highest number of engagements with 100% positive responses (see Table 2 and Table 3). Contrasting the engagement between the two incongruent treatments, OSP had over twice the engagement as OS (108 vs. 49; see Table 2). The moderate incongruity of OSP appears to attract respondents’ attention in producing a higher level of engagement.

12.1. Insights into the Engagement

The sentiment analysis performed on the comments provided further insights into the engagement. As this analysis was carried out separately for the three treatments, it revealed respondents’ attitudes towards each level of incongruity. All the responses for SM, 32 in total, were positive and directed at the brand. Such positive engagement is associated with brand loyalty, repeat purchase behaviour [89], and positive word-of-mouth [90]. As this treatment was congruent to how customers usually purchased this product, the responses did not include any reaction about the channel compared to the two incongruent ones.

OSP received the highest number of responses, a total of 35. The positive responses (30 in total) were explicitly directed at the channel and subscription plan (see the response given by R347 mentioned under Sentiment Analysis). One respondent suggested (R313; mentioned under Sentiment Analysis) including other brands into the subscription plan. This suggestion can potentially be developed into a virtual “breakfast pantry”, evolving into an innovative logistic channel for complementing FMCG brands. The negative responses received for OSP conveyed some scepticism but simultaneously acknowledged it was an interesting concept (e.g., R316). These responses suggest that the respondents did activate their cognition, which is characteristic of schema incongruity theory.

OS received the least number of responses (16 in total). The positive responses (13) were similar to SM, voicing admiration for the brand’s attributes and flavours. The three negative responses for OS conveyed that this was not the preferred channel option to purchase this brand’s product (see the comment made by R214).

All three treatments included positive and negative responses, typical of dynamic transactional communication observed on social media [91]. Furthermore, the positive sentiments observed in the three treatments indicate respondents’ favourable disposition toward the brand. As such, any variation observed between the treatments could be attributed to the stimulation level.

12.2. Thematic Analysis

The responses for the three simulation levels were analysed separately using unsupervised machine learning available in SAS Enterprise Miner version 14.2. The themes uncovered differed for the three levels (see Table 3), which helped to observe the operation of schema incongruity theory. They are discussed below under the respective simulation levels.

12.2.1. Minimal or No Stimulation

In the SM treatment, the themes related to two brand variants (Big packs; Honey & Golden Syrup) and one attribute (Health-conscious). The fourth theme (Generational users) confirmed that many people in New Zealand grew up having this brand for breakfast [85,92]. The responses in this treatment were based on previous experiences (e.g., “I love the big packs of rolled oats. It’s a good price usually…” [R111]). Therefore, the cognitive process required would be minimal or absent, which is the case with ideas or information congruent to what is already known.

12.2.2. Moderately Incongruent

The themes produced for OSP were specific to the brand’s service form (labelled as Convenient, Supply Frequency) and customer segments to whom it would appeal (labelled as Heavy users, Oats lovers). The responses given included approval of the idea (e.g., “Great idea! Convenient, and if it came with different products sometimes, it would give you a reason to try different things” [R311]) and constructive suggestions (e.g., Would also like if you could choose frequency—e.g., a box is $20 a day, but you can get bi-weekly, monthly, or every 2 months [R321]). Giving such responses requires reflection on the idea communicated and evaluating how it would fit into their context. Such reflections and evaluations are evidence of a cognitive process occurring in the respondents’ minds [93,94], and are characteristic of moderate incongruence.

The essence of the themes in this treatment suggests that the service form could strengthen the brand’s image in the customers’ minds (see responses by R347 in the section Sentiment Analysis; R311, R321, R331, R336, and R341 in Table 5). This observation confirms that schema incongruity theory works for this brand’s service form. Encouragingly, the service form appears to meet the needs of the frequent (R321 in Table 5) and heavy (R331 and R336 in Table 5) users of this product. Their interest in OSP was further evident in the suggestions given. For example, the breakfast pantry idea mentioned earlier was based on the responses given by R313 and R316 (see under the section on Sentiment Analysis).

The theme labelled “Oat’s lovers” is worth noting. Respondents stated their children enjoyed eating oats for breakfast; therefore, the service form would help keep their pantry stocked up (R341 in Table 5). Response from R347 (see under Sentiment Analysis) about getting children involved in the kitchen with this brand is worth exploring. It could familiarise the next generation with this service extension, thereby integrating this way of buying the product into their schema networks. Respondents saw the option suitable for family bonding (R347, under Sentiment Analysis) and cooking experience (R331 and R336 in Table 5).

The responses given in this treatment suggest that the service form of this brand provided the necessary OSL for activating a cognitive process. The approval of this form and the novel ideas that respondents suggested indicated that schema incongruity theory works for the brand’s service form. Based on the observations, this brand could potentially extend its market opportunity by innovating its offering to a service form that can be distributed using a digital channel.

12.2.3. Extreme Incongruence

In the case of OS, the themes uncovered related to the channel. Two of them expressed negative views (labelled as Sceptics and Costly), while the third suggested the idea could offer some variety (labelled as Variety). Most of the responses leant toward rejecting the idea, suggesting an aversion to buying the product from a digital channel. This was mainly because of the risk of buying via this channel compared to the traditional channel (e.g., Would need to consider the cost to have it delivered vs. going to the supermarket [R221]).

The responses given in this treatment indicate the presence of a cognitive process. The nature of these responses expressed scepticism (see archetypes for Sceptics and Costly in Table 5), suggesting respondents struggled to find genuine value for this digital channel option. They were emphatic about not purchasing the product from an online store unless the benefits outweighed purchasing from a supermarket (see the responses by R214 under the section Sentiment Analysis; R211 and R221 see in Table 5). Respondents’ concern was evident when examining the importance (in terms of weighting) of the keywords related to the themes. For example, retail price (0.5), postage (0.468), delivery (0.37) and pay (0.312) were the highly weighted terms suggesting they were crucial factors responsible for the non-preference of this channel (see Table 2). While the respondents knew the brand well, they were not keen to purchase it from an online store. The observations made for this treatment confirm the literature that extreme incongruence was ineffective [73,74,75,76].

13. Limitations of the Study

This was an exploratory study that gathered qualitative data from women aged 25–35 who are responsible for their household grocery shopping. As with in-depth interviews, the respondents were presented with three unstructured questions, which they answered at considerable length. The sampling method relied on respondents self-selecting themselves. Hence, some selection bias may be present. Nevertheless, the engagement data and the sentiment analysis suggested that the product was relevant to the respondents and that they were members of the target market of the test brand.

The study used Facebook Adverting to present the questions to potential respondents. Hence, the selection of respondents for each treatment was not under the control of the researchers. However, the procedure successfully obtained responses from individuals belonging to the target market of the test brand. This was confirmed by the researchers scrutinising the Facebook profiles of the respondents. Furthermore, all the responses indicated that the respondents were genuinely interested in the test product.

The methodology adopted ensured the respondents were members of the brand’s target market. The responses obtained indicated that the respondents had previous experience with the product. Hence, the data collected were genuine and valid. The text mining technique examined the importance of the words used in the responses. Furthermore, as the words were free-flowing and produced without any framing control, they conveyed the respondents’ cognition honestly, eliminating social desirability biases.

The qualitative research and sampling technique employed limit the generalisability of the results. Thus, the finding is limited to this study. Future research using quantitative data must be carried out to strengthen the findings. One suggestion is to use a test market method to investigate the digital channel options in a real-life context.

14. Conclusions

This study investigated schema incongruity theory to recommend a digital channel for direct marketing FMCG brands. Specifically, the study set out to identify the OSL required for the operation of the theory on FMCG brands. The research design collected respondents’ views for three levels of stimulation. Based on the relevancy and expectancy dimensions, the levels were characterised as relevant and expected (or congruent), irrelevant and expected (or moderately incongruent) and irrelevant and unexpected (or extremely incongruent). The congruent form was the original product available via supermarkets, the moderate incongruent form was a service form of the product distributed via a digital channel, and the extreme incongruent form was the product available via an online store. The results showed that the moderate incongruent form provided the OSL required for activating respondents’ cognitive process. The cognition stimulation was optimal for recognising multiple values of the offering that included convenience, family bonding, health, regular supply and variety.

This study supported extending schema incongruity theory to a service form of the FMCG test brand. The service form could be marketed as a subscription plan via a digital channel. The active engagement observed exemplifies respondents’ relative interest in this form. The themes identified touched on high-level values, such as family bonding via a shared cooking experience. Such values can help attract a premium price for this online extension. Thus, the market opportunity that OSP offers may be an attractive alternative for this brand.

The current study identified that a service form of the test brand provided the OSL required to attract respondents’ interest. Based on this observation and the literature review, schema incongruity theory offers confidence for the FMCG brand used in this study to innovate a service form of its offerings. Such service forms could be distributed directly to customers using a digital channel. Future research is suggested to strengthen this recommendation with a quantitative investigation.

Author Contributions

Conceptualization, M.P. and R.R.; methodology, M.P.; data curation, D.M. and R.R.; writing—original draft preparation, M.P. and R.R.; writing—review and editing, M.P. and D.M.; visualisation, R.R.; supervision, M.P.; project administration, R.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study received Category B Ethics from the University of Otago (protocol code T4159M dated 30 November 2017).

Informed Consent Statement

Not applicable.

Data Availability Statement

3rd Party Data.

Acknowledgments

The authors acknowledge Harraways Oats (https://www.harraways.co.nz/ accessed on 1 May 2022) for the opportunity to conduct this research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chevalier, S. Retail E-Commerce Sales Worldwide from 2014 to 2024. Statista. 2021. Available online: https://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales/ (accessed on 12 November 2021).

- Duff, E. Online FMCG Sales Growing Four Times Faster than Offline. 2018. Available online: https://www.fmcgceo.co.uk/online-fmcg-sales-growing-four-times-faster-than-offline/ (accessed on 21 April 2022).

- Abbu, H.R.; Fleischmann, D.; Gopalakrishna, P. The Digital Transformation of the Grocery Business-Driven by Consumers Powered by Technology and Accelerated by the COVID-19 Pandemic. In Proceedings of the World Conference on Information Systems and Technologies, Terceira Island, Portugal, 30 March–2 April 2021; Volume 3, pp. 329–339. [Google Scholar]

- CSNEWS. Nielsen: Convenience, Continuous Innovation Key to Retail Success. 2014. Available online: https://csnews.com/nielsen-convenience-continuous-innovation-key-retail-success (accessed on 21 April 2022).

- Roberts, M.; Xu, X.M.; Mettos, N. Internet shopping: The Supermarket Model and Customer Perceptions. J. Electron. Commer. Organ. 2003, 1, 32–43. [Google Scholar] [CrossRef]

- Morganosky, M.A.; Cude, B.J. Consumer Response to Online Grocery Shopping. Int. J. Retail. Distrib. Manag. 2000, 28, 17–26. [Google Scholar] [CrossRef]

- Vijayasarathy, L.R. Predicting Consumer Intentions to Use Online Shopping: The Case for an Augmented Technology Acceptance Model. Inf. Manag. 2004, 41, 747–762. [Google Scholar] [CrossRef]

- Ailawadi, K.L.; Farris, P.W. Managing Multi-and Omni-Channel Distribution: Metrics and Research Directions. J. Retail. 2017, 93, 120–135. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Kannan, P.K.; Inman, J.J. From Multi-Channel Retailing to Omni-Channel Retailing: Introduction to the Special Issue on Multi-Channel Retailing to Omni-Channel Retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Chu, J.; Arce-Urriza, M.; Cebollada-Calvo, J.; Chintagunta, P.K. An Empirical Analysis of Shopping Behaviour Across Online and Offline Channels for Grocery Products: The Moderating Effects of Household and Product Characteristics. J. Interact. Mark. 2010, 24, 251–268. [Google Scholar] [CrossRef]

- Melis, K.; Campo, K.; Breugelmans, E.; Lamey, L. The Impact of the Multi-Channel Retail Mix on Online Store Choice: Does Online Experience Matter? J. Retail. 2015, 91, 272–288. [Google Scholar] [CrossRef]

- Maxwell, J.G.; Hudson, M. Customers Take Control: How the Multi-Channel Shopper Is Changing the Global Retail Landscape. Price Water Cooper. 2011. Available online: https://www.pwc.com/gx/en/retail-consumer/retail-consumer-publications/global-multi-channel-consumer-survey/assets/2011-multi-channel-survey.pdf (accessed on 1 November 2021).

- Chen, L.; Nan, G.; Li, M.; Feng, B.; Liu, Q. Manufacturer’s Online Selling Strategies Under Spillovers from Online to Offline Sales. J Oper. Res. Soci. 2022, 1–24. [Google Scholar] [CrossRef]

- Cao, L.; Li, L. The Impact of Cross-Channel Integration on Retailers’ Sales Growth. J. Retail. 2015, 91, 198–216. [Google Scholar] [CrossRef]

- Shriver, S.; Bollinger, B. Structural Analysis of Multi-Channel Demand. Columbia Bus. Sch. Res. Pap. 2015, 1, 15–50. [Google Scholar] [CrossRef][Green Version]

- Wang, K.; Goldfarb, A. Can Offline Stores Drive Online Sales? J. Mark. Res. 2017, 54, 706–719. [Google Scholar] [CrossRef]

- Beck, N.; Rygl, D. Categorisation of Multiple Channel Retailing in Multi-, Cross-, and Omni-Channel Retailing for Retailers and Retailing. J. Retail. Consum. Serv. 2015, 27, 170–178. [Google Scholar] [CrossRef]

- Cao, L.; Li, L. Determinants of Retailers’ Cross-Channel Integration: An Innovation Diffusion Perspective on Omni-Channel Retailing. J. Interact. Mark. 2018, 44, 1–16. [Google Scholar] [CrossRef]

- Neslin, S.A.; Grewal, D.; Leghorn, R.; Shankar, V.; Teerling, M.L.; Thomas, J.S.; Verhoef, P.C. Challenges and Opportunities in Multi-Channel Customer Management. J. Serv. Res. 2006, 9, 95–112. [Google Scholar] [CrossRef]

- Rigby, D. The Future of Shopping. Harv. Bus. Rev. 2011, 89, 65–76. [Google Scholar]

- Lusch, R.F.; Vargo, S.L.; O’Brien, M. Competing Through Service: Insights from Service-Dominant Logic. J. Retail. 2007, 83, 5–18. [Google Scholar] [CrossRef]

- Pauwels, K.; Leeflang, P.S.H.; Teerling, M.L.; Huizingh, K.R.E. Does Online Information Drive Offline Revenues? Only for Specific Products and Consumer Segments! J. Retail. 2011, 71, 1–17. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Neslin, S.A.B.; Vroomen, B. Multi-Channel Customer Management: Understanding the Research Shopper Phenomenon. Int. J. Res. Mark. 2007, 24, 129–148. [Google Scholar] [CrossRef]

- Bell, D.R.; Gallino, S.; Moreno, A. Offline Showrooms in Omnichannel Retail: Demand and Operational Benefits. Manag. Sci. 2018, 64, 1629–1651. [Google Scholar] [CrossRef]

- Cook, G. Customer Experience in the Omni-Channel World and the Challenges and Opportunities this Presents. J. Direct Data Digit. Mark. Pract. 2014, 15, 262–266. [Google Scholar] [CrossRef]

- Pauwels, K.; Neslin, S.A. Building with Bricks and Mortar: The Revenue Impact of Opening Physical Stores in a Multi-Channel Environment. J. Retail. 2015, 91, 182–197. [Google Scholar] [CrossRef]

- Kumar, R.; Lange, T.; Silen, P. Building Omnichannel Excellence. McKinsey 2016, 1–10. Available online: https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/building-omnichannel-excellence (accessed on 1 December 2021).

- Jindal, R.P.; Gauri, D.K.; Li, W.; Ma, Y. Omnichannel Battle Between Amazon and Walmart: Is the Focus on Delivery the Best Strategy? J. Bus. Res. 2021, 122, 270–280. [Google Scholar] [CrossRef] [PubMed]

- Stojanov, M.; Zhelyazkova, D.; Gramatikova, E. Development of Courier Services in the Context of Omnichannel Strategy. In Proceedings of the 5th International Multidisciplinary Scientific Conference on Social Sciences & Arts (SGEM 2018), Albena, Bulgaria, 26 August–1 September 2018; pp. 261–268. [Google Scholar] [CrossRef]

- DHL. Omni-Channel Retail: Fulfilling Demand Profitably DHL Supply Chain—Excellence. Simply Delivered. 2019. Available online: https://dhl.lookbookhq.com/ao_thought-leadership_omni-channel?utm_source=Eloqua&utm_medium=Eloqua-LP&utm_campaign=OmniChannel2018&utm_content=Always-On&sfid=701440000012aBhAAI (accessed on 12 November 2021).

- FedEx Blogpost. E-Commerce Playbook: Reaching Your Next E-Commerce Goal. Available online: https://www.fedex.com/content/dam/fedex/eu-europe/downloads/ecommerce-playbook-GB.pdf (accessed on 1 December 2021).

- Reblin, G. Marketing Technology Powers Direct Mail and Omni Channel Marketing. USPS Blog, 12 February 2019. Available online: https://uspsblog.com/direct-mail/ (accessed on 21 December 2021).

- Mirzabeiki, V.; Saghiri, S.S. From Ambition to Action: How to Achieve Integration in Omni-Channel? J. Bus. Res. 2020, 110, 1–11. [Google Scholar] [CrossRef]

- Grewal, D.; Roggeveen, A.L.; Nordfält, J. The Future of Retailing. J. Retail. 2017, 93, 1–6. [Google Scholar] [CrossRef]

- Carnein, M.; Heuchert, M.; Homann, L.; Trautmann, H.; Vossen, G.; Becker, J.; Kraume, K. Towards Efficient and Informative Omni-Channel Customer Relationship Management. In Advances in Conceptual Modeling. ER 2017. Lecture Notes in Computer Science; De Cesare, S., Frank, U., Eds.; Springer: Cham, Switzerland, 2017; Volume 10651. [Google Scholar] [CrossRef]

- Campo, K.; Breugelmans, E. Buying Groceries in Brick and Click Stores: Category Allocation Decisions and the Moderating Effect of Online Buying Experience. J. Interact. Mark. 2015, 31, 63–78. [Google Scholar] [CrossRef]

- Fu, Y.; Lai, K.K.; Liang, L. Bricks or clicks: The Impact of Manufacturers’ Encroachment on Both Manufacturer-Owned and Traditional Retail Channels. Asia Pac. J. Mark. Logist. 2013, 25, 695–714. [Google Scholar] [CrossRef]

- Marimon, F.; Vidgen, R.; Barnes, S.; Cristóbal, E. Purchasing Behaviour in an Online Supermarket: The Applicability of ES-QUAL. Int. J. Mark. Res. 2010, 52, 111–129. [Google Scholar] [CrossRef]

- Rafiq, M.; Fulford, H. Loyalty Transfer From Offline to Online Stores in the UK Grocery Industry. Int. J. Retail. Distrib. Manag. 2005, 33, 444–460. [Google Scholar] [CrossRef]

- Mercier, P.; Welch, D.; Crétenot, G. In Omnichannel Retail, It’s Still About Detail. BCG Perspect. 2014, 5, 1–4. [Google Scholar]

- Lapoule, P. The French Grocery Retail Company Intermarché Develops the ‘Click and Drive’ Model. South Asian J. Bus. Manag. Cases 2014, 3, 65–76. [Google Scholar] [CrossRef]

- Durden, T. Visualising Walmart’s Domination of the US Grocery Market. Zero Hedge, 11 August 2019. Available online: https://archive.ph/ER7HI#selection-401.0-449.23 (accessed on 12 November 2021).

- Gain. Canada—Retail Foods Retail Sector Overview—2019. Global Agricultural Information Network, Gain Report Number CA19022. 2019. Available online: https://apps.fas.usda.gov/newgainapi/api/report/downloadreportbyfilename?filename=Retail%20Foods_Ottawa_Canada_7-10-2019.pdf (accessed on 1 December 2021).

- Gain. New Zealand—Retail Food Sector. Global Agricultural Information Network. Gain Report Number NZ9020. 2009. Available online: https://gain.fas.usda.gov/Recent%20GAIN%20Publications/RETAIL%20FOOD%20SECTOR_Wellington_New%20Zealand_11-16-2009.pdf (accessed on 1 December 2021).

- Berges-Sennou, F.; Bontems, P.; Réquillart, V. Economics of Private Labels: A Survey of Literature. J. Agric. Food Ind. Organ. 2004, 2. [Google Scholar] [CrossRef]

- Dobson, P.W. Exploiting Buyer Power: Lessons From the British Grocery Trade. Antitrust Law J. 2005, 72, 529–562. [Google Scholar]

- Wang, Y.; Gerchak, Y. Supply Chain Coordination when Demand is Shelf-Space Dependent. Manuf. Serv. Oper. Manag. 2001, 3, 82–87. [Google Scholar] [CrossRef]

- Gómez, M.; Rubio, N. Shelf Management of Store Brands: Analysis of Manufacturers’ Perceptions. Int. J. Retail. Distrib. Manag. 2008, 36, 50–70. [Google Scholar] [CrossRef]

- Nogales, A.F.; Suarez, M.G. Shelf Space Management of Private Labels: A Case Study in Spanish Retailing. J. Retail. Consum. Serv. 2005, 12, 205–216. [Google Scholar] [CrossRef]

- Matos, P.V.; do Vale, R.C. The Market Power of Private Labels-Retailer’s Brand and Industry Effect. In Marketing Dynamism and Sustainability: Things Change, Things Stay the Same; Springer: Berlin/Heidelberg, Germany, 2015; p. 136. [Google Scholar]

- Davcik, N.S.; Sharma, P. Impact of Product Differentiation, Marketing Investments and Brand Equity on Pricing Strategies: A Brand Level Investigation. Eur. Mark. 2015, 49, 760–781. [Google Scholar] [CrossRef]

- Dobson, P.W.; Zhou, L. The Competition Effects of Look-Alike Private Label Products. In The National Brands and Private Labels in Retailing; Springer: Berlin/Heidelberg, Germany, 2014; pp. 17–26. [Google Scholar]

- Dobson, P.W.; Chakraborty, R. Private Labels and Branded Goods: Consumers’ Horrors and Heroes. In Private Labels, Brands and Competition Policy: The Changing Landscape of Retail Competition; Ezrachi, A., Bernitz, U., Eds.; Oxford University Press: Oxford, UK, 2005; pp. 99–124. [Google Scholar]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and Innovation: An inverted-U Relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar]

- Gierszewska, G.; Seretny, M. Sustainable Behaviour–the Need of Change in Consumer and Business Attitudes and Behaviour. Found. Manag. 2019, 11, 197–208. [Google Scholar] [CrossRef]

- Lubowiecki-Vikuk, A.; Dąbrowska, A.; Machnik, A. Responsible Consumer and Lifestyle: Sustainability Insights. Sustain. Prod. Consum. 2020, 25, 91–101. [Google Scholar] [CrossRef]

- Mommens, K.; Rai, H.B.; Van Lier, T.; Macharis, C. Delivery to Homes or Collection Points? A Sustainability Analysis for Urban, Urbanised and Rural Areas in Belgium. J. Transp. Geogr. 2021, 94, 103095. [Google Scholar] [CrossRef]

- Louis, D.; Lombart, C.; Durif, F. Packaging-Free Products: A Lever of Proximity and Loyalty Between Consumers and Grocery Stores. J. Retail. Consum. Serv. 2021, 60, 102499. [Google Scholar] [CrossRef]

- Giesler, M.; Veresiu, E. Creating the Responsible Consumer: Moralistic Governance Regimes and Consumer Subjectivity. J. Consum. Res. 2014, 41, 840–857. [Google Scholar] [CrossRef]

- Kautish, P.; Soni, S. The Determinants of Consumer Willingness to Search for Environmental-Friendly Products: A survey. Int. J. Manag. 2012, 29, 696. [Google Scholar]

- Bemporad, R.; Baranowski, M. Conscious Consumers Are Changing the Rules of Marketing. Are You Ready? Highlights from the BBMG Conscious Consumer Report. 2007. Available online: https://www.fmi.org/docs/sustainability/BBMG_Conscious_Consumer_White_Paper.pdf (accessed on 1 November 2021).

- Sarkar, A.N. Promoting Eco-Innovations to Leverage Sustainable Development of Eco-Industry and Green Growth. Eur. J. Sustain. Dev. 2013, 2, 171. [Google Scholar]

- Rubio-Tapia, A.; Ludvigsson, J.F.; Brantner, T.L.; Murray, J.A.; Everhart, J.E. The Prevalence of Celiac Disease in the United States. Off. J. Am. Coll. Gastroenterol. ACG 2012, 107, 1538–1544. [Google Scholar] [CrossRef]

- Celiac Disease Foundation. What Is Celiac Disease? 2021. Available online: https://celiac.org/about-celiac-disease/what-is-celiac-disease/ (accessed on 1 November 2021).

- Mandler, G. The Structure of Value: Accounting for Taste. In Affect and Cognition: The 17th Annual Carnegie Symposium; Clark, M.S., Fiske, S.T., Eds.; Lawrence Erlbaum: Hillsdale, NJ, USA, 1982; pp. 3–36. [Google Scholar]

- Beals, D.E. Reappropriating Schema: Conceptions of Development from Bartlett and Bakhtin. Mind Cult. Act. 1998, 5, 3–24. [Google Scholar] [CrossRef]

- Geenty, M. Aussies Ban NZ’s Favourite Car Ad. New Zealand Herald, 23 February 2007. Available online: https://www.nzherald.co.nz/nz/aussies-ban-nzs-favourite-car-ad/HX2NQRDASAY5HQI3RUUHOVZZ2M/ (accessed on 21 April 2022).

- Lee, E.J.; Schumann, D.W. Explaining the Special Case of Incongruity in Advertising: Combining Classic Theoretical Approaches. Mark. Theory 2004, 4, 59–90. [Google Scholar] [CrossRef]

- Petty, R.E.; Cacioppo, J.T. The Elaboration Likelihood Model of Persuasion. In Advances in Experimental Social Psychology; Berkowitz, L., Ed.; Academic Press: San Diego, CA, USA, 1986; Volume 19, pp. 123–205. [Google Scholar]

- Zuckerman, M. Behavioral Expressions and Biosocial Bases of Sensation Seeking; Cambridge University Press: New York, NY, USA, 1994. [Google Scholar]

- Yoon, H.J. Understanding Schema Incongruity as a Process in Advertising: Review and Future Recommendations. J. Mark. Commun. 2013, 19, 360–376. [Google Scholar] [CrossRef]

- Gao, X.; De Hooge, I.E.; Fischer, A.R. Something Underneath? Using a Within-Subjects Design to Examine Schema Congruity Theory at an Individual Level. J. Retail. Consum. Serv. 2022, 68, 102994. [Google Scholar] [CrossRef]

- Halkias, G.; Kokkinaki, F. Increasing Advertising Effectiveness Through Incongruity-Based Tactics: The Moderating Role of Consumer Involvement. J. Mark. Commun. 2013, 19, 182–197. [Google Scholar] [CrossRef]

- Halkias, G.; Kokkinaki, F. The Degree of Ad– Brand Incongruity and the Distinction Between Schema Driven and Stimulus-Driven Attitudes. J. Advert. 2014, 43, 397–409. [Google Scholar] [CrossRef]

- Jhang, J.H.; Grant, S.J.; Campbell, M.C. Get It? Got It. Good! Enhancing New Product Acceptance by Facilitating Resolution of Extreme Incongruity. J. Mark. Res. 2012, 49, 247–259. [Google Scholar] [CrossRef]

- Srivastava, K.; Sharma, N.K. Consumer Attitude Towards Brand-Extension Incongruity: The Moderating Role of Need for Cognition and Need for Change. J. Mark. Manag. 2012, 28, 652–675. [Google Scholar] [CrossRef]

- Heckler, S.E.; Childers, T.L. The Role of Expectancy and Relevancy in Memory for Verbal and Visual Information: What is Incongruency? J. Consum. Res. 1992, 18, 475–492. [Google Scholar] [CrossRef]

- Alden, D.L.; Mukherjee, A.; Hoyer, W.D. The Effects of Incongruity, Surprise and Positive Moderators on Perceived Humour in Television Advertising. J. Advert. 2000, 29, 1–15. [Google Scholar] [CrossRef]

- Hirschberg, C.; Rajko, A.; Schumacher, T.; Wrulich, M. The Changing Market for Food Delivery. 2016. Available online: https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-changing-market-for-food-delivery (accessed on 1 December 2021).

- Microsoft NZ News Centre. Digital Transformation the Recipe for Success at My Food Bag. 2018. Available online: https://news.microsoft.com/en-nz/2018/09/05/digital-transformation-the-recipe-for-success-at-my-food-bag/ (accessed on 1 November 2021).

- Ryan, H. My Food Bag’s Phenomenal Rise: From Zero to $100m Revenue in Three Years. NZ Herald, Business, 10 December 2015. Available online: https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11558913 (accessed on 21 December 2021).

- My Food Bag. My Family Bag. 2021. Available online: https://www.myfoodbag.co.nz/products?feeds=three (accessed on 21 April 2022).

- Wang, S.; Wang, S.; Wang, M.T. Shopping Online or Not? Cognition and Personality Matters. J. Theor. Appl. Electron. Commer. Res. 2006, 1, 68–80. [Google Scholar] [CrossRef]

- Chang, S.S.; Chang, C.C.; Chien, Y.L.; Chang, J.H. Having Champagne Without Celebration? The Impact of Self-Regulatory Focus on Moderate Incongruity Effect. Eur. J. Mark. 2014, 48, 1939–1961. [Google Scholar] [CrossRef]

- Otago Daily Times. Harraways Celebrates 150 Years with Going for Grain Book. Otago Daily Times, 9 May 2019. Available online: https://www.odt.co.nz/features/sponsored-content/story/harraways-celebrates-150-years-going-grain-book (accessed on 1 November 2021).

- Chakraborty, G.; Pagolu, M.; Garla, S. Text Mining and Analysis. Practical Methods, Examples, and Case Studies Using SAS; SAS Institute Inc.: Cary, NC, USA, 2013; Available online: http://csyue.nccu.edu.tw/ch/Text%20Mining%20and%20Analysis,%20Practical%20Methods,%20Examples%20and%20Case%20Studies%20(2013%20Book).pdf (accessed on 16 June 2021).

- Robertson, S. Understanding Inverse Document Frequency: On Theoretical Arguments for IDF. J. Doc. 2004, 60, 503–520. [Google Scholar] [CrossRef]

- Abidin, T.F.; Yusuf, B.; Umran, M. Singular Value Decomposition for Dimensionality Reduction in Unsupervised Text Learning Problems. In Proceedings of the Second International Conference on Education Technology and Computer, Shanghai, China, 22–24 June 2010; Volume 4, p. V4-422. [Google Scholar]

- Bowden, J.L.H. The Process of Customer Engagement: A Conceptual Framework. J. Mark. Theory Pract. 2009, 17, 63–74. [Google Scholar] [CrossRef]

- van Doorn, J.; Lemon, K.N.; Mittal, V.; Nass, S.; Pick, D.; Pirner, P.; Verhoef, P.C. Customer Engagement Behaviour: Theoretical Foundations and Research Directions. J. Serv. Res. 2010, 13, 253–266. [Google Scholar]

- Parackal, M.; Parackal, S.; Mather, D.; Eusebius, S. Dynamic Transactional Model: A Framework for Communicating Public Health Messages via Social Media. Perspect. Public Health 2021, 141, 279–286. [Google Scholar] [CrossRef] [PubMed]

- FMCG Business. Harraways Rebrands in Style. FMCG Business, 29 March 2019. Available online: https://www.fmcgbusiness.co.nz/harraways-rebrands-in-style/ (accessed on 1 December 2021).

- Thorsen, C.A.; DeVore, S. Analyzing Reflection On/For Action: A New Approach. Reflective Pract. 2013, 14, 88–103. [Google Scholar] [CrossRef]

- Crozier, R.; Ranyard, R. Cognitive Process Models and Explanations of Decision Making. In Decision Making; Routledge: London, UK, 2002; pp. 19–34. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).